The Daily Shot: 26-Oct-23

• The United States

• The Eurozone

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the housing market.

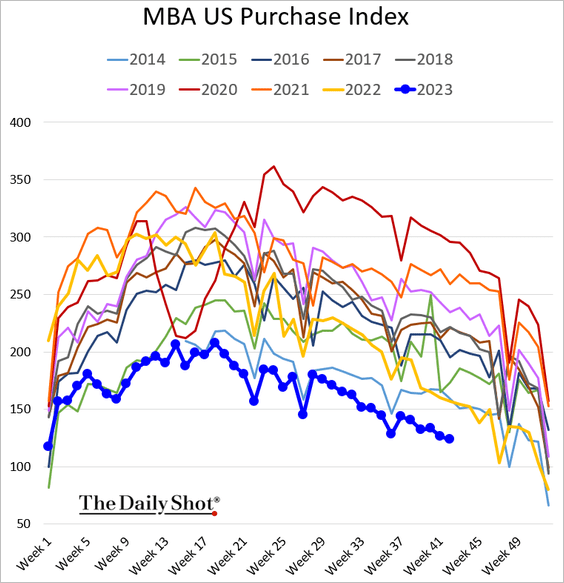

• Mortgage rates near 8% are exerting downward pressure on demand for housing loans.

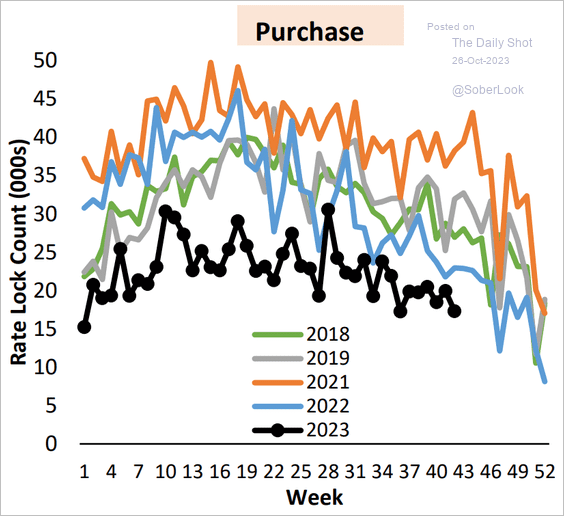

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

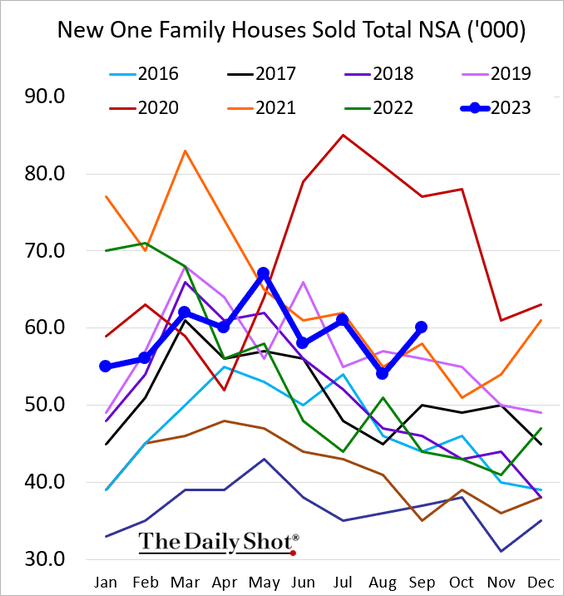

• New home sales surprised to the upside.

Source: Reuters Read full article

Source: Reuters Read full article

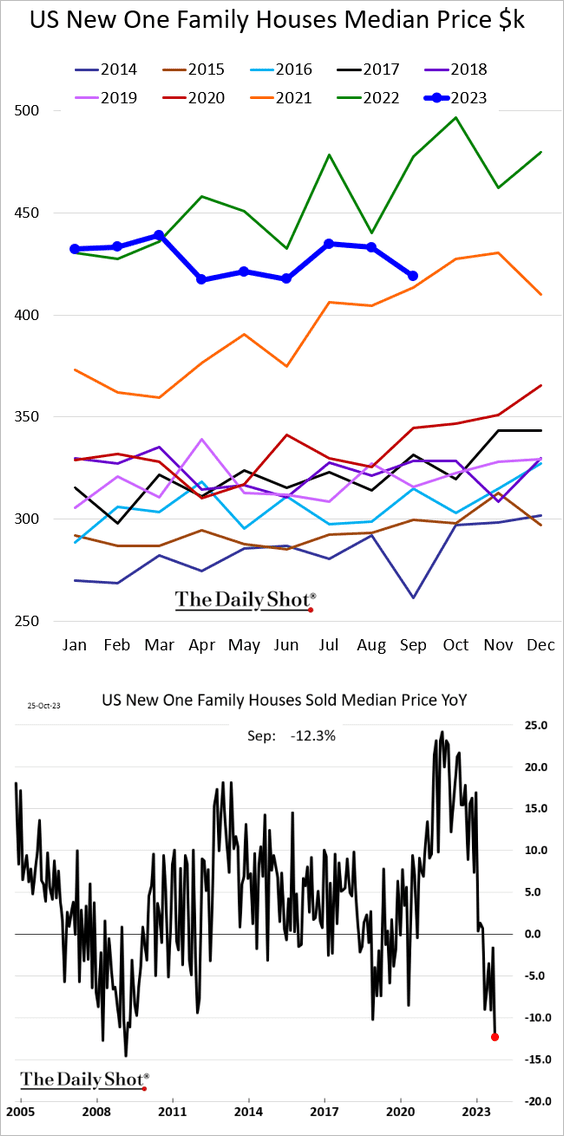

– The median new home sale price is down 12% from a year ago.

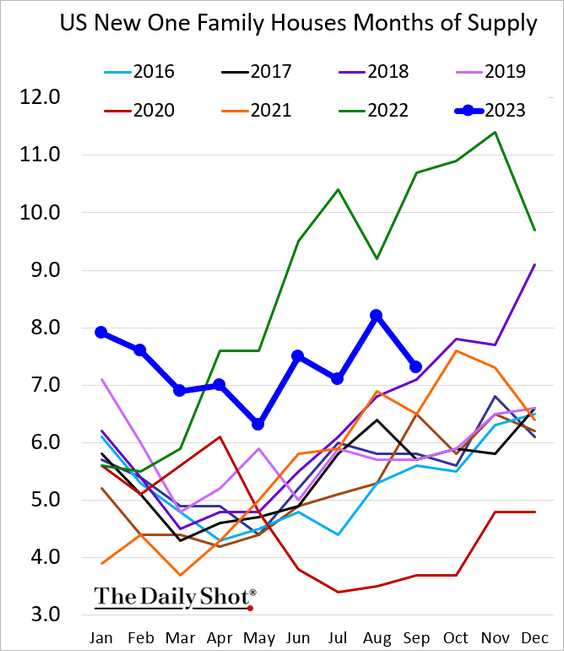

– Measured in months of supply, inventories of new homes declined.

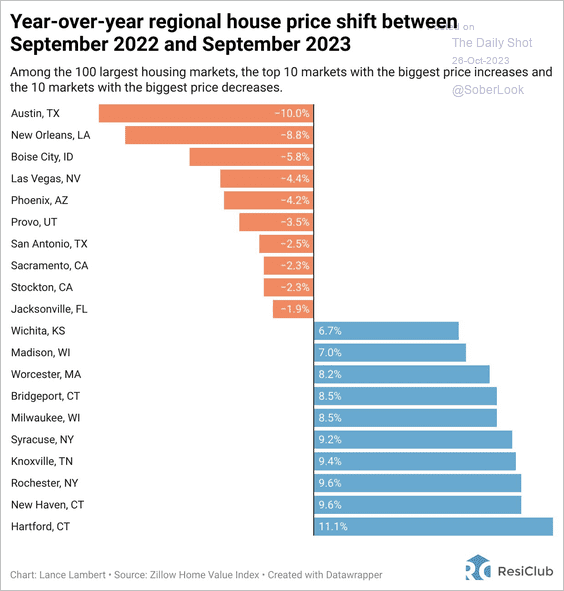

• This chart shows year-over-year home price changes by metro area.

Source: @APompliano, @NewsLambert Read full article

Source: @APompliano, @NewsLambert Read full article

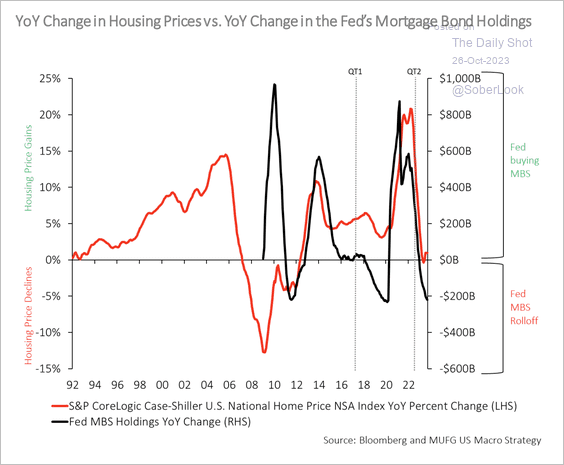

• The rise in home prices coincided with the Fed’s purchases of mortgage-backed securities (MBS) over the past 15 years.

Source: MUFG Securities

Source: MUFG Securities

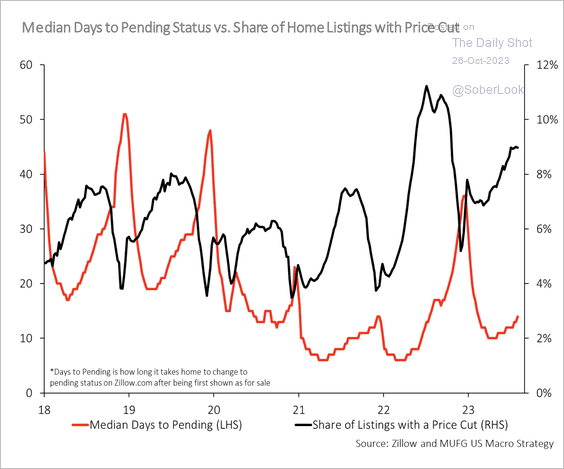

• Longer selling times tend to coincide with listing price cuts.

Source: MUFG Securities

Source: MUFG Securities

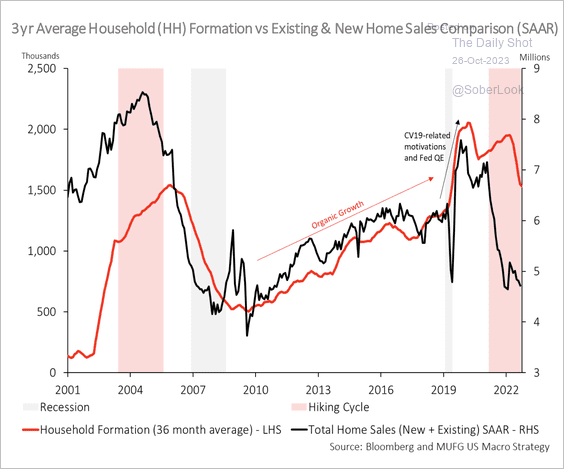

• Household formation was an organic driver of housing between 2012-2019.

Source: MUFG Securities

Source: MUFG Securities

——————–

2. Next, we have some updates on inflation.

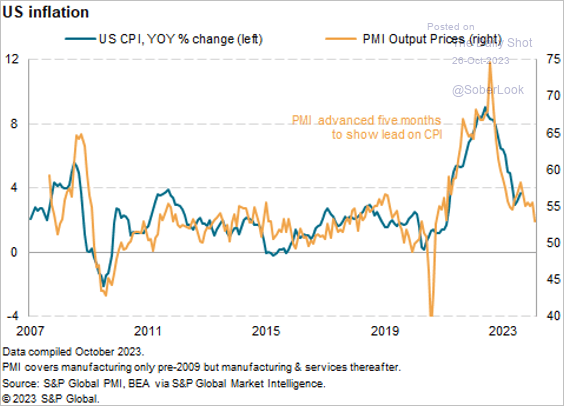

• The latest PMI report from S&P Global signals further easing in US consumer price gains.

Source: @SPGlobal, @PMInstitute

Source: @SPGlobal, @PMInstitute

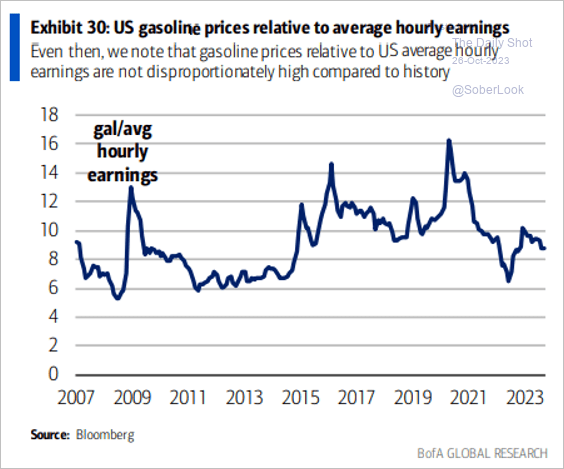

• Adjusted for wages, gasoline prices are below pre-COVID levels.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

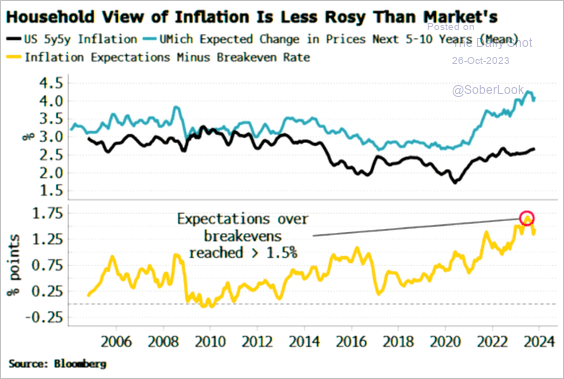

• Consumer inflation expectations have been higher than those reflected in the bond market.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

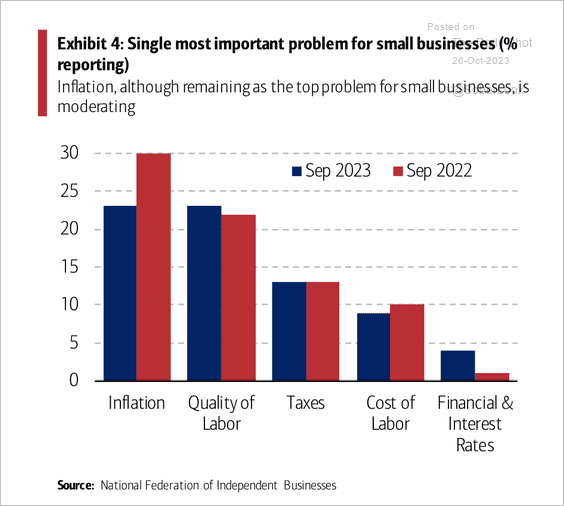

3. Inflation worries among small business owners have moderated, while concerns about rising interest rates have increased over the past year.

Source: BofA Global Research

Source: BofA Global Research

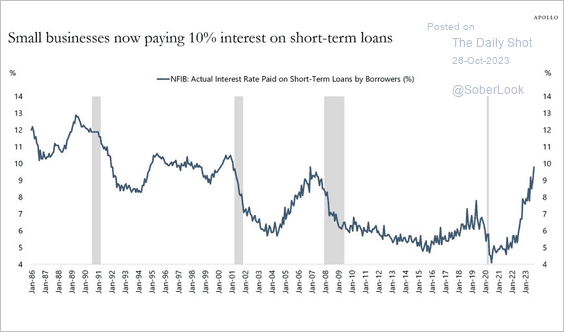

• The average interest rate paid by US small firms has reached 10%.

Source: @scottdavisCRE

Source: @scottdavisCRE

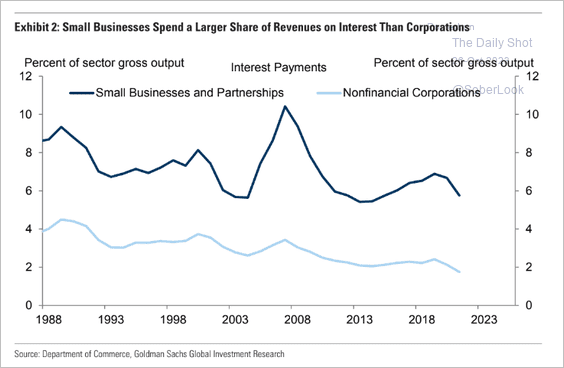

• In general, small businesses tend to spend a higher share of their revenues on interest expense than large firms.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

The Eurozone

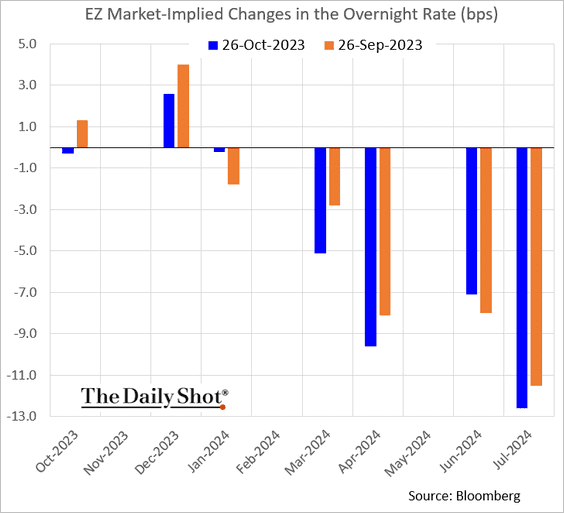

1. The market does not expect any more rate hikes from the ECB (less than 3 bps is priced for December).

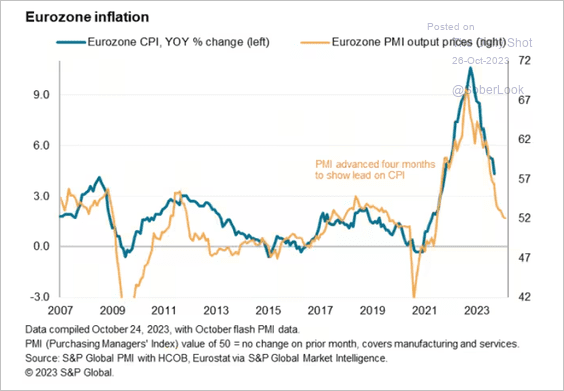

2. The PMI data continues to signal softer inflation ahead.

Source: @SPGlobal, @PMInstitute

Source: @SPGlobal, @PMInstitute

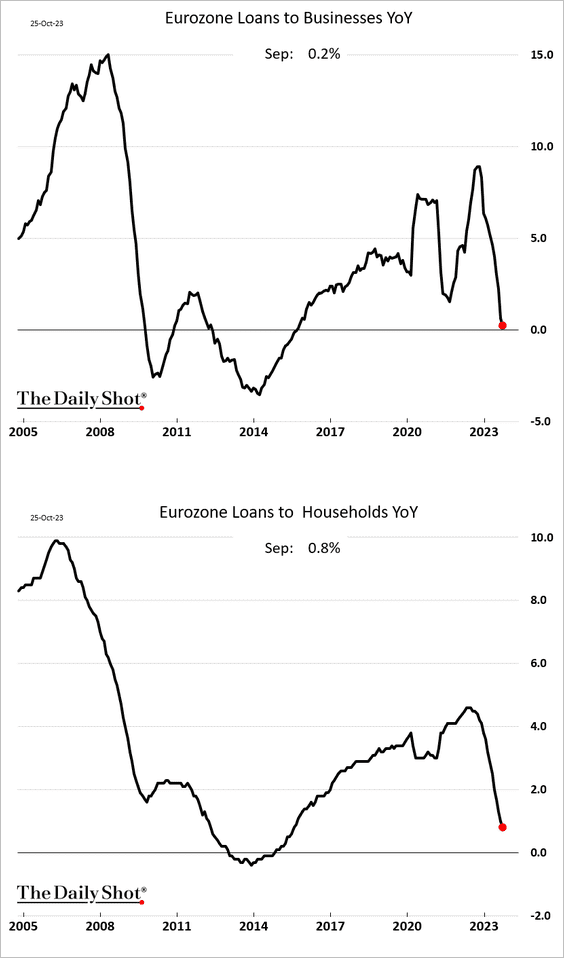

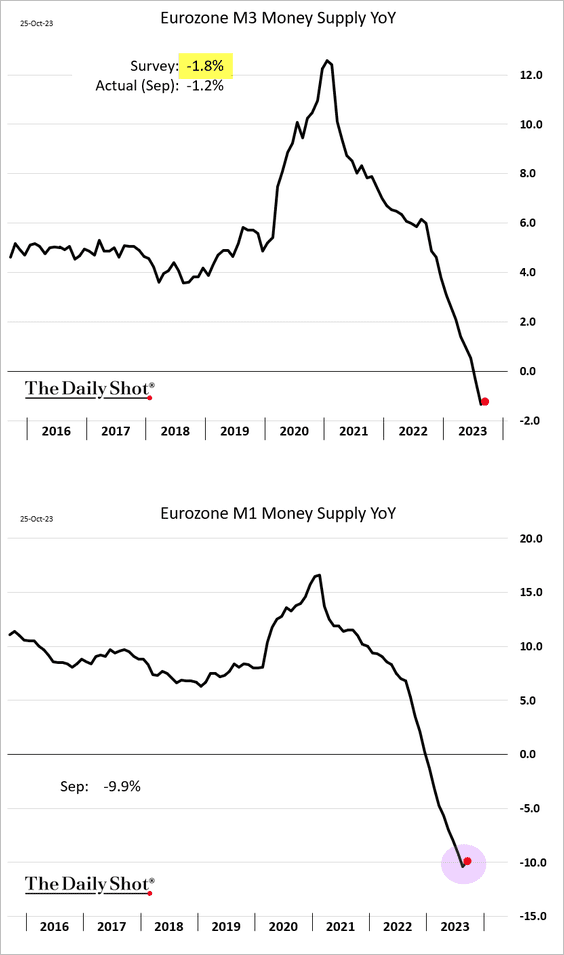

3. Loan growth has been declining rapidly.

However, the contraction in the money supply appears to be slowing.

——————–

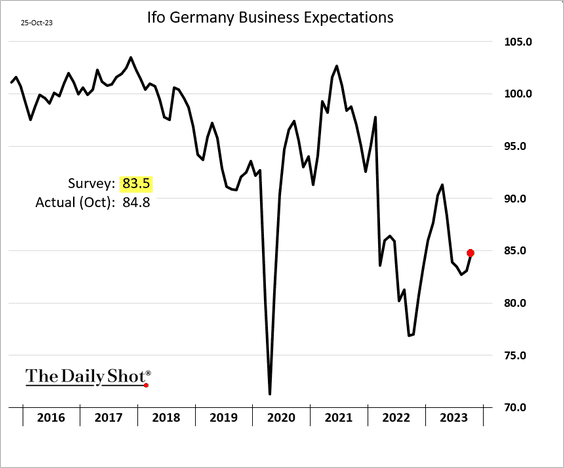

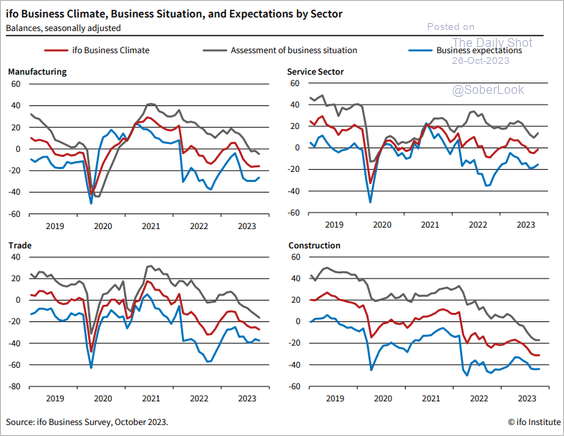

4. Germany’s Ifo business expectations index surprised to the upside.

Below are the Ifo trends by sector.

Source: ifo Institute

Source: ifo Institute

Back to Index

Japan

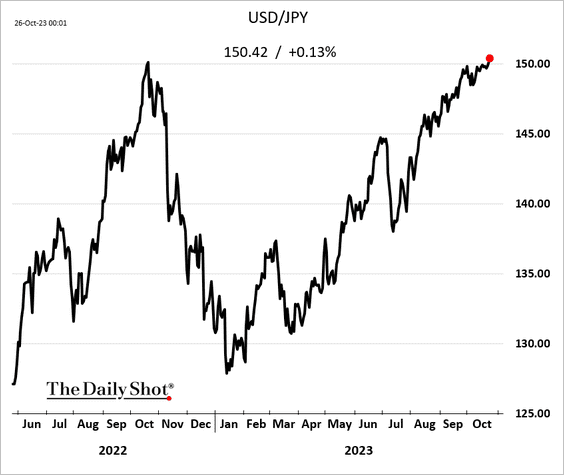

1. Dollar-yen is above 150. Will Tokyo intervene?

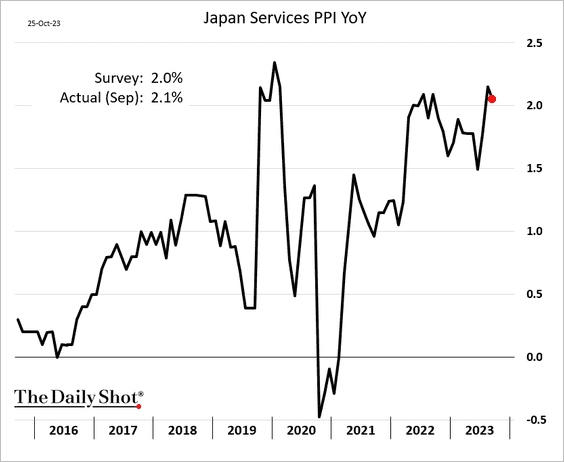

2. Services PPI was a bit higher than expected.

Back to Index

Asia-Pacific

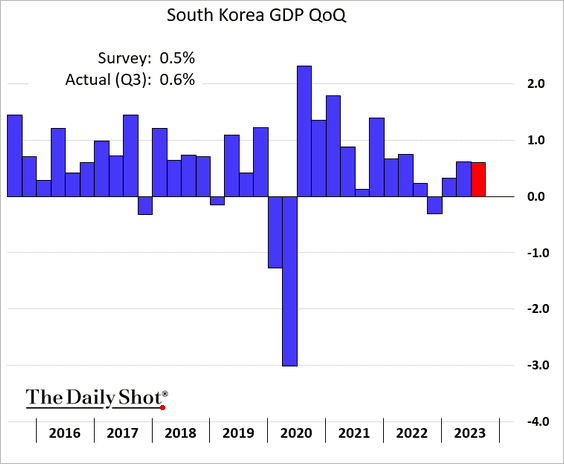

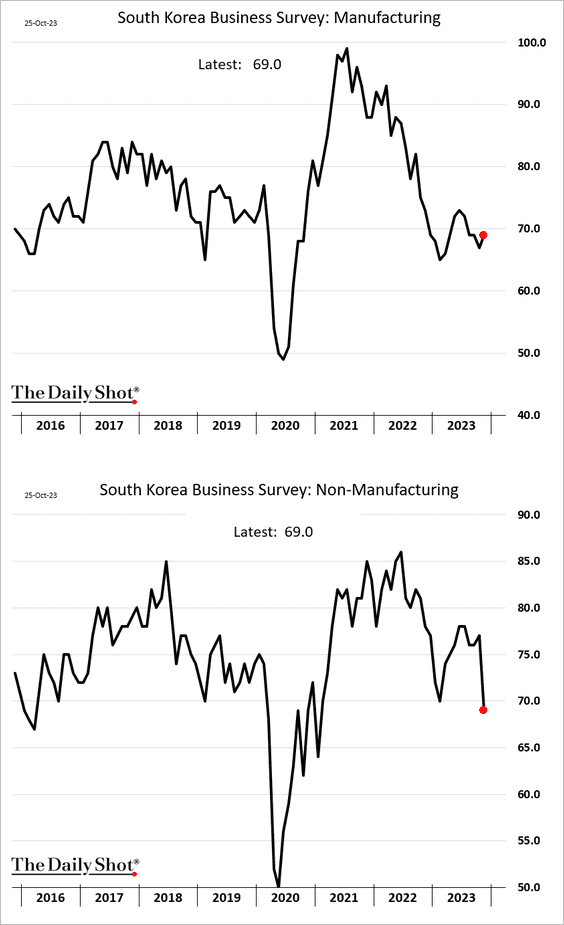

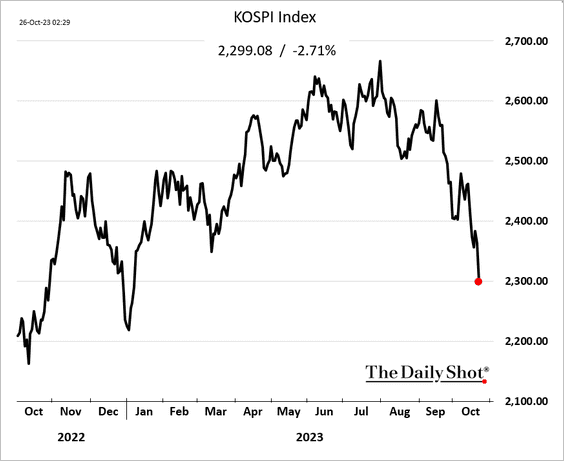

1. Let’s begin with South Korea.

• Economic growth held up well last quarter.

• Business surveys showed better sentiment in manufacturing this month but a large drop in services.

• South Korea’s stocks have been tumbling.

——————–

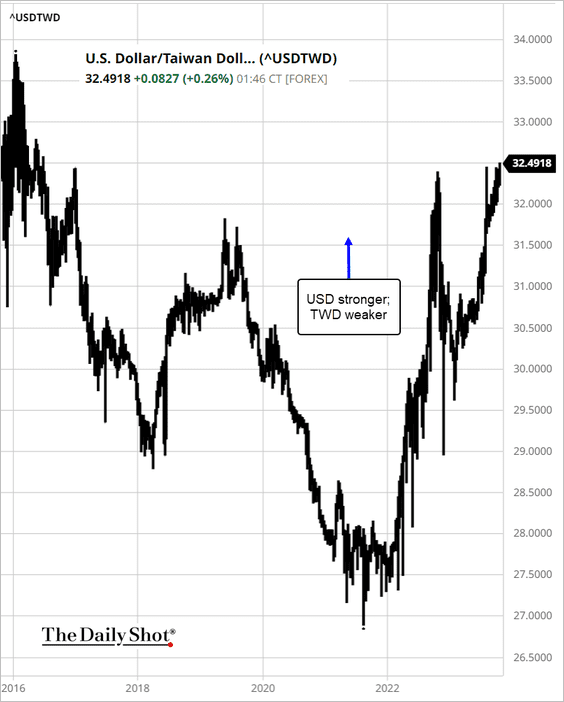

2. The Taiwan dollar hit a multi-year low against USD.

Source: barchart.com

Source: barchart.com

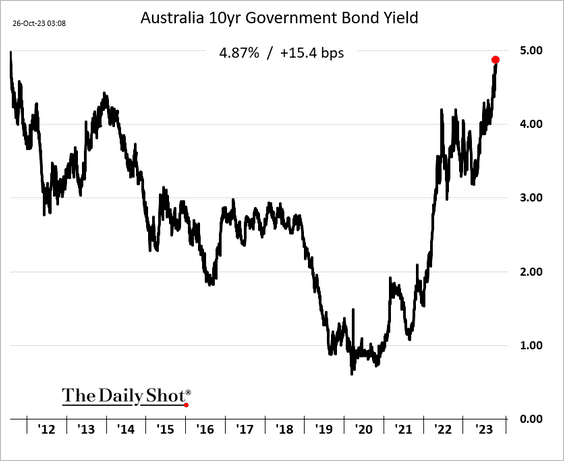

3. Australian bond yields continue to surge, …

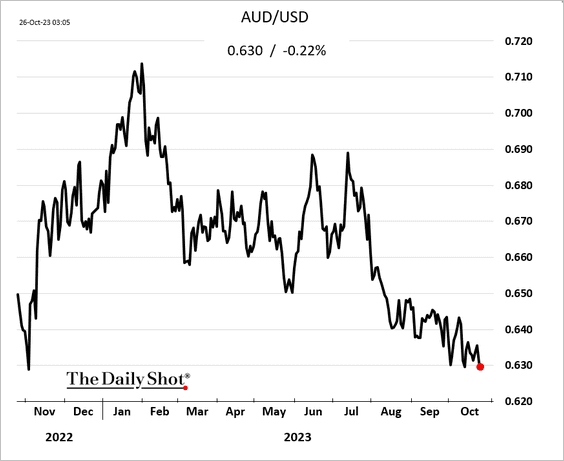

… while the Aussie dollar is trending lower.

Back to Index

China

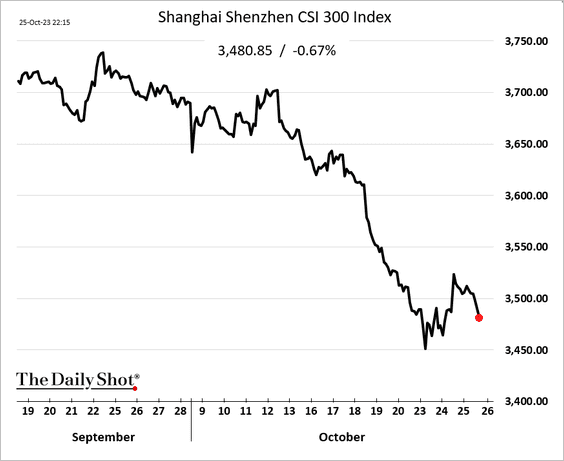

1. The stock market is not rebounding despite a promise of fresh fiscal stimulus.

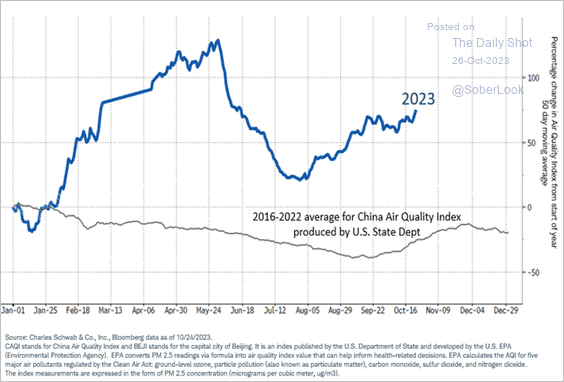

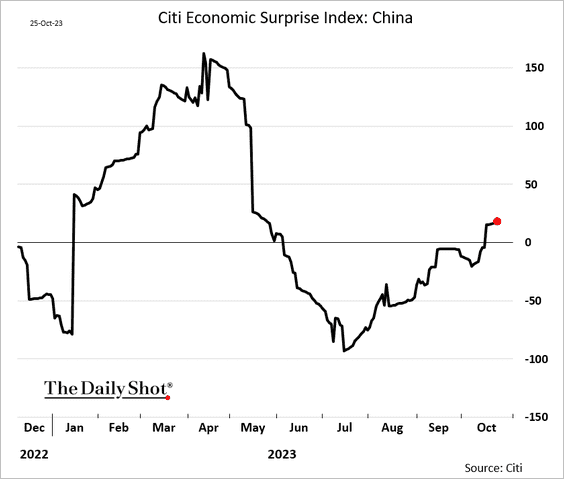

2. Rising air pollution tends to indicate stronger economic activity, …

Source: @JeffreyKleintop

Source: @JeffreyKleintop

… as evidenced by the Citi Economic Surprise Index.

——————–

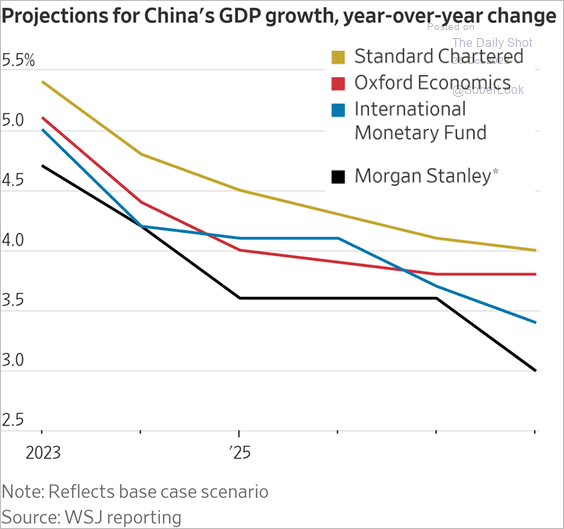

3. Analysts see slower growth ahead for China.

Source: @WSJ Read full article

Source: @WSJ Read full article

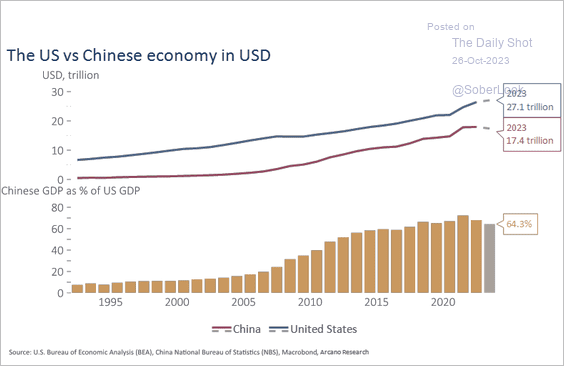

The expectations of China’s GDP soon overtaking the US may have been premature.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Emerging Markets

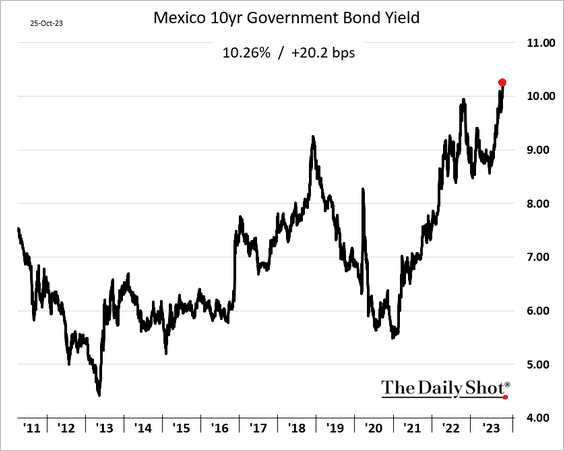

1. Mexican bond yields are surging.

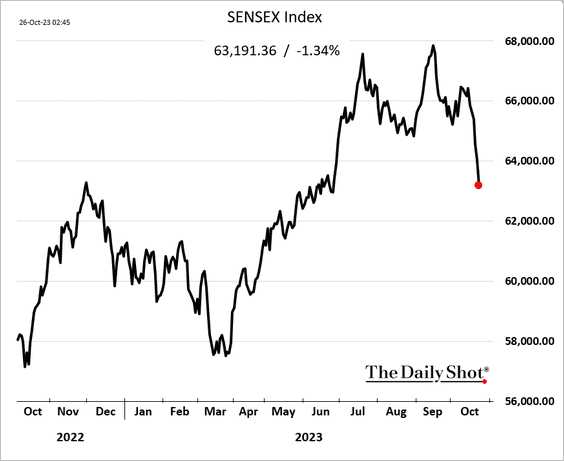

2. Indian stocks tumbled in recent days.

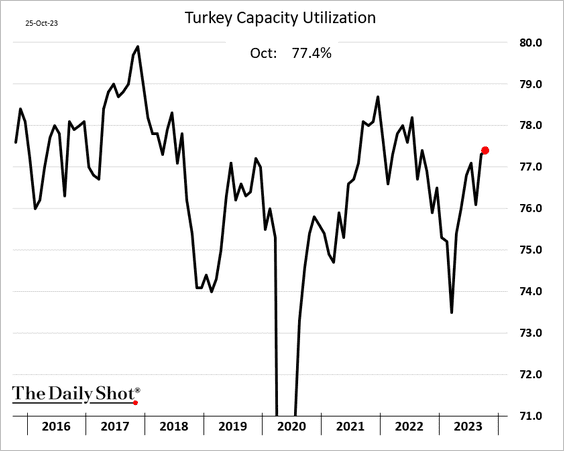

3. Turkey’s capacity utilization is holding up despite industrial sector weakness in the EU.

Back to Index

Commodities

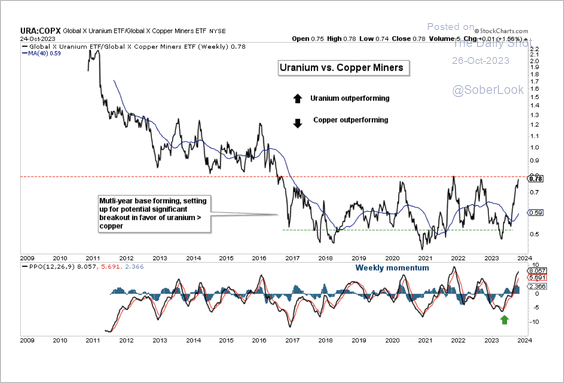

1. Uranium stocks have been improving relative to copper miners. Could we see a relative breakout?

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

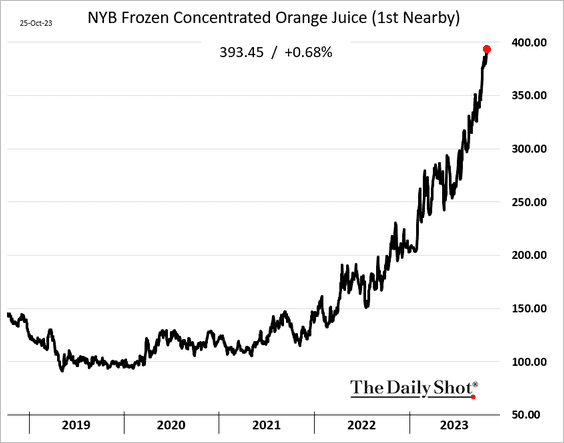

2. Orange juice prices continue to hit record highs.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

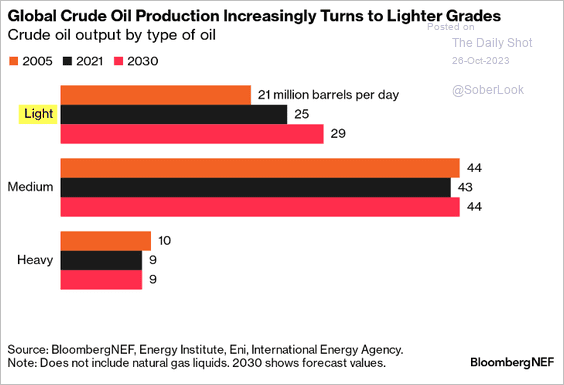

1. Global crude oil production is increasingly characterized by a higher proportion of lighter crude.

Source: Philip Geurts, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: Philip Geurts, @TheTerminal, Bloomberg Finance L.P. Read full article

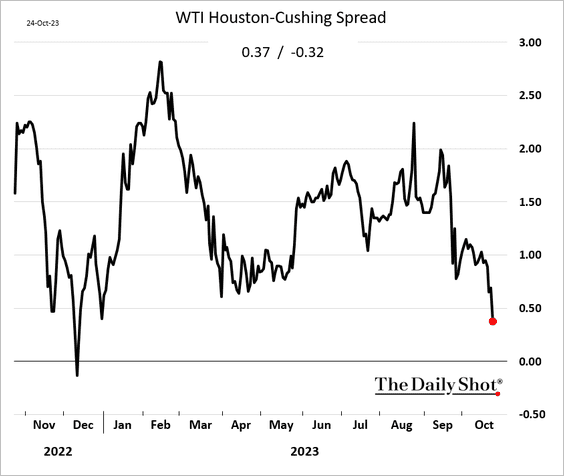

2. The Houston-Cushing crude spread is tightening rapidly, suggesting softer international demand.

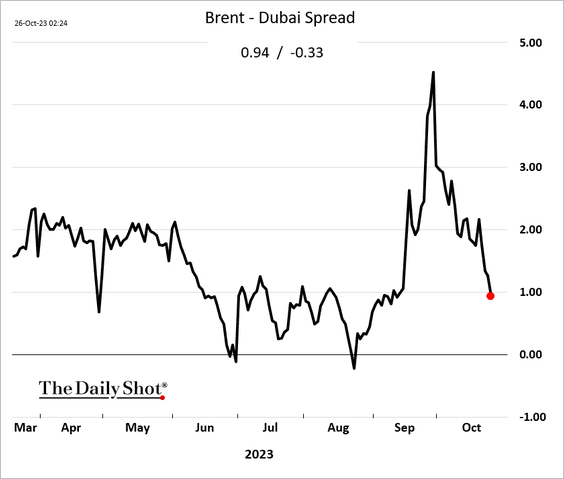

3. The Brent-Dubai spread continues to tighten.

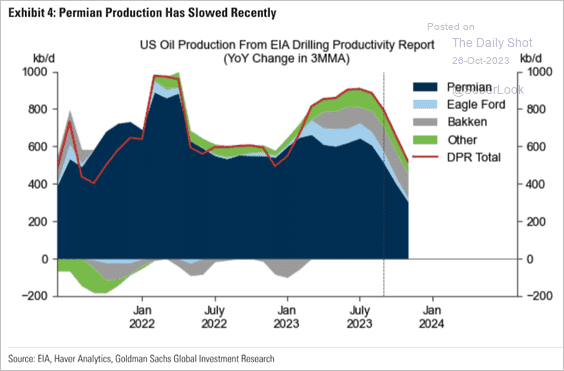

4. US Permian production has been slowing.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

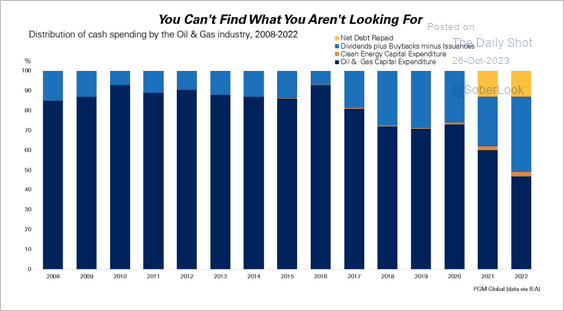

5. Oil and gas capital spending has declined in recent years as companies focused on shareholder payouts and debt servicing.

Source: PGM Global

Source: PGM Global

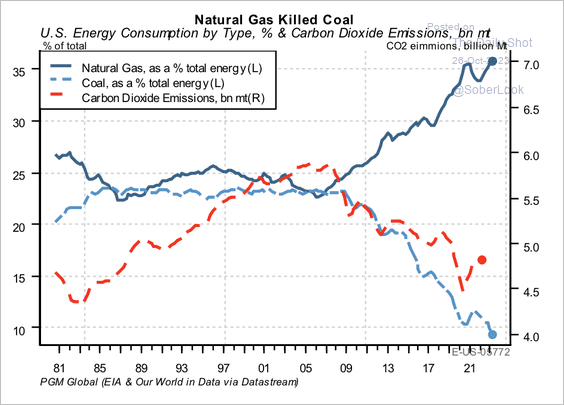

6. US coal consumption peaked about 15 years ago as natural gas usage accelerated.

Source: PGM Global

Source: PGM Global

Back to Index

Equities

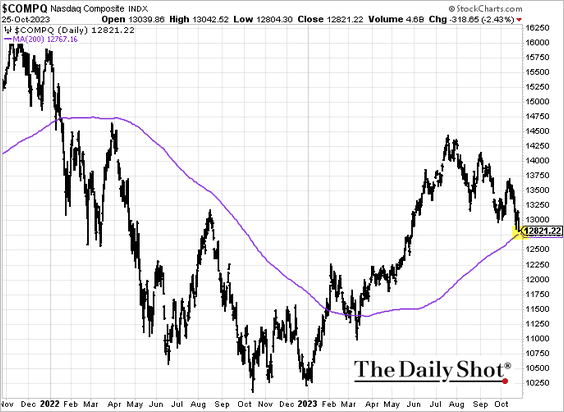

1. The Nasdaq Composite is at the 200-day moving average.

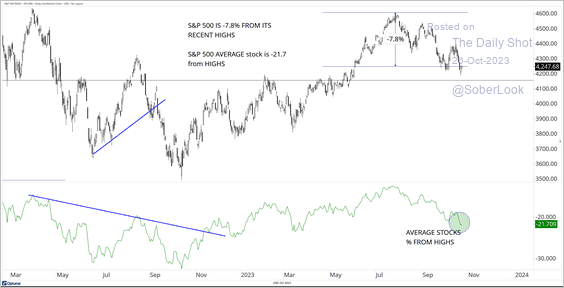

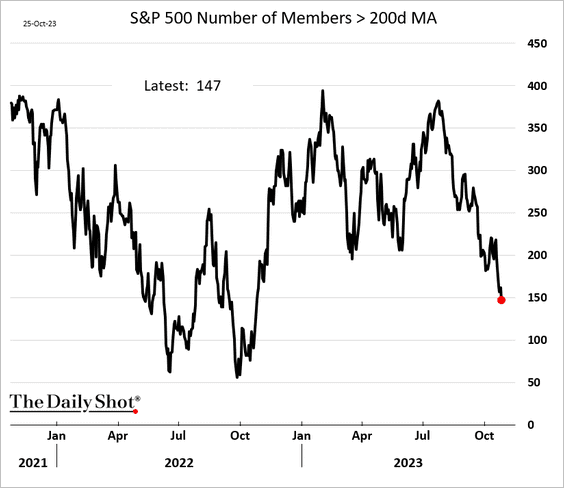

2. Breadth remains very weak as the average S&P 500 stock is down ~21% from its one-year high.

Source: @DavidCoxRJ

Source: @DavidCoxRJ

• Only 147 S&P 500 stocks are above their 200-day moving average.

——————–

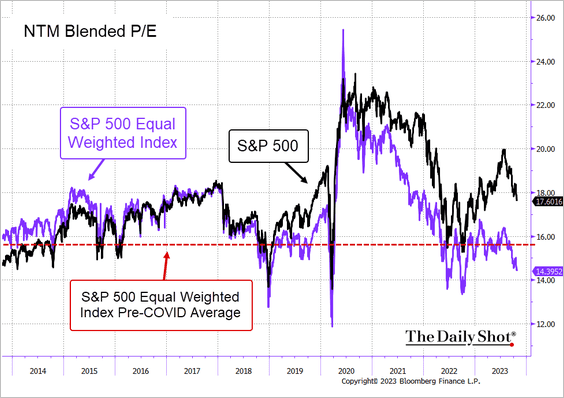

3. The average S&P 500 stock valuation (S&P 500 equal weight index) is now well below the pre-COVID average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

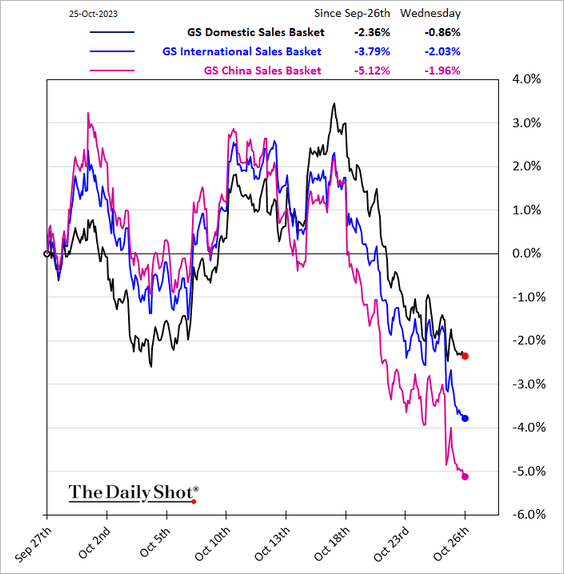

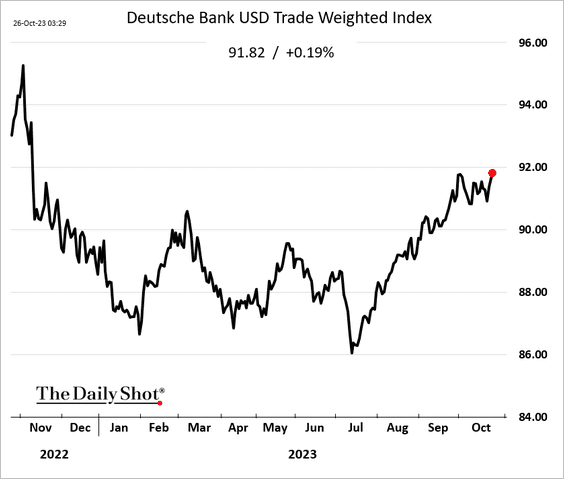

4. US-listed companies with significant international sales are underperforming, …

… as the US dollar rally resumes.

——————–

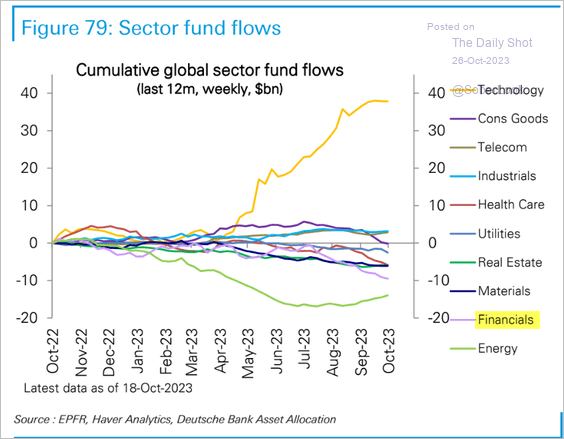

5. Financials continue to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

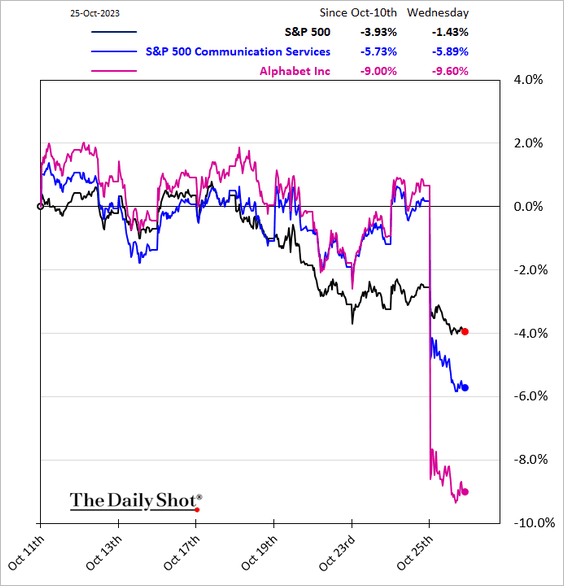

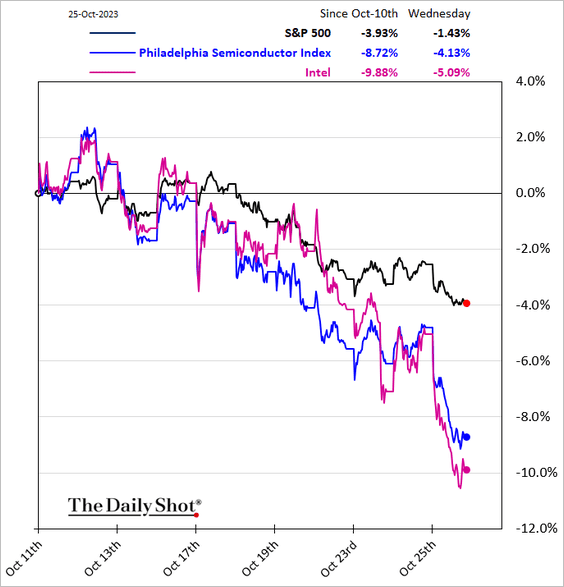

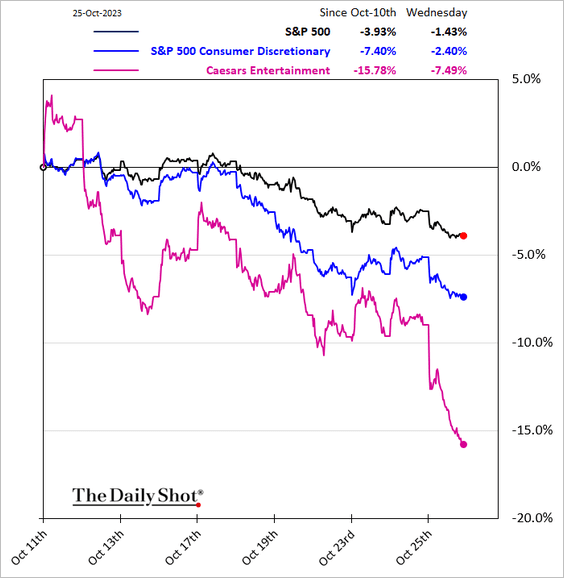

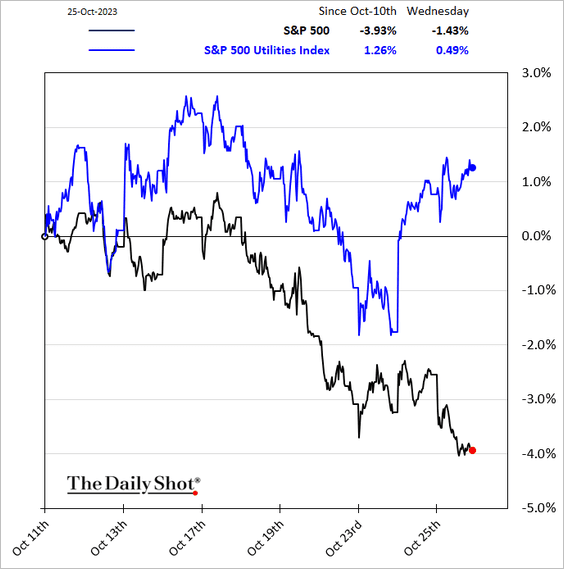

6. Next, we have some sector performance data over the past ten business days.

• Communication Services:

• Semiconductors:

• Consumer Discretionary:

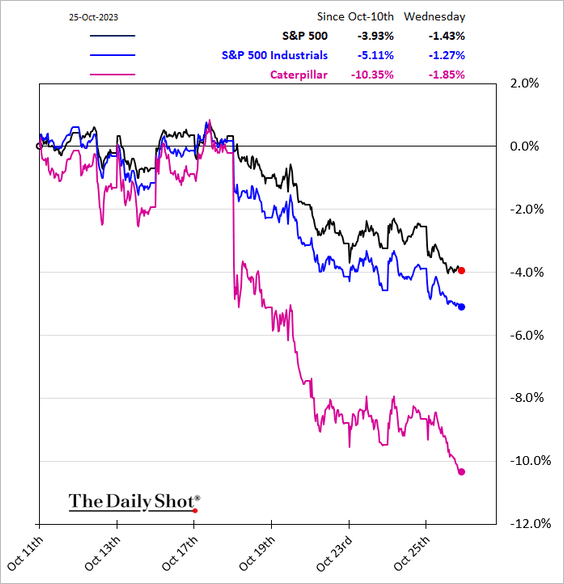

• Industrials:

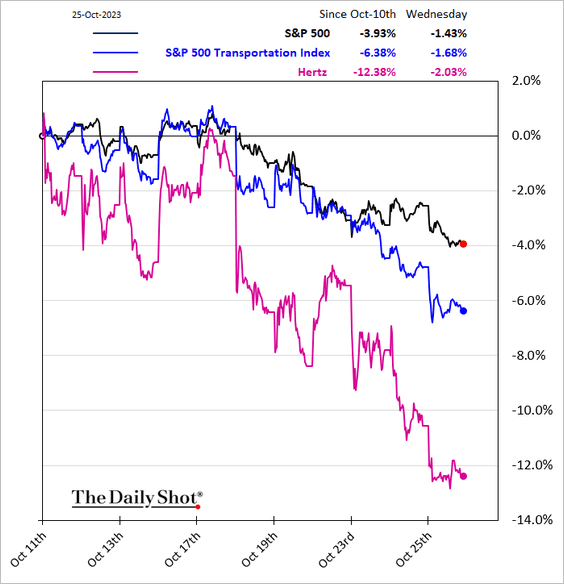

• Transportation:

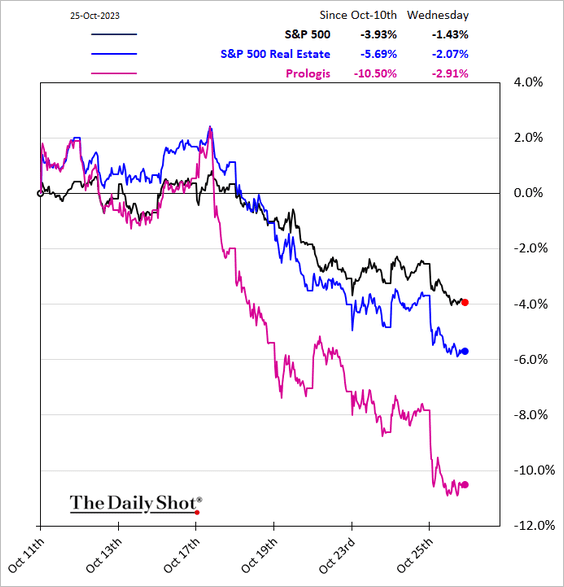

• Real Estate:

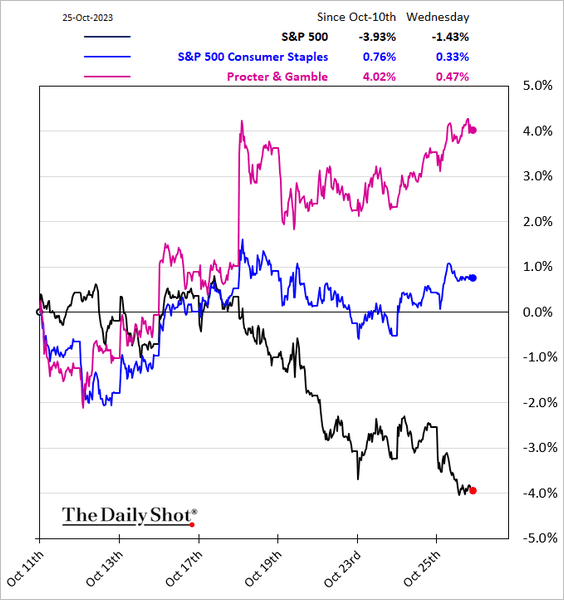

• Consumer Staples:

• Utilities:

Back to Index

Credit

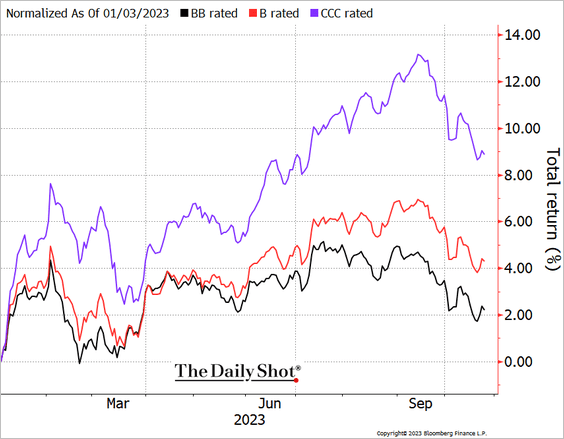

CCC-rated bonds have outperformed this year.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Rates

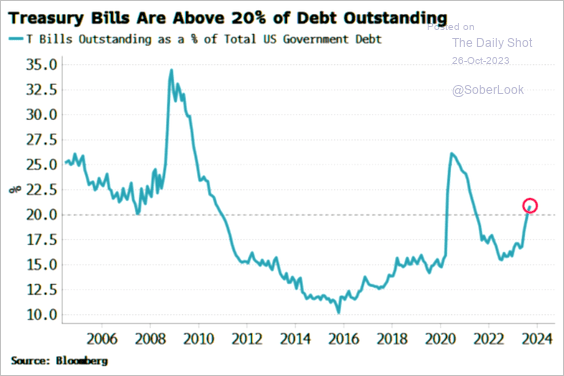

1. T-bills as a share of total US Treasury debt have been rising.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

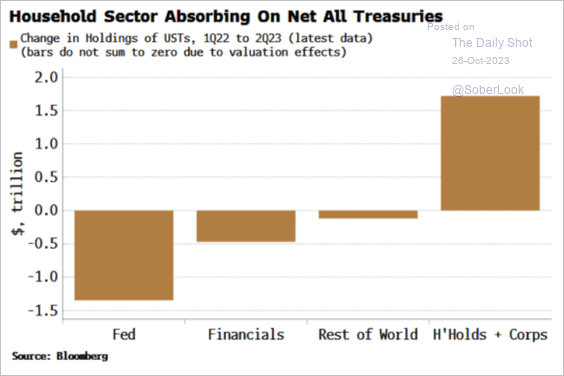

2. Households have been buying Treasuries while others have been selling.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Global Developments

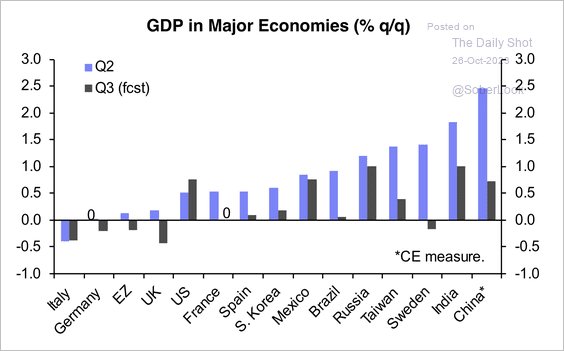

1. Most major economies avoided contractions in Q2, although some developed markets could experience declines in Q3.

Source: Capital Economics

Source: Capital Economics

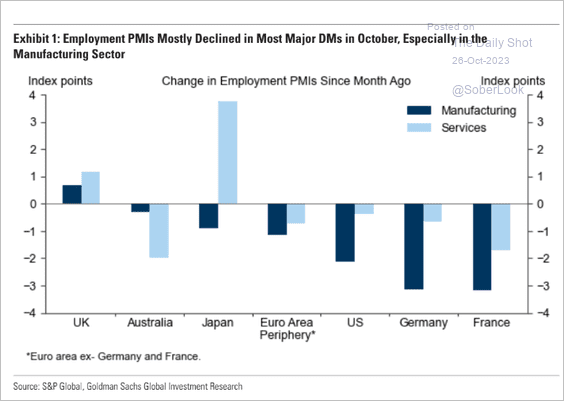

2. The PMI reports show softening labor markets in advanced economies.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

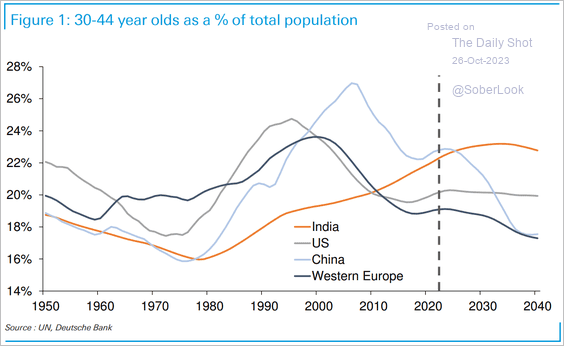

3. The share of individuals in their thirties and forties in China, the US, and Western Europe has plateaued in recent decades while India continues to grow.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

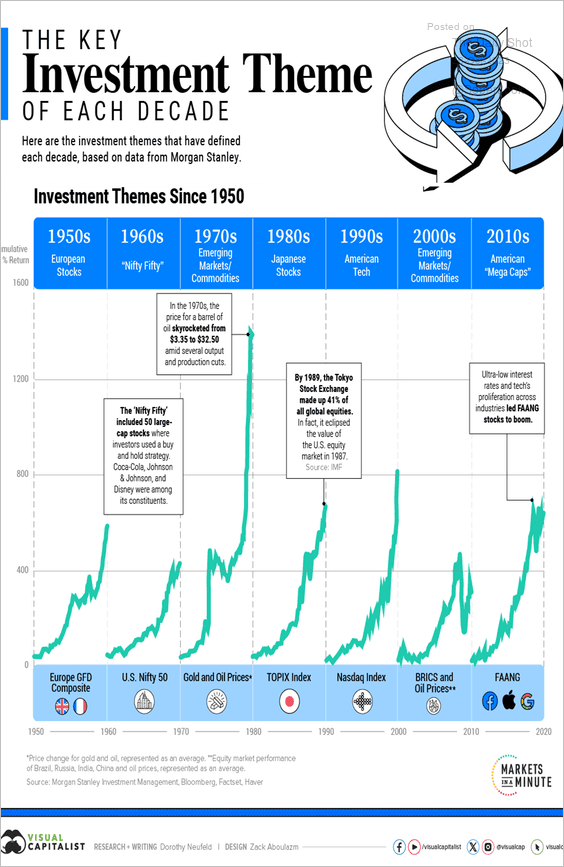

1. Key investment themes by decade:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

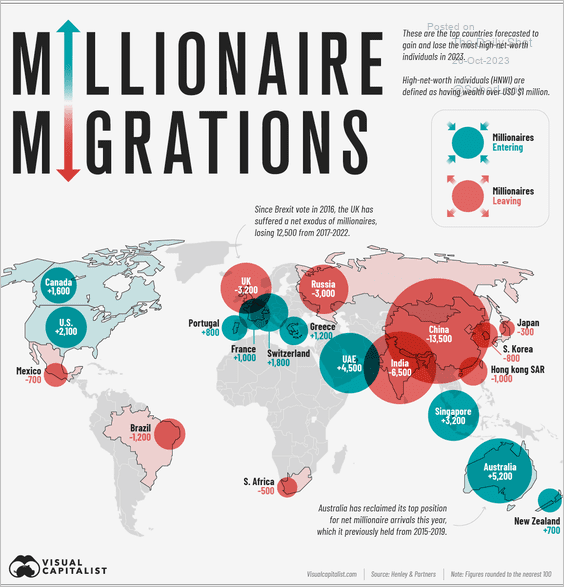

2. Migration of the world’s millionaires in 2023:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

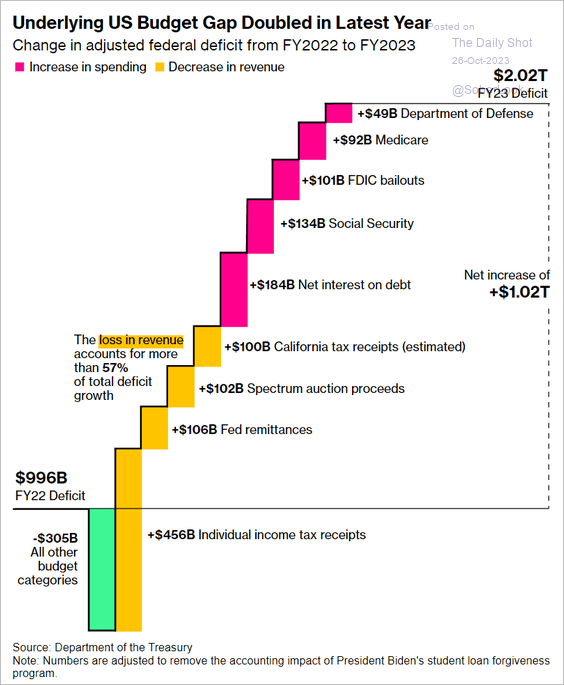

3. Drivers of the US budget deficit surge:

Source: @economics Read full article

Source: @economics Read full article

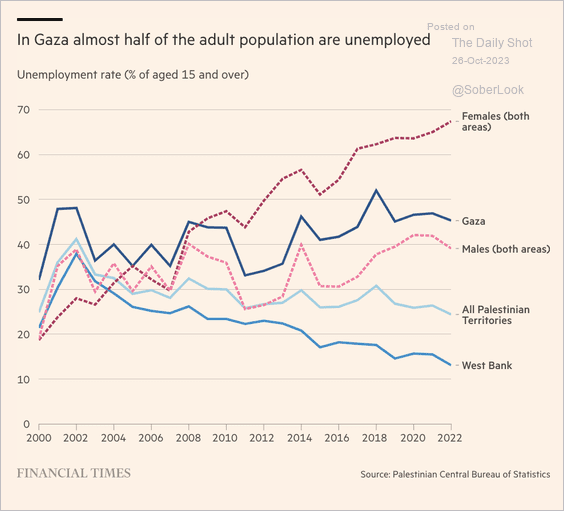

4. Unemployment rates in Gaza and the West Bank:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

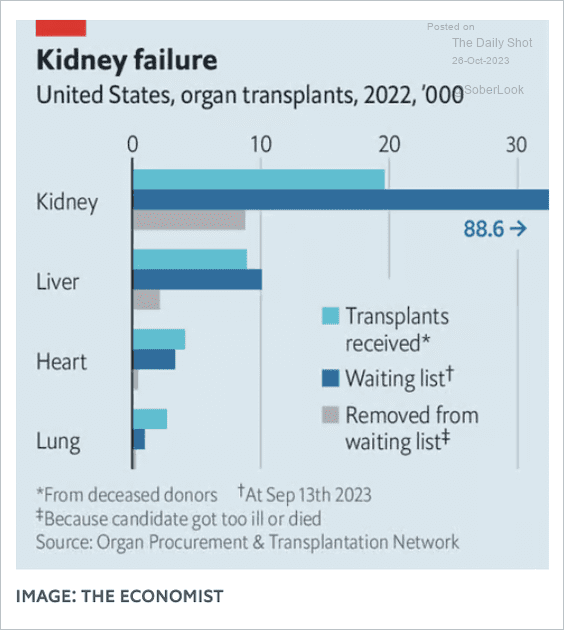

5. Organ transplant waiting lists:

Source: The Economist Read full article

Source: The Economist Read full article

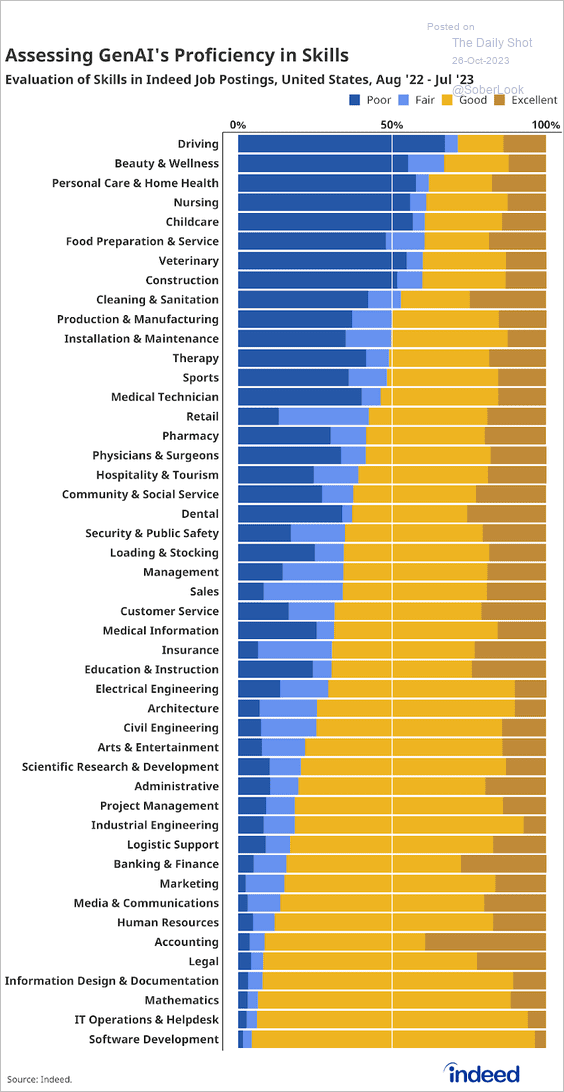

6. Generative AI proficiency:

Source: Indeed Hiring Lab

Source: Indeed Hiring Lab

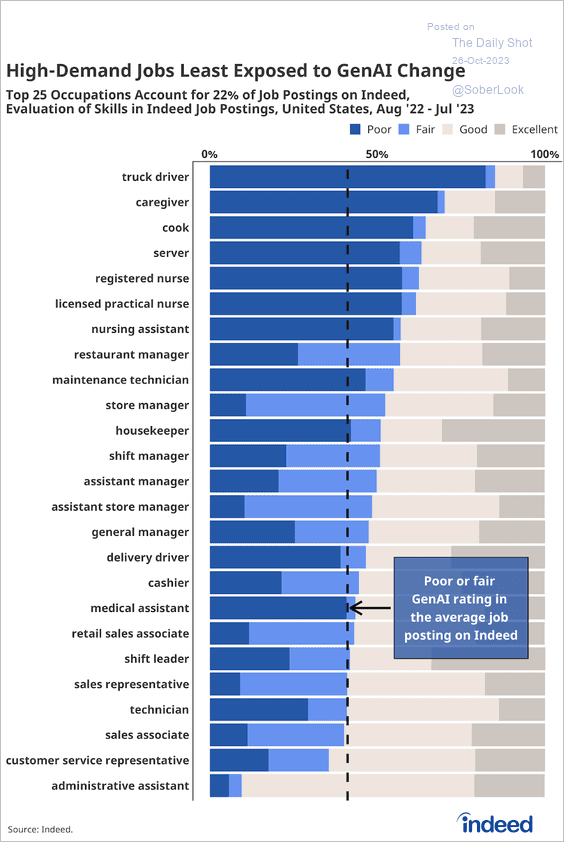

• Jobs least exposed to generative AI:

Source: Indeed Hiring Lab

Source: Indeed Hiring Lab

——————–

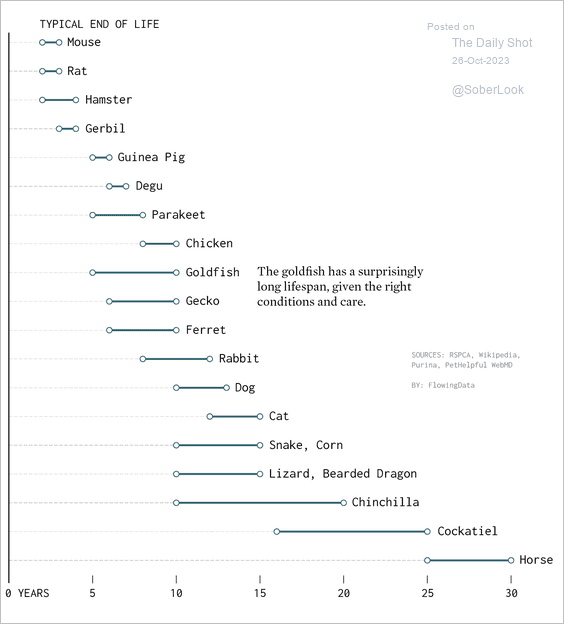

7. Life expectancy ranges for selected house pets:

Source: FlowingData

Source: FlowingData

——————–

Back to Index