The Daily Shot: 31-Oct-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Food for Thought

The United States

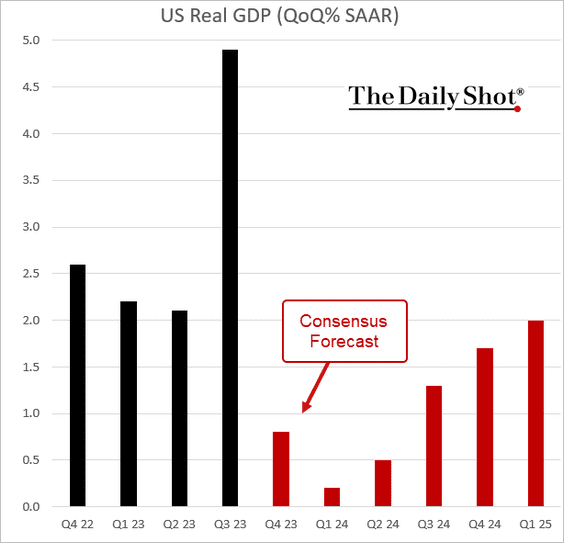

1. Forecasts indicate a significant economic slowdown following a robust quarter, and with bond yields hovering near multi-year highs, the Fed is likely on hold for the time being.

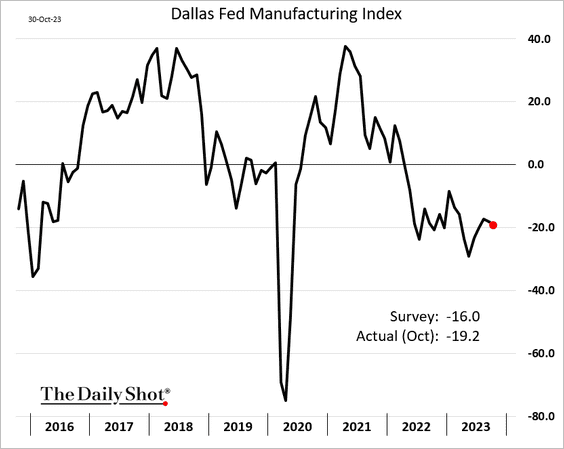

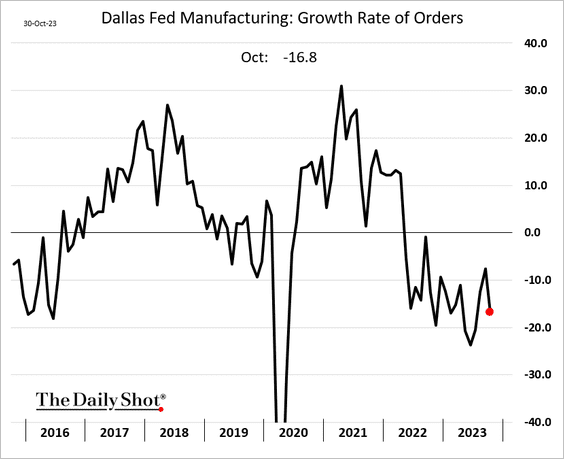

2. The Dallas Fed’s regional manufacturing report continues to show contracting factory activity.

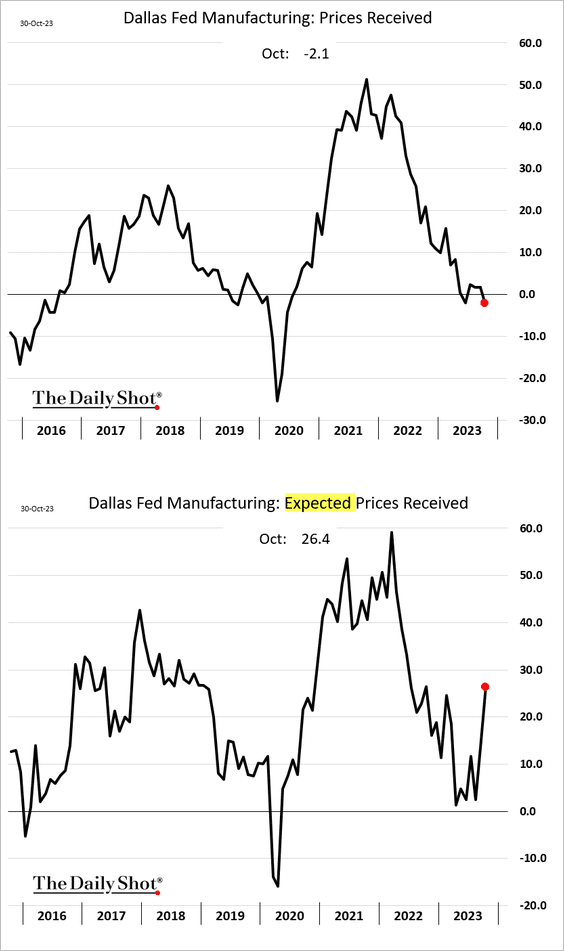

Factories have stopped raising prices for now but expect to boost them in the months ahead.

——————–

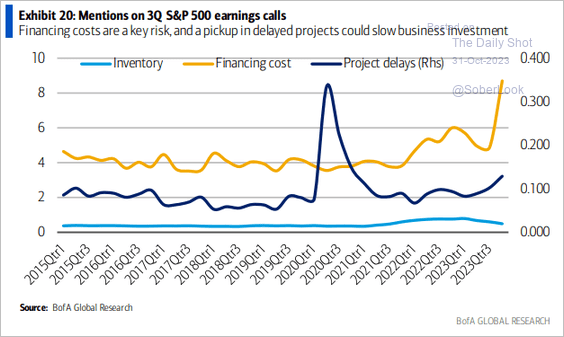

3. Companies are increasingly concerned about rising financing costs.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

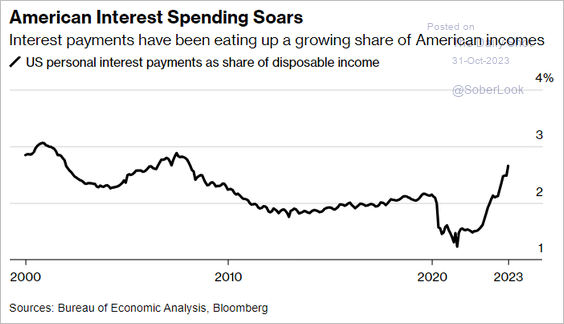

4. Households are also incurring significantly higher interest expenses.

Source: @economics Read full article

Source: @economics Read full article

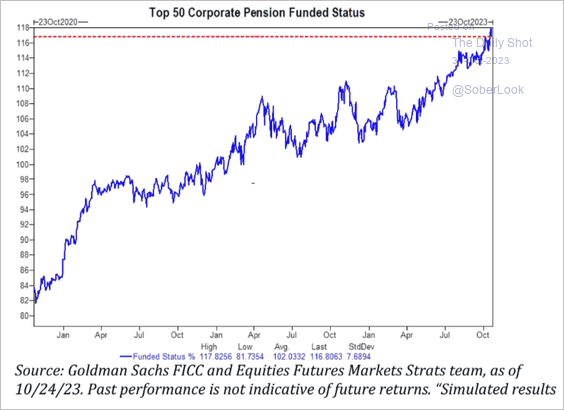

5. With heavily discounted liabilities resulting from elevated bond yields, corporate pension plans are now in a well-funded position.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

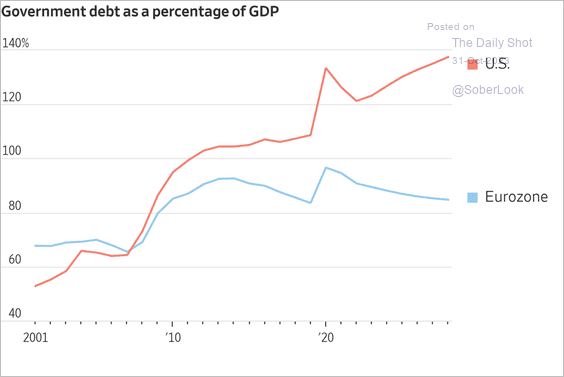

6. The US debt-to-GDP ratio continues to diverge from the Eurozone.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The United Kingdom

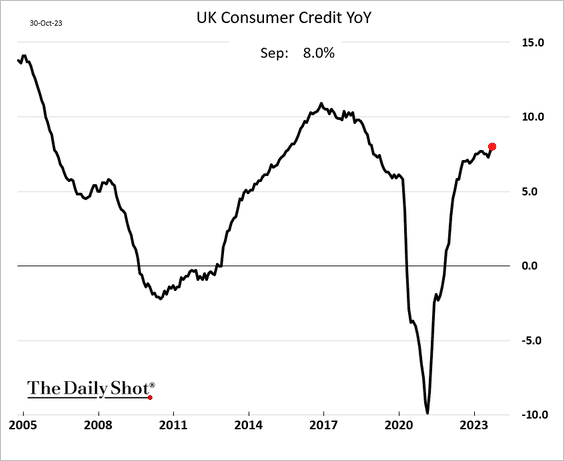

1. Growth in consumer credit has been robust, …

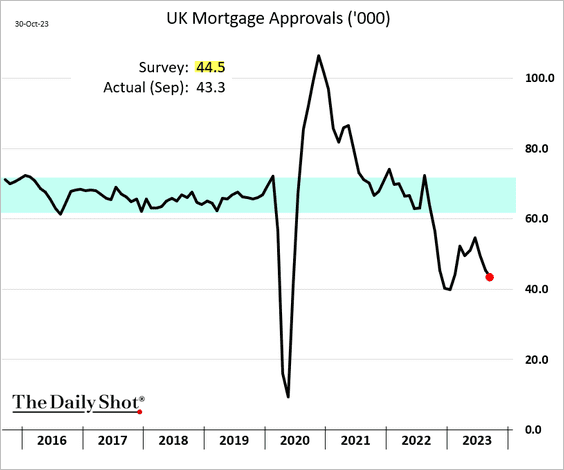

… but mortgage approvals continue to fall.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

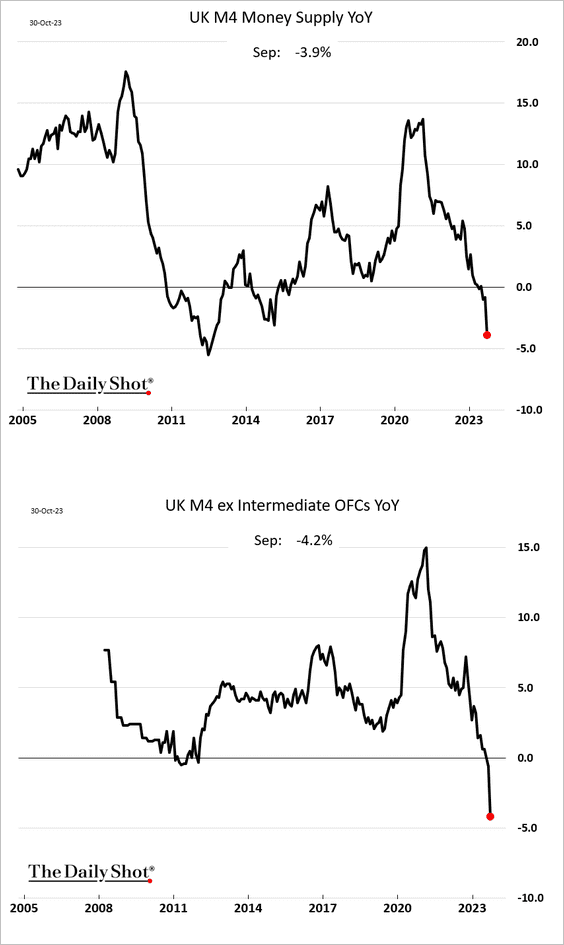

2. The broad money supply is down sharply on a year-over-year basis.

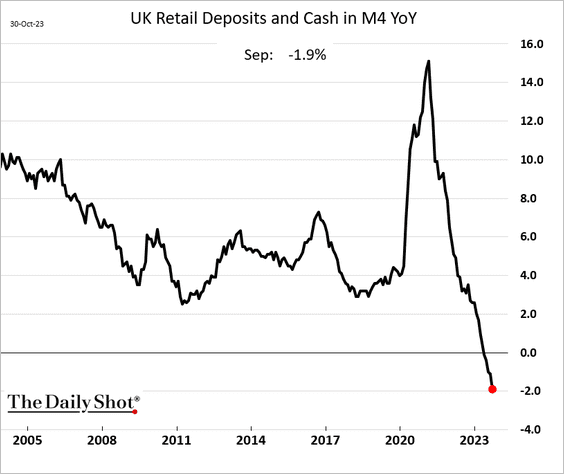

Retail deposits continue to sink.

——————–

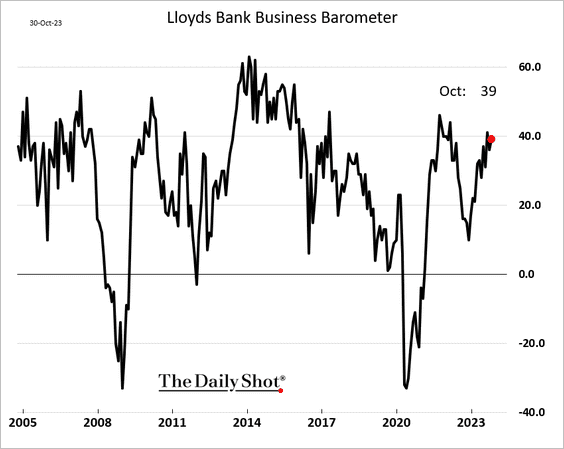

3. The Lloyds Bank business sentiment indicator remains robust.

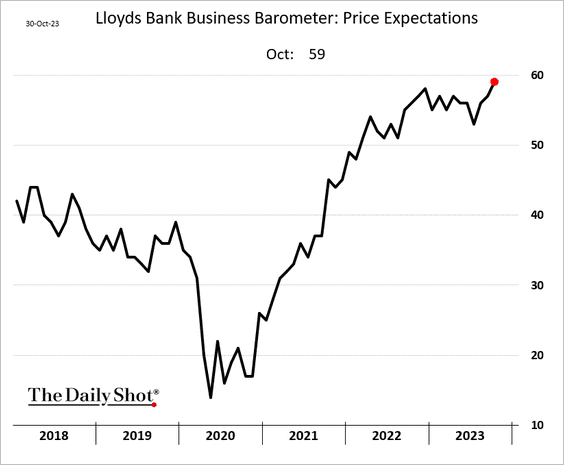

Companies increasingly see higher prices ahead.

——————–

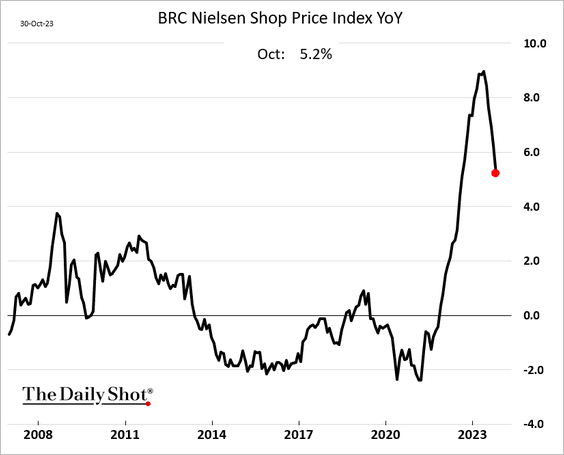

4. Shop price inflation continues to moderate.

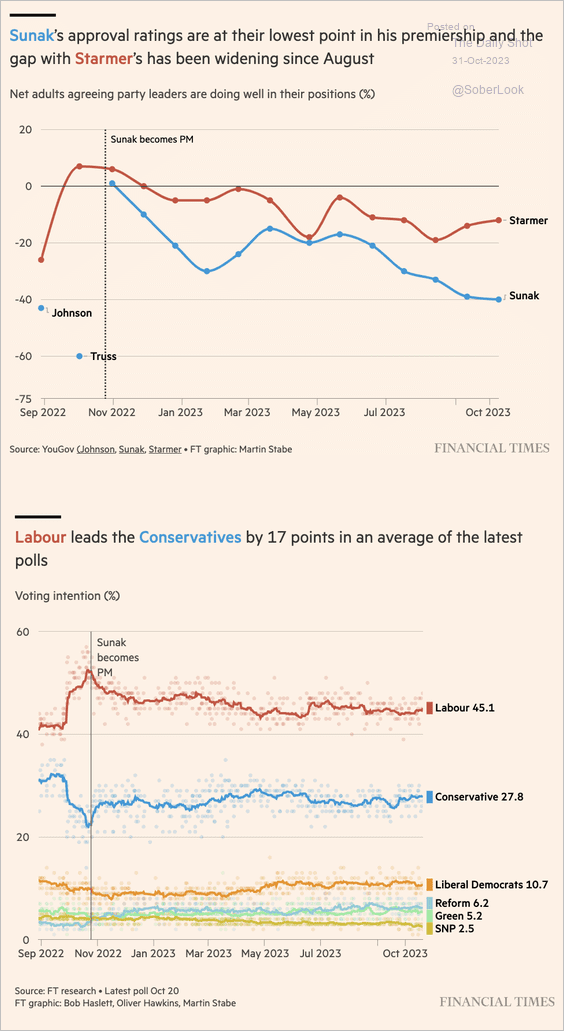

5. Here is a look at some political poll data.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

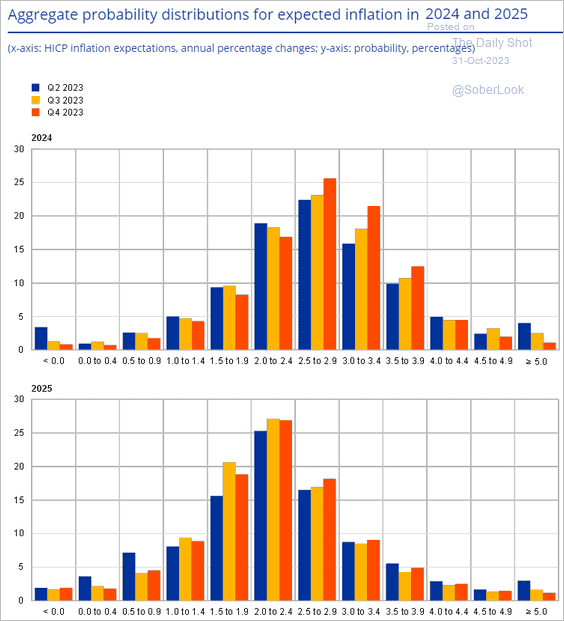

The Eurozone

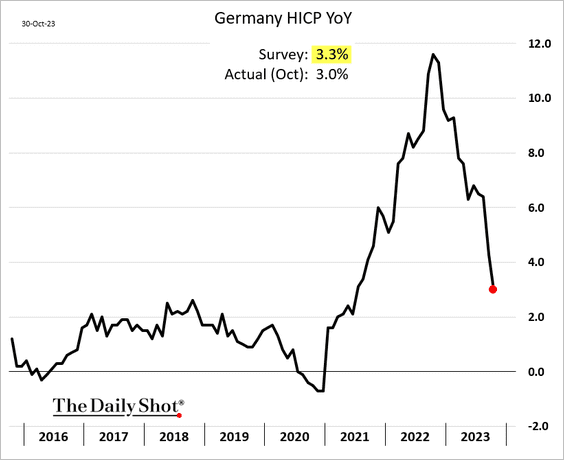

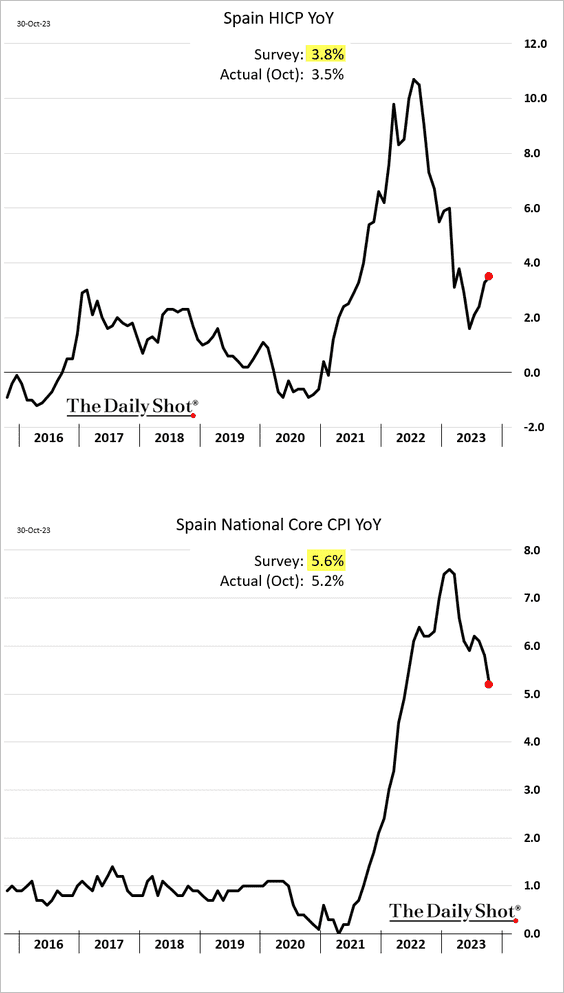

1. October inflation reports surprised to the downside.

• Germany:

Source: Reuters Read full article

Source: Reuters Read full article

• Spain:

Source: Reuters Read full article

Source: Reuters Read full article

Economists have been revising their inflation forecasts higher as oil prices climbed.

Source: ECB Read full article

Source: ECB Read full article

——————–

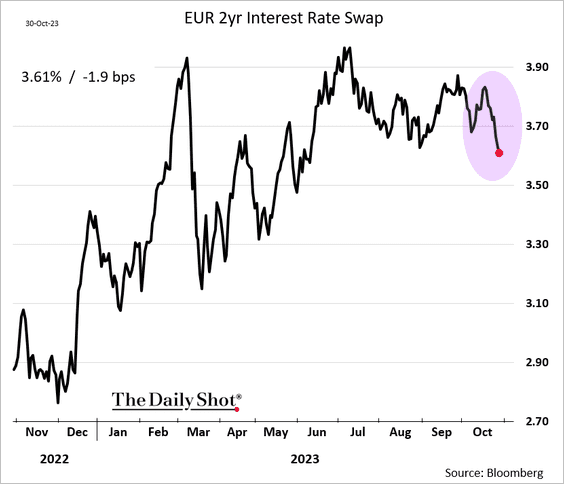

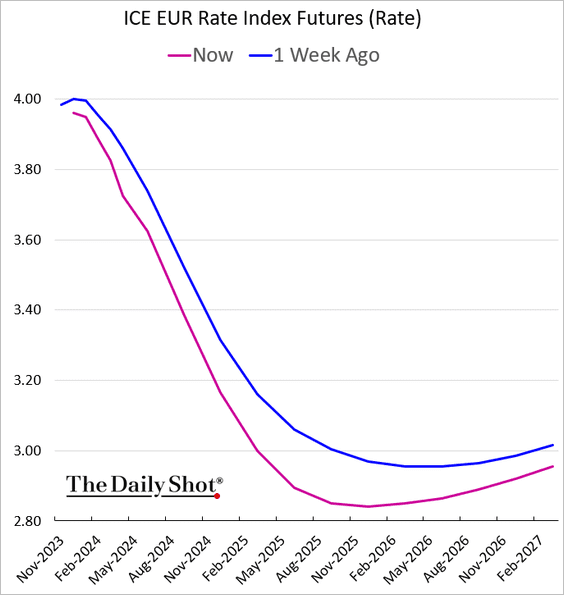

2. Short-term market rates have been moving lower, …

… as the market prices in deeper ECB rate cuts ahead.

——————–

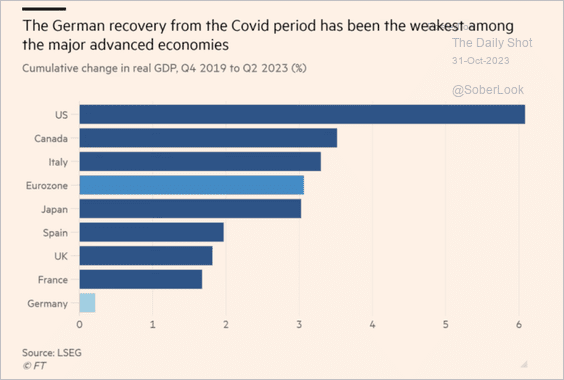

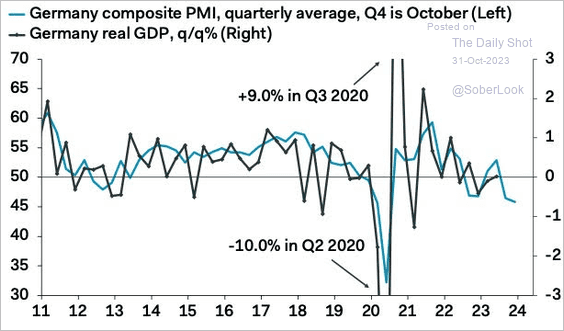

3. Germany’s COVID-era economic performance has been lackluster.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

And the PMI data point to a recession ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

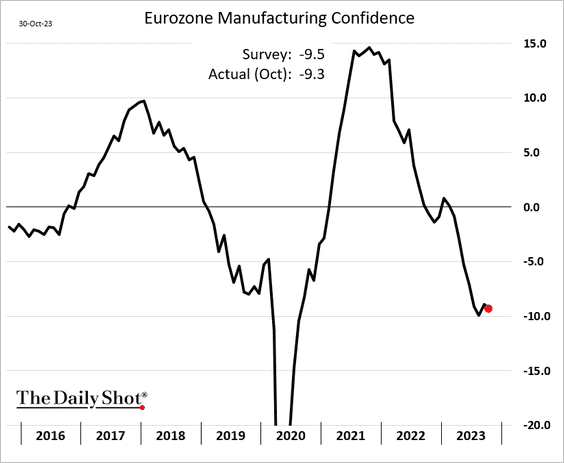

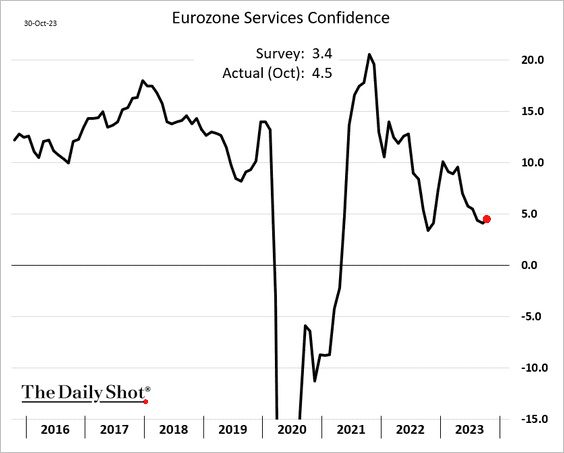

4. Euro-area business sentiment has been relatively stable over the past three months.

• Manufacturing:

• Services:

——————–

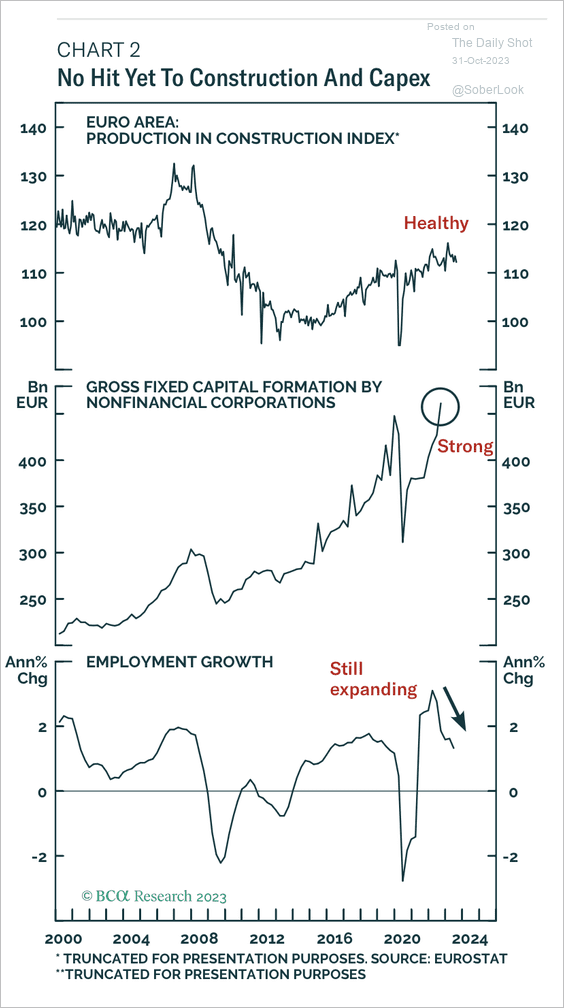

5. Euro-area construction growth and capex remain healthy, although employment growth has slowed.

Source: BCA Research

Source: BCA Research

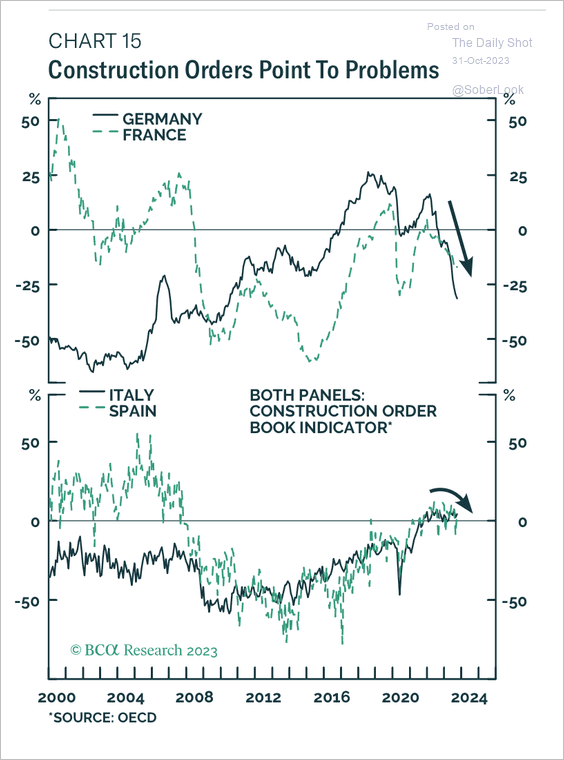

However, construction orders in Germany and France have weakened sharply.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

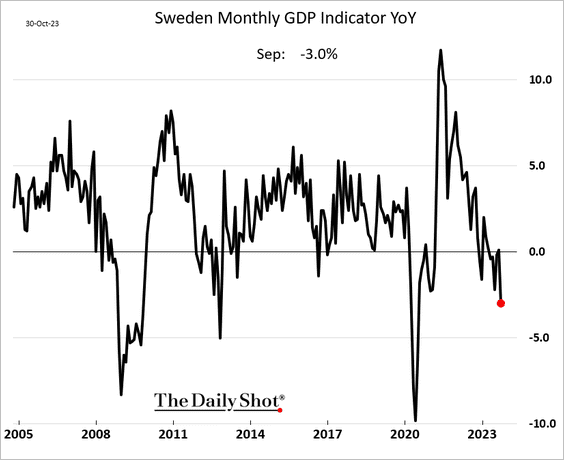

1. Sweden’s GDP stagnated last quarter and is down on a year-over-year basis.

Source: @economics Read full article

Source: @economics Read full article

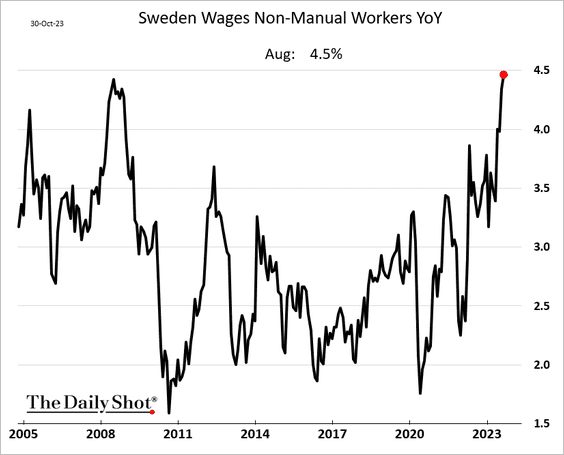

Wage growth continues to surge.

——————–

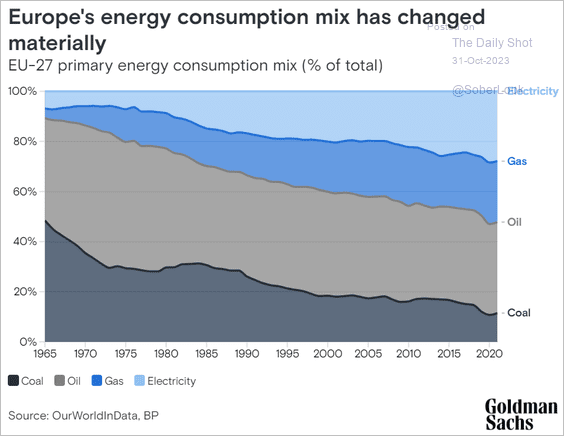

2. Here is a look at energy consumption in the EU.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Japan

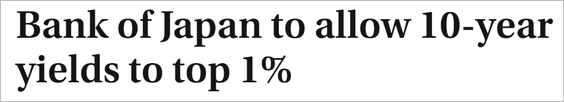

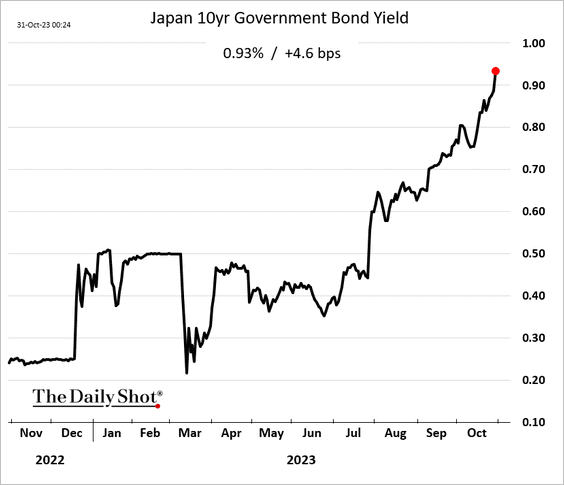

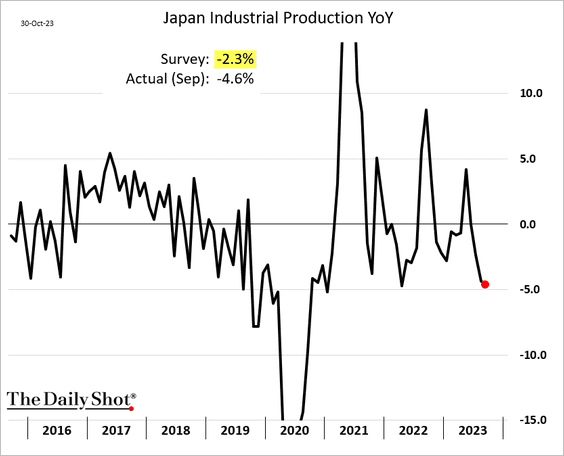

1. The BoJ will allow the 10-year JGB yield to rise further.

Source: Japan Times Read full article

Source: Japan Times Read full article

Bonds sold off on the news, …

… but long-dated yields have been relatively steady.

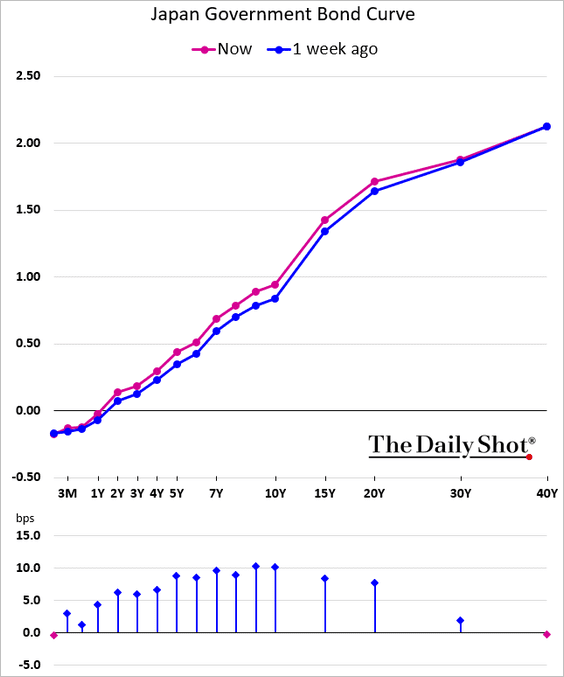

• Despite the BoJ’s slightly hawkish policy tweak, the yen sold off, with dollar-yen trading above 150.

Source: @economics Read full article

Source: @economics Read full article

——————–

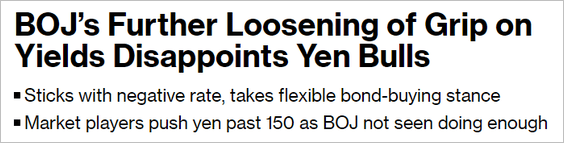

2. The central bank boosted its inflation forecasts and lowered growth expectations.

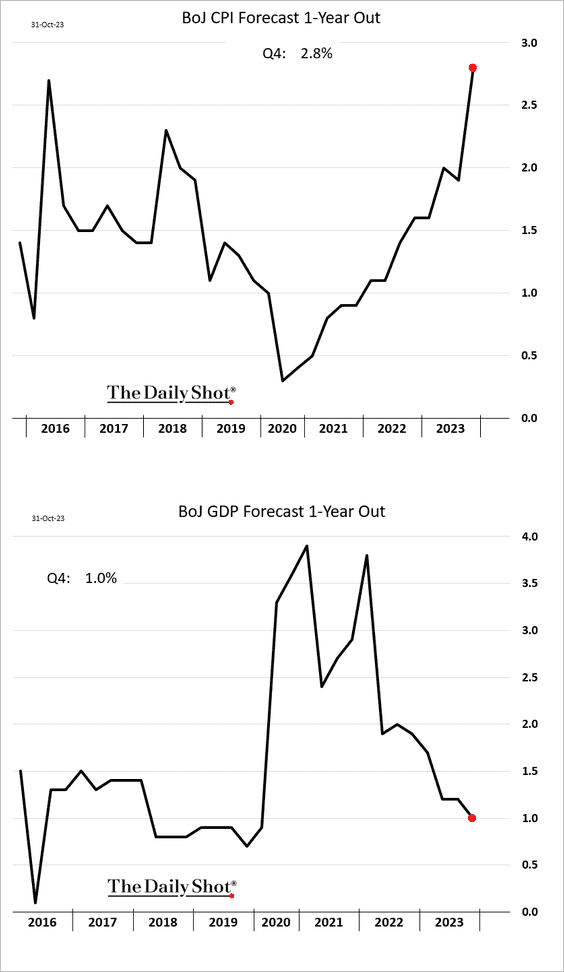

• Market-based inflation expectations have risen significantly over the past two years.

Source: BCA Research

Source: BCA Research

——————–

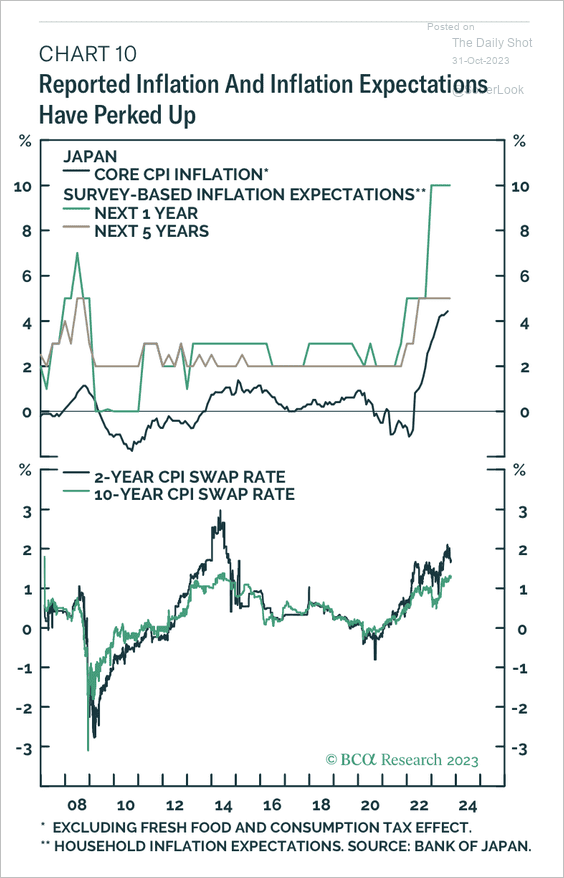

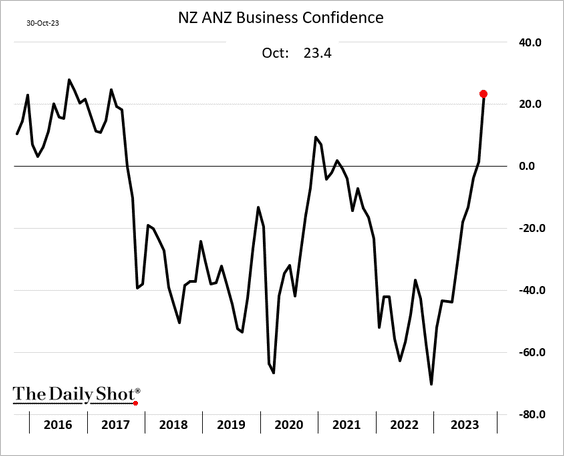

3. Industrial production fell short of expectations in September.

Source: Japan Times Read full article

Source: Japan Times Read full article

——————–

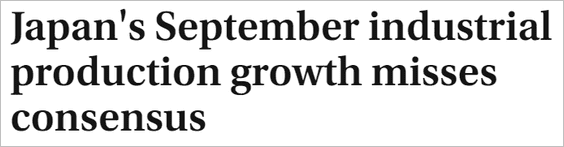

4. The unemployment rate ticked lower last month.

Back to Index

Asia-Pacific

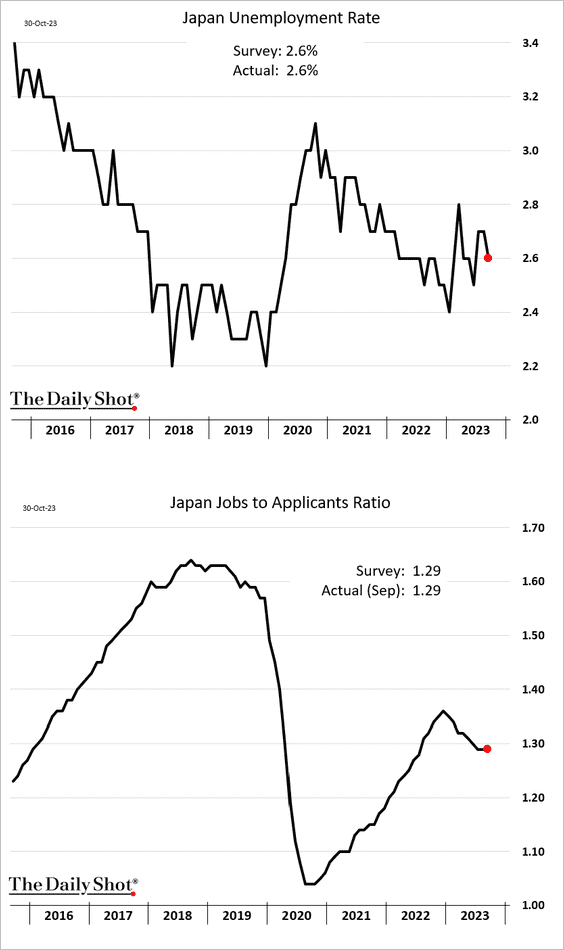

1. South Korea’s industrial production surprised to the upside.

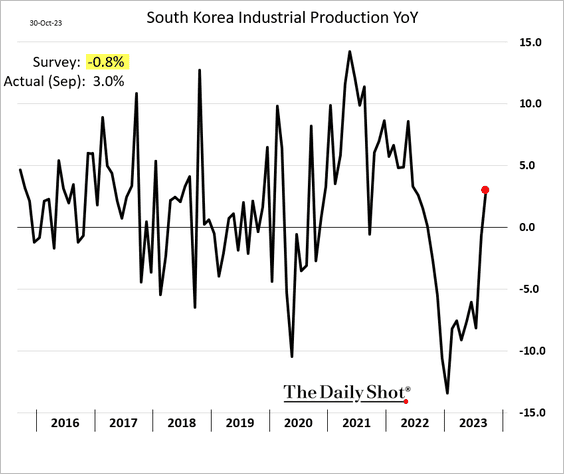

2. New Zealand’s business confidence has been rebounding.

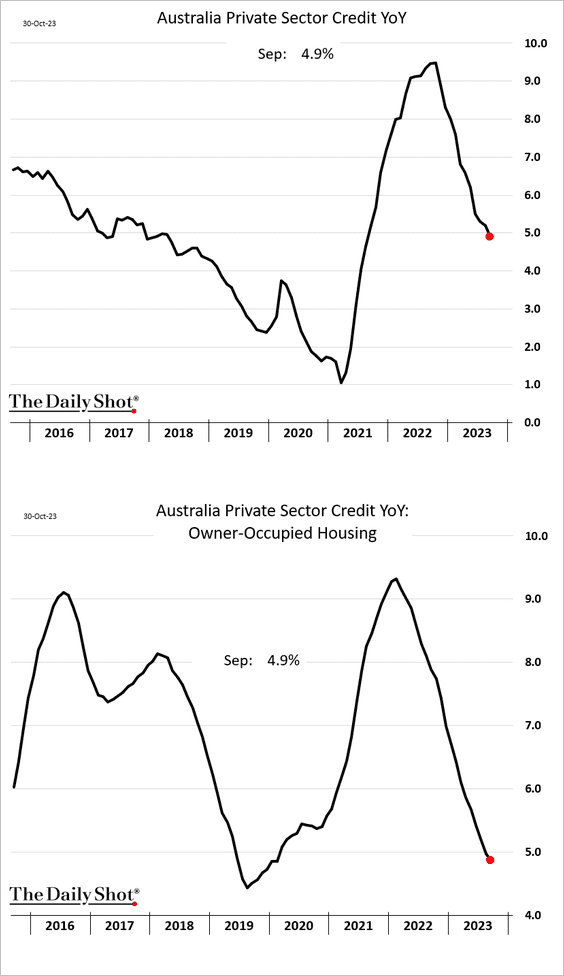

3. Australian private sector credit growth continues to slow.

Back to Index

China

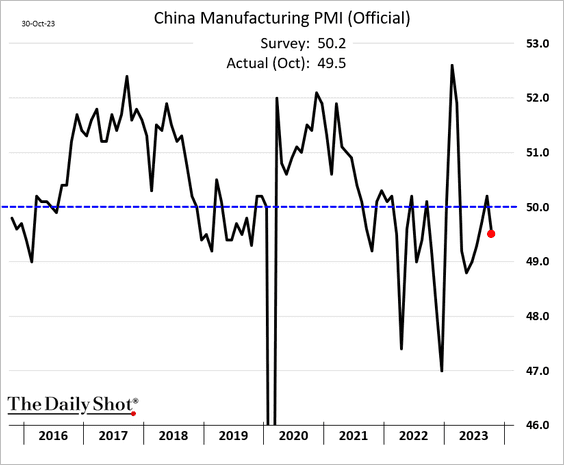

1. The official manufacturing PMI unexpectedly entered contraction territory in October.

Source: @economics Read full article

Source: @economics Read full article

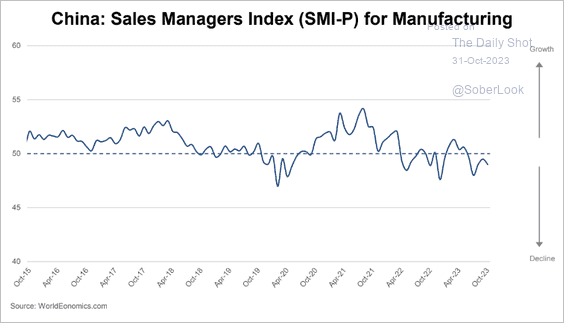

The World Economics manufacturing SMI also shows declining activity this month.

Source: World Economics

Source: World Economics

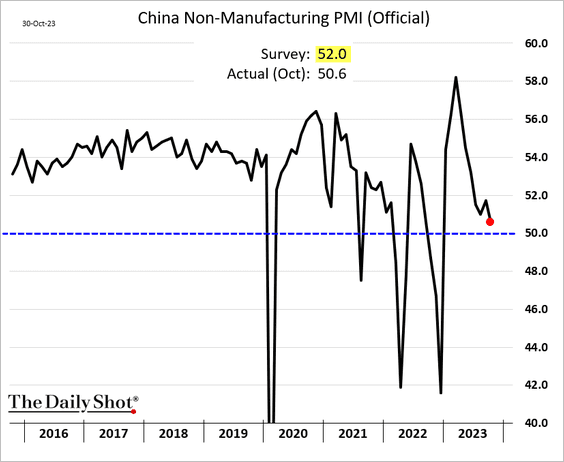

• The non-manufacturing PMI, encompassing services and construction, signals stalling growth.

——————–

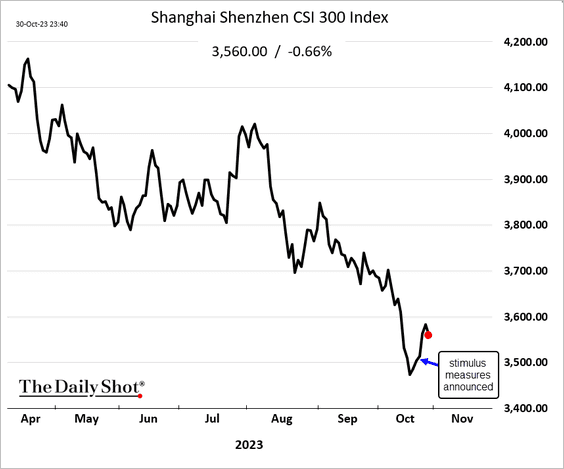

2. A sustained stock market rebound remains elusive …

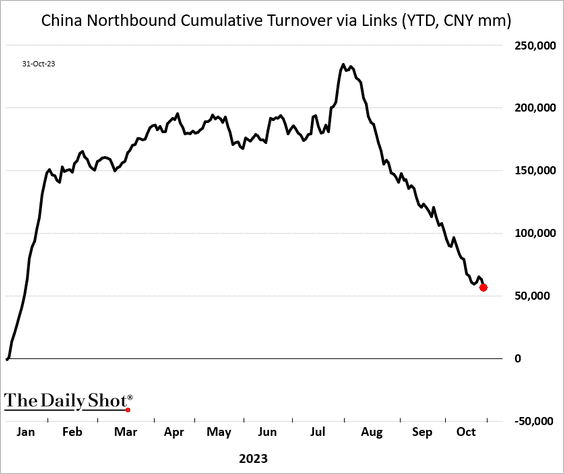

… as foreign investors pull more capital out of mainland markets.

Back to Index

Emerging Markets

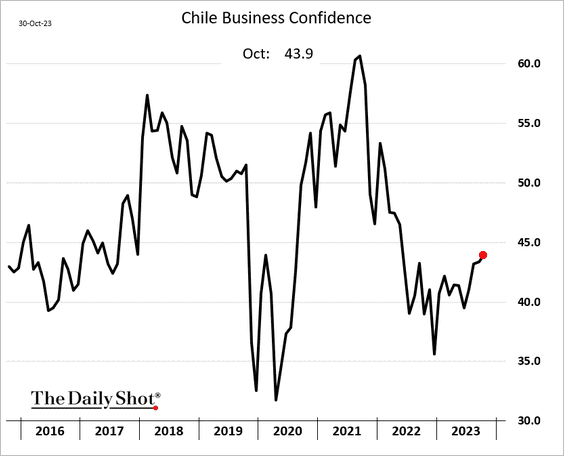

1. Chile’s business confidence is improving.

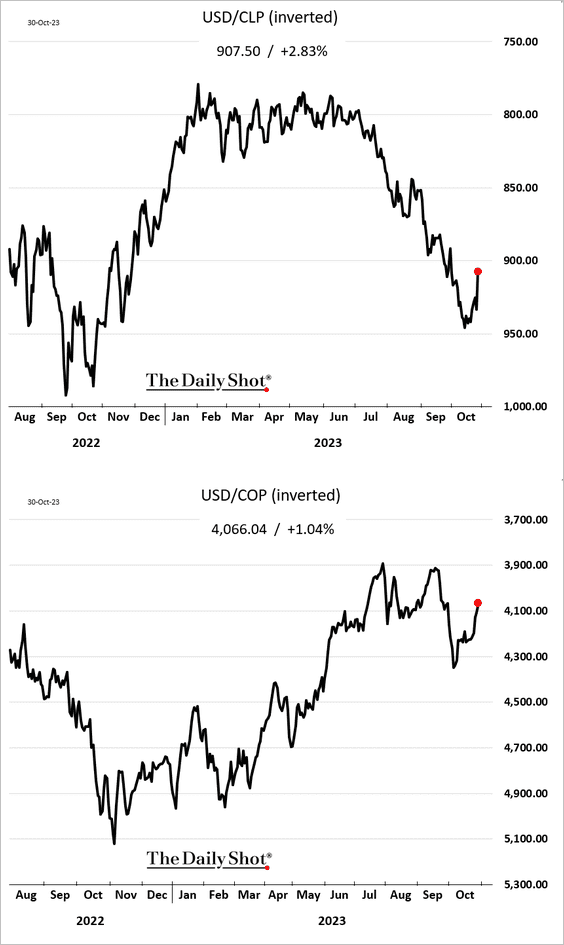

2. The Chilean peso and the Colombian peso have been rebounding.

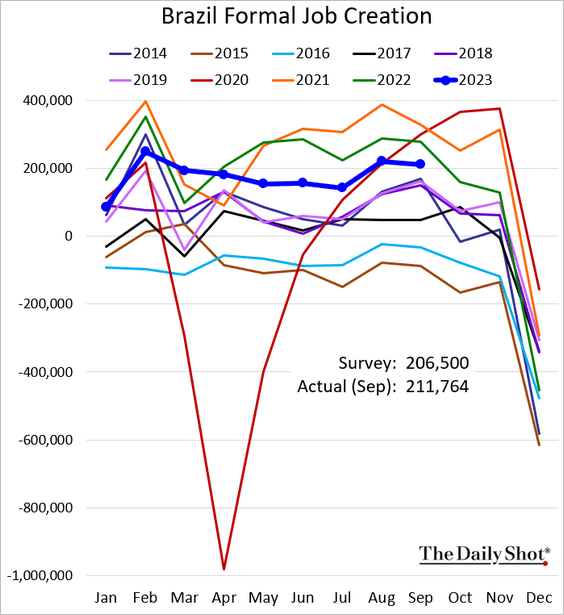

3. Brazil’s formal job creation topped forecasts in September.

——————–

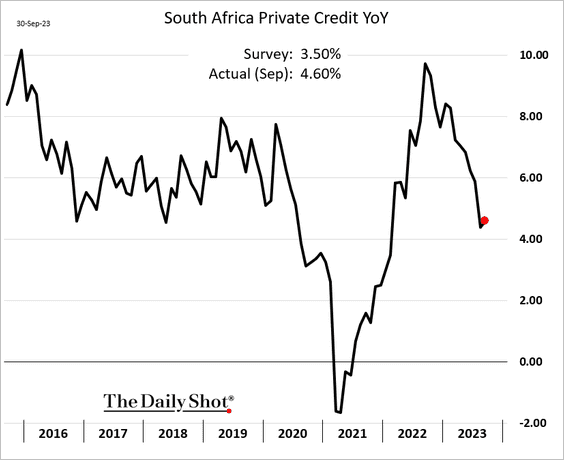

4. South Africa’s private credit growth has stabilized.

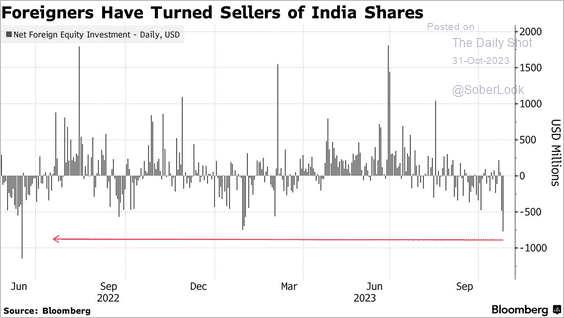

5. Foreigners have been selling Indian stocks.

Source: @markets Read full article

Source: @markets Read full article

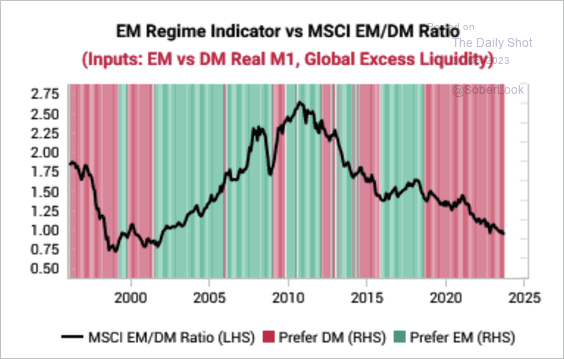

6. Global excess liquidity remains weak, which is a headwind for EM equities relative to developed markets.

Source: Variant Perception

Source: Variant Perception

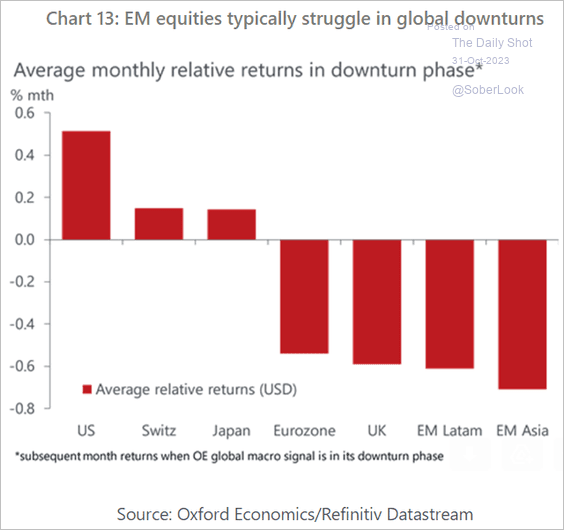

7. EM equities tend to underperform in an economic downturn.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

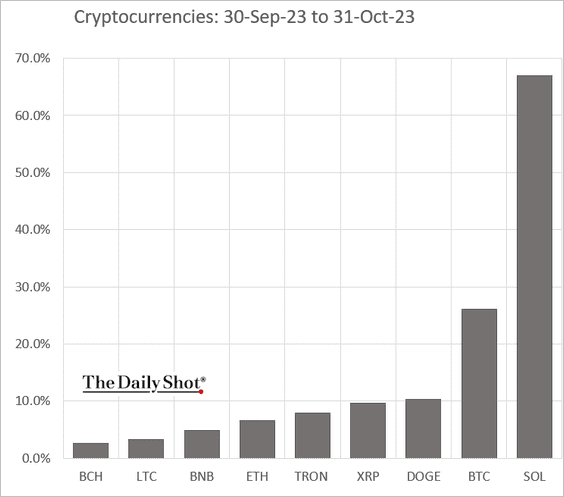

1. Let’s start with the month-to-date performance for some of the most liquid cryptos.

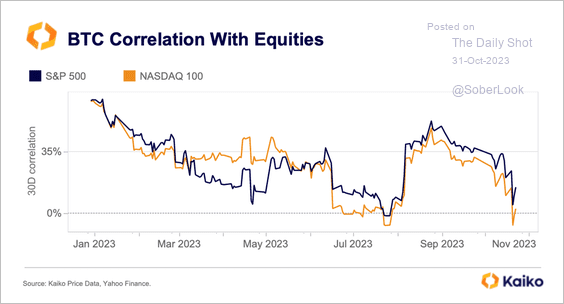

2. Bitcoin’s correlation with equities dipped negative for the first time since July.

Source: @KaikoData

Source: @KaikoData

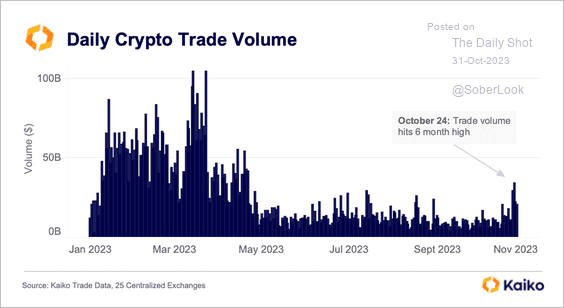

3. The recent crypto rally occurred alongside an uptick in trading volume.

Source: @KaikoData

Source: @KaikoData

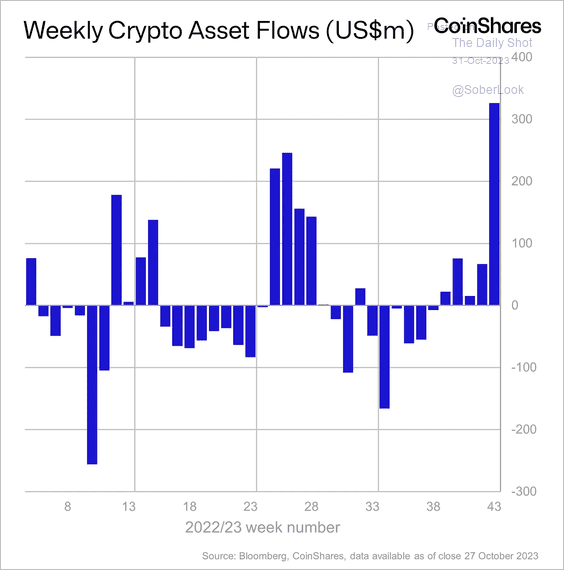

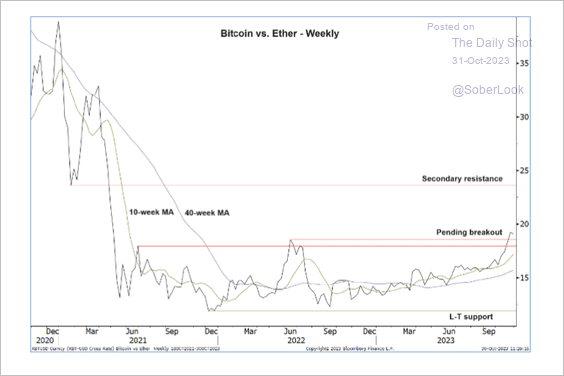

4. Crypto funds saw the largest single week of inflows since July 2022.

Source: CoinShares Read full article

Source: CoinShares Read full article

• Long-bitcoin funds accounted for roughly 90% of inflows last week, although investors continued to exit Ethereum and multi-asset funds. Short-bitcoin funds also saw inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

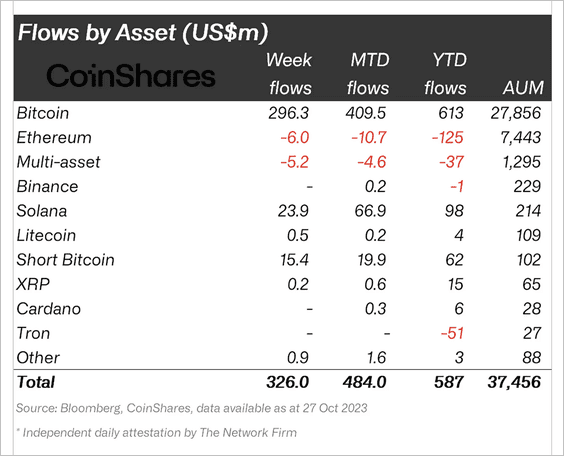

5. The BTC/ETH price ratio is breaking above its two-year long range.

Source: @StocktonKatie

Source: @StocktonKatie

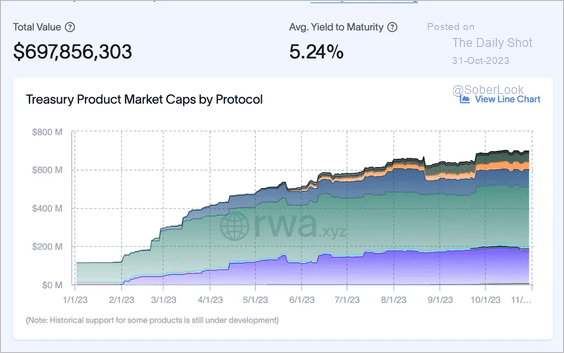

6. Tokenized versions of Treasury grew nearly seven-fold this year.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

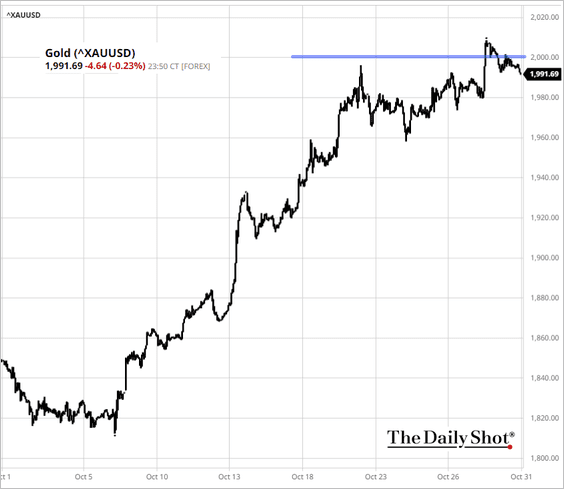

1. Gold briefly surpassed the $2,000 mark.

Source: barchart.com

Source: barchart.com

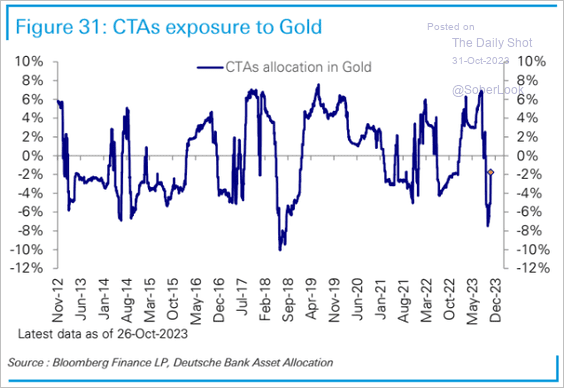

• When it comes to gold, CTAs have a case of FOMO.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

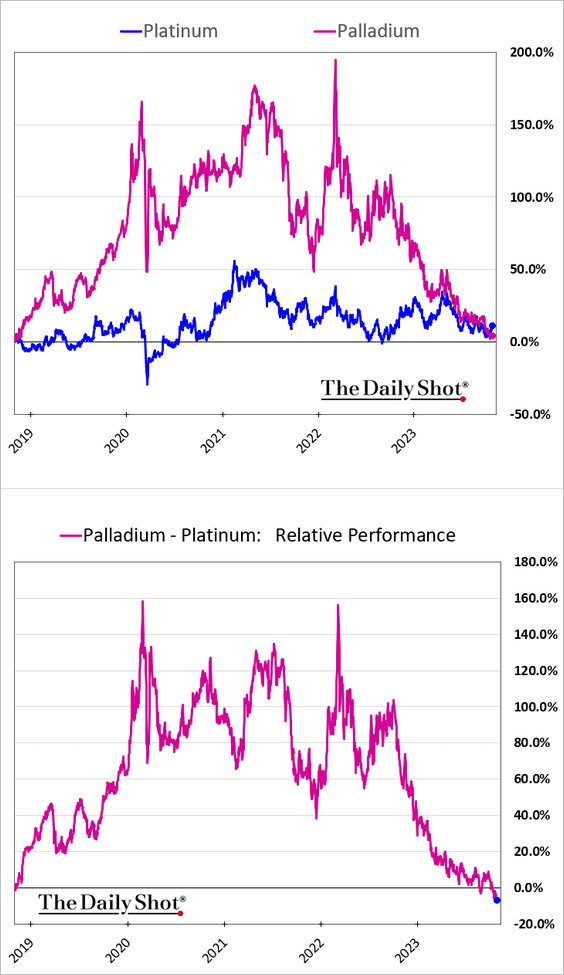

2. Palladium has given up all of its outperformance versus platinum over the past five years.

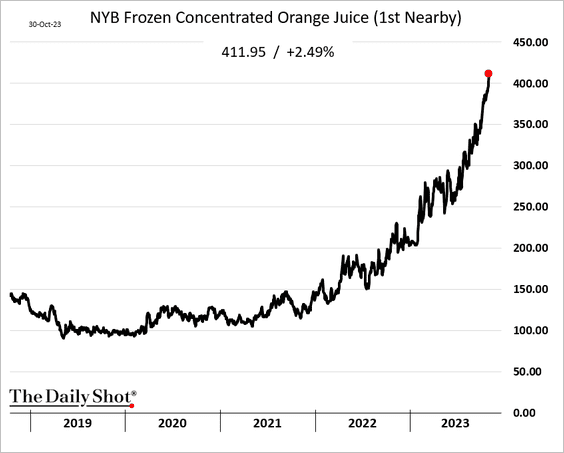

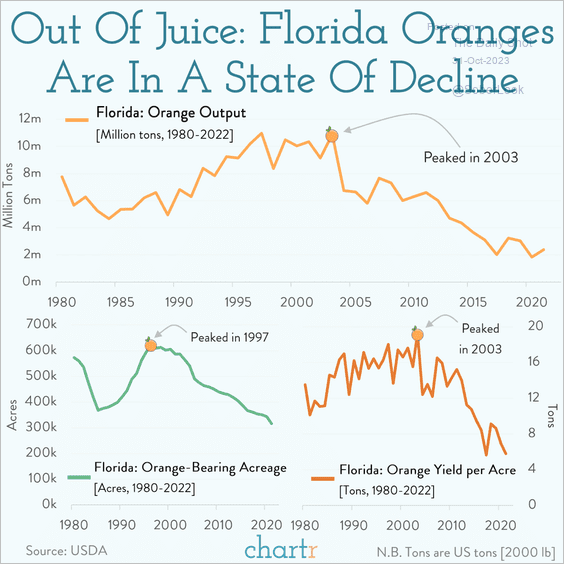

3. US orange juice futures climbed above $400 for the first time.

This chart illustrates why.

Source: @chartrdaily

Source: @chartrdaily

Back to Index

Equities

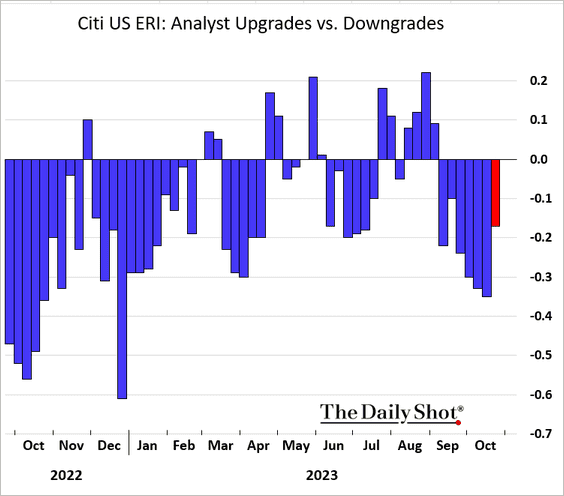

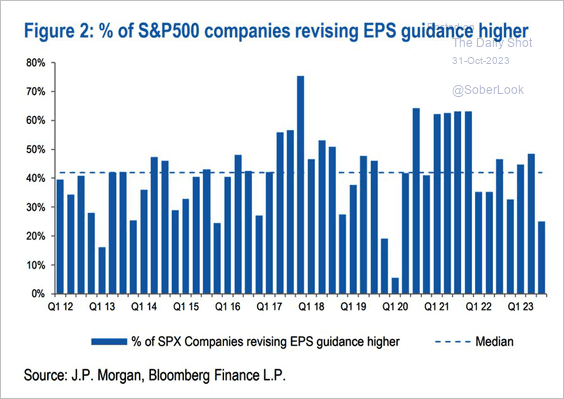

1. Analysts’ earnings downgrades have exceeded upgrades for seven weeks in a row.

And corporate guidance has been weak.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

——————–

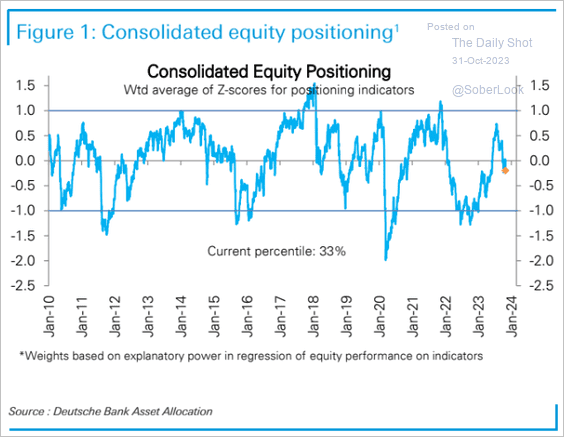

2. Deutsche Bank’s positioning indicator is back in underweight territory.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

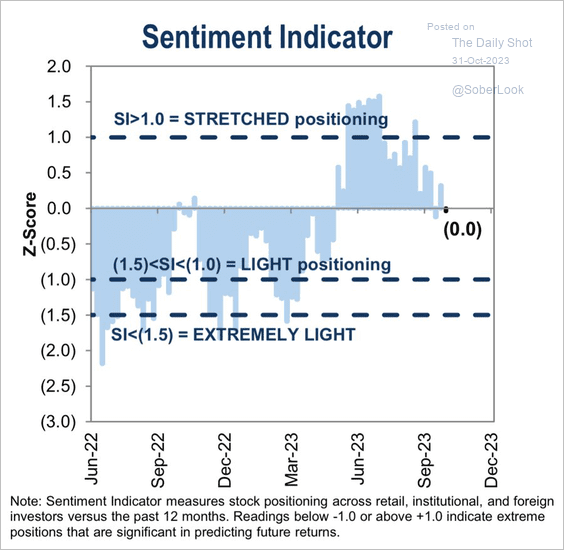

• Here is Goldman’s sentiment indicator.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

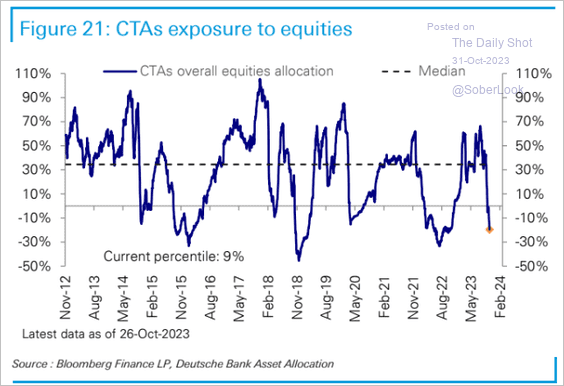

• CTAs are increasingly betting against stocks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

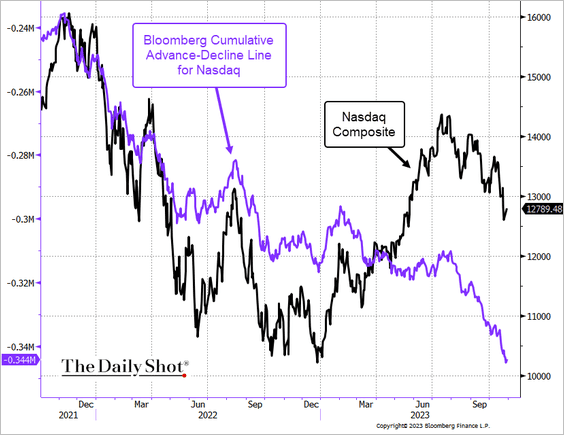

3. The Nasdaq Composite breadth continues to deteriorate.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

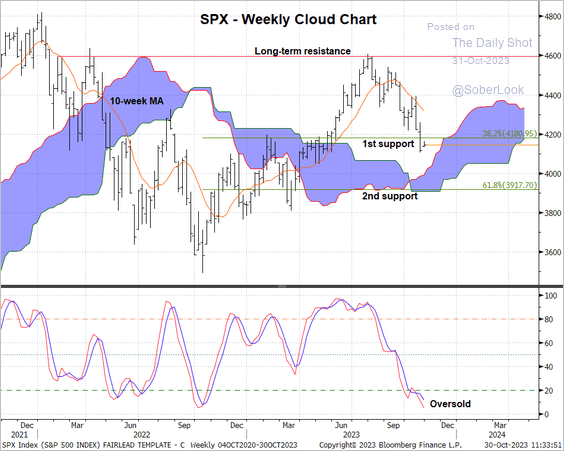

4. Technicals suggest the S&P 500 is oversold and near initial support.

Source: @StocktonKatie

Source: @StocktonKatie

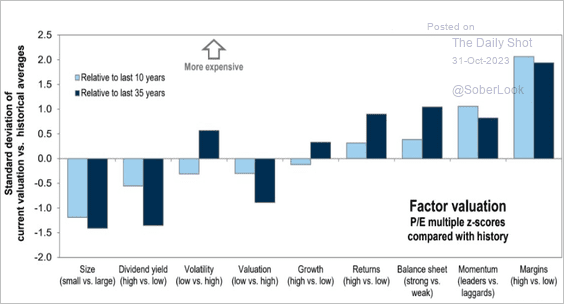

5. Here is a look at equity factor valuations relative to historical averages.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

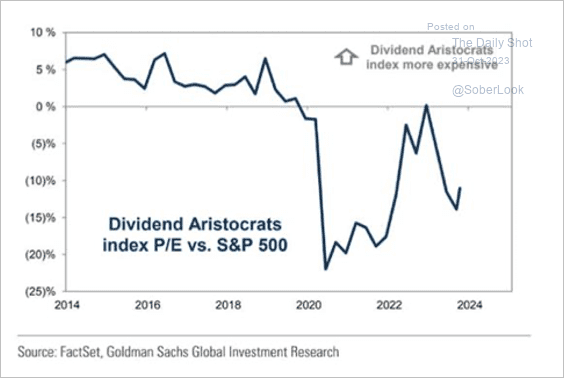

• Dividend stocks are trading at a wide discount relative to the S&P 500.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

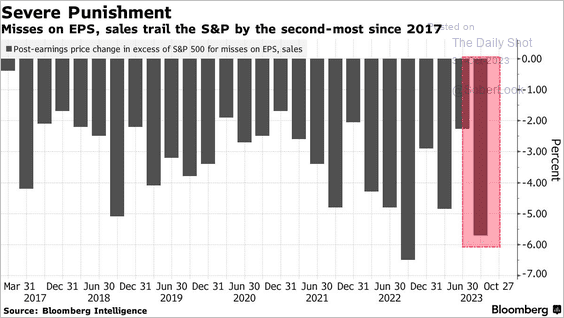

6. Companies have felt the pinch of earnings misses.

Source: @markets Read full article

Source: @markets Read full article

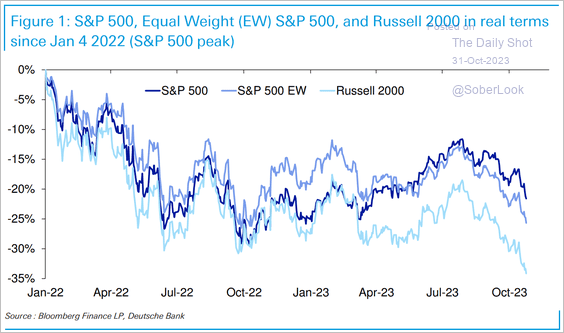

7. The S&P 500 is still down about 20% from its highs in real terms, while equal-weight and small-cap indices continue to lag.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

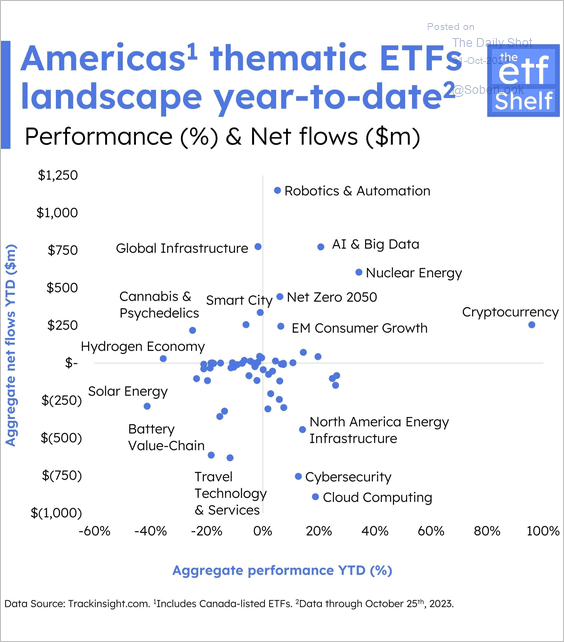

8. This chart shows the aggregate performance and flows of North American thematic ETFs this year.

Source: The ETF Shelf

Source: The ETF Shelf

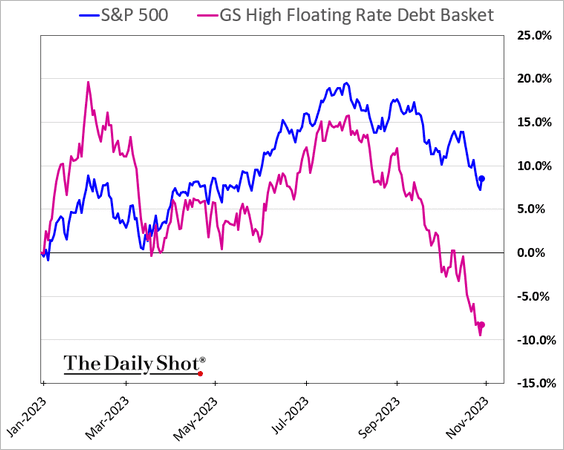

9. Companies with significant floating-rate debt have been widening their underperformance. These tend to be businesses that rely on leveraged loans for funding.

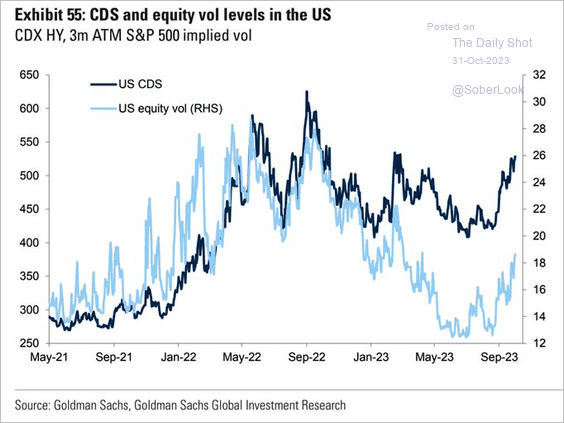

10. Credit spreads suggest that implied volatility could be higher.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

Back to Index

Credit

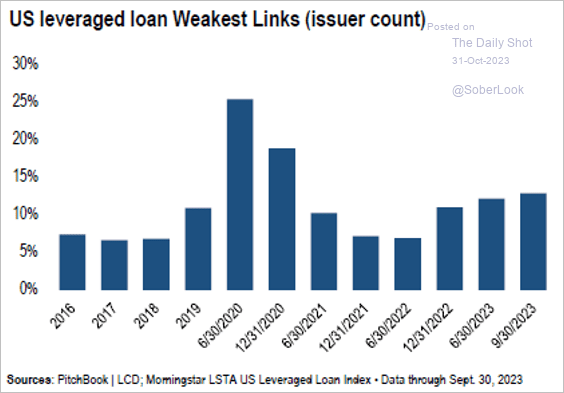

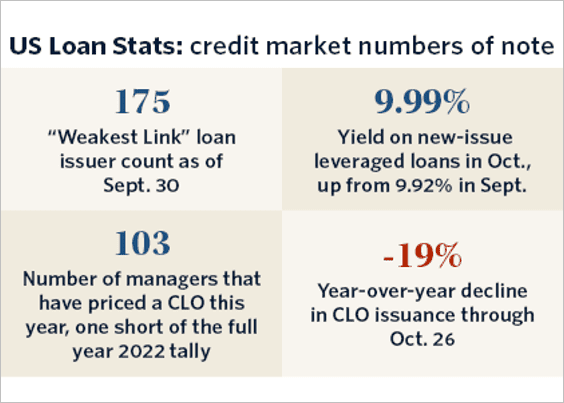

1. The ranks of US leveraged loan “weakest links” – low-rated loan issuers on negative watch from S&P – jumped about 50% over the past year.

Source: PitchBook

Source: PitchBook

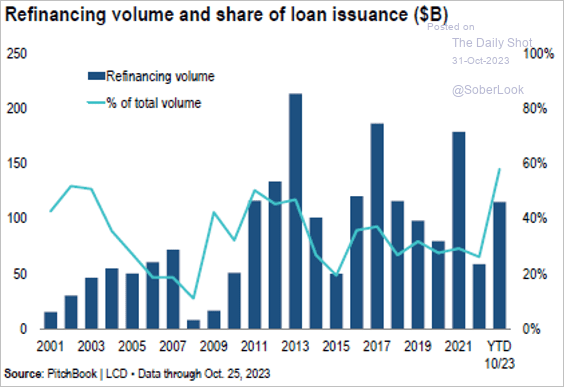

• So far this year, refinancing has accounted for 60% of the US leveraged loan market as borrowers look to address maturities and take advantage of narrowing loan spreads, according to PitchBook.

Source: PitchBook

Source: PitchBook

2. Below are some stats on the US credit market.

Source: PitchBook

Source: PitchBook

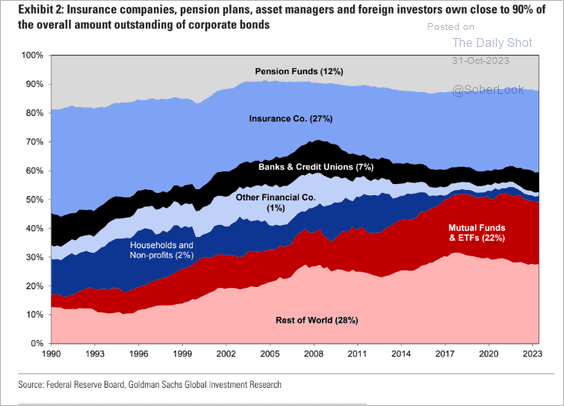

3. Who owns corporate bonds?

Source: Goldman Sachs; @MikeZaccardi, @awealthofcs

Source: Goldman Sachs; @MikeZaccardi, @awealthofcs

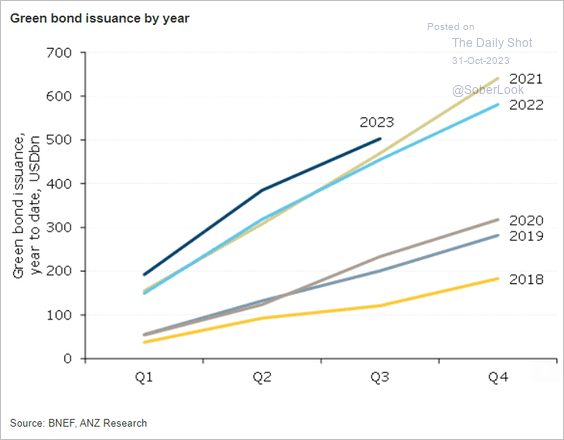

4. Here is a look at green bond issuance.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

Food for Thought

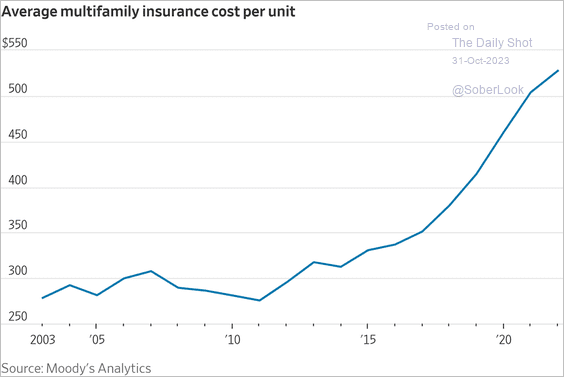

1. Apartment insurance costs:

Source: @WSJ Read full article

Source: @WSJ Read full article

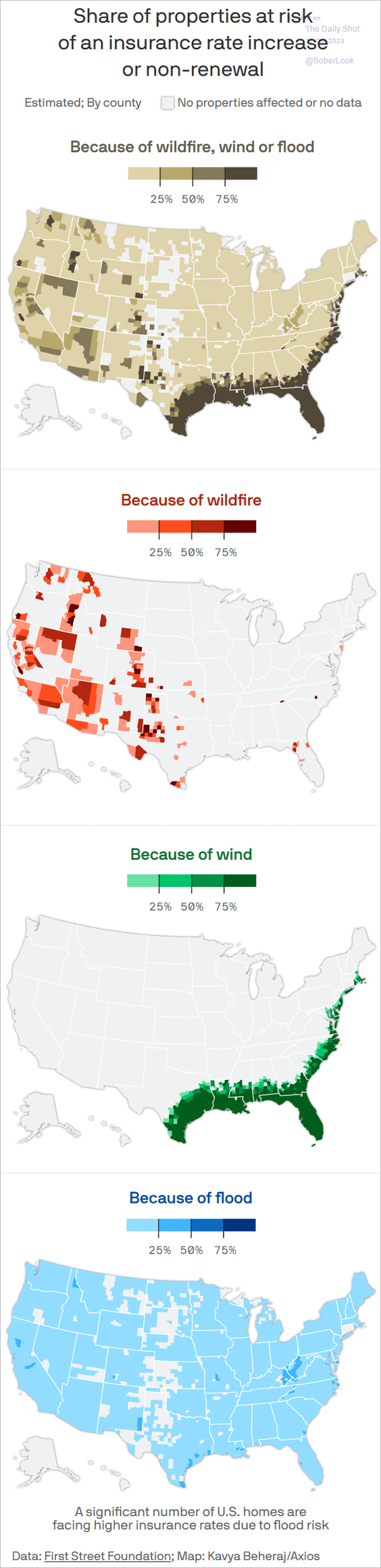

2. Surging insurance rates across the country due to extreme weather:

Source: @axios Read full article

Source: @axios Read full article

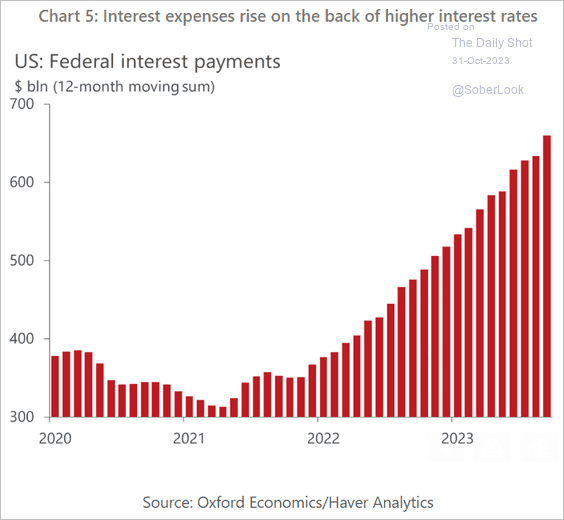

3. US federal interest payments:

Source: Oxford Economics

Source: Oxford Economics

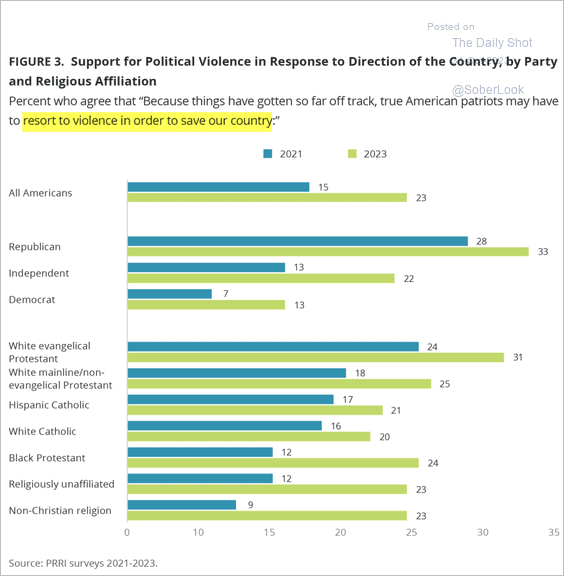

4. Increasing support for political violence in the US:

Source: PRRI

Source: PRRI

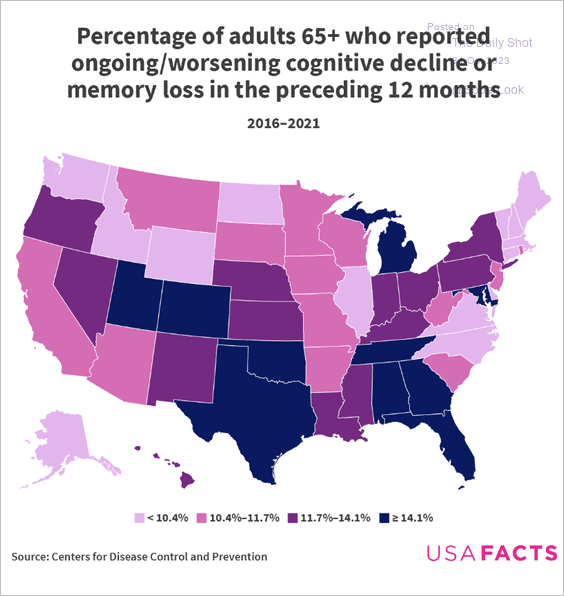

5. The prevalence of Alzheimer’s disease:

Source: USAFacts

Source: USAFacts

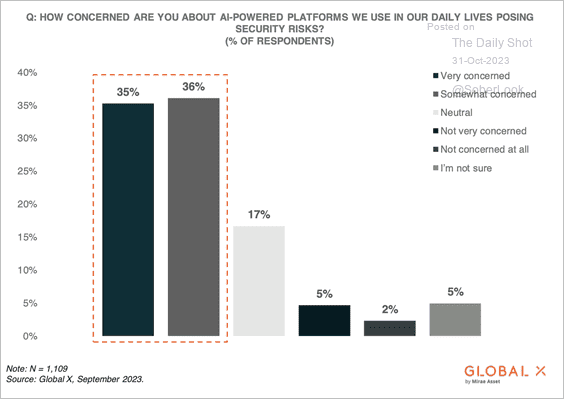

6. Most consumers are concerned about the security risks from AI-powered platforms.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

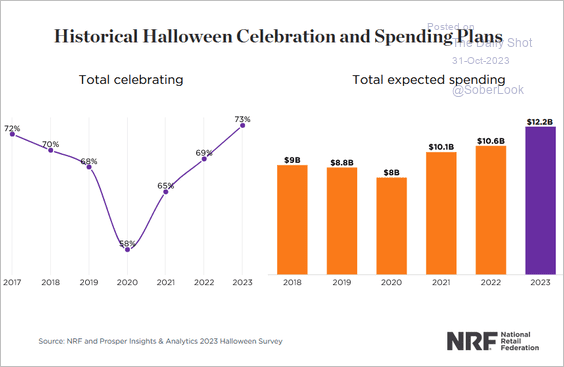

7. Halloween celebration and spending:

Source: National Retail Federation

Source: National Retail Federation

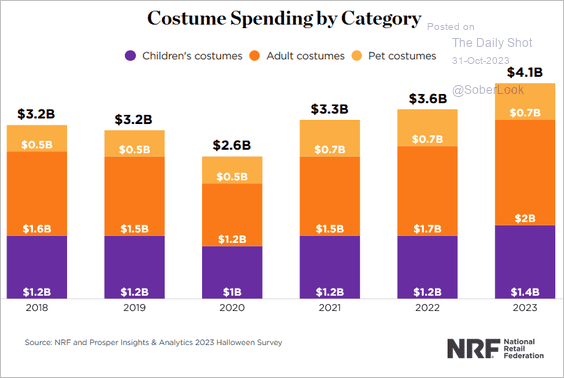

• Halloween costume spending by category:

Source: National Retail Federation

Source: National Retail Federation

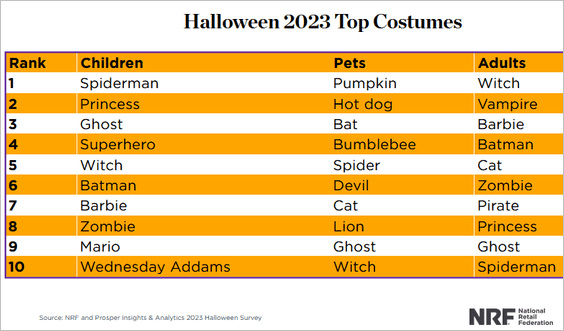

• Halloween top costumes in 2023:

Source: National Retail Federation

Source: National Retail Federation

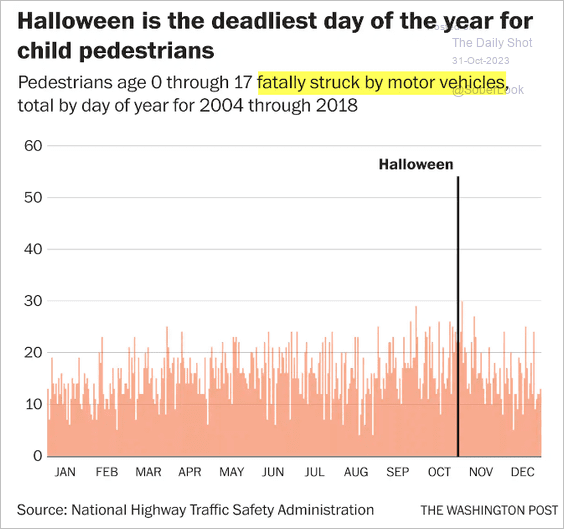

• Please be careful driving today.

Source: The Washington Post Read full article

Source: The Washington Post Read full article

——————–

Back to Index