The Daily Shot: 04-Oct-23

• The United States

• Europe

• Japan

• Asia-Pacific

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

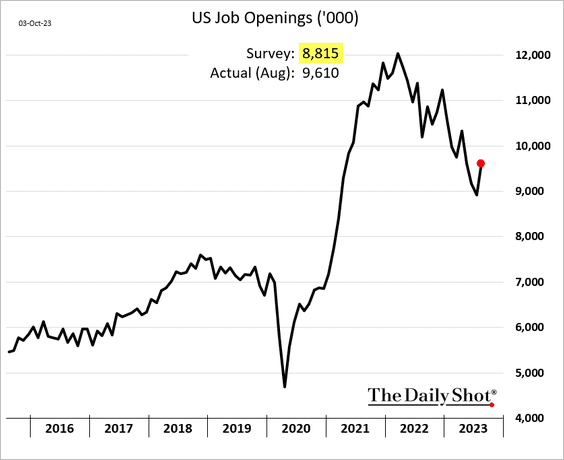

1. The job openings report exceeded expectations, suggesting that the labor market may not be cooling fast enough for the Fed.

Source: CNBC Read full article

Source: CNBC Read full article

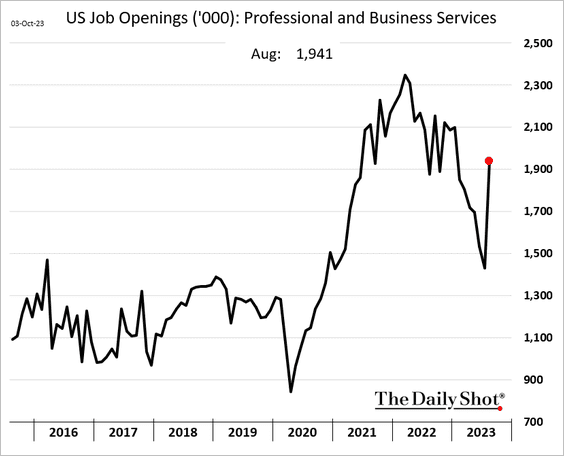

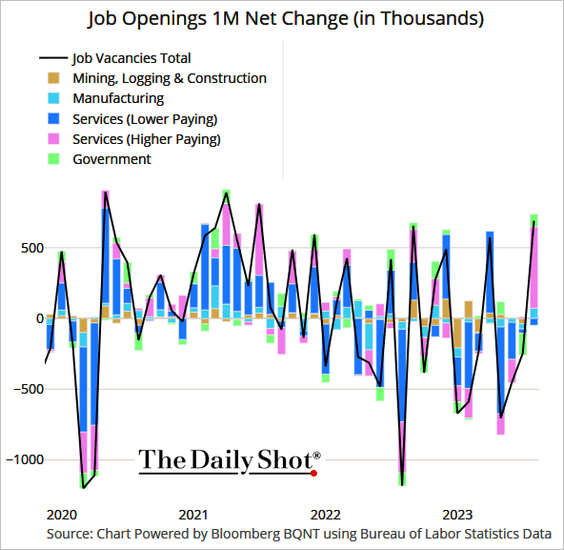

• Most of the gains were in white-collar jobs, …

… with manufacturing and public schools (shown as “government”) also increasing demand for workers.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

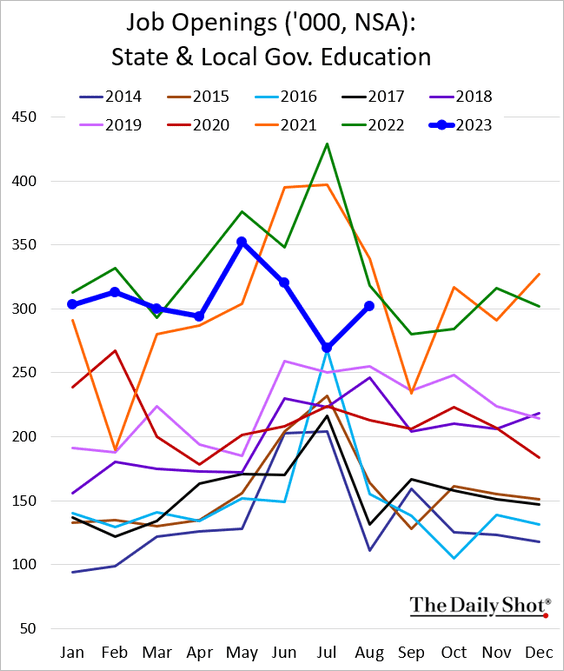

Job vacancies for teachers bounced from weaker levels in July.

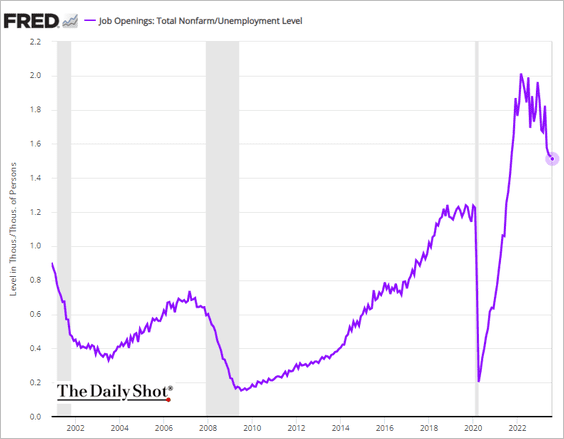

• Job openings per unemployed person edged lower but remained well above the pre-COVID peak.

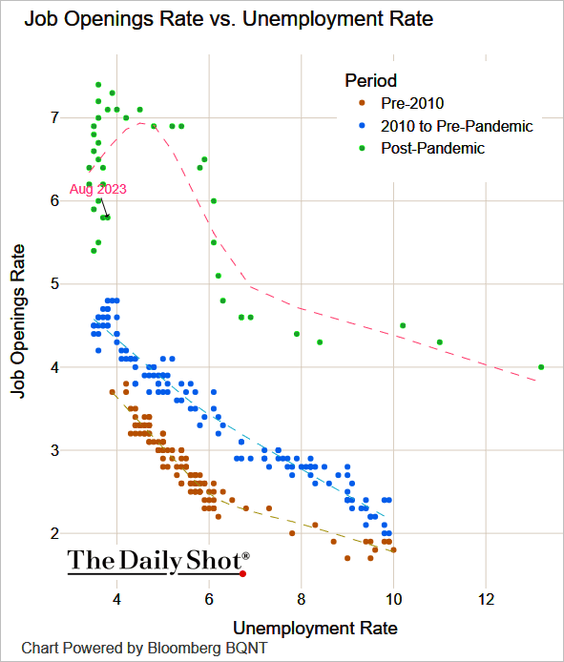

– The Beveridge Curve moved in the “wrong” direction.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

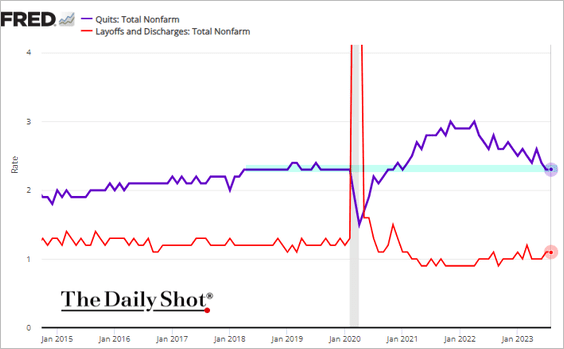

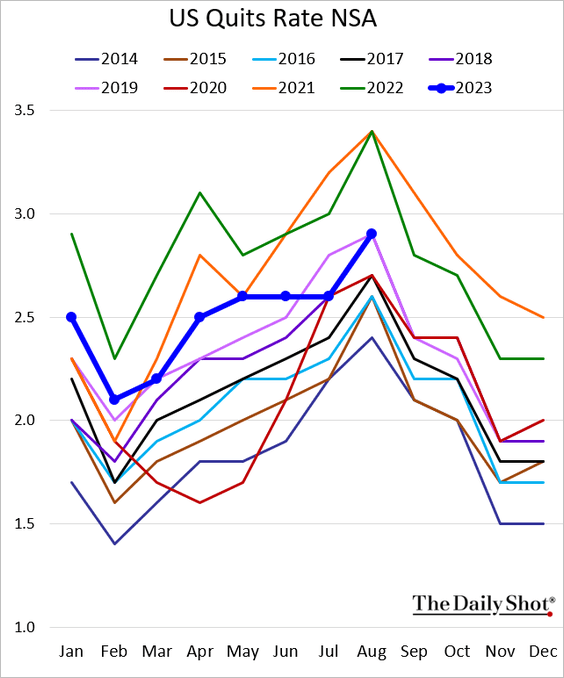

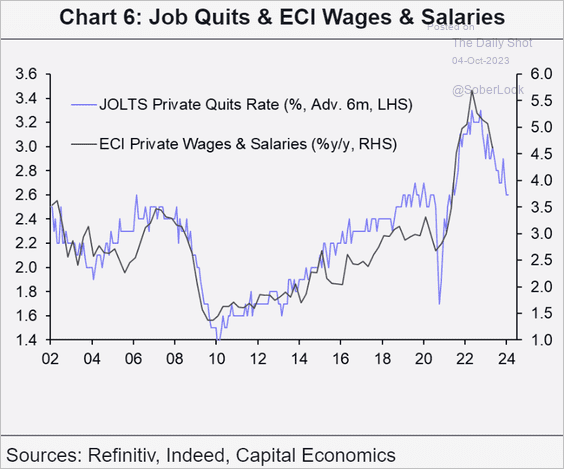

• The quits rate (voluntary resignations) held at pre-COVID levels (2 charts), …

… and still signals slower wage growth ahead.

Source: Capital Economics

Source: Capital Economics

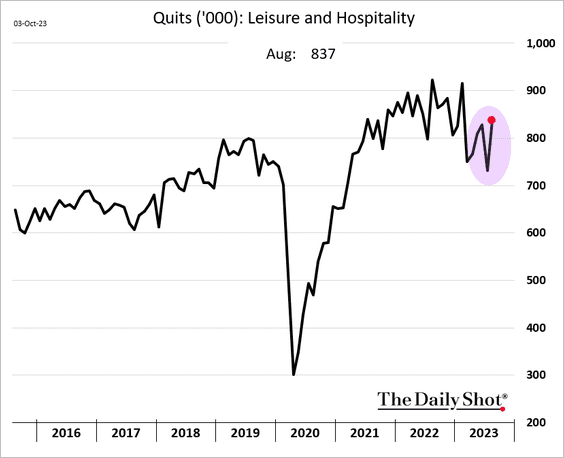

– Resignations at hotels and restaurants jumped.

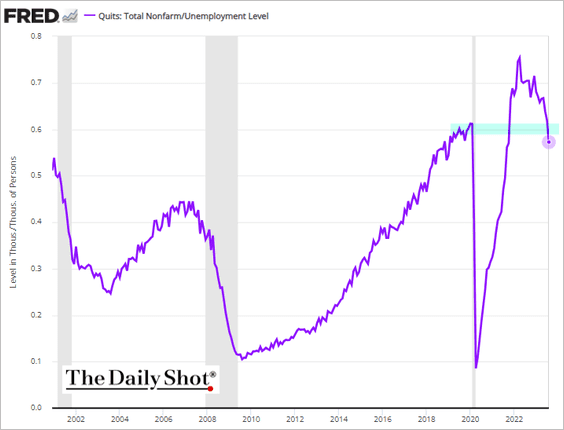

– The number of quits per unemployed person declined further.

——————–

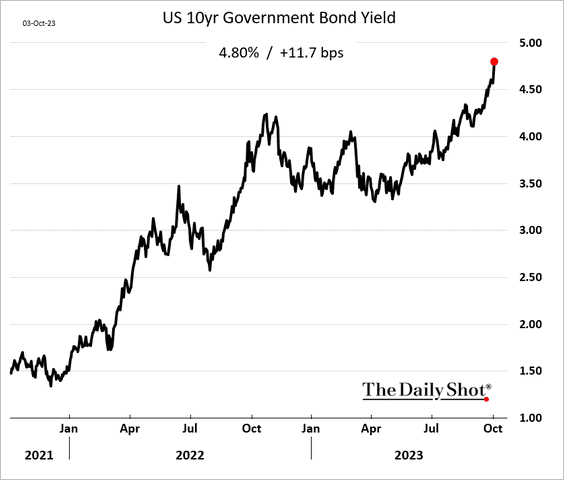

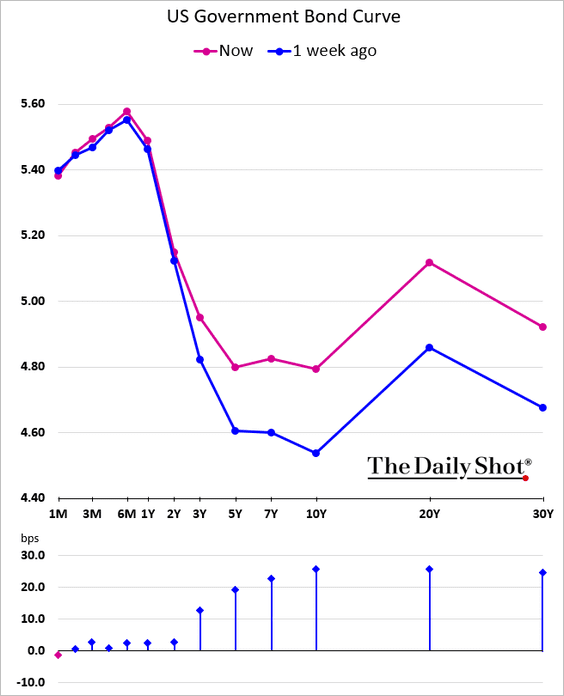

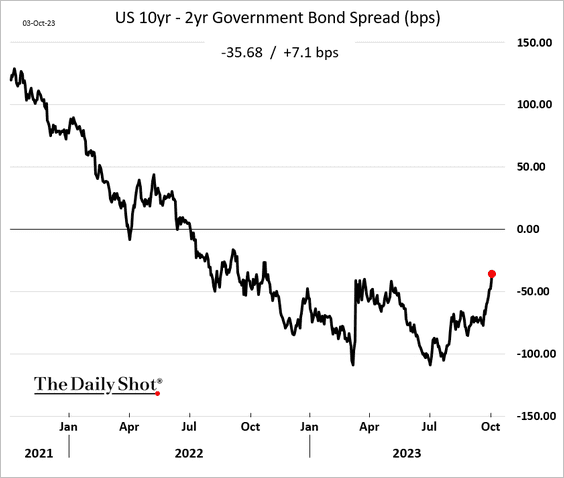

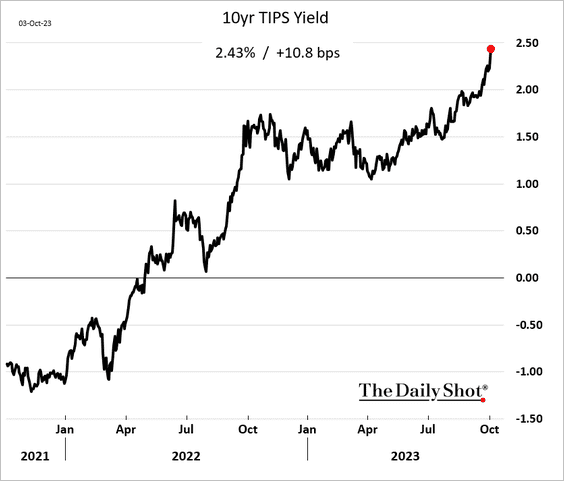

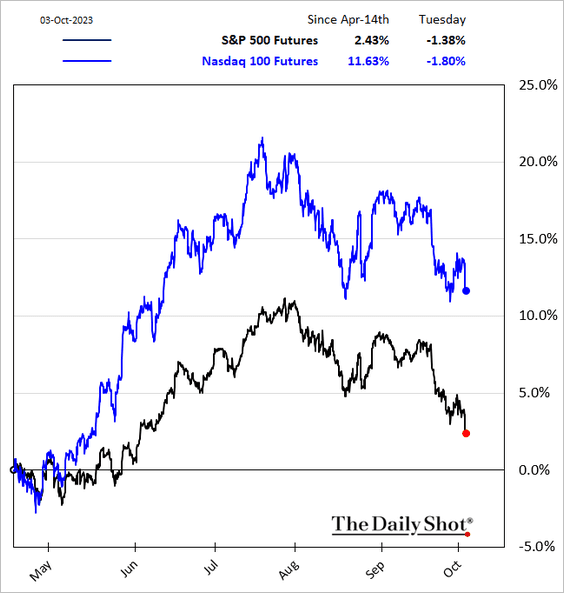

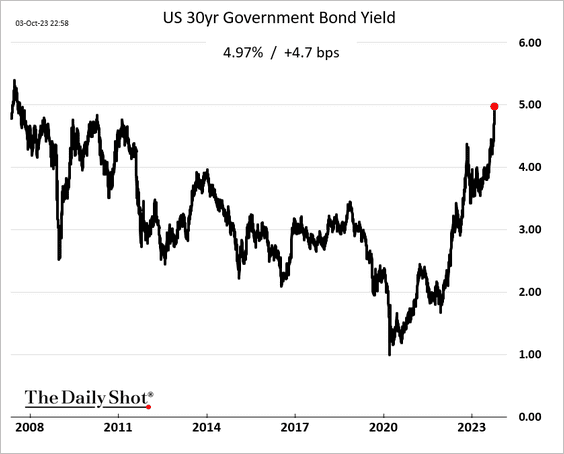

2. Reacting to the strong job openings report, traders pushed yields to their highest levels in years, intensifying the global bond market rout.

• The yield curve’s bear steepening continues (2 charts).

• Real rates climbed further, …

… putting pressure on stocks.

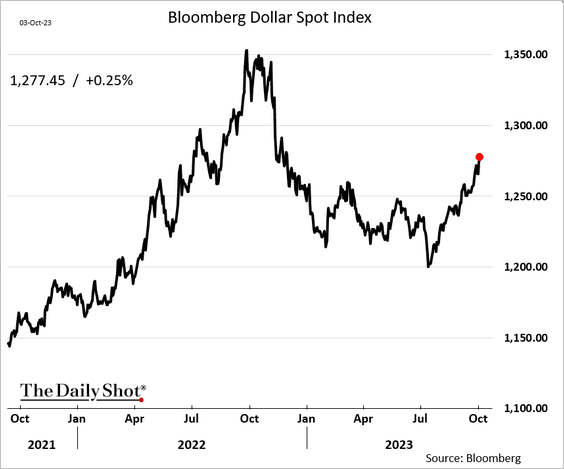

• The US dollar keeps rising.

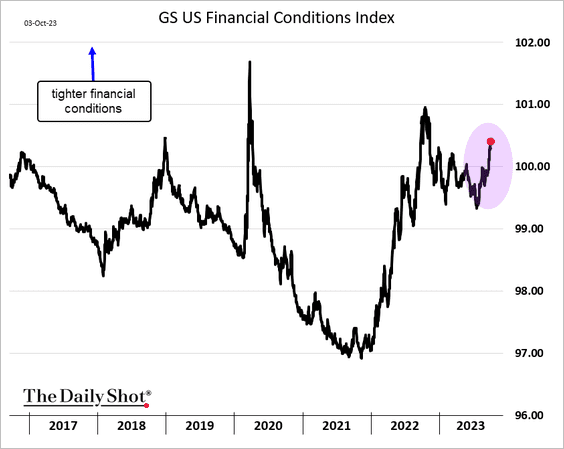

• Financial conditions continue to tighten.

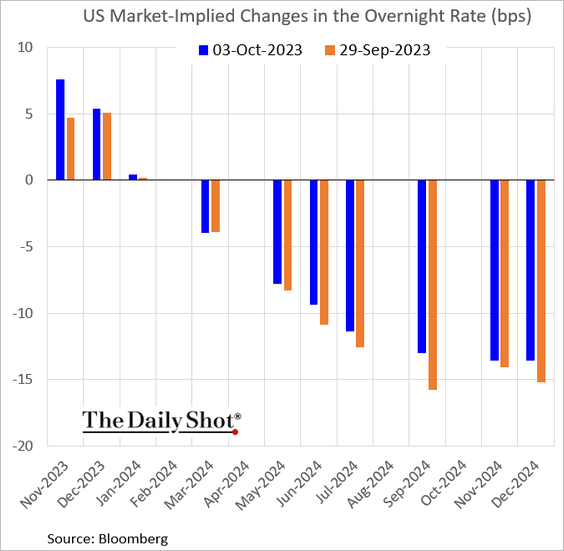

• The market is pricing about a 50% probability of another Fed rate hike in this cycle.

——————–

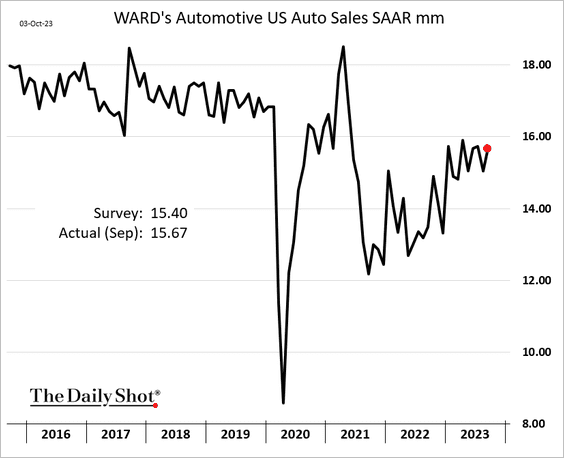

3. US vehicle sales were stronger than expected in September, closing a robust quarter for automakers.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Detroit Free Press Read full article

Source: Detroit Free Press Read full article

——————–

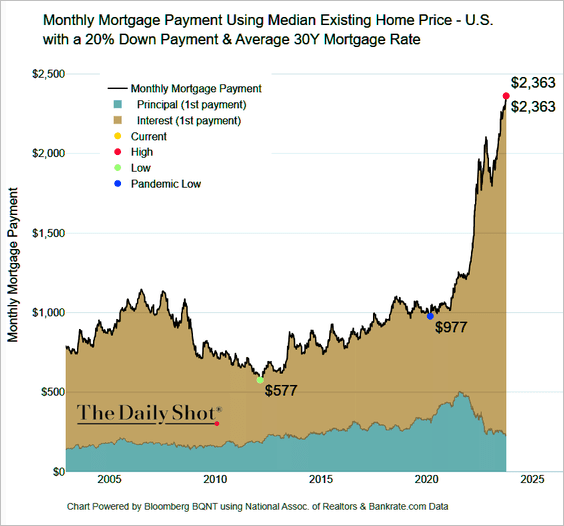

4. Housing affordability for new buyers continues to deteriorate. This chart shows an estimate of monthly mortgage payments.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

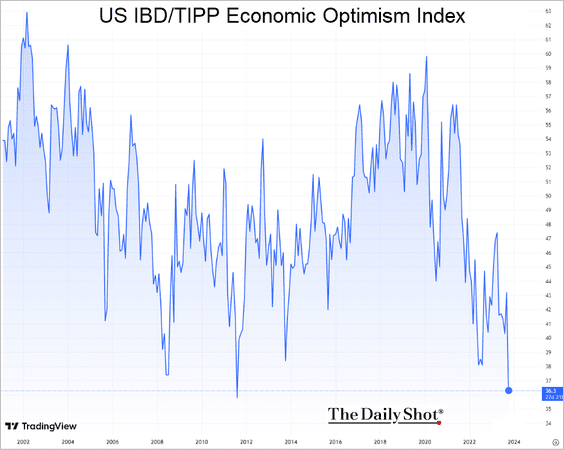

5. The Investor’s Business Daily/TIPP economic optimism index tumbled this month.

Source: Business Wire Read full article

Source: Business Wire Read full article

Back to Index

Europe

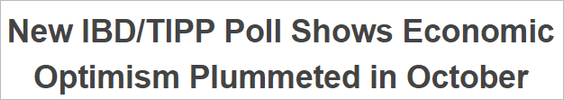

1. European bonds have been caught up in the global debt market rout.

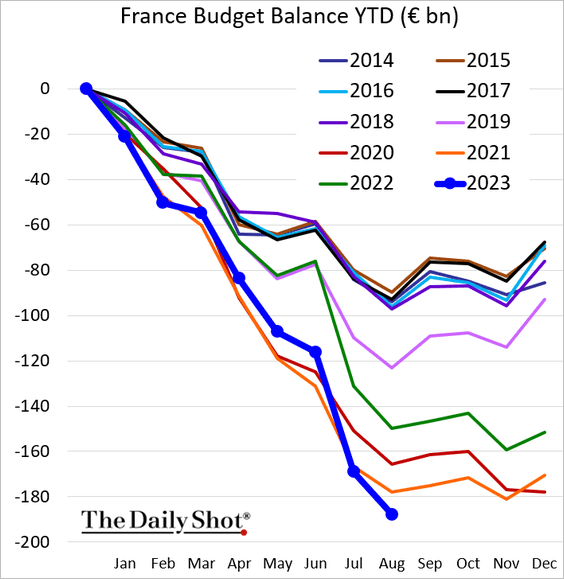

2. The French budget deficit is blowing up.

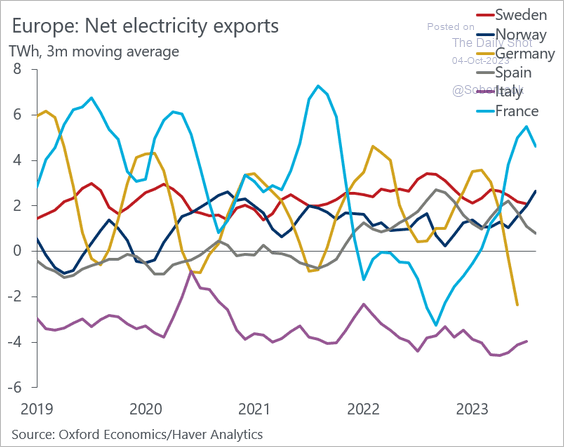

3. French electricity exports climbed in recent months as nuclear reactors came back online.

Source: @DanielKral1

Source: @DanielKral1

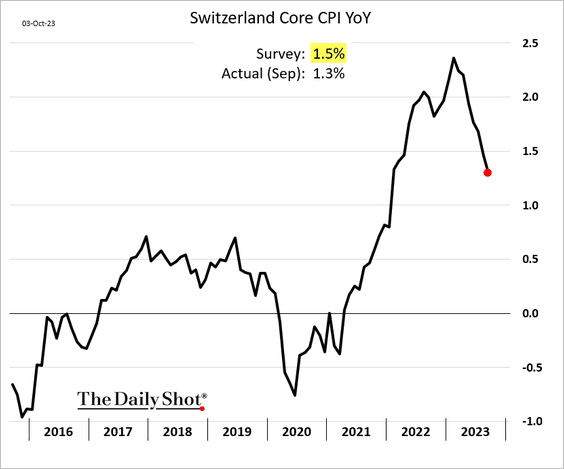

4. Swiss inflation is moderating.

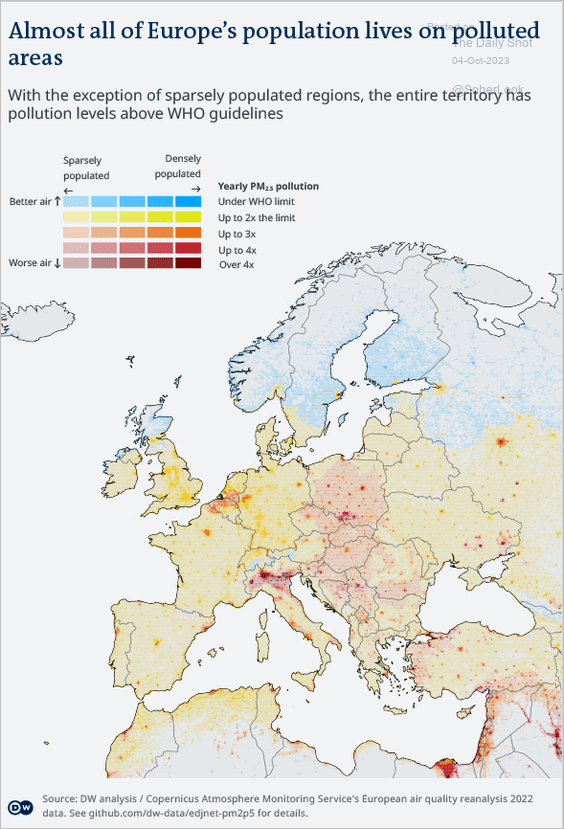

5. Here is a look at air pollution across Europe.

Source: Voxeurop Read full article

Source: Voxeurop Read full article

Back to Index

Japan

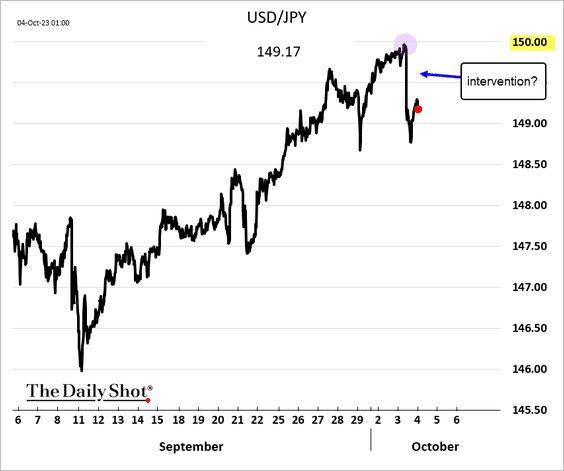

1. Was this an intervention?

Source: @markets Read full article

Source: @markets Read full article

——————–

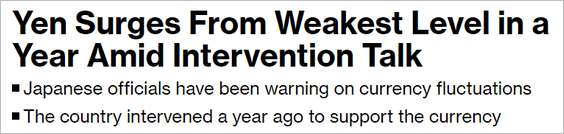

2. The 10-year JGB yield is the highest in a decade.

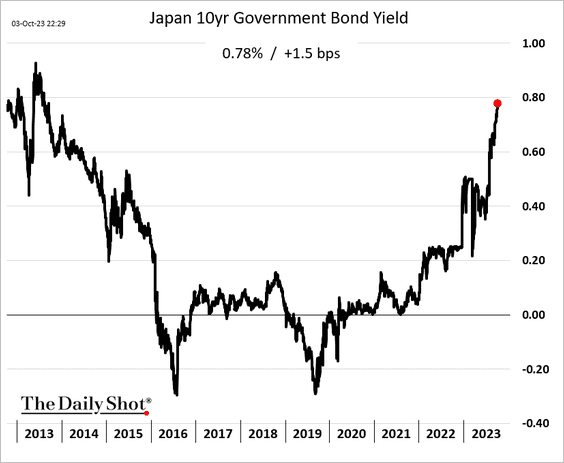

3. The rally in EUR/JPY appears stretched.

Source: Alpine Macro

Source: Alpine Macro

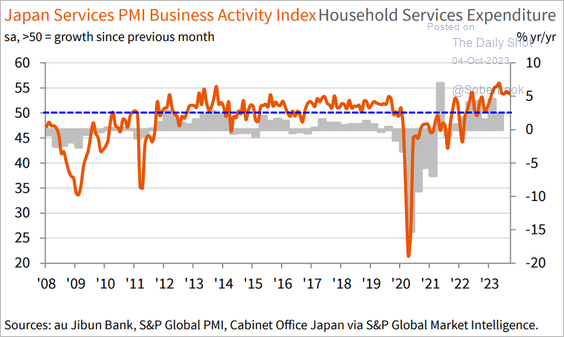

4. Japan’s service sector activity remains robust.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

Asia-Pacific

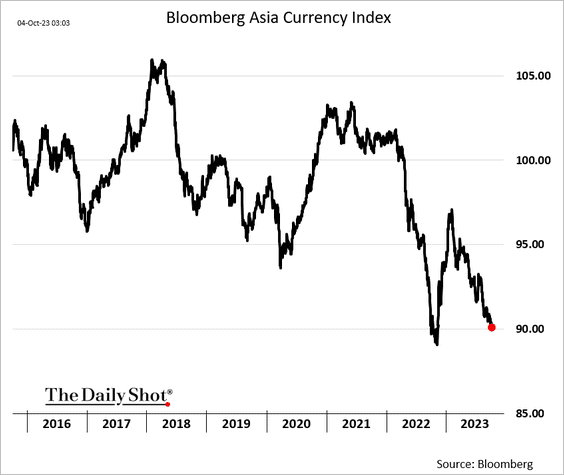

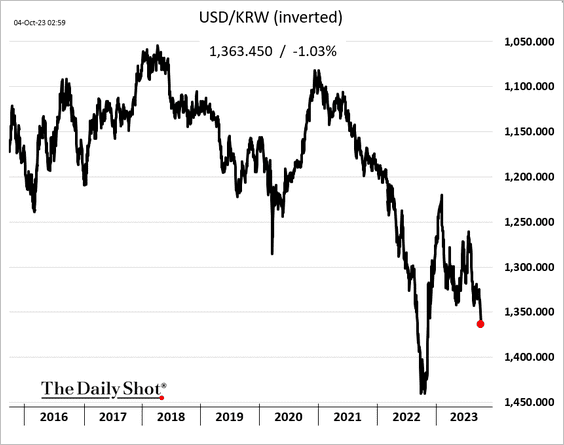

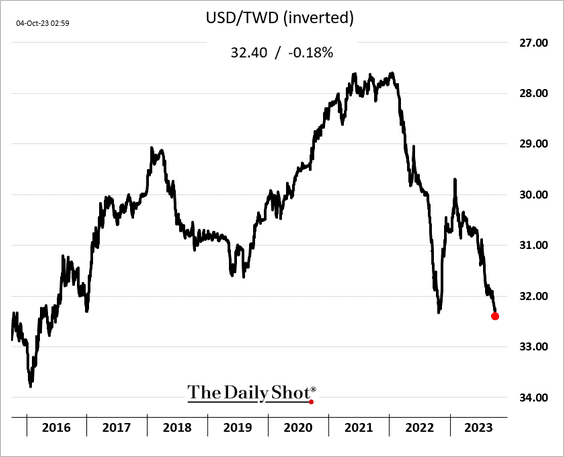

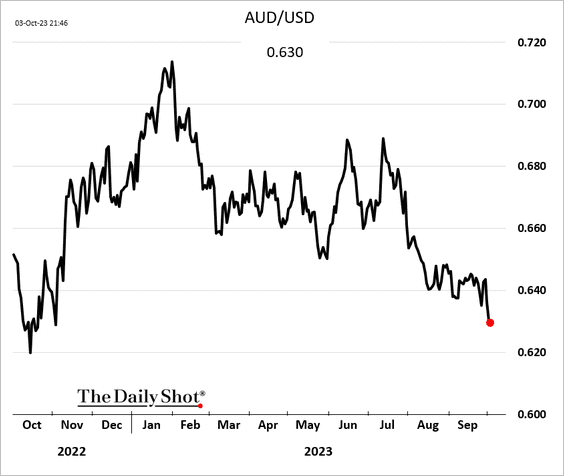

1. Asian currencies are under pressure (vs. USD).

• The South Korean won:

• The Taiwan dollar (lowest since 2016):

The Aussie dollar is also weakening.

——————–

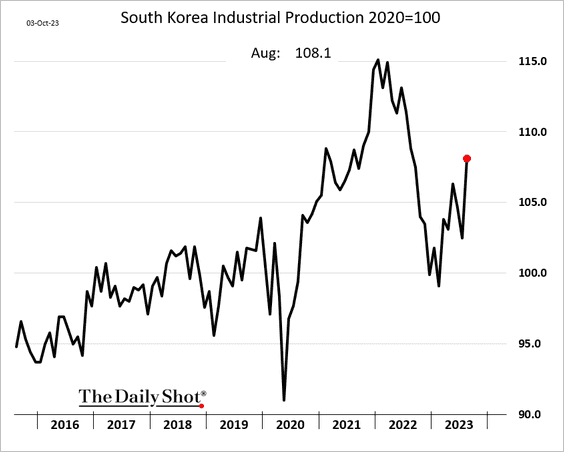

2. South Korea’s industrial production jumped in August.

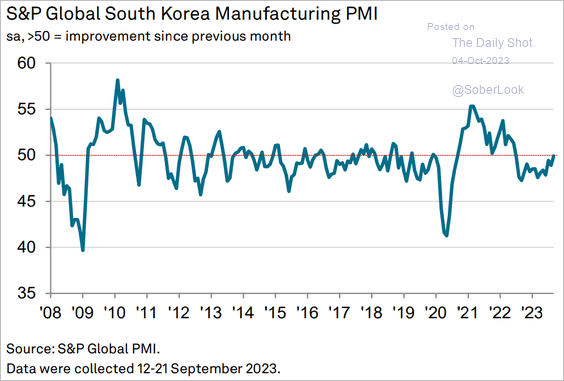

• The manufacturing PMI shows stabilization.

Source: S&P Global PMI

Source: S&P Global PMI

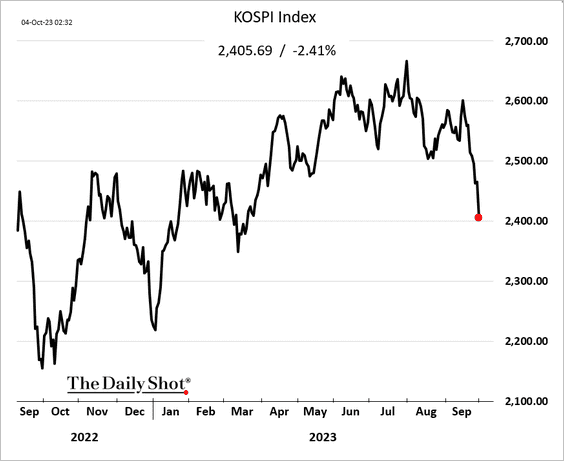

• South Korea’s stocks are tumbling.

——————–

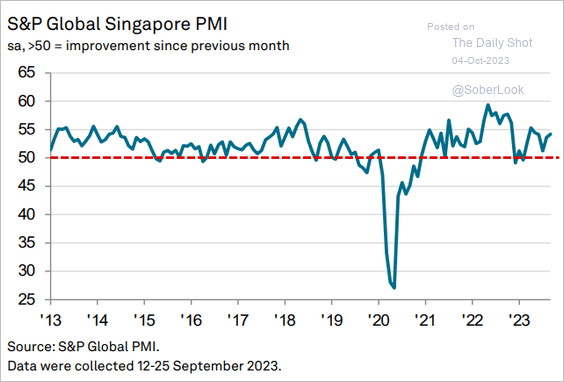

3. Singapore’s business activity has been holding up well.

Source: S&P Global PMI

Source: S&P Global PMI

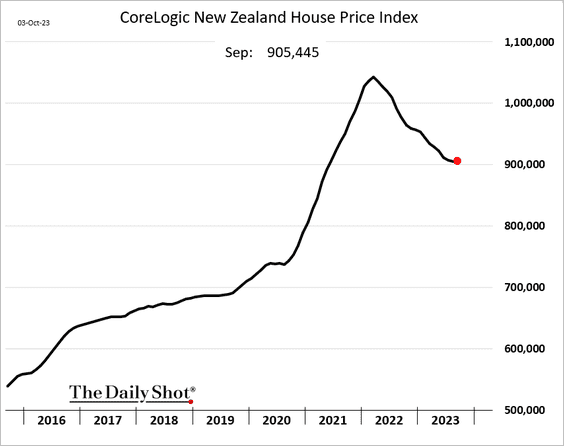

4. New Zealand’s home prices have stabilized.

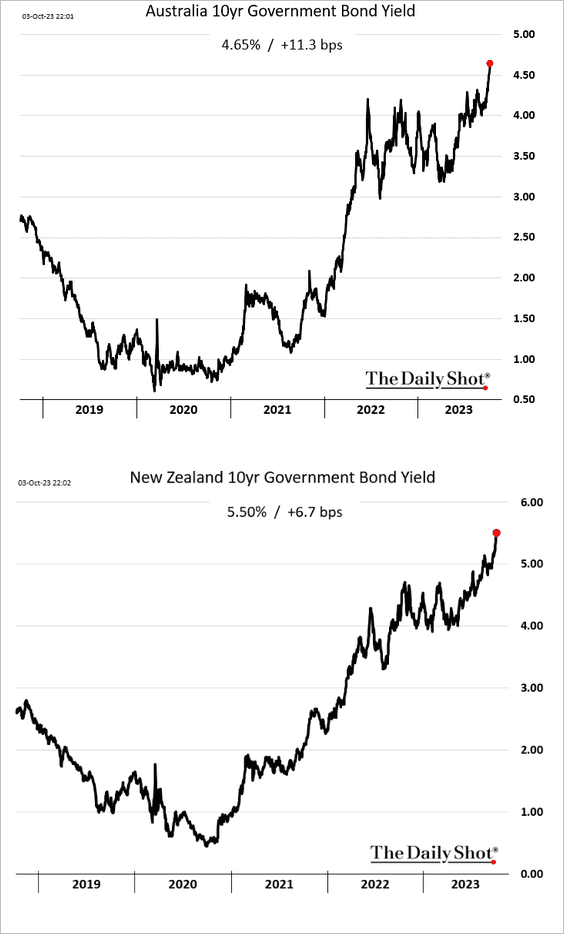

5. Australian and New Zealand bonds have been caught up in the global debt market rout.

Back to Index

Emerging Markets

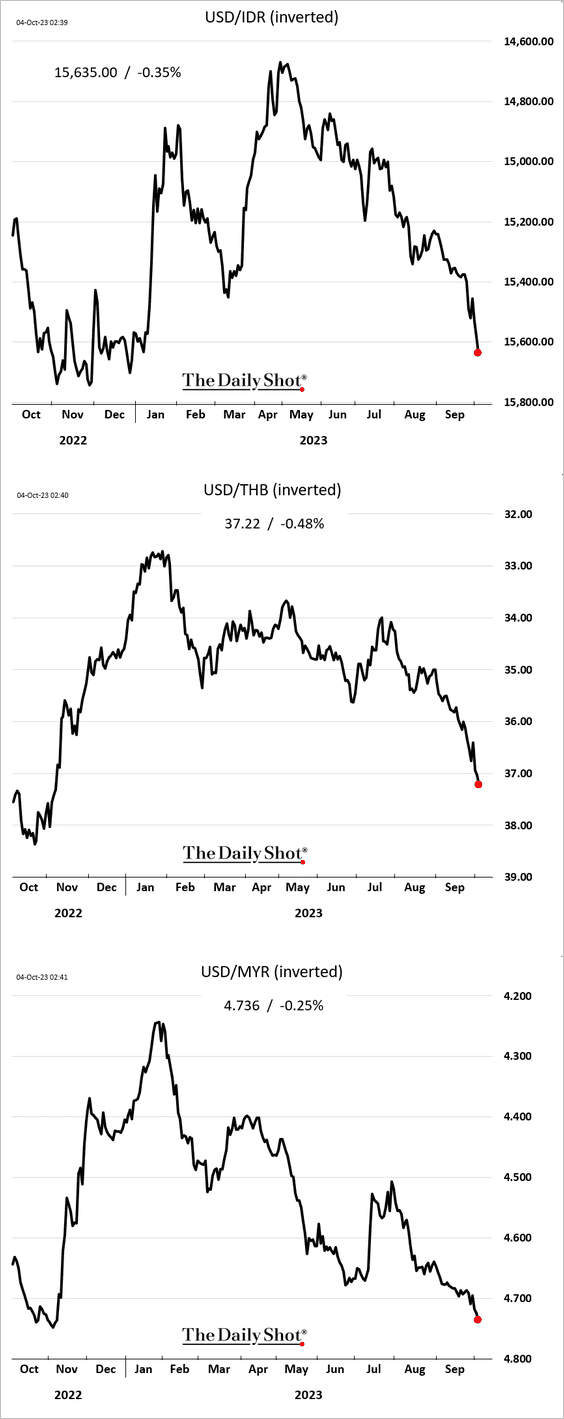

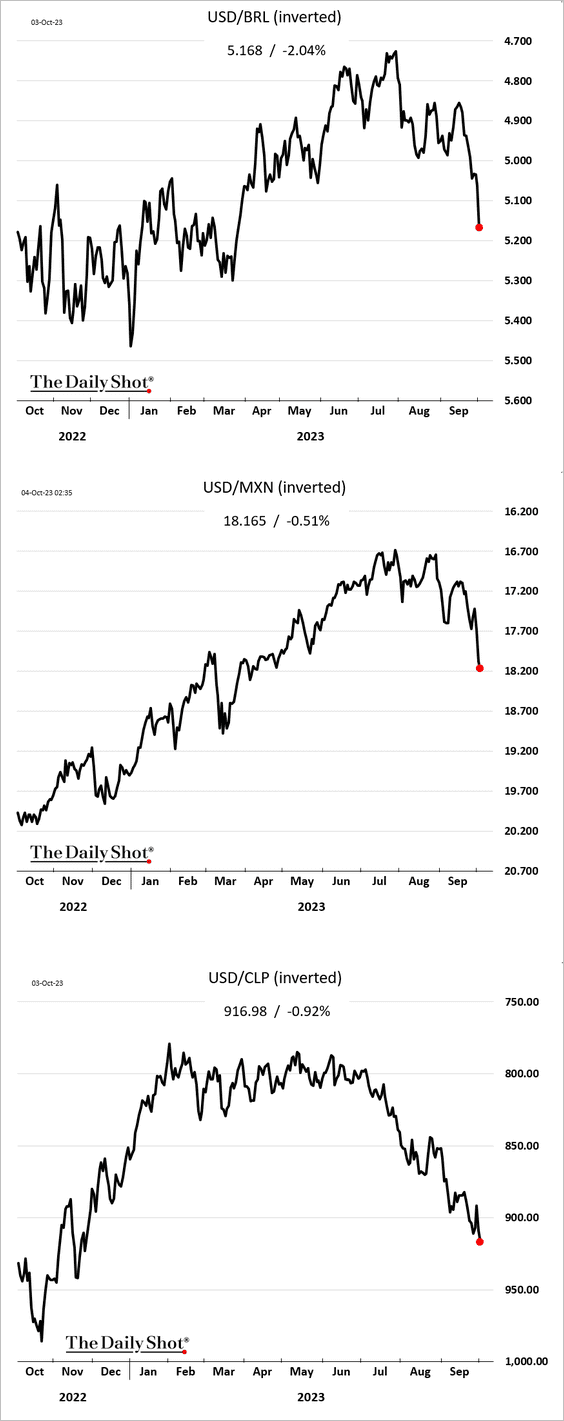

1. EM currencies are tumbling.

• Asia (Indonesian rupiah, Thai baht, Malaysian ringgit):

• LatAm (Brazilian real, Mexican peso, Chilean peso):

——————–

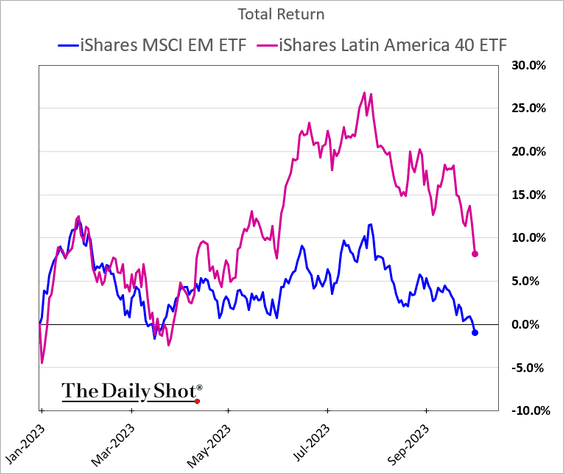

2. LatAm stocks are narrowing their outperformance (in dollar terms).

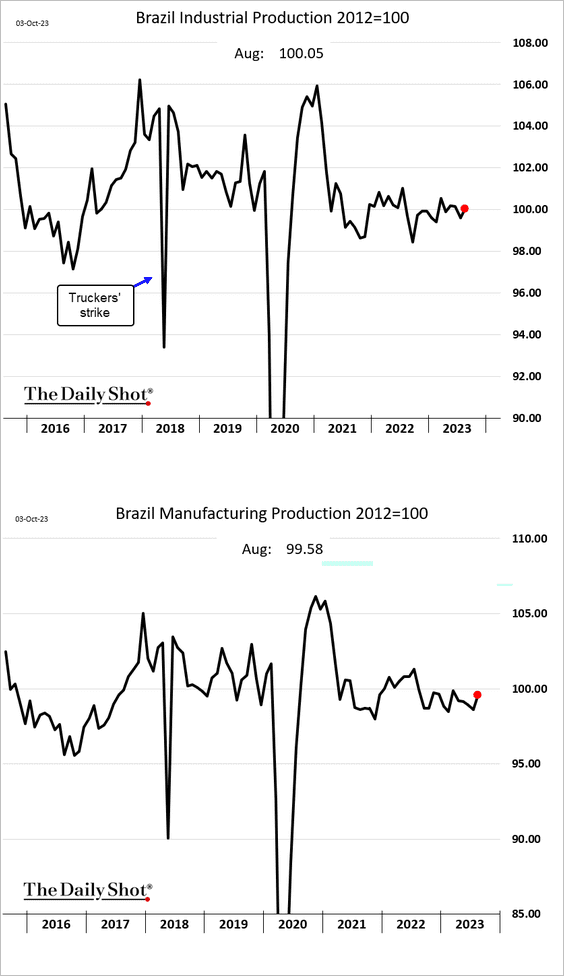

3. Brazil’s industrial production edged higher in August.

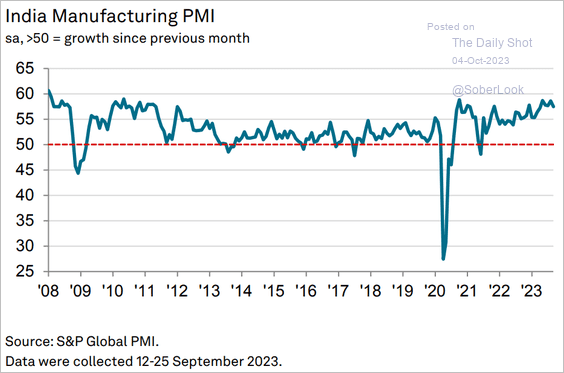

4. India’s factory activity remains remarkably strong.

Source: S&P Global PMI

Source: S&P Global PMI

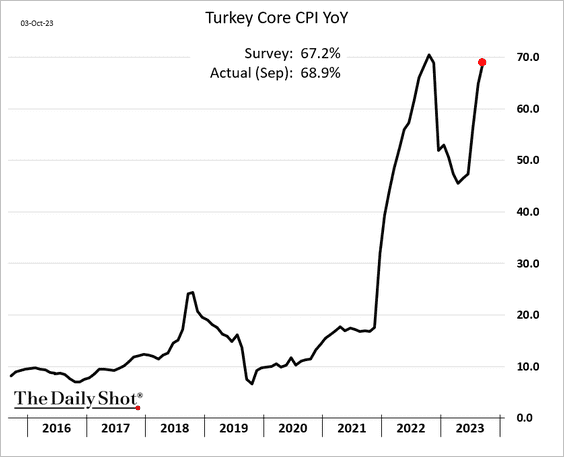

5. Turkey’s core inflation is nearing 70% again (topping forecasts).

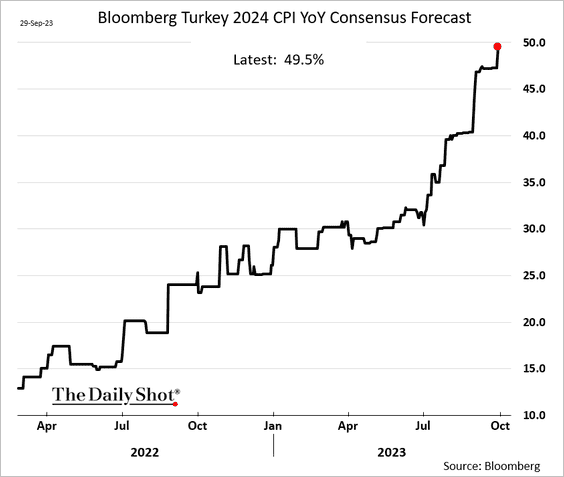

Economists have been boosting their projections for next year’s inflation.

Back to Index

Commodities

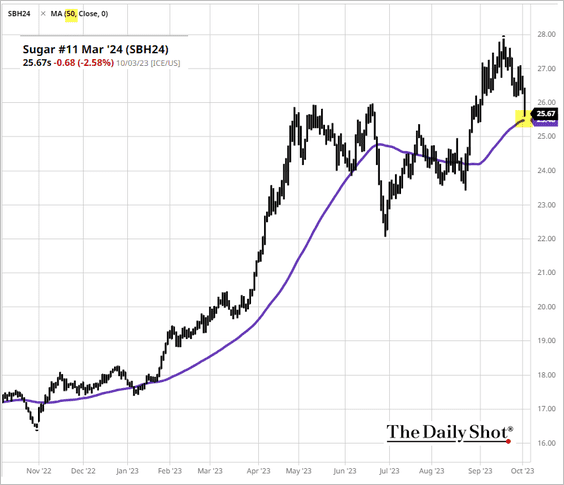

1. Sugar futures are rolling over, hitting the 50-day moving average.

Source: barchart.com

Source: barchart.com

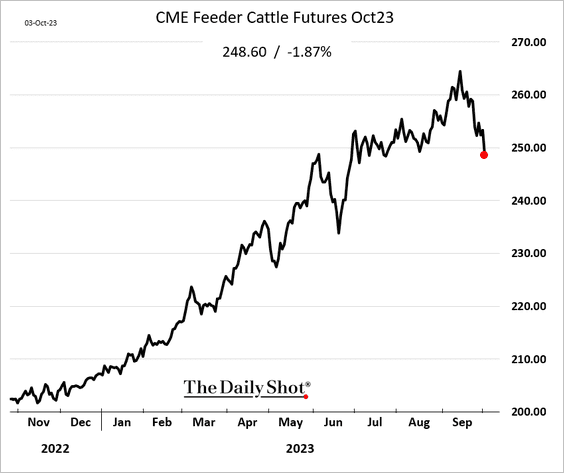

2. US cattle futures are retreating after the Wholesale Boxed Beef report came in softer than expected.

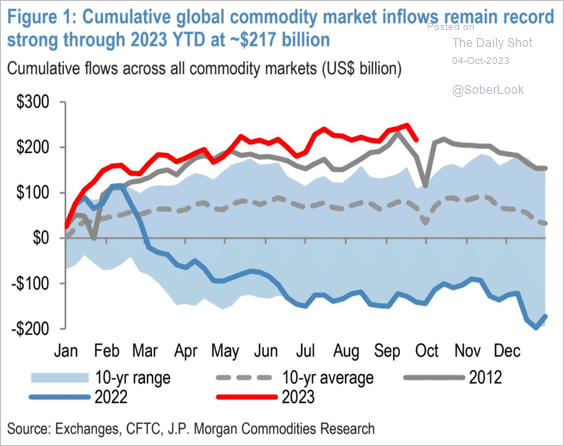

3. Commodity market inflows remain robust.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

Back to Index

Equities

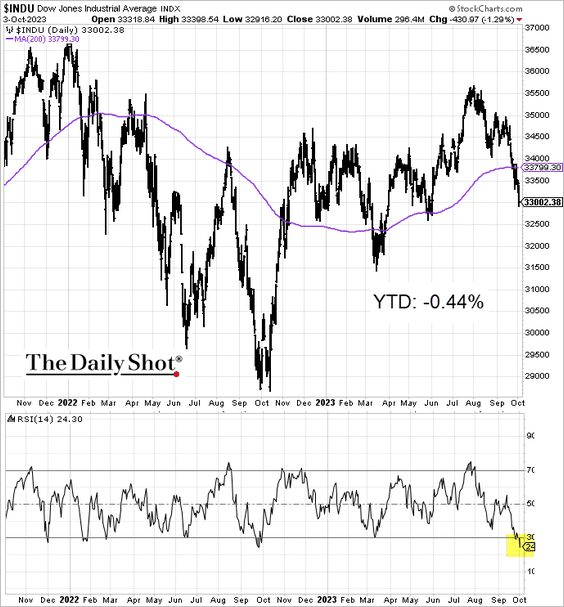

1. The Dow has given up its gains for the year and is now firmly in oversold territory.

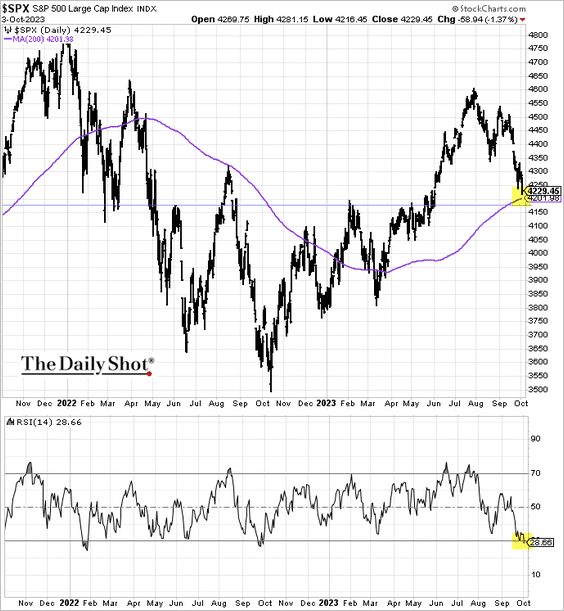

The S&P 500 is at its 200-day moving average and is also oversold (based on the RSI measure).

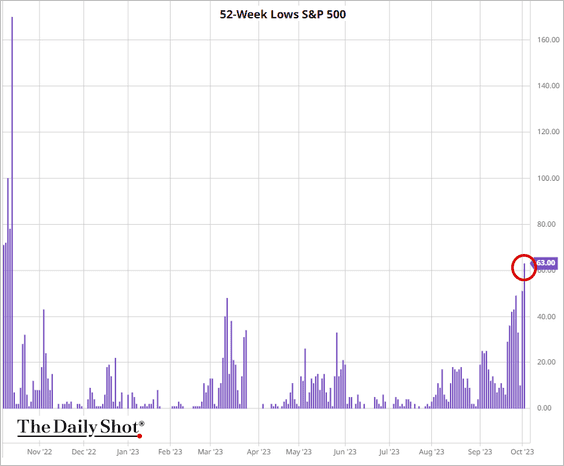

• An increasing number of S&P 500 stocks are hitting 52-week lows.

Source: barchart.com

Source: barchart.com

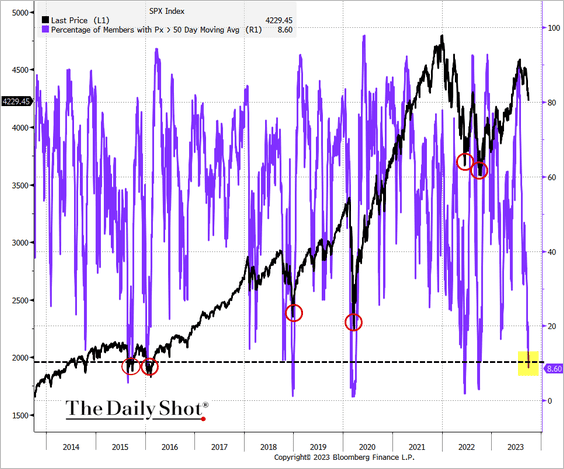

• In recent years, when the proportion of S&P 500 stocks trading above their 50-day moving average dipped below 10%, we usually got a quick bounce.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

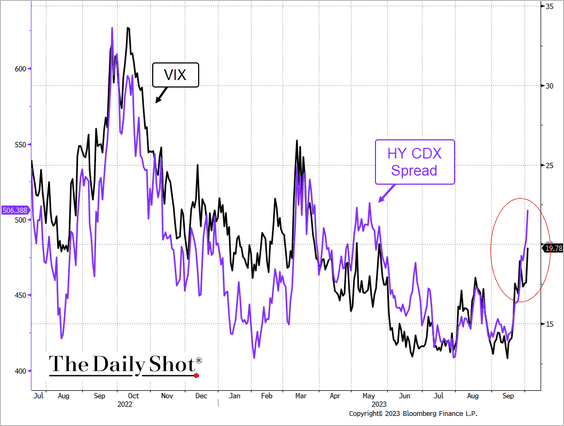

2. Credit markets suggest that VIX could move higher.

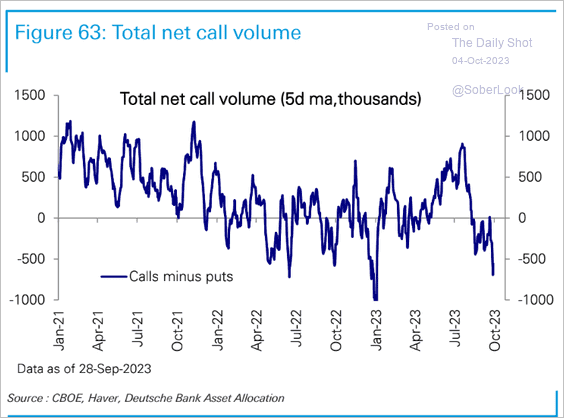

• The net call volume has declined sharply as options traders turn bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

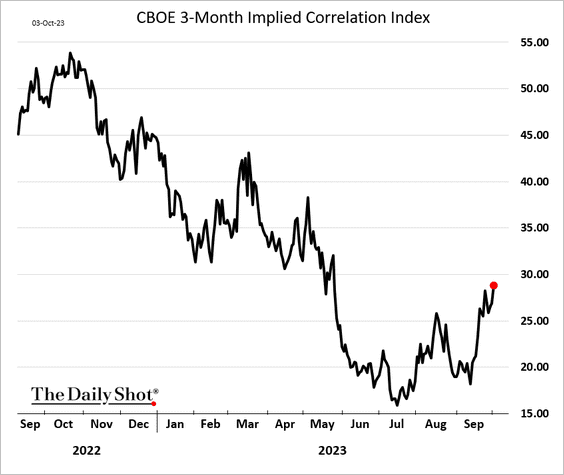

3. Implied correlation among large-cap stocks is rebounding.

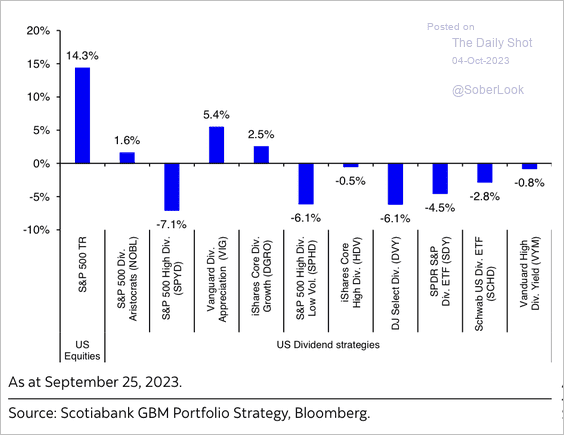

4. US dividend strategies have underperformed this year.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

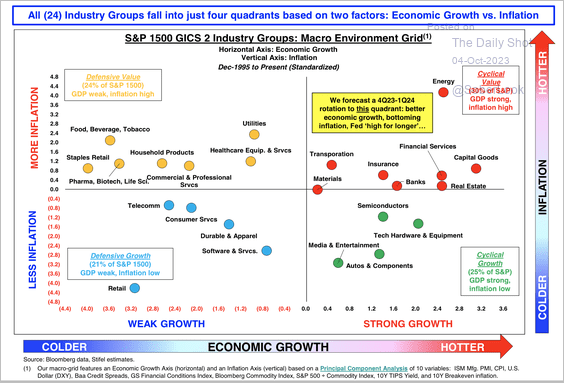

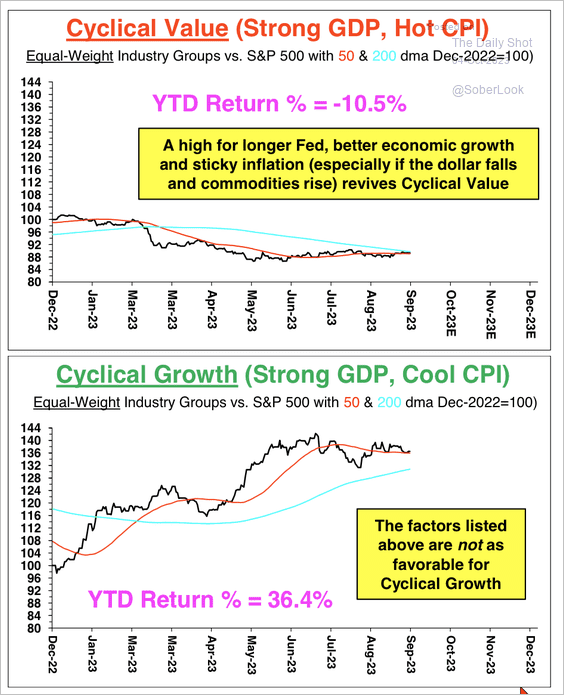

5. Solid economic growth and sticky inflation/elevated interest rates could benefit cyclical value stocks. Could we see a rotation? (2 charts)

Source: Stifel

Source: Stifel

Source: Stifel

Source: Stifel

——————–

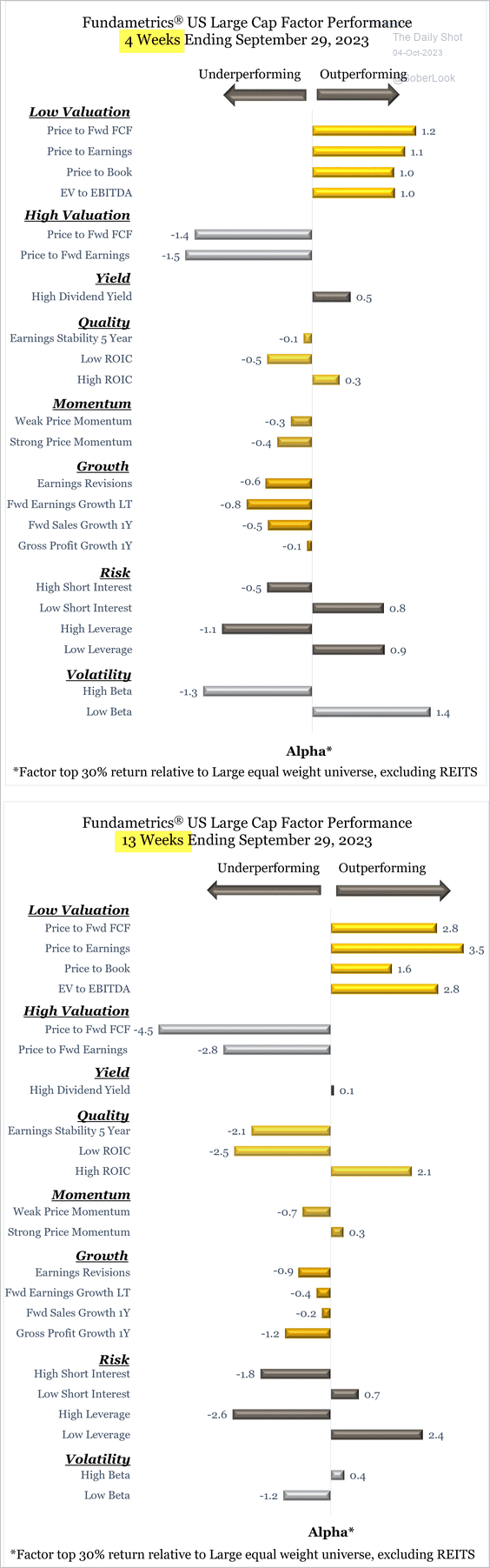

6. Here is a detailed look at equity factor/style performance over the past four and 13 weeks.

Source: CornerCap Institutional

Source: CornerCap Institutional

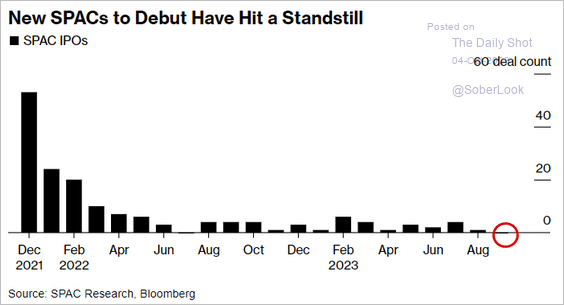

7. SPAC activity has ground to a halt.

Source: @markets Read full article

Source: @markets Read full article

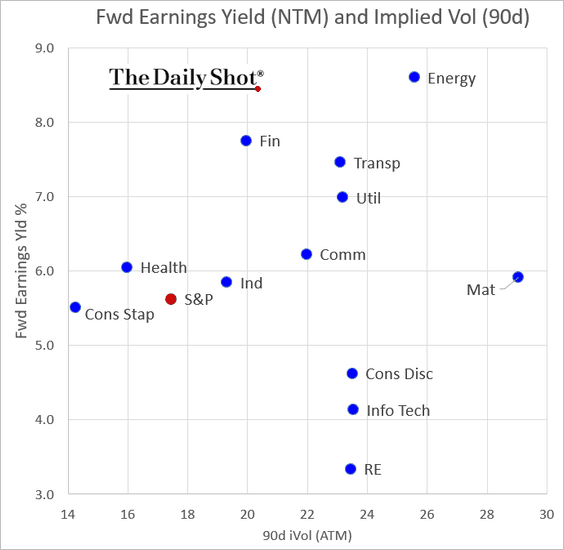

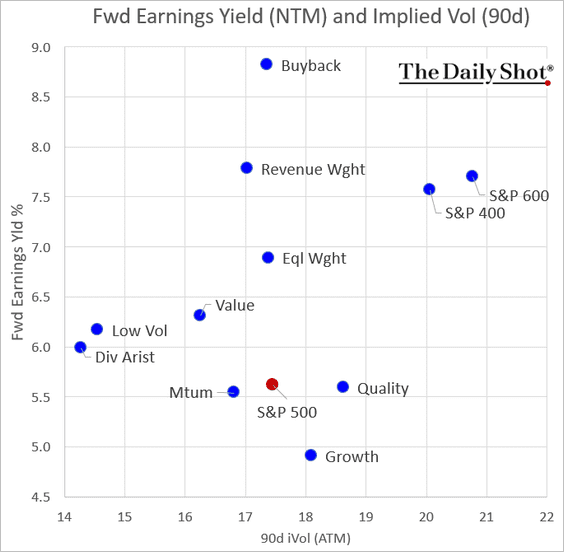

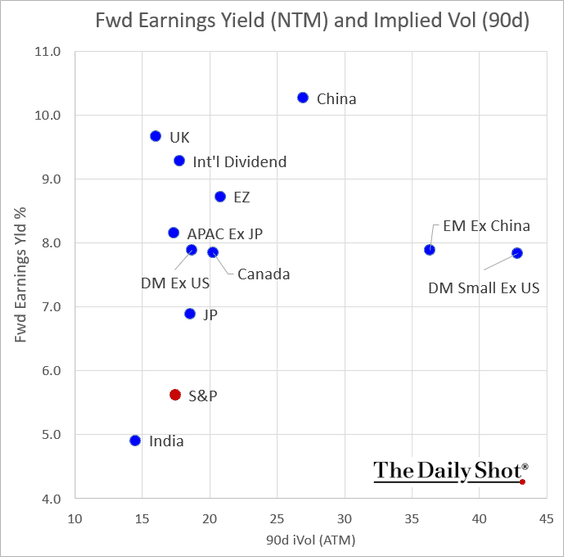

8. Next, we have three charts showing expected earnings yields (projected performance) vs. implied volatility (perceived risk).

• Sectors:

• Equity factors:

• Selected international markets:

Back to Index

Credit

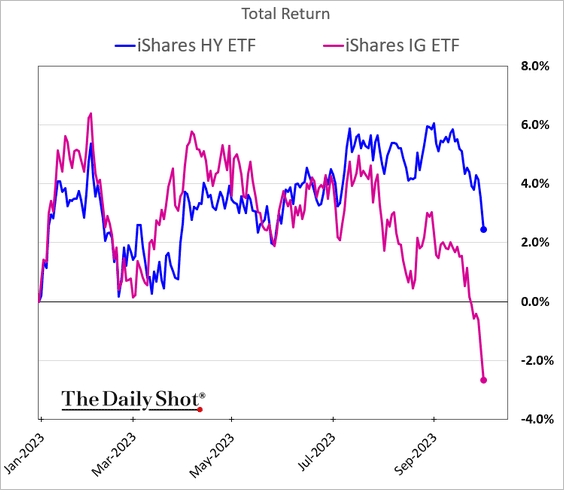

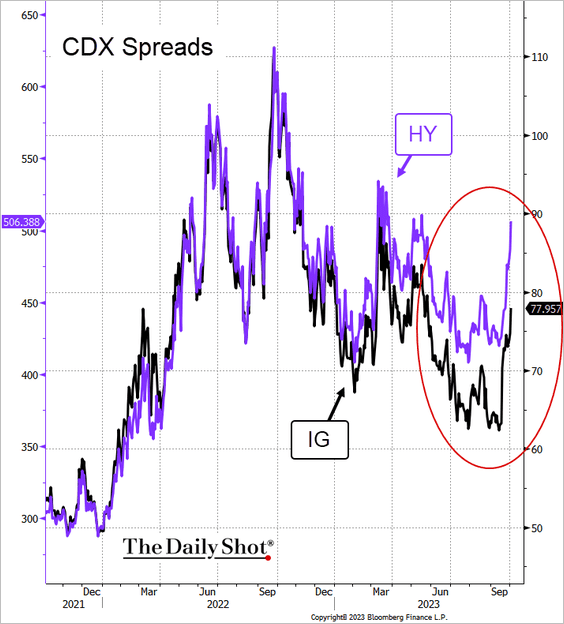

1. Investment-grade (IG) bonds continue to underperform high-yield (HY) as Treasury yields surge.

However, on a spread basis, IG bonds have outperformed HY.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

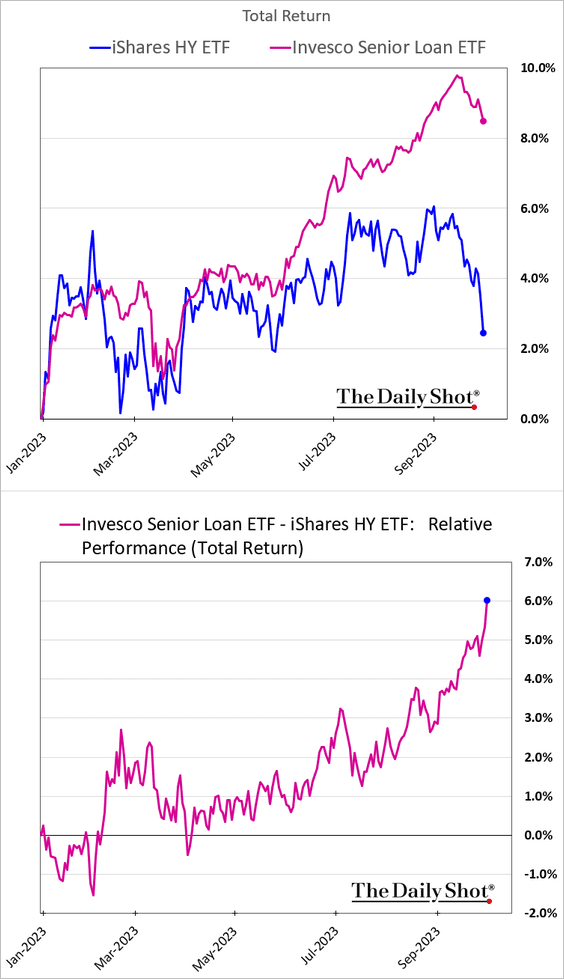

2. Leveraged loans (which pay a floating-rate coupon) continue to outperform high-yield bonds.

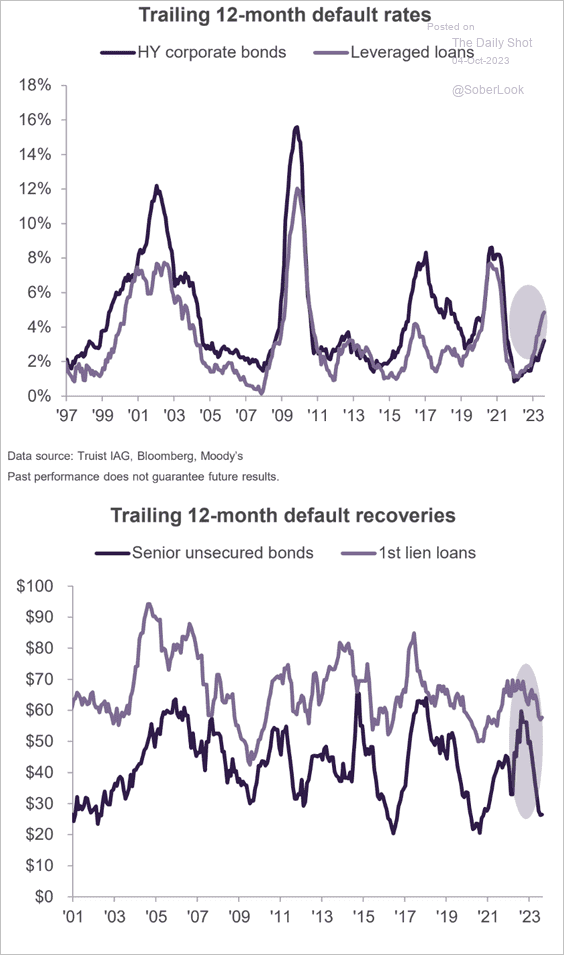

3. Here is a look at default and recovery rates.

Truist: – Riskier fixed-income sectors, such as high-yield corporate bonds and leveraged loans, are witnessing rising default rates. Additionally, bondholder recovery rates are deteriorating. Put together, investors are facing more frequent defaults and are enduring greater losses. We expect this trend to continue and reiterate our up-in-quality bias within fixed-income portfolios.

Source: Truist Advisory Services

Source: Truist Advisory Services

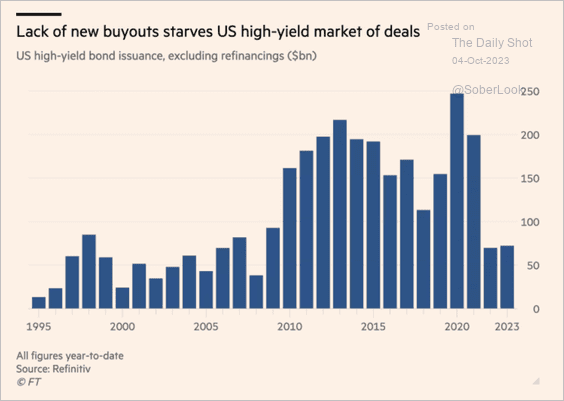

4. High-yield issuance, excluding refi, has been slow.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Rates

1. The 30-year bond yield is nearing 5%.

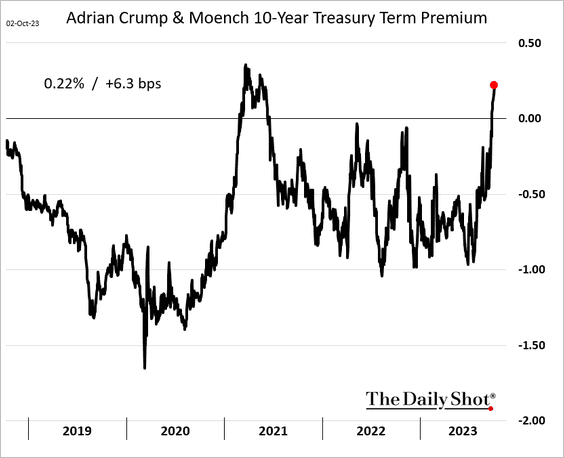

2. Treasury term premium continues to rise.

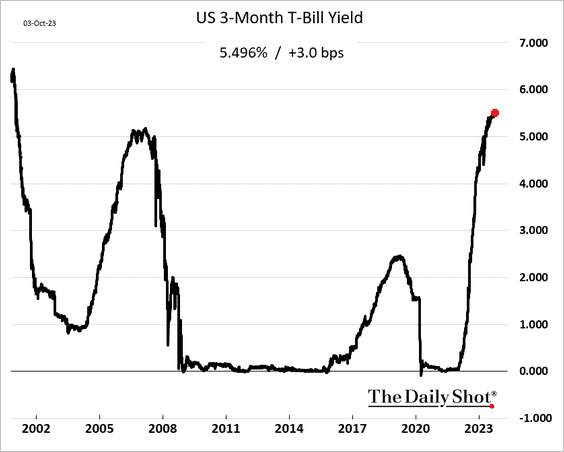

3. The three-month T-bill yield hit the highest level since 2001 amid increased issuance.

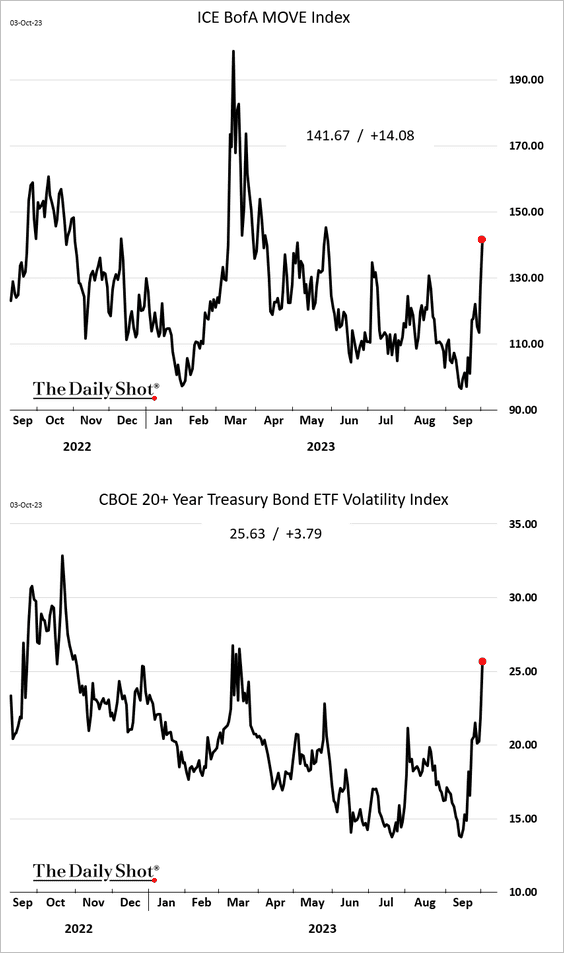

4. Treasury implied volatility jumped on Tuesday.

Back to Index

Global Developments

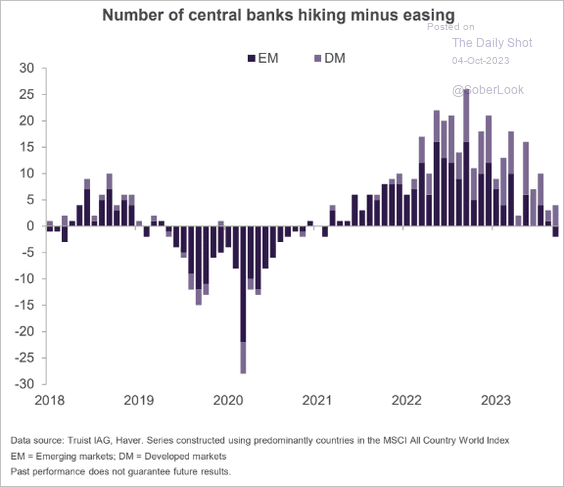

1. The global rate hike cycle is ending.

Source: Truist Advisory Services

Source: Truist Advisory Services

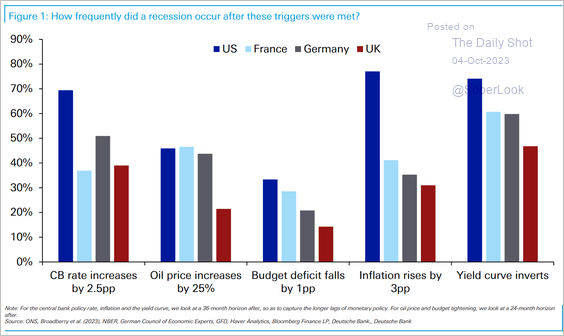

2. How effective are the various recession signals in the US and Europe?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

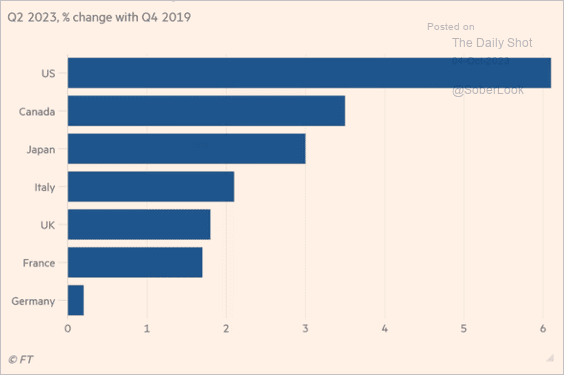

3. Here is a look at economic growth in advanced economies since the start of the pandemic.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Food for Thought

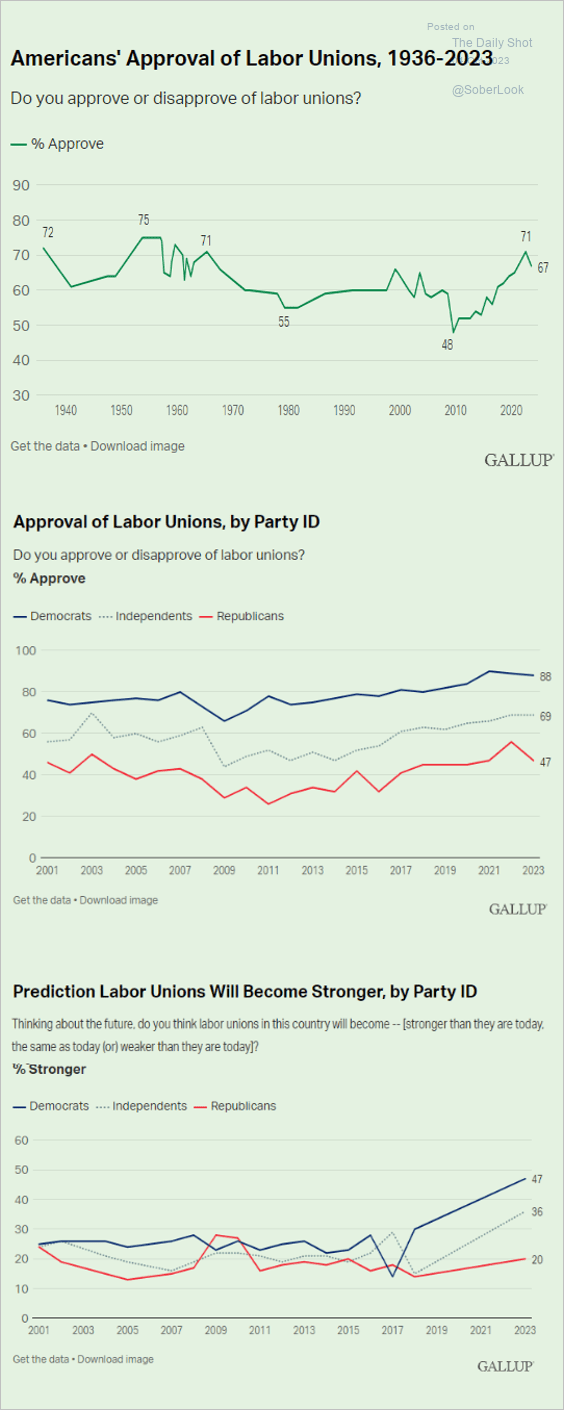

1. Americans’ approval of labor unions:

Source: Gallup Read full article

Source: Gallup Read full article

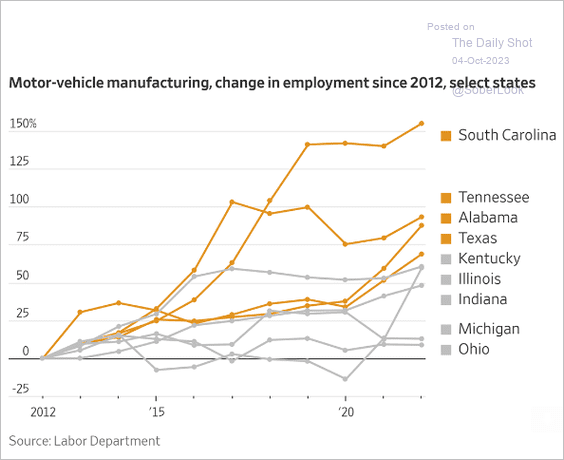

2. Auto manufacturing employment growth in the South:

Source: @WSJ Read full article

Source: @WSJ Read full article

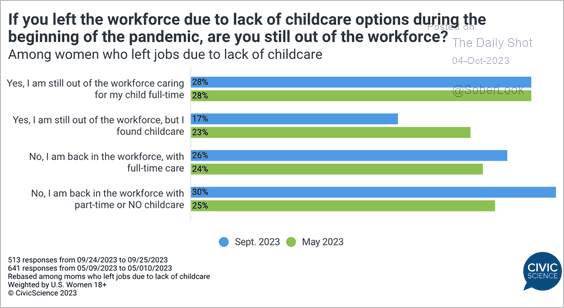

3. Not working due to lack of childcare options:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

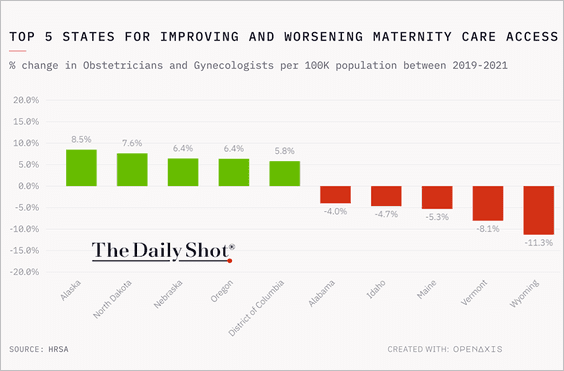

4. Top five states for Improving and worsening maternity care access:

Source: @TheDailyShot

Source: @TheDailyShot

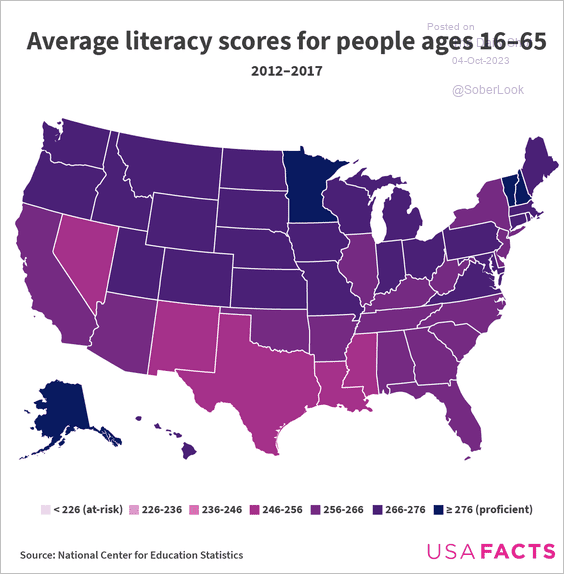

5. Literacy scores:

Source: USAFacts

Source: USAFacts

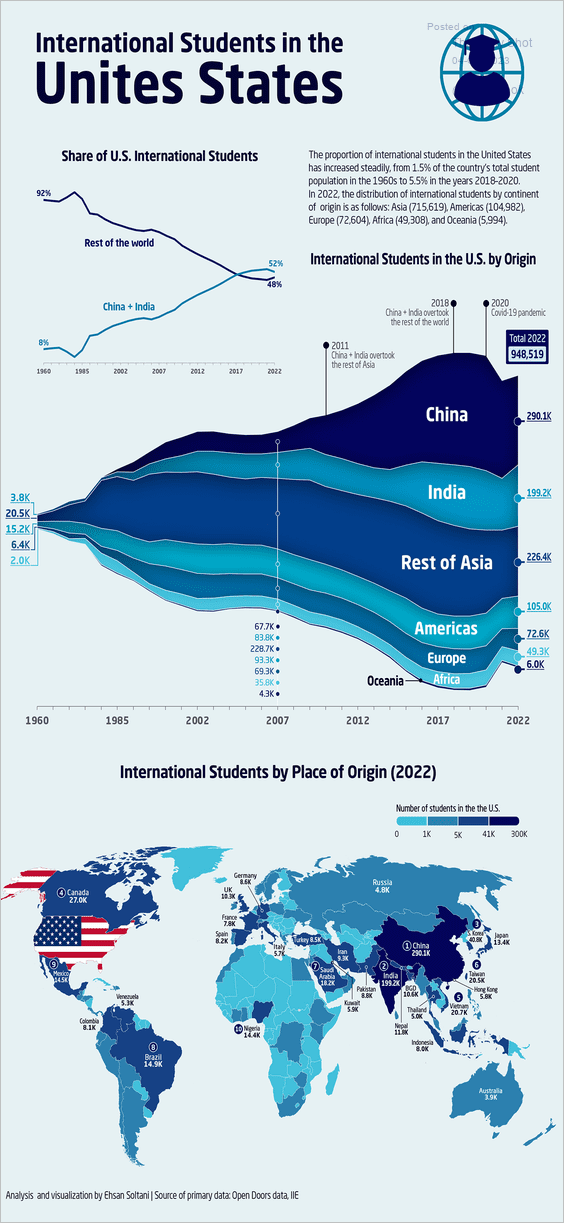

6. International students in the US:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

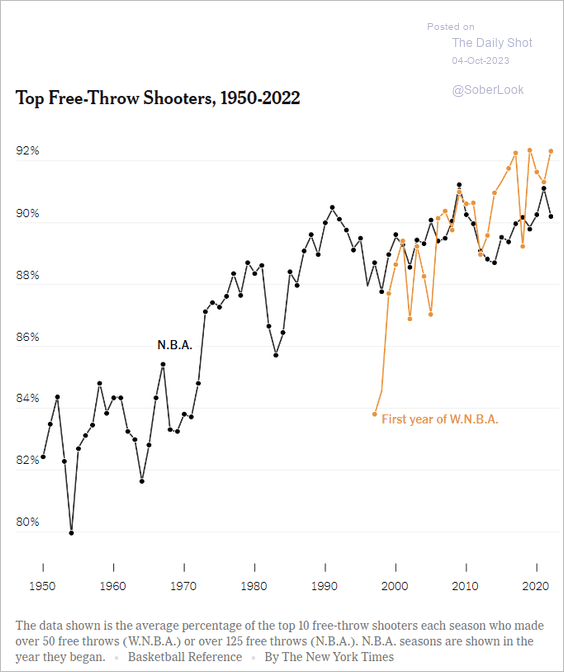

7. Top free-throw NBA and WNBA shooters over time:

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

Back to Index