The Daily Shot: 29-Sep-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Australia

• Emerging Markets

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

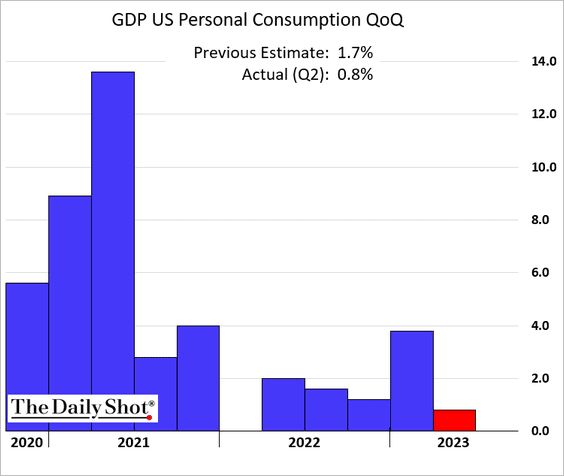

1. Second-quarter consumer spending growth was revised lower.

SAAR

SAAR

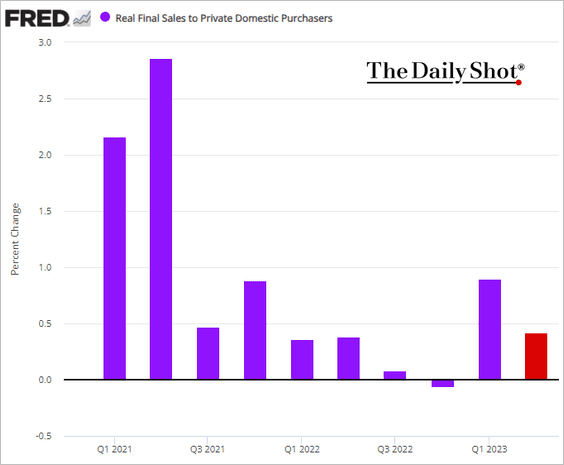

Nonetheless, real final sales to private domestic purchasers (“core GDP”) registered a notable increase.

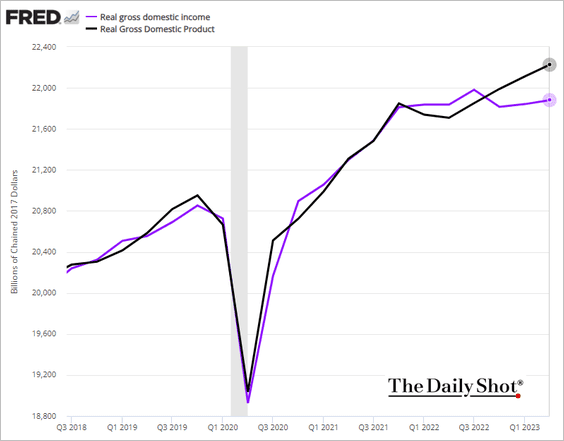

• The GDP-GDI divergence (see definition) remains a concern.

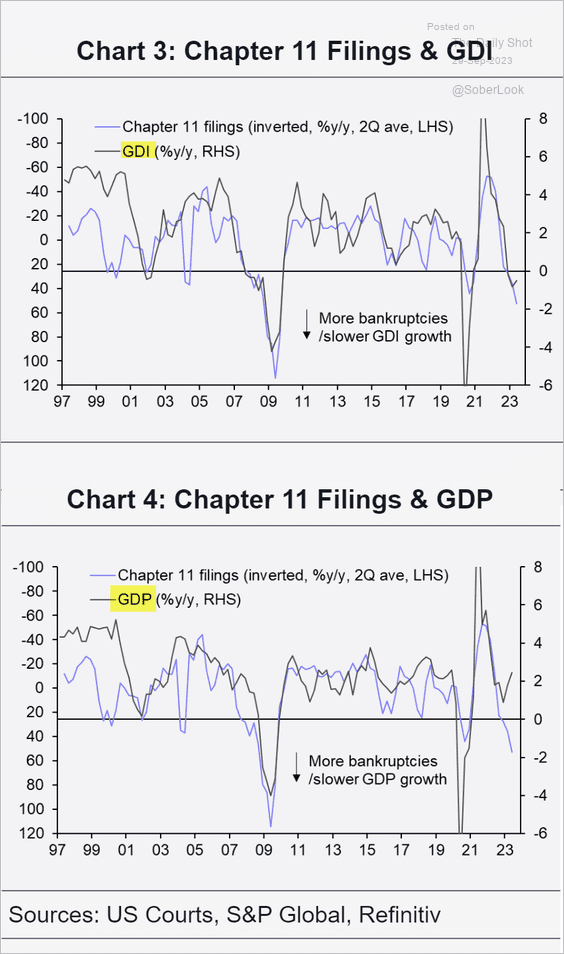

Compared to the GDP, the GDI measure signals slower US growth, aligning more closely with the observed rise in corporate bankruptcies.

Source: Capital Economics

Source: Capital Economics

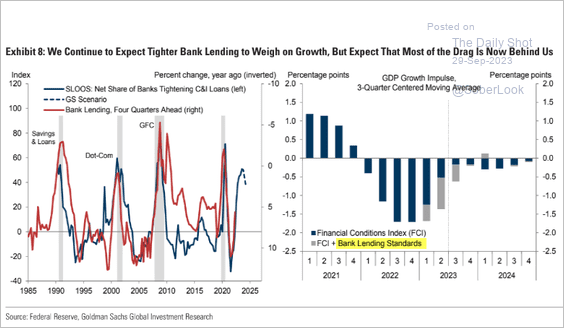

• Is the drag on growth from tighter credit conditions starting to ease?

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

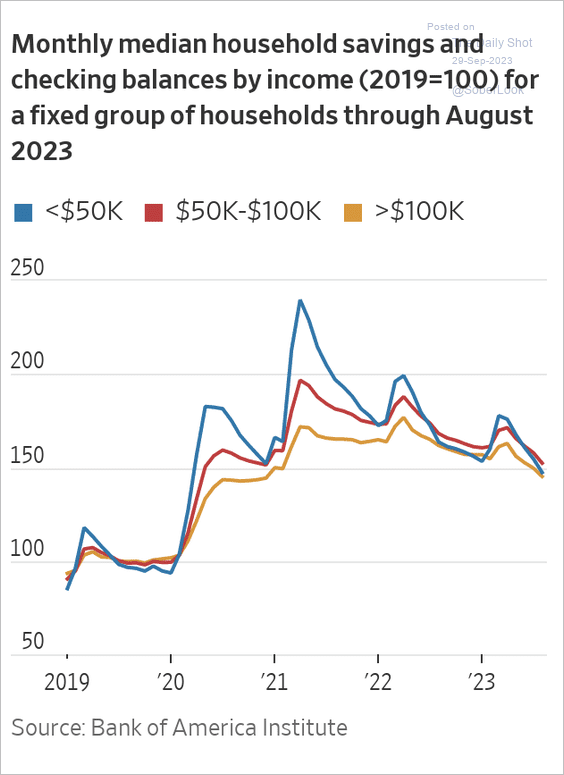

2. Households’ cash balances remain elevated.

Source: @WSJ Read full article

Source: @WSJ Read full article

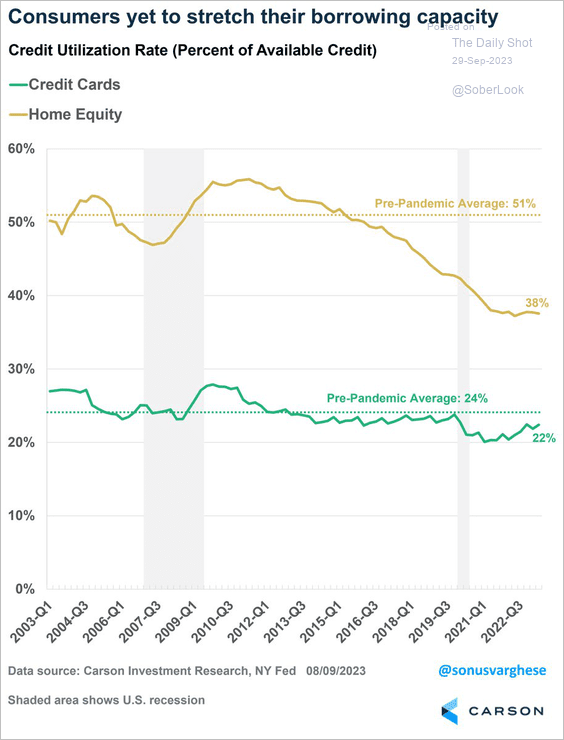

And consumers seem to have plenty of borrowing capacity.

Source: @RyanDetrick, @sonusvarghese

Source: @RyanDetrick, @sonusvarghese

——————–

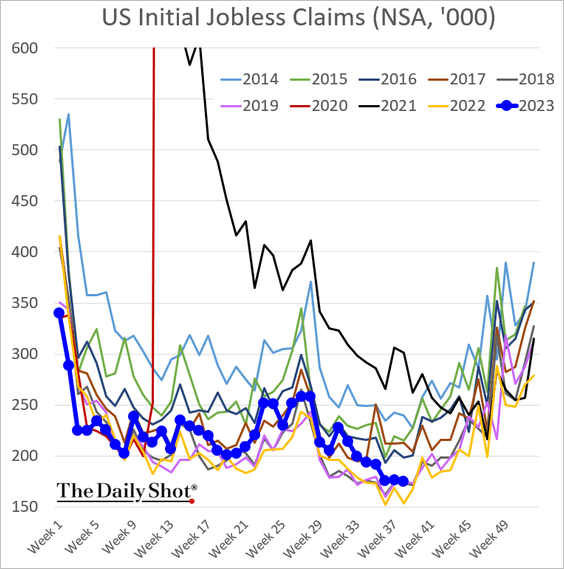

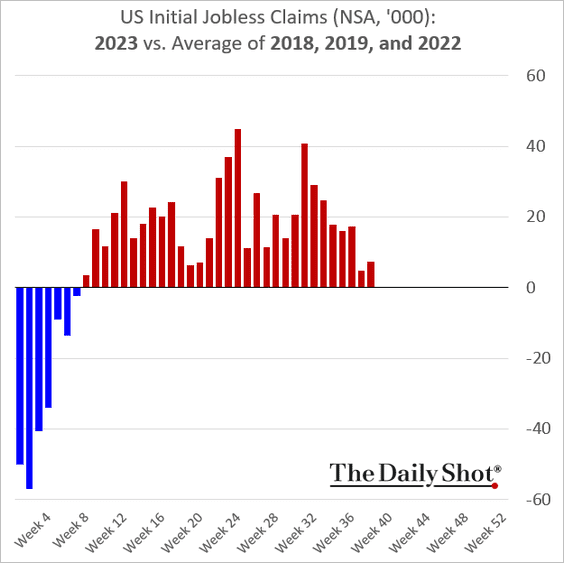

3. Initial jobless claims remain low.

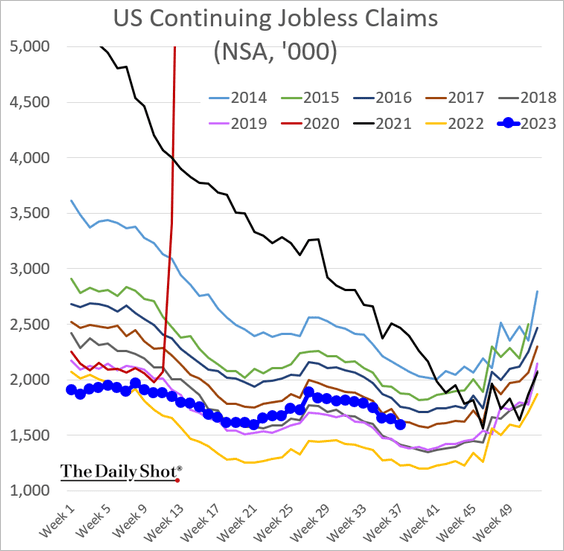

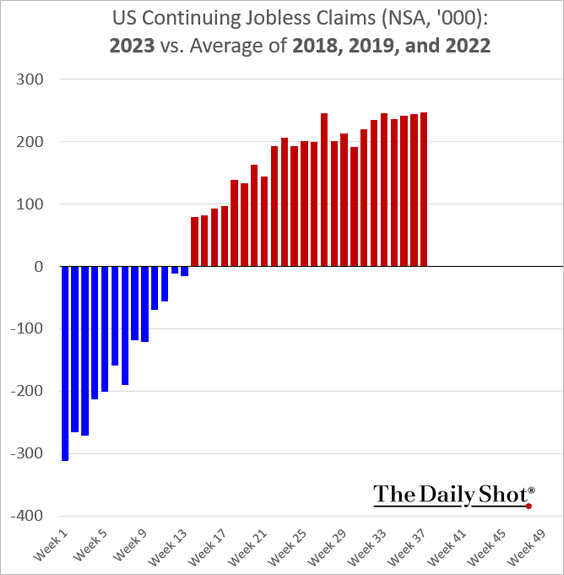

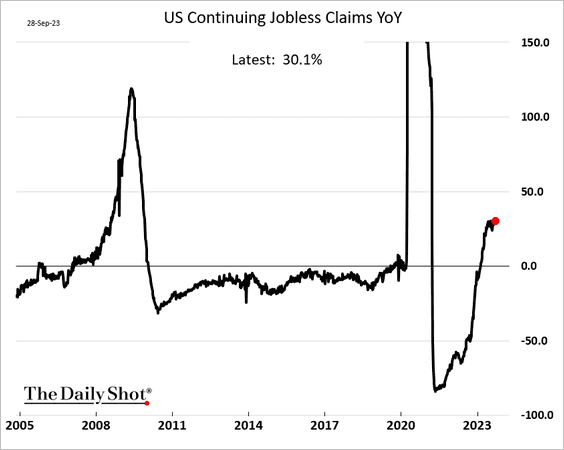

However, the number of Americans receiving unemployment benefits is elevated relative to recent years (30% above last year’s level).

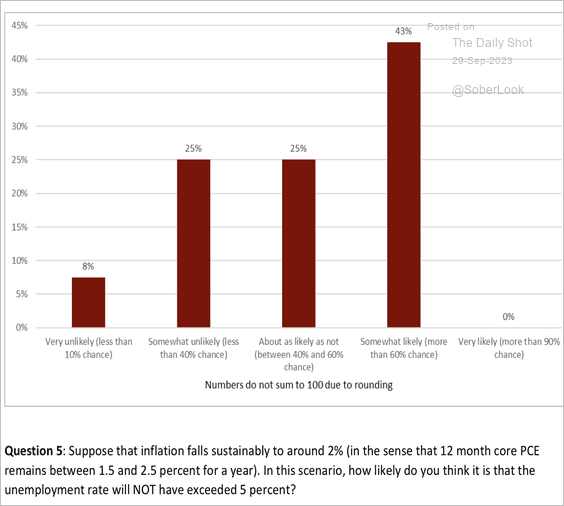

• Most economists believe it is likely that unemployment could stay below 5% if inflation sustainably falls toward the 2% target, according to a survey by FT and Chicago Booth.

Source: FT/Chicago Booth

Source: FT/Chicago Booth

——————–

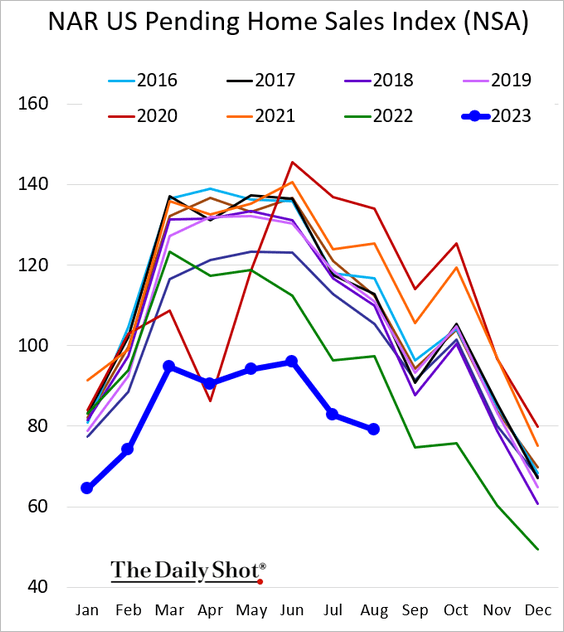

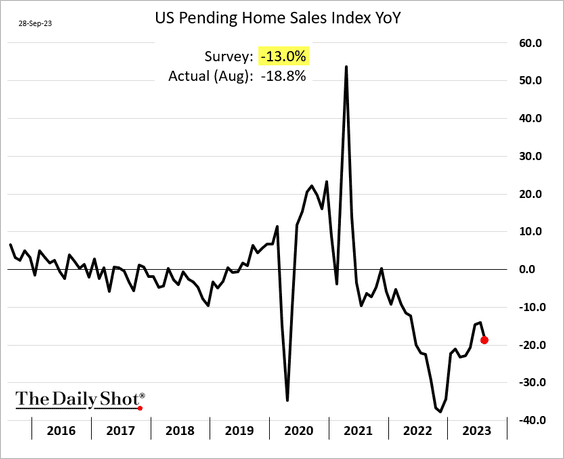

4. Pending home sales remain at multi-year lows, down about 19% from 2022.

——————–

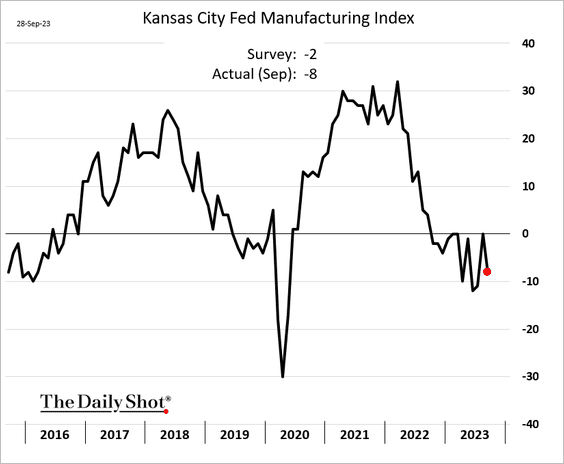

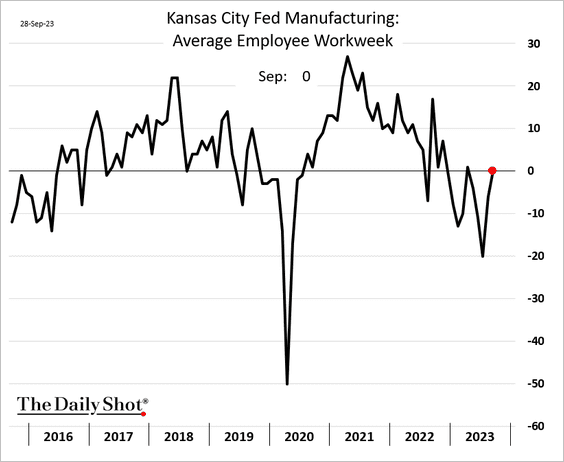

5. The Kansas City Fed’s regional manufacturing report signaled a contraction this month.

However, employee hours have stabilized.

Back to Index

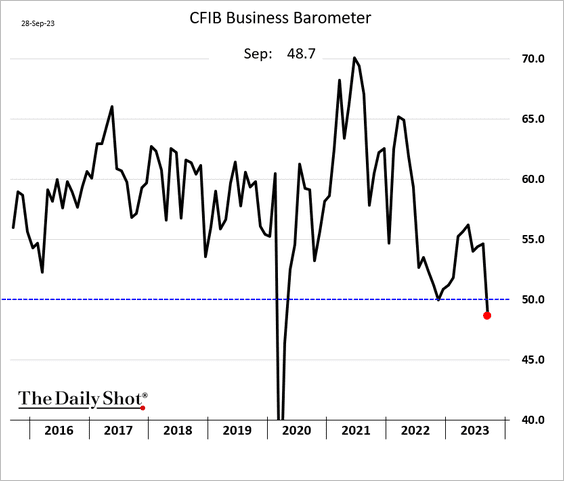

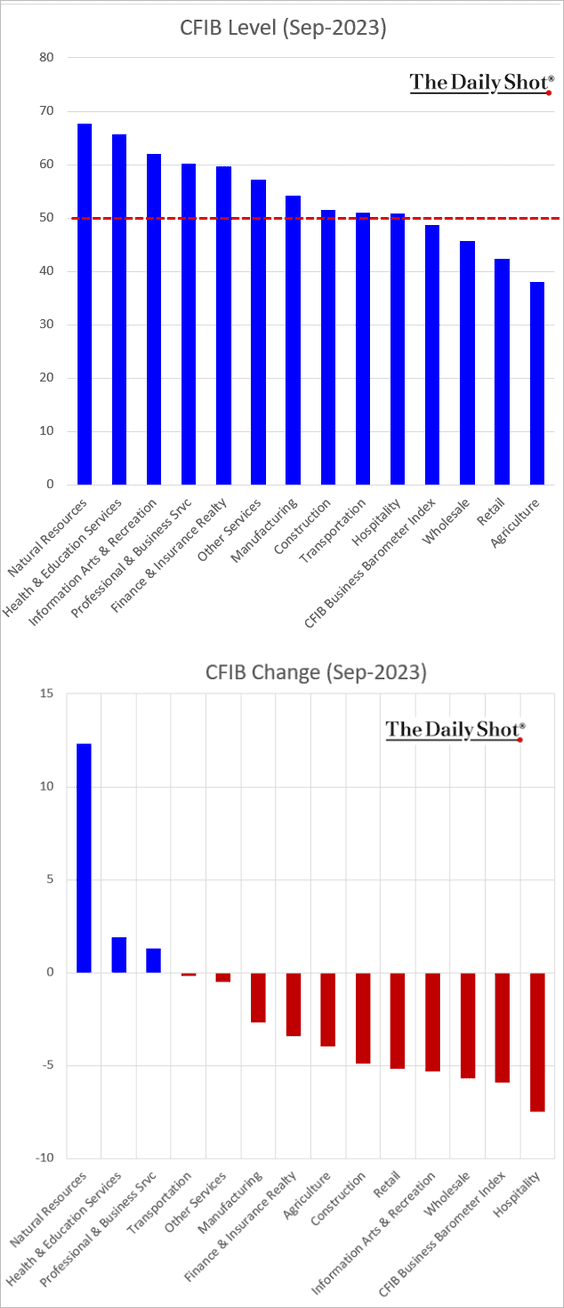

Canada

For the first time since the initial impact of COVID, the CFIB index, which measures business sentiment for small and medium-sized businesses, has fallen into contraction territory.

Here is a look at CFIB levels and changes by sector.

Back to Index

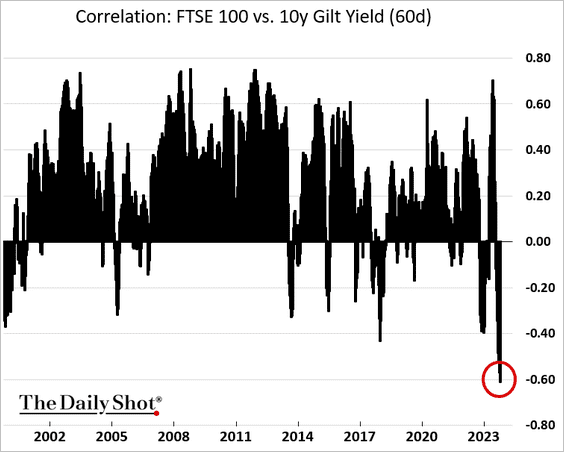

The United Kingdom

UK stocks and bonds have been highly correlated.

Back to Index

The Eurozone

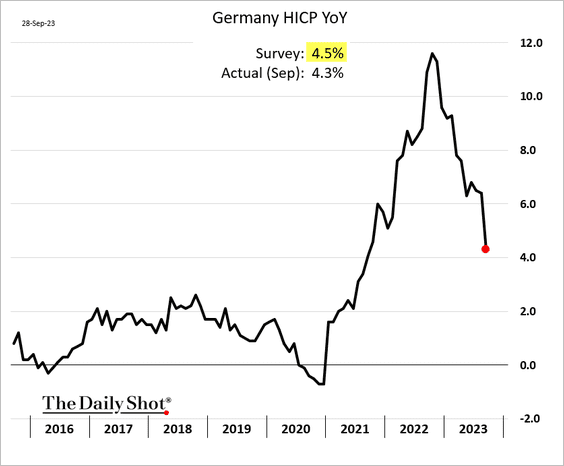

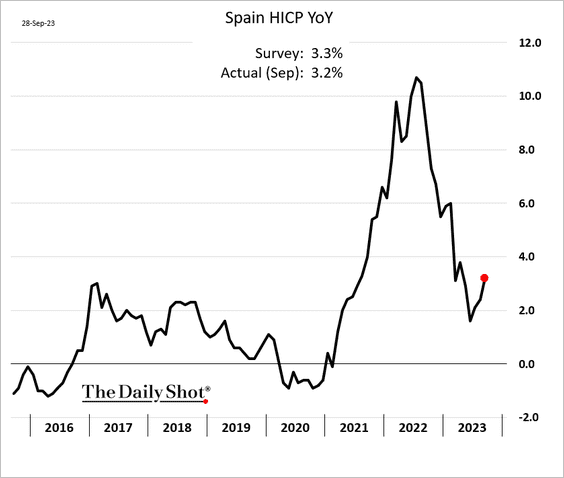

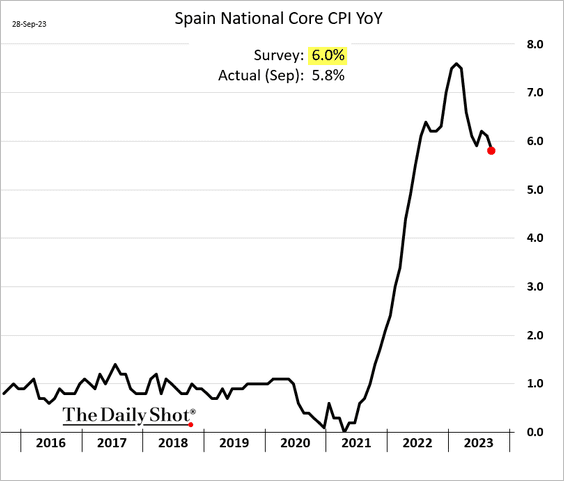

1. Inflation reports from Germany and Spain were softer than expected.

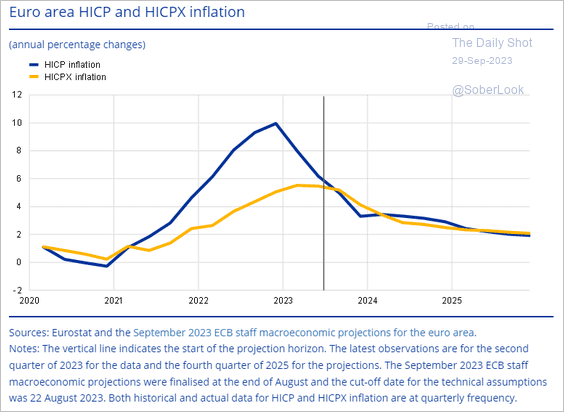

This chart shows the headline and core inflation forecast from the ECB.

Source: ECB

Source: ECB

——————–

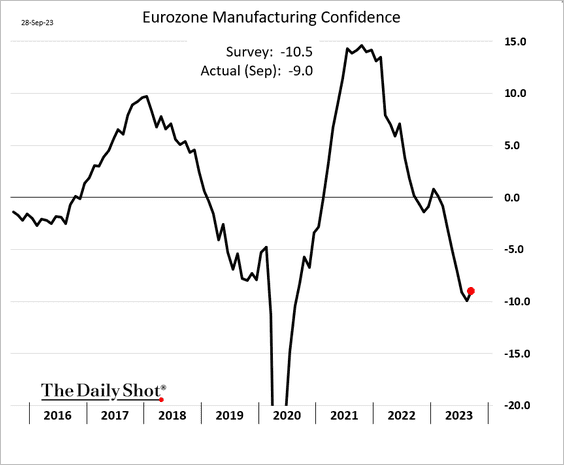

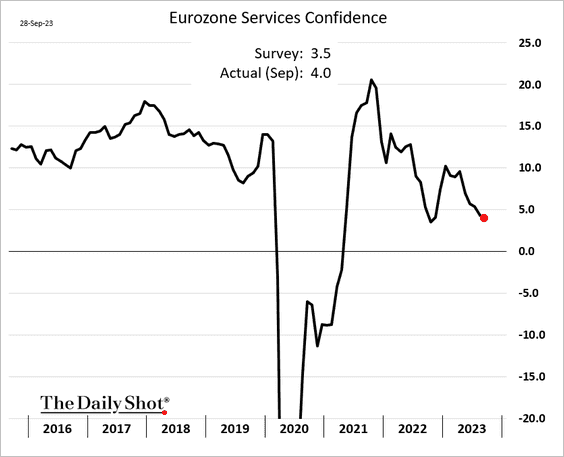

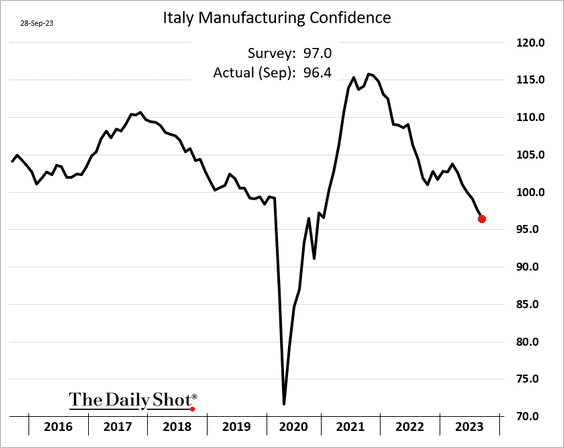

2. Sentiment indicators were a touch stronger than expected.

• Manufacturing:

• Services:

Italian manufacturing sentiment dipped below pre-COVID levels.

——————–

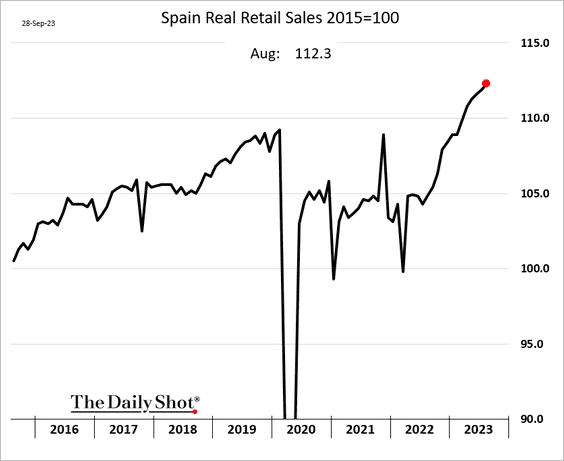

3. Spain’s real retail sales continue to climb.

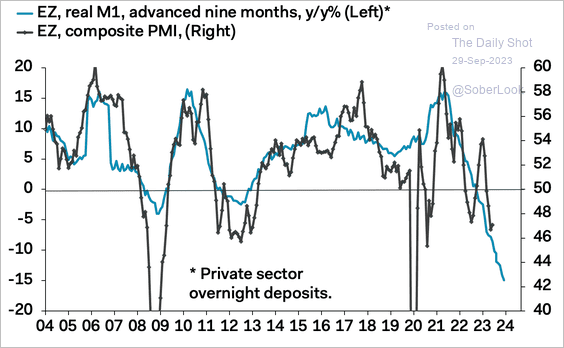

4. The rapid money-supply contraction signals weaker economic activity ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Japan

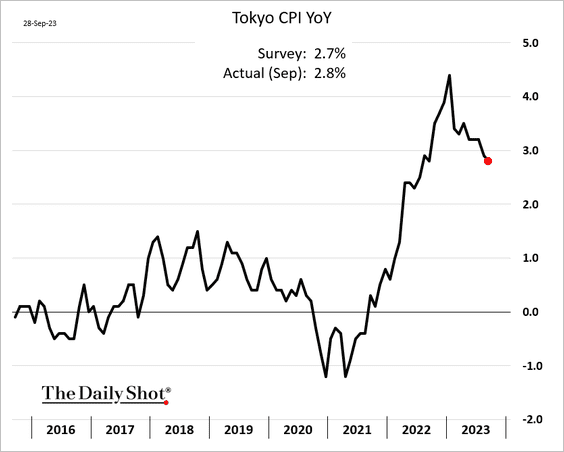

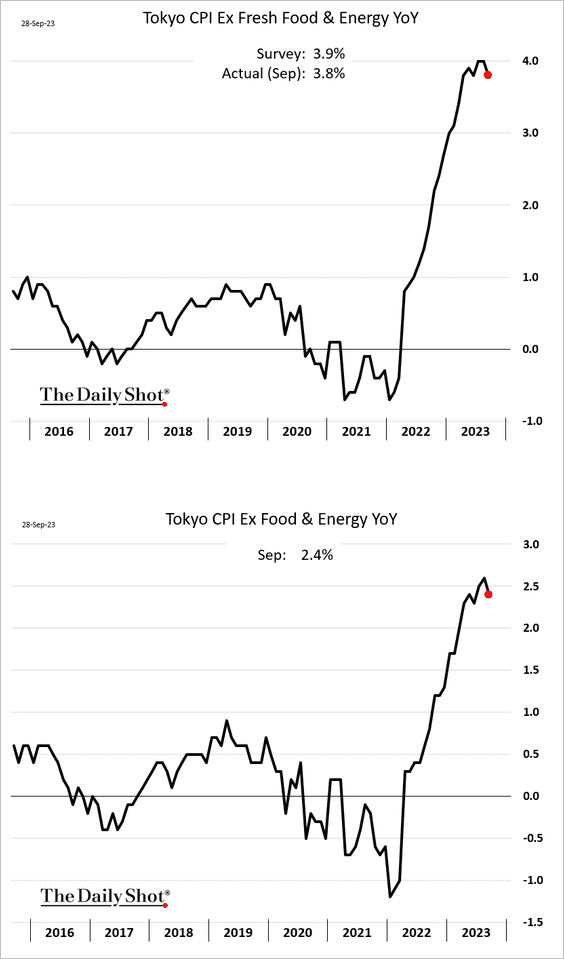

1. The September Tokyo CPI report showed core inflation peaking.

• Headline:

• Core:

——————–

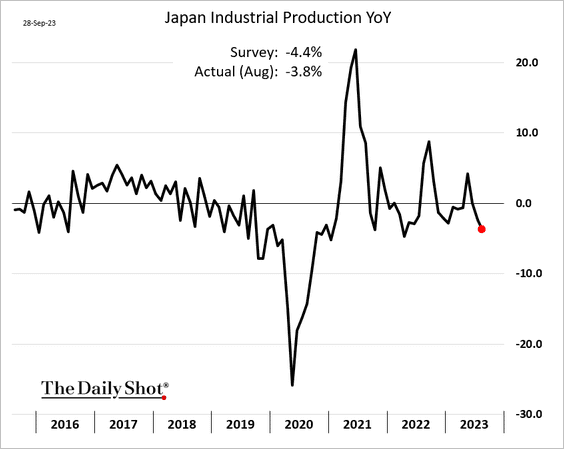

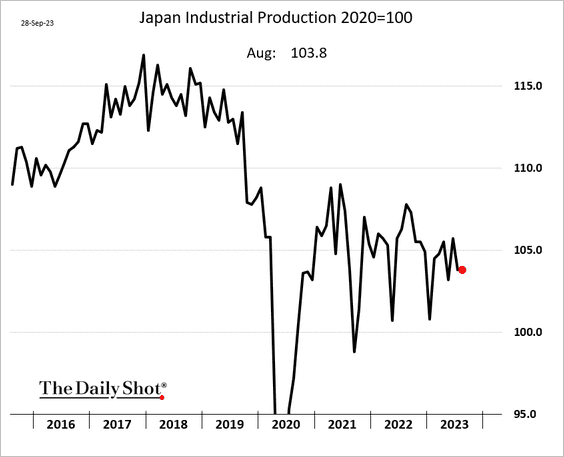

2. Industrial production was a bit stronger than expected in August.

• Yea-over-year:

• Level:

——————–

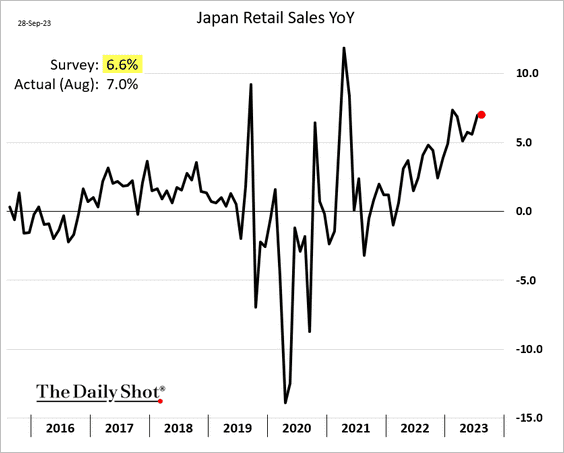

3. Retail sales remain robust.

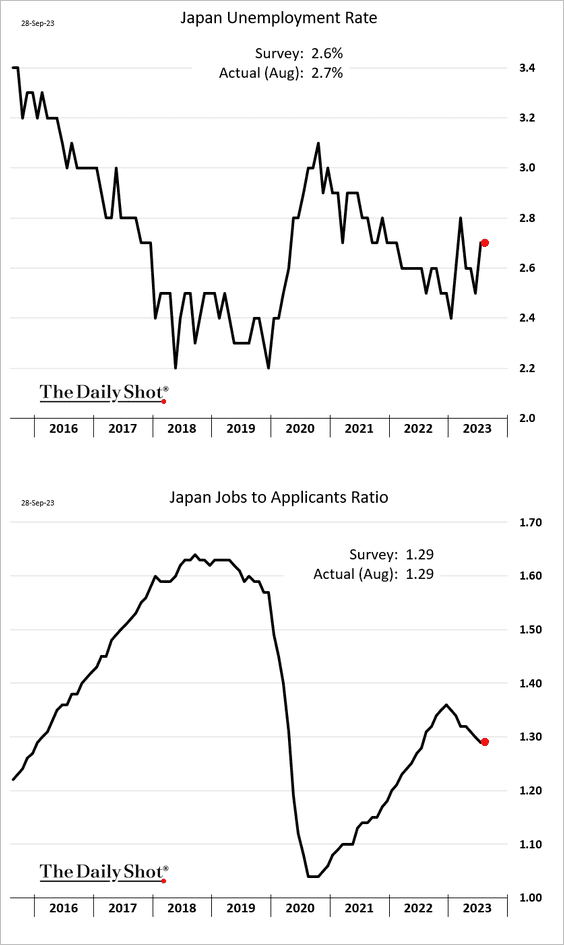

4. Labor market metrics held steady in August.

Back to Index

Australia

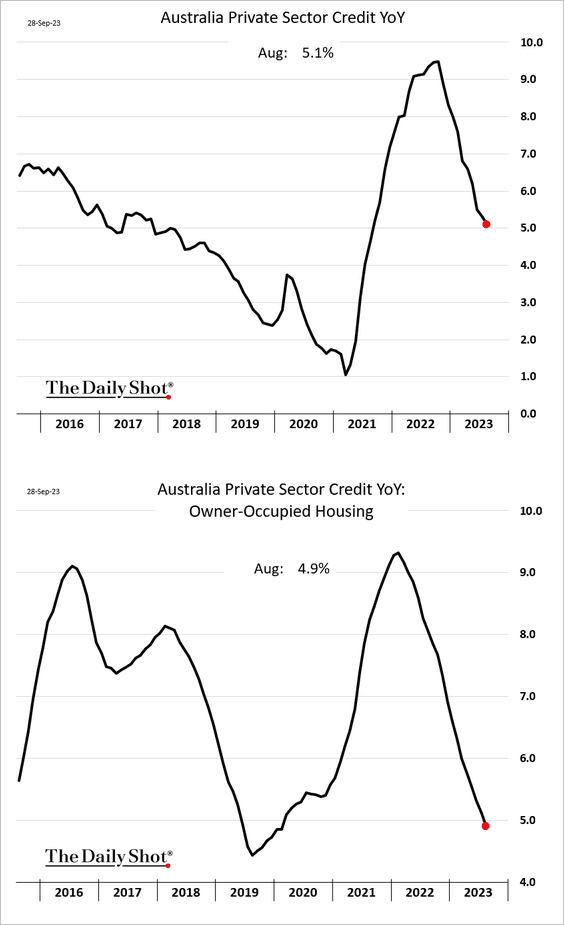

1. Credit expansion continues to slow.

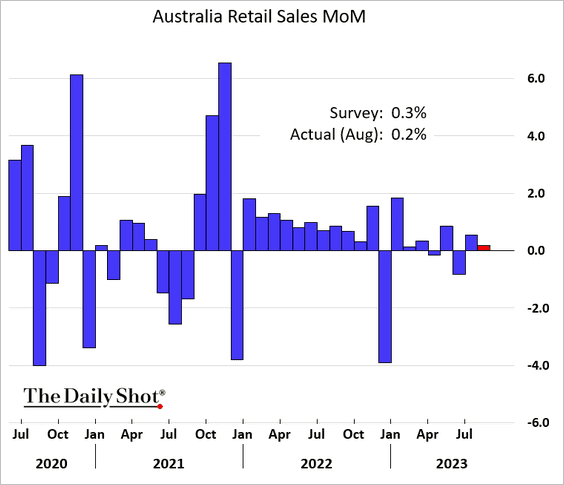

2. Retail sales growth has been moderating.

Source: @economics Read full article

Source: @economics Read full article

——————–

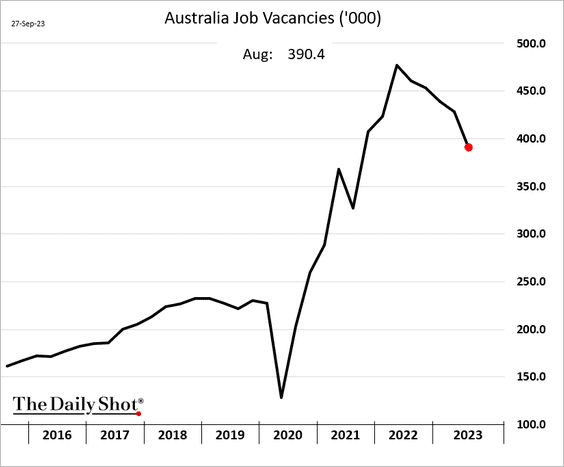

3. Job openings are still elevated.

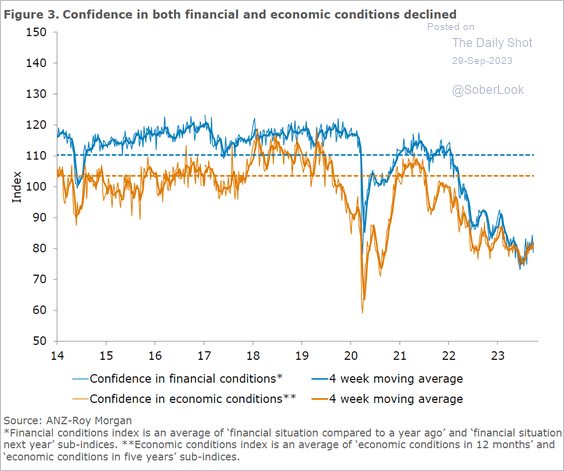

4. Consumer confidence is not rebounding.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Emerging Markets

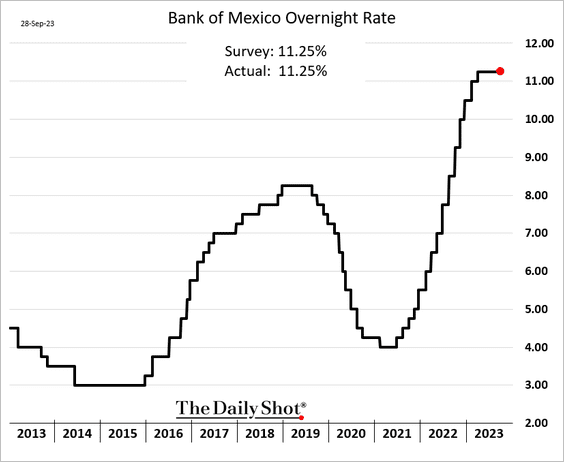

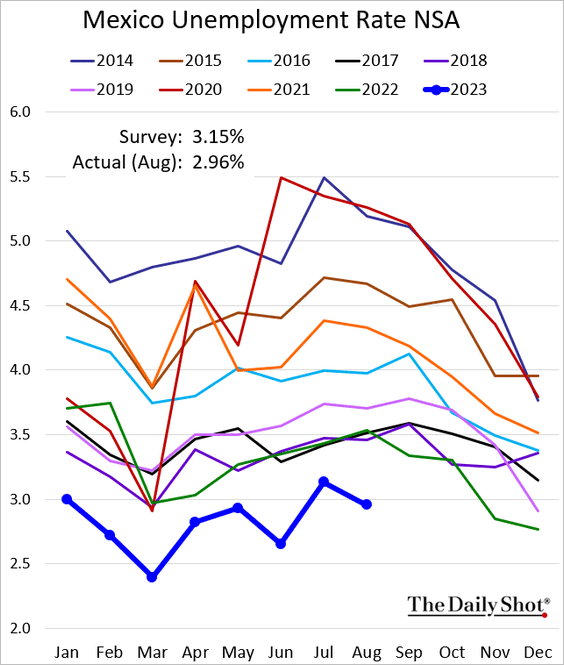

1. Banxico is holding rates steady, …

… amid robust economic activity. Mexico’s unemployment rate is at multi-year lows.

——————–

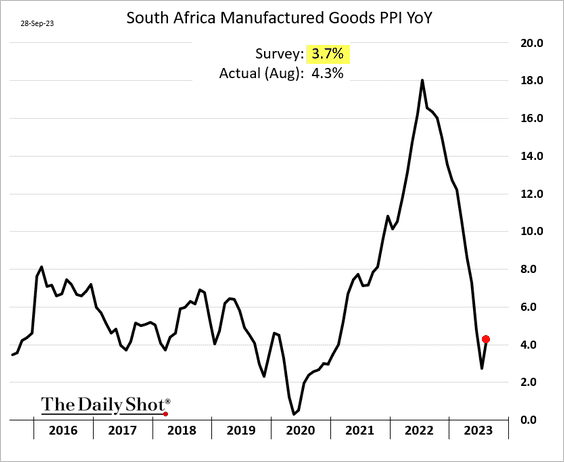

2. South Africa’s PPI accelerated in August.

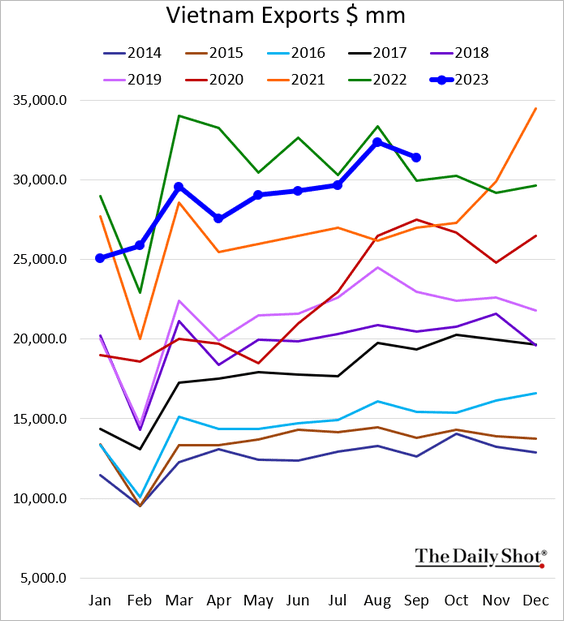

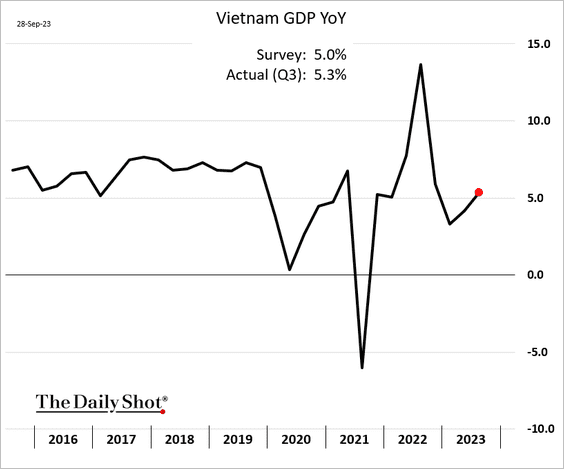

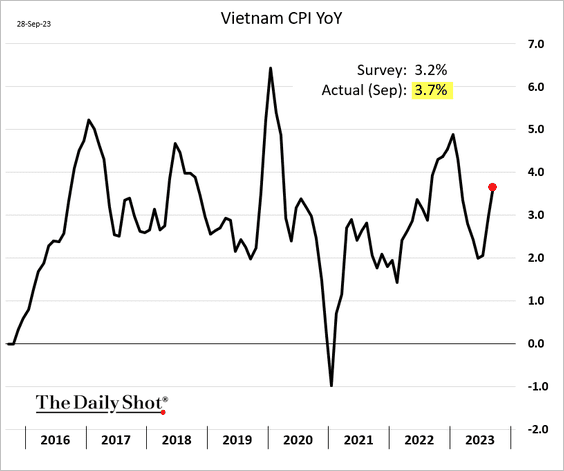

3. Next, we have some updates on Vietnam.

• Exports (back above 2022 levels):

• GDP growth (strengthening):

• Inflation (rebounding):

Back to Index

Energy

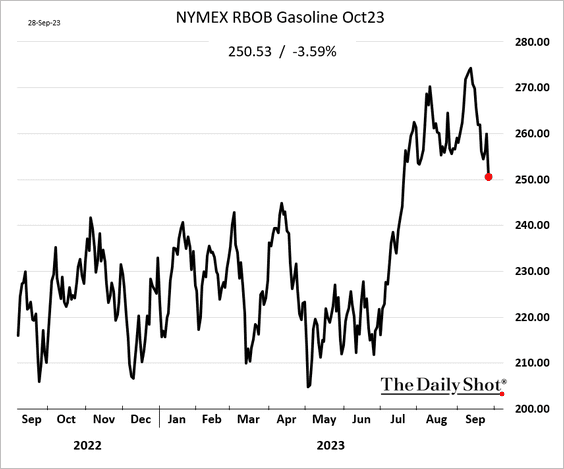

1. US gasoline futures fell further on Thursday.

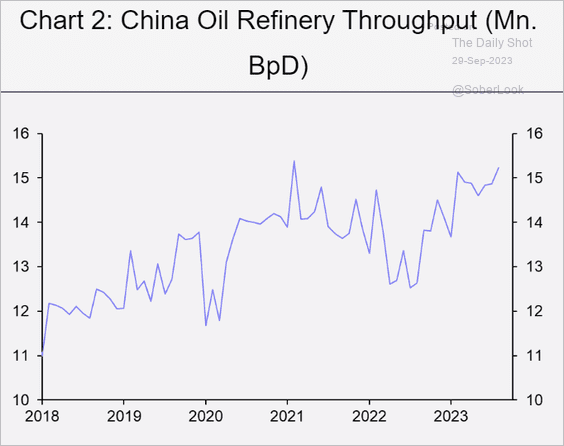

2. China’s refining activity has been rising.

Source: Capital Economics

Source: Capital Economics

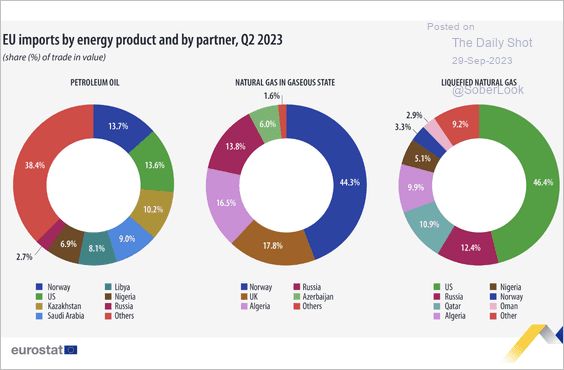

3. Here is a look at EU energy imports.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Equities

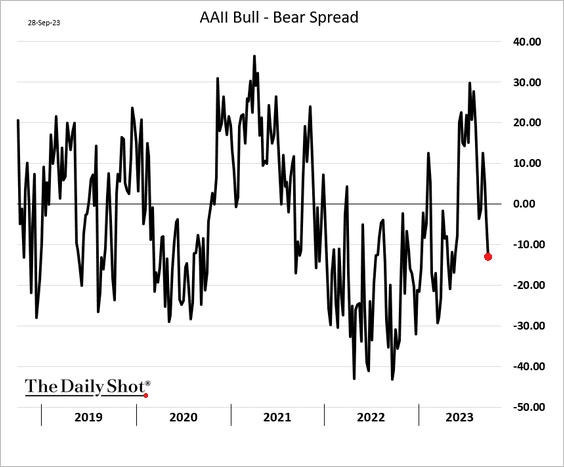

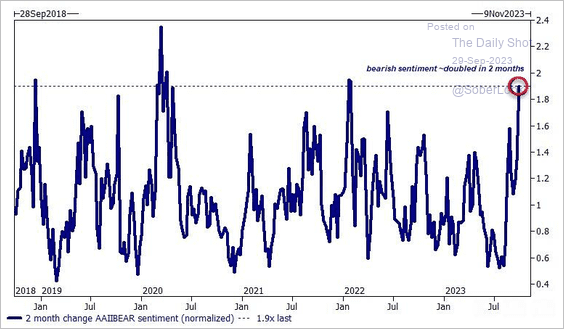

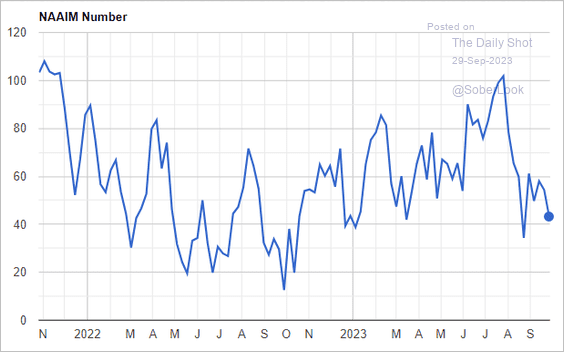

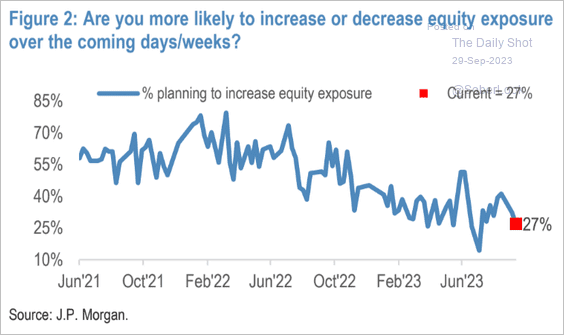

1. Sentiment has soured among retail and institutional investors alike.

• AAII bull-bear spread:

– Changes in the AAII Bear index:

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

• Investment managers:

Source: NAAIM

Source: NAAIM

• JP Morgan’s clients:

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

——————–

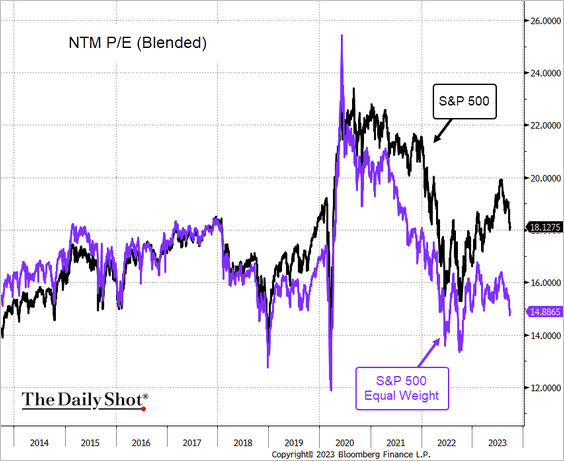

2. With a P/E multiple of under 15x on the S&P 500’s equal weight index, the average stock valuation appears to be quite reasonable.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

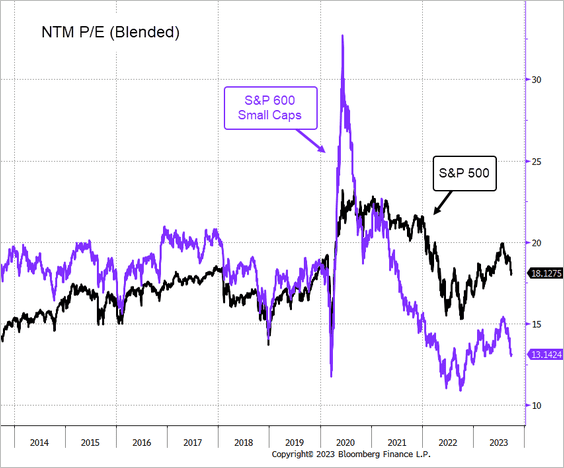

Small-cap multiples are just over 13x.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

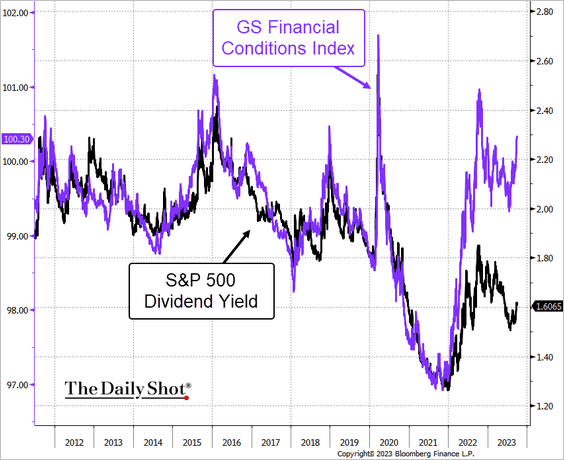

3. Tight financial conditions suggest that dividend yields should be higher.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

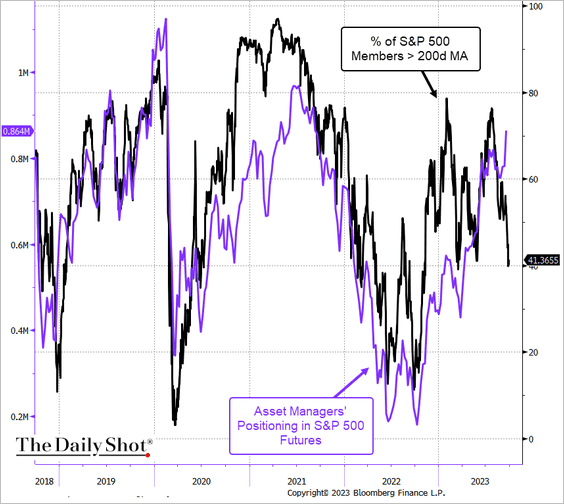

4. Asset manager positioning in the S&P 500 futures has been bullish.

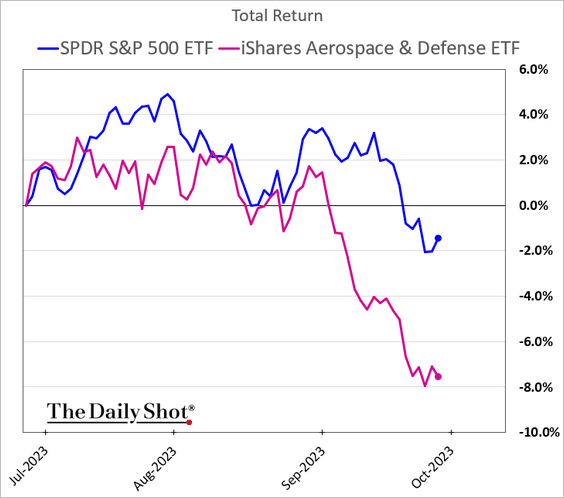

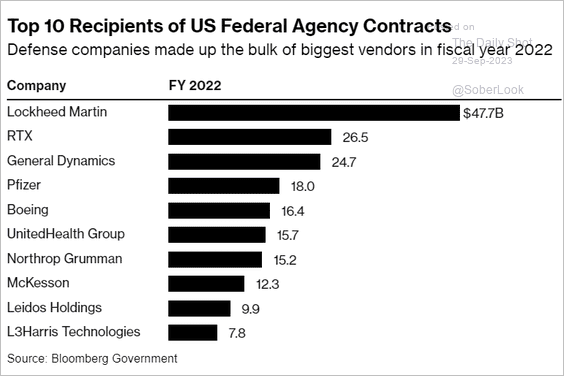

5. Shares of defense contractors are under pressure as the government shutdown looms (2 charts).

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

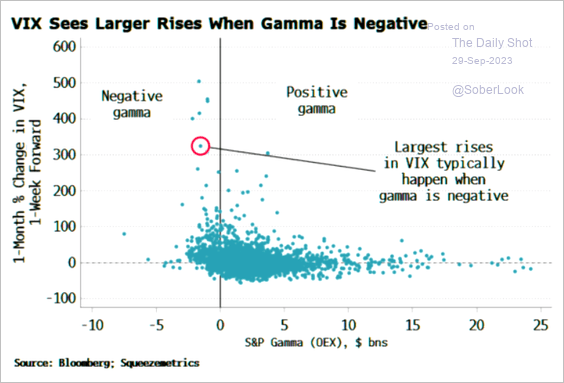

6. Dealers’ short gamma positioning (see chart) increases the risk of higher volatility ahead.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

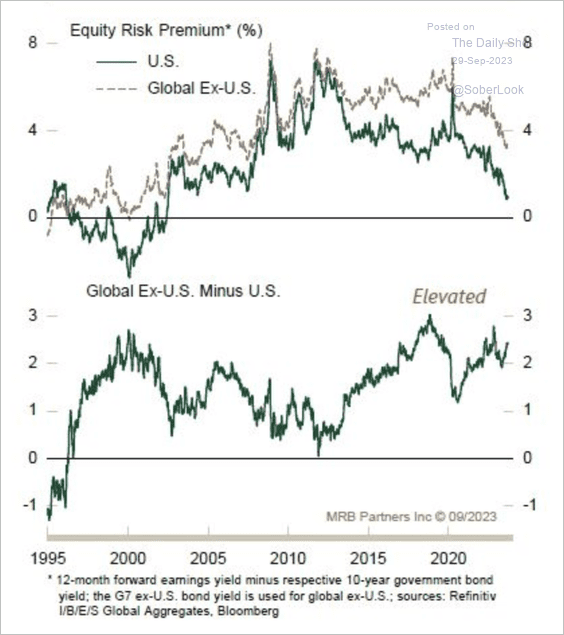

7. A wide equity risk premium gap exists between the US and international equities.

Source: MRB Partners

Source: MRB Partners

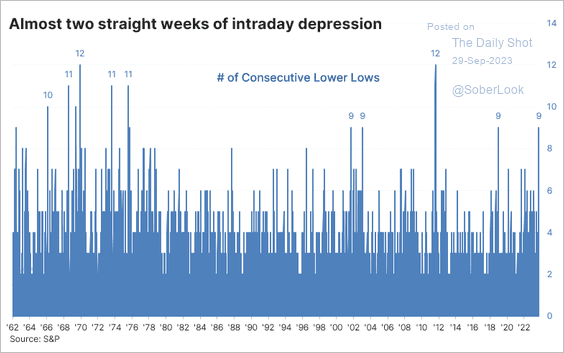

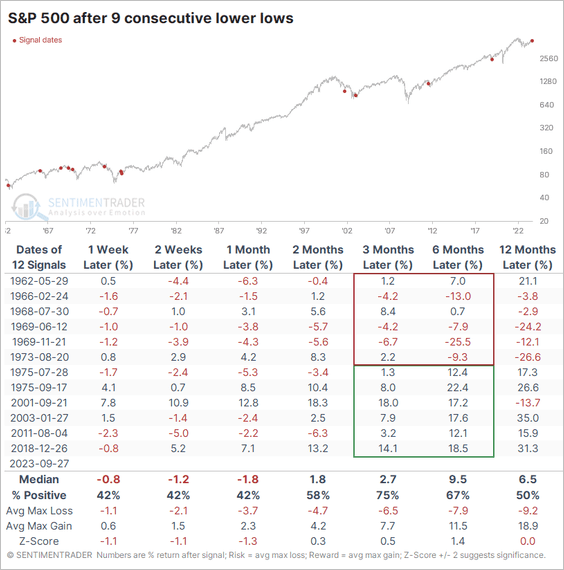

8. The S&P 500 has made lower price lows for almost two straight weeks, which is typically associated with oversold conditions. (2 charts)

Source: @jasongoepfert

Source: @jasongoepfert

Source: @jasongoepfert

Source: @jasongoepfert

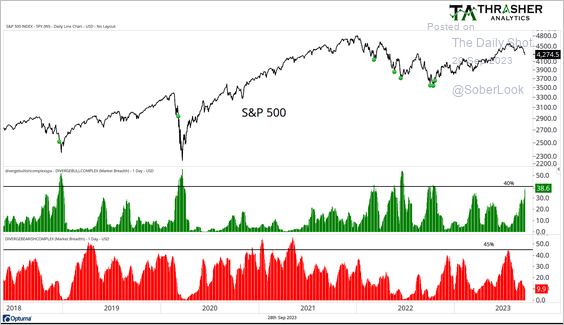

• Roughly 38% of S&P 500 stocks have a bullish divergence between momentum and price (slowing downtrends), which could precede an improvement in market breadth from oversold levels.

Source: @AndrewThrasher

Source: @AndrewThrasher

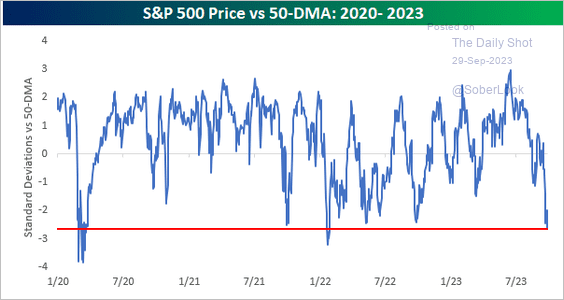

• The S&P 500 has deviated far from its 50-day moving average – another oversold signal.

Source: @bespokeinvest

Source: @bespokeinvest

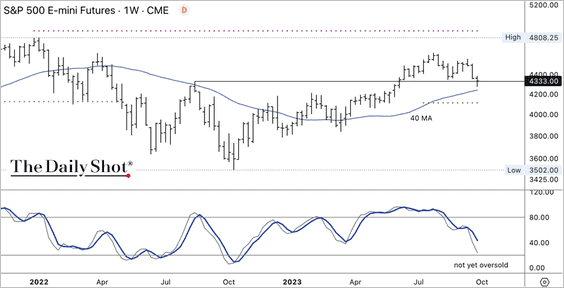

• The S&P 500 is holding short-term support but is not yet oversold on the weekly chart.

——————–

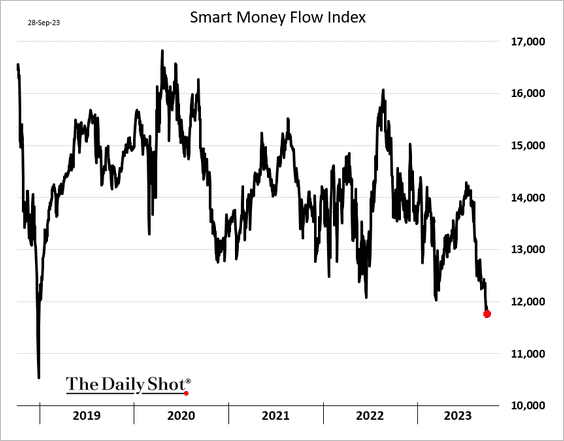

9. This chart shows the Smart Money Flow Index (see definition).

Back to Index

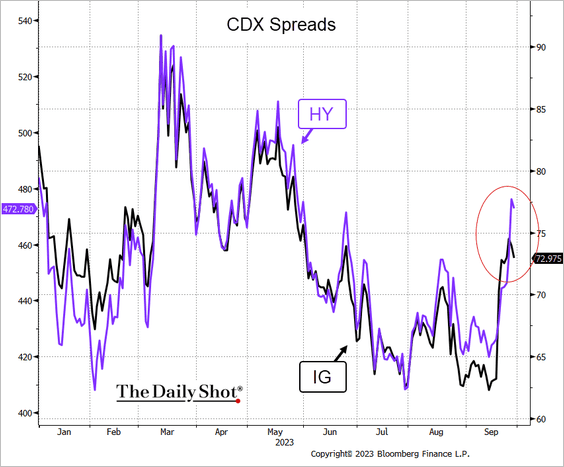

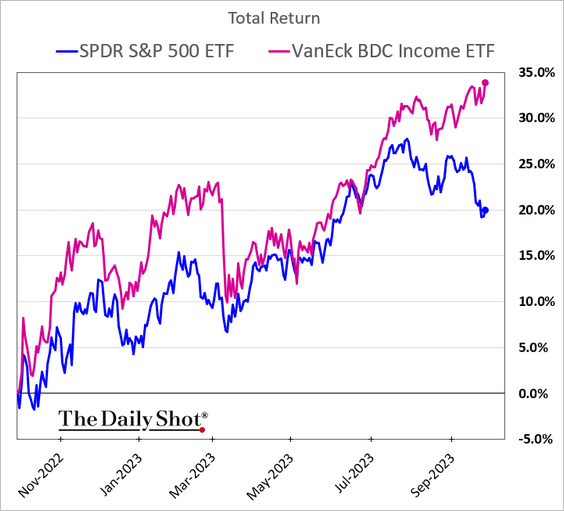

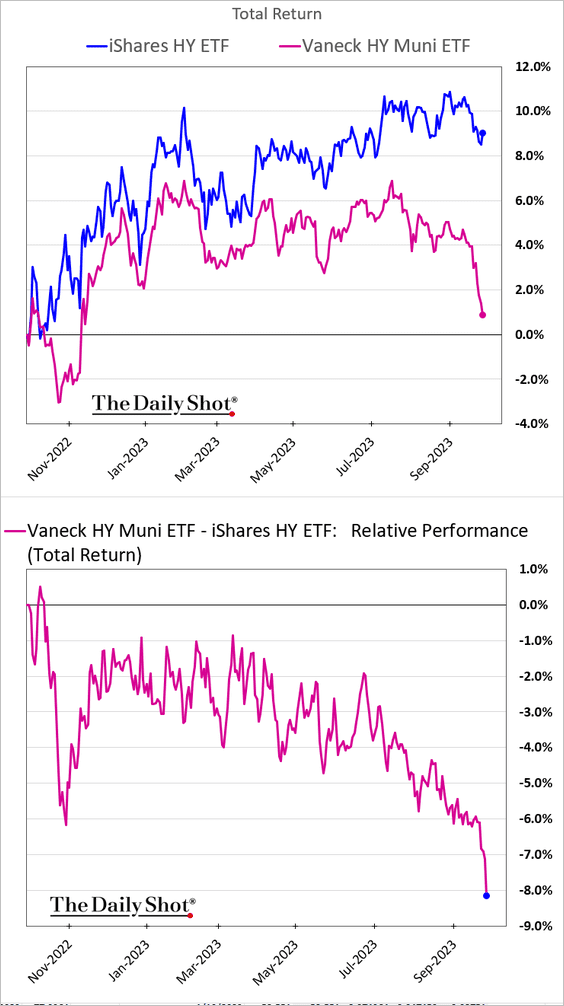

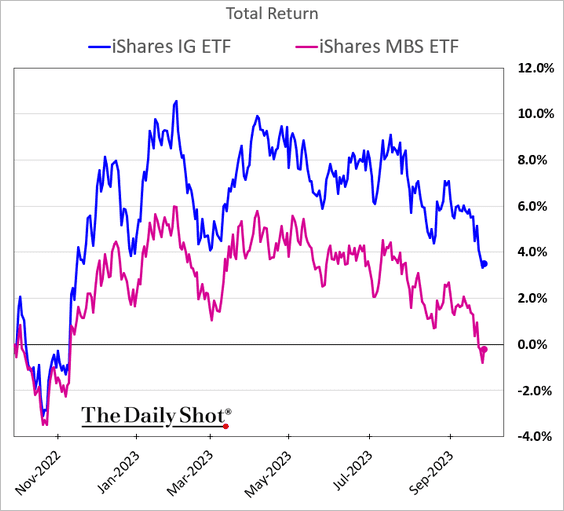

Credit

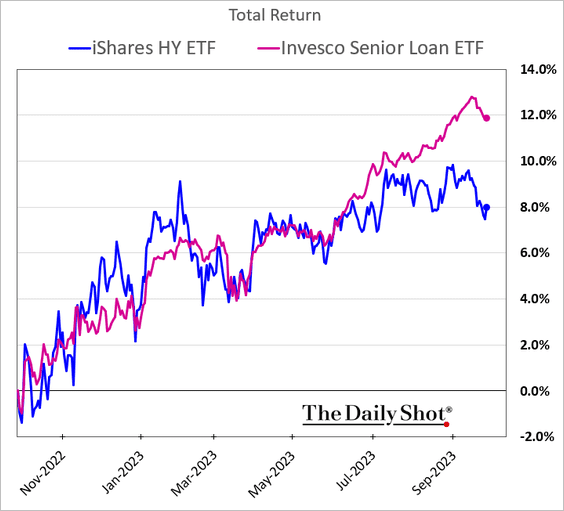

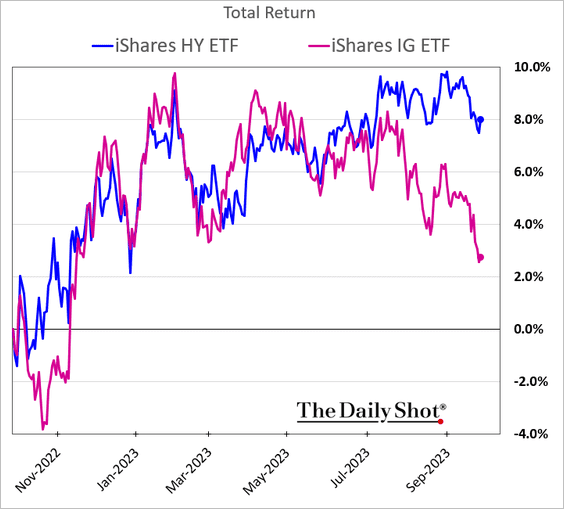

1. Let’s look at some performance data over the past twelve months.

• Leveraged loans have been outperforming high-yield bonds.

• Investment-grade bonds have been dragged lower by Treasuries.

But IG spreads have held up well relative to high yield.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• BDCs have been surging.

• It’s been a rough month for high-yield munis.

• This chart compares IG corporate bonds with mortgage-backed securities.

——————–

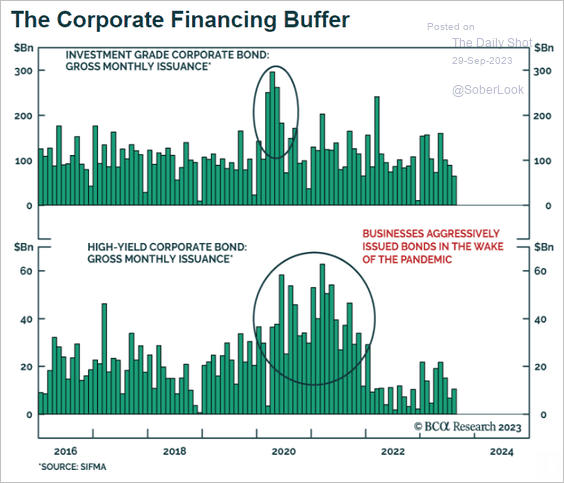

2. Many companies locked in exceptionally low rates that were available immediately after the COVID shock.

Source: BCA Research

Source: BCA Research

Back to Index

Rates

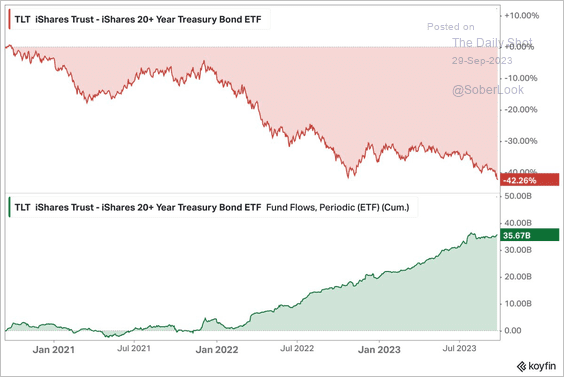

1. The 20+ Year Treasury ETF (TLT) continues to see inflows despite significant price drawdowns.

Source: @KoyfinCharts

Source: @KoyfinCharts

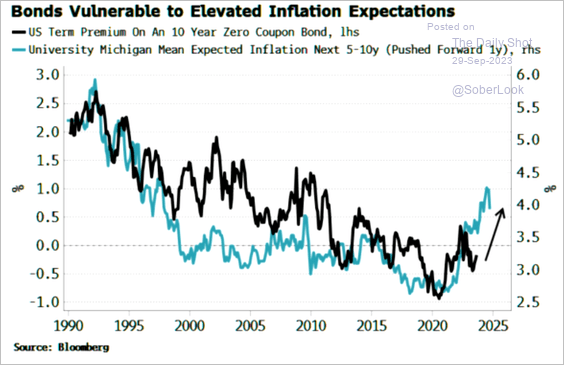

2. Elevated inflation expectations could boost Treasury term premium.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

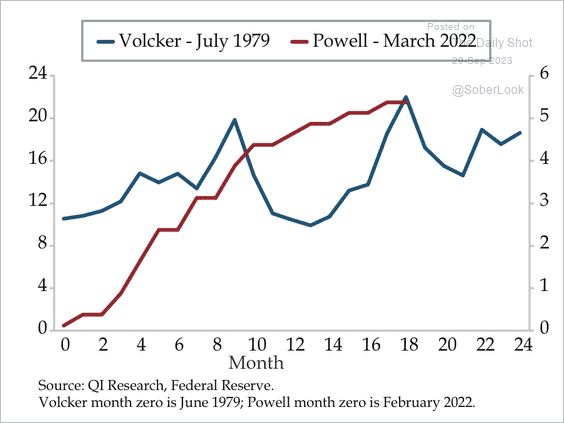

3. Is Powell poised to maintain rates higher for longer than Volker?

Source: Quill Intelligence

Source: Quill Intelligence

——————–

Food for Thought

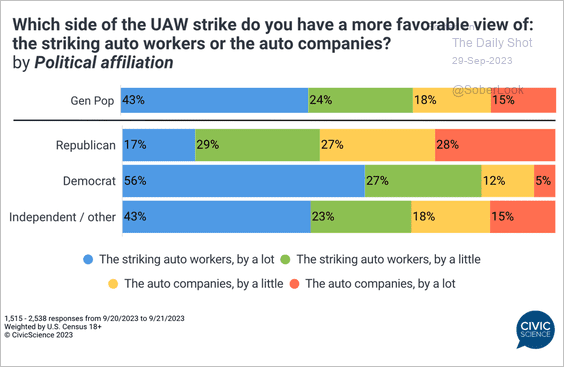

1. Views on the UAW strike:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

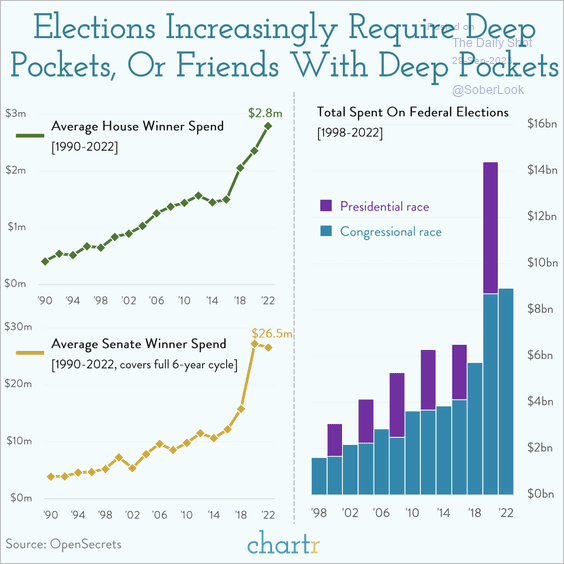

2. Rising costs of US federal elections:

Source: @chartrdaily

Source: @chartrdaily

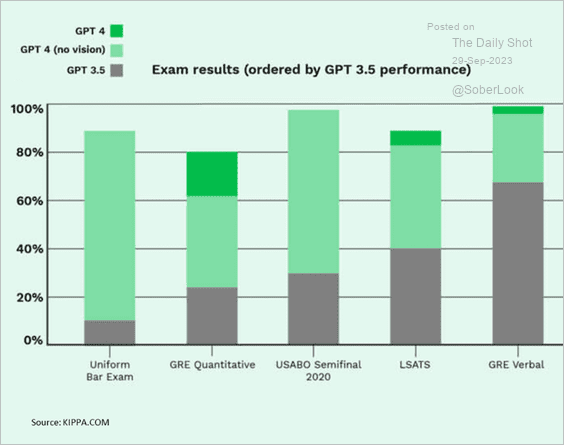

3. ChatGPT exam performance:

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

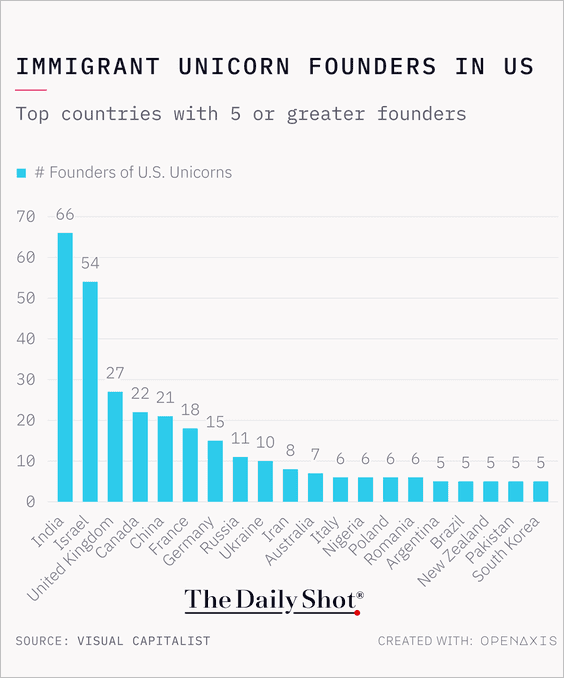

4. Immigrant founders of unicorn companies in the US:

Source: @TheDailyShot

Source: @TheDailyShot

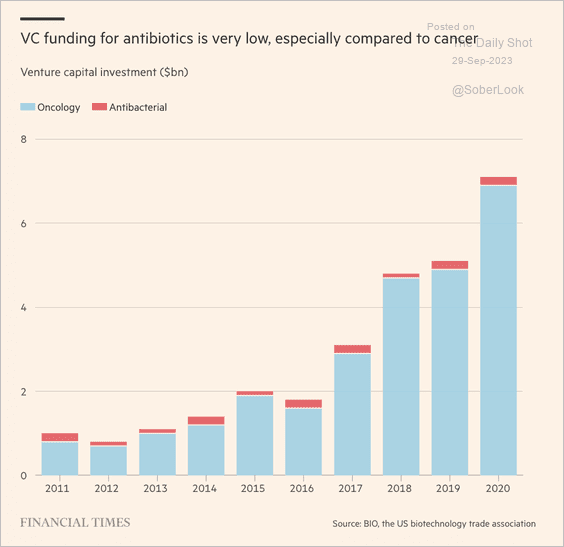

5. Funding for antibiotics development (red) vs. oncology investment (blue):

Source: @financialtimes Read full article

Source: @financialtimes Read full article

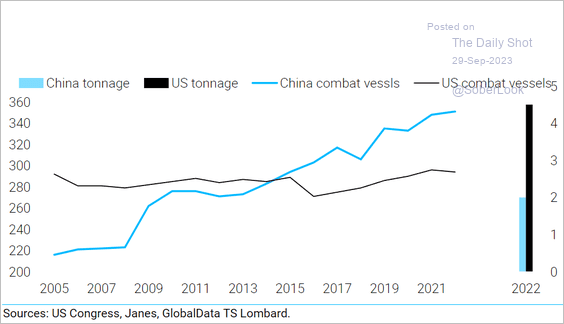

6. US vs. China navies:

Source: TS Lombard

Source: TS Lombard

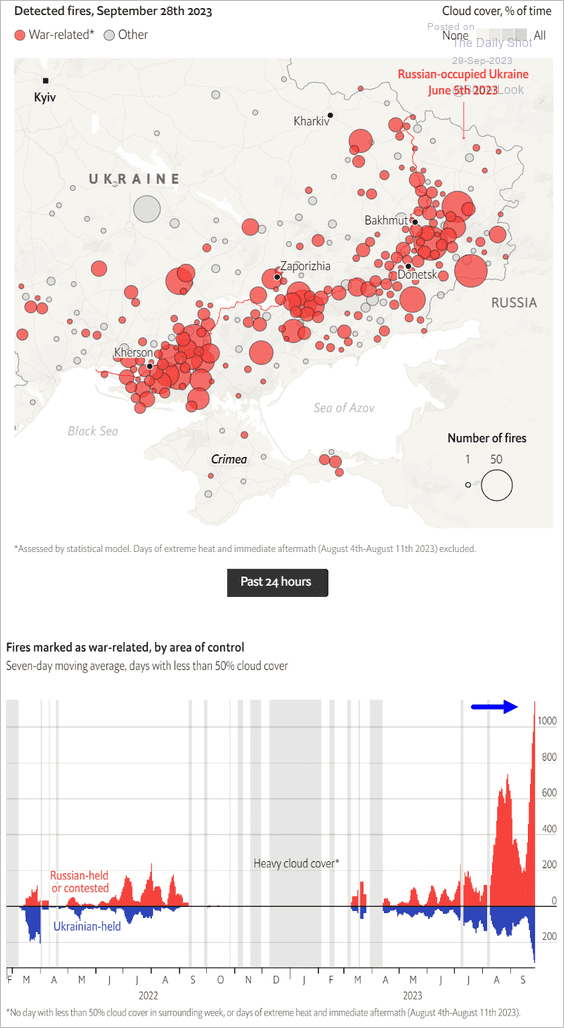

7. Battle-related fires suggest that the Ukraine-Russia fighting is intensifying.

Source: The Economist Read full article

Source: The Economist Read full article

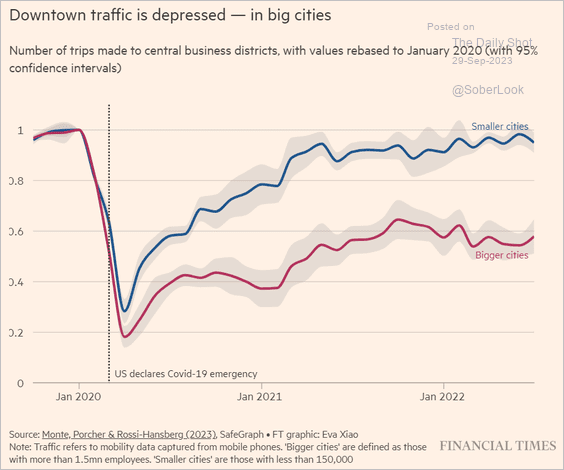

8. Downtown traffic in big and small cities:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

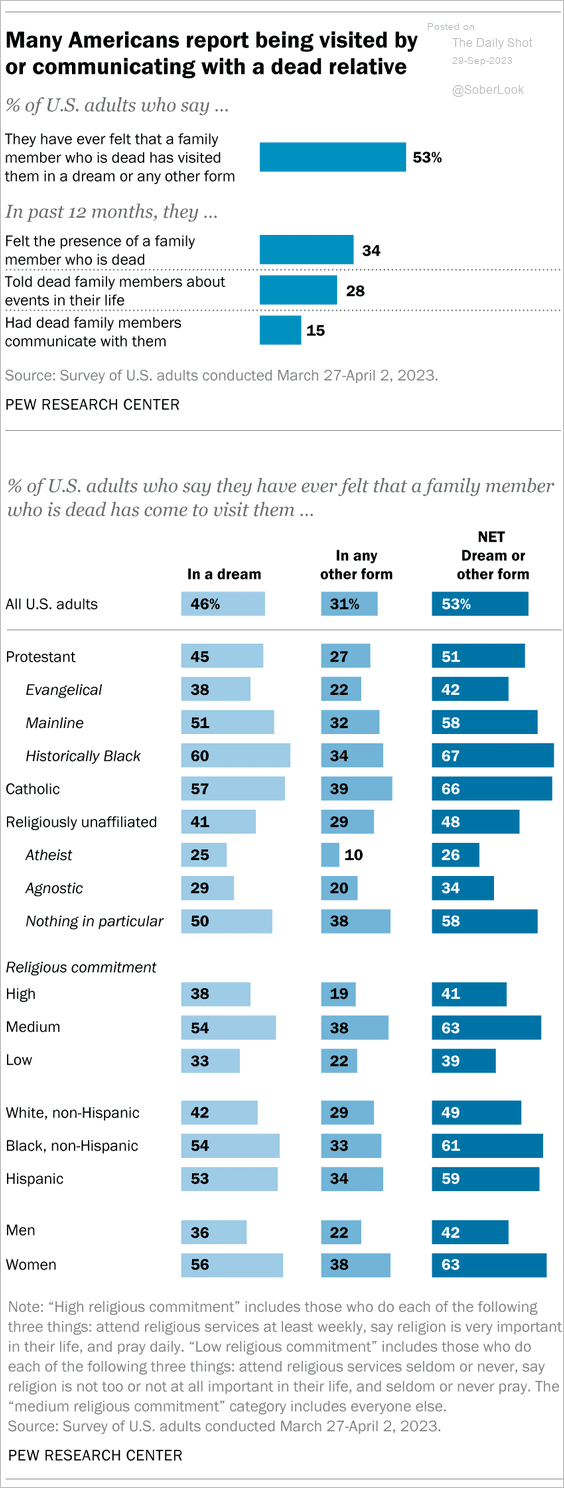

9. Talking to dead relatives:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

Have a great weekend!

Back to Index