The Daily Shot: 06-Oct-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

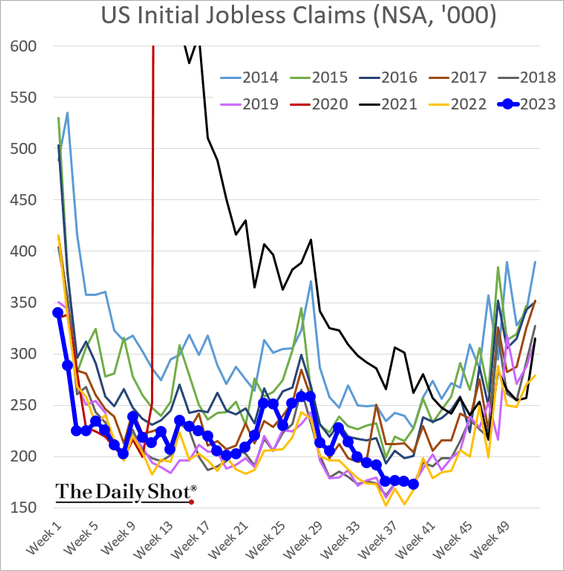

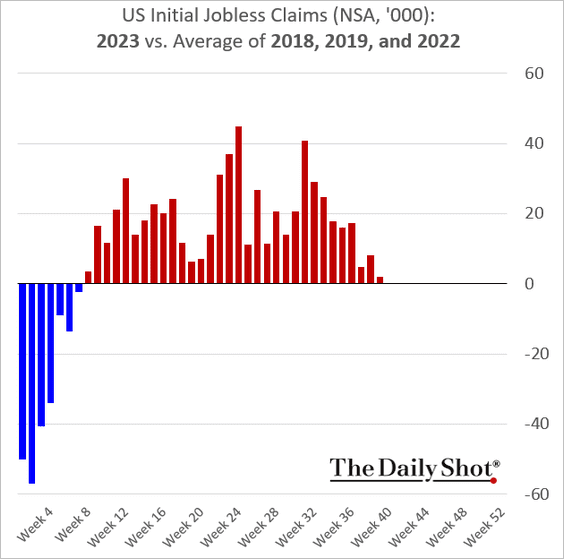

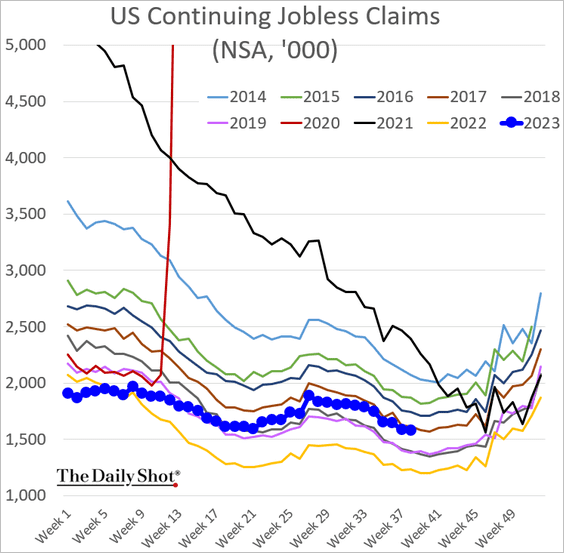

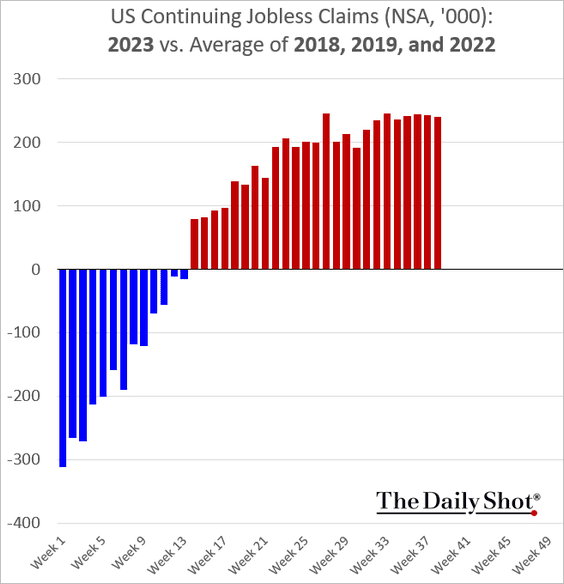

1. Let’s begin with the labor market.

• Initial jobless claims are nearing multi-year lows for this time of the year.

– Continuing claims are holding steady relative to the average of 2018, 2019, and 2022.

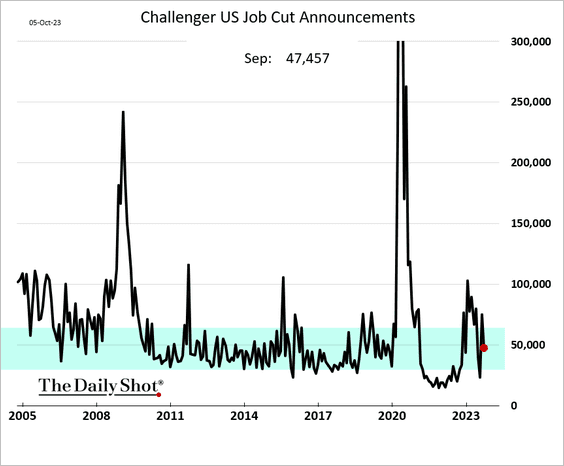

• Job cut announcements eased last month and are back at pre-COVID levels.

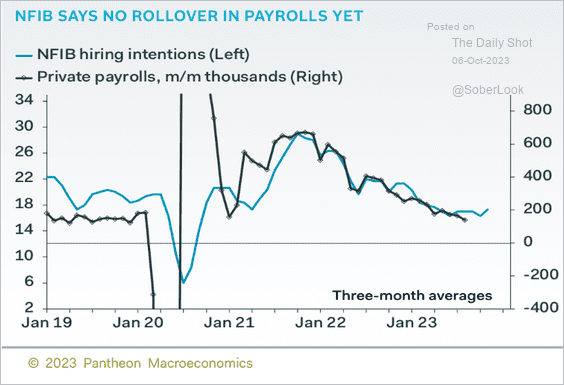

• The NFIB small business survey suggests that payrolls are not rolling over just yet.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

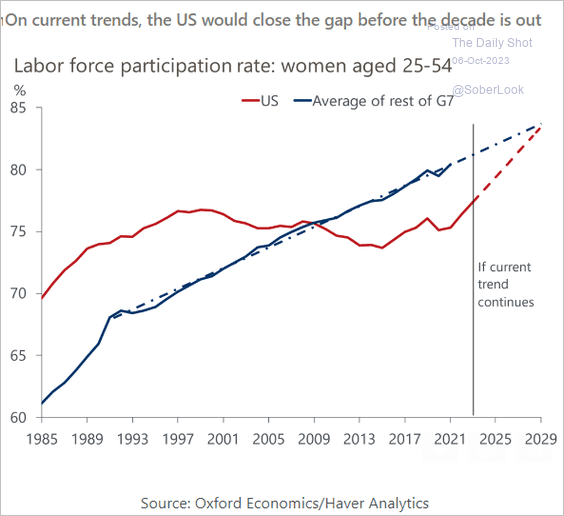

• Will the labor force participation rate of women in the US match that of the other G7 countries by the end of the decade?

Source: Oxford Economics

Source: Oxford Economics

——————–

2. Next, let’s take a look at some consumer-related trends.

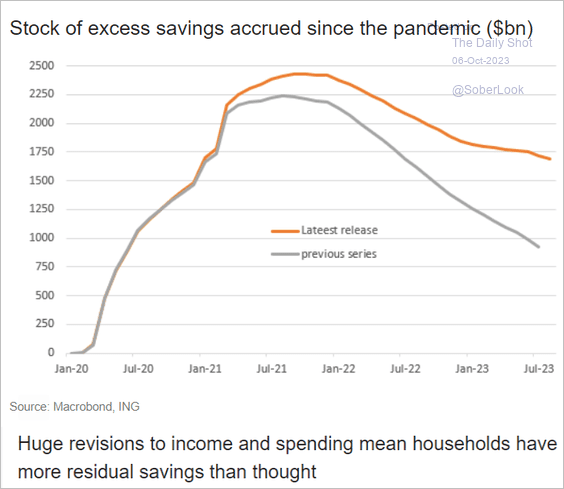

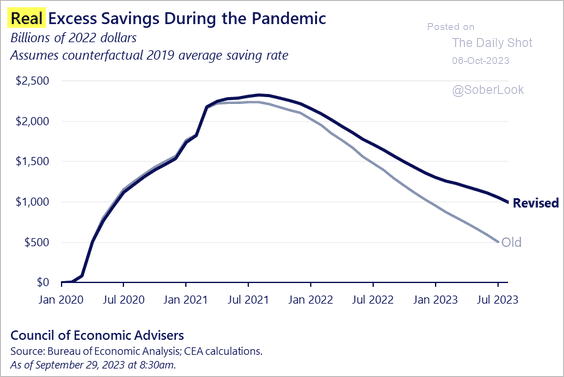

• Households’ excess savings have been revised higher (2 charts). Consumer spending could have a longer runway than implied by earlier projections.

Source: ING

Source: ING

Source: The White House Read full article

Source: The White House Read full article

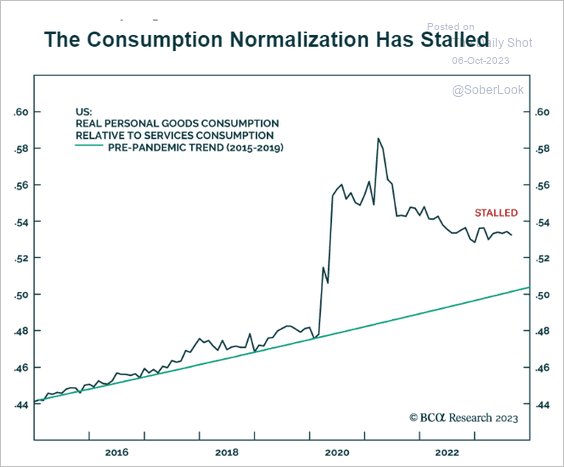

• Goods consumption is no longer declining relative to services.

Source: BCA Research

Source: BCA Research

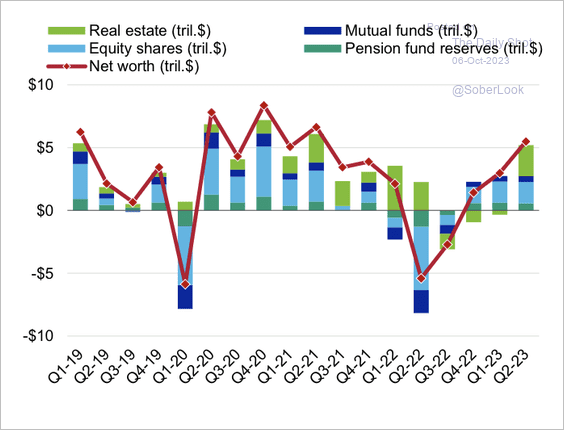

• The overall net worth of households remains buoyant.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

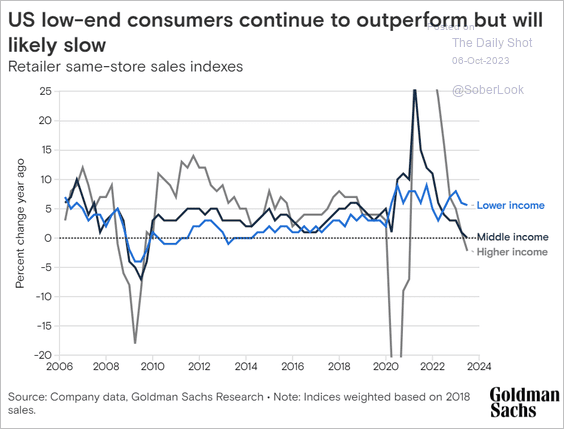

• Retail sales growth for lower-income consumers has been remarkably strong.

Source: Goldman Sachs

Source: Goldman Sachs

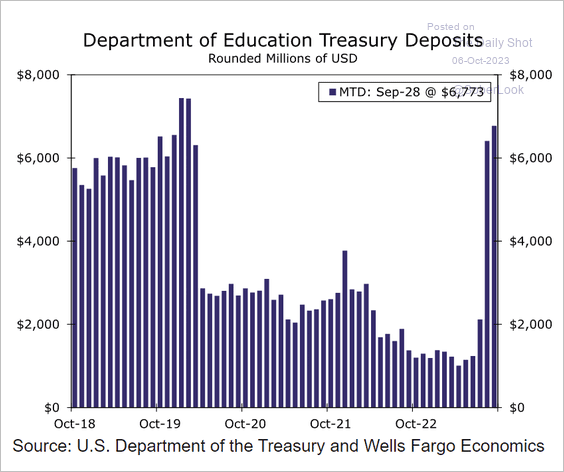

• Student loan payments are running at pre-COVID levels.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

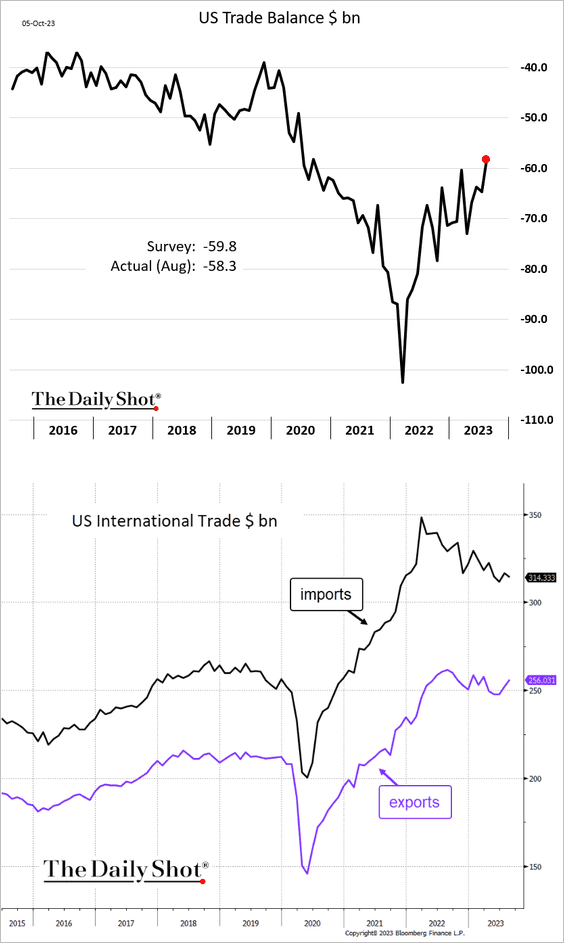

3. The trade deficit continues to narrow.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Canada

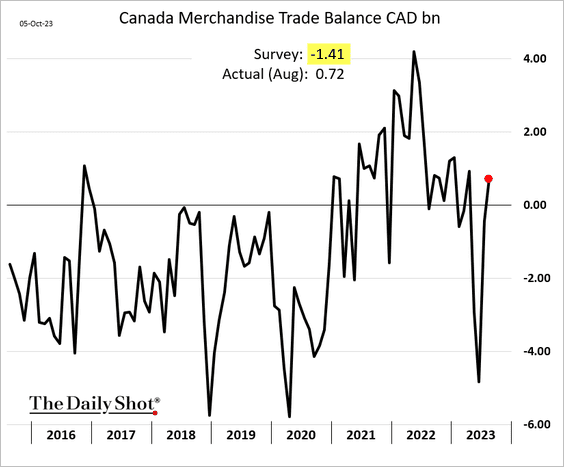

1. Canada’s trade balance unexpectedly swung into surplus.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

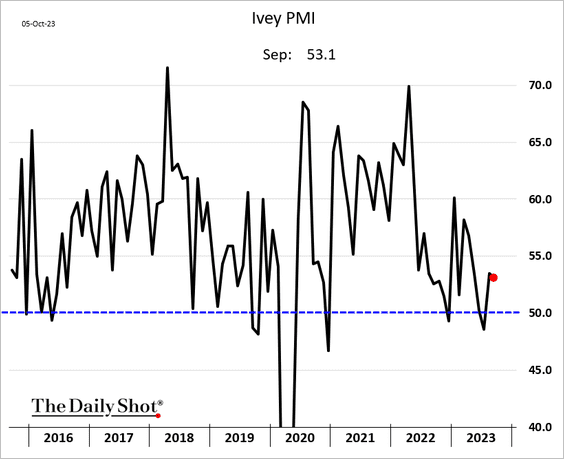

2. The Ivey PMI suggests that business activity remains in growth mode.

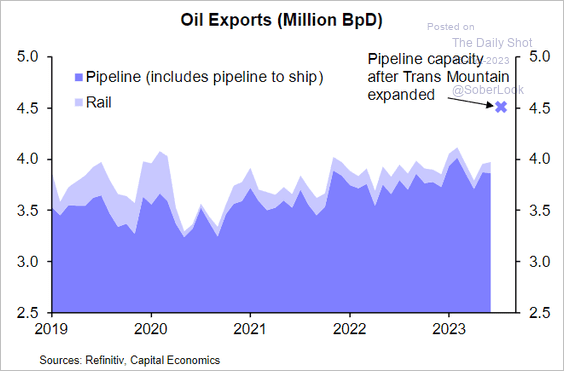

3. Canada stands to substantially increase crude oil exports next year after the Trans Mountain pipeline capacity is expanded.

Source: Capital Economics

Source: Capital Economics

Back to Index

The United Kingdom

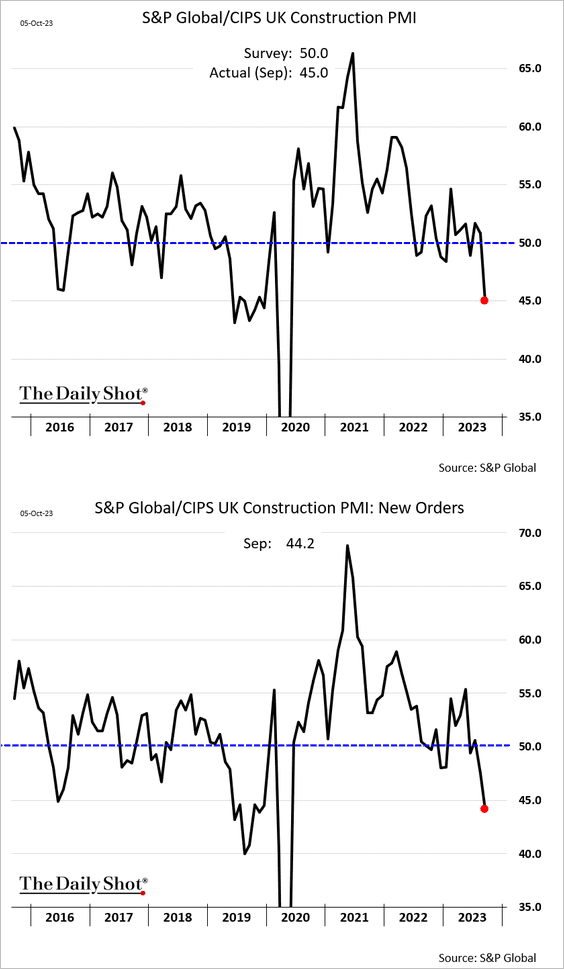

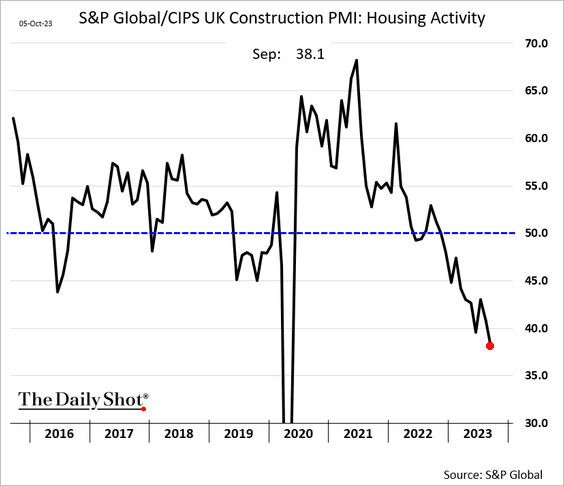

1. Construction activity is sinking, …

… dragged lower by crashing residential demand.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

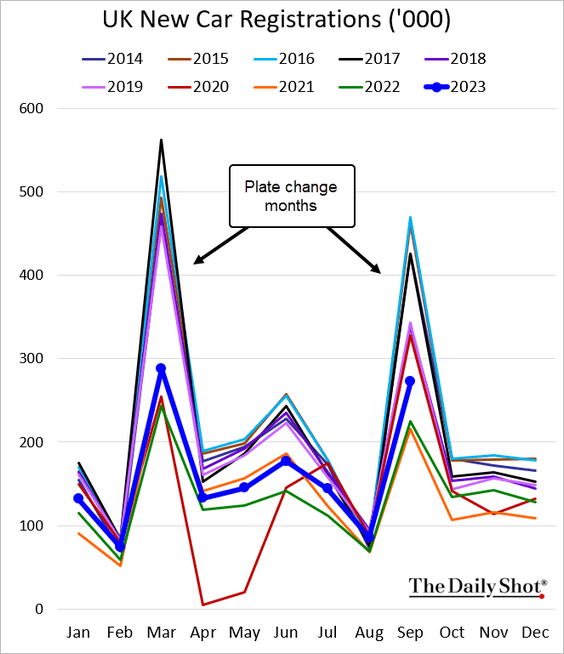

2. New car registrations remain well above last year’s levels.

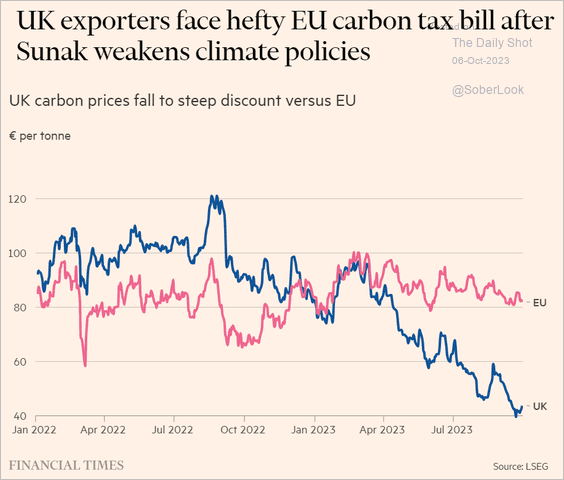

3. Here is a look at UK carbon emission contract prices vs. the EU.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

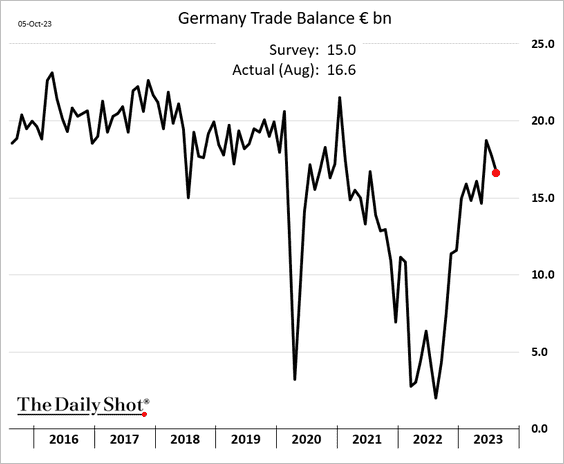

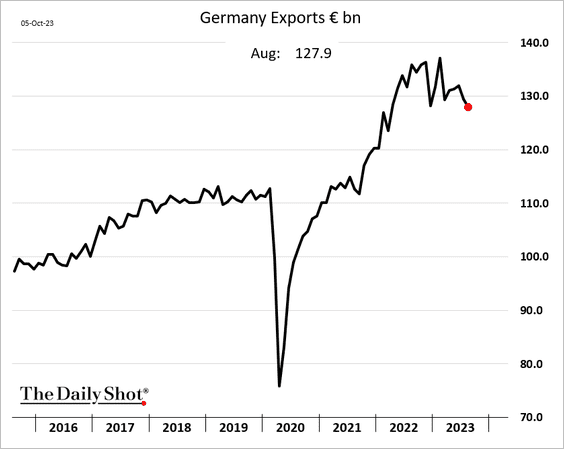

1. Germany’s trade surplus declined in August but was higher than expected.

Exports are slowing.

——————–

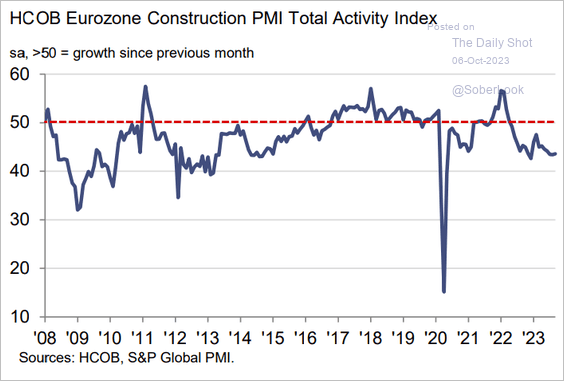

2. The Eurozone’s construction activity continues to shrink.

Source: S&P Global PMI

Source: S&P Global PMI

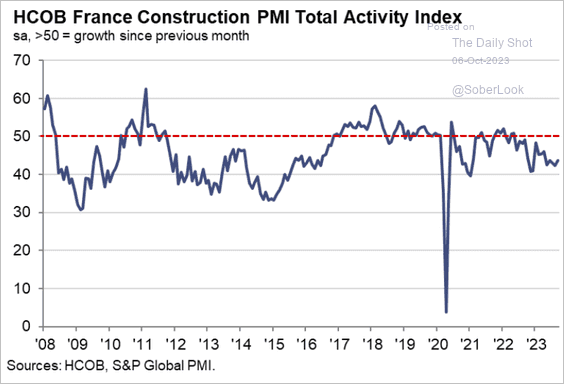

While the French construction PMI has been soft, …

Source: S&P Global PMI

Source: S&P Global PMI

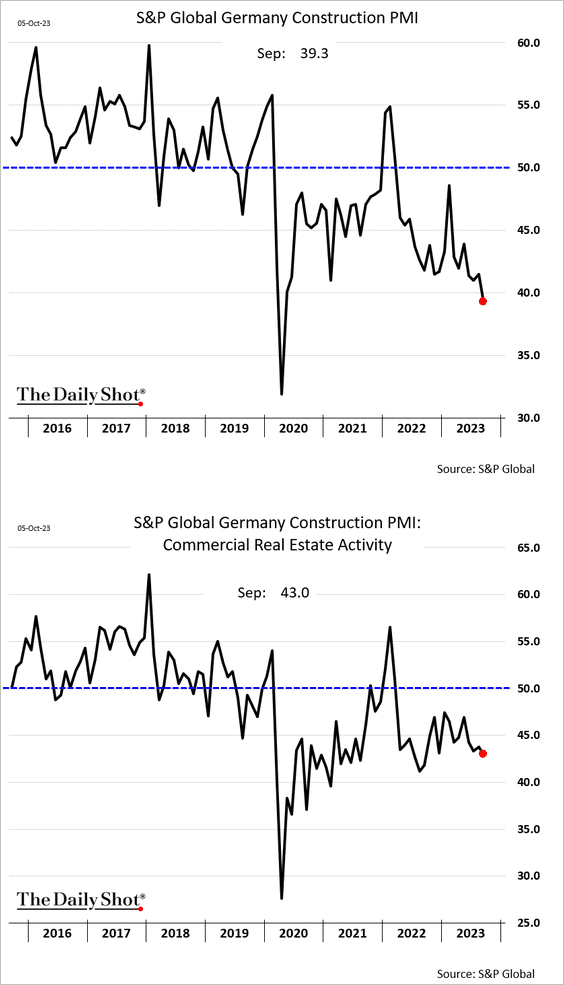

… Germany’s construction sector is under severe pressure, …

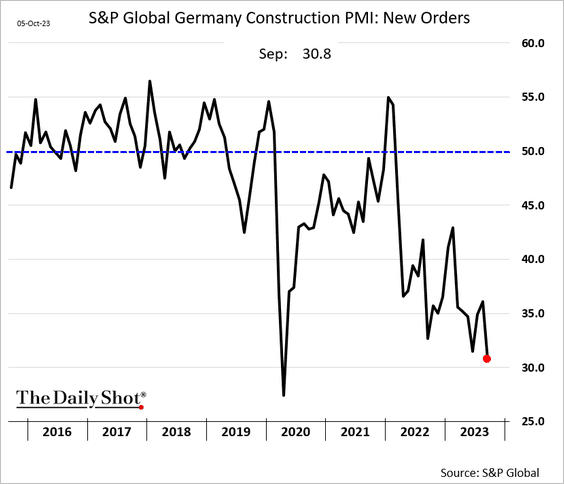

… as demand collapses.

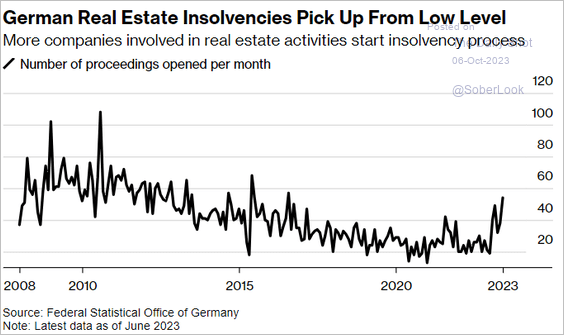

Real estate insolvencies are rising.

Source: @markets Read full article

Source: @markets Read full article

Source: The Economist Read full article

Source: The Economist Read full article

——————–

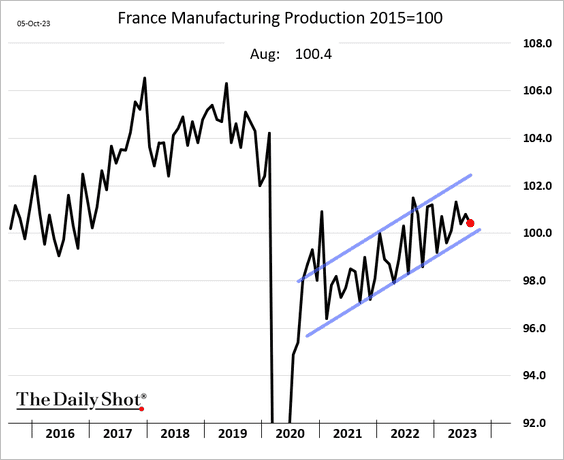

3. French manufacturing output eased in August but remains on an upward trajectory (though still below pre-COVID levels).

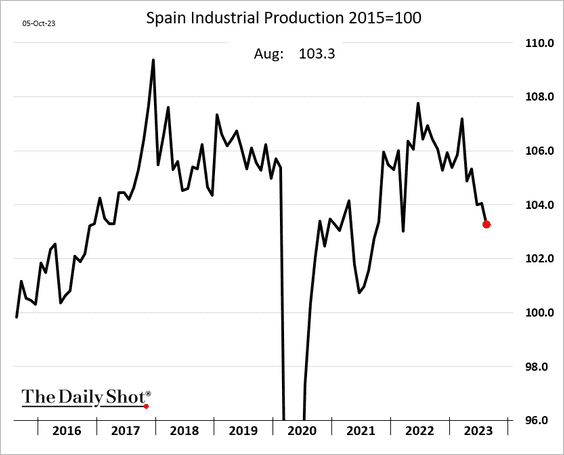

Spain’s industrial production is rolling over.

——————–

4. Here is Danske Bank’s euro-area growth tracker.

![]() Source: Danske Bank

Source: Danske Bank

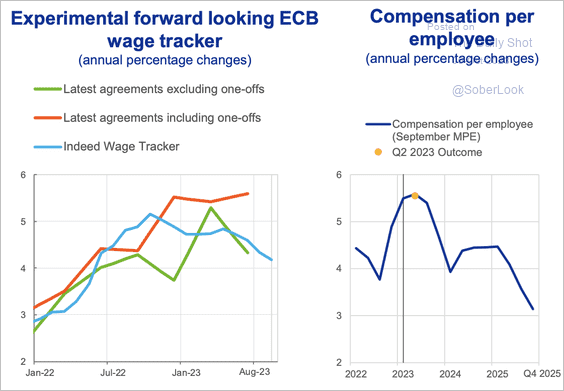

5. Has wage growth peaked?

Source: ECB Read full article

Source: ECB Read full article

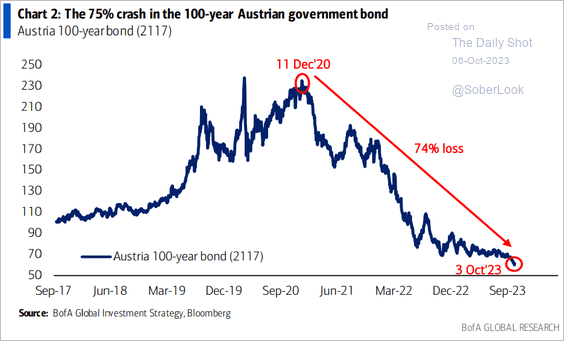

6. Longer-dated debt rout has been remarkable. The Austrian 100-year bond is down 74% from the peak.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

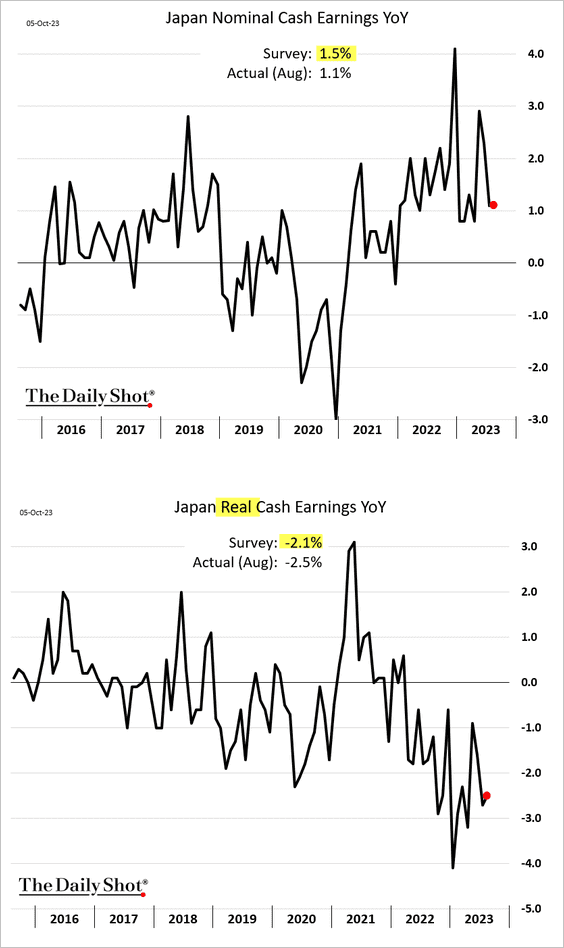

Japan

1. Wage growth was below forecasts in August, with real wages holding well below last year’s levels.

Source: @economics Read full article

Source: @economics Read full article

——————–

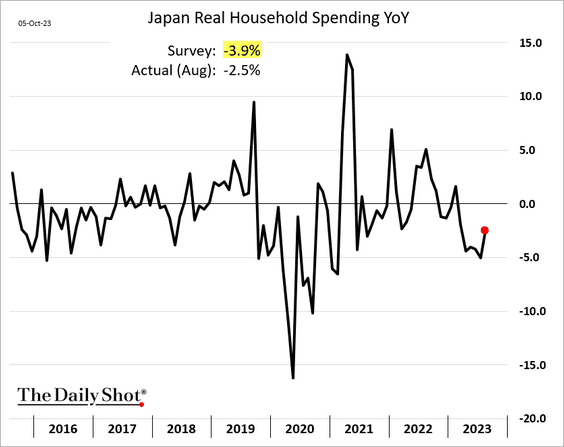

2. Household spending topped expectations.

Back to Index

China

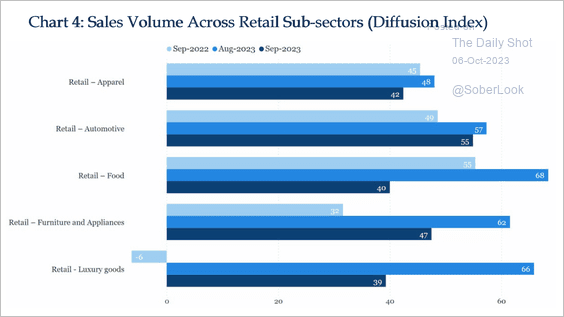

1. Retail sales volumes declined in September, particularly luxury.

Source: China Beige Book

Source: China Beige Book

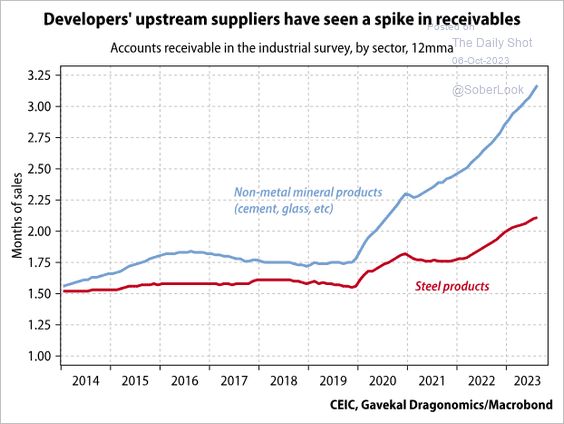

2. Suppliers for real estate developers are seeing a spike in account receivables.

Source: Gavekal Research

Source: Gavekal Research

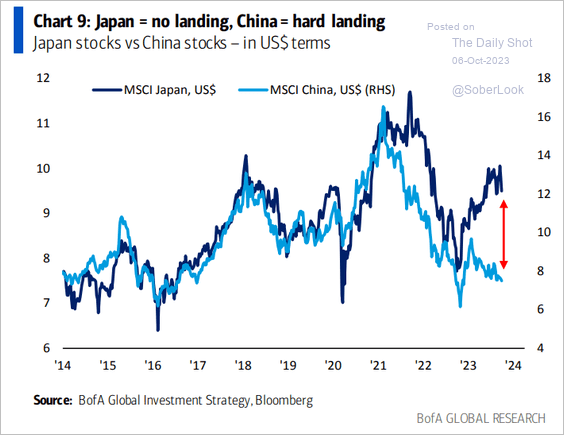

3. Here is a look at equity indices for China and Japan (in USD terms).

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Emerging Markets

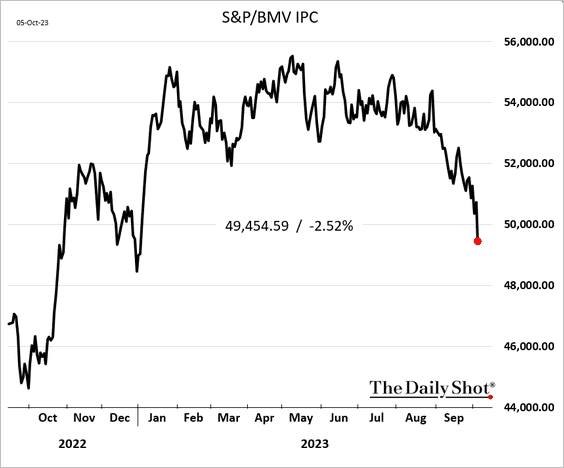

1. Let’s begin with Mexico.

• Stocks tumbled after the news on airport fees.

Source: @markets Read full article

Source: @markets Read full article

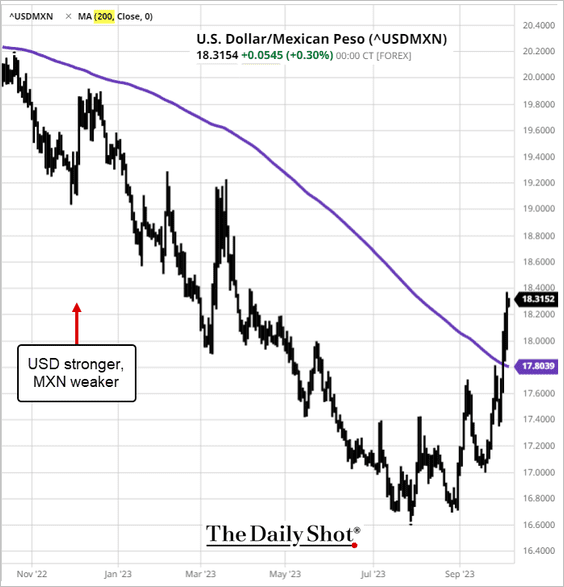

– USD/MXN is now well above the 200-day moving average.

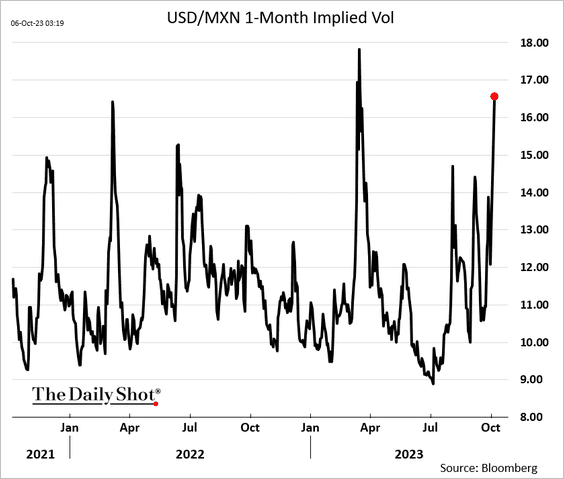

The peso implied volatility surged.

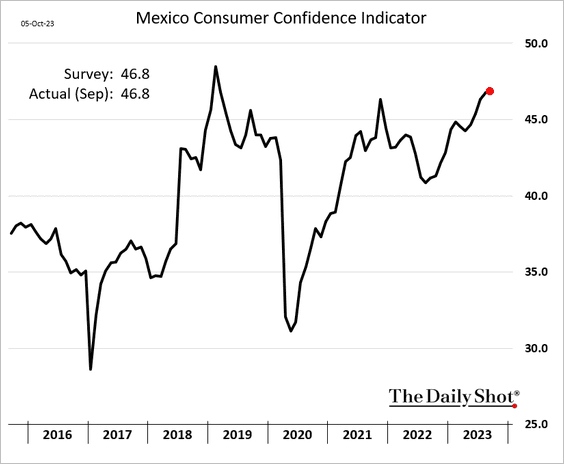

• Consumer confidence remains robust.

——————–

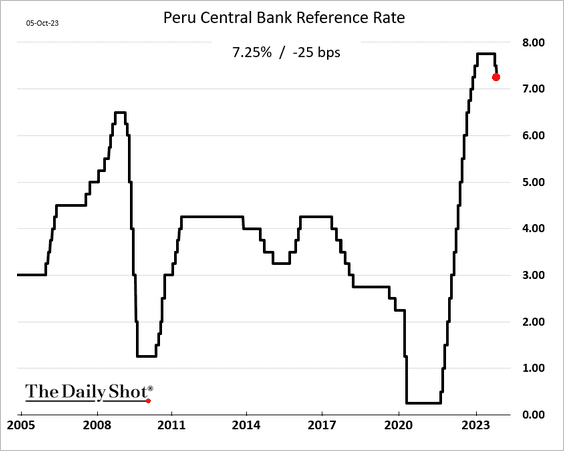

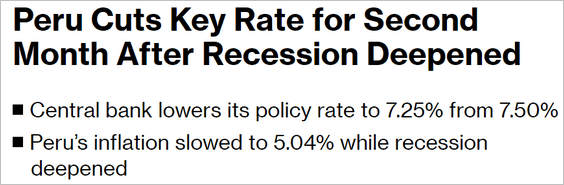

2. Peru’s central bank cut rates again.

Source: @economics Read full article

Source: @economics Read full article

——————–

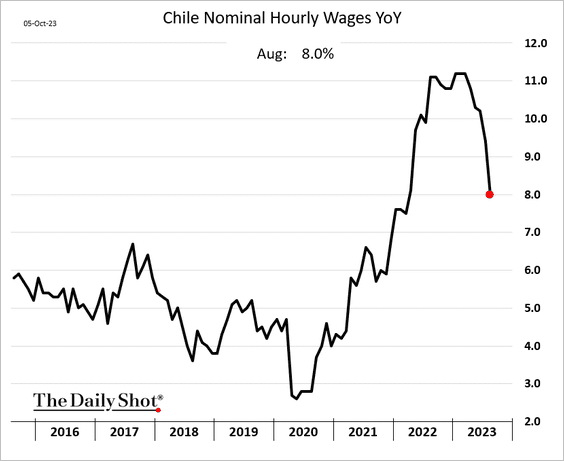

3. Chile’s wage growth is rolling over.

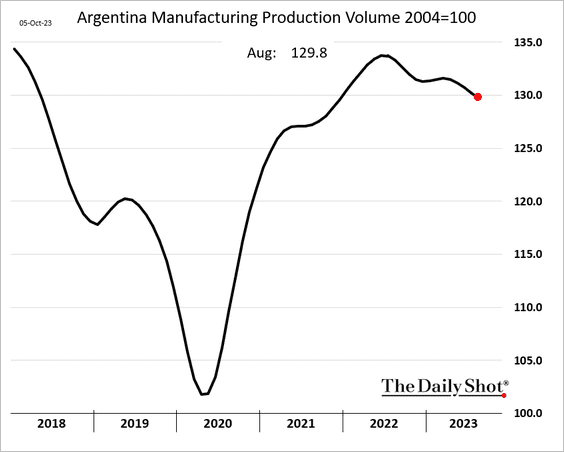

4. Argentina’s manufacturing output is slowing.

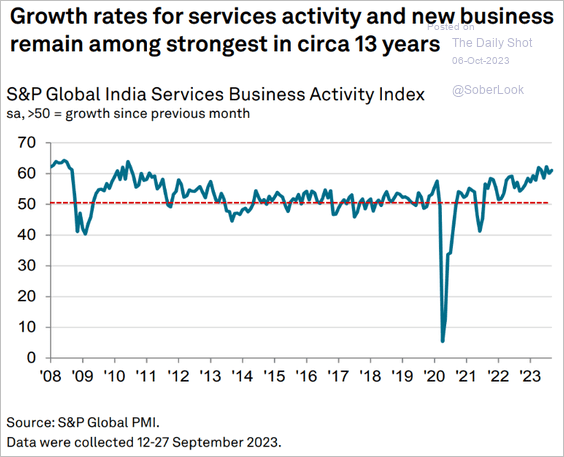

5. India’s service sector growth remains remarkably strong.

Source: S&P Global PMI

Source: S&P Global PMI

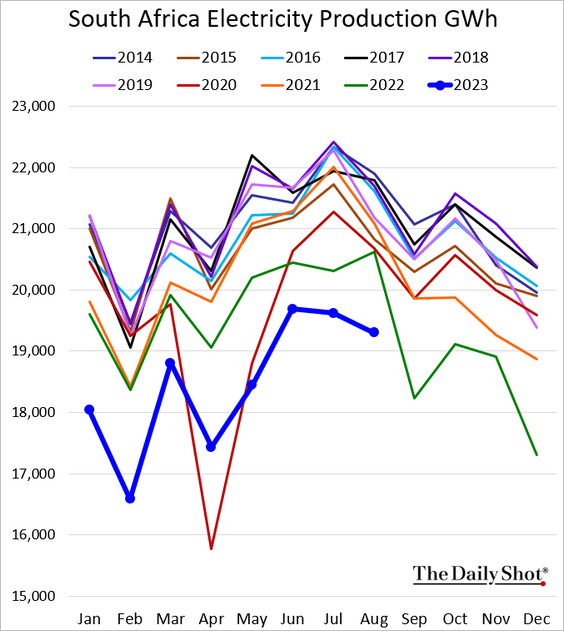

6. South Africa’s electricity production is at multi-year lows, putting pressure on economic growth.

Back to Index

Cryptocurrency

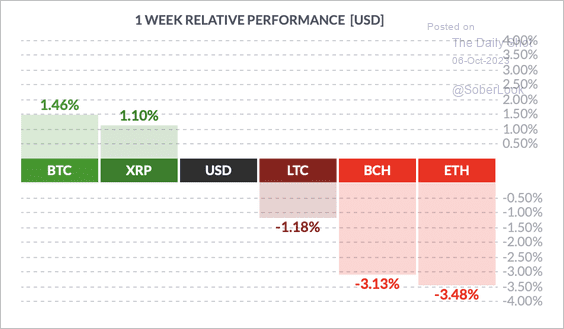

1. It has been a mixed week for cryptos, with BTC and XRP outperforming ETH.

Source: FinViz

Source: FinViz

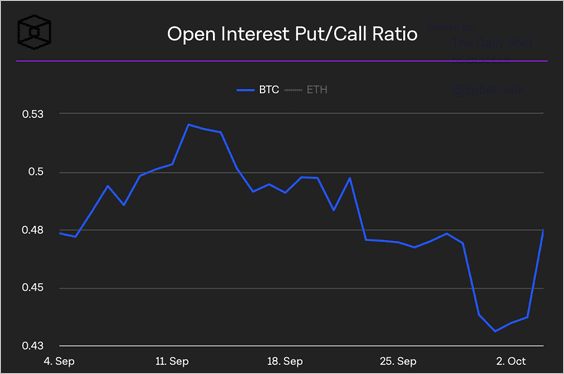

2. Bitcoin’s put/call ratio ticked higher over the past week.

Source: The Block

Source: The Block

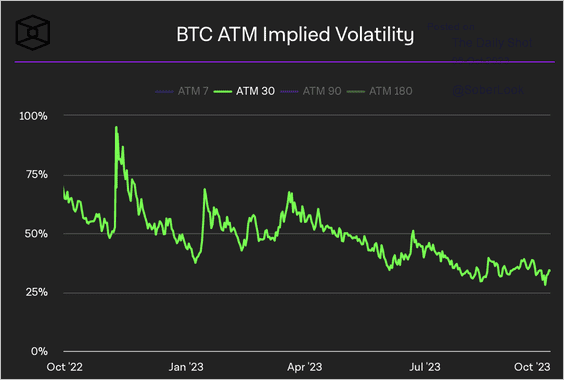

• Bitcoin’s implied volatility remains historically low.

Source: The Block

Source: The Block

——————–

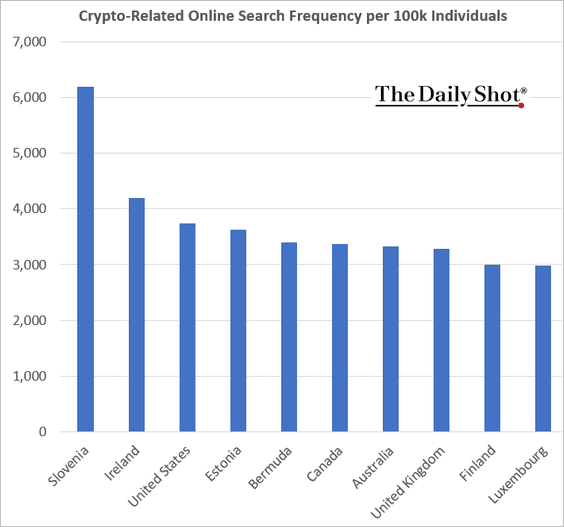

3. This chart shows the most “crypto-obsessed” countries.

Source: Marketplacefairness.org

Source: Marketplacefairness.org

Back to Index

Commodities

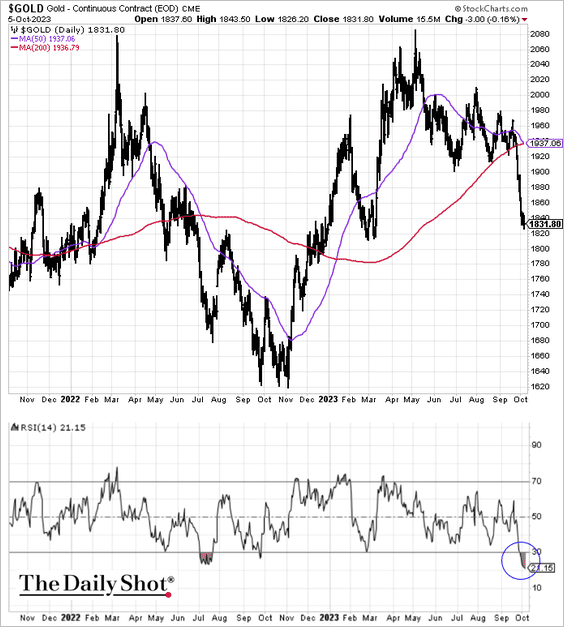

Gold entered a death cross and is now firmly in oversold territory.

Back to Index

Energy

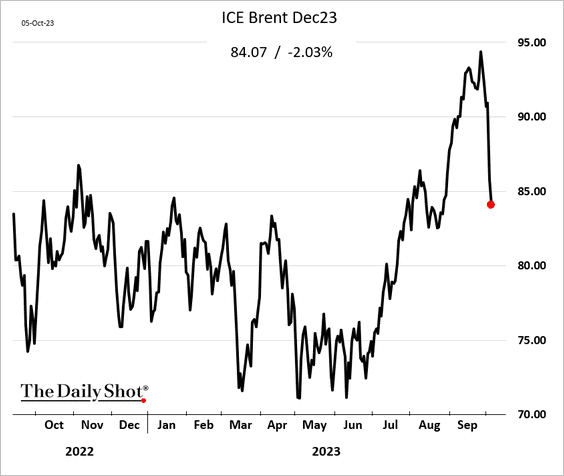

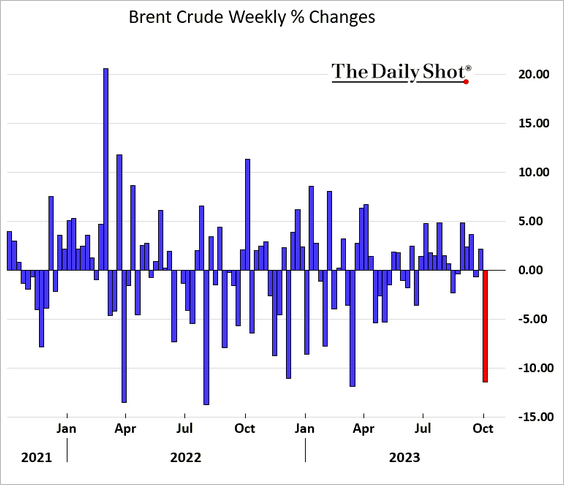

1. Crude oil entered correction territory, with Brent down 10.9% from the peak.

• It has been a rough week so far.

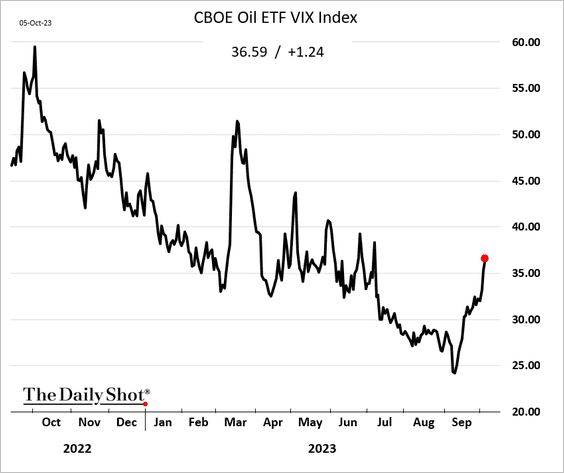

• Oil implied volatility jumped in recent days.

——————–

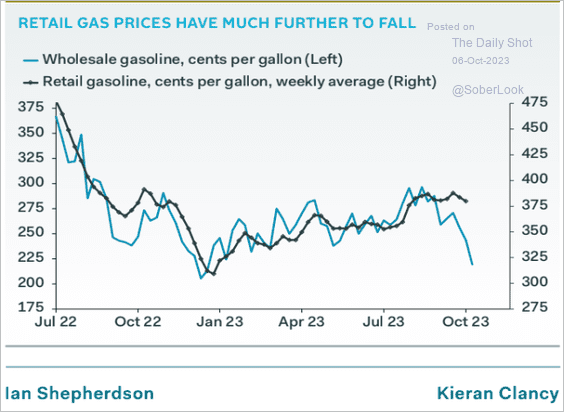

2. US retail gasoline prices are headed lower.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

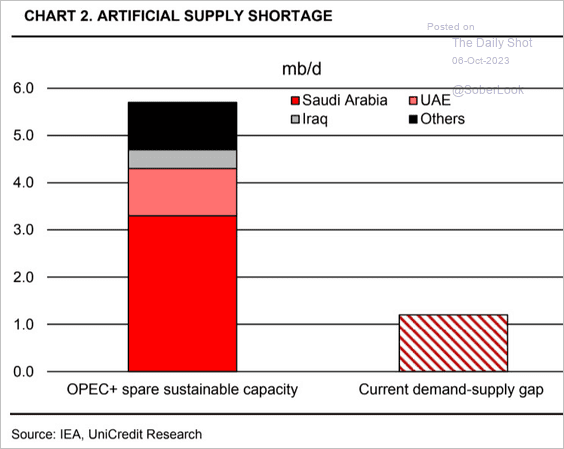

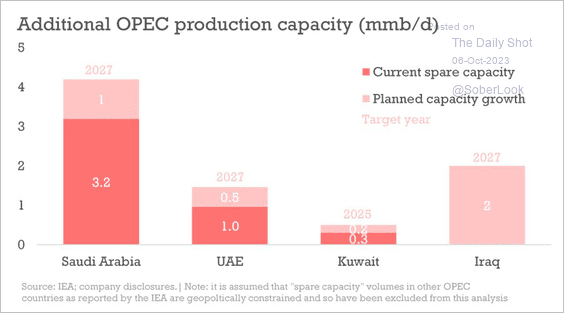

3. OPEC has plenty of spare capacity (2 charts).

Source: UniCredit; @dailychartbook

Source: UniCredit; @dailychartbook

Source: IEA; @harryhhutch

Source: IEA; @harryhhutch

——————–

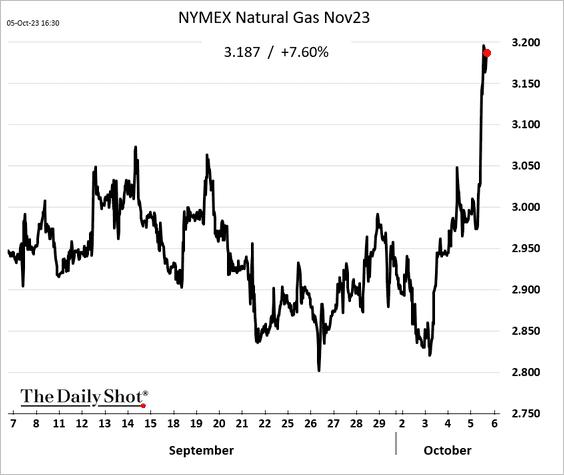

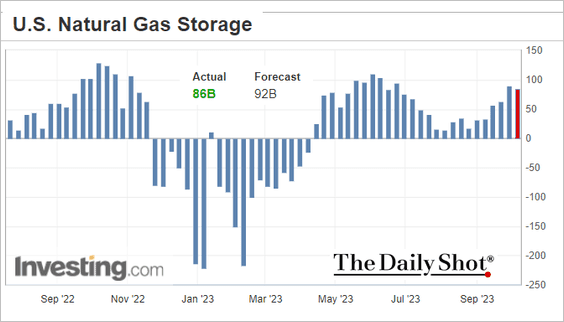

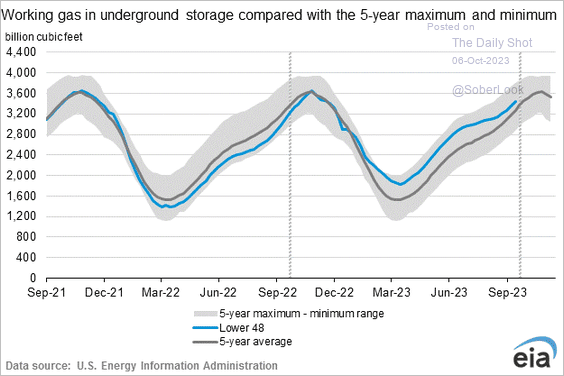

3. US natural gas futures jumped …

… in response to smaller-than-expected storage injection (2 charts).

Source: barchart.com Read full article

Source: barchart.com Read full article

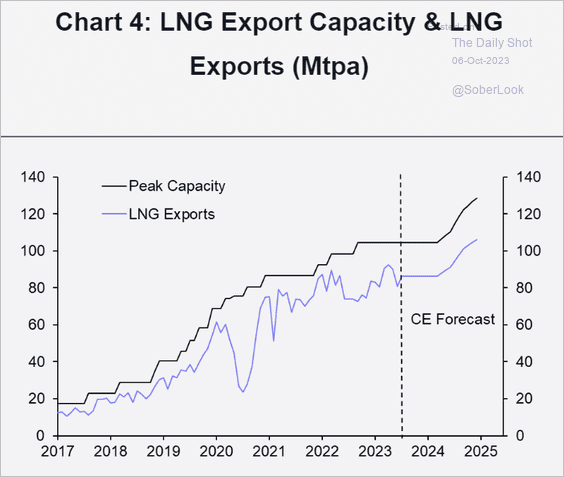

• Increasing LNG exports could keep US natural gas prices elevated next year.

Source: Capital Economics

Source: Capital Economics

Back to Index

Equities

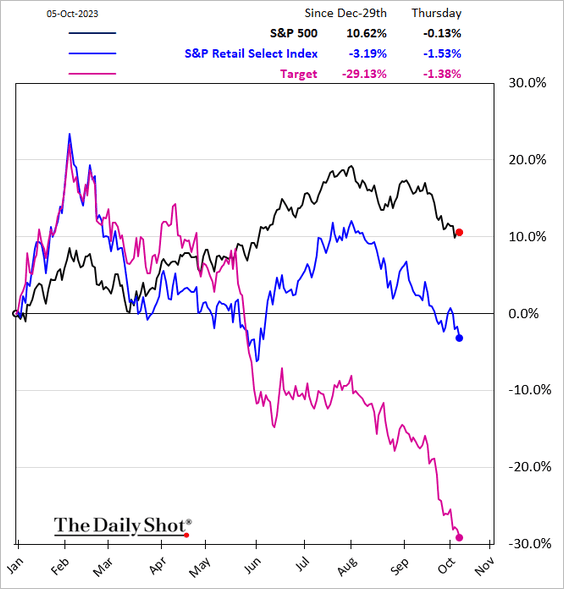

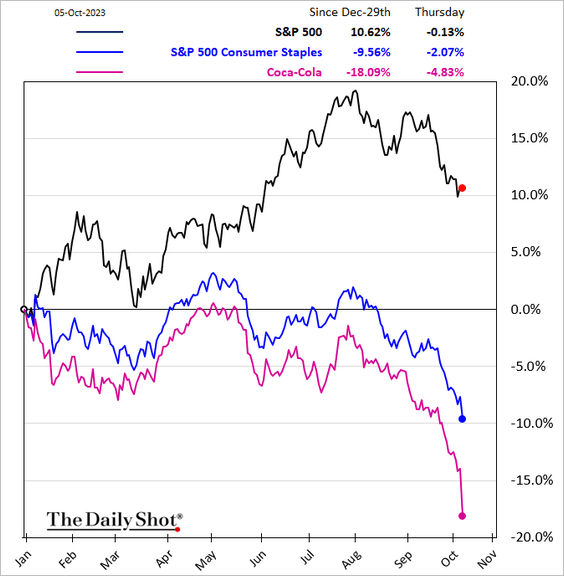

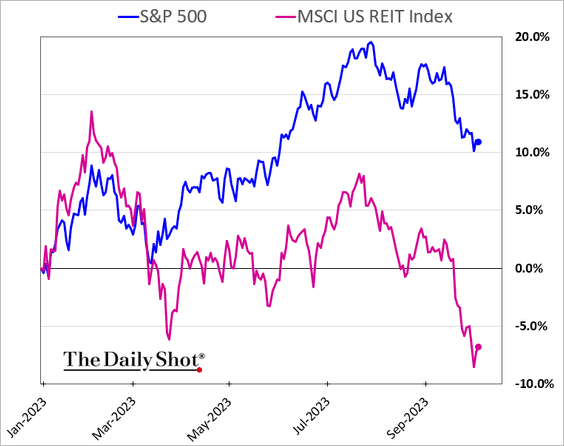

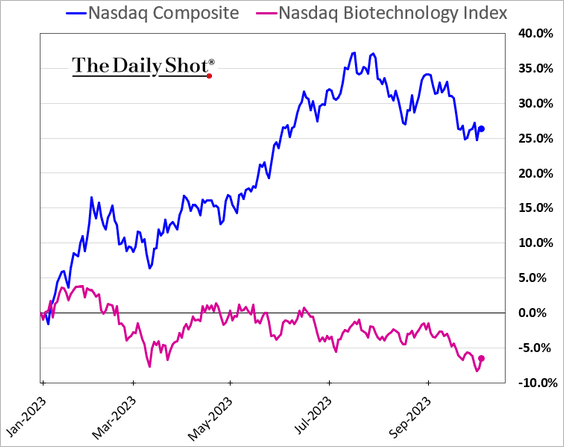

1. Here is a look at some sectors that have struggled this year.

• Retail:

• Consumer staples:

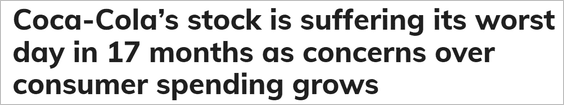

Source: MarketWatch Read full article

Source: MarketWatch Read full article

• REITs:

• Biotech:

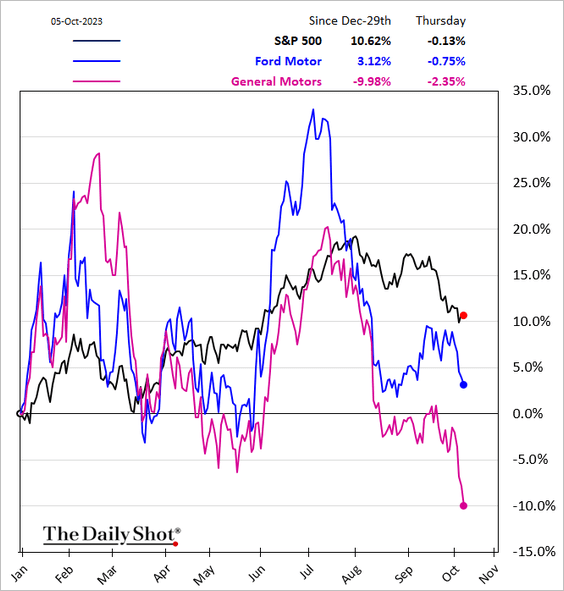

2. Automakers’ shares are under pressure from the UAW strike and GM’s air-bag issue.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

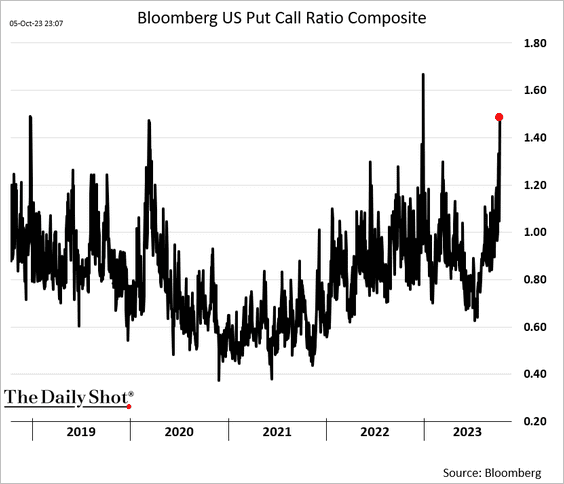

3. The put-call ratio surged this week, pointing to bearish sentiment.

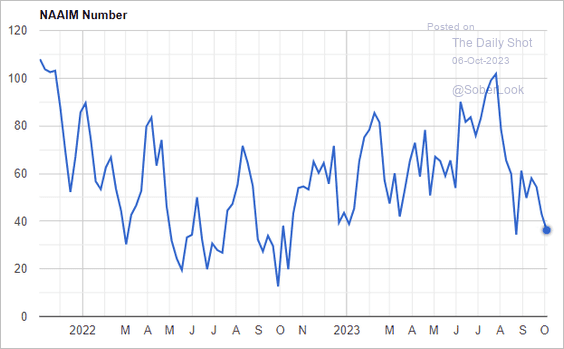

• Investment managers’ positioning has deteriorated sharply.

Source: NAAIM

Source: NAAIM

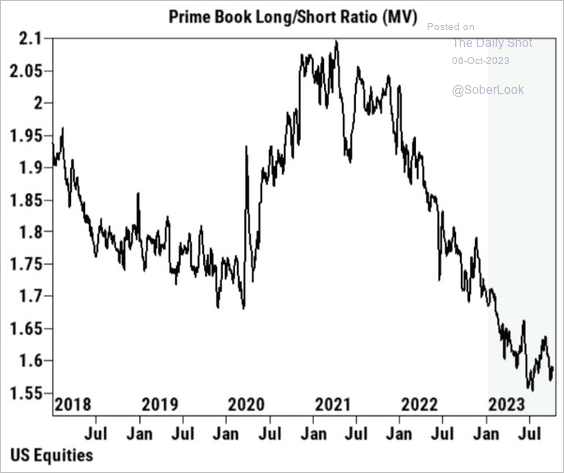

• Hedge funds remain cautious on stocks.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

——————–

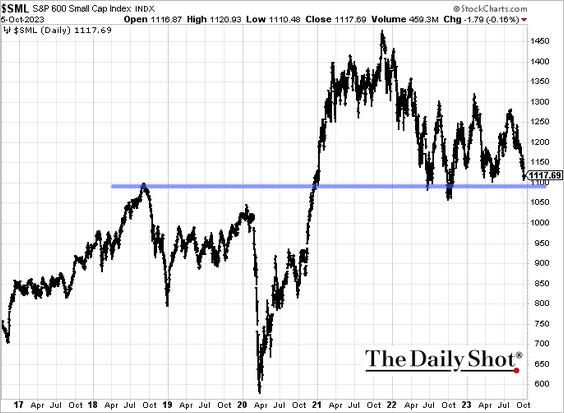

4. The S&P 600 (small caps) is nearing support.

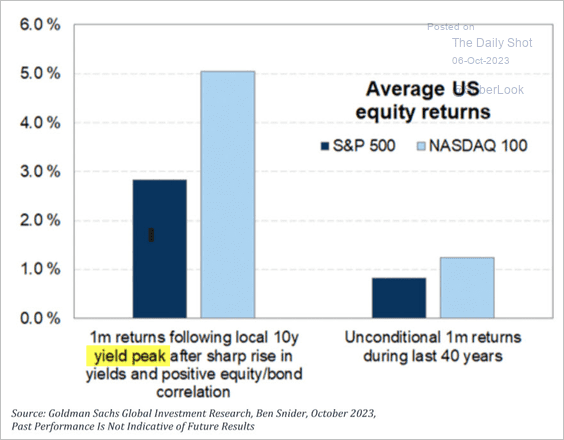

5. If Treasury yields have peaked, we could see a bounce in stocks over the next month.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

Back to Index

Credit

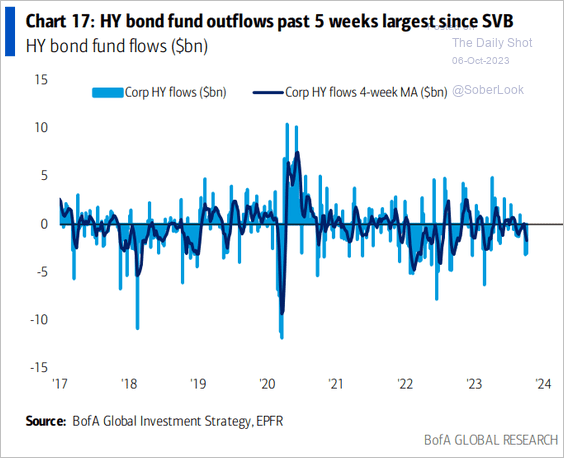

1. High-yield funds are seeing outflows.

Source: BofA Global Research

Source: BofA Global Research

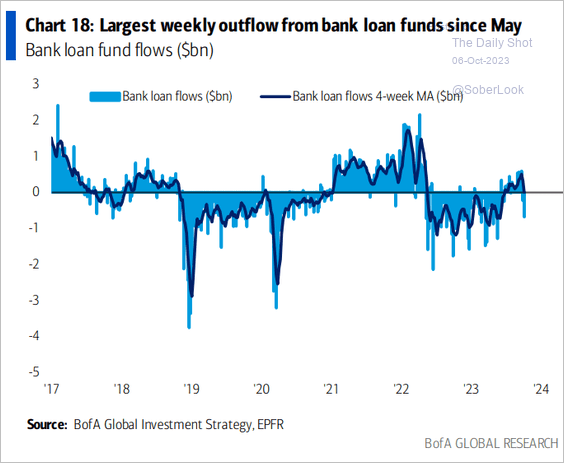

Leveraged loan fund flows have also turned negative.

Source: BofA Global Research

Source: BofA Global Research

——————–

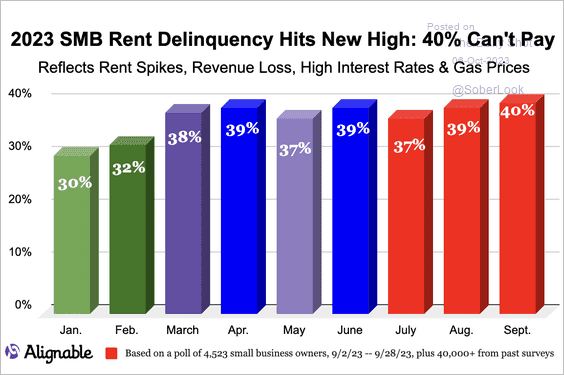

2. US small business rent delinquencies is trending higher.

Source: Alignable

Source: Alignable

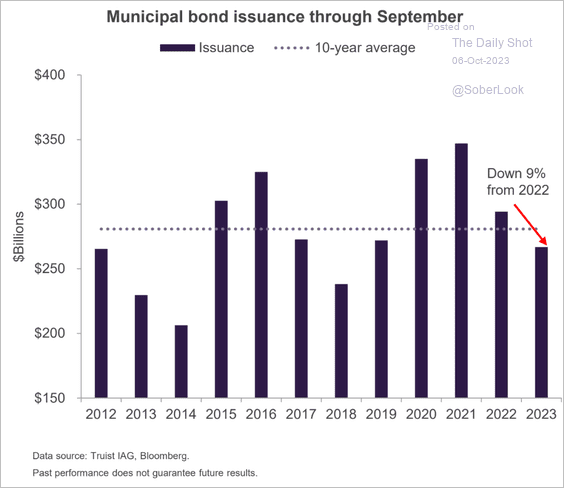

3. Muni issuance has been slowing.

Source: Truist Advisory Services

Source: Truist Advisory Services

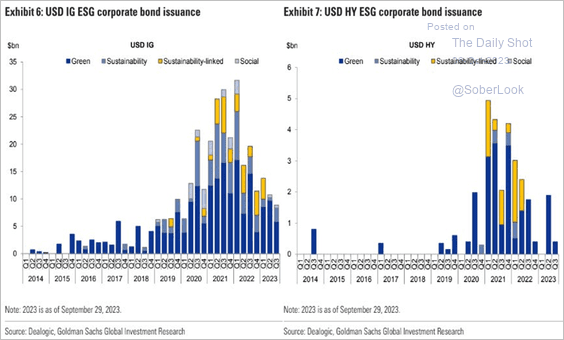

4. Here is a look at ESG bond issuance.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

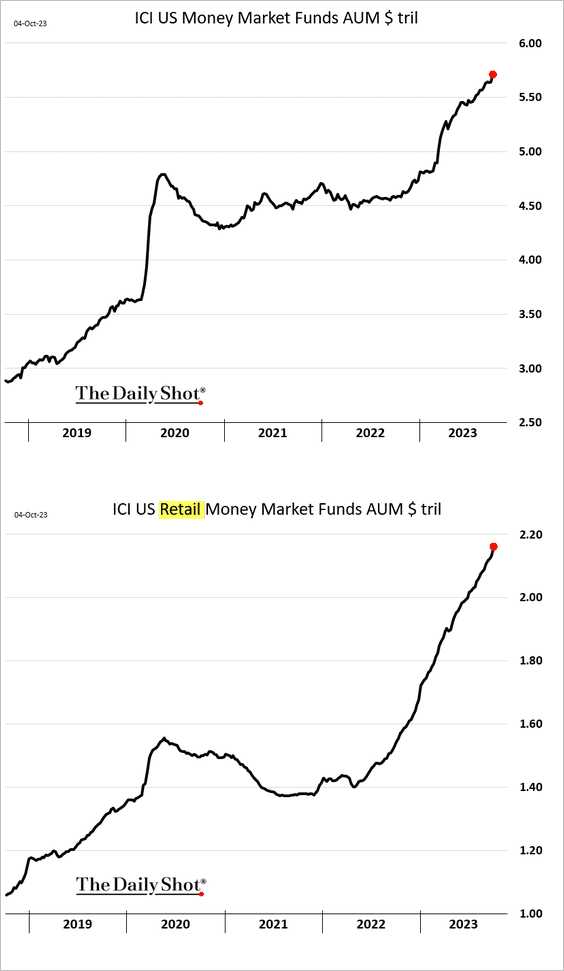

5. US money market funds’ AUM continues to surge.

Back to Index

Rates

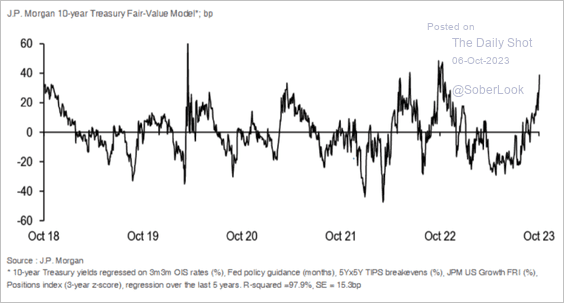

1. Treasury yields are dislocated, according to JP Morgan.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

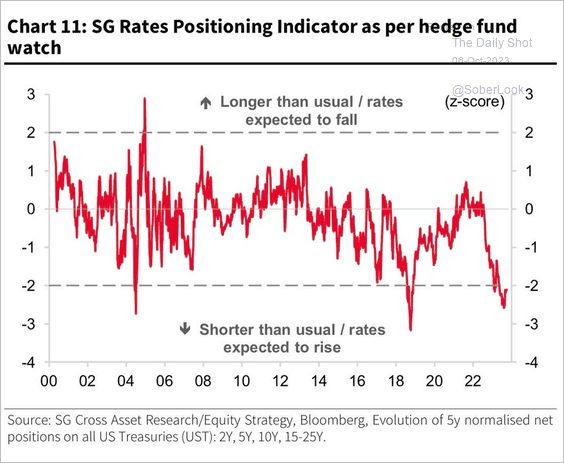

• The Treasury selloff appears to be overextended.

Source: Societe Generale Cross Asset Research; @WallStJesus

Source: Societe Generale Cross Asset Research; @WallStJesus

——————–

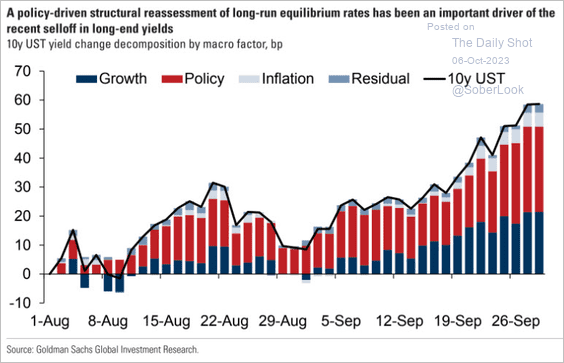

2. Here is a look at macro factors driving the surge in Treasury yields.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

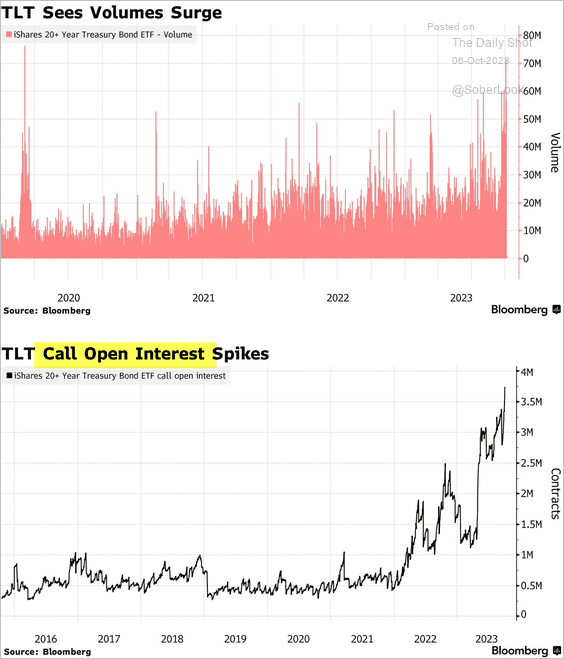

3. TLT trading volume and open interest in call options surged this week.

Source: @markets Read full article

Source: @markets Read full article

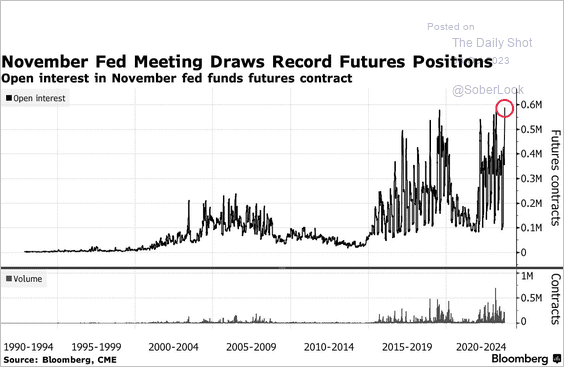

4. Traders are placing massive bets on the outcome of the November FOMC meeting.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Global Developments

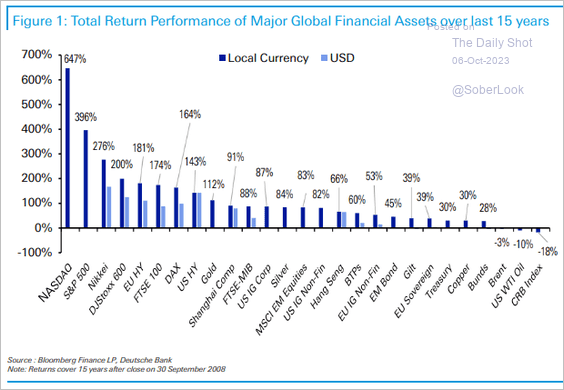

1. Over the past 15 years, since the initial round of the Fed’s Quantitative Easing, US equities have outperformed other major assets, with commodities trailing behind.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

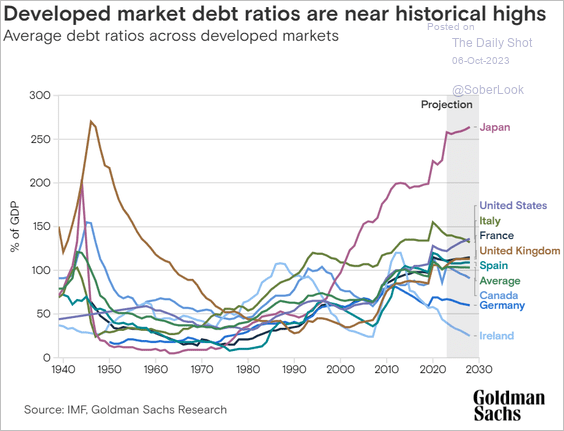

2. Here is a look at debt-to-GDP ratios in advanced economies.

Source: Goldman Sachs

Source: Goldman Sachs

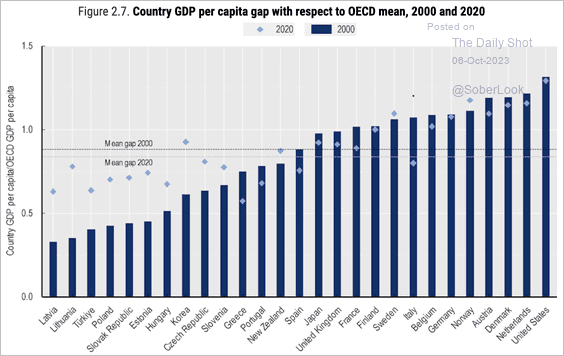

3. This chart shows the GDP per capita relative to the OECD mean.

Source: OECD Read full article

Source: OECD Read full article

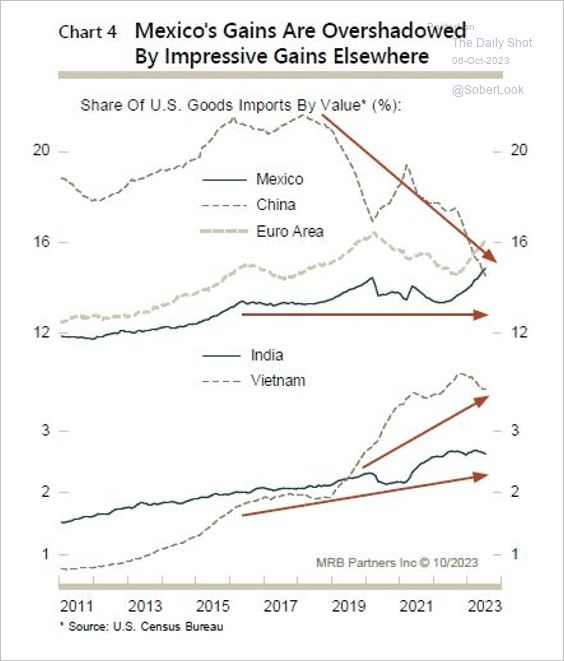

4. Mexico, Vietnam, India, and the euro area account for a growing share of US goods imports, possibly displacing China.

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

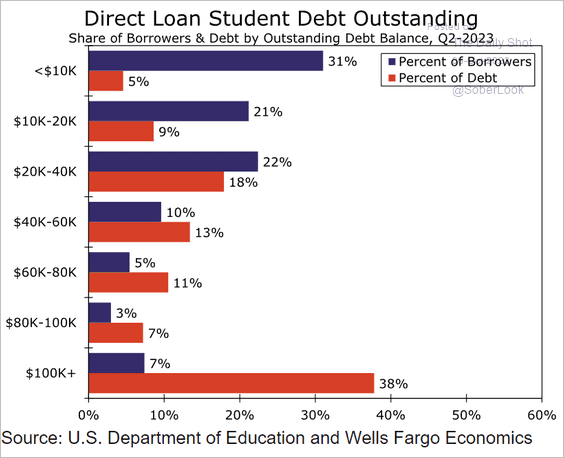

1. Student loan debt:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

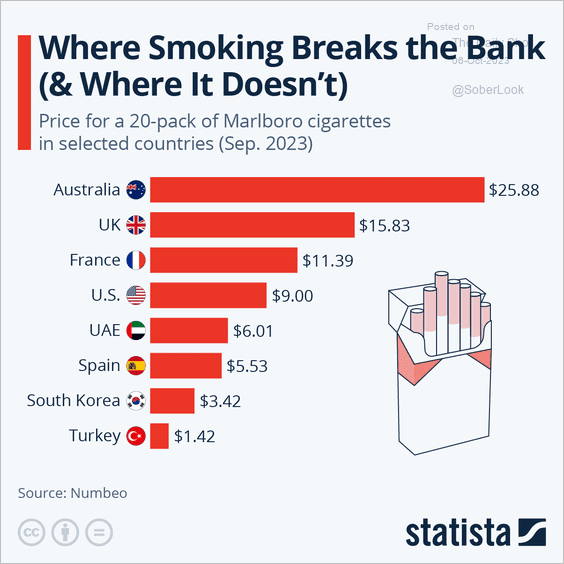

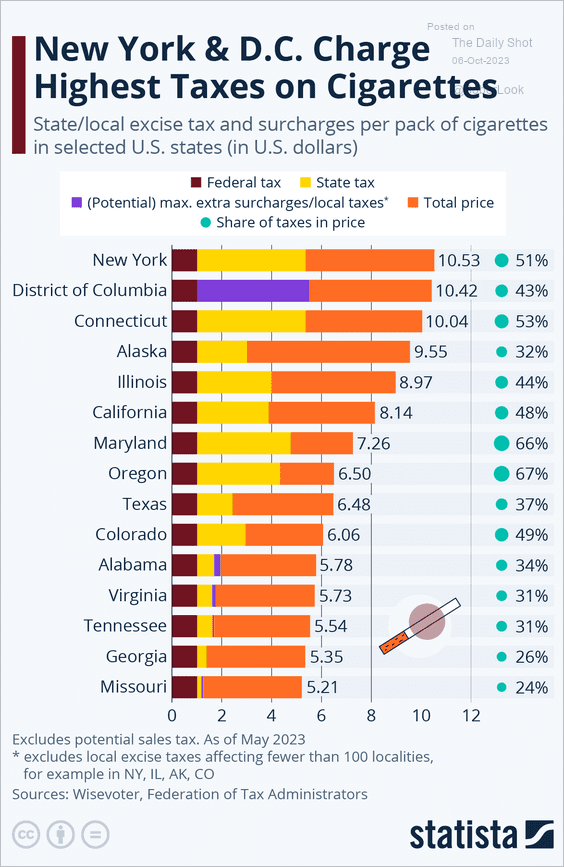

2. Cigarette prices around the world:

Source: Statista

Source: Statista

• Taxes on cigarettes in the US:

Source: Statista

Source: Statista

——————–

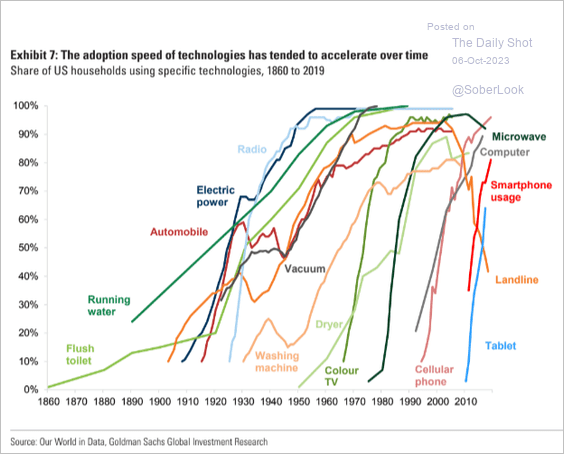

3. Accelerating adoption rates of technologies:

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

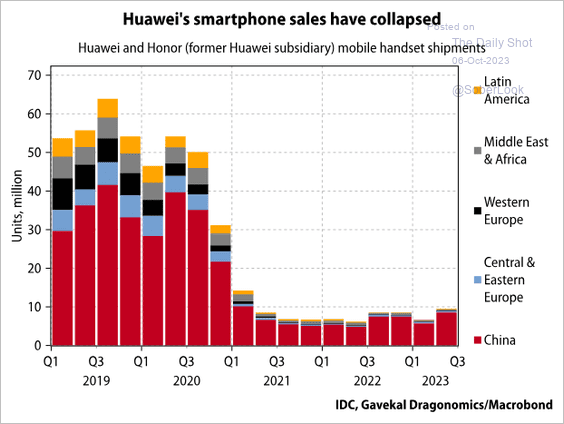

4. Huawei mobile phone shipments:

Source: Gavekal Research

Source: Gavekal Research

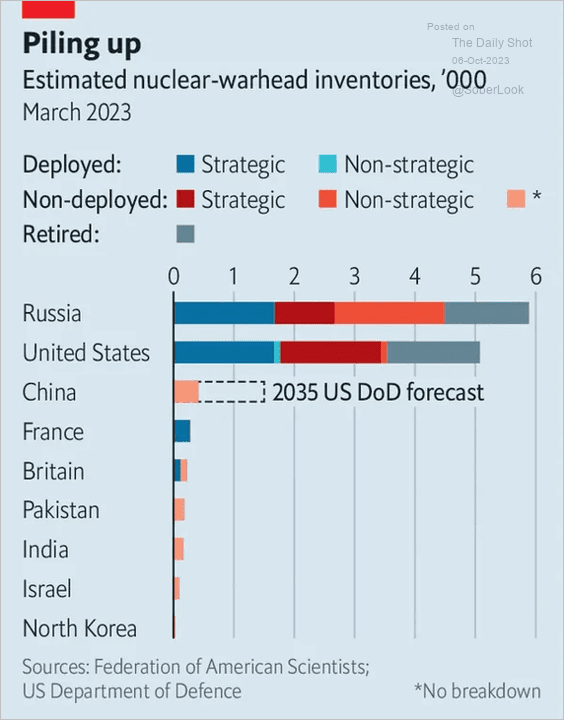

5. Nuclear warhead inventories:

Source: The Economist Read full article

Source: The Economist Read full article

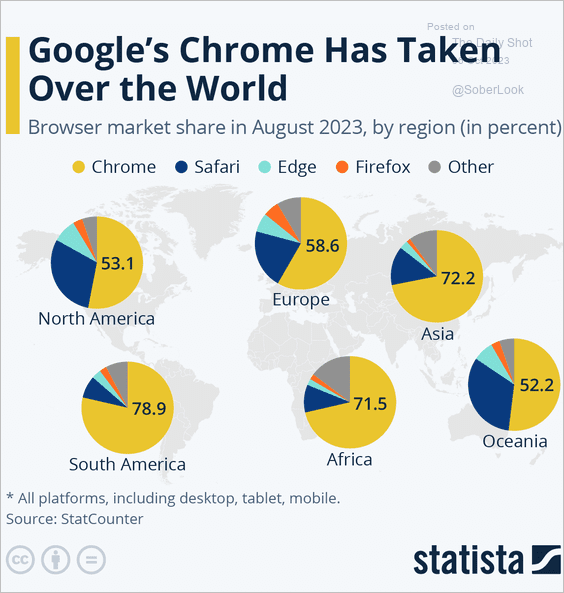

6. Browser market share by region:

Source: Statista

Source: Statista

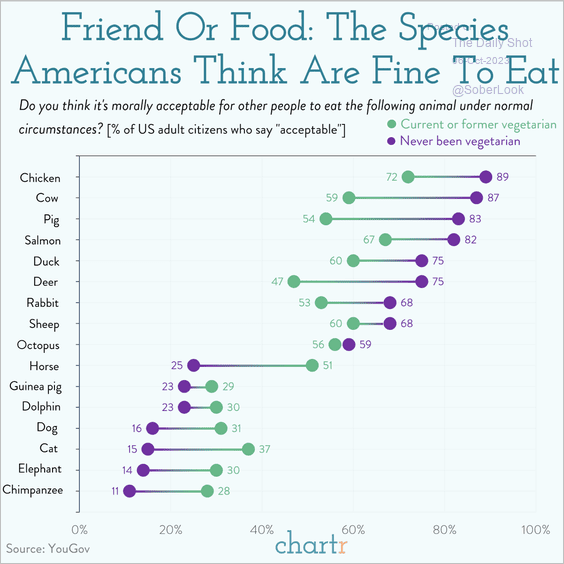

7. Which animals are morally acceptable to eat?

Source: @chartrdaily

Source: @chartrdaily

——————–

Have a great weekend!

Back to Index