The Daily Shot: 05-Oct-23

• The United States

• Canada

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

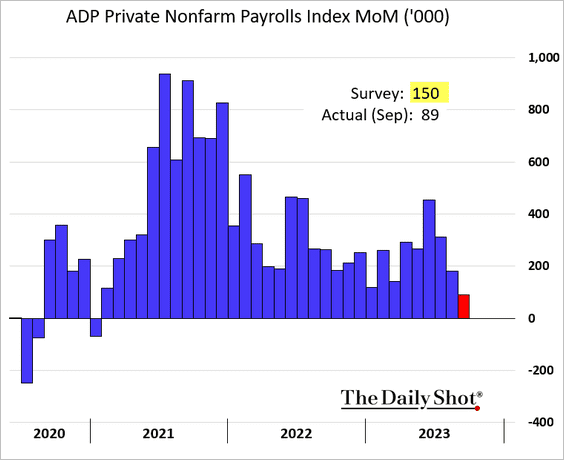

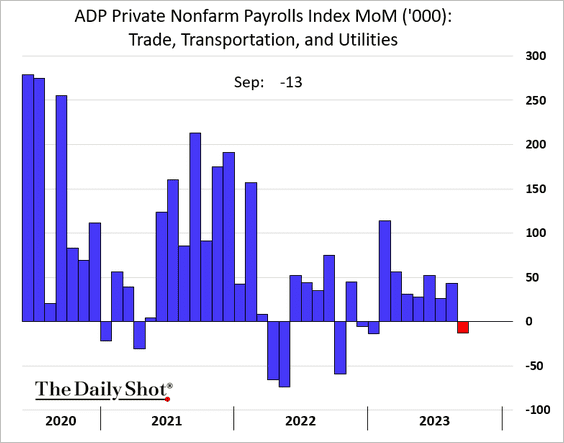

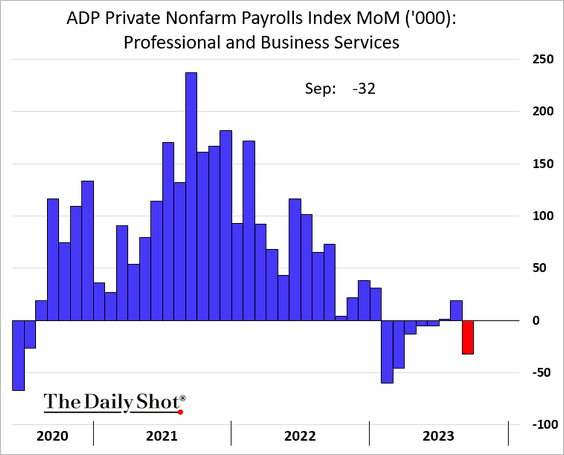

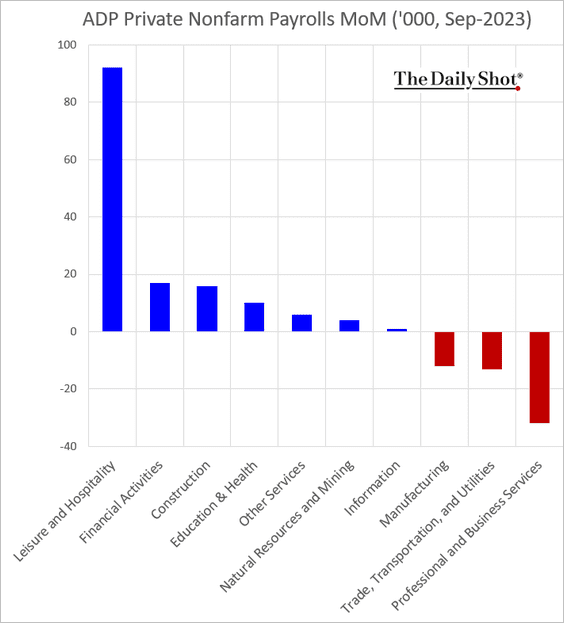

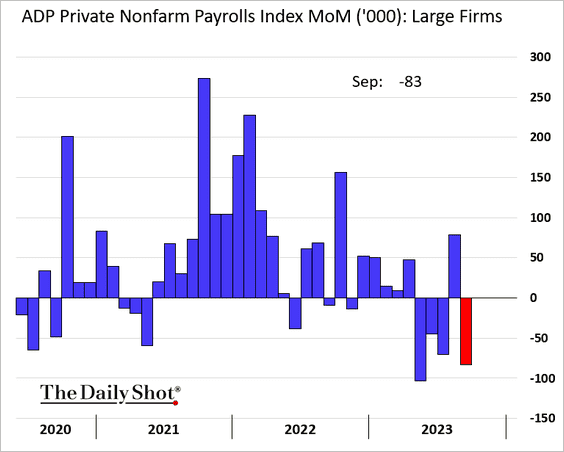

1. The ADP private payrolls report alleviated some concerns about the US labor market’s vitality raised by the job openings data.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

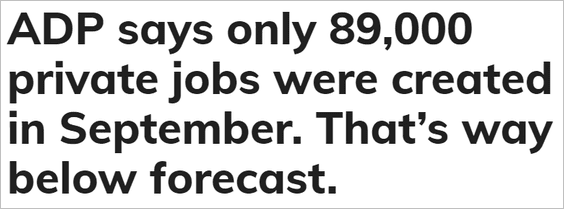

• While hiring at hotels and restaurants increased last month, …

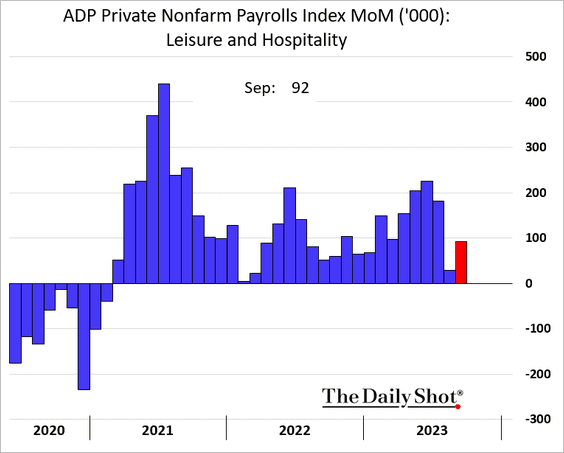

… logistics, business services, and manufacturing sectors reported declines.

• It was another month of staff reductions at large firms.

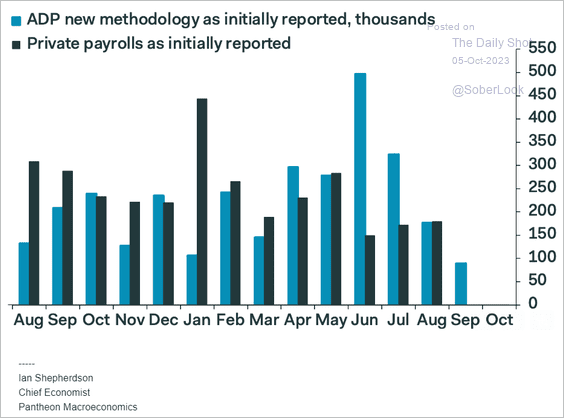

• Will tomorrow’s official payrolls report reflect the weakness in the ADP data?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

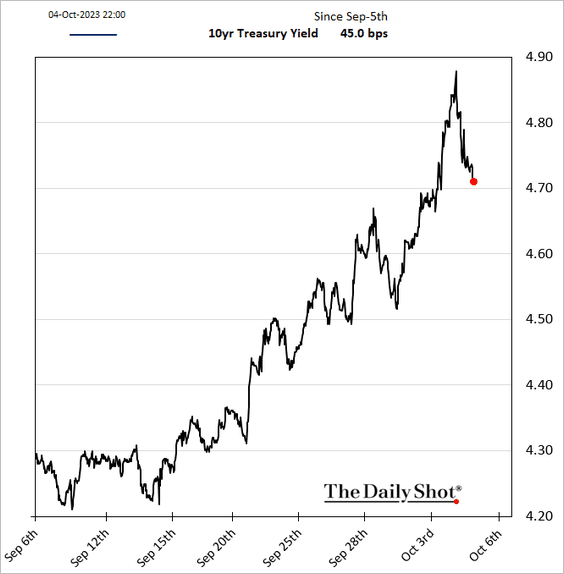

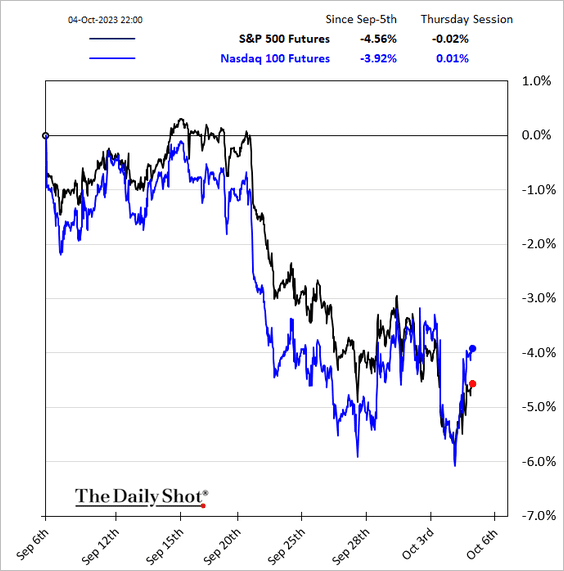

2. Treasury yields declined in response to the ADP report, …

… stabilizing stock prices …

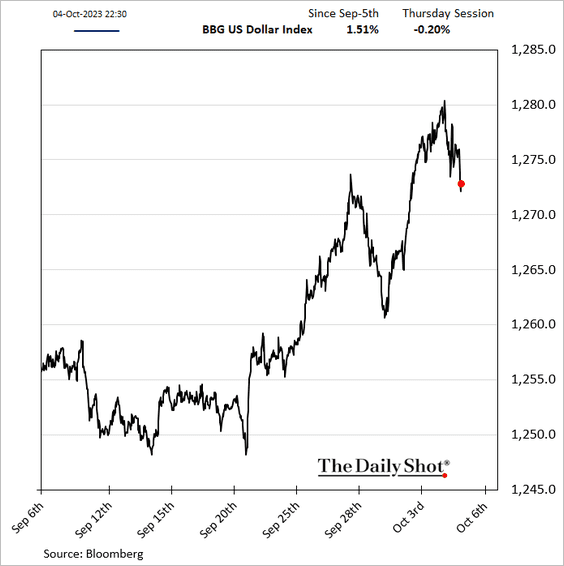

… and halting the US dollar rally.

——————–

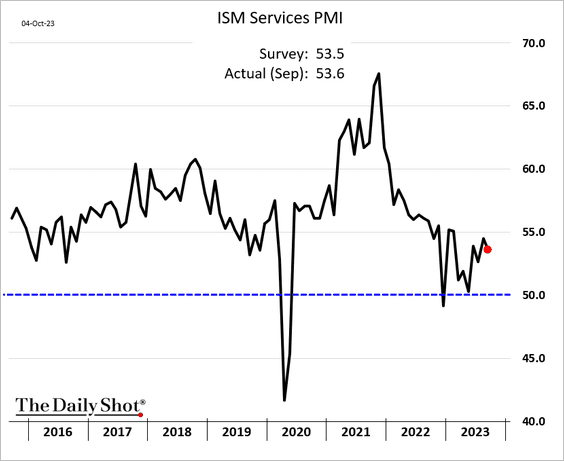

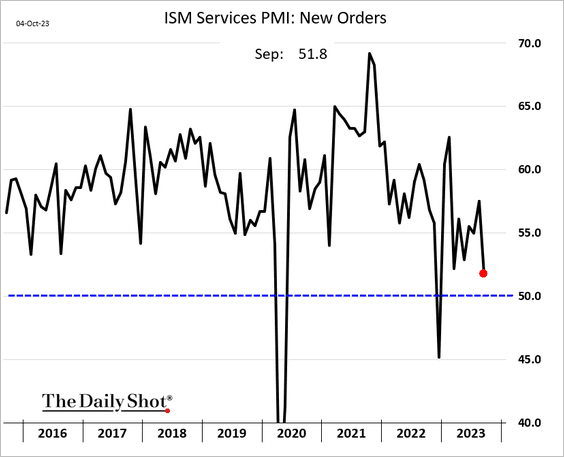

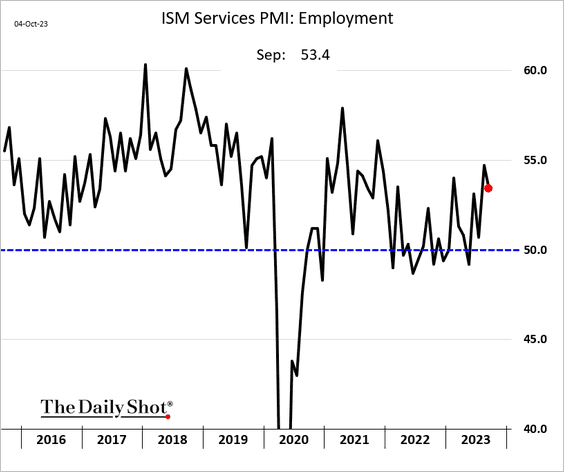

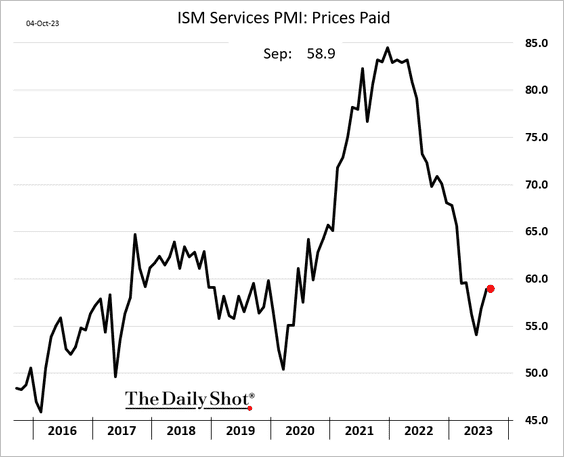

3. The ISM Services PMI points to ongoing service sector expansion.

• Demand growth slowed.

• Hiring remains robust.

• Companies report the pace of their cost increases running near pre-COVID levels.

——————–

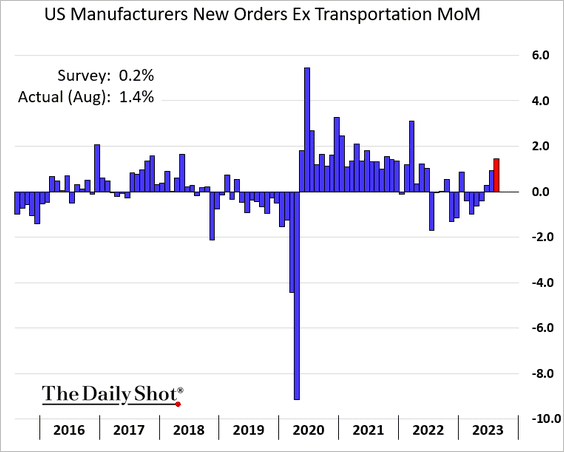

4. Factory orders jumped more than expected in August.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

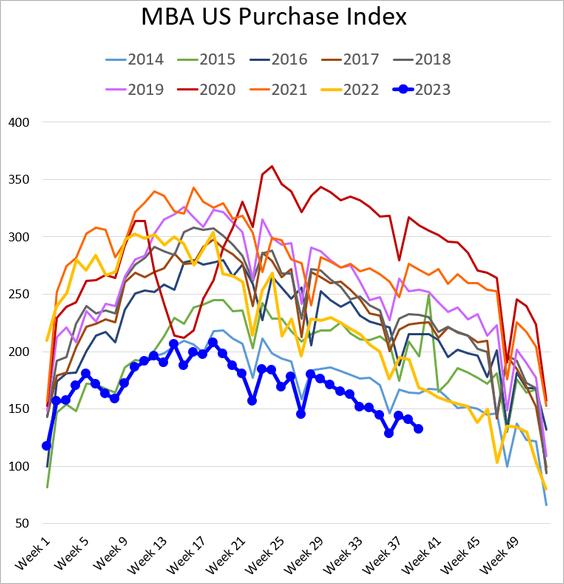

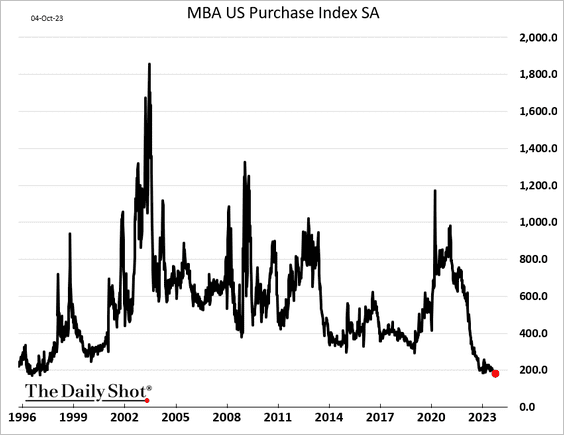

5. Mortgage applications continue to sink.

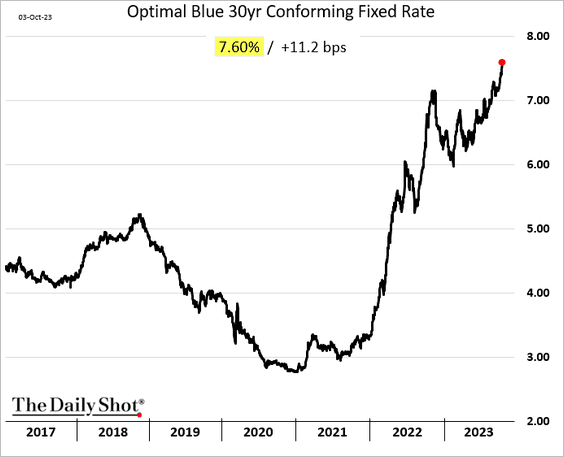

While seasonal adjustments to this index are not very reliable, it is worth noting that the adjusted index of loan applications hit the lowest level in decades, …

… as mortgage rates surge.

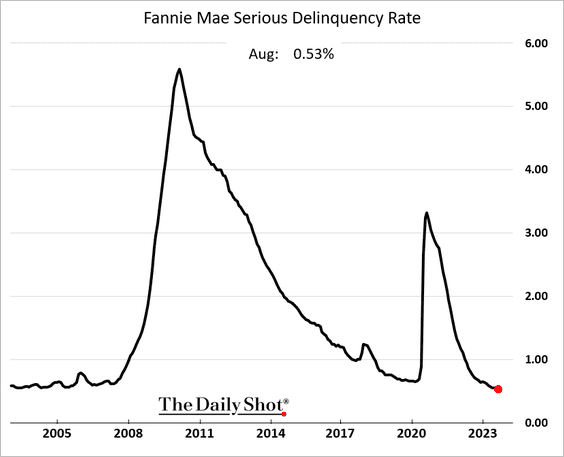

• Mortgage delinquencies remain exceptionally low.

——————–

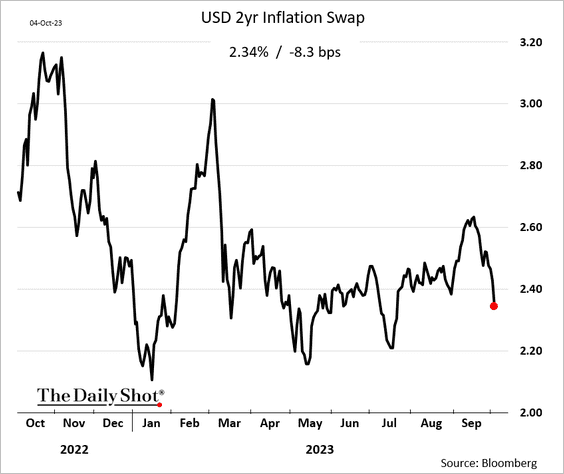

6. Short-term market-based inflation expectations eased after a pullback in oil prices (see the energy section)

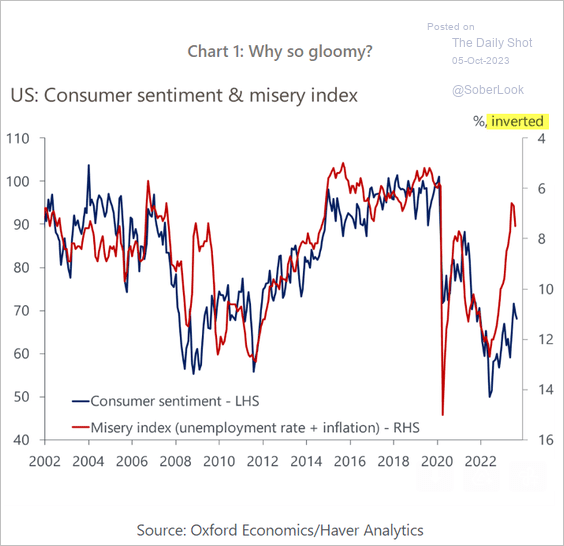

7. The U. Michigan Consumer Sentiment Index has decoupled from the US Misery Index.

Source: Oxford Economics

Source: Oxford Economics

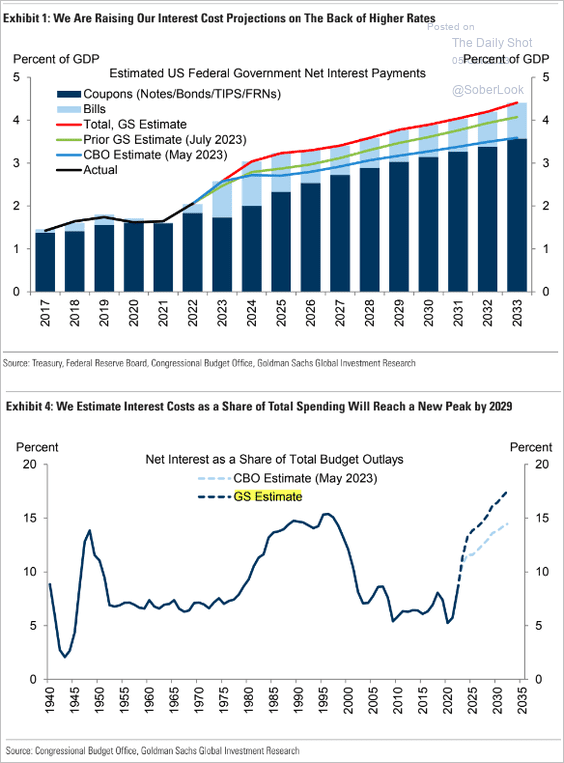

8. Goldman raised their forecast for US federal interest expense after the latest surge in Treasury yields.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Canada

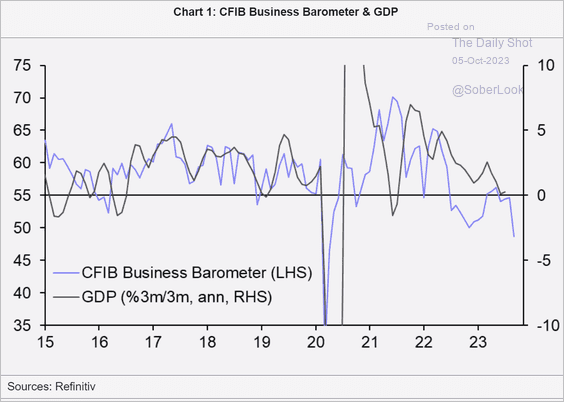

1. The CFIB Business Barometer points to a downturn in Canada’s GDP.

Source: Capital Economics

Source: Capital Economics

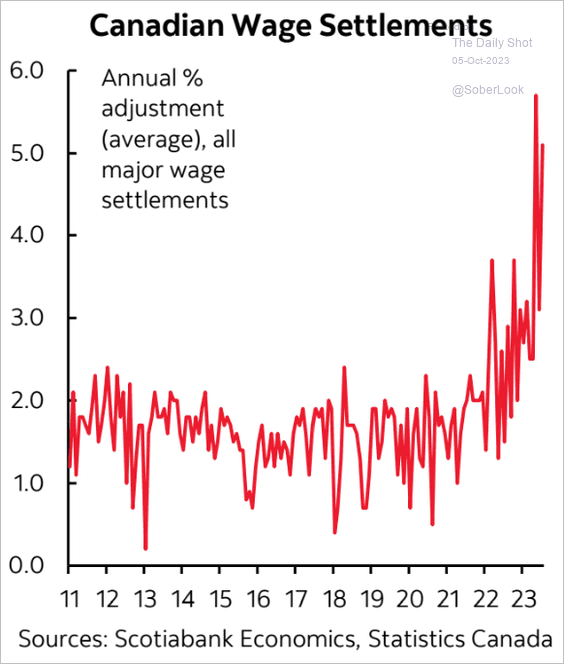

2. Wage increases surged this year.

Source: Scotiabank Economics

Source: Scotiabank Economics

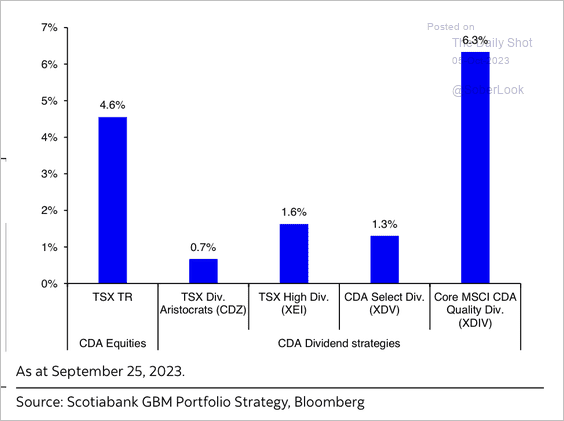

3. Canadian dividend strategies performed better than their US peers this year, although mostly lagging the TSX ex-quality dividend.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

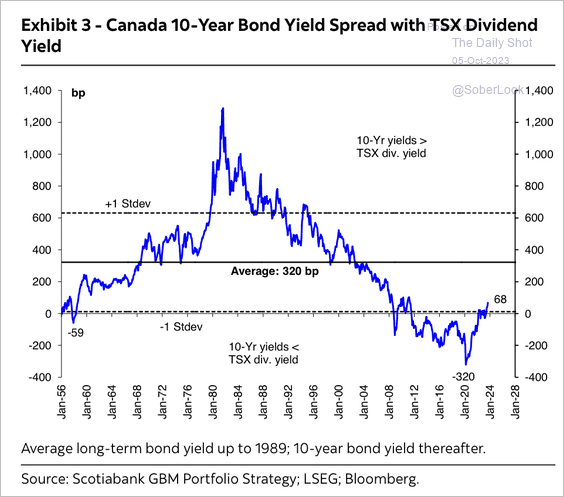

The steep rise in interest rates and bond yields eroded the competitiveness of dividend-paying stocks.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The Eurozone

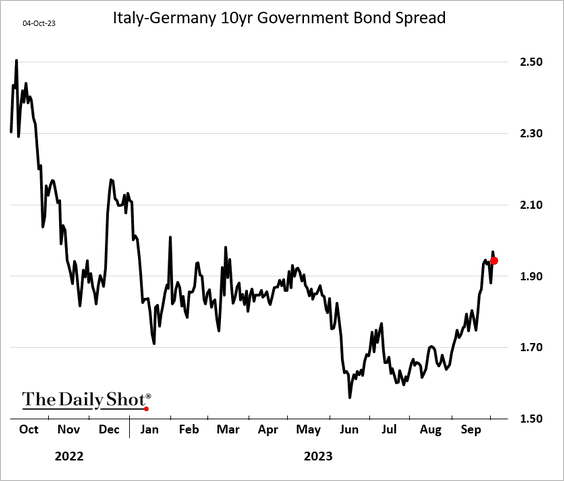

1. Italian bond spreads have been rising since August.

Source: @economics Read full article

Source: @economics Read full article

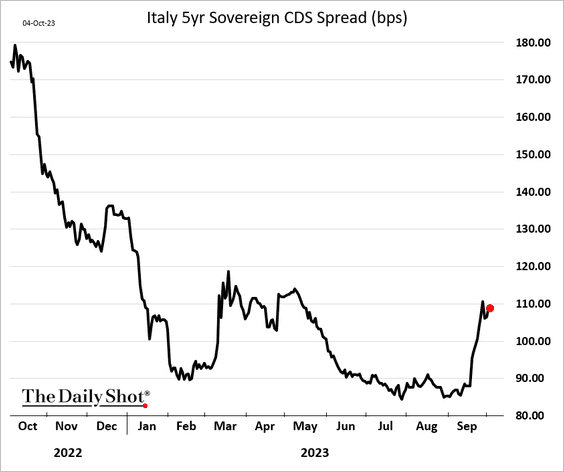

The CDS spread widened as well.

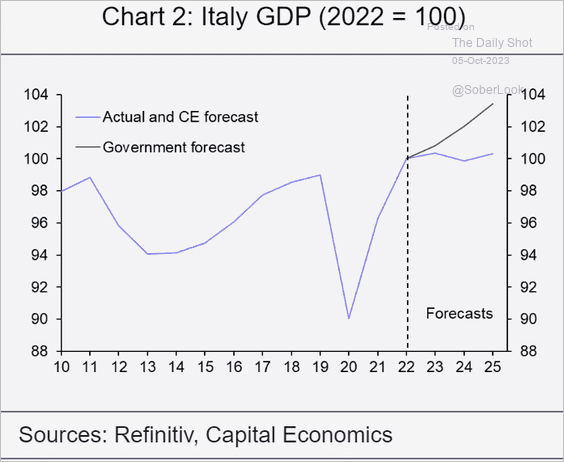

• Is Italy’s government too optimistic about GDP growth? Here is a forecast from Capital Economics.

Source: Capital Economics

Source: Capital Economics

——————–

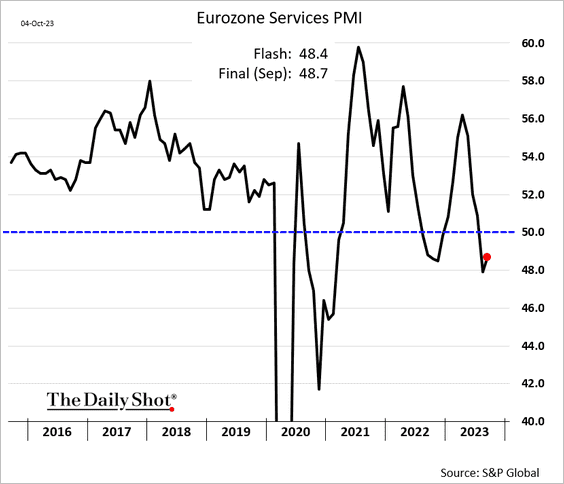

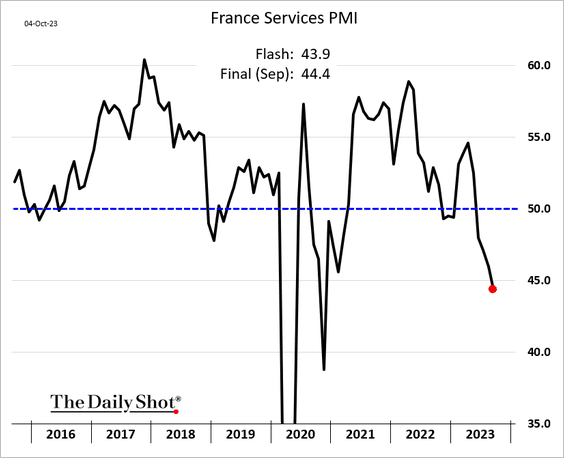

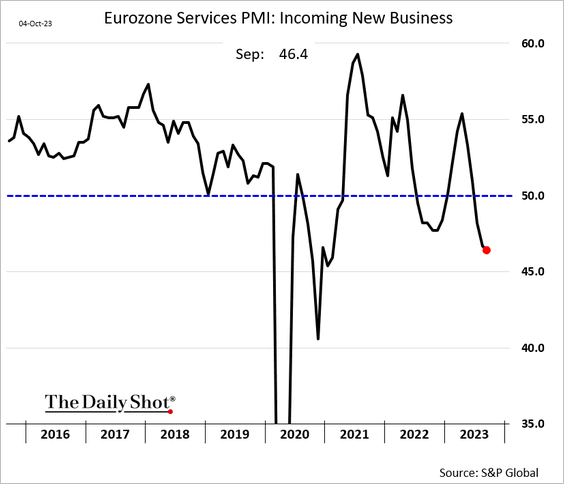

2. The final services PMI was a bit less painful than the flash report.

Service firms continue to report worsening demand.

——————–

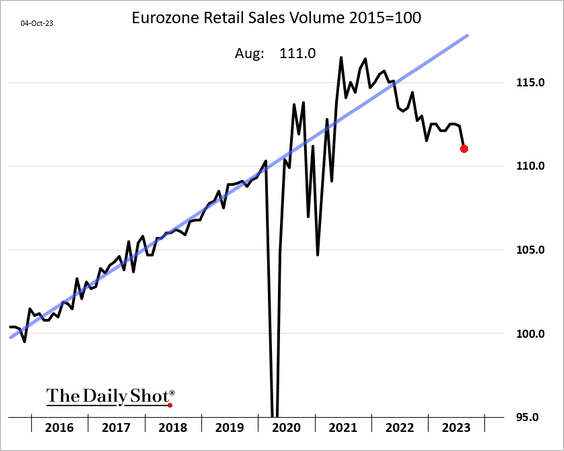

3. Retail sales dropped sharply in August.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Europe

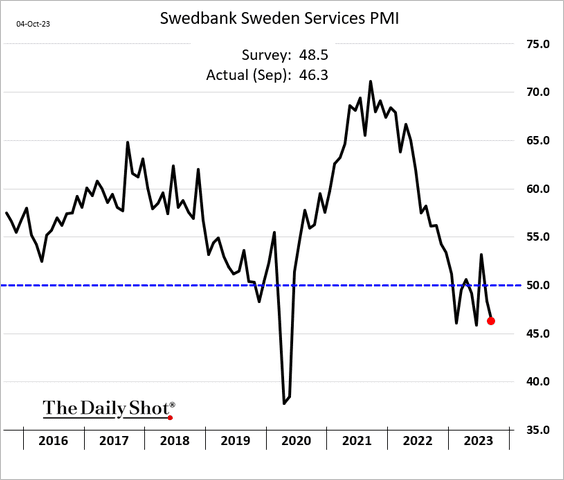

1. Sweden’s services contraction accelerated last month.

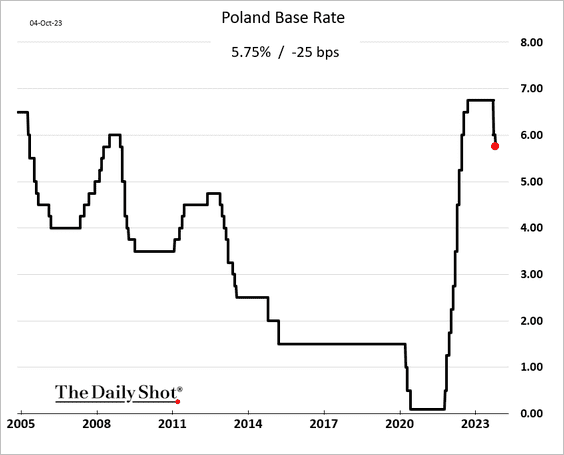

2. Poland’s central bank cut rates as inflation slows.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

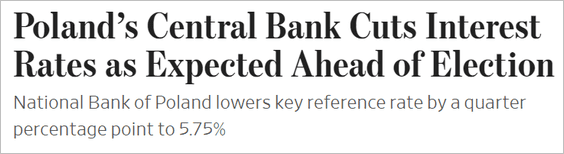

3. Here is a look at private debt as a percentage of GDP.

Source: BCA Research

Source: BCA Research

Back to Index

Asia-Pacific

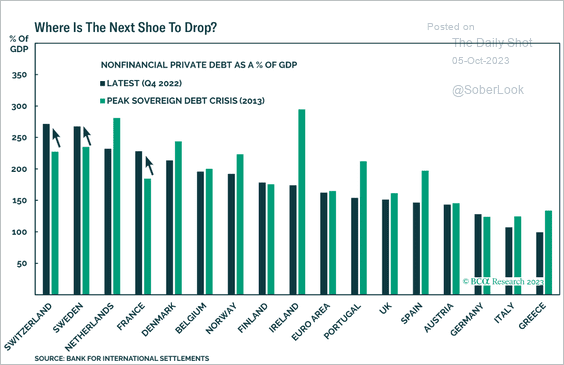

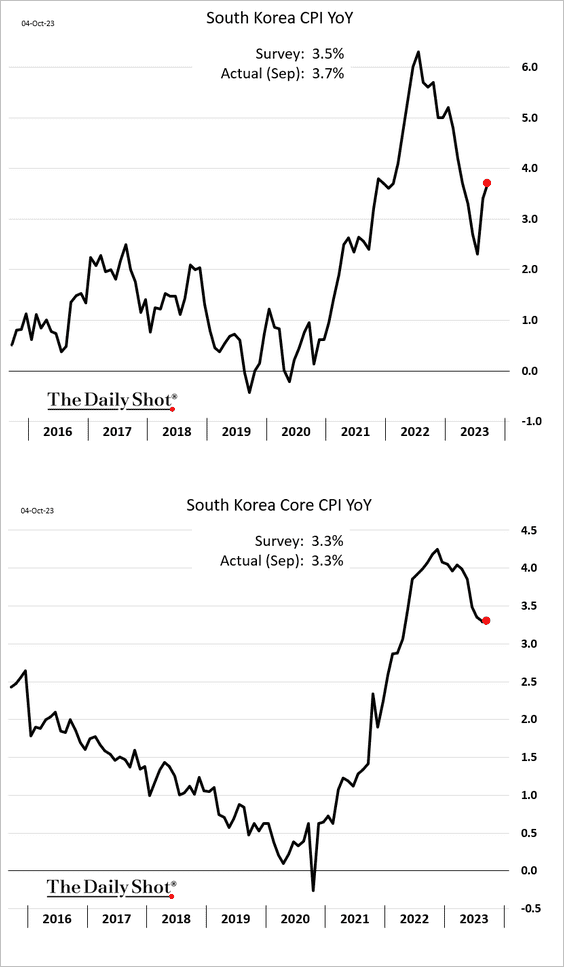

1. South Korea’s CPI accelerated last month (on a year-over-year basis). Core inflation held steady.

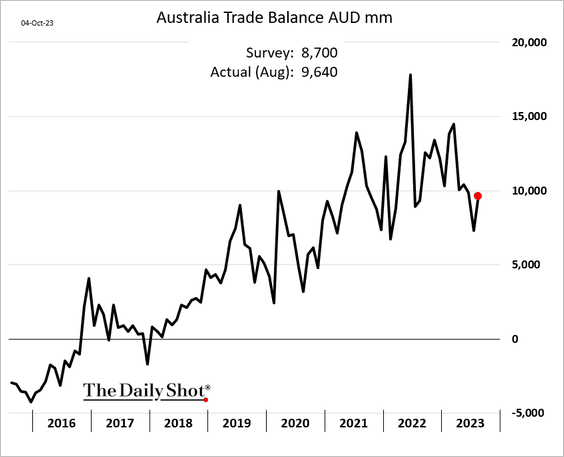

2. Australia’s trade surplus topped expectations.

Back to Index

China

1. Developers’ offshore bond prices continue to sink.

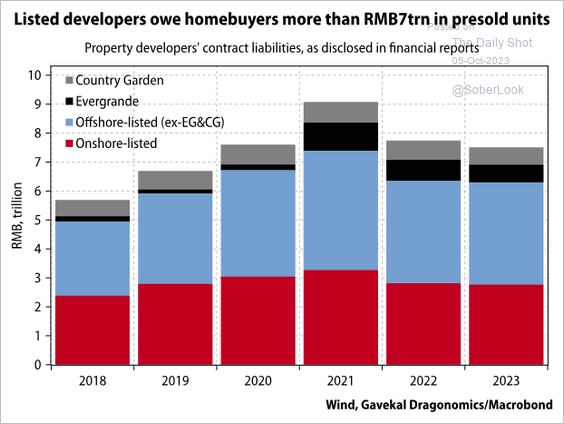

• Developers owe homebuyers a lot of presold units.

Source: Gavekal Research

Source: Gavekal Research

——————–

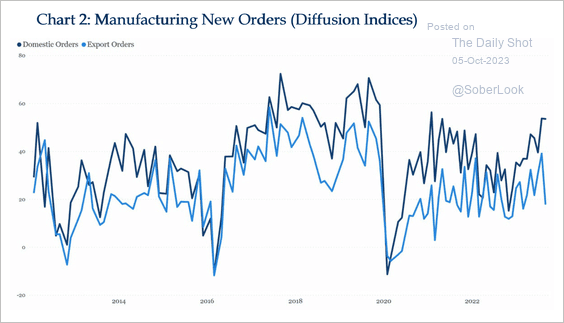

2. Domestic orders have outpaced export orders.

Source: China Beige Book

Source: China Beige Book

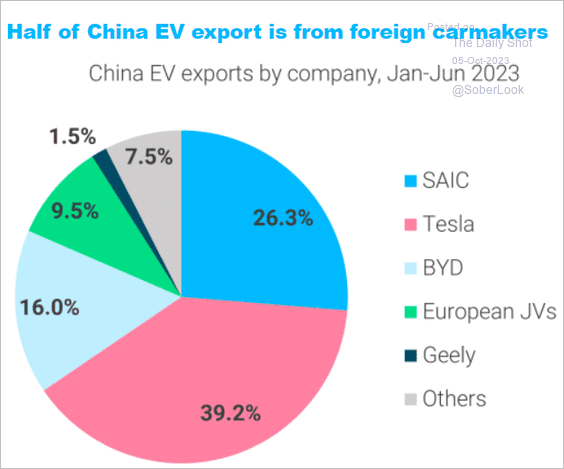

3. Here is a look at EV exports by company.

Source: TS Lombard

Source: TS Lombard

Back to Index

Emerging Markets

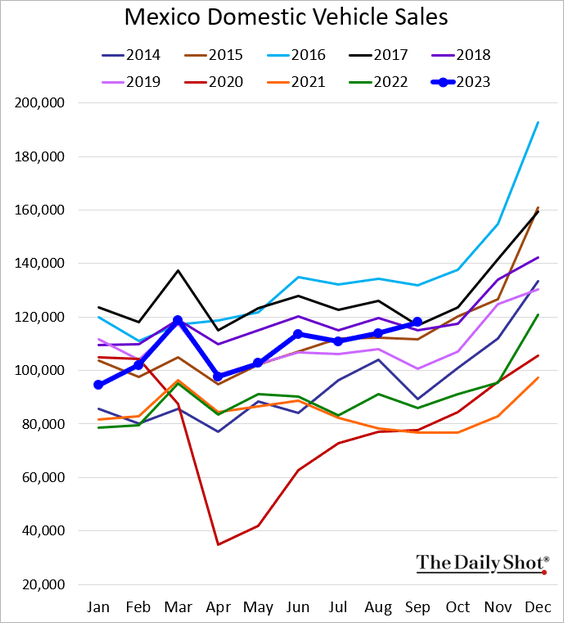

1. Mexican domestic vehicle sales remain relatively strong.

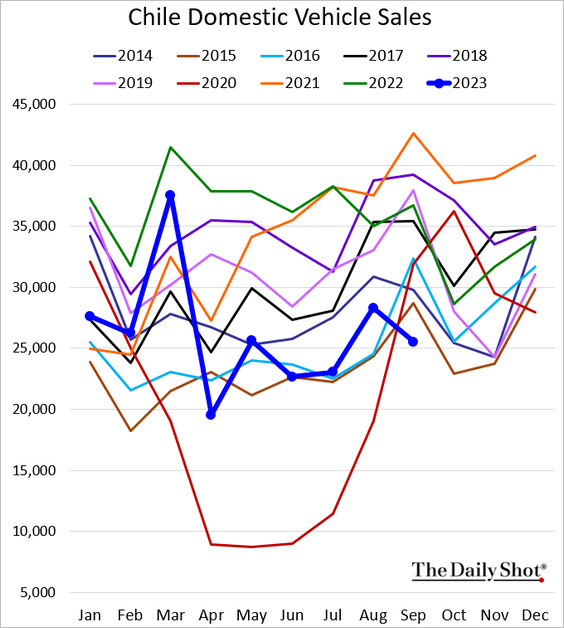

2. Chile’s vehicle sales hit a multi-year low.

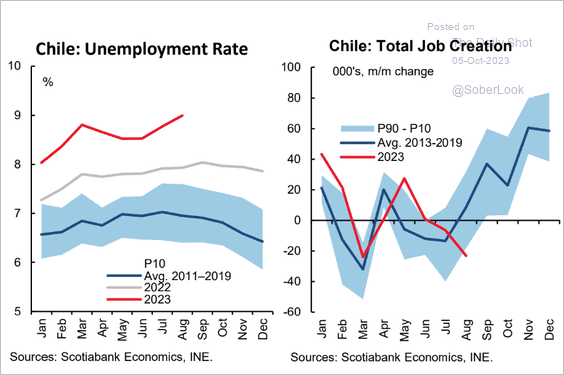

• Chile’s labor market is facing some headwinds.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

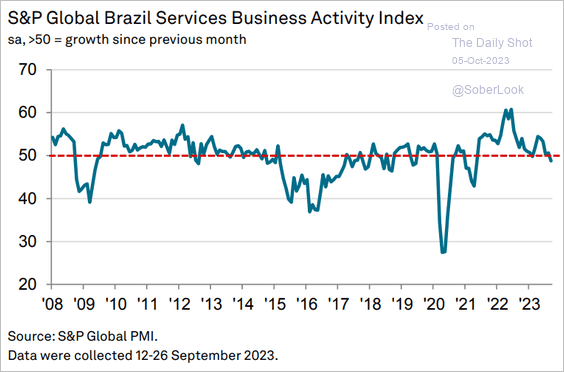

3. Brazil’s service sector PMI is back in contraction territory.

Source: S&P Global PMI

Source: S&P Global PMI

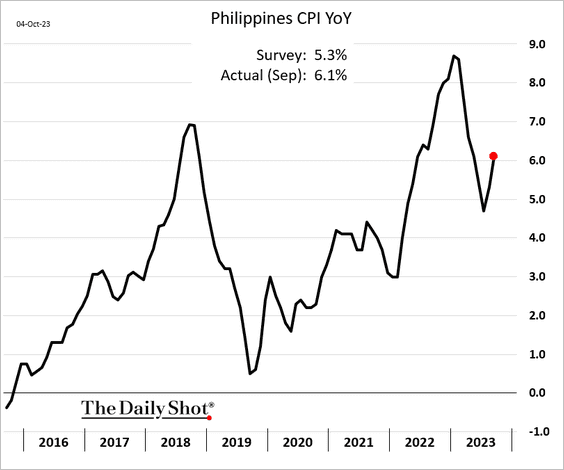

4. The Philippine CPI unexpectedly accelerated last month.

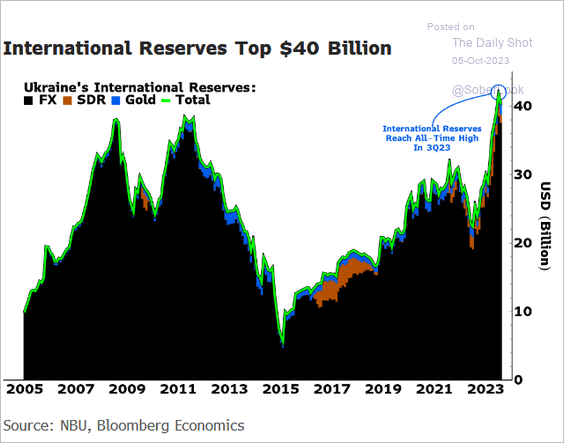

5. Ukraine’s FX reserves are near record highs.

Source: @x1skv, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: @x1skv, @TheTerminal, Bloomberg Finance L.P. Read full article

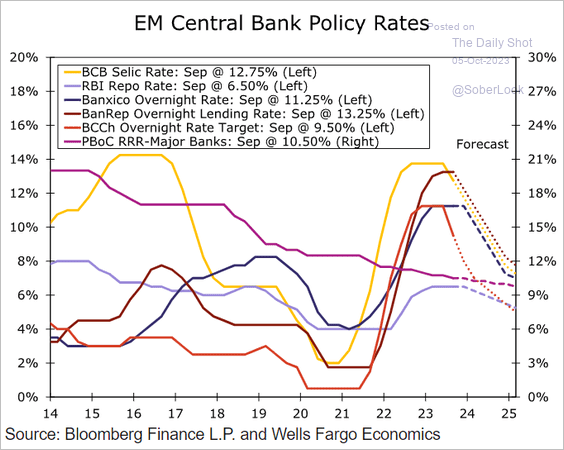

6. This chart shows EM central banks’ policy rate projections from Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Energy

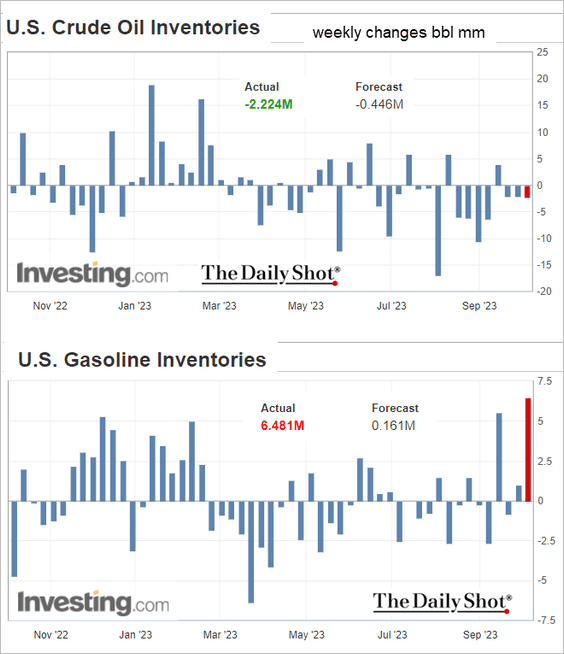

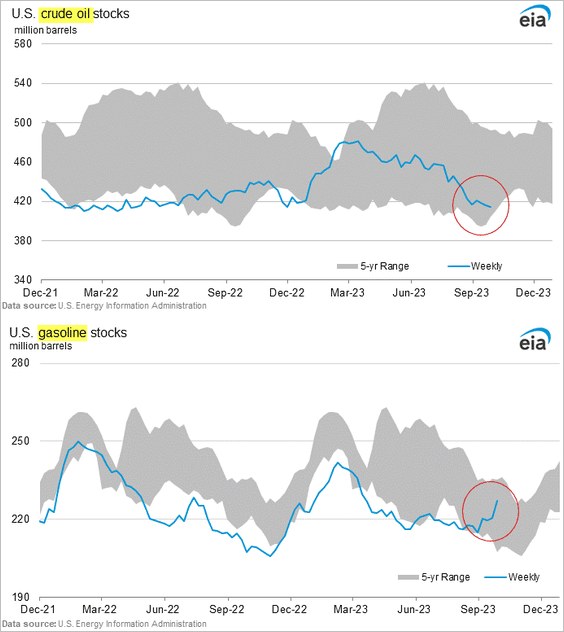

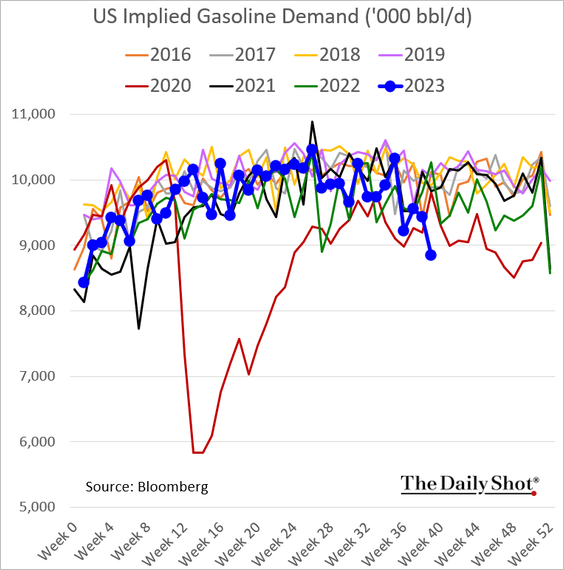

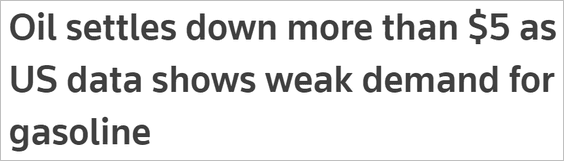

1. While US oil inventories continue to shrink, gasoline stockpiles surged last week (2 charts), …

… as demand tumbled.

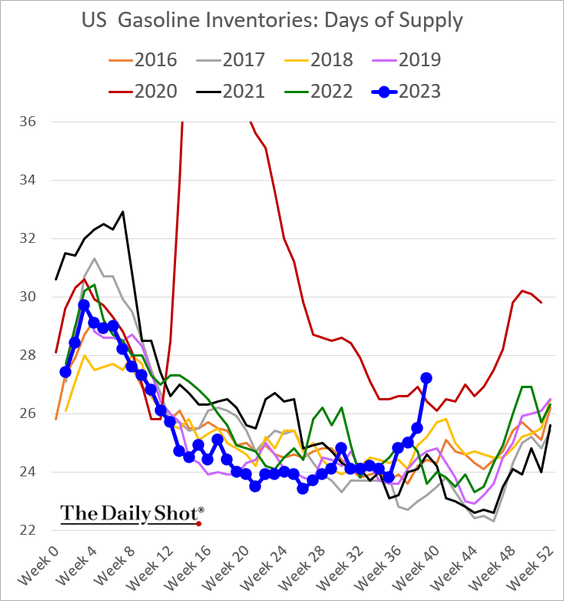

• Gasoline inventories measured in days of supply hit a multi-year high, exceeding 2020 levels.

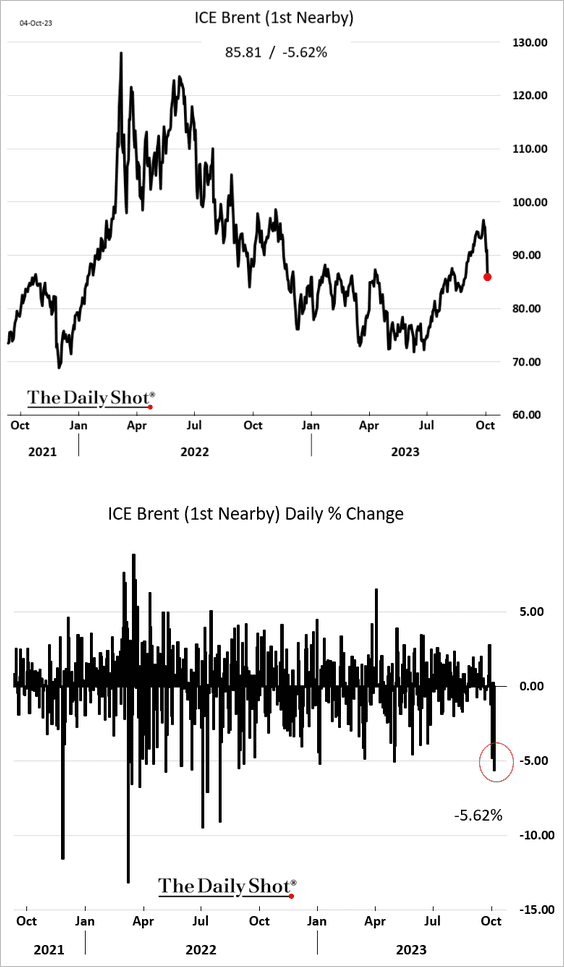

• Crude oil prices plunged in response to weak gasoline demand in the US.

Source: Reuters Read full article

Source: Reuters Read full article

• Gasoline futures were down almost 7%.

——————–

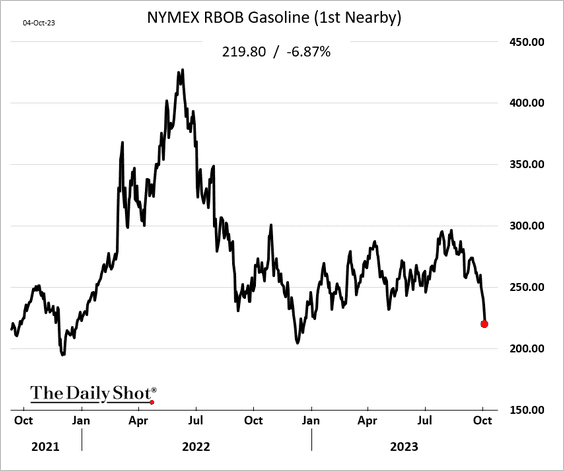

2. US refinery runs dipped below 2021 levels.

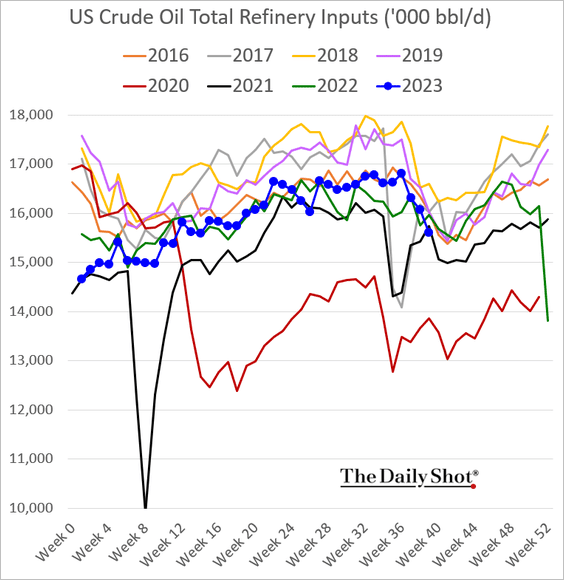

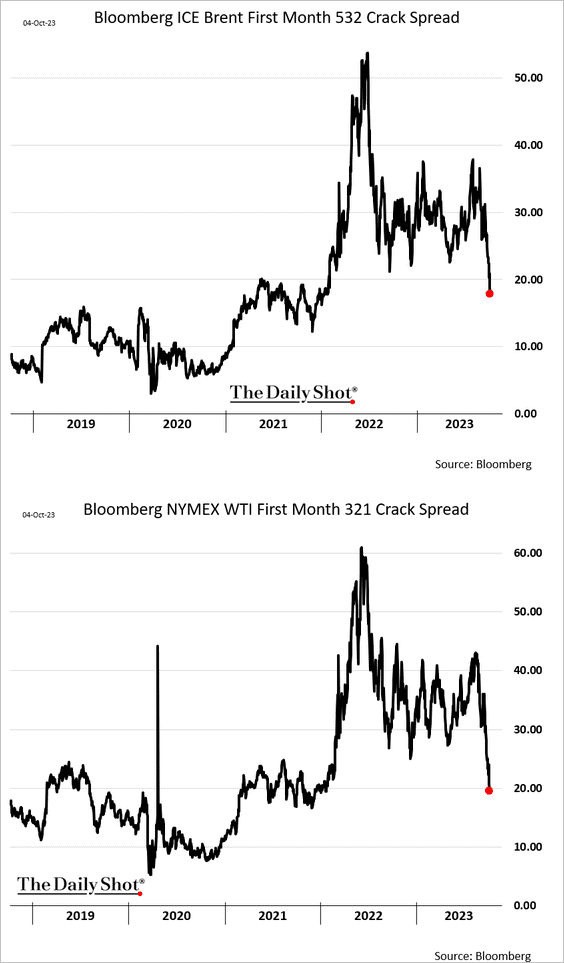

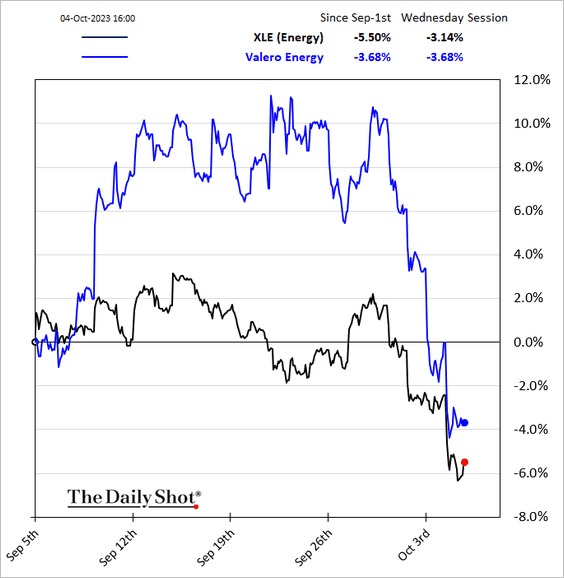

3. As gasoline demand weakens, crack spreads continue to tighten, …

… pressuring refiners, such as Valero Energy.

——————–

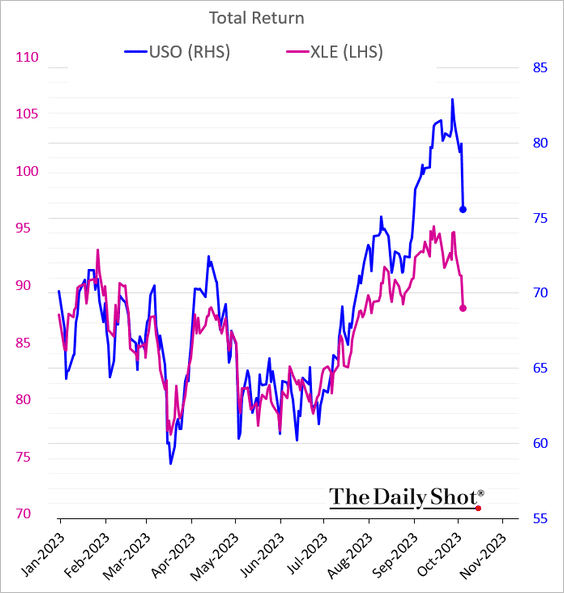

4. Despite the decline, crude oil is still outpacing energy shares year-to-date.

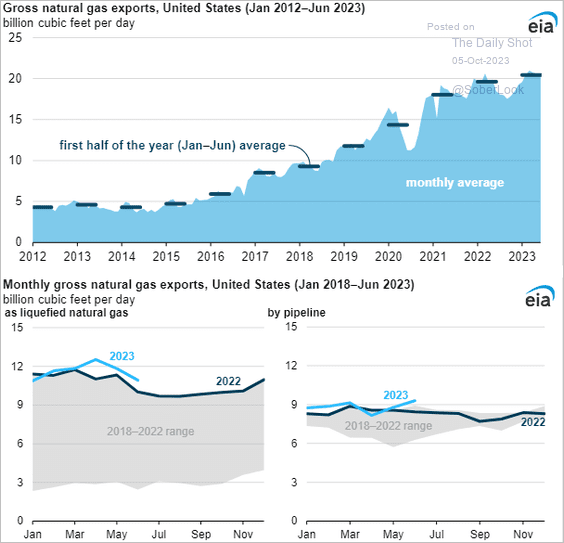

5. US natural gas exports in the first half of the year hit a record high.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

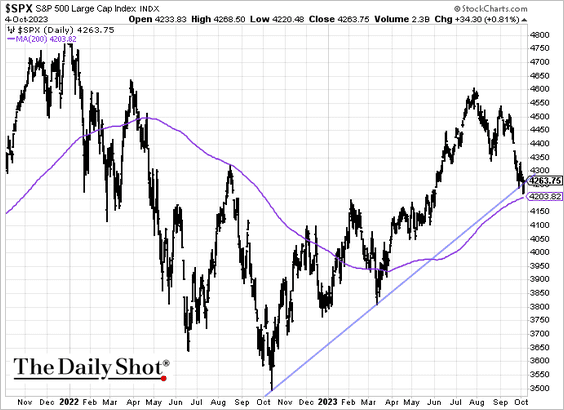

1. The S&P 500 held support as Treasury yields stabilized.

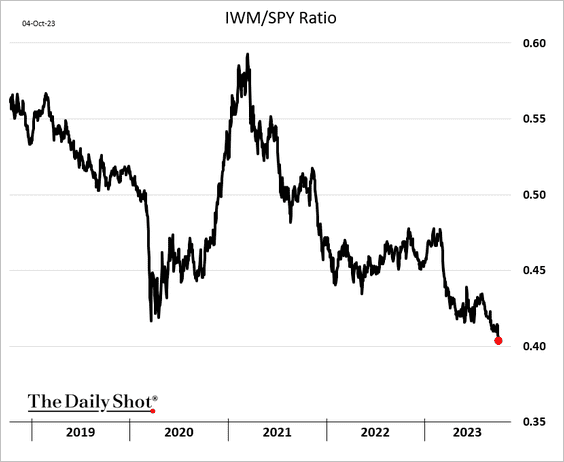

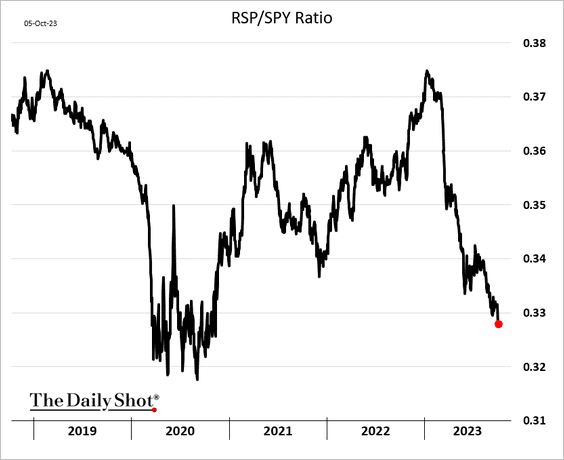

2. Small caps continue to widen their underperformance. Here is the Russell 2000/S&P 500 ETF ratio.

The equal-weight S&P 500 index (RSP) is also lagging.

——————–

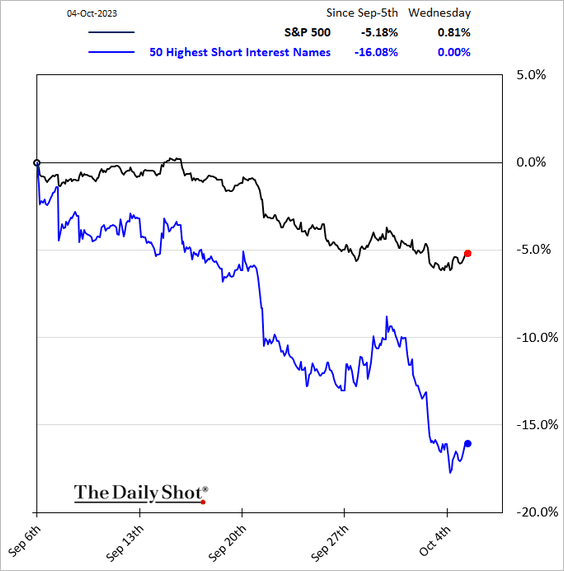

3. The most-shorted stocks underperformed massively over the past month. Could we see a short squeeze?

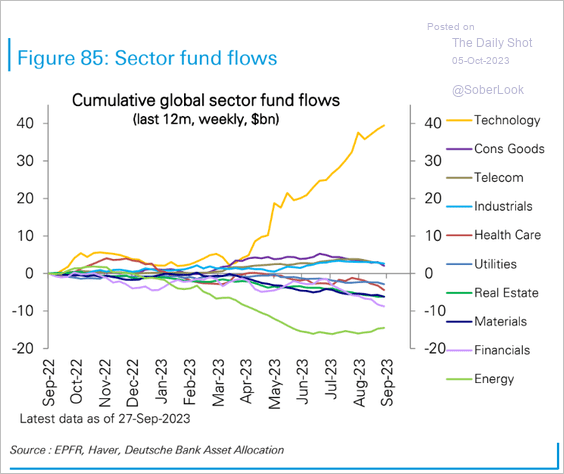

4. Tech funds continue to see inflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

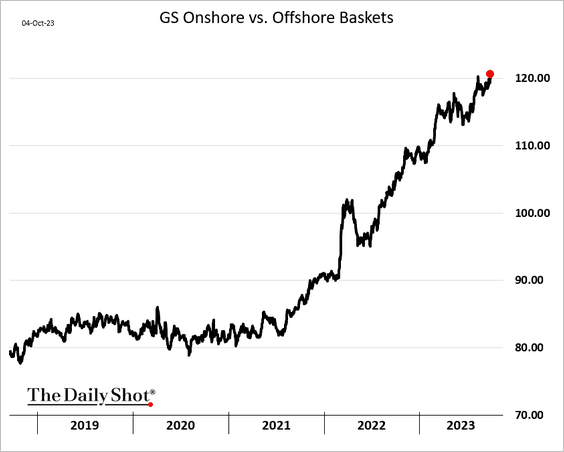

5. The market keeps betting on the US onshoring trend.

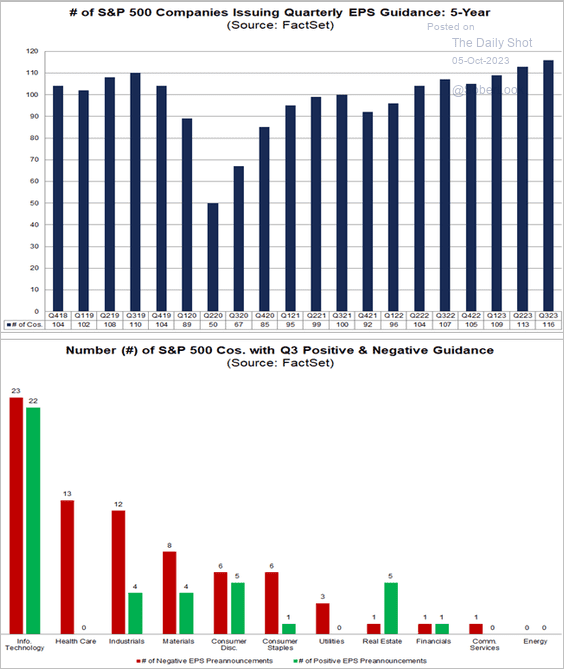

6. More companies have issued Q3 guidance, with negative guidance dominating in most sectors.

Source: @FactSet Read full article

Source: @FactSet Read full article

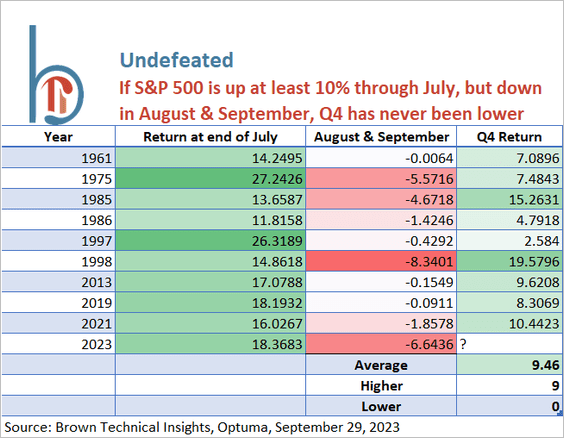

7. A strong first half of the year for the S&P 500 and a seasonally weak August-September typically bodes well for Q4 performance.

Source: @scottcharts

Source: @scottcharts

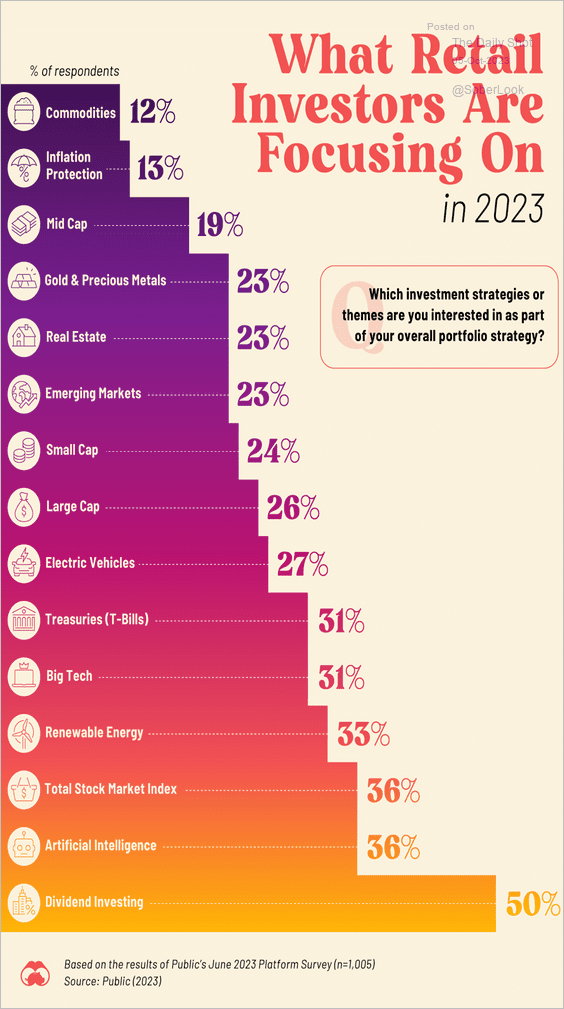

8. Here is a look at retail investor interest in various markets/styles.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Credit

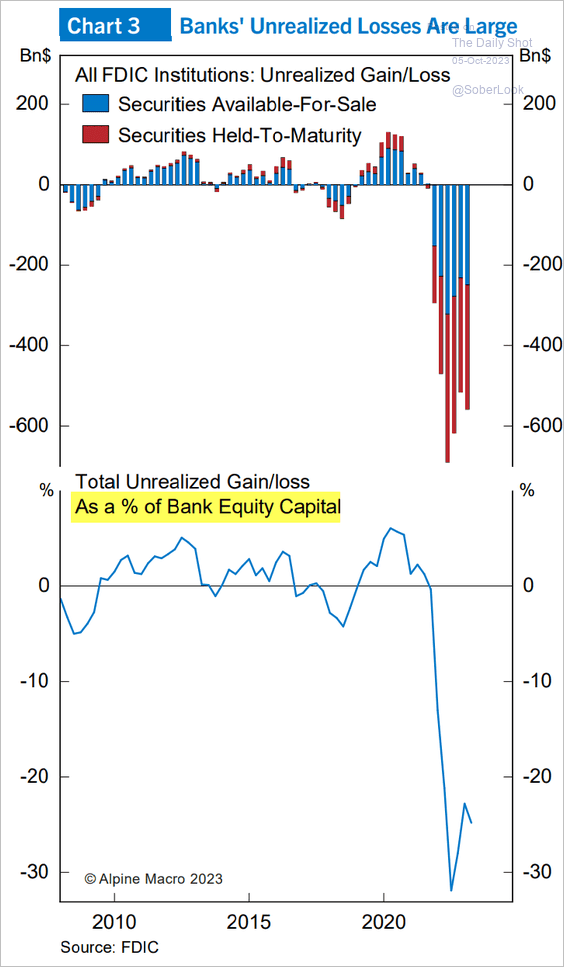

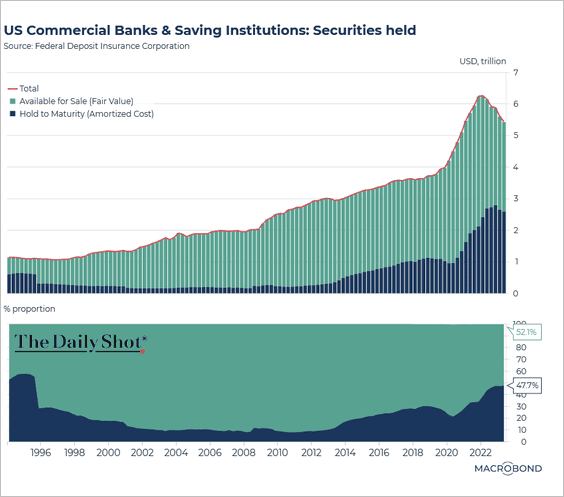

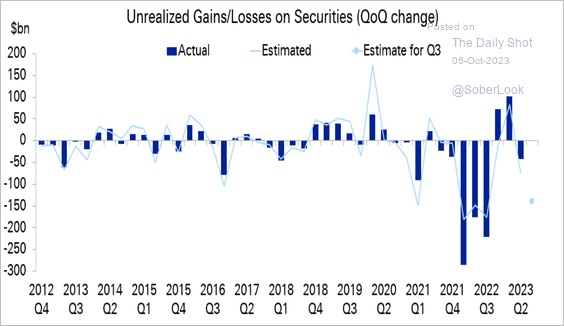

1. Banks face substantial unrealized losses on their securities portfolios.

Source: Alpine Macro

Source: Alpine Macro

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

The Q3 sell-off in Treasuries could push banks’ unrealized losses back to recent highs, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

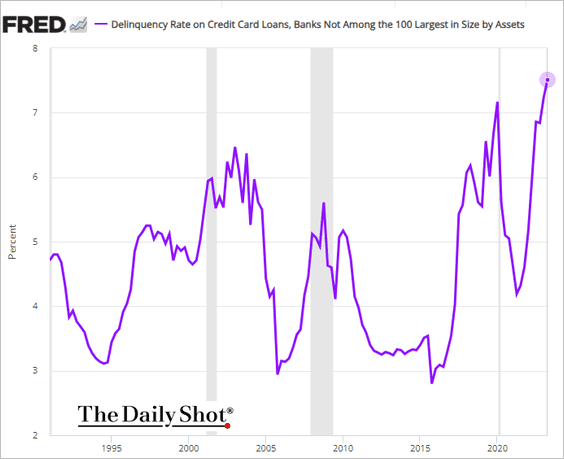

• Small banks’ credit card delinquency rates hit a multi-decade high.

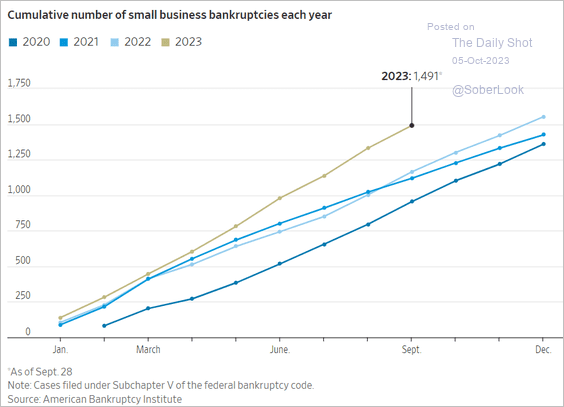

• Rising small business defaults are also a headwind for smaller lenders.

Source: @WSJ Read full article

Source: @WSJ Read full article

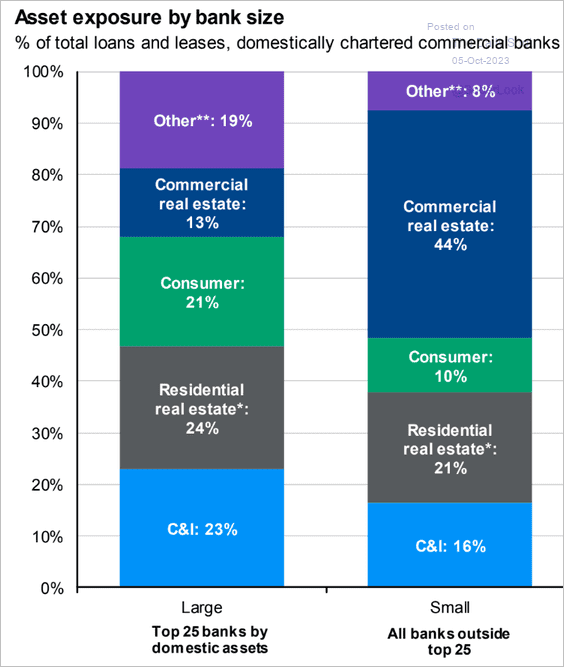

• Small banks’ commercial real estate loan portfolio represents 44% of assets.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

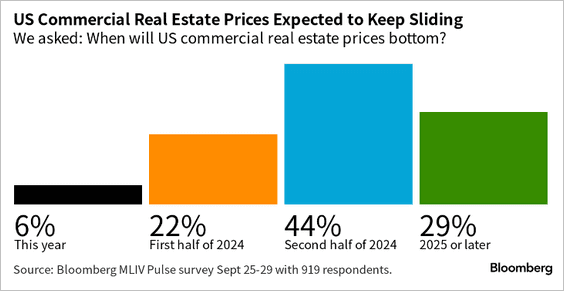

– And commercial real estate prices are expected to keep falling.

Source: Scott Carpenter and Sarah Holder; @TheTerminal, Bloomberg Finance L.P. Read full article

Source: Scott Carpenter and Sarah Holder; @TheTerminal, Bloomberg Finance L.P. Read full article

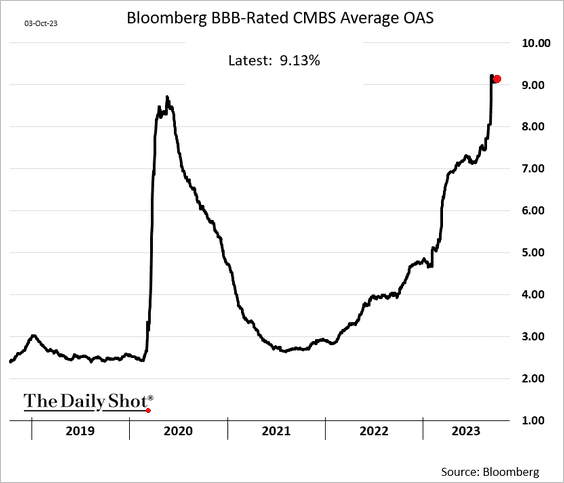

– BBB-rated CMBS spreads have widened sharply.

h/t Truist Advisory Services

h/t Truist Advisory Services

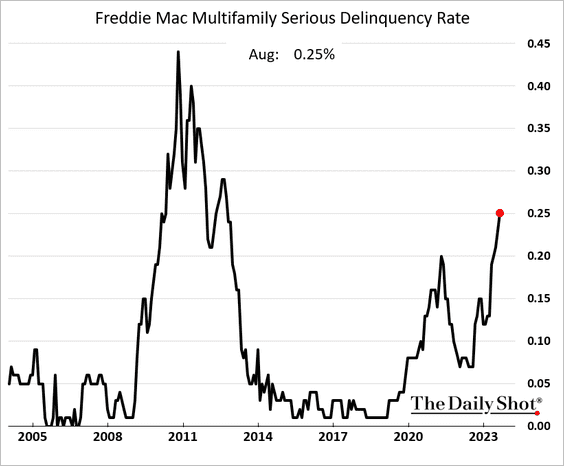

– Multi-family housing loan delinquency rates continue to rise.

——————–

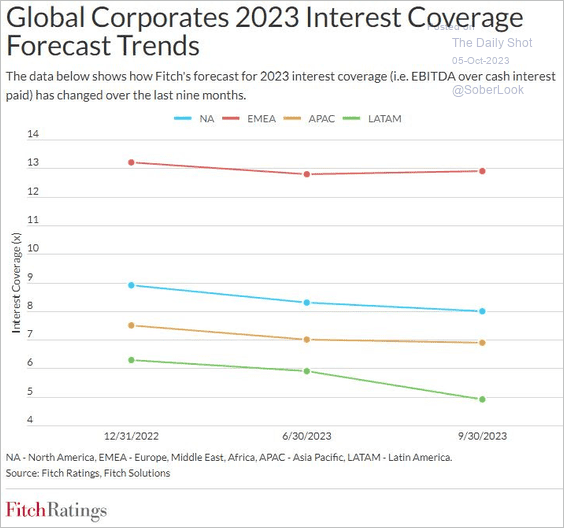

2. Interest coverage is trending lower globally.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Global Developments

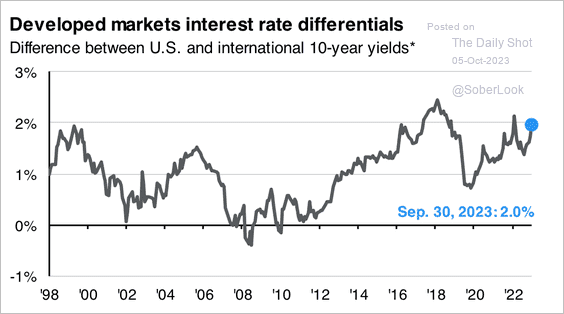

1. Wider interest rate differentials supported the recent dollar rally.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

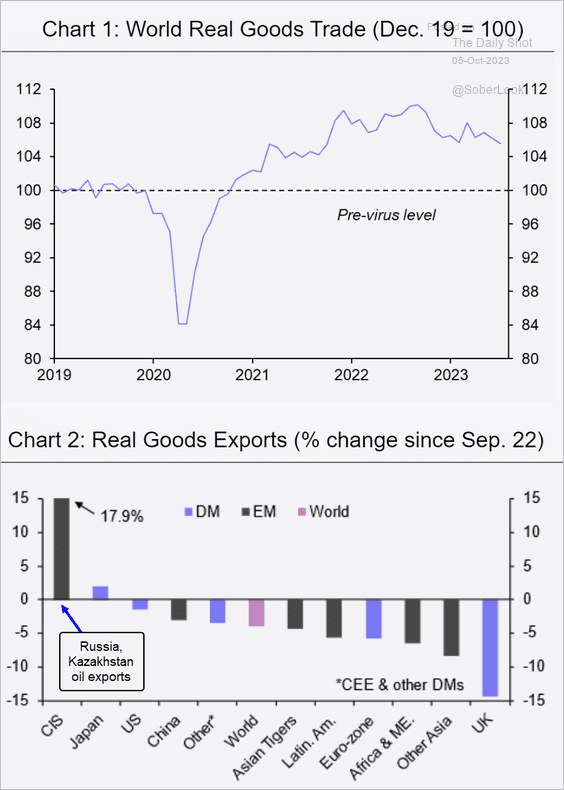

2. Global goods exports are slowing in real terms.

Source: Capital Economics

Source: Capital Economics

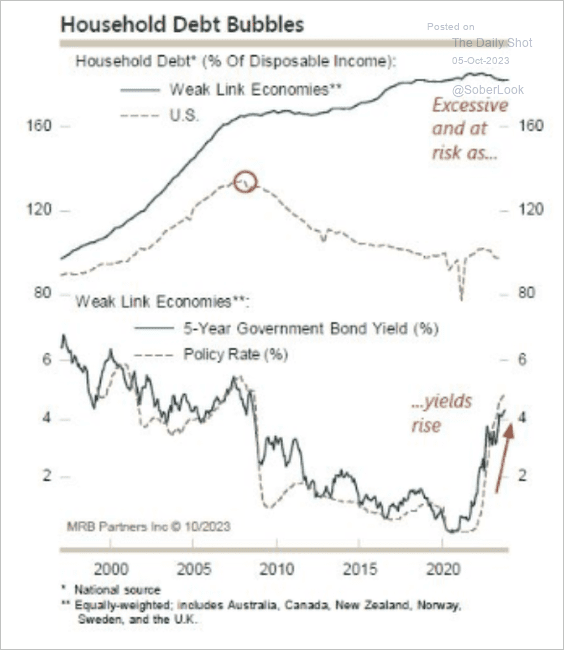

3. Countries with high household debt, such as Australia, Canada, and New Zealand, remain vulnerable to rising yields.

Source: MRB Partners

Source: MRB Partners

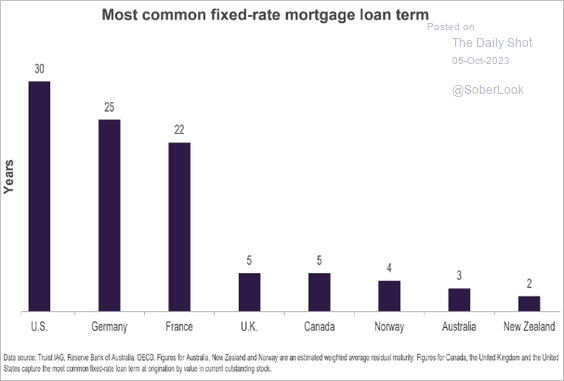

4. This chart shows the most common mortgage term in select countries.

Source: Truist Advisory Services

Source: Truist Advisory Services

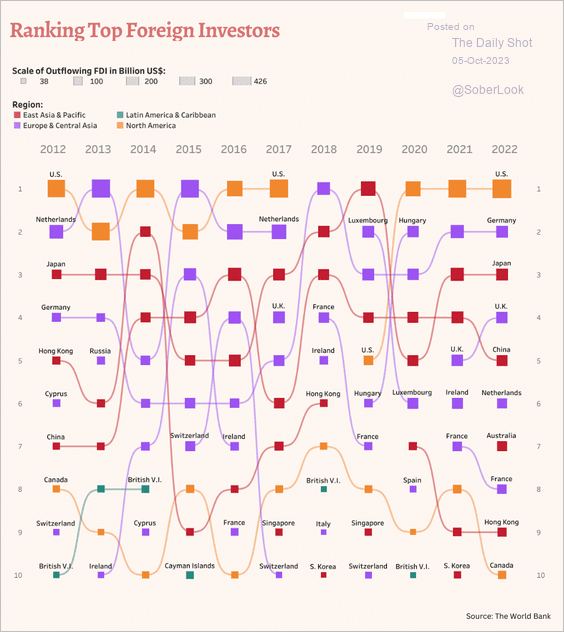

5. Here is a look at countries with the highest outflowing foreign direct investment (FDI).

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Food for Thought

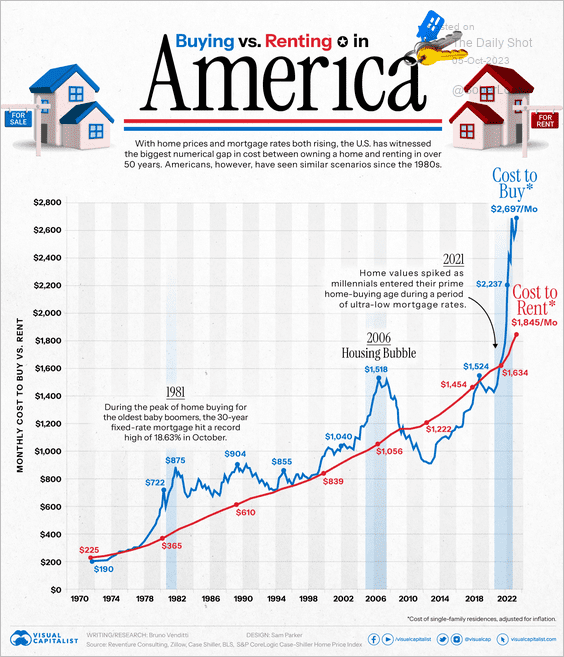

1. Buying vs. renting:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

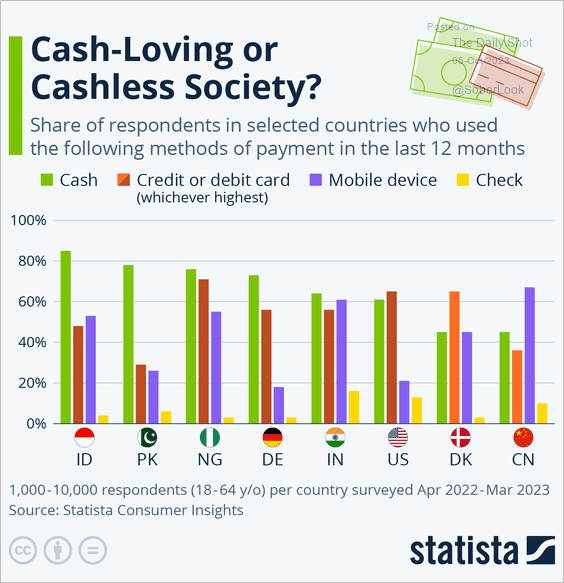

2. Methods of payment:

Source: Statista

Source: Statista

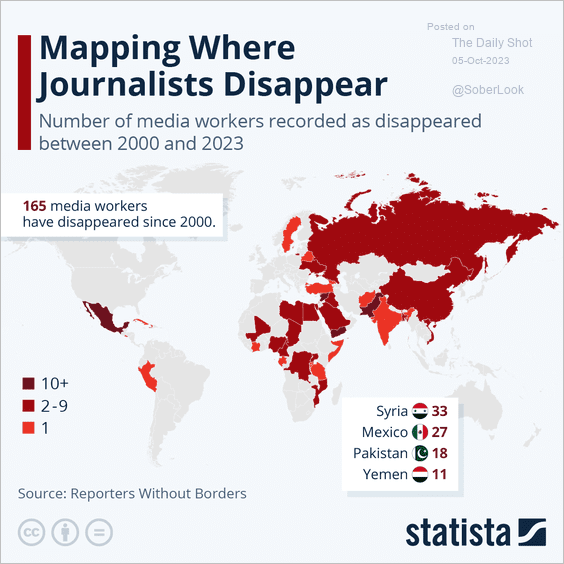

3. Disappearing media workers:

Source: Statista

Source: Statista

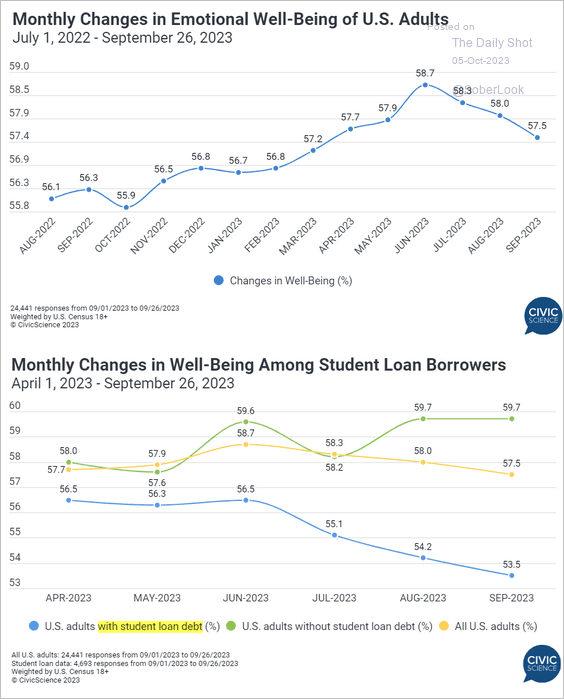

4. The resumption of student loan payments is adding to Americans’ stress.

Source: @CivicScience Read full article

Source: @CivicScience Read full article

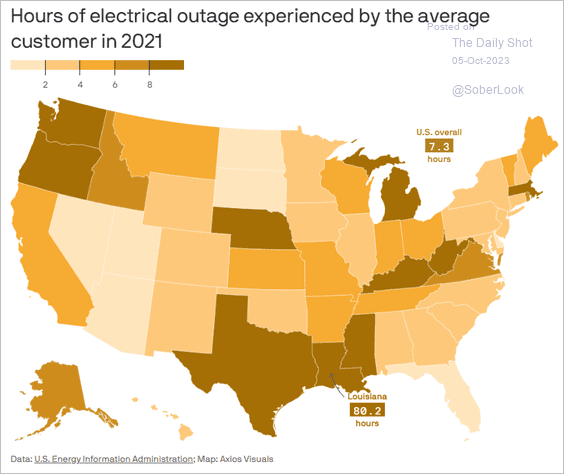

5. Electrical outages:

Source: @axios Read full article

Source: @axios Read full article

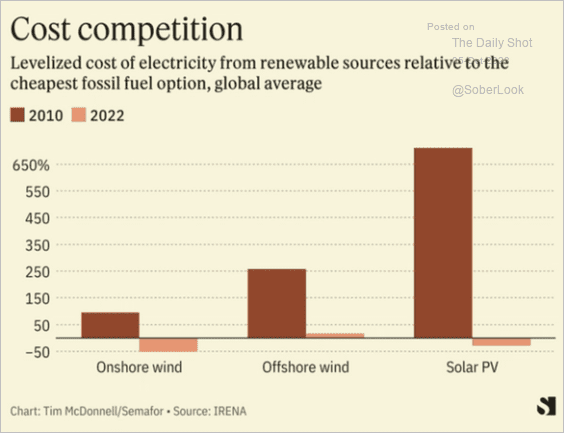

6. Electricity costs from renewables vs. fossil fuels:

Source: Semafor

Source: Semafor

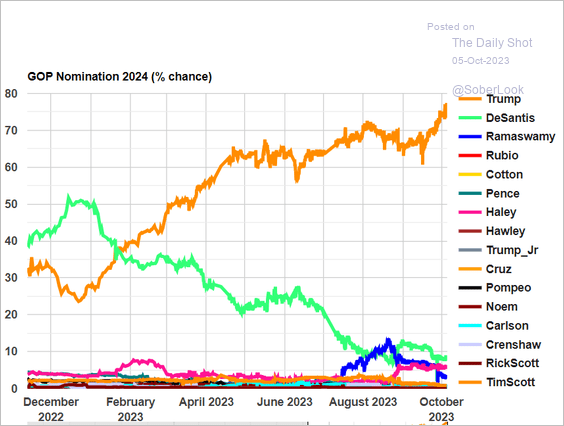

7. GOP 2024 presidential nomination probabilities in the betting markets:

Source: Election Betting Odds

Source: Election Betting Odds

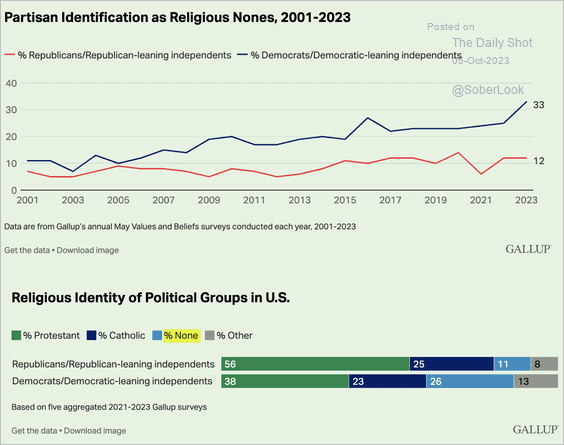

8. Religious “nones” by political affiliation:

Source: Gallup Read full article

Source: Gallup Read full article

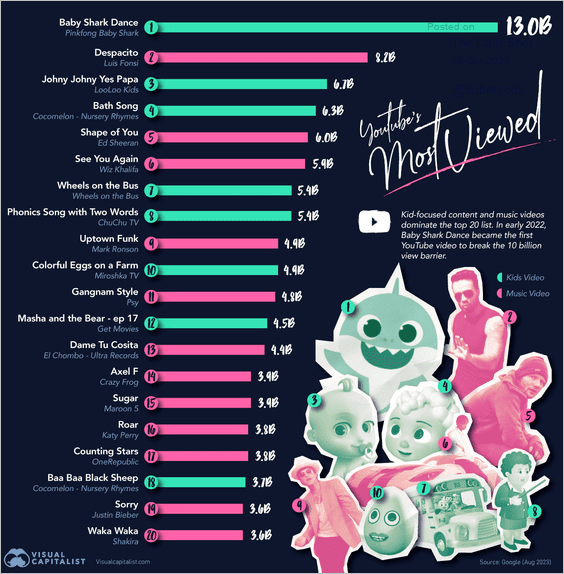

9. The most-viewed YouTube videos:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index