The Daily Shot: 26-Sep-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

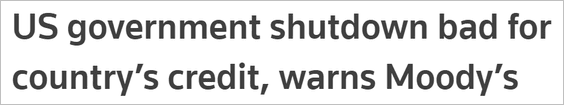

1. Moody’s warned that the government shutdown could affect its assessment of US debt.

Source: Reuters Read full article

Source: Reuters Read full article

• Treasury yields continue to hit multi-year highs, …

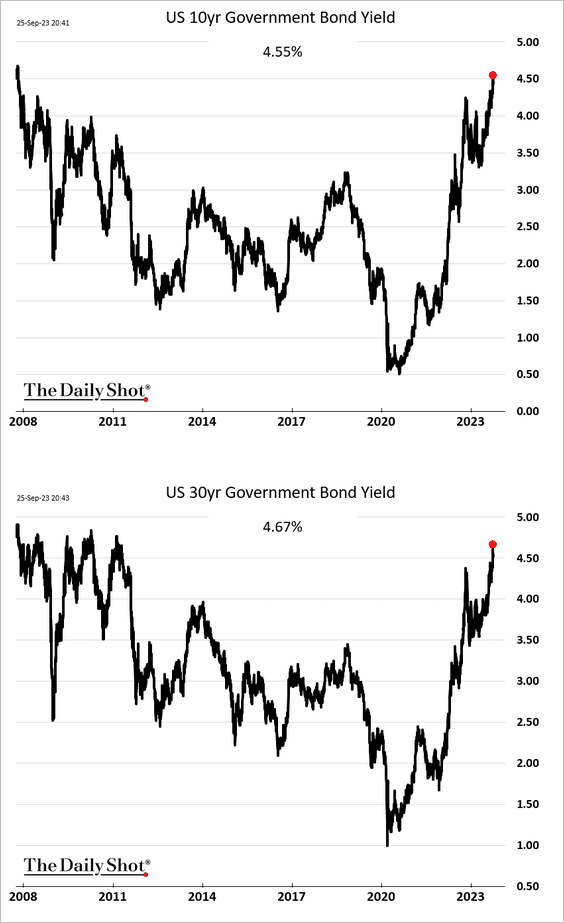

… with the yield curve steepening further.

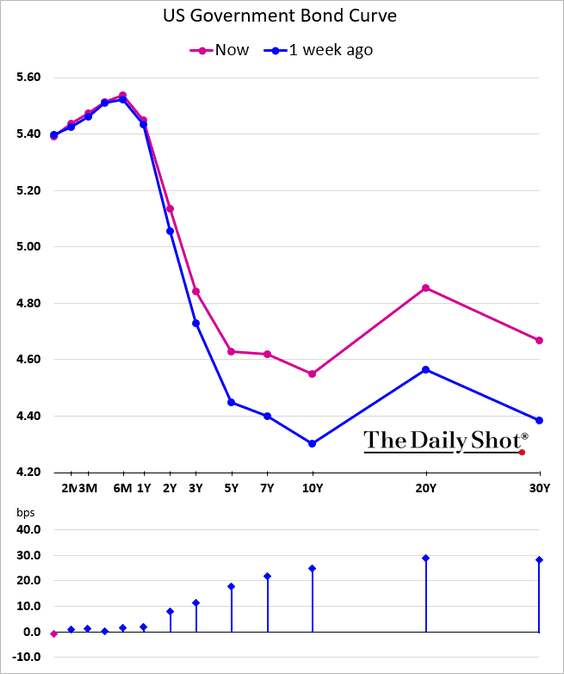

• Here is the 30-year bond price drawdown.

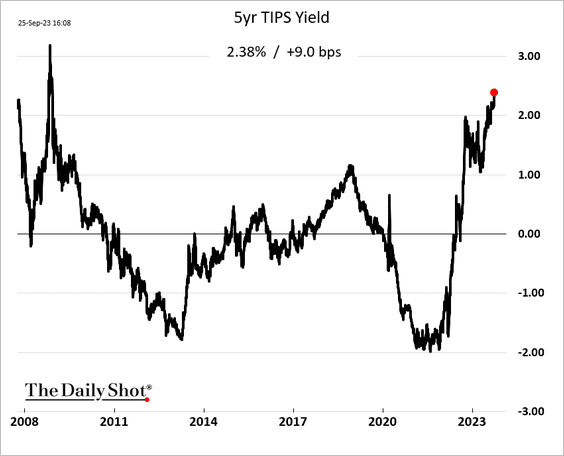

• TIPS yields (real rates) are climbing as well.

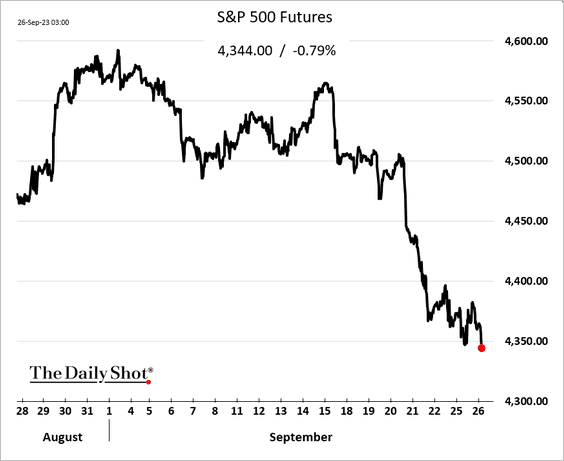

• Equity futures are down this morning, driven by the selloff in bonds.

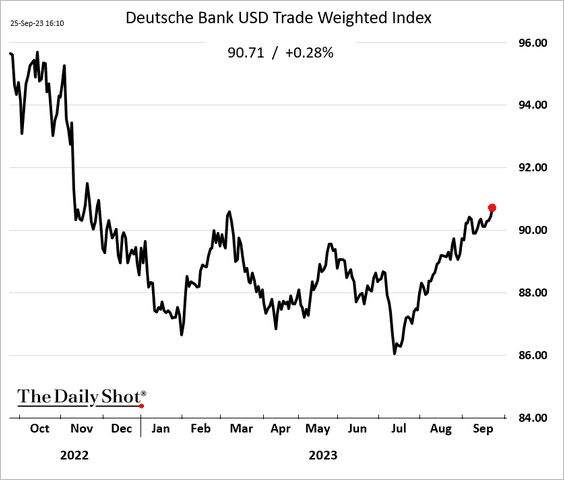

• The US dollar continues to climb amid increased risk aversion.

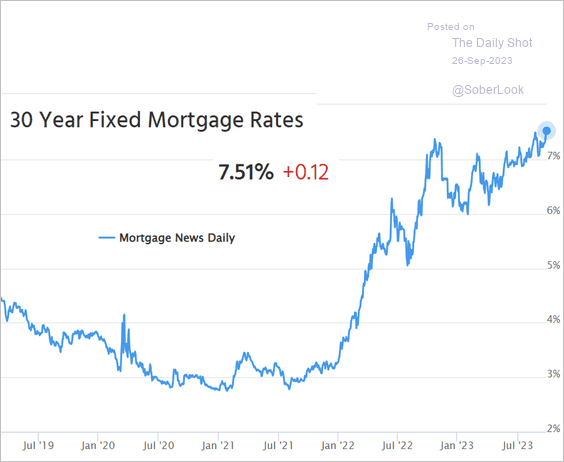

• The 30-year mortgage rate hit a multi-year high.

Source: Mortgage News Daily

Source: Mortgage News Daily

——————–

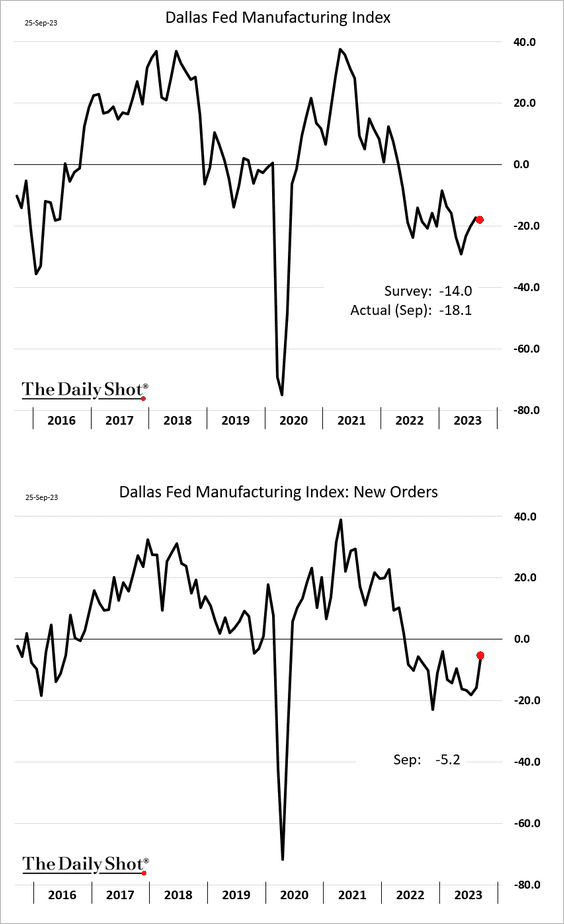

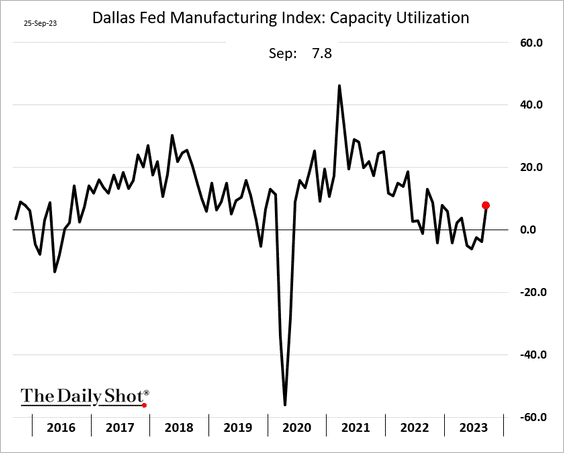

2. The Dallas Fed’s manufacturing index showed ongoing weakness in the region’s factory activity. However, the underlying indicators signaled some improvement, with new orders starting to stabilize.

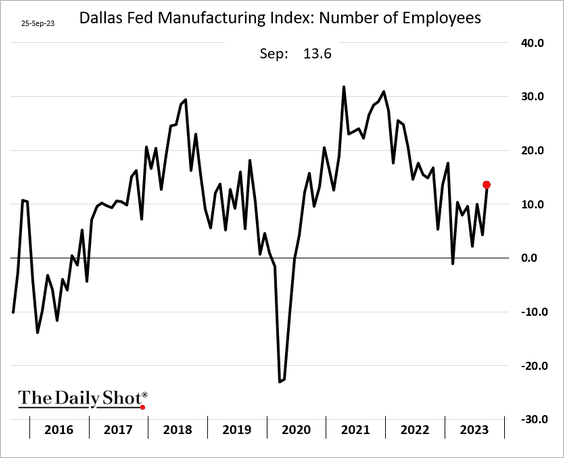

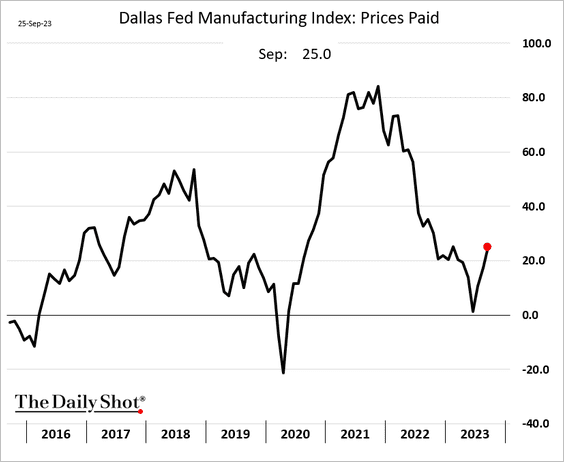

Measures of capacity utilization and employment improved.

As we’ve seen elsewhere, more companies report rising costs.

——————–

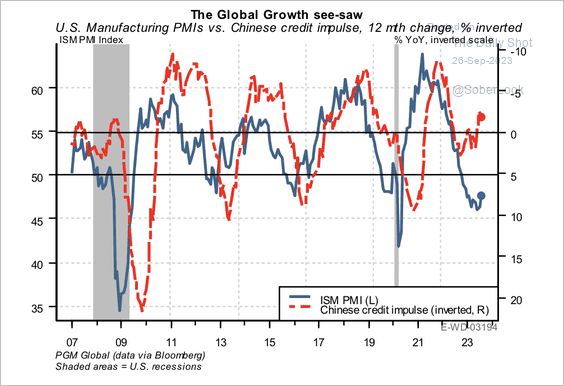

3. US industrial activity is stabilizing along with China’s credit impulse.

Source: PGM Global

Source: PGM Global

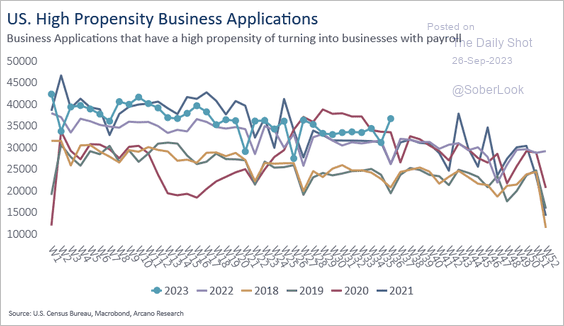

4. Business applications remain elevated.

Source: Arcano Economics

Source: Arcano Economics

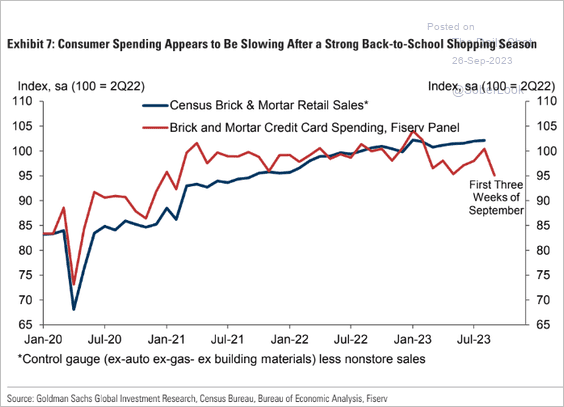

5. As we pointed out earlier, US consumption is slowing.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

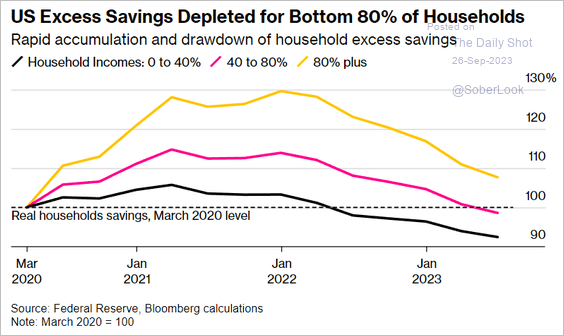

• Here is an estimate of excess savings.

Source: @economics Read full article

Source: @economics Read full article

——————–

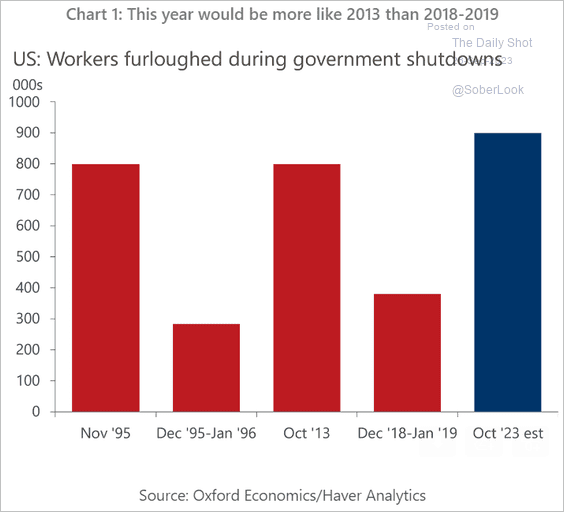

6. How many workers will be furloughed in the upcoming government shutdown? Below is an estimate from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

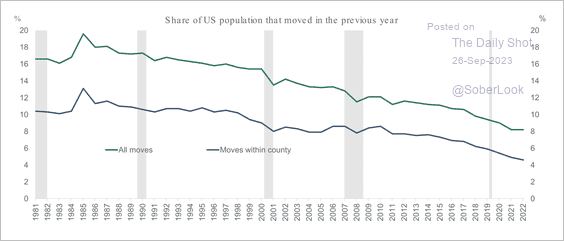

7. There is a structural decline in the share of the population moving to a new address (falling mobility).

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

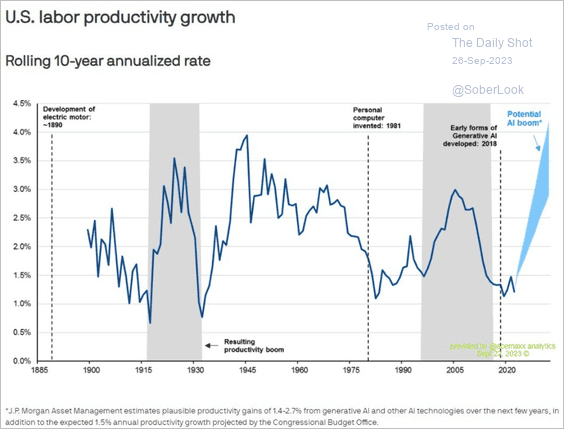

8. Will advances in AI boost US productivity growth?

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

The United Kingdom

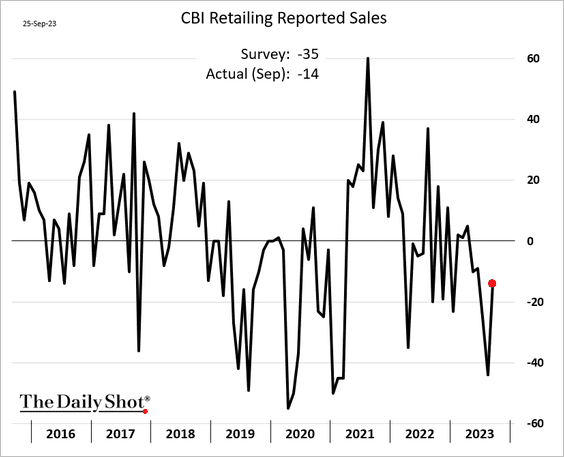

1. The slump in retail sales unexpectedly eased this month.

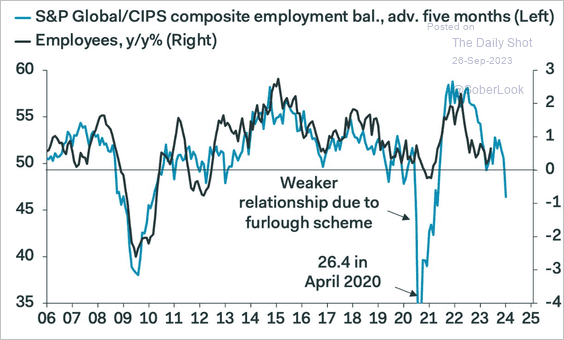

2. As we saw yesterday, the PMI report points to a deterioration in the labor market.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

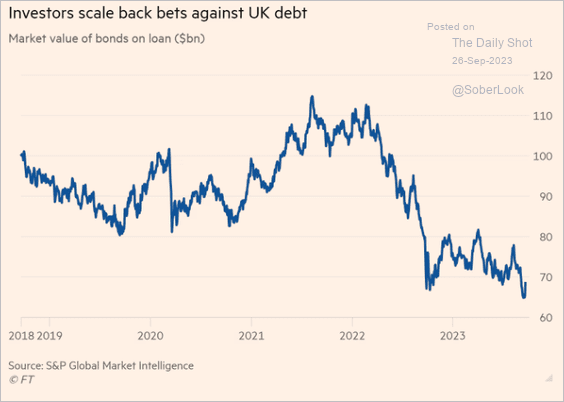

3. Investors have been reducing their bets against gilts.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

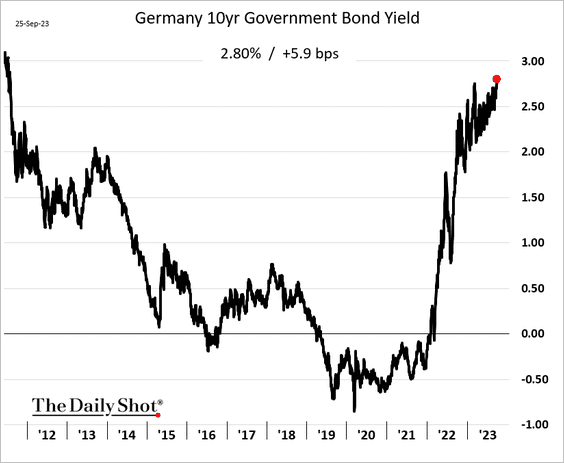

1. Bund yields are hitting multi-year highs.

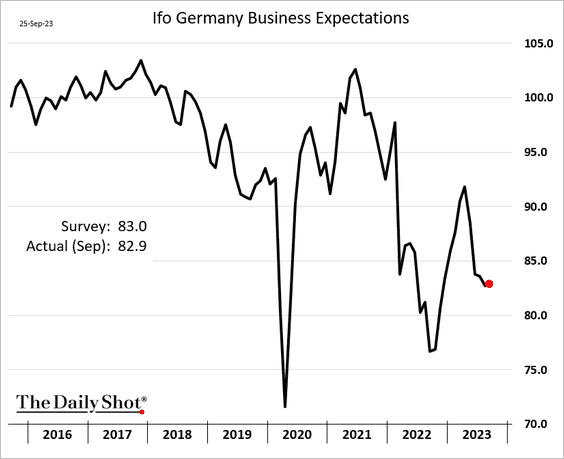

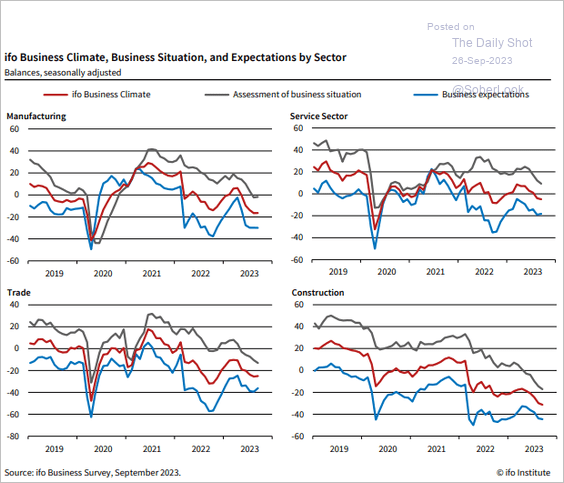

2. Germany’s Ifo expectations indicator was roughly unchanged from August.

Below, we have the sector trends.

Source: ifo Institute

Source: ifo Institute

——————–

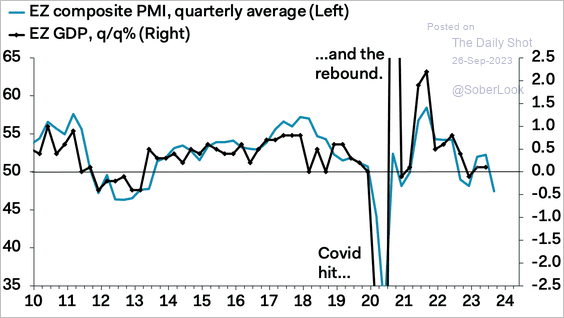

3. PMI indicators point to downside risks for economic growth …

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

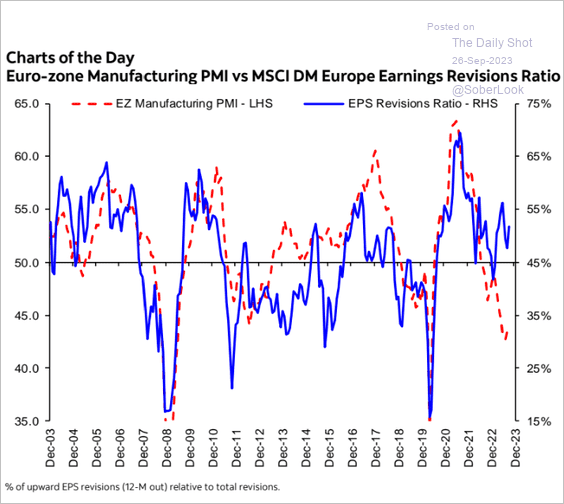

… and corporate earnings.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

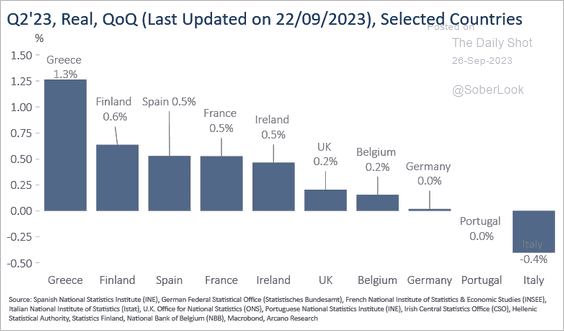

4. Here is a look at the Q2 GDP growth by country (with the UK added for comparison).

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Europe

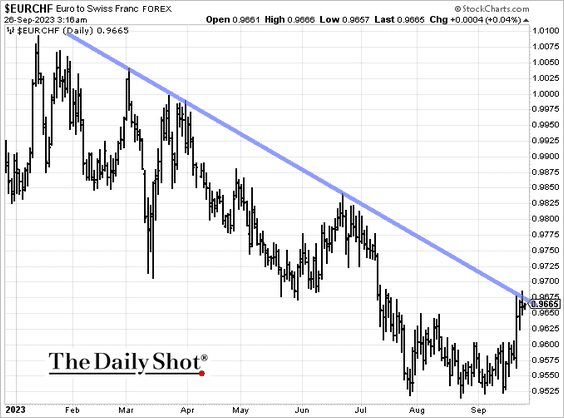

1. Will the Swiss franc decline further after the SNB’s unexpected hold on rates? EUR/CHF is at resistance.

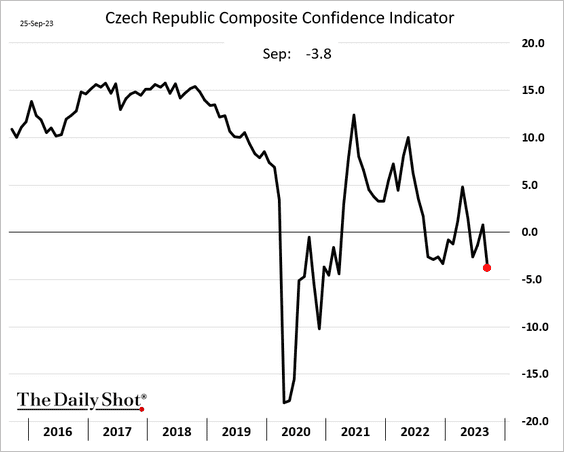

2. Czech sentiment indicators declined this month.

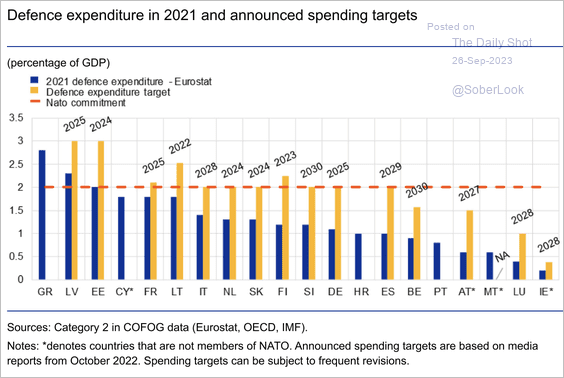

3. Here is a look at defense spending in the EU.

Source: ECB

Source: ECB

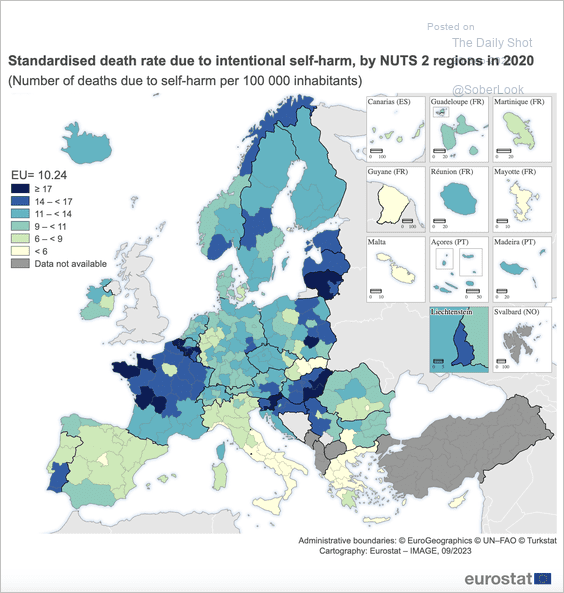

4. Which countries/regions have the highest suicide rates?

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

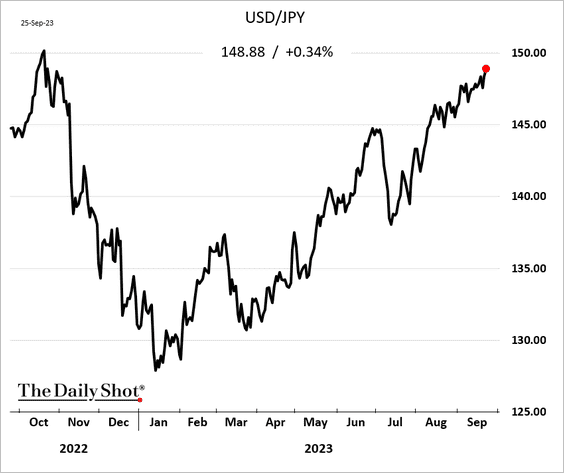

1. Dollar-yen continues to grind higher.

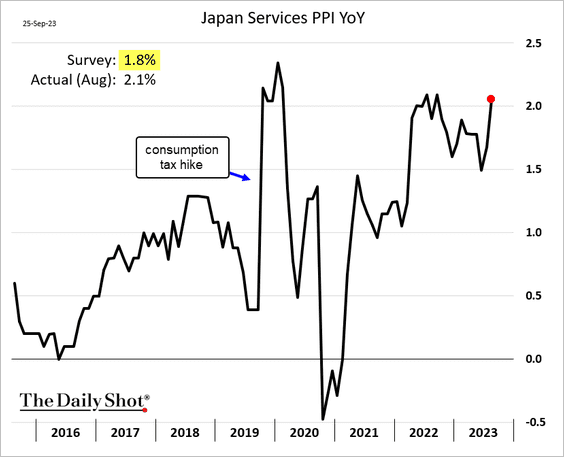

2. Japan’s services PPI topped expectations.

Back to Index

Asia-Pacific

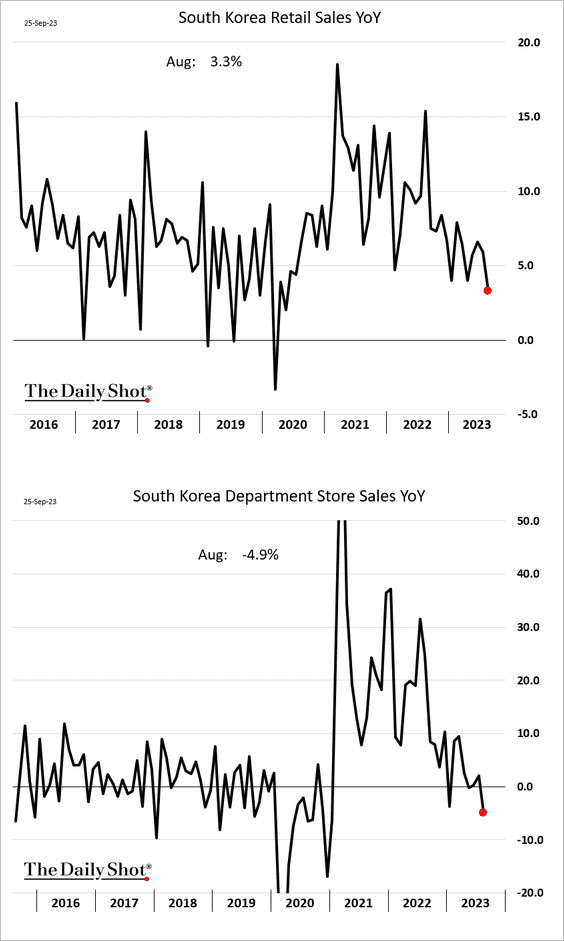

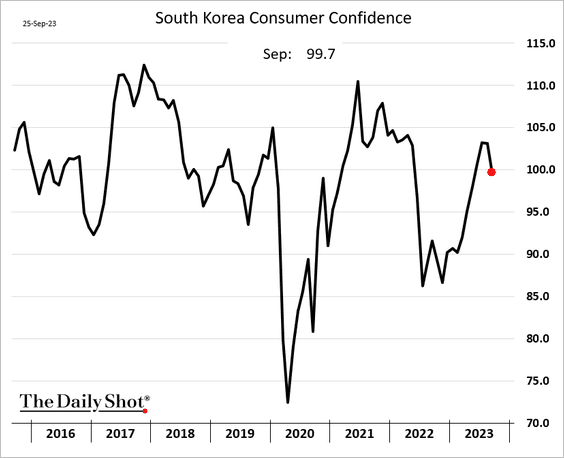

1. South Korea’s retail sales are slowing.

Consumer confidence appears to have peaked.

——————–

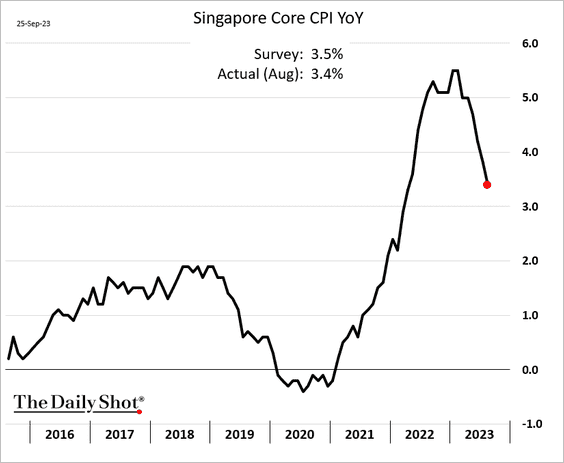

2. Singapore’s inflation continues to ease.

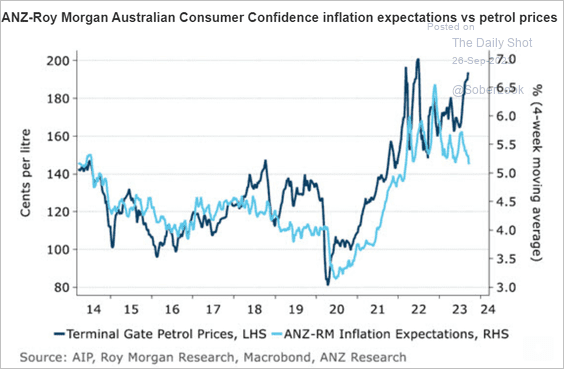

3. Will higher fuel prices boost Australian inflation expectations?

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

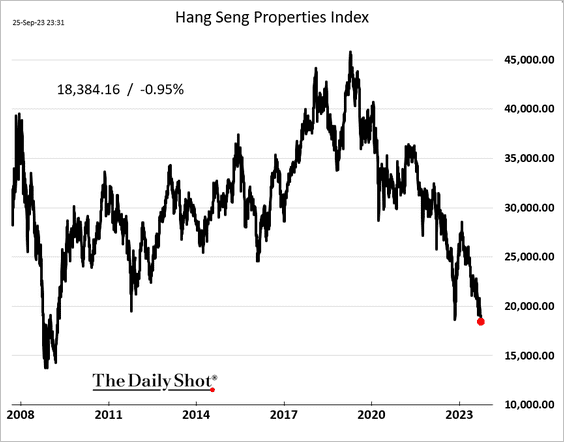

1. The Hang Seng Properties Index hit the lowest level since the GFC.

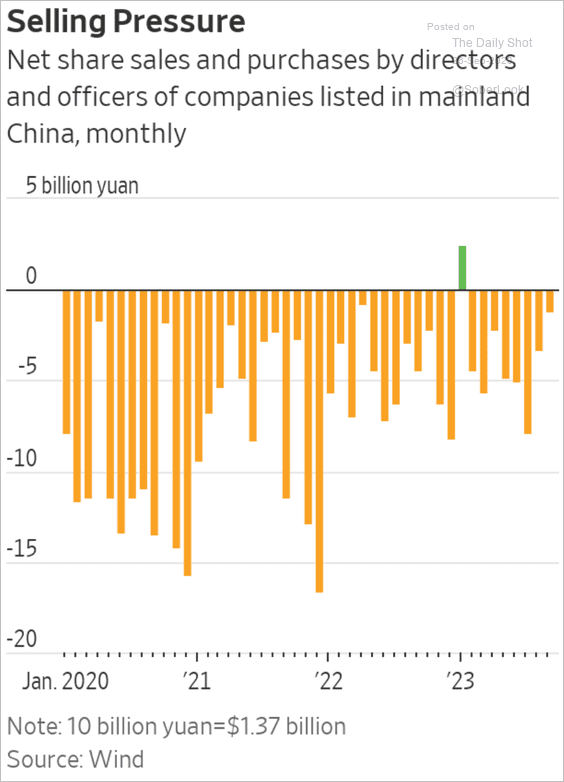

2. Regulators have been banning some of the biggest corporate shareholders from selling.

Source: @WSJ Read full article

Source: @WSJ Read full article

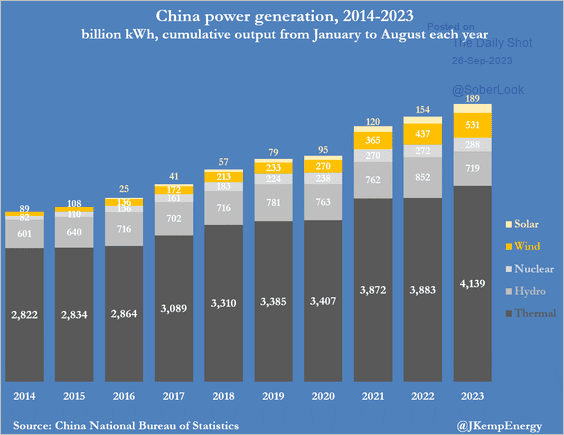

3. This chart shows power generation by source. Coal usage continues to climb.

Source: @JKempEnergy

Source: @JKempEnergy

Back to Index

Emerging Markets

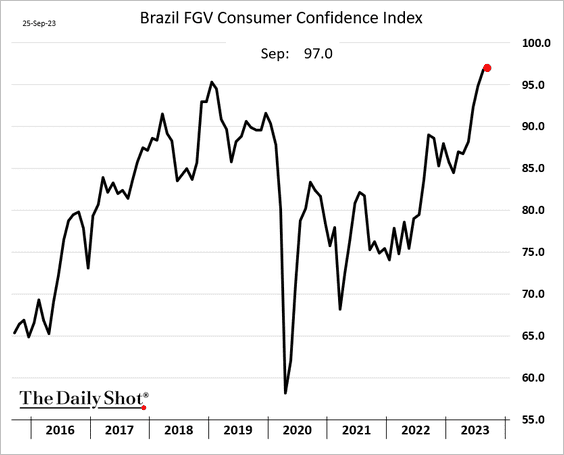

1. Brazil’s consumer confidence keeps rising.

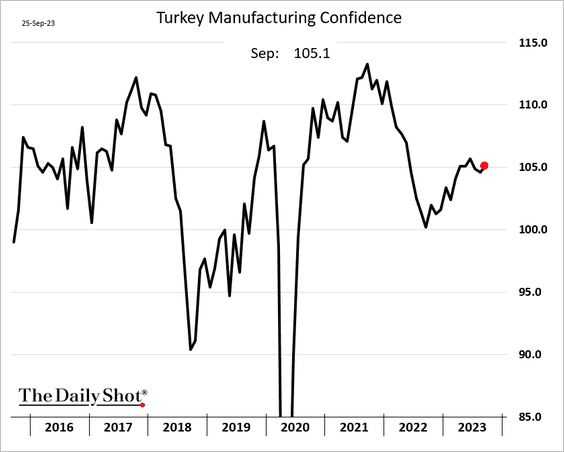

2. Turkey’s manufacturing confidence edged higher this month.

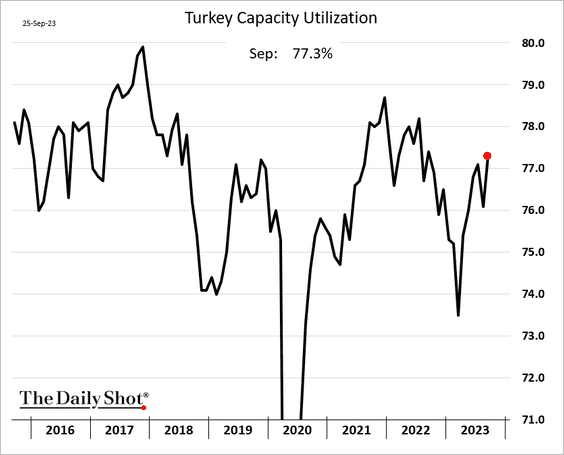

Capacity utilization improved.

——————–

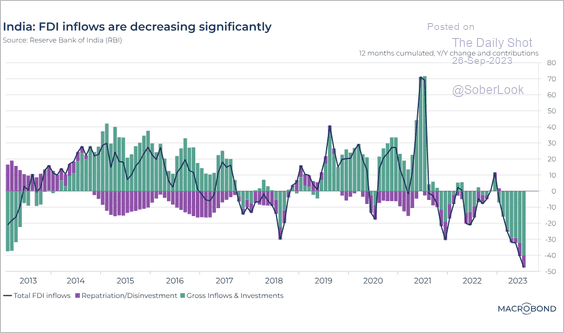

3. India’s foreign direct investment outflows accelerated this year.

Source: Macrobond

Source: Macrobond

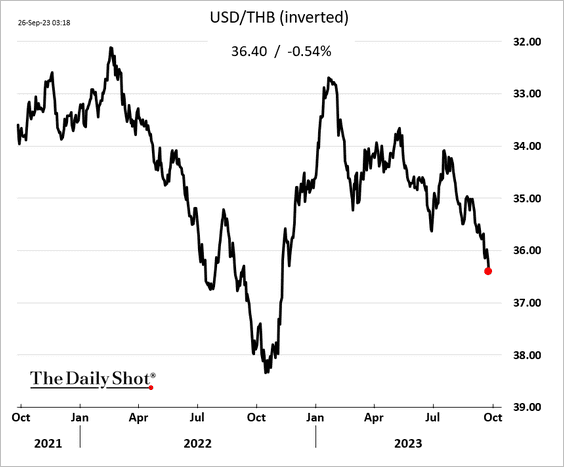

4. The Thai baht selloff continues.

Back to Index

Cryptocurrency

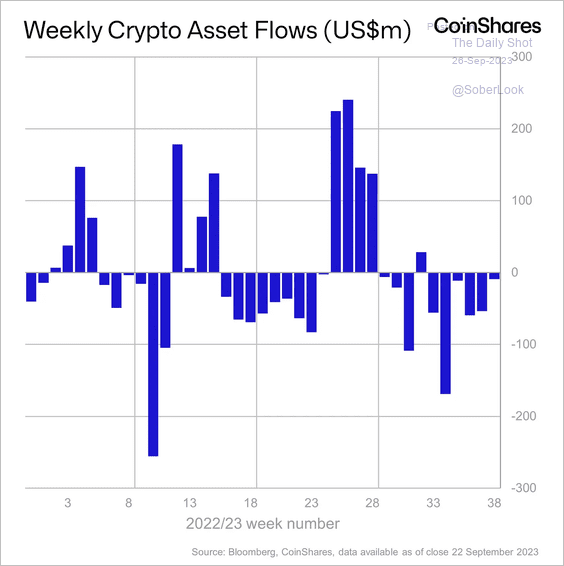

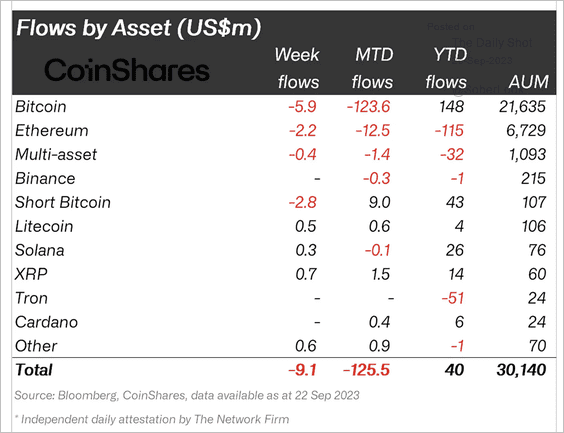

1. Crypto funds saw minor outflows last week led by bitcoin products. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

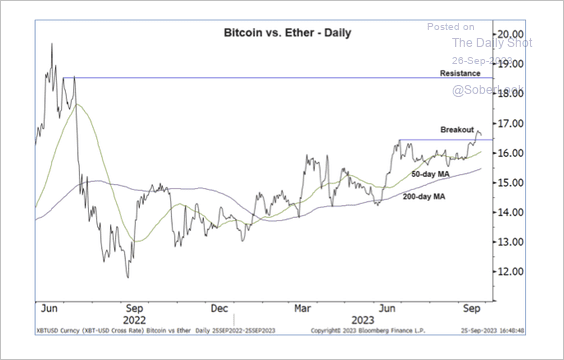

2. The BTC/ETH price ratio continues to trend higher with a short-term breakout.

Source: @StocktonKatie

Source: @StocktonKatie

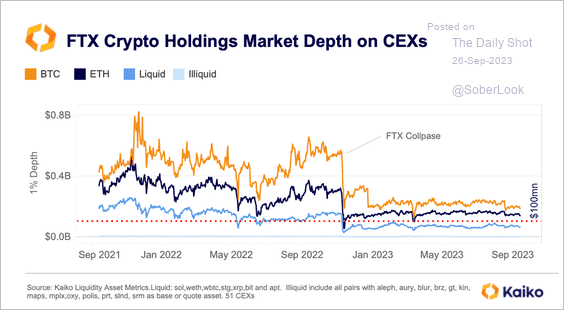

3. The most liquid altcoins on FTX’s balance sheet have seen their liquidity decline.

Source: @KaikoData

Source: @KaikoData

Back to Index

Commodities

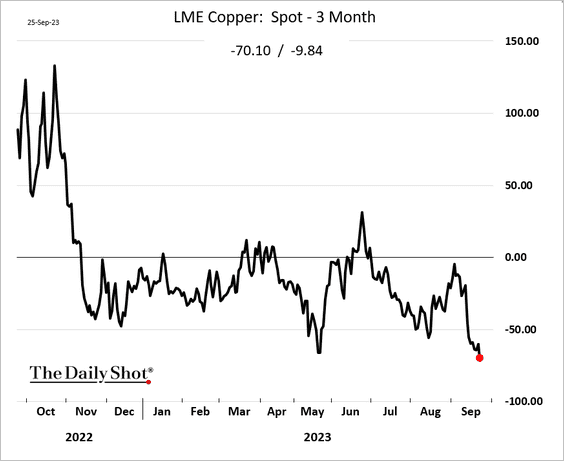

Copper moved deep into contango, signaling a well-supplied market.

Back to Index

Energy

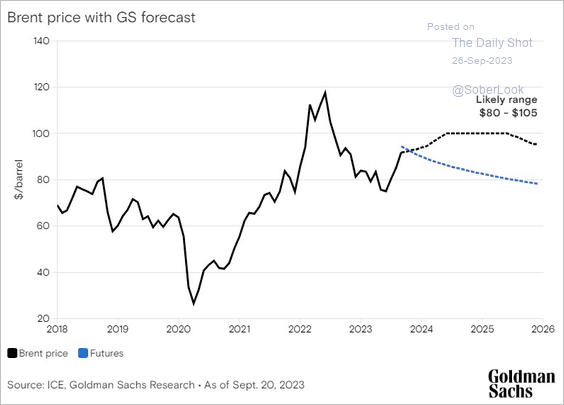

1. Here is Goldman’s forecast for Brent crude prices.

Source: Goldman Sachs

Source: Goldman Sachs

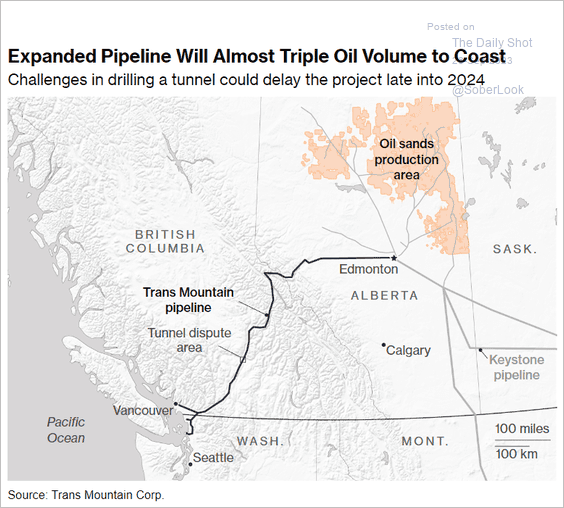

2. Canada is expected to significantly boost heavy crude sales to Asian refineries, cutting dependence on the US market.

Source: @markets Read full article

Source: @markets Read full article

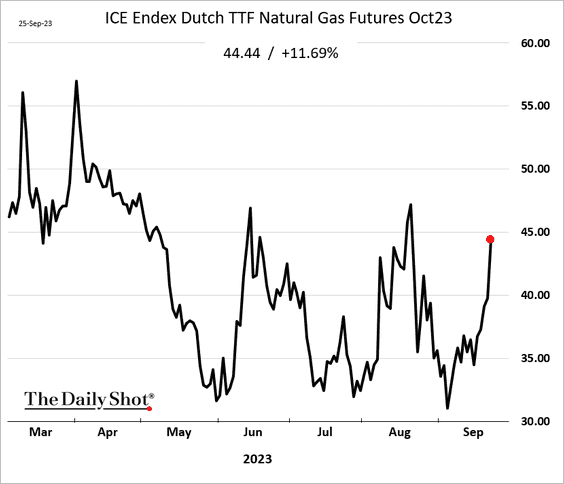

3. European natural gas prices jumped recently, partly due to Russia’s ban on diesel exports.

Source: @markets Read full article

Source: @markets Read full article

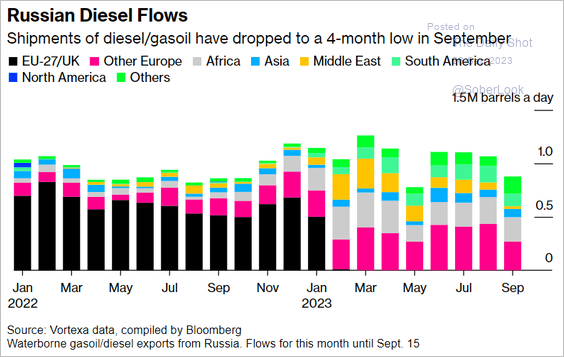

• By the way, here is a look at Russia’s diesel sales.

Source: @cangsizhi, @markets Read full article

Source: @cangsizhi, @markets Read full article

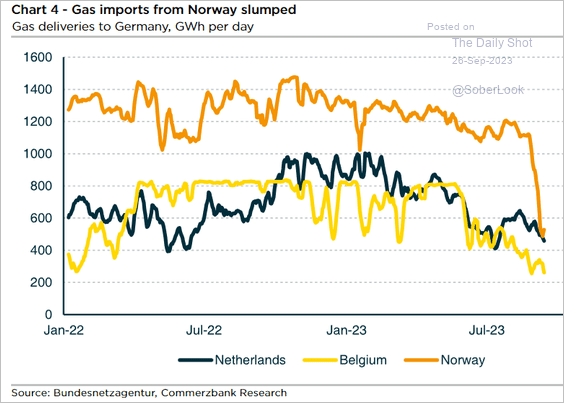

• Gas imports from Norway have declined sharply in recent months.

Source: Commerzbank Research

Source: Commerzbank Research

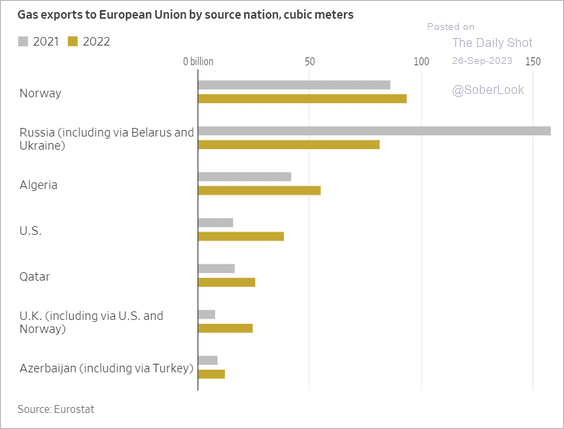

• This chart shows natural gas exports to the EU by source.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

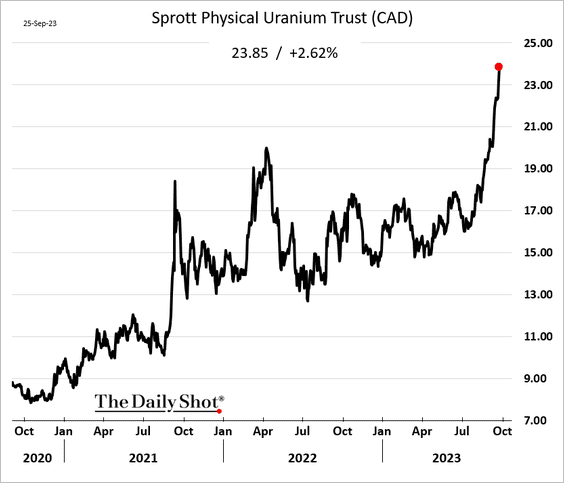

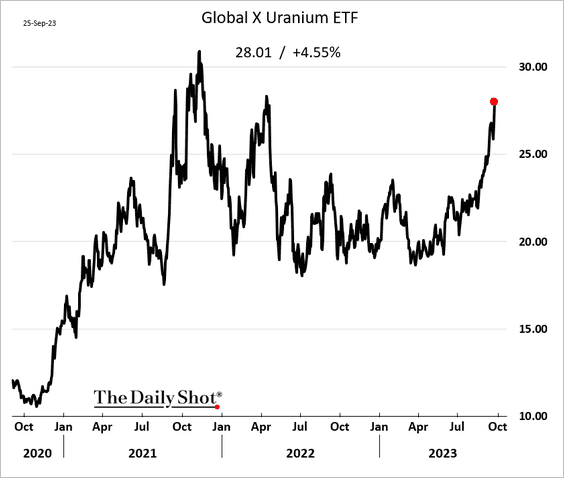

4. Uranium prices are surging, …

… boosting share prices of uranium producers.

Back to Index

Equities

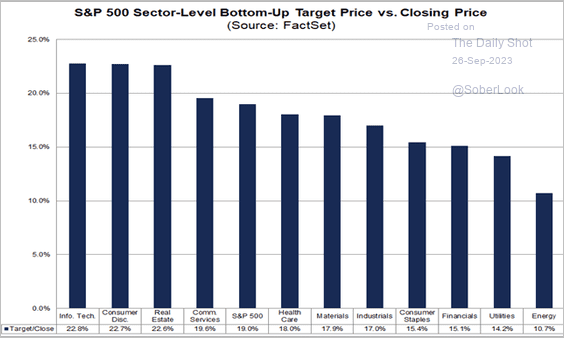

1. Consensus price targets 12 months out look very optimistic.

Source: @FactSethttps Read full article

Source: @FactSethttps Read full article

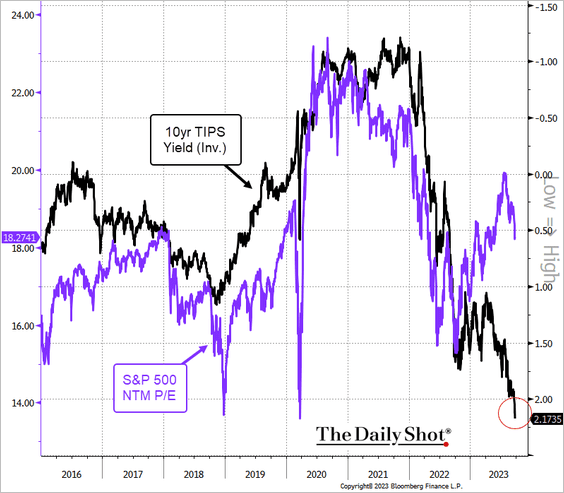

2. Rising real yields suggest that valuations are stretched.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

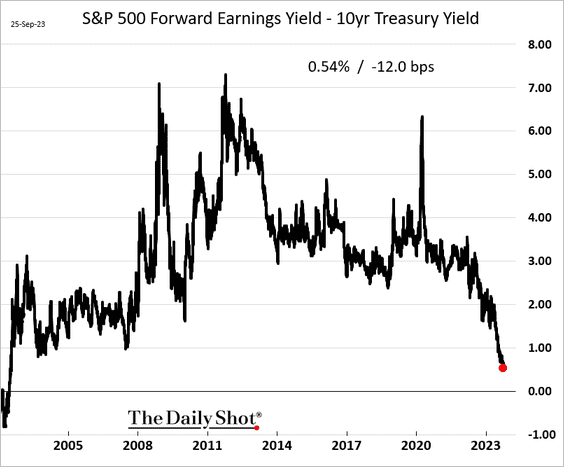

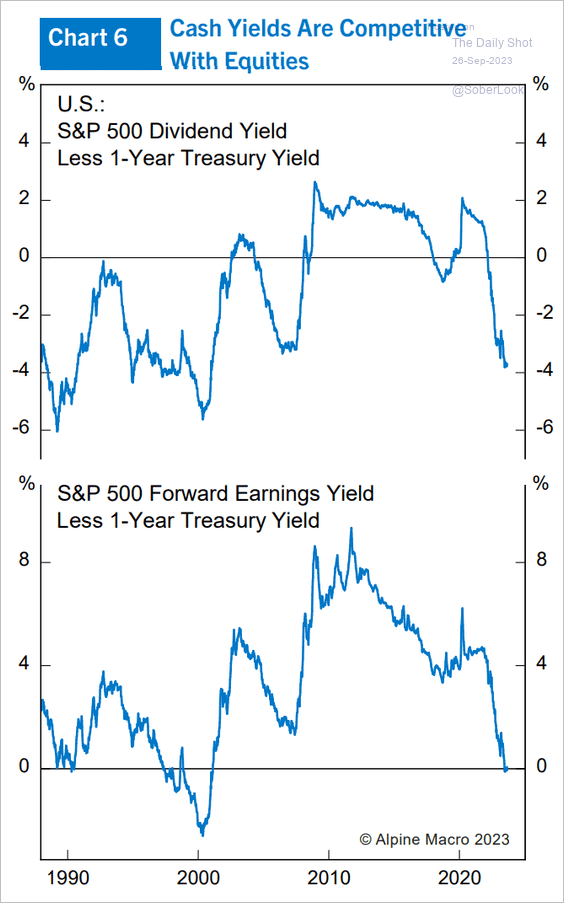

• The S&P 500 equity risk premium is hitting multi-year lows.

Here is a similar measure using the 1-year yield.

Source: Alpine Macro

Source: Alpine Macro

——————–

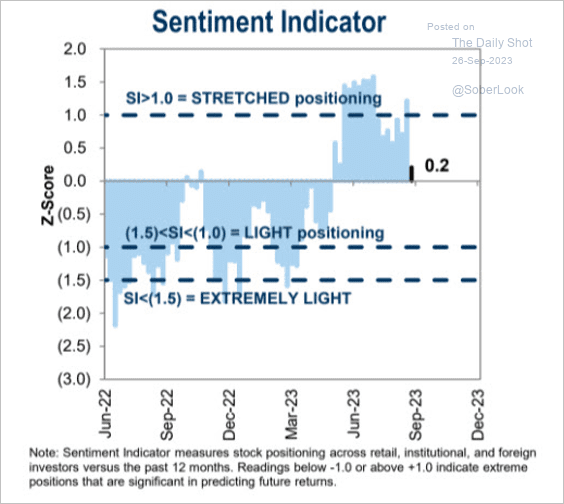

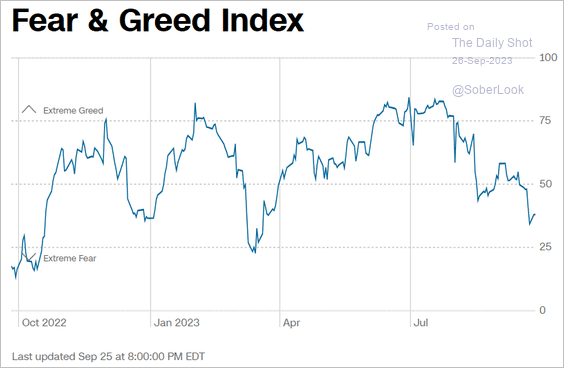

3. Sentiment indicators point to a pullback in risk appetite.

• Goldman’s positioning indicator:

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

• CNN’s Fear & Greed Index:

Source: CNN Business

Source: CNN Business

——————–

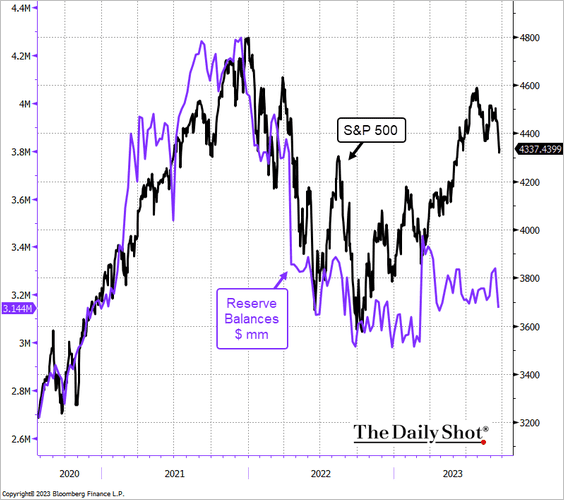

4. Tighter liquidity conditions (due to the Fed’s QT) could weigh on stocks.

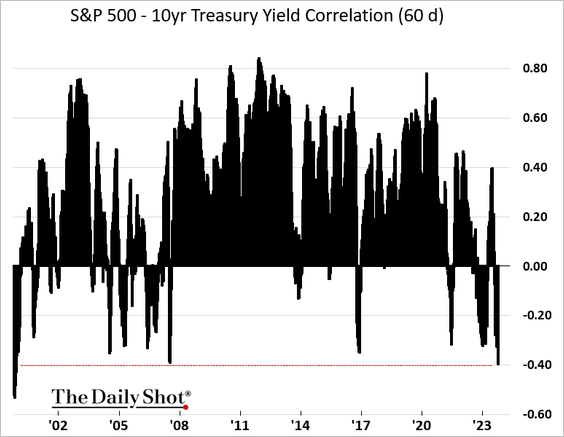

5. Stock-bond correlations remain elevated.

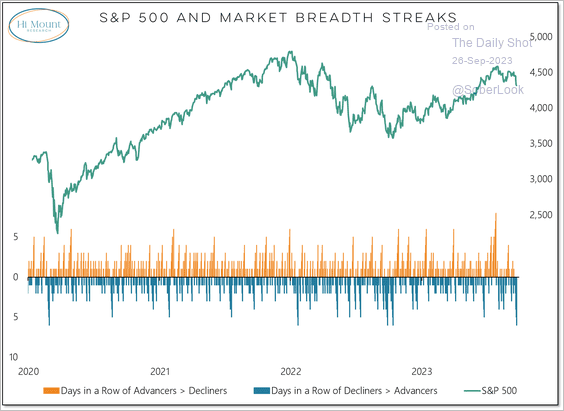

6. The S&P 500 has seen the longest streak of declining versus advancing stocks this year – tied for the longest since December 2018.

Source: @WillieDelwiche

Source: @WillieDelwiche

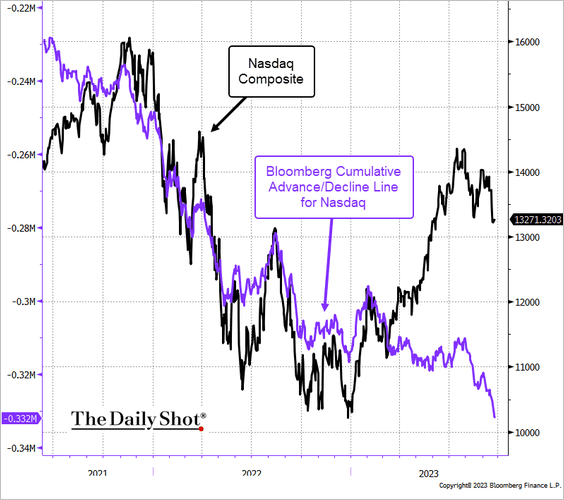

This chart shows the advance/decline line for the Nasdaq Composite.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

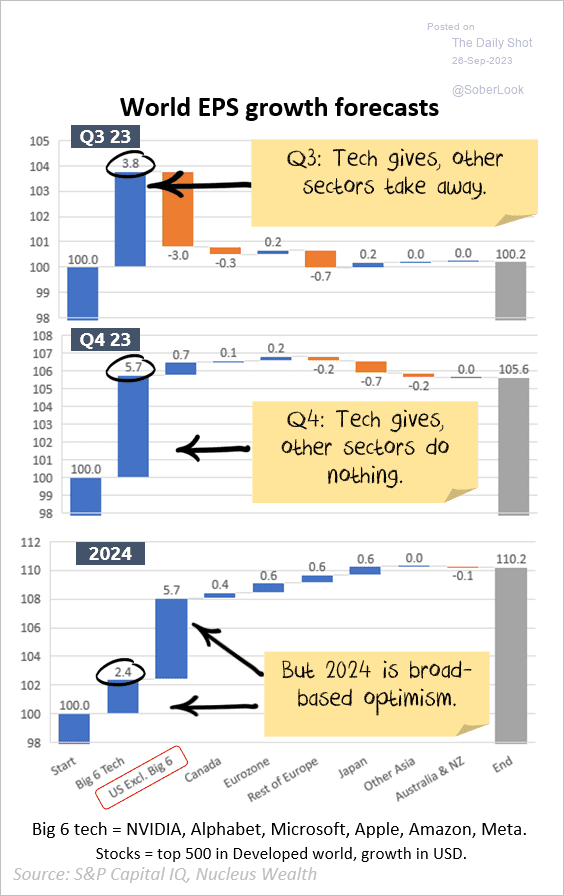

7. Here is a look at global EPS growth attributions for Q3 and consensus estimates for Q4 and 2024 (blue=growth, orange=declines).

Source: Nucleus Wealth

Source: Nucleus Wealth

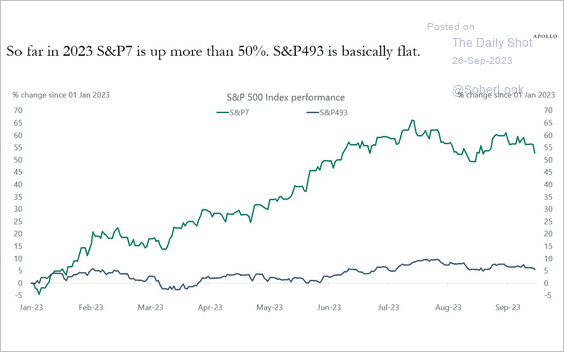

8. Year-to-date, the top seven stocks have accounted for the majority of the returns in the S&P 500.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

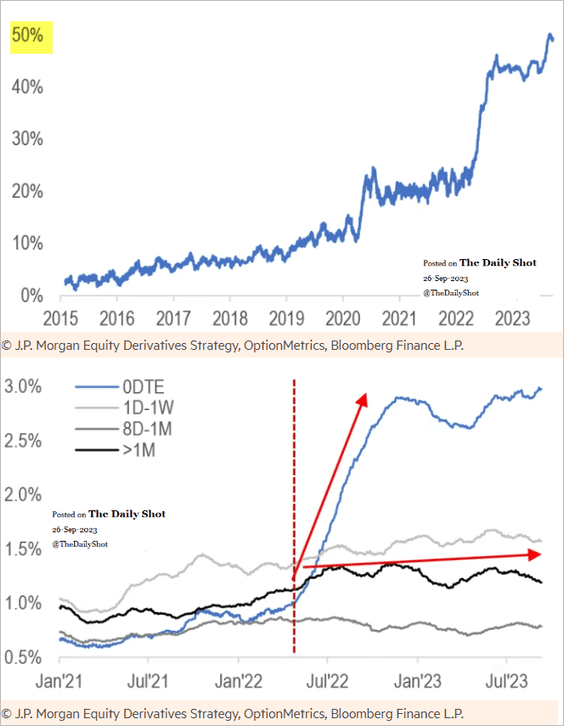

9. Overnight options are now half of the total S&P 500 options volume.

Source: JP Morgan Research; @RobinWigg, @FTAlphaville, @financialtimes Read full article

Source: JP Morgan Research; @RobinWigg, @FTAlphaville, @financialtimes Read full article

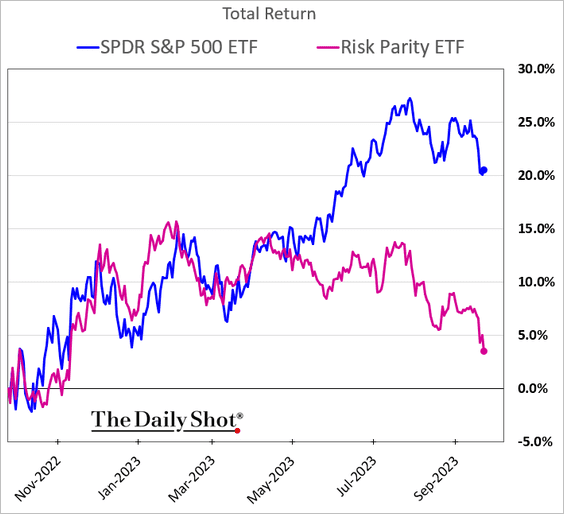

10. Risk parity strategies have been struggling amid increased correlations.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Credit

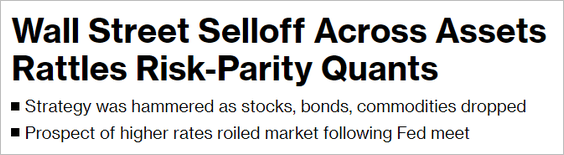

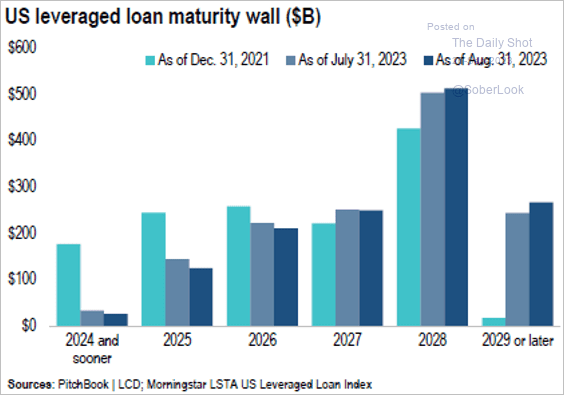

1. Momentum in the US leveraged loan market continued last week.

Source: PitchBook

Source: PitchBook

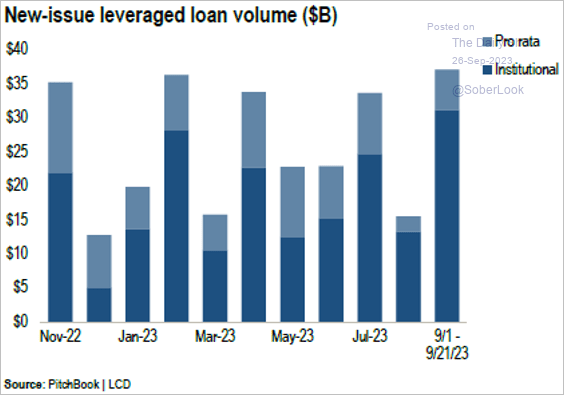

• Borrowers keep refinancing outstanding debt. According to PItchBook, 60% of US loan activity this year is refinancing.

Source: PitchBook

Source: PitchBook

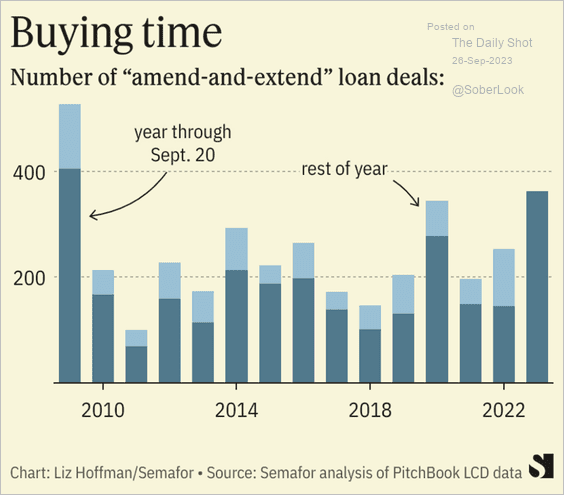

• Along with refinancings, US leveraged loan issuers have addressed upcoming maturities via a record volume of amend-and-extend deals (2 charts).

Source: PitchBook

Source: PitchBook

Source: Semafor

Source: Semafor

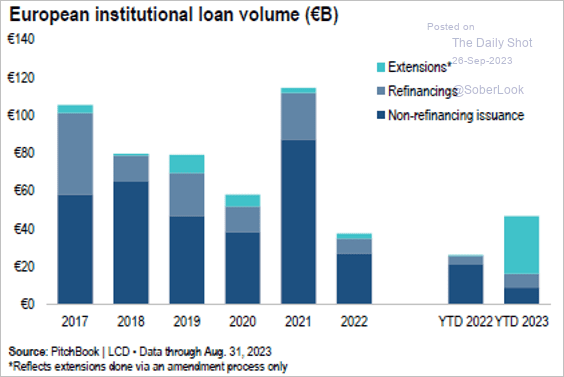

The story is similar in Europe, where loan extensions account for roughly two-thirds of this year’s loan activity, according to PitchBook.

Source: PitchBook

Source: PitchBook

——————–

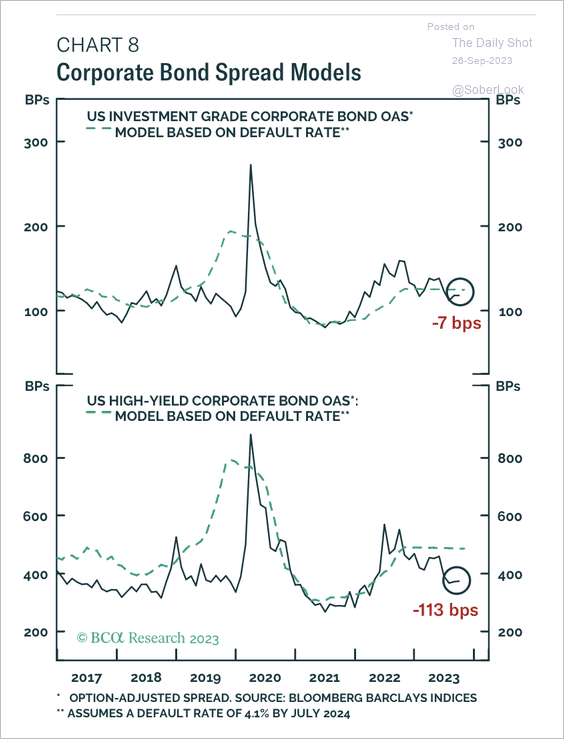

2. BCA Research forecasts higher US corporate bond spreads driven by a rise in defaults next year.

Source: BCA Research

Source: BCA Research

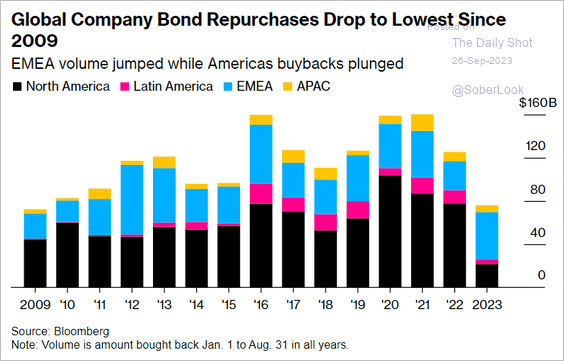

3. Bond repurchases have slowed.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Global Developments

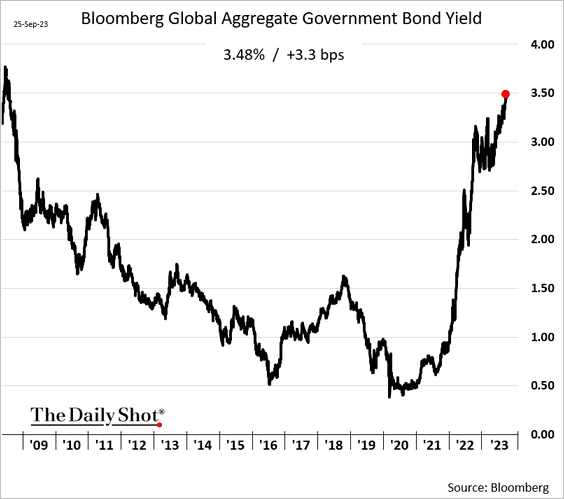

1. Bond yields are rising globally.

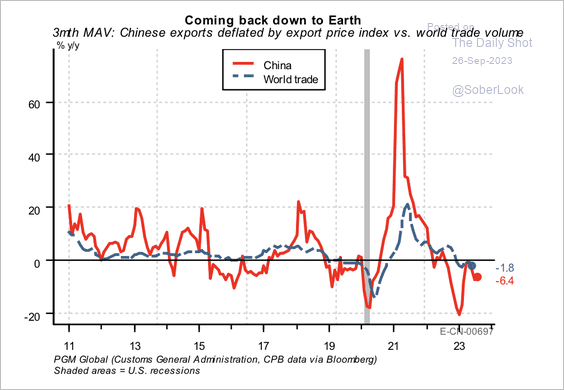

2. Trade has been slowing.

Source: PGM Global

Source: PGM Global

——————–

Food for Thought

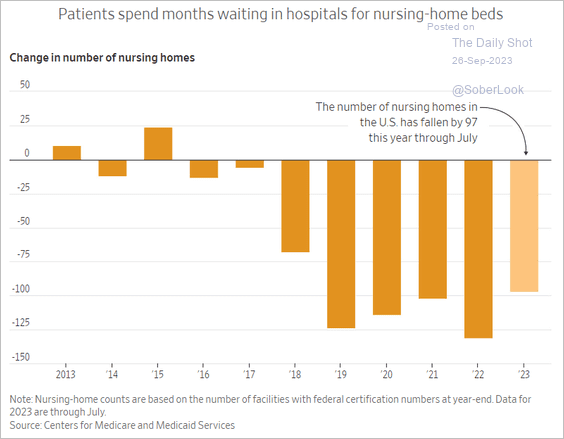

1. Disappearing nursing homes:

Source: @WSJ Read full article

Source: @WSJ Read full article

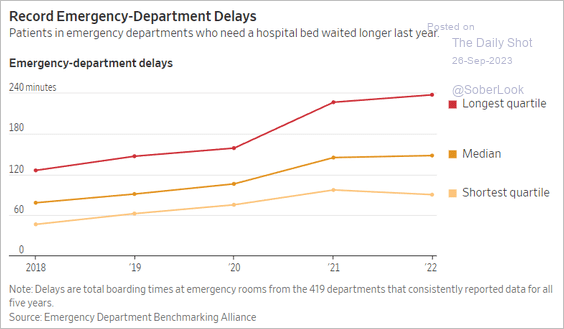

2. US emergency-department backlogs:

Source: @WSJ Read full article

Source: @WSJ Read full article

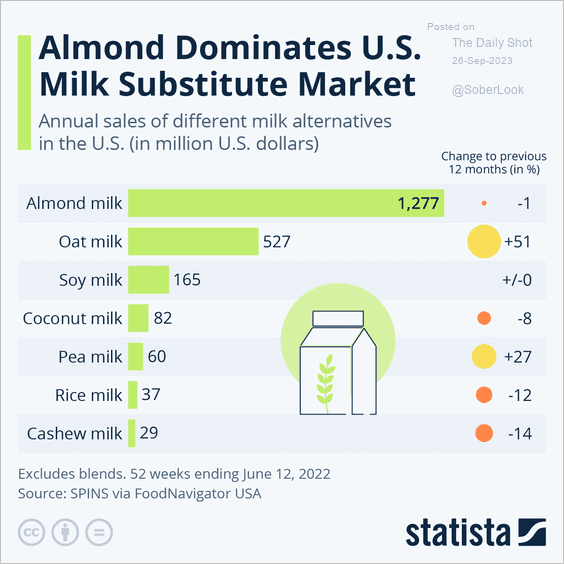

3. The US plant-based milk market:

Source: Statista

Source: Statista

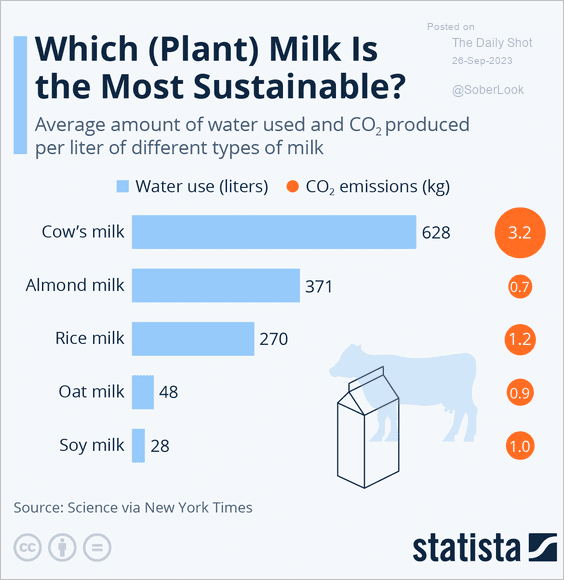

• Water usage and CO2 emissions from the production of different types of milk:

Source: Statista

Source: Statista

——————–

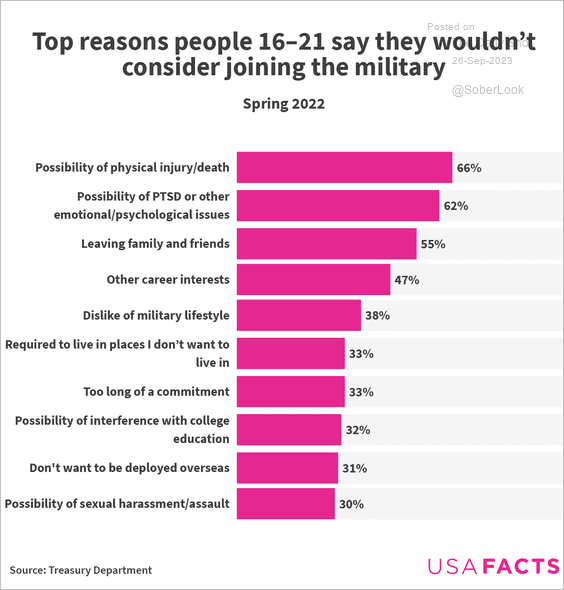

4. Top reasons young Americans wouldn’t consider joining the military:

Source: USAFacts

Source: USAFacts

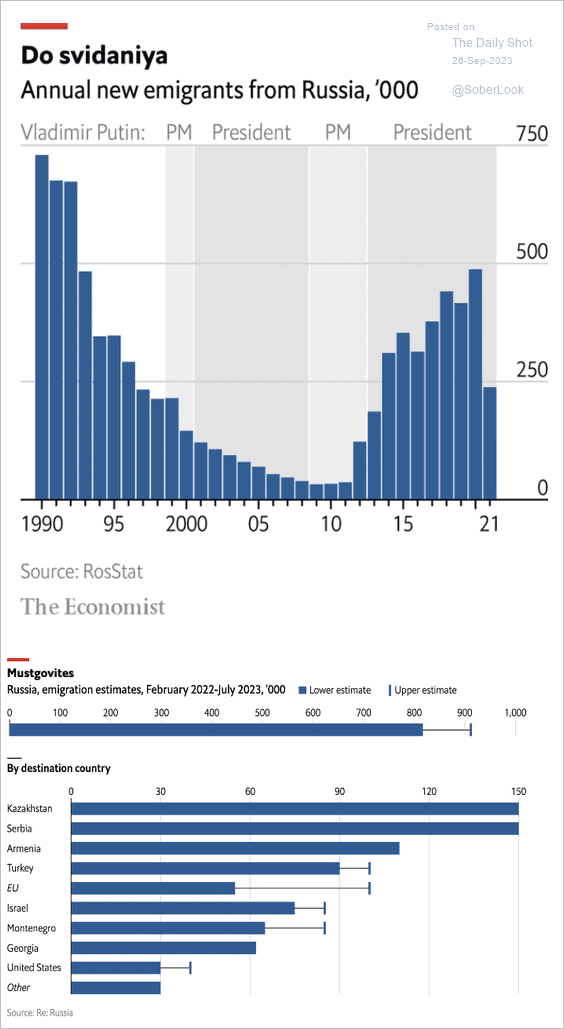

5. Emigration from Russia:

Source: The Economist Read full article

Source: The Economist Read full article

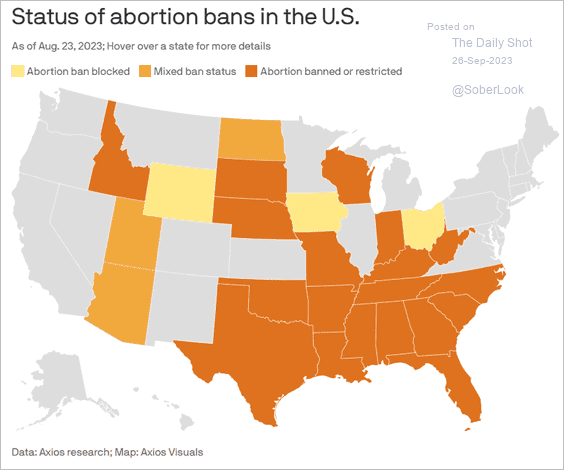

6. Abortion bans:

Source: @axios Read full article

Source: @axios Read full article

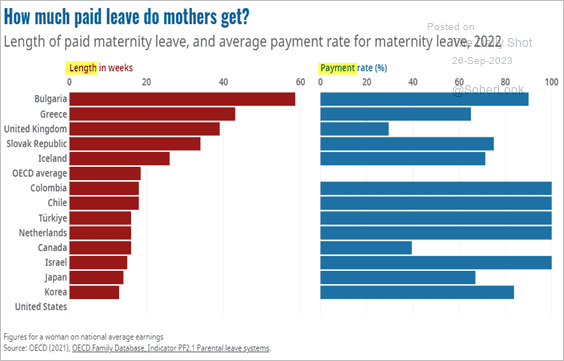

7. Paid leave:

Source: OECD Read full article

Source: OECD Read full article

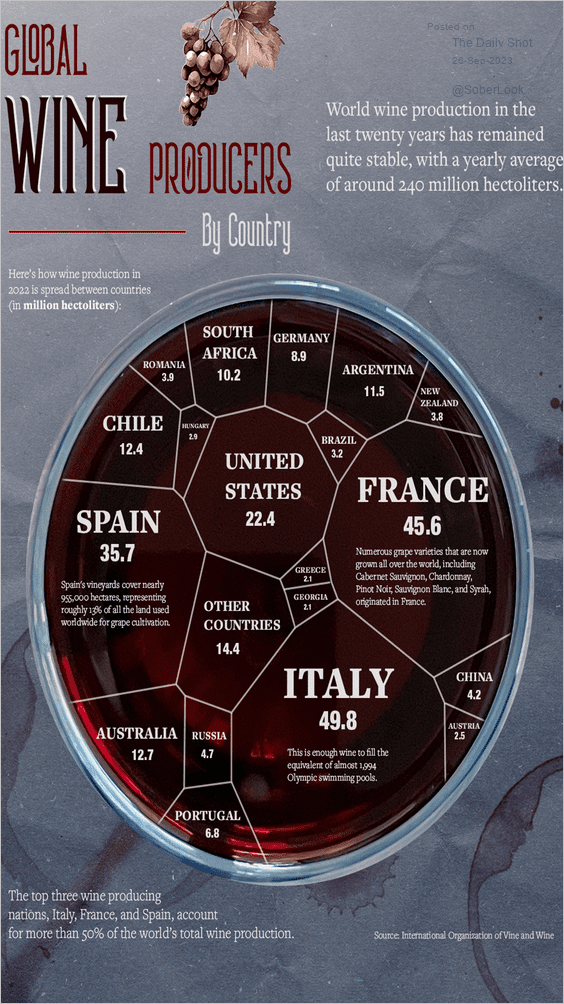

8. Largest wine producers:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index