The Daily Shot: 25-Sep-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

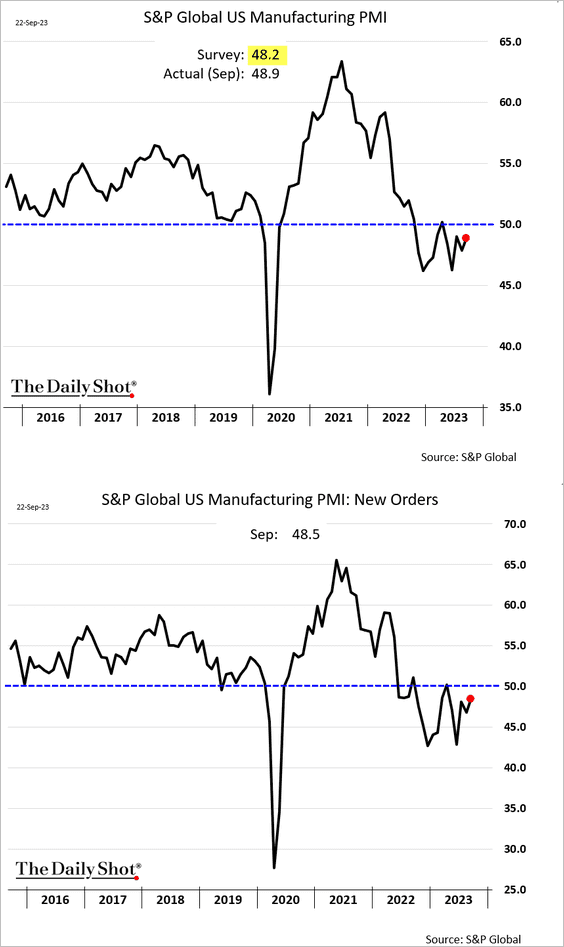

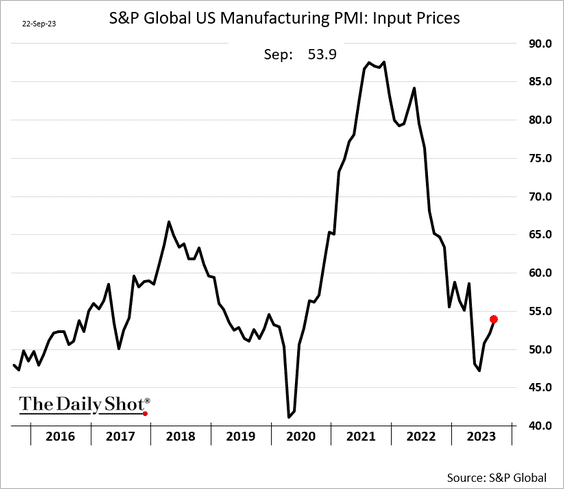

1. The US manufacturing PMI report from S&P Global showed a modest improvement this month but held in contraction territory (PMI < 50).

A higher share of factories reported rising input costs.

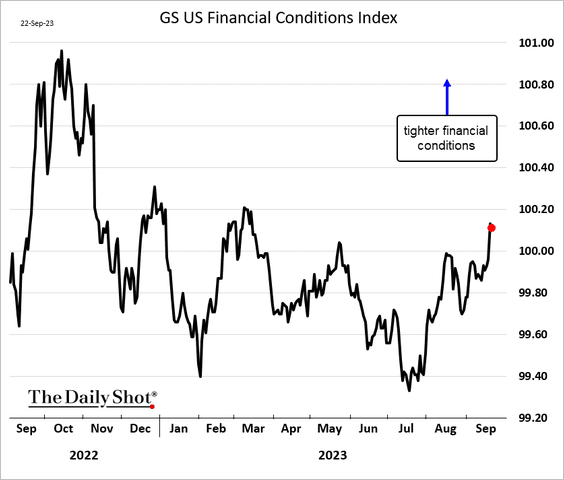

• Growth in service sector activity is stalling, with companies reporting net declines in new business (2nd panel).

——————–

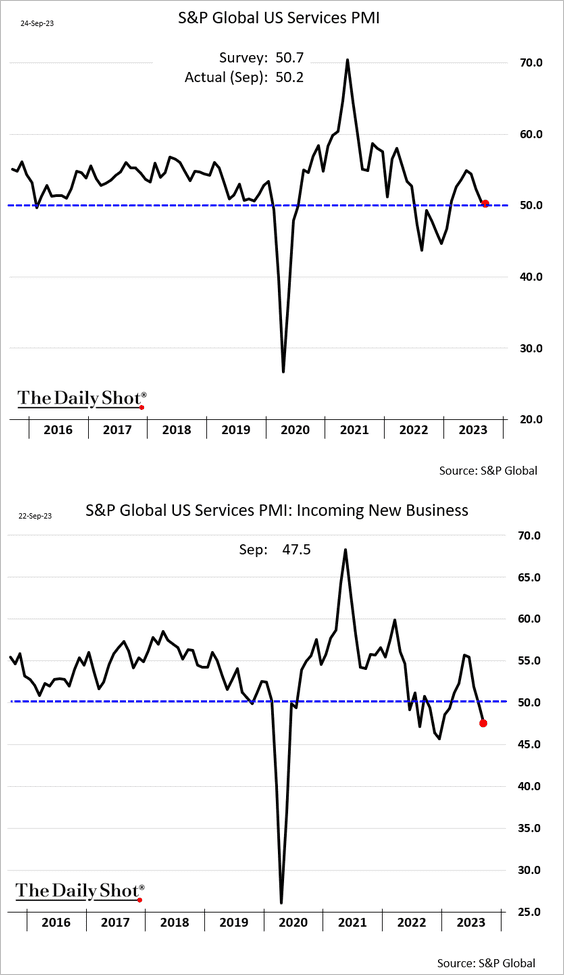

2. US financial conditions have been tightening, driven by a stronger US dollar, higher yields, wider credit spreads, and a pullback in stocks.

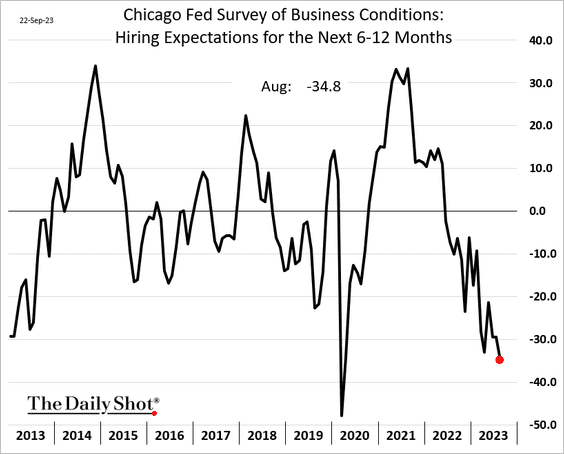

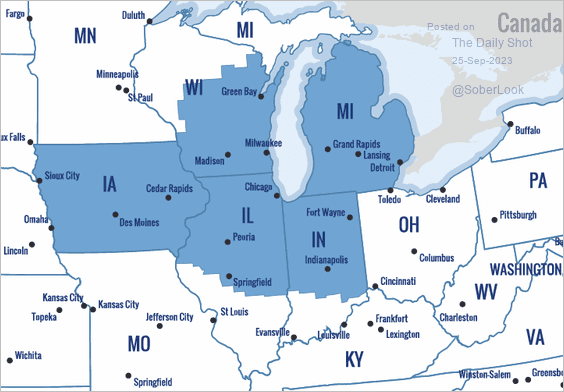

3. A survey by the Chicago Fed indicates that businesses in the Midwest region (refer to the Seventh Federal Reserve District map below) are rapidly reducing hiring.

Source: Federal Reserve Bank of Chicago

Source: Federal Reserve Bank of Chicago

——————–

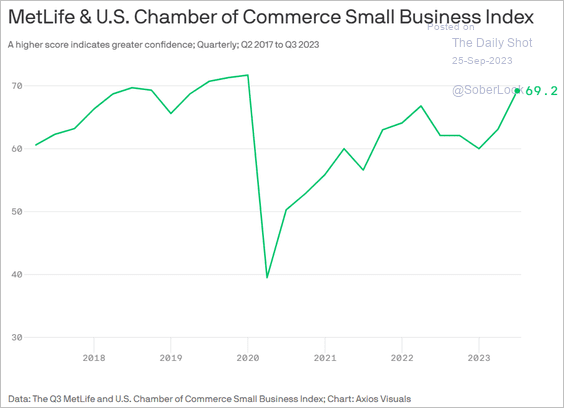

4. The MetLife & US Chamber of Commerce Small Business Index paints a different picture from the NFIB’s small business sentiment indicator.

Source: @axios Read full article

Source: @axios Read full article

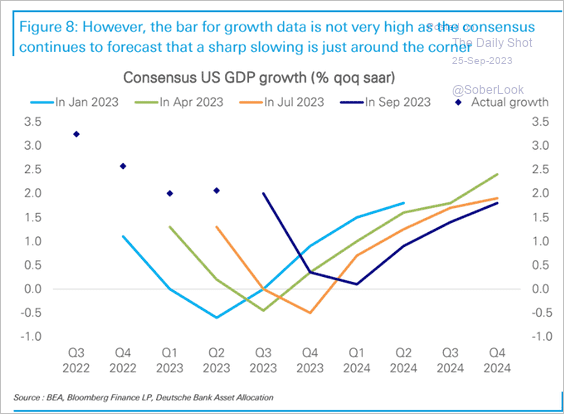

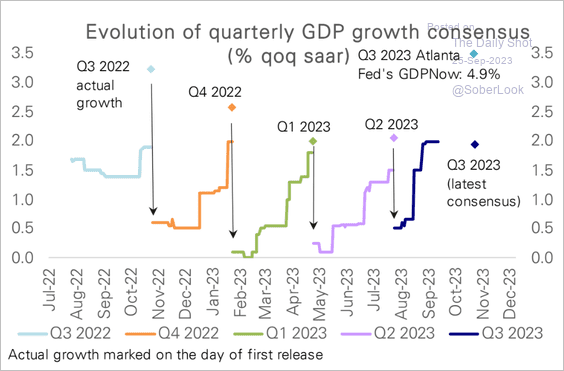

5. Economists still forecast a sharp slowdown ahead but no longer expect a recession (median consensus estimate).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Growth has been surprising to the upside.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

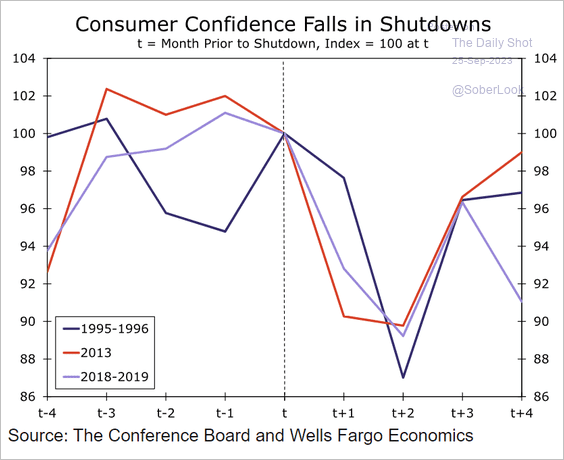

6. Consumer confidence is expected to deteriorate as the government shutdown looms.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

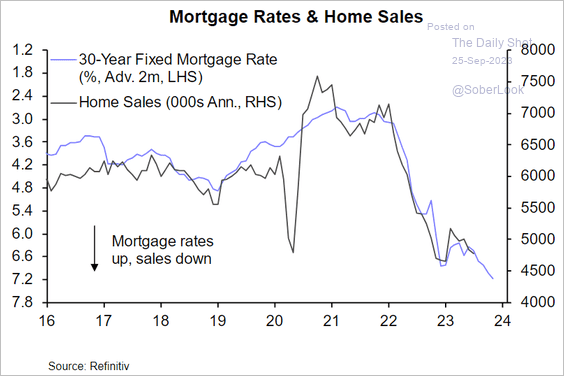

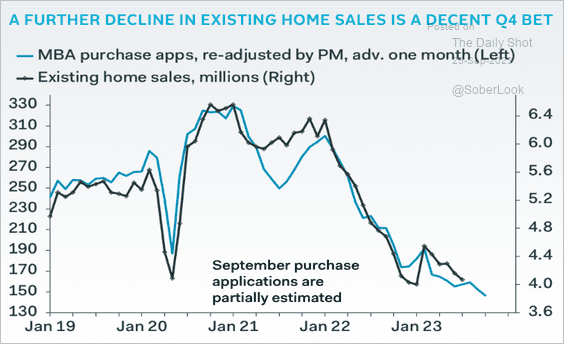

7. Elevated mortgage rates, combined with mortgage applications at multi-year lows (2nd chart), indicate further declines in home sales.

Source: Capital Economics

Source: Capital Economics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

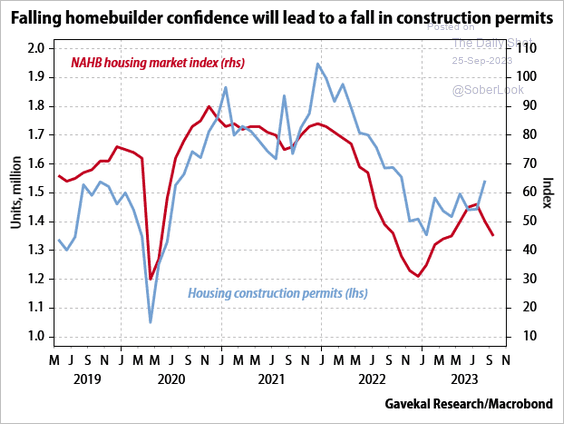

• Weak homebuilder confidence signals a slowdown in residential construction.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Canada

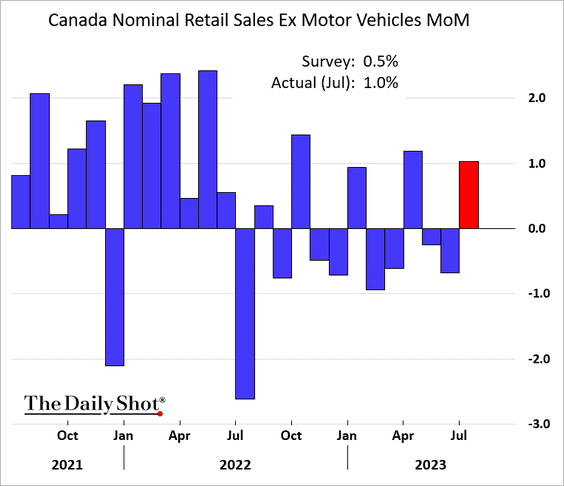

1. Retail sales were stronger than expected in July.

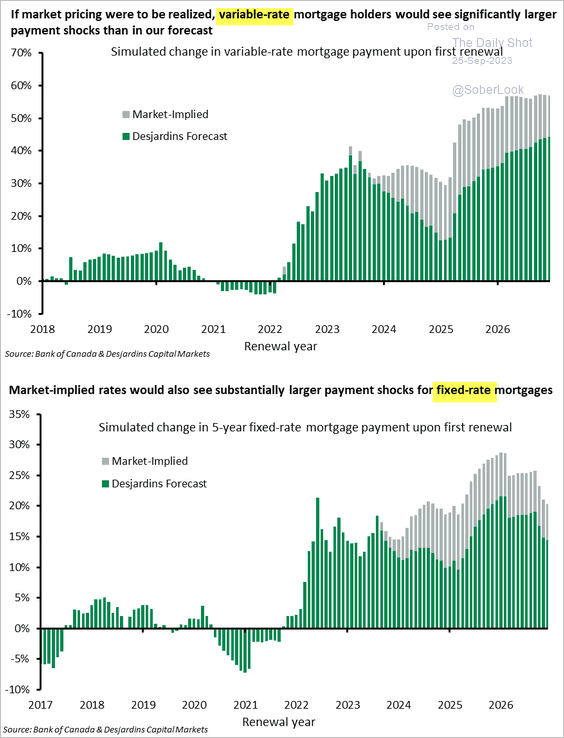

2. Fixed-income markets are pricing a substantial rate shock for mortgage holders ahead.

Source: Desjardins

Source: Desjardins

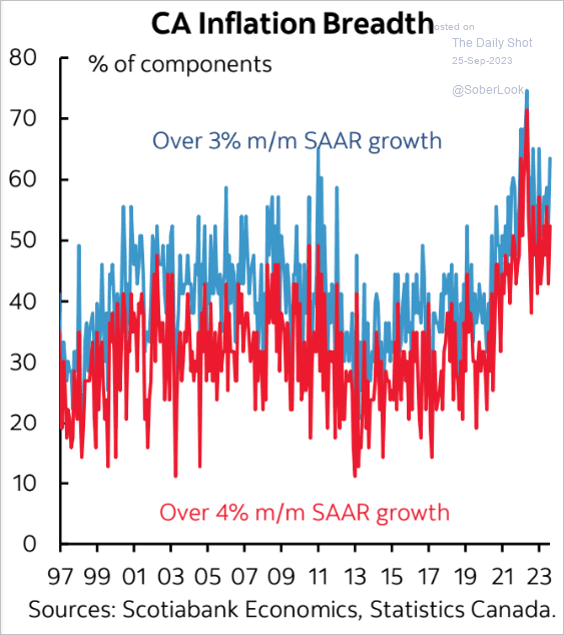

3. The CPI breadth remains elevated.

Source: Scotiabank Economics

Source: Scotiabank Economics

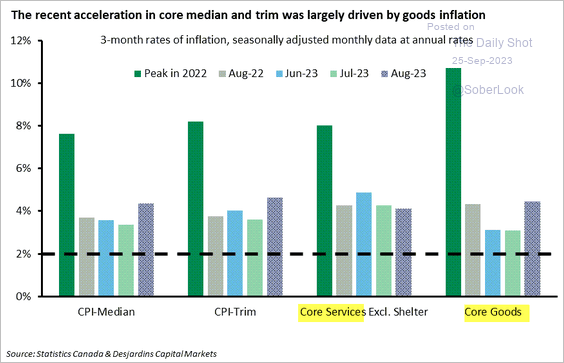

• The August CPI acceleration was driven by goods.

Source: Desjardins

Source: Desjardins

——————–

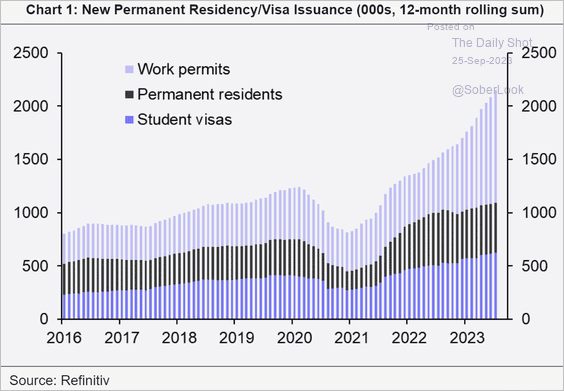

4. Here is a look at permanent residency and visa issuance.

Source: Capital Economics

Source: Capital Economics

Back to Index

The United Kingdom

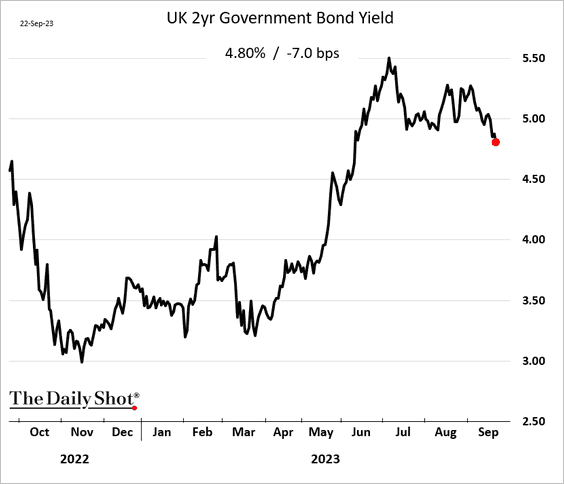

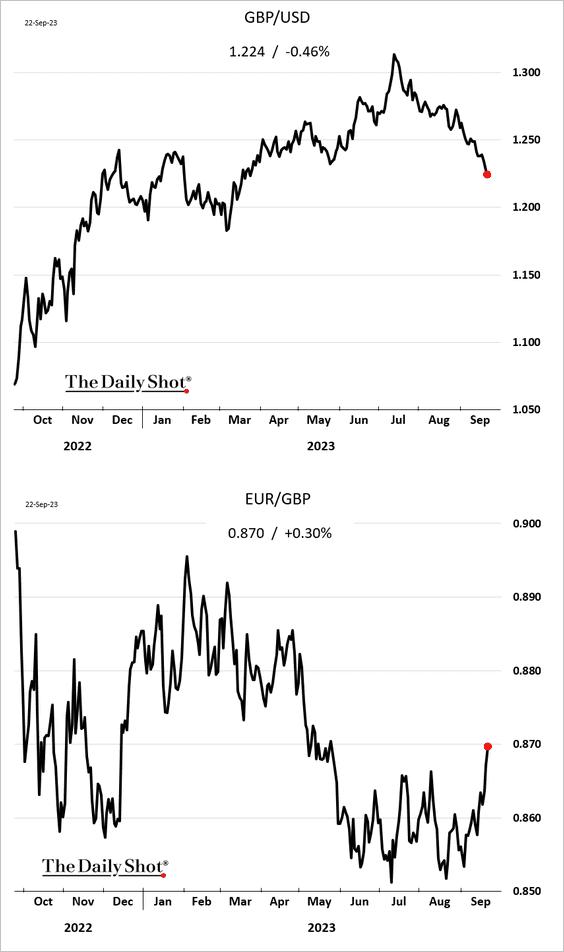

1. Gilt yields and the pound continue to trend lower.

——————–

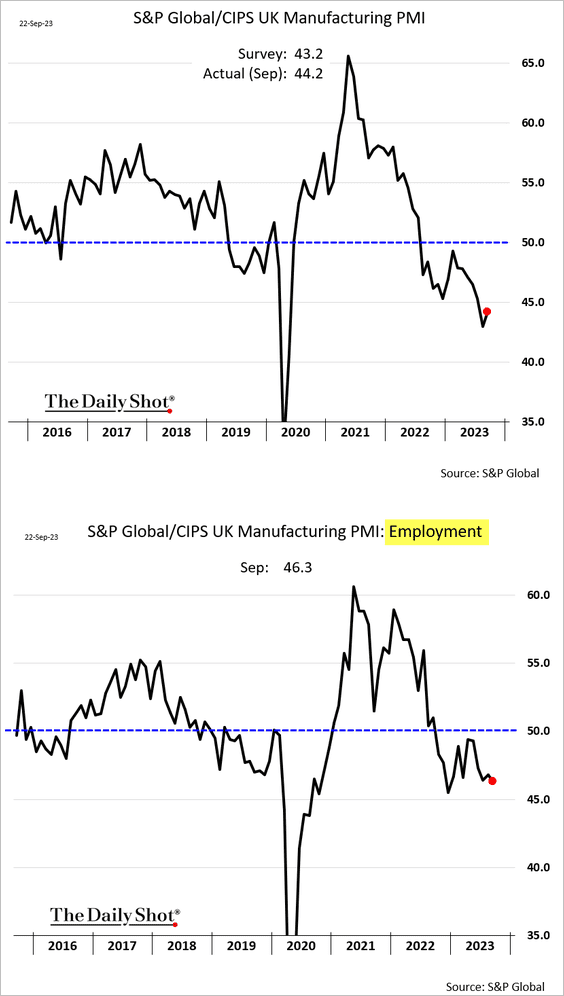

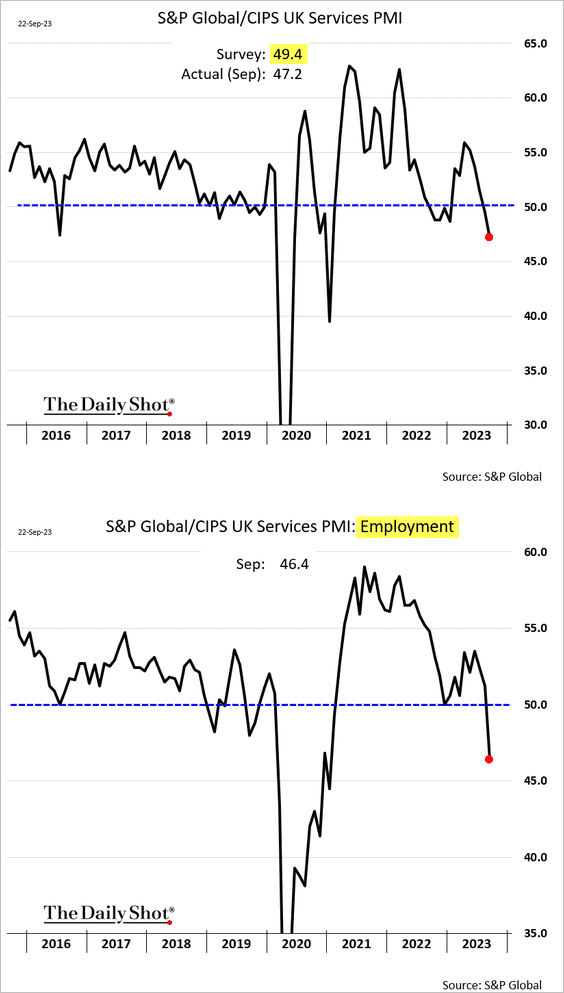

2. The September flash PMI report confirmed persistent weakness in business activity. The labor market faces incresing headwinds.

• Manufacturing:

• Services:

Here is the composite PMI.

Source: S&P Global PMI

Source: S&P Global PMI

Source: @economics Read full article

Source: @economics Read full article

——————–

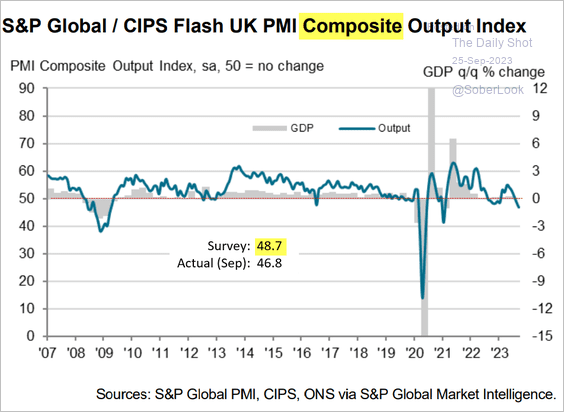

3. The CBI reported softer industrial orders this month.

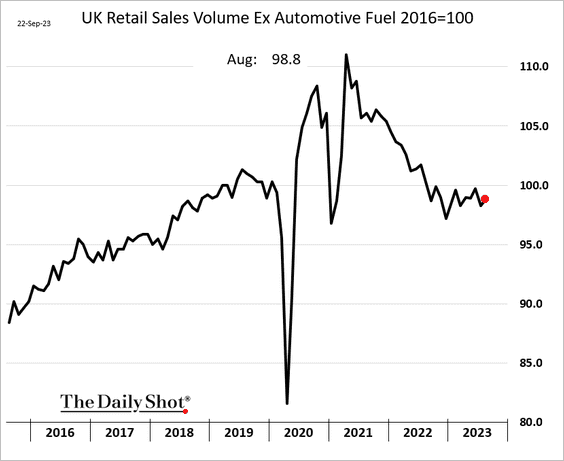

4. Retail sales edged higher in August.

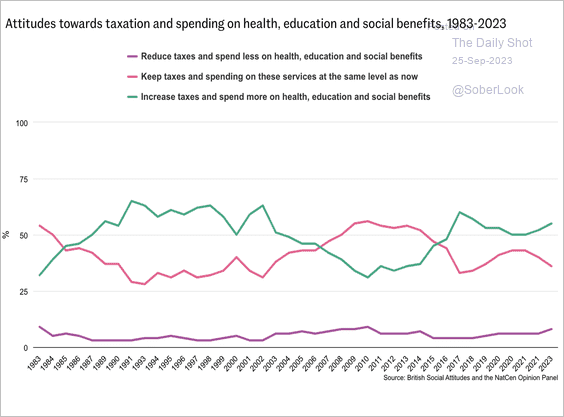

5. Britons want higher taxes …

Source: National Centre for Social Research Read full article

Source: National Centre for Social Research Read full article

Back to Index

The Eurozone

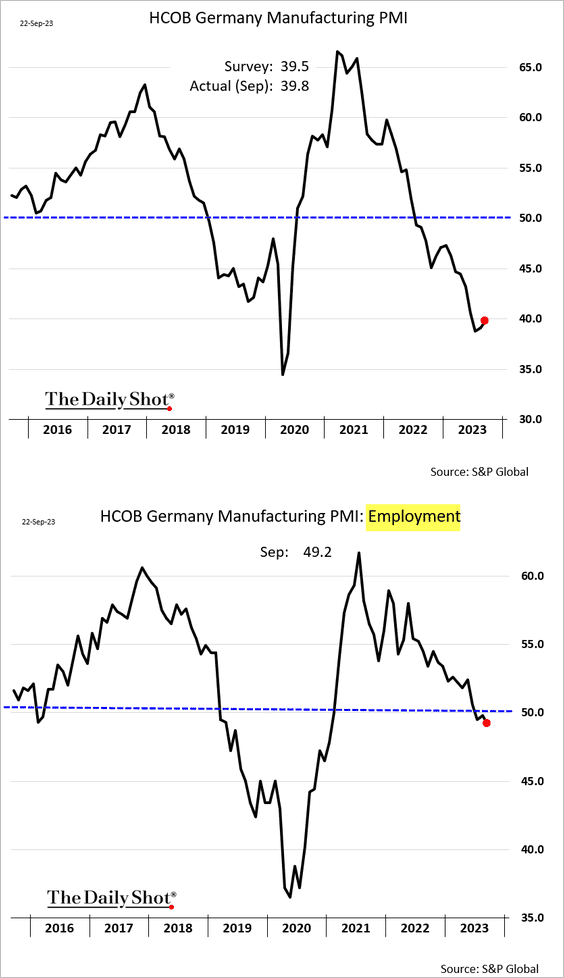

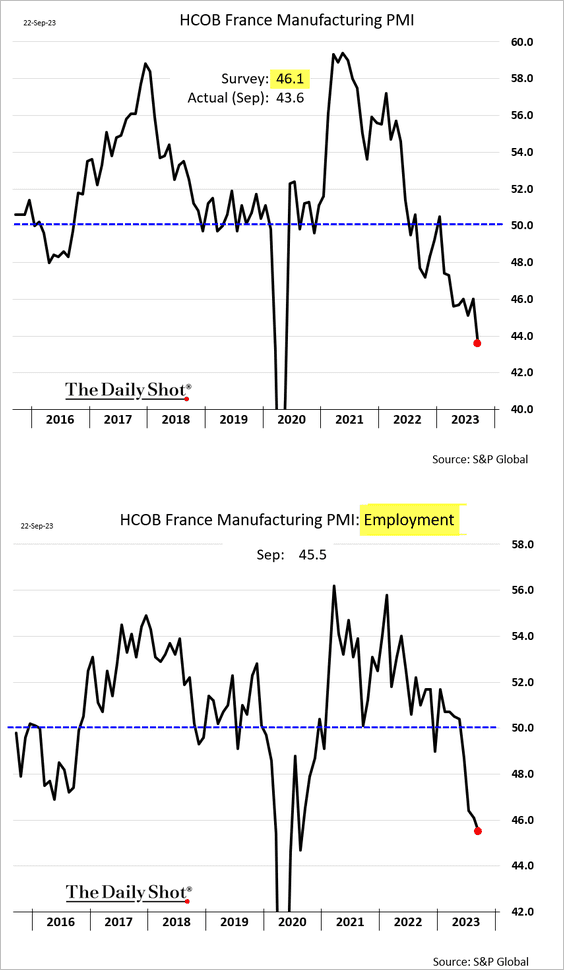

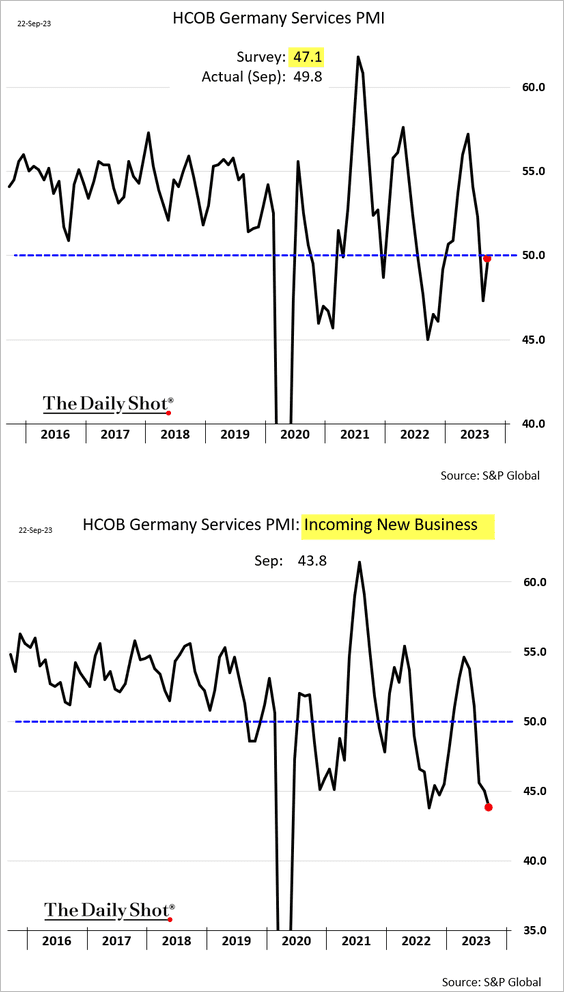

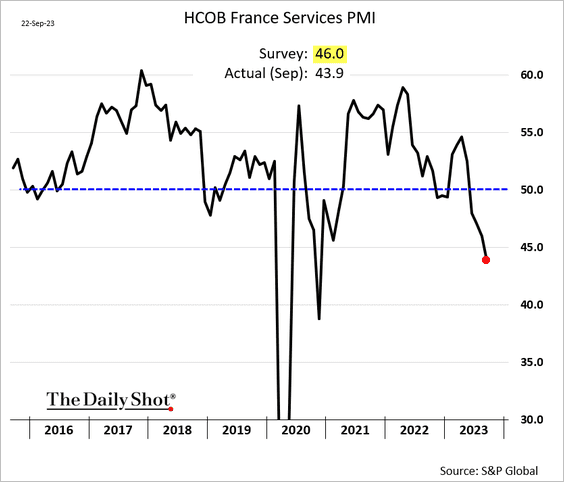

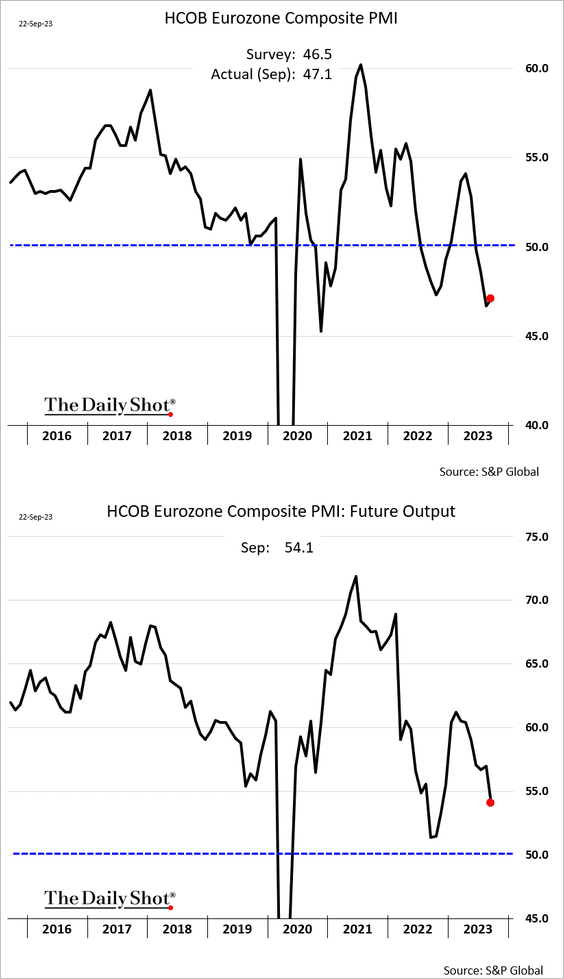

1. The flash PMI report suggests that business activity continued to contract this month.

• Manufacturing (the labor market is under pressure):

– Germany:

– France

• Services:

– Germany:

– France:

• Composite PMI (weakening outlook):

Source: @economics Read full article

Source: @economics Read full article

——————–

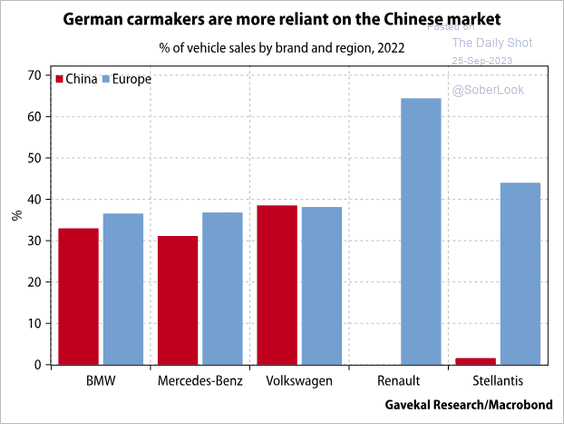

2. Which German carmakers are most exposed to China?

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Europe

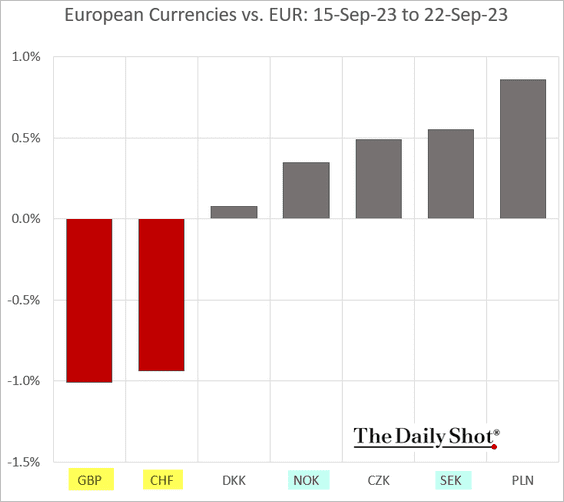

1. Switzerland and the UK, which held rates unchanged, saw their currencies underperform last week.

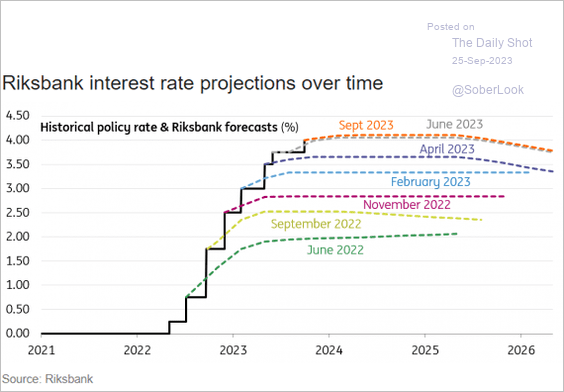

2. Riksbank’s rate projections this month were almost unchanged from June.

Source: ING

Source: ING

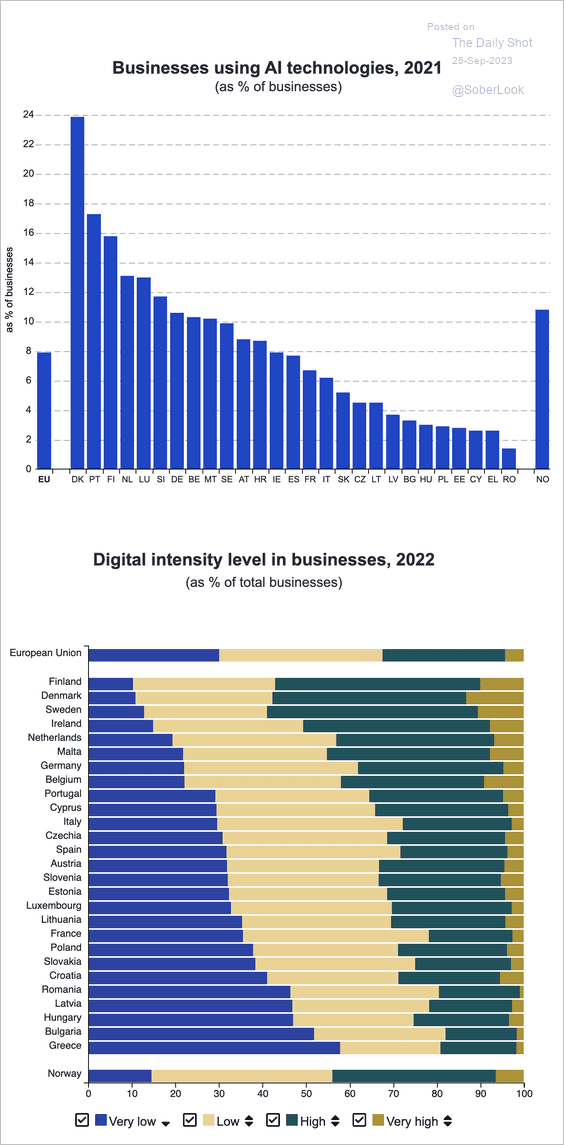

3. Here is a look at AI usage in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

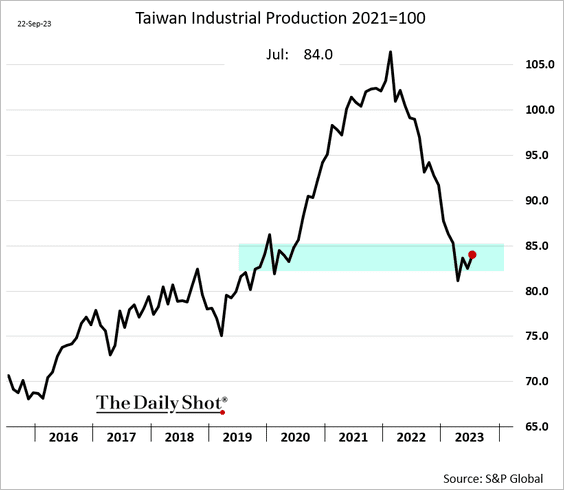

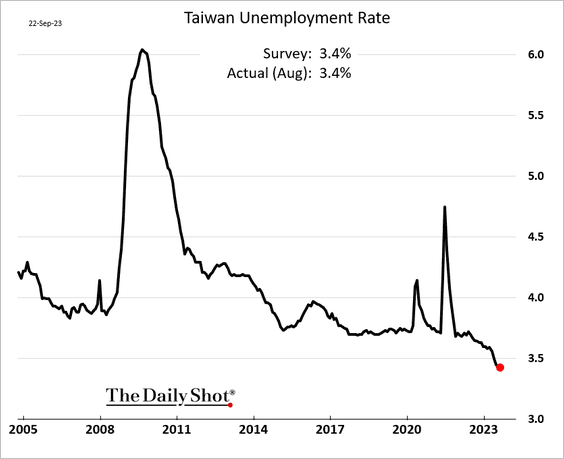

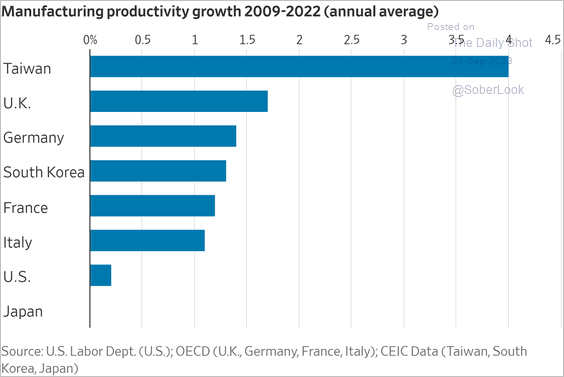

1. Let’s begin with Taiwan.

• Industrial production is running at pre-COVID levels.

• The unemployment rate remains at multi-year lows.

• Productivity growth has been very strong.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

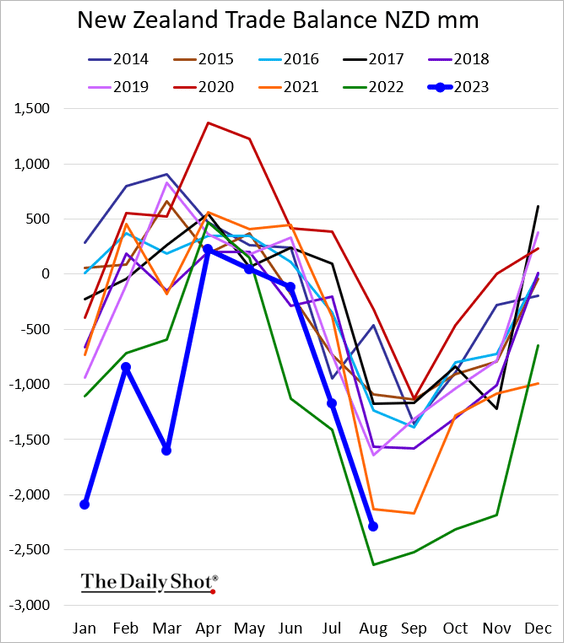

2. New Zealand’s trade deficit remains elevated.

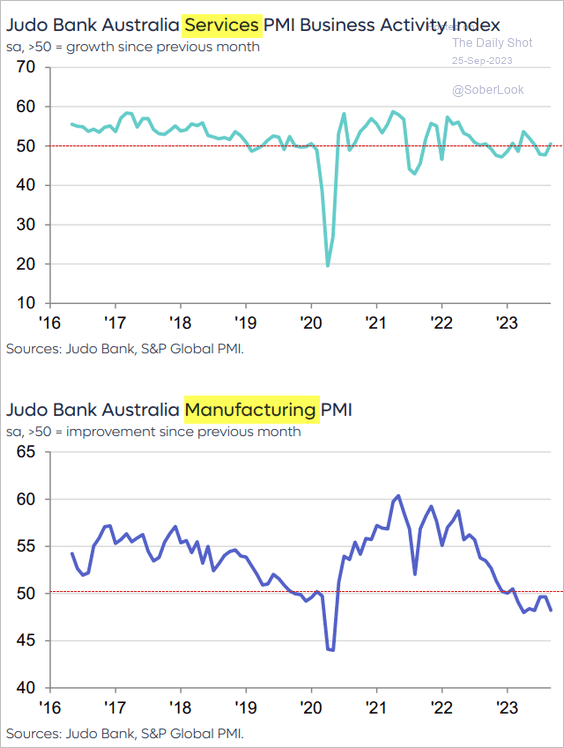

3. Australia’s services are back in growth mode, but manufacturing contraction accelerated this month.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

China

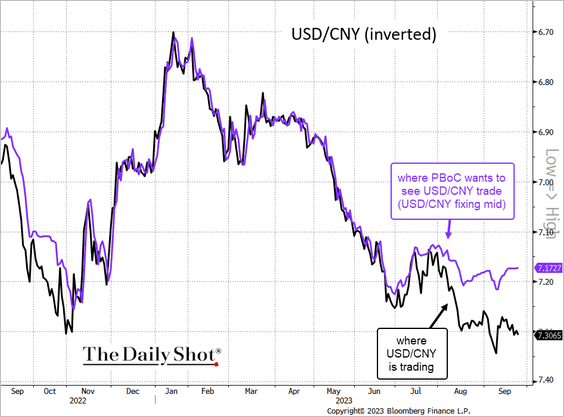

1. The PBoC is struggling to strengthen the renminbi.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

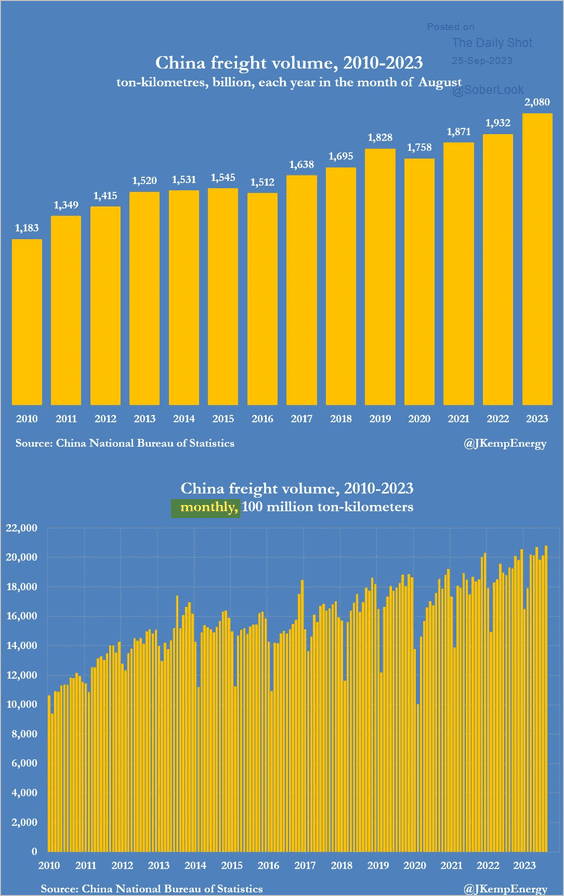

2. Domestic freight volume has been strong.

Source: @JKempEnergy

Source: @JKempEnergy

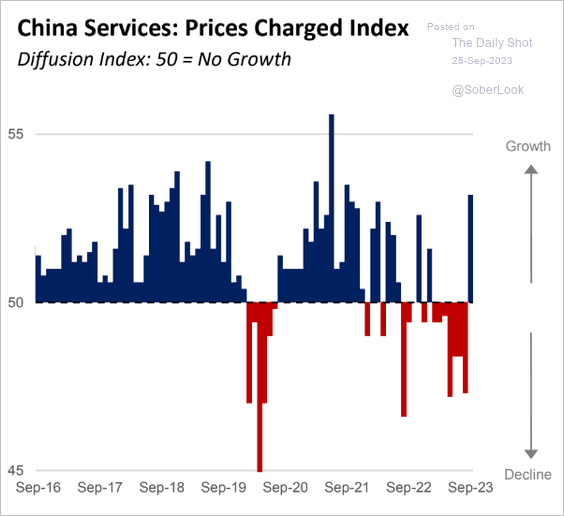

3. According to the World Economics SMI report, inflation has returned to China’s services sector.

Source: World Economics

Source: World Economics

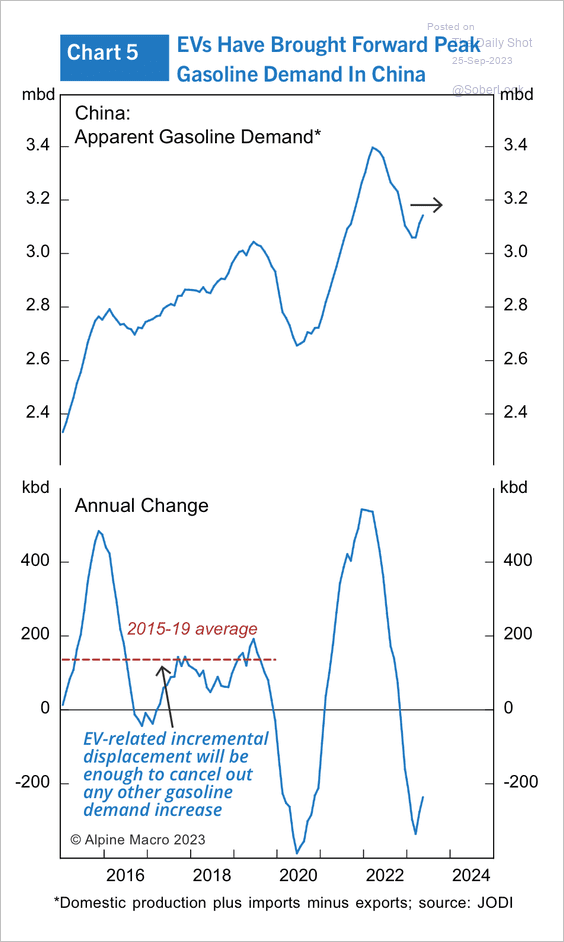

4. Has China reached peak gasoline demand?

Source: Alpine Macro

Source: Alpine Macro

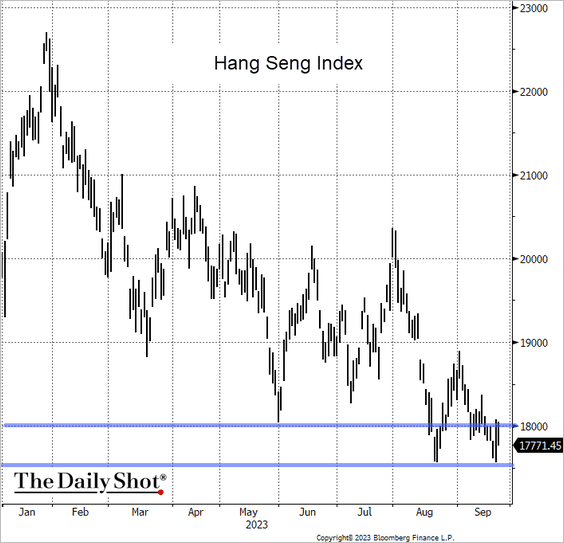

5. The Hang Seng Index continues to struggle.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Emerging Markets

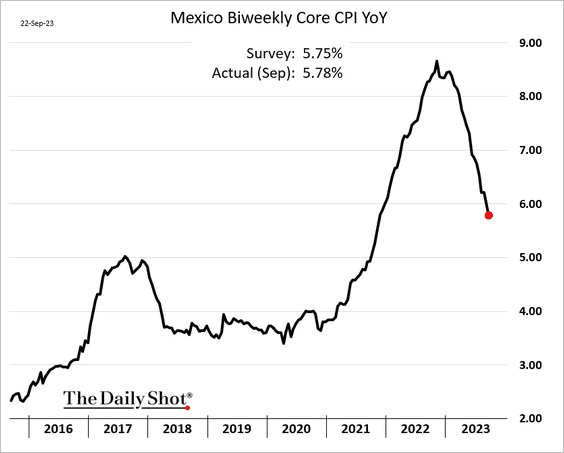

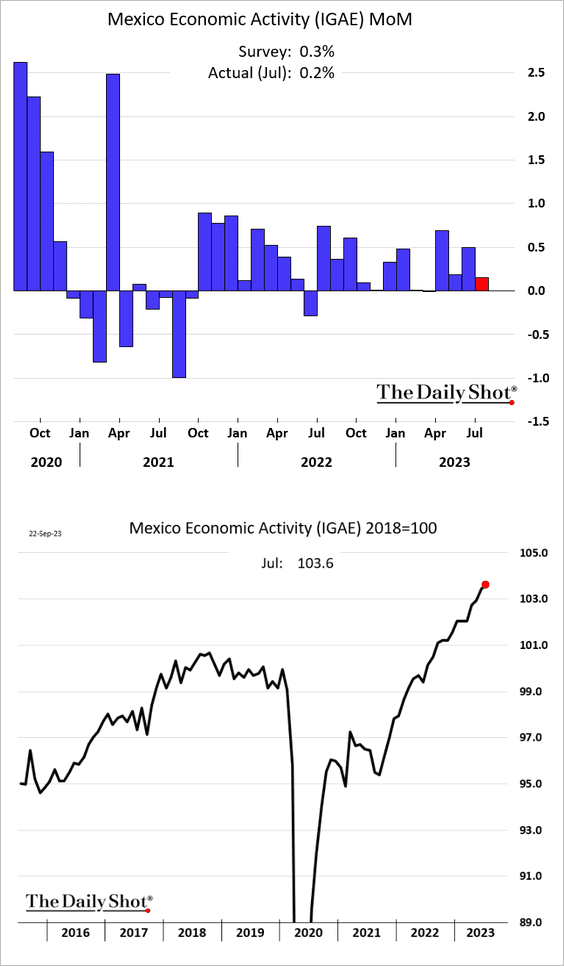

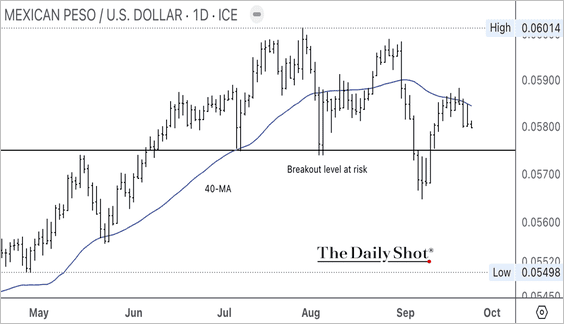

1. Let’s begin with Mexico.

• Inflation continues to ease.

• Economic activity edged higher in July. The trend remains strong.

• MXN/USD is capped below resistance at its 40-day moving average as long-term momentum weakens.

——————–

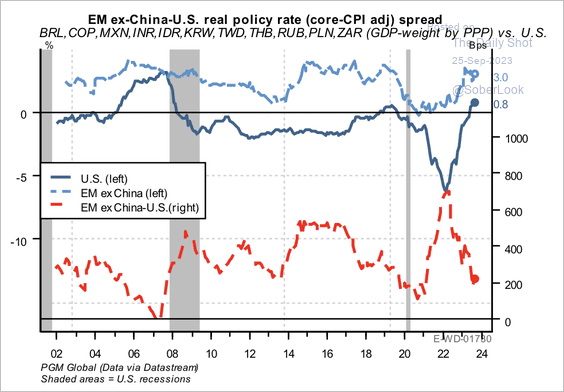

2. Real rate differentials are less supportive of EM carry trades.

Source: PGM Global

Source: PGM Global

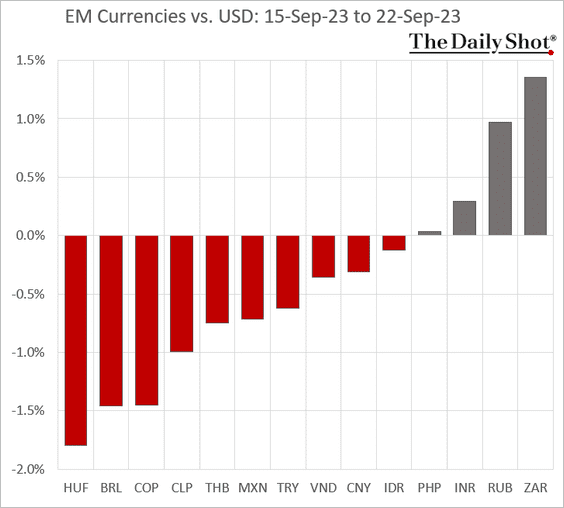

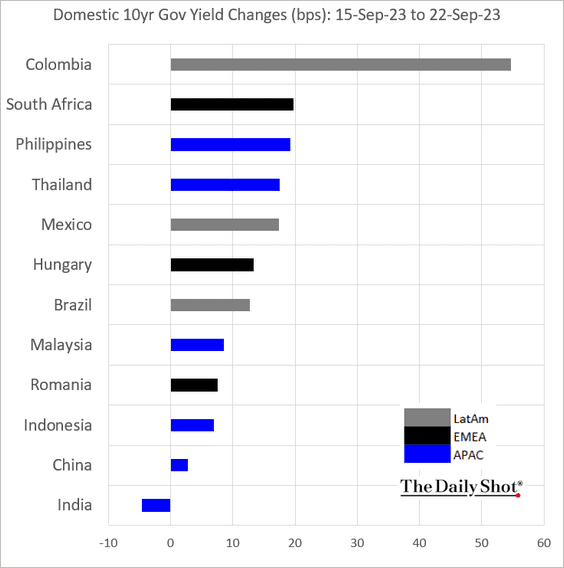

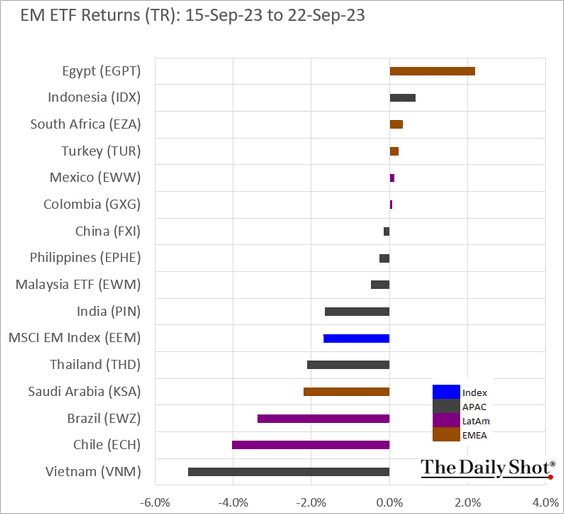

3. Here is last week’s performance data.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

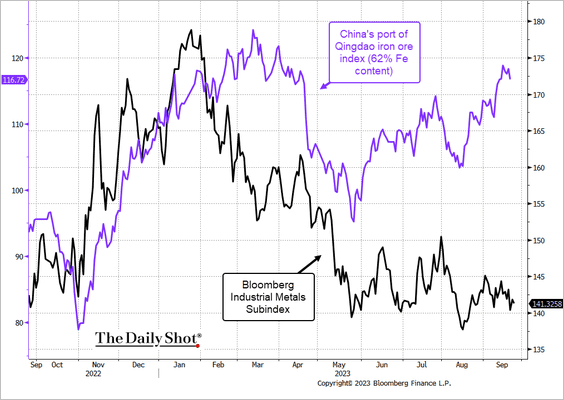

1. Iron ore prices have diverged from Bloomberg’s industrial metals index.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t BCA Research

Source: @TheTerminal, Bloomberg Finance L.P.; h/t BCA Research

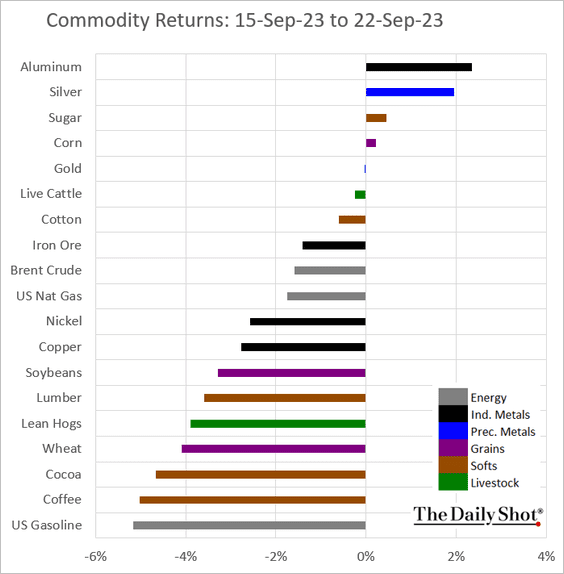

2. Here is a look at last week’s performance across key commodity markets.

Back to Index

Energy

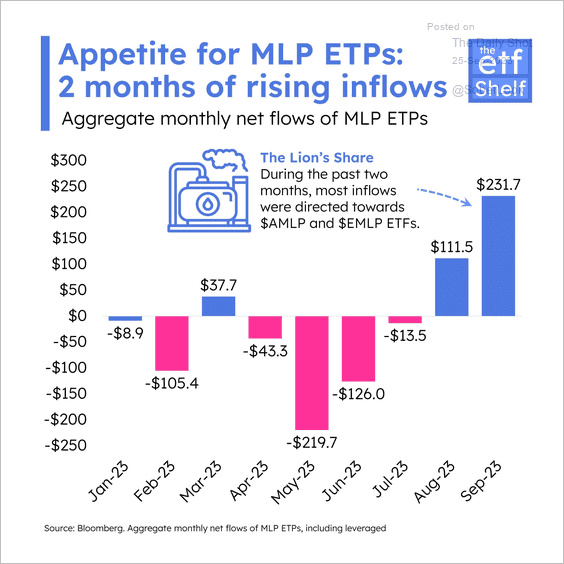

1. Inflows into MLP ETFs are rising.

Source: The ETF Shelf

Source: The ETF Shelf

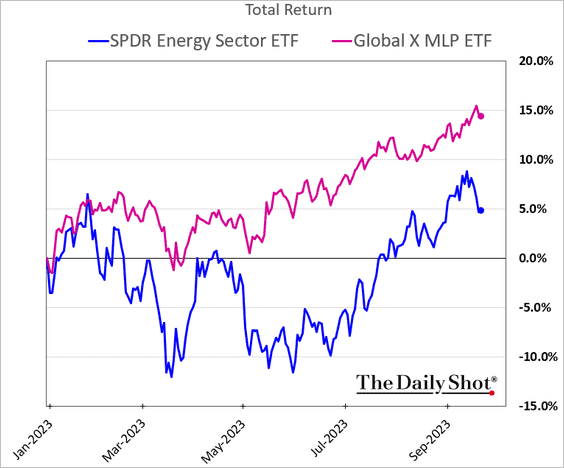

MLPs have outperformed the energy sector this year.

——————–

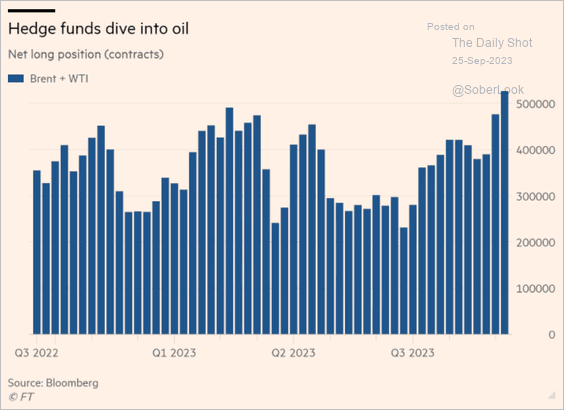

2. Hedge funds helped drive oil prices higher in recent weeks.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

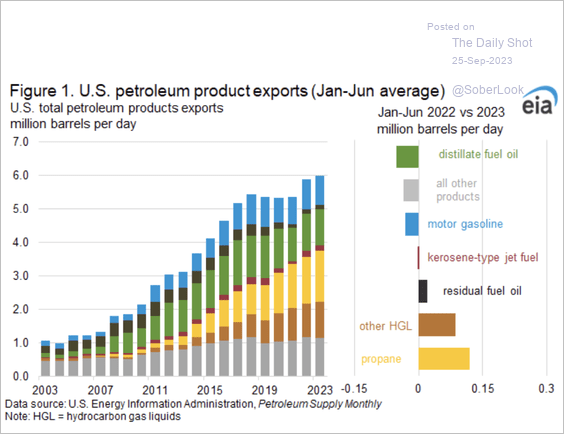

3. Next, we have US petroleum product exports.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

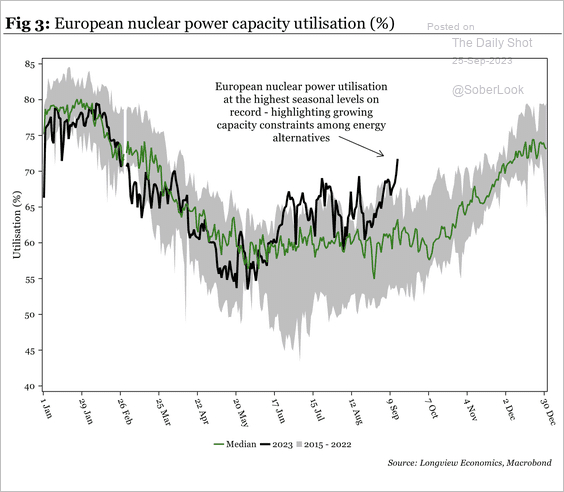

4. European nuclear power capacity utilization is trending above seasonal norms as the rivers used for French reactor cooling return to a more typical temperature.

Source: Longview Economics

Source: Longview Economics

Back to Index

Equities

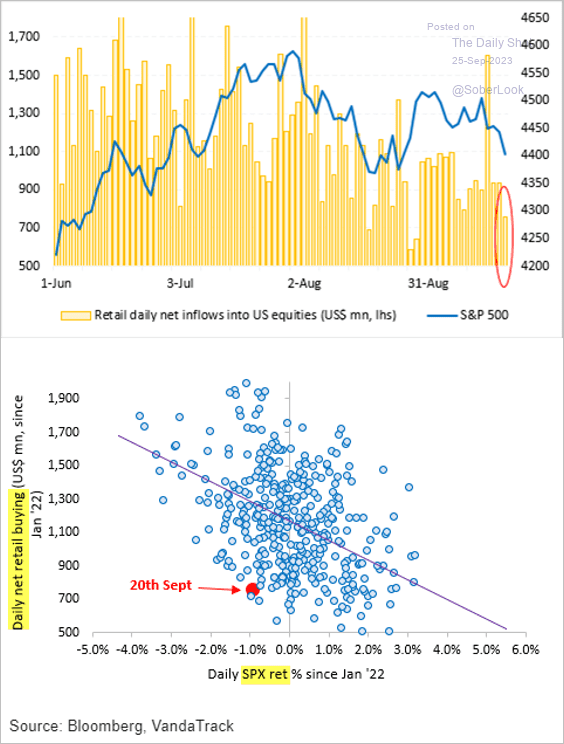

1. Retail investors are not as keen on buying the dip in the current selloff.

Source: Vanda Research

Source: Vanda Research

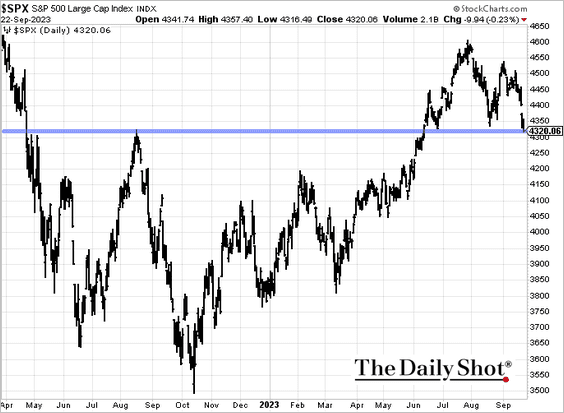

2. Will the S&P 500 hold support?

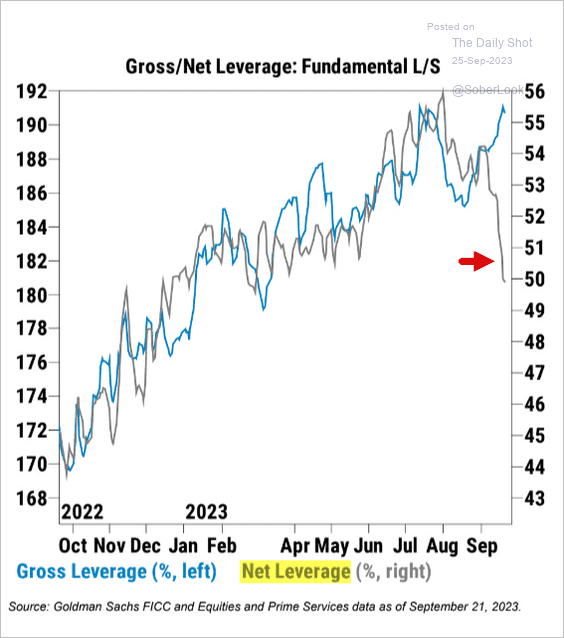

3. Long-short hedge funds have been scaling back their market exposure.

Source: Goldman Sachs; @ResearchQf

Source: Goldman Sachs; @ResearchQf

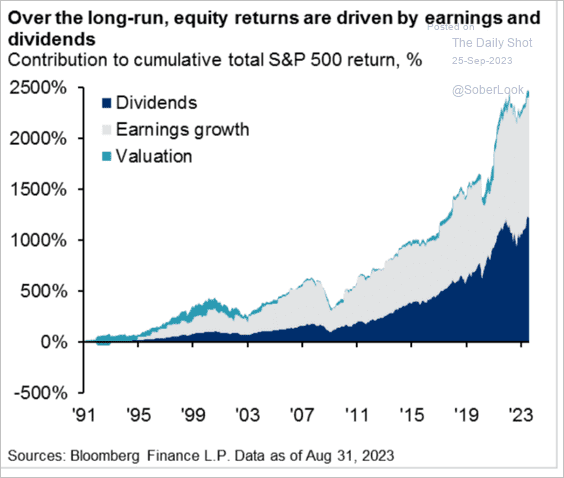

4. Over the long run, equity returns are driven by earnings and dividends.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

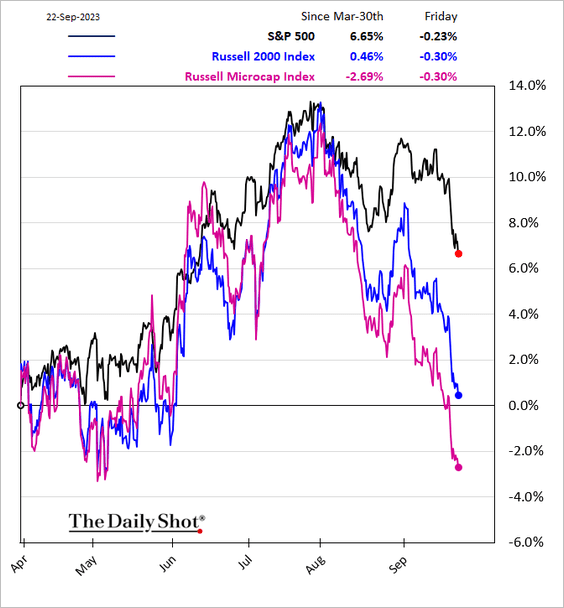

5. Microcaps are near the May lows.

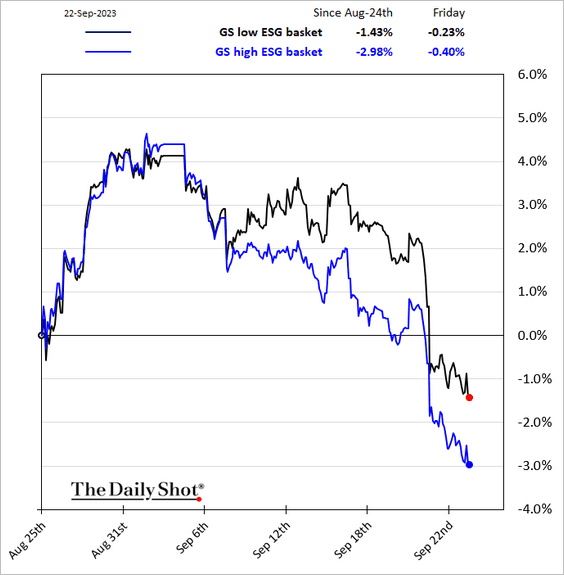

6. ESG-focused firms have been underperforming.

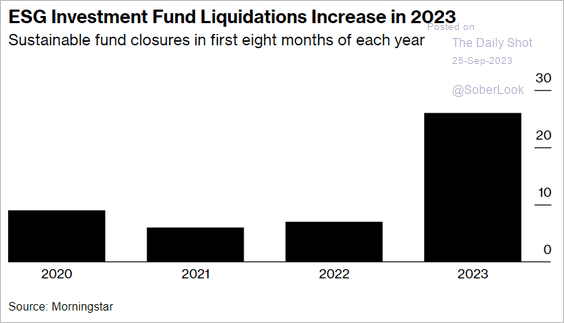

ESG fund liquidations surged this year.

Source: @markets Read full article

Source: @markets Read full article

——————–

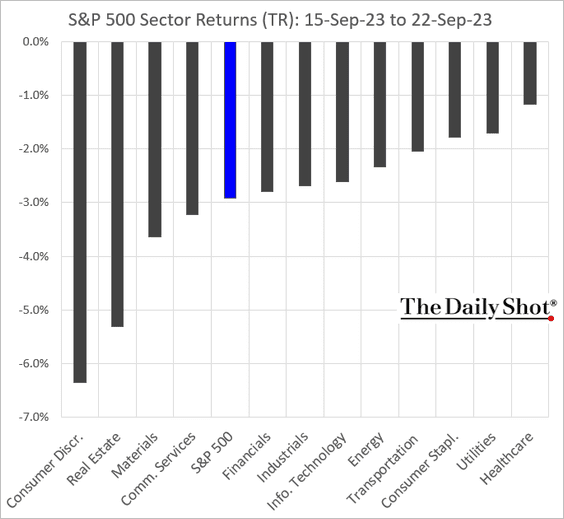

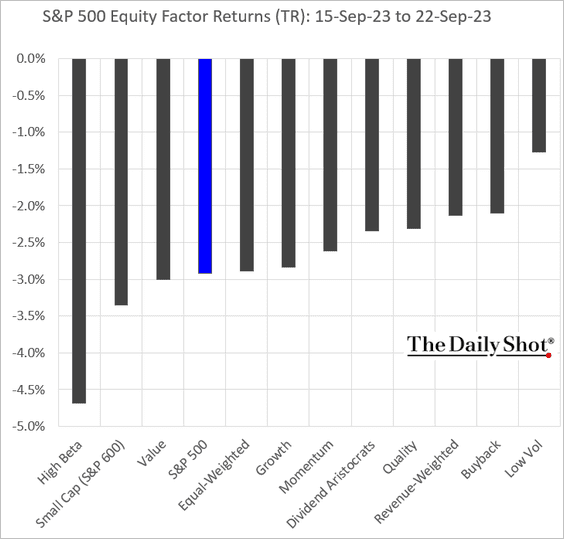

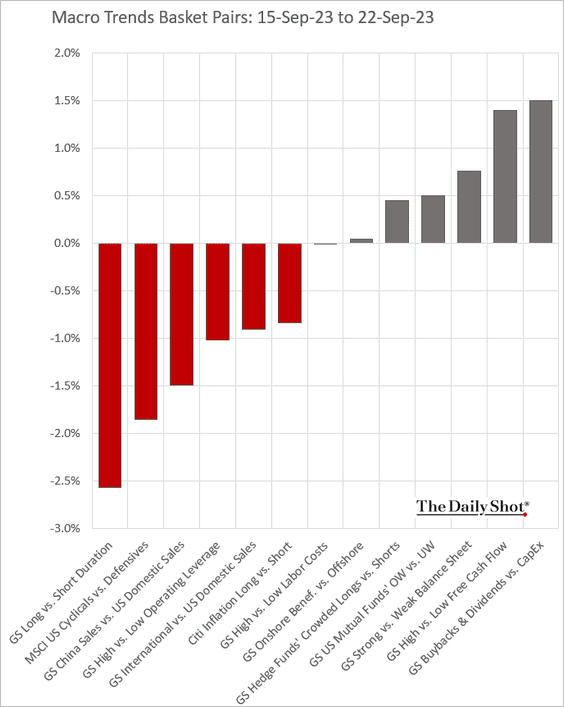

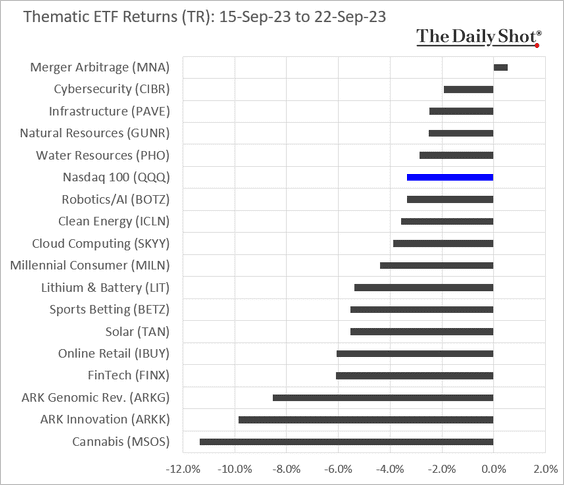

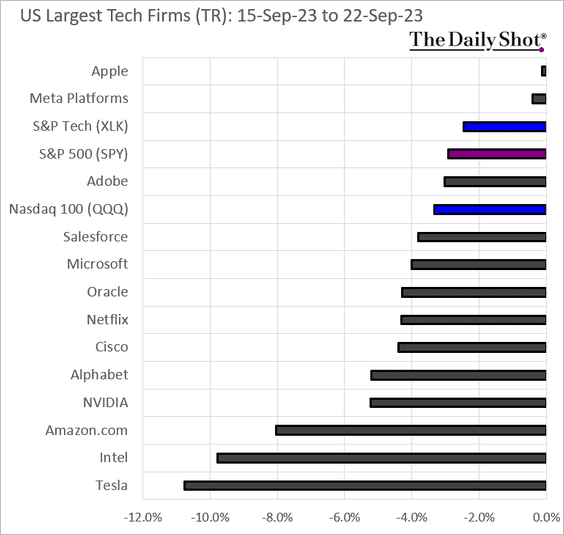

7. Next, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

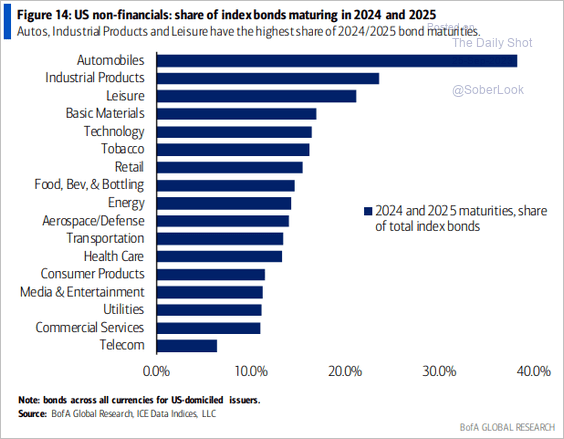

1. Which sectors have the highest share of 2024 and 2025 bond maturities?

Source: BofA Global Research; @MikeZaccardi, @TheStalwart

Source: BofA Global Research; @MikeZaccardi, @TheStalwart

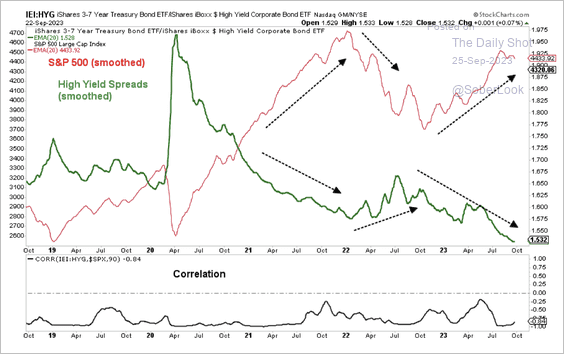

2. So far, the pullback in stocks has not triggered a rise in high-yield credit spreads.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

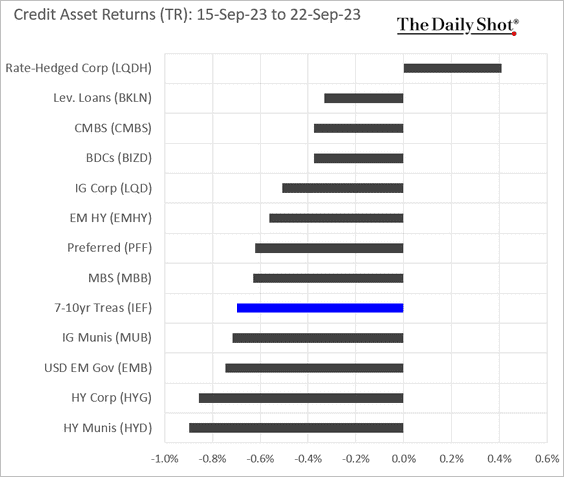

3. Here is last week’s performance data across credit asset classes. Rising rates drove much of the selloff in credit, with spreads remaining resilient.

Back to Index

Rates

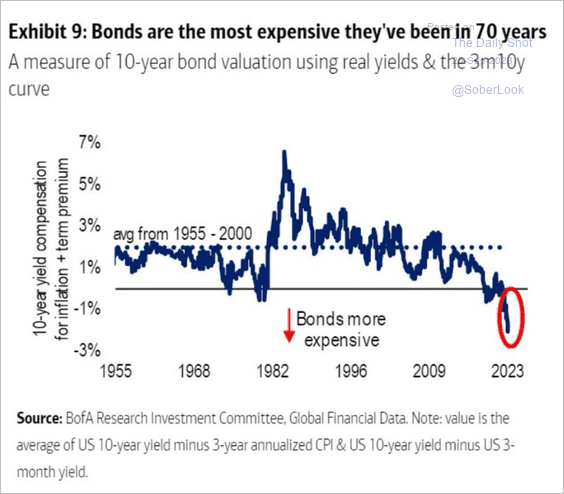

1. By some measures, Treasuries are expensive.

Source: BofA Global Research

Source: BofA Global Research

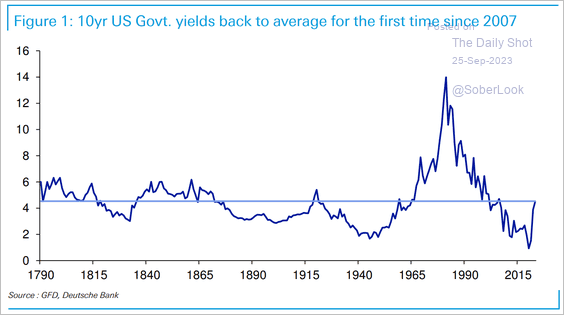

2. The 10-year Treasury yield has returned to its long-term average.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

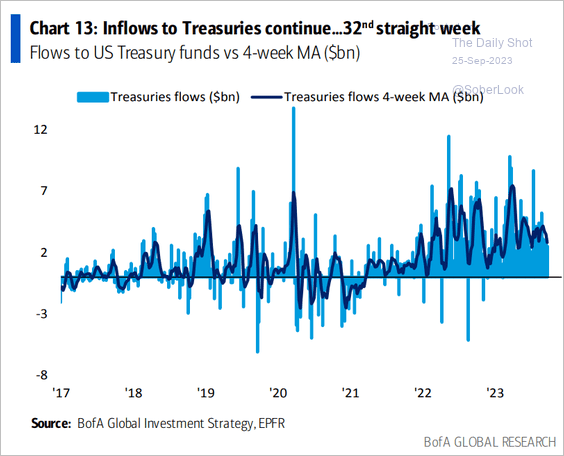

3. Treasury funds continue to register inflows.

Source: BofA Global Research

Source: BofA Global Research

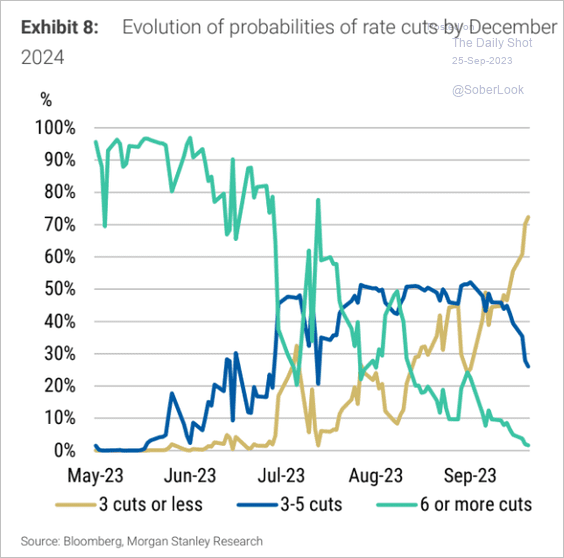

4. The market sees fewer Fed rate cuts next year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

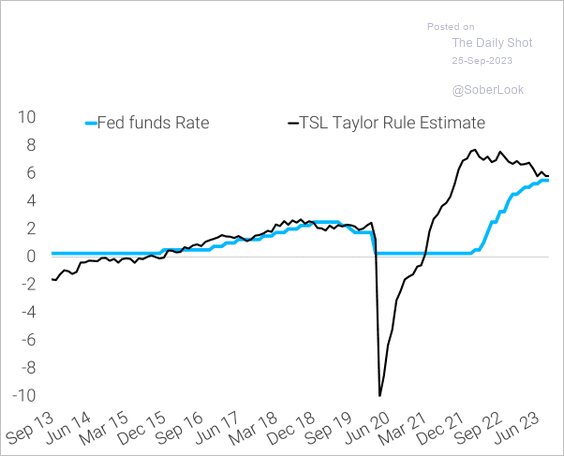

5. Here is a look at TS Lombard’s Taylor Rule estimate vs. the fed funds rate.

Source: TS Lombard

Source: TS Lombard

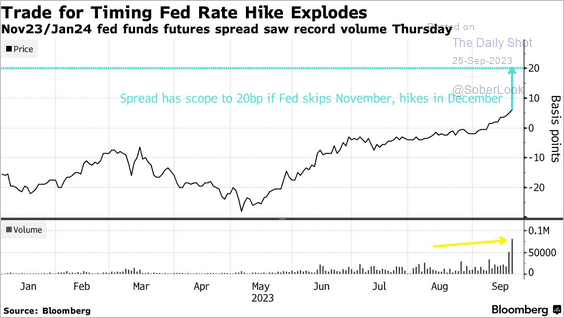

6. According to Bloomberg, …

Trading volume surged [last] week in a corner of the fed funds futures market, based on the notion that the Federal Reserve is likelier to raise rates in December than November.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Global Developments

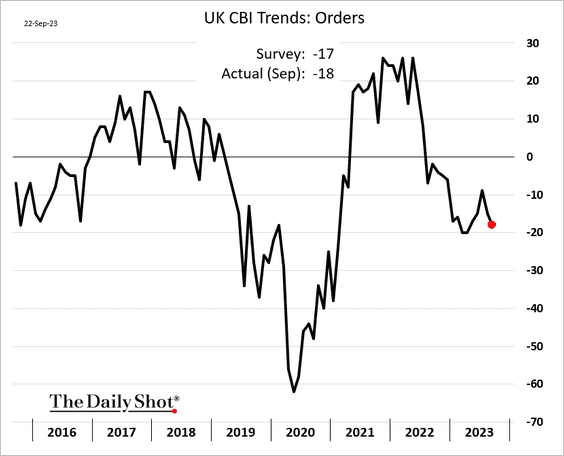

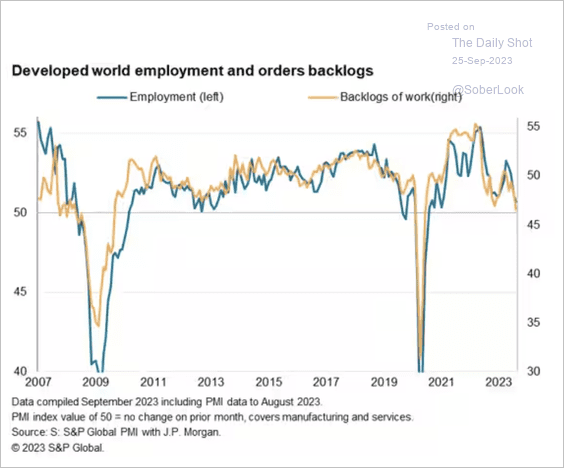

1. Slumping business demand is loosening labor markets in advanced economies.

Source: S&P Global PMI

Source: S&P Global PMI

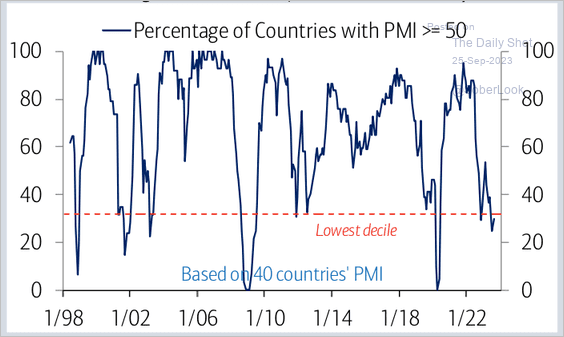

2. Only 30% of countries have manufacturing PMIs in expansion territory.

Source: BofA Global Research

Source: BofA Global Research

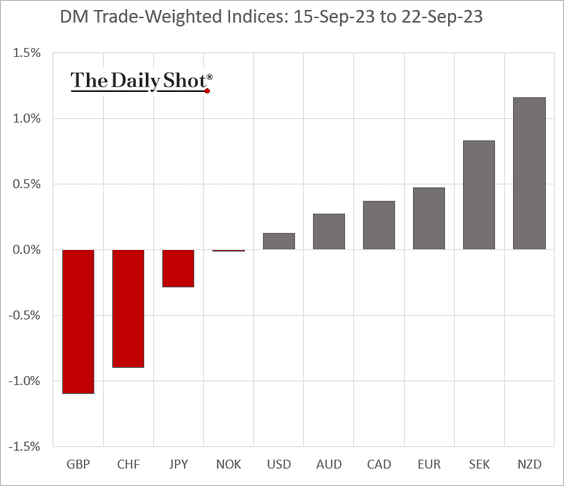

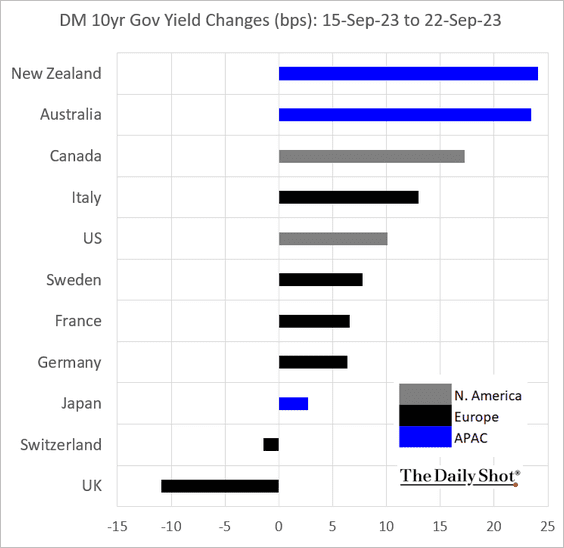

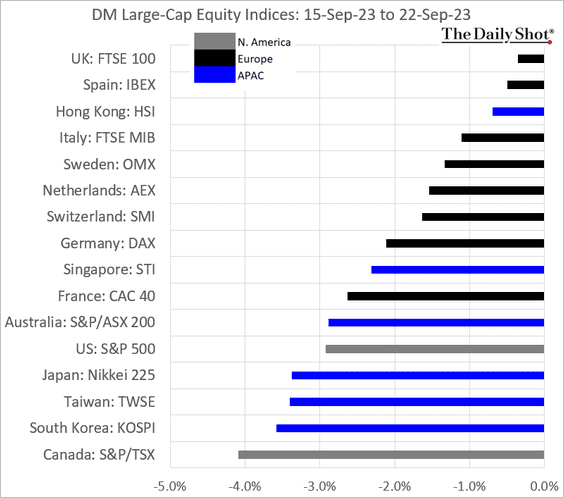

3. Finally, we have last week’s performance data for advanced economies.

• Currencies:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

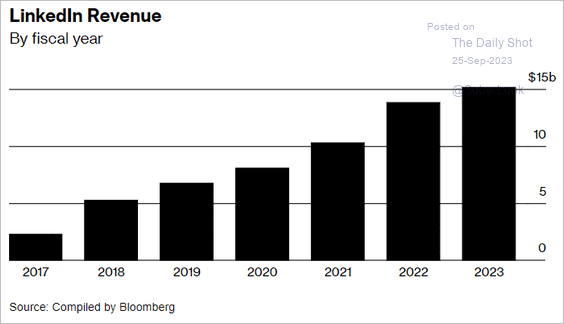

1. LinkedIn revenue:

Source: @BW Read full article

Source: @BW Read full article

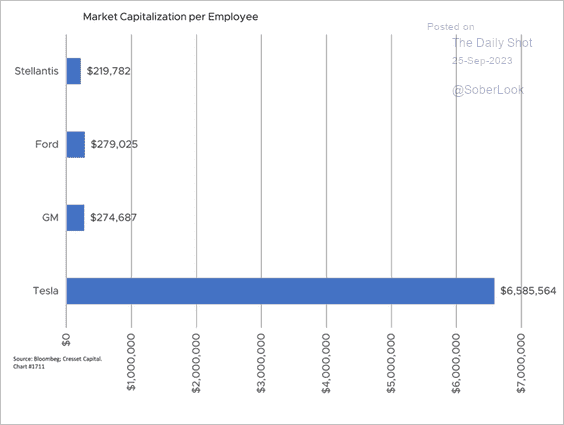

2. US automakers’ market capitalization per employee:

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

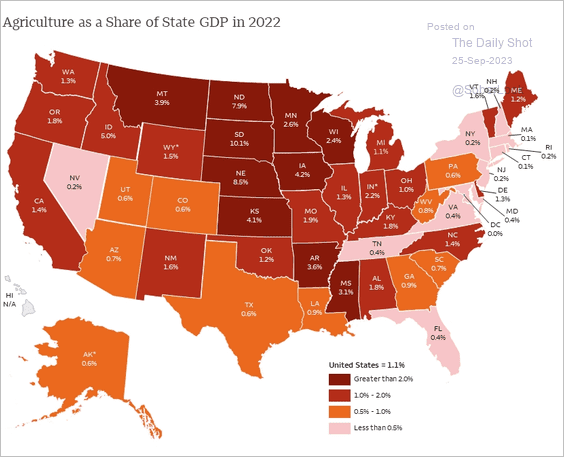

3. Agriculture as a share of each state’s GDP:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

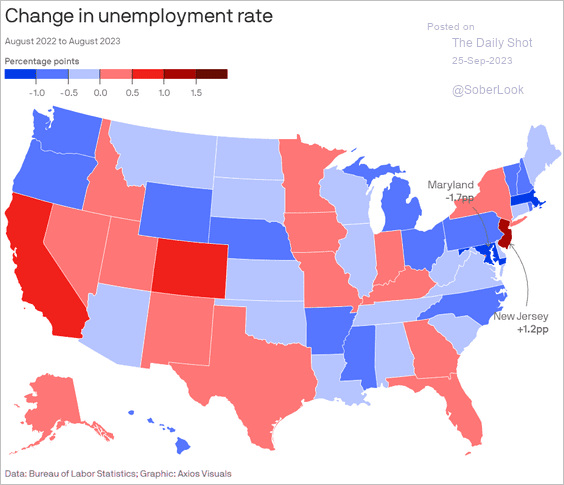

4. Changes in the unemployment rate:

Source: @axios Read full article

Source: @axios Read full article

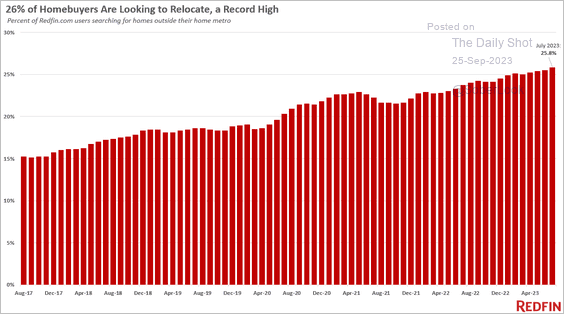

5. Americans looking to relocate:

Source: Redfin

Source: Redfin

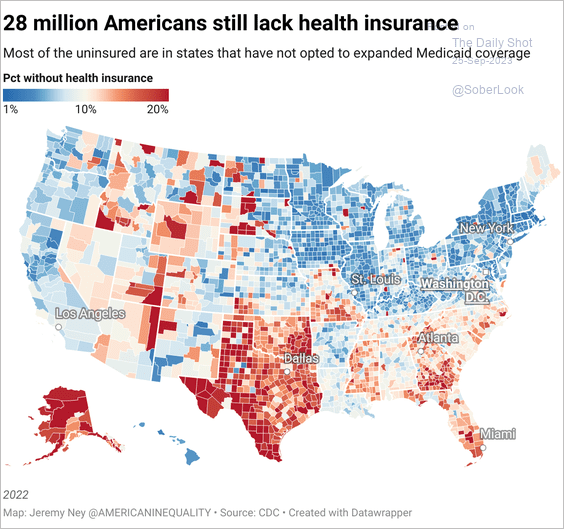

6. Americans without health insurance:

Source: @jeremybney

Source: @jeremybney

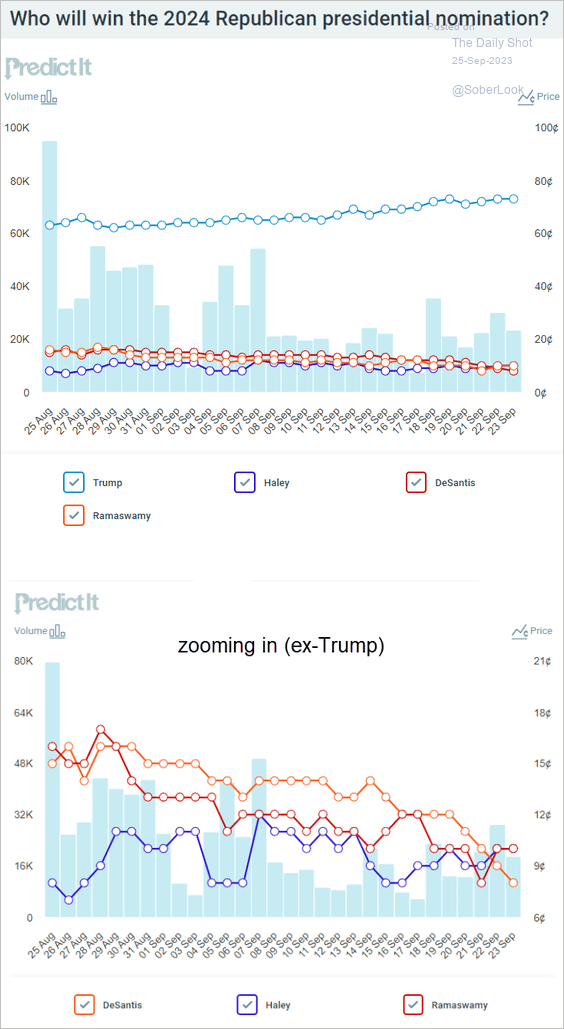

7. Betting markets’ probabilities for the 2024 GOP presidential nomination:

Source: @PredictIt

Source: @PredictIt

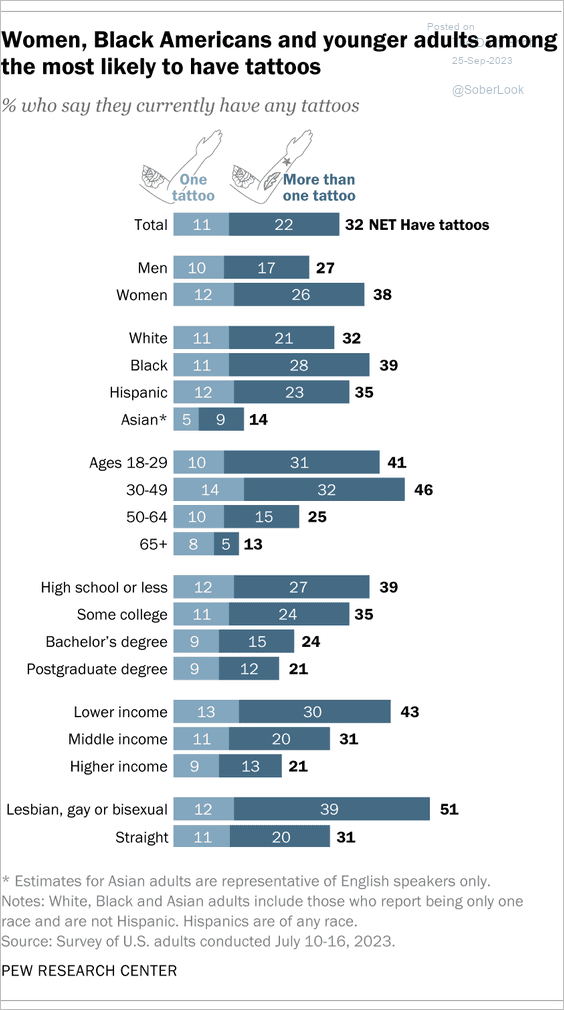

8. Who has tattoos?

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

Back to Index