The Daily Shot: 12-Oct-23

• The United Kingdom

• The Eurozone

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

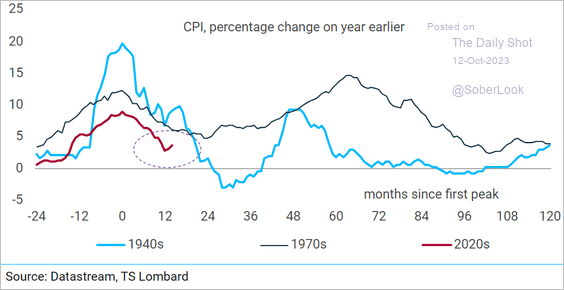

1. The FOMC minutes showed the Fed’s ongoing concerns about upside risks to inflation, …

These risks included the imbalance of aggregate demand and supply persisting longer than expected, as well as risks emanating from global oil markets, the potential for upside shocks to food prices, the effects of a strong housing market on shelter inflation, and the potential for more limited declines in goods prices.

… amid robust economic growth.

Some participants remarked that an upside risk to their projections for economic activity was that the unexpected resilience that the economy had demonstrated so far could persist.

The focus has shifted from the level of the terminal rate to “higher for longer” …

All participants agreed that policy should remain restrictive for some time until the Committee is confident that inflation is moving down sustainably toward its objective.

… to reduce the risk of “reacceleration.”

Source: TS Lombard

Source: TS Lombard

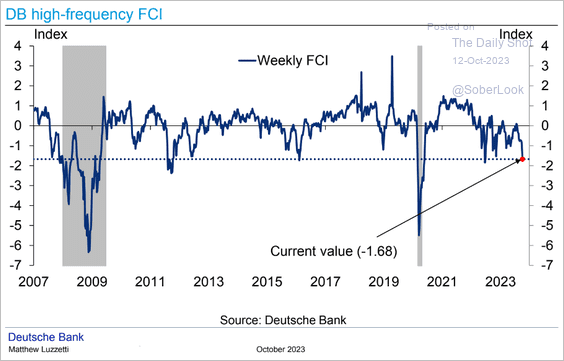

• But with Treasury yields surging since the FOMC meeting and financial conditions tightening sharply (chart below), the minutes represent stale information.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

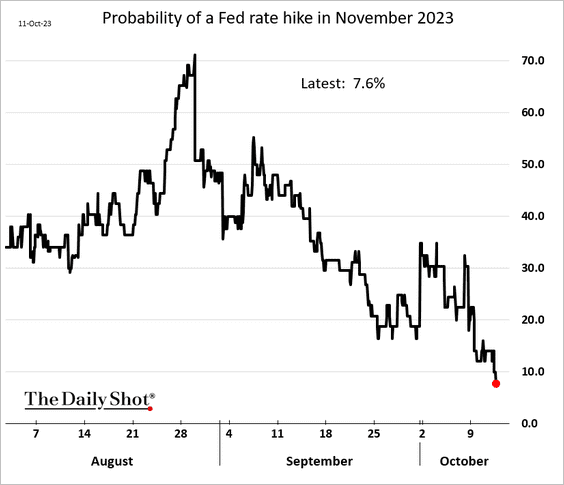

At this point, the market does not expect a rate hike in November.

——————–

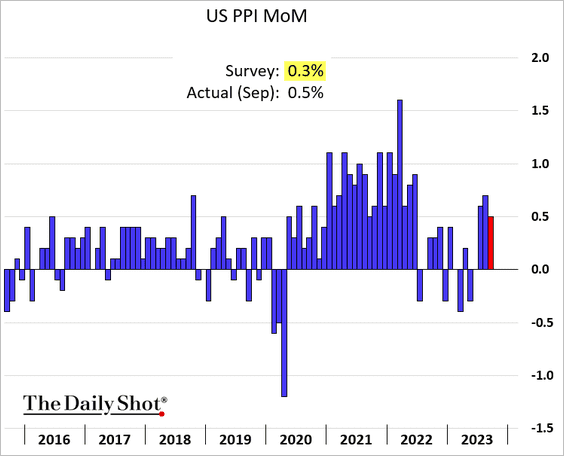

2. Gains in producer prices last month topped expectations.

Source: CNBC Read full article

Source: CNBC Read full article

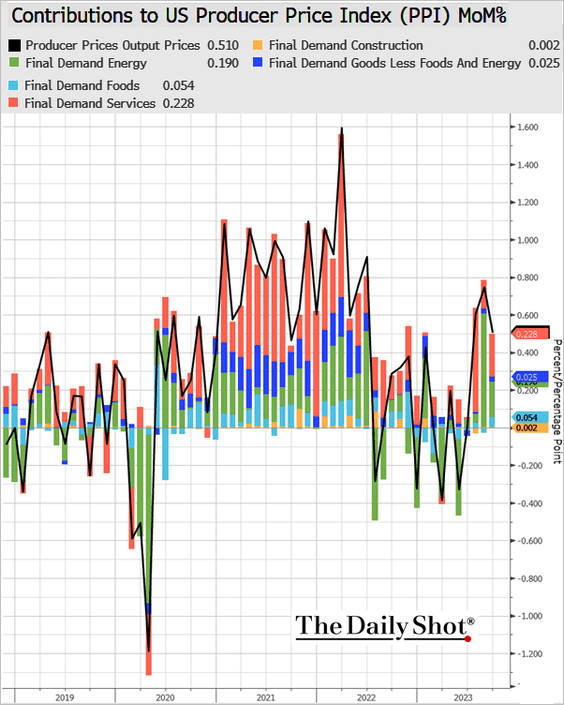

• PPI components (month over month):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

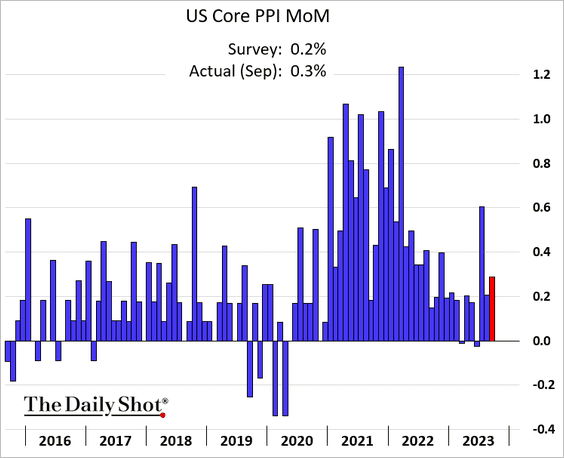

• Core PPI:

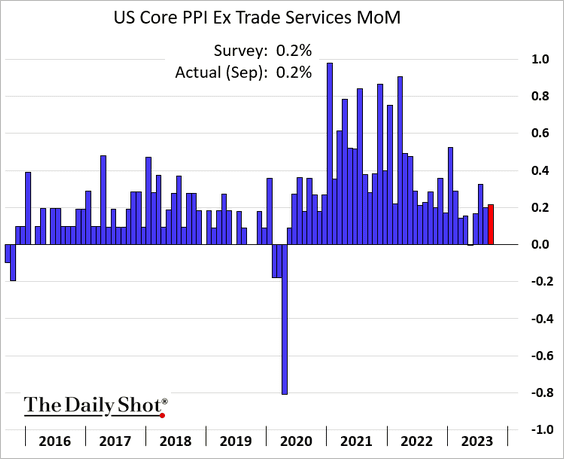

• Core PPI excluding trade services (business markups):

——————–

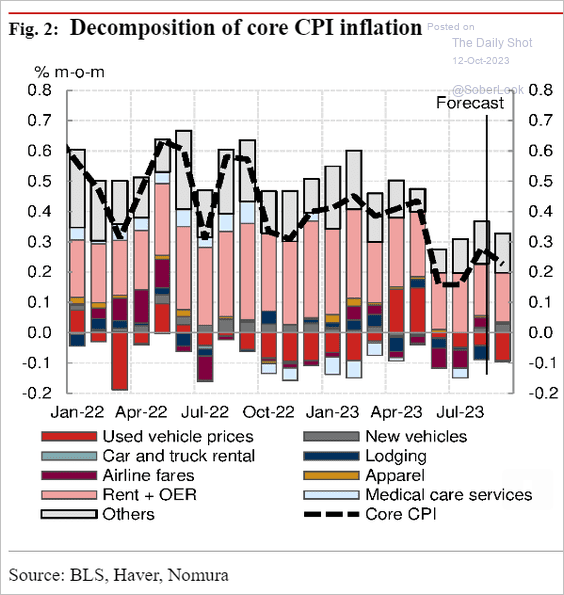

3. Lower used vehicle prices and a deceleration in rent inflation drove a modest reduction in core CPI gains last month, according to Nomura.

Source: Nomura Securities

Source: Nomura Securities

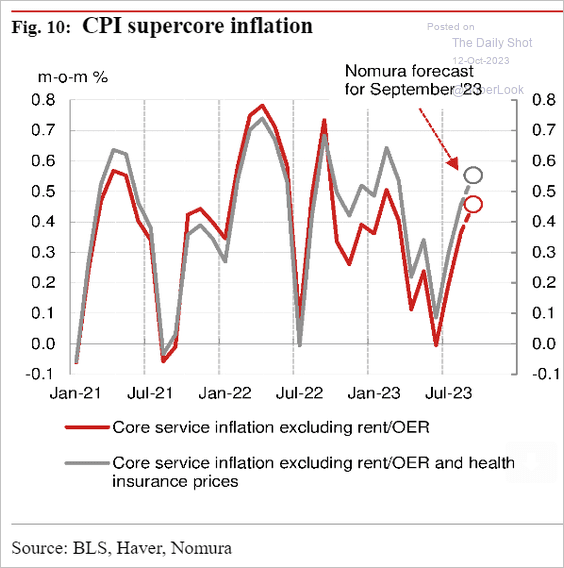

• However, the supercore CPI rate is expected to be higher.

Source: Nomura Securities

Source: Nomura Securities

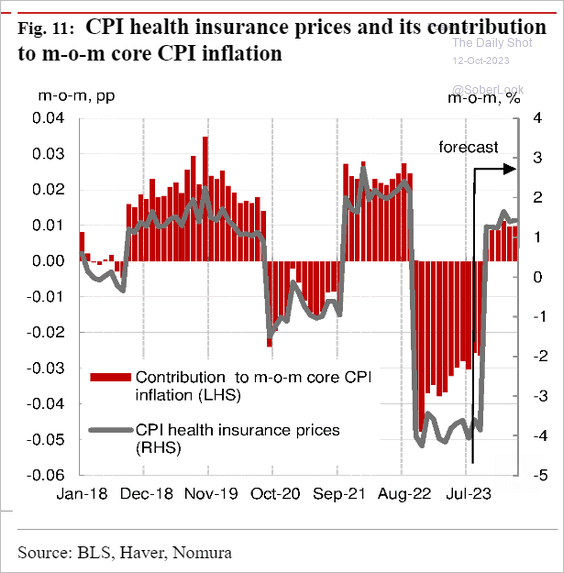

• What about October?

Nomura: … we see upside risks to October core CPI inflation as a widely anticipated drop in new vehicle supply due to the ongoing UAW strikes might push up vehicle prices further. In addition, … CPI’s health insurance prices will likely start increasing 1.2-1.4% m-o-m in October due to the BLS annual sample updates and methodological changes for that component …

Source: Nomura Securities

Source: Nomura Securities

——————–

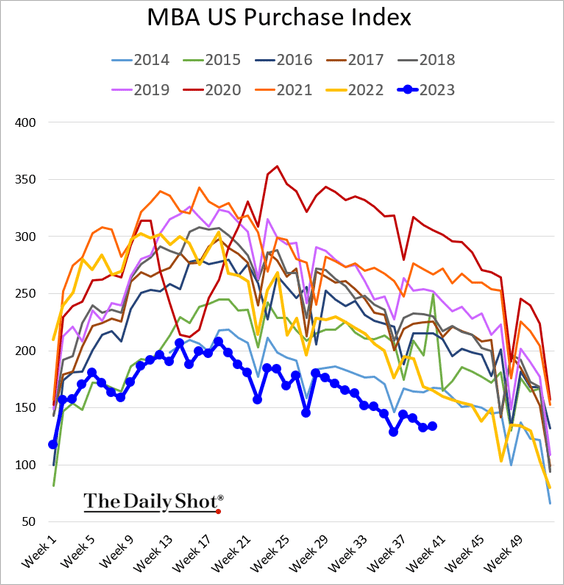

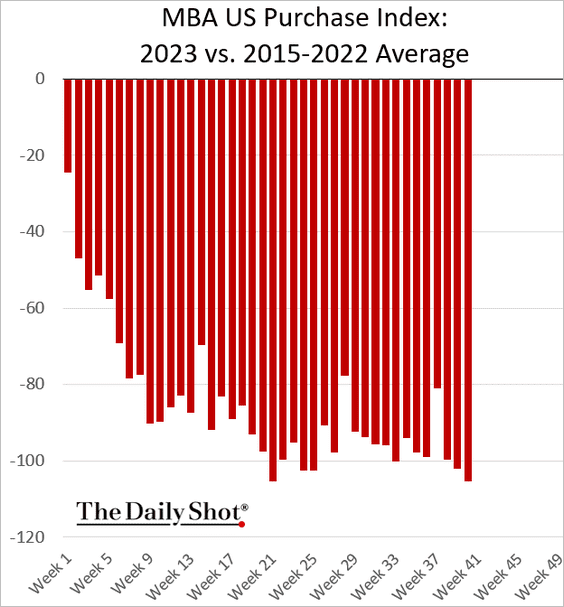

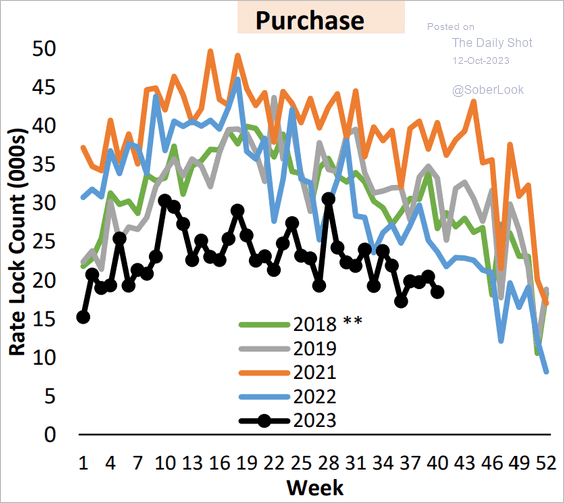

4. Mortgage applications remain depressed (2 charts).

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

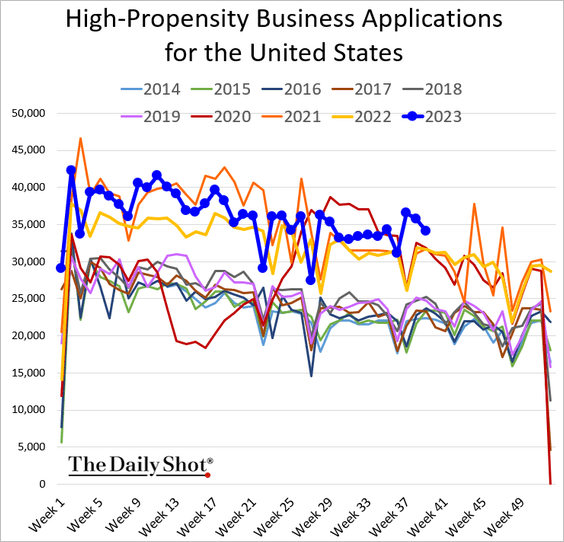

5. Business applications are running well above pre-COVID levels.

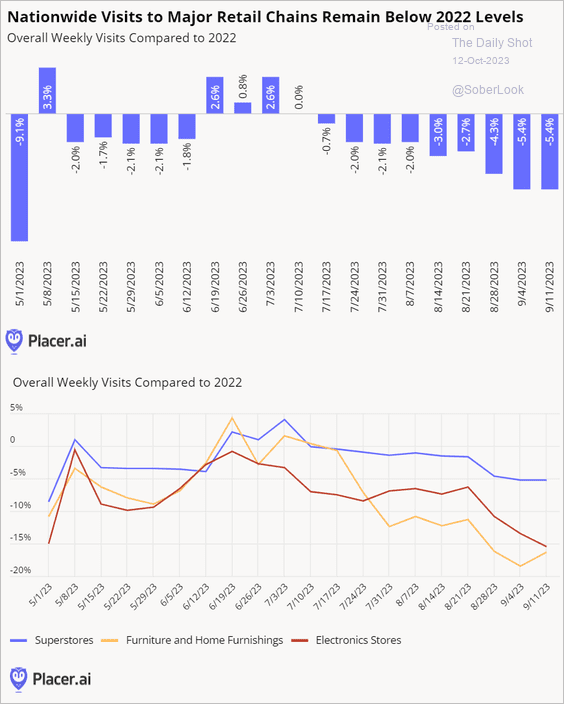

6. Visits to major retail chains remain well below last year’s levels.

Source: Placer.ai

Source: Placer.ai

The United Kingdom

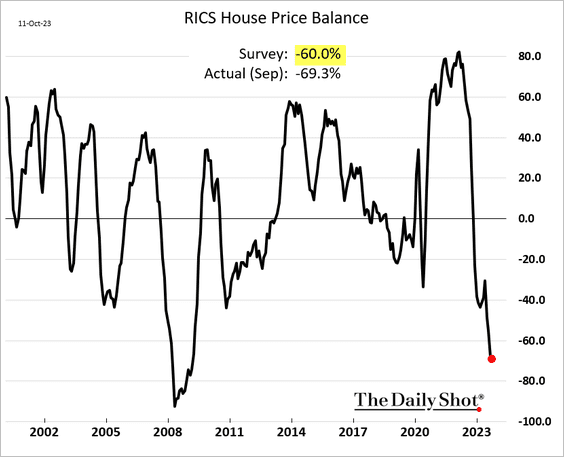

1. The housing market slump hasn’t been this severe since the financial crisis.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

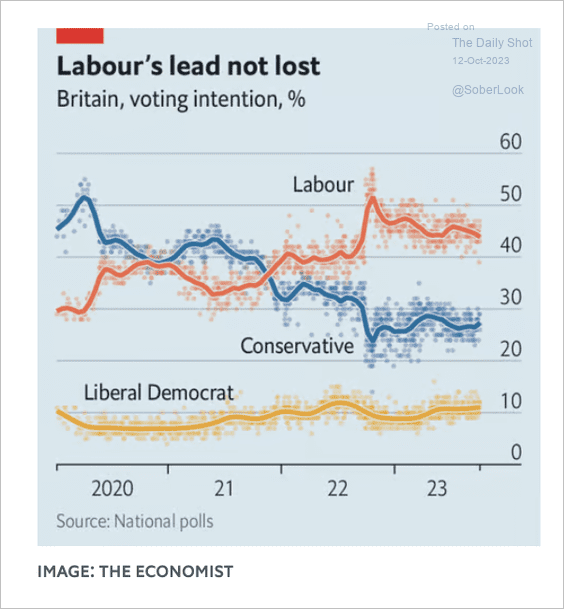

2. Here is a look at the latest voting intention polls.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

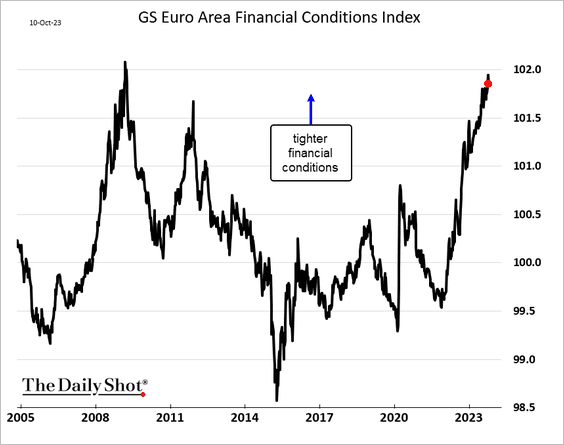

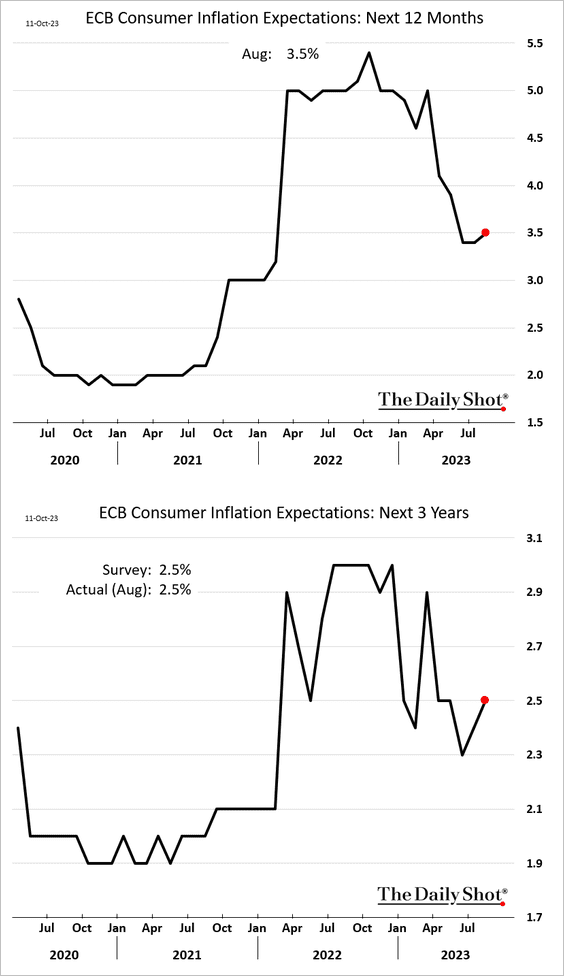

The Eurozone

1. According to Goldman’s indicator, euro-area financial conditions haven’t been this tight since the GFC.

2. Consumer inflation expectations climbed in August.

Back to Index

Japan

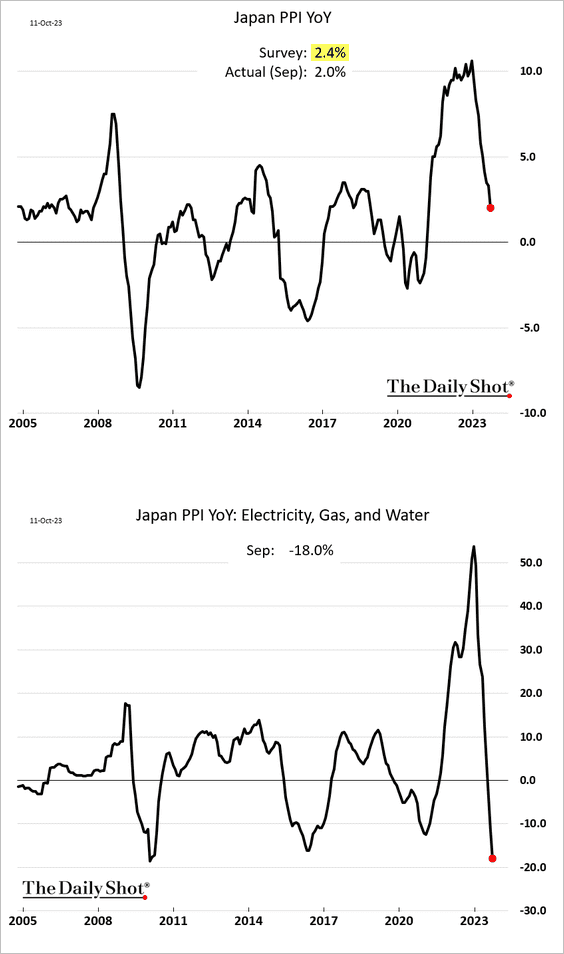

1. The PPI report surprised to the downside, showing a rapid deceleration in upstream inflation.

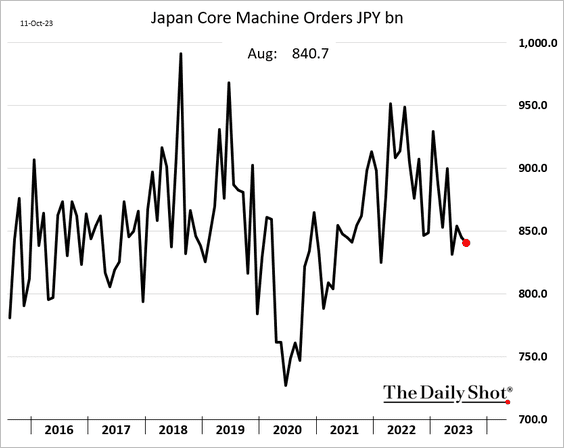

2. August machinery orders disappointed.

Source: Reuters Read full article

Source: Reuters Read full article

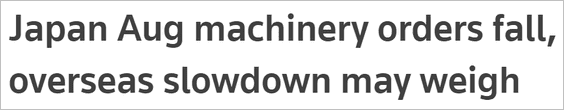

But machine tool orders showed an improvement last month.

Back to Index

Asia-Pacific

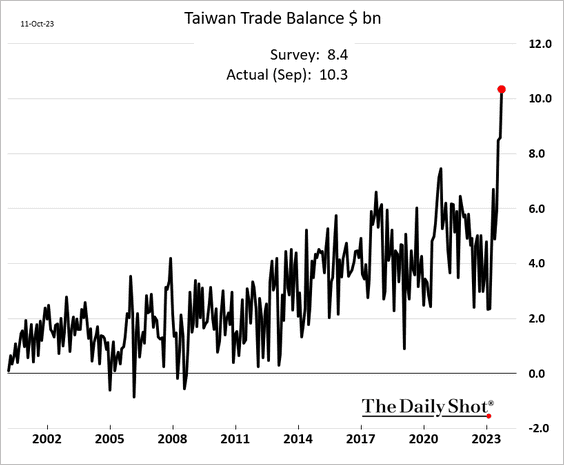

1. Taiwan’s trade surplus surged to a record high, …

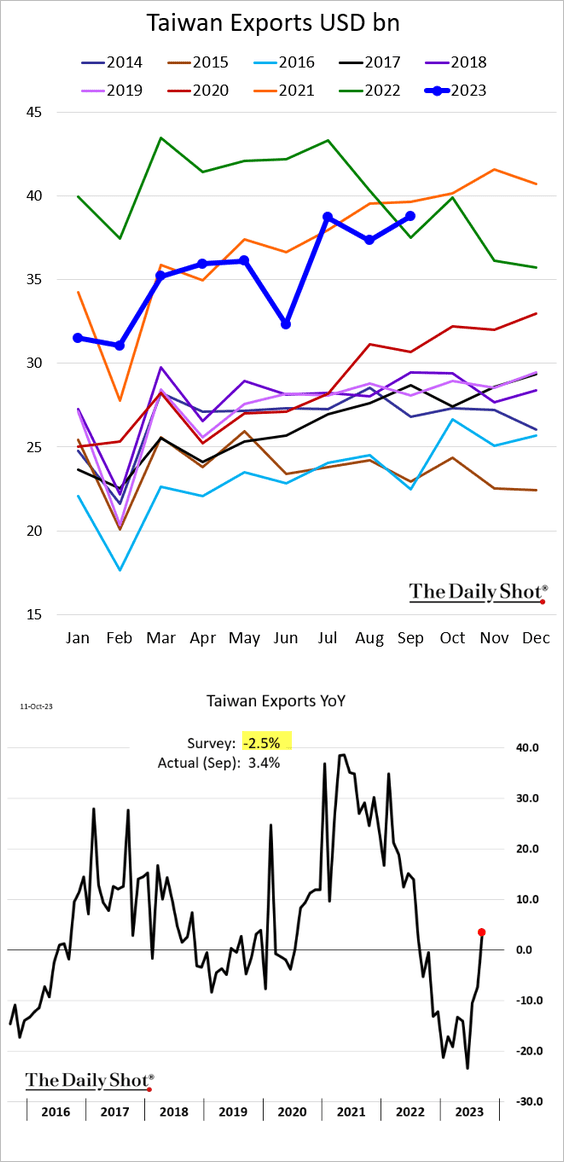

… as exports unexpectedly climbed above last year’s level.

Source: @markets Read full article

Source: @markets Read full article

——————–

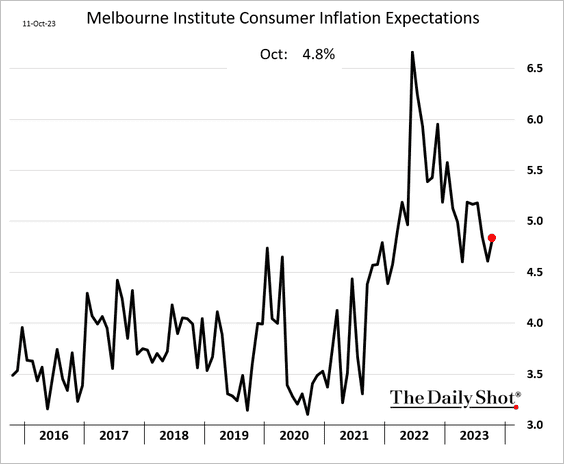

2. Australian inflation expectations are back above the pre-COVID peak.

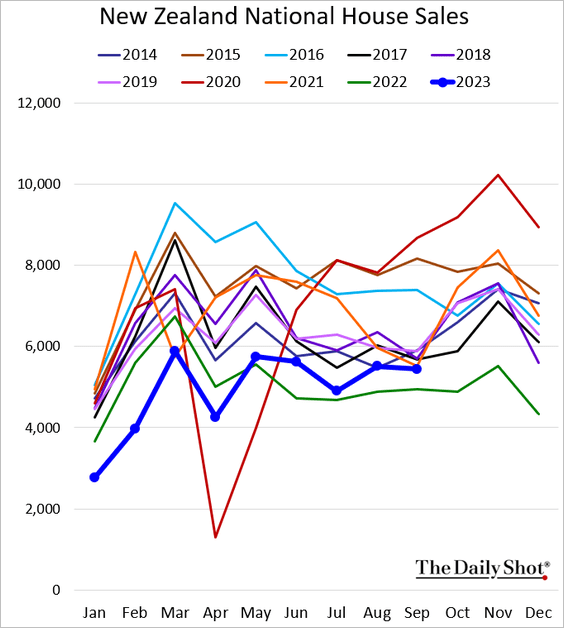

3. New Zealand’s house sales are holding above 2022 levels.

Back to Index

China

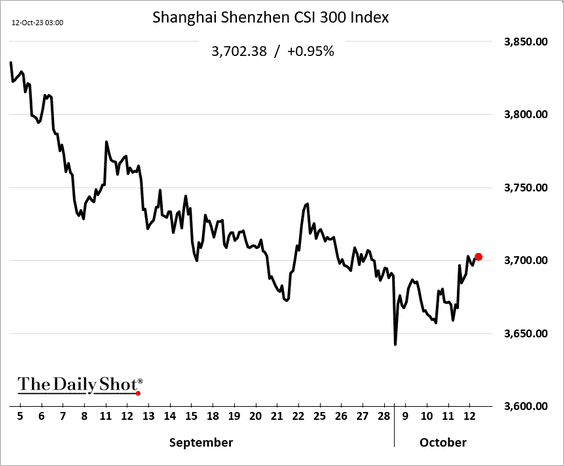

1. Stocks jumped this week, …

… as Beijing attempts to prop up the market.

Source: @markets Read full article

Source: @markets Read full article

——————–

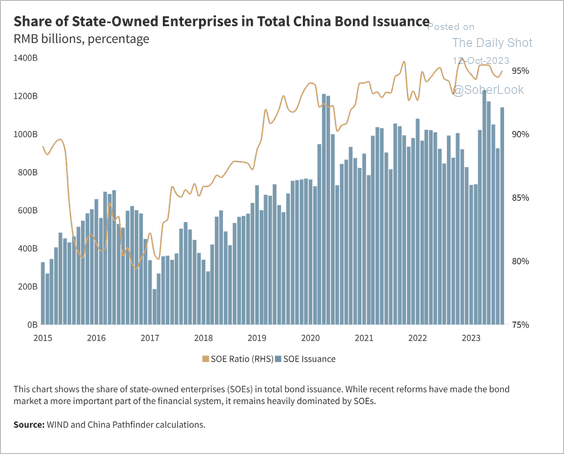

2. State-owned enterprises dominate China’s bond market.

Source: China Pathfinder Read full article

Source: China Pathfinder Read full article

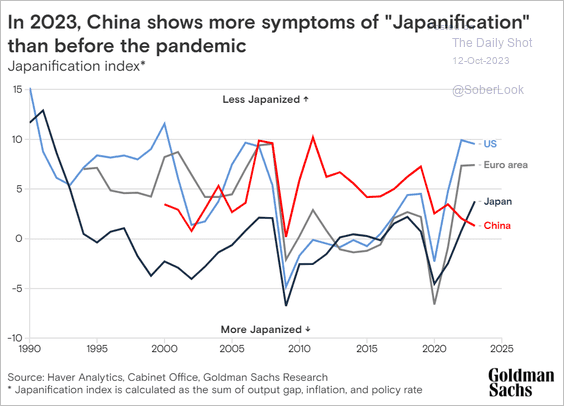

3. Japanification?

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Emerging Markets

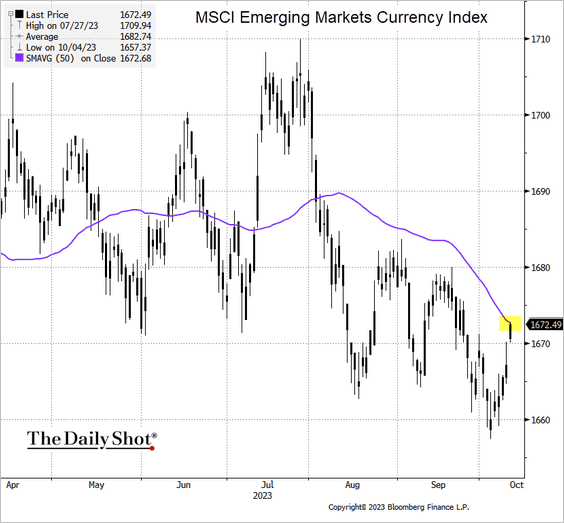

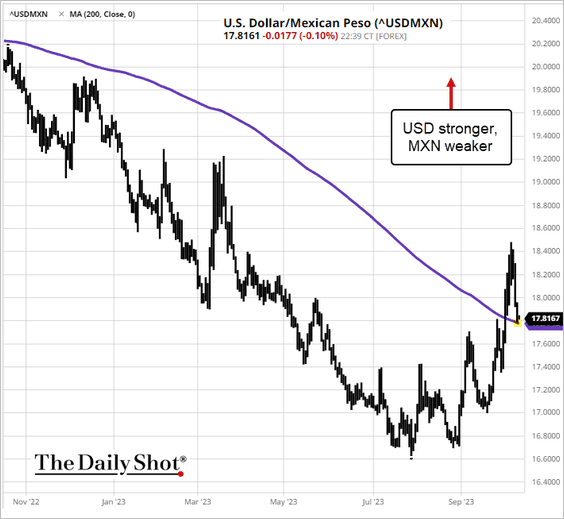

EM currencies bounced this week, with the MSCI currency index reaching its 50-day moving average.

• The Mexican peso rebounded, with USD/MXN testing support at the 200-day moving average.

Source: barchart.com

Source: barchart.com

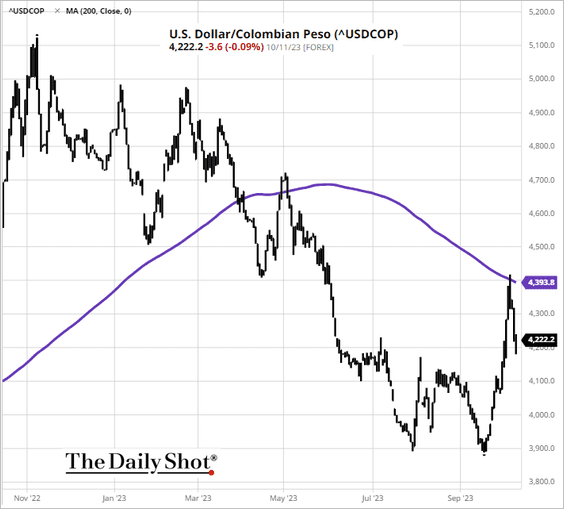

• Here is USD/COP (the Colombian peso).

Back to Index

Cryptocurrency

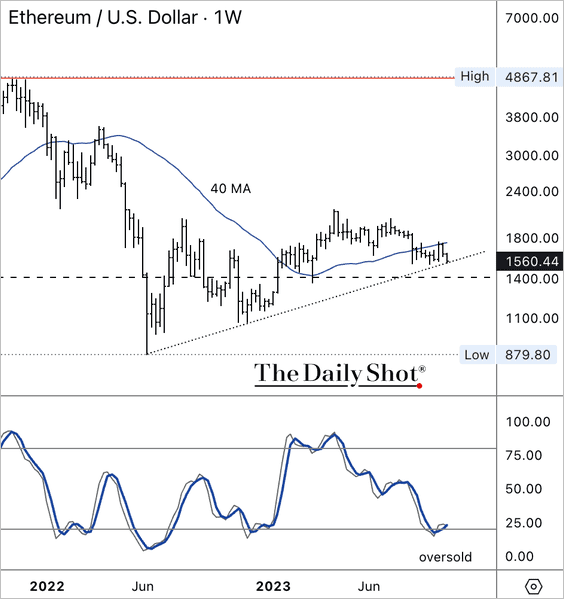

1. ETH/USD is stuck below its 40-week moving average, although technicals suggest the pair is oversold.

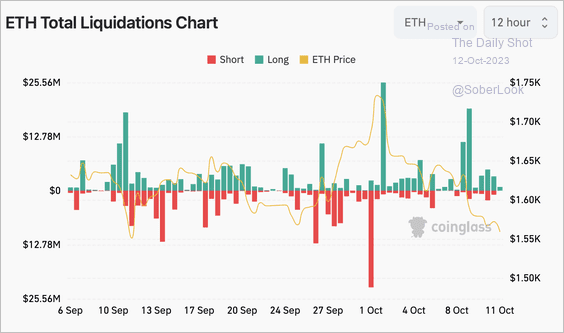

2. ETH saw a spike in long liquidations since breaking below $1,730 (near its 40-week moving average).

Source: Coinglass

Source: Coinglass

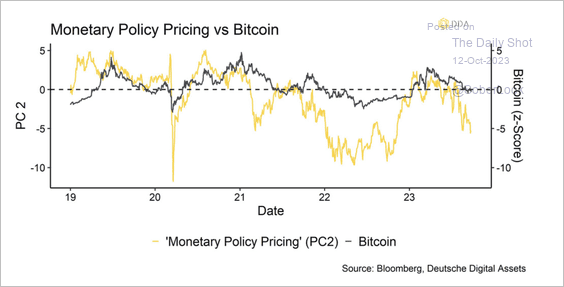

3. Tight monetary policy remains a headwind for cryptocurrencies.

Source: Deutsche Digital Assets

Source: Deutsche Digital Assets

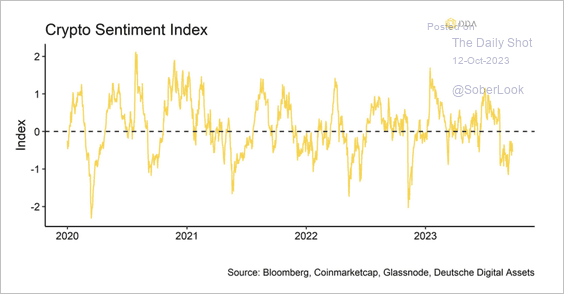

4. Crypto sentiment is slightly bearish.

Source: Deutsche Digital Assets

Source: Deutsche Digital Assets

Back to Index

Commodities

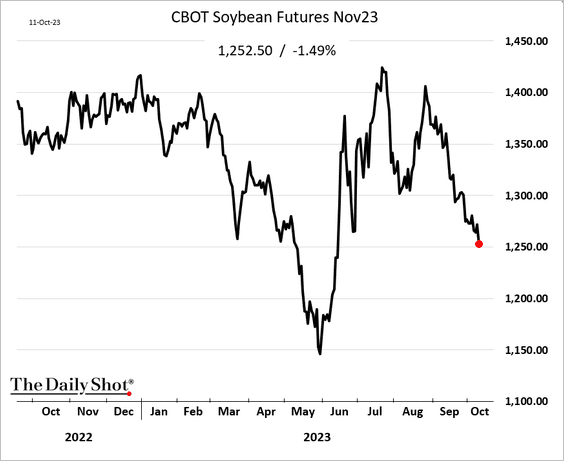

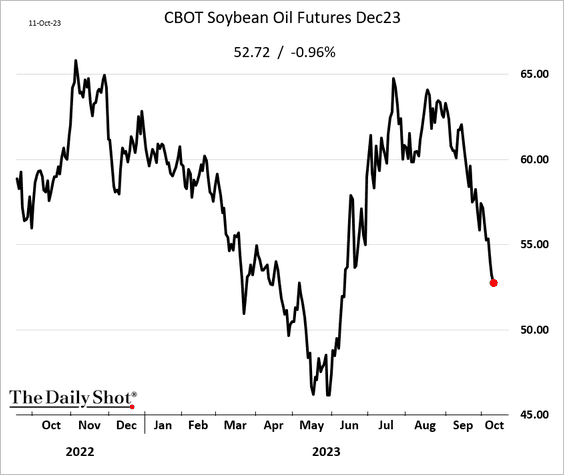

1. Soybean futures slumped in recent weeks on improving supply outlook in the US and Brazil.

Here is soybean oil.

——————–

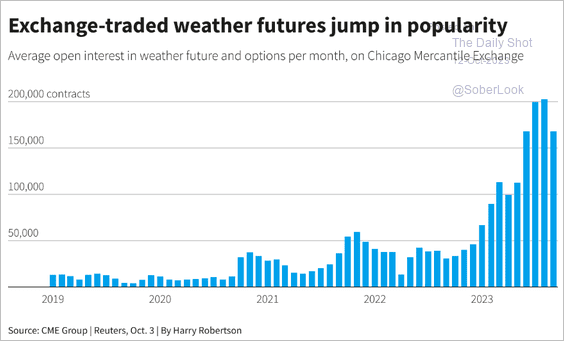

2. Exchange-traded weather derivatives are becoming more popular.

Source: Reuters Read full article

Source: Reuters Read full article

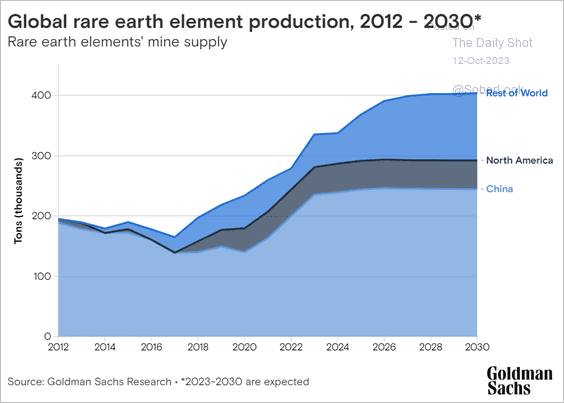

3. This chart shows Goldman’s forecast for rare earths production.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Energy

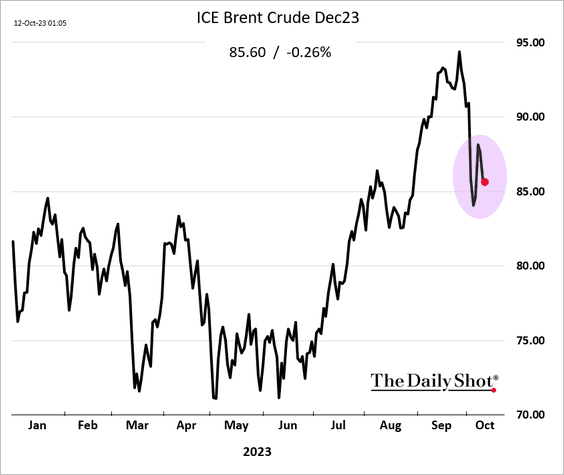

1. Crude oil prices are retreating from earlier gains that were spurred by the surge in Middle East violence.

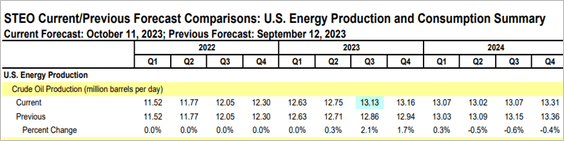

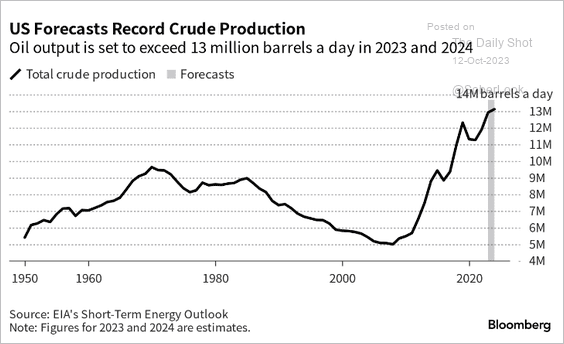

• According to the US Department of Energy, US crude oil production hit a record high in Q3 (13.13 million barrels per day).

Source: @EIAgov Read full article

Source: @EIAgov Read full article

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

——————–

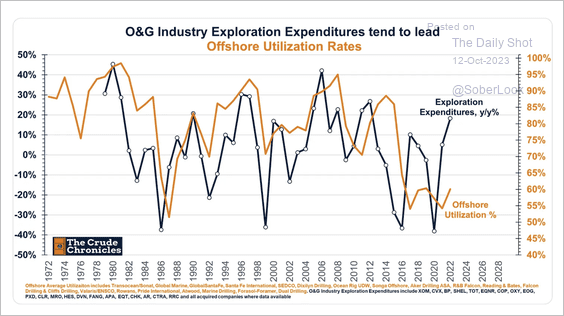

2. US oil and gas exploration spending growth rebounded last year off a low base, which could point to higher offshore utilization.

Source: The Crude Chronicles

Source: The Crude Chronicles

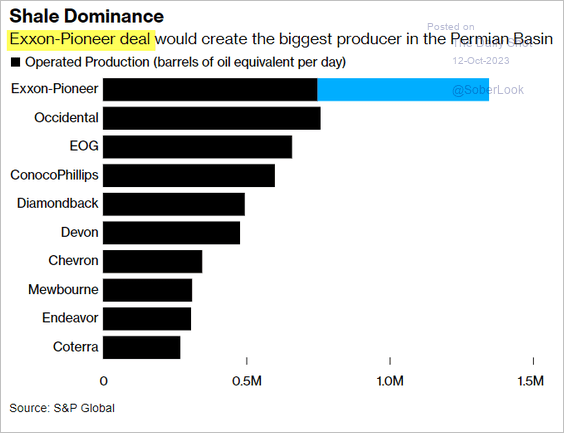

3. Here is a look at top shale producers after the Exxon-Pioneer deal.

Source: @markets Read full article

Source: @markets Read full article

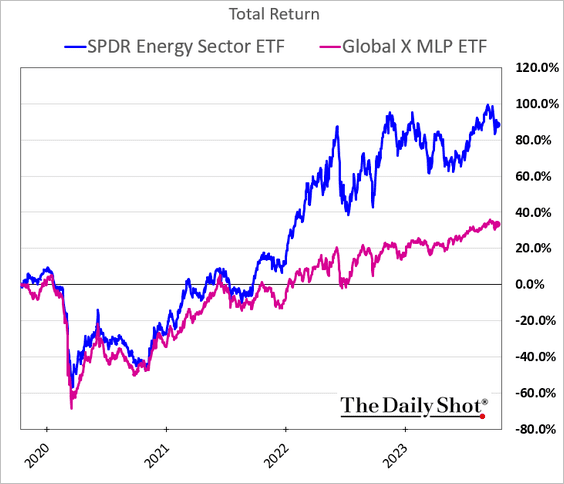

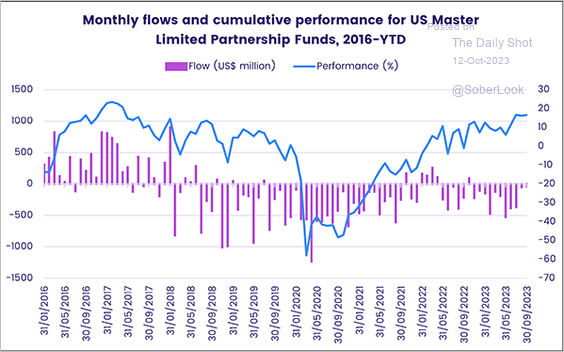

4. MLPs (pipeline companies) have been rebounding (on a total return basis) but are lagging the overall energy sector.

• MLP funds continue to see outflows.

Source: EPFR

Source: EPFR

Back to Index

Equities

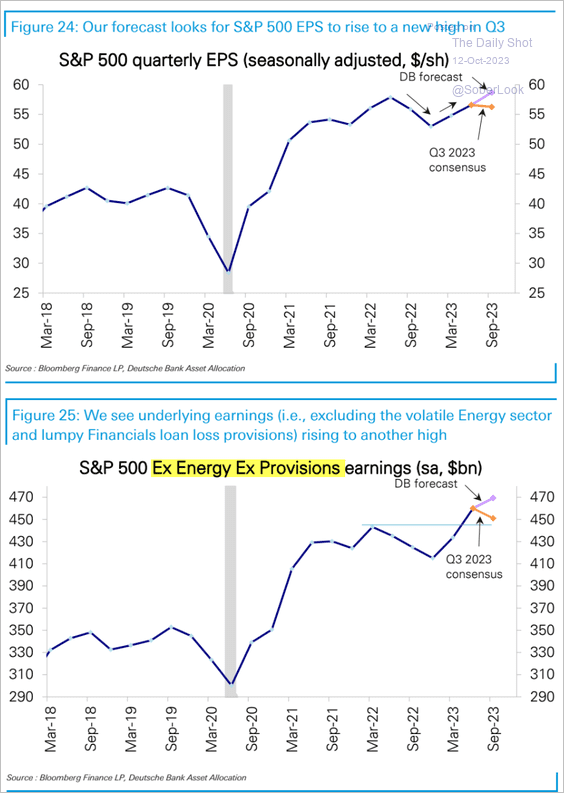

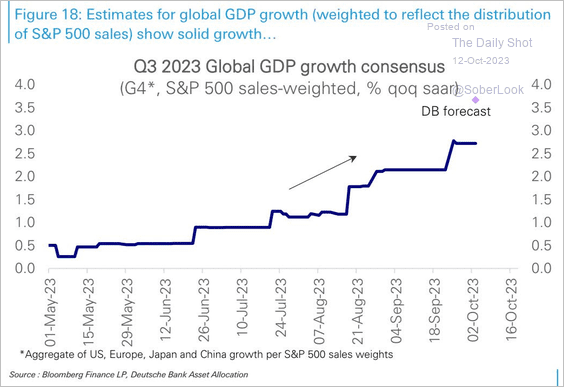

1. Deutsche Bank sees the S&P 500 earnings per share hitting a record high in Q3, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… after robust economic growth last quarter.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

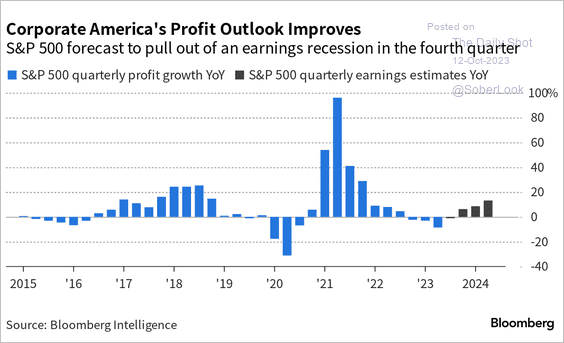

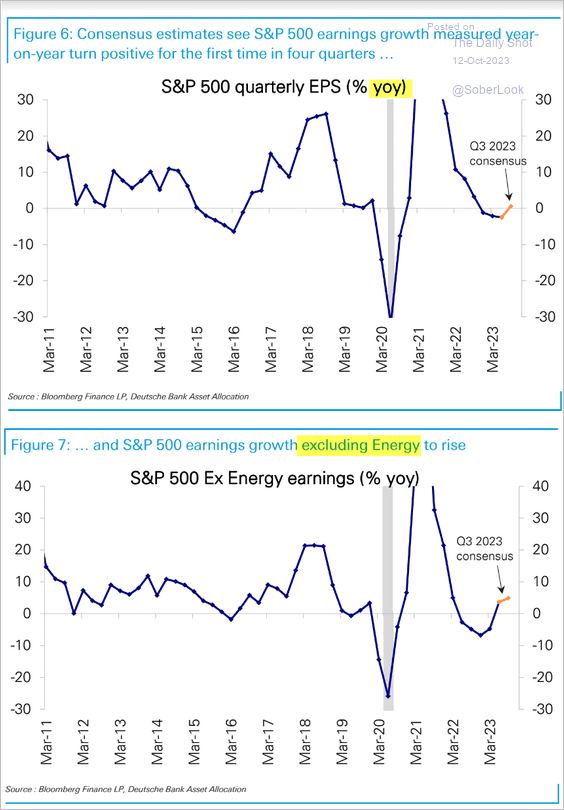

2. The earnings recession appears to be over (2 charts).

Source: @markets Read full article

Source: @markets Read full article

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

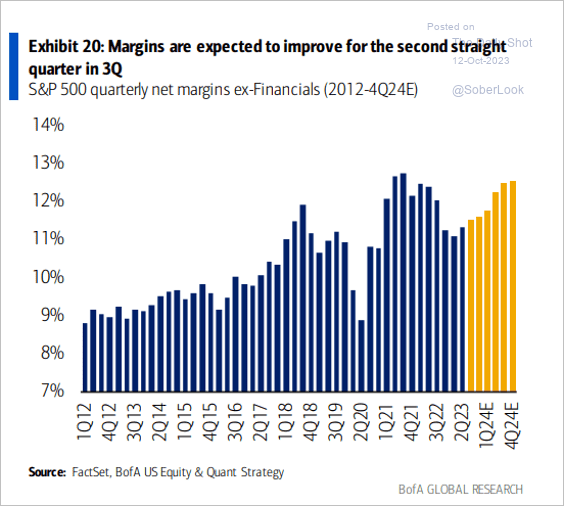

3. The market continues to see a rebound in margins.

Source: BofA Global Research

Source: BofA Global Research

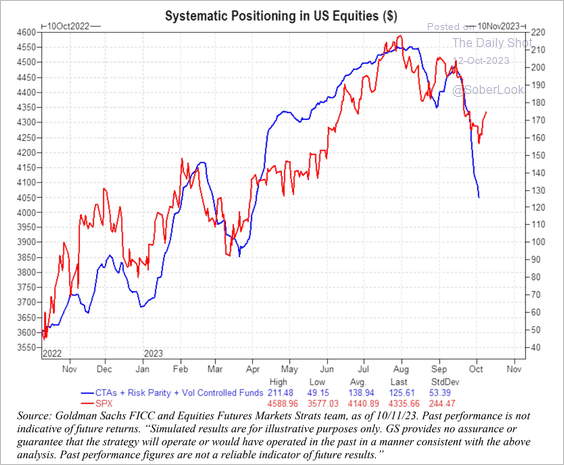

4. Have systematic strategies/investors oversold during the market pullback?

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

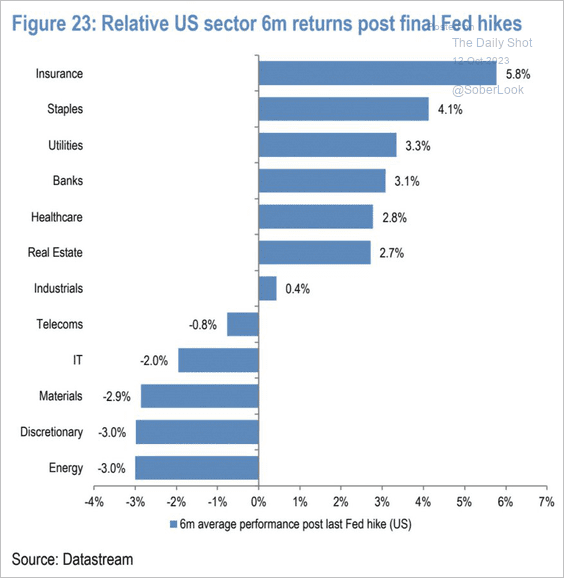

5. How do different sectors perform after the Fed’s final hike?

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

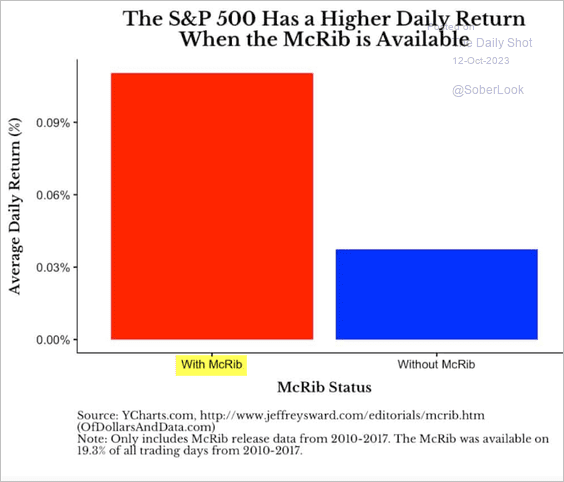

6. Forget all the macro indicators. It’s about the McRib availability …

Source: USA Today Read full article

Source: USA Today Read full article

Source: @dollarsanddata Read full article

Source: @dollarsanddata Read full article

Back to Index

Credit

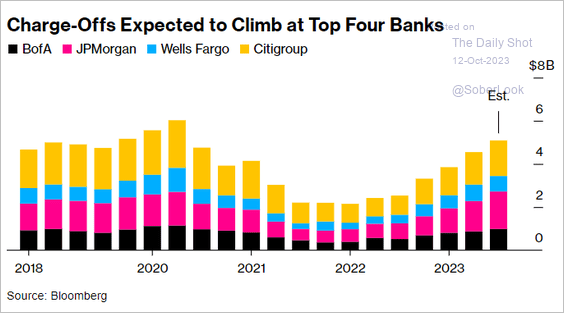

1. Bank charge-offs are expected to hit the highest level since 2020.

Source: @business Read full article

Source: @business Read full article

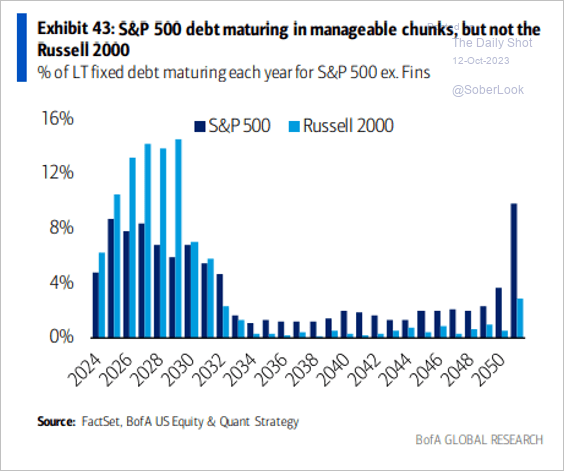

2. The debt maturity walls for the S&P 500 and the Russell 2000 look very different.

Source: BofA Global Research

Source: BofA Global Research

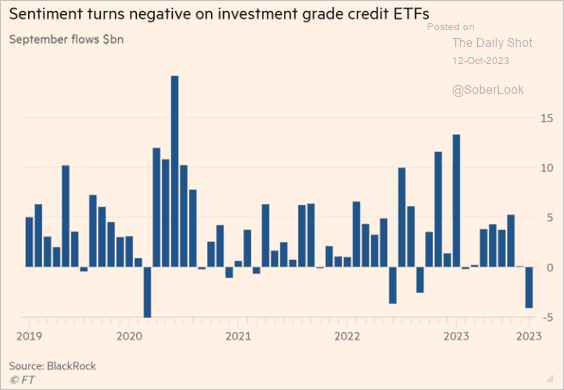

3. Investment-grade ETFs registered substantial outflows last month.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

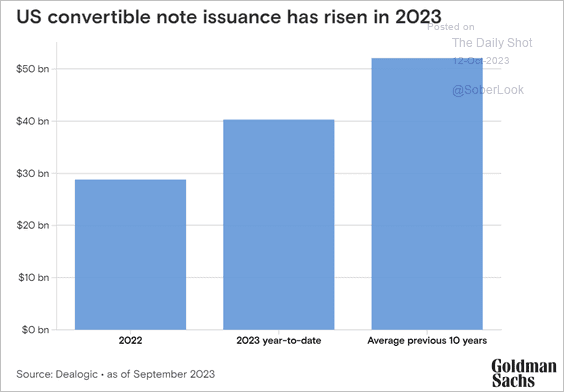

4. Convertible debt issuance increased this year.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

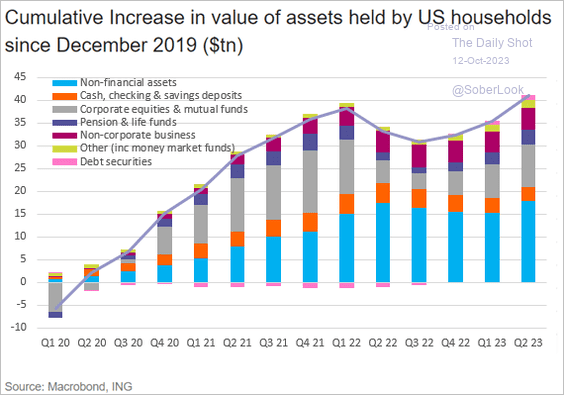

1. Components of COVID-era household wealth gains in the US:

Source: ING

Source: ING

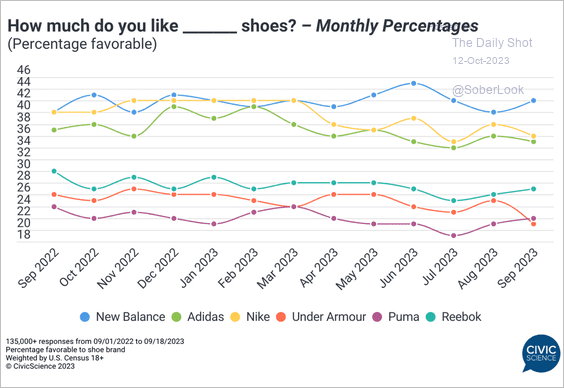

2. Shoe brand preferences:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

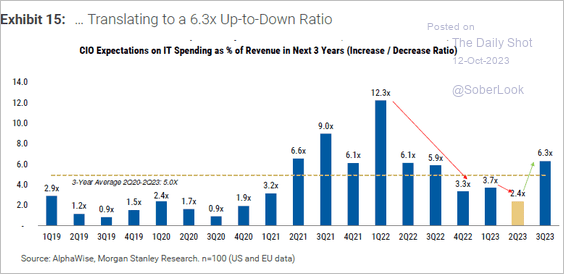

3. A rebound in IT spending expectations:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

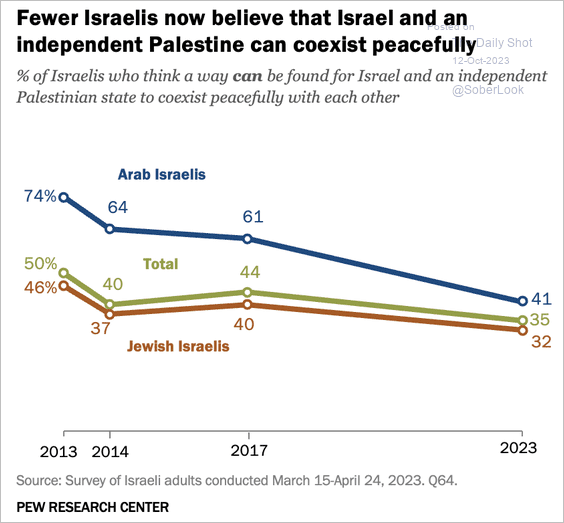

4. Views on Israel and independent Palestine coexisting peacefully:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

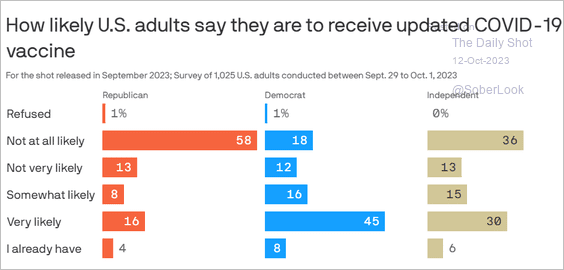

5. Getting the new COVID vaccine:

Source: @axios Read full article

Source: @axios Read full article

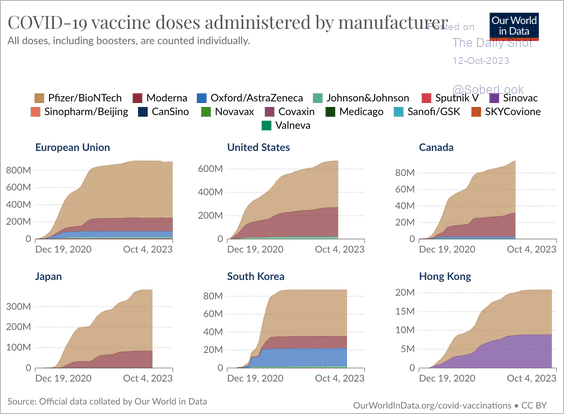

• Total COVID vaccines administered in select countries:

Source: Our World in Data

Source: Our World in Data

——————–

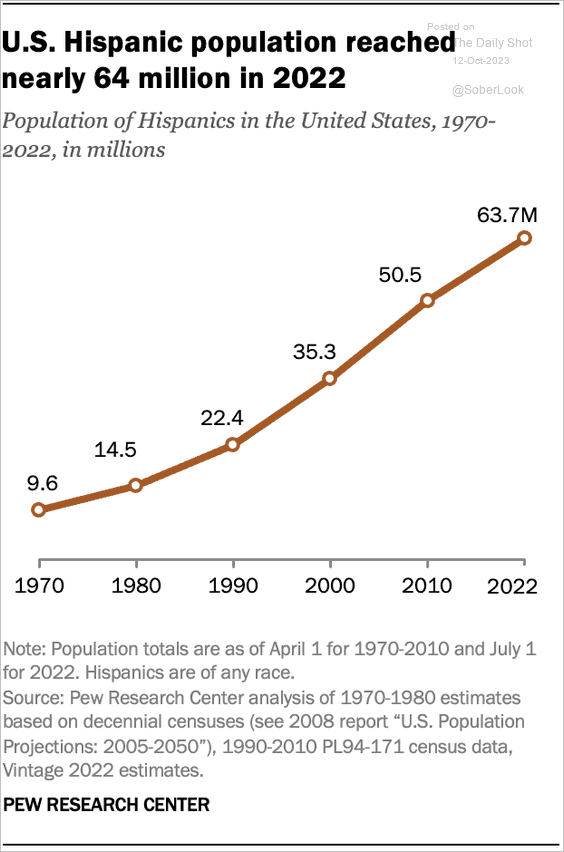

6. US Hispanic population:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

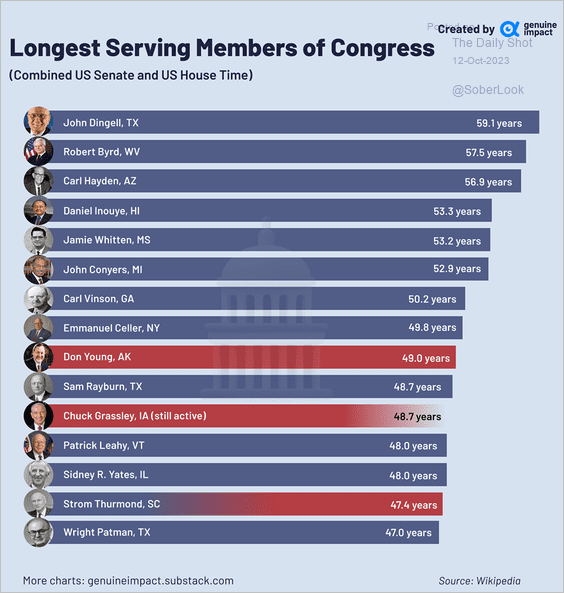

7. Longest serving members of Congress:

Source: @genuine_impact

Source: @genuine_impact

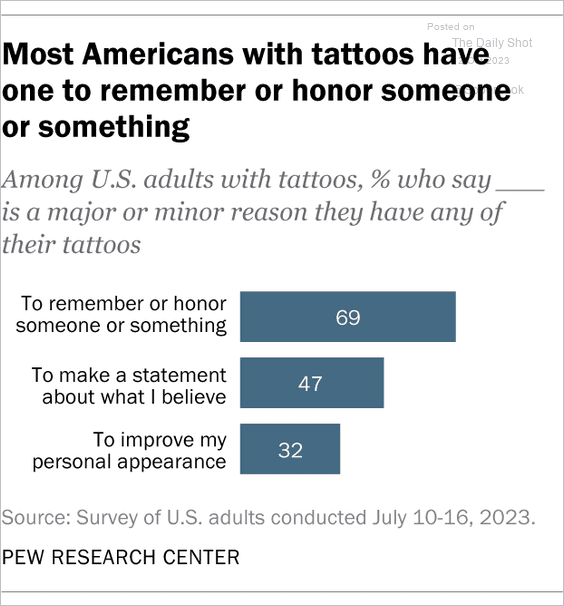

8. Reasons for tattoos:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

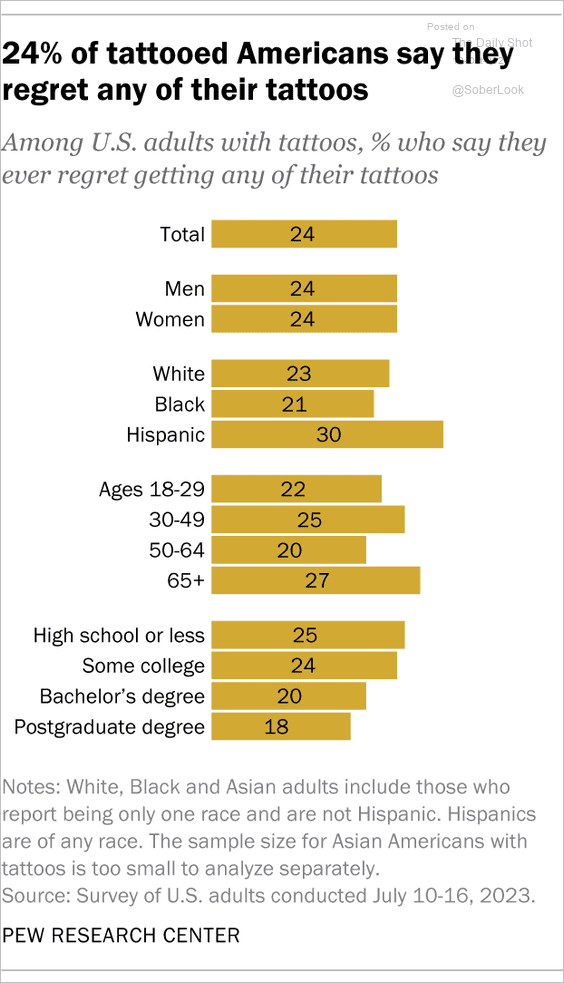

• Regrets:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

Back to Index