The Daily Shot: 16-Oct-23

• The United States

• Europe

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

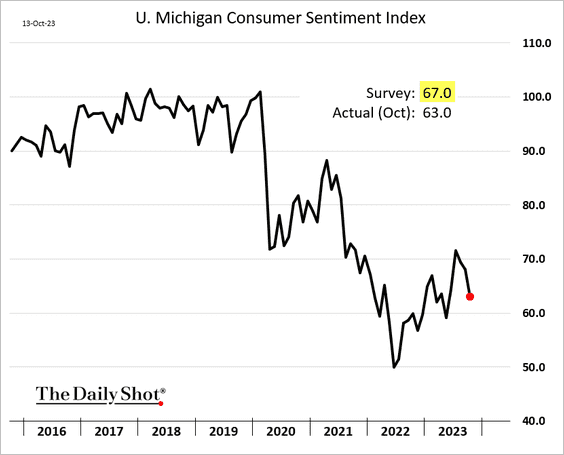

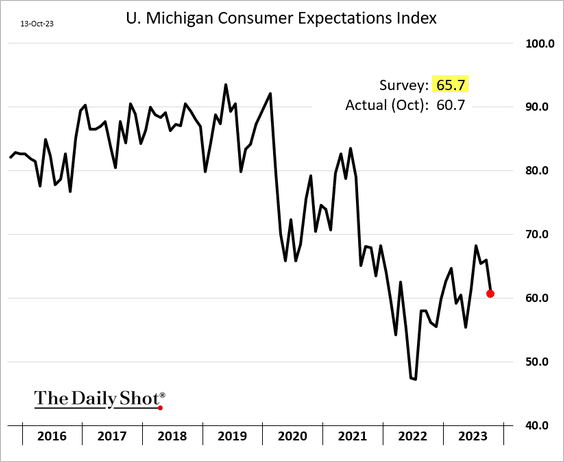

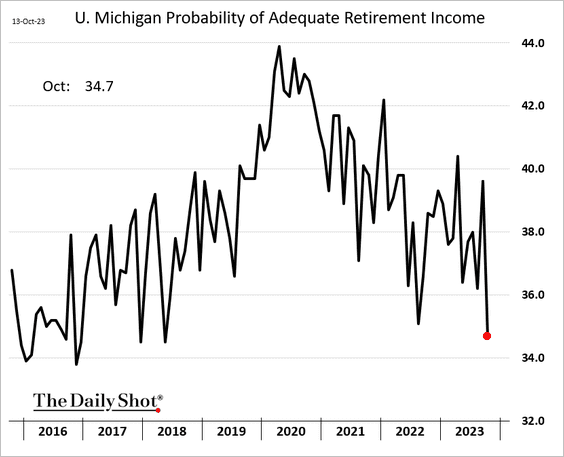

1. The October U. Michigan consumer sentiment indicator declined more than anticipated.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

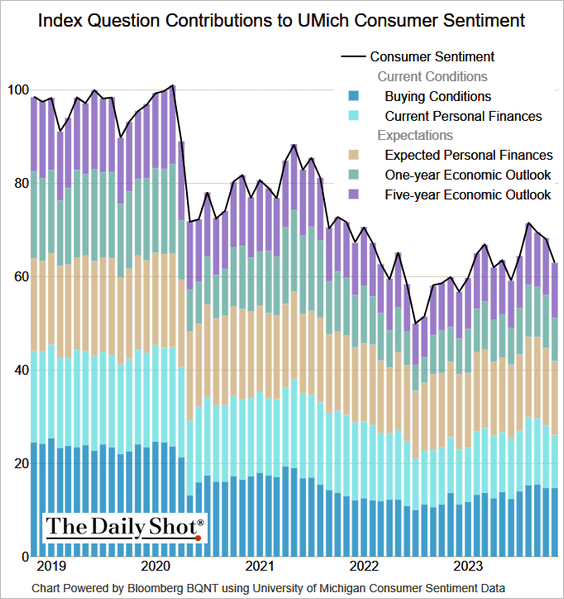

• Here are the contributions to the index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

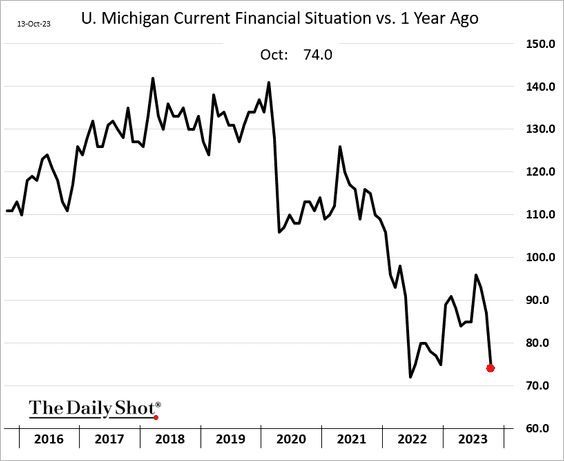

• The resumption of student loan payments, stock market volatility, and persistent inflation have left households feeling less confident about their financial situation (2 charts).

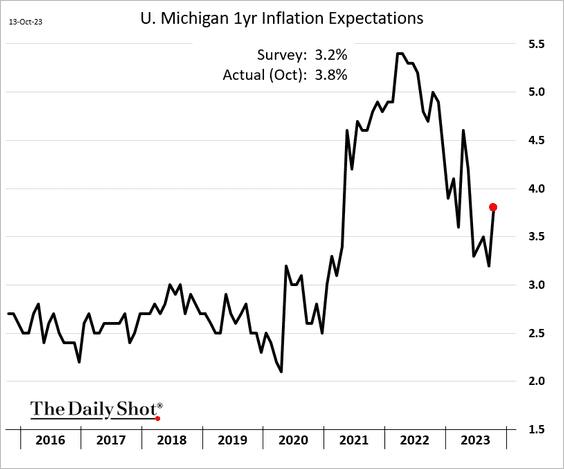

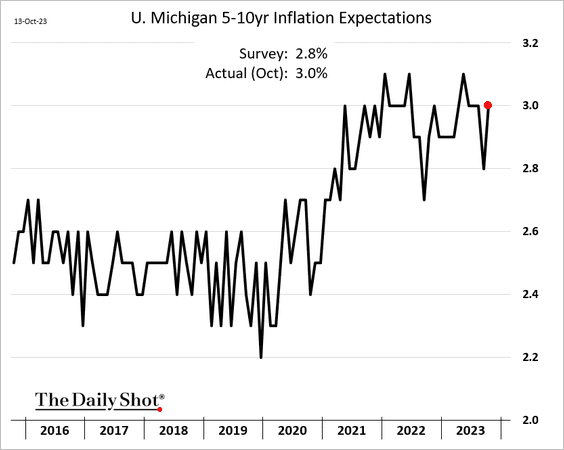

• Inflation expectations rose, topping forecasts.

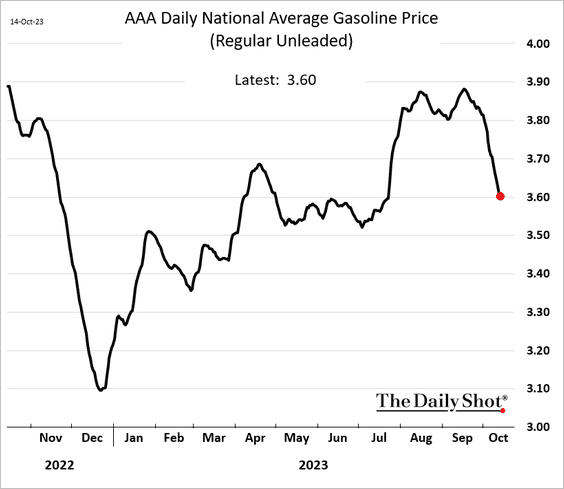

Will lower gasoline prices ease consumer anxiety?

——————–

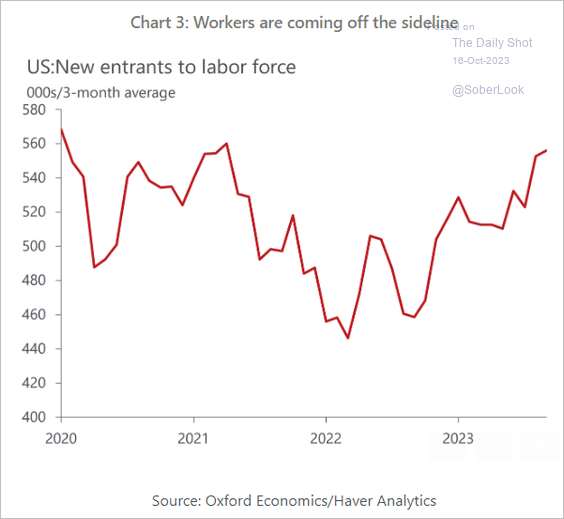

2. Next, we have some updates on the labor market.

• More new entrants into the labor force are capping wage growth.

Source: Oxford Economics

Source: Oxford Economics

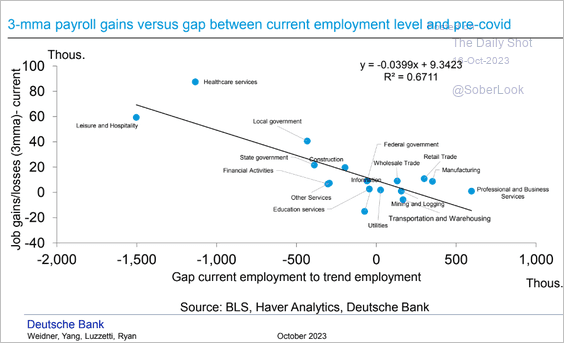

• Sectors with the greatest COVID-era employment disruptions have seen the biggest job gains.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

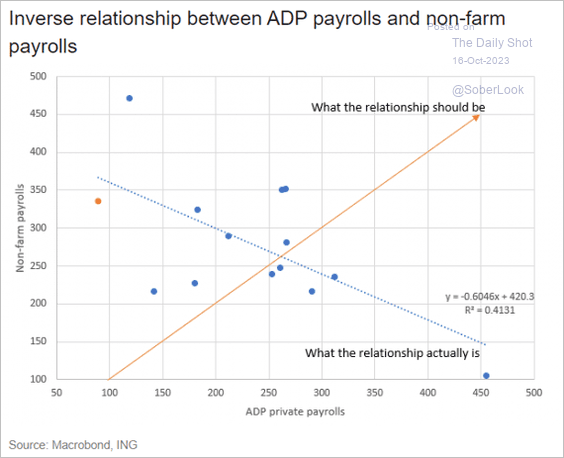

• The ADP private payrolls indicator has been a terrible predictor of the official nonfarm payrolls figures.

Source: ING

Source: ING

——————–

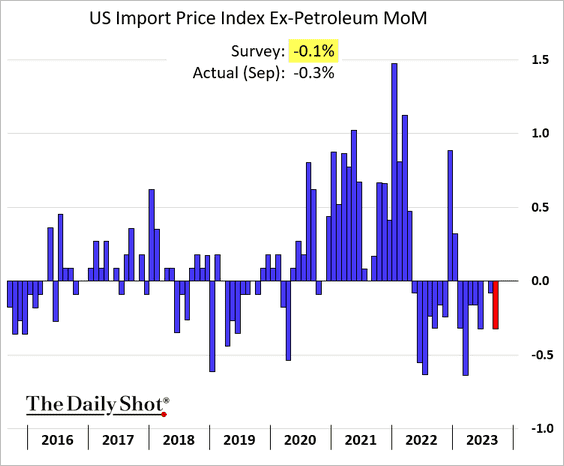

3. US import prices continue to ease, pulled lower by the recent US dollar strength.

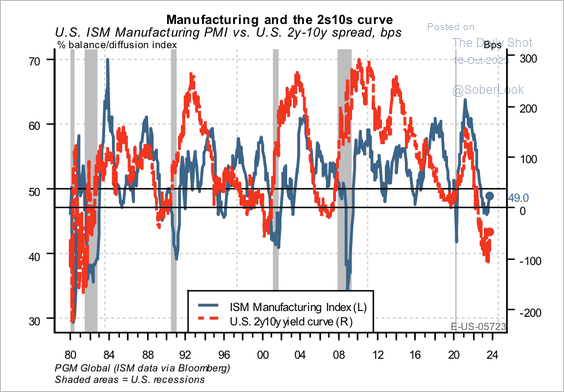

4. Manufacturing conditions have improved alongside a steeper Treasury curve.

Source: PGM Global

Source: PGM Global

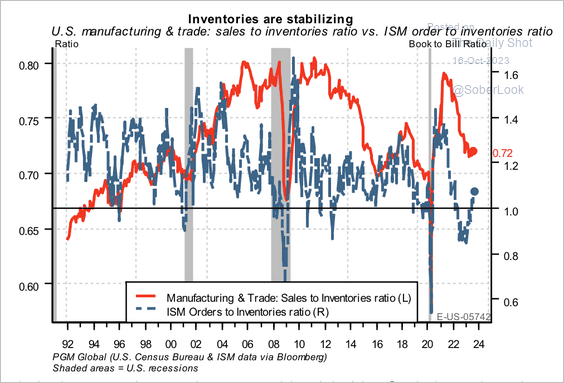

The positive turn in the inventory cycle also signals an upswing in manufacturing activity.

Source: PGM Global

Source: PGM Global

——————–

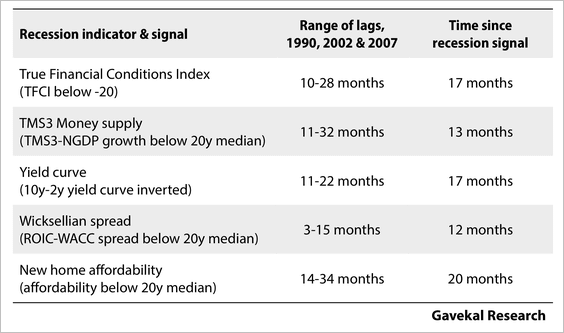

5. Key recession indicators are still within the historical range of lags.

Source: Gavekal Research

Source: Gavekal Research

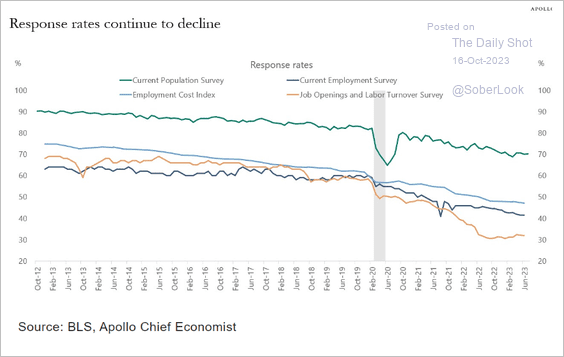

6. Response rates to key official economic surveys have been trending lower.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Europe

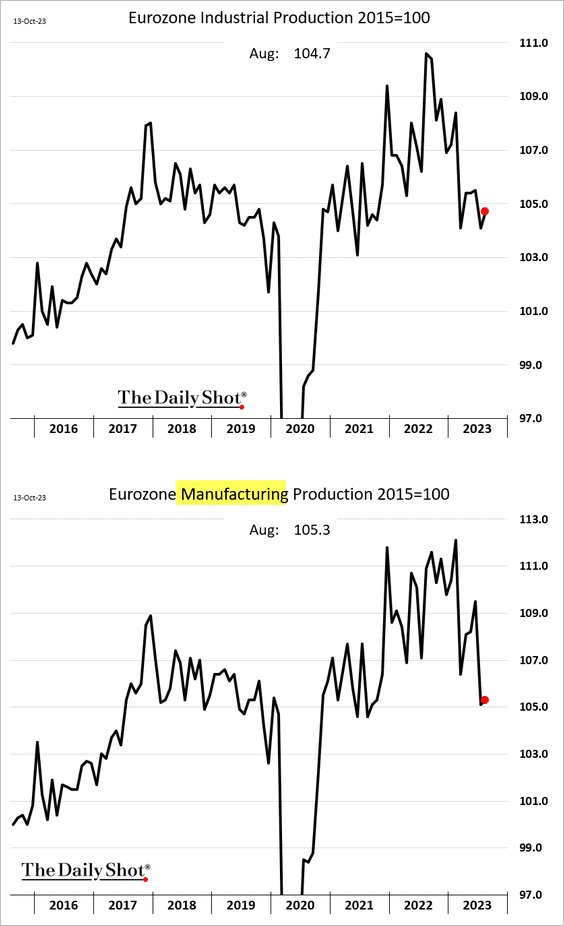

1. Euro-area industrial production edged higher in August, although manufacturing output barely budged from the lowest levels since 2021.

Base effects resulted in large declines on a year-over-year basis.

——————–

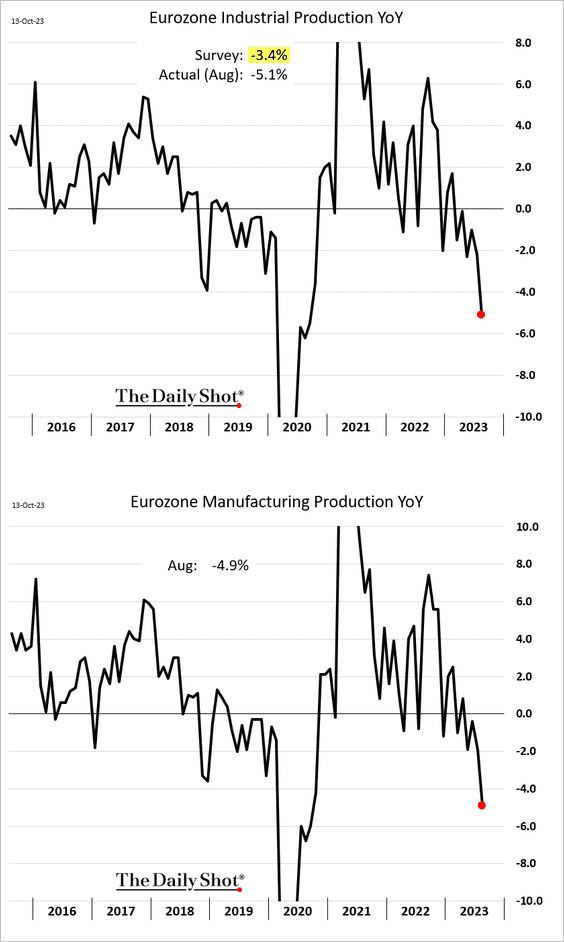

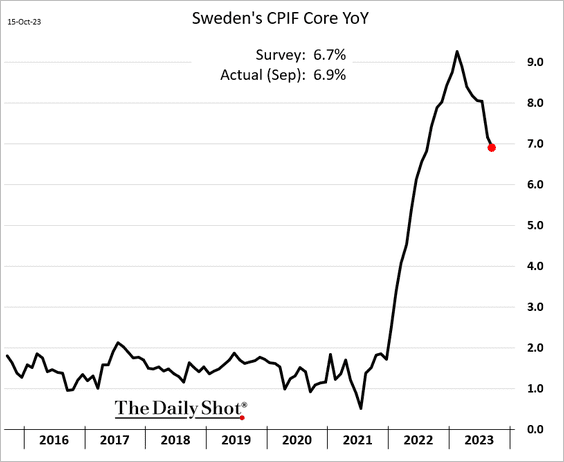

2. Here is a look at house price changes in Q2.

Source: ING

Source: ING

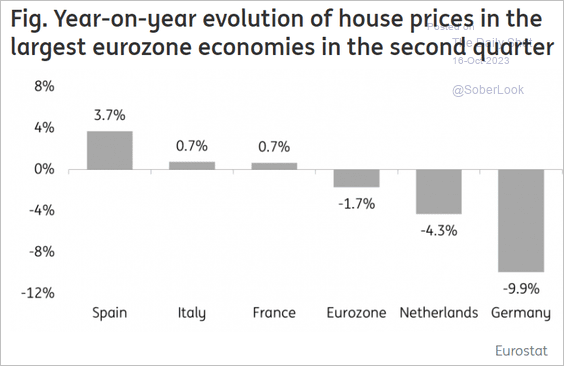

3. Sweden’s core inflation has been easing but was higher than expected last month.

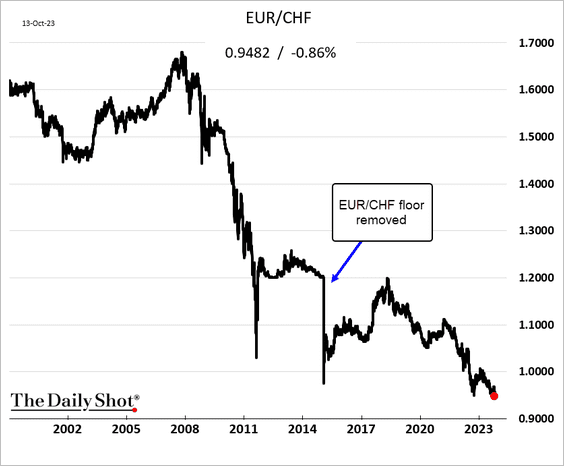

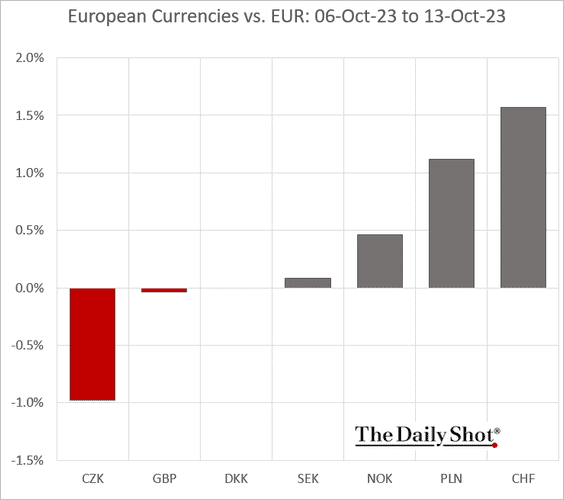

4. Tensions in the Middle East sent the Swiss franc to its strongest close on record vs. the euro.

——————–

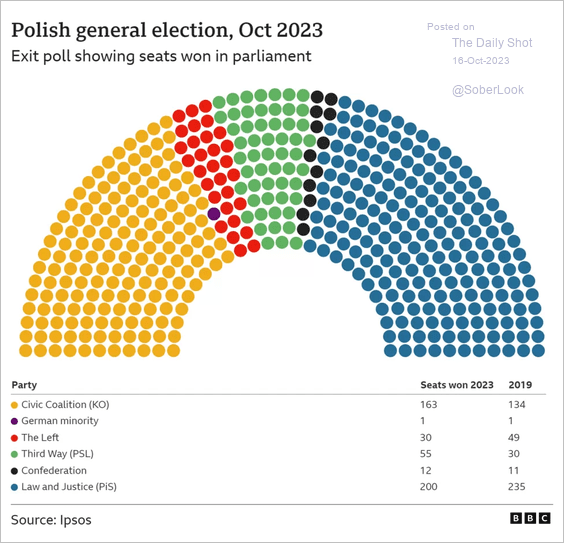

5. Here is a look at Poland’s exit polls.

Source: BBC Read full article

Source: BBC Read full article

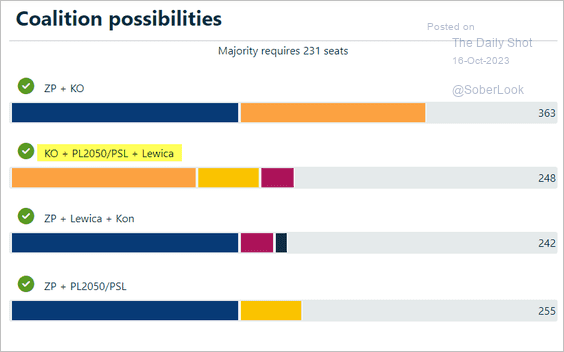

Poland’s ruling party, Zjednoczona Prawica (Law and Justice Party), is likely out. The second option in the chart below appears to be the most likely coalition.

Source: PolitPro

Source: PolitPro

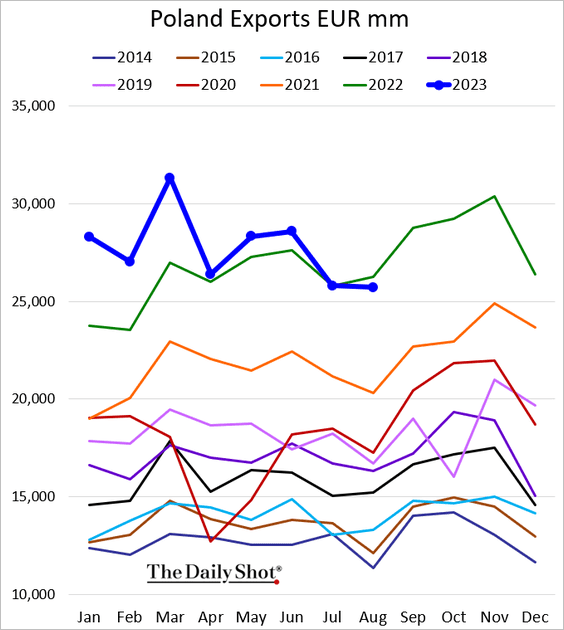

• Separately, Poland’s exports are slowing.

Back to Index

China

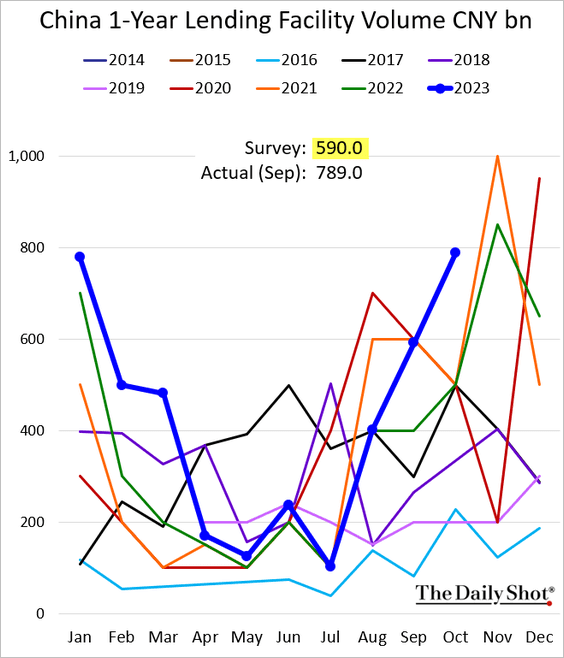

1. The PBoC left rates unchanged on the one-year facility but injected a much larger amount of liquidity than anticipated.

Source: @markets Read full article

Source: @markets Read full article

——————–

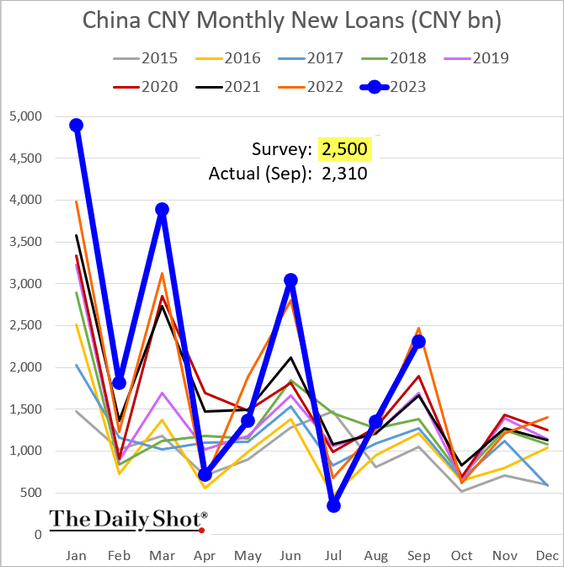

2. Bank loan growth was below 2022 levels last month, …

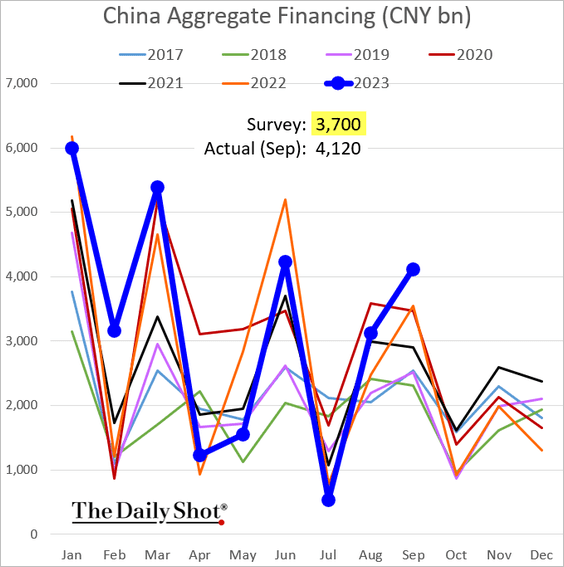

… but aggregate financing surged.

Source: @markets Read full article

Source: @markets Read full article

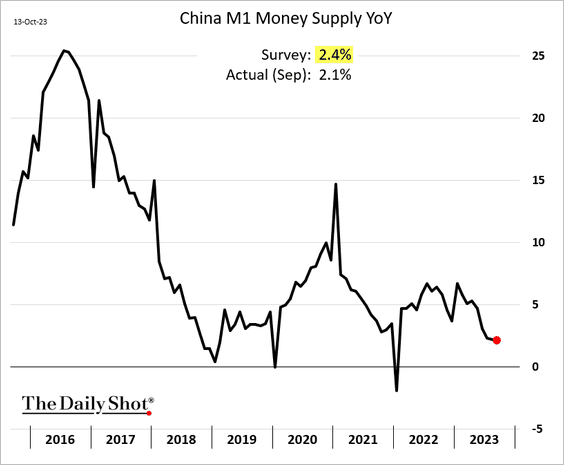

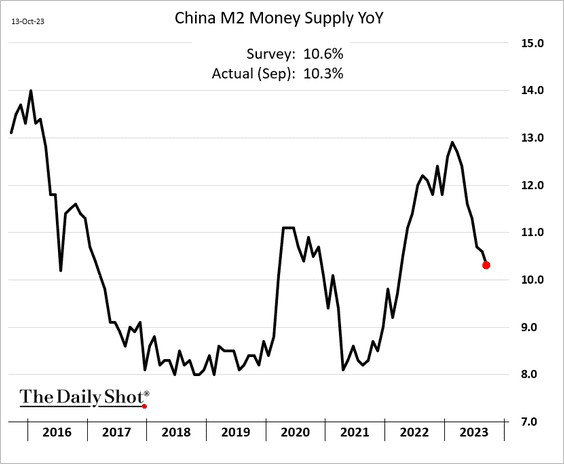

• Growth in China’s money supply continues to ease.

——————–

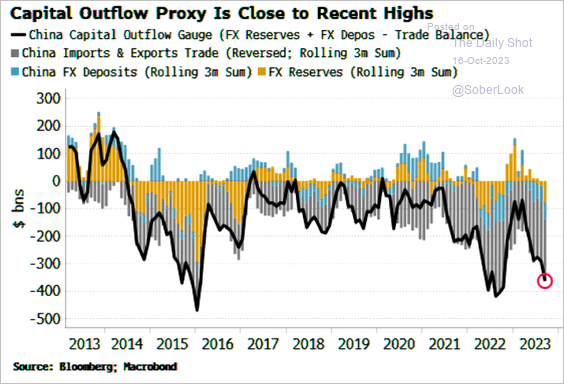

3. Capital outflows persist.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Emerging Markets

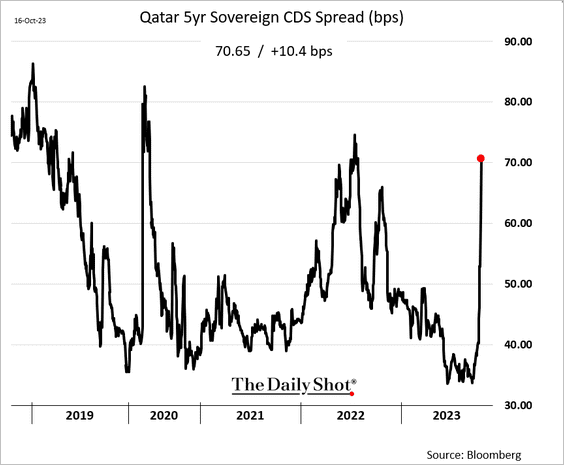

1. Sovereign CDS spreads have widened across the Middle East.

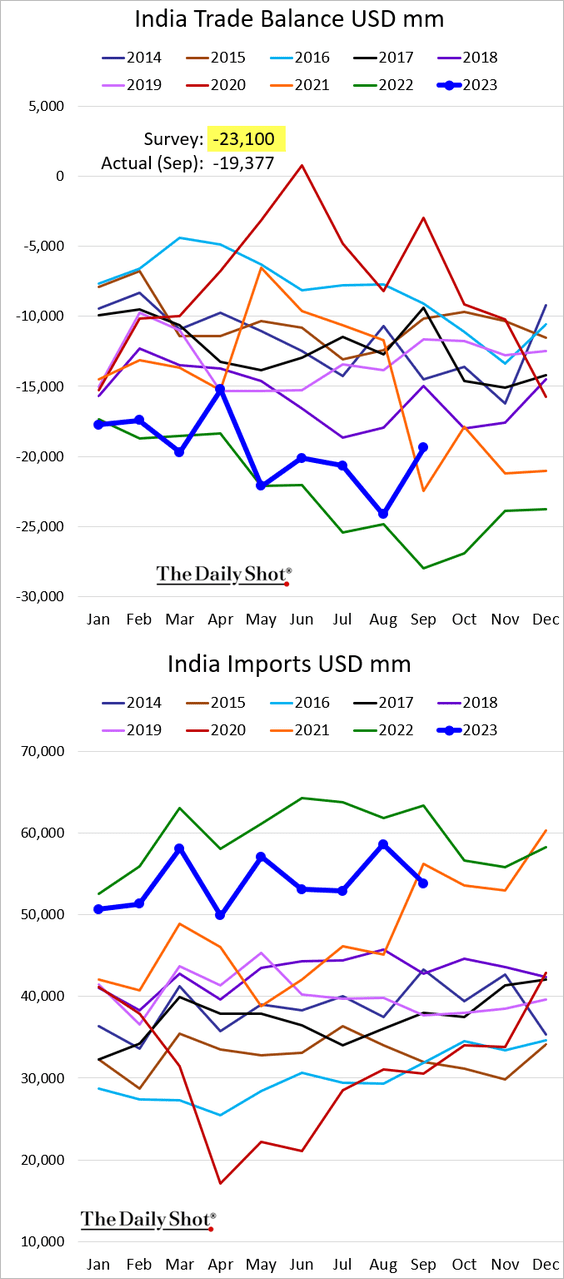

2. India’s trade deficit narrowed in September as imports slowed.

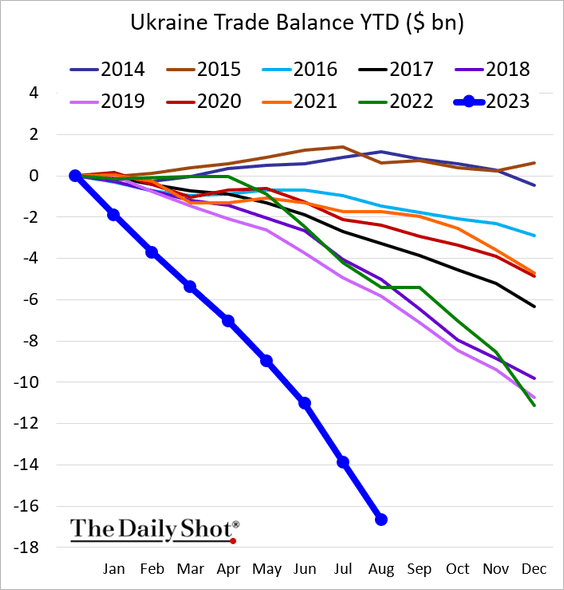

3. Ukraine’s trade deficit continues to widen.

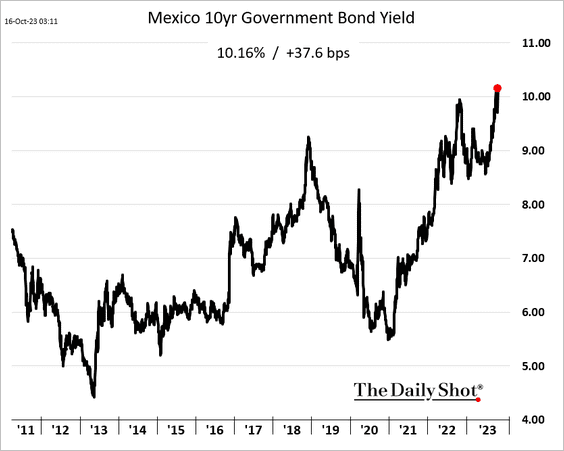

4. Mexico’s bond yields are hitting multi-year highs.

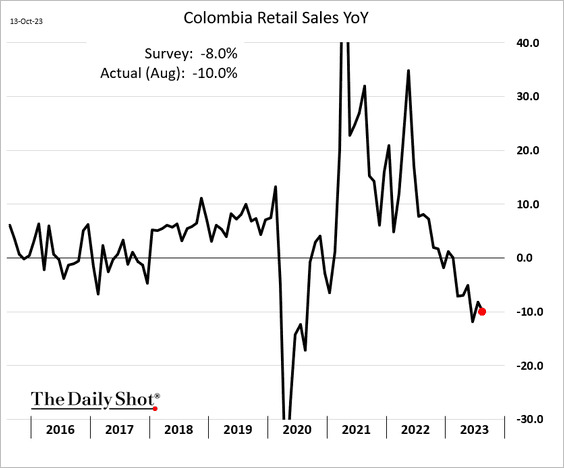

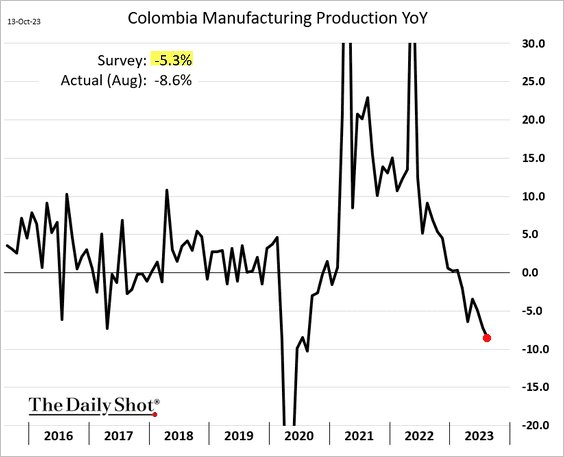

5. Colombia’s economic activity has been slowing (2 charts).

——————–

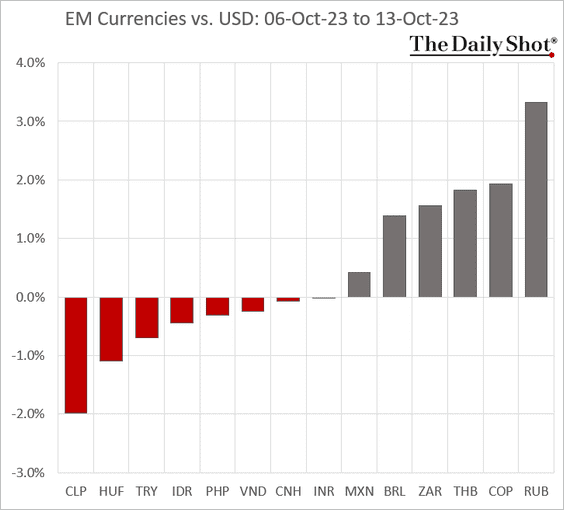

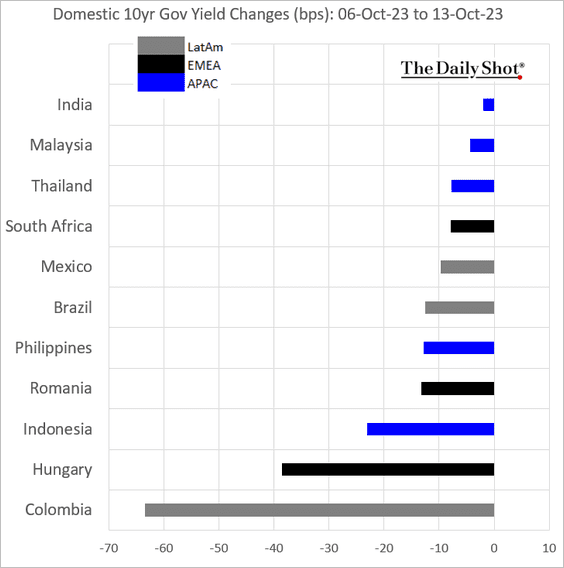

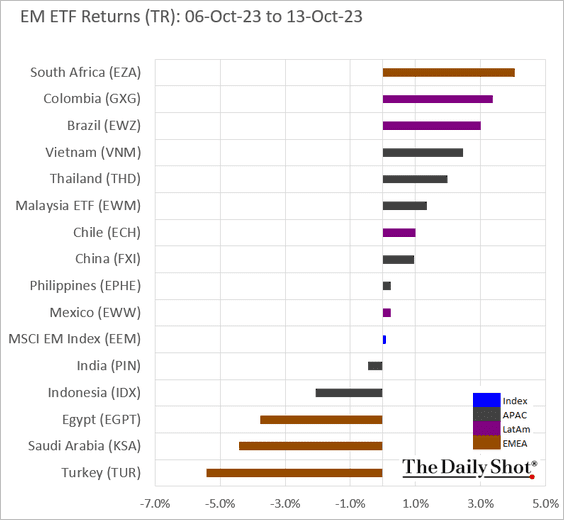

6. Next, we have some performance updates from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

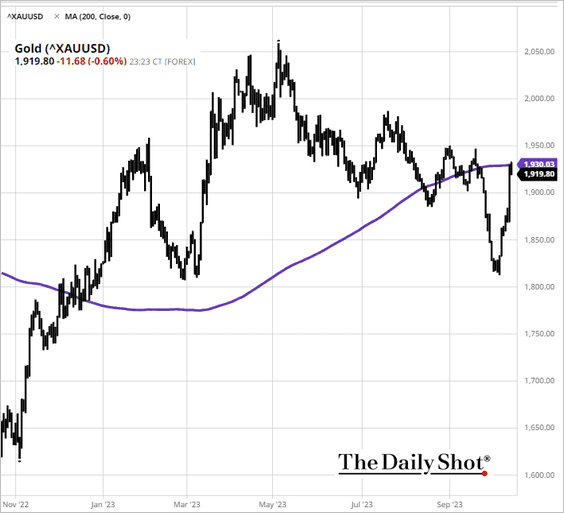

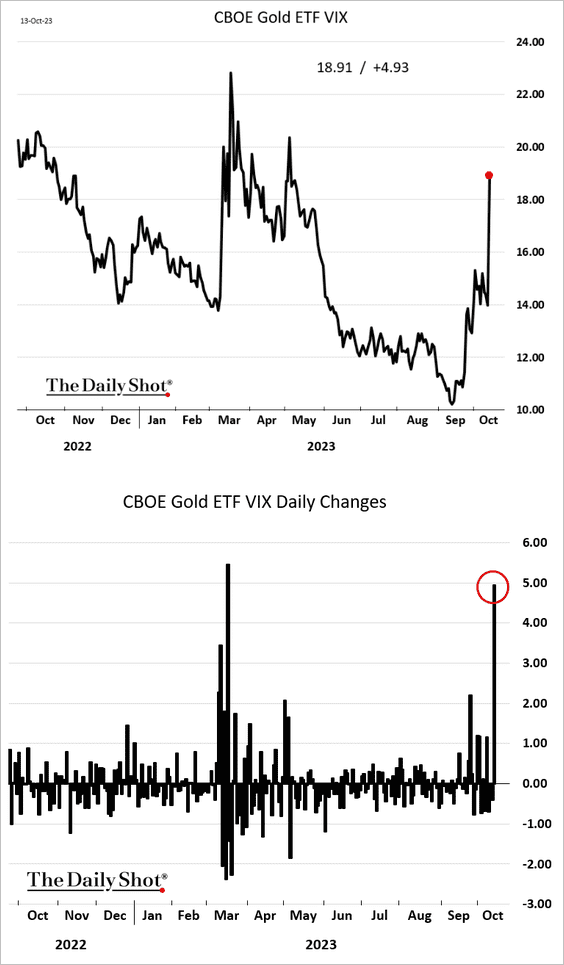

1. Gold surged last week on geopolitical uncertainty but hit resistance at the 200-day moving average.

Gold implied volatility jumped.

——————–

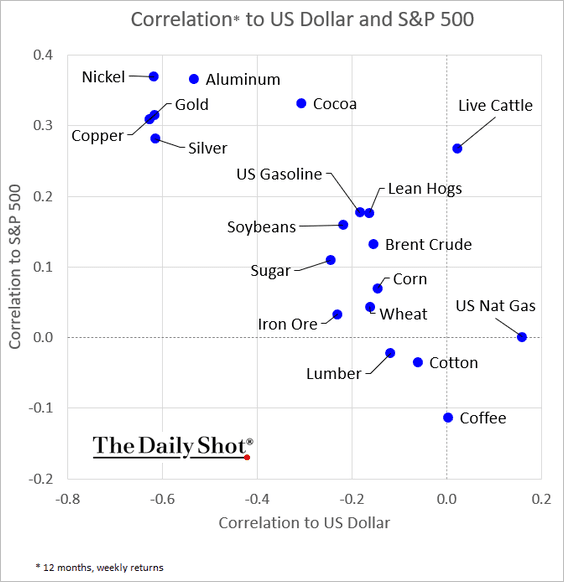

2. How correlated are different commodity markets to US stocks and the dollar?

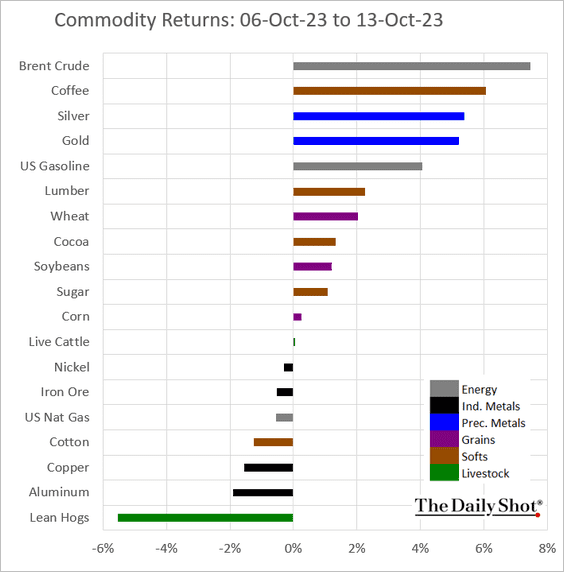

3. Here is a look at last week’s performance across key commodity markets.

Back to Index

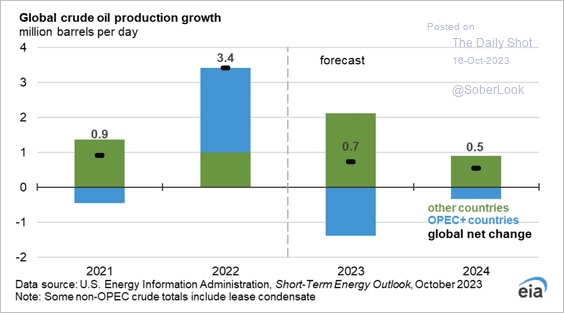

Energy

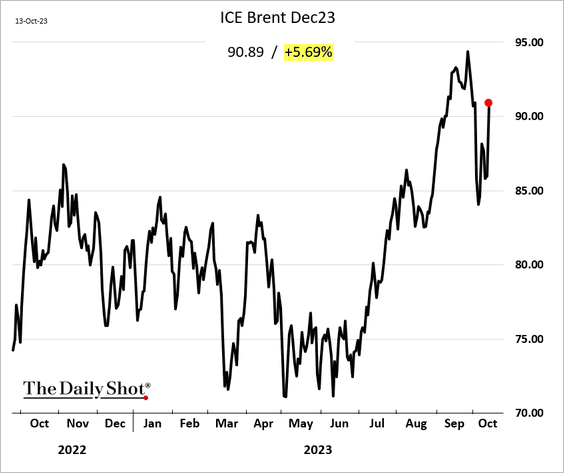

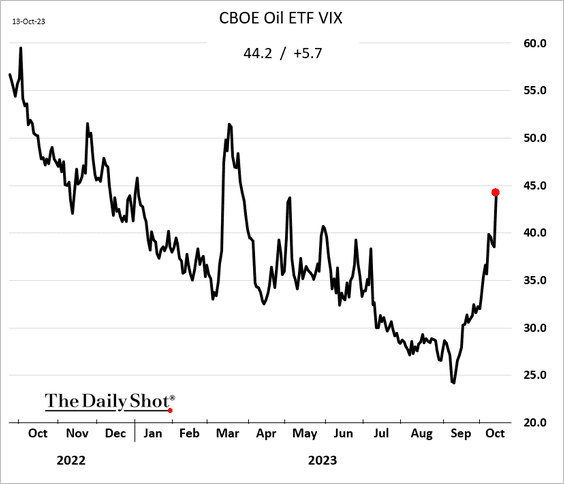

1. Crude oil prices jumped on Friday amid escalating tensions in the Middle East.

Crude oil implied volatility has been surging.

——————–

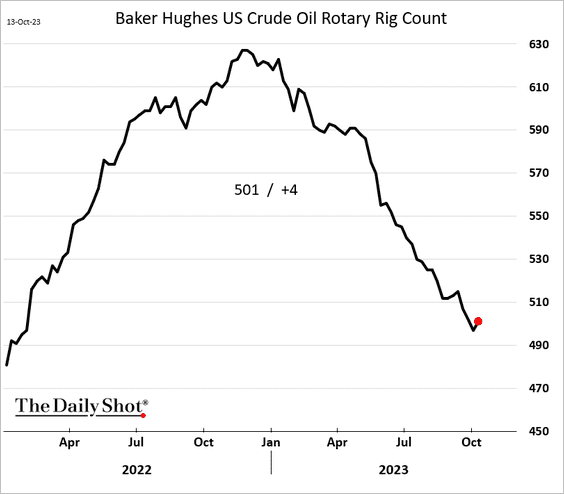

2. The US oil rig count registered a rare increase last week.

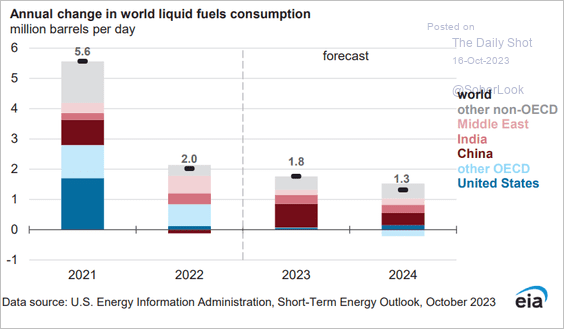

3. Growth in global liquid fuels consumption is expected to slow next year.

Source: @EIAgov

Source: @EIAgov

Source: @EIAgov

Source: @EIAgov

——————–

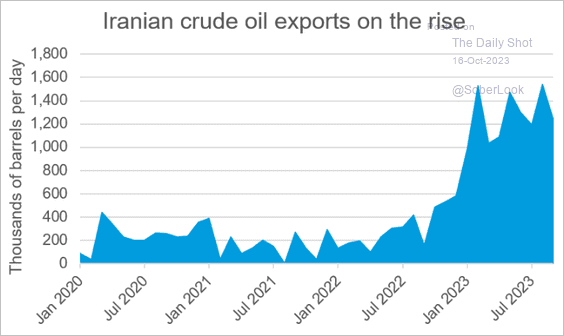

4. Iran’s crude oil exports remain elevated.

Source: The Real Economy Blog

Source: The Real Economy Blog

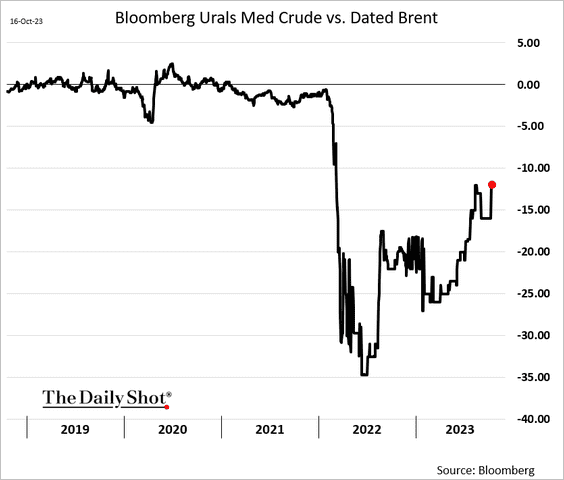

5. The Russian crude oil discount to Brent has been narrowing.

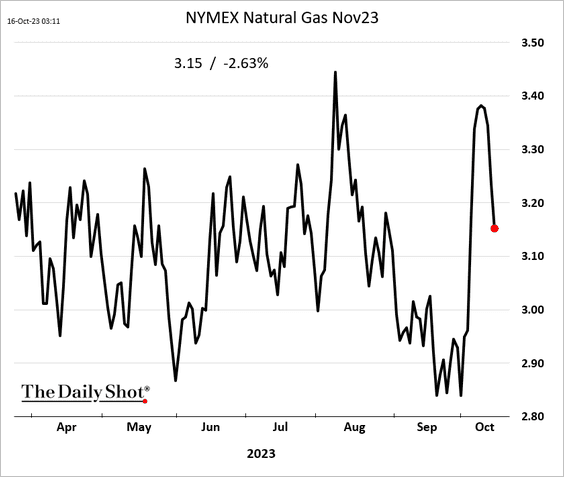

6. US natural gas is reversing this month’s rally.

Back to Index

Equities

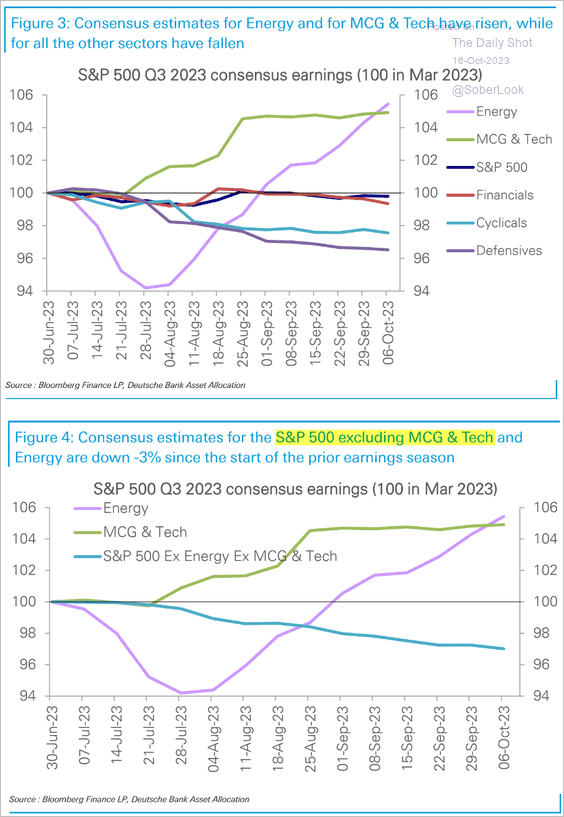

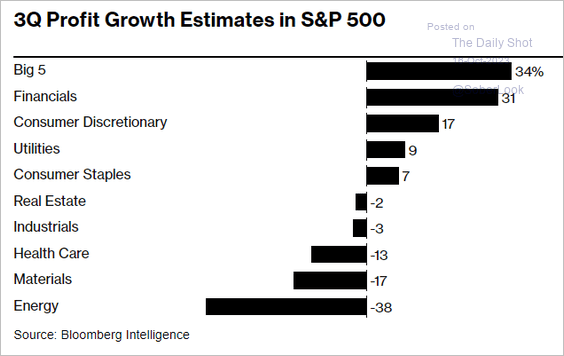

1. Let’s begin with some sector updates.

• Here is a look at the Q3 earnings estimates by sector over time.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

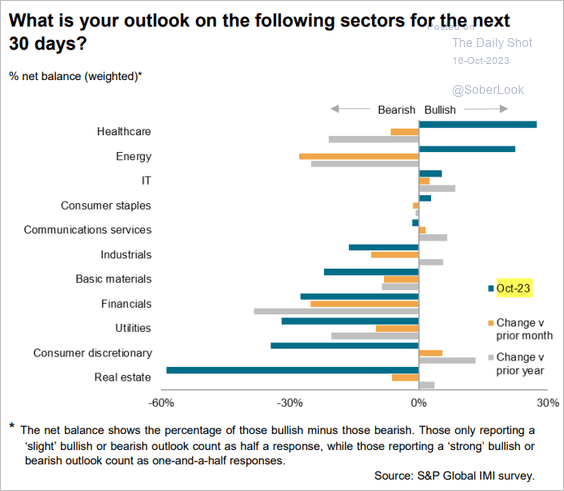

• How do investors feel about US stocks? Here is a survey from S&P Global.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

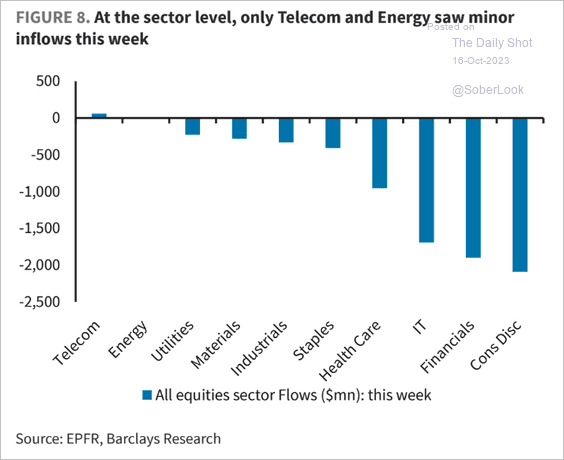

• Fund flows were negative across most sectors last week.

Source: Barclays Research; @dailychartbook

Source: Barclays Research; @dailychartbook

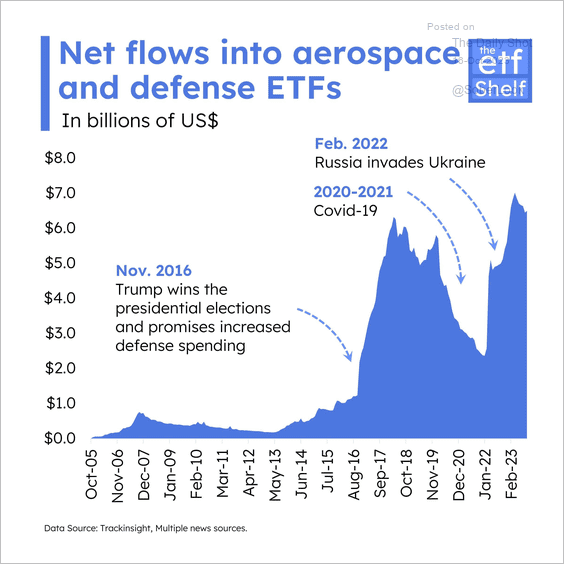

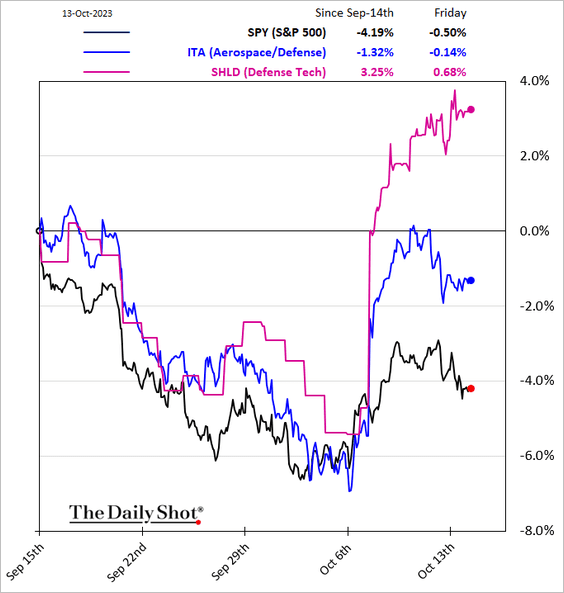

• Aerospace and defense ETFs experienced a surge in inflows. (2 charts)

Source: http://theetfshelf.substack.com/

Source: http://theetfshelf.substack.com/

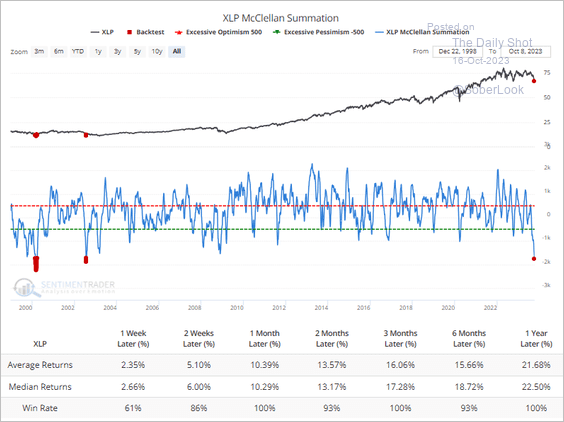

• Breadth among US consumer staples stocks is extremely weak.

Source: SentimenTrader

Source: SentimenTrader

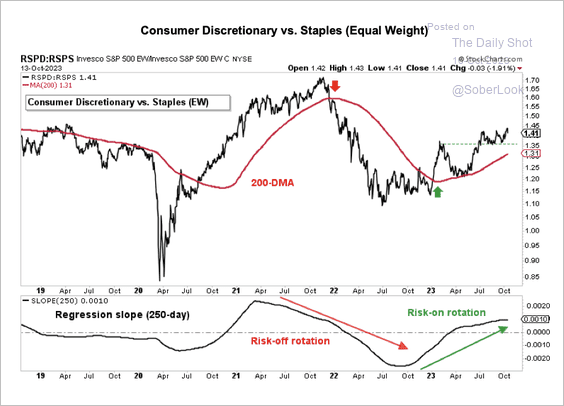

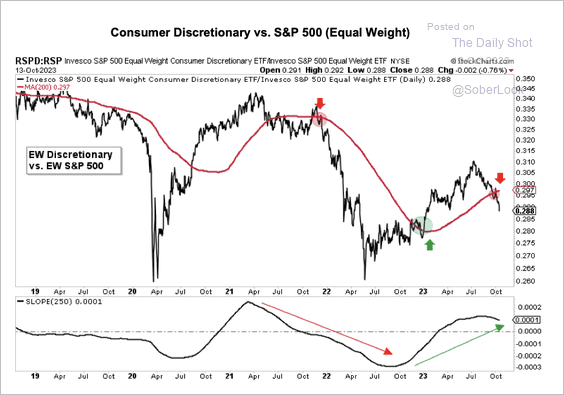

• The S&P 500 consumer discretionary sector is holding its uptrend relative to consumer staples but is weakening relative to the equal-weight S&P 500 index. (2 charts)

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

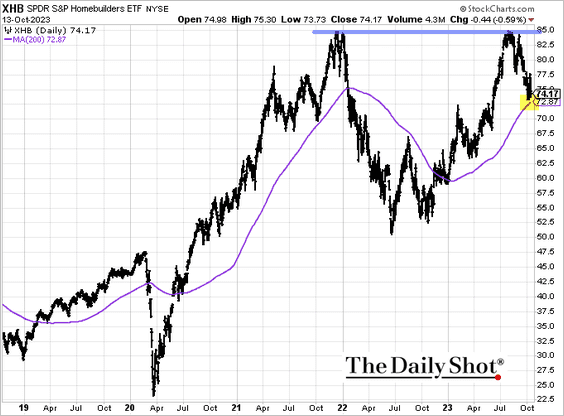

• After hitting resistance at the previous peak, the housing market ETF (XHB) has been trending lower and is now nearing the 200-day moving average.

——————–

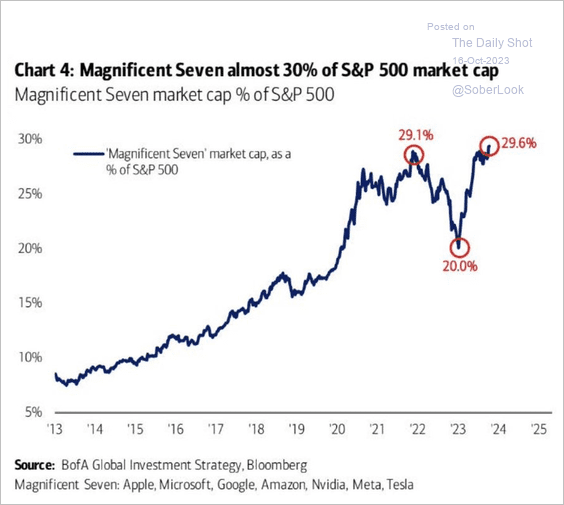

2. The top seven stocks now represent almost 30% of the S&P 500 market cap.

Source: BofA Global Research

Source: BofA Global Research

• The “big tech” concentration is powering the S&P 500 profit growth estimates.

Source: @markets Read full article

Source: @markets Read full article

——————–

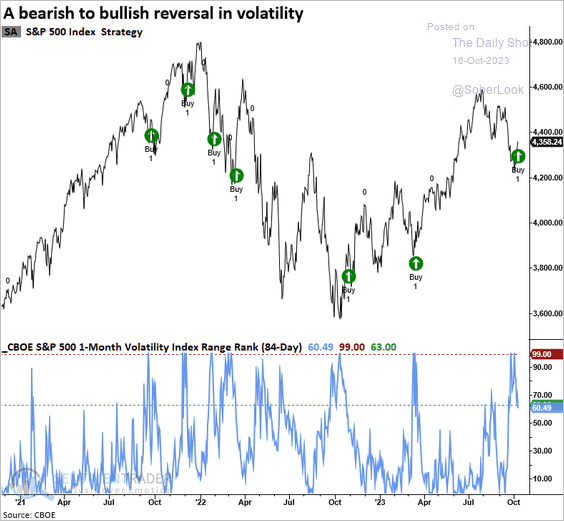

3. VIX rose to the top of its 84-day range and reversed lower, which typically precedes a rebound in the S&P 500.

Source: SentimenTrader

Source: SentimenTrader

• Options skew is rebounding.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

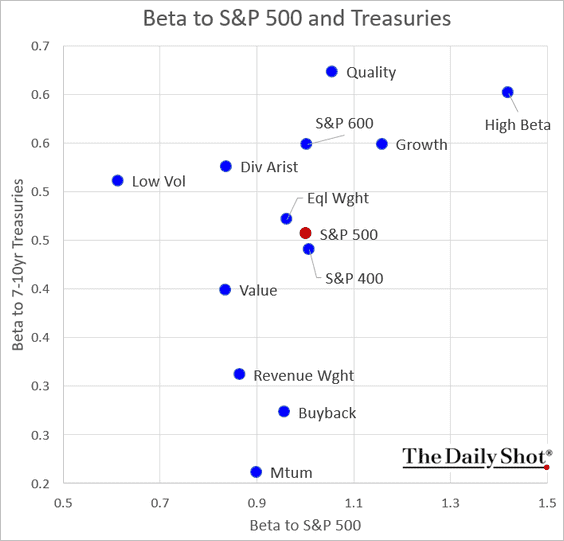

4. How sensitive are equity factors to price movements in the S&P 500 and Treasuries?

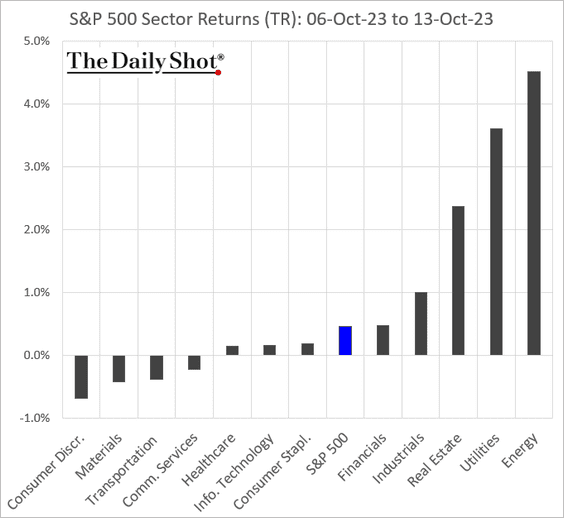

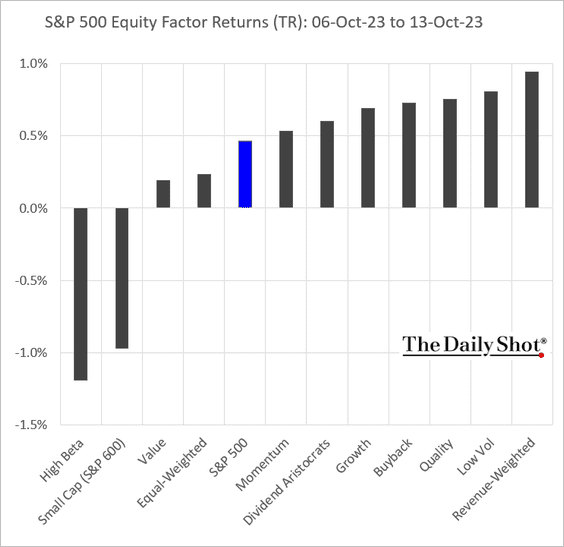

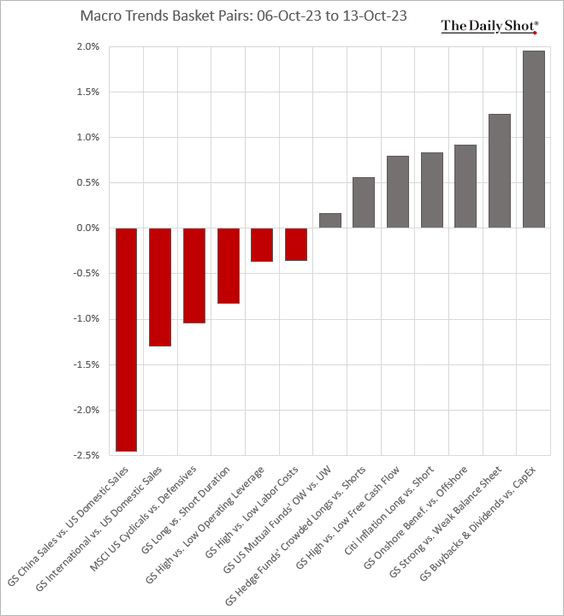

5. Finally, we have some performance data from last week.

• Sectors:

• Equity factors:

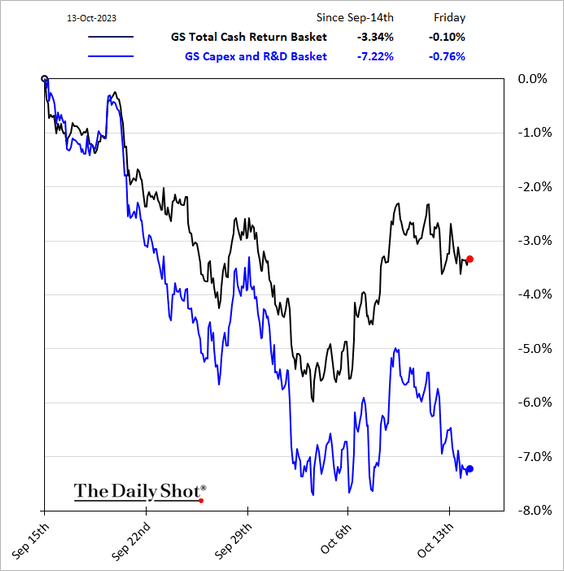

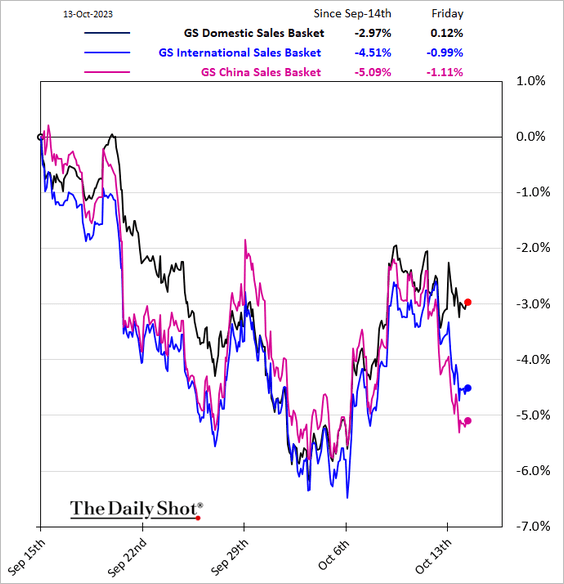

• Macro basket pairs’ relative performance (followed by two trends):

– Investors punished companies focused on CapEx and R&D and rewarded firms with high share buybacks and dividends.

– Companies with high international sales underperformed.

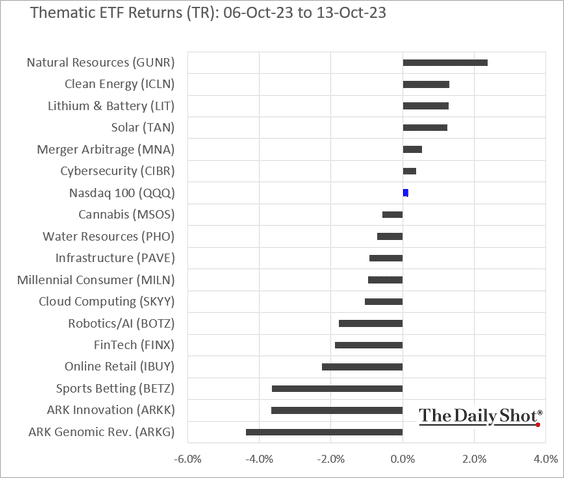

• Thematic ETFs:

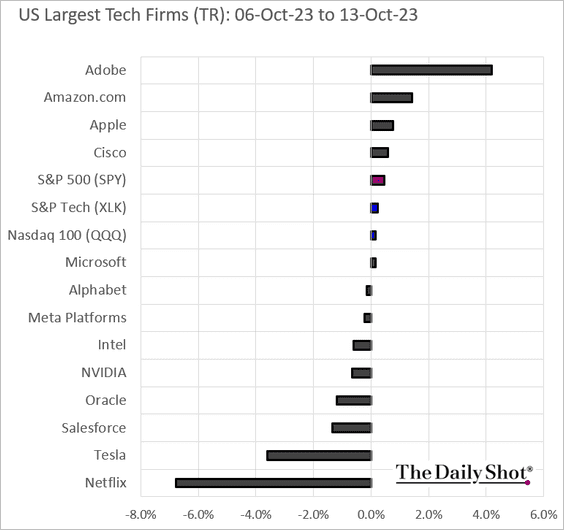

• Largest US tech firms:

Back to Index

Credit

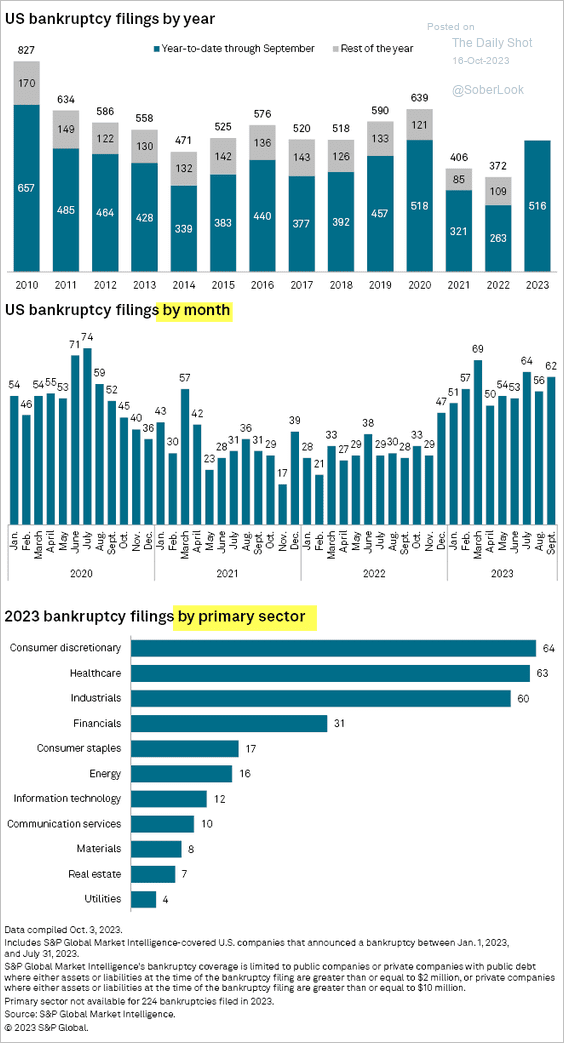

1. US bankruptcy filings remain elevated.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

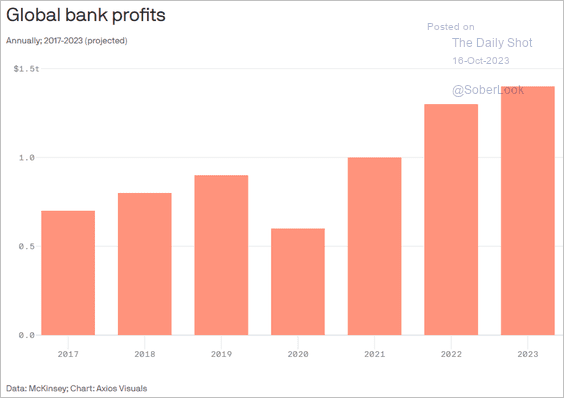

2. What banking crisis?

Source: @axios Read full article

Source: @axios Read full article

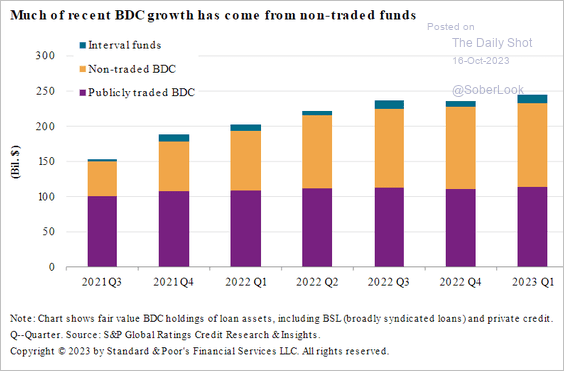

3. BDC growth has been dominated by private BDCs.

Source: S&P Global Ratings

Source: S&P Global Ratings

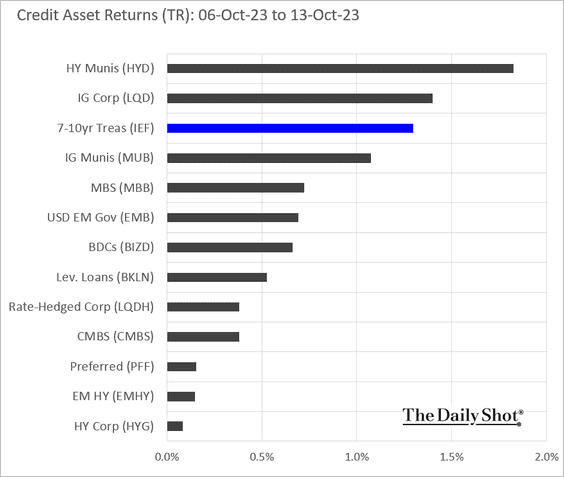

4. Here is a look at last week’s performance.

Back to Index

Rates

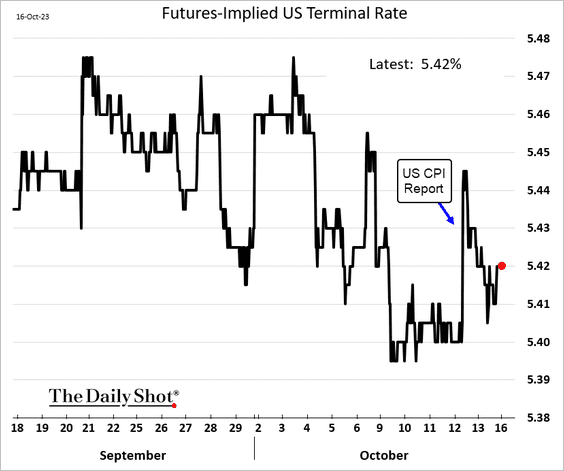

1. Despite the strong CPI report last week, the US terminal rate is holding just above 5.4%.

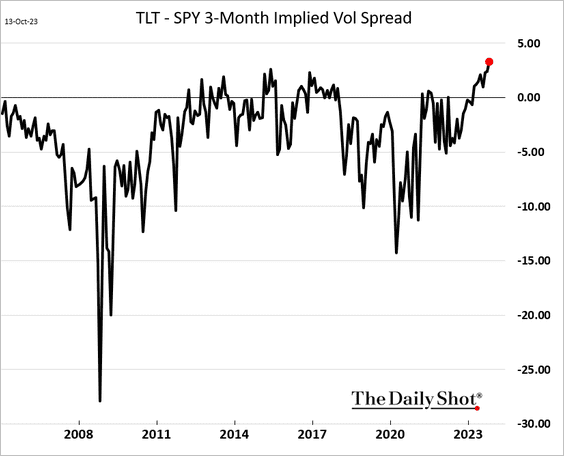

2. Long-term Treasury implied volatility has been outpacing the equity-market equivalent.

Further reading

Further reading

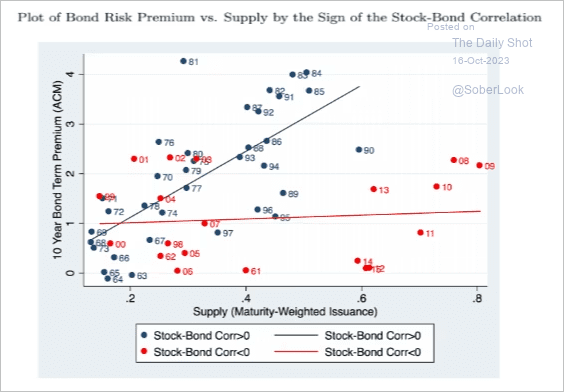

3. Treasury term premium is more sensitive to new supply of debt when the correlation between stocks and bonds is positive.

Source: Steve Hou; @financialtimes Read full article

Source: Steve Hou; @financialtimes Read full article

Back to Index

Global Developments

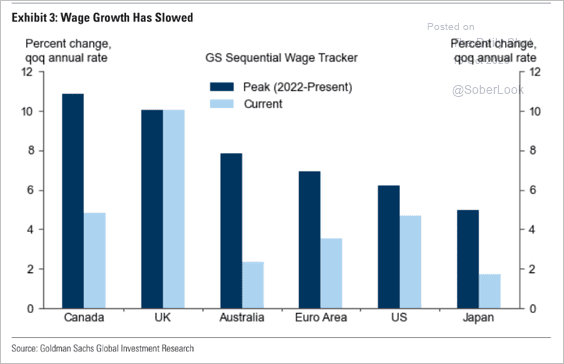

1. Wage growth is slowing.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

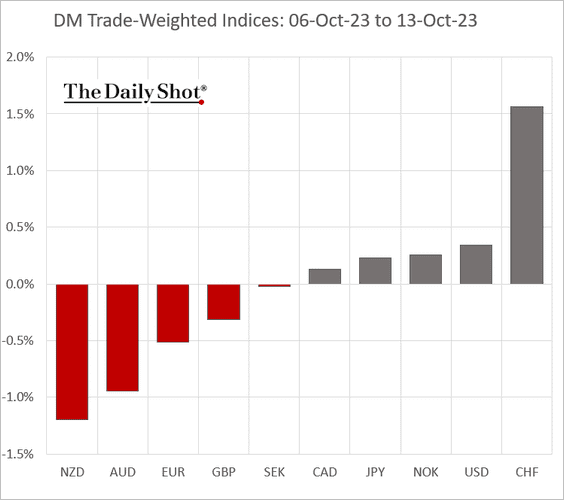

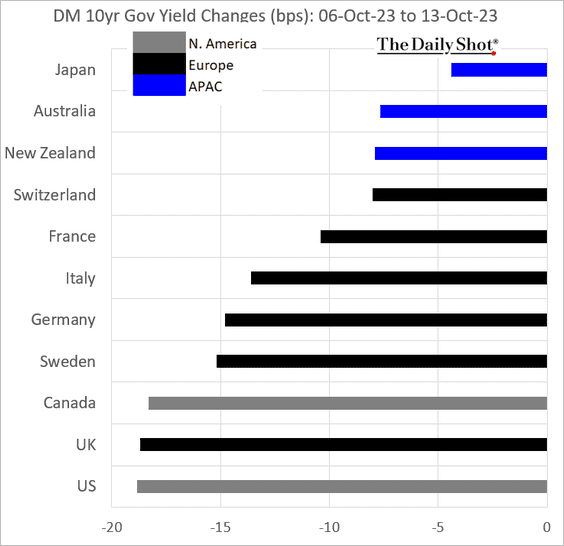

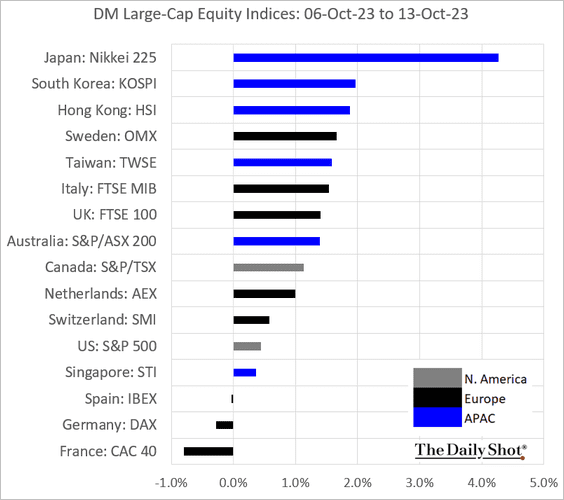

2. Here is a look at last week’s performance across advanced economies.

• Currencies:

• Bond yields:

• Equity indices:

——————–

Food for Thought

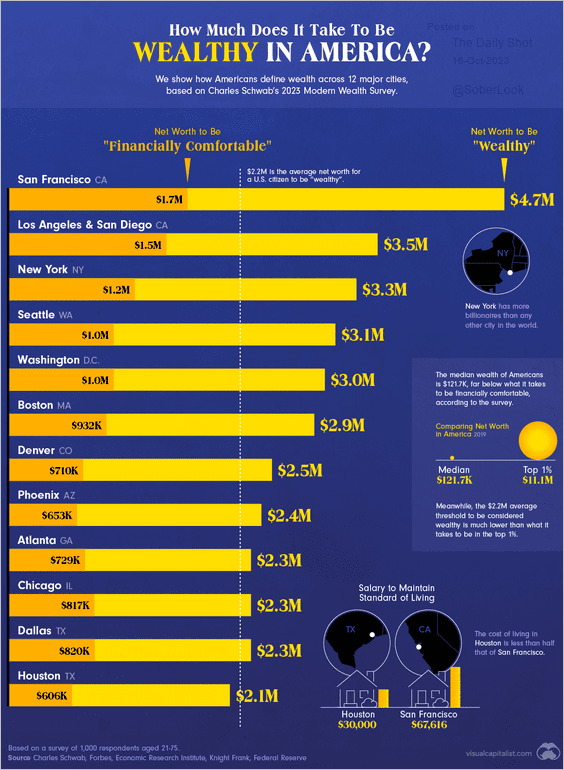

1. Definitions of “financially comfortable” and “wealthy” across US metro areas:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

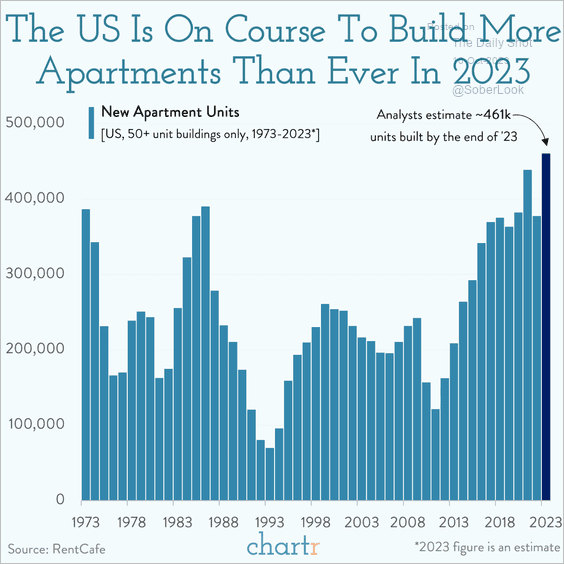

2. New apartment units:

Source: @chartrdaily

Source: @chartrdaily

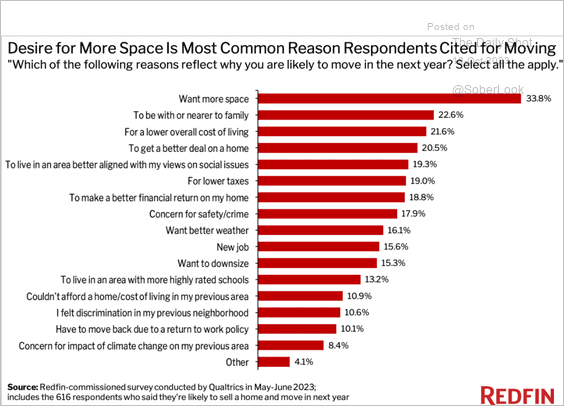

3. Reasons for moving:

Source: Redfin Read full article

Source: Redfin Read full article

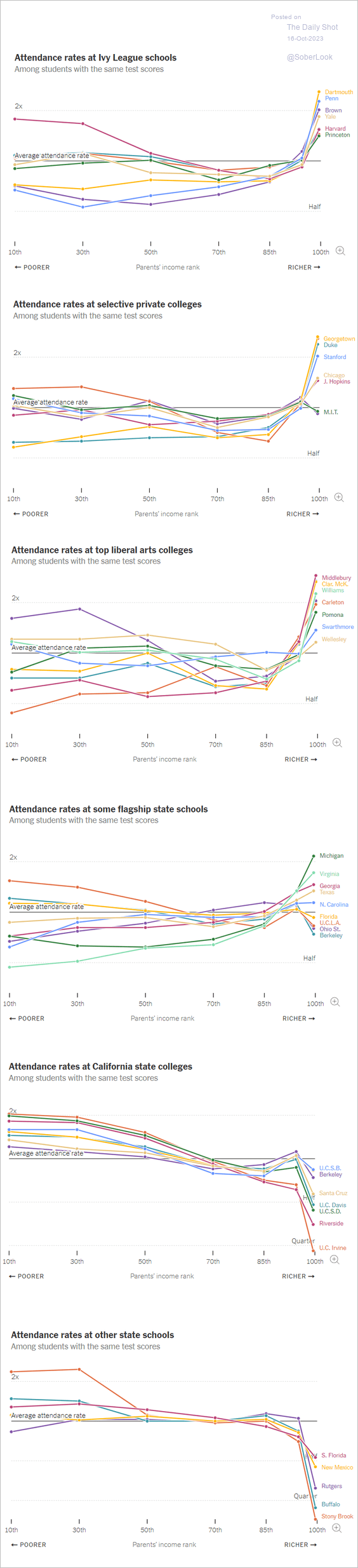

4. Attendance by income at top colleges:

Source: The New York Times Read full article

Source: The New York Times Read full article

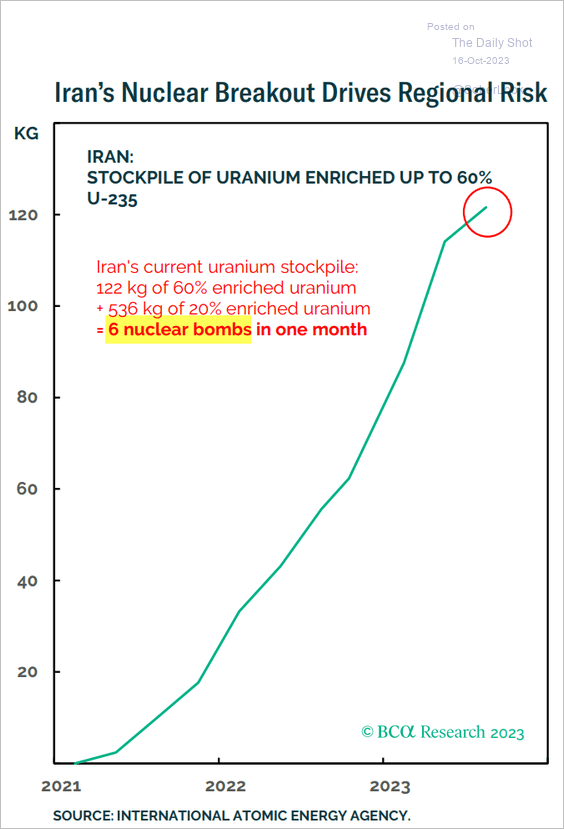

5. Iran’s stockpile of enriched uranium:

Source: BCA Research

Source: BCA Research

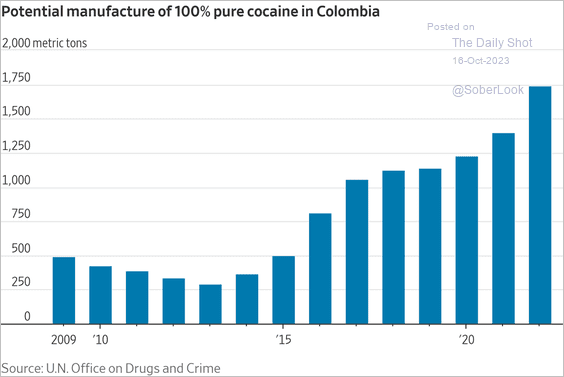

6. Colombia’s cocaine production:

Source: @WSJ Read full article

Source: @WSJ Read full article

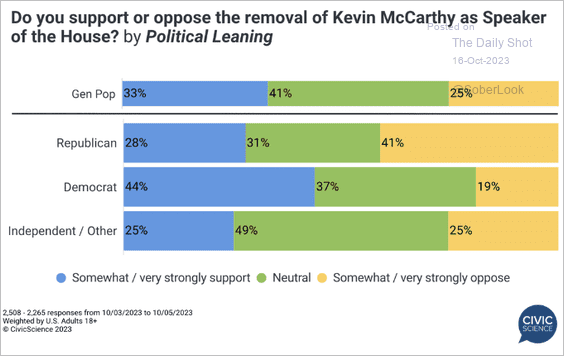

7. Views on Kevin McCarthy’s removal:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

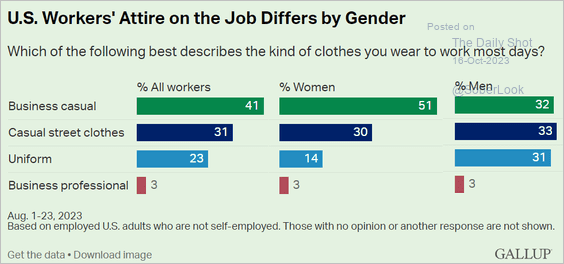

8. US workers’ attire on the job:

Source: Gallup Read full article Further reading

Source: Gallup Read full article Further reading

——————–

Back to Index