The Daily Shot: 10-Oct-23

• The United States

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

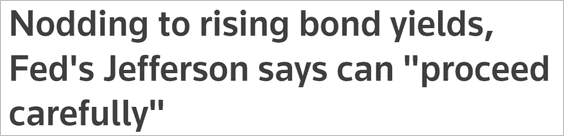

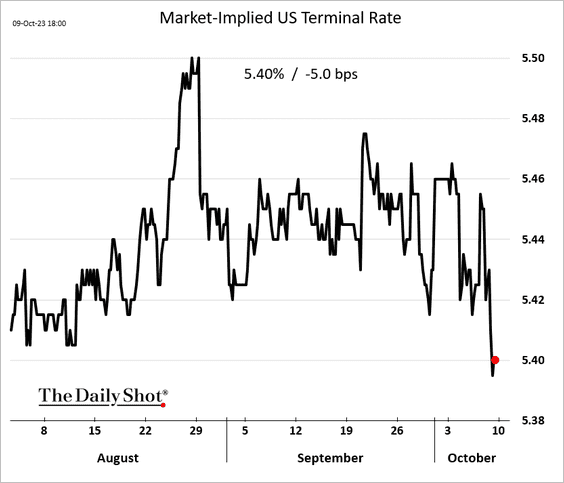

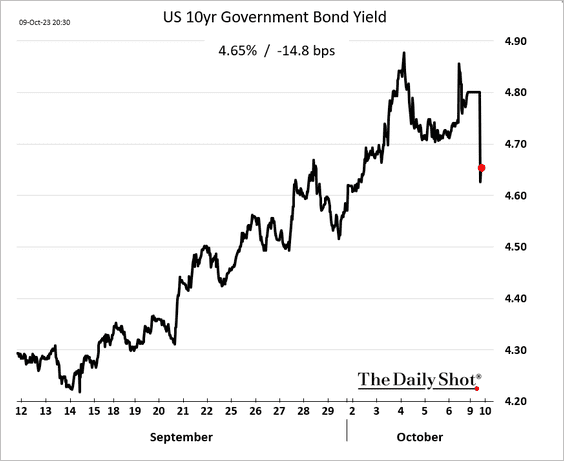

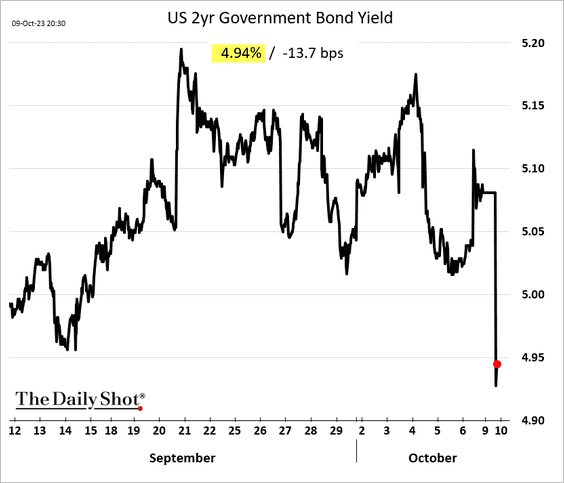

1. Fed officials are growing concerned about the surge in Treasury yields, with financial conditions tightening substantially in recent weeks. If there were intentions to raise rates further, the market has effectively taken that initiative.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

The probability of a rate hike in November declined, …

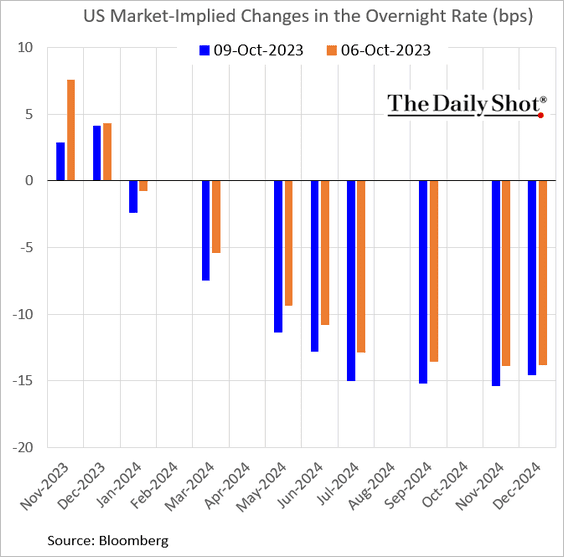

… pushing the terminal rate lower (2 charts).

• Treasury yields dropped sharply, …

… with the 2-year rate dipping below 5%.

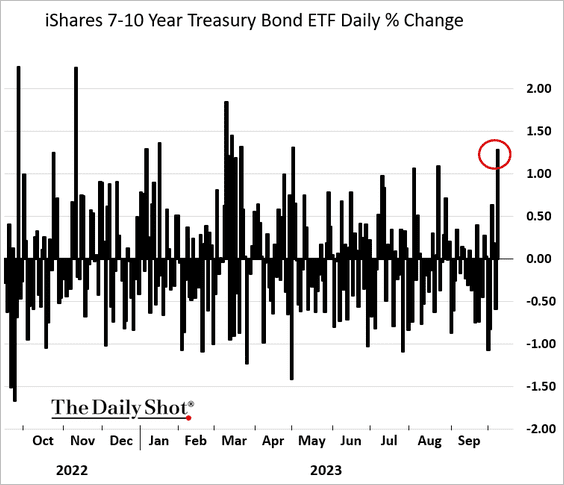

It was the best day for Treasuries in months.

——————–

2. Next, we have some updates on the labor market.

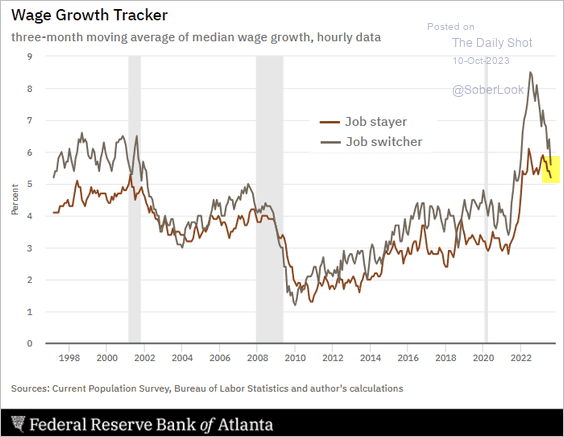

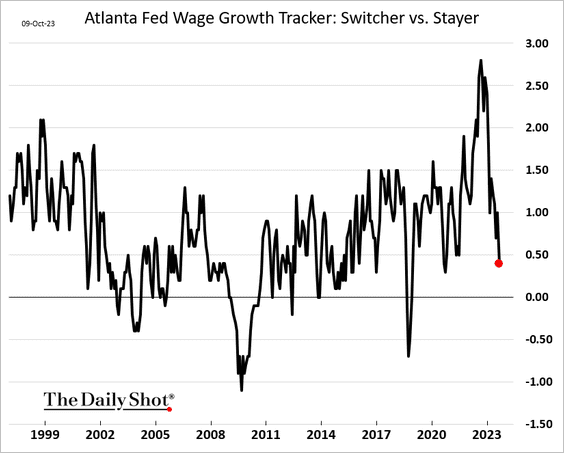

• Job hopping continues to become less lucrative, signaling normalization in the labor market. The charts below compare wage growth for job “stayers” and “switchers.”

Source: Federal Reserve Bank of Atlanta Further reading

Source: Federal Reserve Bank of Atlanta Further reading

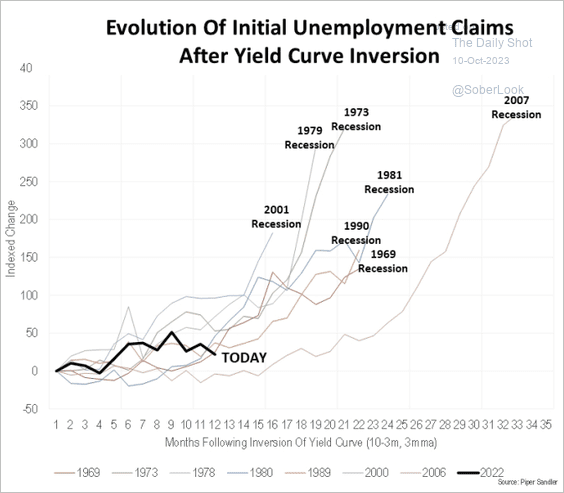

• Given the yield curve inversion, jobless claims should be rising now if a recession is coming.

Source: Piper Sandler

Source: Piper Sandler

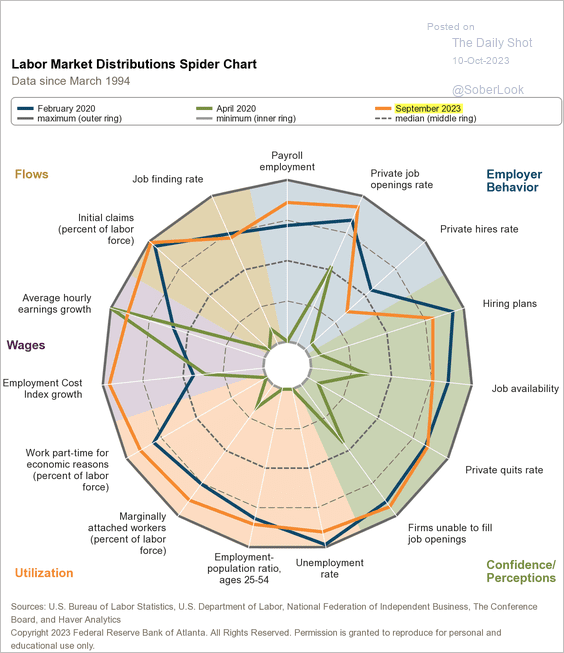

• Here is the Atlanta Fed’s labor market spider chart, which compares labor market metrics before the pandemic, right after the COVID shock, and now.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

——————–

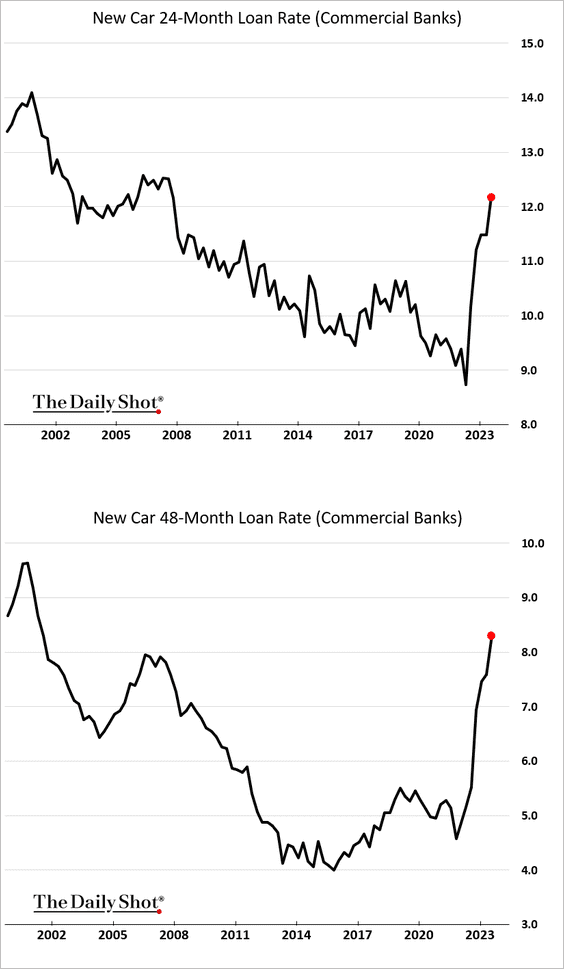

3. US commercial bank auto loan rates are at the highest levels since 2008.

4. Next, we have some updates on the housing market.

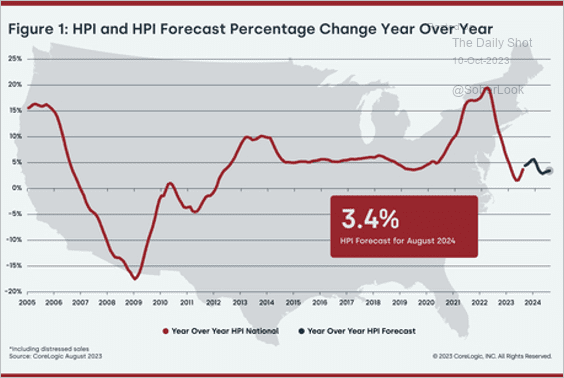

• CoreLogic expects home price appreciation to hold in low single-digits next year.

Source: CoreLogic

Source: CoreLogic

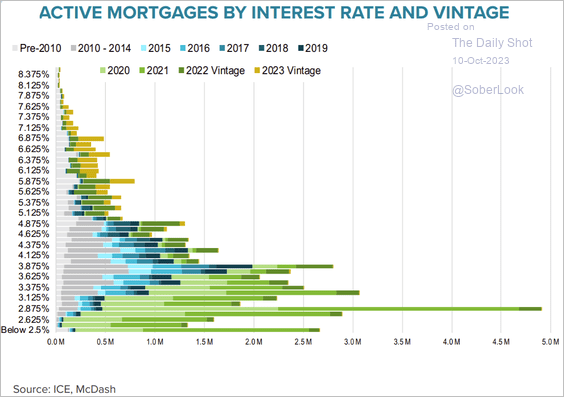

• Here is a look at mortgage loans outstanding by rate and vintage.

Source: Calculated Risk

Source: Calculated Risk

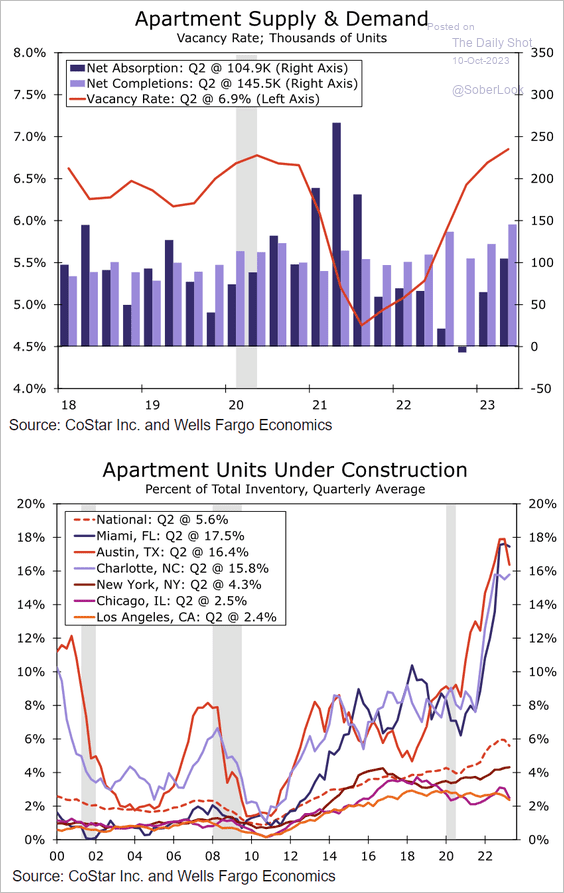

• Multifamily housing supply is now outstripping demand, raising vacancy rates …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

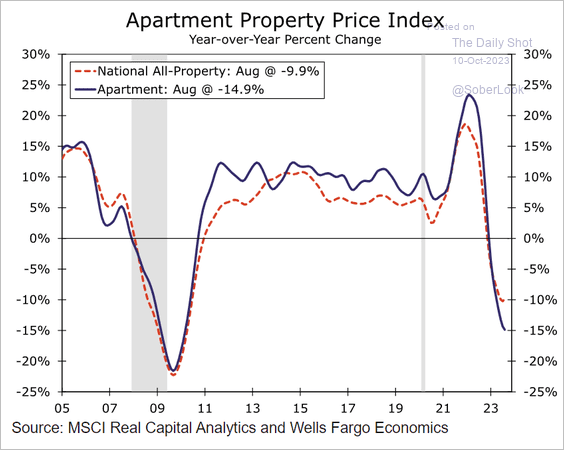

… and pressuring property prices.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Europe

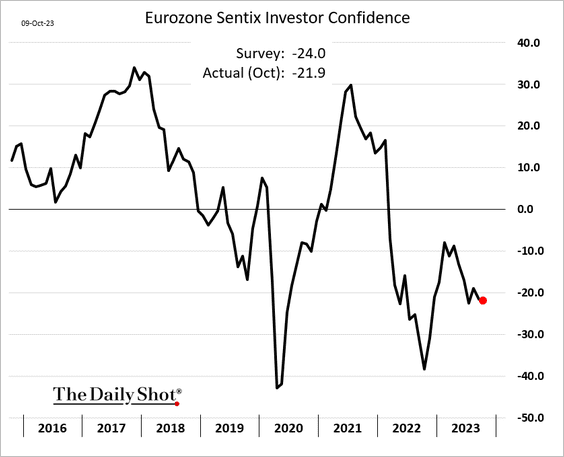

1. Eurozone investor confidence declined again but was a bit better than expected.

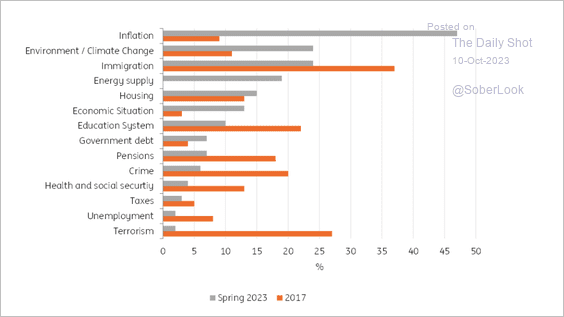

2. Inflation and the environment are top concerns facing Germany, according to a survey by Eurobarometer.

Source: ING

Source: ING

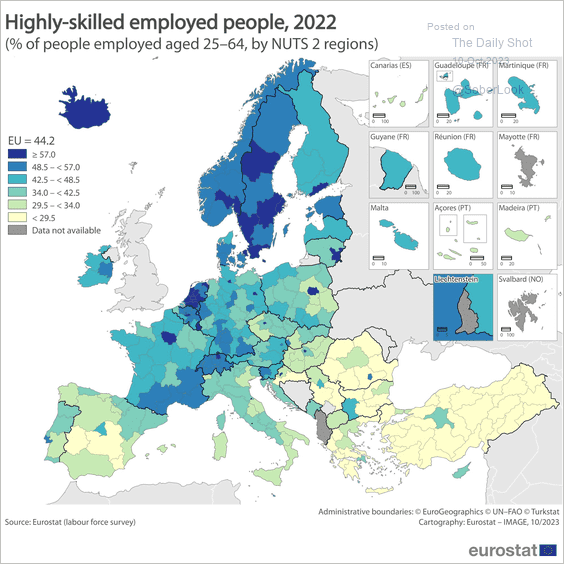

3. This map shows the concentration of highly skilled workers across Europe.

Source: Eurostat Read full article

Source: Eurostat Read full article

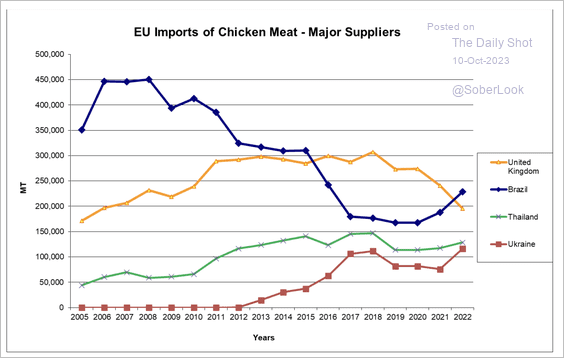

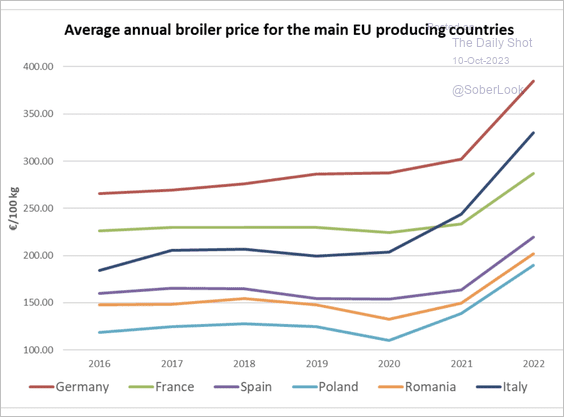

4. Here is a look at EU chicken imports and prices.

Source: USDA Read full article

Source: USDA Read full article

Source: USDA Read full article

Source: USDA Read full article

Back to Index

Japan

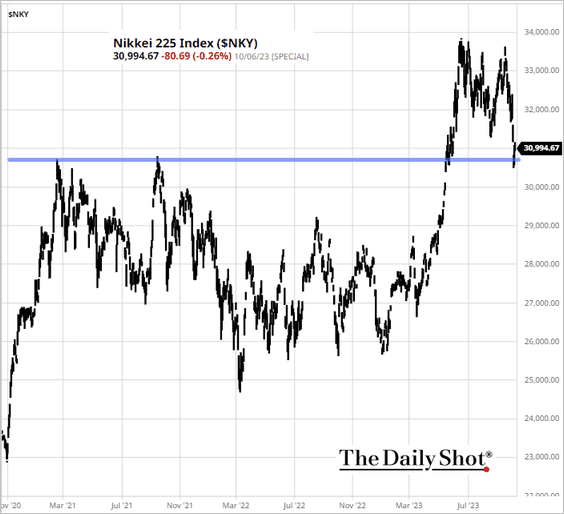

1. The Nikkei 225 held support.

Source: barchart.com

Source: barchart.com

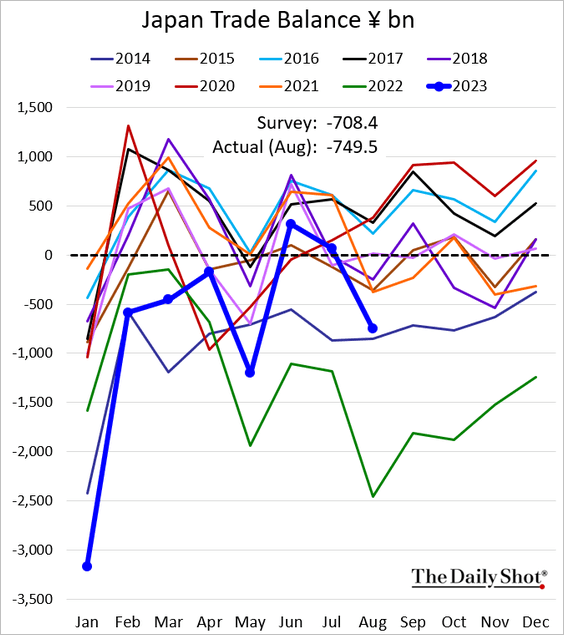

2. The trade deficit was wider than expected in August.

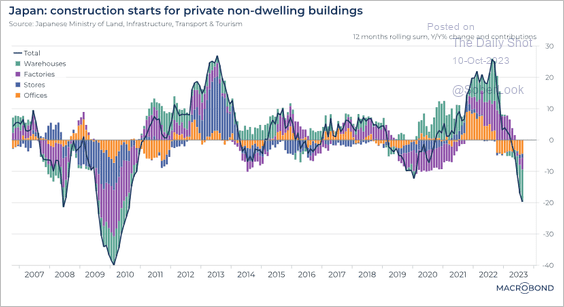

3. Nonresidential construction starts are down sharply this year.

Source: Macrobond

Source: Macrobond

Back to Index

Asia-Pacific

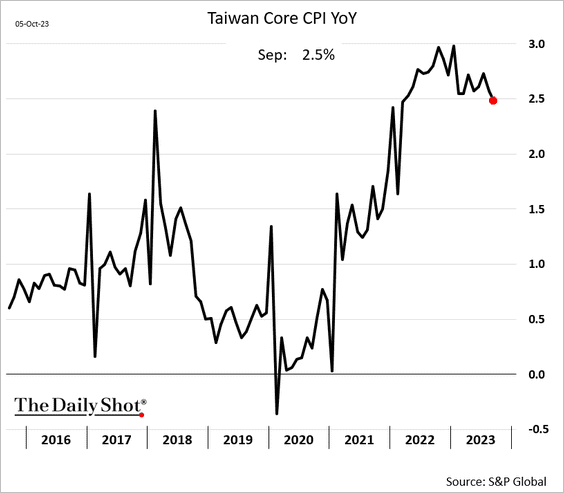

1. Taiwan’s inflation appears to be easing.

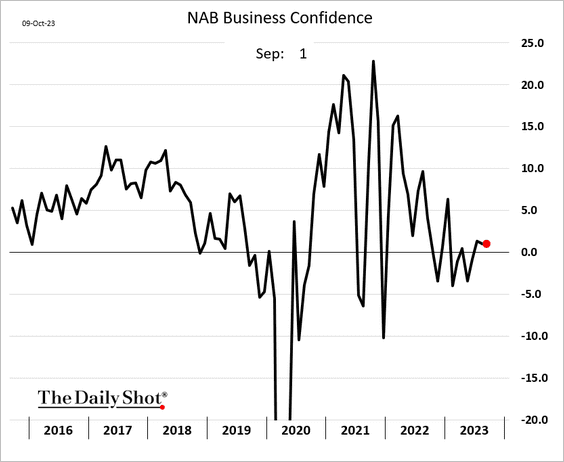

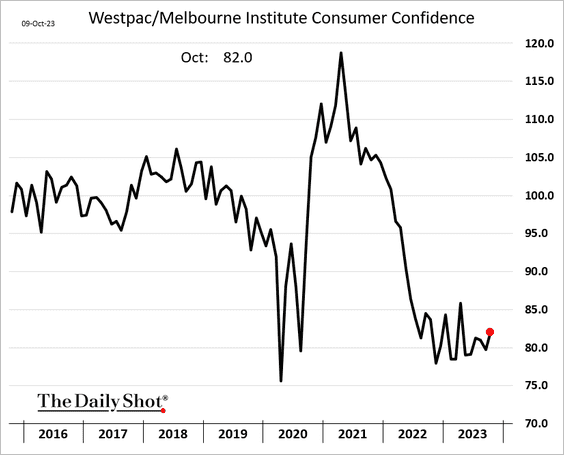

2. There hasn’t been much improvement in Australia’s consumer and business confidence indicators.

Back to Index

China

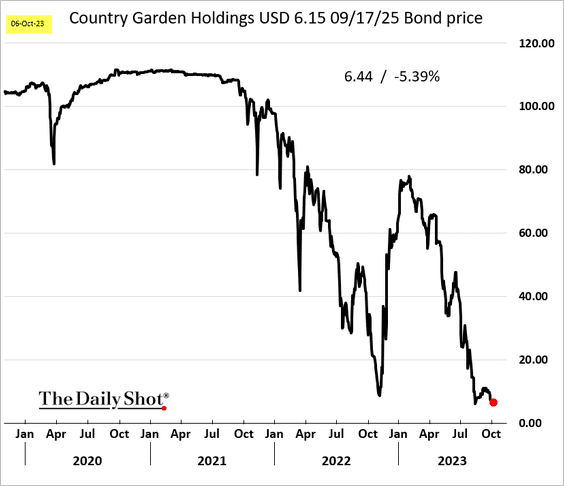

1. After the Evergrande fiasco, markets viewed Country Garden as a relatively safe bet. That bet didn’t end well.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

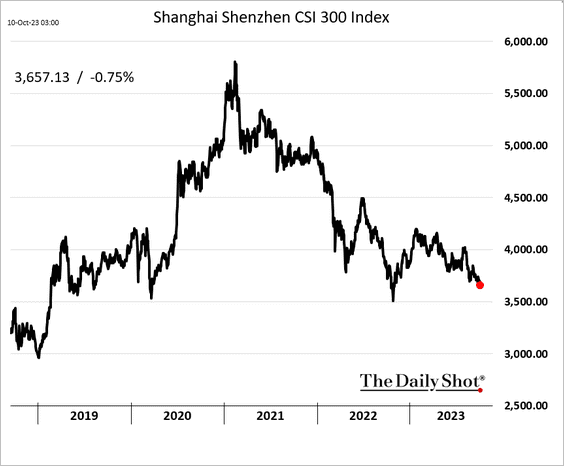

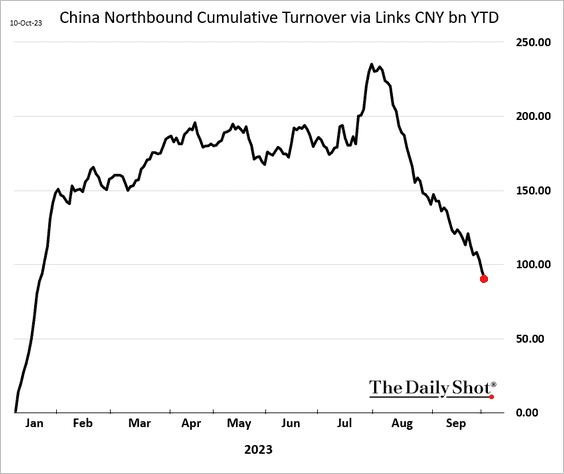

2. The Shanghai Shenzhen CSI 300 Index continues to trend lower, …

… as outflows accelerate.

——————–

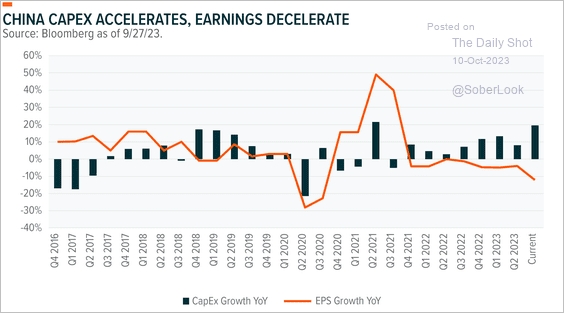

3. Companies have increased capital spending despite slowing earnings growth.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Emerging Markets

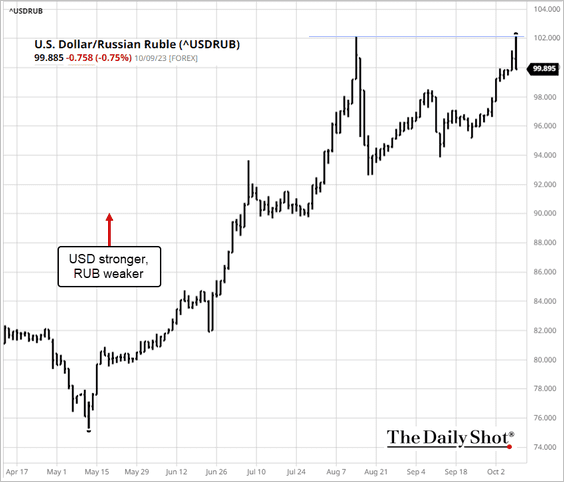

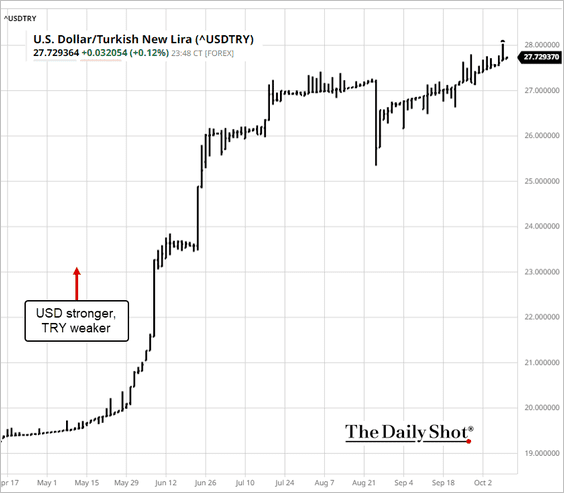

1. Despite central banks boosting rates in Russia and Turkey, the ruble and the lira continue to struggle.

Source: barchart.com

Source: barchart.com

Source: barchart.com

Source: barchart.com

——————–

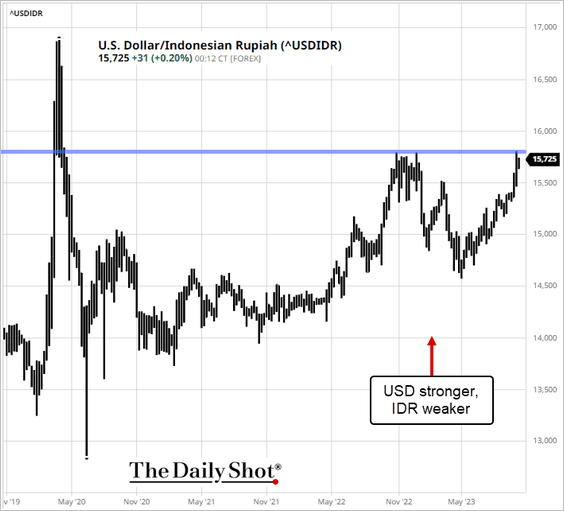

2. USD/IDR is at resistance as the Indonesian rupiah weakens.

Source: barchart.com

Source: barchart.com

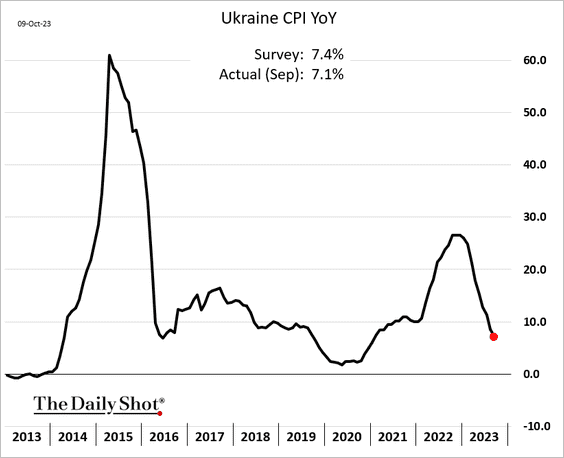

3. Ukraine’s inflation continues to moderate as the currency remains stable.

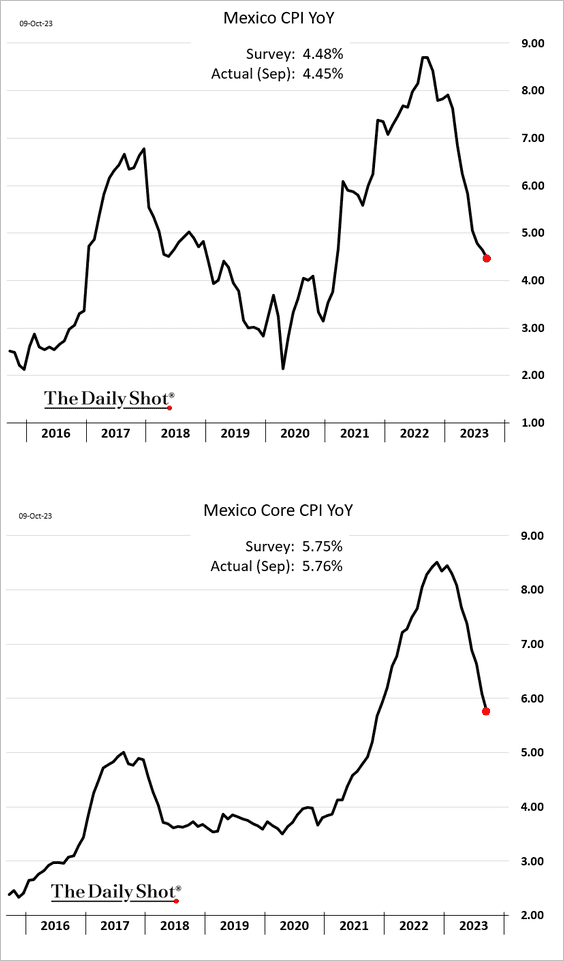

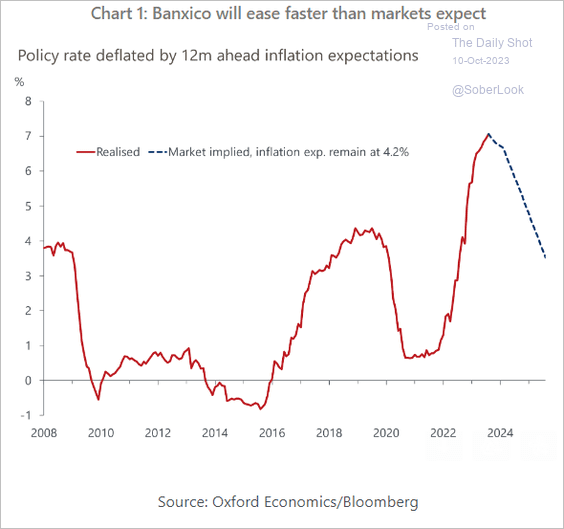

4. Mexico’s inflation is slowing.

• Here is a look at Mexico’s real policy rate with a forecast from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

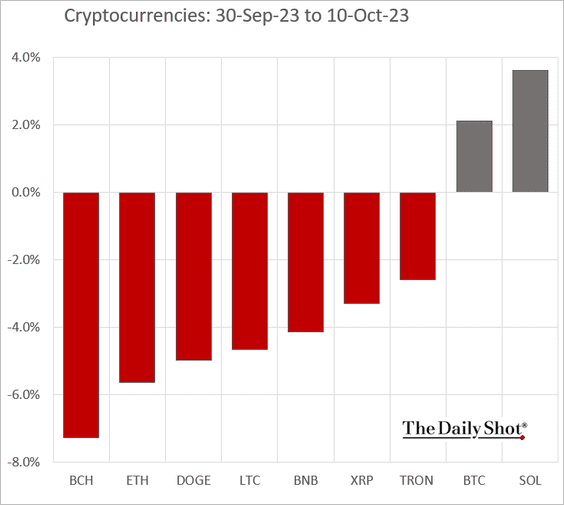

1. Let’s begin with the month-to-date performance for some of the most liquid cryptos.

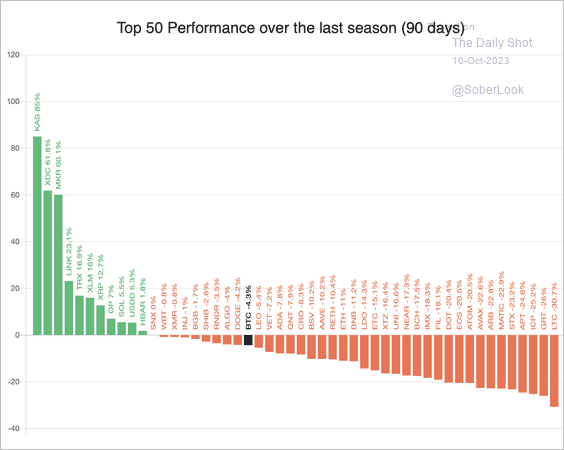

2. Approximately 40% of the top 50 altcoins have outperformed bitcoin over the past 90 days.

Source: Blockchain Center

Source: Blockchain Center

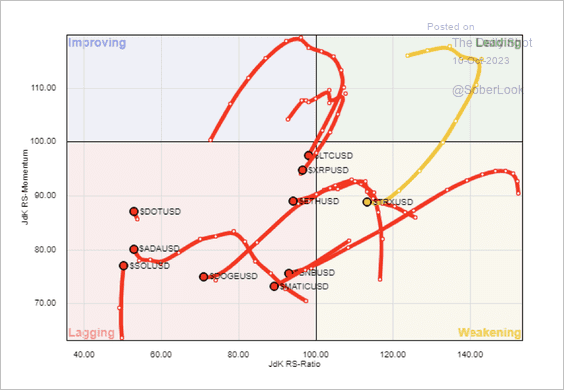

However, top altcoins have lost significant relative strength and momentum versus bitcoin over the past 12 months.

Source: @StocktonKatie

Source: @StocktonKatie

——————–

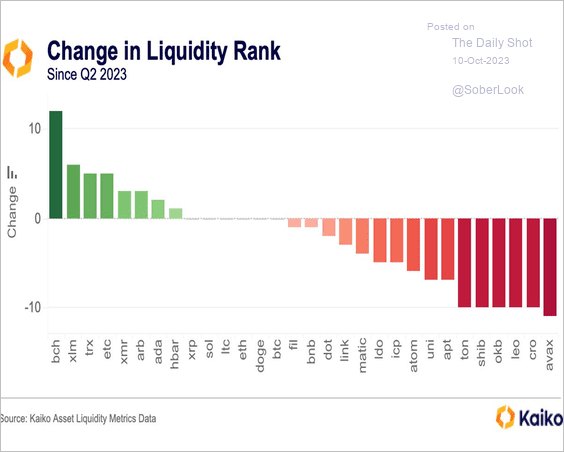

3. Bitcoin cash (BCH) has improved the most in Kaiko’s liquidity rankings in Q3.

Source: @KaikoData

Source: @KaikoData

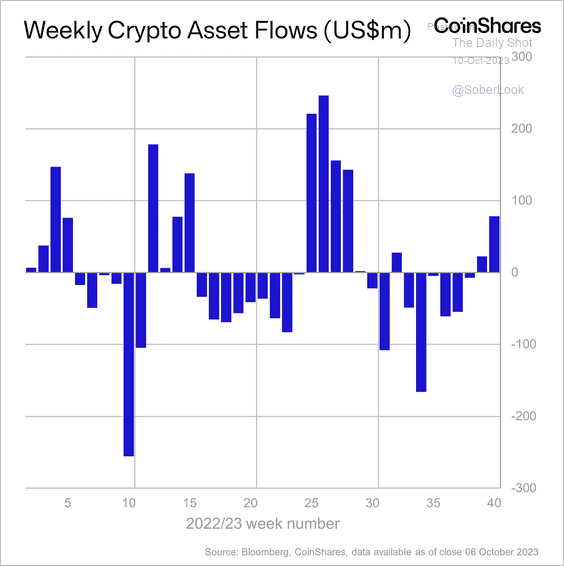

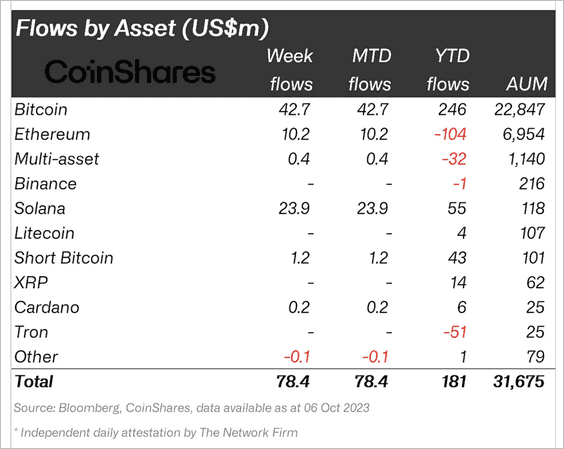

4. Crypto funds saw inflows for the second straight week led by bitcoin and solana-focused products. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

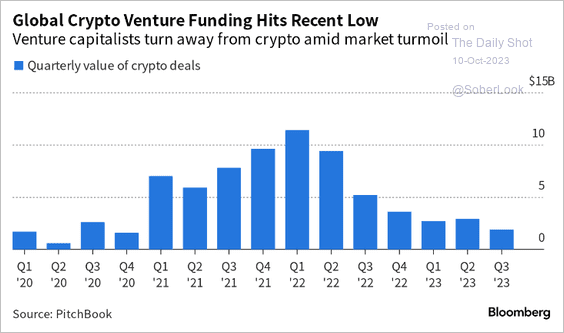

5. Crypto VC funding is drying up.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

Back to Index

Commodities

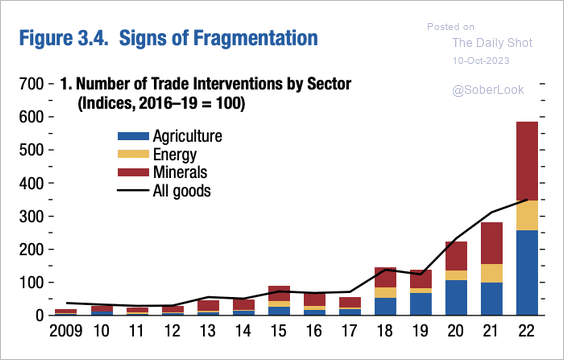

1. New restrictions affecting trade in commodities have been on the rise.

Source: IMF Read full article

Source: IMF Read full article

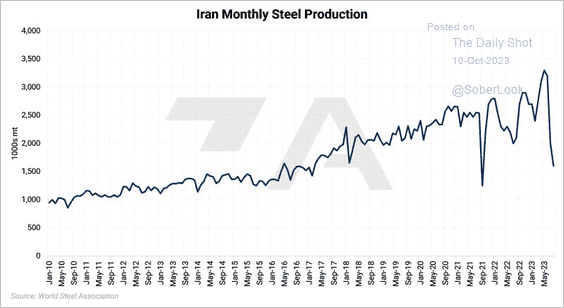

2. Iran’s steel production declined this year. According to AEGIS, Iran is the tenth largest steel producer in the world, with most exports going to the UAE for use in the oil industry.

Source: Chris Stadele; AEGIS Hedging

Source: Chris Stadele; AEGIS Hedging

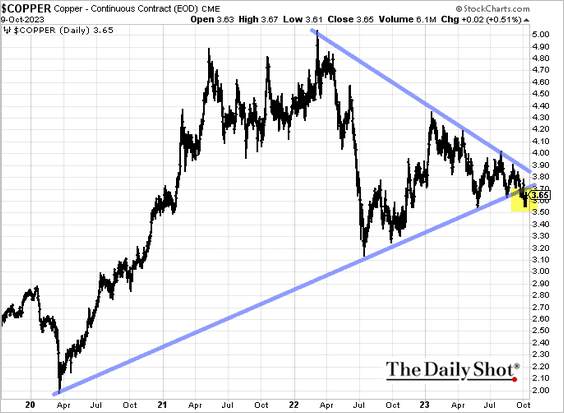

3. A fakout?

Back to Index

Energy

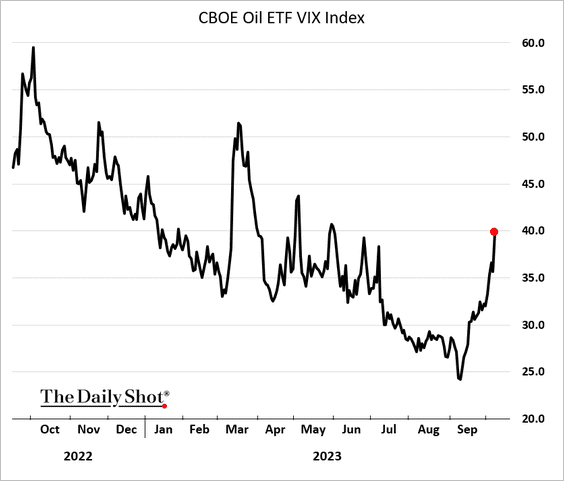

1. Oil implied volatility continues to rise.

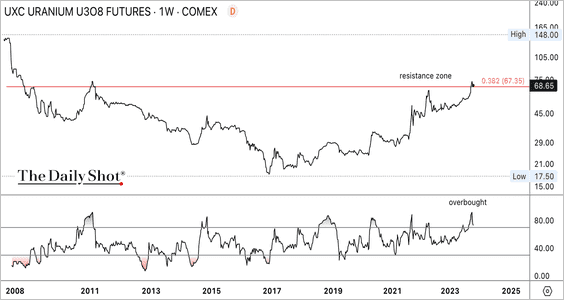

2. Uranium stocks are reversing a multi-year downtrend versus the broader commodity index.

• The Uranium futures price appears overbought.

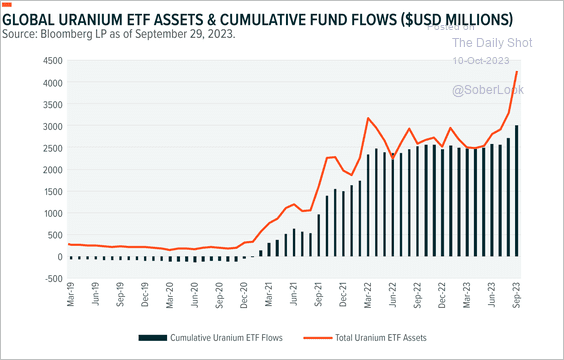

• Flows into uranium ETFs have accelerated in recent years.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Equities

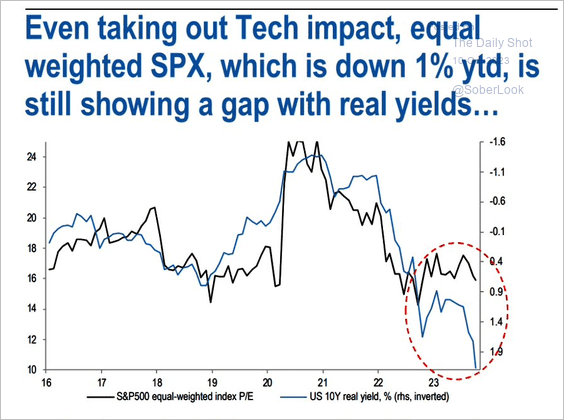

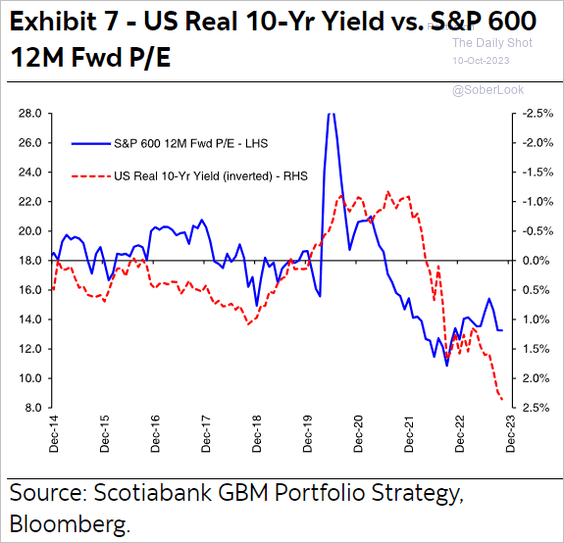

1. The disparity between valuations and real yields extends beyond the tech-heavy S&P 500.

• Equal-weighted index:

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

• Small caps:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

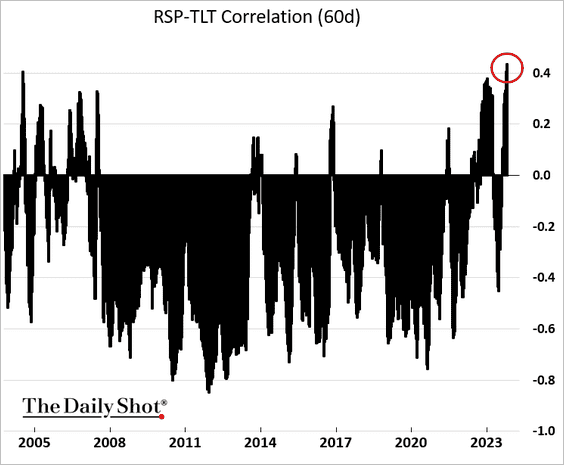

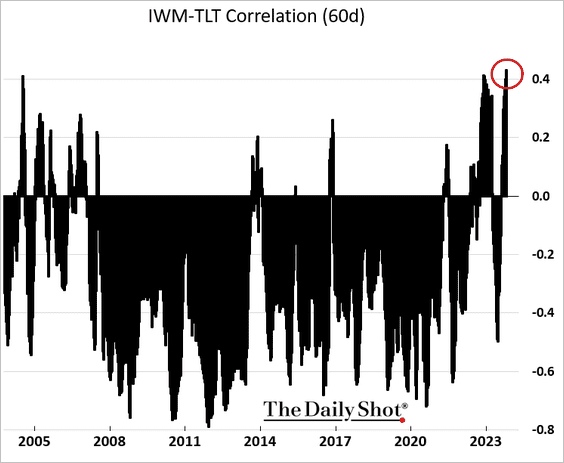

2. Similarly, the elevated correlation between stocks and bonds is not limited to the tech-heavy S&P 500.

• Equal-weighted index:

• Small caps (Russell 2000):

——————–

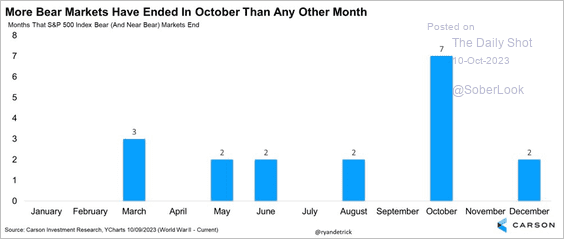

3. Seven of the past 18 bear markets ended in October.

Source: @RyanDetrick

Source: @RyanDetrick

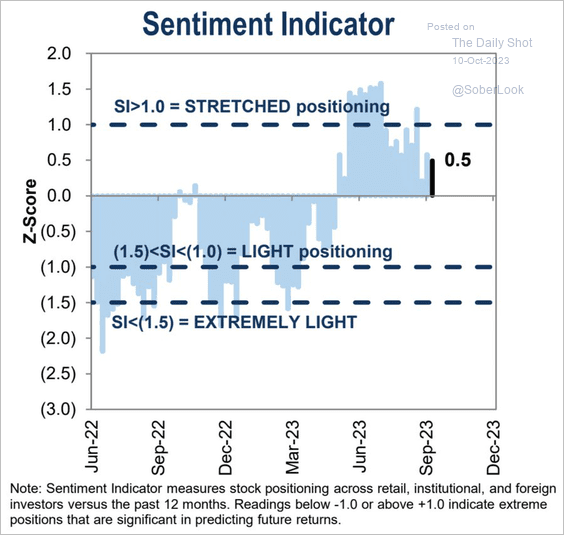

4. Goldman’s positioning index is holding up.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

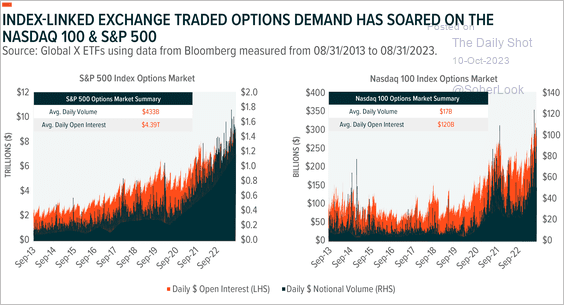

5. Open interest for index options on S&P 500 and Nasdaq 100 surged over the past three years.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

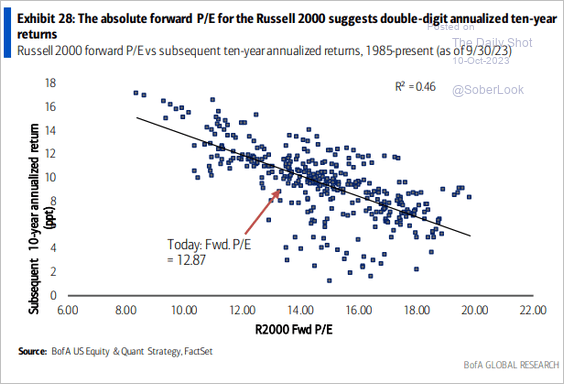

6. Should we expect attractive returns for small caps over the next decade?

Source: BofA Global Research

Source: BofA Global Research

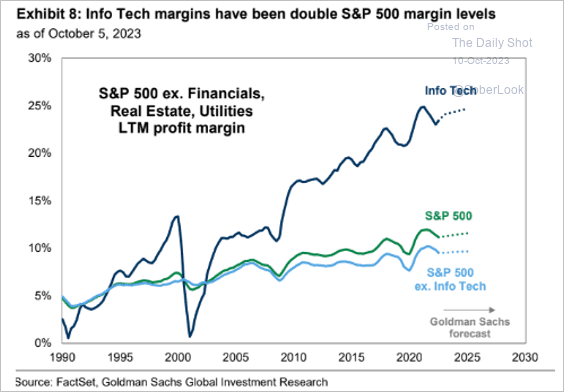

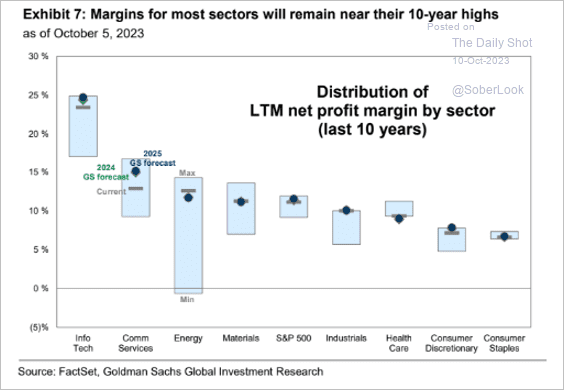

7. Here is a look at tech sector margins relative to the S&P 500.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Goldman expects margins to remain elevated.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Alternatives

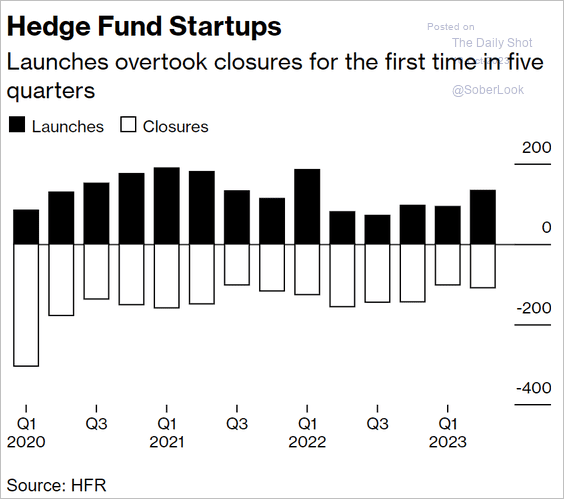

1. Let’s start with hedge fund launches and closures.

Source: @markets Read full article

Source: @markets Read full article

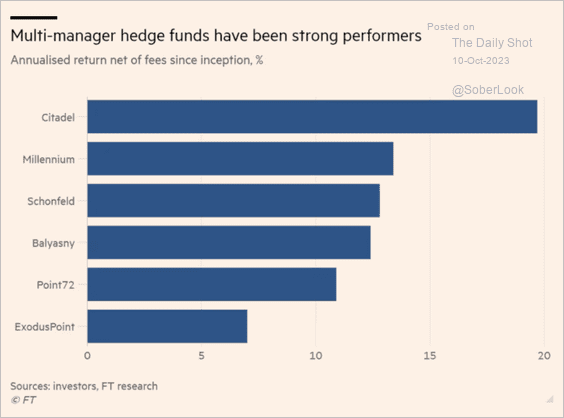

2. Several multimanager hedge funds have been very successful.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

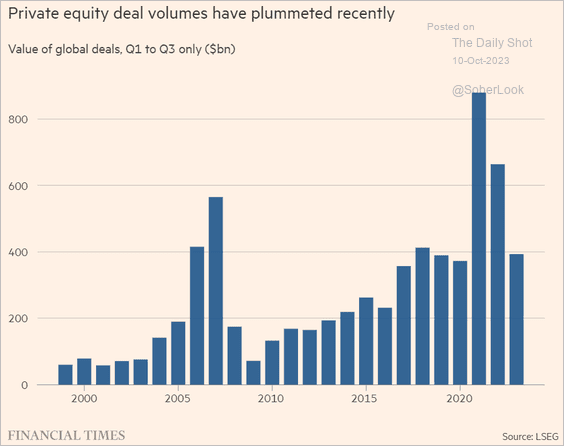

3. PE deal activity has been soft this year (chart shows Q1-Q3 deal volume for each year).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

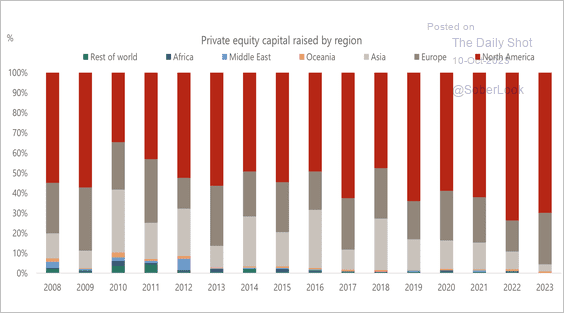

4. Roughly 70% of private equity capital is raised in North America.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

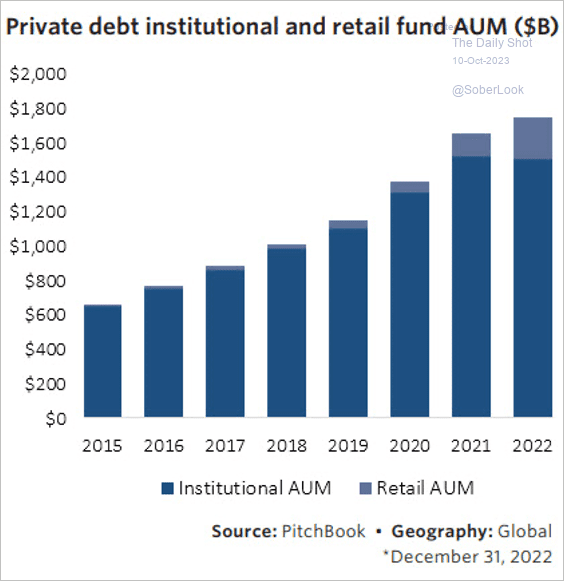

5. Institutional and retail investors continue to flock to private debt.

Source: PitchBook

Source: PitchBook

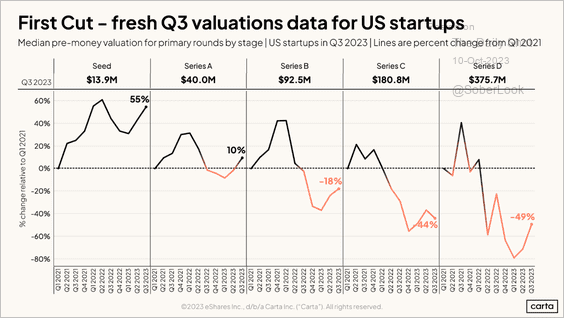

6. Median valuations for US primary rounds continued higher in Q3, although later rounds remain historically weak.

Source: Carta

Source: Carta

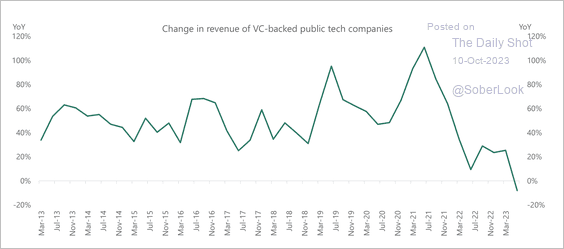

7. Revenue growth in venture capital-backed public tech companies turned negative.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Credit

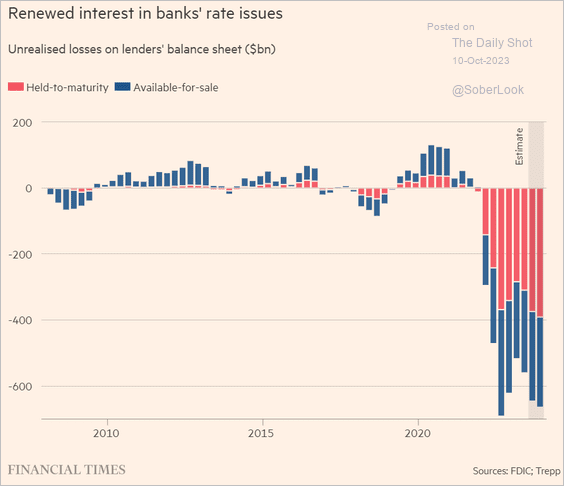

1. Let’s start with the updated chart showing unrealized losses at US banks.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

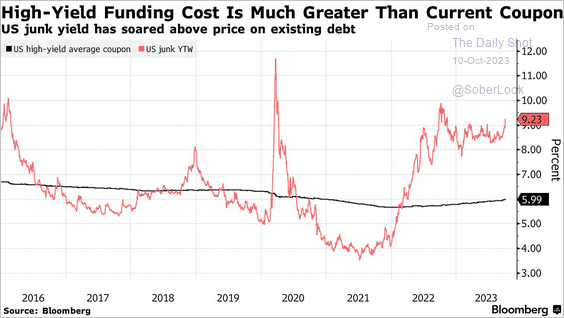

2. Refinancing will be painful for many companies.

Source: @markets Read full article

Source: @markets Read full article

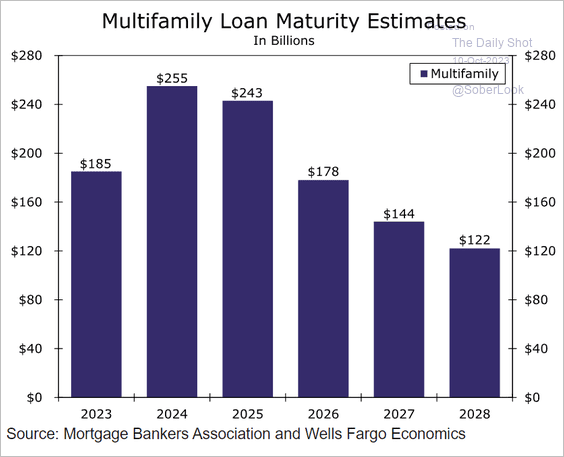

3. Multifamily credit markets face a challenging maturity wall.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

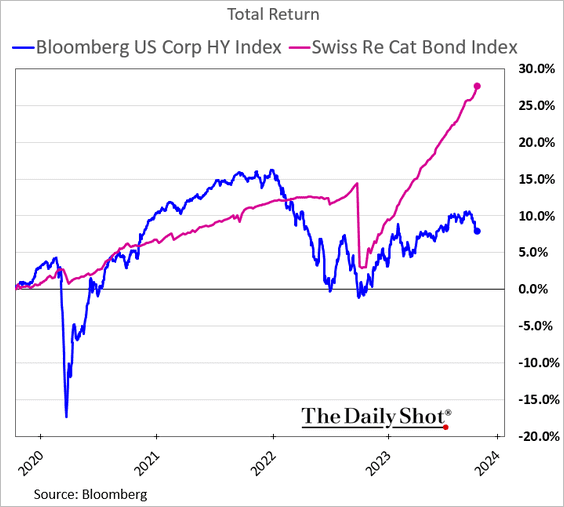

4. Cat bonds have been outperforming.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Rates

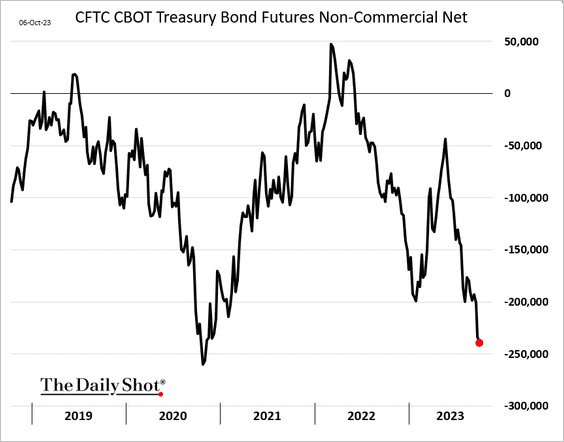

1. Bets against long-term Treasuries remain extreme.

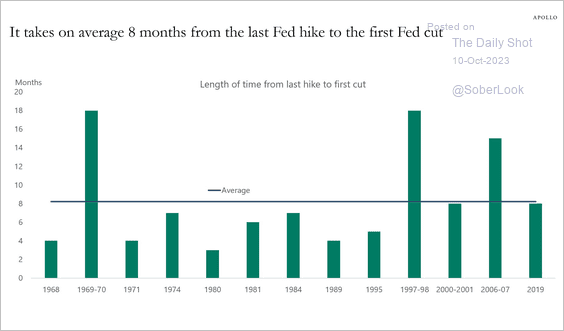

2. How long does it take between the last Fed rate hike and the first cut?

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Global Developments

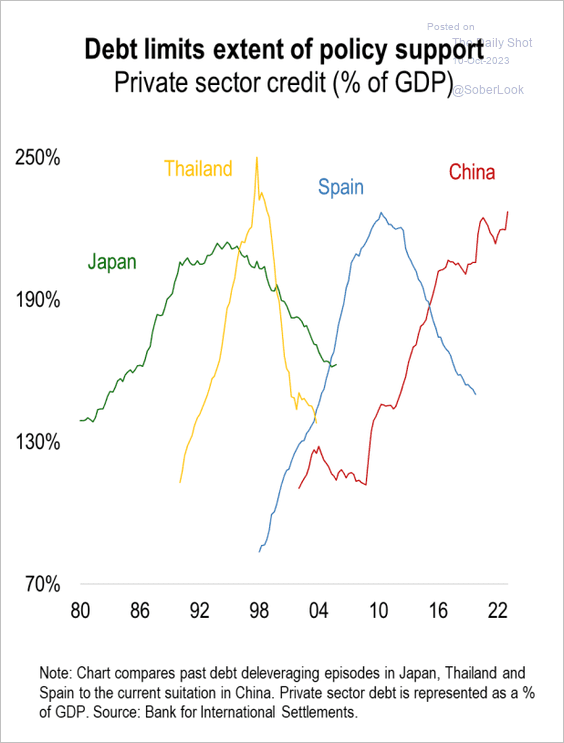

1. Here is a look at private sector credit cycles in select economies.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

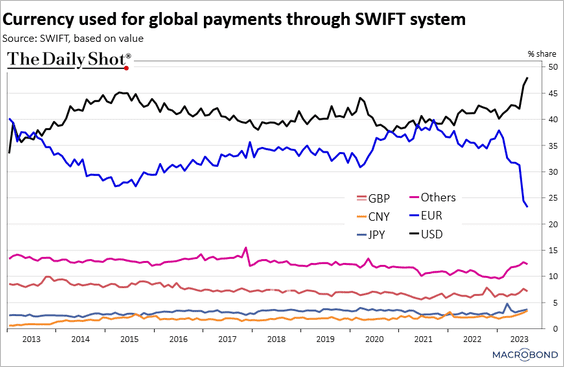

2. Recent months have seen a surge in US dollar usage for SWIFT system payments (at the expense of the euro).

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

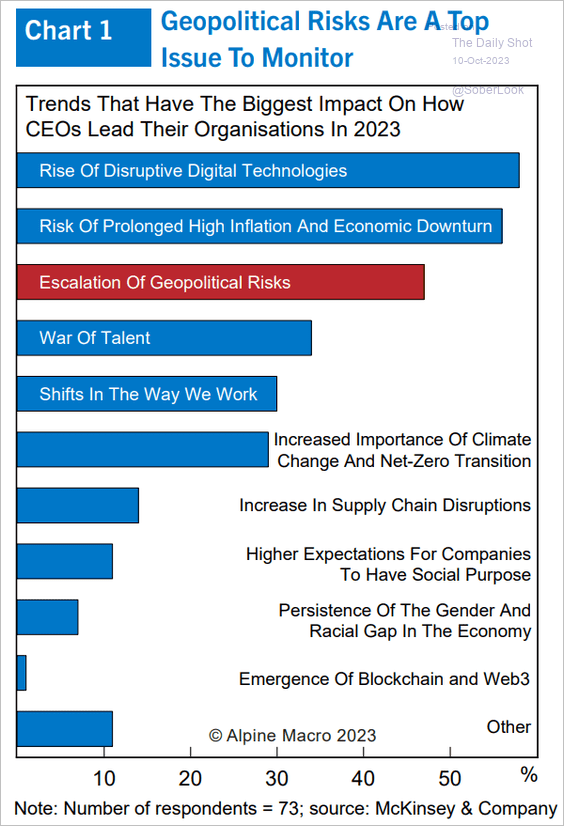

3. How concerned are CEOs about geopolitical risks?

Source: Alpine Macro

Source: Alpine Macro

——————–

Food for Thought

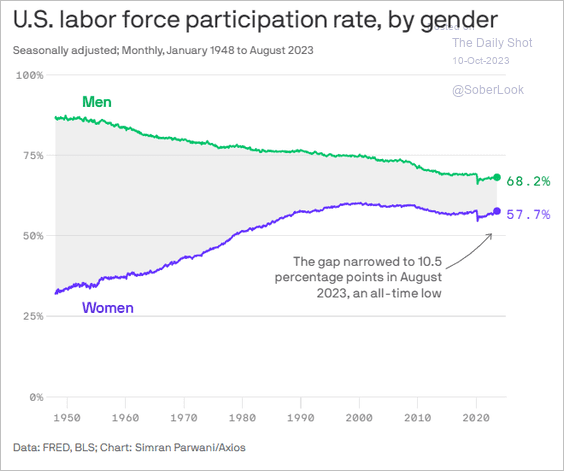

1. Labor force participation by gender:

Source: @axios Read full article

Source: @axios Read full article

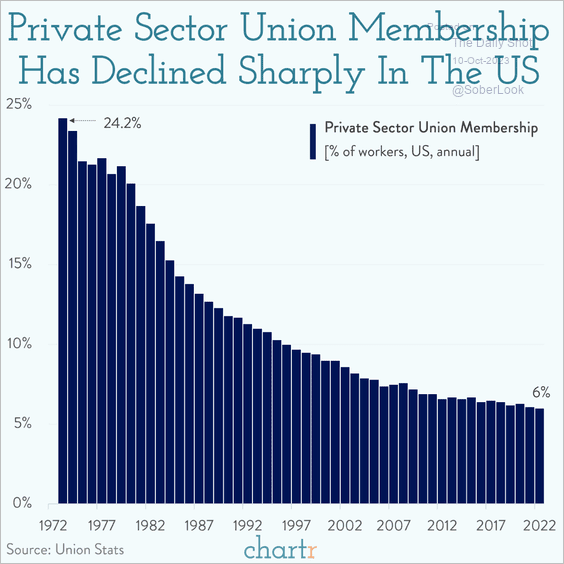

2. Private sector union membership:

Source: @chartrdaily

Source: @chartrdaily

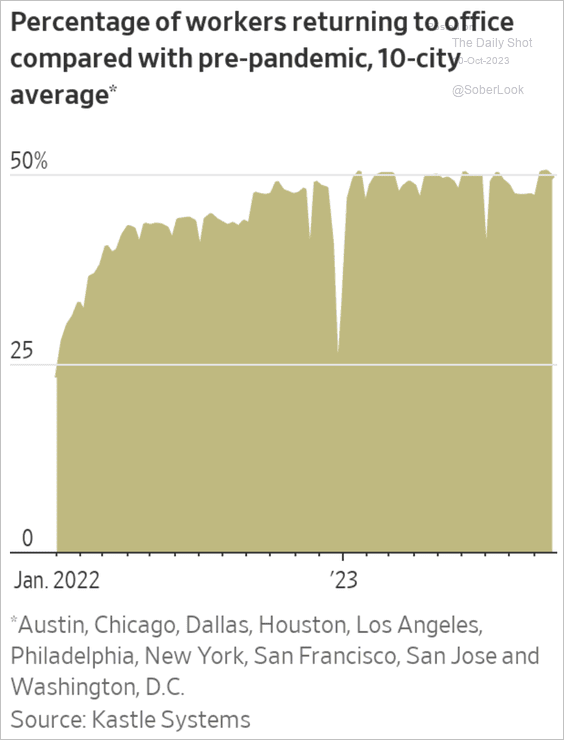

3. Office return rates in major US cities have plateaued at around 50%.

Source: @WSJ Read full article

Source: @WSJ Read full article

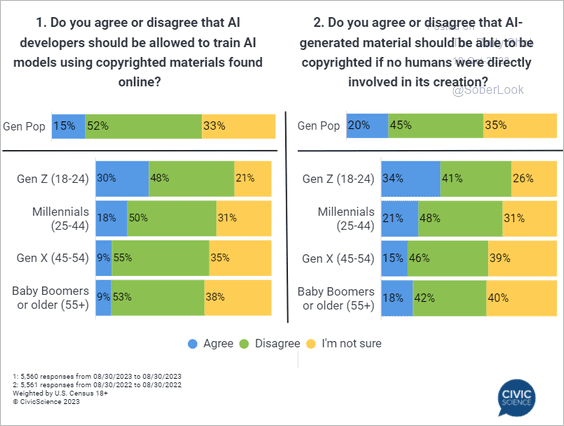

4. AI and intellectual property:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

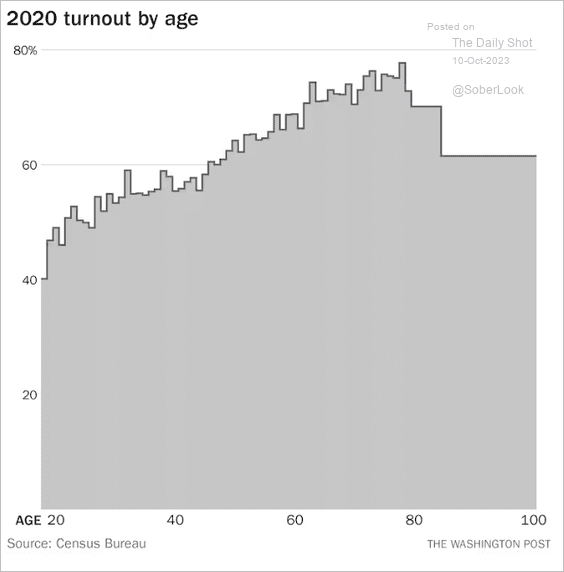

5. US voter turnout by age:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

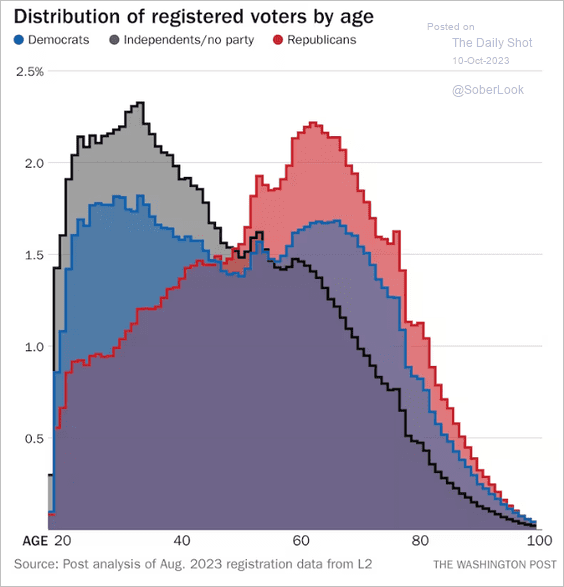

• The distribution of US voters by age:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

——————–

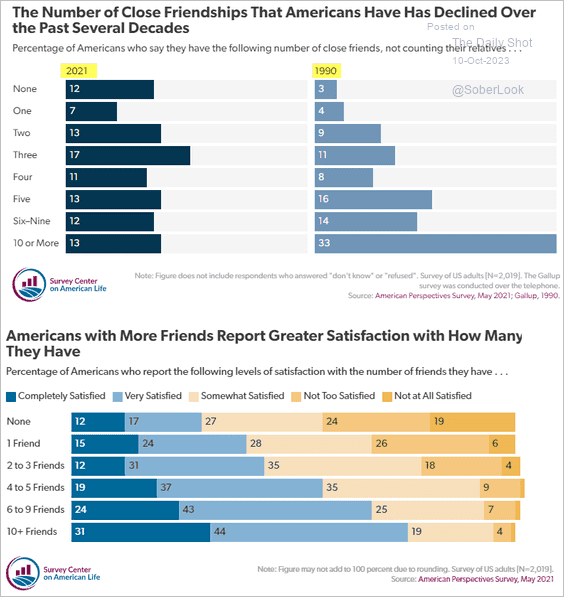

6. The number of close friendships:

Source: AEI, The Survey Center on American Life Read full article

Source: AEI, The Survey Center on American Life Read full article

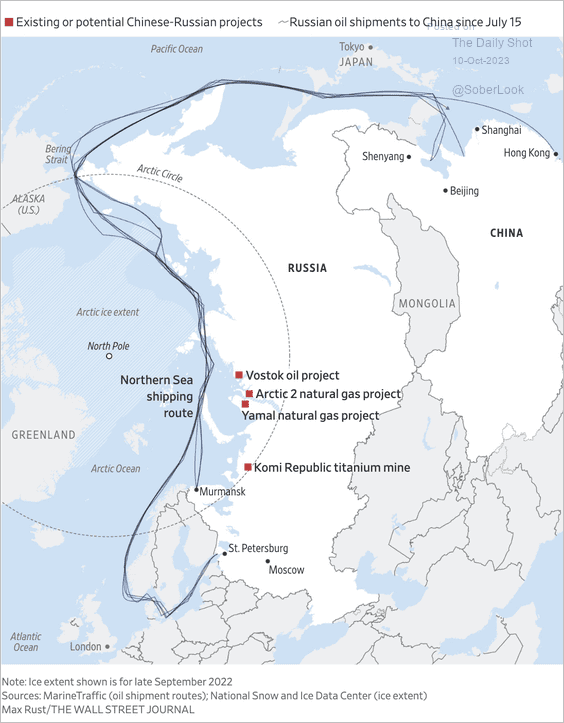

7. Russian oil shipments to China:

Source: @WSJ Read full article

Source: @WSJ Read full article

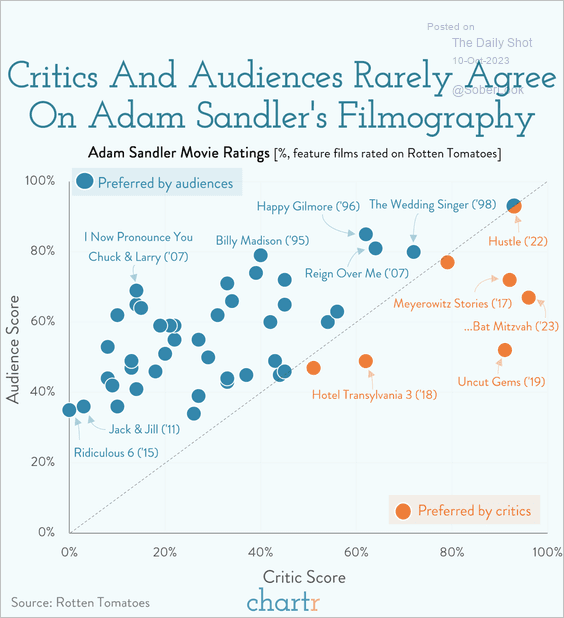

8. Adam Sandler movie ratings:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index