The Daily Shot: 25-Oct-23

• The United States

• The United Kingdom

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

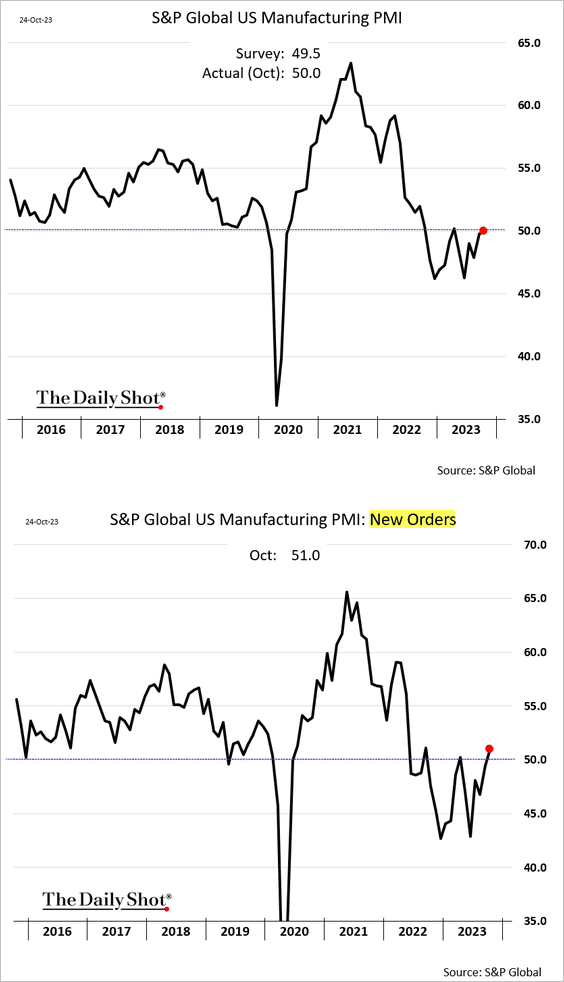

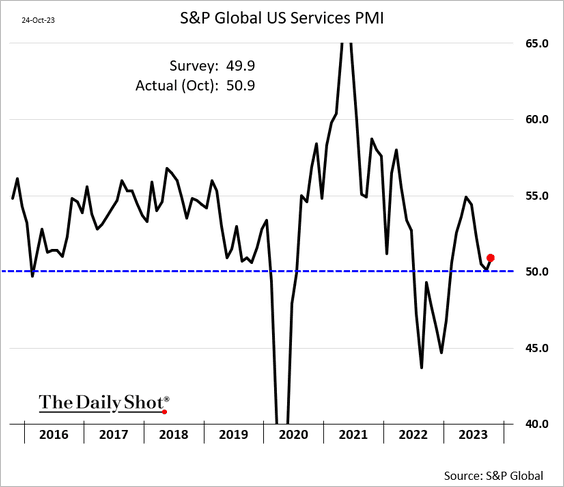

1. According to the PMI report by S&P Global, US business activity is now in growth mode (PMI > 50), indicating a divergence from the economic trends seen in other advanced economies.

• Manufacturing:

• Services:

Source: Reuters Read full article

Source: Reuters Read full article

Service-sector price pressures continue to ease.

——————–

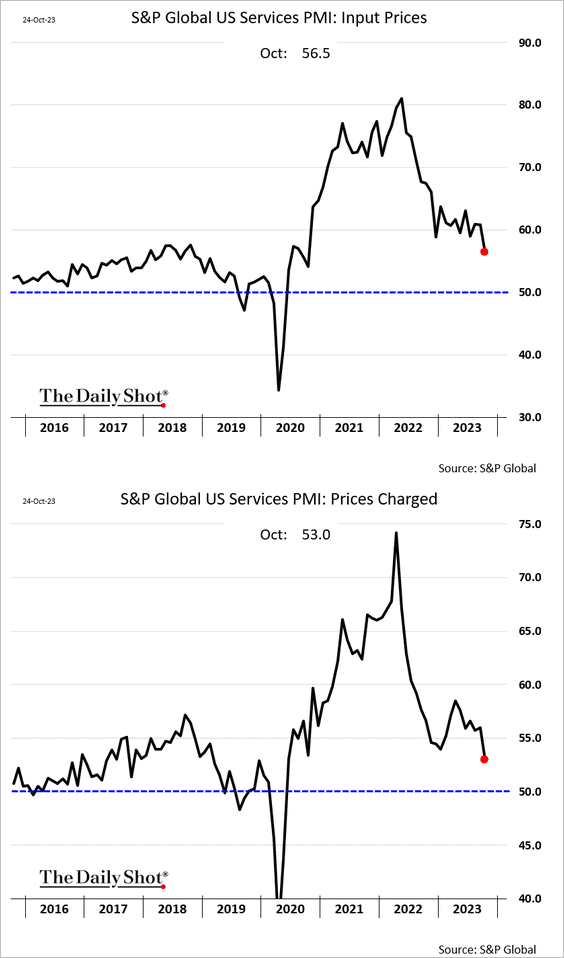

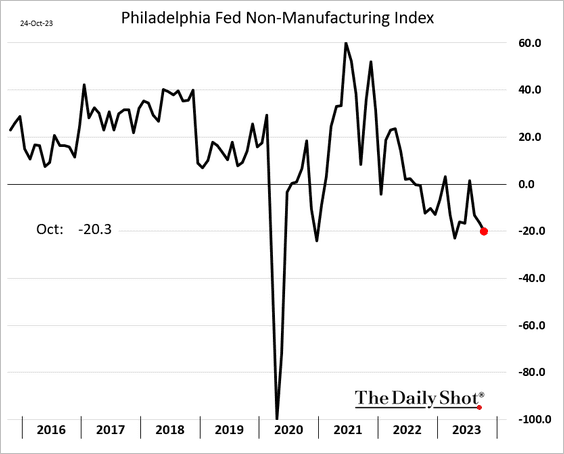

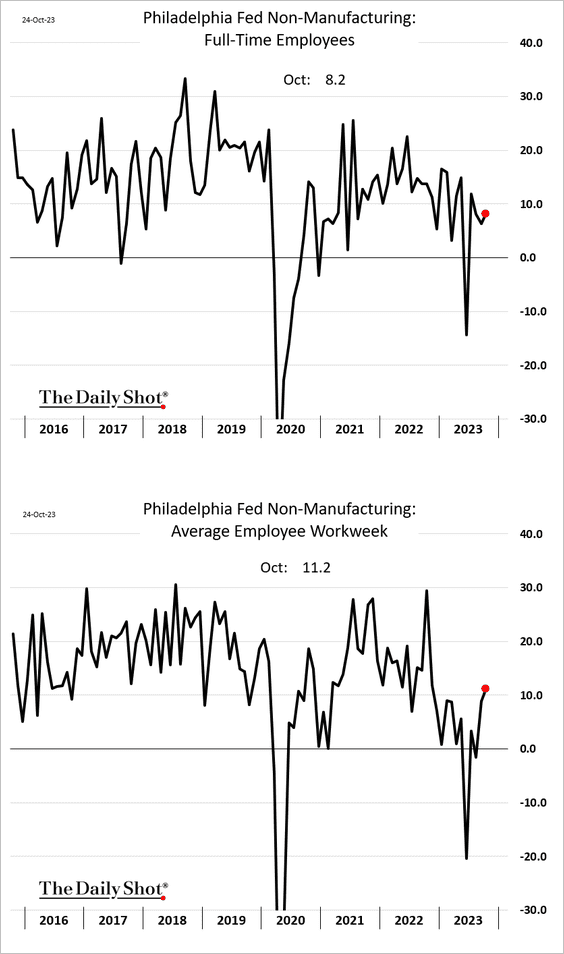

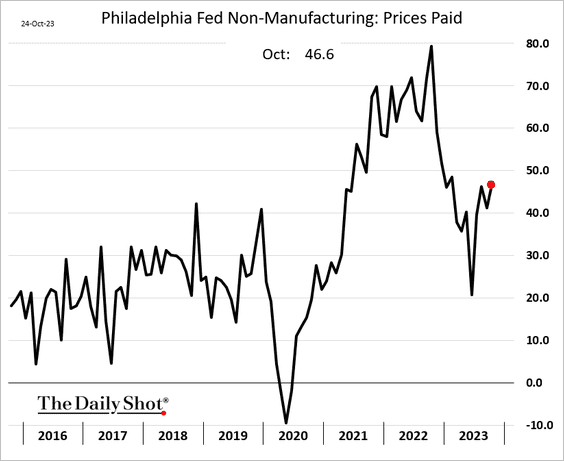

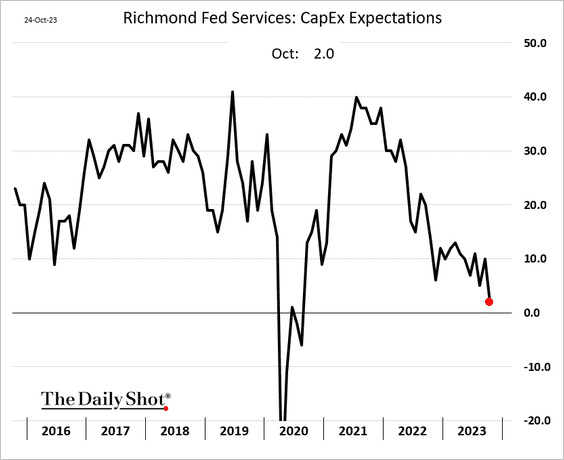

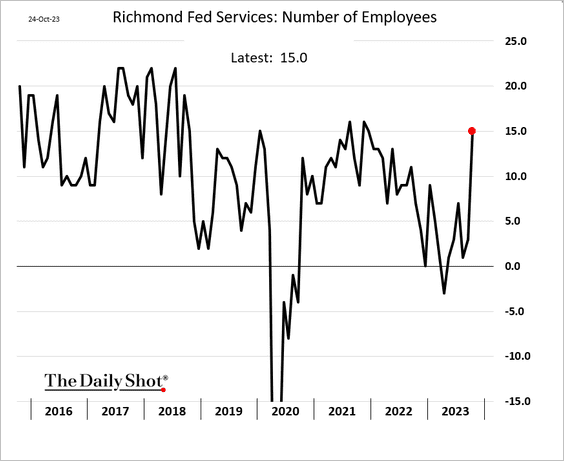

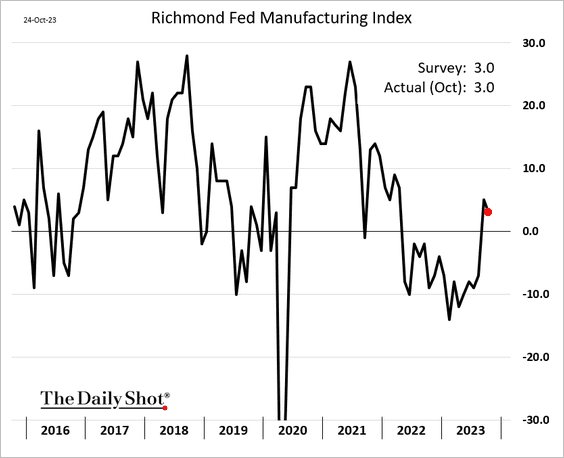

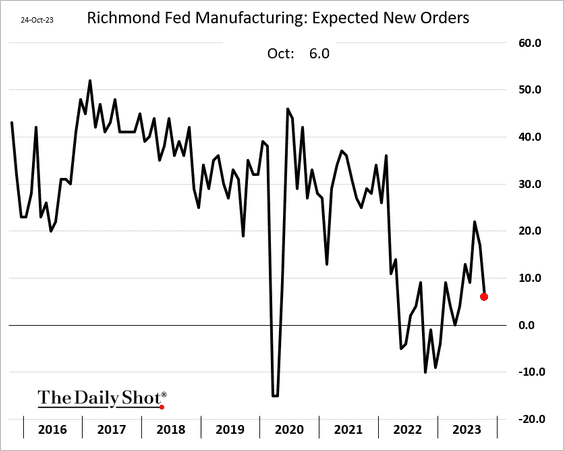

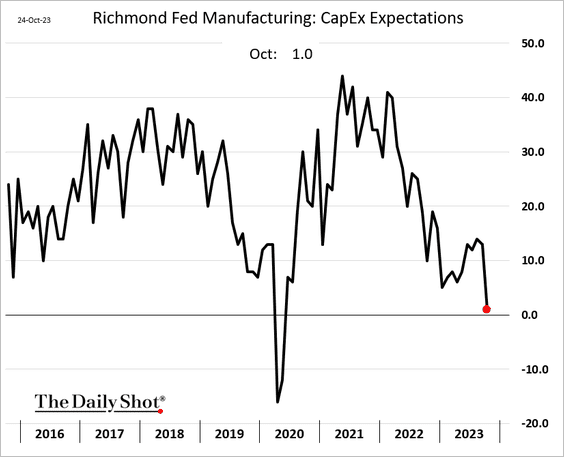

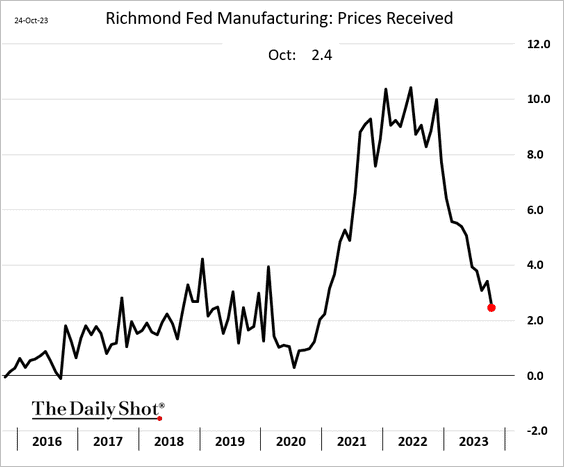

2. Next, let’s take a look at some regional reports. Sentiment and CapEx expectations are subdued, but companies continue to hire.

• The Philly Fed’s regional services sector activity is very sluggish.

– But hiring and employee hours remain robust.

– More businesses reported rising costs this month.

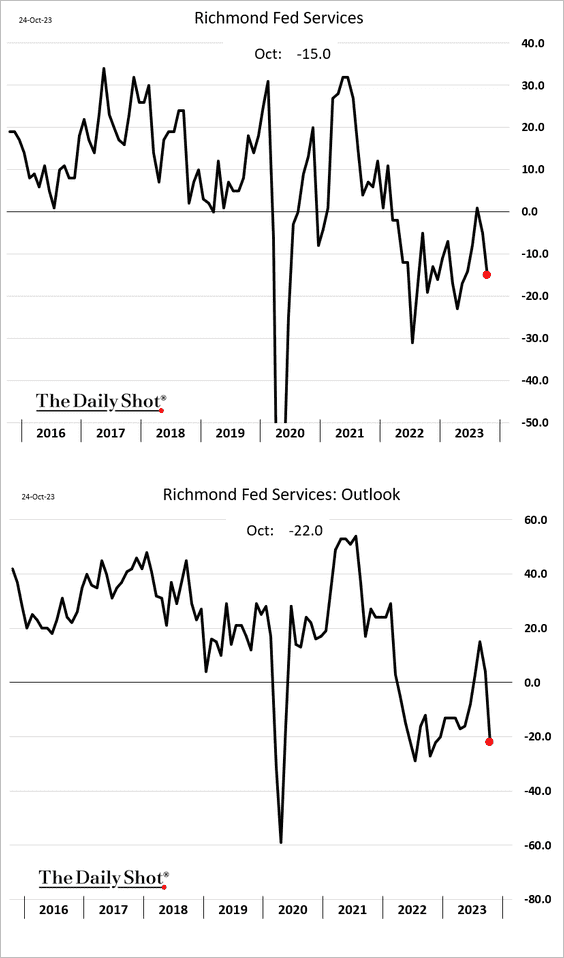

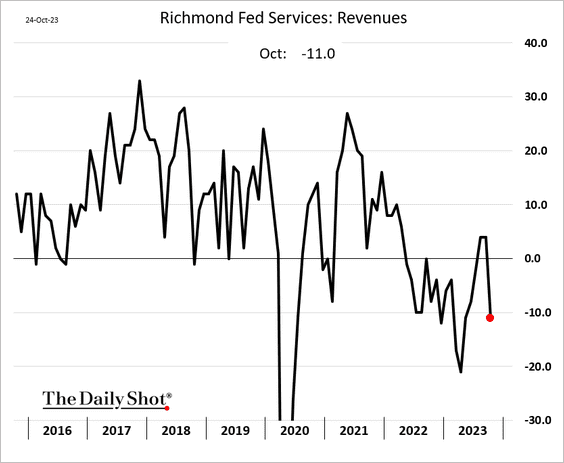

• The Richmond Fed’s services report also shows softening activity and outlook.

– Revenues saw a pullback.

– CapEx growth expectations are stalling.

– But hiring surged this month.

• The Richmond Fed’s manufacturing index is still in growth mode.

• Fewer companies expect an increase in new orders.

• The CapEx trend is similar to the region’s services sector.

• Fewer manufacturers are boosting prices.

——————–

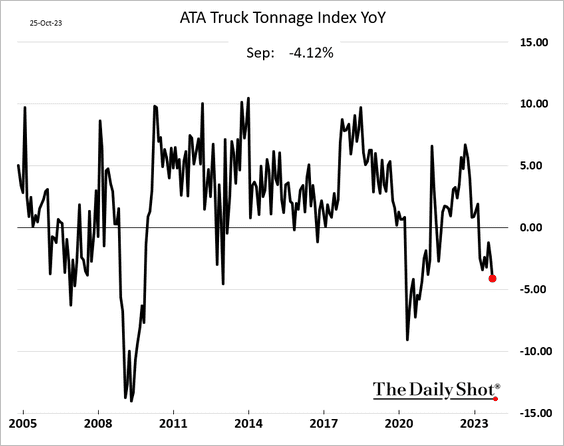

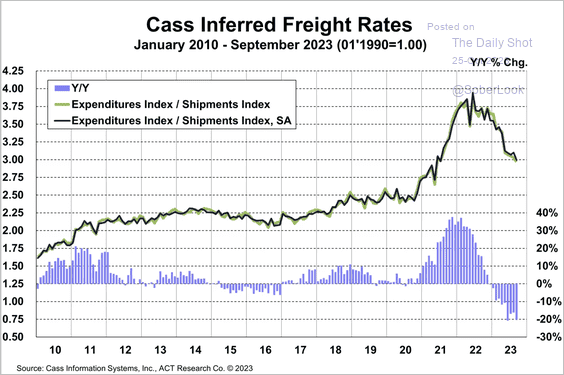

3. US truck tonnage is down from a year ago.

• Freight rates remain in deflation.

Source: Cass Information Systems

Source: Cass Information Systems

——————–

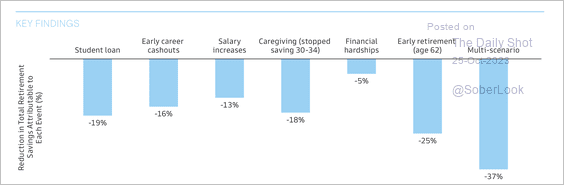

4. Here are some reasons for reduced retirement savings, according to a survey by Goldman Sachs, …

Source: Goldman Sachs

Source: Goldman Sachs

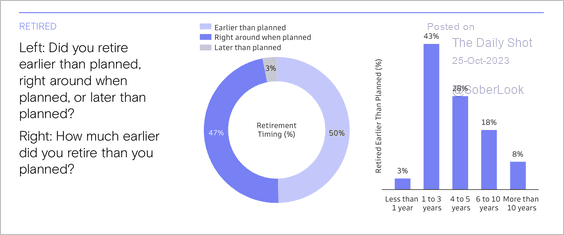

…although most participants retired/plan to retire earlier than planned.

Source: Goldman Sachs

Source: Goldman Sachs

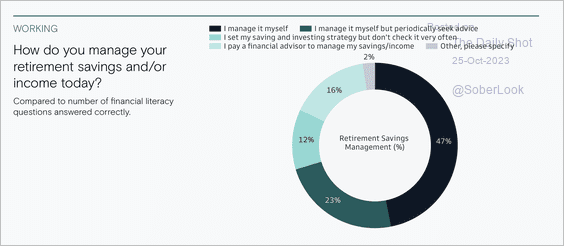

Despite low financial literacy, most survey participants manage their own retirement savings.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

The United Kingdom

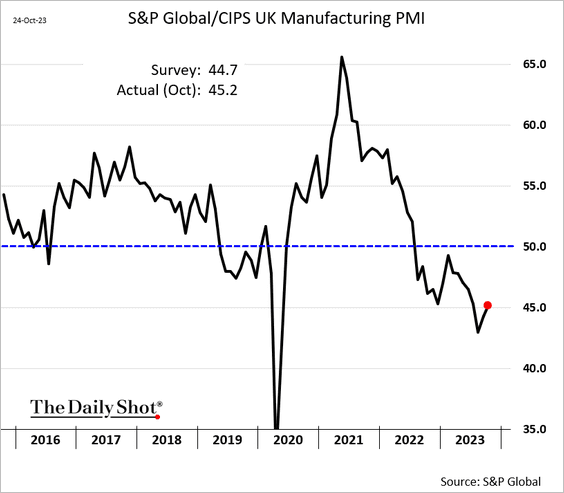

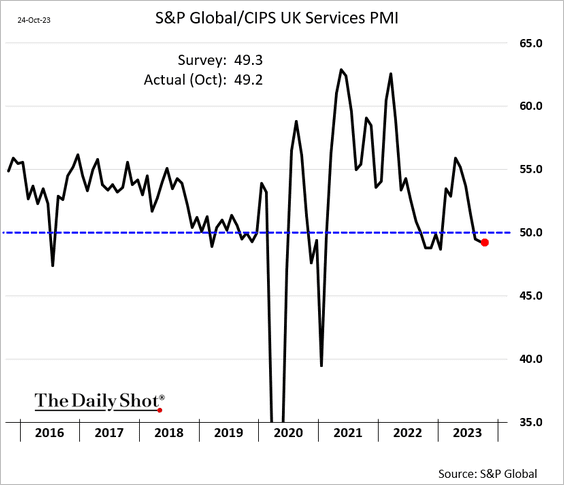

1. Business activity remained in contraction this month (PMI < 50).

• Manufacturing:

• Services:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

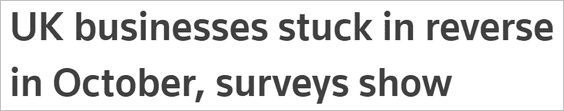

2. Industrial orders weakened more than expected in October.

Source: Reuters Read full article

Source: Reuters Read full article

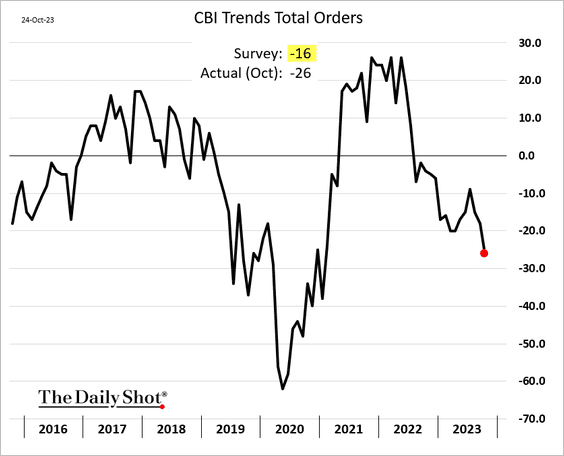

Fewer businesses are boosting prices.

——————–

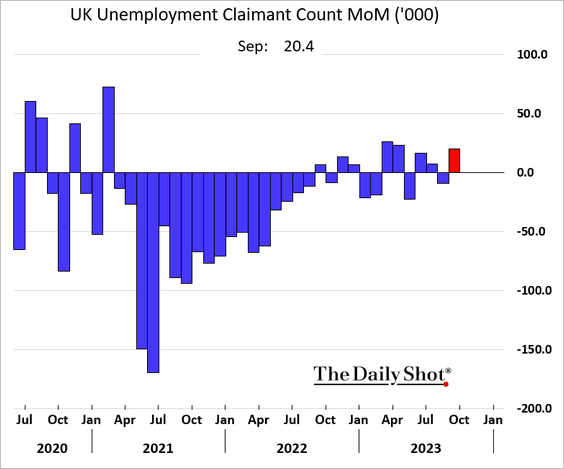

3. Unemployment claims jumped last month.

It’s worth noting that the UK jobs data is a bit of a mess right now.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

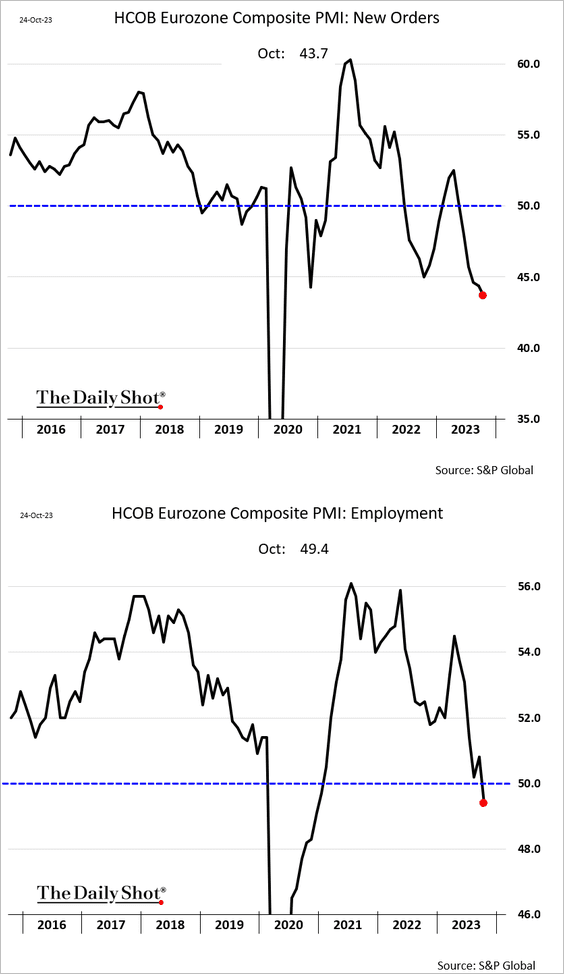

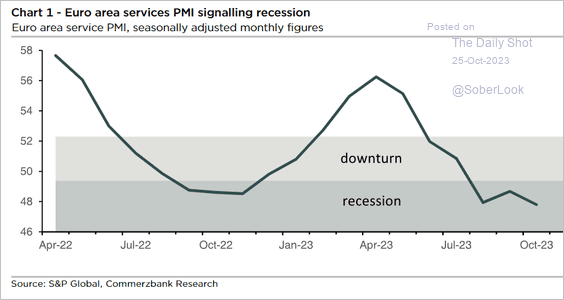

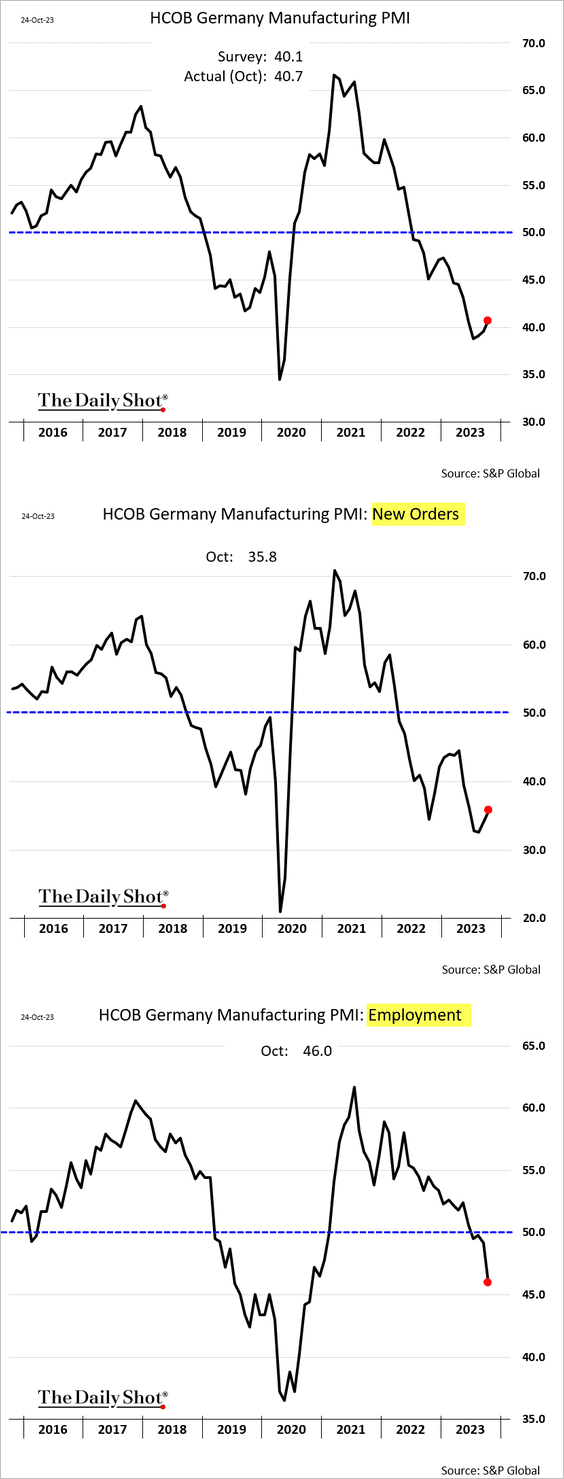

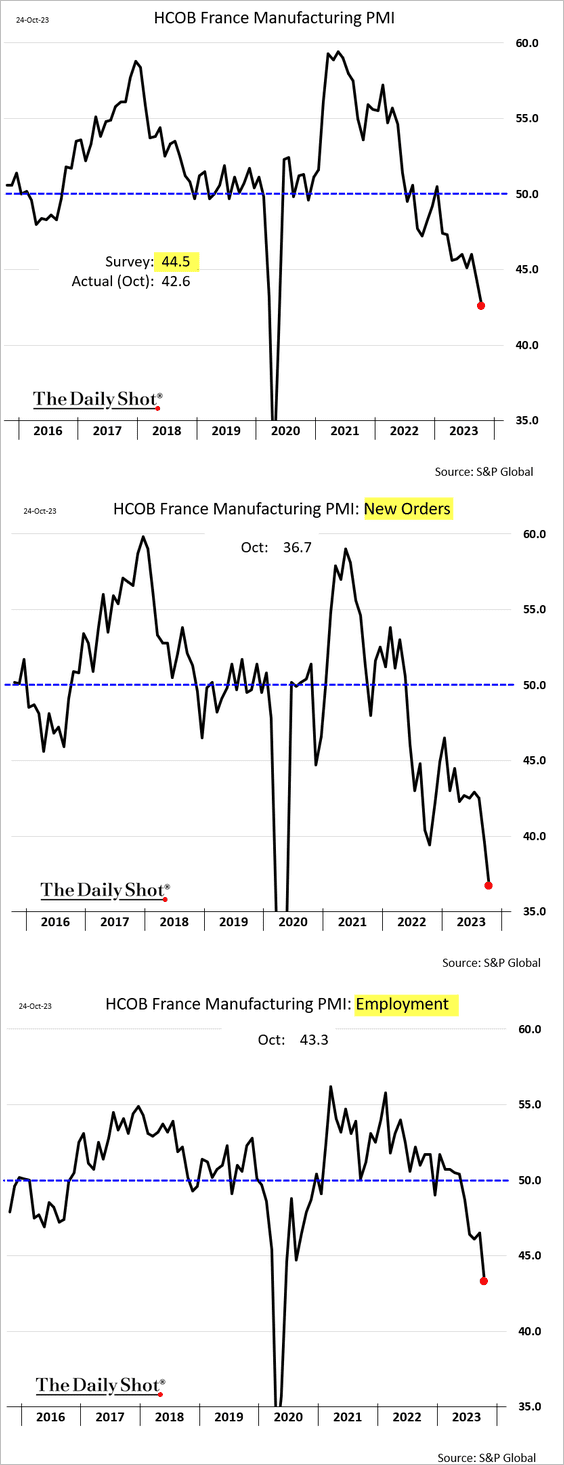

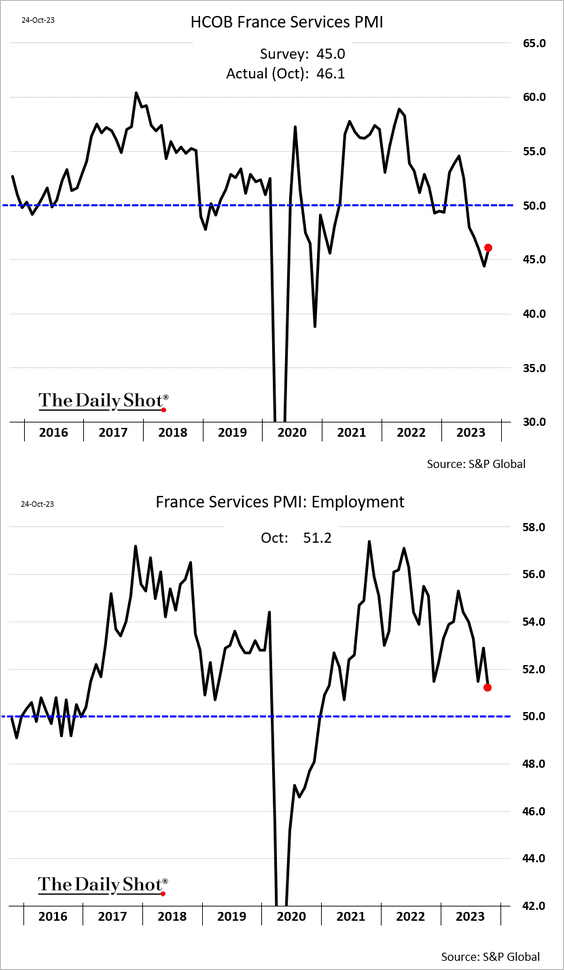

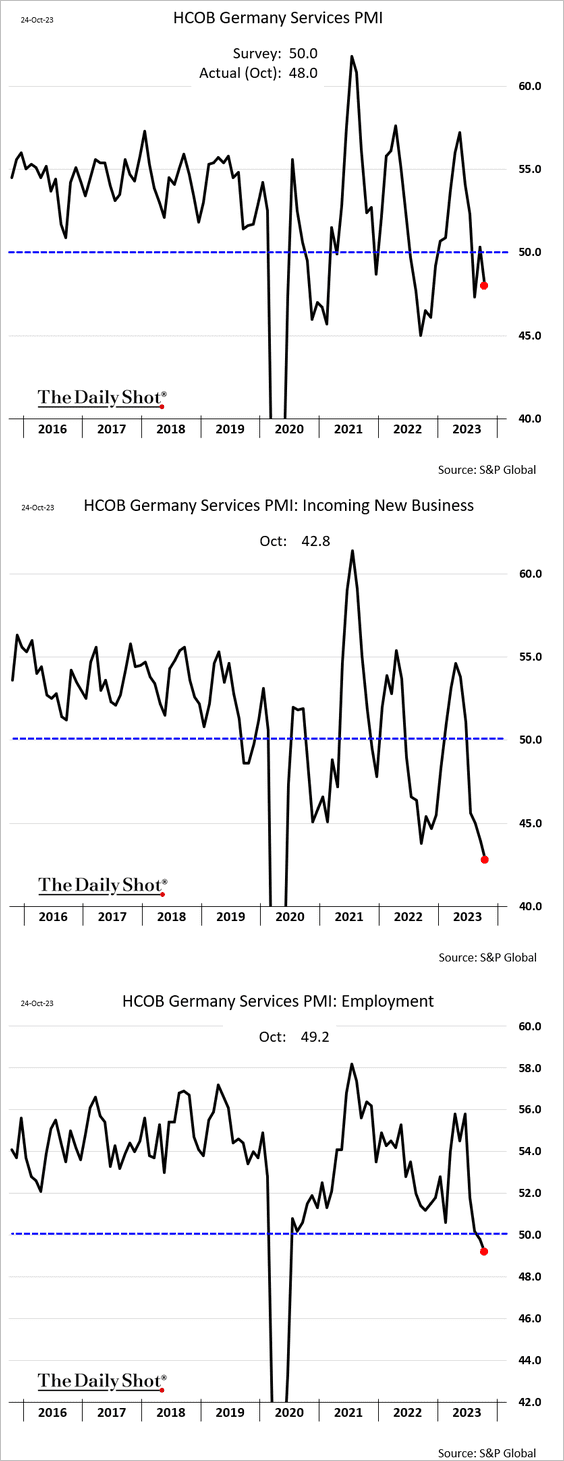

1. As we saw yesterday, euro-area business activity contraction worsened this month. The PMI reports show deteriorating demand, which is starting to show up in the labor market.

We are firmly in recession territory.

Source: Commerzbank Research

Source: Commerzbank Research

• Manufacturing is in deep contraction (PMI < 50).

– Germany:

– France (significant deterioration):

• Services:

– France:

– Germany:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

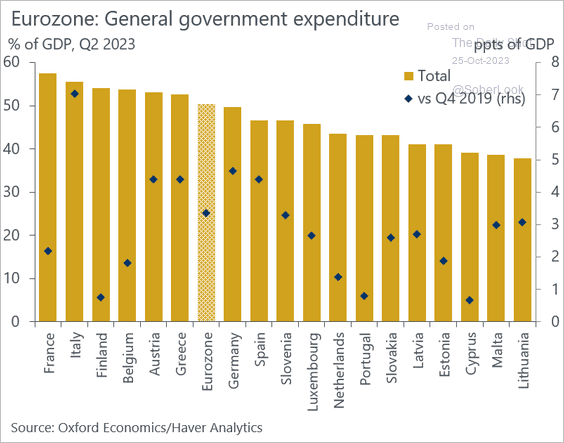

2. Here is a look at pandemic-era increases in government spending.

Source: @DanielKral1

Source: @DanielKral1

Back to Index

Asia-Pacific

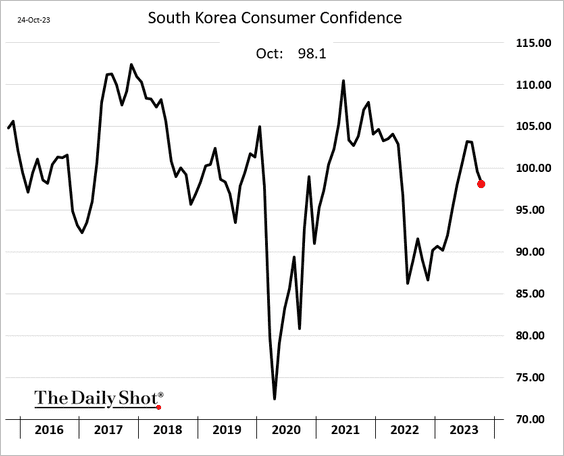

1. South Korea’s consumer confidence declined again this month.

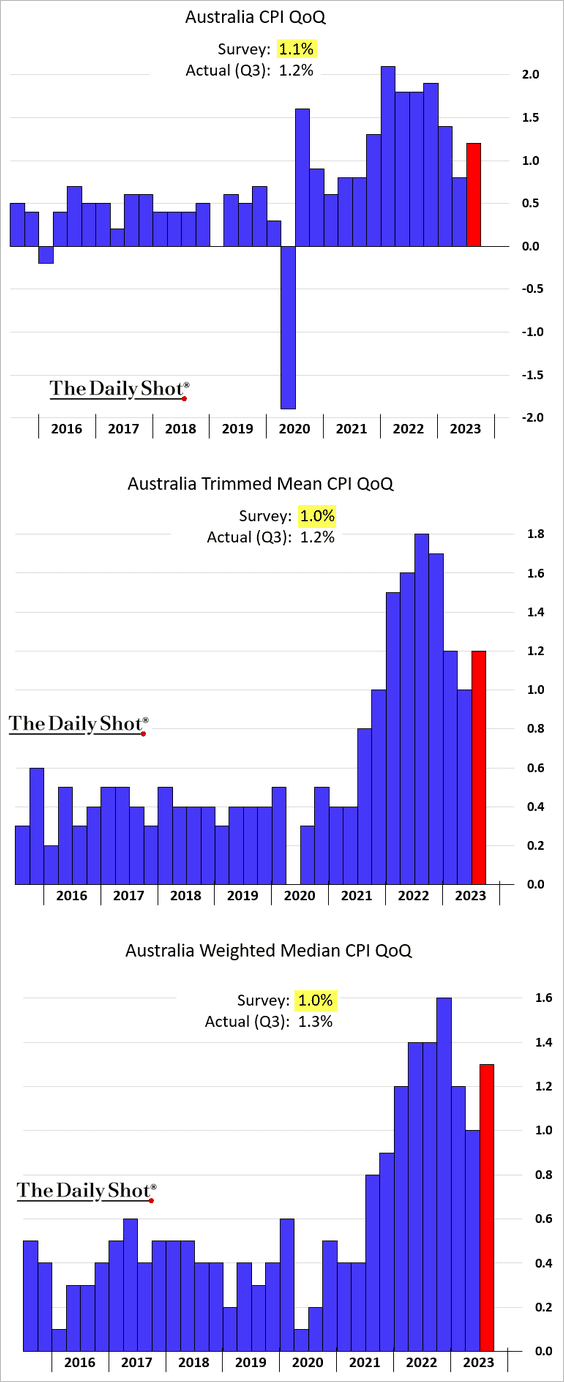

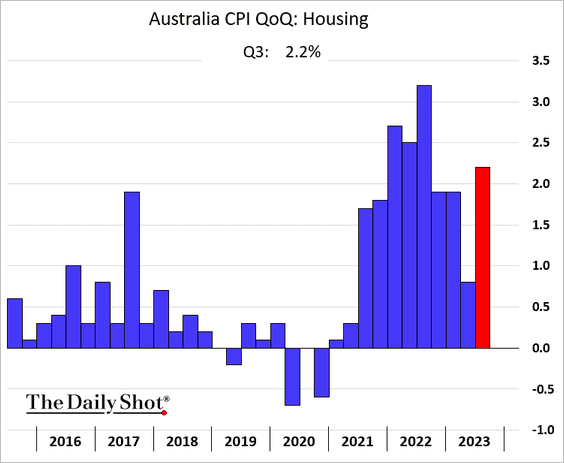

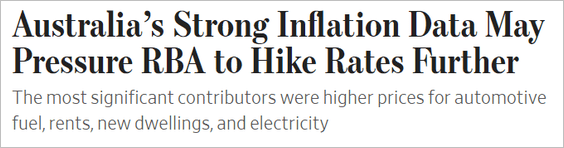

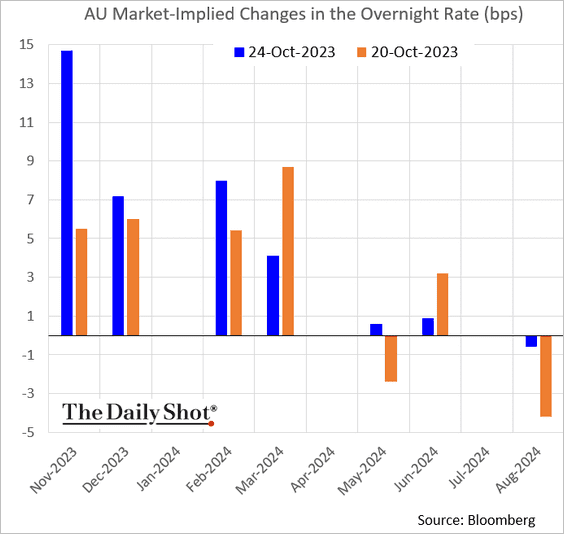

2. Australia’s inflation jumped last quarter, with both the headline and core CPI topping forecasts.

Housing inflation accelerated.

Source: @WSJ Read full article

Source: @WSJ Read full article

• A November RBA rate hike looks increasingly likely.

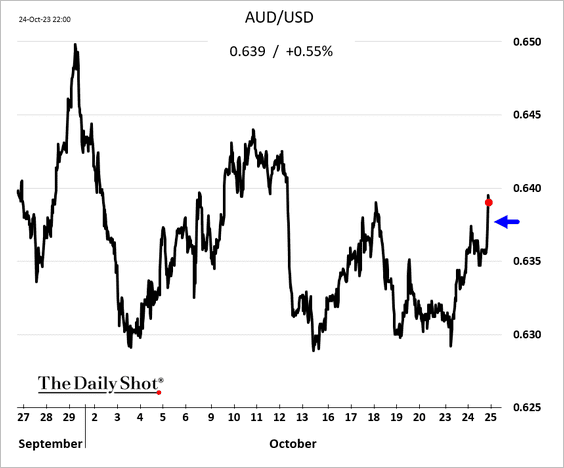

• The Aussie dollar jumped in response to the CPI report.

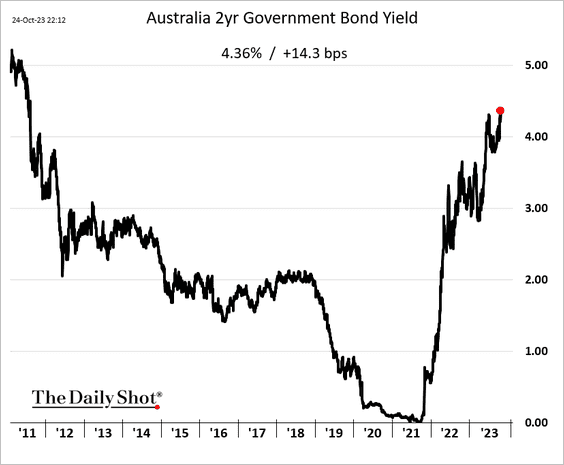

• The 2-year yield hit the highest level since 2011.

Back to Index

China

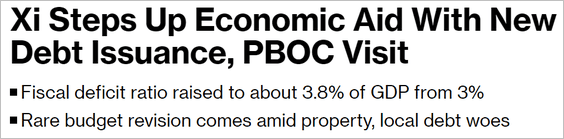

1. China’s stimulus announcement halted the stock market declines.

Source: @economics Read full article

Source: @economics Read full article

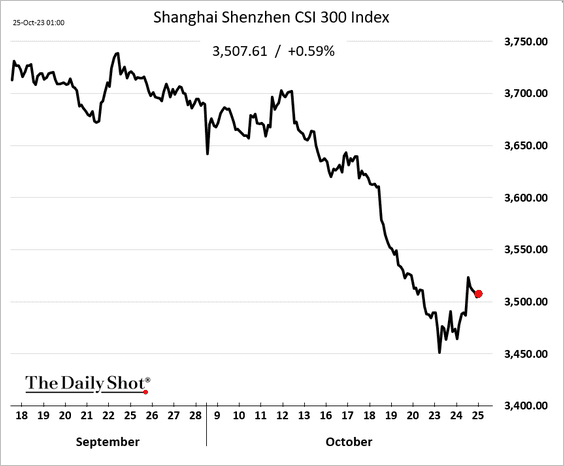

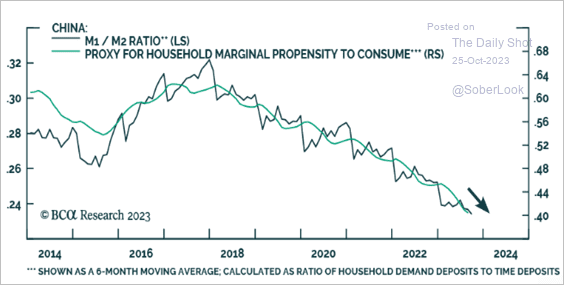

The primary budget deficit is expected to stay elevated.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

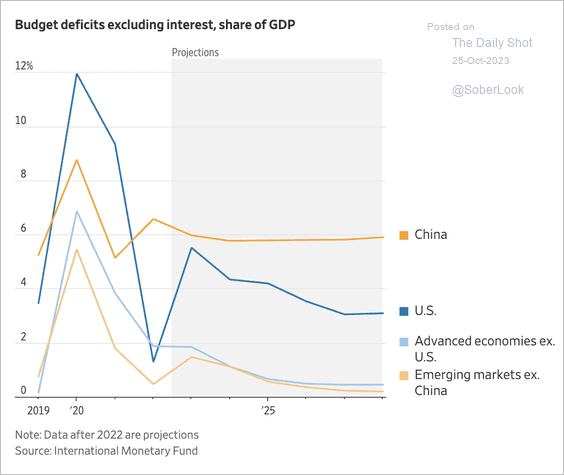

2. Leading indicators point to softer household consumption.

Source: BCA Research

Source: BCA Research

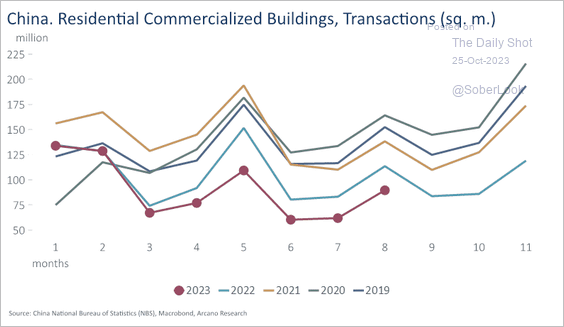

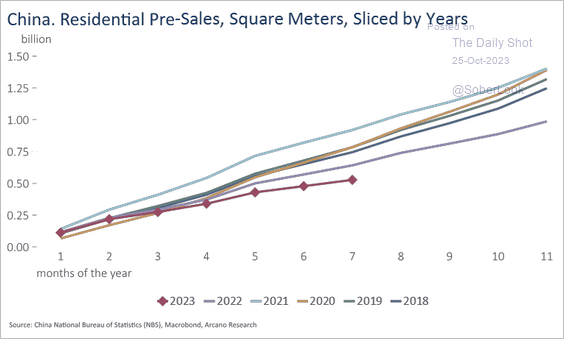

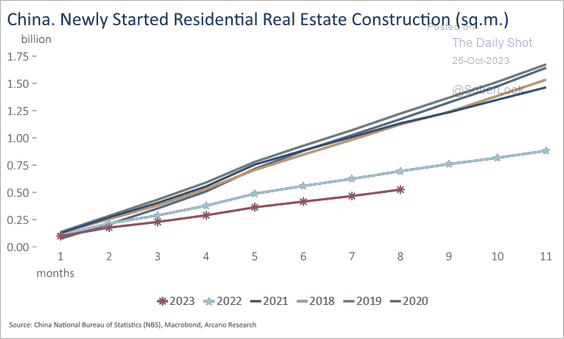

3 Next, let’s take a look at some trends in residential real estate.

• Transactions:

Source: Arcano Economics

Source: Arcano Economics

• Pre-sales (cumulative, YTD):

Source: Arcano Economics

Source: Arcano Economics

• Starts (cumulative, YTD):

Source: Arcano Economics

Source: Arcano Economics

——————–

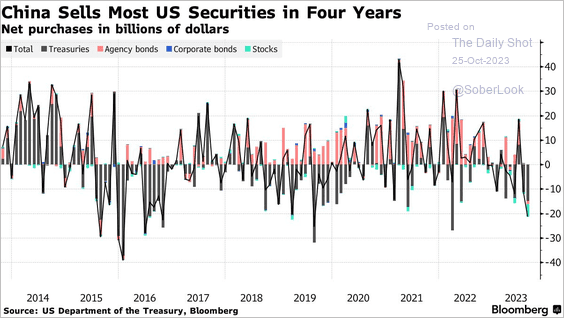

3. China has been dumping US securities.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Emerging Markets

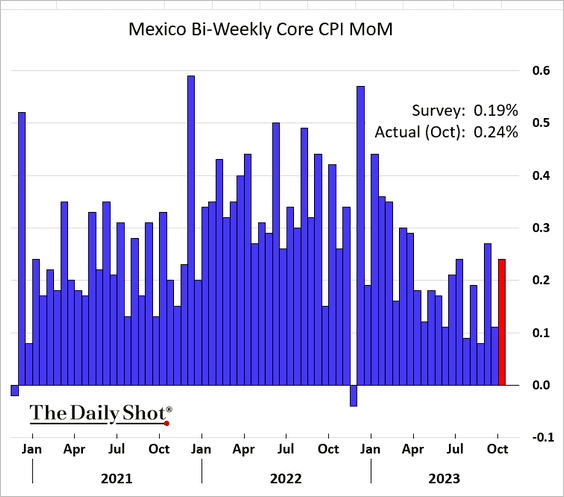

1. Mexico’s inflationary pressures are far from over.

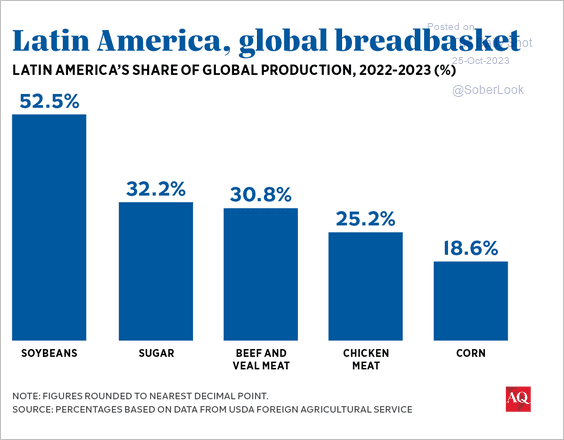

2. Here is a look at LatAm’s share of global production among agriculture and meats.

Source: Americas Quarterly Read full article

Source: Americas Quarterly Read full article

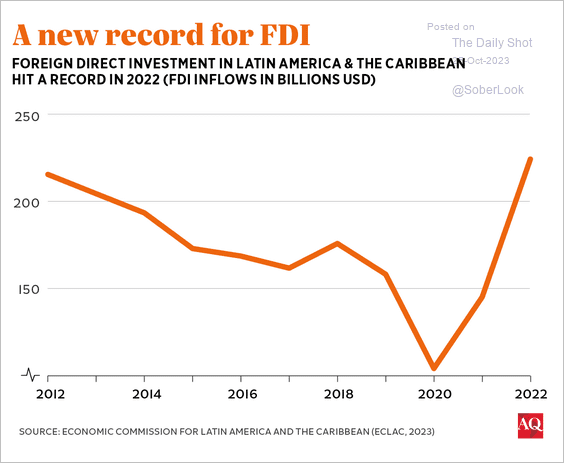

3. Foreign direct investment in LatAm and the Caribbean is rising.

Source: Americas Quarterly Read full article

Source: Americas Quarterly Read full article

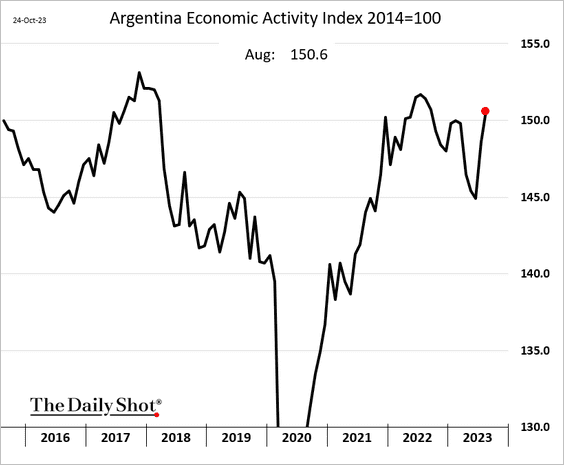

4. Argentina’s economic activity improved in August.

——————–

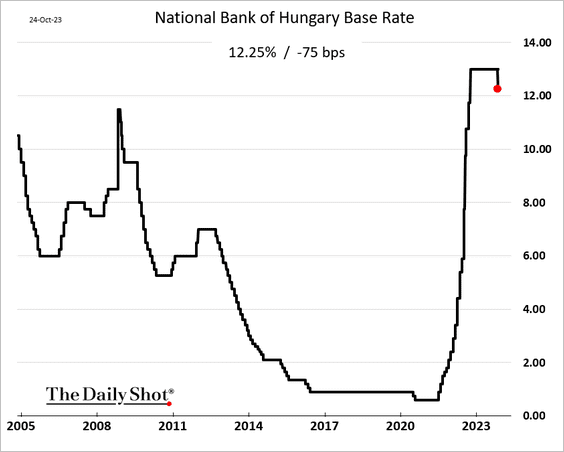

5. Hungary’s central bank cut the base rate by 75 bps (the market expected 50 bps).

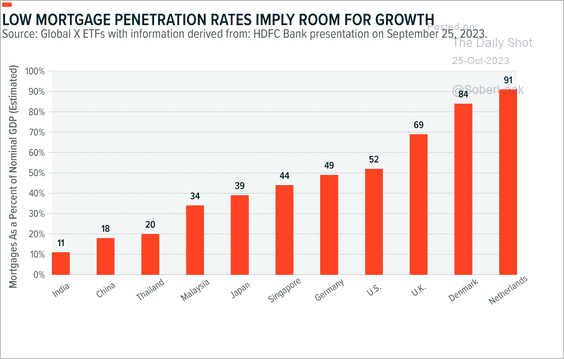

5. India has a relatively low mortgage penetration rate compared with other large countries.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

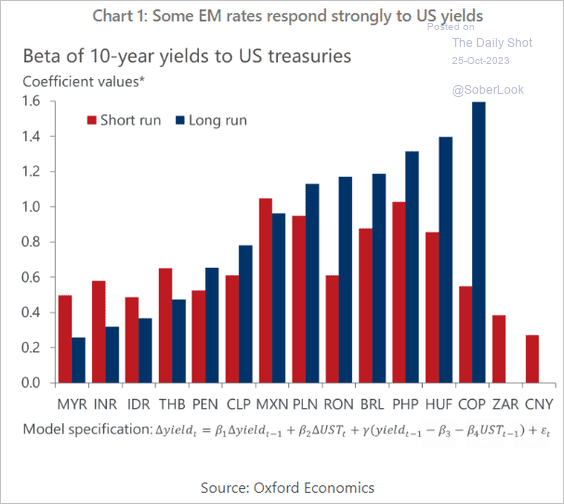

6. How sensitive are EM rates to changes in Treasury yields?

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Commodities

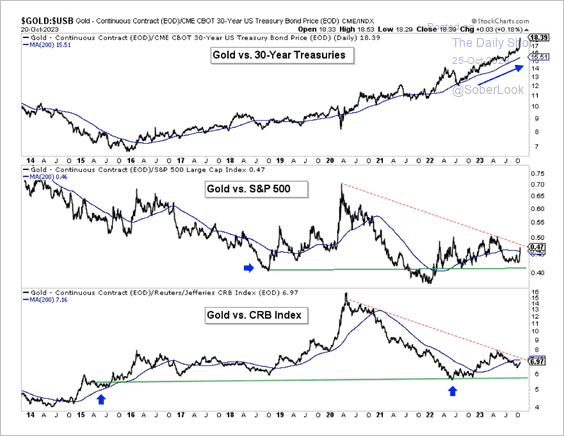

1. Gold is improving relative to bonds, stocks, and commodities.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

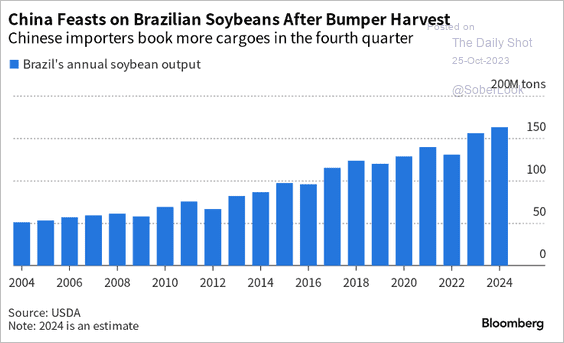

2. China is importing a lot of soybeans from Brazil.

Source: @TarsoVeloso, @economics Read full article

Source: @TarsoVeloso, @economics Read full article

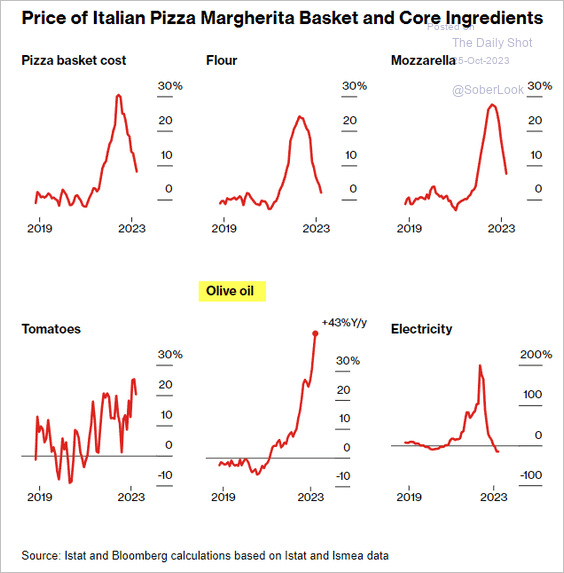

3. Here is Bloomberg’s “pizza basket,” an indicator of price trends in select commodities.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

Energy

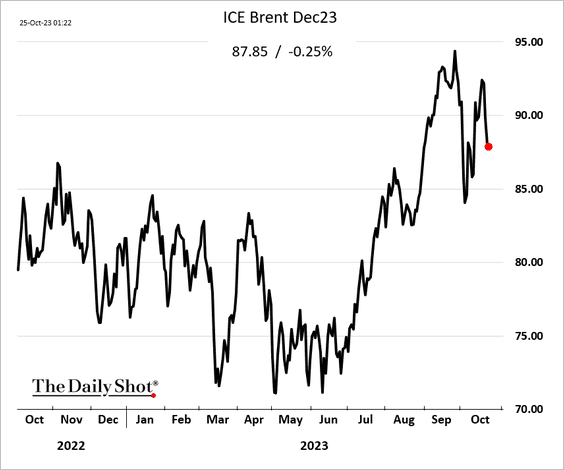

1. Brent crude is back below $90/bbl amid demand concerns (see the Eurozone section).

Source: Reuters Read full article

Source: Reuters Read full article

——————–

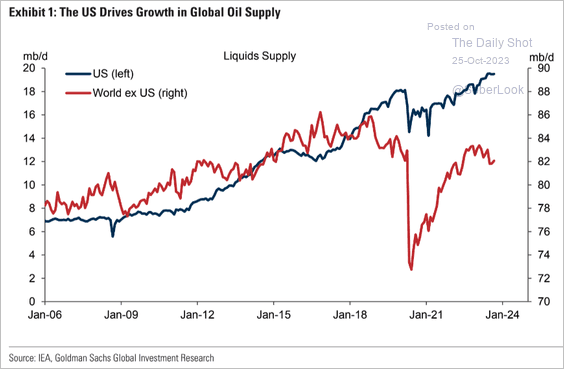

2. The US has been driving global growth in crude oil production.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

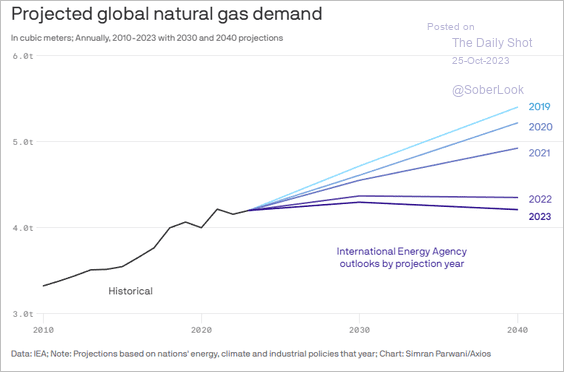

3. Analysts have been downgrading their forecasts for global natural gas demand.

Source: @axios Read full article

Source: @axios Read full article

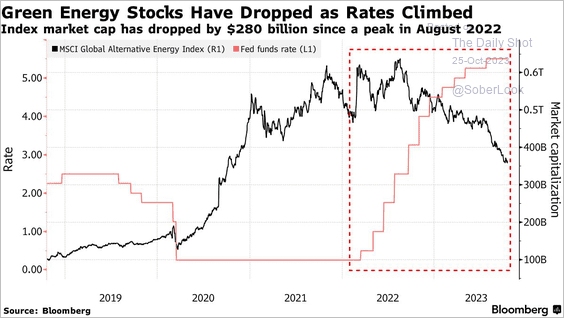

4. Capital-intensive clean energy companies have been under pressure as rates surged.

Source: @markets Read full article

Source: @markets Read full article

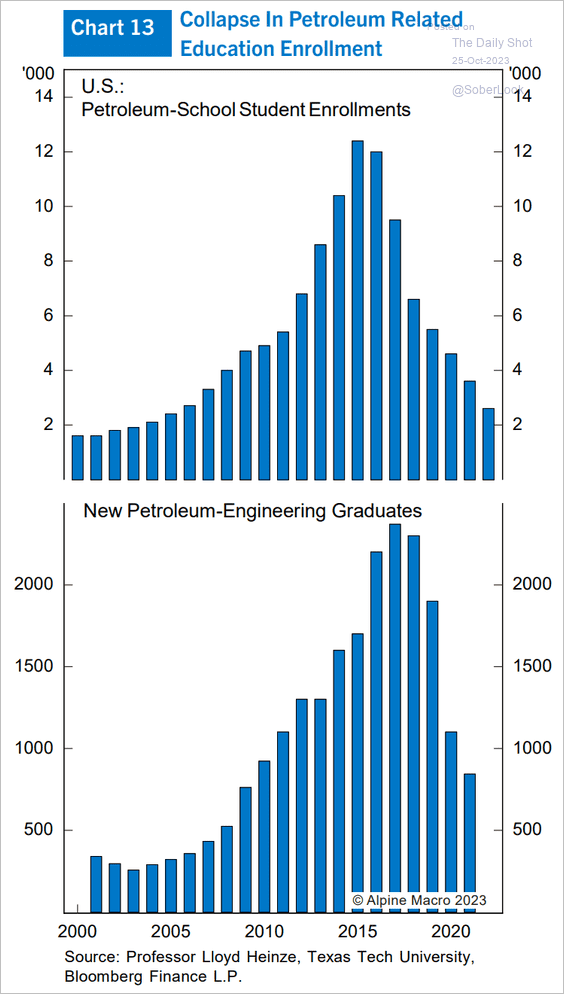

5. US energy firms are facing shortages of skilled workers.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Equities

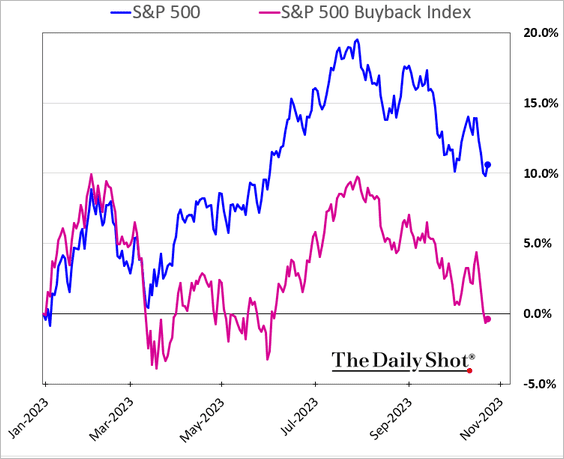

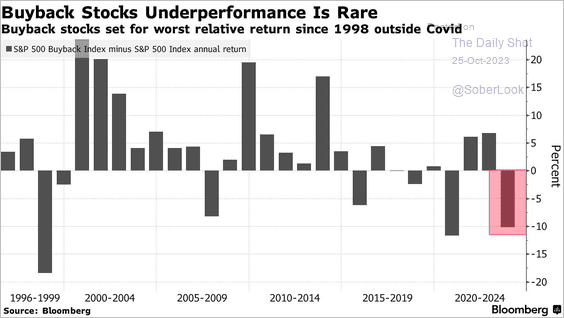

1. Companies that are active in buying back their shares are underperforming this year.

Source: @markets Read full article

Source: @markets Read full article

——————–

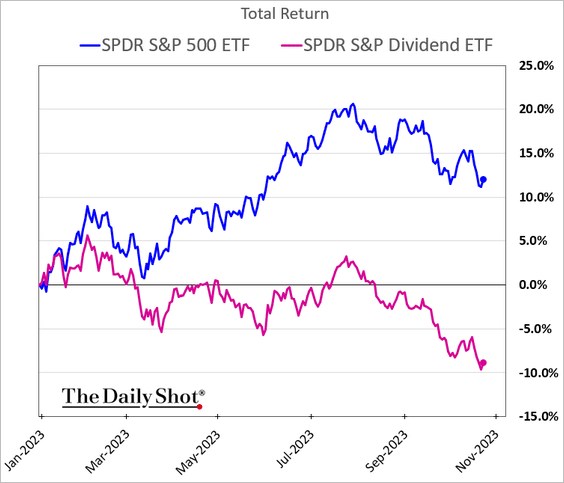

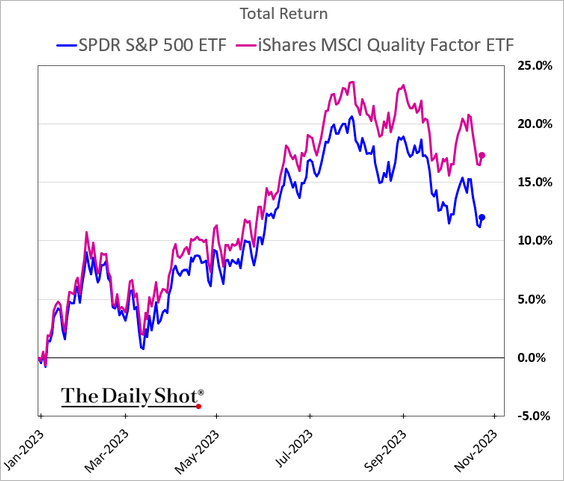

2. Below are a couple of equity factor trends (year-to-date).

• High-dividend companies:

• Quality:

——————–

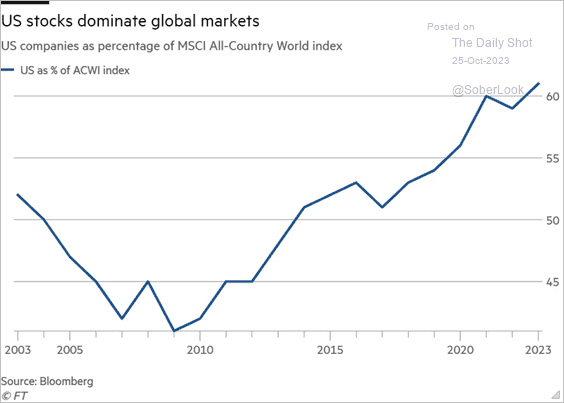

3. US companies now make up 61% of the $60 trillion MSCI All-Country World Index index, a significant increase from their representation of less than 50% a decade ago.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

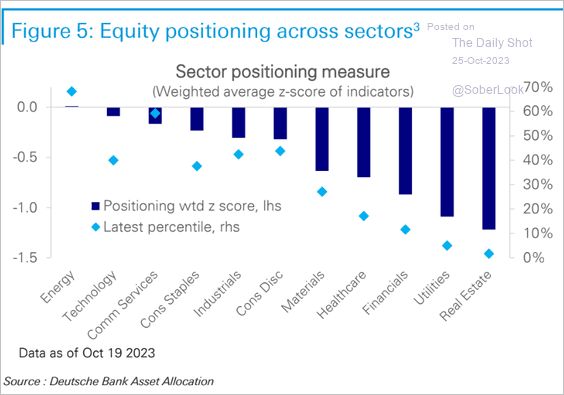

4. Positioning remains cautious in most sectors.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

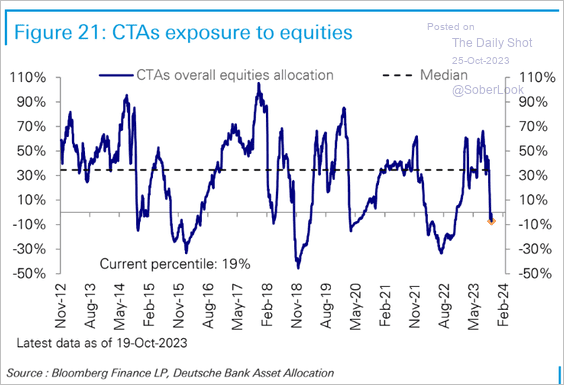

• CTAs are bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

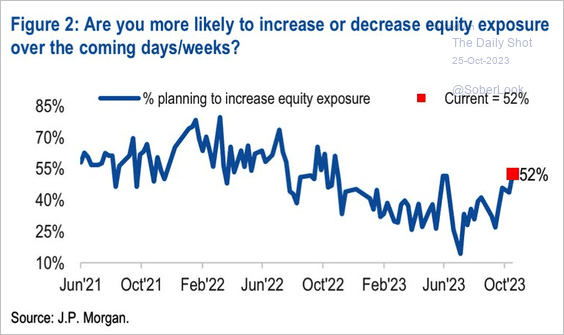

• But JP Morgan’s clients are becoming more constructive on stocks.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

——————–

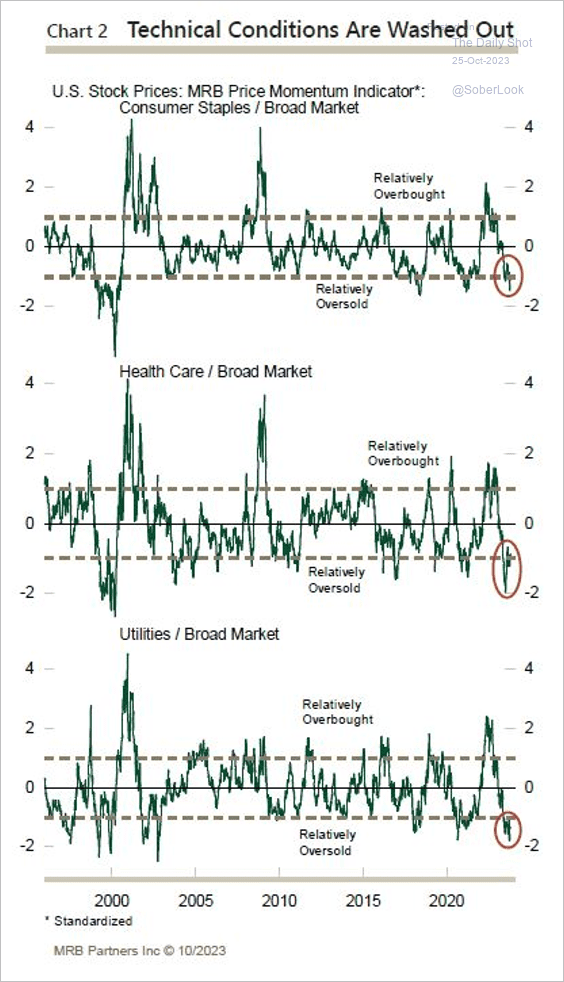

5. US defensive sectors appear oversold relative to the broader market.

Source: MRB Partners

Source: MRB Partners

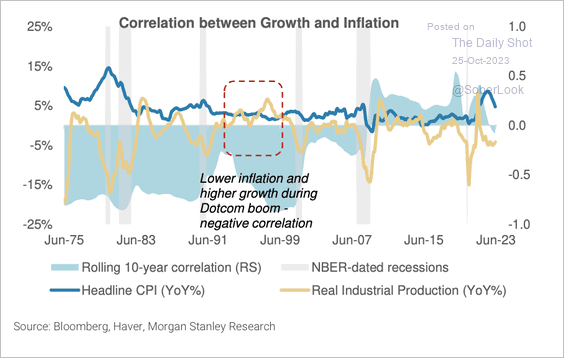

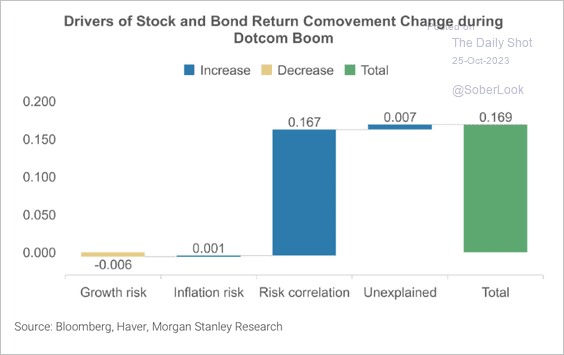

6. Technology diffusion could drive a negative correlation between growth and inflation, which could lead to an increase in the stock/bond correlation, according to Morgan Stanley. (2 charts)

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Credit

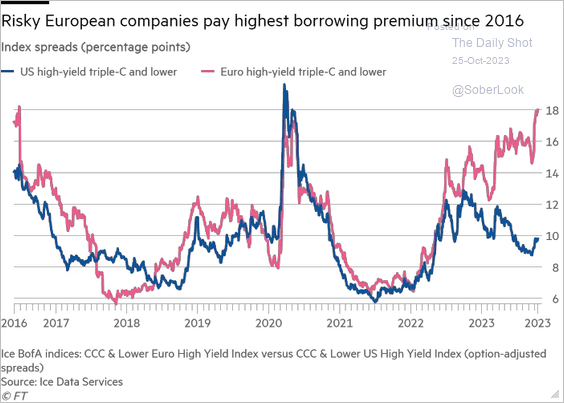

1. Stressed companies’ bond yields are much higher in Europe than in the US.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

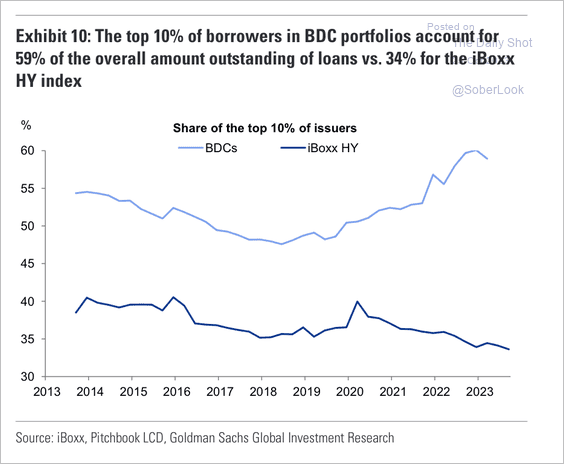

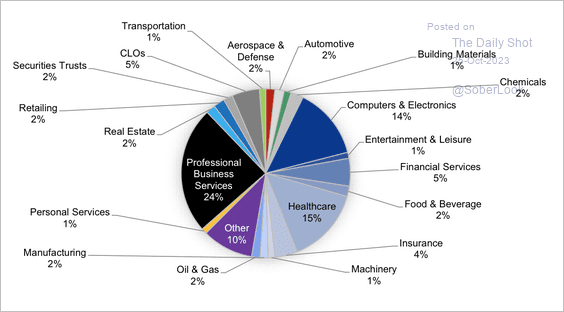

2. There is a high level of concentration at the borrower level within the business development company (BDC) universe.

Source: Goldman Sachs

Source: Goldman Sachs

• Below is a sector breakdown of public and private BDC portfolios.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

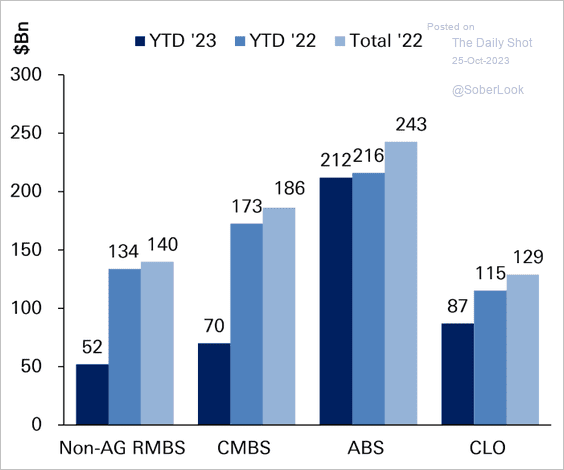

3. Here is a look at securitized product issuance compared to last year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

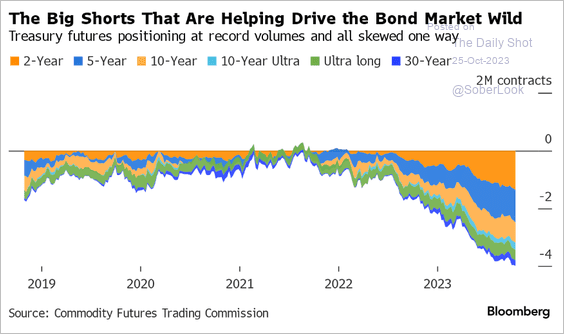

1. This chart shows the composition of speculative positioning in Treasury futures.

Source: @GarfieldR1966, @markets Read full article

Source: @GarfieldR1966, @markets Read full article

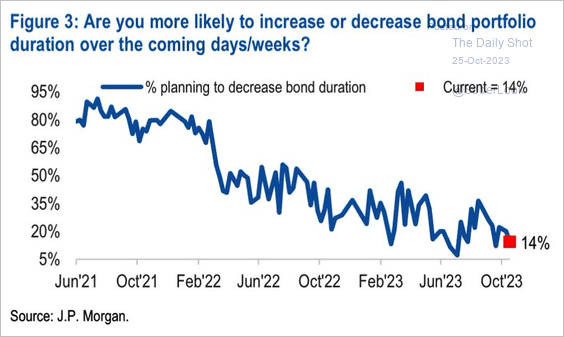

2. 14% of JP Morgan’s clients plan to decrease their portfolio duration.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

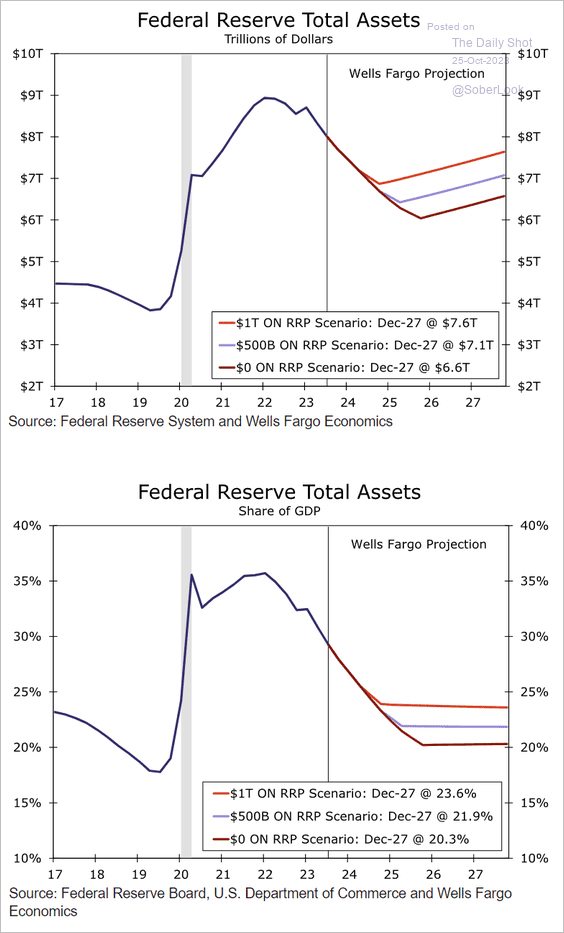

3. The evolution of the Fed’s balance sheet will depend on the demand/availability of the RRP program.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Global Developments

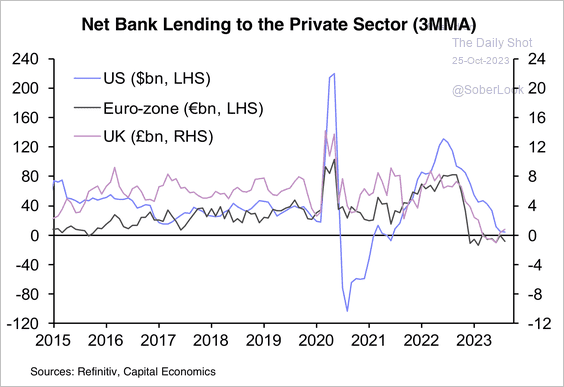

1. Net bank lending to the private sector has declined in the US and Europe, although the UK appears to be at a trough.

Source: Capital Economics

Source: Capital Economics

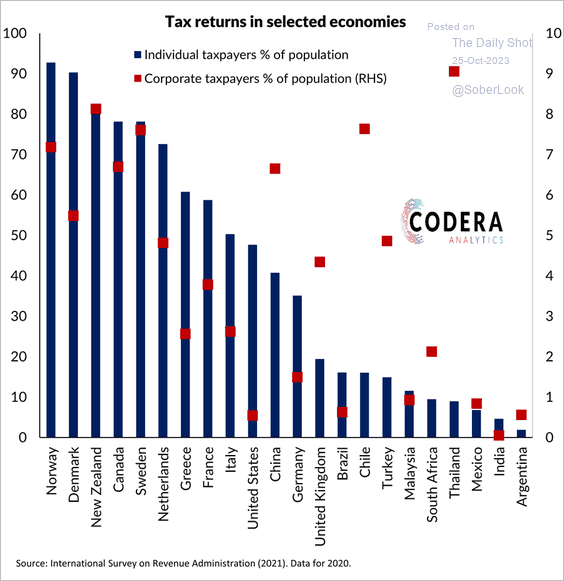

2. Estimates from the International Survey on Revenue Administration show that there are large differences in the proportion of personal taxpayers and corporate taxpayers to the total population around the world.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

——————–

Food for Thought

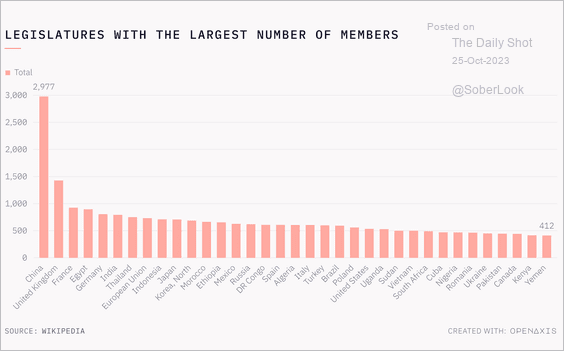

1. Legislatures with the largest number of members:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

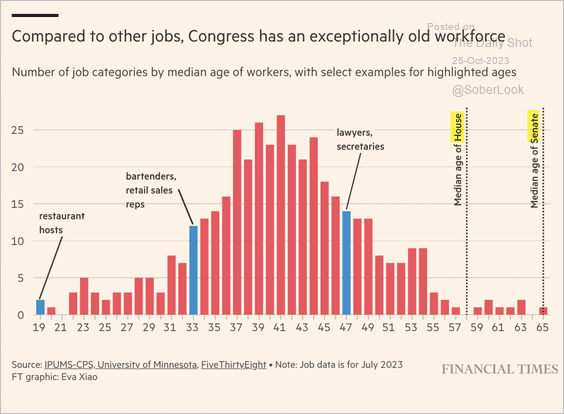

2. The median age of US Congress members relative to other professions:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

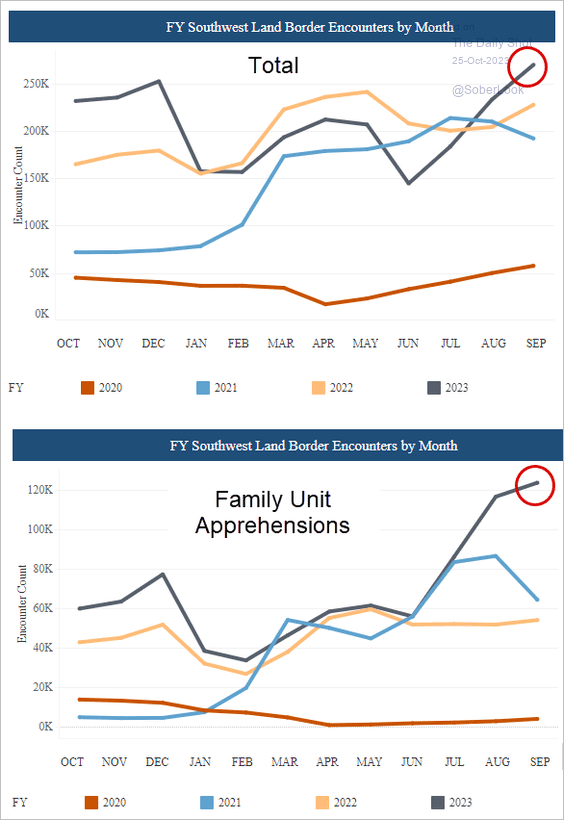

3. US southwest land border encounters (updated):

Source: CBP Further reading

Source: CBP Further reading

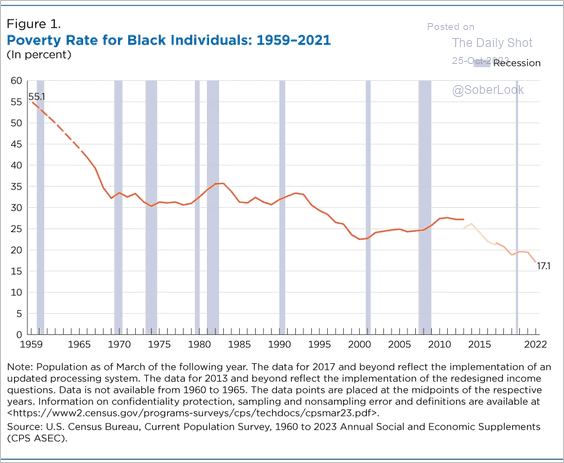

4. Poverty rates among African Americans:

Source: US Census Bureau Read full article

Source: US Census Bureau Read full article

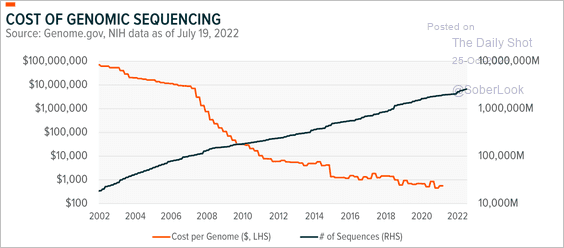

5. Cost of genomic sequencing:

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

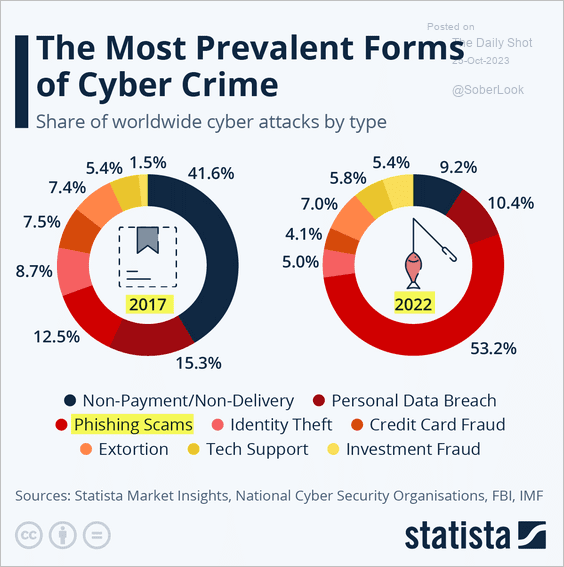

6. The most prevalent forms of cybercrime:

Source: Statista

Source: Statista

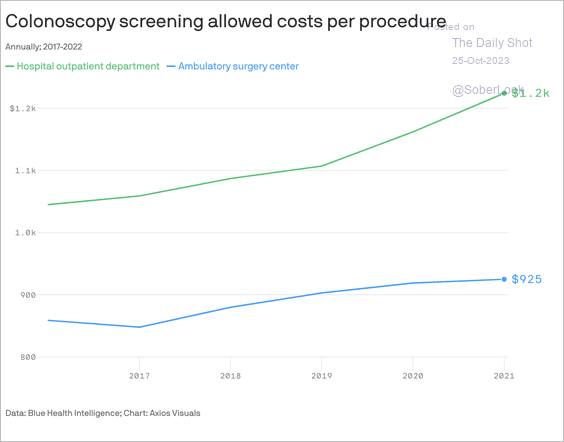

7. Colonoscopy costs:

Source: @axios Read full article

Source: @axios Read full article

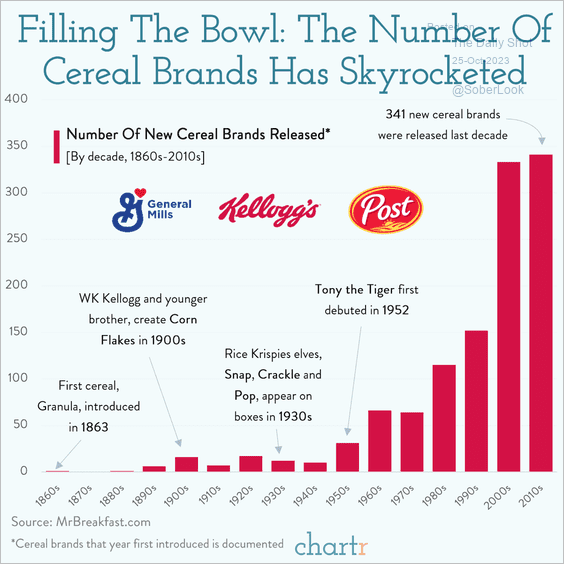

8. Cerial brands:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index