The Daily Shot: 24-Oct-23

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

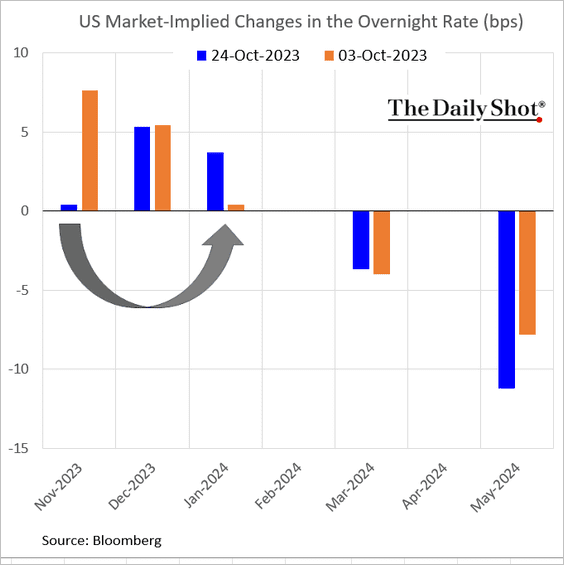

1. While a November rate increase is off the table, the market has been pricing in some probability of a hike in January.

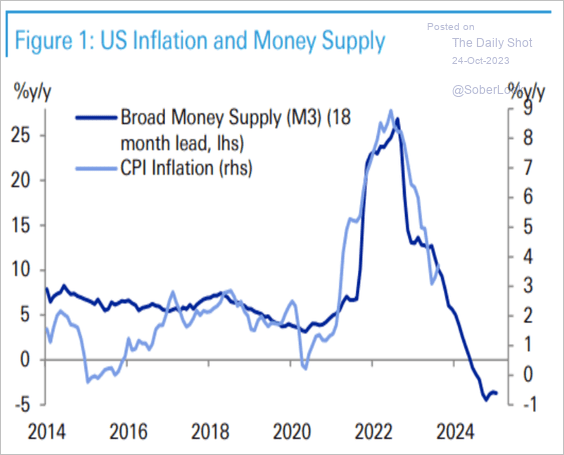

2. Next, we have some updates on inflation.

• The deceleration in broad money supply growth should assist the Fed in its battle against inflation.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

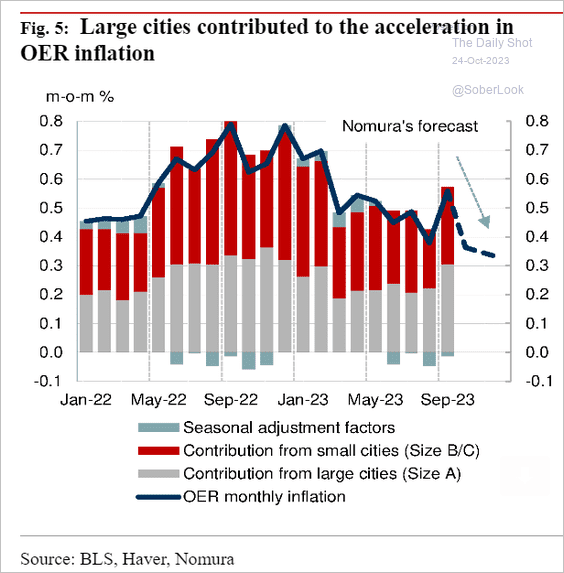

• Nomura expects a downshift in owners’ equivalent rent CPI over the next few months.

Source: Nomura Securities

Source: Nomura Securities

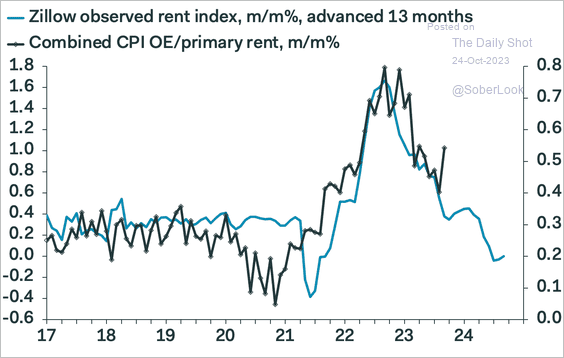

– This chart shows the combined rent and owners’ equivalent rent CPI (year-over-year) and Zillow’s rent index.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

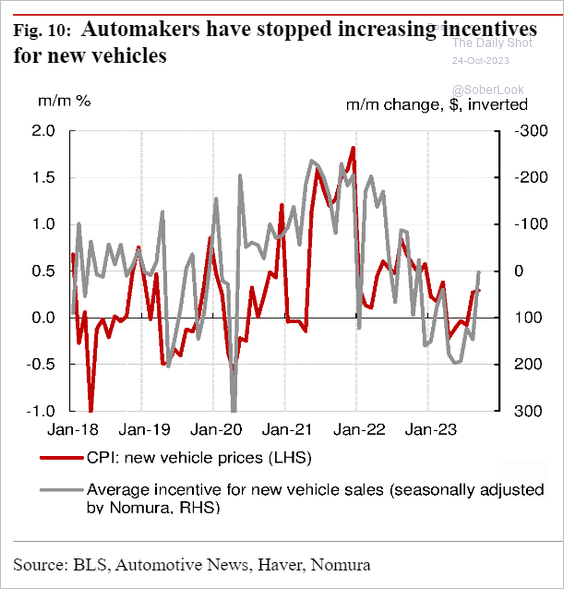

• With the UAW strike in progress, automakers have stopped incentives for new vehicles, potentially contributing to an increase in vehicle CPI.

Source: Nomura Securities

Source: Nomura Securities

——————–

3. Now, we have some data on the housing market.

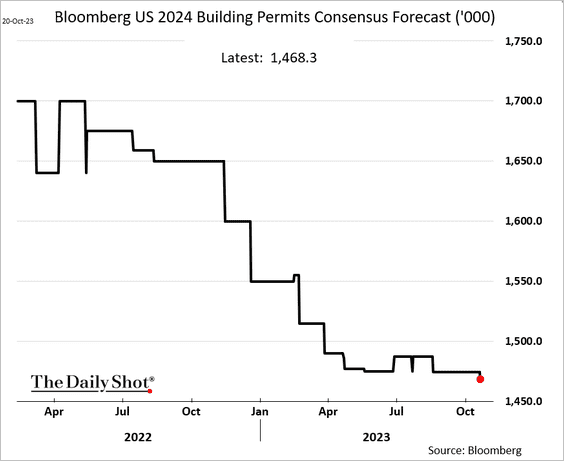

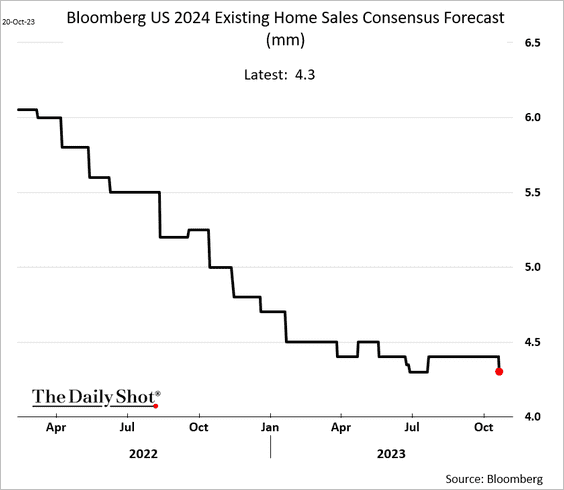

• Economists have been downgrading their forecasts for next year’s housing market activity.

– Building permits:

– Existing home sales:

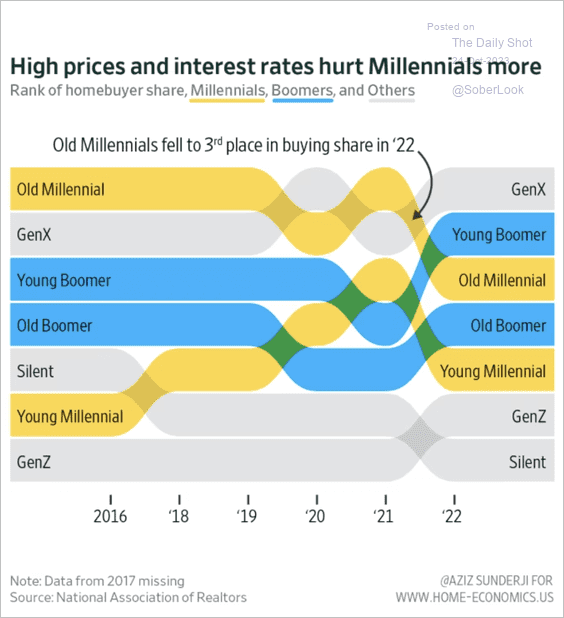

• Here is a look at homebuyer share rankings by generation.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

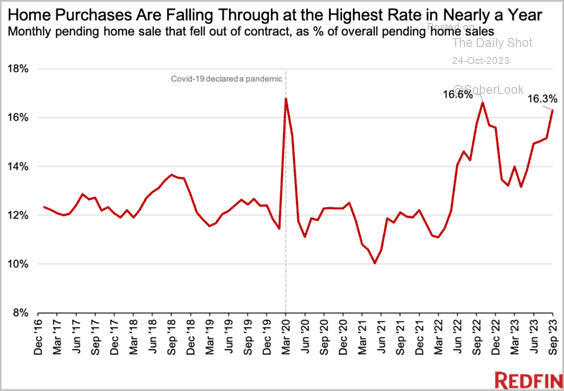

• The share of house purchases that fall through has been rising.

Source: Redfin

Source: Redfin

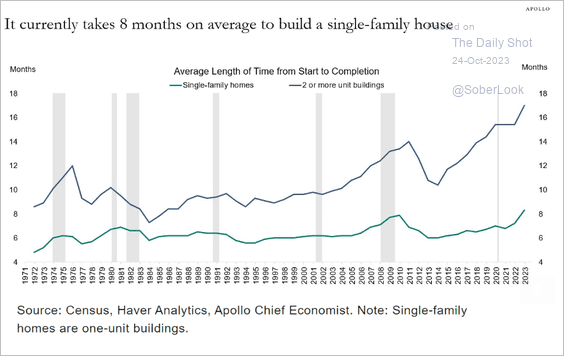

• How long does it take to build single-family and multi-family housing?

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

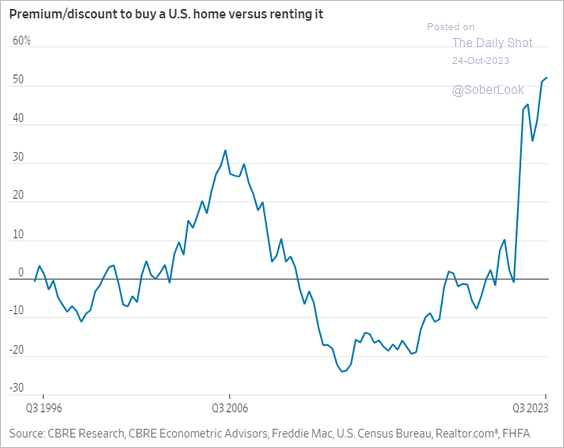

• Buying a home is now 52% more expensive than renting.

Source: @WSJ Read full article

Source: @WSJ Read full article

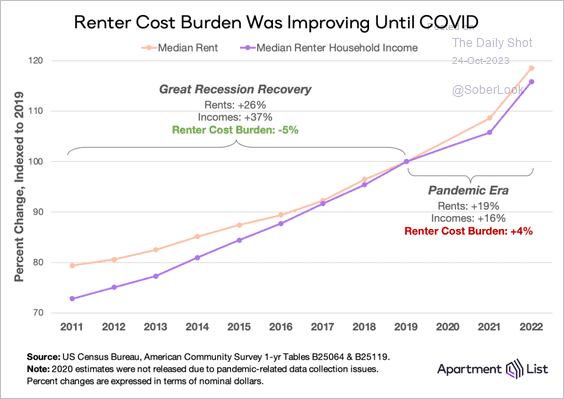

– Rent was becoming more affordable before COVID.

Source: Apartment List

Source: Apartment List

——————–

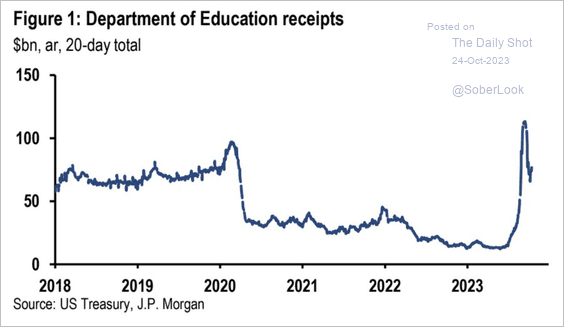

4. Student loan payments remain elevated.

Source: JP Morgan Research; @dailychartbook

Source: JP Morgan Research; @dailychartbook

Back to Index

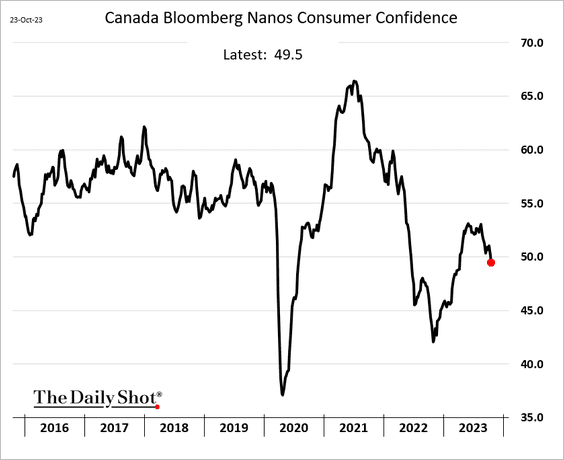

Canada

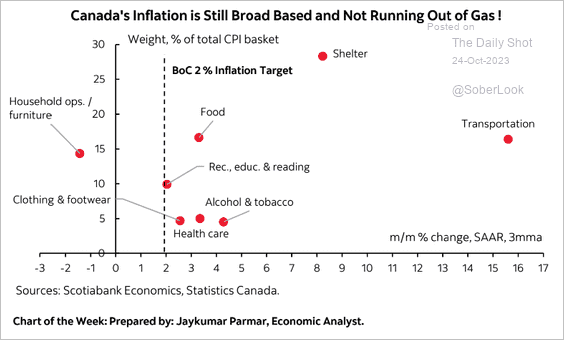

1. Inflation remains high and broad-based.

Source: Scotiabank Economics

Source: Scotiabank Economics

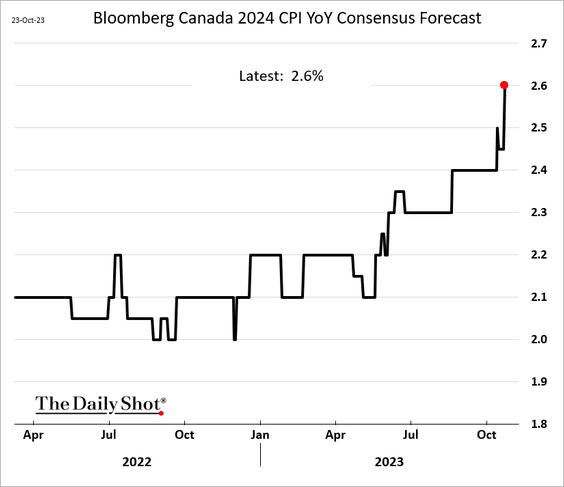

Economists have been boosting their projections for the 2024 CPI.

——————–

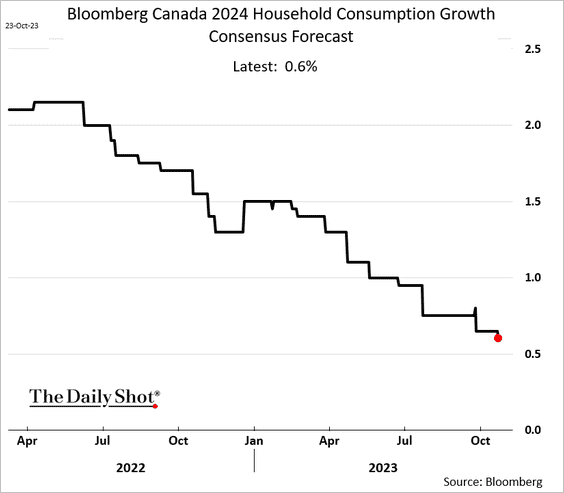

2. Economists continue to downgrade their forecasts for next year’s consumer spending.

3. Consumer confidence continues to slide.

Back to Index

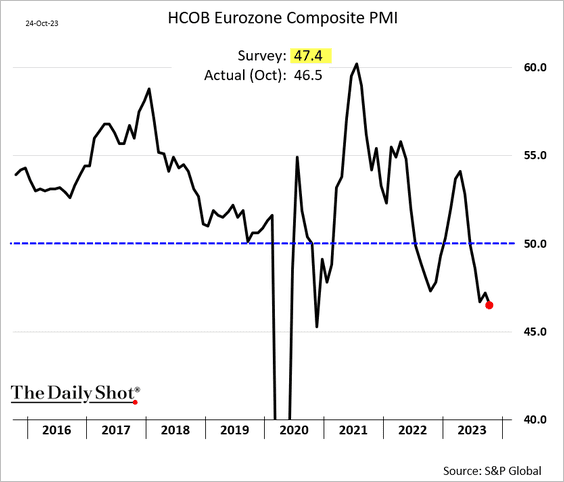

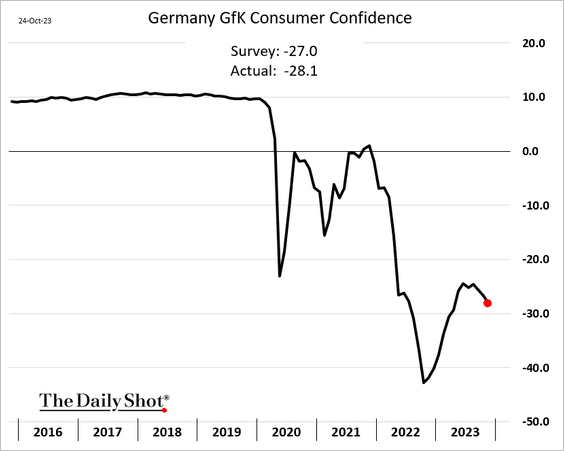

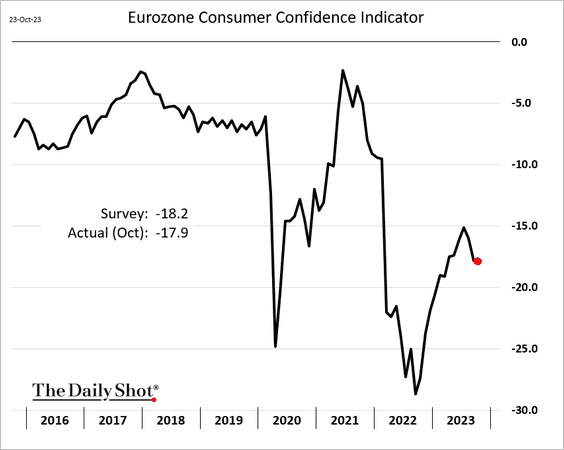

The Eurozone

1. The PMI report showed a deepening contraction in the euro-area business activity this month. We will have more on the PMI report tomorrow.

2. Germany’s consumer confidence declined again this month.

At the Eurozone level, consumer sentiment was roughly flat.

——————–

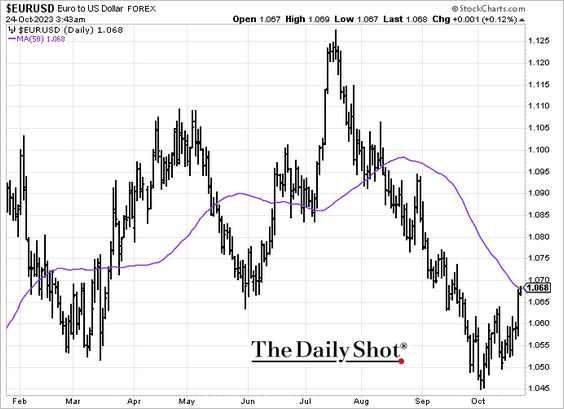

3. The euro jumped on Monday, stopping at the 50-day moving average.

Back to Index

Europe

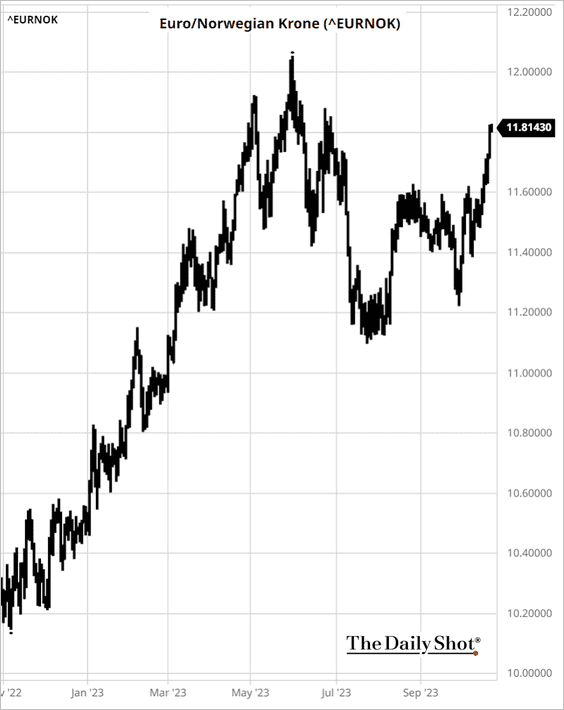

1. The Norwegian krone is under pressure again.

Source: barchart.com

Source: barchart.com

2. After hitting a multi-year high against the euro, the Swiss franc saw a sharp pullback.

Source: barchart.com

Source: barchart.com

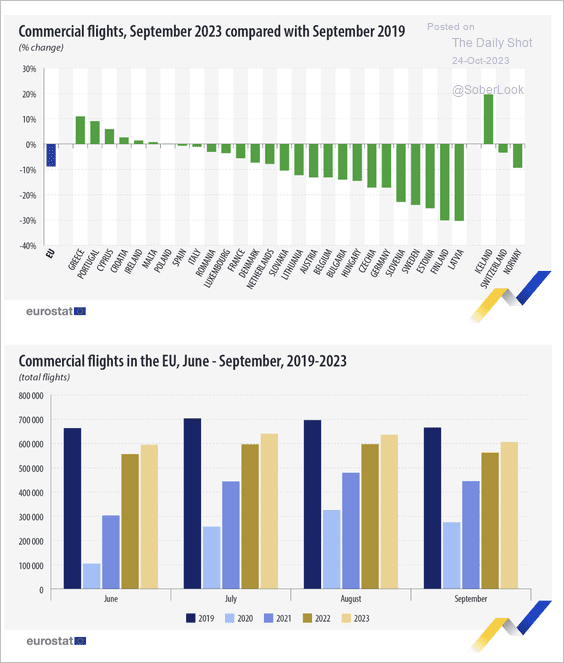

3. Here is a look at commercial flights in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

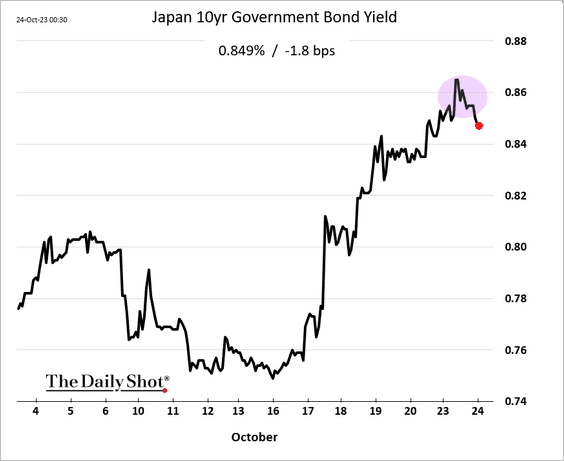

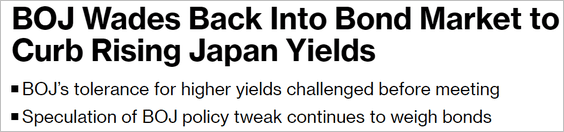

1. The BoJ stepped in to halt the rise in JGB yields.

Source: @markets Read full article

Source: @markets Read full article

——————–

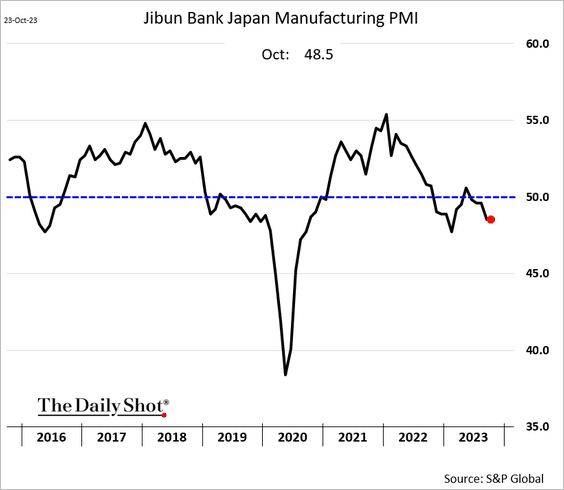

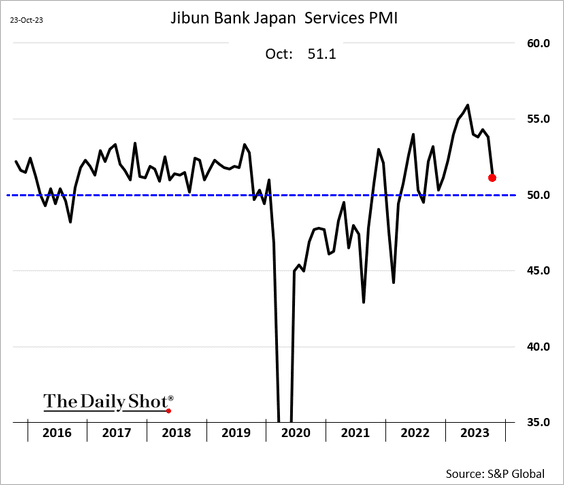

2. Manufacturing activity held in contraction territory this month.

Service sector growth slowed sharply.

Back to Index

Asia-Pacific

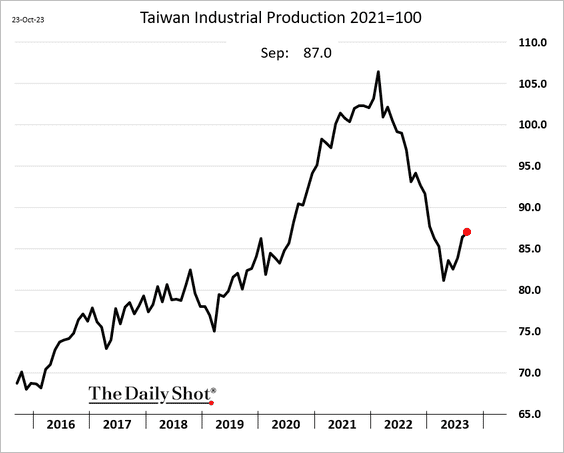

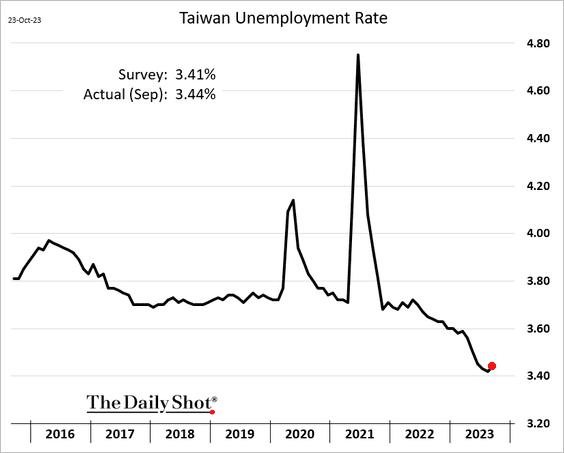

1. Taiwan’s industrial production edged higher in September.

The unemployment rate moved up slightly but remains very low.

——————–

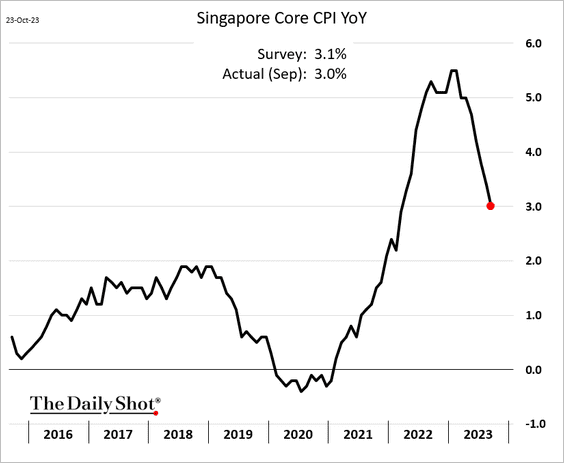

2. Singapore’s inflation is slowing.

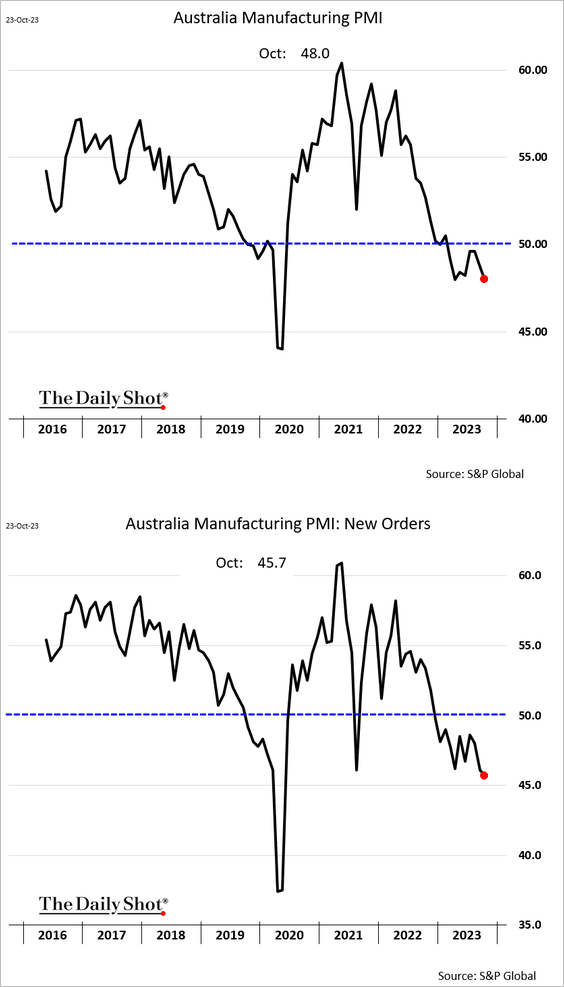

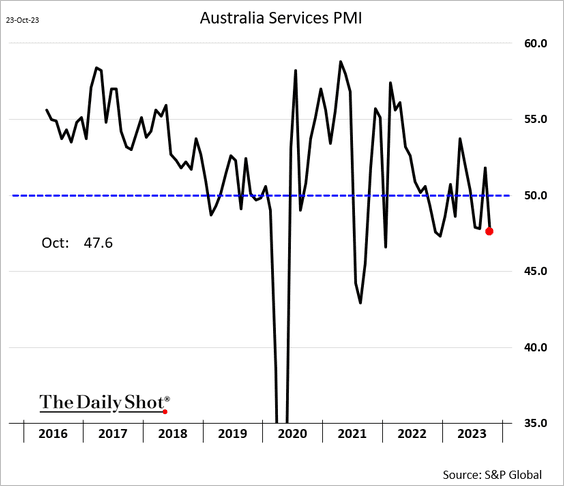

3. Australian PMI indicators are now both in contraction territory.

• Manufacturing:

• Services:

Back to Index

China

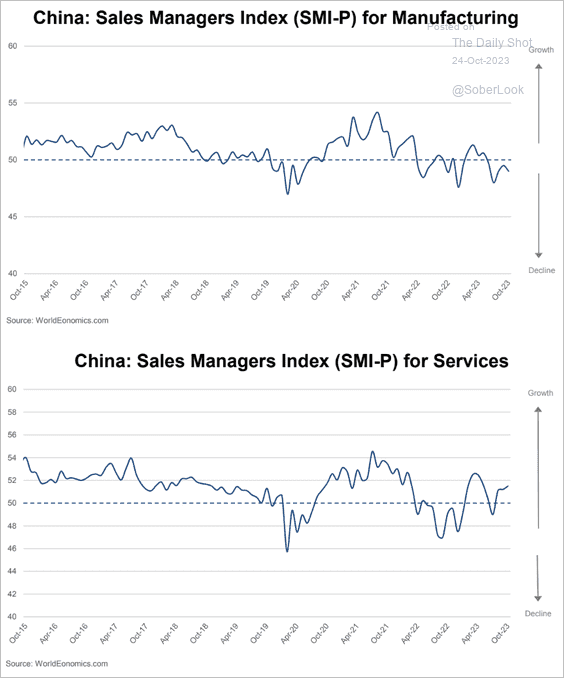

1. The World Economics report shows service sector growth improving this month. Factory activity remains soft.

Source: World Economics

Source: World Economics

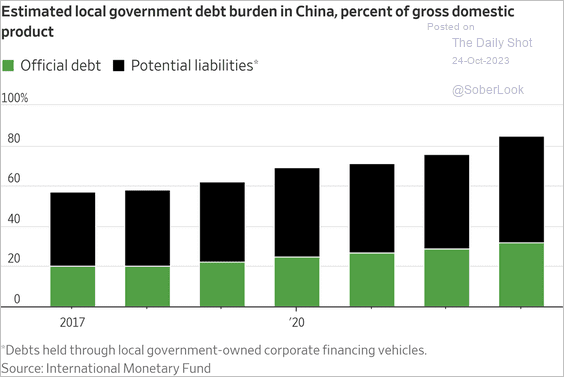

2. Local government debt continues to grow.

Source: @WSJ Read full article

Source: @WSJ Read full article

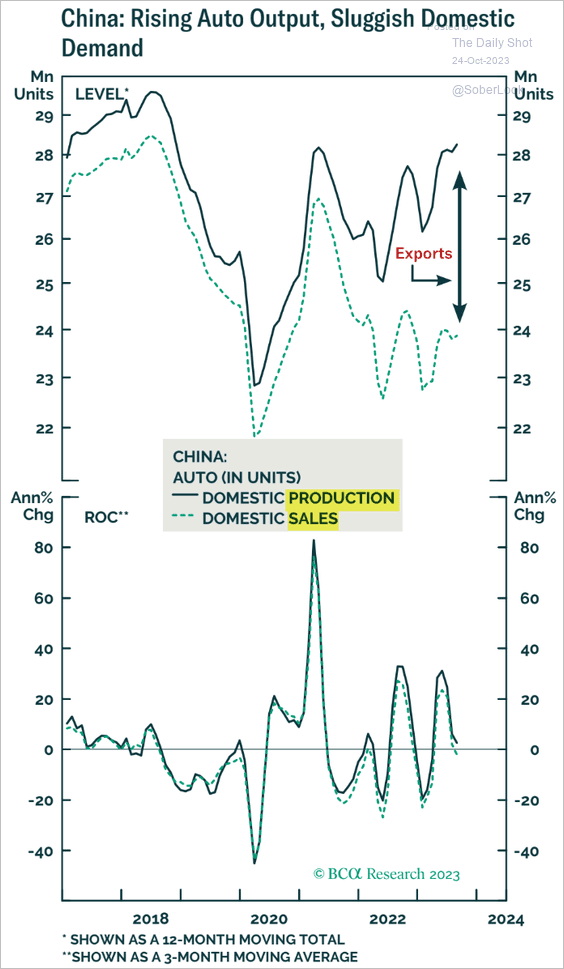

3. Domestic demand for autos has been weak.

Source: BCA Research

Source: BCA Research

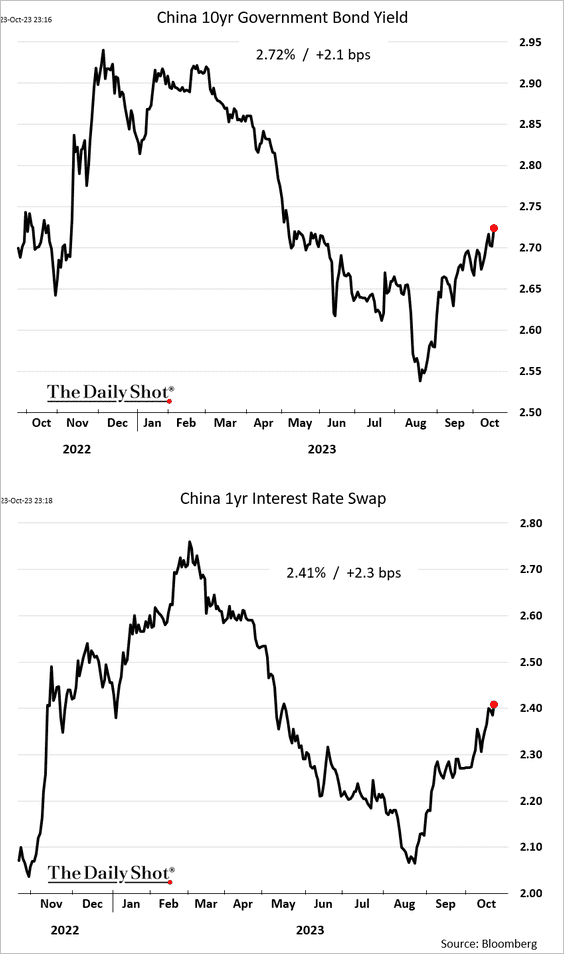

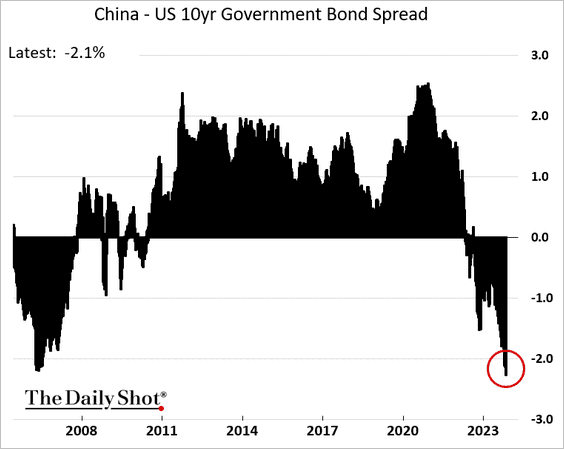

4. Market rates continue to climb.

But China’s 10-year government bond yield remains well below the US equivalent.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Emerging Markets

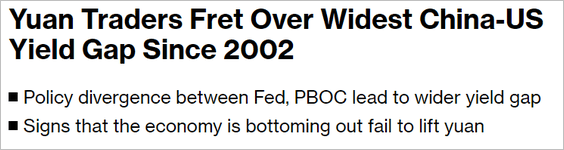

1. Mexico’s economic activity has been growing rapidly.

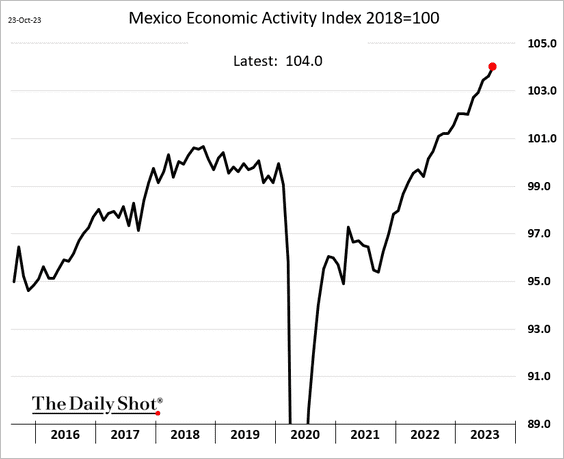

2. Turkey’s consumer sentiment jumped this month.

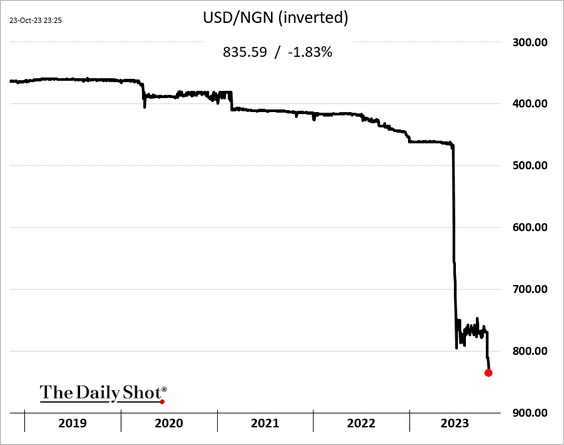

3. The Nigerian naira hit a record low vs. the dollar. Will the central bank intervene?

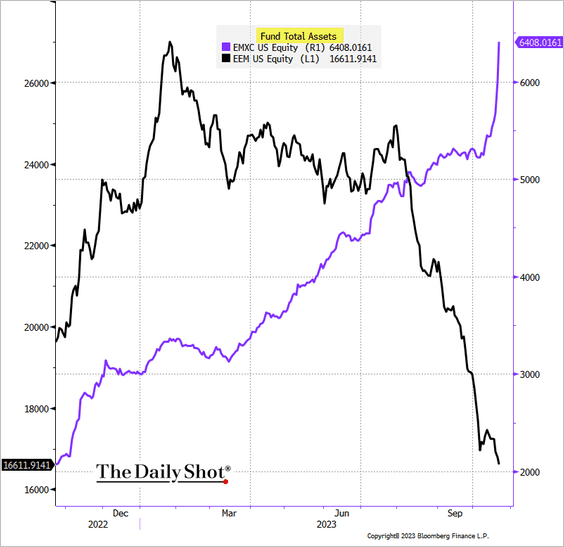

4. Investors have been rotating out of the broad EM equity ETF (EEM) into the EM ex-China ETF (EMXC).

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Goldman Sachs

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Goldman Sachs

Back to Index

Cryptocurrency

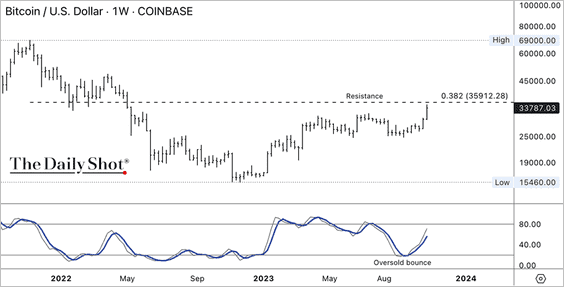

1. Bitcoin rallied from oversold levels and is approaching initial resistance near $35K.

Source: @crypto Read full article

Source: @crypto Read full article

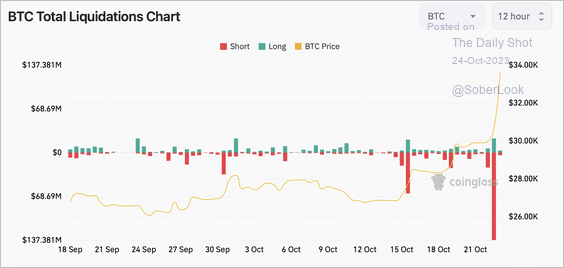

• The rally triggered a spike in short BTC liquidations.

Source: Coinglass

Source: Coinglass

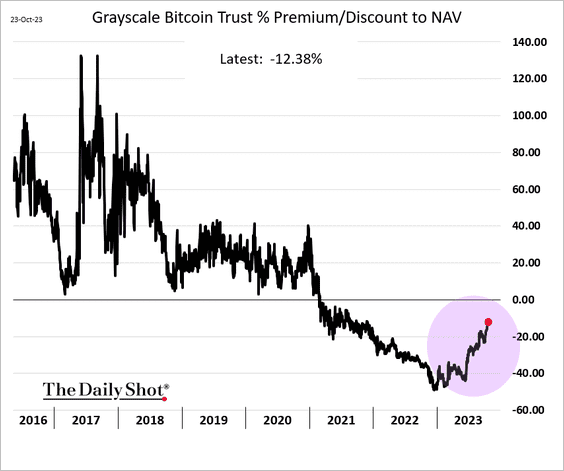

• The Grayscale news contributed to the rally.

Source: @crypto Read full article

Source: @crypto Read full article

The discount to NAV continues to shrink as the ETF conversion becomes more likely.

——————–

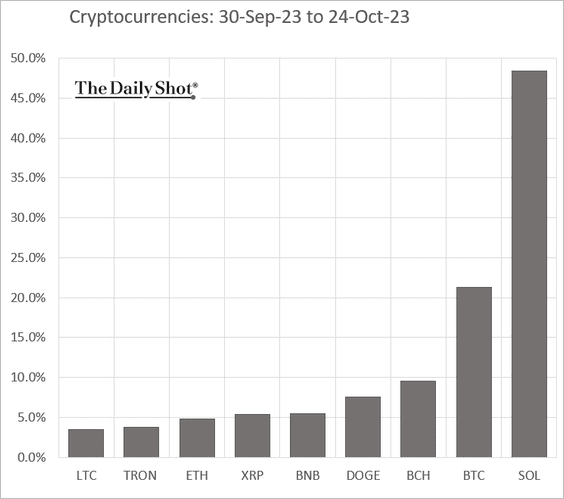

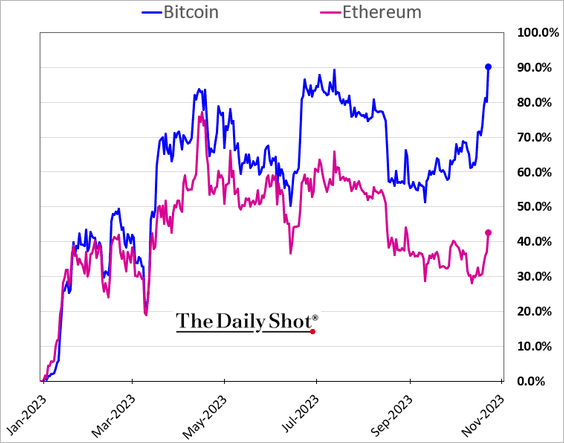

2. This chart shows the month-to-date performance across some of the most liquid cryptos.

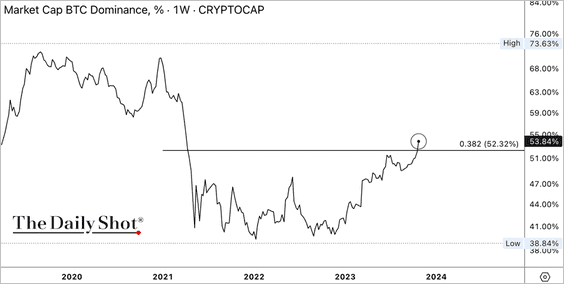

3. Bitcoin’s market cap relative to the crypto market cap (dominance ratio) is breaking out.

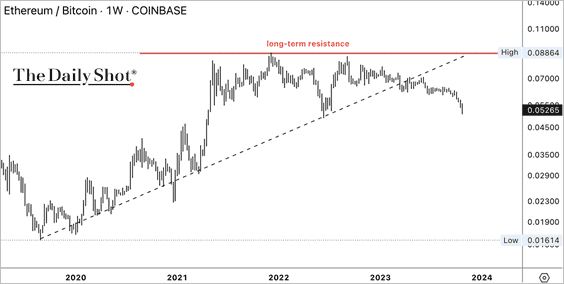

4. The ETH/BTC price ratio continues to decline from long-term resistance.

Here is the relative performance.

——————–

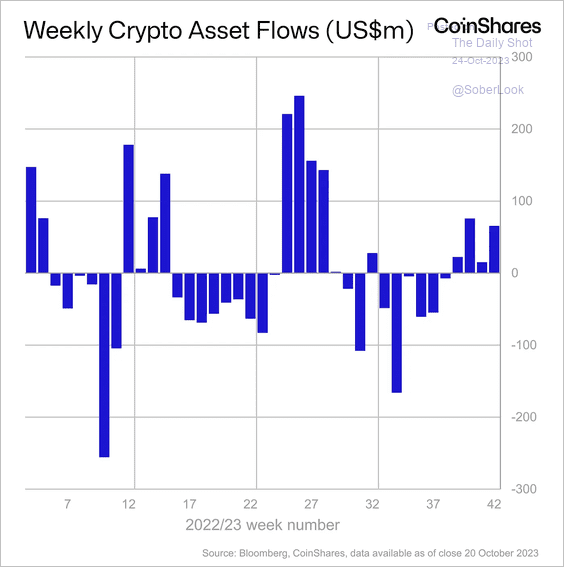

5. Crypto funds saw inflows for the fourth consecutive week.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

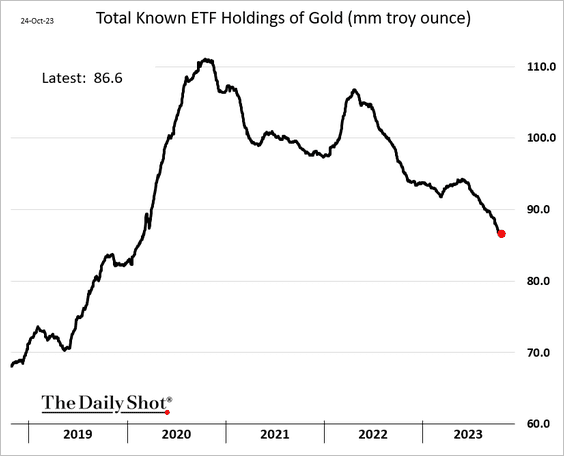

1. So far, ETFs’ gold holdings have not rebounded.

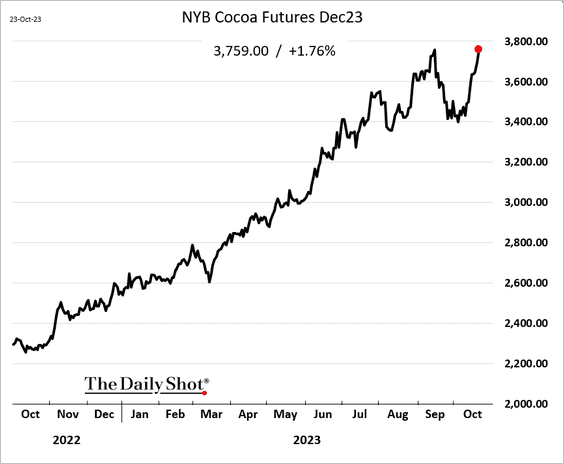

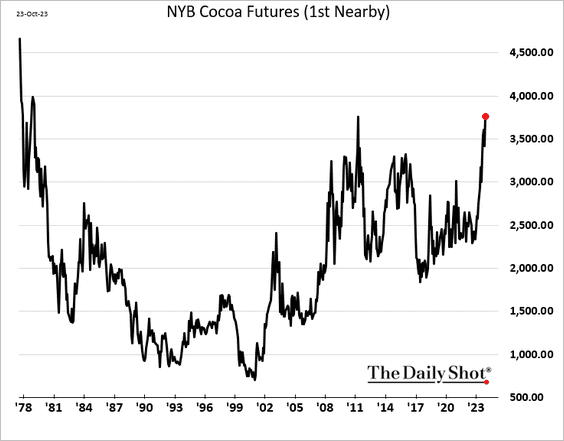

2. Cocoa prices are surging.

Source: @markets Read full article

Source: @markets Read full article

——————–

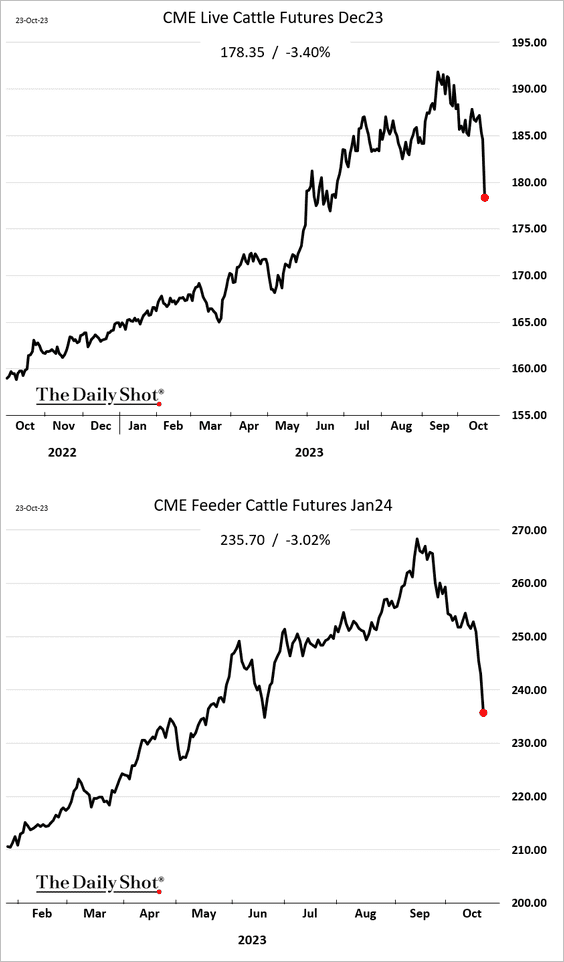

3. Cattle futures tumbled after a USDA report showed higher-than-expected livestock numbers.

Back to Index

Energy

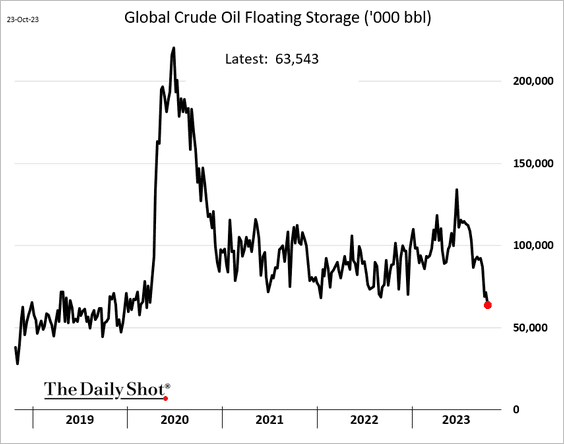

1. Floating storage of crude oil is down sharply as Iran liquidates its stockpiles.

h/t @JavierBlas

h/t @JavierBlas

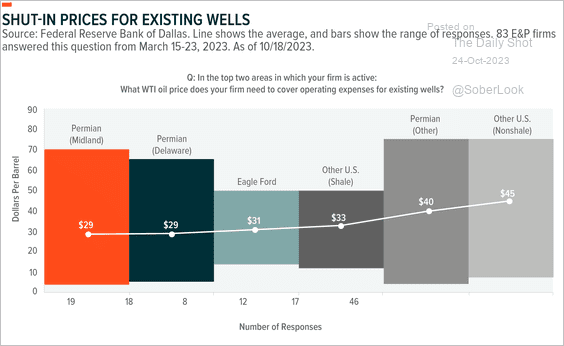

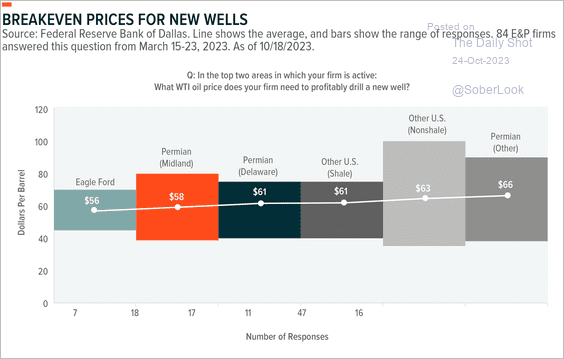

2. The WTI Crude Oil price is well above breakeven prices for existing and new US drilling wells. (2 charts)

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

——————–

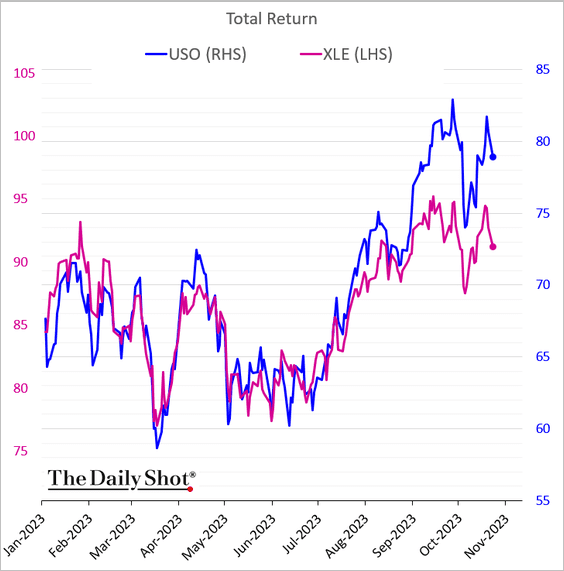

3. Energy shares continue to underperform crude oil.

Back to Index

Equities

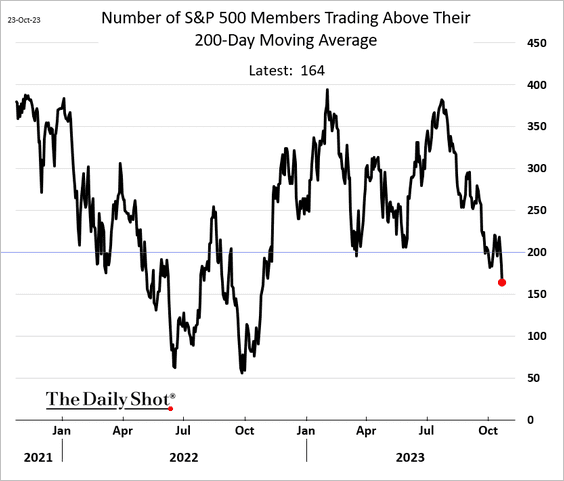

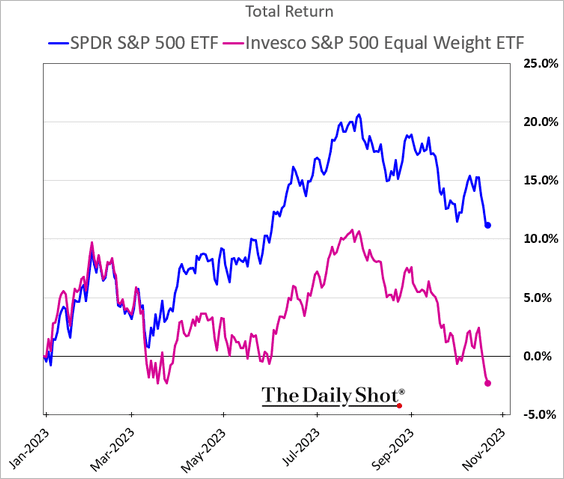

1. Market breadth continues to deteriorate.

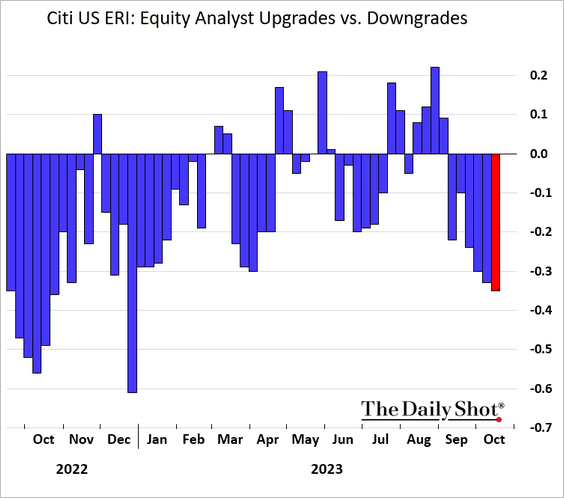

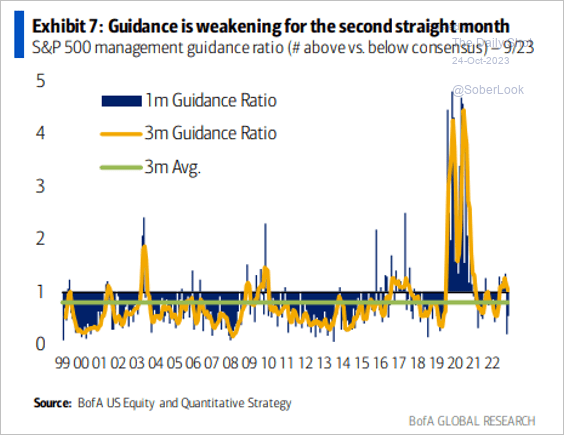

2. Analysts’ earnings downgrades are outnumbering upgrades.

Corporate guidance has also been soft.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

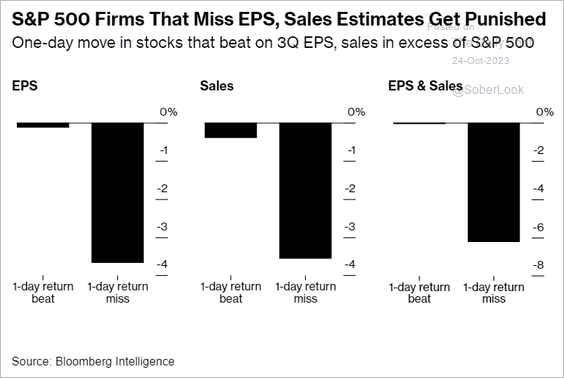

3. The market hasn’t been kind to companies missing earnings or sales estimates.

Source: @markets Read full article

Source: @markets Read full article

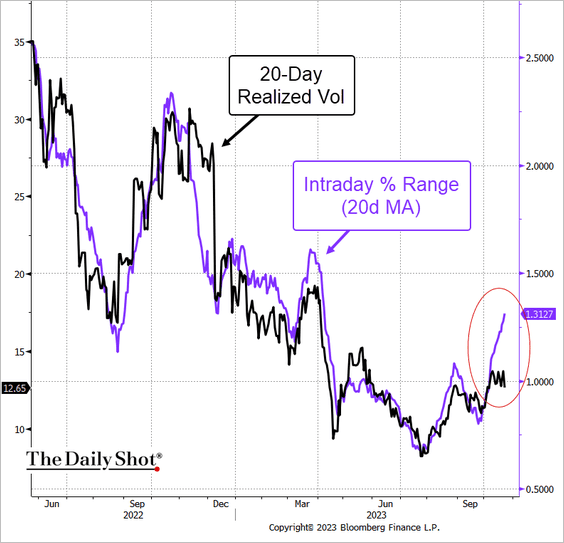

4. Intraday price movements have diverged from realized volatility based on closing prices.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Goldman Sachs

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Goldman Sachs

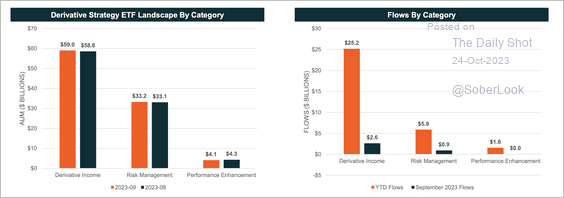

5. Derivative income ETFs continue to see strong inflows.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

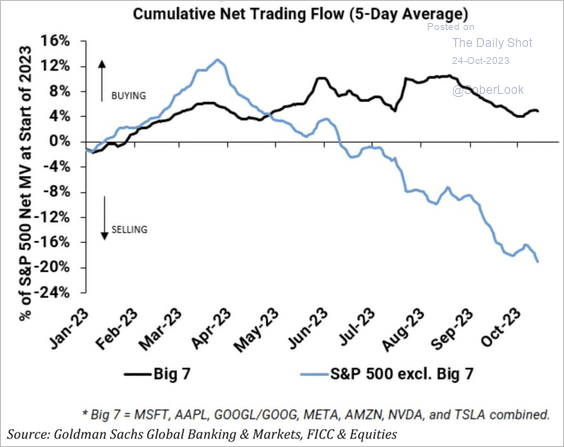

6. Hedge funds like the tech mega-caps but not the rest of the S&P 500.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

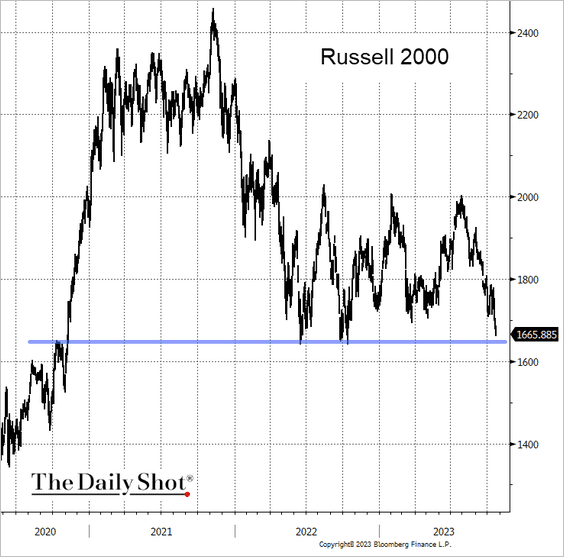

7. The Russell 2000 is nearing support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

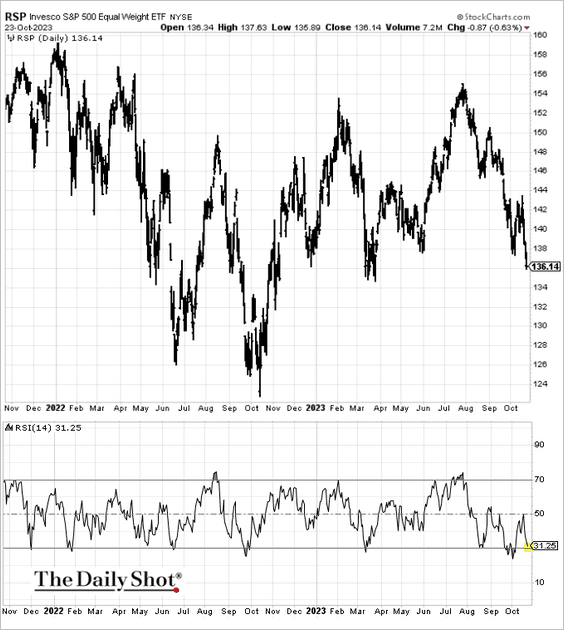

8. The S&P 500 equal-weight index is nearing oversold territory.

Back to Index

Rates

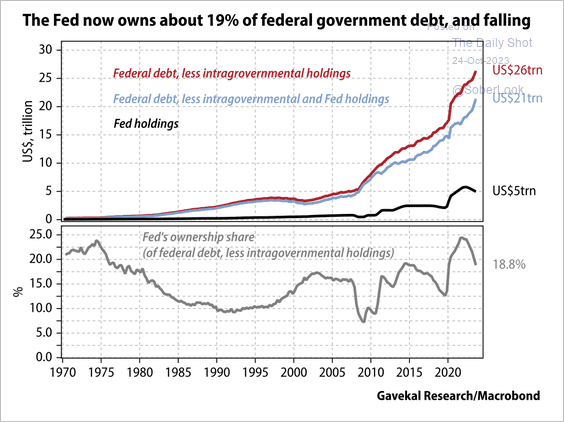

1. The Fed’s ownership share of government debt is falling.

Source: Gavekal Research

Source: Gavekal Research

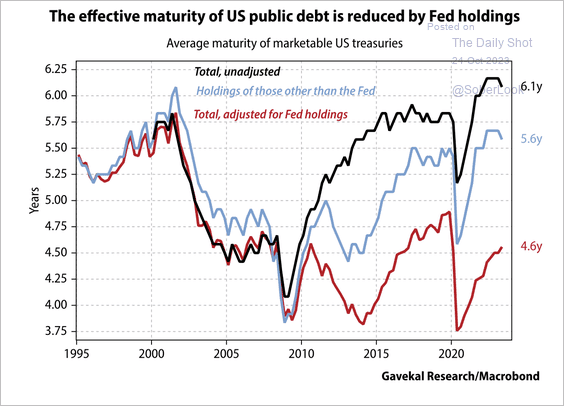

• The Fed has managed to reduce the maturity profile of public debt.

Source: Gavekal Research

Source: Gavekal Research

——————–

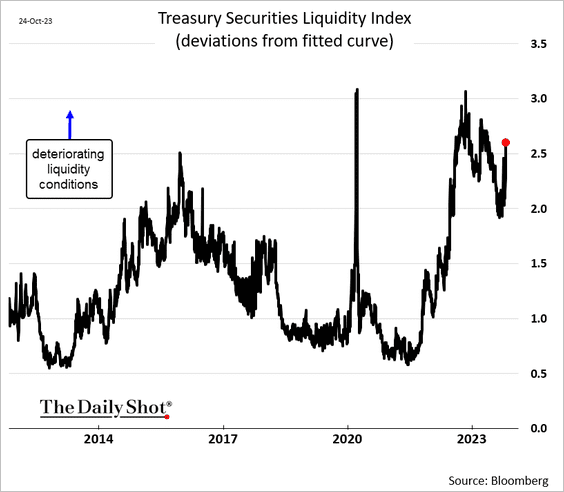

2. Treasury market liquidity is worsening again.

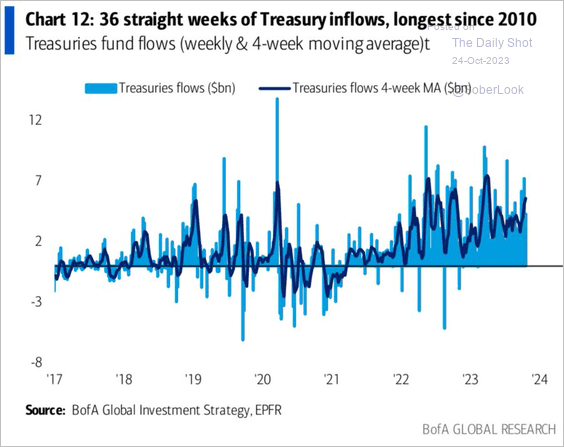

3. Treasury funds continue to see inflows.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Global Developments

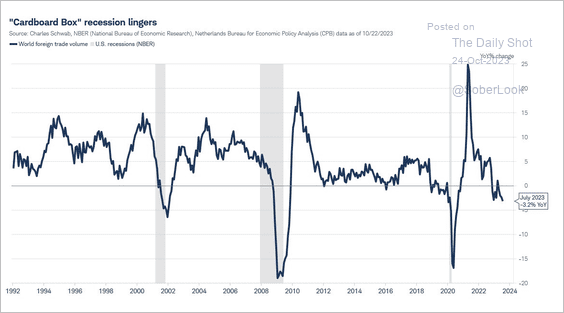

1. Global trade is now firmly below last year’s levels.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

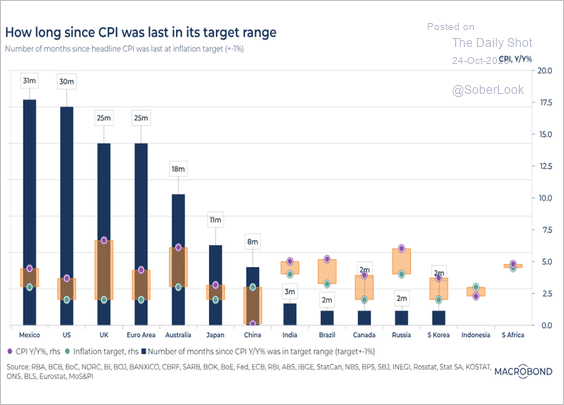

2. How long has it been since each country’s CPI was in its target range?

Source: Macrobond

Source: Macrobond

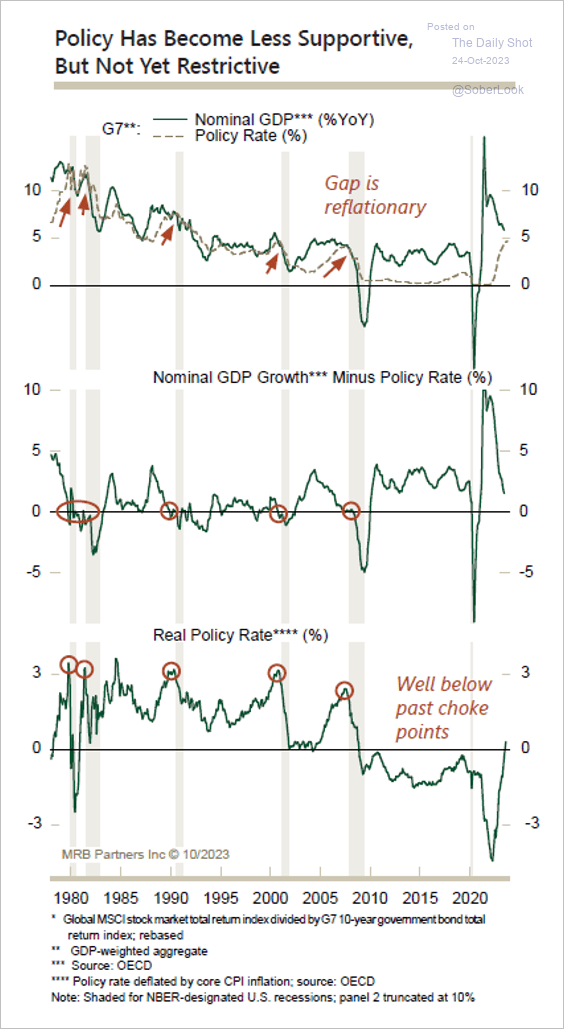

3. Based on nominal GDP growth, policy rates across G7 nations are not yet restrictive.

Source: MRB Partners

Source: MRB Partners

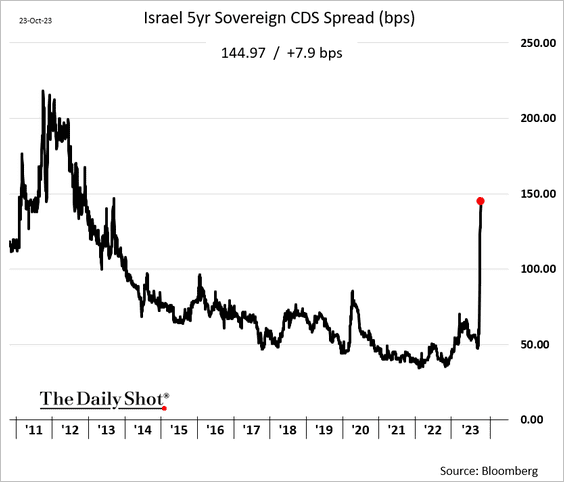

4. Israel’s sovereign CDS spread has reached its highest level in a decade, driven by concerns about the conflict expanding.

——————–

Food for Thought

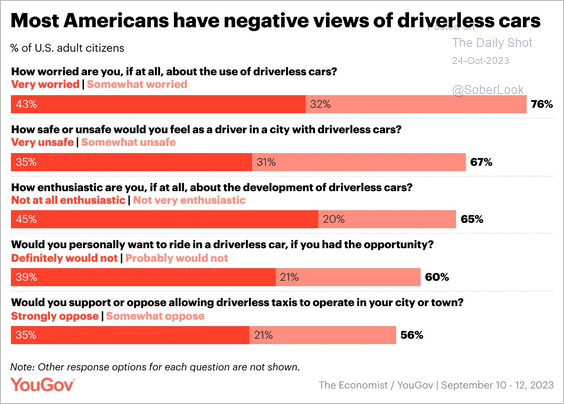

1. Views on driverless cars:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

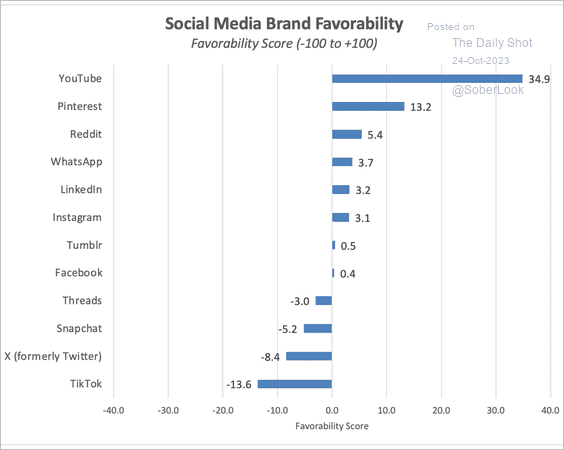

2. Favorability scores for social media brands:

Source: @CivicScience

Source: @CivicScience

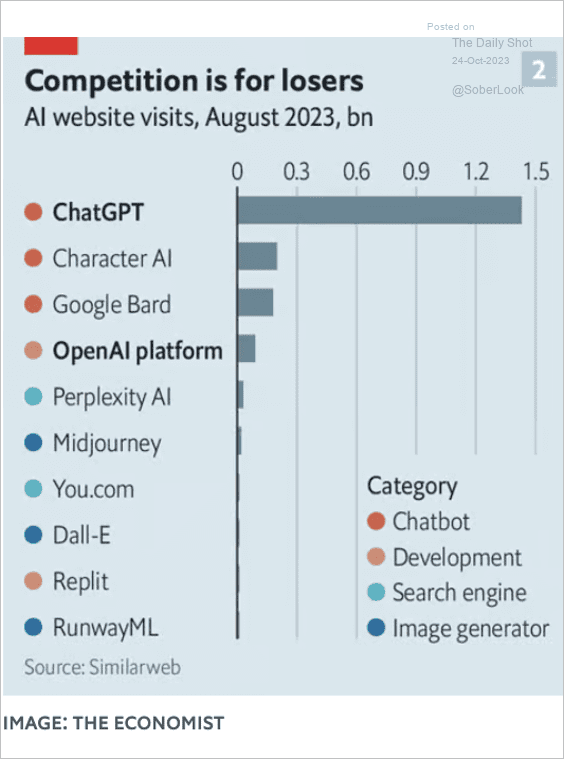

3. AI platform website visits:

Source: The Economist Read full article

Source: The Economist Read full article

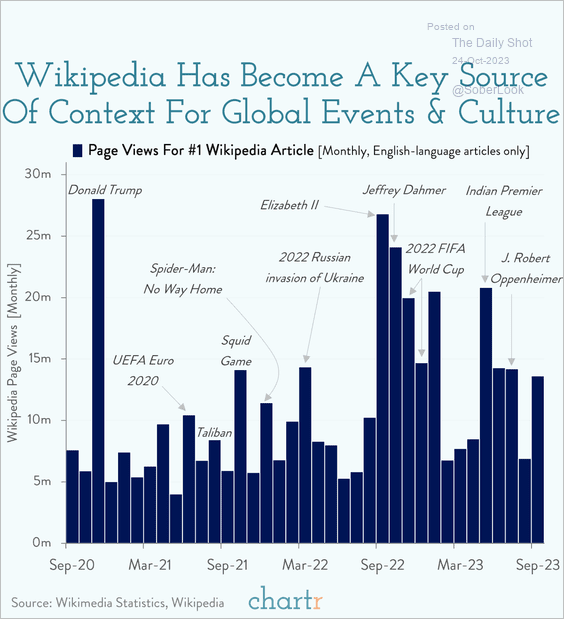

4. Wikipedia page views:

Source: @chartrdaily

Source: @chartrdaily

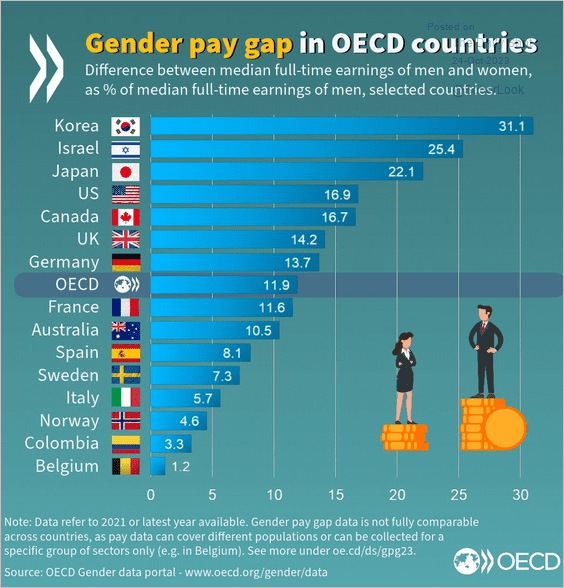

5. Gender pay gaps in OECD countries:

Source: @OECD Read full article

Source: @OECD Read full article

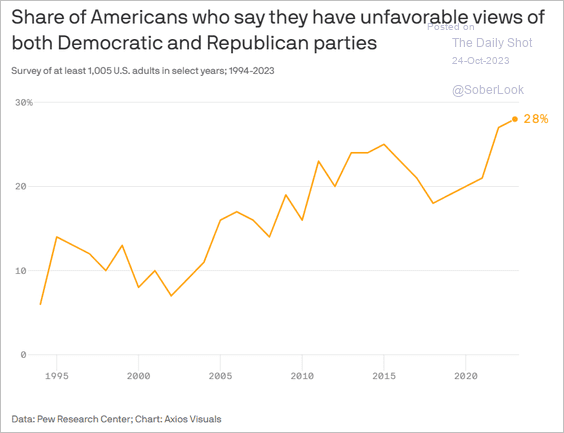

6. Unfavorable views of both Democratic and Republican parties:

Source: @axios Read full article

Source: @axios Read full article

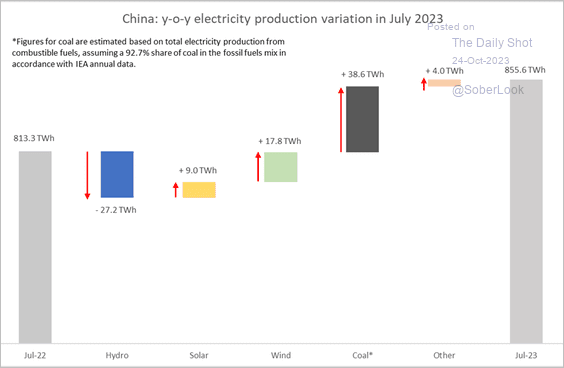

7. A large increase in China’s coal usage:

Source: IEA

Source: IEA

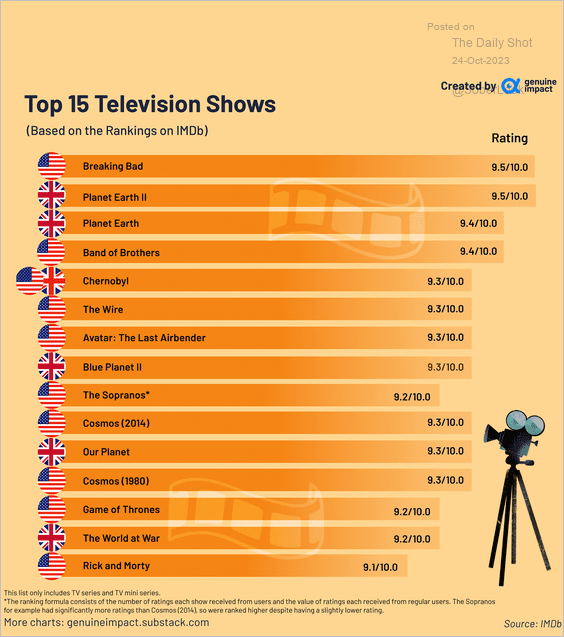

8. TV shows with the highest ratings:

Source: @genuine_impact

Source: @genuine_impact

——————–

Back to Index