The Daily Shot: 17-Oct-23

• The United States

• Canada

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

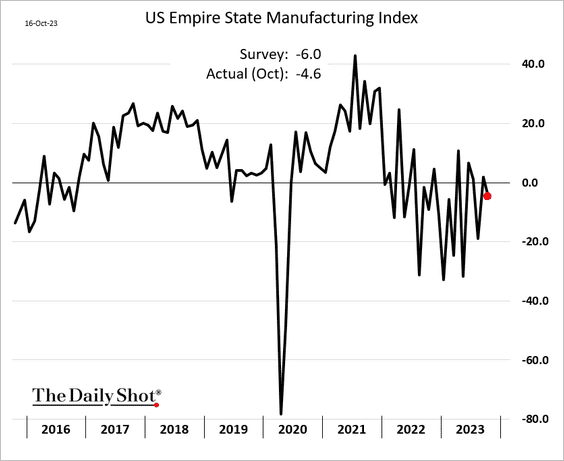

1. The NY Fed’s manufacturing index (the first such report of the month) continues to show lackluster factory activity in the region.

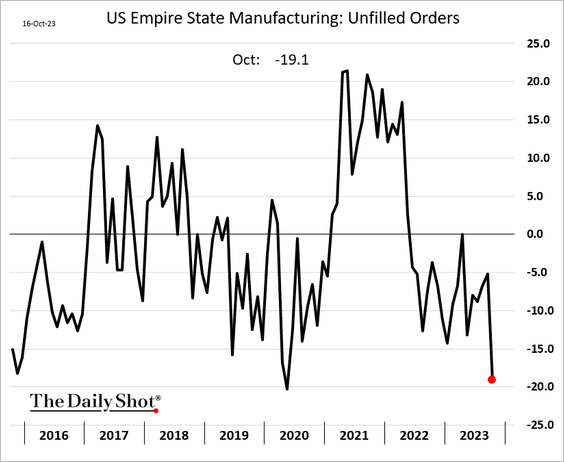

• Manufacturers have more than cleared their order backlog.

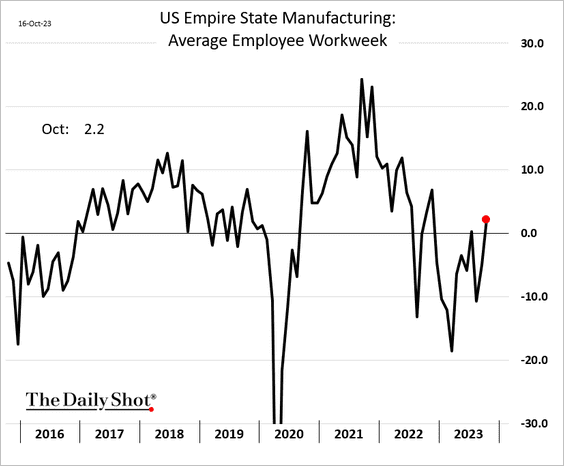

• However, workers’ hours are no longer declining.

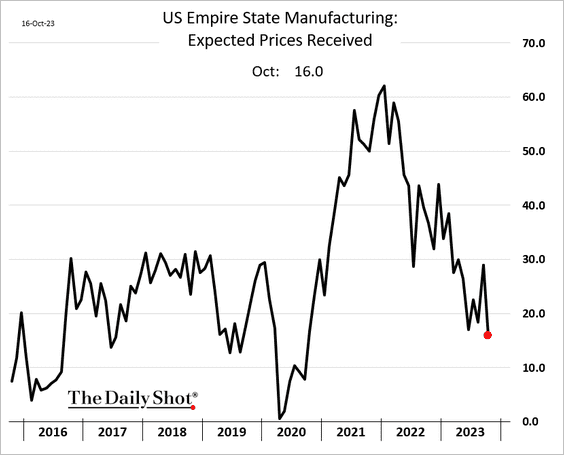

• Fewer firms expect to boost prices.

——————–

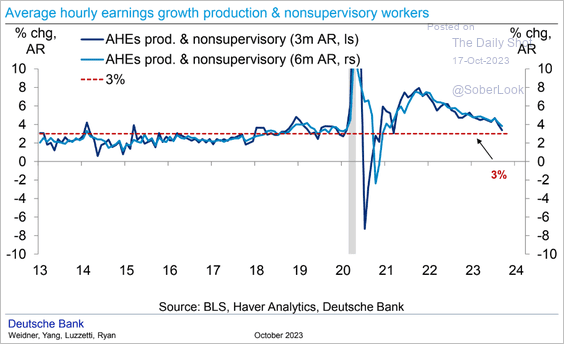

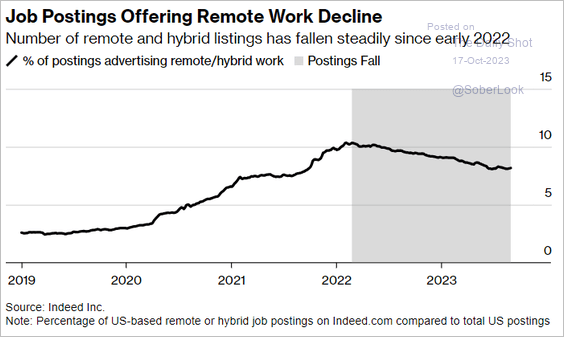

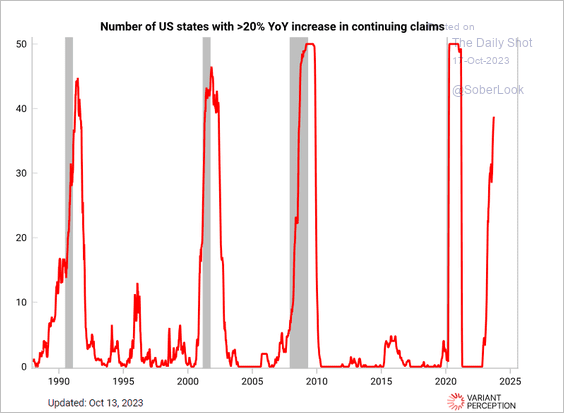

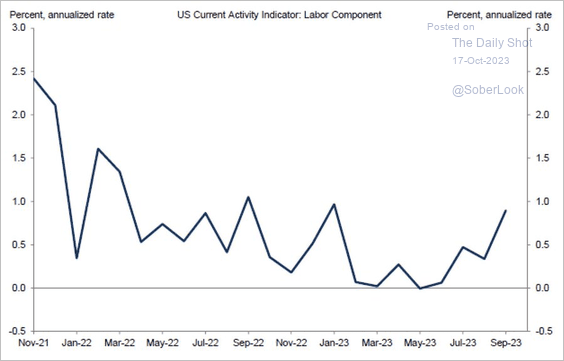

2. Next, we have some updates on the labor market.

• Wage growth among non-supervisory workers is back at pre-COVID levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Remote and hybrid work job postings are slowing.

Source: @thefuture Read full article

Source: @thefuture Read full article

• The number of states with significant increases in continuing jobless claims keeps rising.

Source: Variant Perception

Source: Variant Perception

• The labor component of Goldman’s economic activity index has been rebounding, pointing to persistent strength of the job market.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

——————–

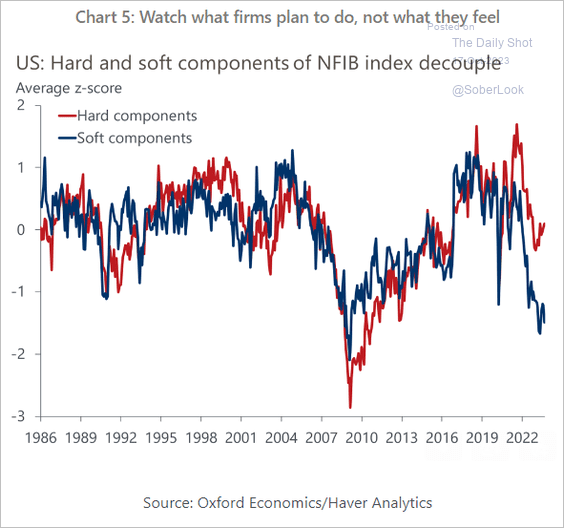

3. Next, let’s take a look at a couple of sentiment indicators.

• The NFIB small business optimism index is a combination of consumer and business sentiment. Many NFIB members are very small companies, with responses often reflecting owners’ personal opinions. The business component of this report is the “hard” data such as sales, hiring, credit, etc.

Source: Oxford Economics

Source: Oxford Economics

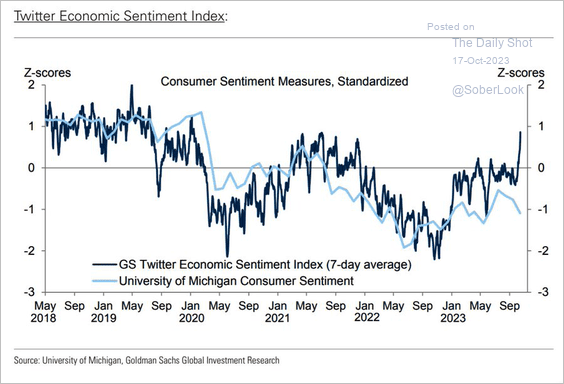

• The U. Michigan Consumer Sentiment has diverged from Goldman’s Twitter Economic Sentiment index.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

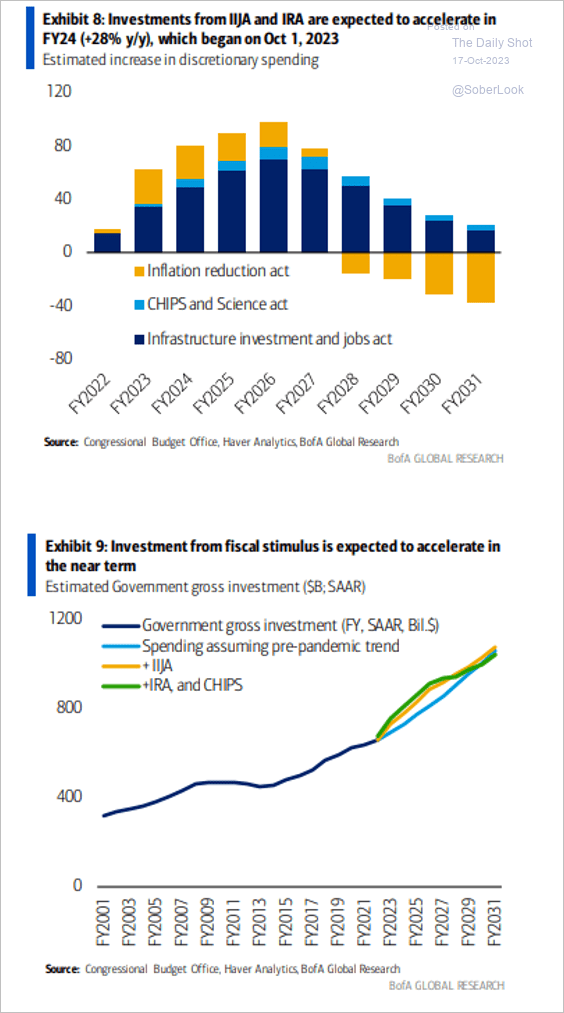

4. COVID-era government programs are expected to accelerate investment over the next few years.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

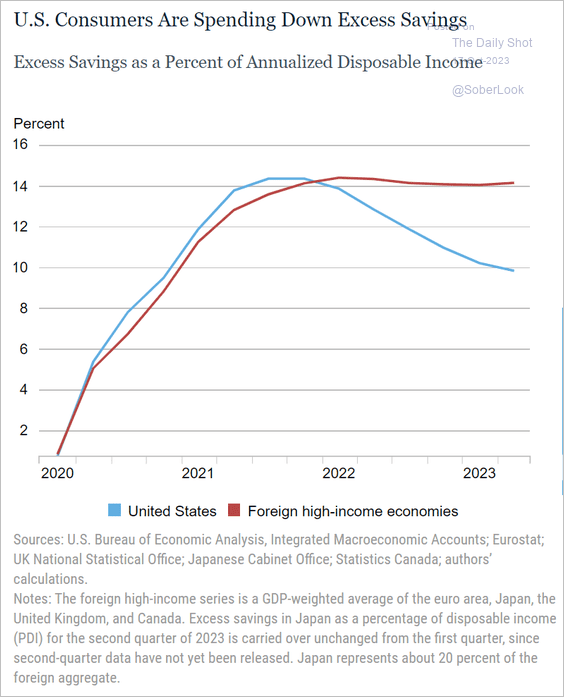

5. Americans don’t like to hold on to their savings.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

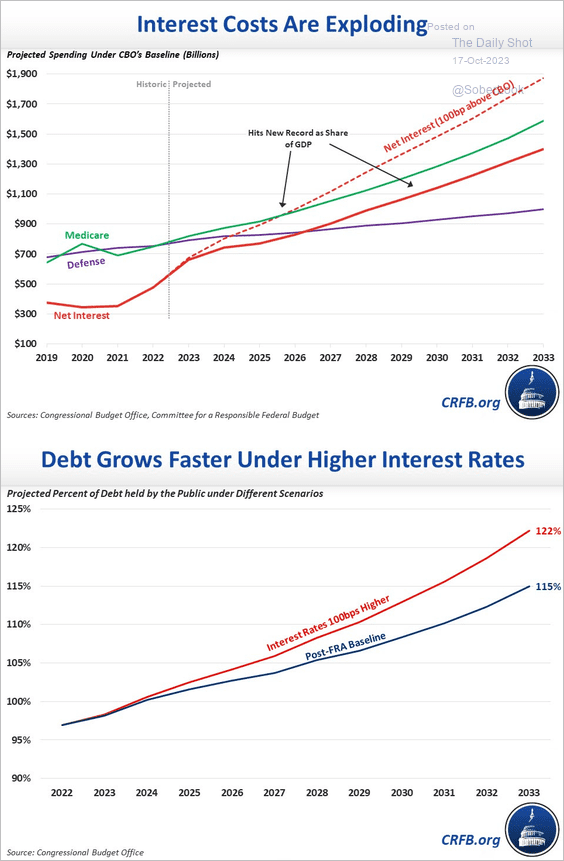

6. Here is a look at federal interest expense and the debt-to-GDP ratio under a higher Treasury yield scenario.

Source: CRFB

Source: CRFB

Back to Index

Canada

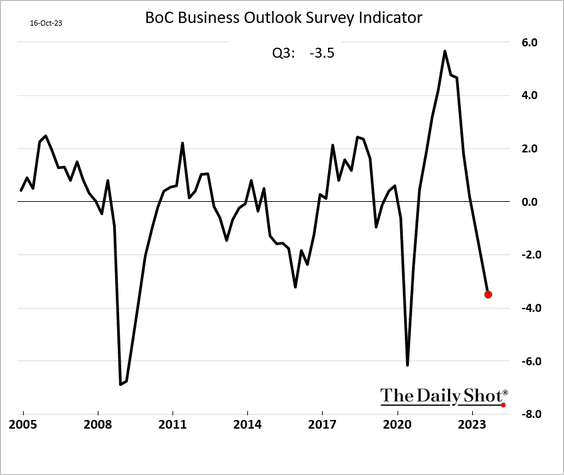

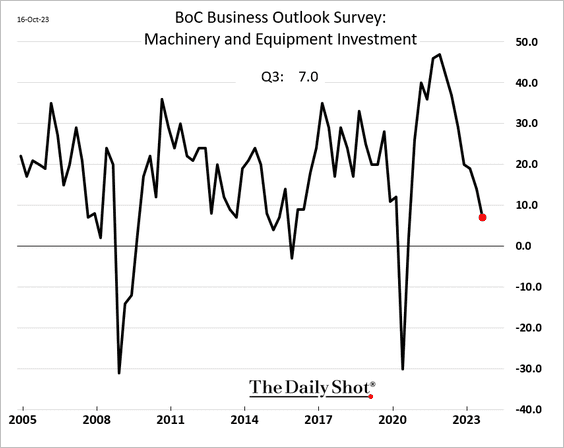

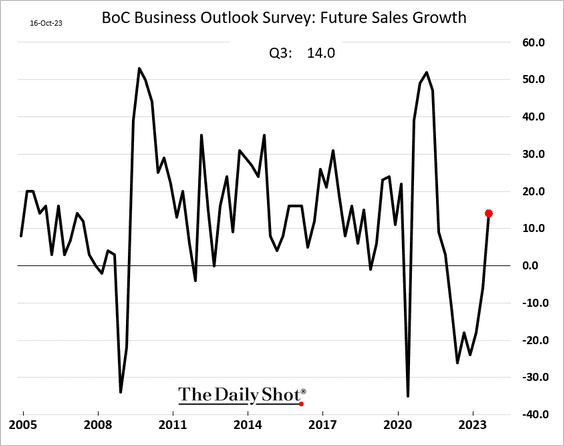

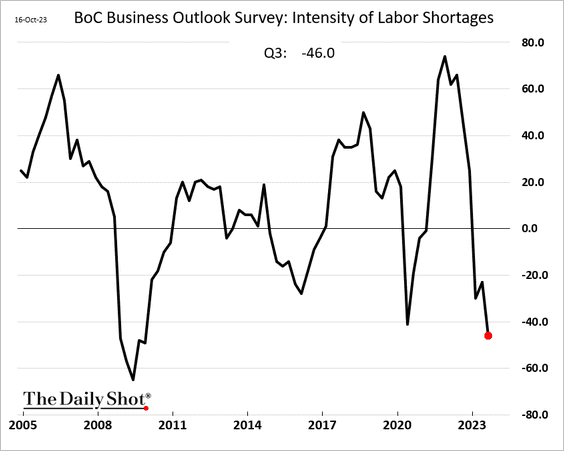

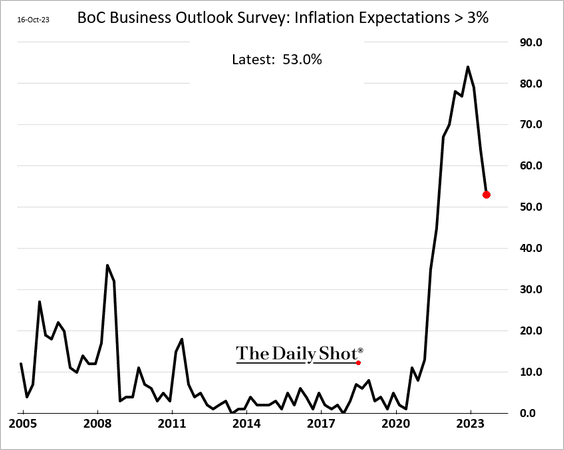

1. The BoC business survey indicator deteriorated further in Q3.

• CapEx growth is slowing.

• But businesses are more upbeat on future sales growth.

• No more labor shortages.

• Fewer firms expect inflation to be above 3%.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

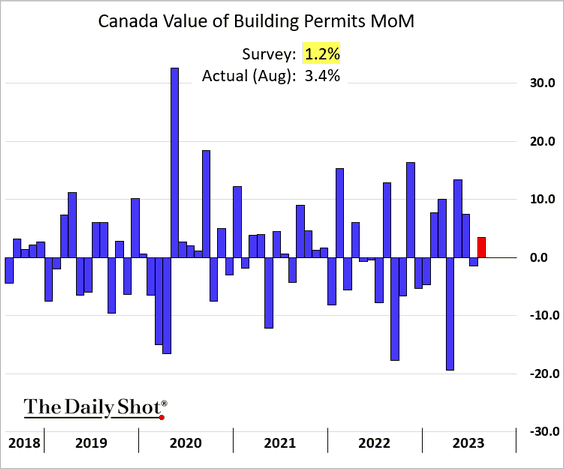

2. Building permits were higher than expected in August.

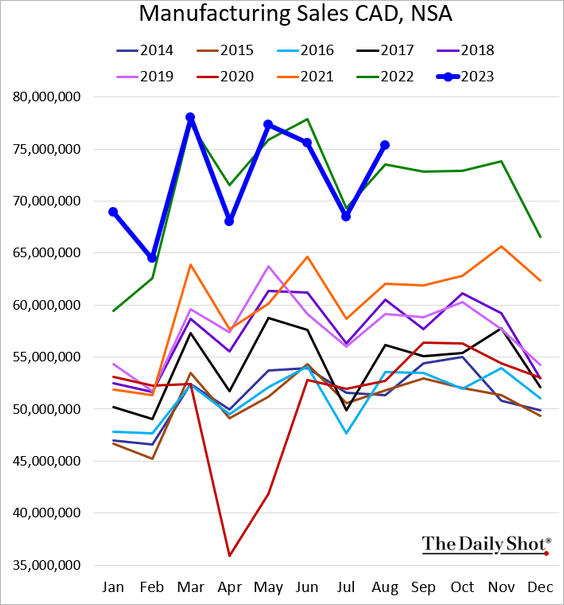

3. Manufacturing sales climbed above last year’s levels, but the increase was smaller than expected.

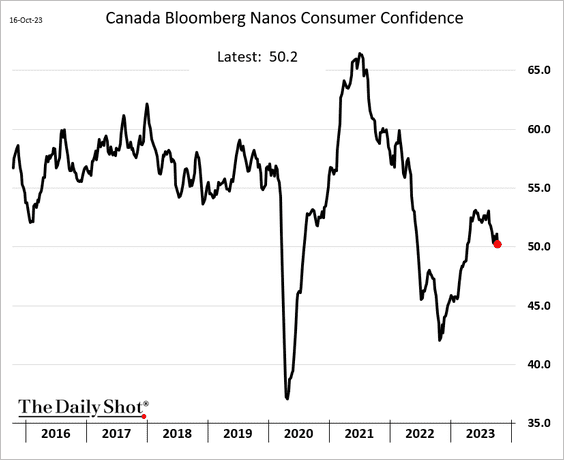

4. Consumer confidence is rolling over.

Back to Index

The Eurozone

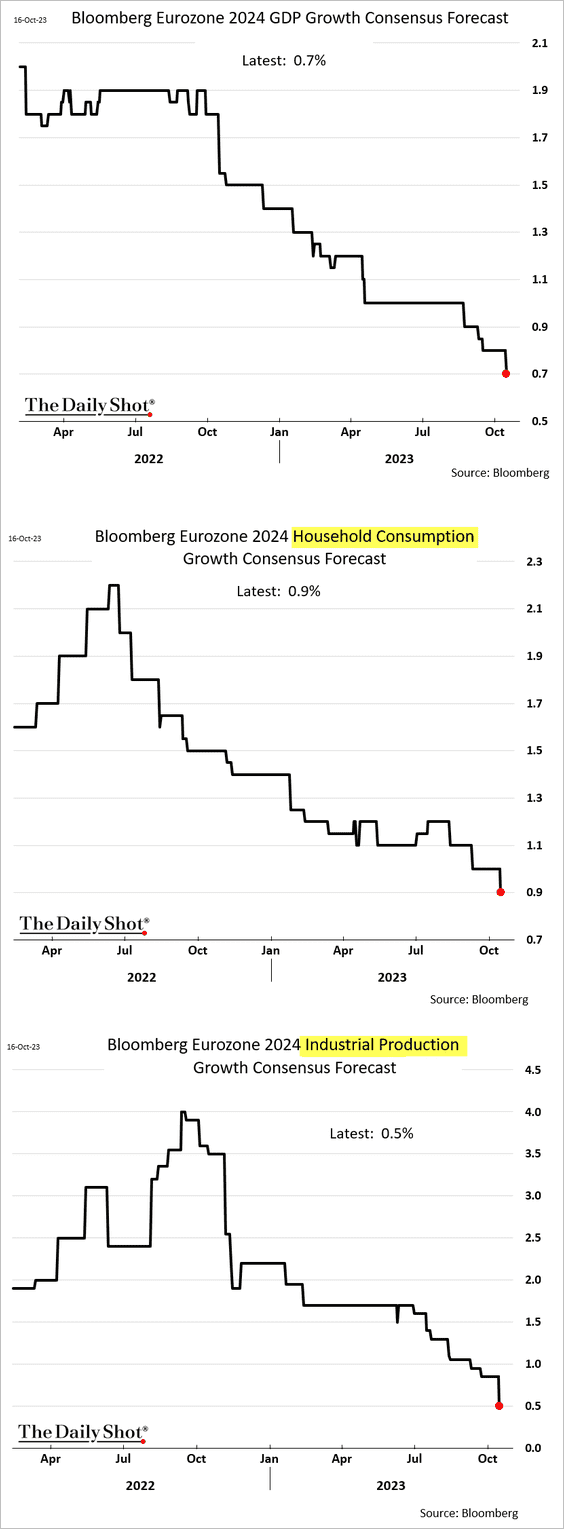

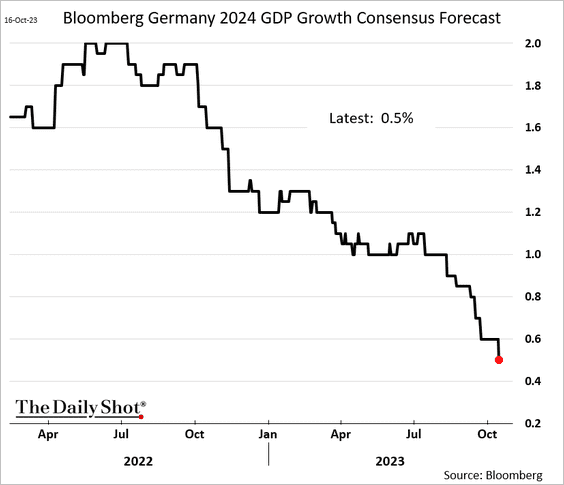

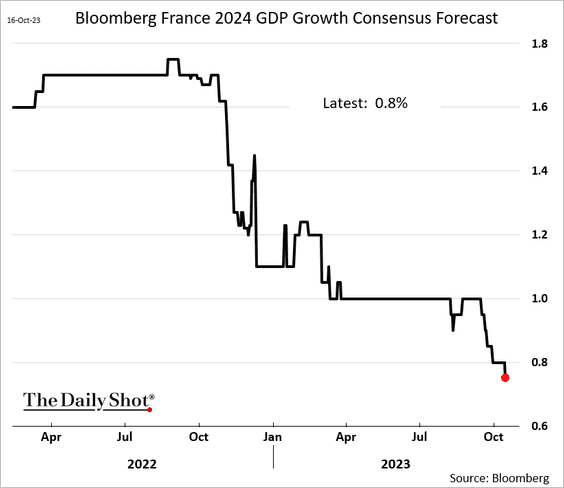

1. Economists continue to downgrade their forecasts for the 2024 euro-area GDP growth. Estimates for consumer spending and industrial production keep moving lower.

• Germany:

• France:

——————–

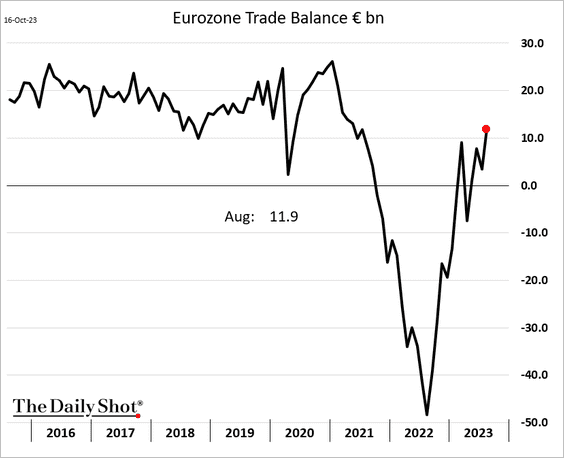

2. Euro-area trade surplus hit the highest level since 2021.

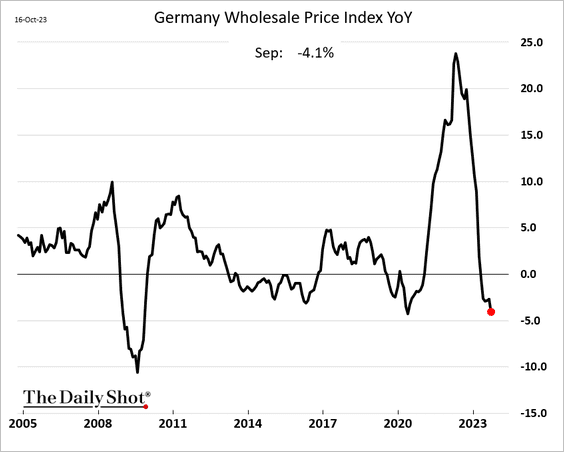

3. Here is Germany’s wholesale price index (year-over-year).

Back to Index

Asia-Pacific

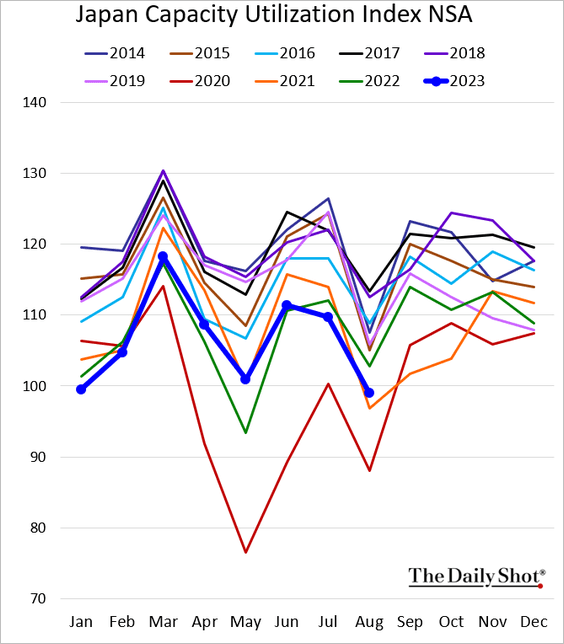

1. Japan’s industrial capacity utilization is back below last year’s levels.

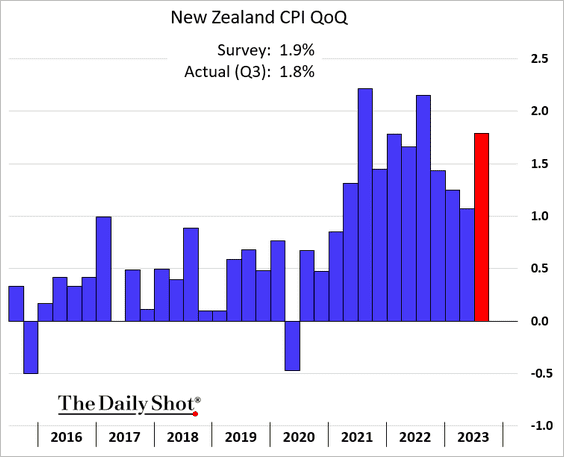

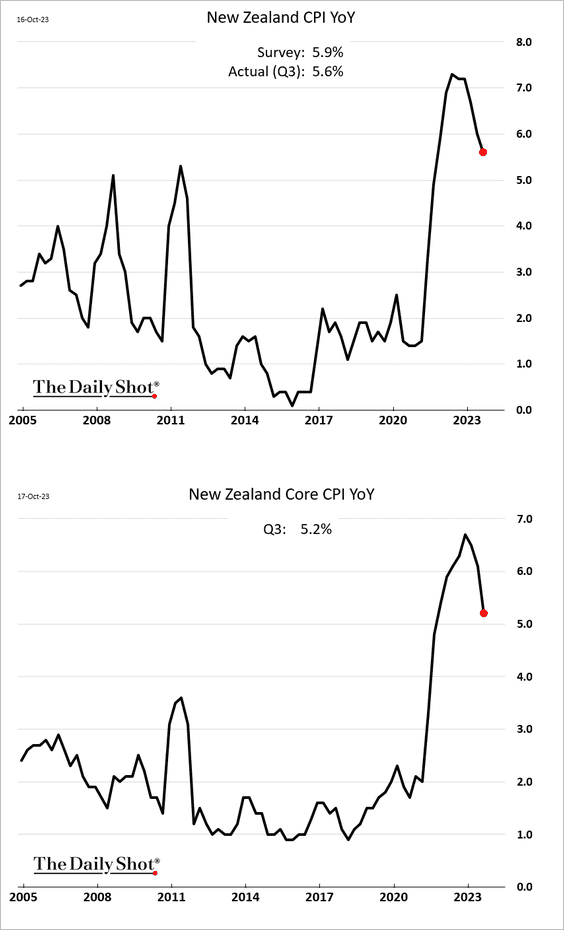

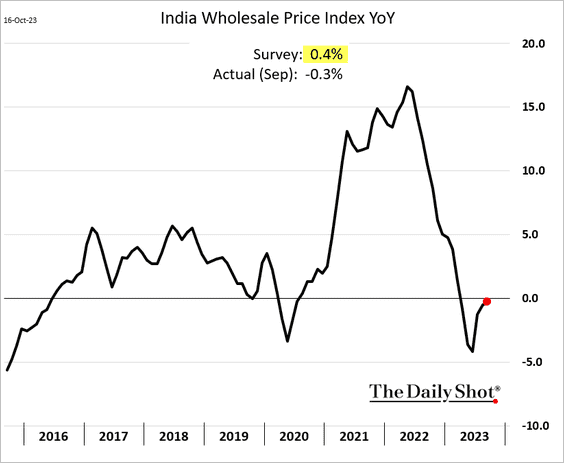

2. New Zealand’s inflation accelerated last quarter, but the increase was smaller than expected.

Below are the year-over-year trends.

Back to Index

China

1. Beijing wants companies to buy back their shares to mitigate the market downturn.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

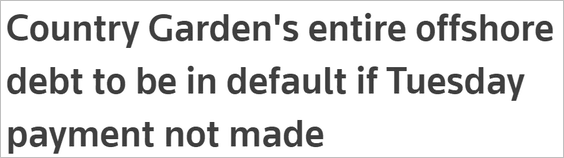

2. Country Garden is about to default on all of its offshore debt.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Emerging Markets

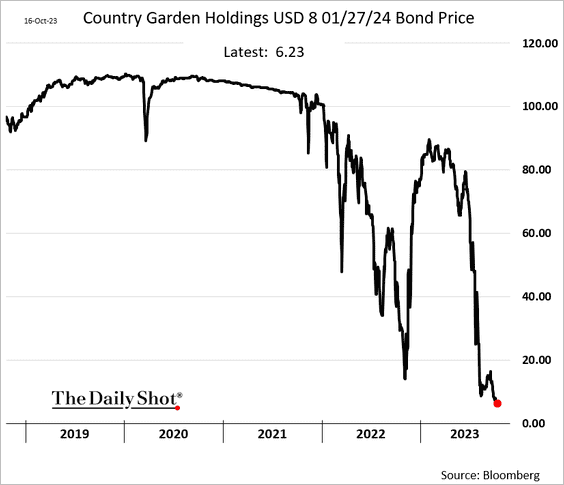

1. India’s wholesale prices remain subdued.

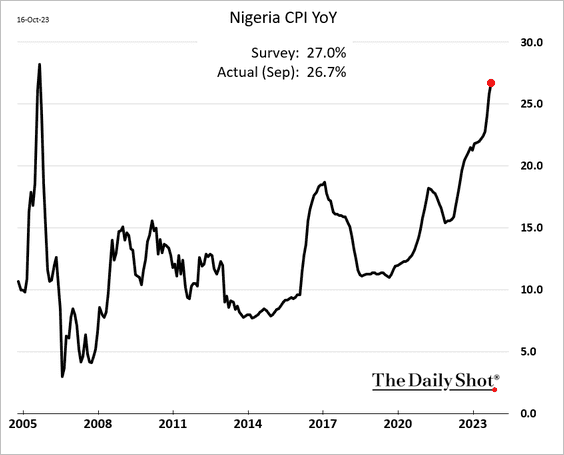

2. Nigeria’s CPI continues to climb.

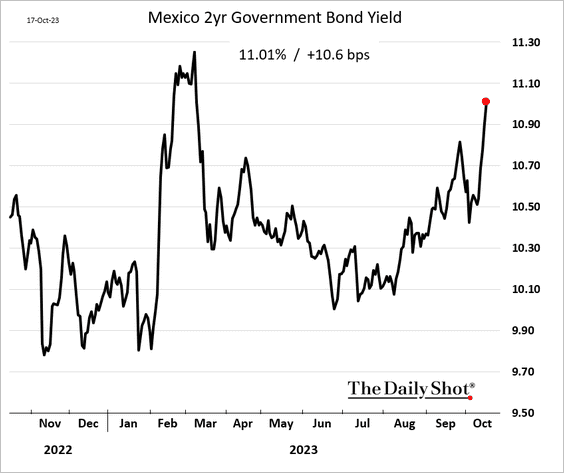

3. Mexican bond yields are surging.

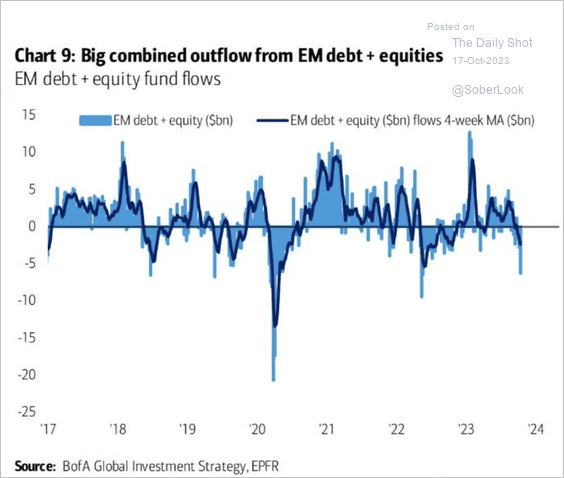

4. EM stock and bond fund outflows have accelerated.

Source: BofA Global Research

Source: BofA Global Research

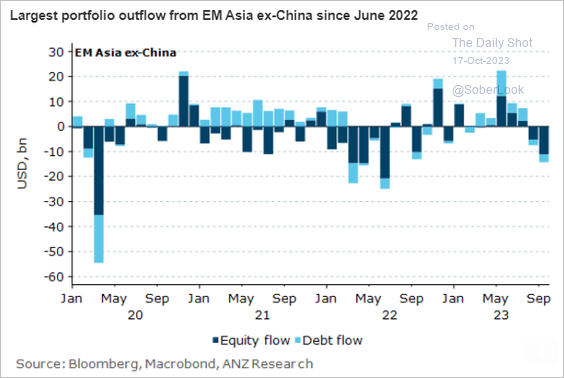

• EM Asia saw substantial portfolio outflows last month.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

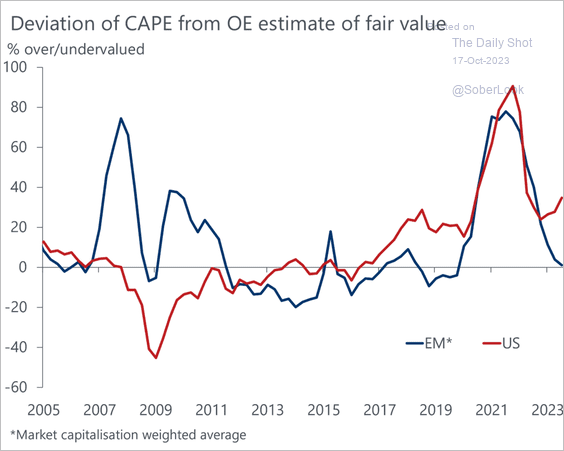

5. EM equities appear fairly valued, unlike the US, which could bolster higher relative returns over the next five years.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

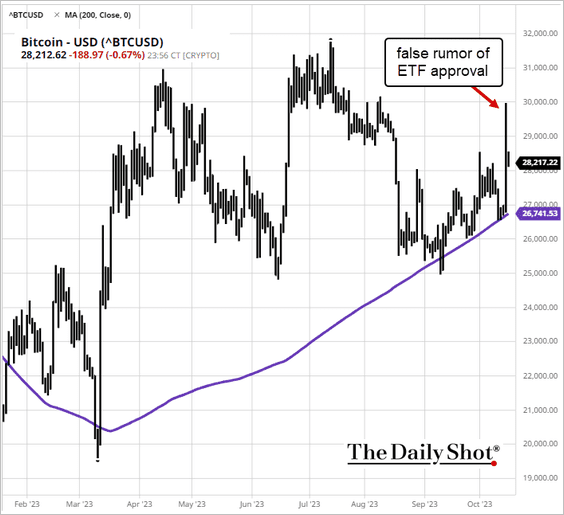

1. A false report about a BlackRock spot-BTC ETF approval triggered a spike in bitcoin toward $30K on Monday, …

Source: @technology Read full article

Source: @technology Read full article

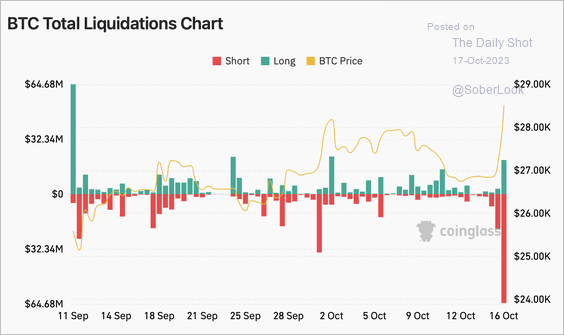

… which led to a surge in short liquidations.

Source: Coinglass

Source: Coinglass

——————–

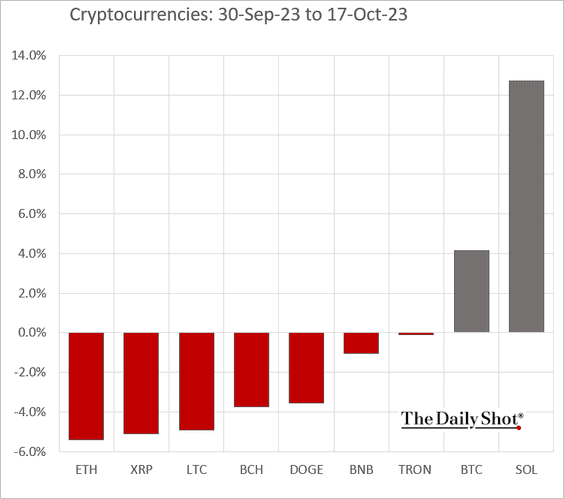

2. Here is a look at the month-to-date performance for some of the most liquid cryptos.

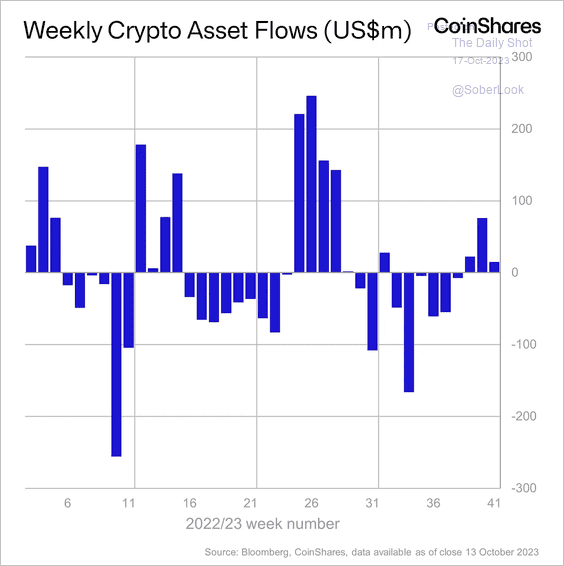

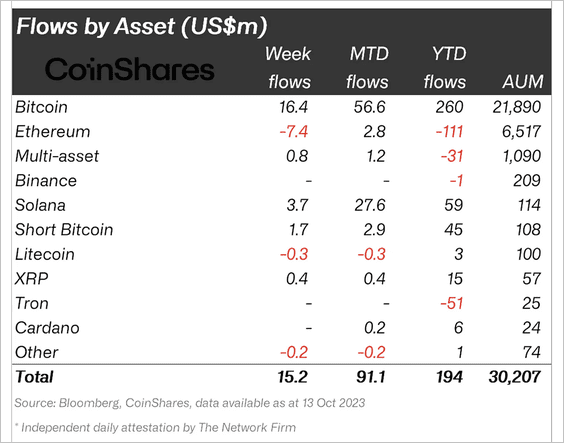

3. Crypto funds saw inflows for the third consecutive week.

Source: CoinShares Read full article

Source: CoinShares Read full article

Long-bitcoin products attracted fresh capital, while some altcoin funds saw outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

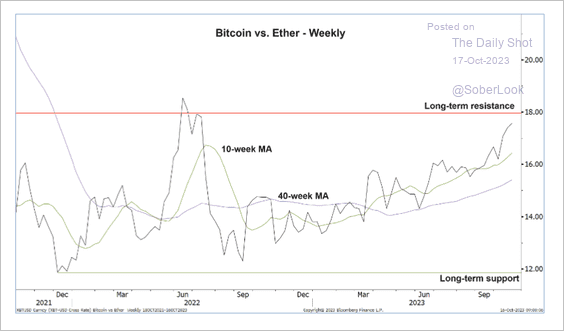

4. The BTC/ETH price ratio is approaching long-term resistance.

Source: @StocktonKatie

Source: @StocktonKatie

Back to Index

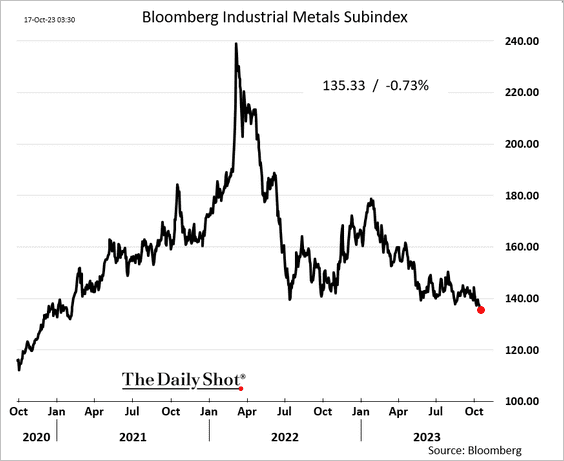

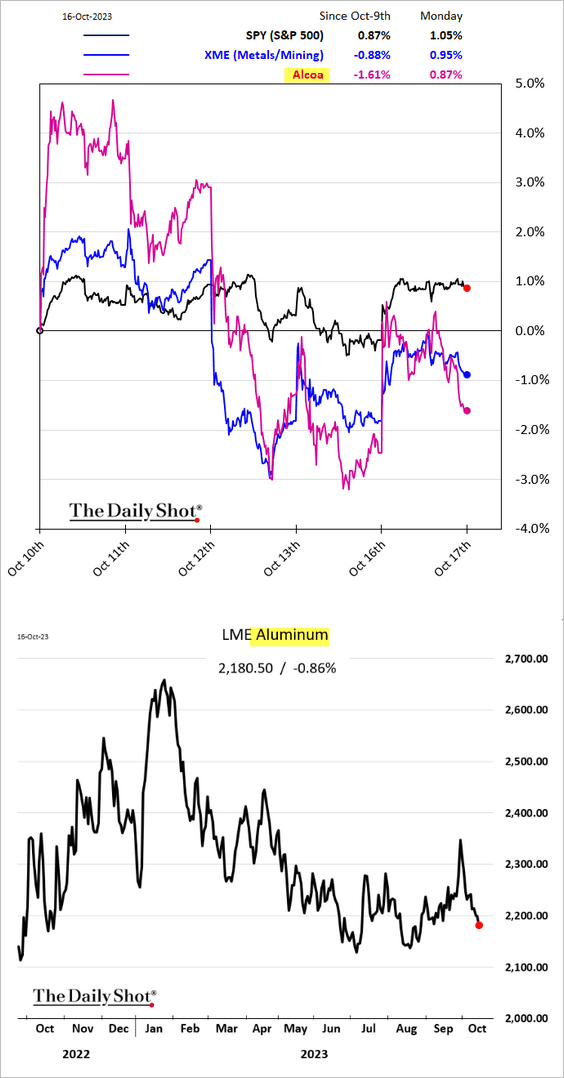

Commodities

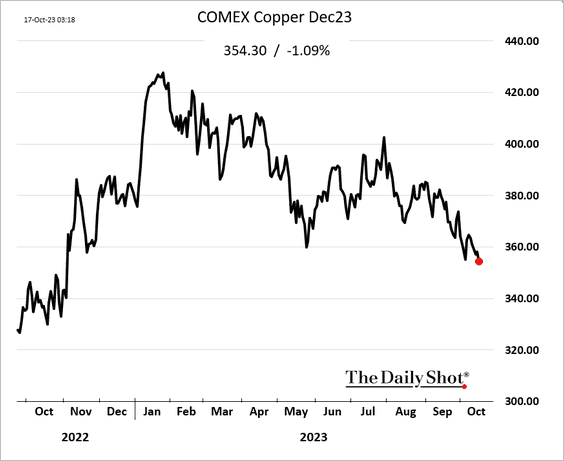

Industrial metals have been struggling amid soft demand from China.

• Copper:

• Bloomberg’s industrial metals index.

• Metals & Mining shares:

Back to Index

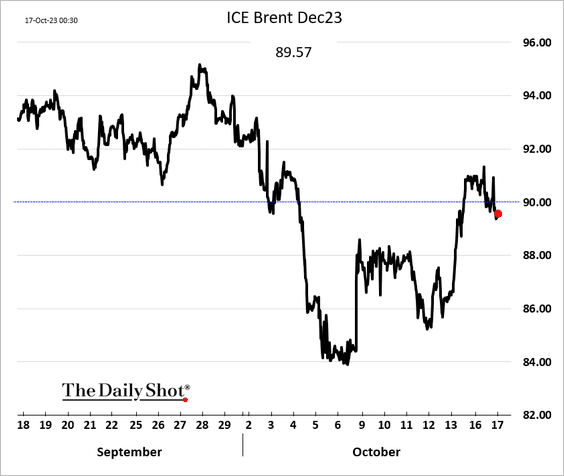

Energy

1. Brent crude dipped below $90/bbl on the Venezuela opposition talks.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

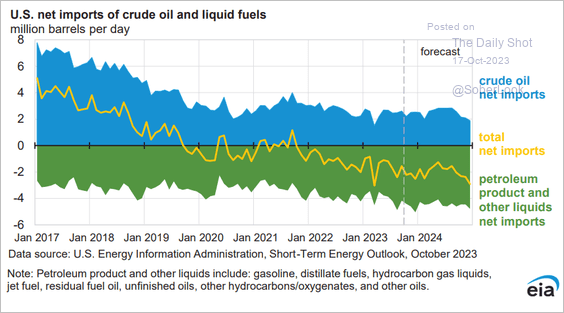

2. The US is expected to increase its petroleum liquids trade surplus.

Source: @EIAgov

Source: @EIAgov

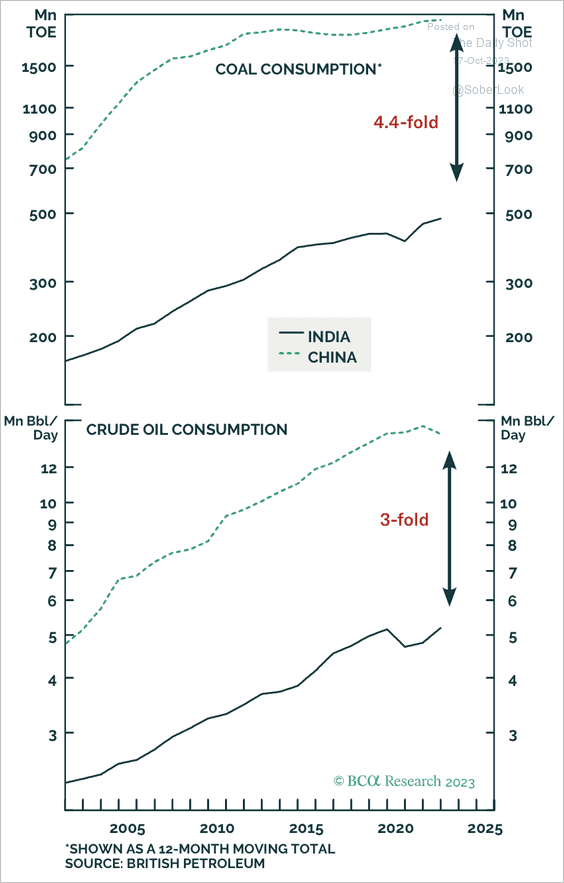

3. India’s oil consumption is around a third of China’s.

Source: BCA Research

Source: BCA Research

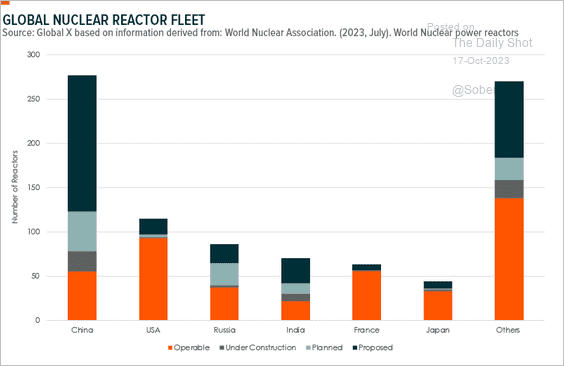

4. China intends to construct a vast nuclear reactor fleet over the next 15 years, which could far surpass what has been achieved globally in recent decades.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Equities

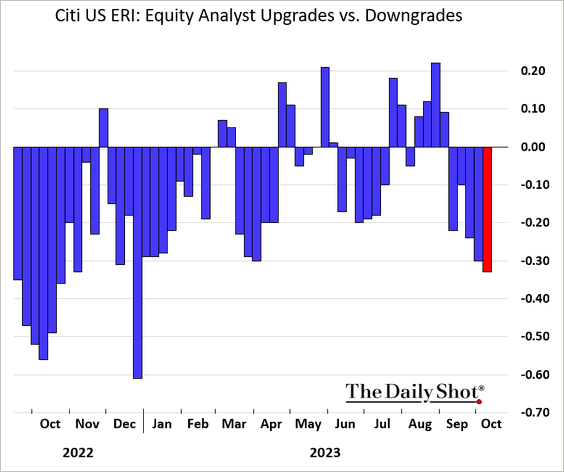

1. Analysts’ earnings downgrades are increasingly outpacing upgrades.

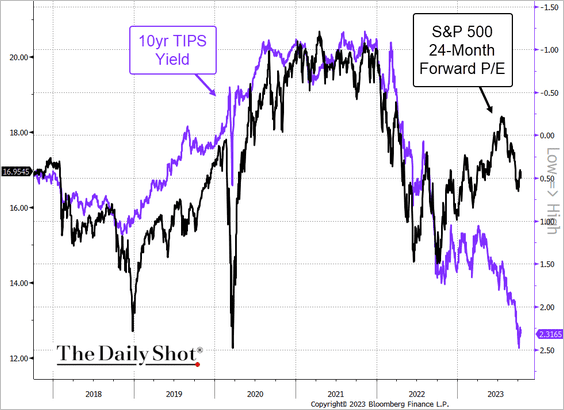

2. Valuations based on the 24-month earnings projections remain decoupled from real rates.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

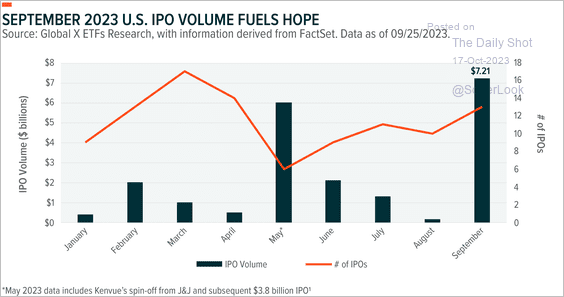

3. The IPO market started to recover in recent months.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

• Institutional investor appetite for IPOs is rising, according to a survey by Goldman Sachs.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

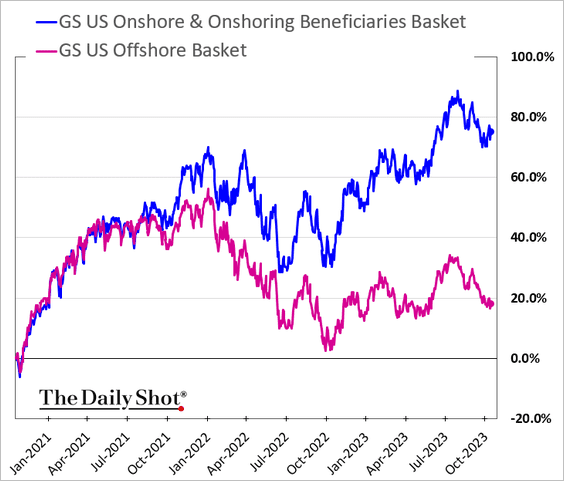

4. The market continues to reward companies focused on onshoring.

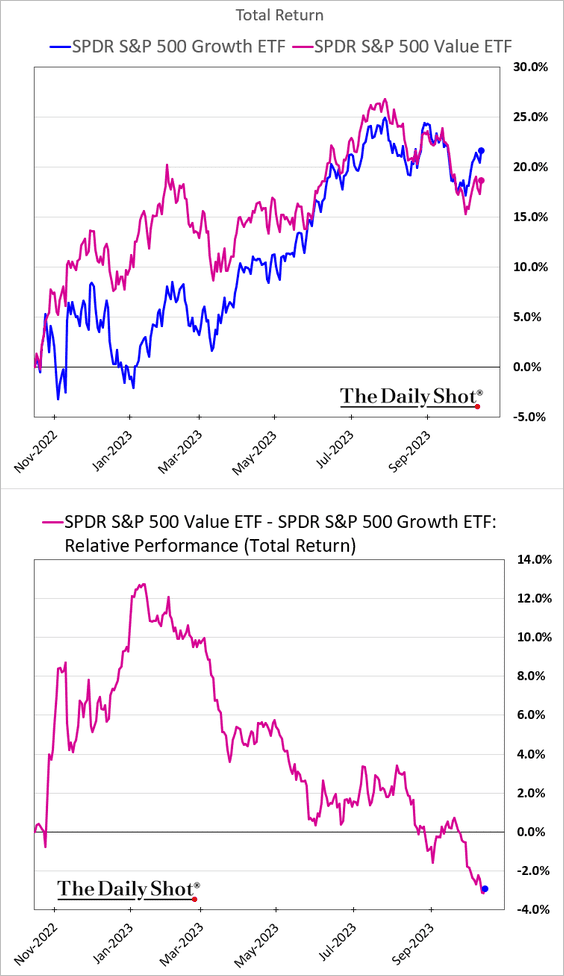

5. Value has been underperforming growth again.

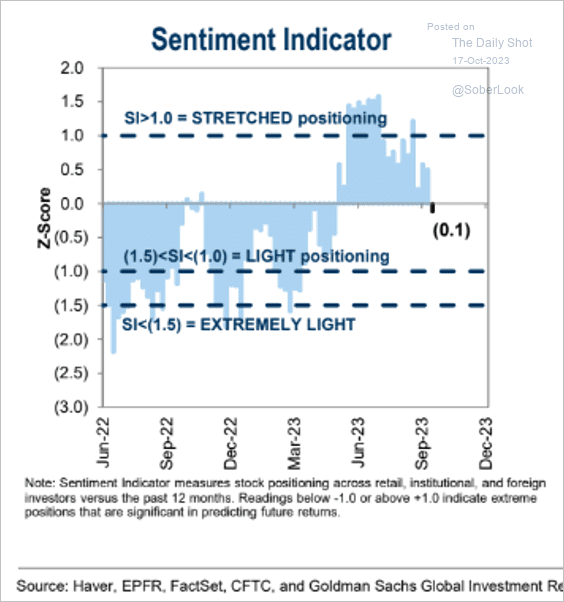

6. The GS positioning indicator has turned negative for the first time since last spring.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

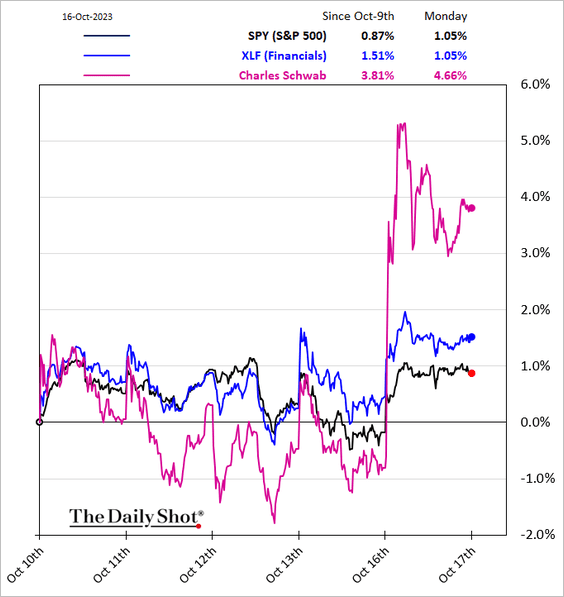

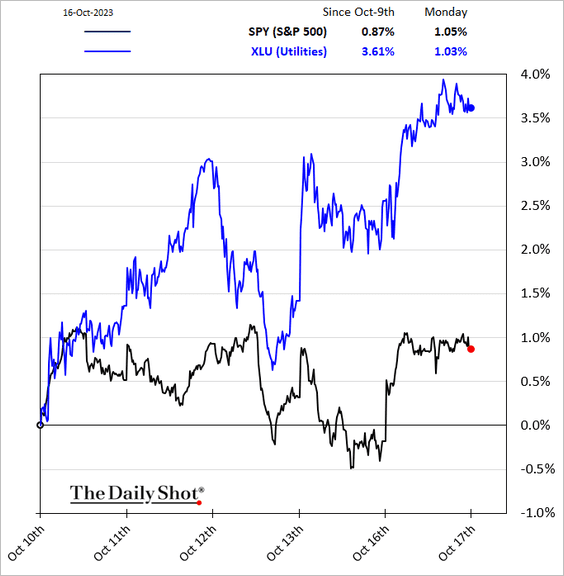

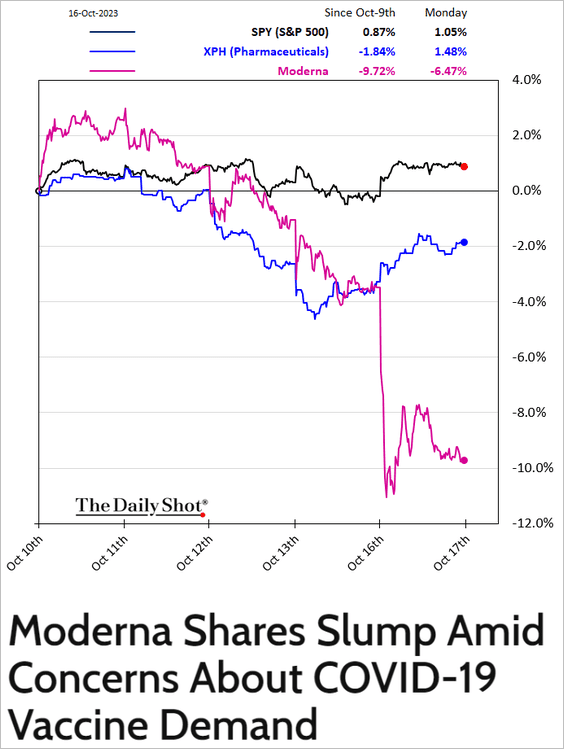

7. Next, we have some sector updates.

• Here are some performance charts over the past five business days.

– Financials:

– Utilities:

– Pharma:

Source: Investopedia Read full article

Source: Investopedia Read full article

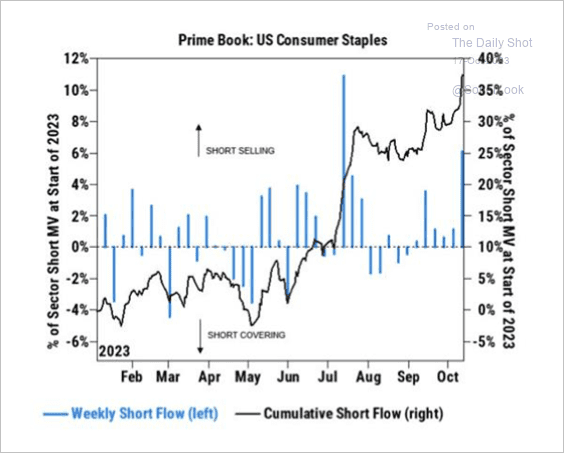

• Short selling of US consumer staples stocks is at the highest level in three months.

Source: Goldman Sachs

Source: Goldman Sachs

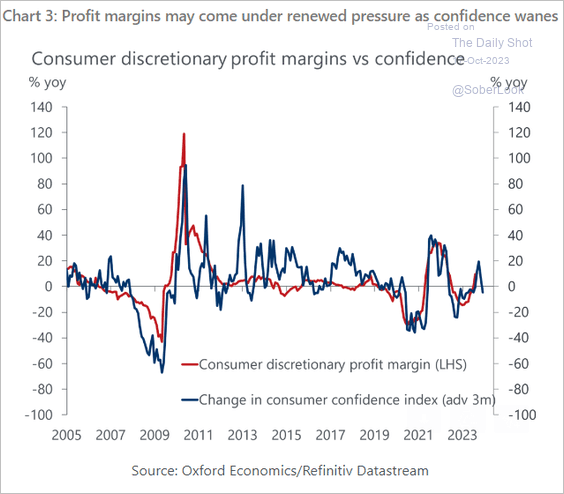

• Consumer sentiment signals lower margins for consumer discretionary companies ahead.

Source: Oxford Economics

Source: Oxford Economics

——————–

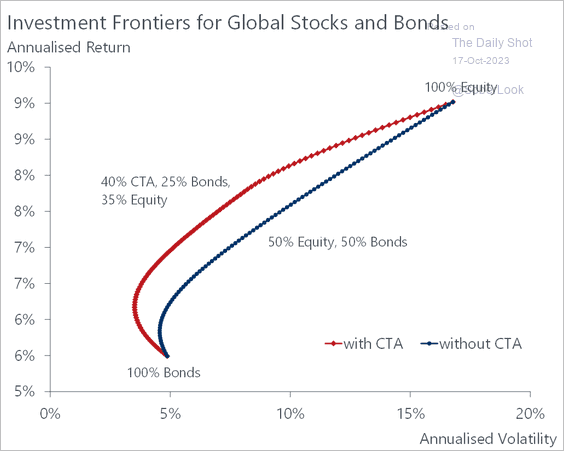

8. Adding managed futures to a stock/bond portfolio can lead to an outward shift of the efficient frontier. Oxford Economics expects the diversification potential of trend-following strategies to stay elevated as stock/bond correlations rise.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Rates

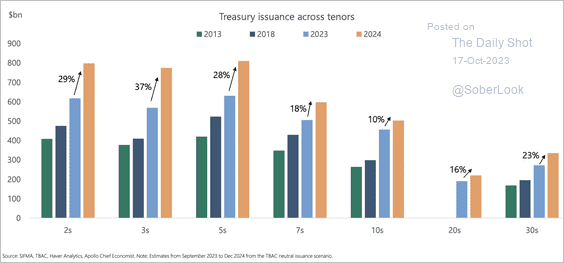

1. Treasury auctions will grow substantially in 2024.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

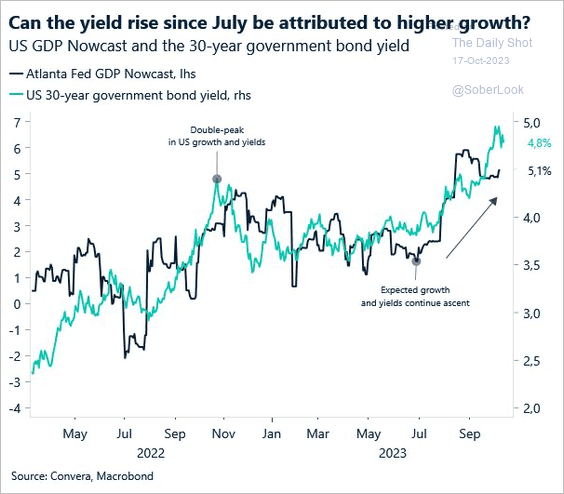

2. The rise in long-term Treasury yields occurred alongside higher US GDP growth estimates this year.

Source: Convera

Source: Convera

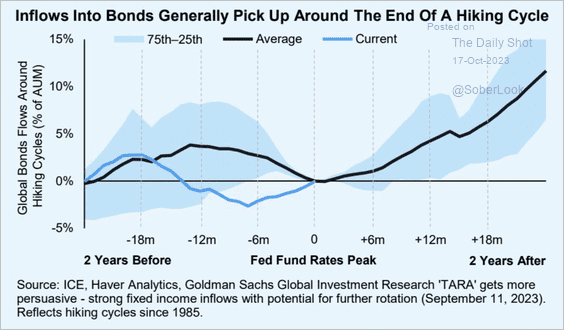

3. Treasury fund inflows tend to accelerate at the end of rate hiking cycles.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

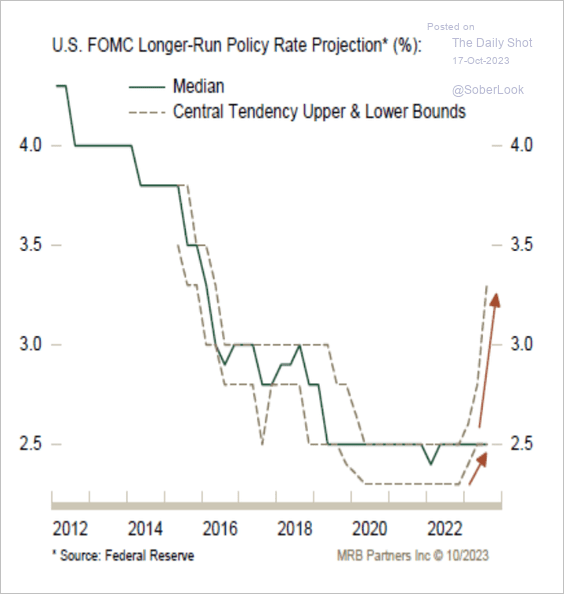

4. Some FOMC members have raised their longer-run policy rate estimates. MRB Partners expects a resilient economy will eventually force investors and the Fed to abandon expectations for policy rate cuts next year.

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

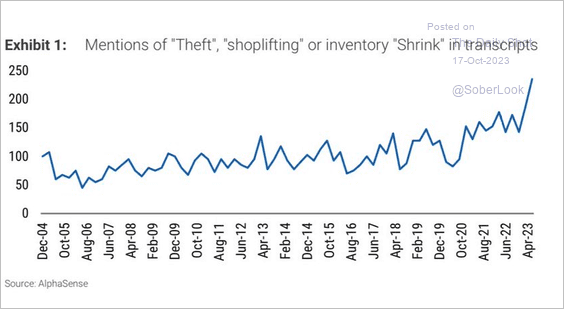

1. Companies are increasingly concerned about shoplifting.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

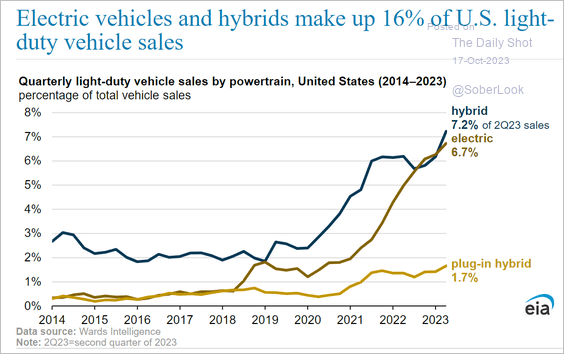

2. US EV and hybrid sales:

Source: @EIAgov

Source: @EIAgov

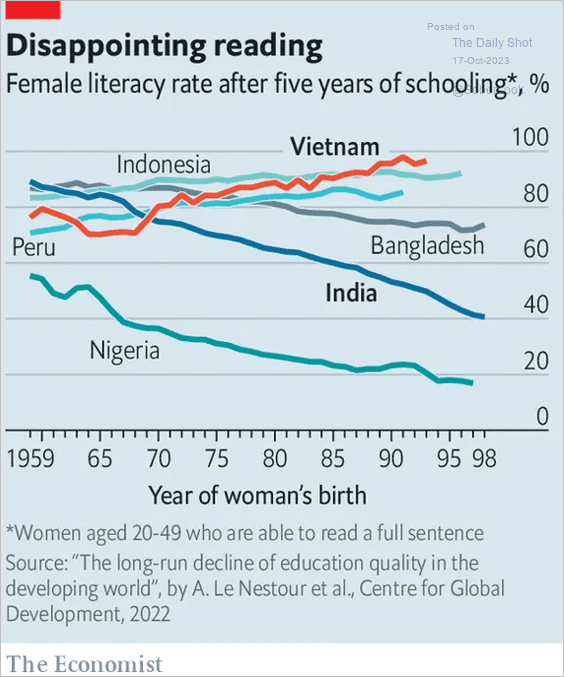

3. Female literacy rates by year of birth:

Source: The Economist Read full article

Source: The Economist Read full article

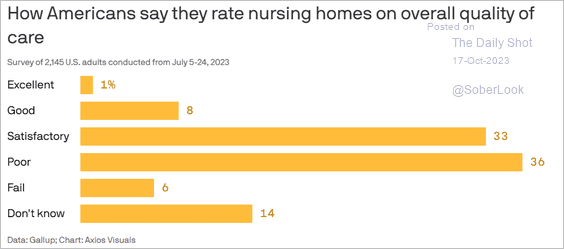

4. Views on nursing homes’ quality:

Source: @axios Read full article

Source: @axios Read full article

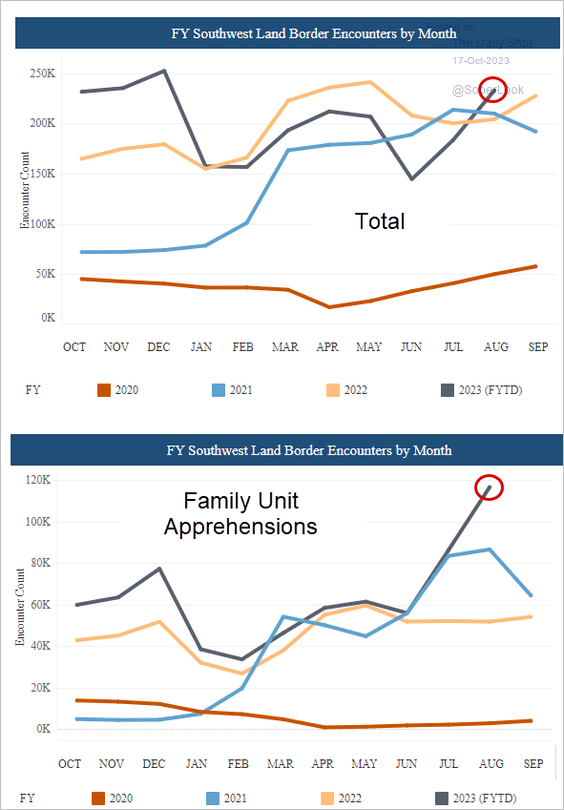

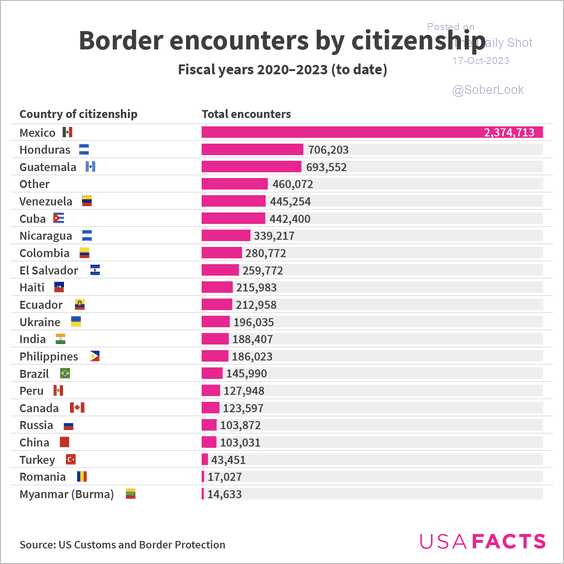

5. Southwest land border encounters:

Source: CBP

Source: CBP

• Border encounters by country of origin:

Source: USAFacts

Source: USAFacts

——————–

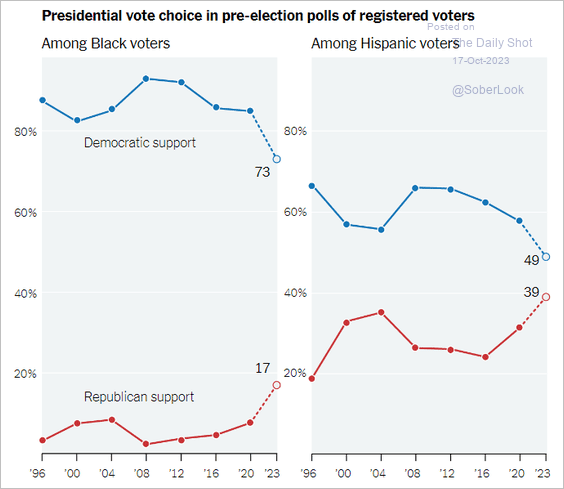

6. Democrats’ weakness among nonwhite voters:

Source: The New York Times Read full article

Source: The New York Times Read full article

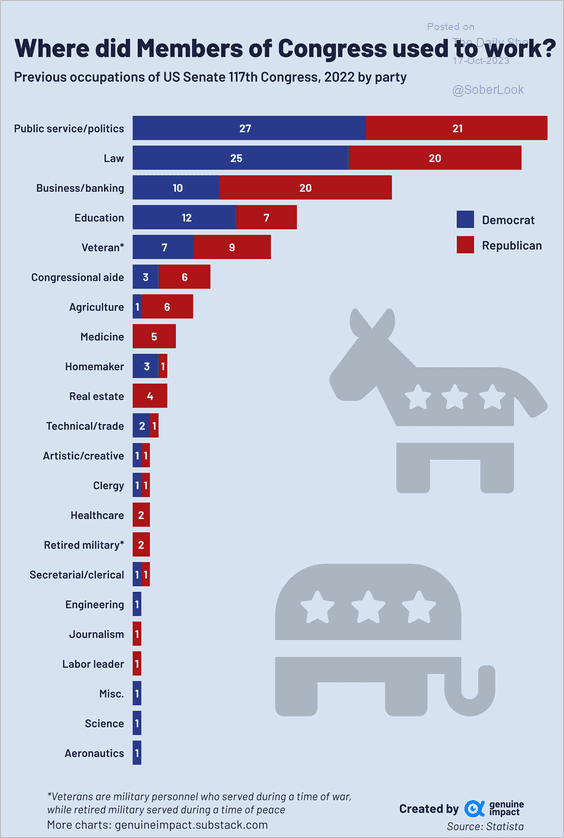

7. Previous occupations held by members of Congress:

Source: @genuine_impact

Source: @genuine_impact

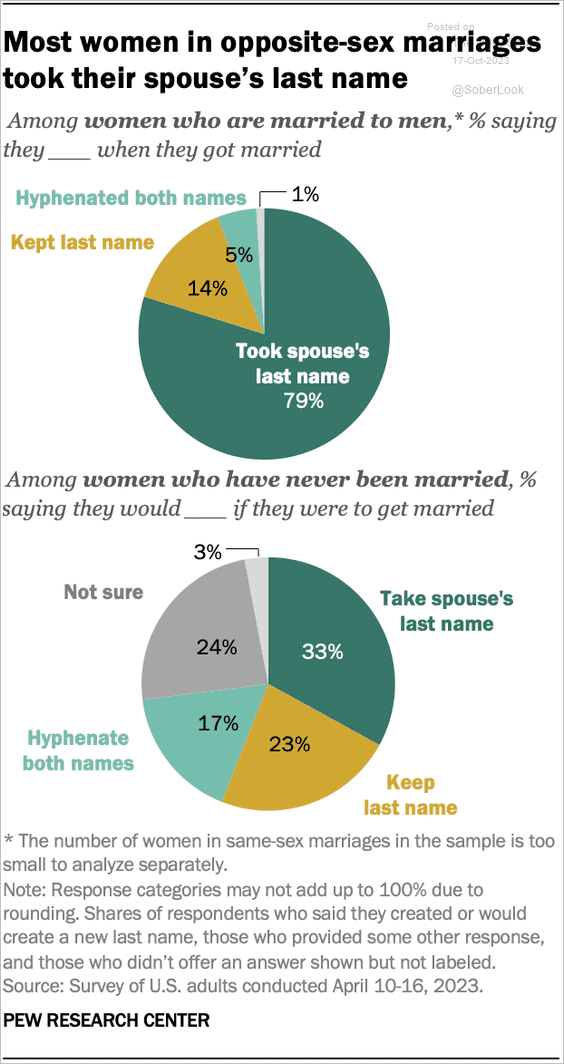

8. Women taking their spouse’s last name:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

Back to Index