The Daily Shot: 20-Oct-23

• The United States

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

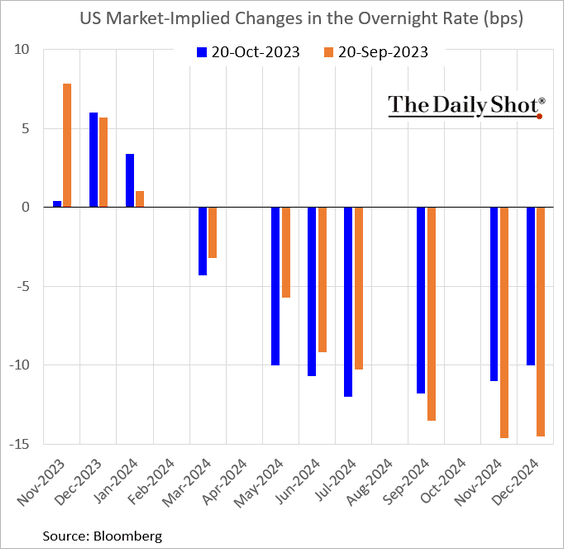

1. Jerome Powell’s speech confirmed what we’ve been hearing from other Fed officials. Given the recent upsurge in long-term interest rates, which may serve as a viable alternative to another Fed rate hike, the Federal Reserve is expected to pause for now. This holds true only if Treasury yields remain elevated.

Chair Powell: – Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening. We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

The market still sees about a 40% chance of another rate hike in this cycle.

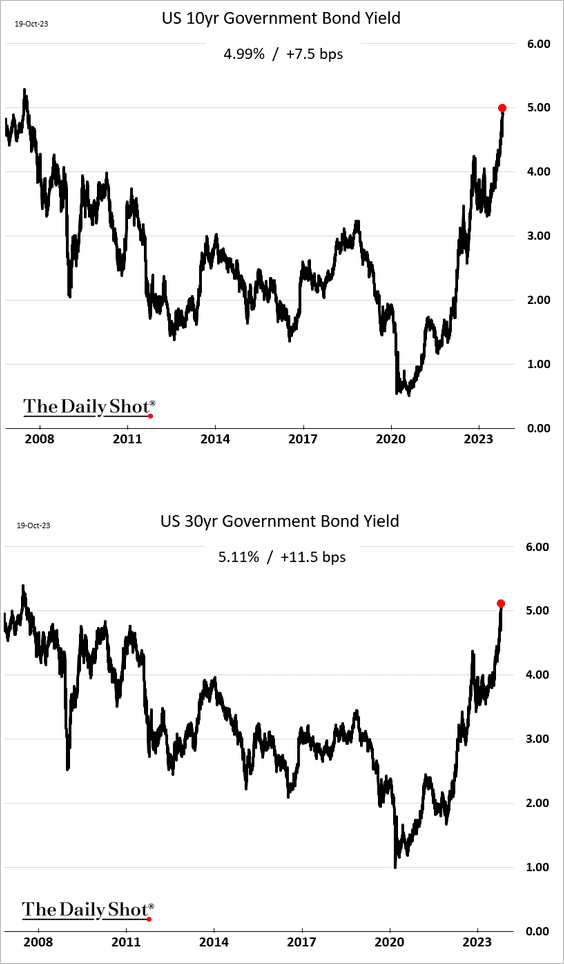

• Treasury yields climbed further, although there seems to be some buying this morning.

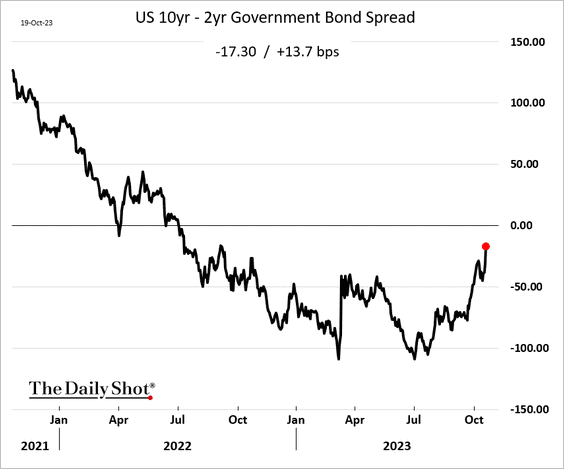

The yield curve inversion is diminishing, with less than 20 basis points separating the 2-year and the 10-year rates.

——————–

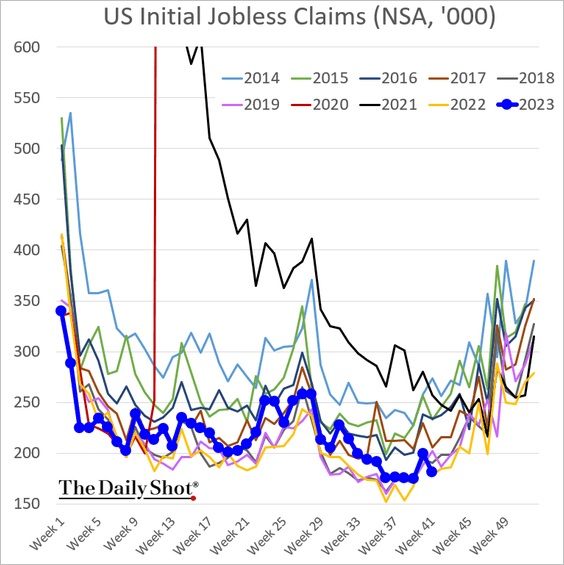

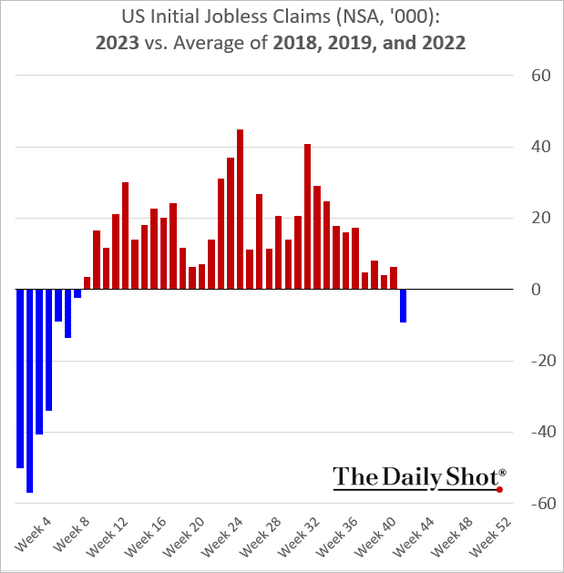

2. Initial jobless claims neared multi-year lows last week.

Source: Reuters Read full article

Source: Reuters Read full article

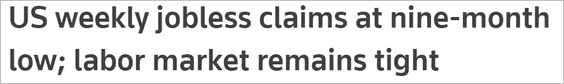

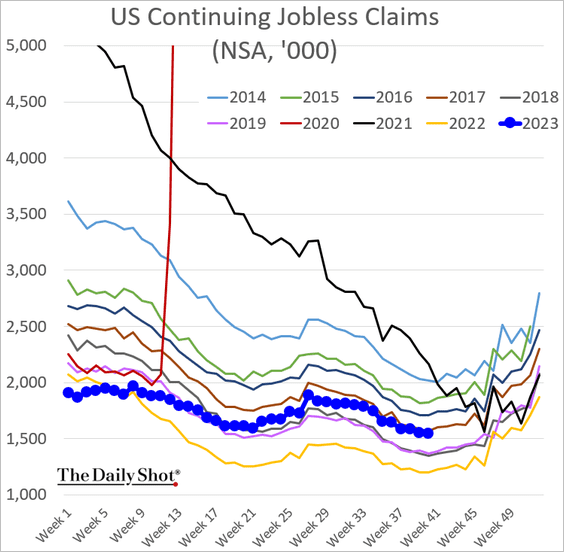

But continuing claims remain elevated.

——————–

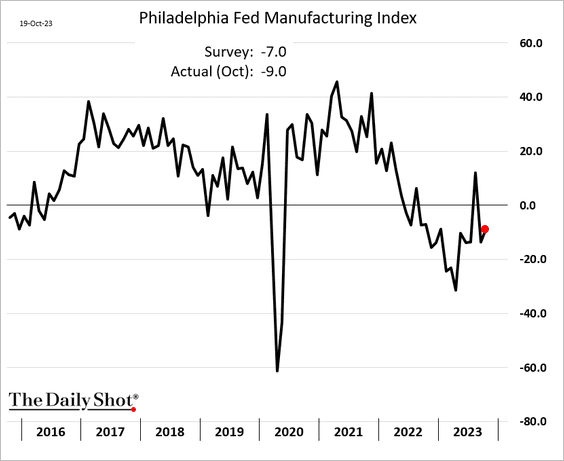

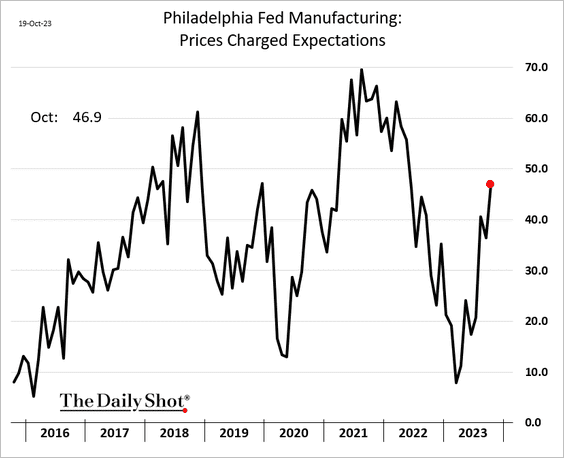

3. The Philly Fed’s manufacturing index points to persistent weakness in the region’s factory activity.

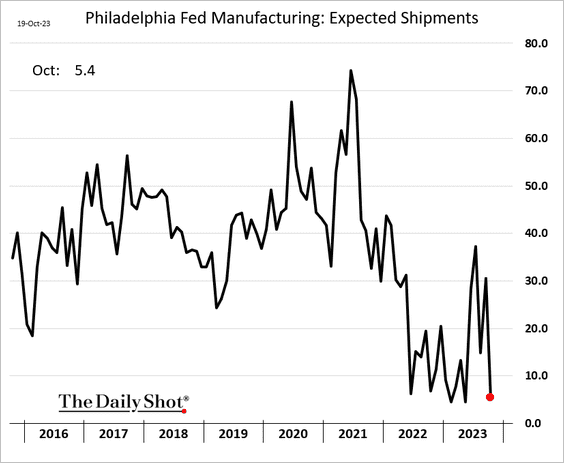

• Business outlook is also soft, …

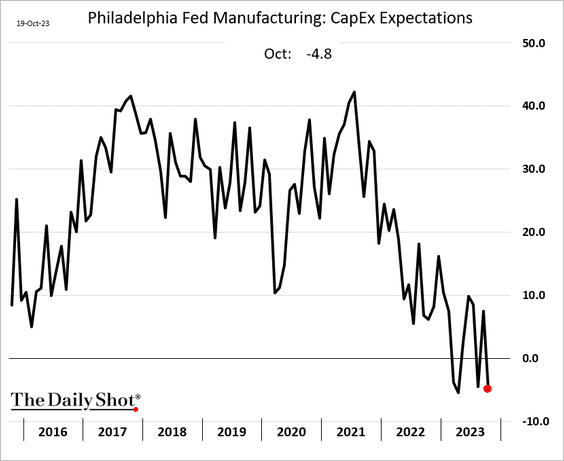

… with factories planning to reduce CapEx.

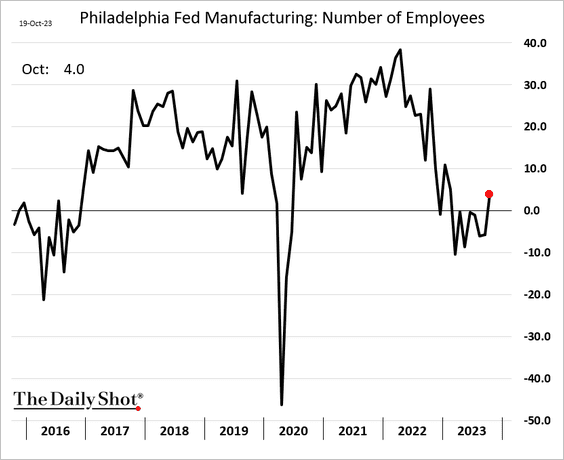

• However, staff reductions appear to be over.

• A worrisome trend in this report is the increasing number of manufacturers intending to raise prices.

——————–

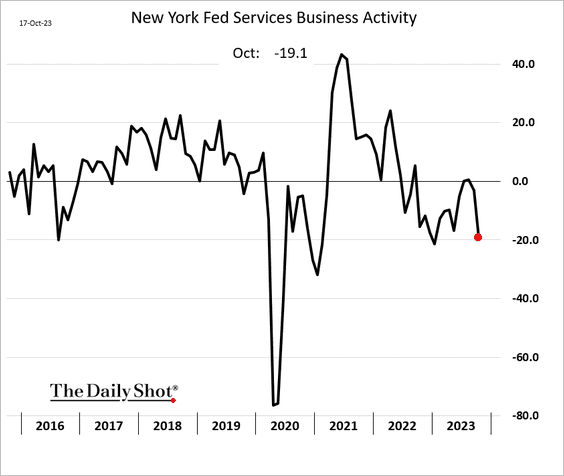

4. Service-sector activity in the NY Fed’s region deteriorated further this month.

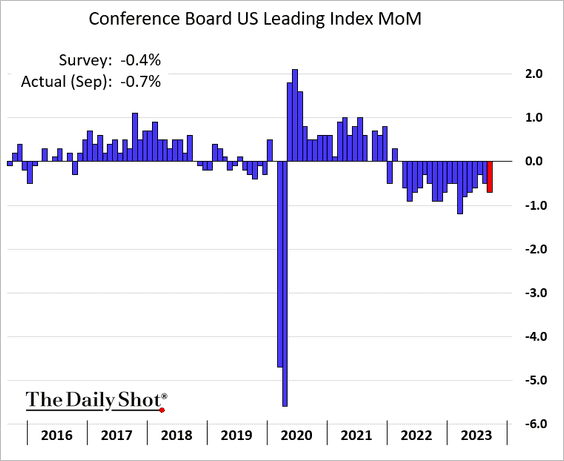

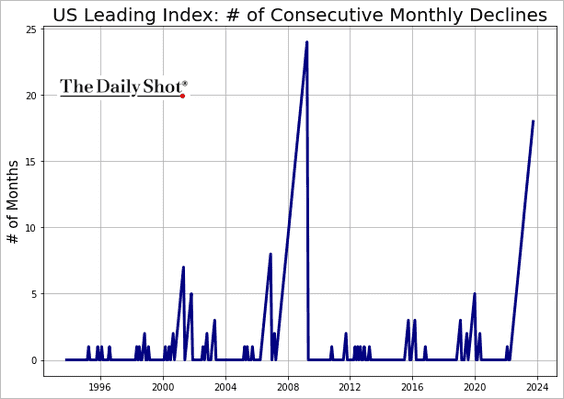

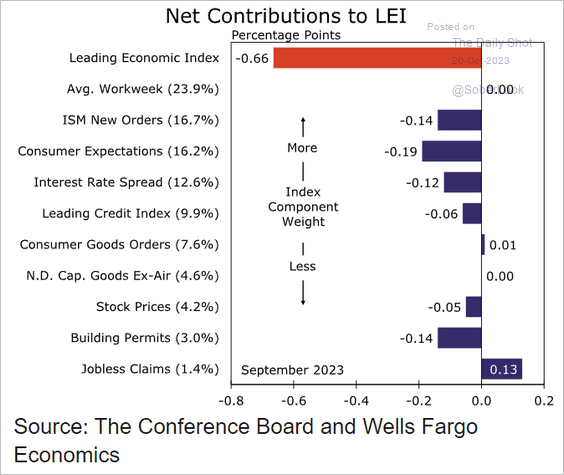

5. The US index of leading economic indicators dropped for the 18th month in a row (2 charts).

Here are the contributions to the September decline.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

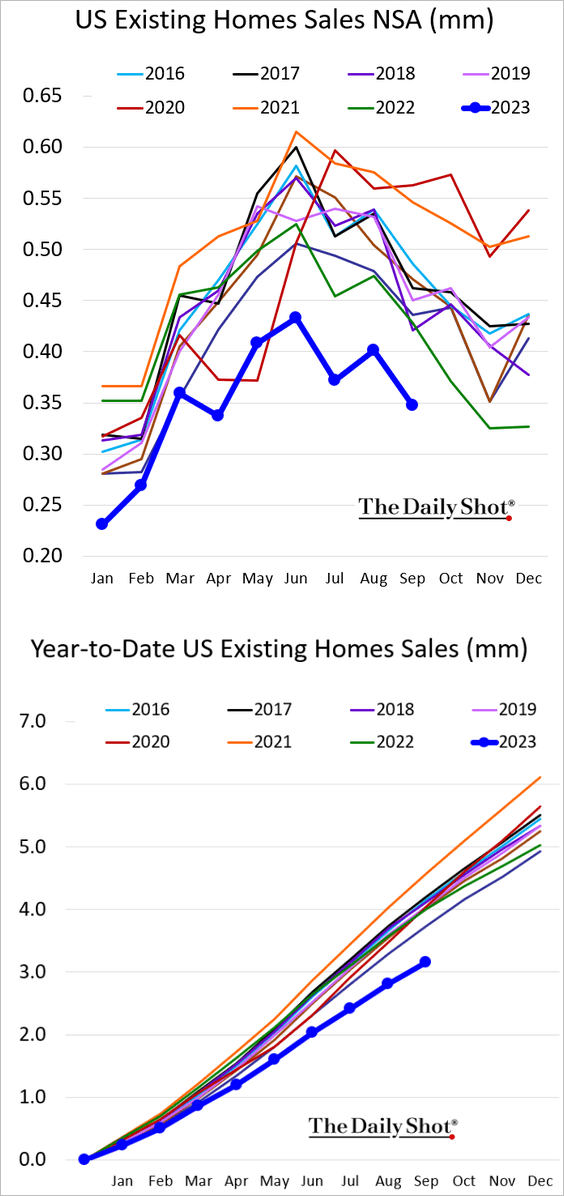

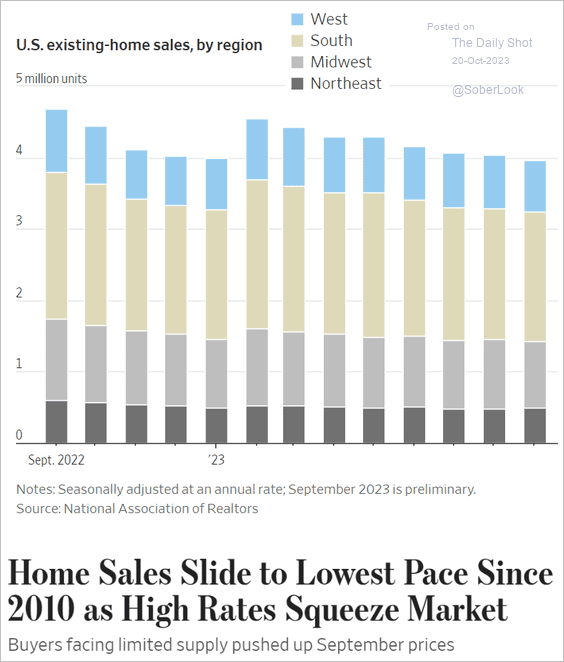

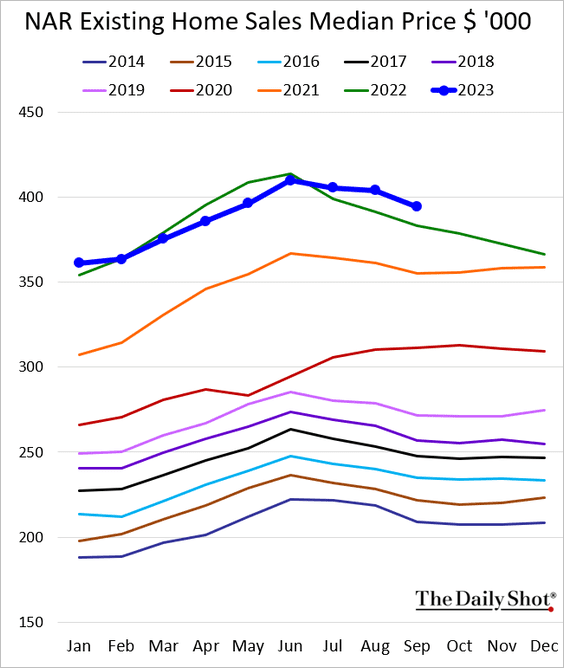

6. Existing home sales remain at multi-year lows (2 charts).

Source: @WSJ Read full article

Source: @WSJ Read full article

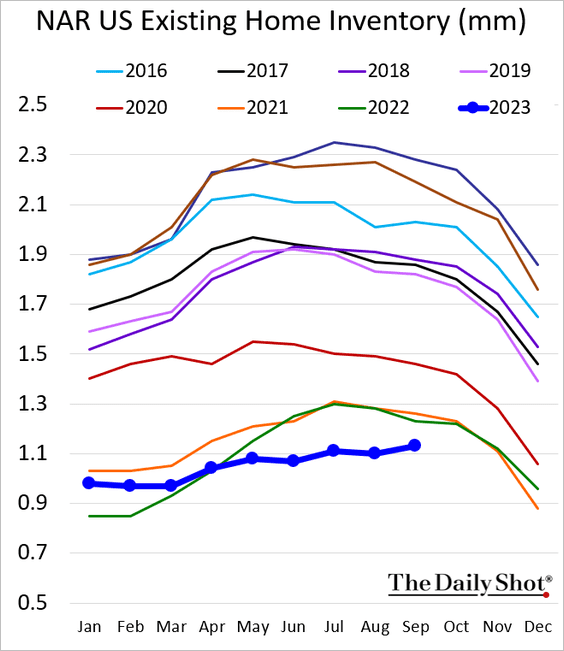

• Inventories are tight, …

… pushing up prices.

——————–

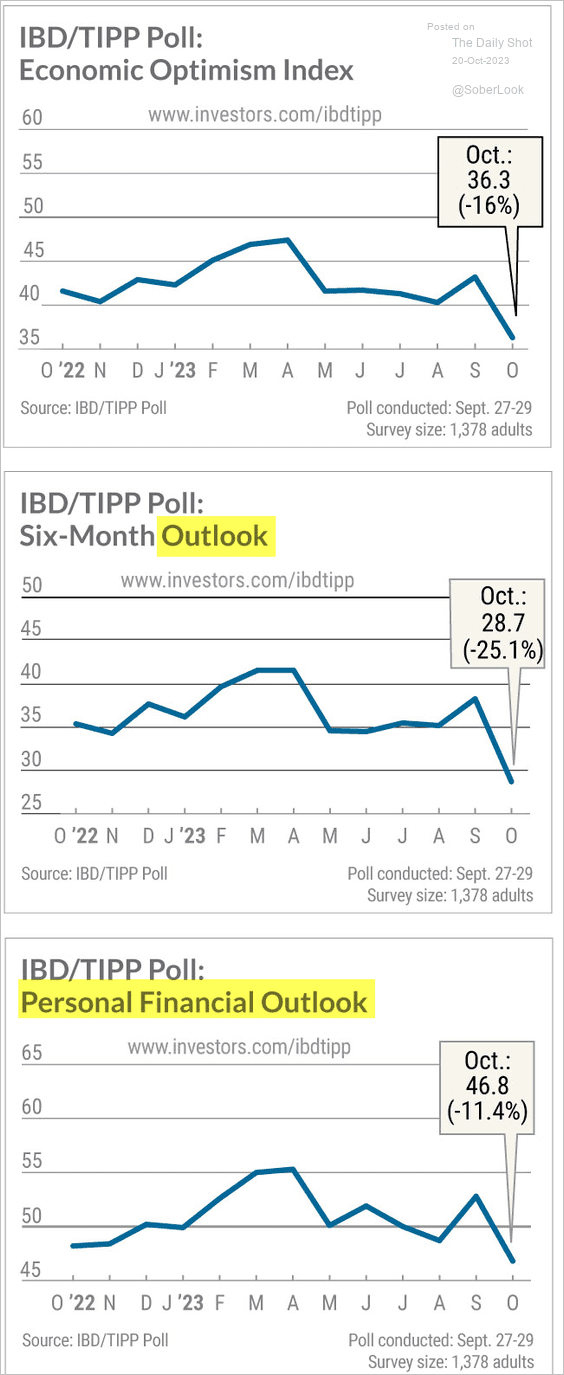

7. Inflation concerns, student loan payments, stock market volatility, and surging mortgage rates are among the drivers of deteriorating consumer sentiment.

Source: IBD

Source: IBD

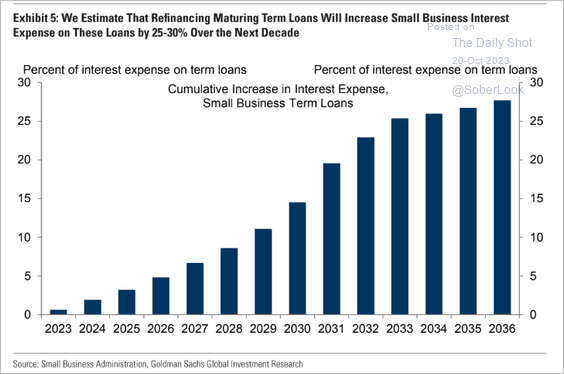

8. Small businesses are facing massive increases in interest expenses as they refinance their debt.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Europe

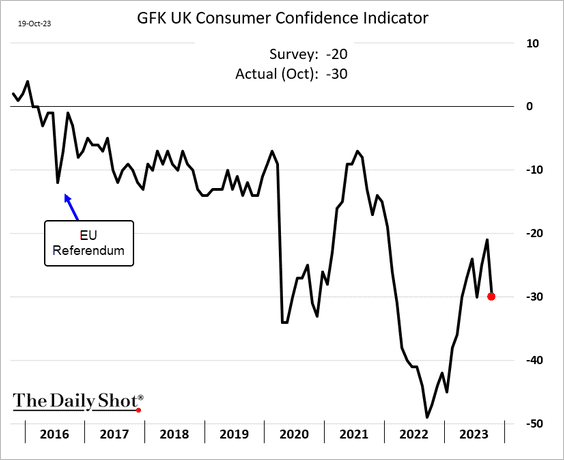

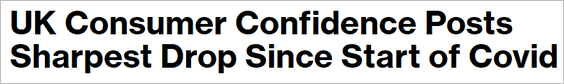

1. UK consumer sentiment declined sharply this month.

Source: @economics Read full article

Source: @economics Read full article

——————–

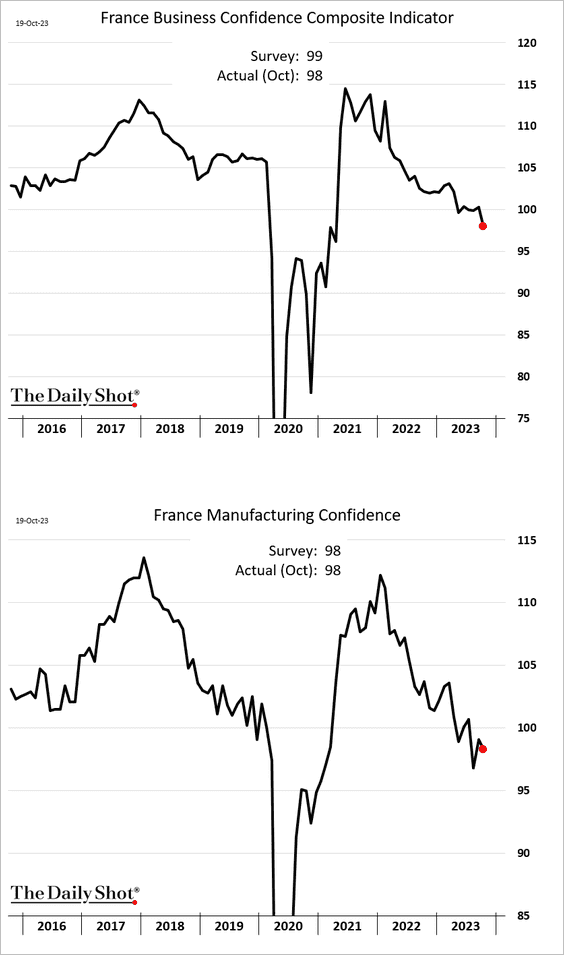

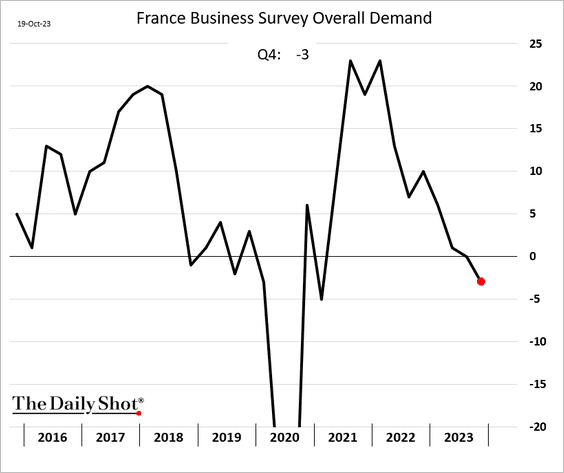

2. French business confidence continues to trend lower.

——————–

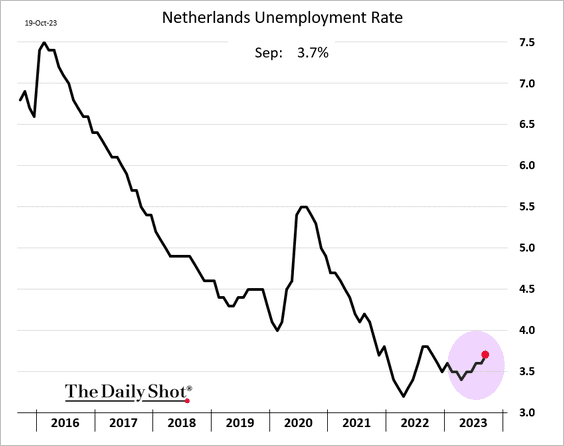

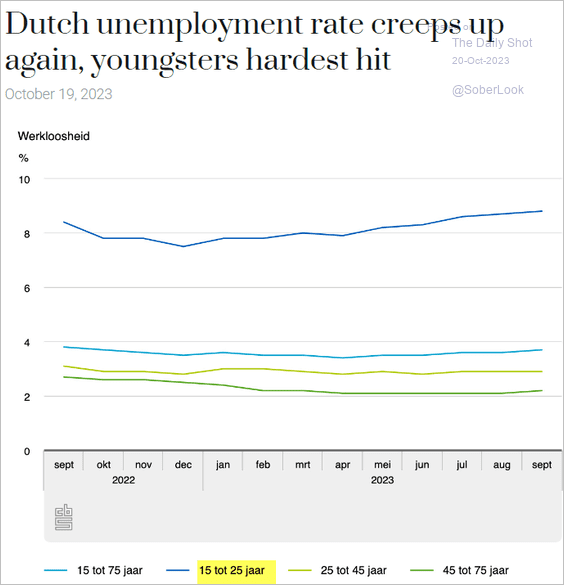

3. The Dutch unemployment rate has been grinding higher, primarily due to elevated youth joblessness.

Source: DutchNews Read full article

Source: DutchNews Read full article

——————–

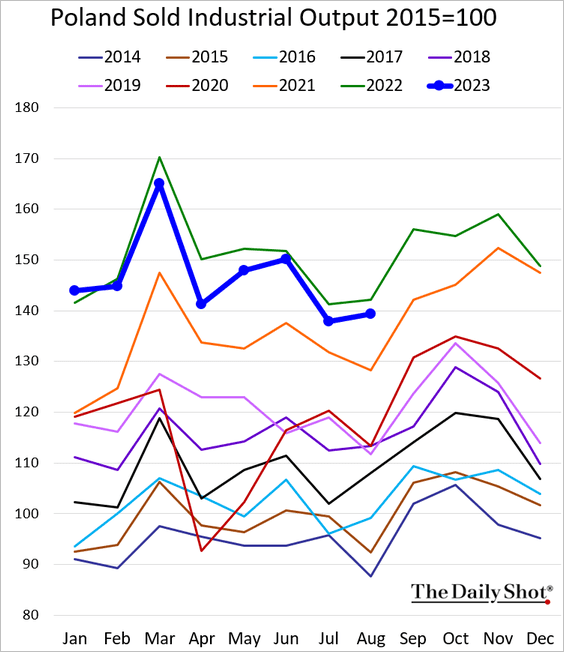

4. Poland’s industrial production continues to run below last year’s levels.

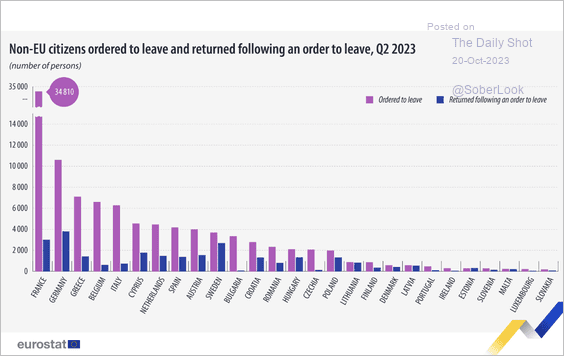

5. Here is an overview of the count of non-EU citizens who were issued departure orders and subsequently came back.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

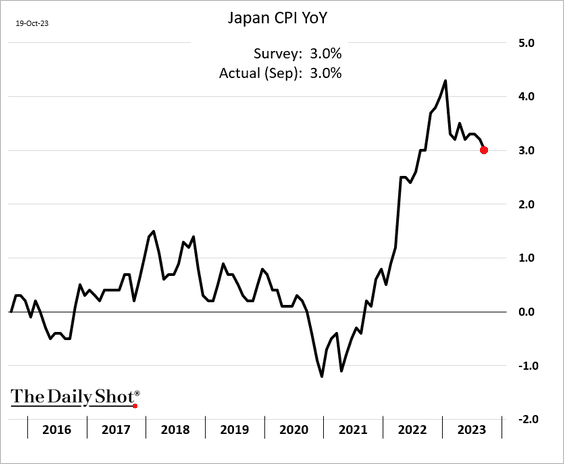

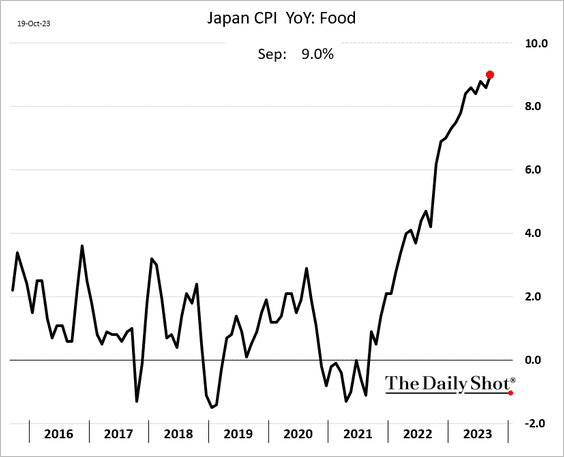

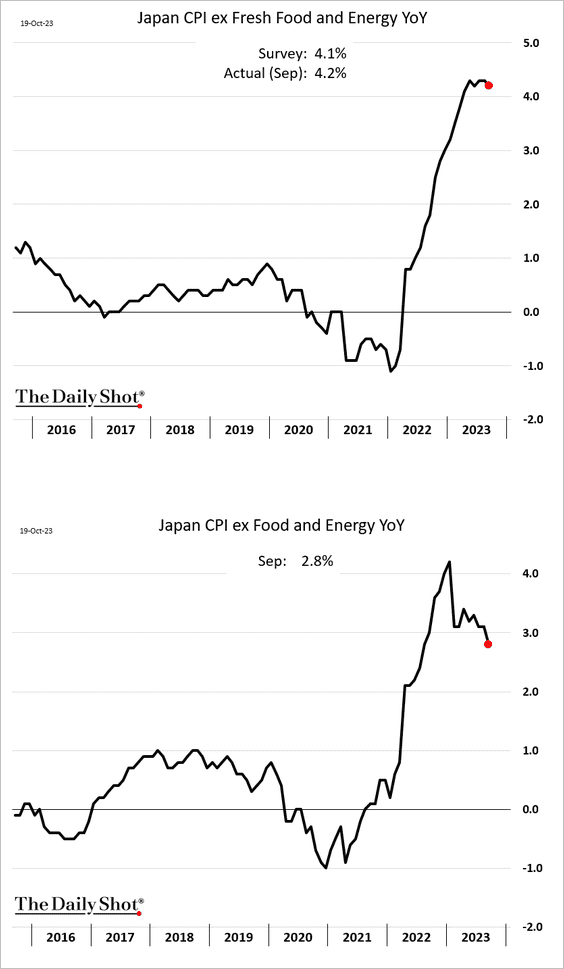

1. Inflation has been slowing, …

… despite surging food prices.

• Here is the core CPI.

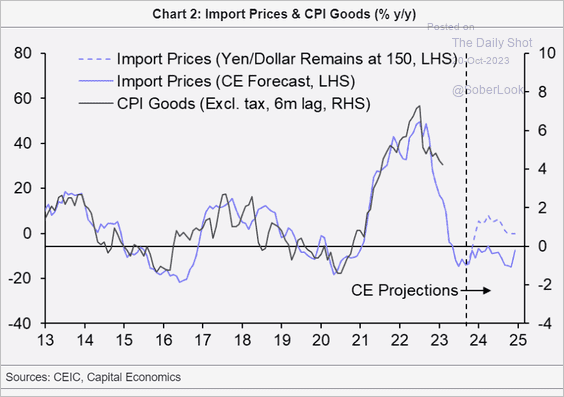

• Goods inflation should moderate sharply going forward.

Source: Capital Economics

Source: Capital Economics

——————–

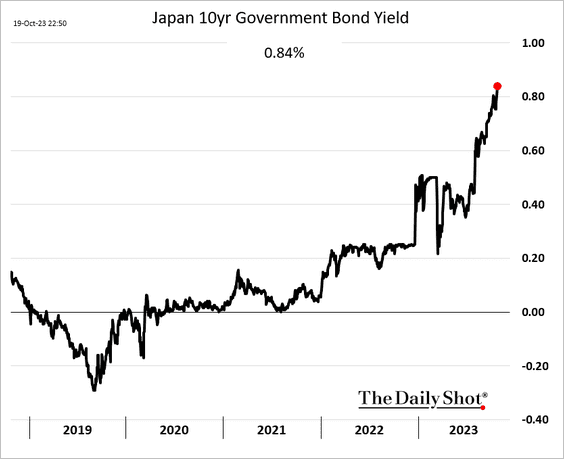

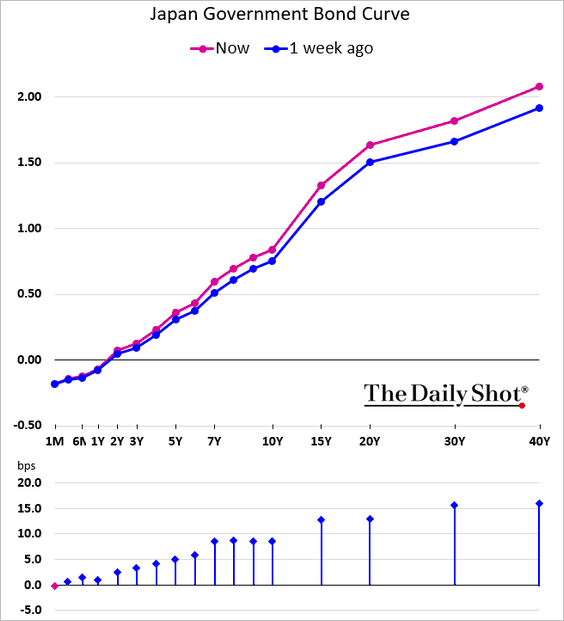

2. JGB yields continue to grind higher, …

… as the yield curve steepens.

Back to Index

Asia-Pacific

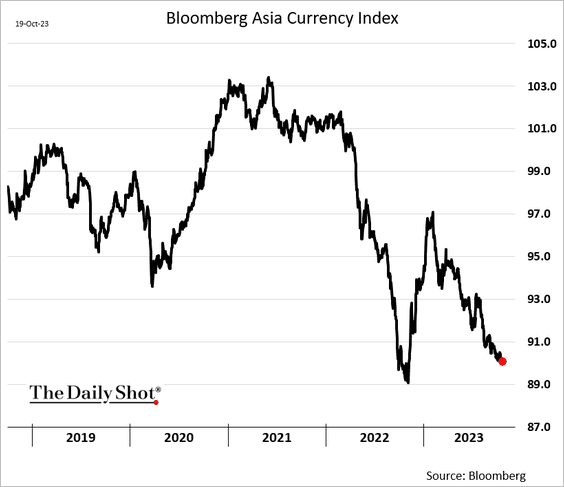

1. Asian currencies have been trending lower, …

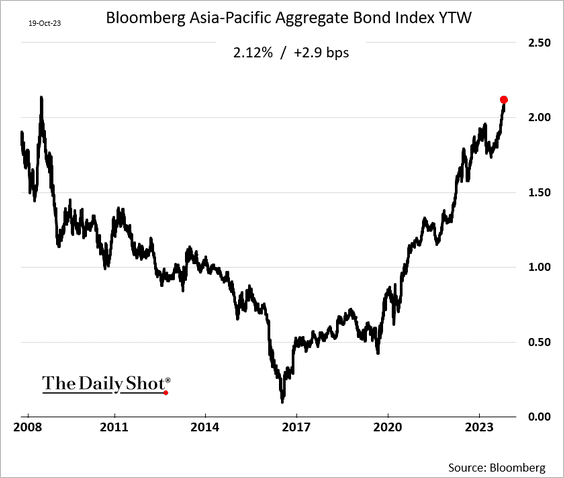

… while bond yields hit multi-year highs.

——————–

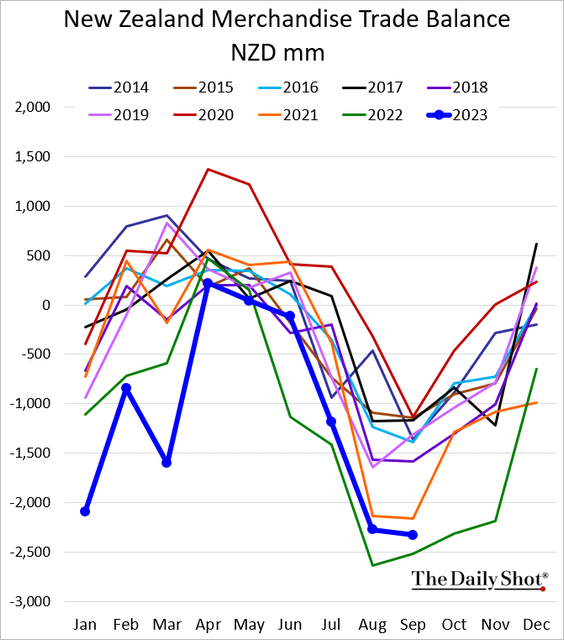

2. New Zealand’s trade deficit is only slightly narrower than the record levels we saw last year.

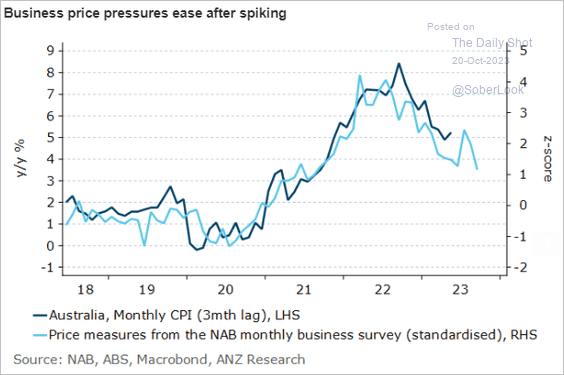

3. Australian business price pressures are easing.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

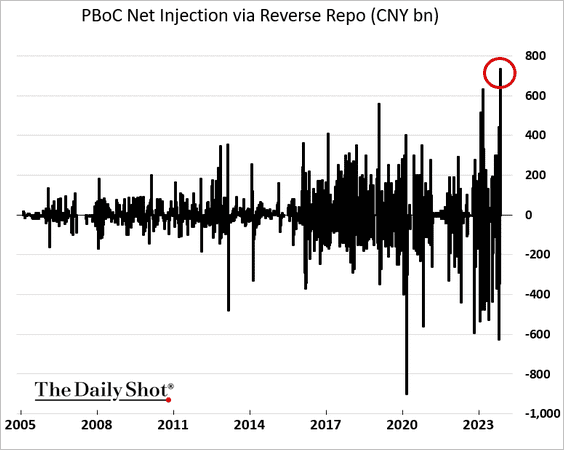

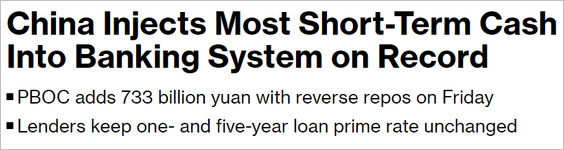

1. The PBoC injected a massive amount of short-term liquidity into the banking system.

Source: @markets Read full article

Source: @markets Read full article

——————–

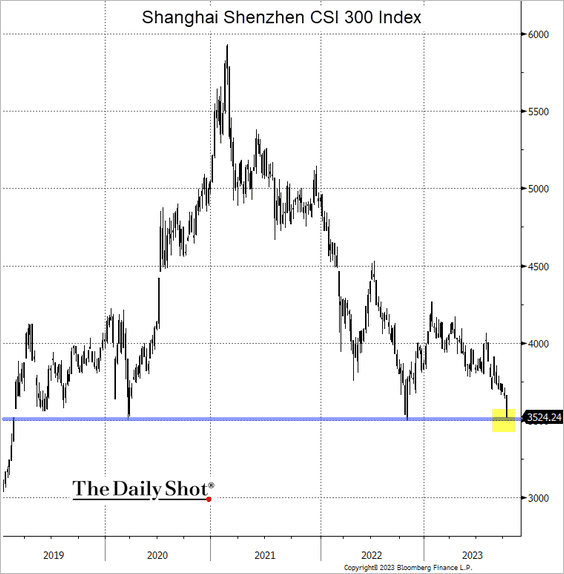

2. The Shanghai Shenzhen CSI 300 Index is nearing 3500. Will we see an intervention from Beijing?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

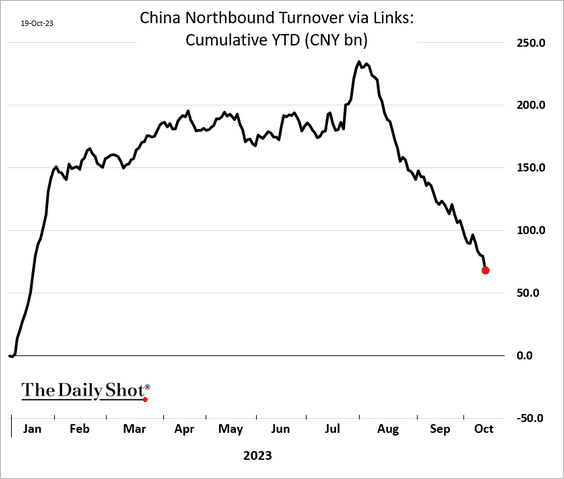

Foreign and Hong Kong flight of capital from the mainland stock market is accelerating.

——————–

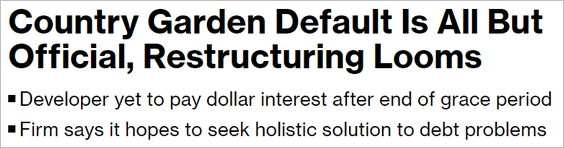

3. Country Garden is in default, …

Source: @markets Read full article

Source: @markets Read full article

… with bonds trading at pennies on the dollar.

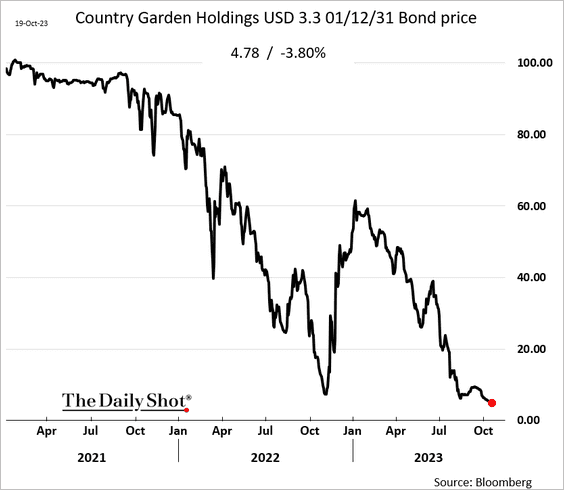

The total return index of developers’ bonds hit the lowest level since the GFC.

——————–

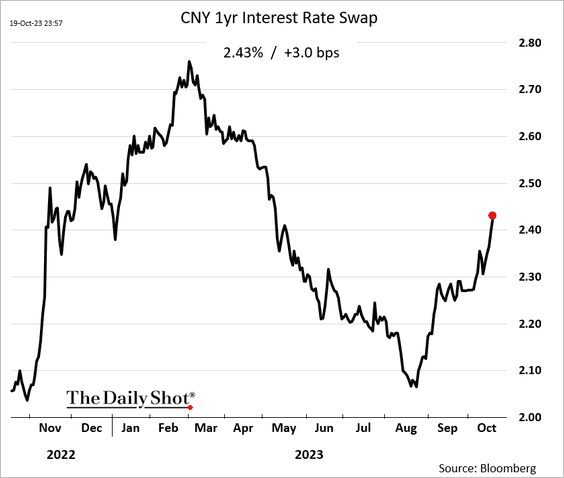

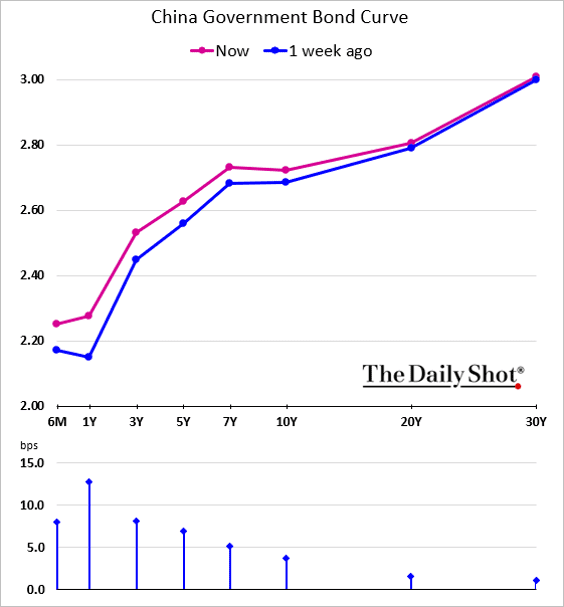

4. Interest rates keep rising, especially at the short end.

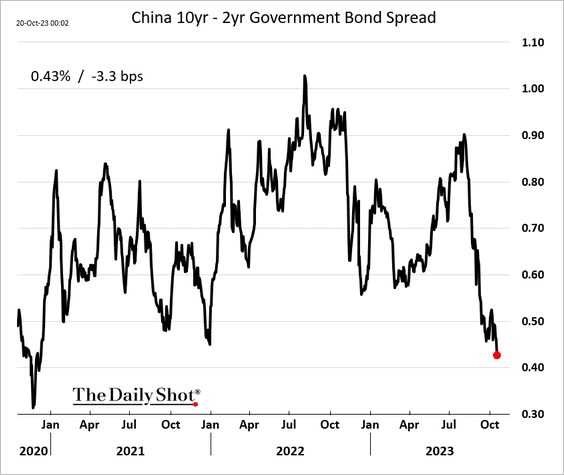

The yield curve has been in a bear-flattening mode (2 charts).

——————–

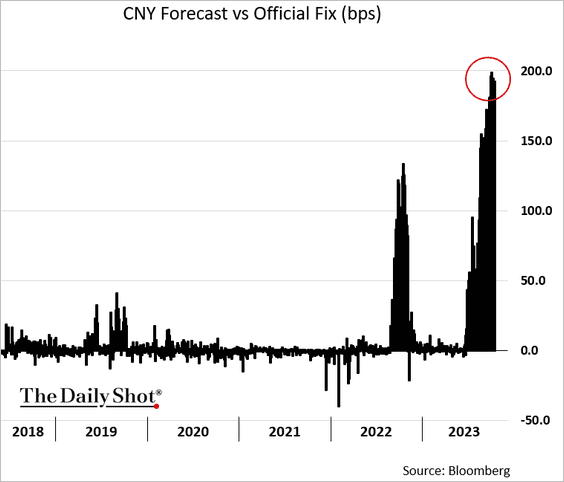

5. Beijing is still trying to strengthen the renminbi.

Back to Index

Emerging Markets

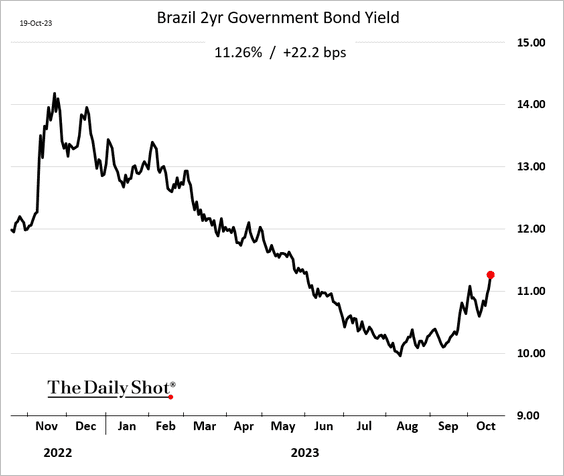

1. Brazil’s short-term yields have been rising rapidly.

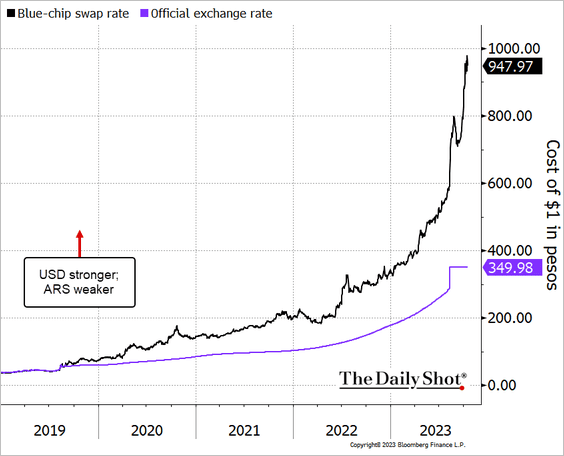

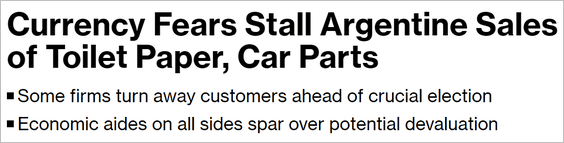

2. Argentina’s currency has been crashing, nearing 1000 pesos to the dollar in the unofficial markets.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

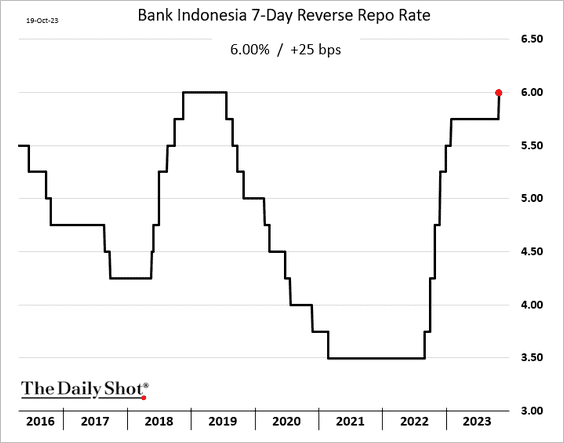

3. Indonesia unexpectedly hiked rates to halt the currency decline.

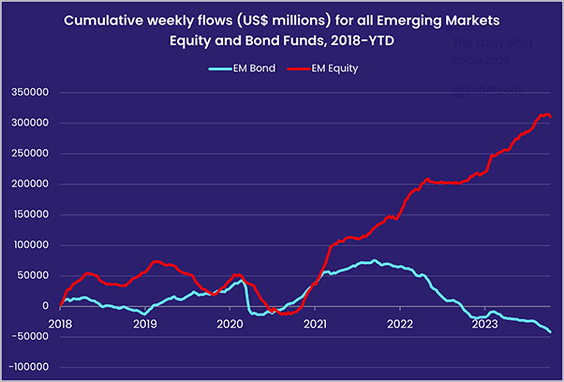

4. Here is a look at fund flows for EM bonds and equities.

Source: EPFR

Source: EPFR

Back to Index

Energy

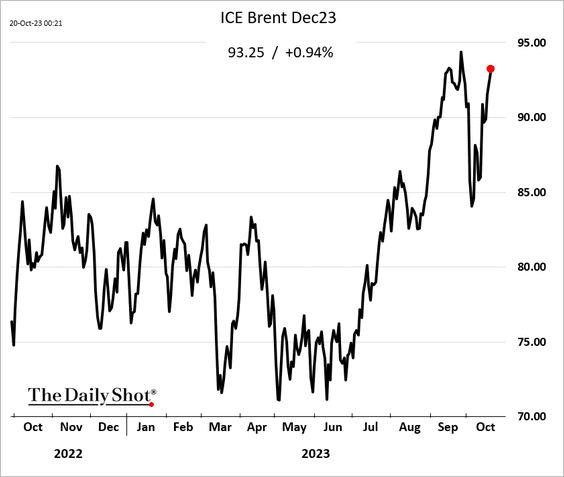

1. Crude oil futures continue to climb.

Source: @markets Read full article

Source: @markets Read full article

——————–

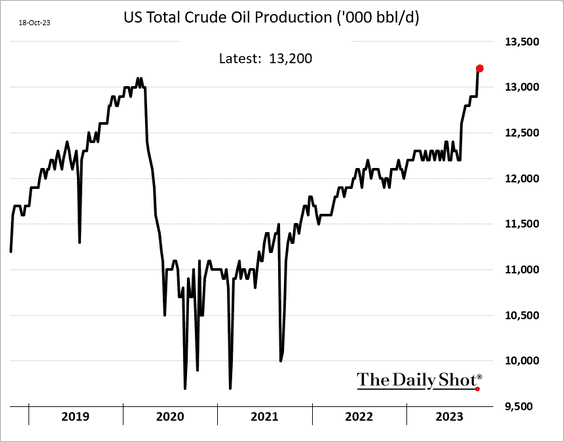

2. US crude oil production has risen substantially in recent weeks.

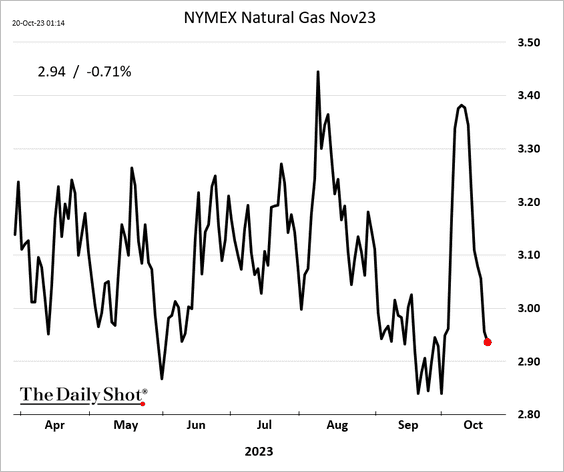

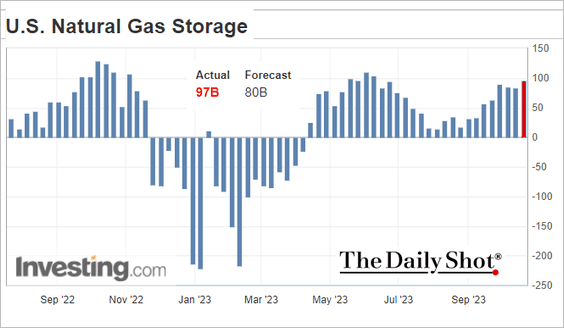

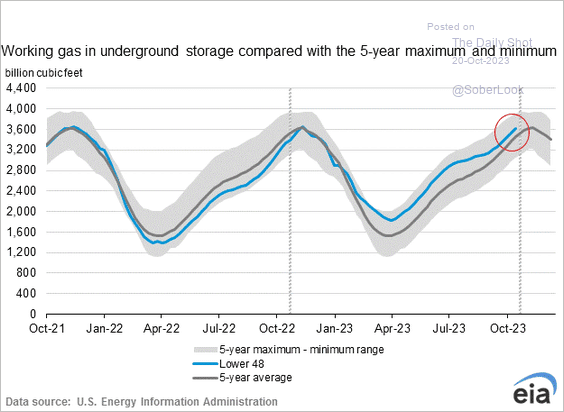

3. US natural gas futures saw a stunning roundtrip this month.

Last week’s natural gas injections into storage were higher than expected.

Back to Index

Equities

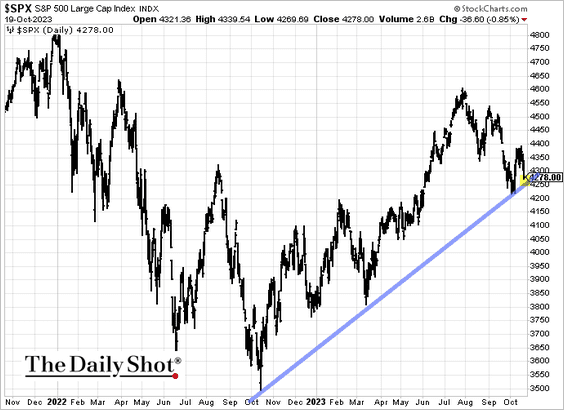

1. The S&P 500 is nearing support.

2. Market breadth has deteriorated again.

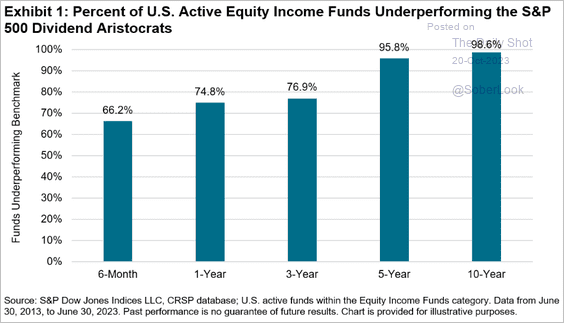

3. Most active equity income funds have been underperforming their benchmark.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

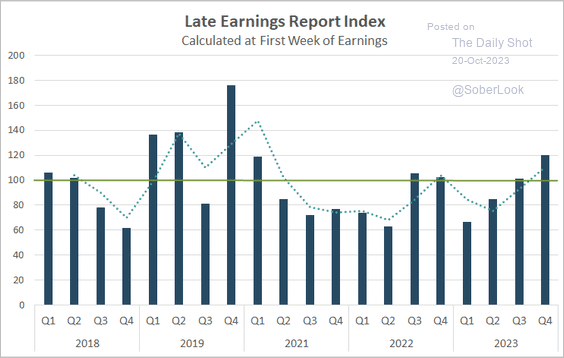

4. The Late Earnings Report Index indicates a growing sense of uncertainty among CEOs.

Source: Wall Street Horizon Read full article

Source: Wall Street Horizon Read full article

Wall Street Horizon: – The Late Earnings Report Index tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100; anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near term.

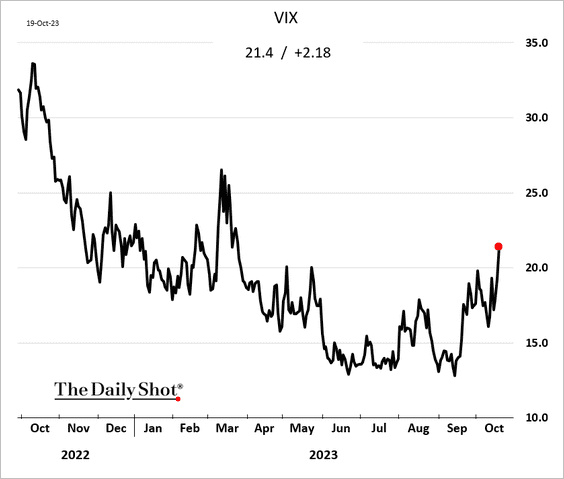

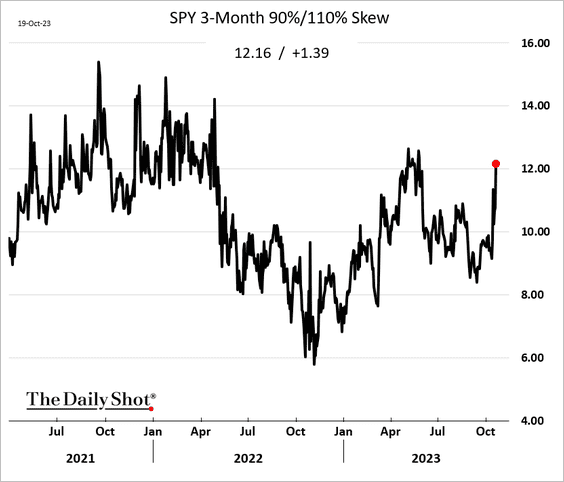

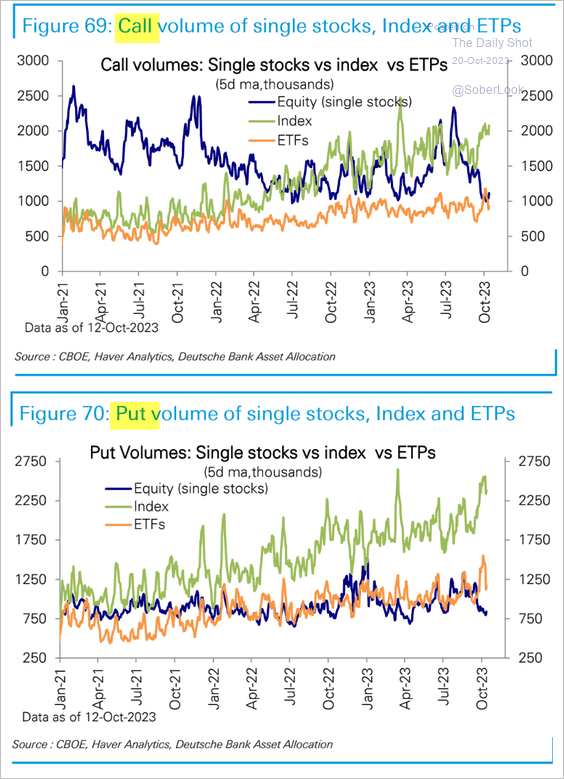

5. Next, we have some updates on the volatility markets.

• VIX hit the highest level since March.

• The S&P 500 (SPY) skew has been rising.

• Traders have been focusing on index options, while single-stock options activity has deteriorated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

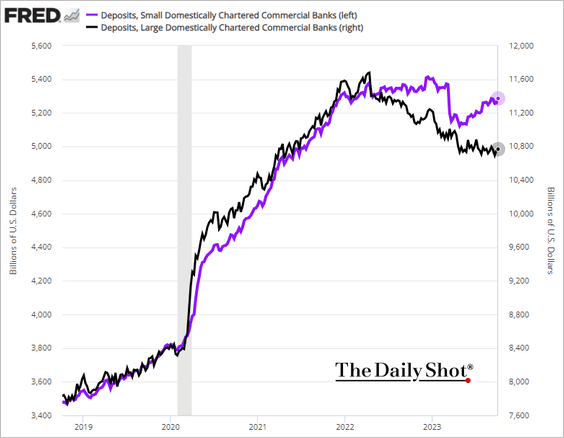

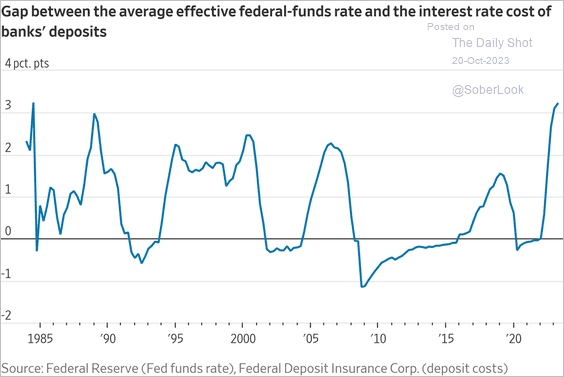

1. Deposits have been rising at small banks, …

… but lenders are paying much higher costs.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

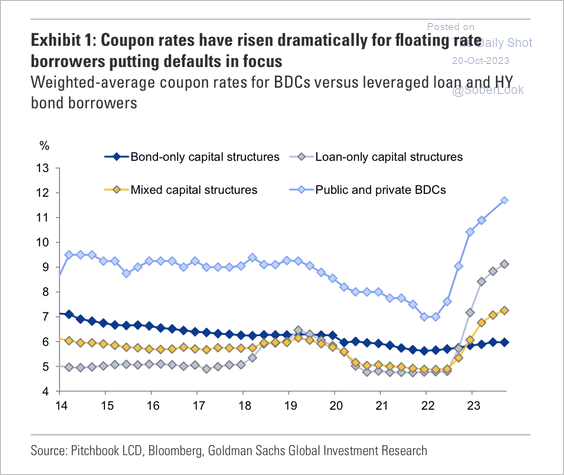

2. According to Goldman, US private debt borrowers are unlikely to get any relief on their funding costs after the dramatic increase in interest expenses incurred over the past few quarters.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Rates

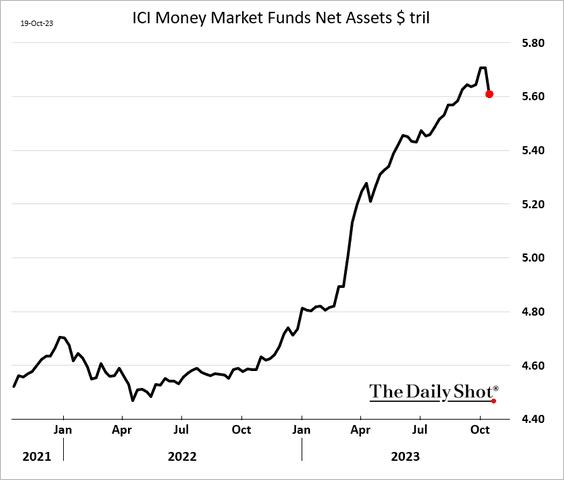

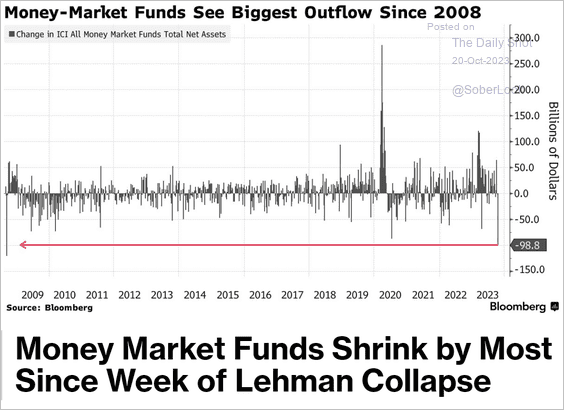

1. Money market fund assets declined sharply over the past couple of weeks.

Source: @wealth Read full article

Source: @wealth Read full article

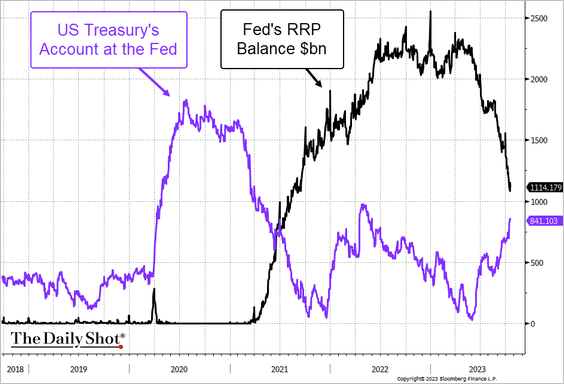

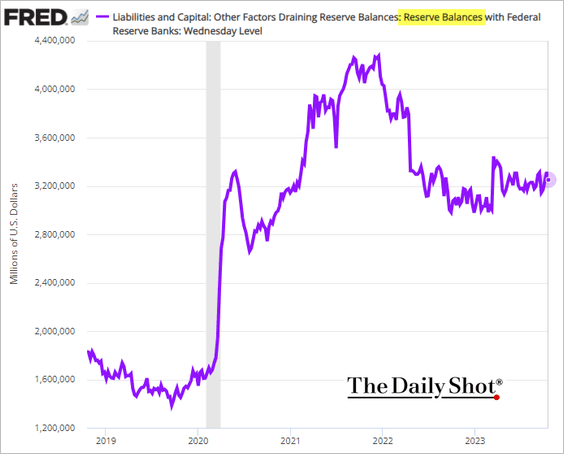

2. Rapidly falling demand for the Fed’s RRP facility is offsetting rising US Treasury balances at the Fed and the central bank’s QT, …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… which is keeping reserve balances relatively stable.

——————–

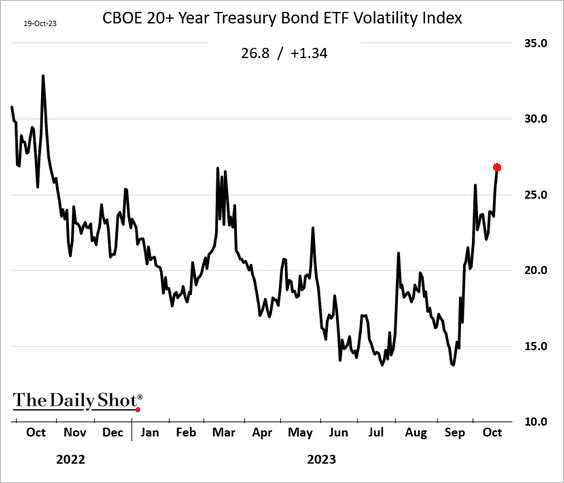

3. Longer-dated Treasury implied volatility continues to climb.

——————–

Food for Thought

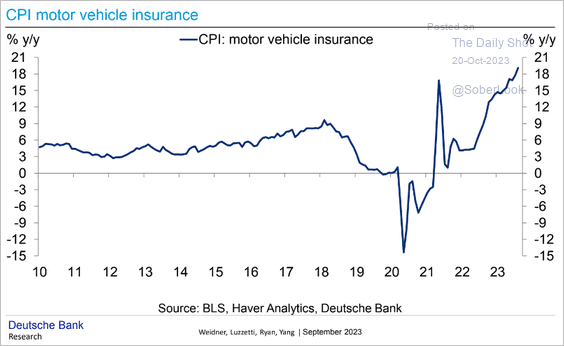

1. Auto insurance inflation:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

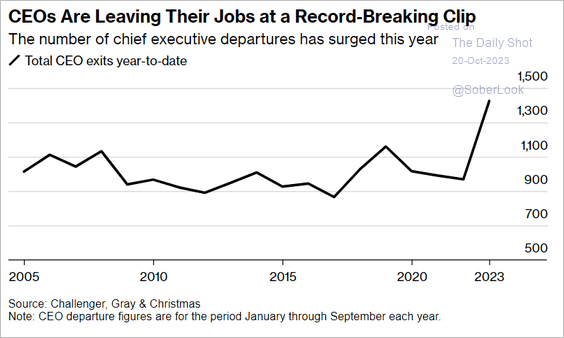

2. CEO departures:

Source: @thefuture Read full article

Source: @thefuture Read full article

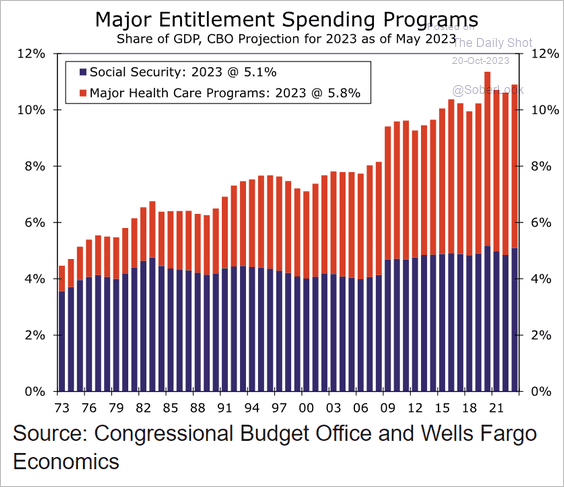

3. US entitlement programs:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

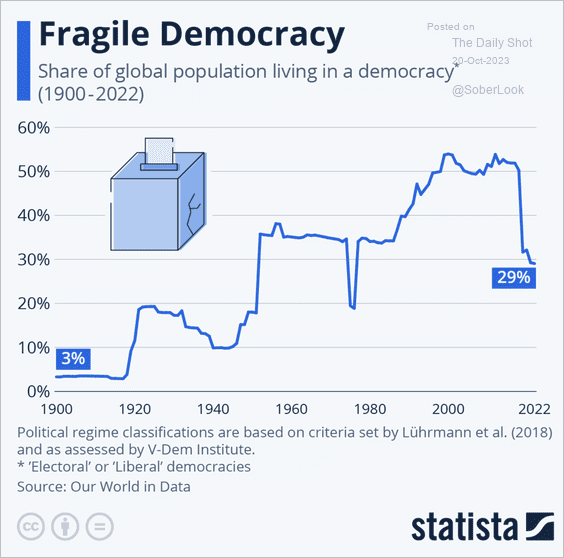

4. Global population living in a democracy:

Source: Statista

Source: Statista

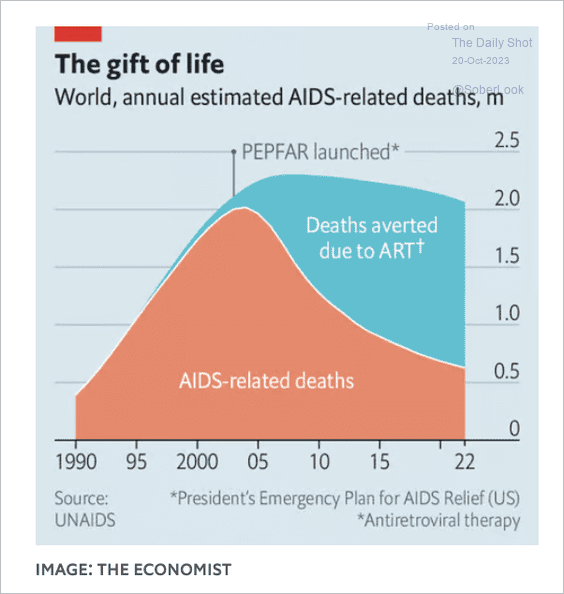

5. AIDS-related deaths:

Source: The Economist Read full article

Source: The Economist Read full article

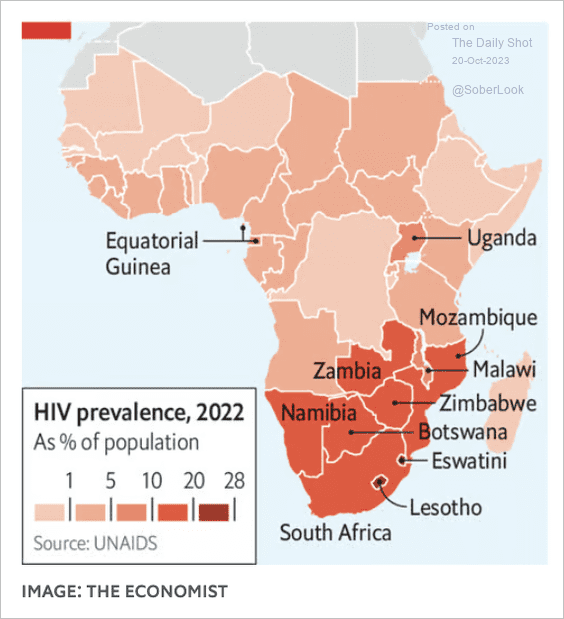

• HIV prevalence in Africa:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

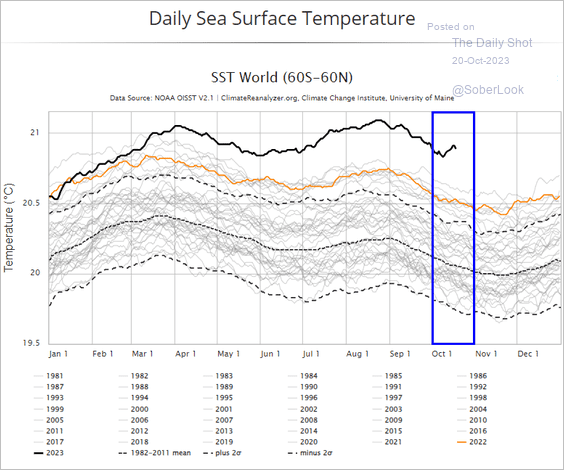

6. Warm oceans:

Source: Climate Reanalyzer

Source: Climate Reanalyzer

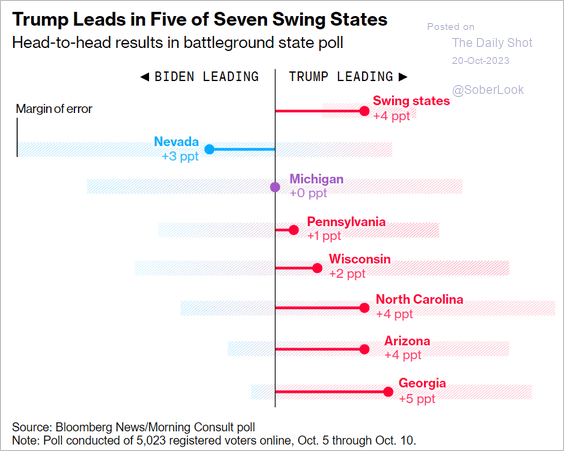

7. Head-to-head polls in battleground states:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

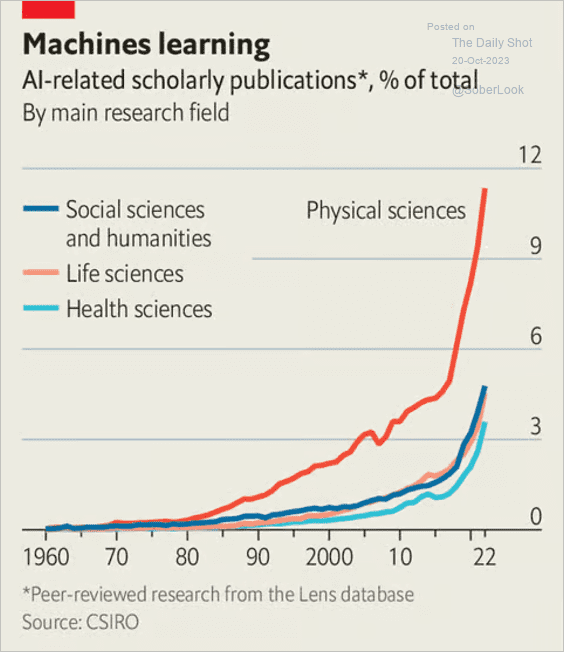

8. AI usage in science:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Have a great weekend!

Back to Index