The Daily Shot: 28-Sep-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Rates

• Global Developments

• Food for Thought

The United States

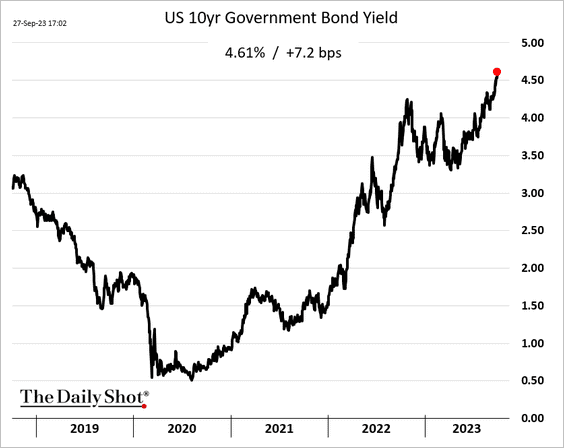

1. The 10-year Treasury yield broke through 4.5%, hitting another multi-year high.

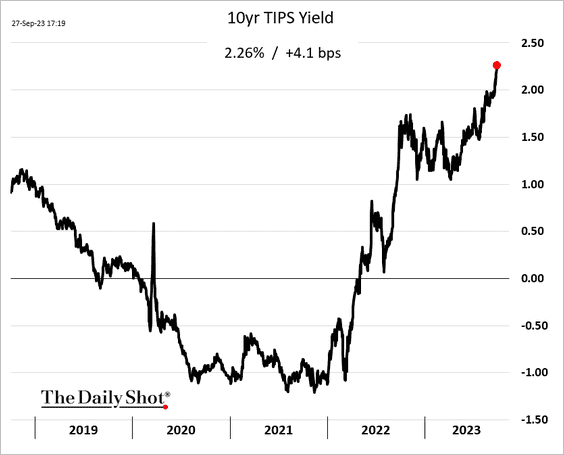

• Real yields are also climbing.

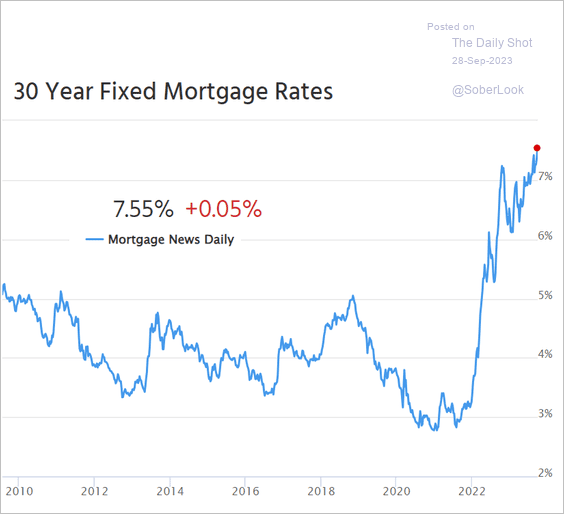

• Mortgage rates are following Treasury yields higher.

Source: Mortgage News Daily

Source: Mortgage News Daily

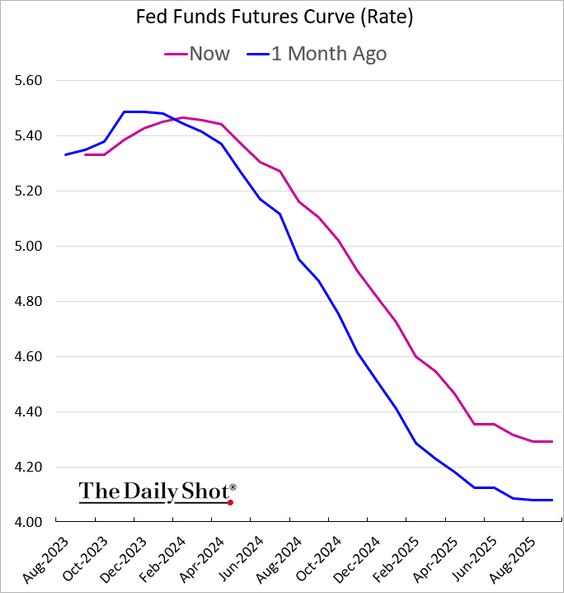

• The market has repriced the expected longer-term fed funds rate trajectory in recent weeks.

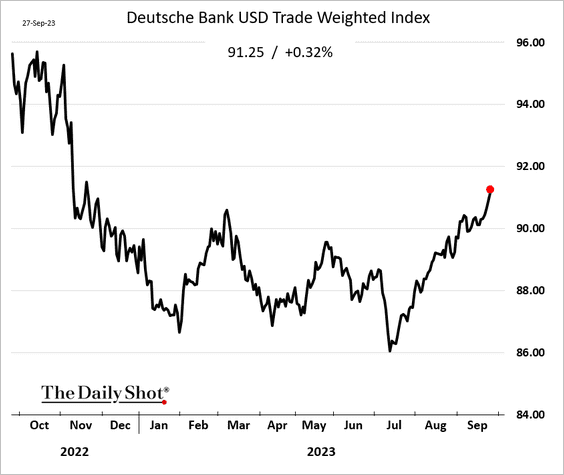

• The US dollar continues to grind higher.

——————–

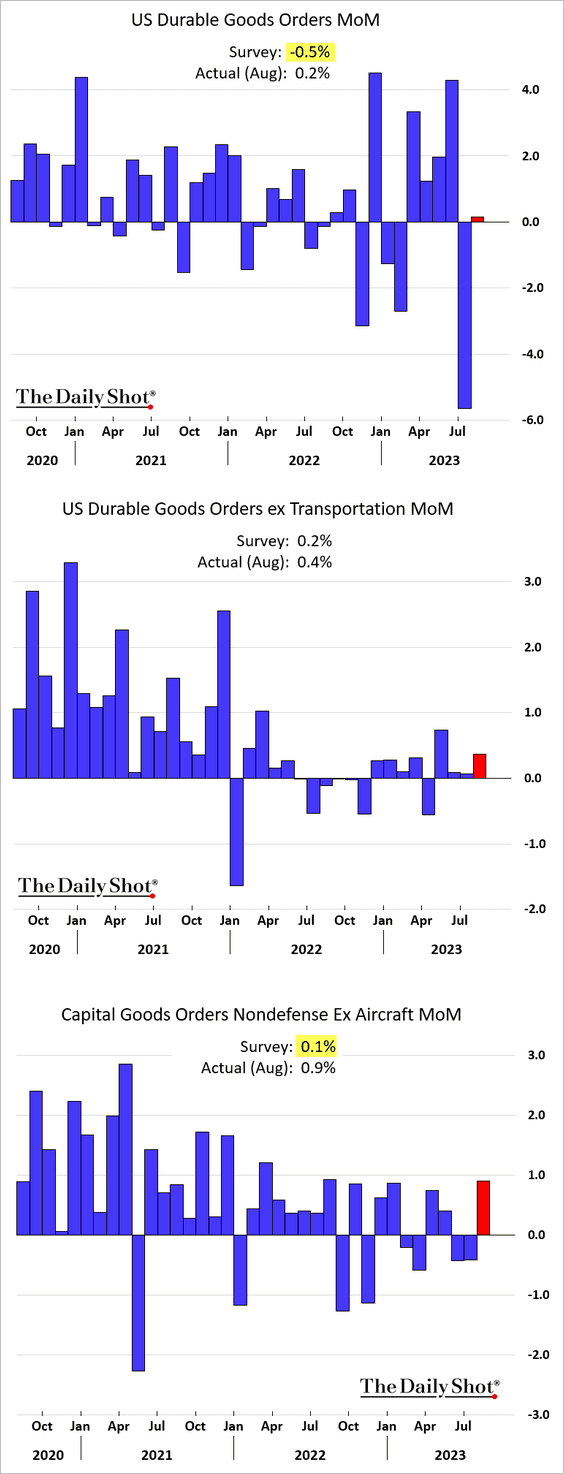

2. Durable goods orders topped expectations. Capital goods orders (3rd panel) saw the largest increase since January.

Source: Reuters Read full article

Source: Reuters Read full article

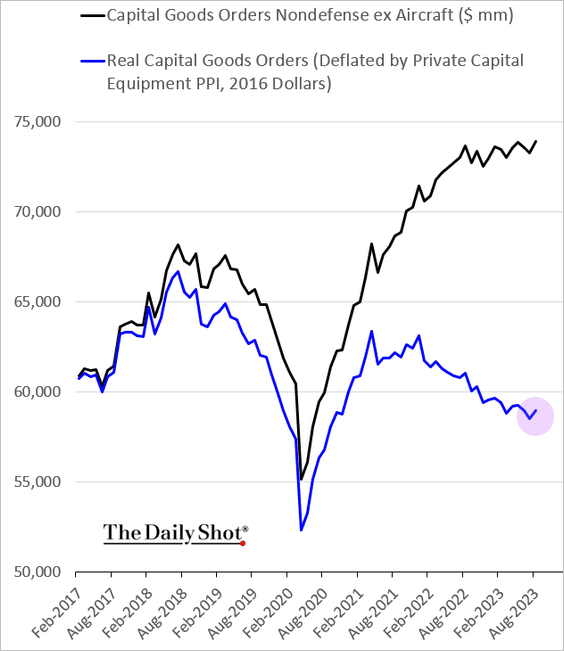

Here is a look at capital goods orders adjusted for inflation.

——————–

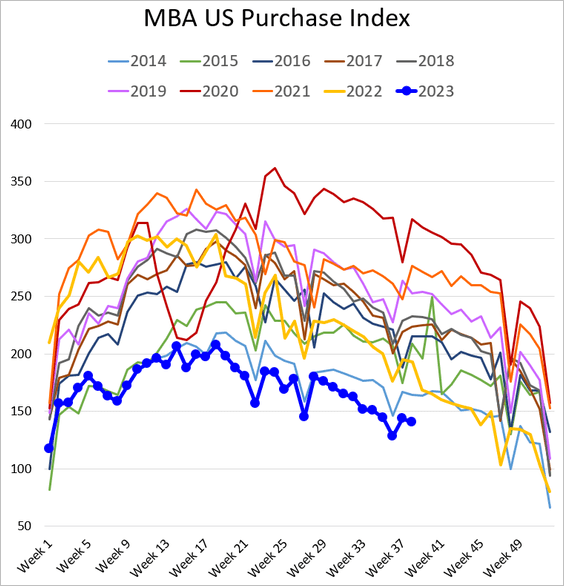

3. Mortgage applications are running well below 2014 levels.

4. Next, we have some updates on inflation.

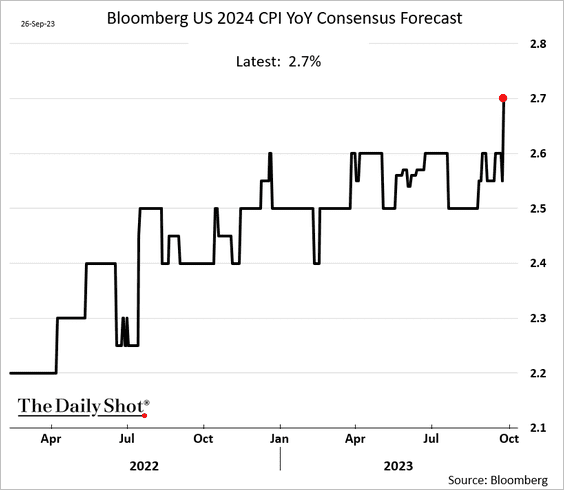

• Economists are boosting their 2024 CPI forecasts as oil prices surge.

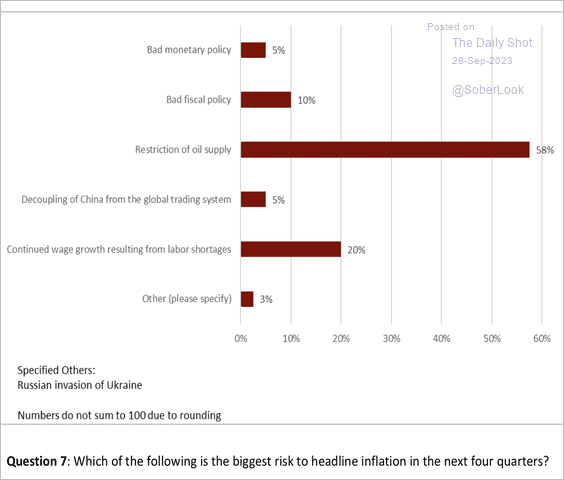

• The restriction of oil supply is viewed as the largest upside risk to headline inflation.

Source: FT/Chicago Booth

Source: FT/Chicago Booth

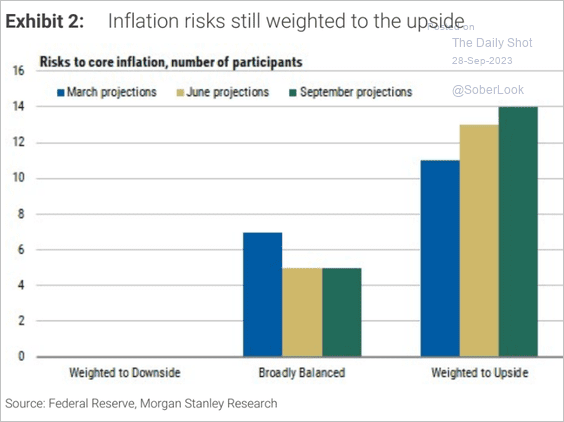

• The FOMC still sees inflation risks skewed to the upside.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

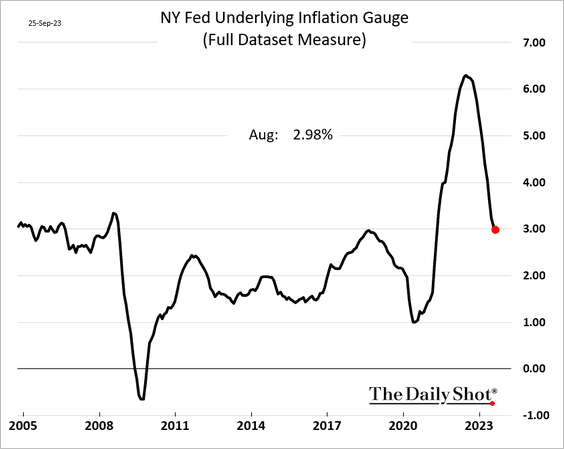

• This chart shows the NY Fed’s UIG inflation tracker.

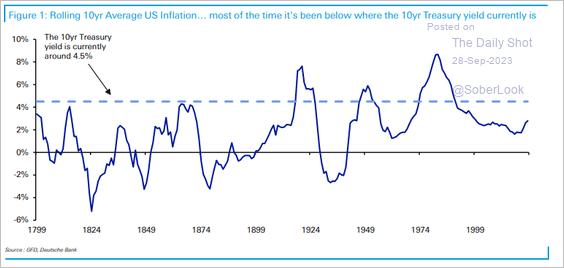

• Sustained US inflation above the long-term average 10-year Treasury yield has only occurred around wars and energy shocks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

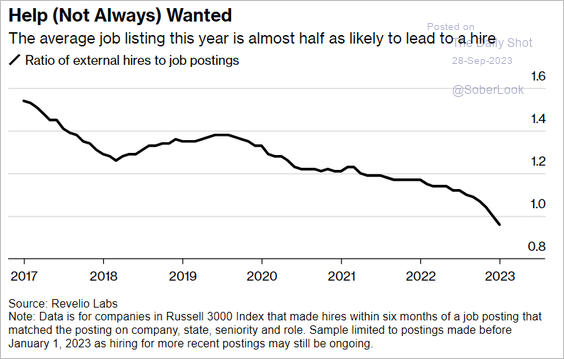

5. What percentage of US job openings are real vs. “ghost” postings?

Source: @economics Read full article

Source: @economics Read full article

Back to Index

Canada

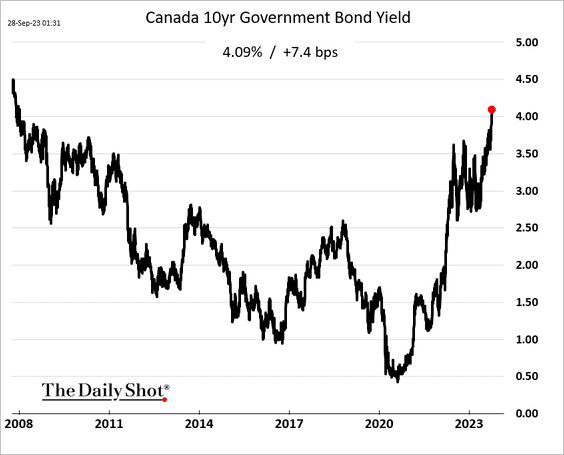

1. Canadian bond yields are reaching multi-year peaks in the midst of the global bond rout.

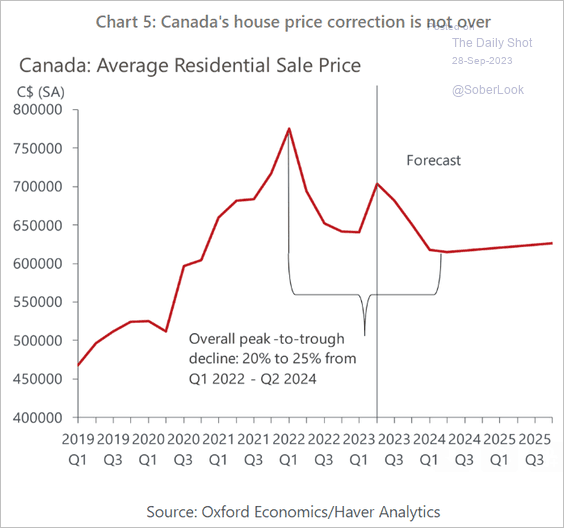

2. More pain ahead for the housing market? Here is a forecast from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

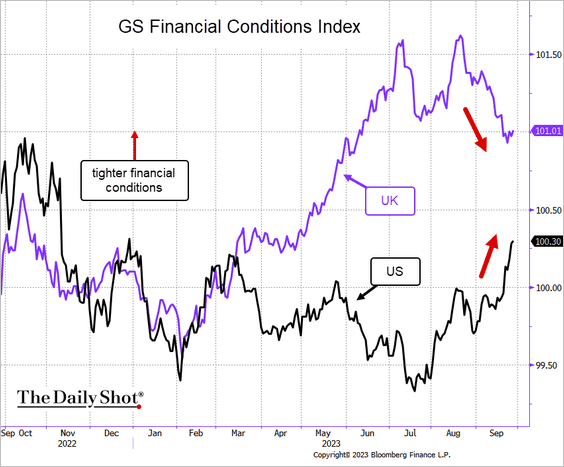

1. Financial conditions in the UK are easing, with the pound and gilt yields declining, while those in the US are tightening.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Goldman Sachs

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Goldman Sachs

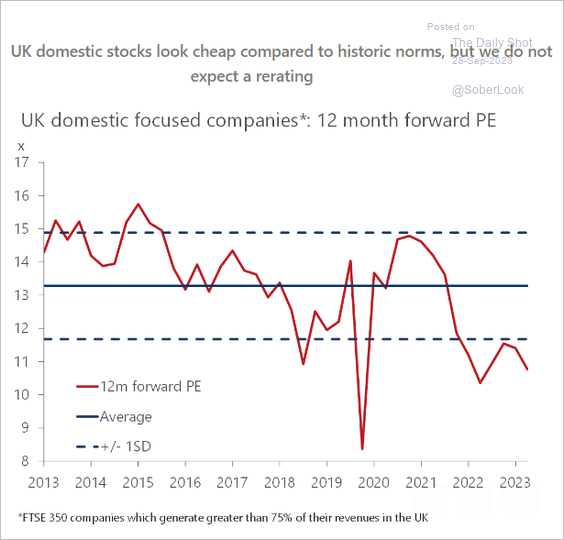

2. Will depressed valuations on domestic-focused companies persist?

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The Eurozone

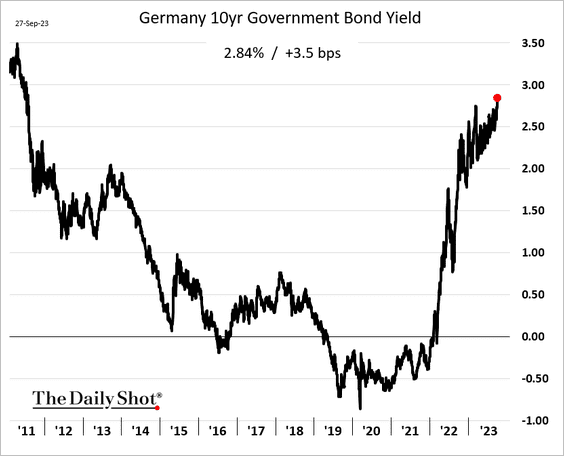

1. Bund yields continue to hit multi-year highs.

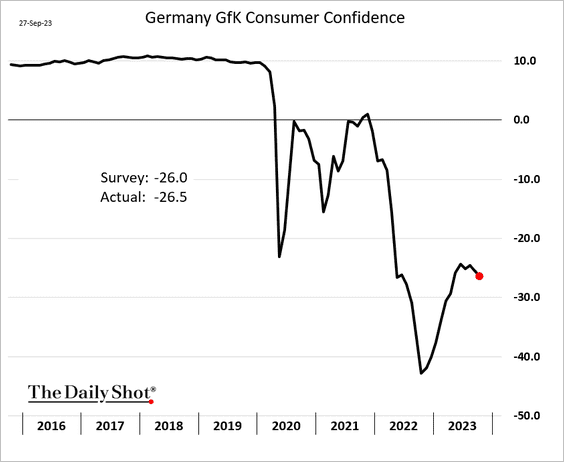

2. Germany’s consumer confidence is rolling over.

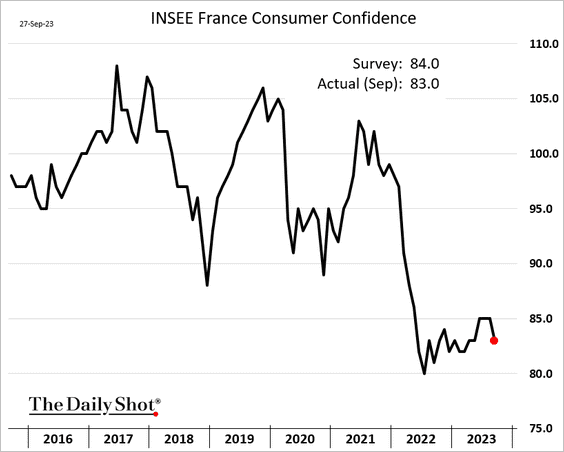

French sentiment also declined this month.

——————–

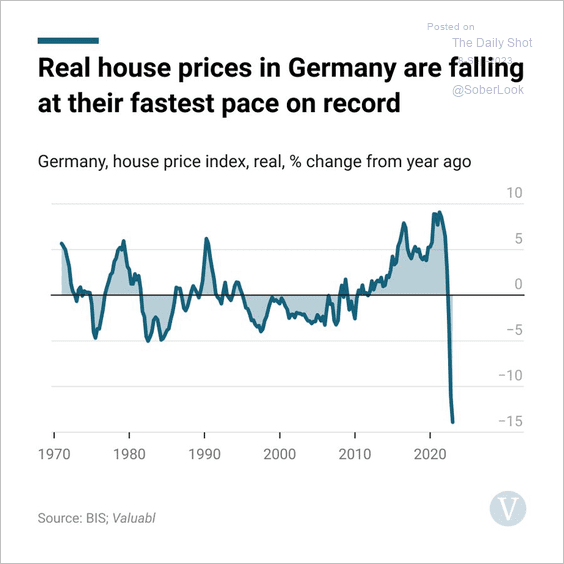

3. This chart shows inflation-adjusted German housing prices (year-over-year).

Source: @ValuablOfficial

Source: @ValuablOfficial

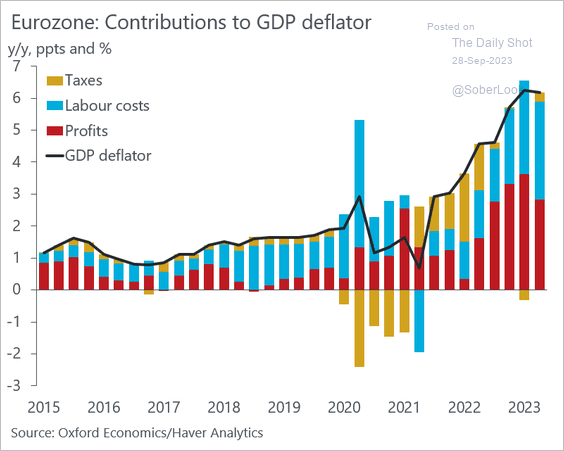

4. Labor costs have increasingly contributed to inflation in the euro area.

Source: @DanielKral1

Source: @DanielKral1

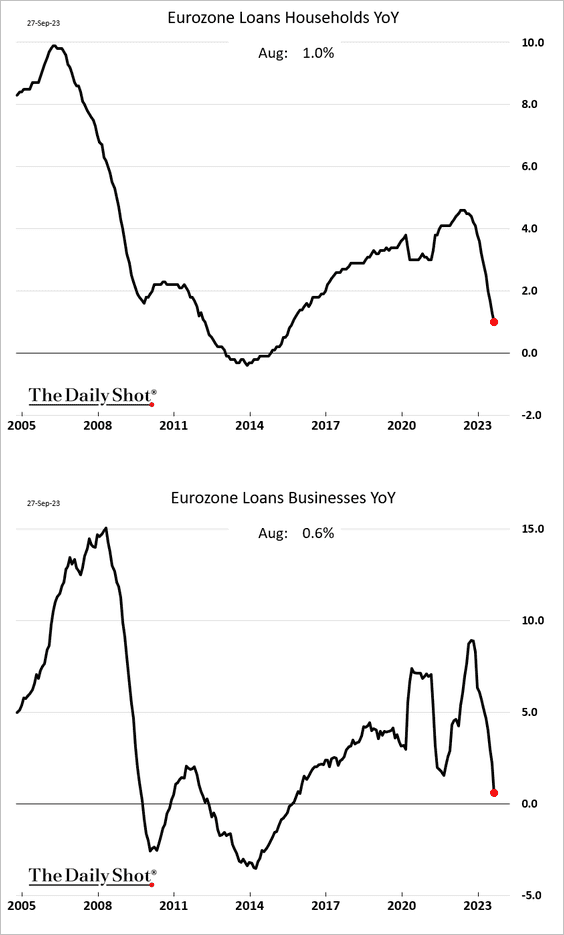

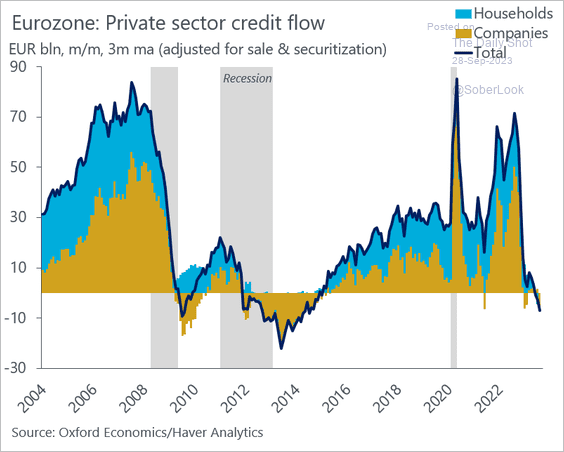

5. Loan growth continues to sink.

• Here is a look at private sector credit flows.

Source: @DanielKral1

Source: @DanielKral1

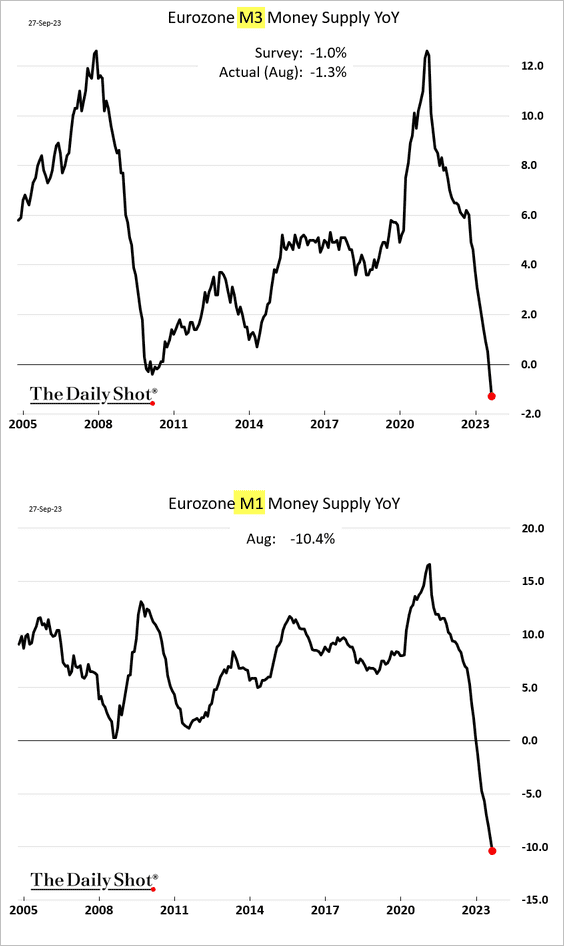

• The contraction in the money supply has accelerated.

——————–

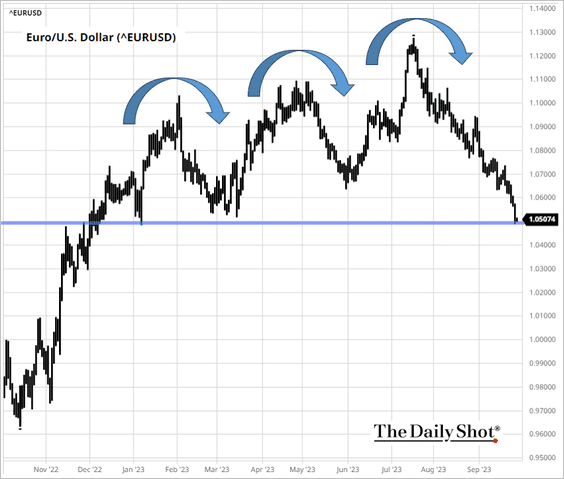

6. A triple-top for the euro?

Back to Index

Europe

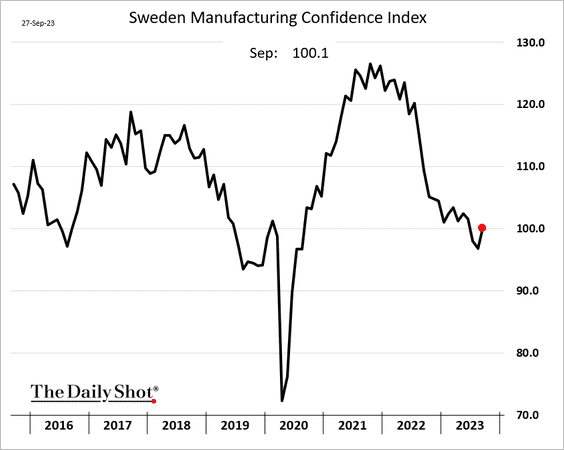

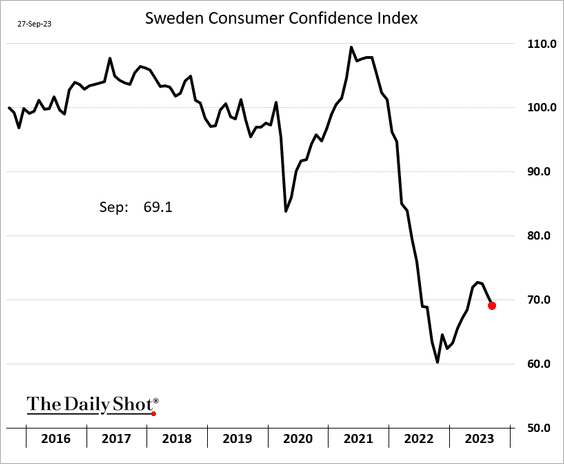

1. Sweden’s manufacturing confidence improved this month.

But consumer sentiment is rolling over.

——————–

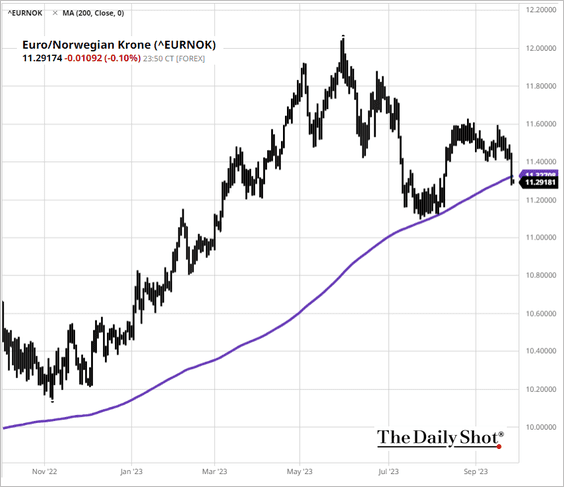

2. The Norwegian krone surged on Wednesday, with EUR/NOK dipping below the 200-day moving average.

Source: barchart.com

Source: barchart.com

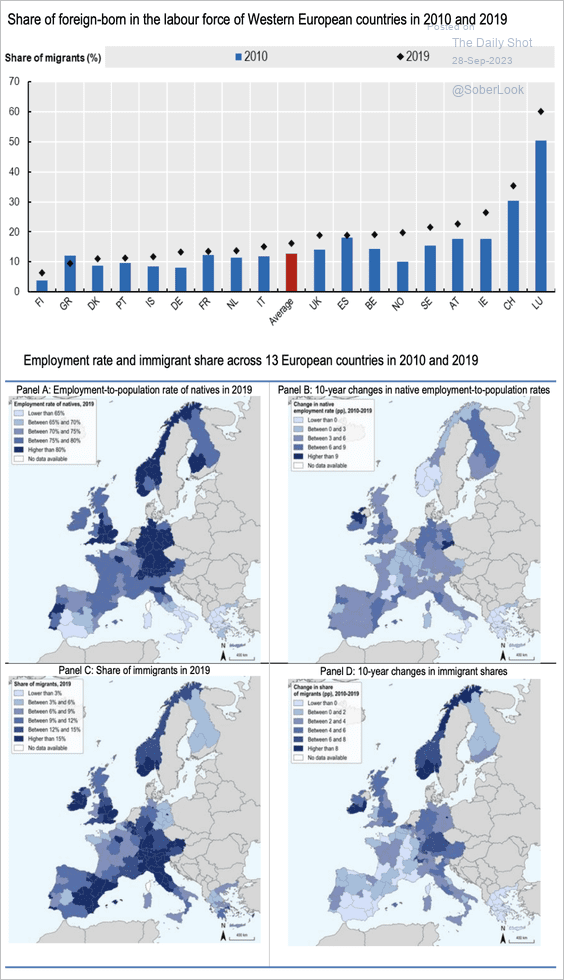

3. Next, we have the share of foreign-born workers in Western Europe.

Source: OECD Regional Development Papers

Source: OECD Regional Development Papers

Back to Index

Japan

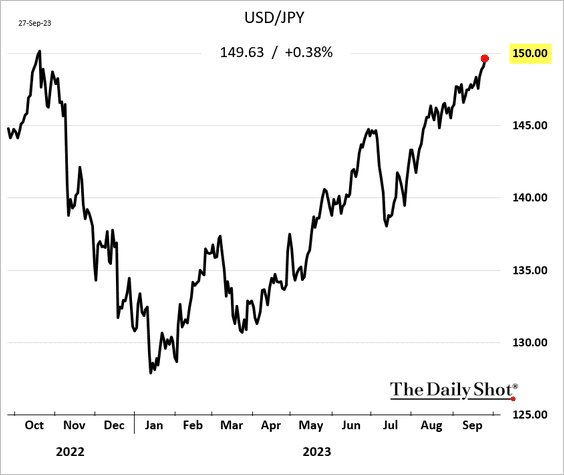

1. Dollar-yen is nearing 150. Will we see another F/X intervention?

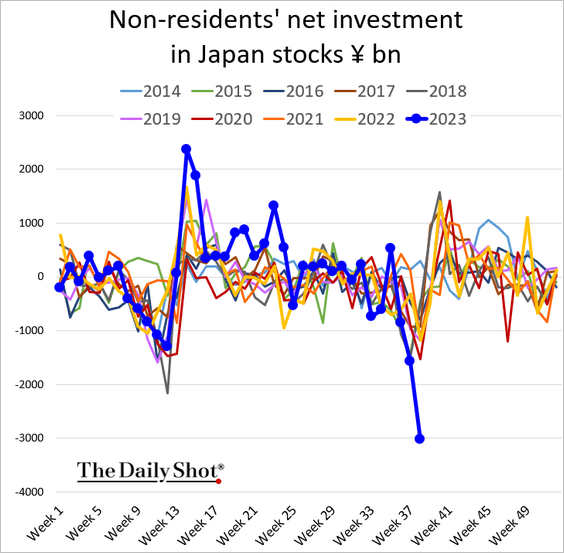

2. Foreigners have been dumping Japanese stocks.

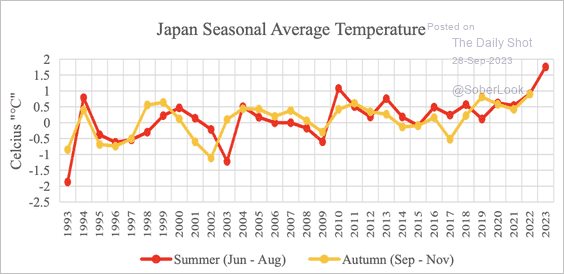

3. It’s been getting warmer in Japan.

Source: USDA Read full article

Source: USDA Read full article

Back to Index

China

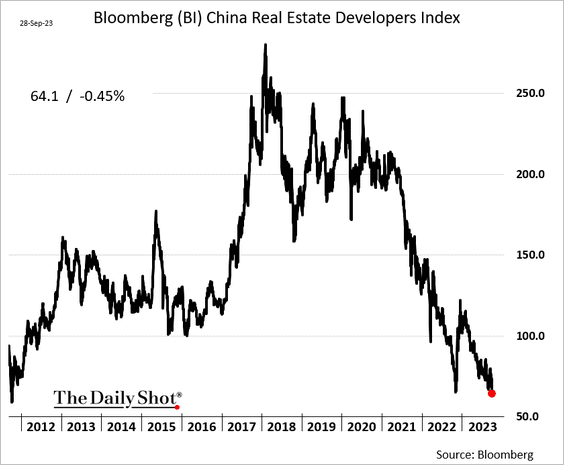

1. Bloomberg’s index of real estate developers hit the lowest level since 2011.

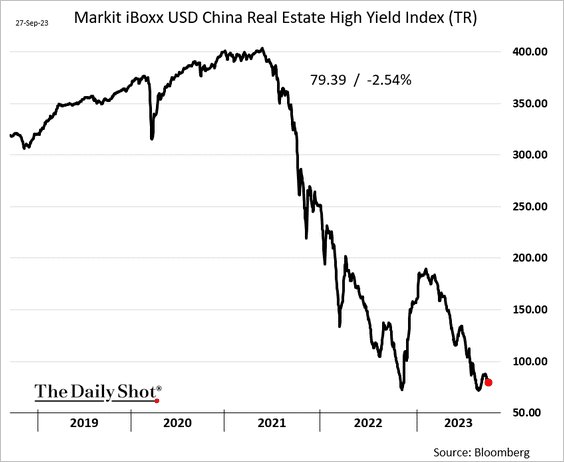

Developers’ bond prices failed to rebound.

——————–

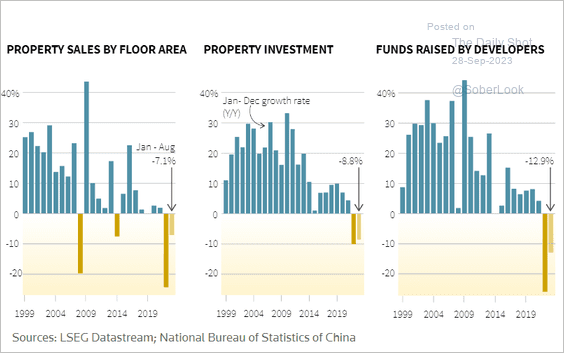

2. Here is a look at key property market indicators.

Source: Reuters Read full article

Source: Reuters Read full article

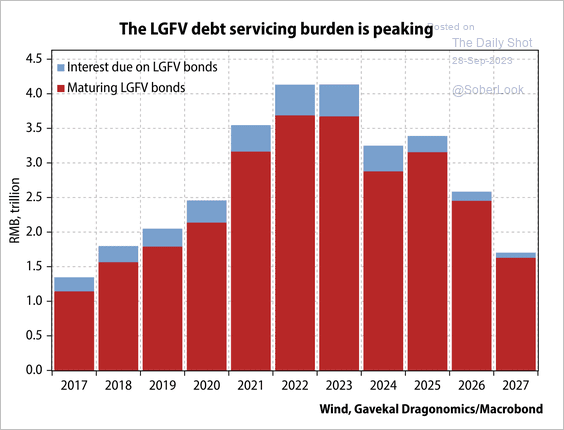

3. A large amount of local government financing vehicle (LGFV) debt is scheduled to mature this year. According to Gavekal, many LGFV projects generate low or no returns, which means officials will probably roll over maturing debt in the coming months.

Source: Gavekal Research

Source: Gavekal Research

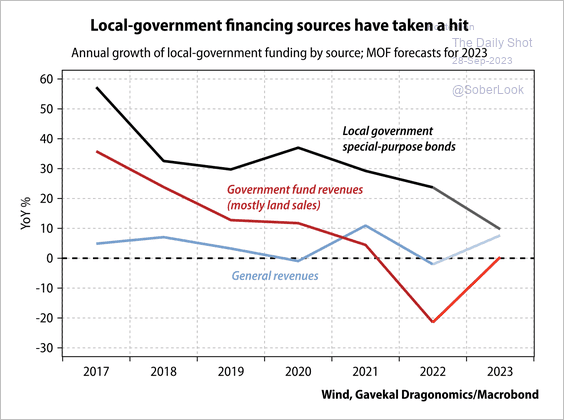

• The property slump has lowered local government income from land-use rights sales.

Source: Gavekal Research

Source: Gavekal Research

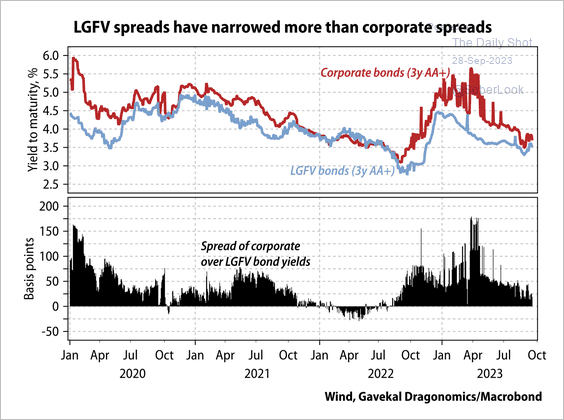

• China’s corporate bond markets appear relatively unfazed by mounting LGFV debt strains.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

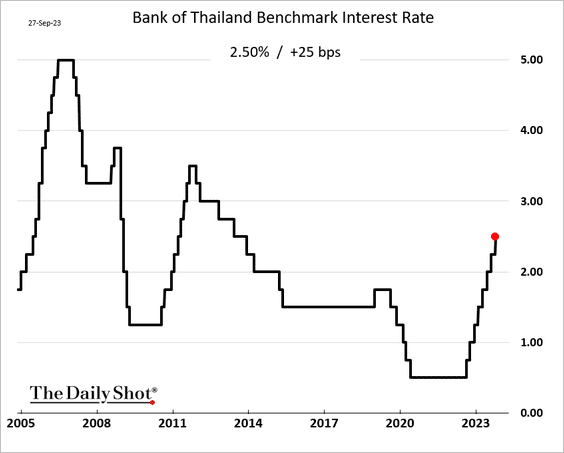

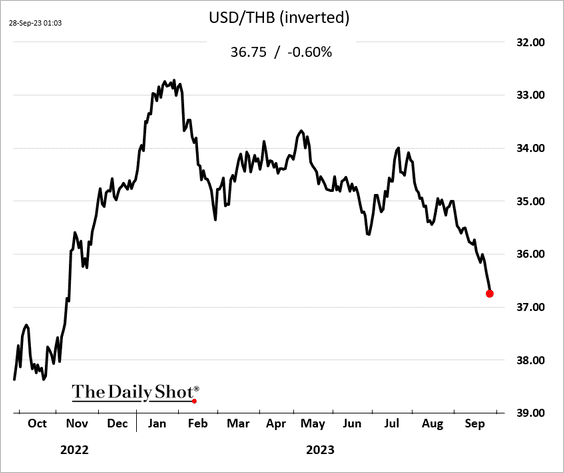

1. Thailand’s central bank unexpectedly hiked rates, …

… as the currency slumps.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

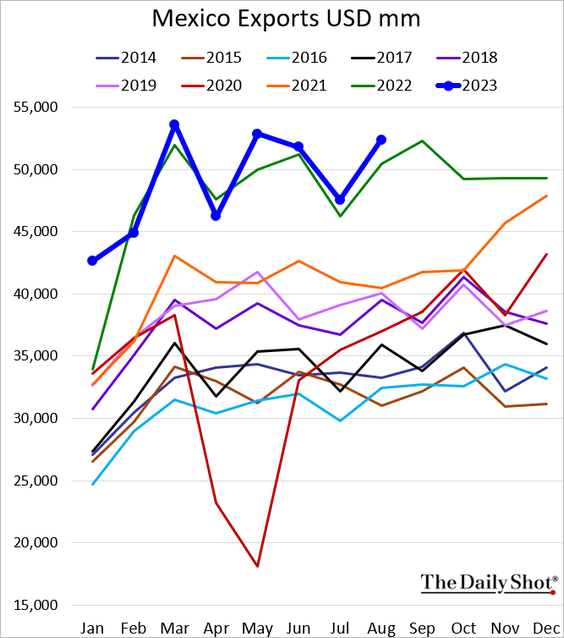

2. Mexican exports are holding at multi-year highs.

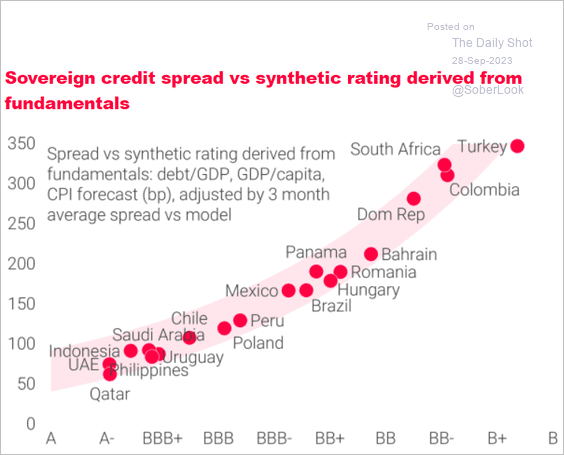

3. Here is a look at sovereign bond spreads vs. effective ratings.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

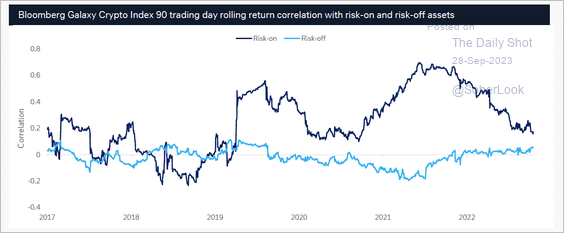

1. Cryptos have been most correlated with risk-on assets and have little to no correlation with risk-off assets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. Bitcoin miner revenue remains well below 2021 peak levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

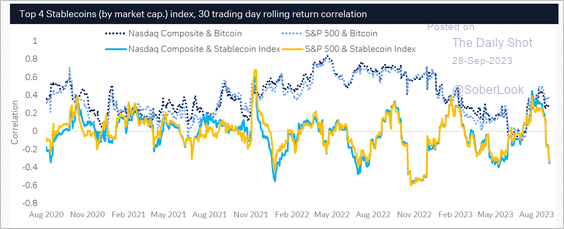

3. Stablecoin returns were increasingly correlated with S&P 500 and Nasdaq returns since July but plummeted in September.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Commodities

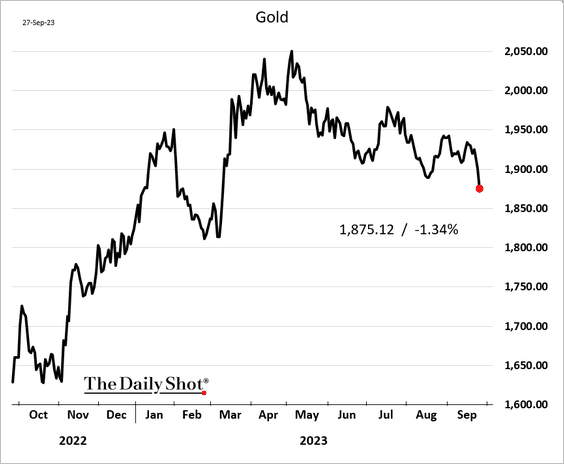

1. Gold is finally succumbing to surging real rates.

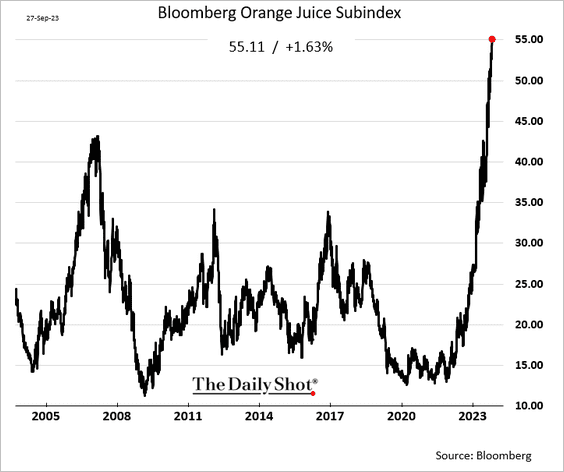

2. US orange juice futures hit another record high.

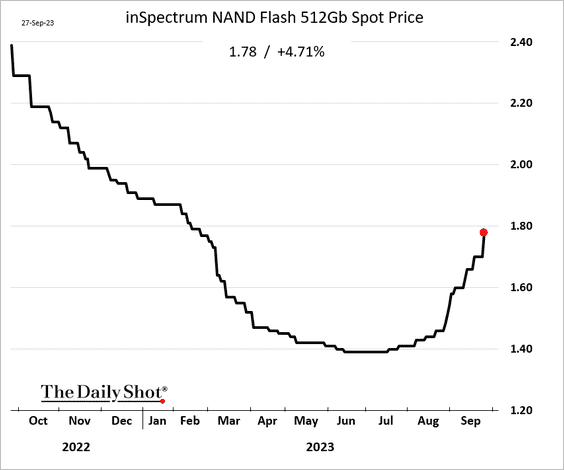

3. Flash memory prices are rebounding.

Back to Index

Energy

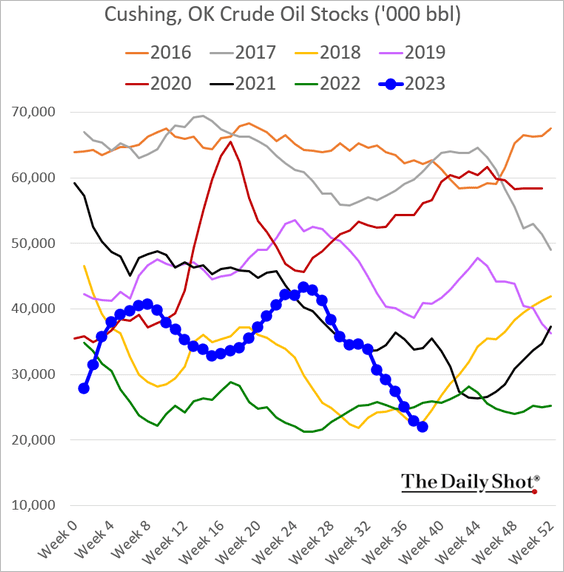

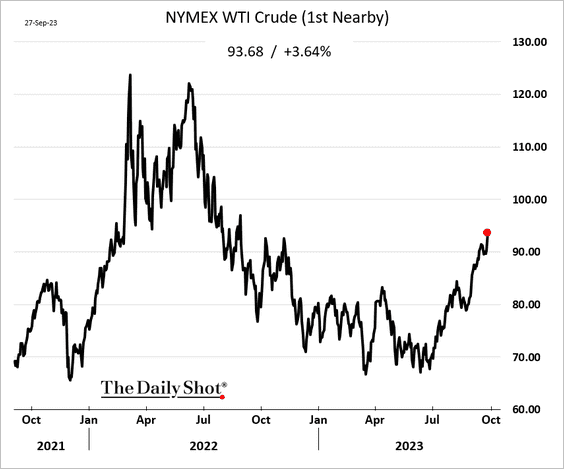

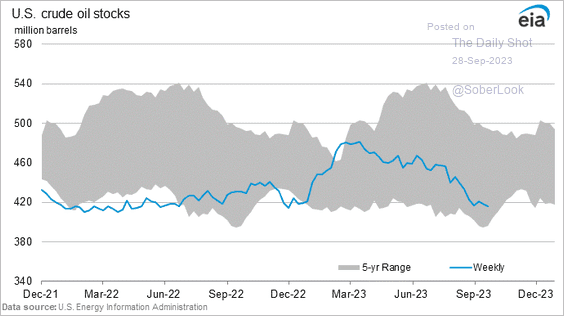

1. Spooked by collapsing inventories at Cushing, OK, …

… traders sent US crude oil futures sharply higher.

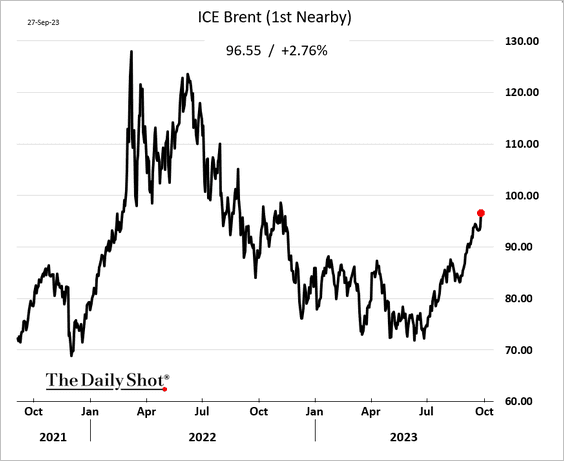

Brent crude futures jumped as well.

——————–

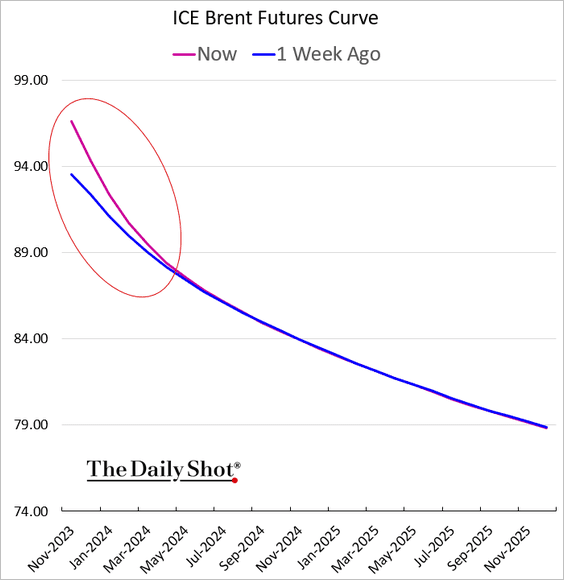

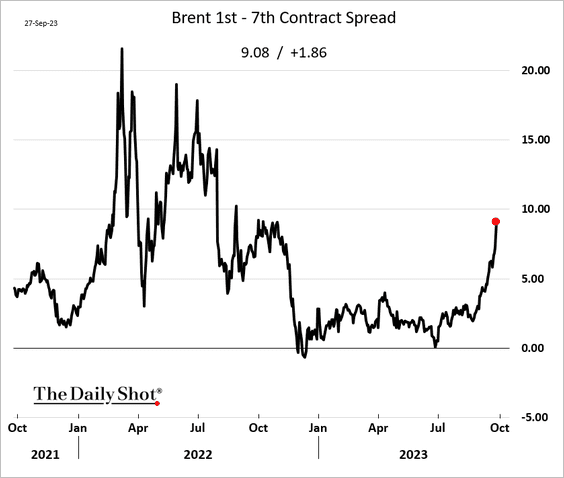

2. Crude oil backwardation is deepening amidst supply concerns (2 charts).

——————–

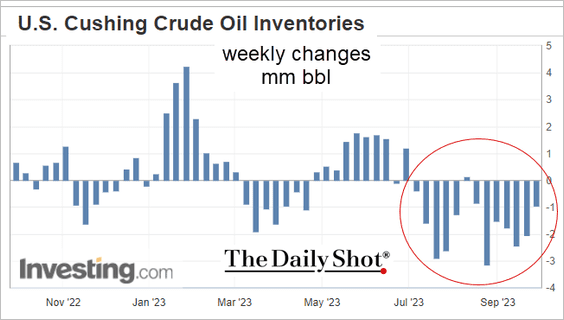

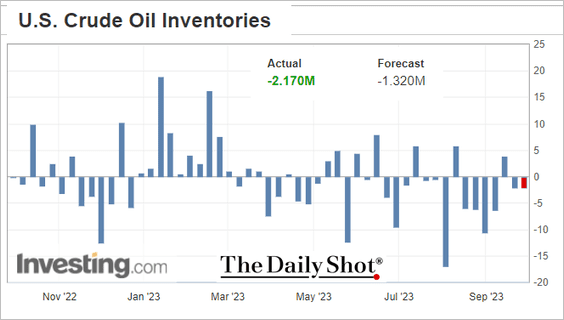

3. US crude oil inventories declined again last week (2 charts).

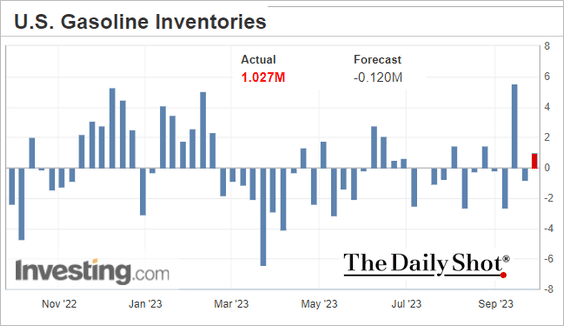

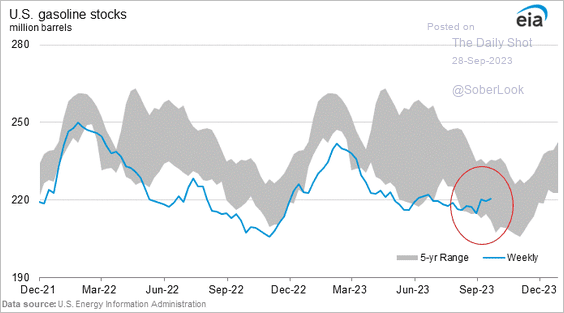

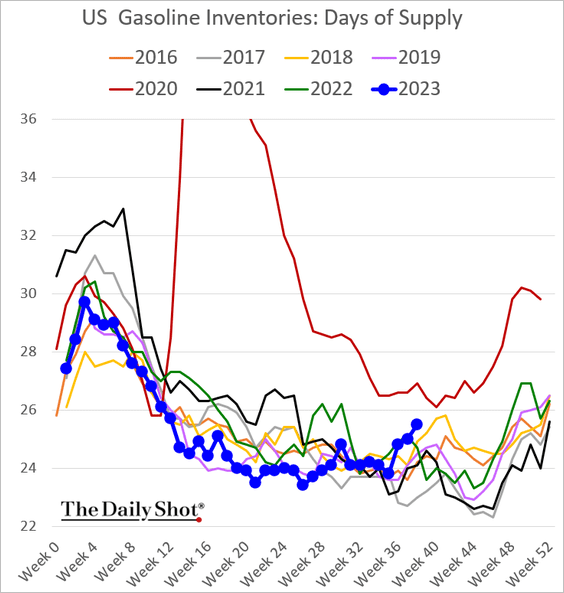

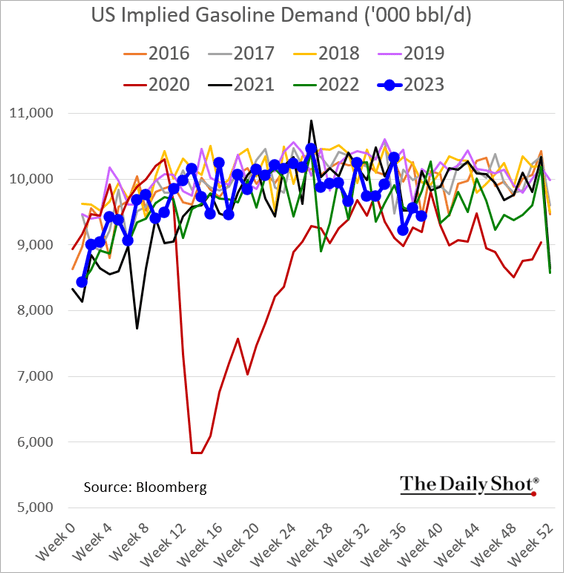

• But gasoline inventories unexpectedly increased (3 charts), …

… as gasoline demand remains lackluster.

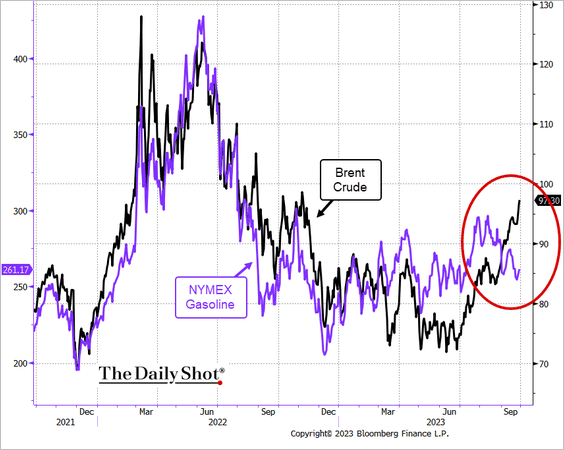

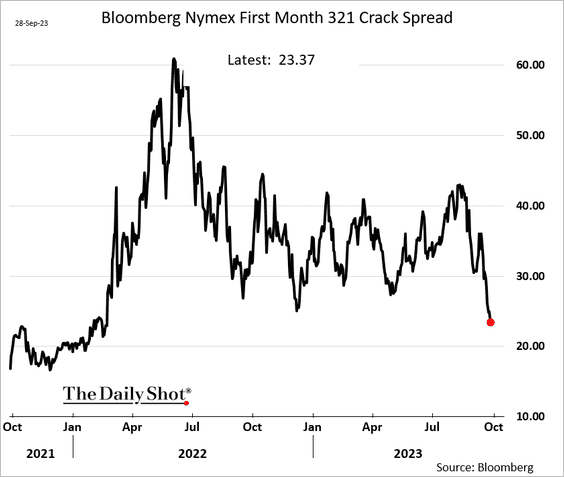

• This divergence in inventory levels between crude oil and refined products is pressuring crack spreads (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

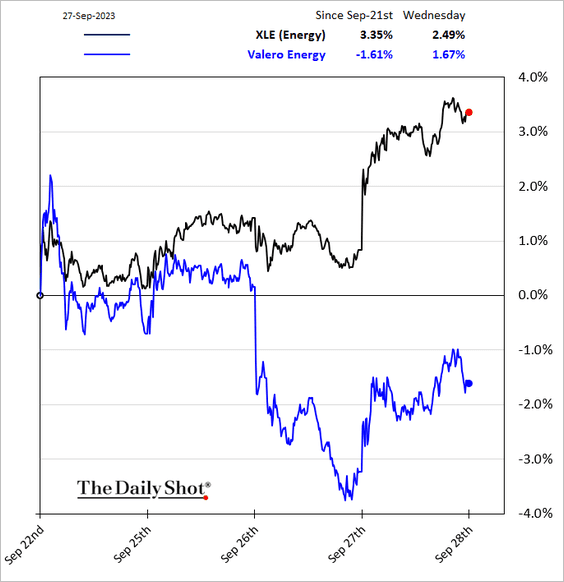

This is not ideal for refinery operators.

——————–

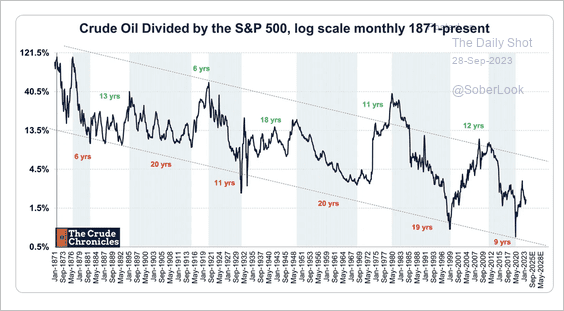

4. On average, the crude oil/S&P 500 price ratio advances every 13 years based on its long-term trend channel.

Source: The Crude Chronicles

Source: The Crude Chronicles

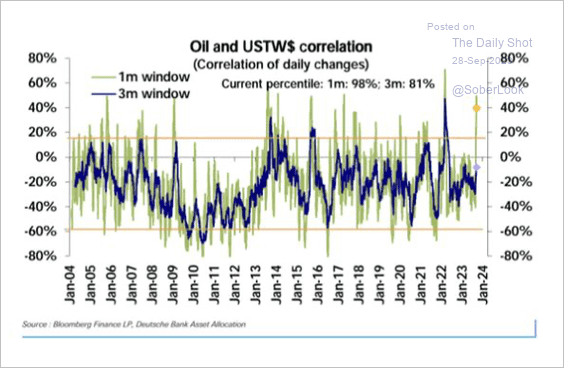

5. The correlation between oil prices and the dollar spiked from its usual negative territory.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

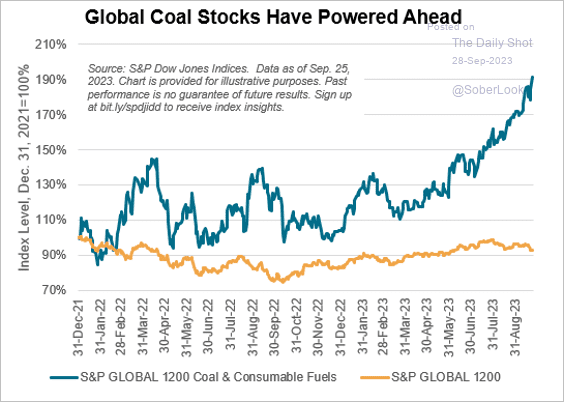

6. Coal stocks have been surging.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

Back to Index

Equities

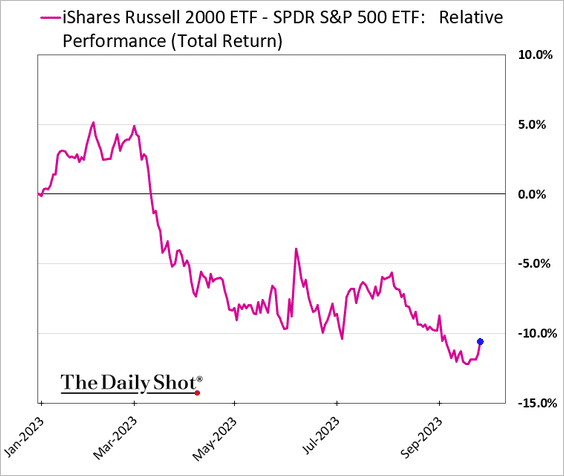

1. Small caps are no longer underperforming.

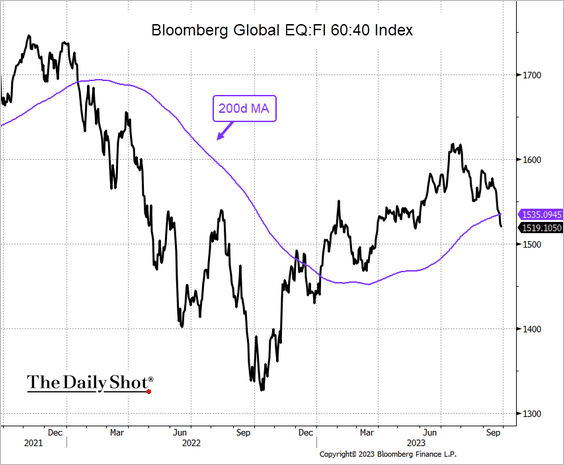

2. It’s been a rough month for the 60:40 portfolio.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @johnauthers

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @johnauthers

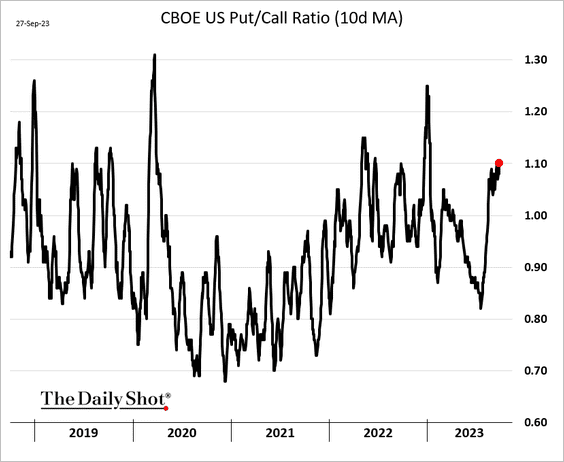

3. The put/call ratio has been climbing, signaling cautious sentiment.

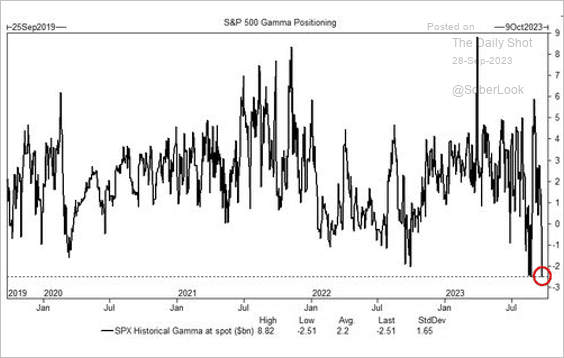

4. Dealers are very short gamma, which could exacerbate market moves.

Source: Goldman Sachs; @Marlin_Capital

Source: Goldman Sachs; @Marlin_Capital

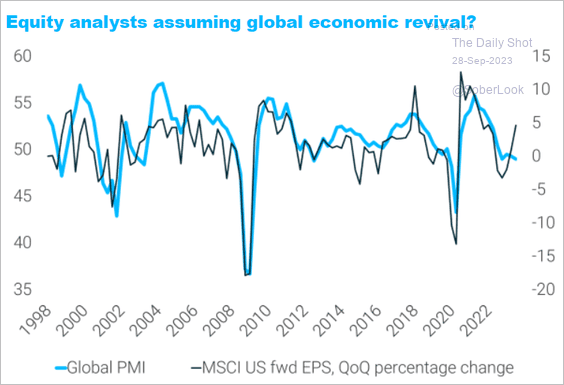

5. Equity analysts are assuming a rebound in business activity ahead. However, surging bond yields (driving up mortgage rates), the resumption of student loan payments, and the looming government shutdown will be a headwind for the US economy.

Source: TS Lombard

Source: TS Lombard

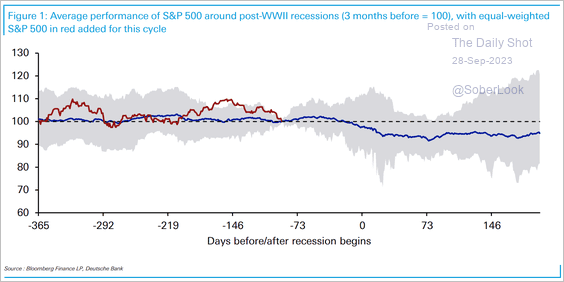

• On average, the S&P 500 typically declines in the year leading up to the start of a recession.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

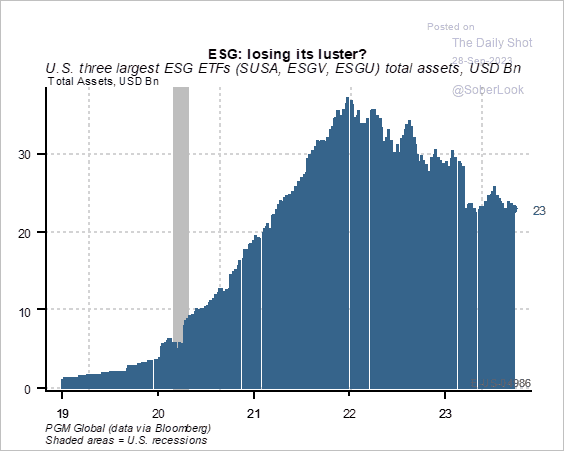

6. ESG funds are losing assets.

Source: PGM Global

Source: PGM Global

Back to Index

Alternatives

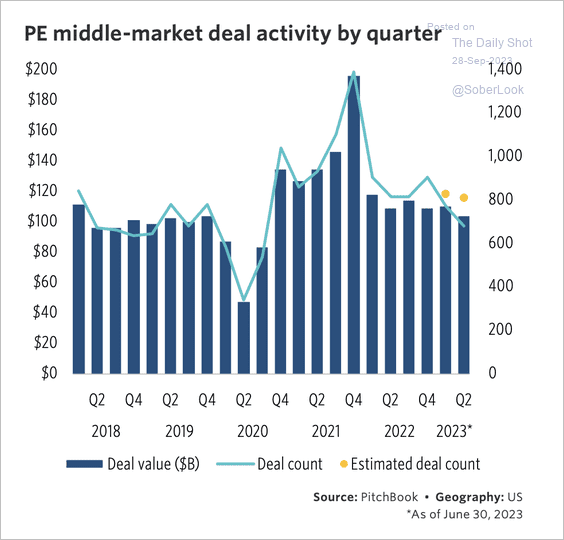

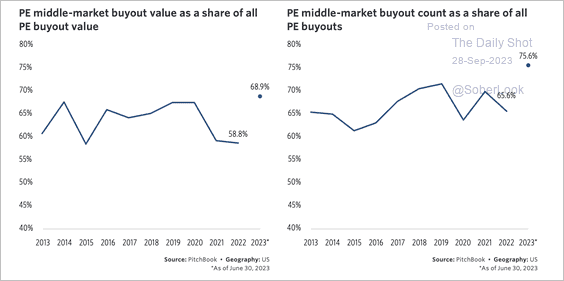

1. US private-equity middle market deal activity remains soft but is gaining share of all buyout values. (2 charts)

Source: PitchBook

Source: PitchBook

Source: PitchBook

Source: PitchBook

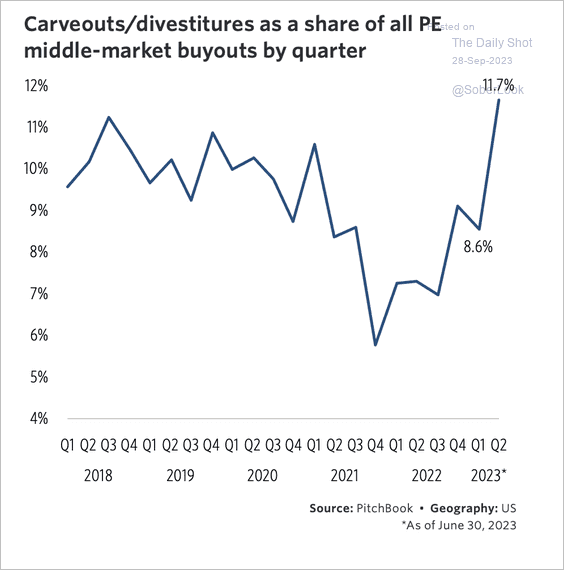

2. There has been a sharp increase in middle market carve-outs and divestitures in recent years.

Source: PitchBook

Source: PitchBook

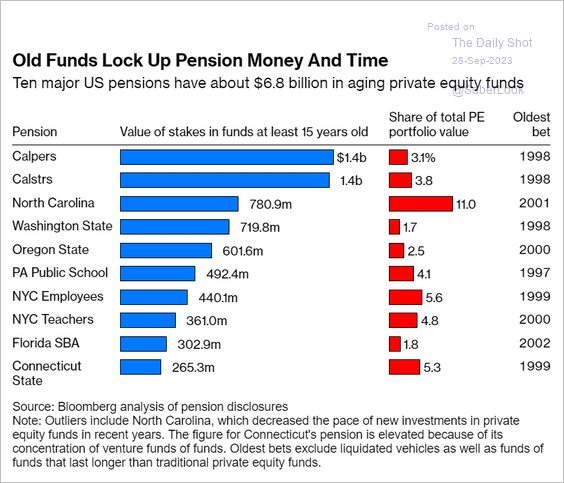

3. Pension funds are holding a lot of “tail-end” PE investments.

Source: @BW Read full article

Source: @BW Read full article

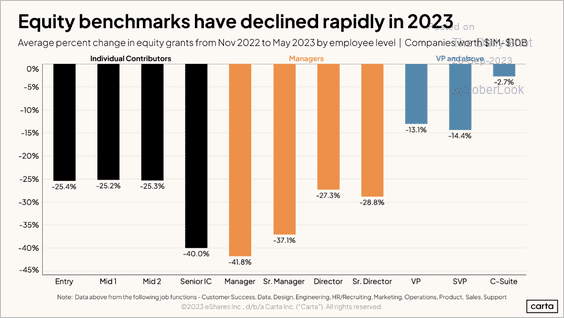

4. Senior executives at startups have seen their equity compensation benchmarks decline much less than middle management.

Source: Carta

Source: Carta

Back to Index

Rates

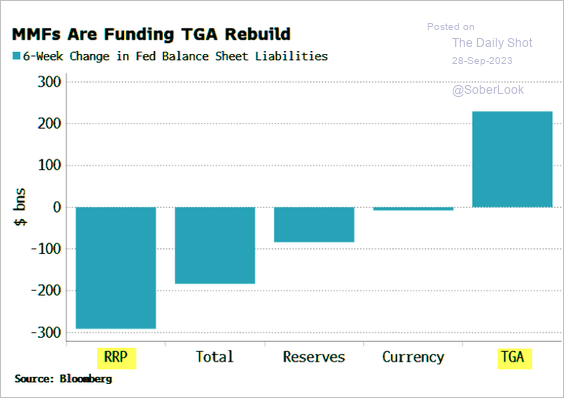

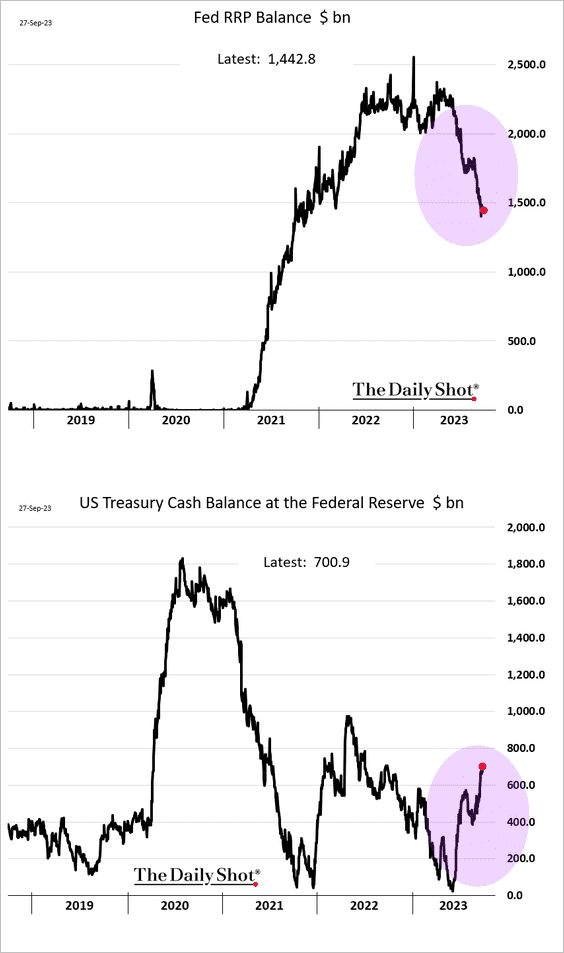

1. Money market funds are shifting from the Fed’s RRP facility to T-bills, aiding the Treasury’s cash balance rebuild. (2 charts).

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

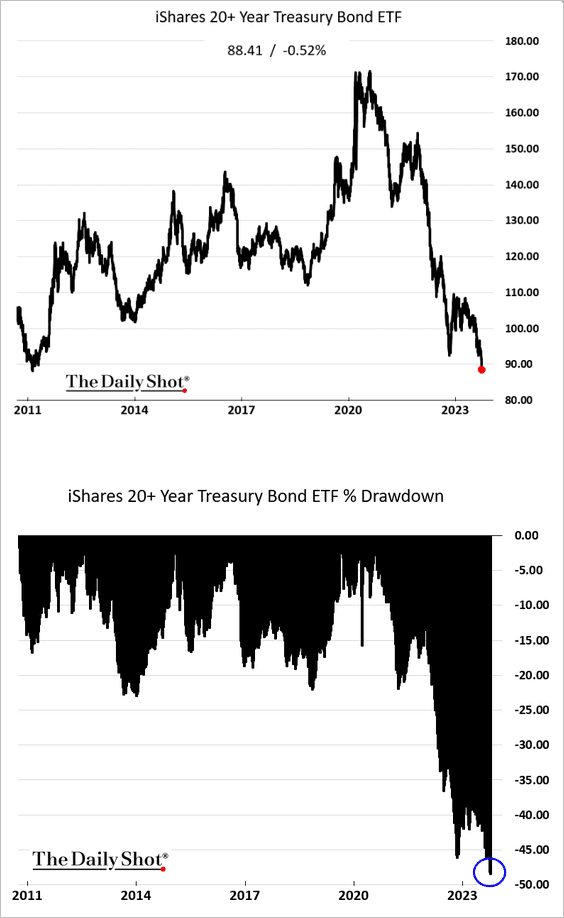

2. The drawdown in longer-dated Treasuries continues to deepen.

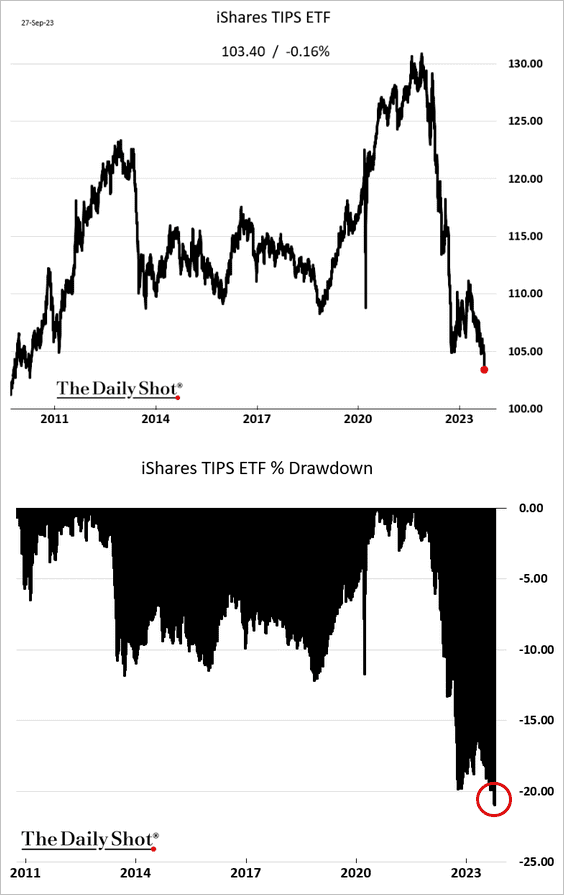

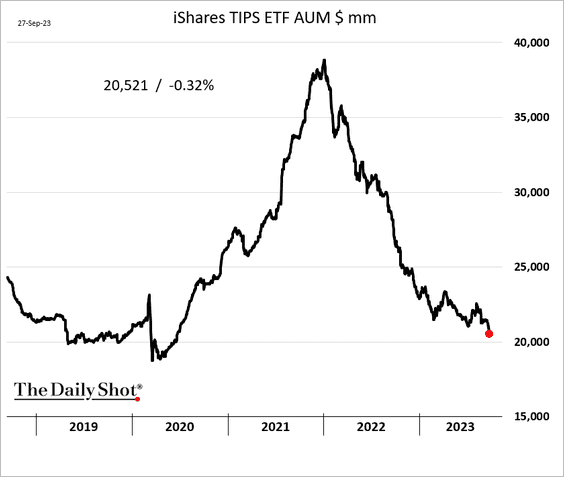

The same holds true for inflation-linked Treasuries (TIPS).

• This chart shows assets under management at the iShares TIPS ETF.

Back to Index

Global Developments

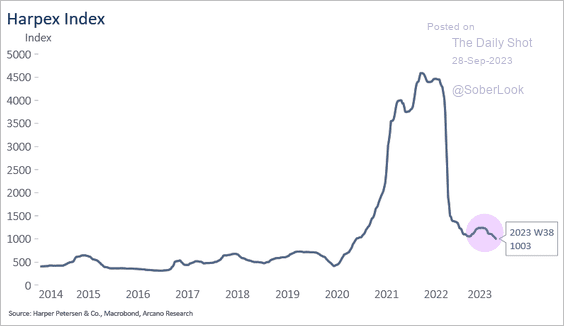

1. The small bounce in container ship charter prices has been reversed, as demand remains soft.

Source: Arcano Economics

Source: Arcano Economics

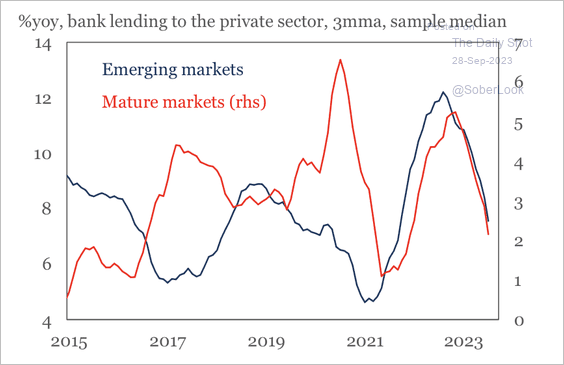

2. There has been a sharp slowdown in bank credit growth.

Source: IIF

Source: IIF

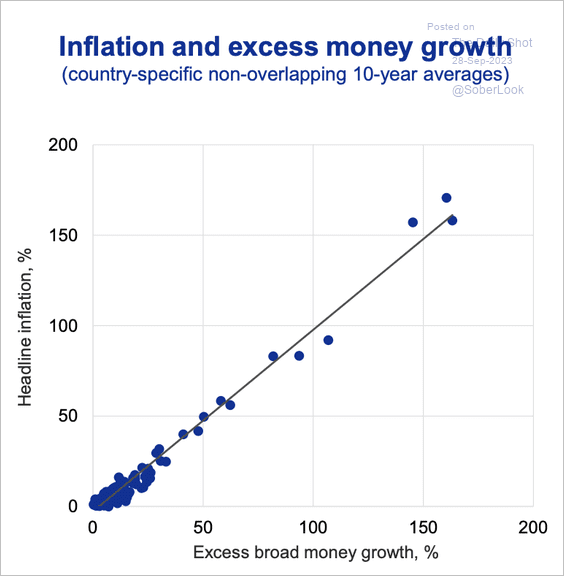

3. Inflation is highly correlated to the excess money supply growth.

Source: ECB Read full article

Source: ECB Read full article

——————–

Food for Thought

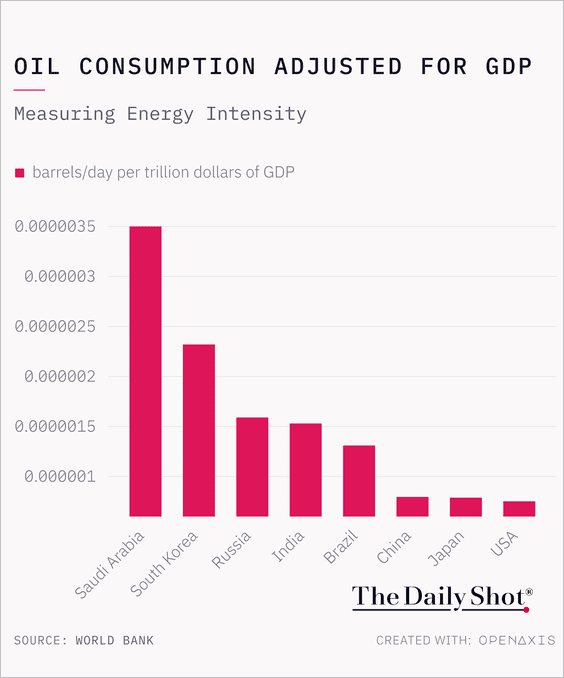

1. Oil consumption adjusted for GDP:

Source: @TheDailyShot

Source: @TheDailyShot

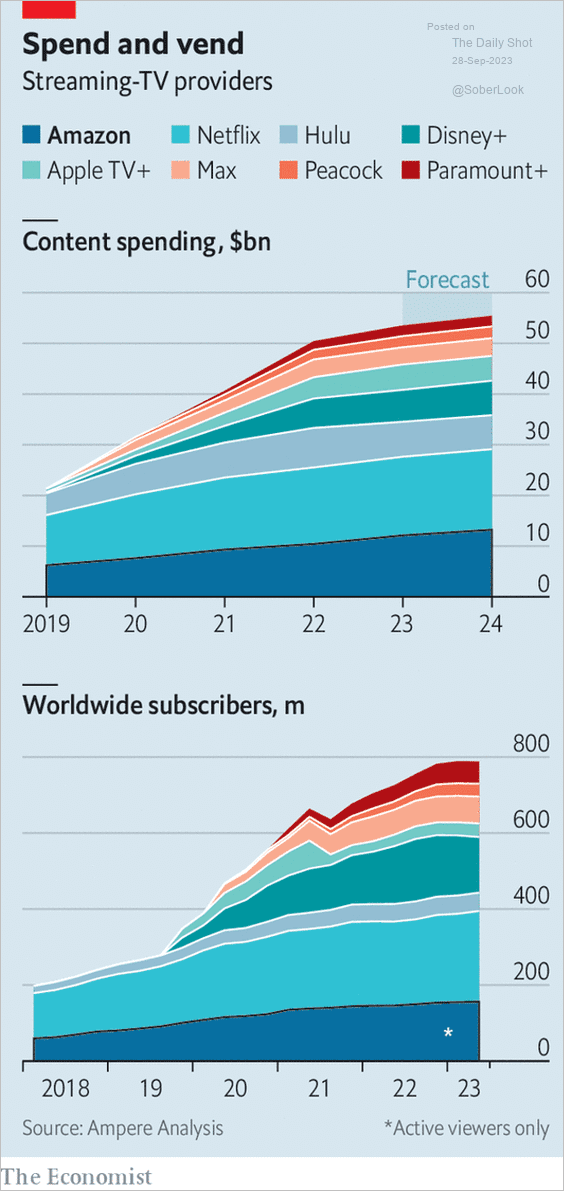

2. Streaming-TV content spending and subscribers:

Source: The Economist Read full article

Source: The Economist Read full article

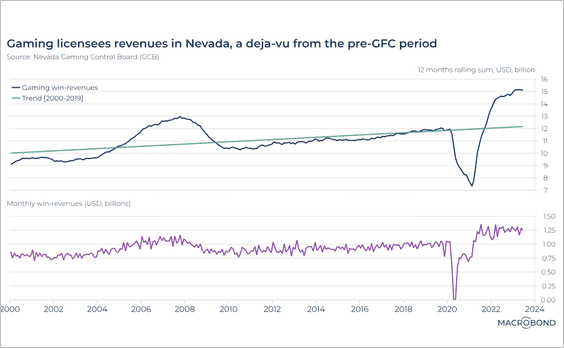

3. Vegas is back:

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

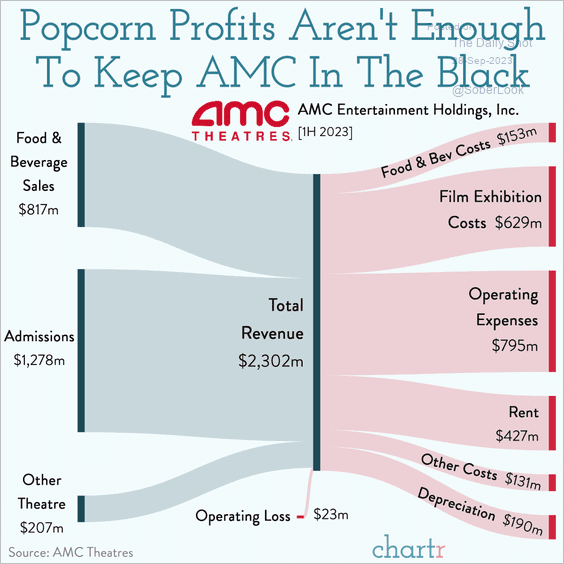

4. AMC financials:

Source: @chartrdaily

Source: @chartrdaily

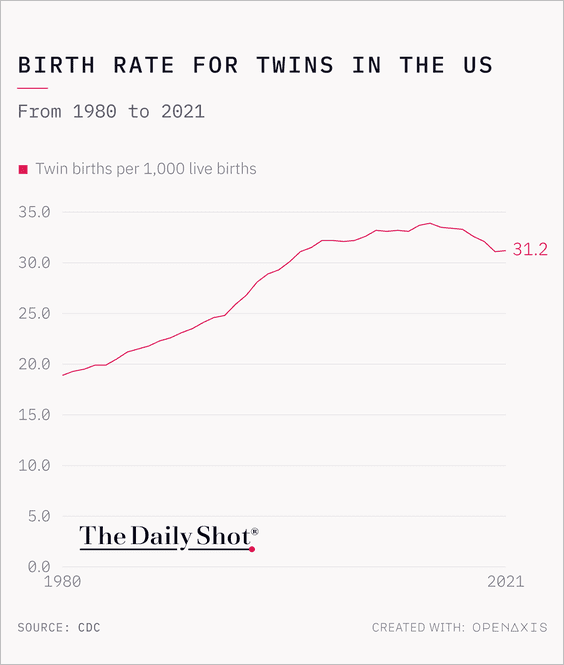

5. The birth rate for twins in the US:

Source: @TheDailyShot

Source: @TheDailyShot

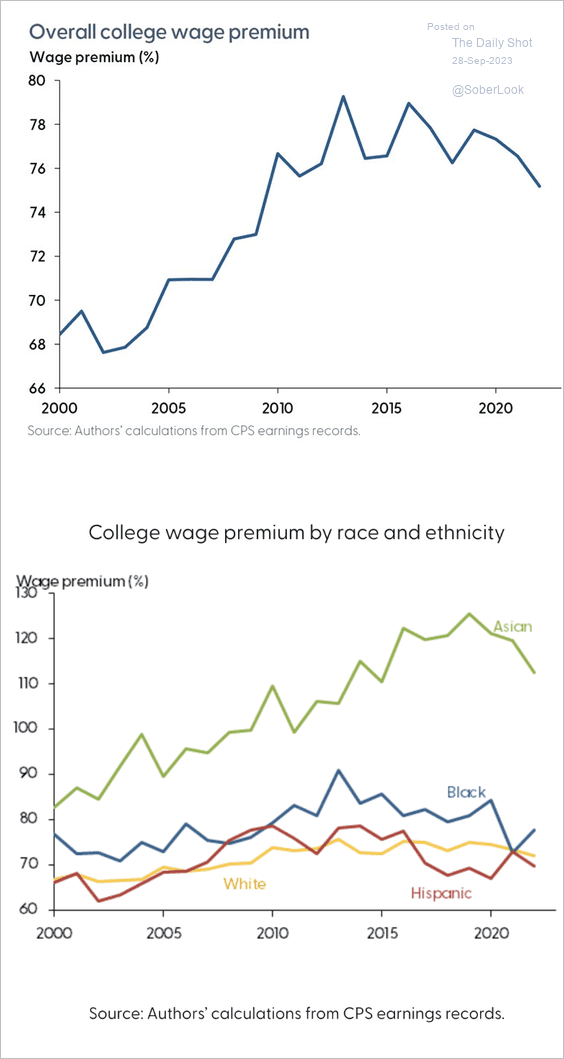

6. College degree wage premium:

Source: Federal Reserve Bank of San Francisco Read full article

Source: Federal Reserve Bank of San Francisco Read full article

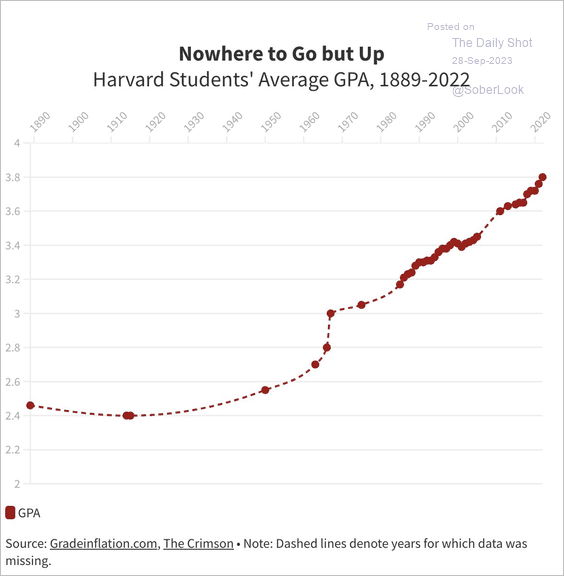

7. Grade inflation:

Source: The Harvard Crimson Read full article

Source: The Harvard Crimson Read full article

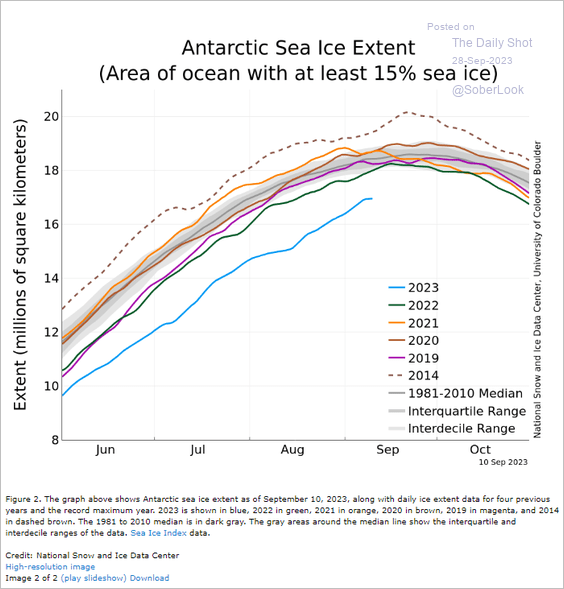

8. Antarctic sea ice extent:

Source: NSIDC Read full article Further reading

Source: NSIDC Read full article Further reading

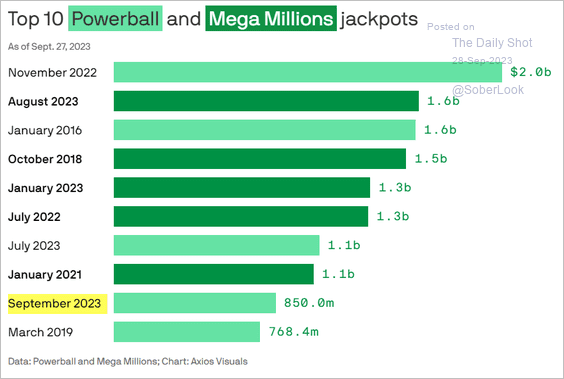

9. Powerball and Mega Millions jackpots:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index