The Daily Shot: 22-Sep-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

The United States

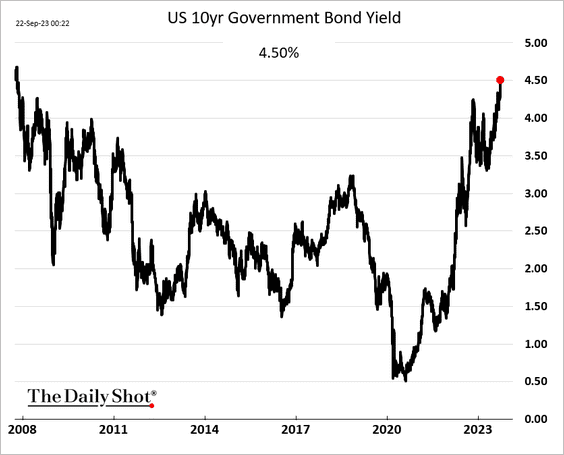

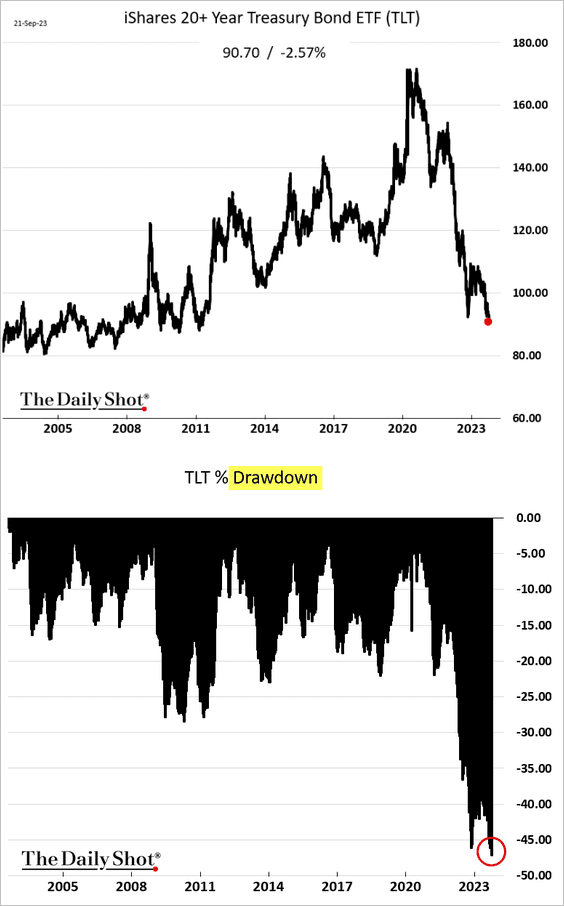

1. The 10-year Treasury yield hit 4.5%, as the Fed’s “higher for longer” message continues to pressure bonds.

The sell-off in longer-dated government debt has been brutal.

——————–

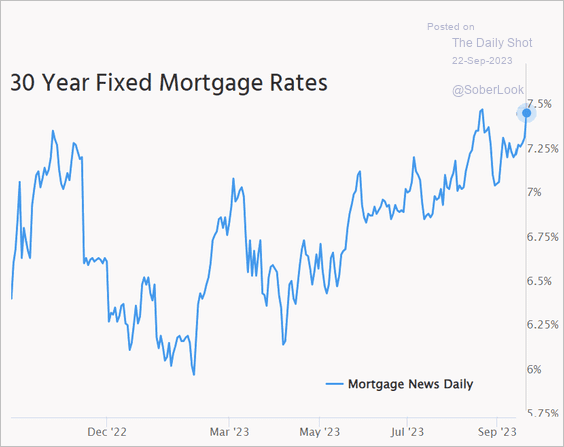

2. Next, we have some updates on the housing market.

• The 30-year mortgage rate is near 7.5%.

Source: Mortgage News Daily

Source: Mortgage News Daily

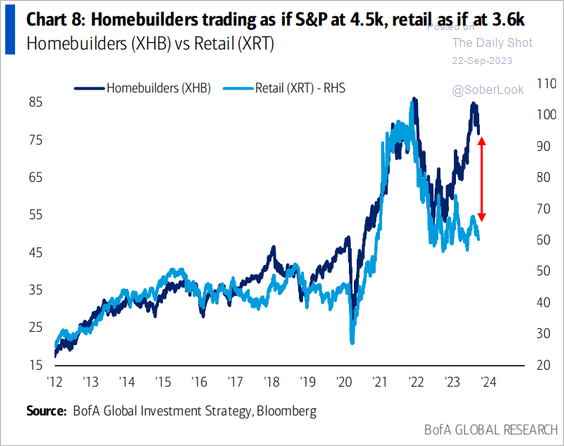

• Despite the housing market headwinds, homebuilders have been outperforming retail stocks.

Source: BofA Global Research

Source: BofA Global Research

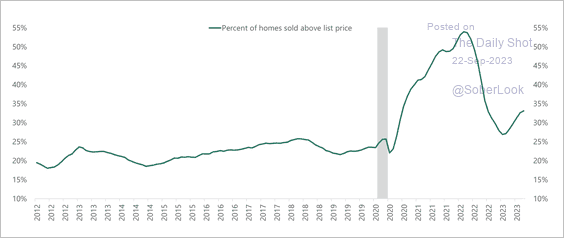

• 33% of homes have been selling above their list price.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

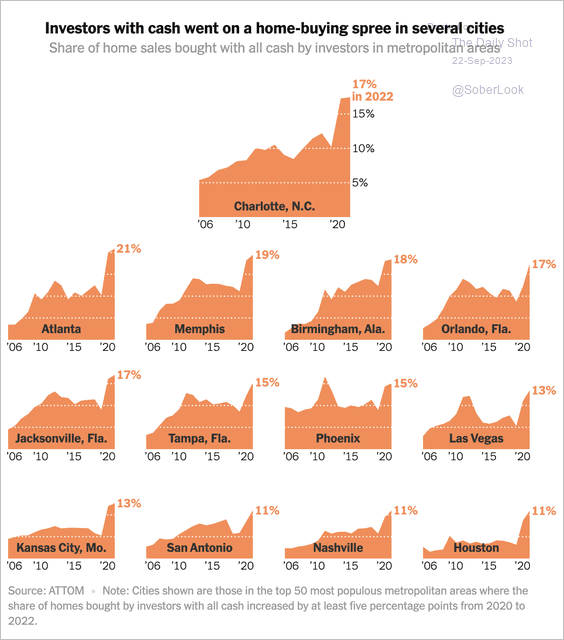

• In many metro areas, property investors are increasing their share of the housing market.

Source: The New York Times Read full article

Source: The New York Times Read full article

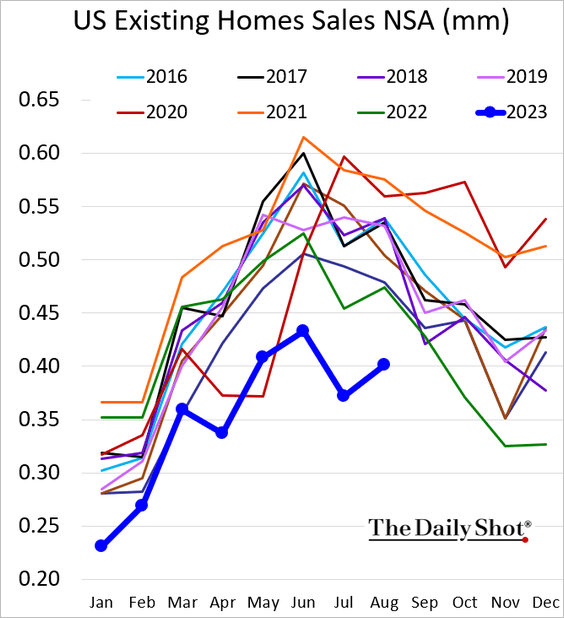

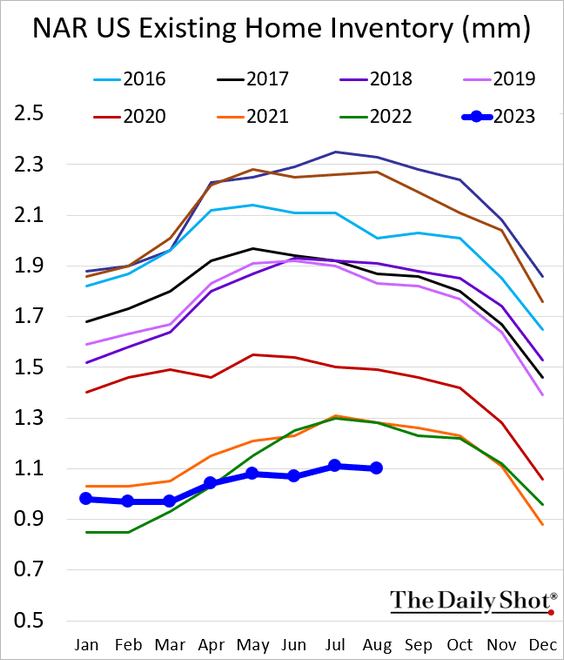

• Existing home sales were at multi-year lows last month …

… amid depressed inventories.

——————–

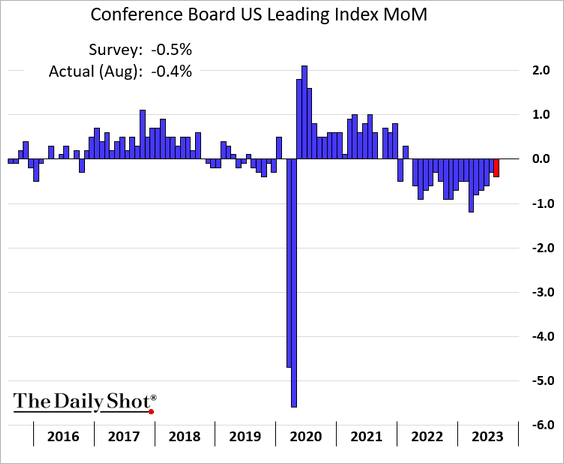

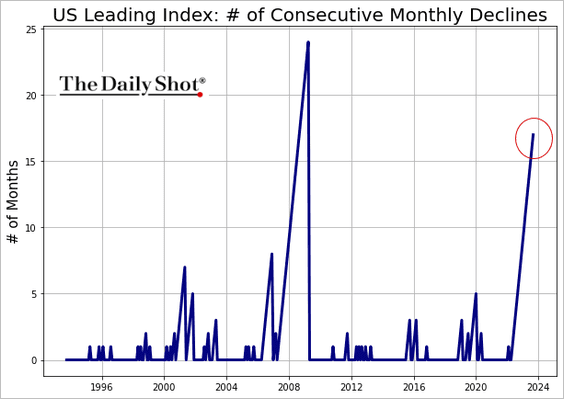

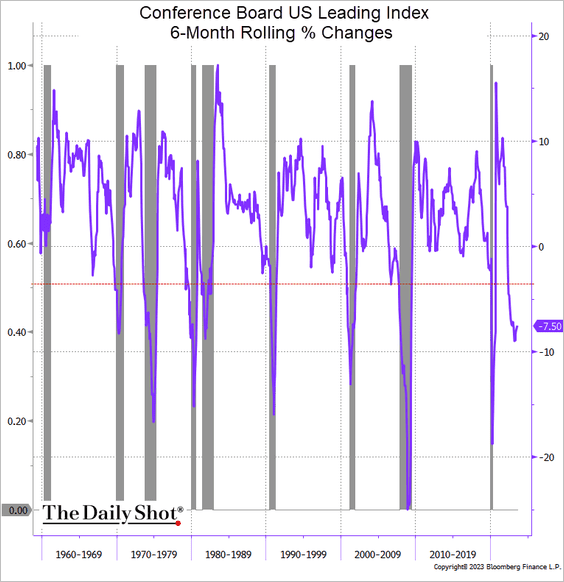

3. The Conference Board’s US Leading Index has seen a 17-month consecutive decline, …

… a pattern not observed since the Global Financial Crisis.

The index continues to signal a recession.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

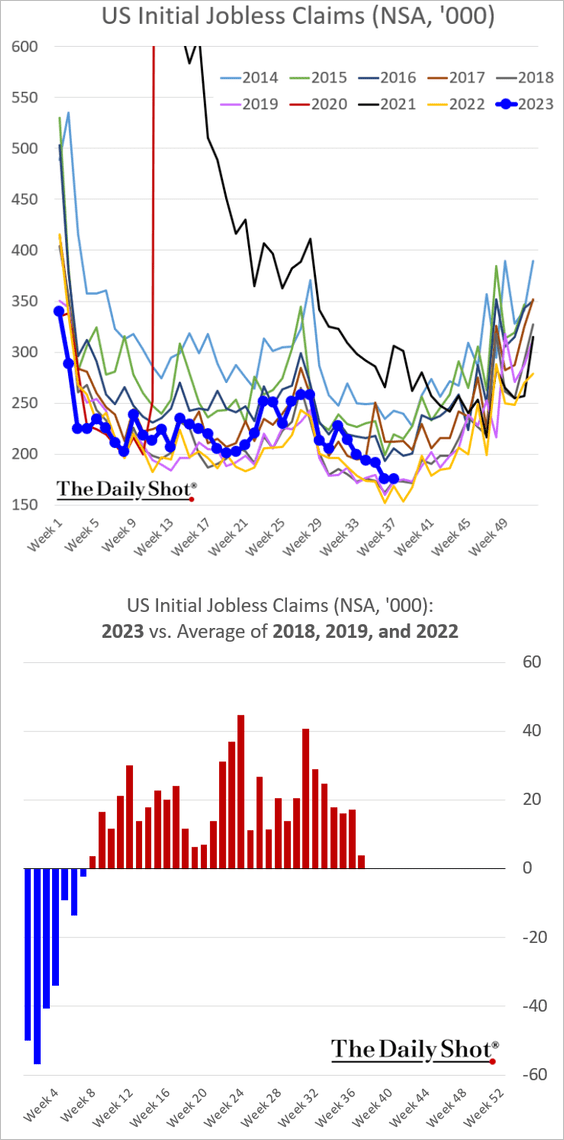

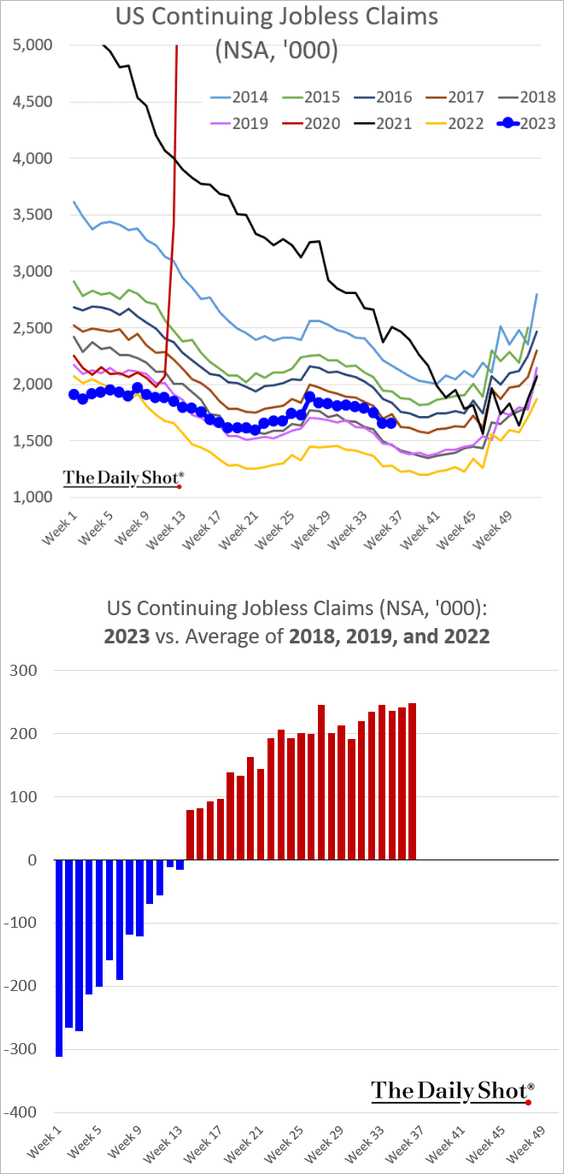

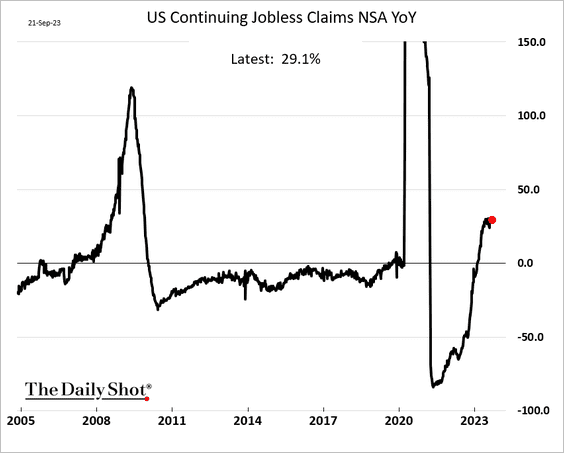

4. We remain in a pattern of lower initial unemployment claims …

… and elevated continuing claims.

Continuing claims are up almost 30% vs. 2022.

——————–

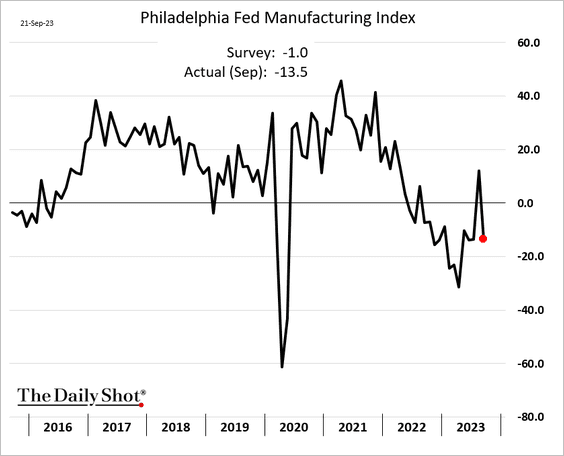

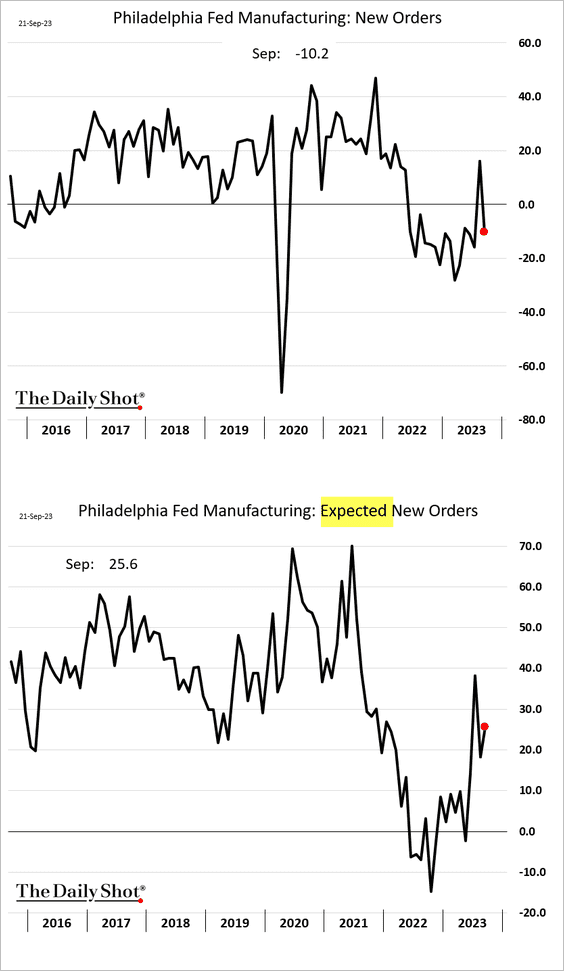

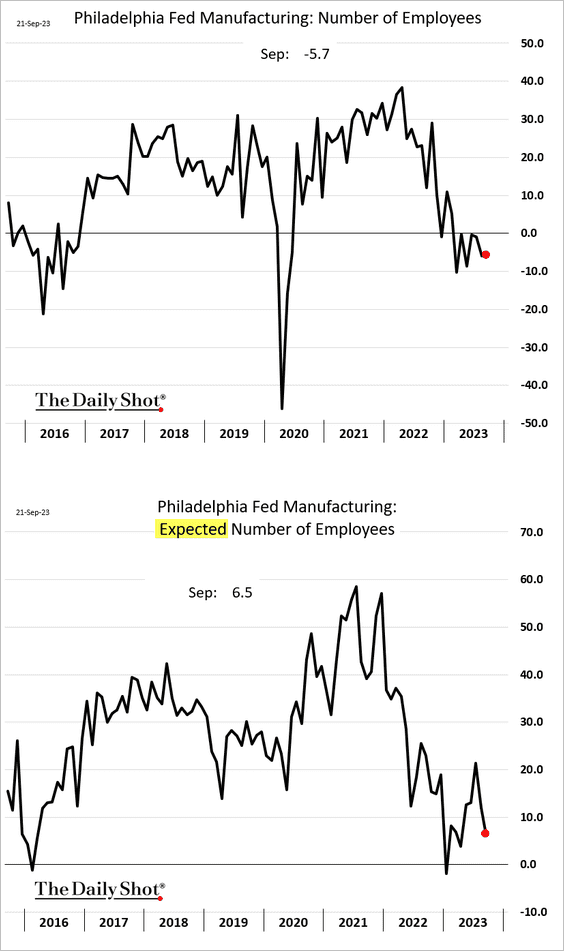

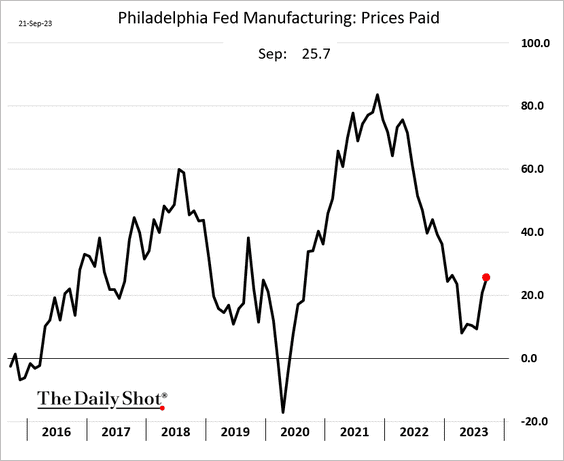

5. The Philly Fed’s regional manufacturing index dipped back into contraction territory.

• While more firms saw softer demand this month, factories are more upbeat about the future.

• There isn’t much hiring taking place.

• More firms are reporting rising input costs.

Back to Index

The United Kingdom

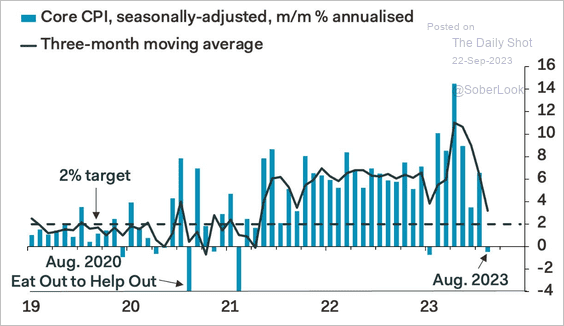

1. The BoE left rates unchanged (MPC voted 5-4 in favor of holding) after core inflation registered a monthly decline in August.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: CNBC Read full article

Source: CNBC Read full article

——————–

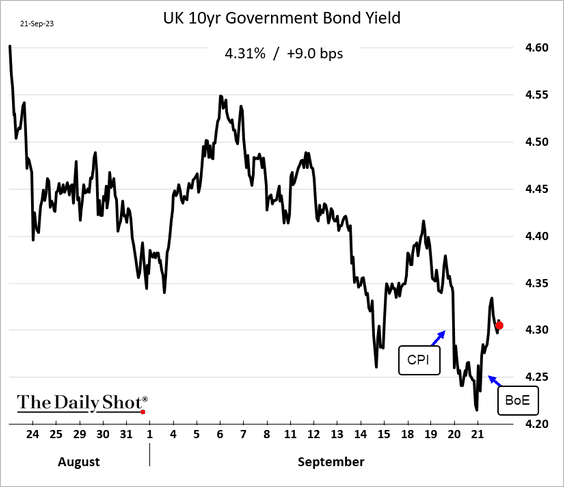

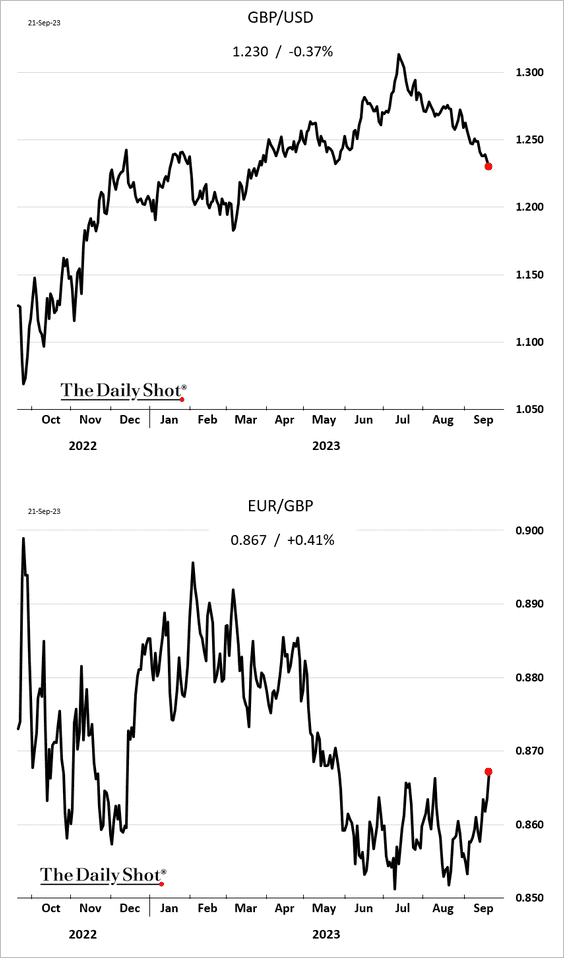

2. Gilt yields bounced from the post-CPI slump.

The pound remains under pressure.

——————–

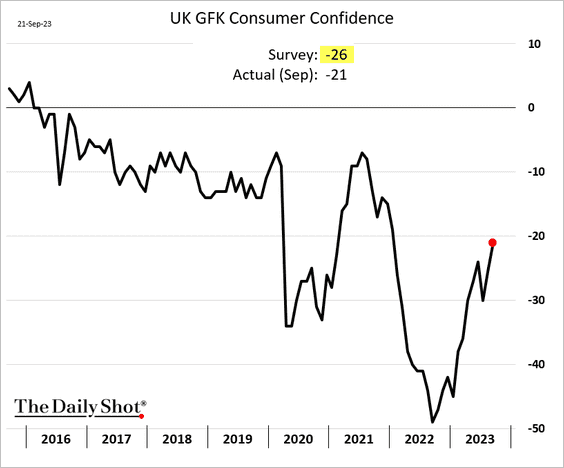

3. Consumer sentiment is recovering.

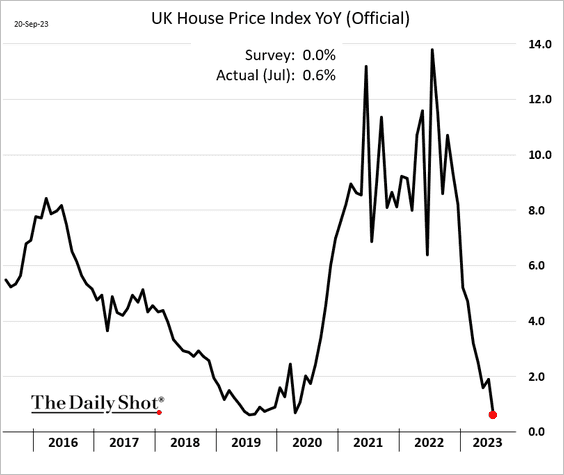

4. In July, the official measure of UK home prices remained positive on a year-over-year basis.

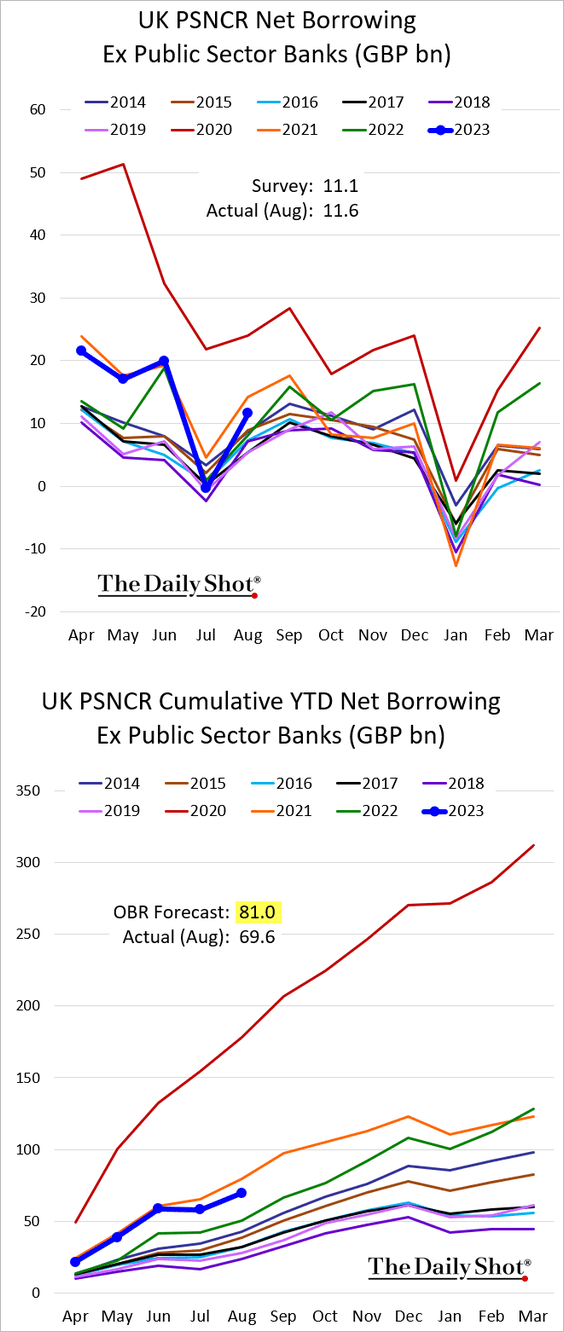

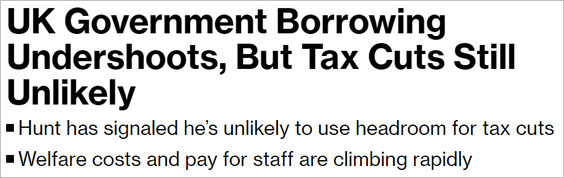

5. Government borrowing for the fiscal year to date has been below the projections of the OBR.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

The Eurozone

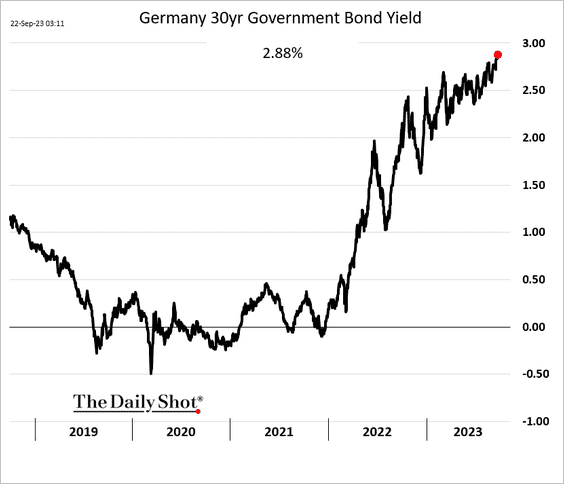

1. The 30-year Bund yield continues to climb.

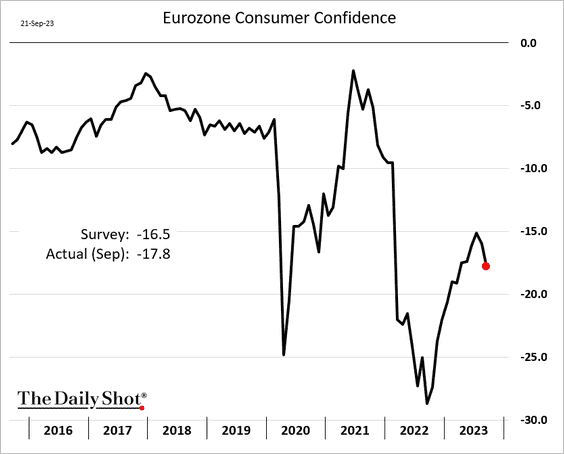

2. Euro-area consumer confidence declined again this month.

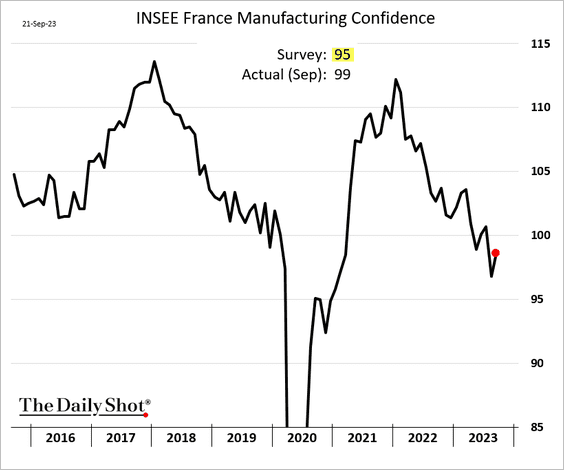

3. French manufacturing sentiment unexpectedly improved this month.

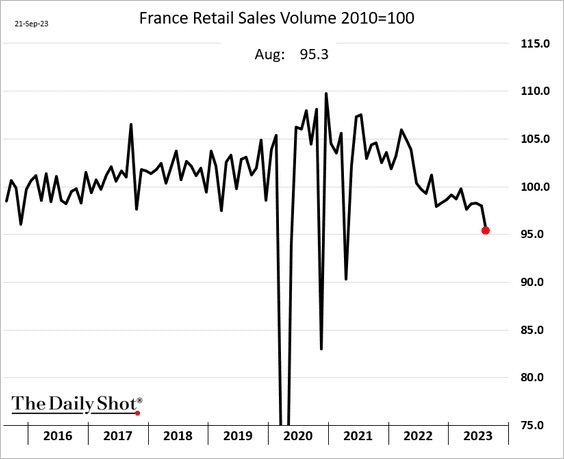

The nation’s real retail sales continue to slump.

——————–

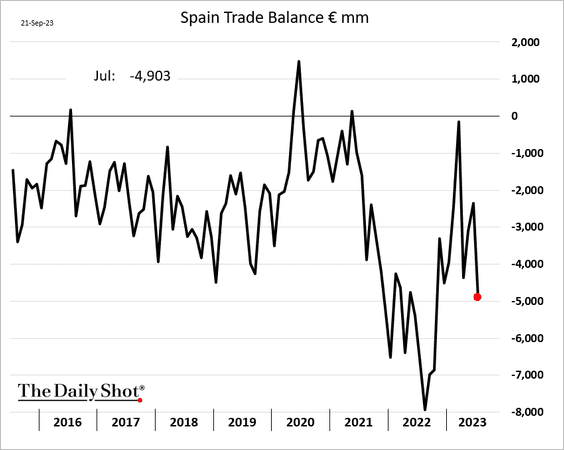

4. Spain’s trade deficit widened in July.

Back to Index

Europe

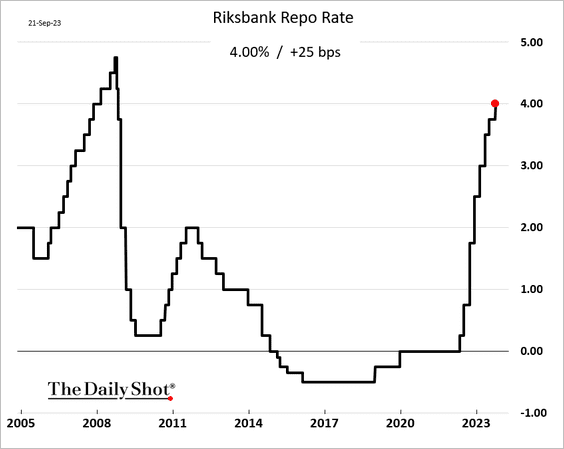

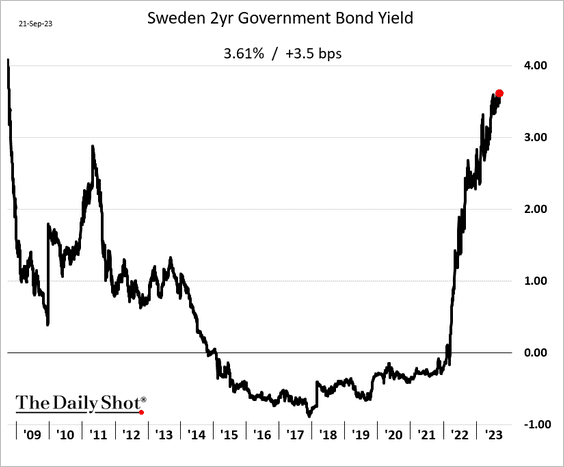

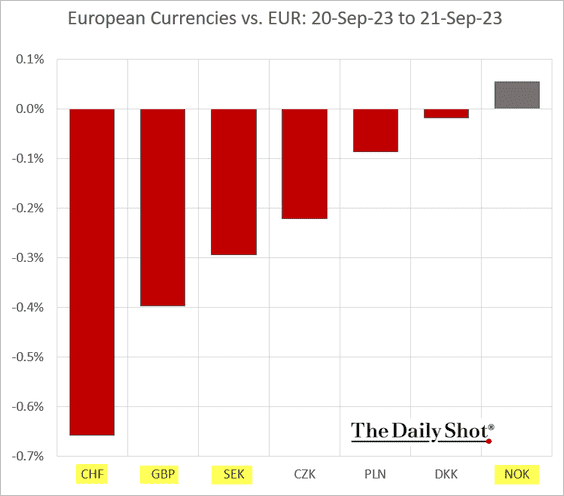

1. Sweden’s central bank hiked rates again.

Source: Reuters Read full article

Source: Reuters Read full article

The 2-year bond yield hit a multi-year high.

——————–

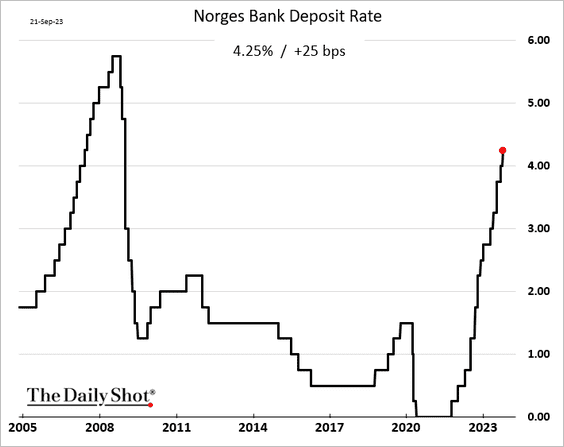

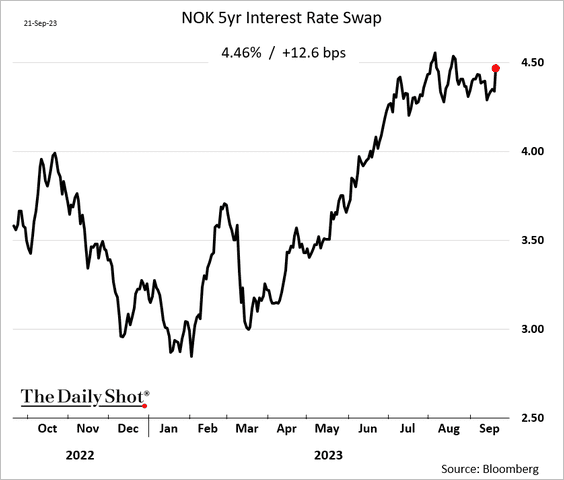

2. Norway’s central bank also raised rates, which was widely expected.

Source: Reuters Read full article

Source: Reuters Read full article

Bond yields (and swap rates) climbed.

——————–

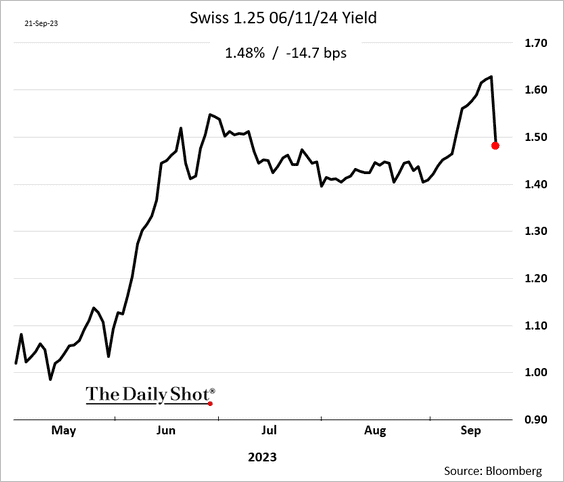

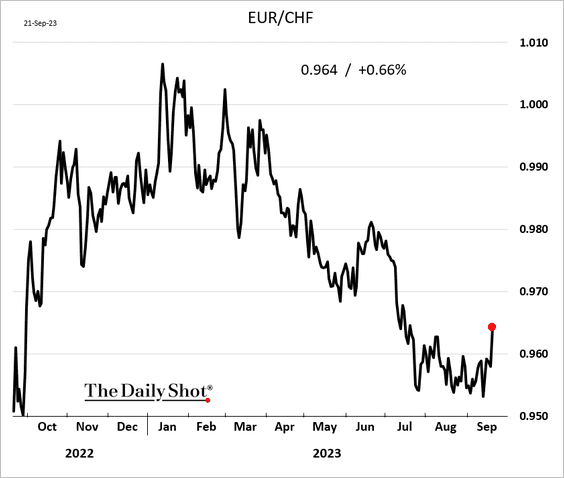

3. The Swiss central bank unexpectedly left rates unchanged.

Source: Reuters Read full article

Source: Reuters Read full article

Swiss bond yields and the franc tumbled.

——————–

4. Here is a look at the performance of European currencies against the euro on “central bank day.”

Back to Index

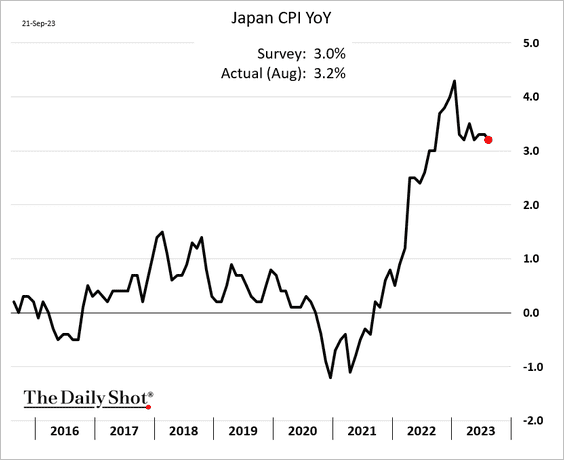

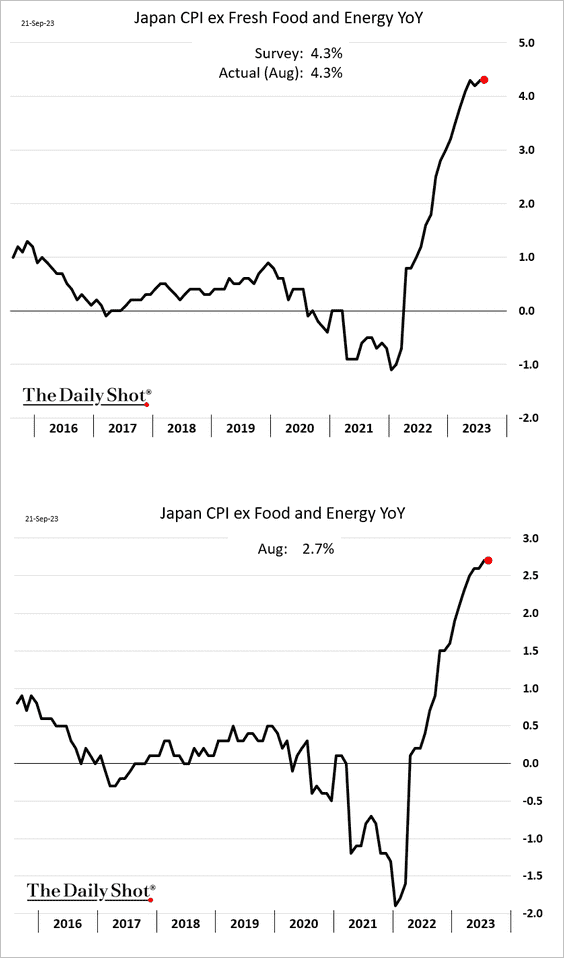

Japan

1. The August headline inflation was firmer than expected.

Core inflation held steady.

——————–

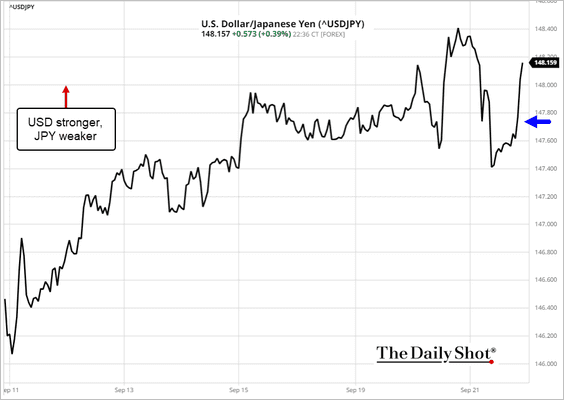

2. The BoJ left policy unchanged, …

Source: @economics Read full article

Source: @economics Read full article

… putting pressure on the yen.

——————–

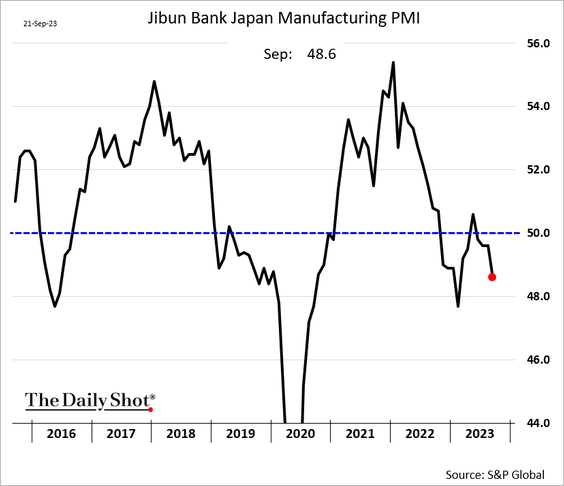

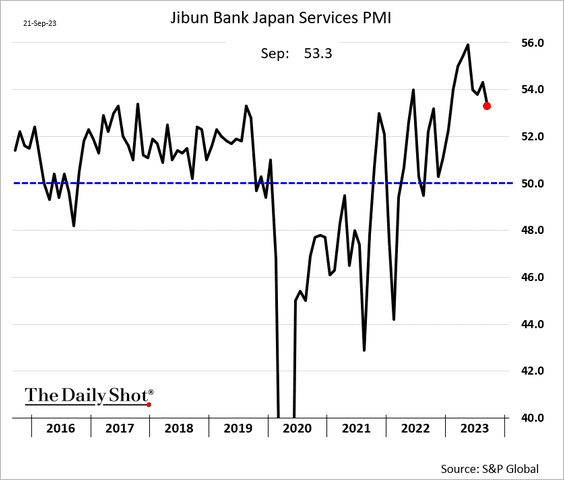

3. The decline in manufacturing activity accelerated this month, according to the S&P Global PMI.

Service sector growth is holding up.

Back to Index

China

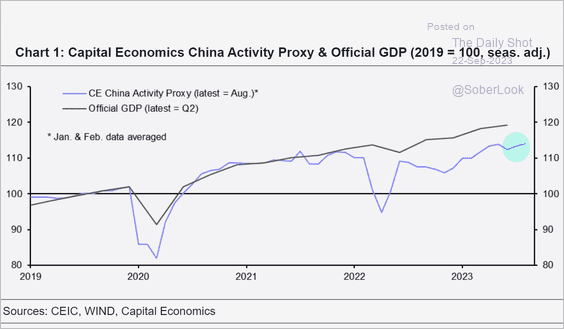

1. The Capital Economics China Activity Proxy points to growth returning.

Source: Capital Economics

Source: Capital Economics

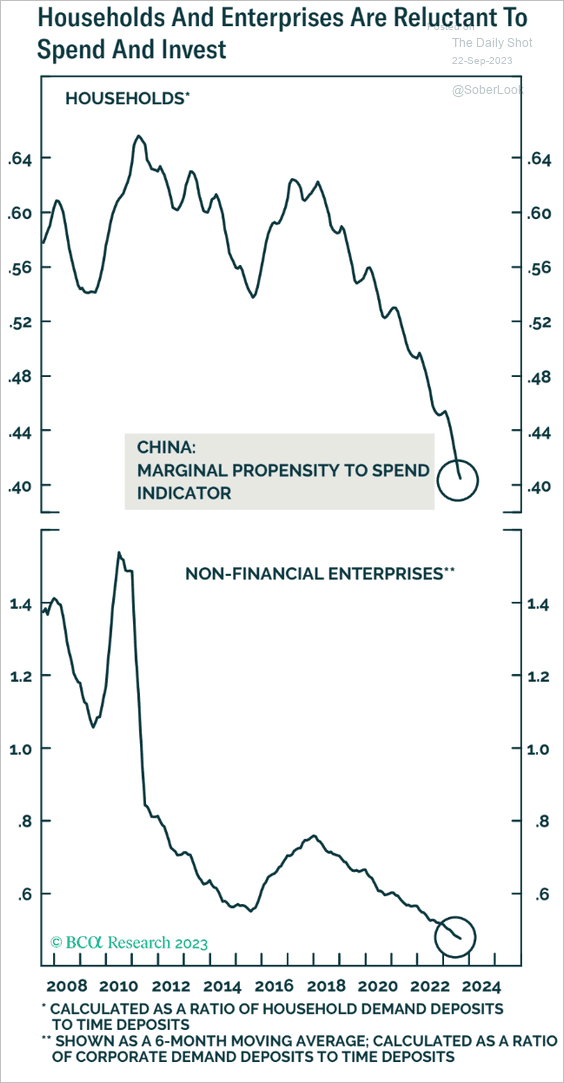

2. Neither households nor businesses show much interest in spending.

Source: BCA Research

Source: BCA Research

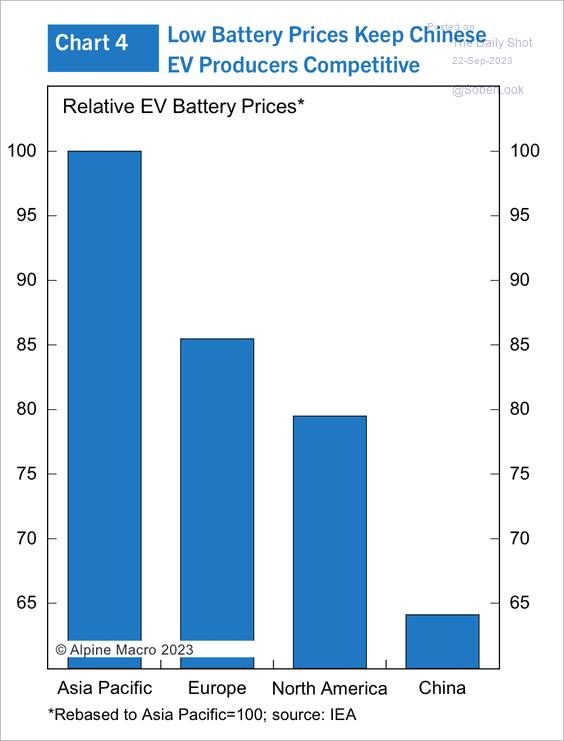

3. Chinese electric vehicle makers have a significant cost advantage relative to global competitors.

Source: Alpine Macro

Source: Alpine Macro

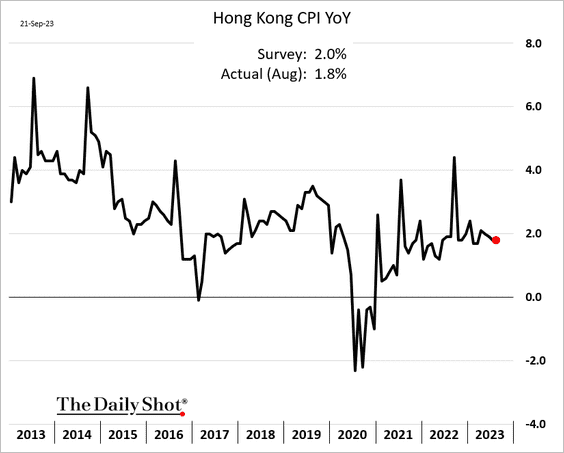

4. Hong Kong’s August CPI was lower than expected (back below 2%).

Back to Index

Emerging Markets

South Africa, Egypt, the Philippines, Indonesia, and Taiwan all left rates unchanged this week.

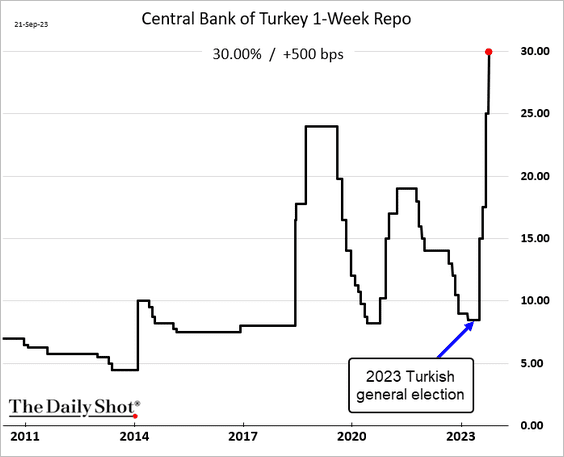

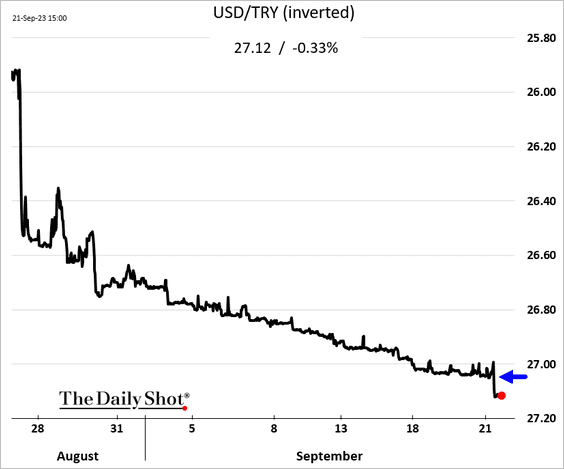

Turkey’s central bank is playing catchup, pushing rates up by another 500 bps.

Source: Reuters Read full article

Source: Reuters Read full article

The markets were hoping for more, sending the lira lower.

Back to Index

Cryptocurrency

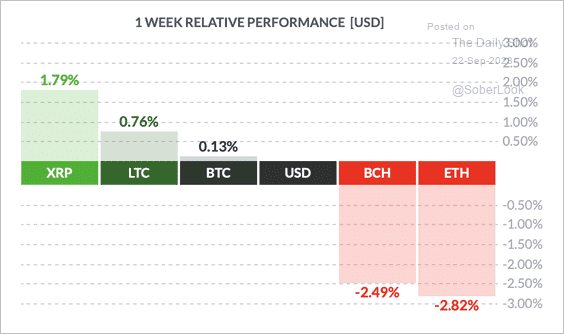

1. It has been a mixed week for cryptos, with XRP outperforming and Ether (ETH) underperforming top peers.

Source: FinViz

Source: FinViz

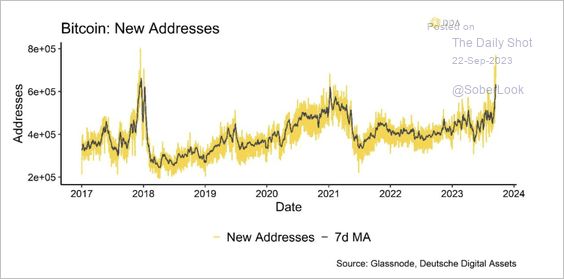

2. Activity on the Bitcoin blockchain advanced despite the recent selloff.

Source: Deutsche Digital Assets

Source: Deutsche Digital Assets

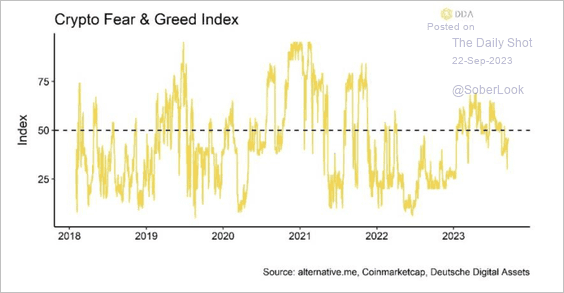

3. The Crypto Fear & Greed Index remains in “fear” territory.

Source: Deutsche Digital Assets

Source: Deutsche Digital Assets

Back to Index

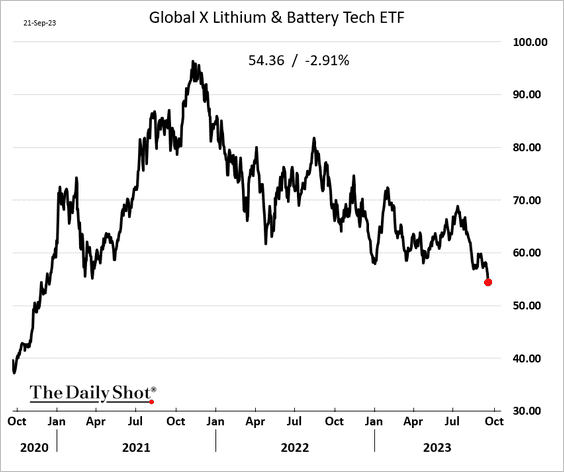

Commodities

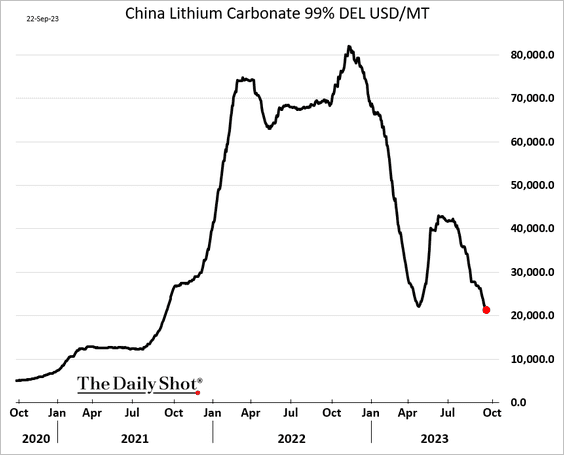

1. Lithium prices are retreating again. In US-dollar terms, China’s lithium carbonate index hit its lowest level since 2021.

Here is the lithium ETF.

——————–

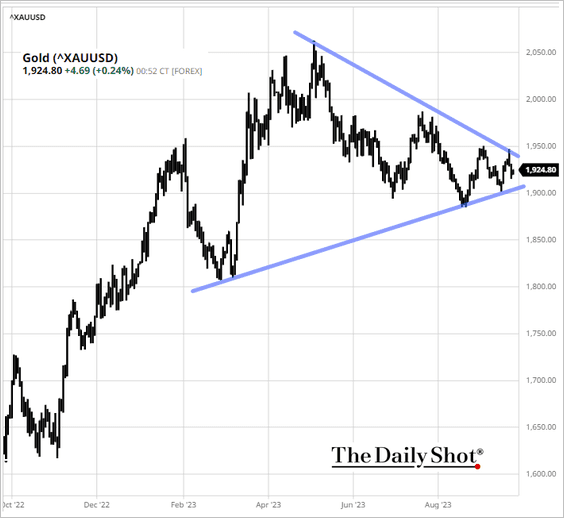

2. Gold continues to consolidate.

Source: barchart.com

Source: barchart.com

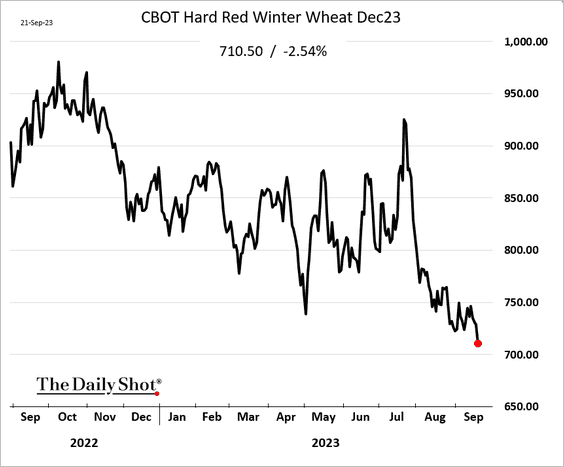

3. The selloff in wheat futures persists.

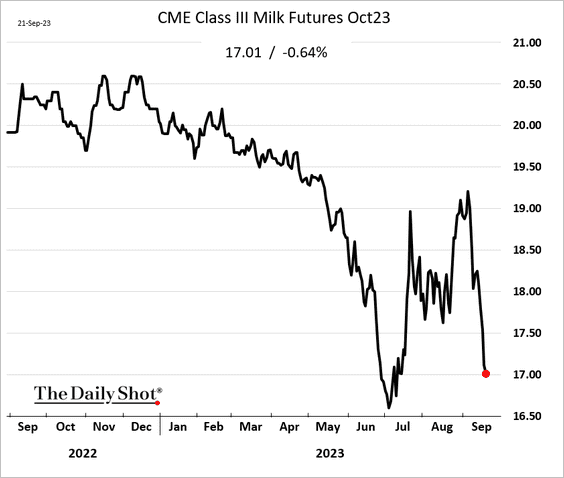

4. The rebound in Chicago milk futures didn’t last very long.

Back to Index

Equities

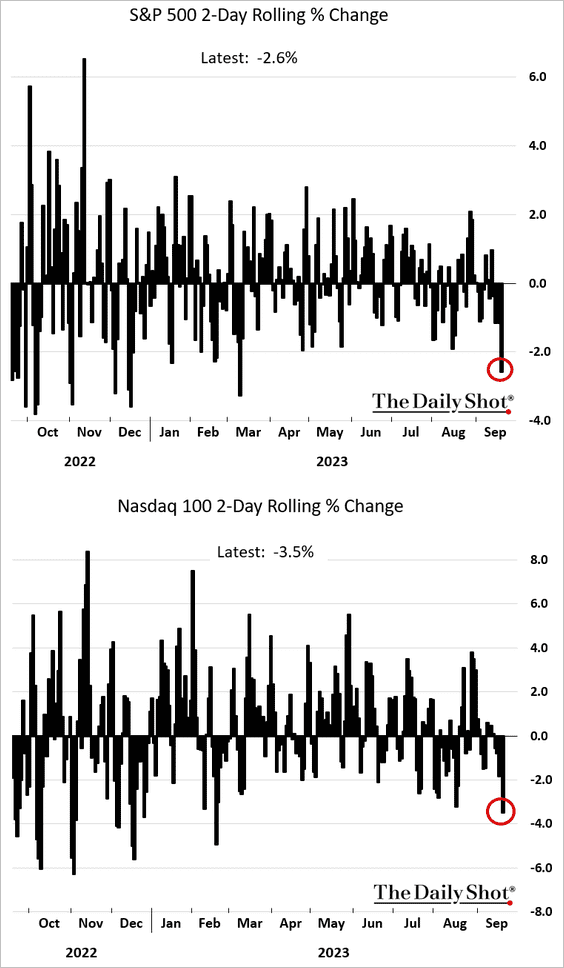

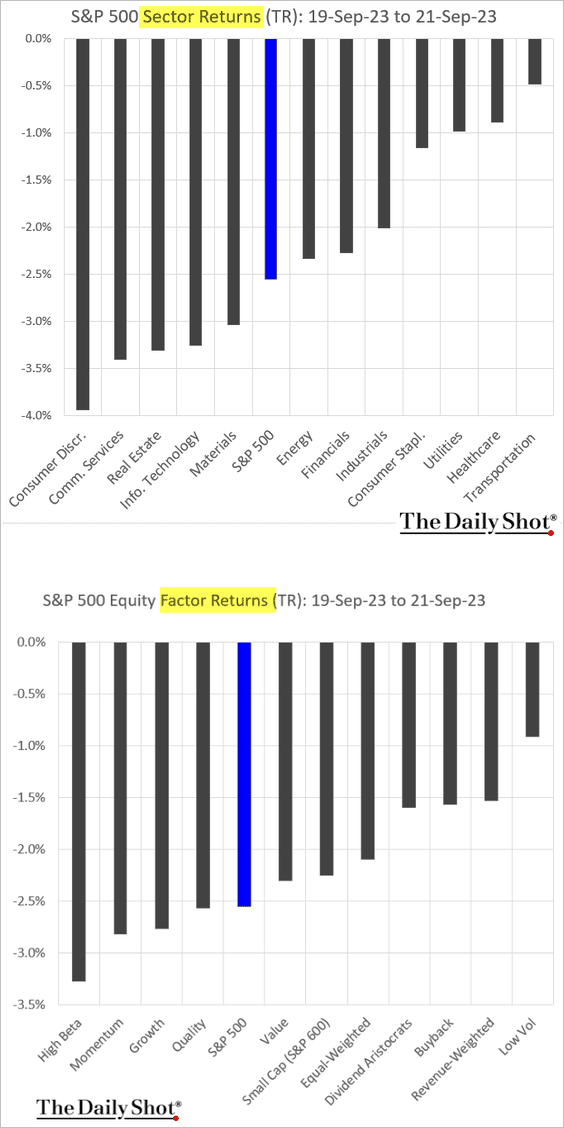

1. It’s been a rough couple of days for stocks after the Fed’s “higher for longer” warning.

Here is the breakdown by sector and equity factor.

——————–

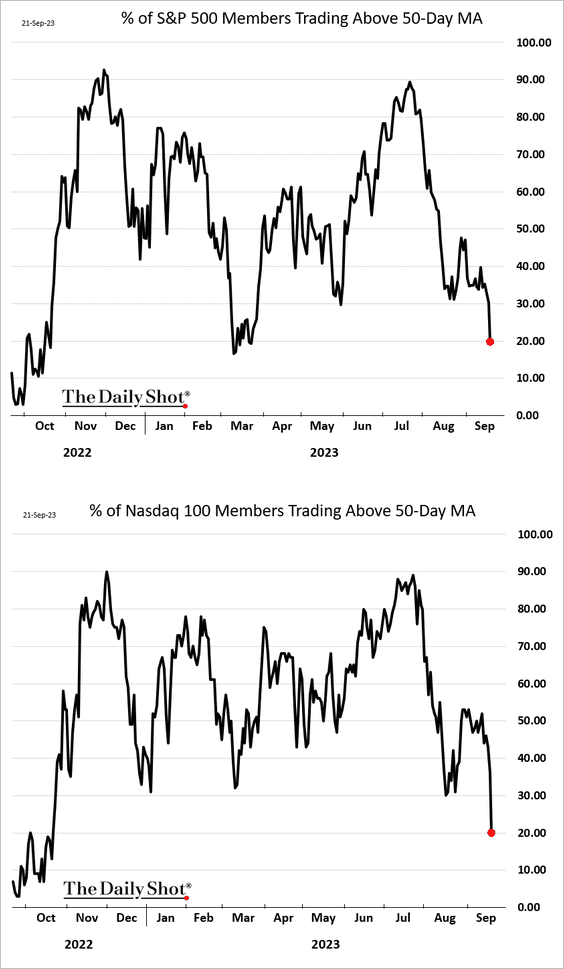

2. Below is a look at the percentage of S&P 500 and Nasdaq 100 members that are above their 50-day moving average.

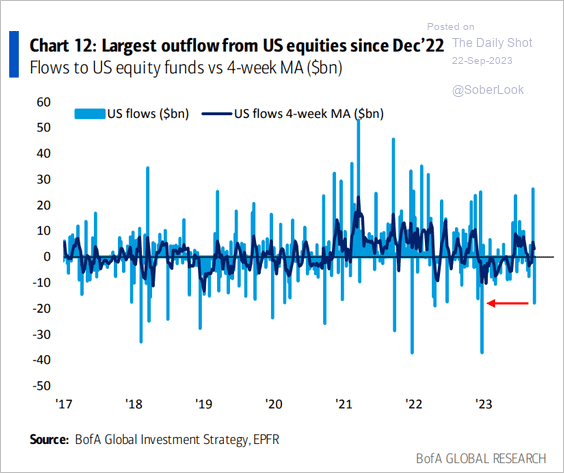

3. BofA reports a big outflow from US equity funds.

Source: BofA Global Research

Source: BofA Global Research

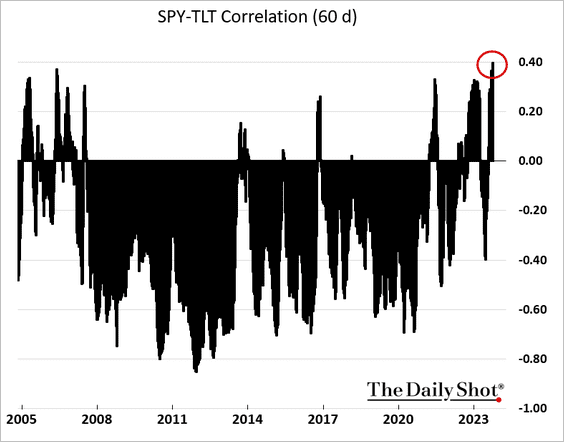

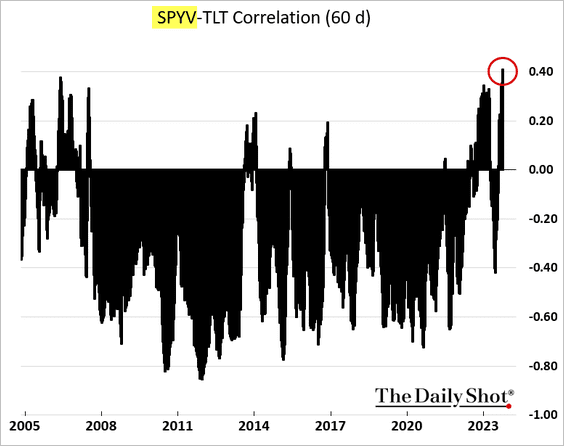

4. The correlation between stocks (SPY) and bonds (TLT) is hitting multi-year highs, reflecting the market’s response to the Fed’s hawkish stance.

This increase in correlation includes values stocks.

——————–

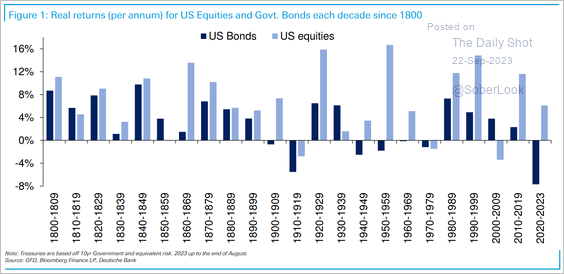

5. Here is a look at historical real returns for US equities and bonds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

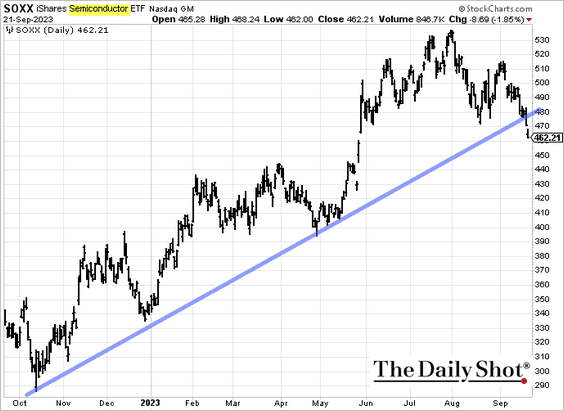

6. Not good …

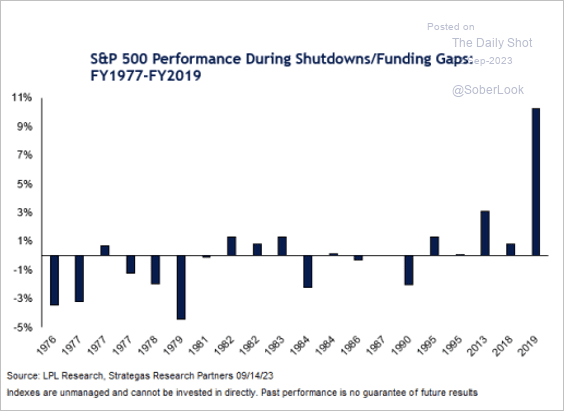

7. The chart below shows stock market performance during government shutdowns.

Source: LPL Research

Source: LPL Research

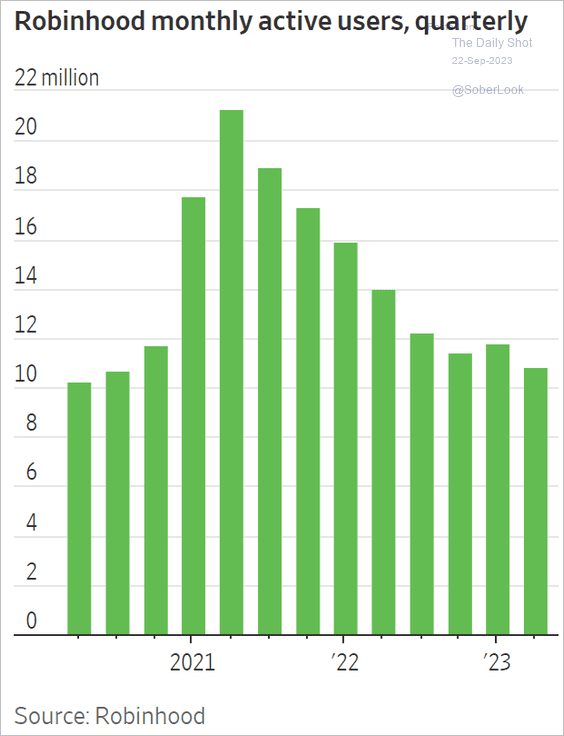

8. Here is a look at Robinhood’s active users.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Credit

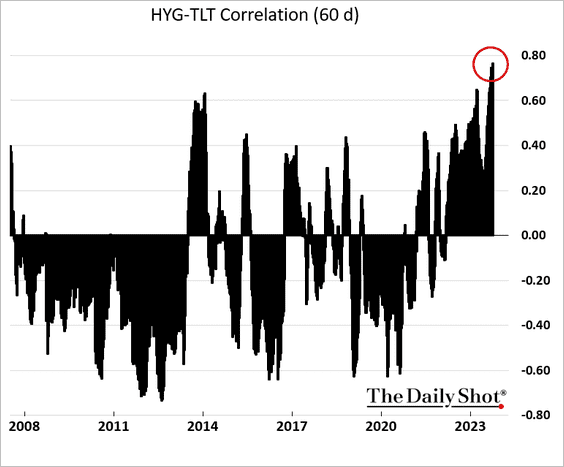

1. The correlation between high-yield bonds (HYG) and longer-dated Treasuries (TLT) is at multi-year highs.

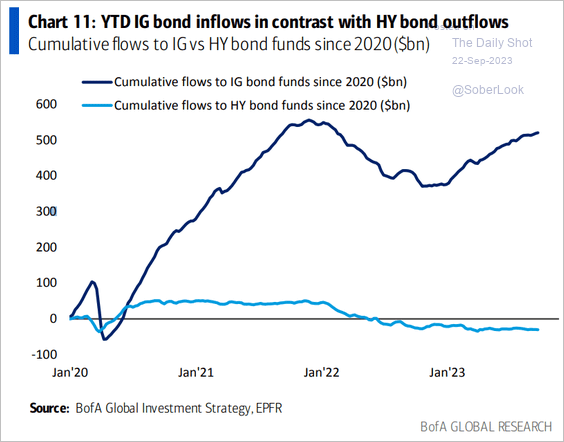

2. Here is a look at COVID-era flows into investment-grade and high-yield bond funds.

Source: BofA Global Research

Source: BofA Global Research

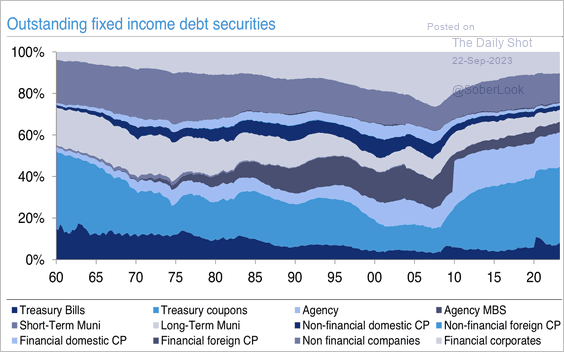

3. The composition of the US fixed-income market has shifted toward more coupon Treasuries and less financial debt.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

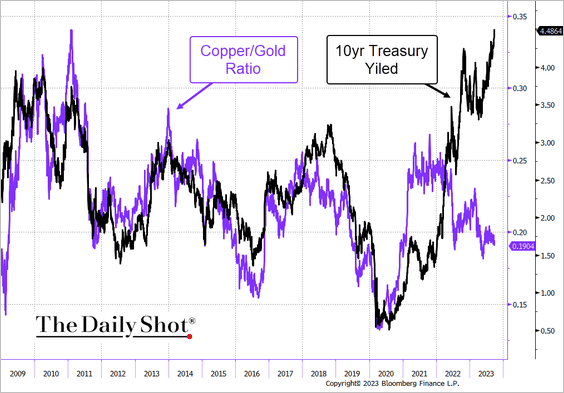

1. The divergence between Treasury yields and the copper-to-gold ratio continues to widen.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

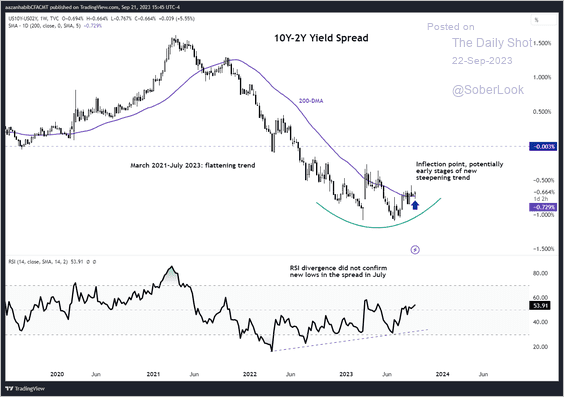

2. The 10s/2s Treasury yield spread is showing early signs of steepening.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

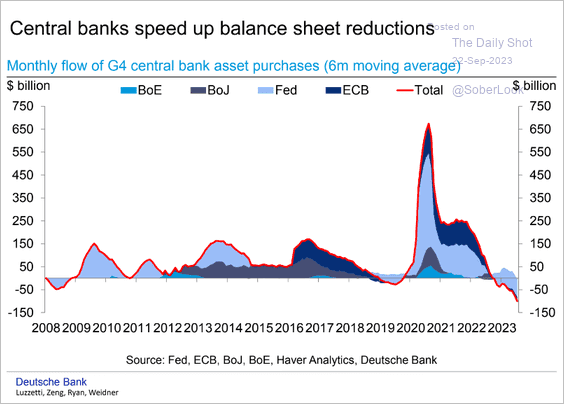

3. Central banks continue to reduce their balance sheets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

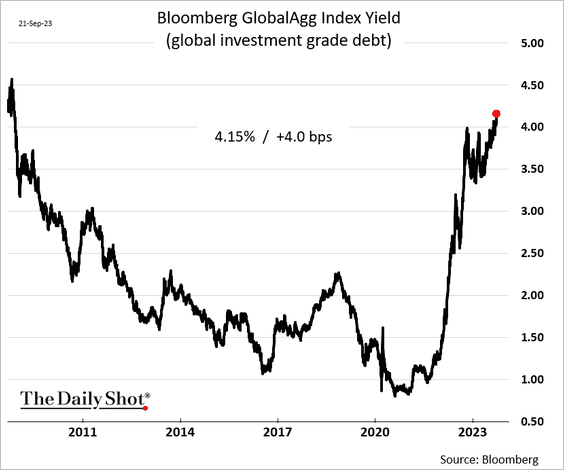

4. Global bond yields are hitting multi-year highs.

h/t Simon White, Bloomberg Markets Live Blog

h/t Simon White, Bloomberg Markets Live Blog

——————–

Food for Thought

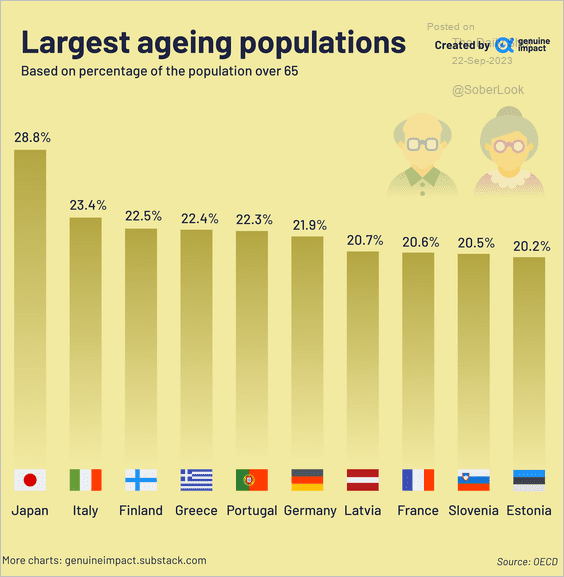

1. Percentage of the population over 65:

Source: @genuine_impact

Source: @genuine_impact

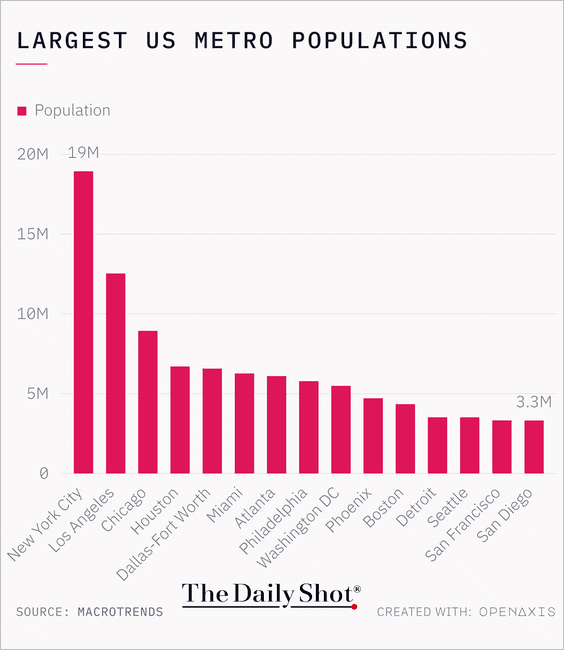

2. US metro areas by population:

Source: @TheDailyShot

Source: @TheDailyShot

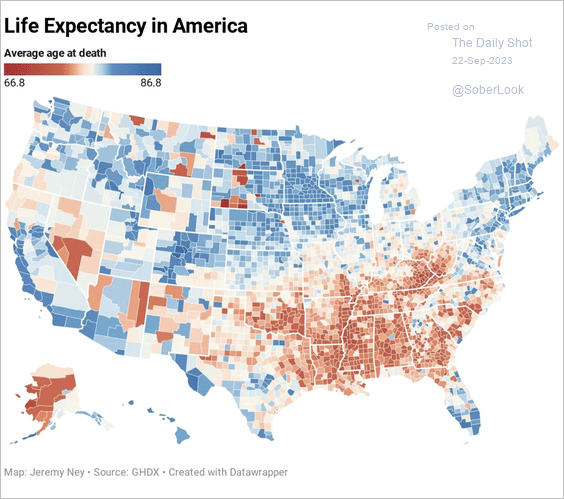

3. Life expectancy across the US:

Source: @jeremybney

Source: @jeremybney

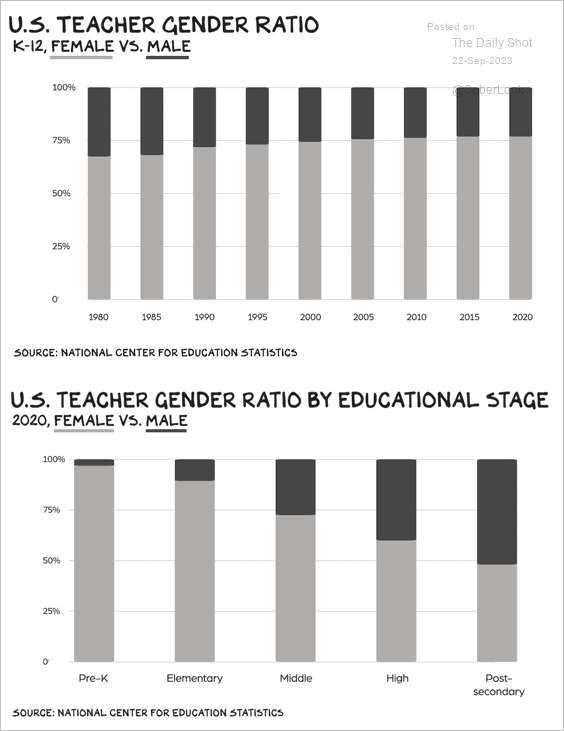

4. Teacher gender ratios:

Source: Scott Galloway Read full article

Source: Scott Galloway Read full article

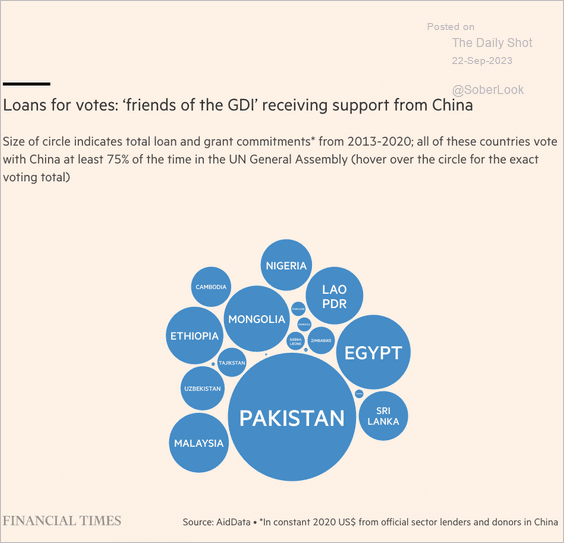

5. China buying support:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

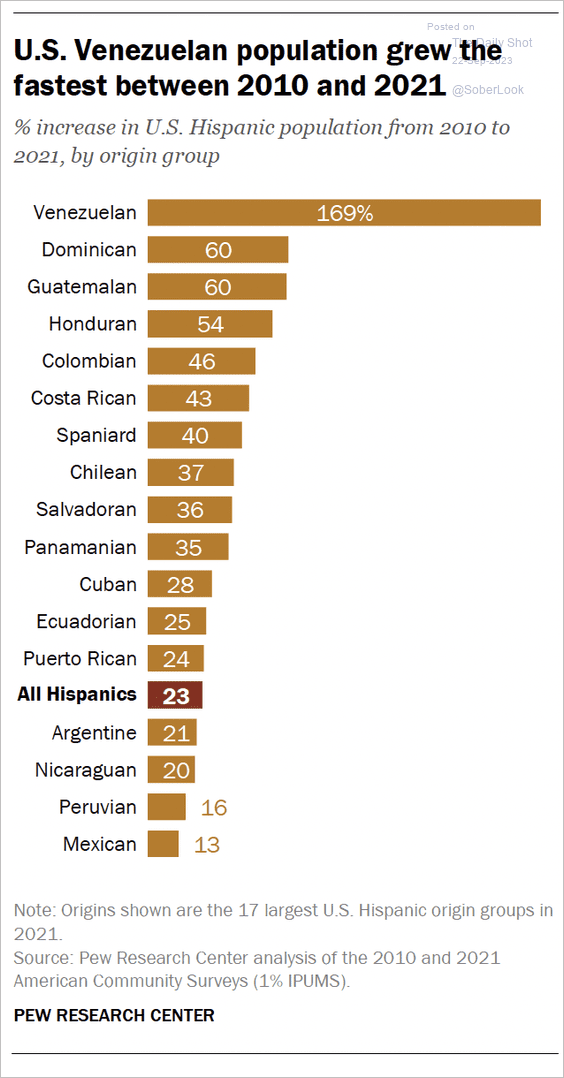

6. Growth in the US Hispanic population:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

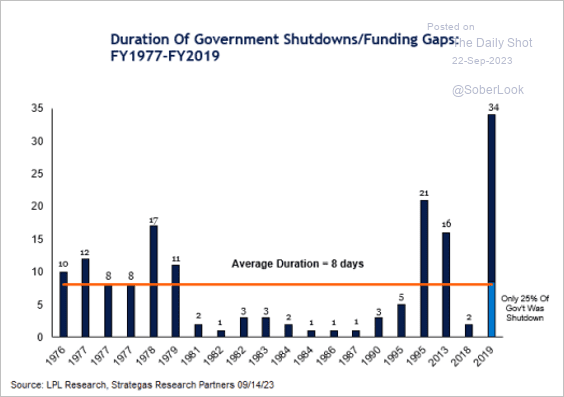

7. Duration of government shutdowns:

Source: LPL Research

Source: LPL Research

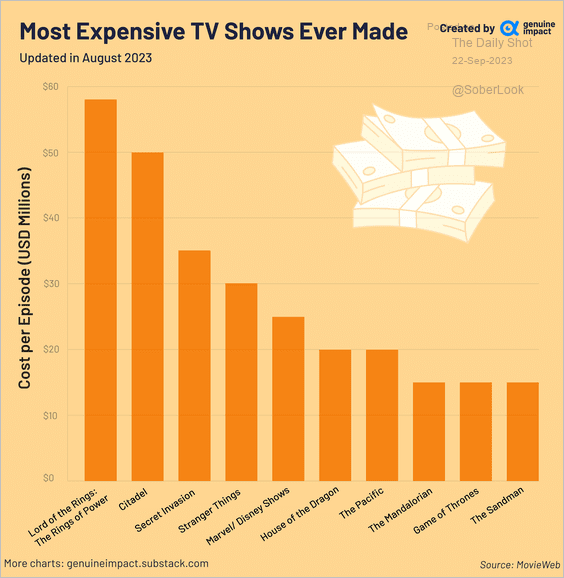

8. The most expensive TV shows:

Source: @genuine_impact

Source: @genuine_impact

——————–

Have a great weekend!

Back to Index