The Daily Shot: 30-Oct-23

• The United States

• Canada

• The Eurozone

• Europe

• Asia-Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

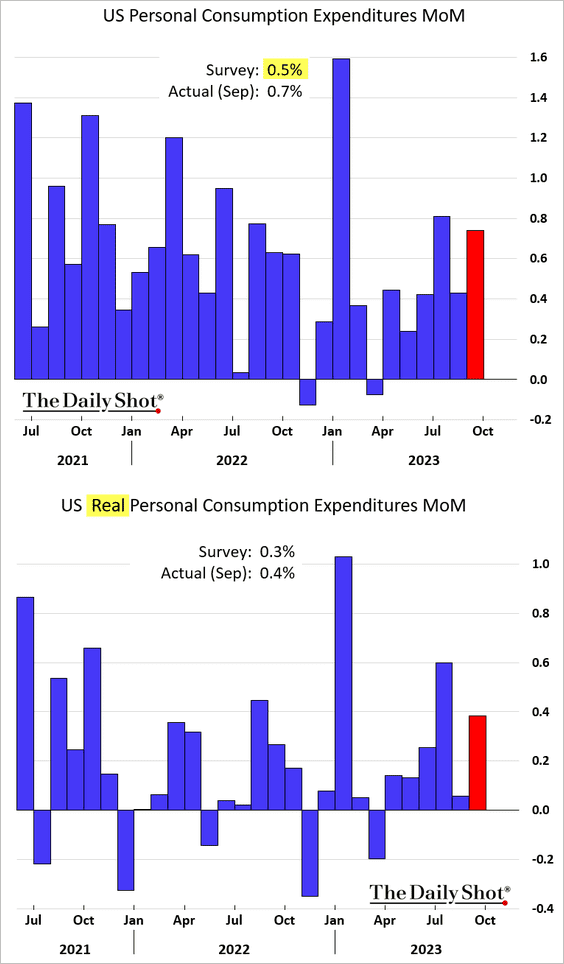

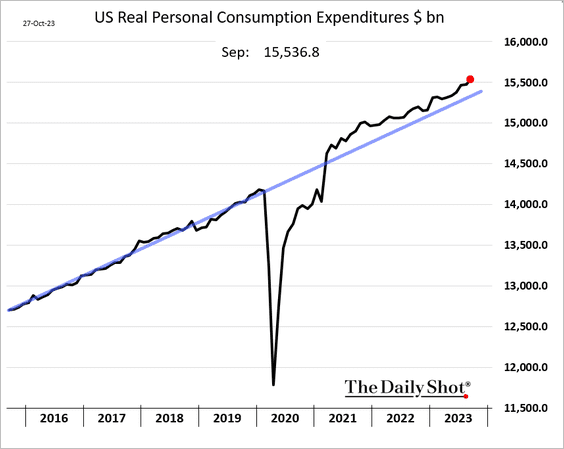

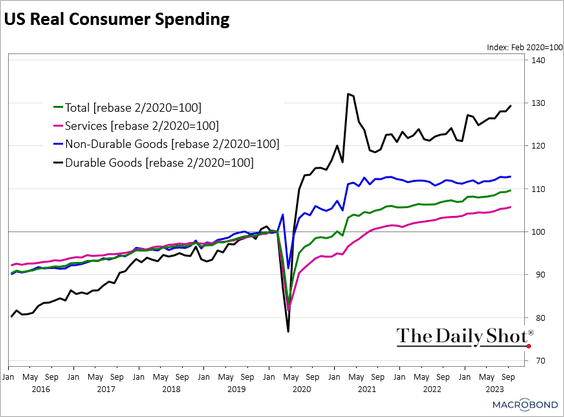

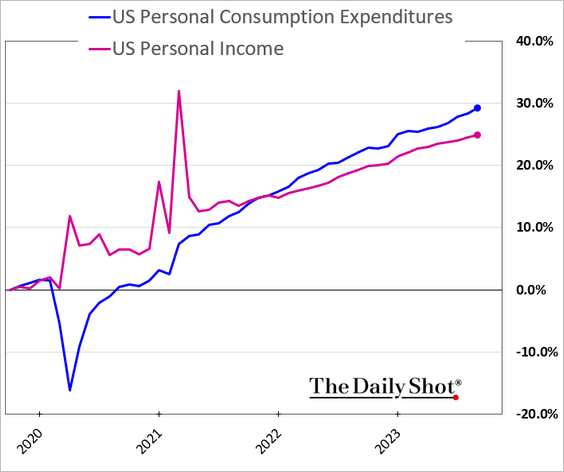

1. Consumer spending exceeded expectations last month, bolstering robust GDP growth in the third quarter.

Source: AP News Read full article

Source: AP News Read full article

• This chart shows real spending on goods and services.

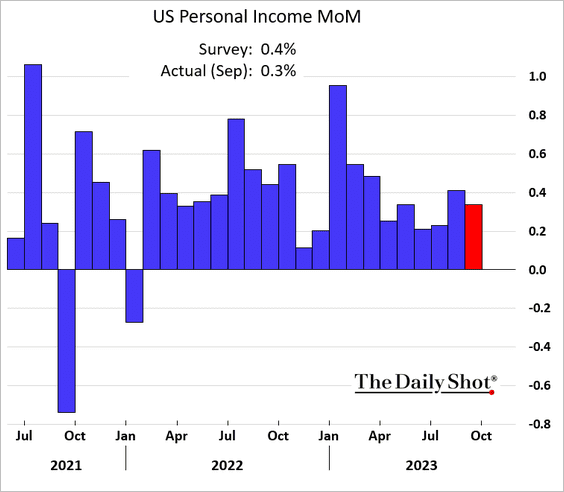

• Household incomes continue to grow, …

.. but are rising slower than consumer spending.

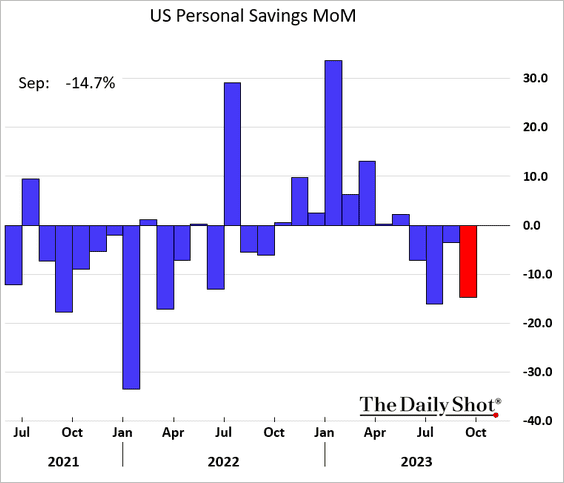

• As a result, savings keep dwindling.

Source: @axios Read full article

Source: @axios Read full article

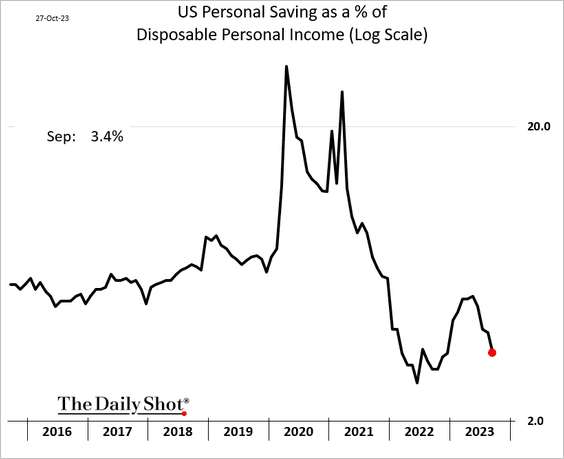

This chart shows personal saving as a percent of disposable income.

——————–

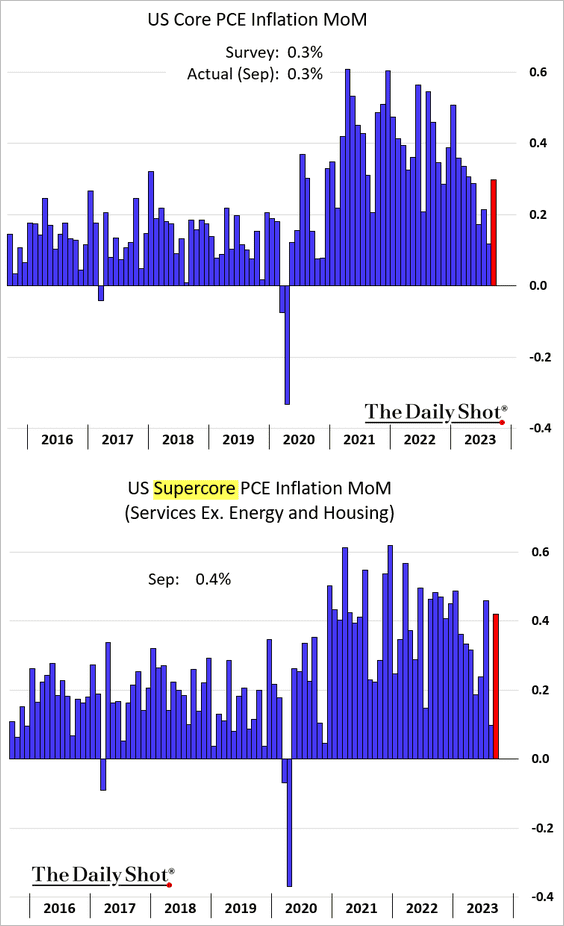

2. The core PCE inflation accelerated last month, which was expected from the CPI and PPI reports.

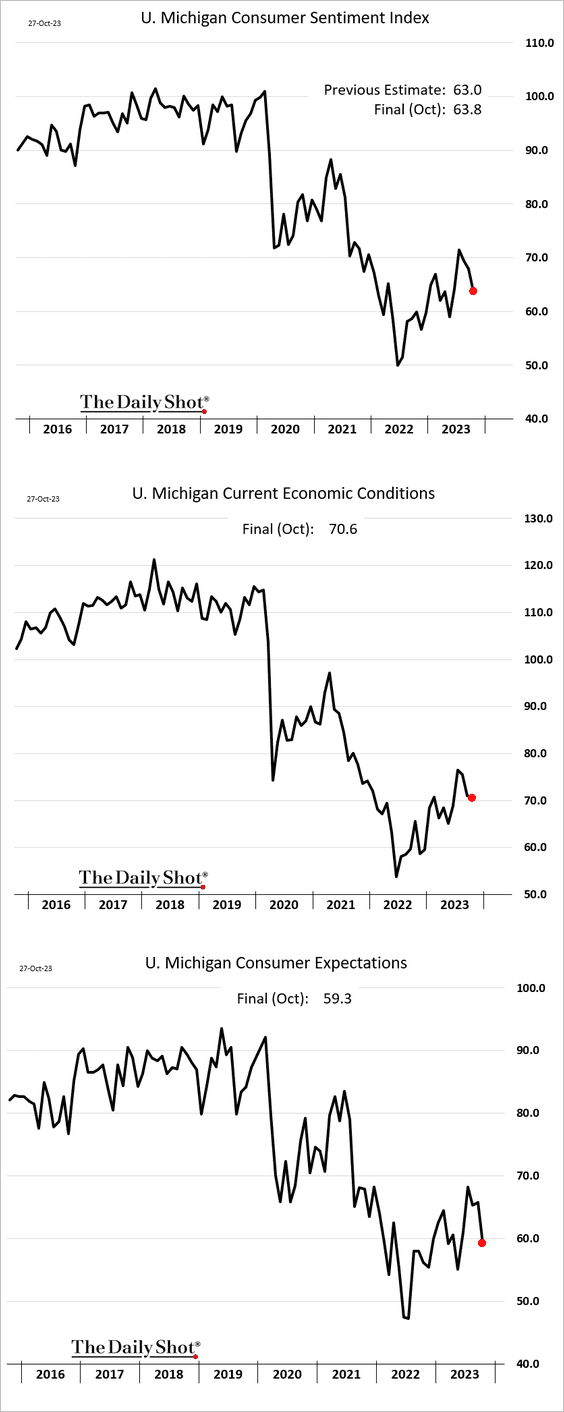

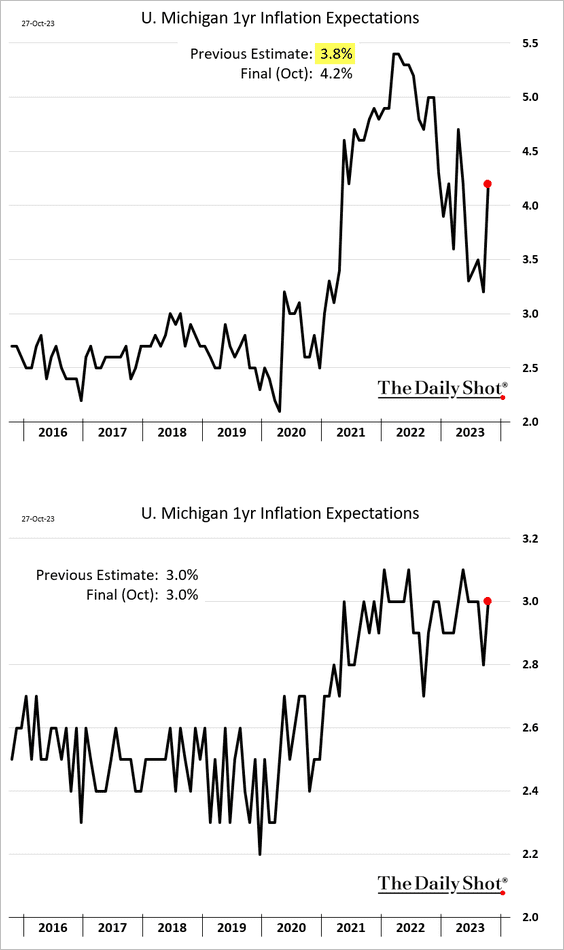

3. Next, we have the final U. Michigan consumer sentiment index for October. The expectations index declined sharply this month.

• Short-term inflation expectations jumped.

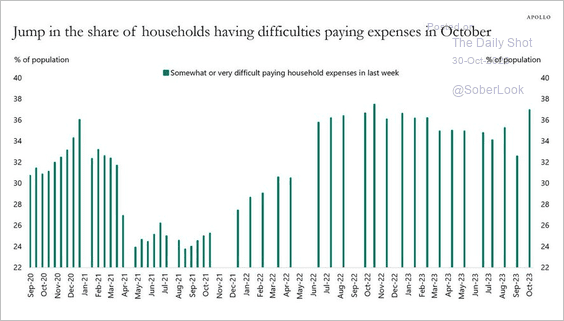

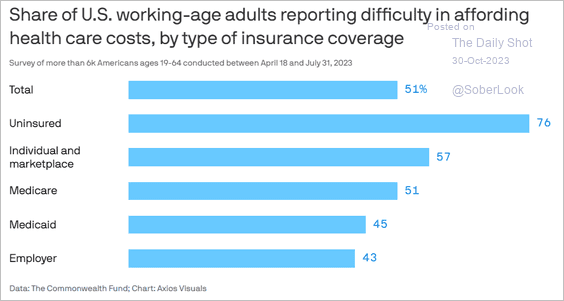

4. A higher share of households are struggling to pay expenses (2 charts).

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Source: @axios Read full article

Source: @axios Read full article

——————–

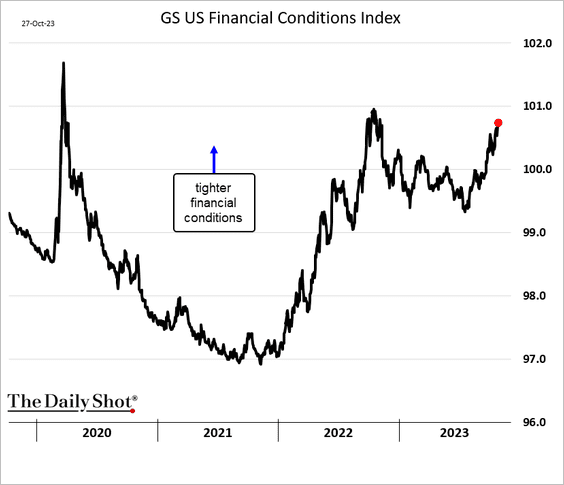

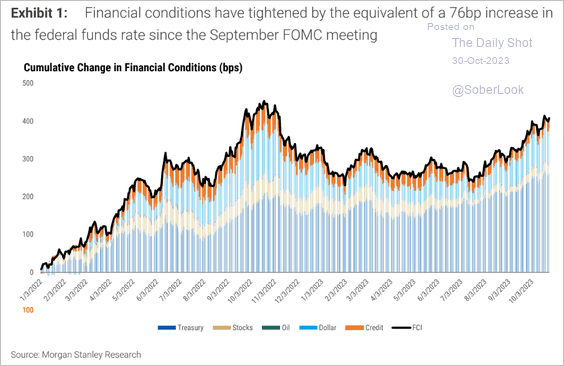

5. US financial conditions continue to tighten (2 charts).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Canada

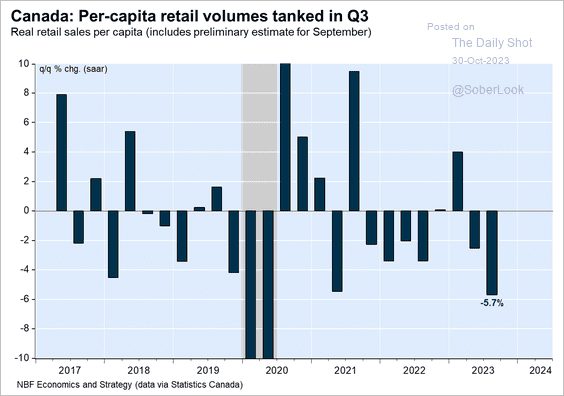

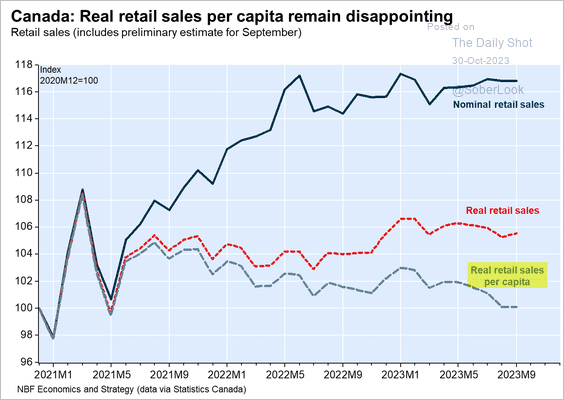

1. Per-capita retail sales tumbled last quarter.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

——————–

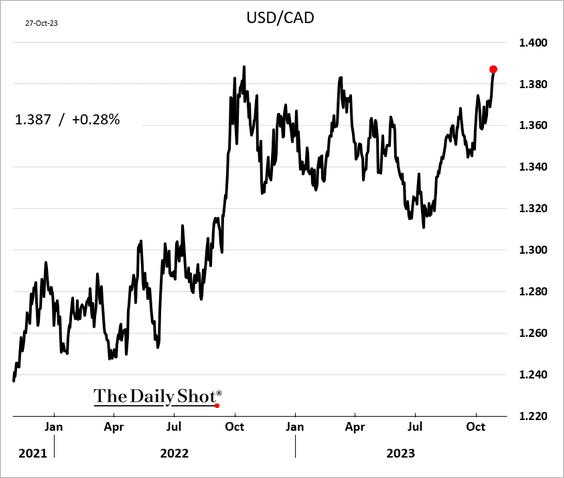

2. The loonie continues to weaken.

Back to Index

The Eurozone

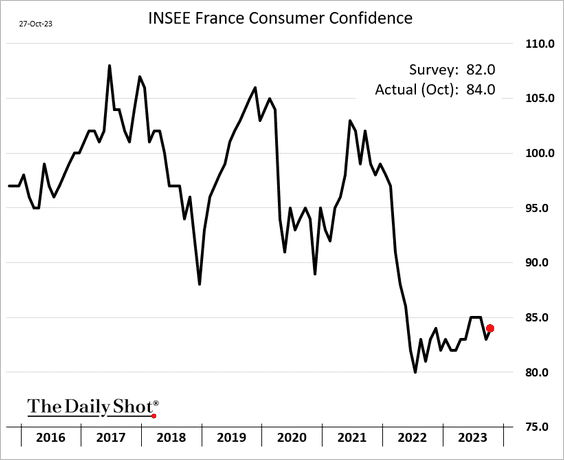

1. French consumer confidence improved slightly this month.

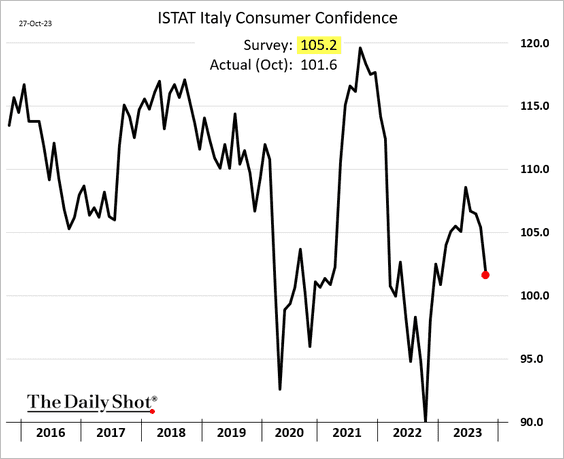

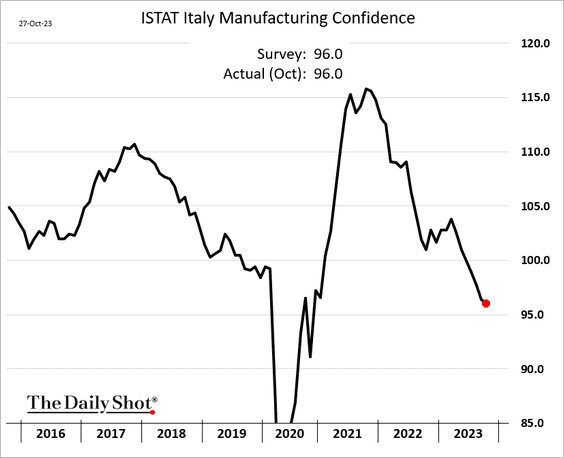

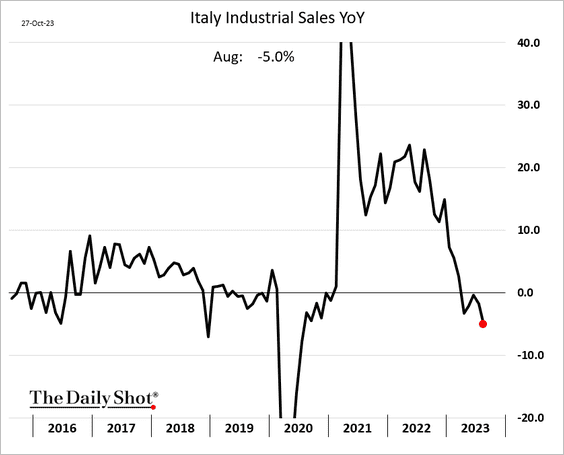

2. Italian sentiment indicators continue to trend lower.

• Industrial sales softened further in August.

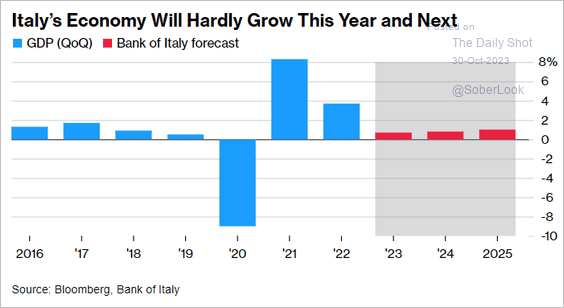

• Slow growth ahead for Italy?

Source: @economics Read full article

Source: @economics Read full article

——————–

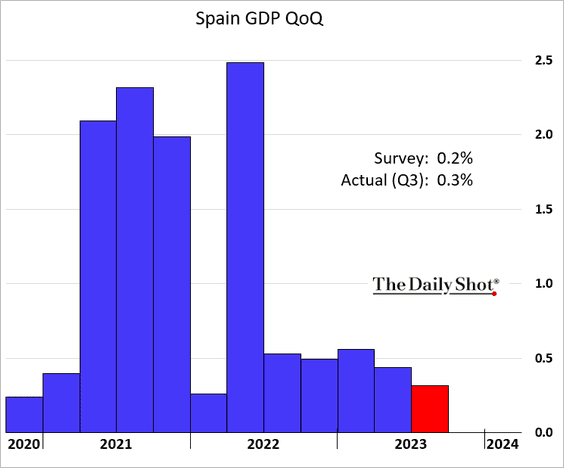

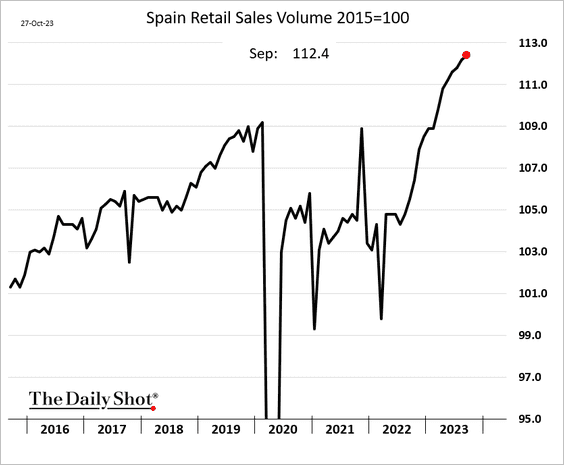

3. Spain’s GDP held up well last quarter.

Retail sales continue to surge.

——————–

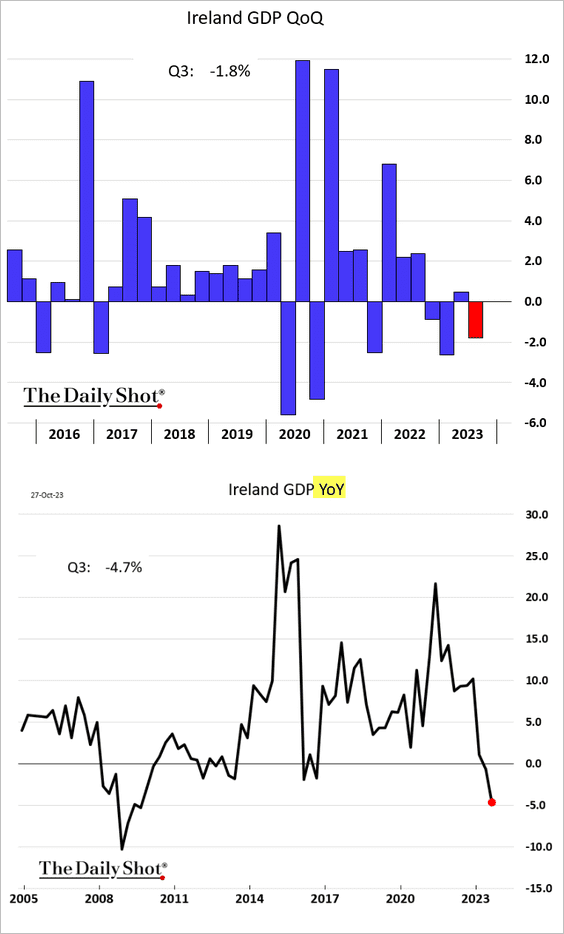

4. Ireland’s economy registered its biggest year-over-year GDP decline since the GFC.

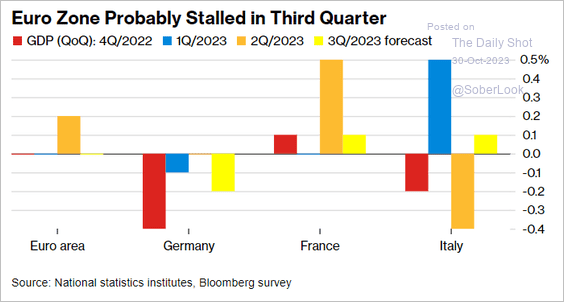

5. Euro-area Q3 GDP is expected to show no growth.

Source: @economics Read full article

Source: @economics Read full article

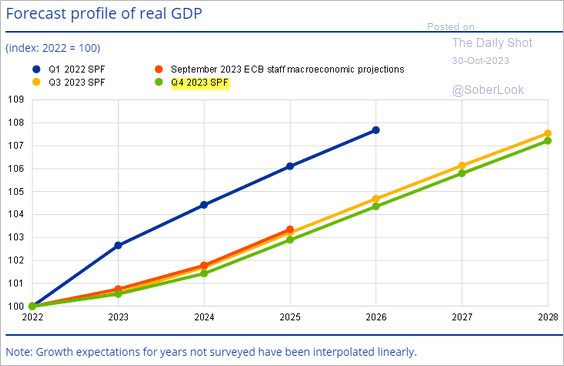

• Economists downgraded their GDP projections for the Eurozone.

Source: ECB Read full article

Source: ECB Read full article

——————–

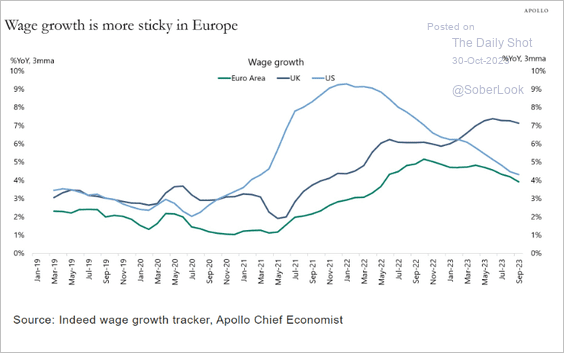

6. Euro-area wage growth has been sticky.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Europe

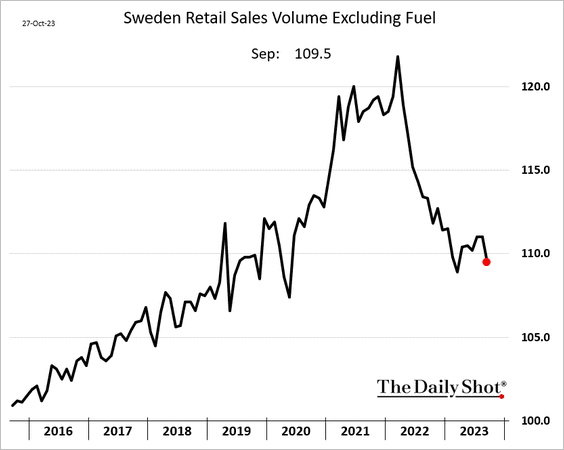

1. Sweden’s retail sales declined in September.

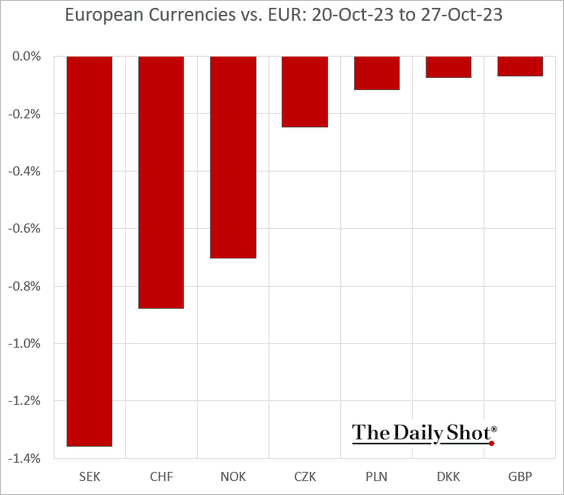

The Swedish krona underperformed last week.

——————–

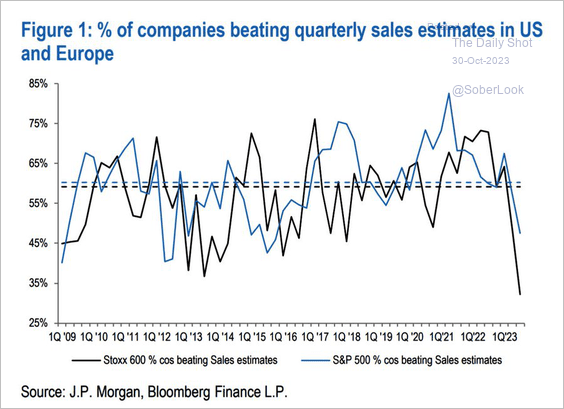

2. Very few European companies’ third-quarter sales have exceeded consensus forecasts.

Source: JP Morgan Research; @MichaelAArouet

Source: JP Morgan Research; @MichaelAArouet

Back to Index

Asia-Pacific

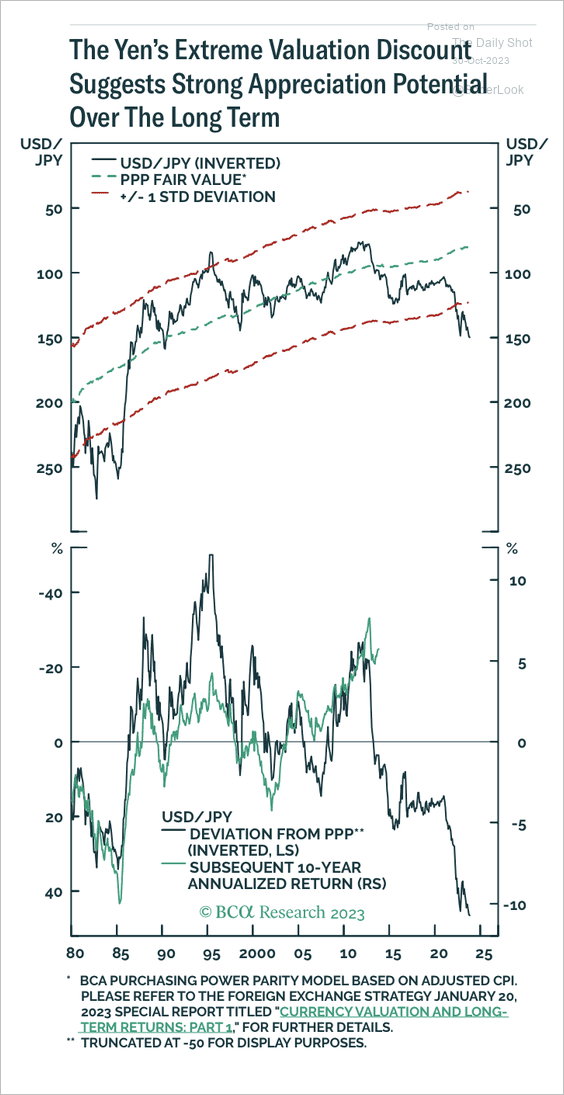

1. The yen is trading at an extreme discount relative to the dollar.

Source: BCA Research

Source: BCA Research

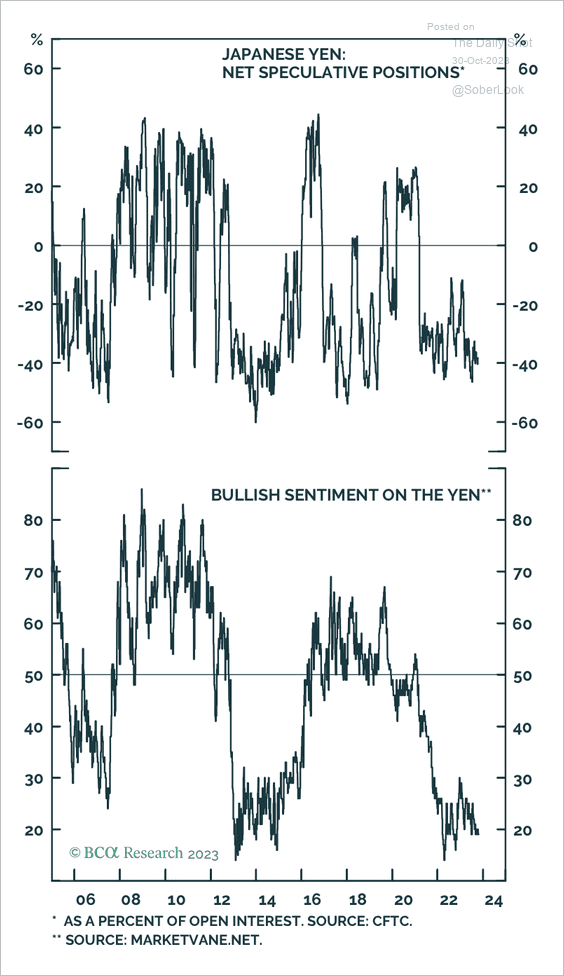

Net-short speculative positioning in the yen is also stretched.

Source: BCA Research

Source: BCA Research

——————–

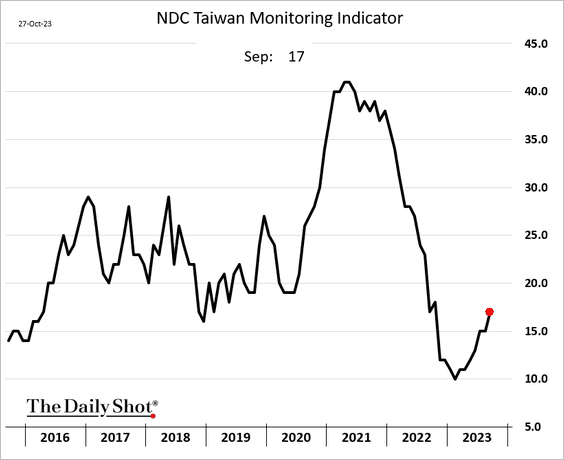

2. Taiwan’s indicator of economic activity is rebounding.

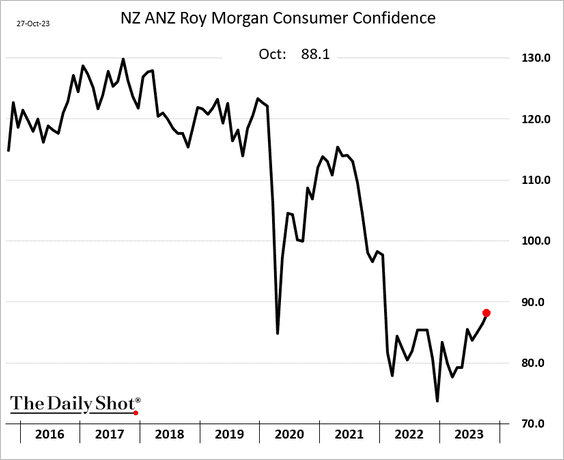

3. New Zealand’s consumer confidence continues to show improvement.

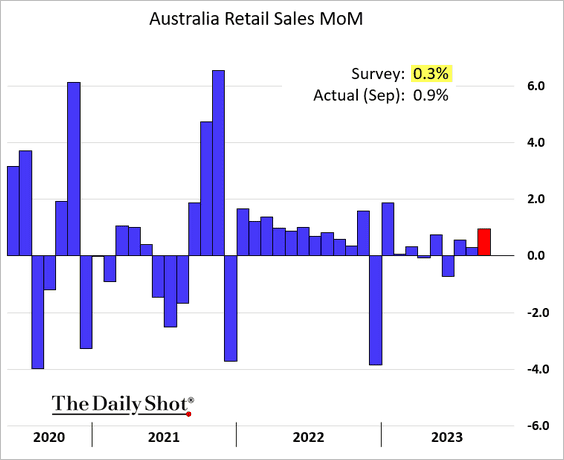

4. Australian retail sales jumped last month.

Source: Reuters Read full article

Source: Reuters Read full article

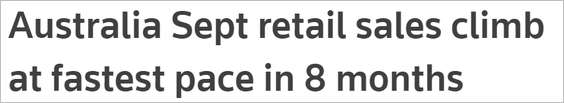

Bond yields continue to climb.

Back to Index

Emerging Markets

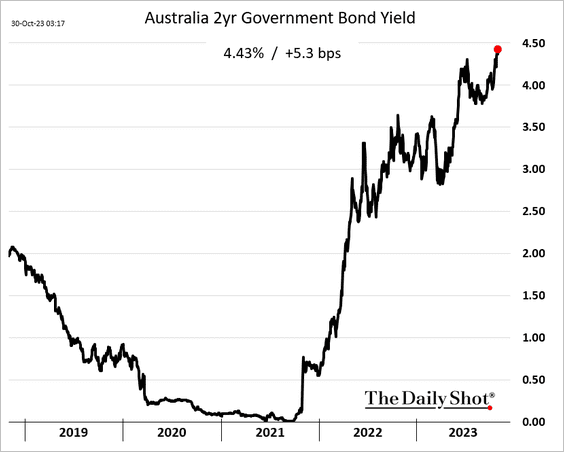

1. Mexican exports dipped below last year’s level in September.

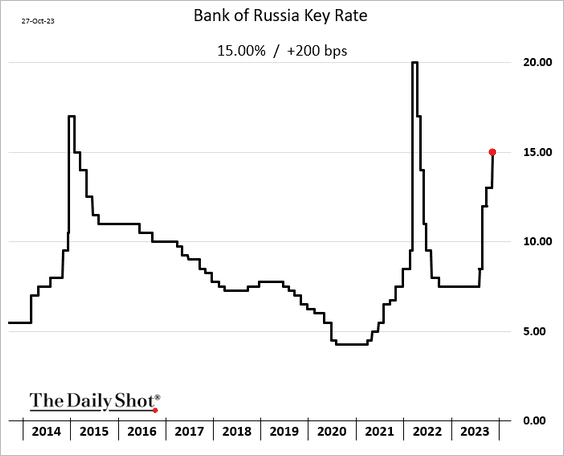

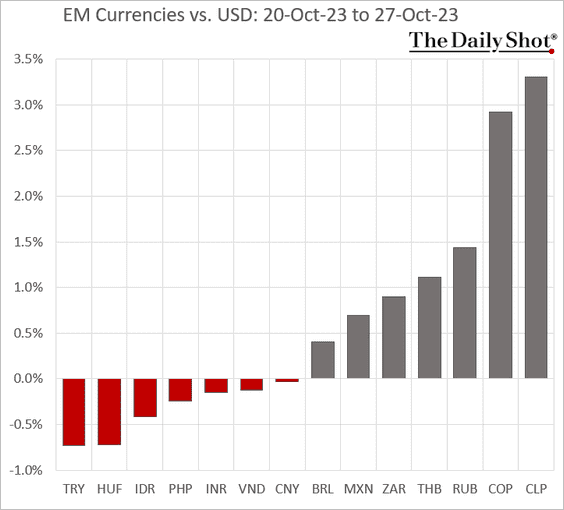

2. Russia’s central bank hiked rates by 200 bps (double the expectations).

Source: Reuters Read full article

Source: Reuters Read full article

——————–

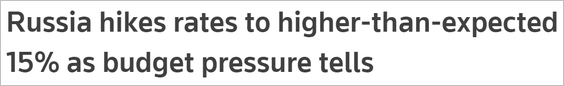

3. Vietnam’s exports hit a new high for this time of the year.

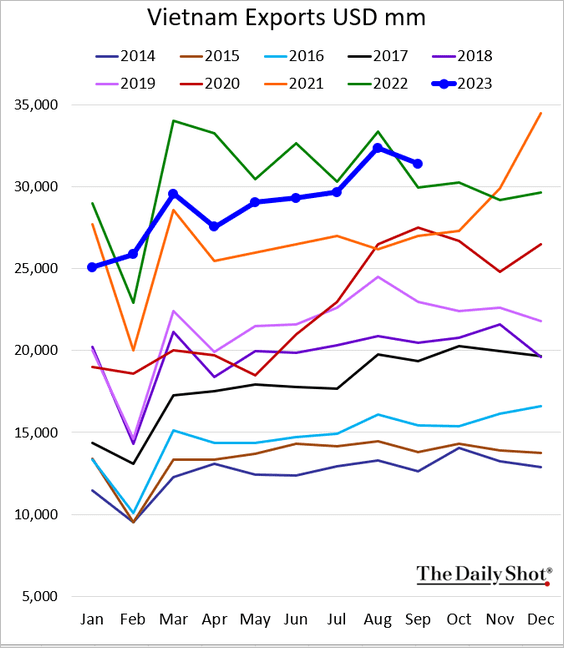

4. Next, we have some performance data from last week.

• Currencies (gains in LatAm, losses in Asia):

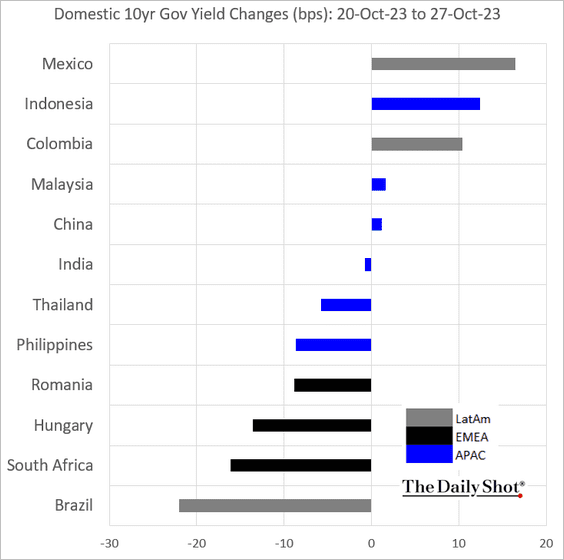

• Bond yields:

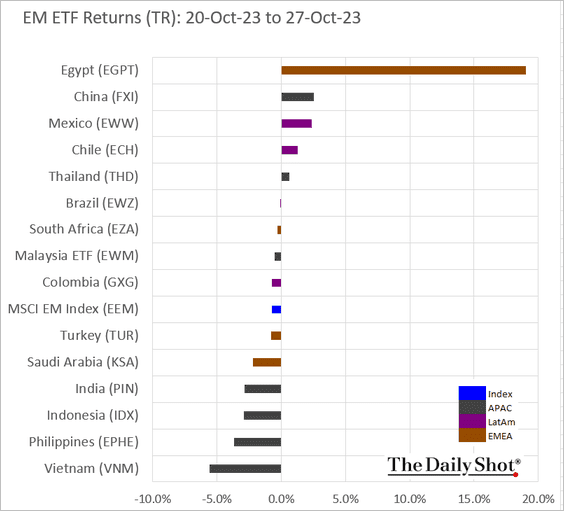

• Equity ETFs:

Back to Index

Commodities

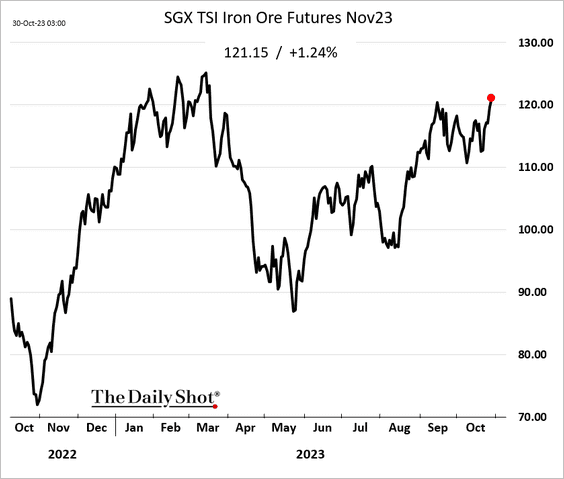

1. Iron ore futures advanced in recent days.

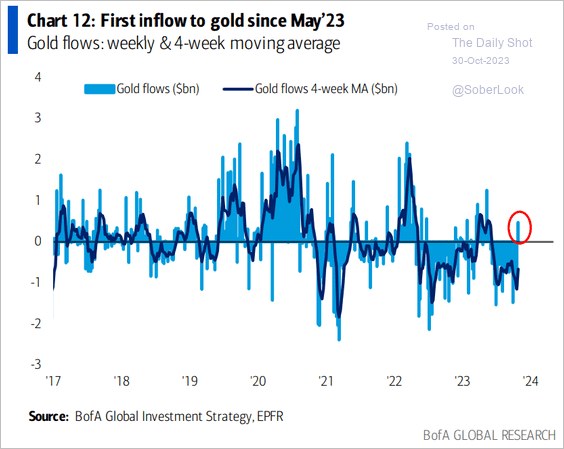

2. Gold funds finally saw an inflow.

Source: BofA Global Research

Source: BofA Global Research

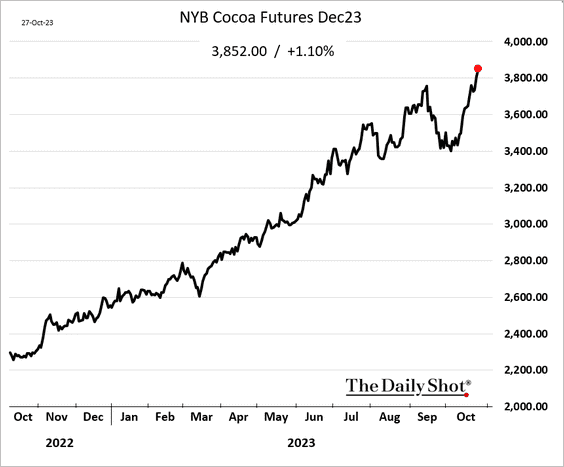

3. Cocoa prices continue to surge.

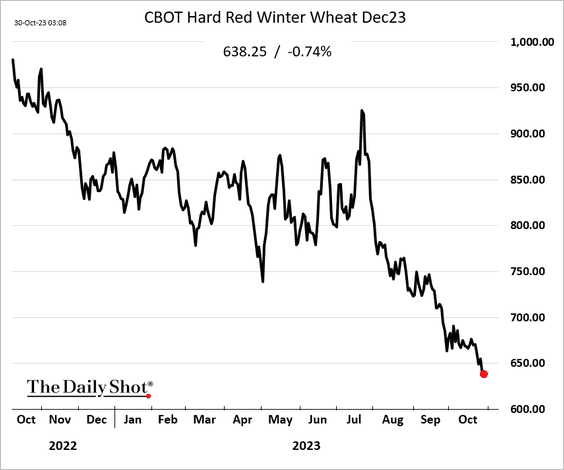

4. With global markets well supplied, US winter wheat prices are sinking.

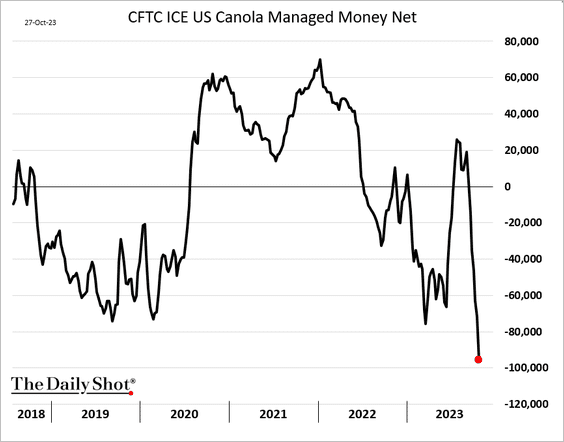

5. Speculative accounts boosted their bets against canola futures.

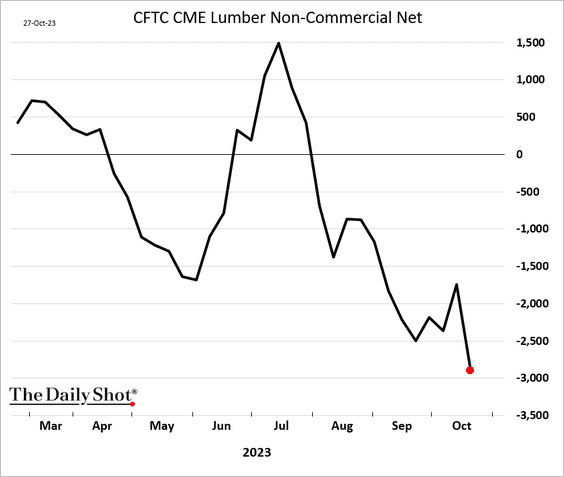

6. Bets against CME lumber are also rising.

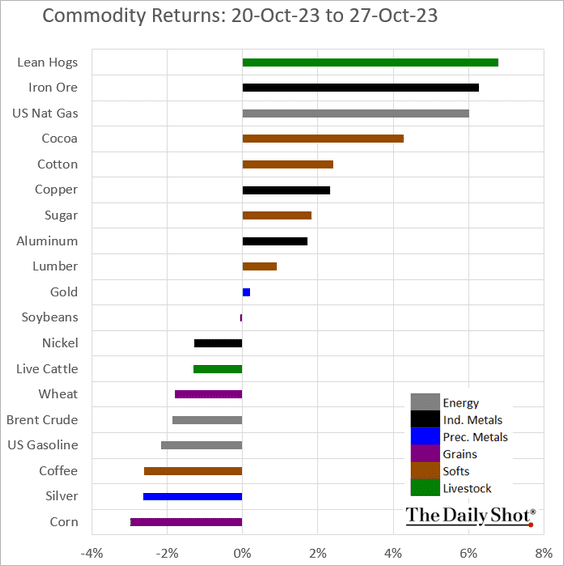

7. Here is last week’s performance data across key commodity markets.

Back to Index

Energy

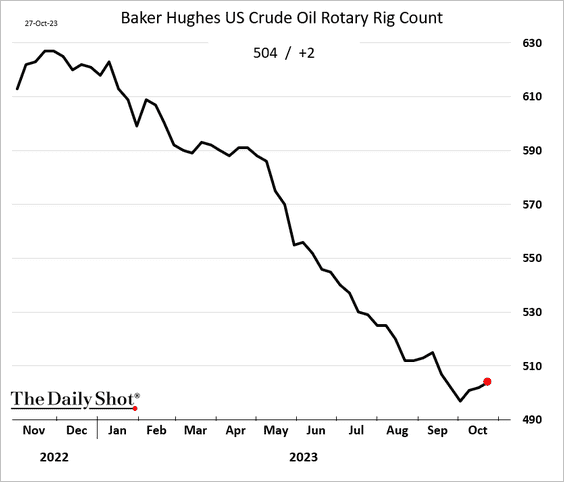

1. The US rig count increased again last week.

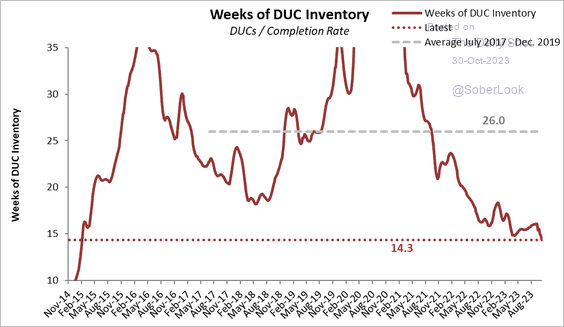

• But DUC inventories are at multi-year lows. More drilling will be needed to maintain production.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

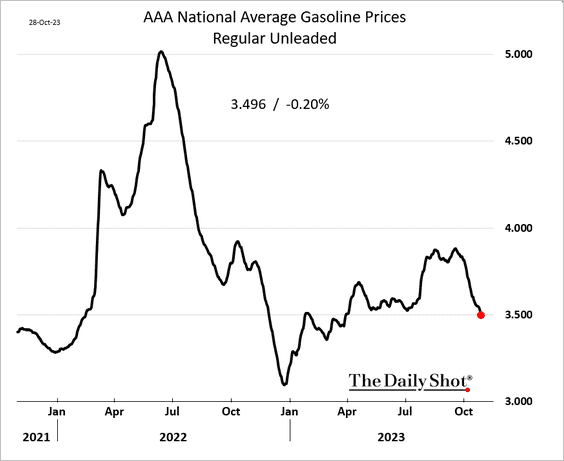

2. US retail gasoline prices dipped below $3.5/gal this weekend.

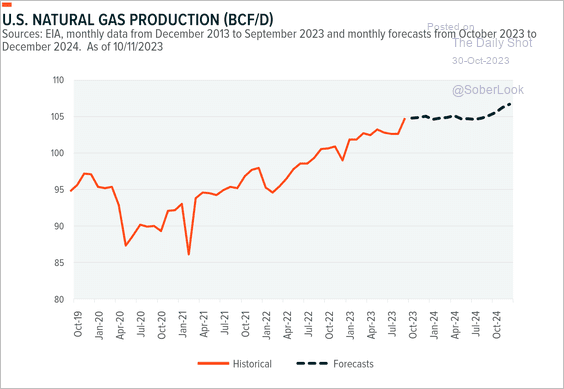

3. US natural gas production is projected to continue to increase next year.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Equities

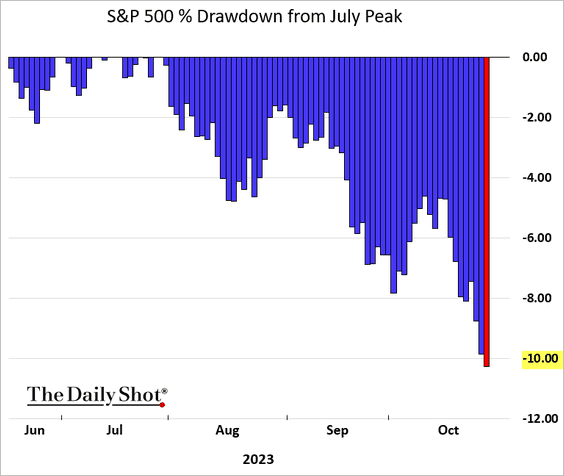

1. The S&P 500 is down 10% from the July peak.

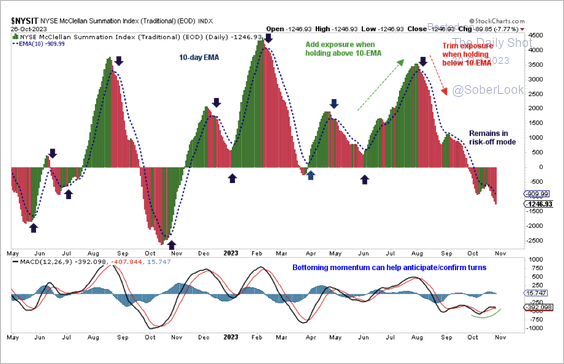

2. Breadth indicators remain in risk-off mode, although technicals show some signs of improvement.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

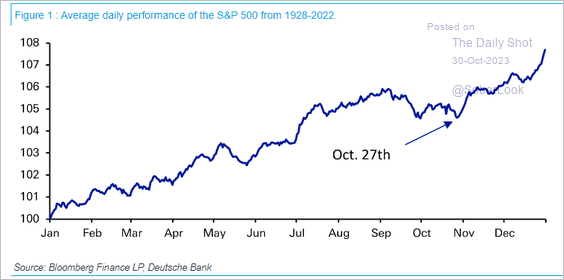

3. On average, the S&P 500 has bottomed around October 27th before a seasonal rally.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

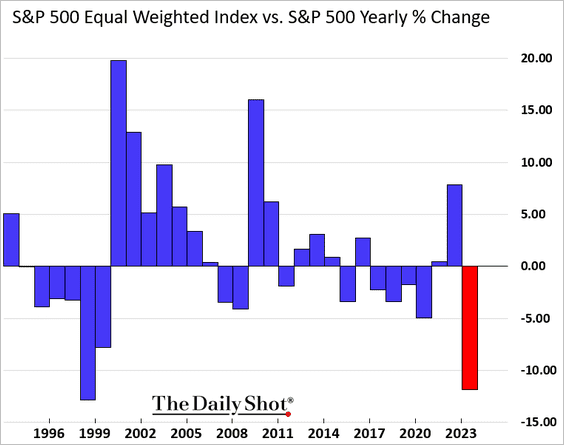

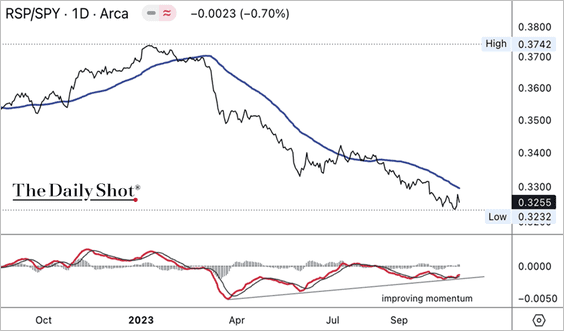

4. From a relative performance perspective, the S&P 500 equal-weight index has faced a challenging year.

But the downtrend in the equal-weight S&P 500 index relative to the market-weight S&P 500 index appears to be slowing.

——————–

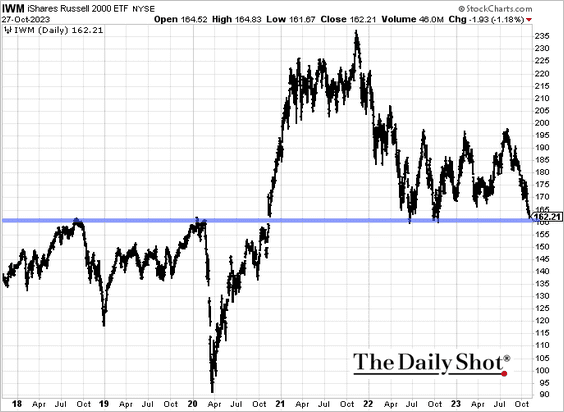

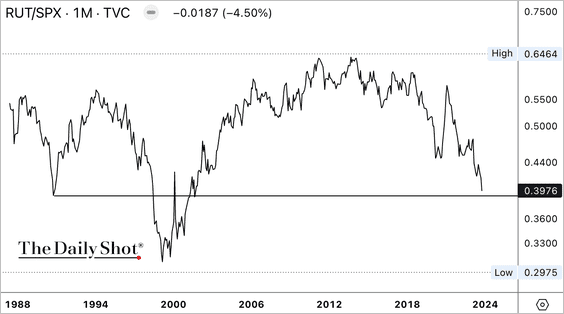

5. The Russell 2000 index is at a critical level.

US small-caps remain in a downtrend relative to the broader market, although initial support is nearby.

——————–

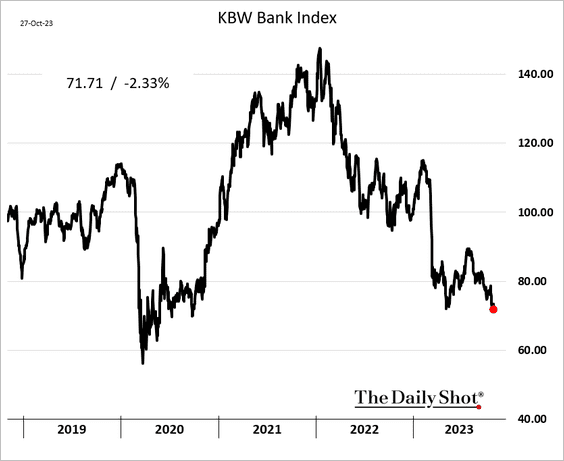

6. The KBW index of bank shares hit the lowest level since the initial COVID shock.

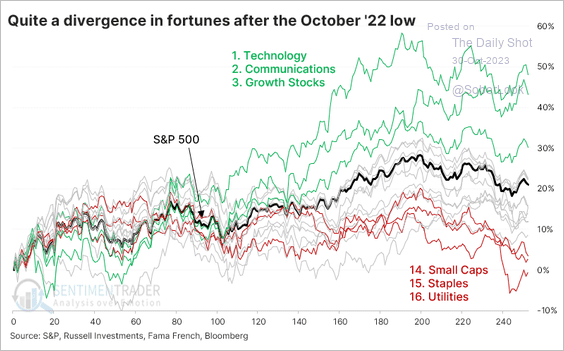

7. There has been a large dispersion in S&P 500 sector performance since the October 2022 low.

Source: SentimenTrader

Source: SentimenTrader

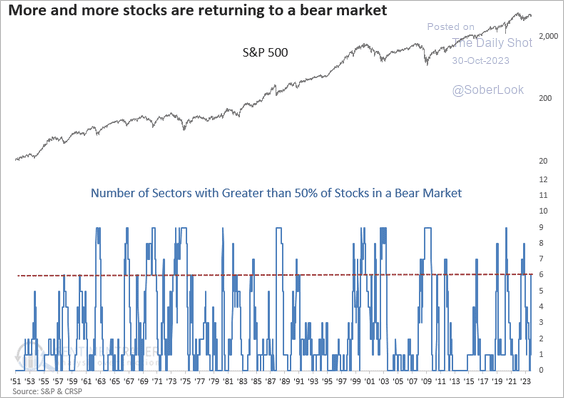

Most S&P 500 sectors have over half of their constituents down more than 20% from their one-year high.

Source: SentimenTrader

Source: SentimenTrader

——————–

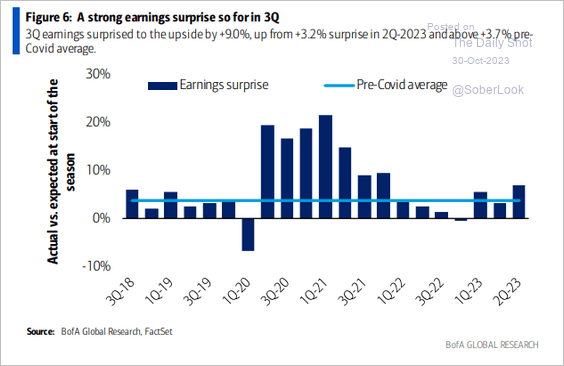

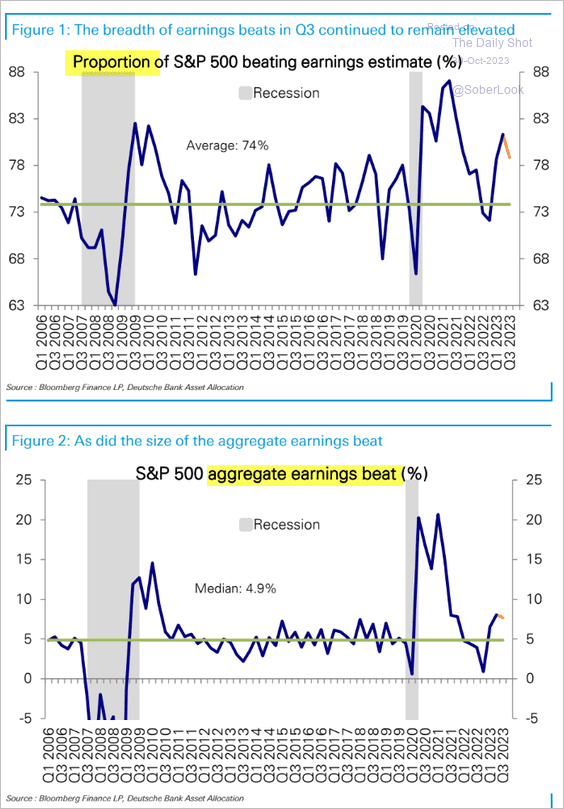

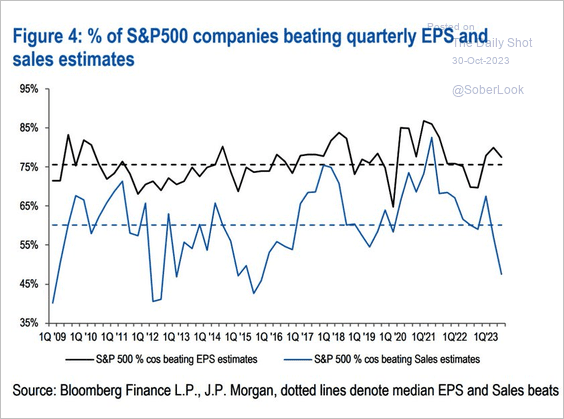

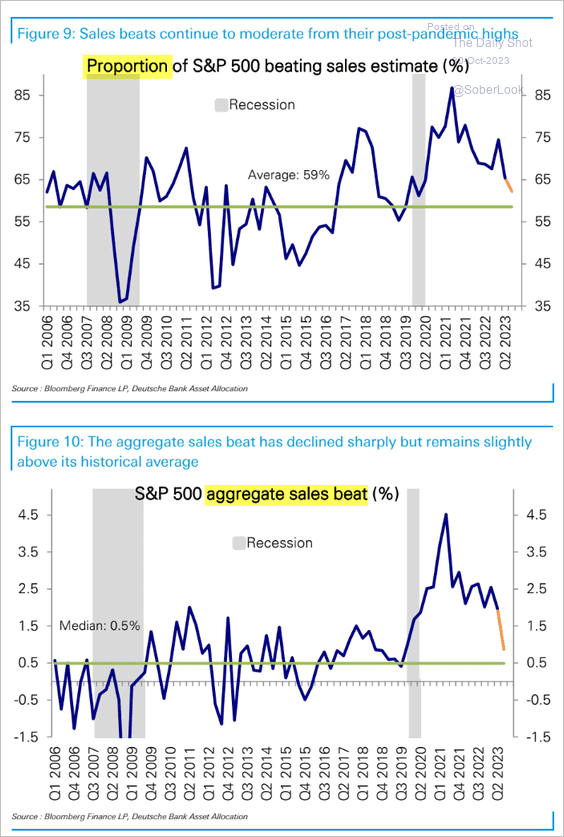

8. The Q3 earnings surprises have been running above the pre-COVID average.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• But sales surprises have been softer.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

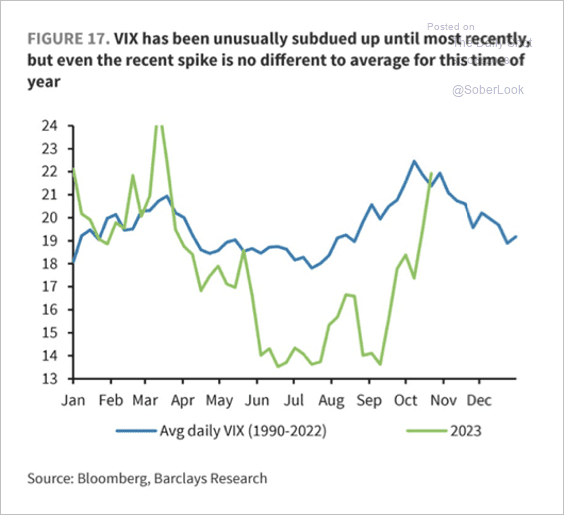

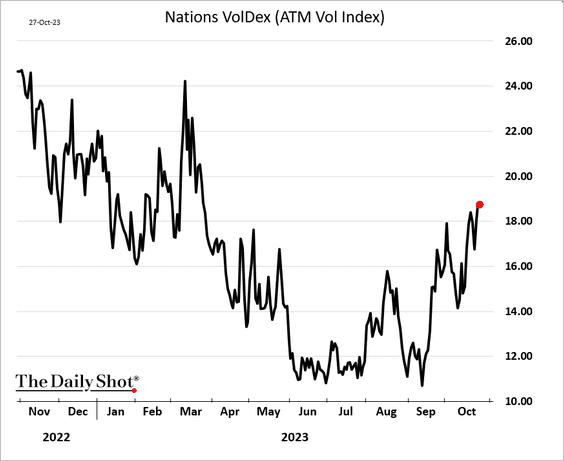

9. The latest VIX spike is consistent with its seasonal pattern, albeit coming off depressed levels.

Source: Barclays Research

Source: Barclays Research

Here is the VolDex index (based on at-the-money options).

——————–

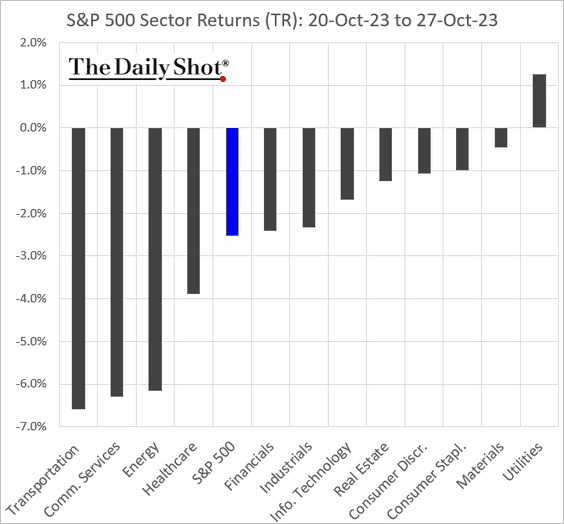

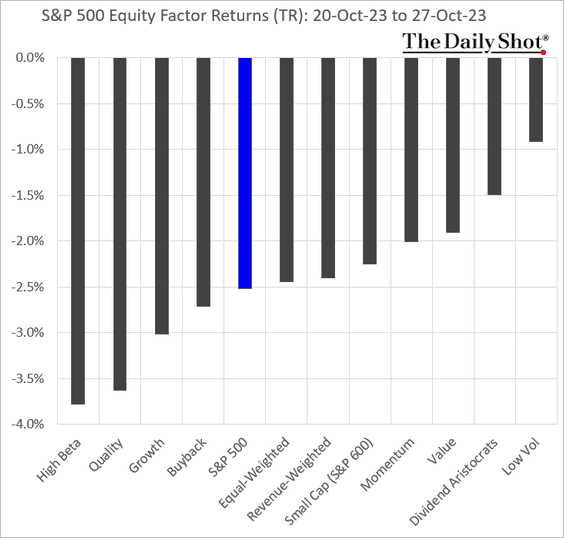

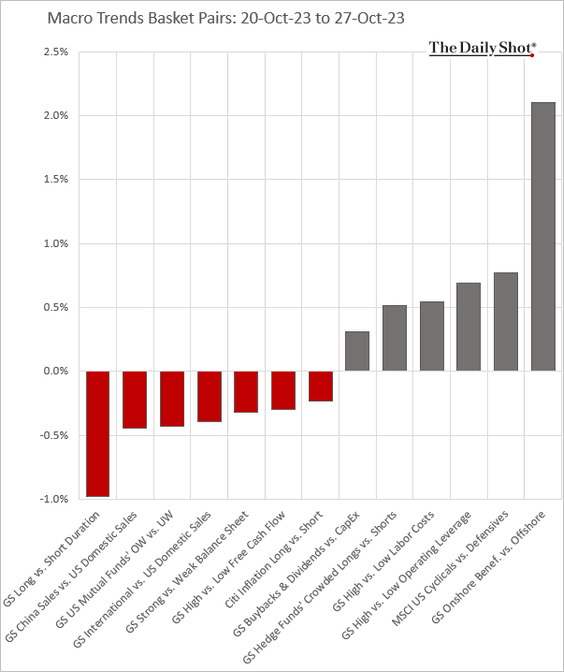

10. Finally, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

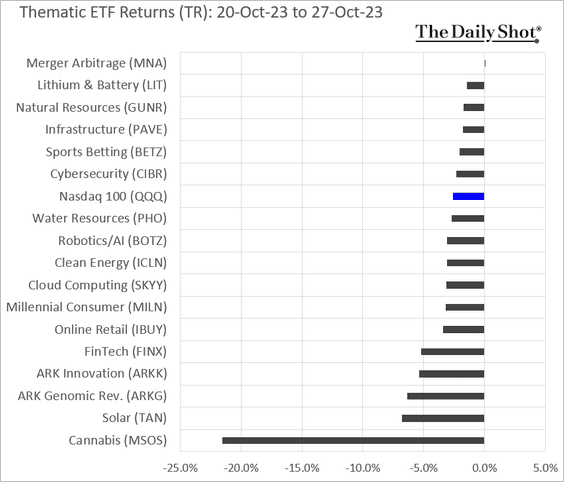

• Thematic ETFs:

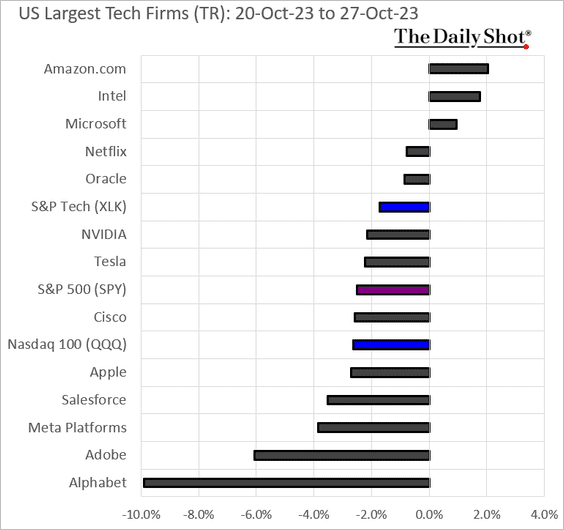

• Largest US tech firms:

Back to Index

Credit

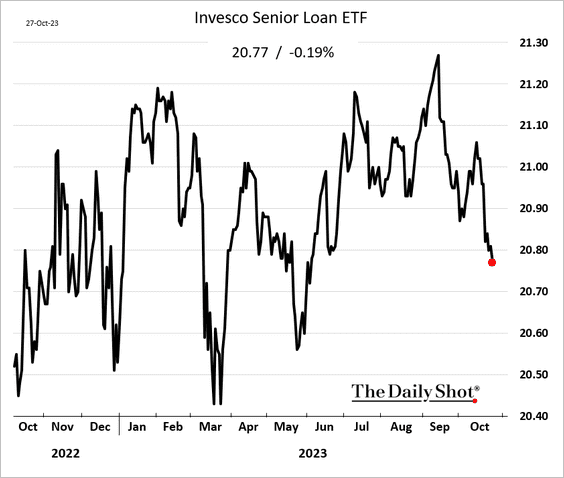

1. Leveraged loans have been under pressure this month.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

——————–

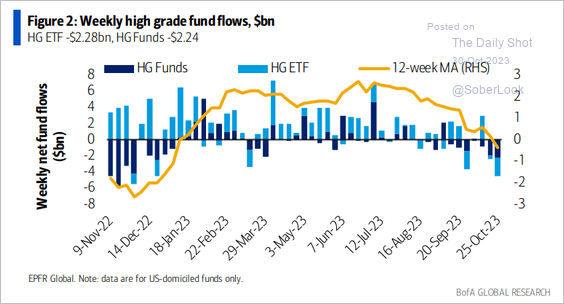

2. Investment-grade debt fund flows remain negative.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

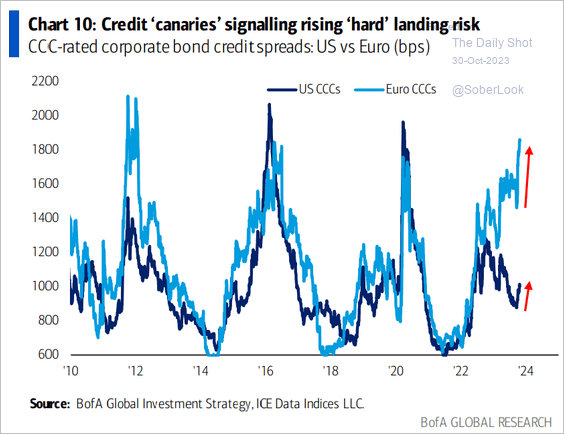

3. European CCC spreads have continued to diverge from those of their US peers.

Source: BofA Global Research

Source: BofA Global Research

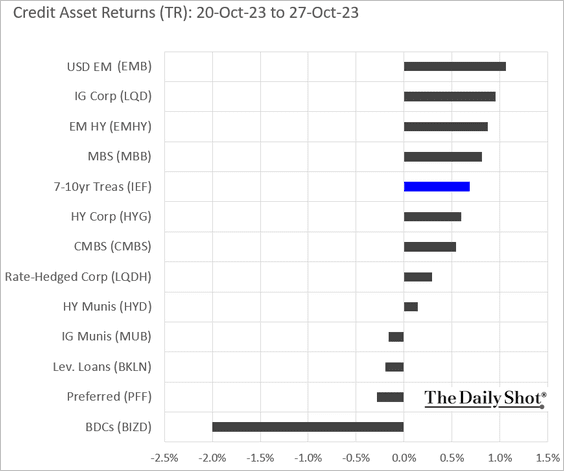

4. Here is last week’s performance data.

Back to Index

Rates

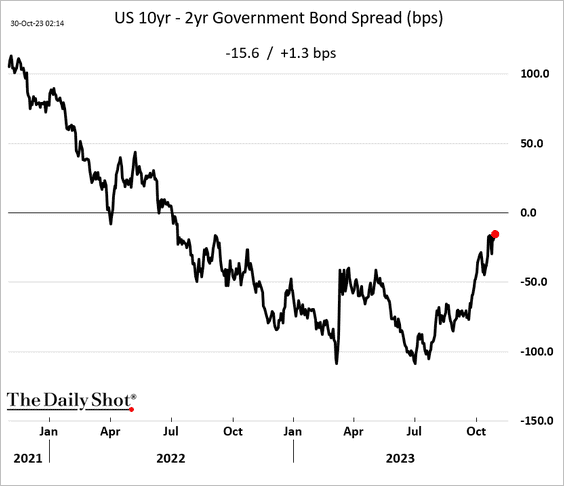

1. The Treasury curve continues to steepen.

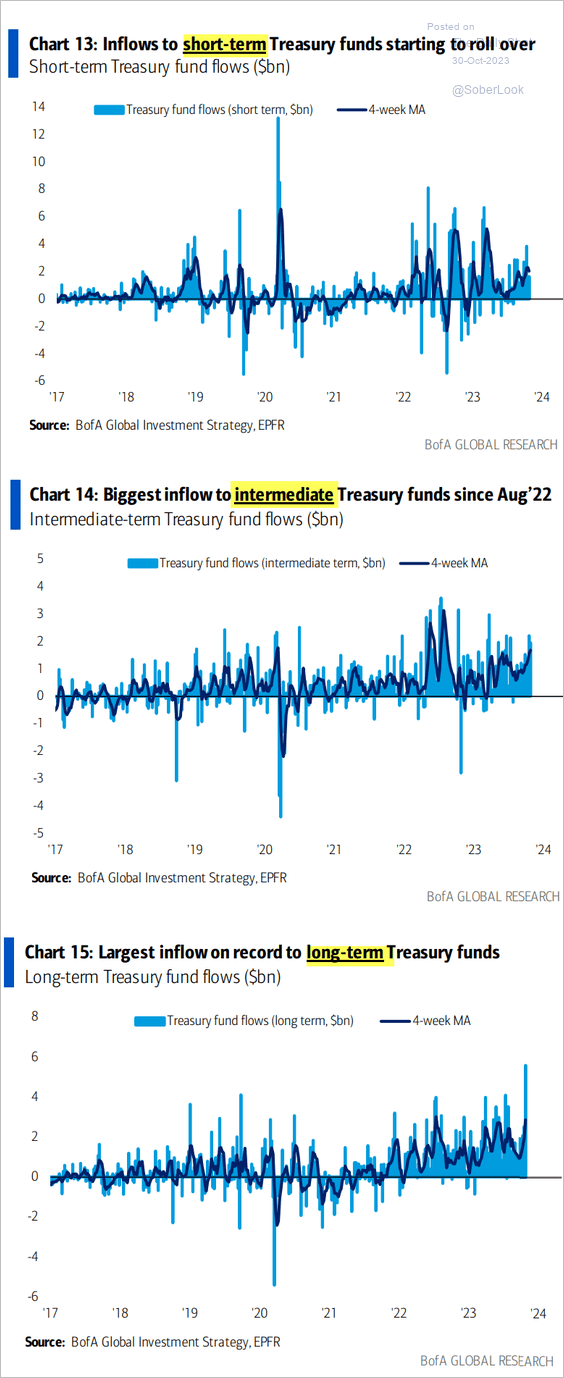

2. Investors are terming out their Treasury holdings (extending maturities).

Source: BofA Global Research

Source: BofA Global Research

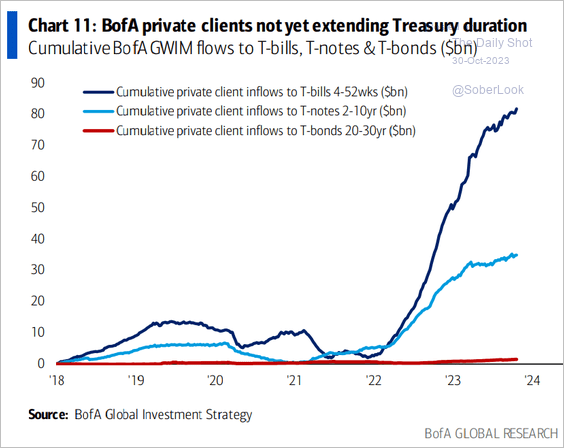

BofA’s private clients are not quite there yet.

Source: BofA Global Research

Source: BofA Global Research

——————–

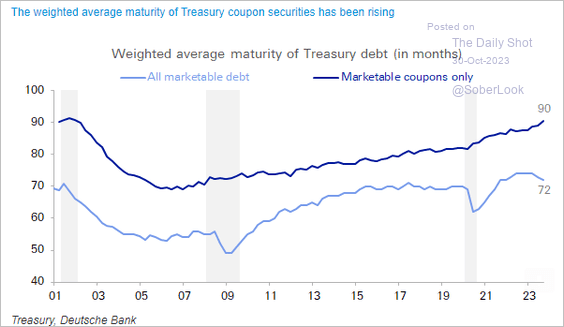

3. The average maturity of Treasury notes and bonds keeps climbing.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

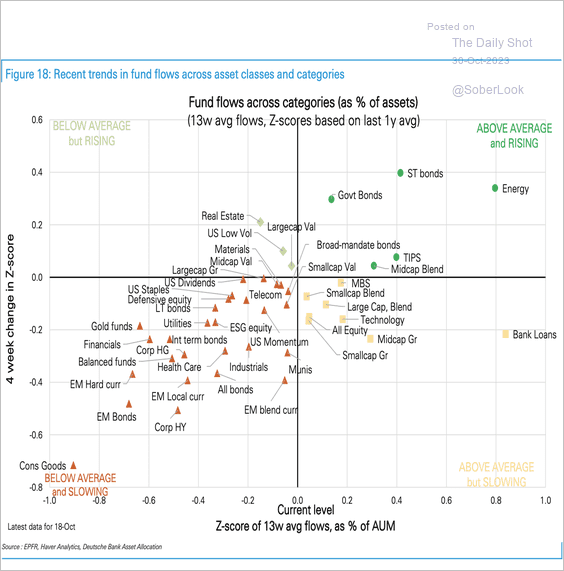

1. Here is a look at trends in fund flows across asset classes.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

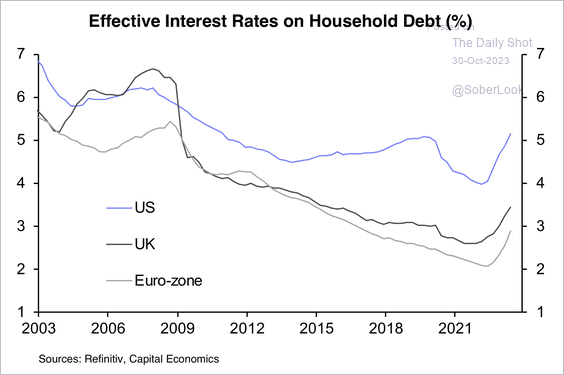

2. According to Capital Economics, the impact of policy tightening in developed markets was met with a greater prevalence of longer-maturity household debt. This means the rise in debt servicing costs has been modest so far.

Source: Capital Economics

Source: Capital Economics

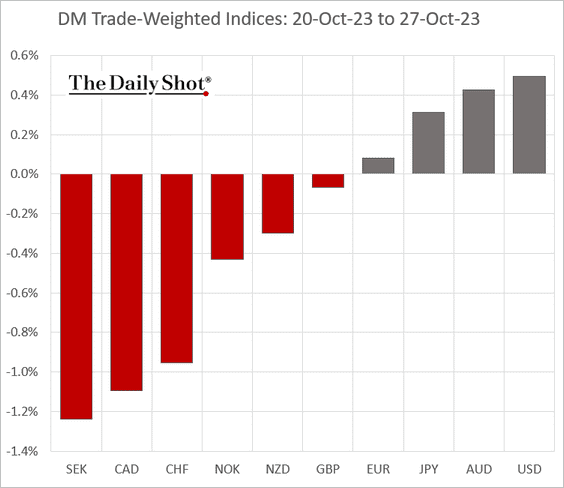

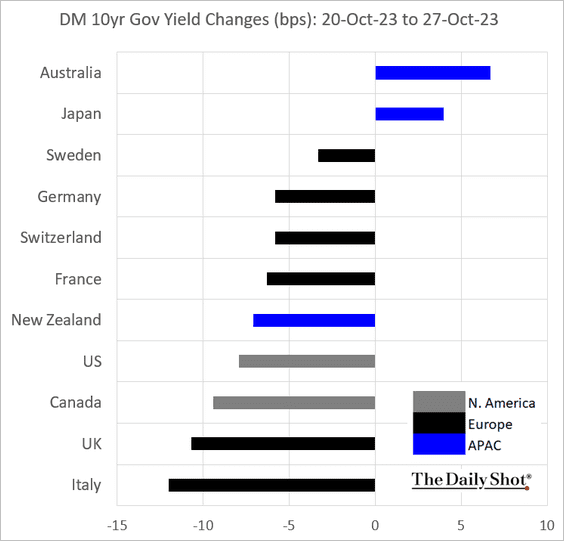

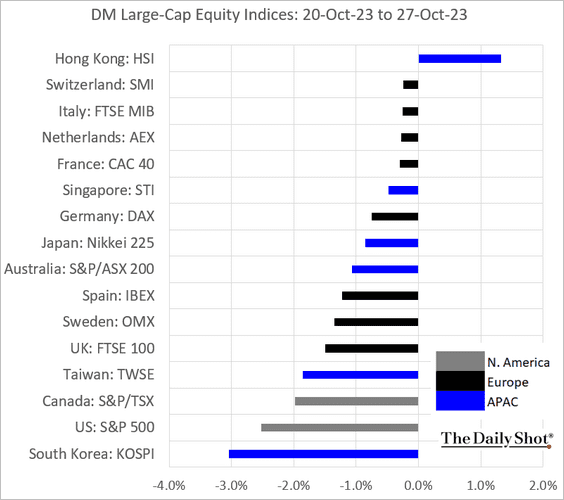

3. Finally, we have last week’s market performance in select economies.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

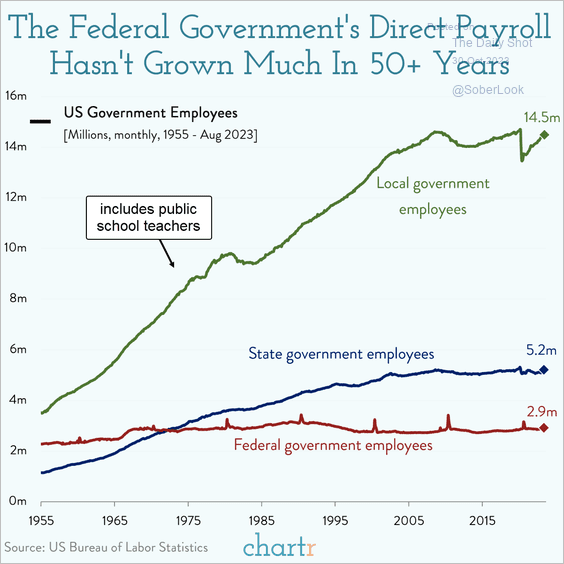

1. US government employees:

Source: @chartrdaily

Source: @chartrdaily

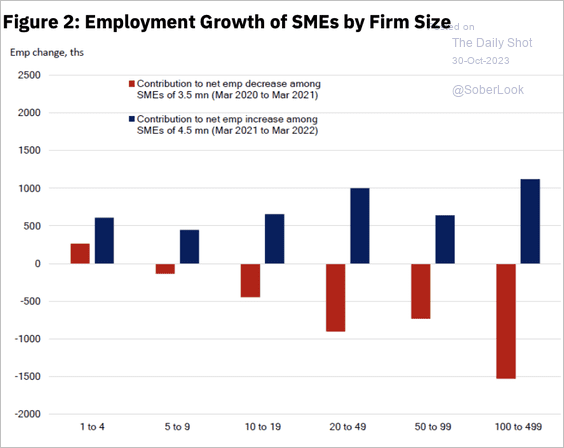

2. The COVID hit to employment and subsequent recovery by firm size:

Source: Federal Reserve Bank of Atlanta Read full article

Source: Federal Reserve Bank of Atlanta Read full article

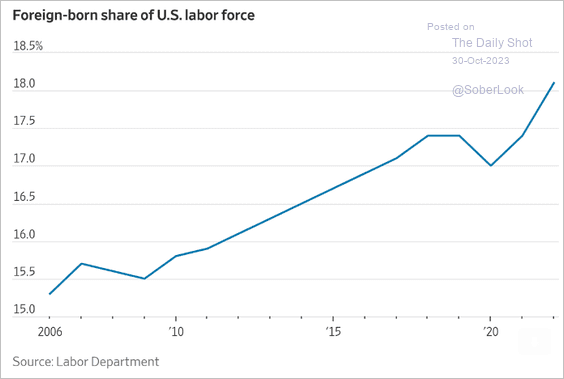

3. The foreign-born share of the US labor force:

Source: @WSJ Read full article

Source: @WSJ Read full article

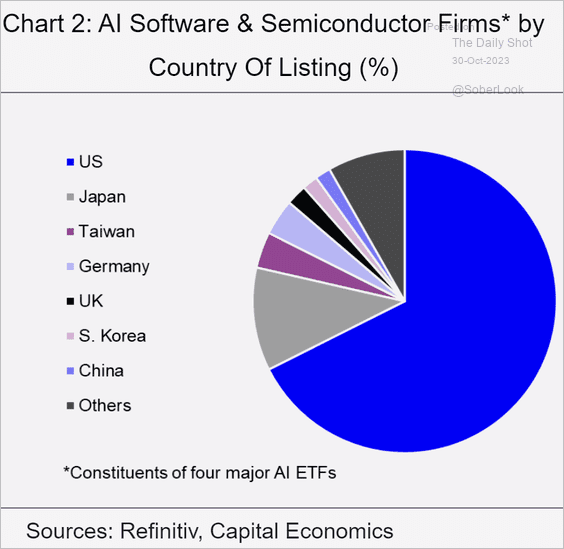

4. AI companies by country of listing:

Source: Capital Economics

Source: Capital Economics

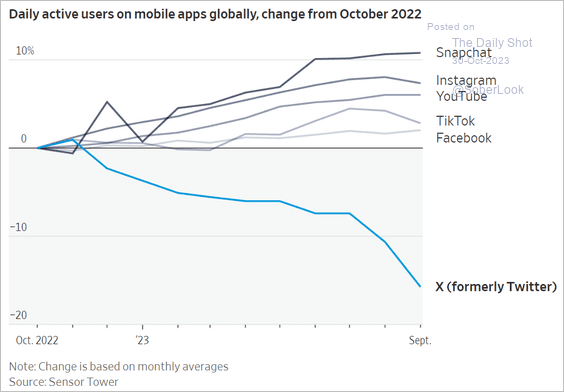

5. One-year changes in the number of daily active users on mobile apps:

Source: @WSJ Read full article

Source: @WSJ Read full article

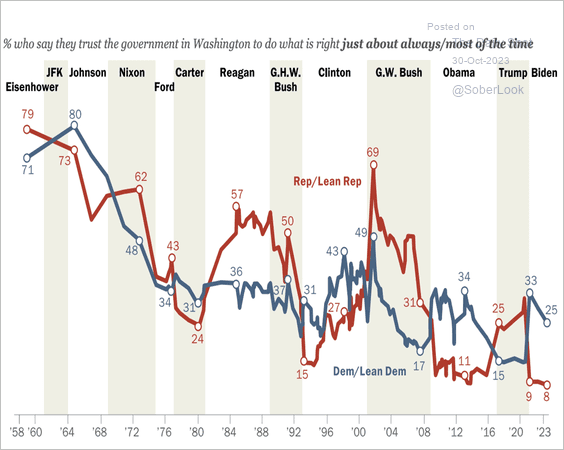

6. Trust in US federal government:

Source: Pew Research Center

Source: Pew Research Center

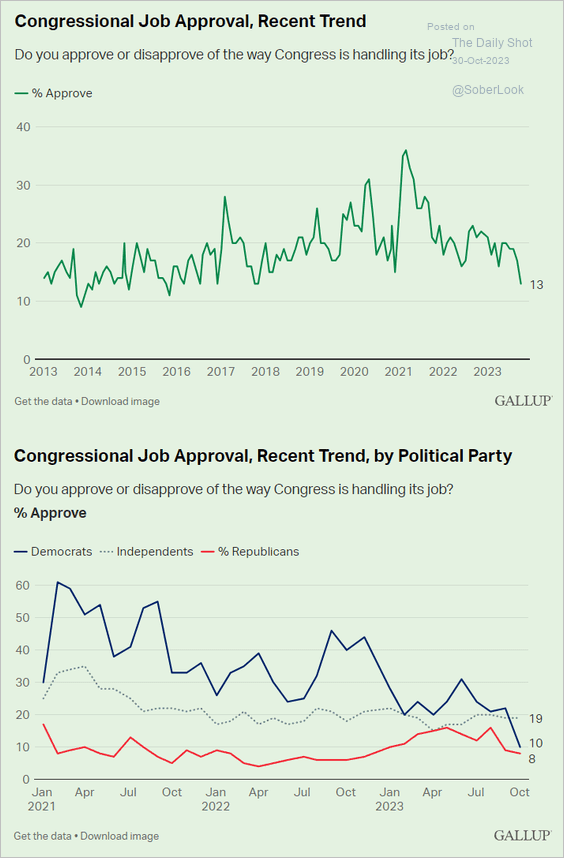

7. Congressional job approval:

Source: Gallup Read full article

Source: Gallup Read full article

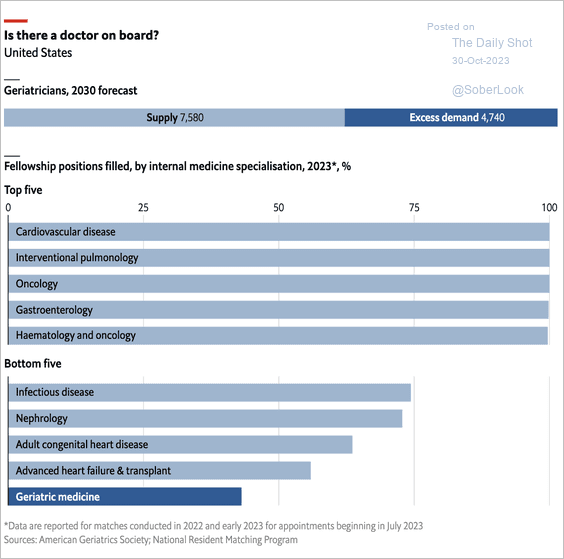

8. Where are all the geriatricians?

Source: The Economist Read full article

Source: The Economist Read full article

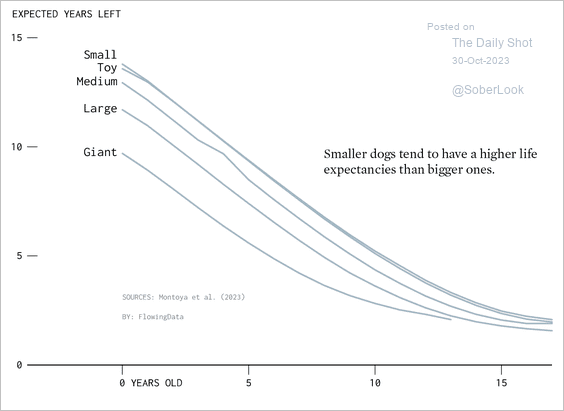

9. Life expectancy for dogs:

Source: FlowingData

Source: FlowingData

——————–

Back to Index