The Daily Shot: 01-Nov-23

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

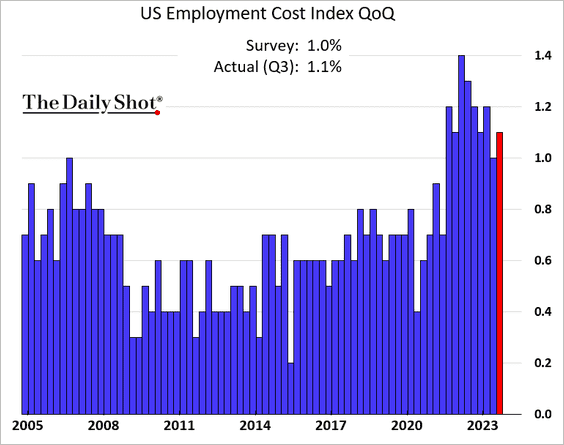

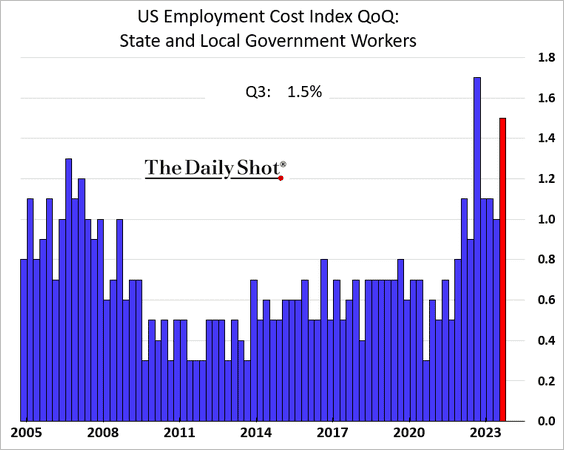

1. Robust growth in labor costs persists, illustrated by last quarter’s increases in the Employment Cost Index.

• Stronger Q3 gains were in part due to higher pay for teachers.

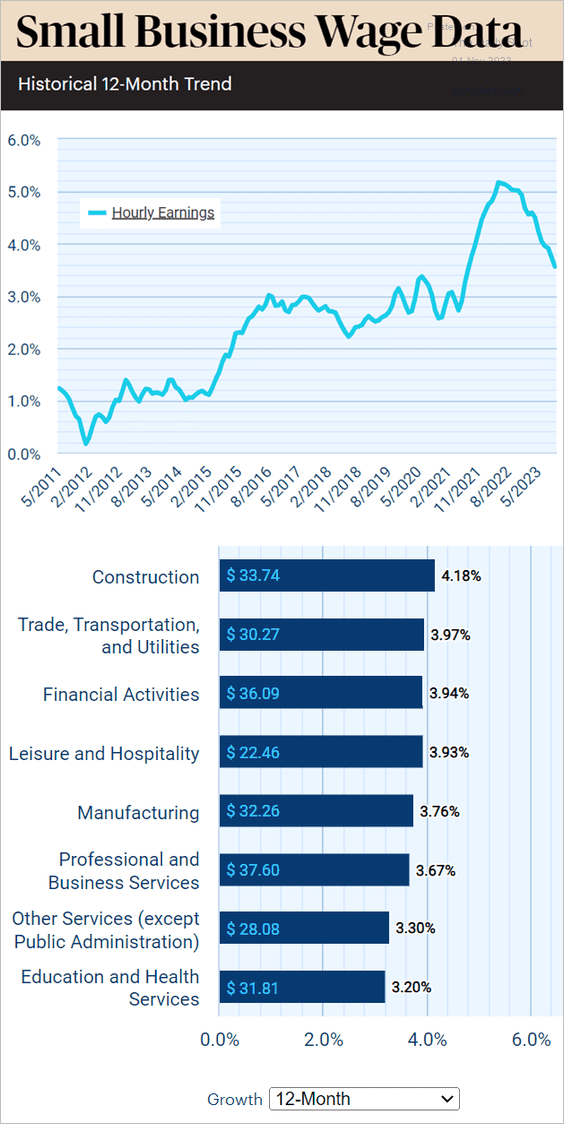

• A separate report indicates that wage growth at small businesses is moderating but remains elevated.

Source: Paychex / IHS Markit

Source: Paychex / IHS Markit

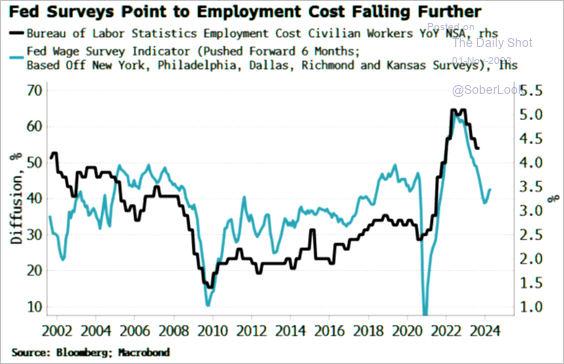

• Surveys signal slower growth in labor costs ahead.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

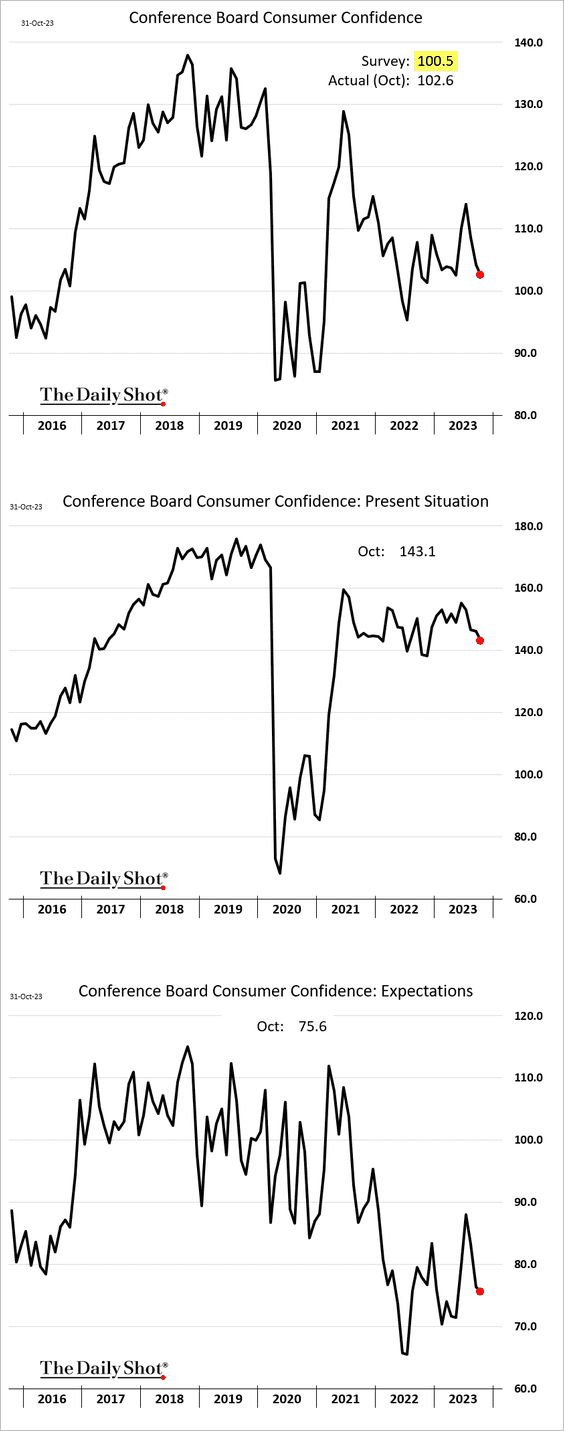

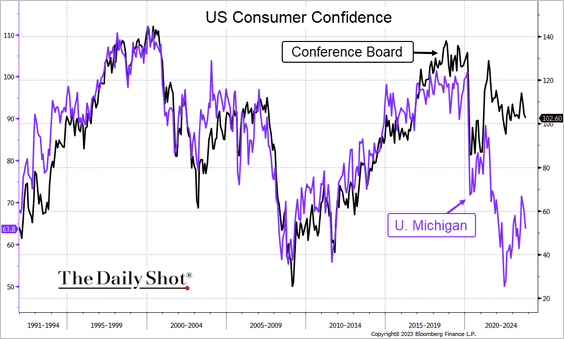

2. The Conference Board’s consumer confidence index declined less than expected in October.

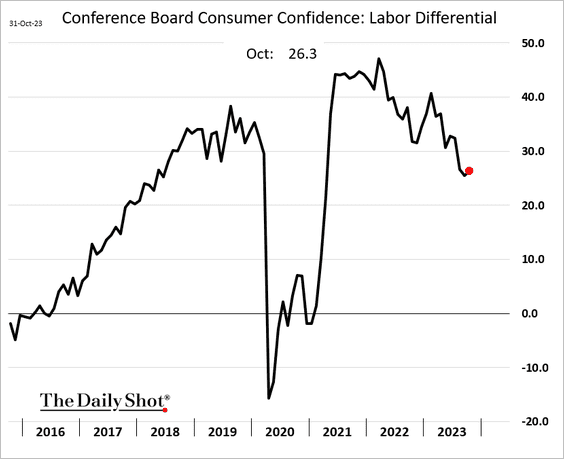

• The labor differential (“jobs plentiful” less “jobs hard to get”) edged higher.

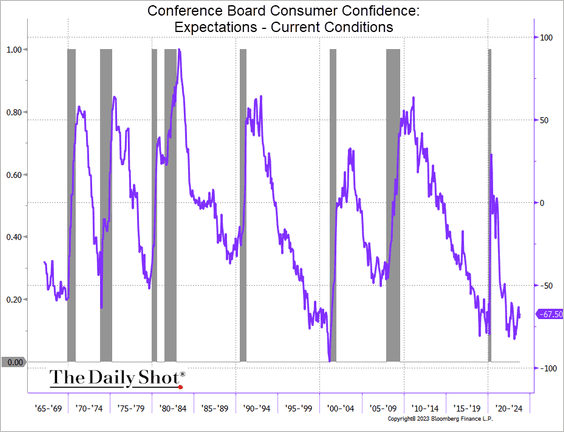

• Consumers are less inclined to buy a new car in the months ahead.

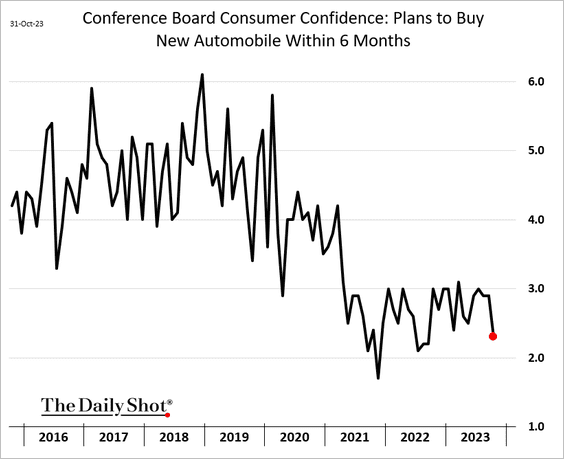

• The spread between expectations and current conditions indicators continues to signal a recession ahead.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Here is a comparison to the U. Michigan’s sentiment index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

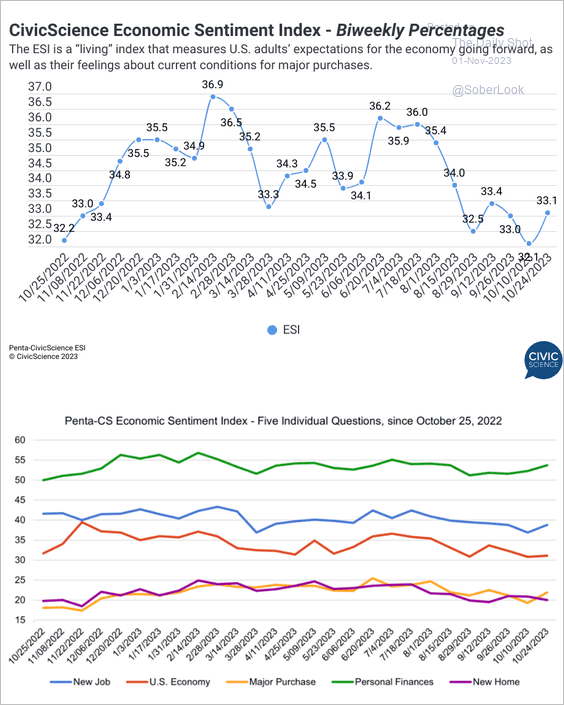

• A separate report from CivicScience points to an uptick in consumer confidence over the past couple of weeks.

Source: Penta-CivicScience Economic Sentiment Index

Source: Penta-CivicScience Economic Sentiment Index

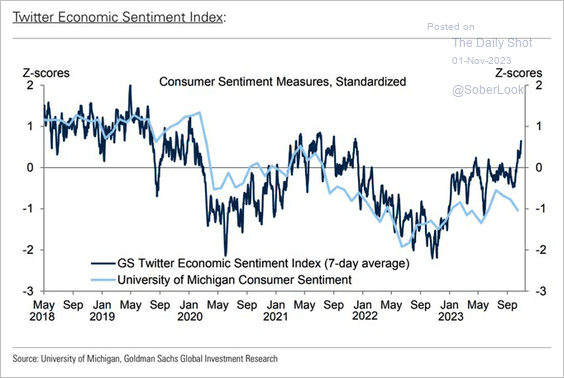

• Goldman’s Twitter Economic Sentiment Index has been rebounding.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

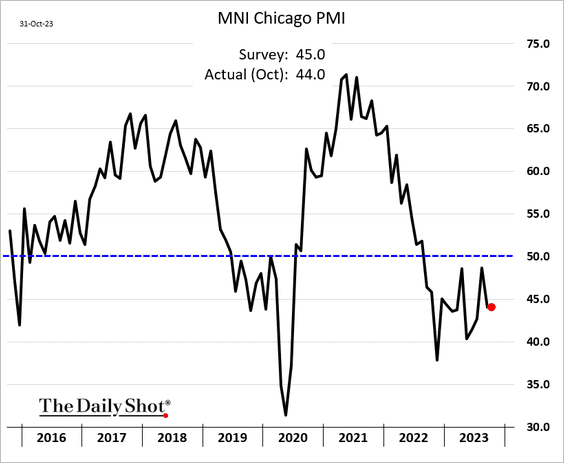

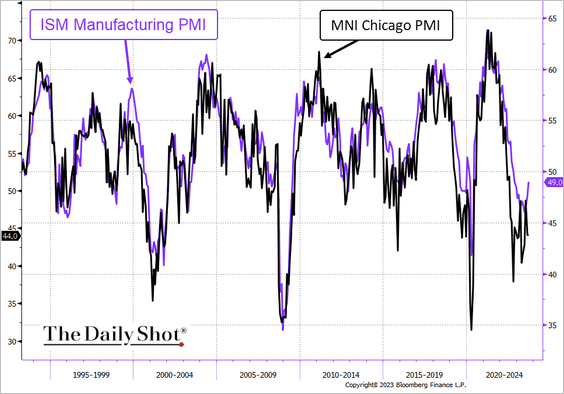

3. The Chicago PMI index remains in contraction territory, …

… signaling softer factory activity at the national level (ISM).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

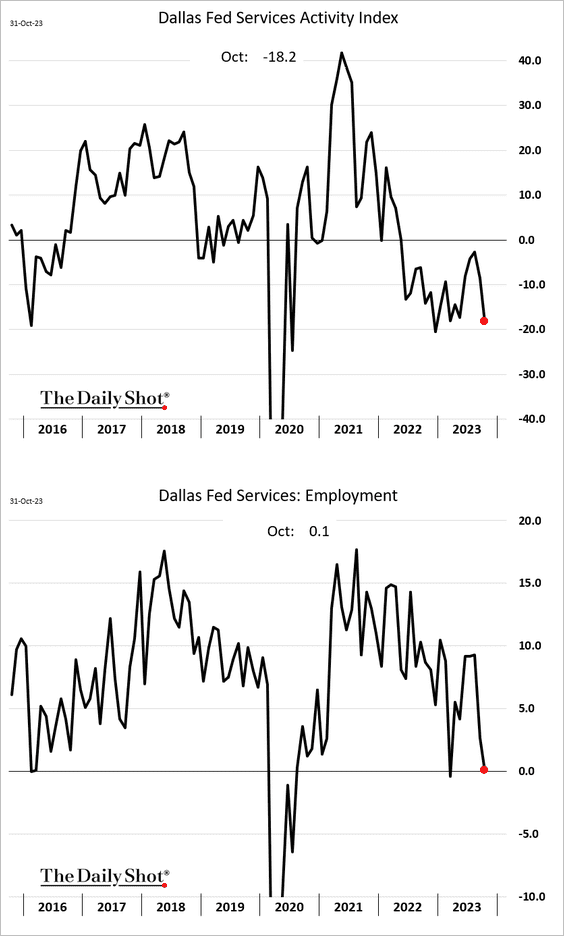

3. Texas-area service businesses continue to struggle.

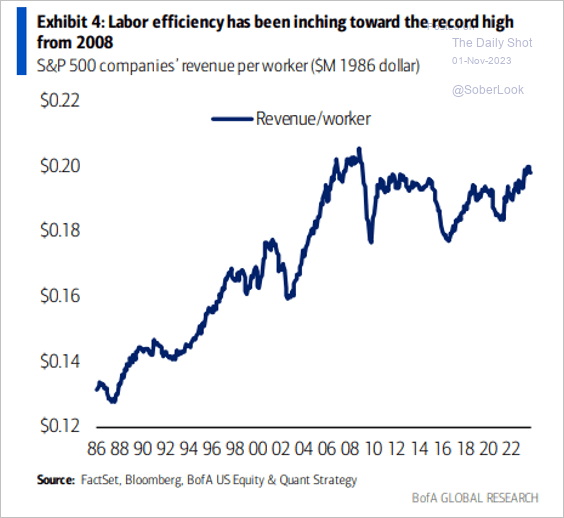

4. Labor efficiency at the largest US firms has been rising.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

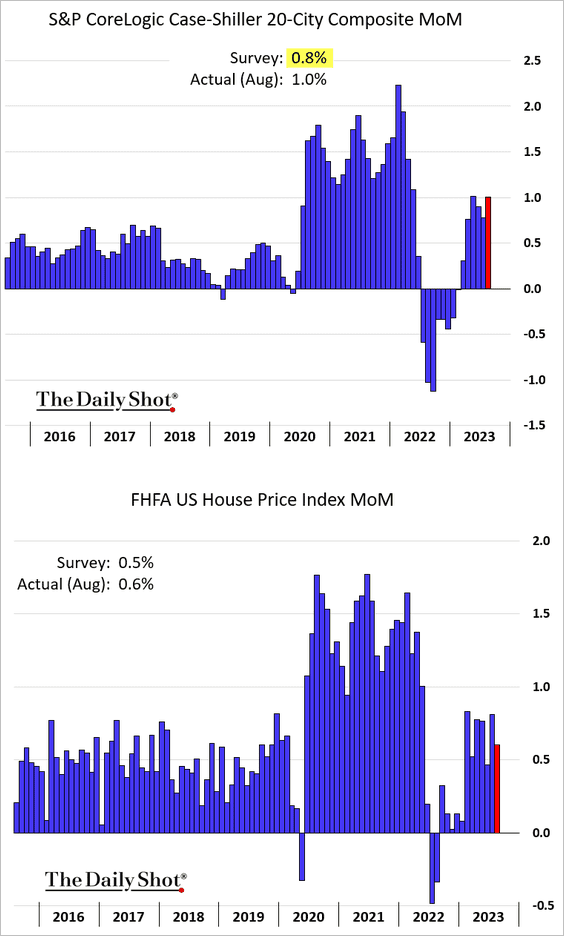

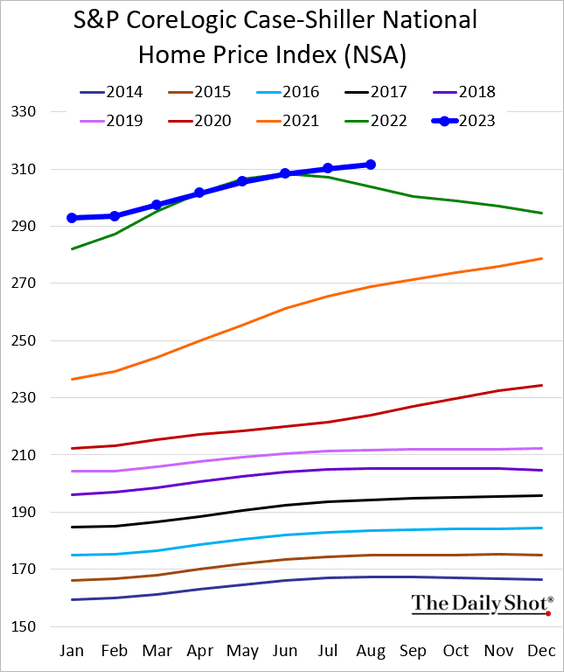

5. Next, we have some updates on the housing market.

• Home prices registered another strong gain in August, …

… hitting a record high.

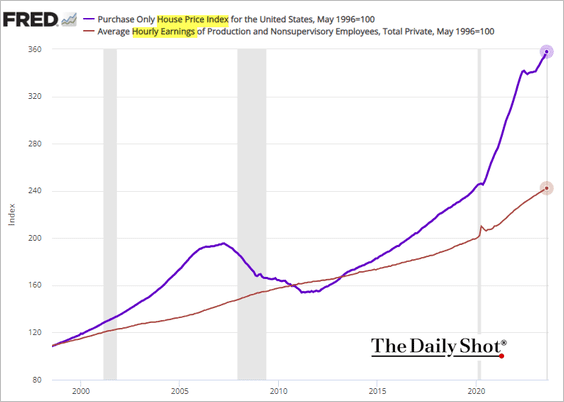

– Gains in home prices continue to outpace wages.

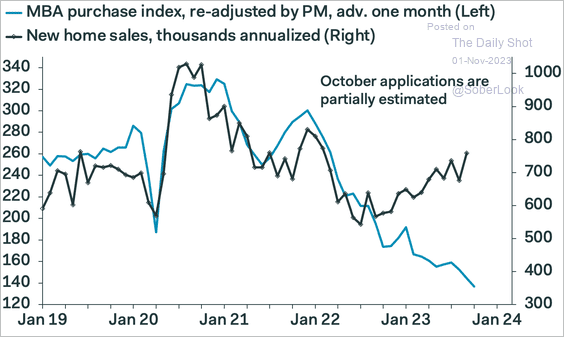

• Weakening demand for mortgages points to slower new home sales ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

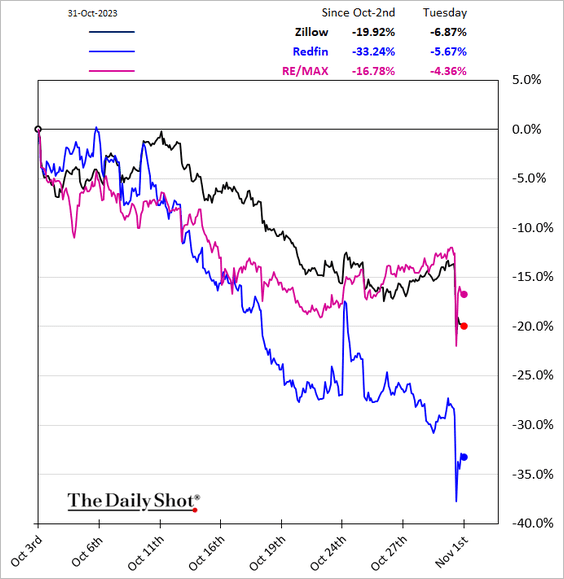

• The outcome of the lawsuit against NAR suggests that realtors may have to change the way they charge fees.

Source: Reuters Read full article

Source: Reuters Read full article

Shares of real estate brokerage firms tumbled in response to the news.

Back to Index

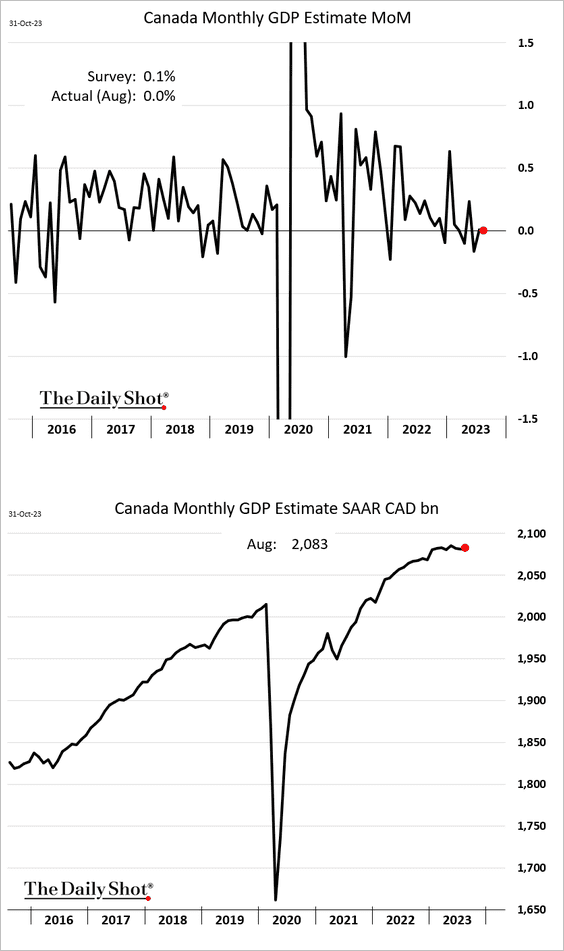

Canada

1. The monthly GDP estimate was flat in August.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

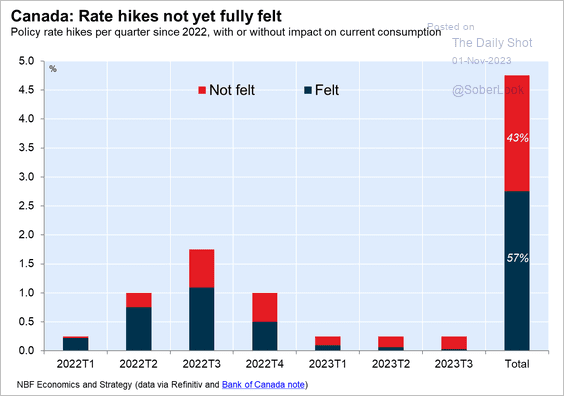

2. The full impact of rate hikes is yet to be felt.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

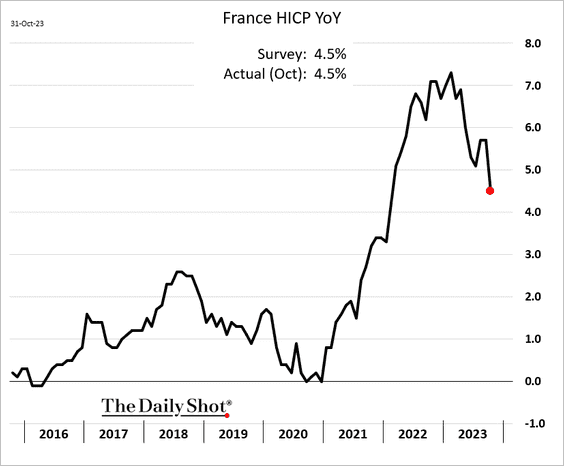

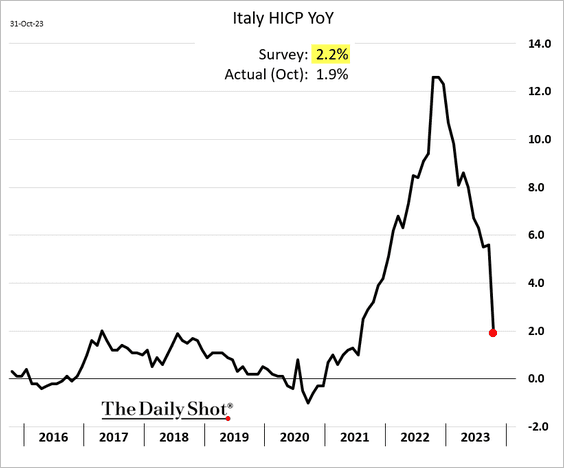

The Eurozone

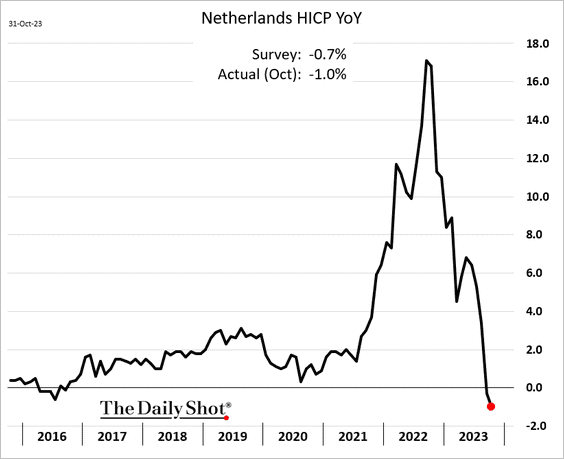

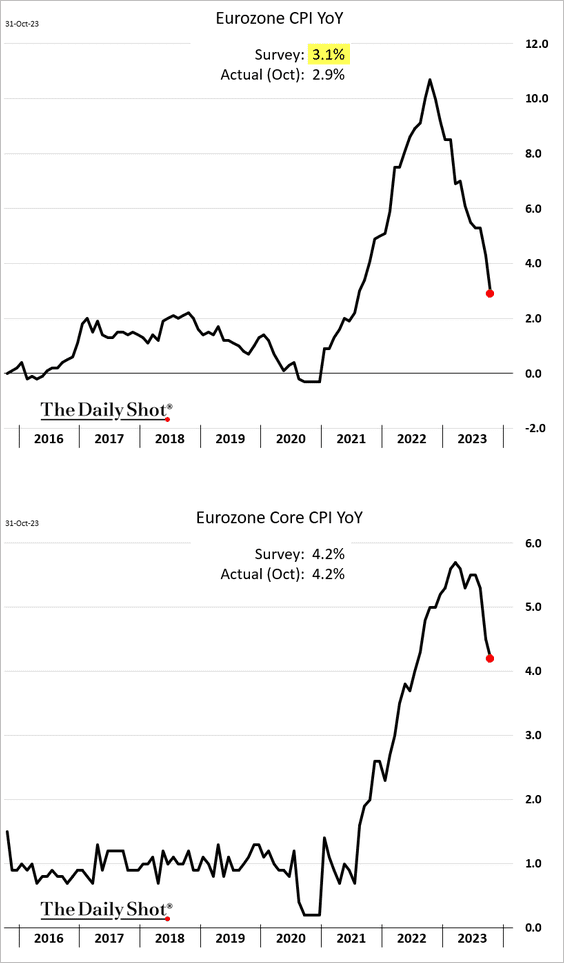

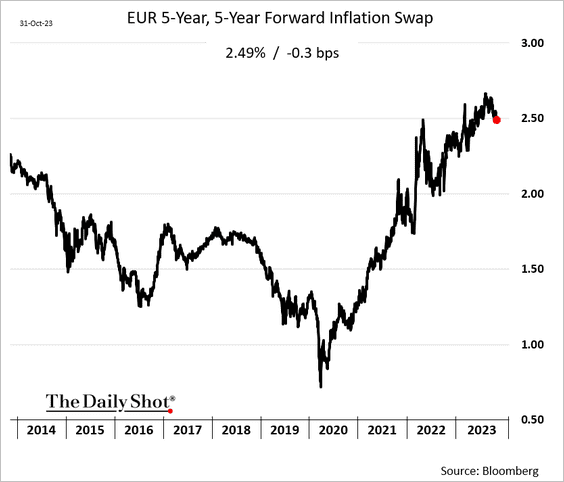

1. Inflation is moderating rapidly.

– France:

– Italy:

– The Netherlands:

– The Eurozone:

• Are long-term market-based inflation expectations peaking?

——————–

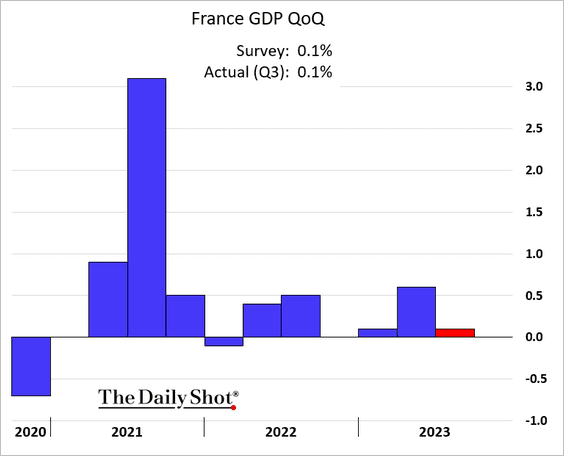

2. The French GDP posted a modest gain last quarter.

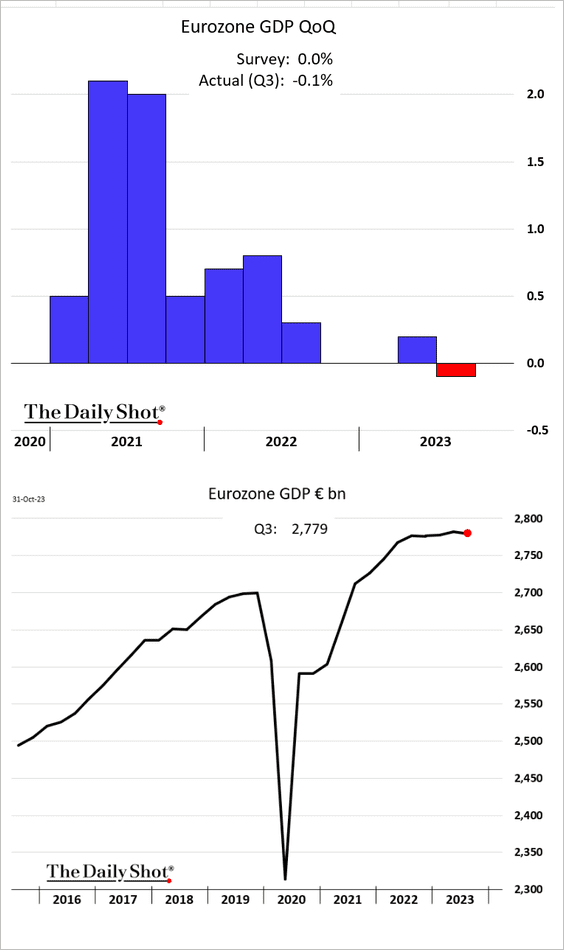

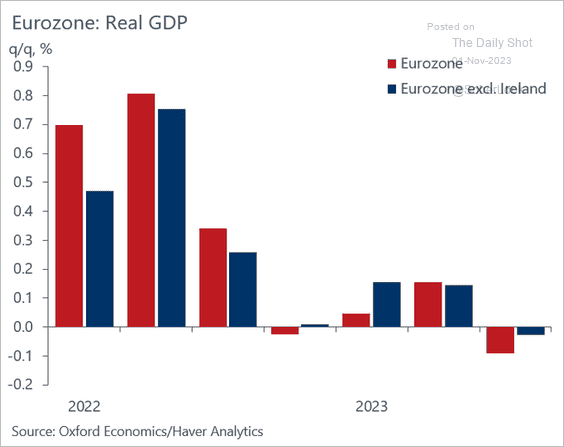

• But the economy unexpectedly contracted at the Eurozone level.

• Ireland’s economy is now a drag on the euro-area GDP.

Source: @DanielKral1

Source: @DanielKral1

——————–

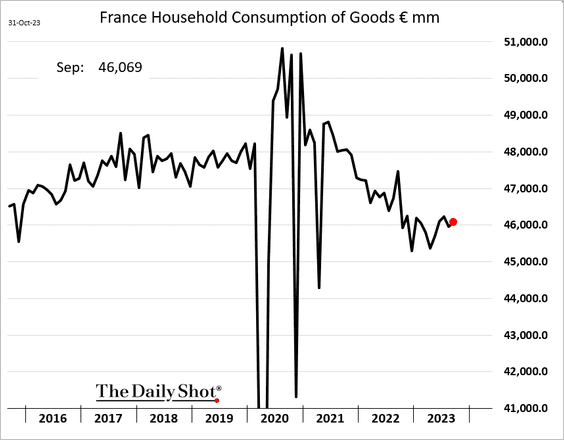

3. French households’ goods consumption edged higher in September.

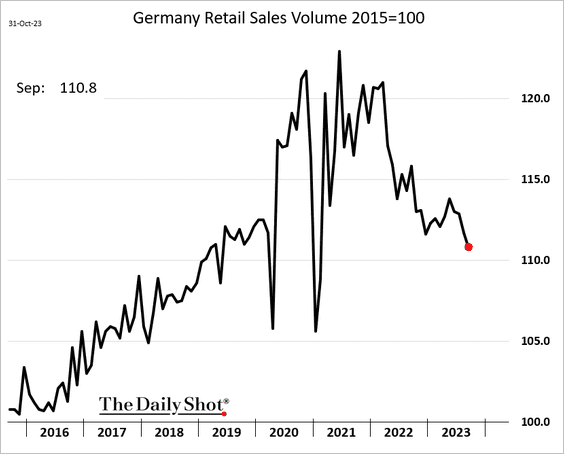

4. Germany’s retail sales continue to sink.

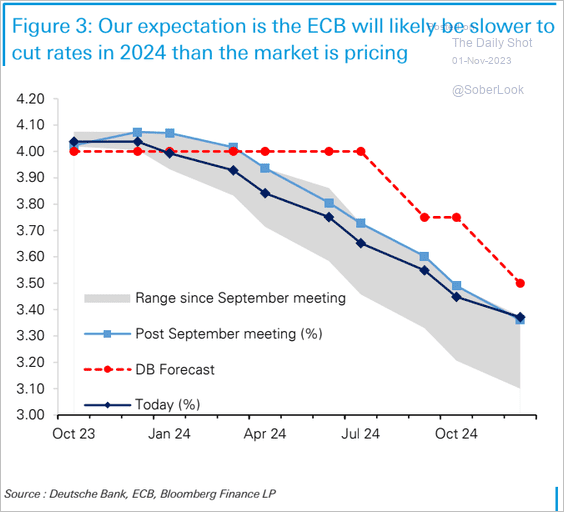

5. How quickly will the ECB cut rates?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

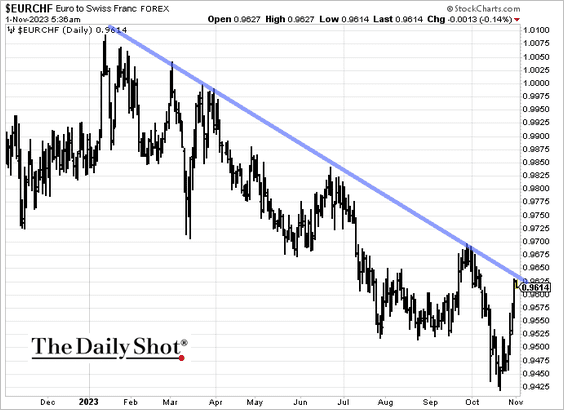

1. EUR/CHF hit a downtrend resistance as the Swiss franc slipped in recent days.

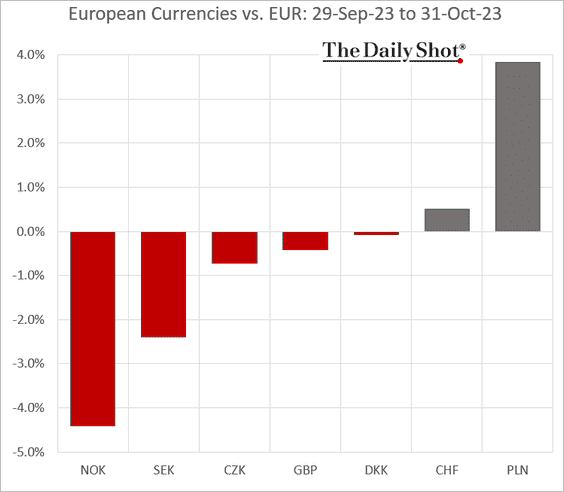

2. Here is the performance of European currencies vs. the euro in October.

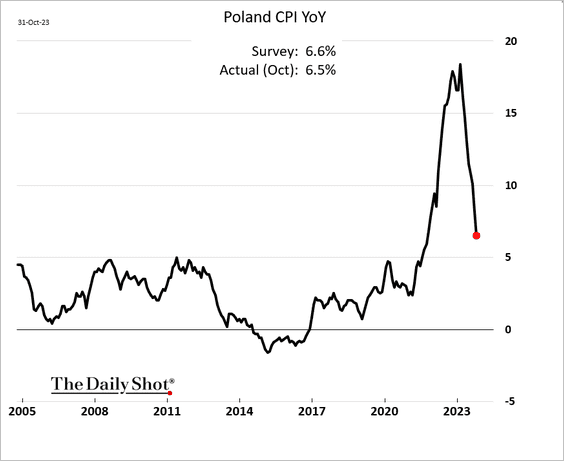

3. Poland’s inflation continues to soften.

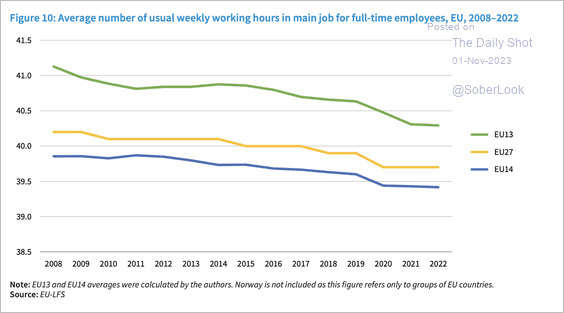

4. EU working hours have been trending lower.

Source: Eurofound Read full article

Source: Eurofound Read full article

Back to Index

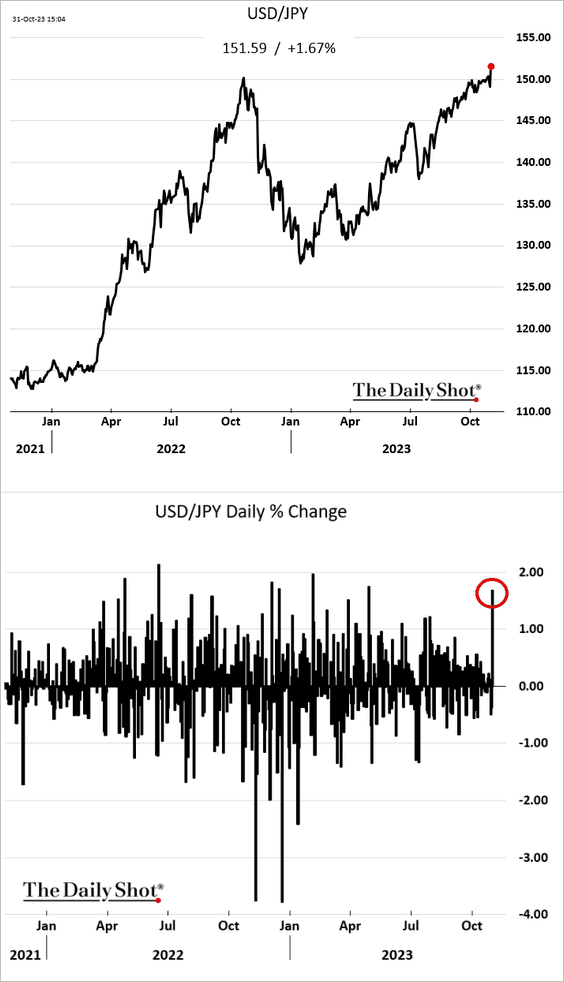

Japan

1. The yen tumbled on Tuesday, …

… but stabilized today as Tokyo threatened intervention.

Source: Nikkei Asia Read full article

Source: Nikkei Asia Read full article

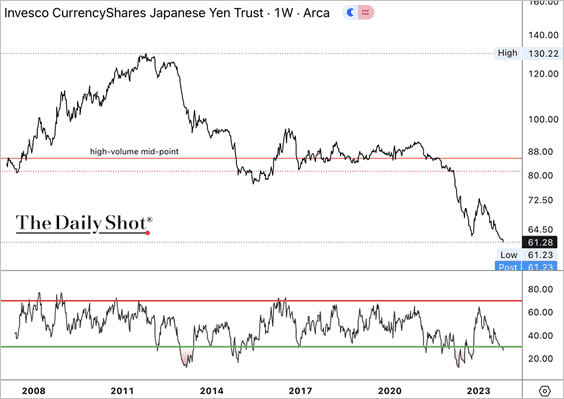

• The Invesco CurrencyShares Japanese Yen ETF (FXY) appears oversold within its long-term downtrend.

——————–

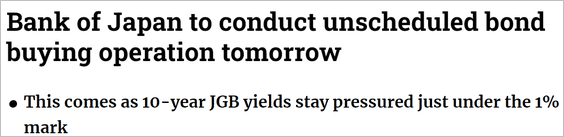

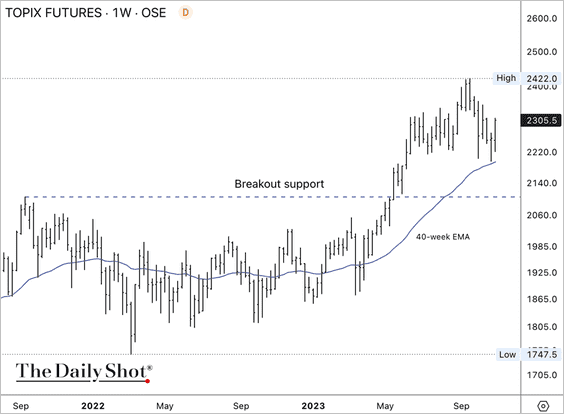

2. The BoJ plans to buy more JGBs …

Source: Forexlive Read full article

Source: Forexlive Read full article

… as the 10-year yield nears 1%.

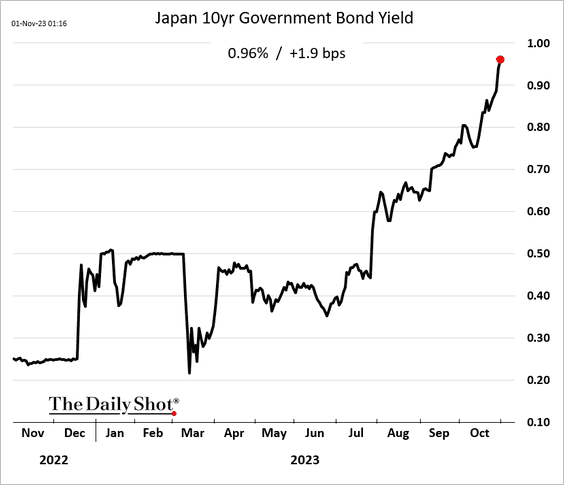

• There is a wide real interest rate differential between the US and Japan.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

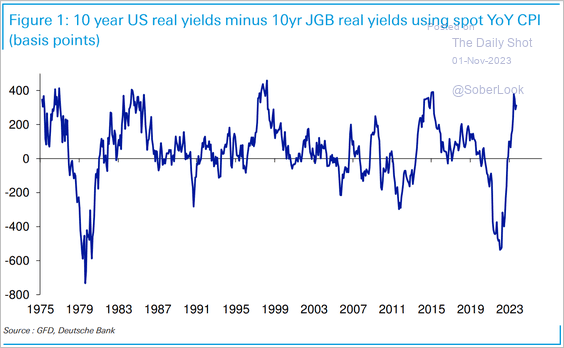

3. Topix futures held support at the 40-week moving average, solidifying its breakout from a wide trading range.

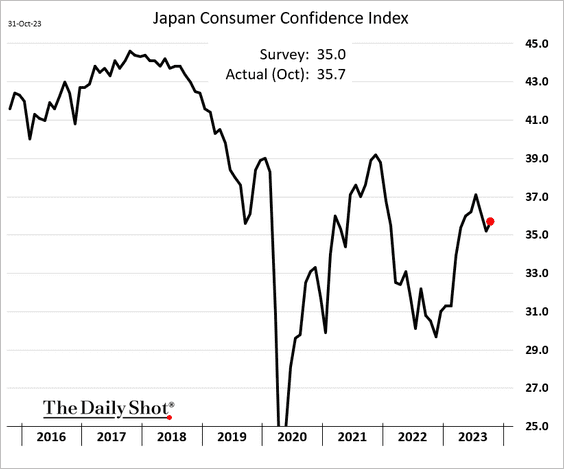

4. Consumer confidence edged higher in October.

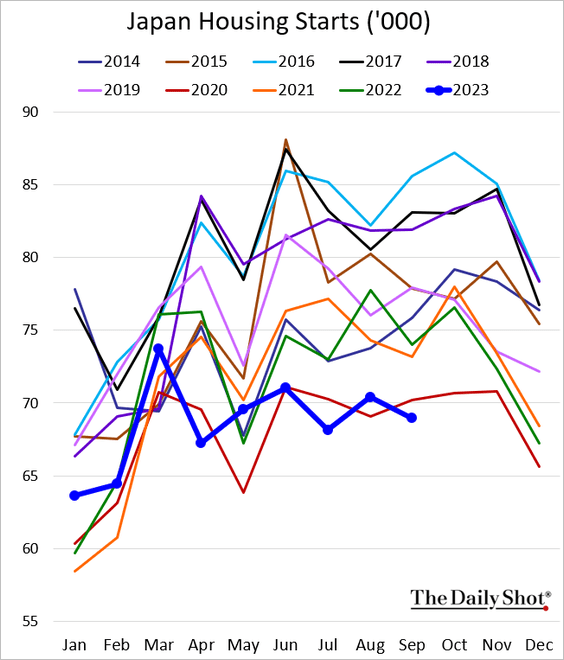

5. Housing starts hit a multi-year low for this time of the year.

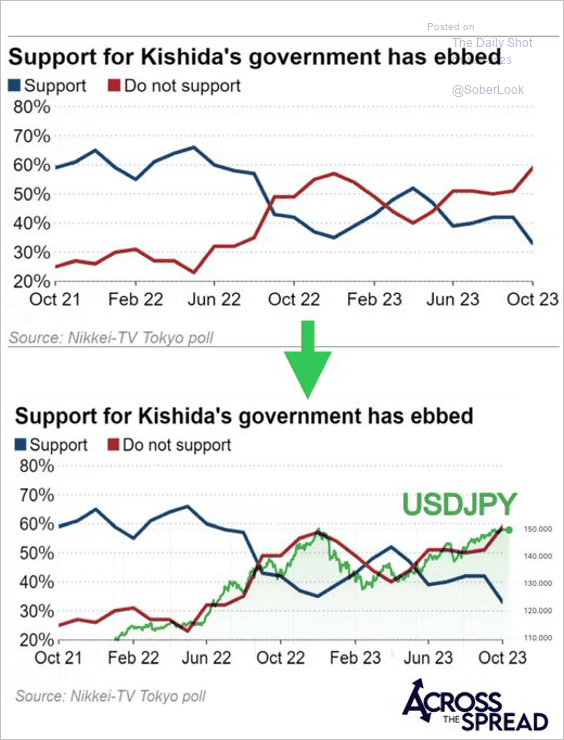

6. Support for Prime Minister Kishida has ebbed.

Source: @acrossthespread

Source: @acrossthespread

Back to Index

Asia-Pacific

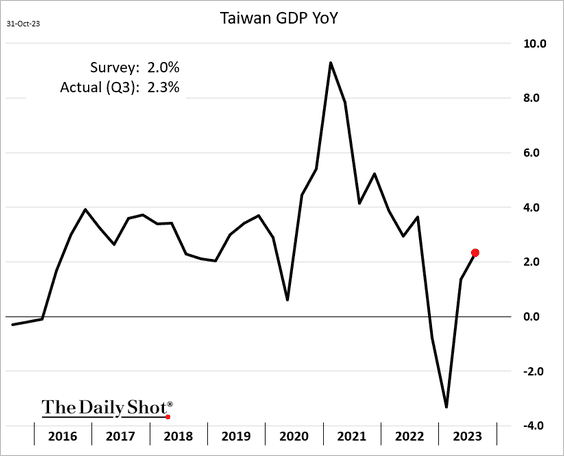

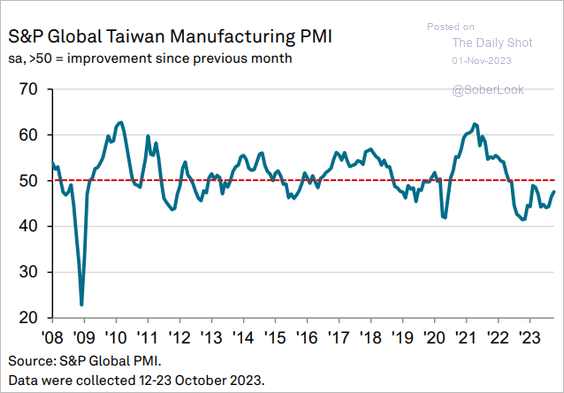

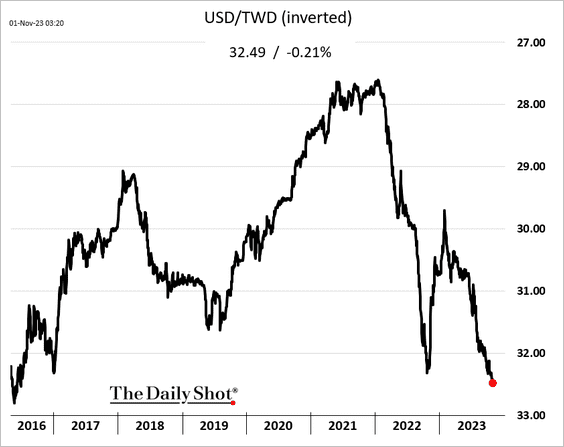

1. Let’s begin with Taiwan.

• Economic expansion strengthened last quarter.

Source: @technology Read full article

Source: @technology Read full article

• Factory activity is still not growing, according to the S&P Global PMI report.

Source: S&P Global PMI

Source: S&P Global PMI

• The Taiwan dollar fell to the lowest level since 2016.

——————–

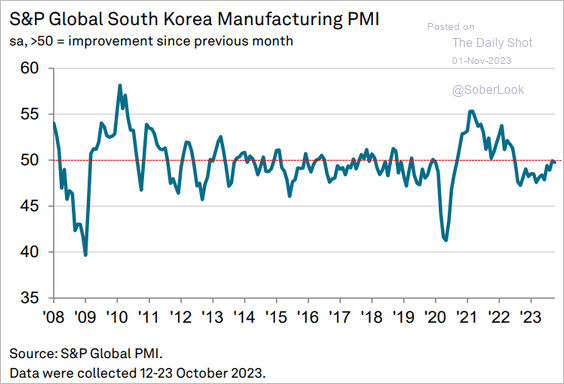

2. South Korea’s manufacturing activity continues to tread water.

Source: S&P Global PMI

Source: S&P Global PMI

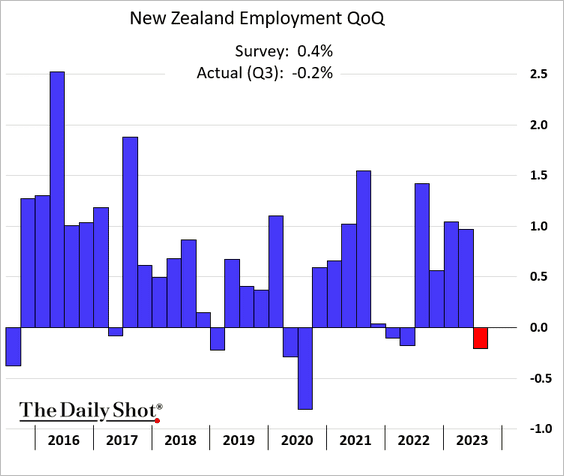

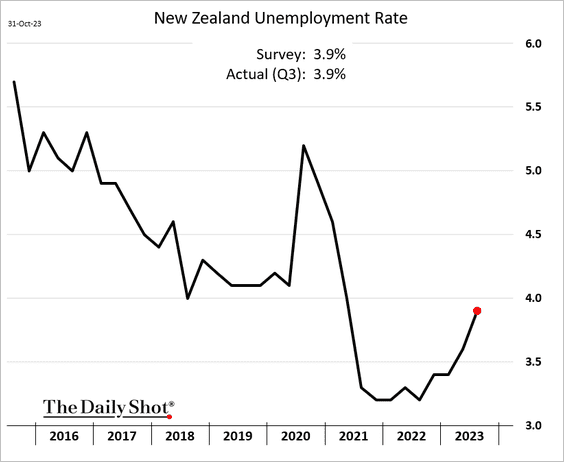

3. New Zealand’s economy unexpectedly shed jobs last quarter, …

… boosting the unemployment rate.

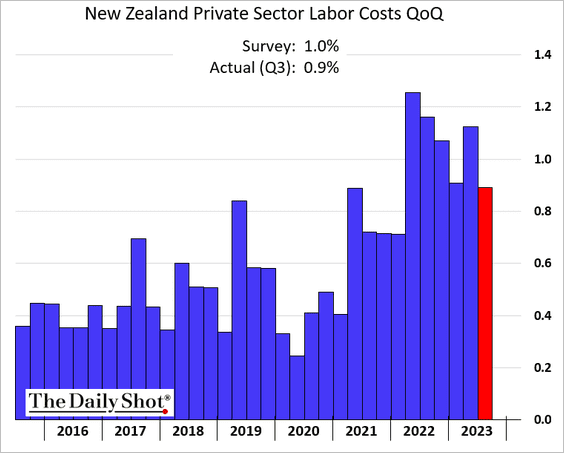

Growth in New Zealand’s labor costs remains elevated.

——————–

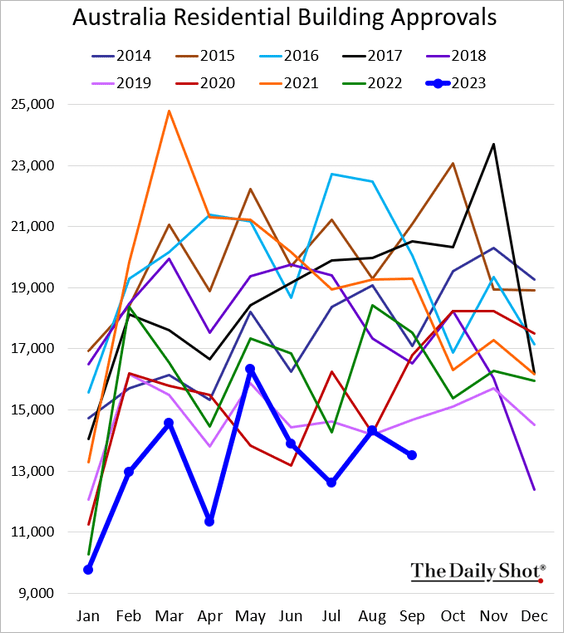

4. Australia’s building approvals hit a multi-year low.

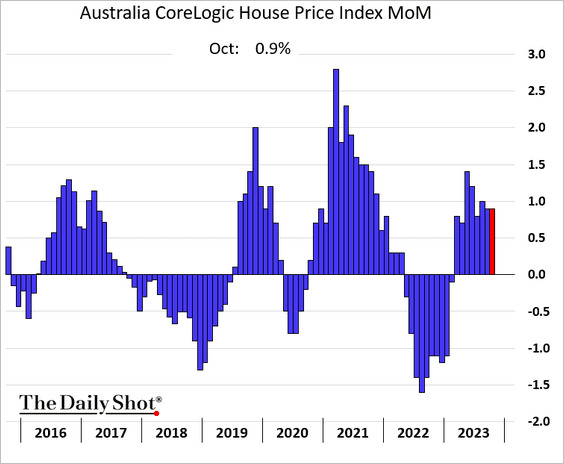

House prices have risen for eight months in a row.

Back to Index

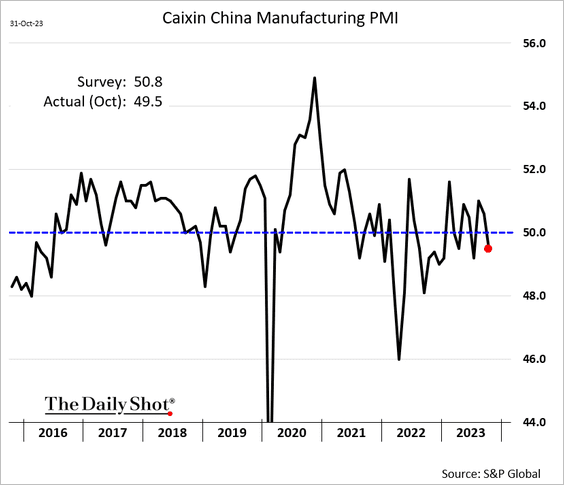

China

1. The manufacturing PMI report from S&P Global confirmed a contraction in factory activity in October.

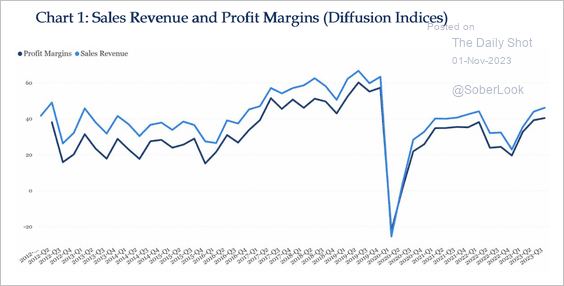

2. Sales revenues and profit margins are starting to recover.

Source: China Beige Book

Source: China Beige Book

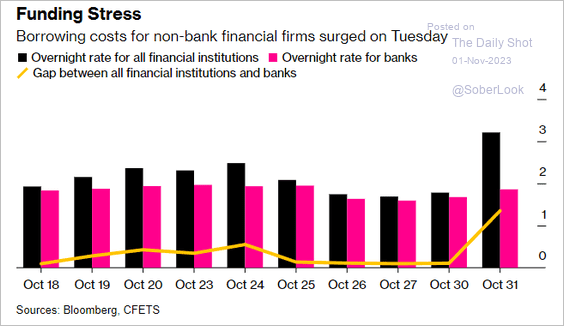

3. The financial system shows some month-end funding stress.

Source: @markets Read full article

Source: @markets Read full article

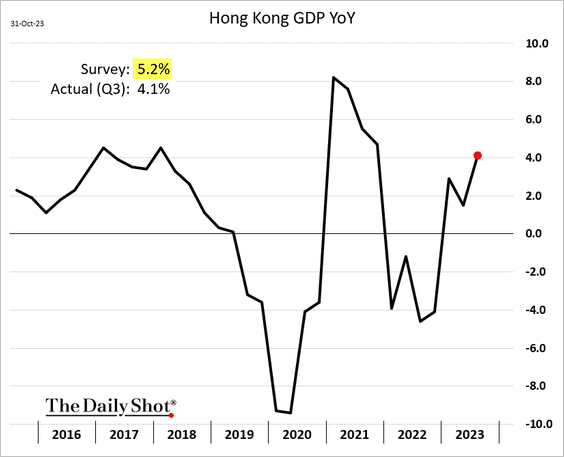

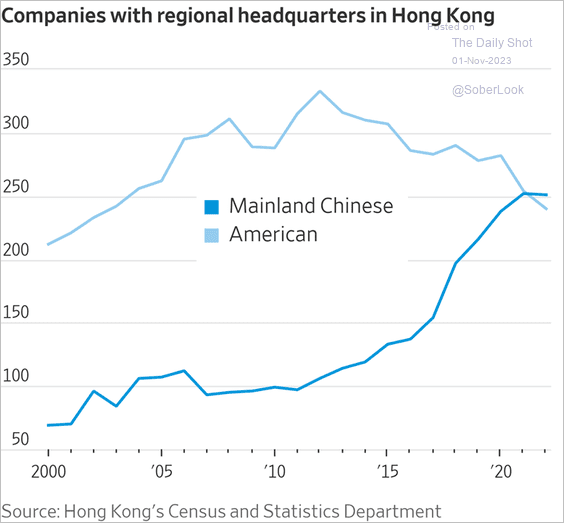

4. Hong Kong’s economy grew slower than expected last quarter.

• Foreign companies are retreating from Hong Kong.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

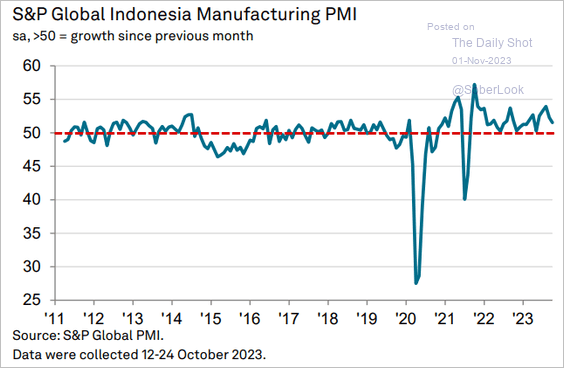

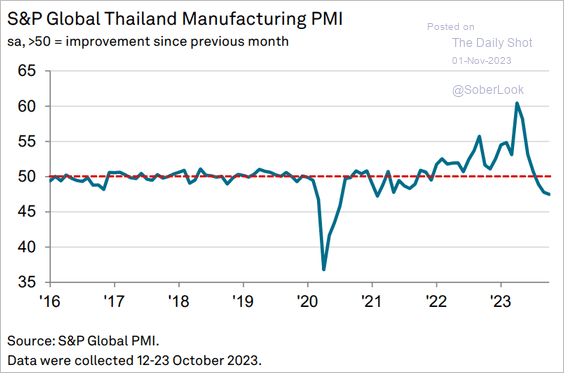

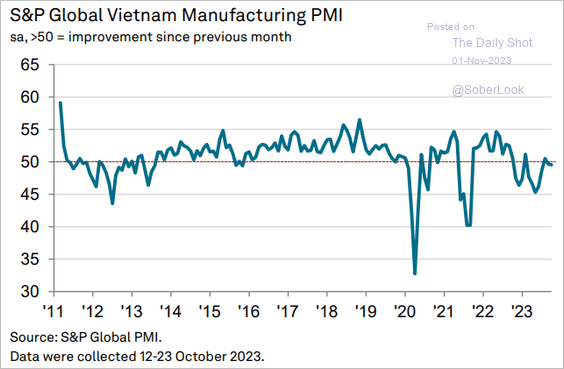

1. Let’s run through the October PMI reports for Asian economies.

• Indonesia (slower growth):

Source: S&P Global PMI

Source: S&P Global PMI

• Thailand (further weakness):

Source: S&P Global PMI

Source: S&P Global PMI

• Vietnam (slight contraction):

Source: S&P Global PMI

Source: S&P Global PMI

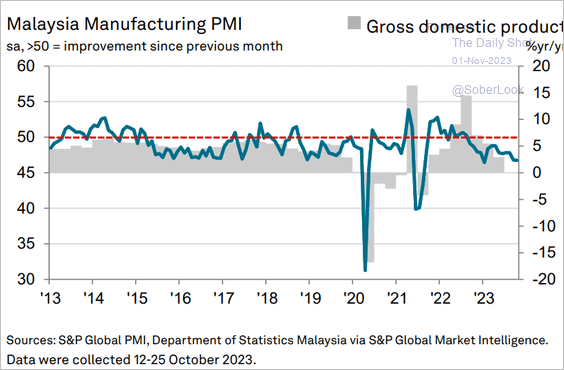

• Malaysia (contraction continues):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

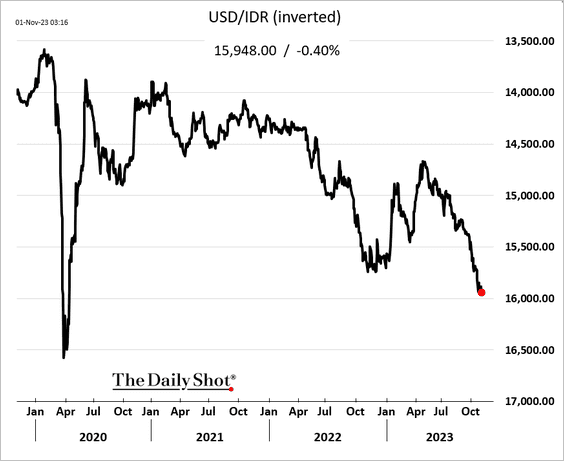

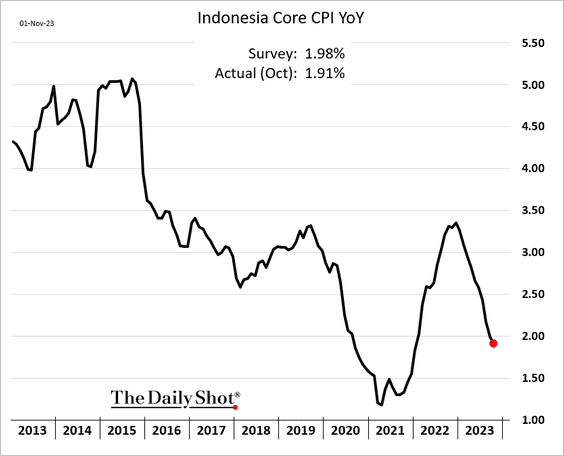

2. The Indonesian rupiah keeps weakening, …

… as inflation dips below 2% (signaling lower rates ahead).

——————–

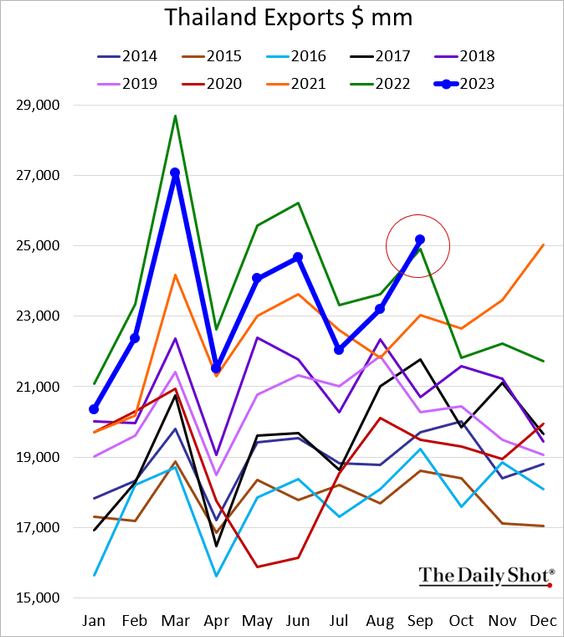

3. Thai exports hit a new high for this time of the year.

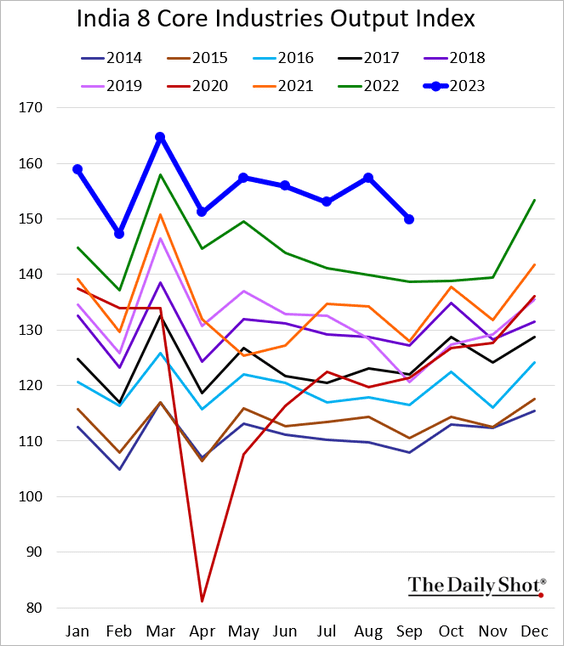

4. India’s core industries’ index softened in September but remains well above last year’s levels.

——————–

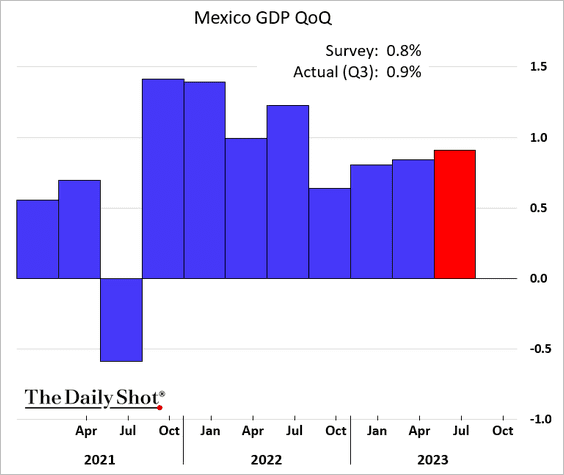

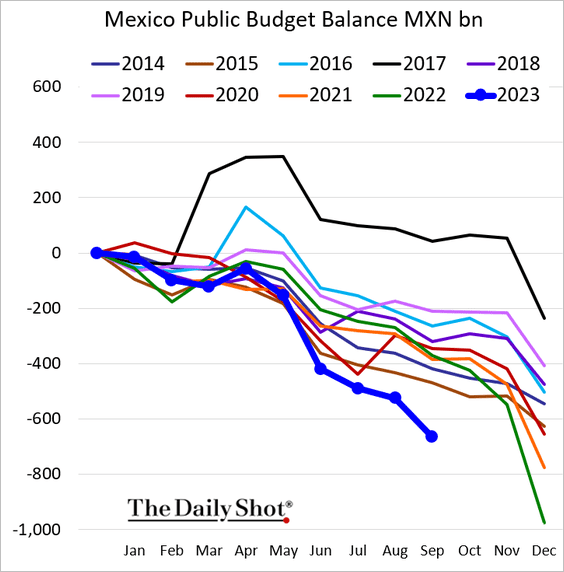

5. Mexico’s economic growth remains resilient, …

… boosted by fiscal stimulus.

——————–

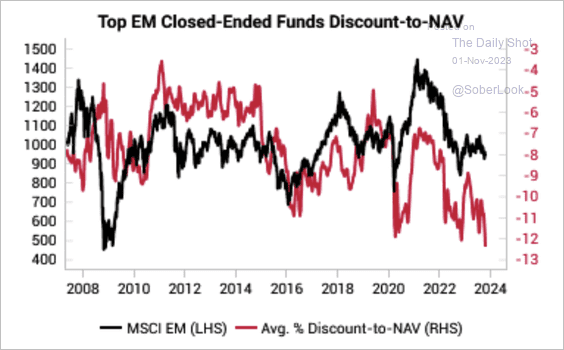

6. EM closed-end funds are trading at a significant discount to NAV.

Source: Variant Perception

Source: Variant Perception

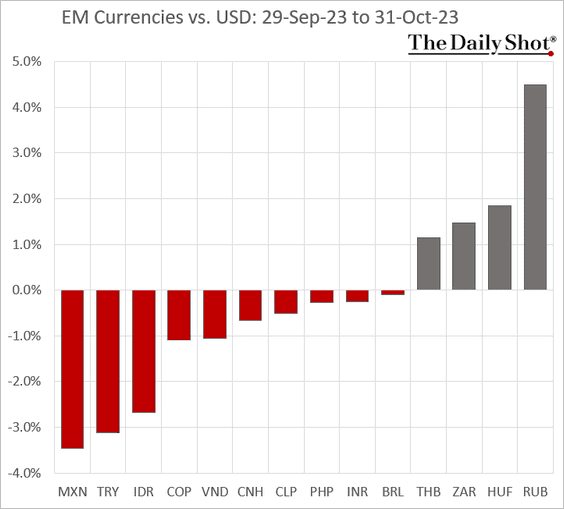

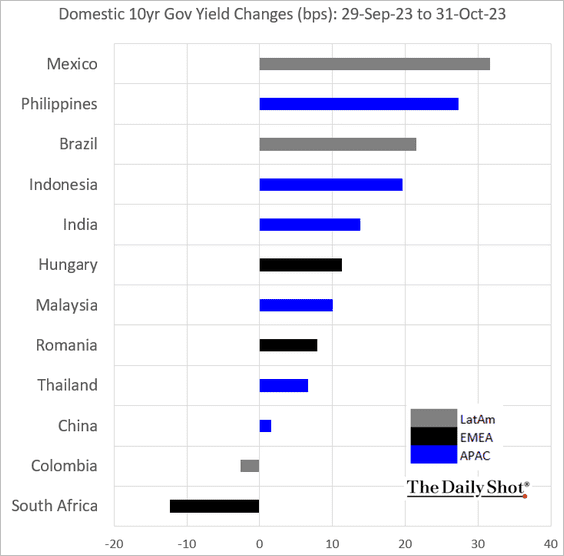

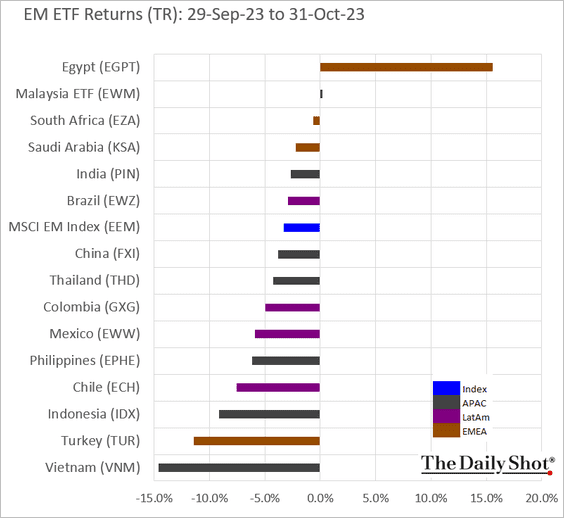

7. Next, we have some performance data for the month of October.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

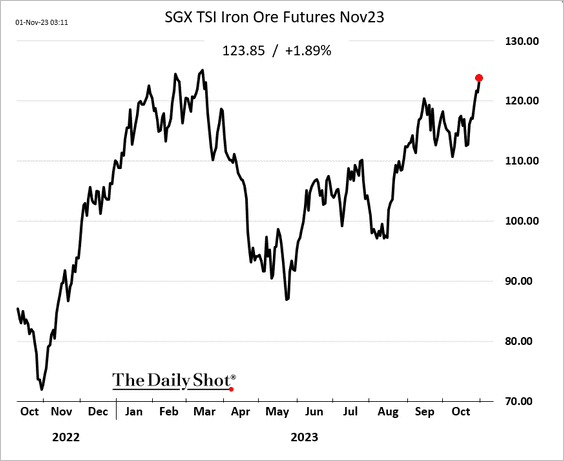

Commodities

1. Iron ore futures continue to rally.

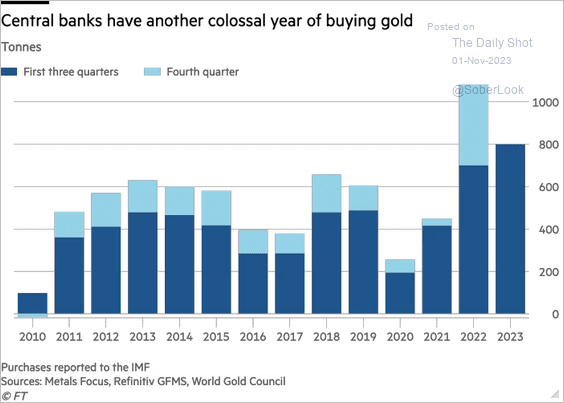

2. Central banks keep buying a lot of gold.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

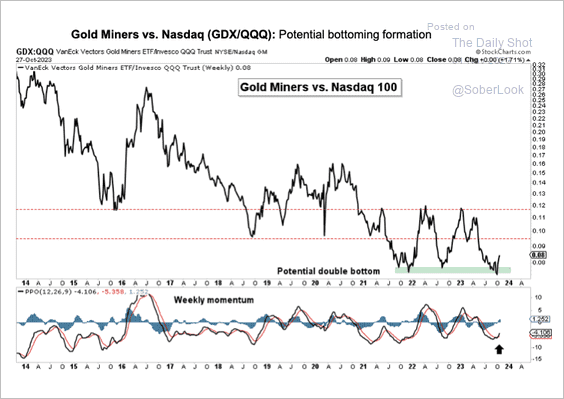

• Gold miners are starting to improve relative to Nasdaq 100 stocks.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

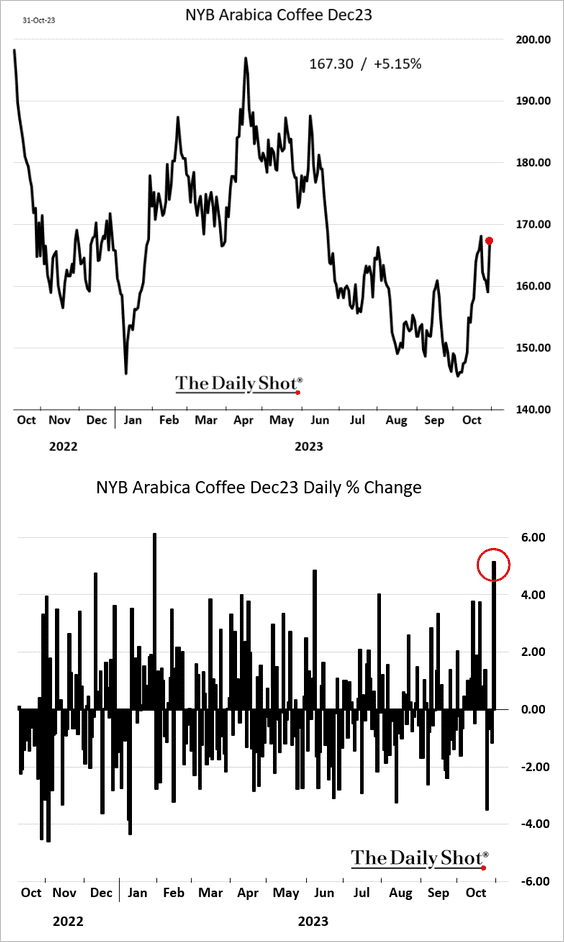

3. New York coffee futures jumped 5% on Tuesday, boosted by lower exchange inventories.

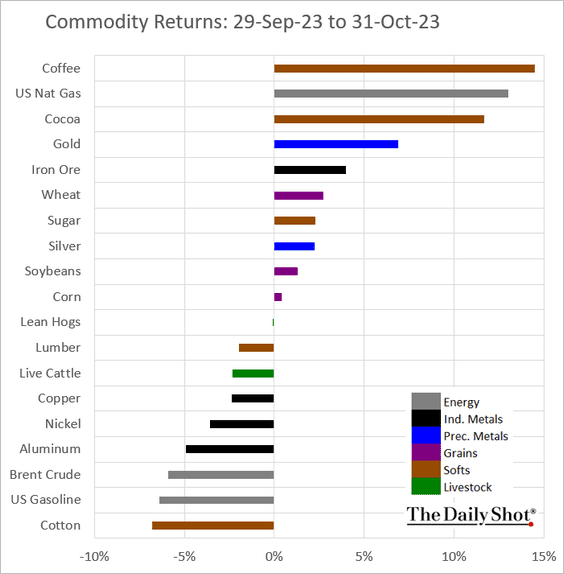

4. Finally, we have the performance data for October.

Back to Index

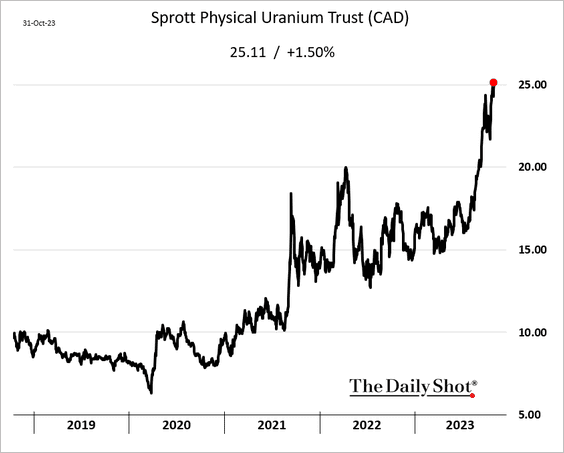

Energy

1. Uranium prices are surging.

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

——————–

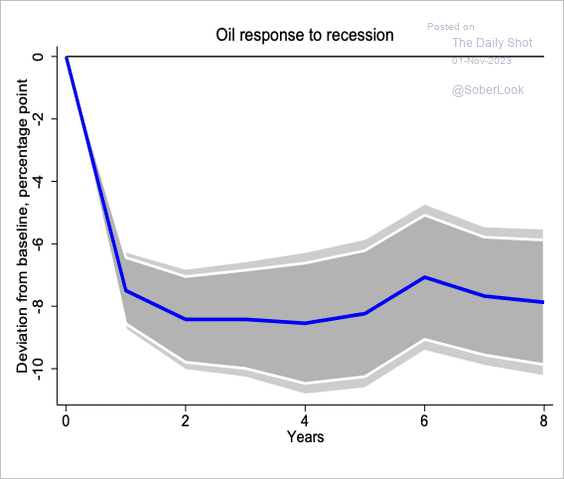

2. How do oil prices respond to recession events?

Source: Bruegel Read full article

Source: Bruegel Read full article

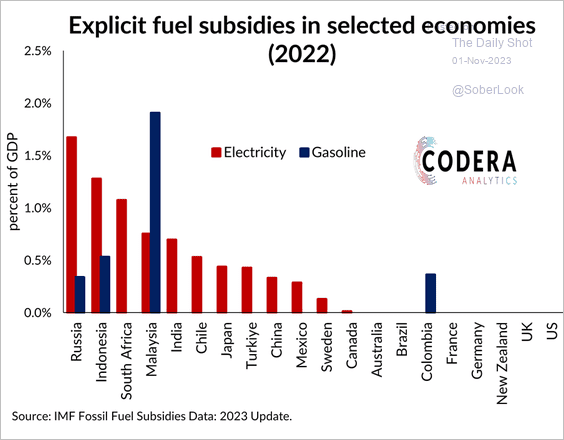

3. Here is a look at fuel subsidies around the world.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

Back to Index

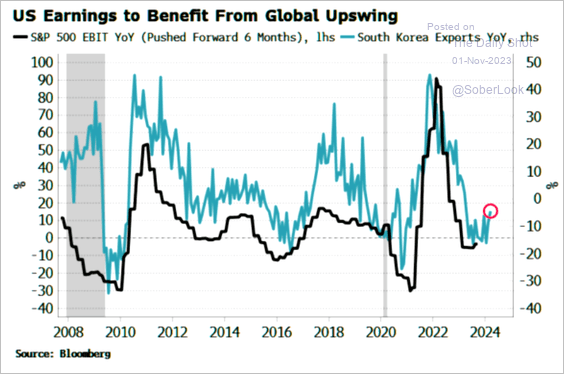

Equities

1. US earnings could benefit from improvements in global growth.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

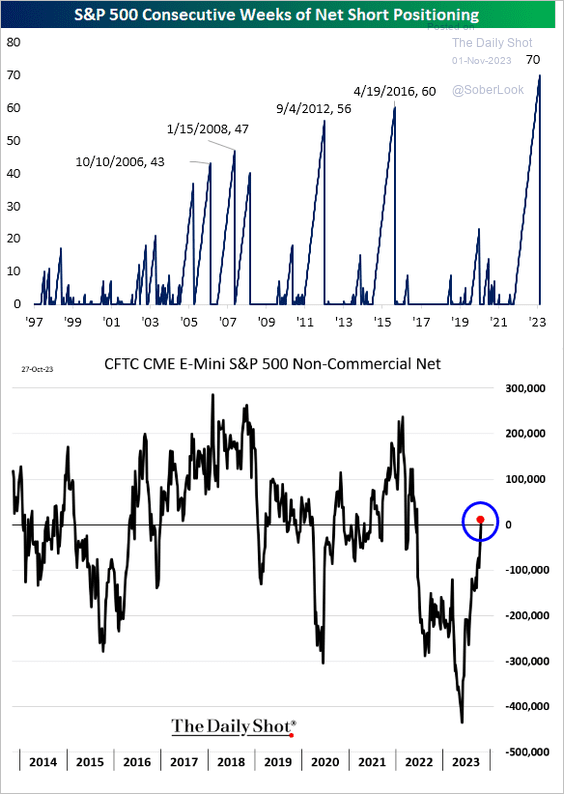

2. S&P 500 futures experienced a long streak of speculative net-short positioning, which ended last week.

Source: @bespokeinvest

Source: @bespokeinvest

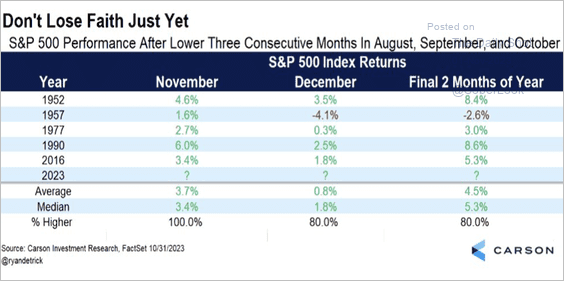

3. The S&P 500 typically recovers after consecutive monthly declines during the August-October period.

Source: @RyanDetrick

Source: @RyanDetrick

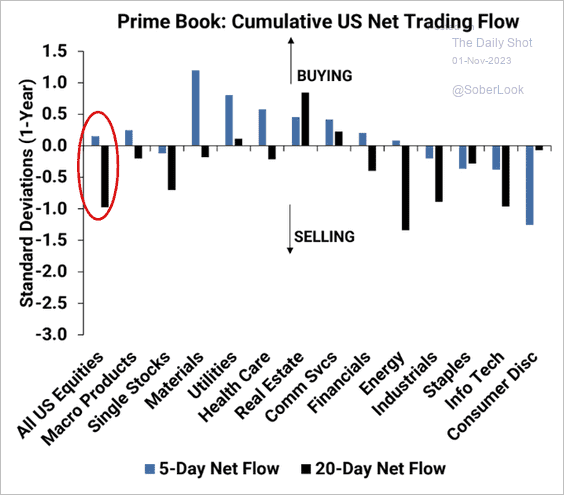

4. After substantial equity sales in recent weeks, hedge funds became net buyers of US stocks over the past few days. Here is the breakdown by sector.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

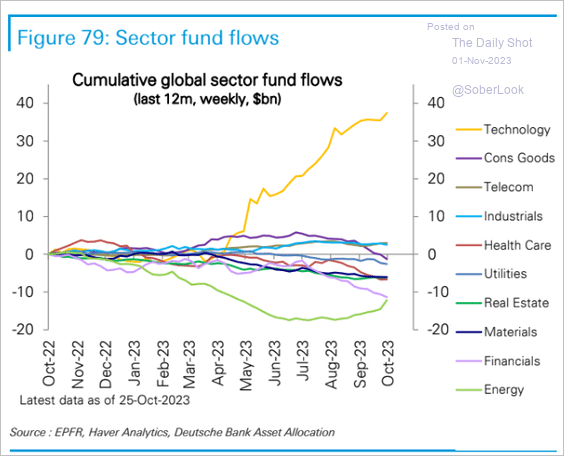

5. Tech funds continue to see inflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

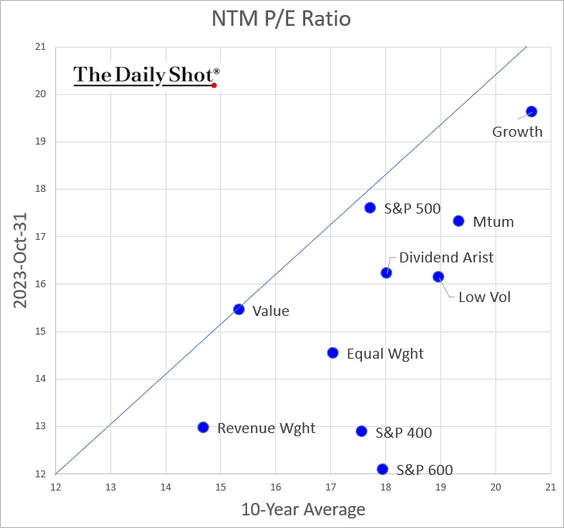

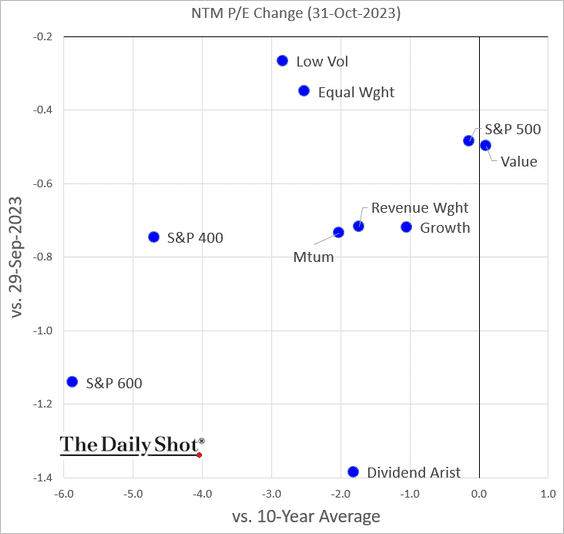

6. Small caps, mid-caps, and most equity factors are trading at a discount to the ten-year average.

• How did forward P/E ratios change over the past month?

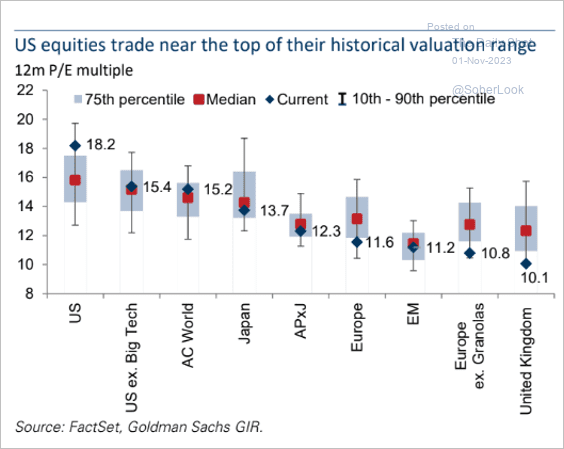

• Here are some international market valuations.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

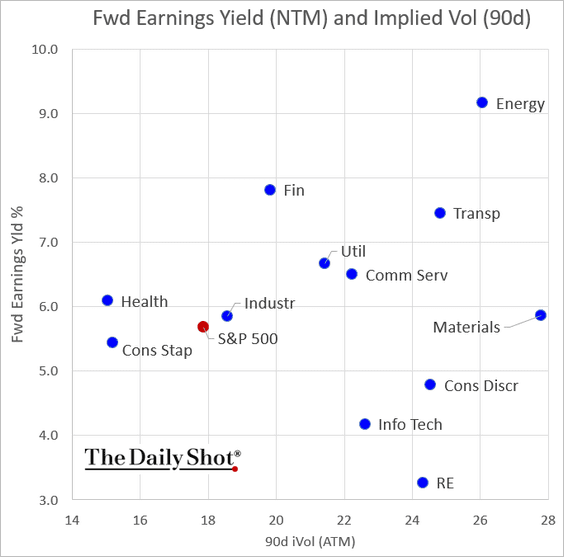

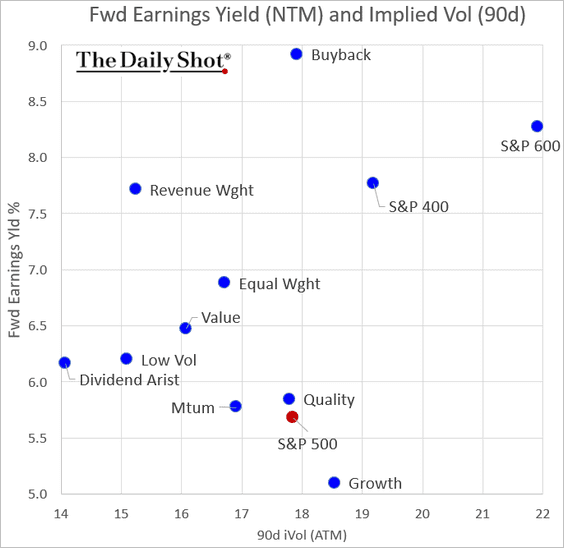

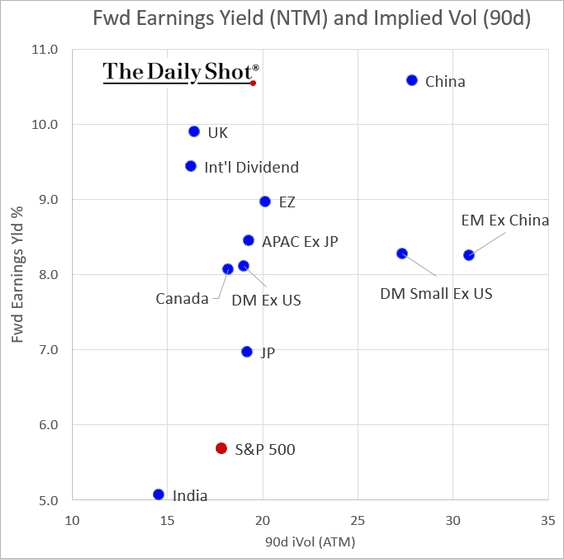

7. Next, let’s take a look at earnings yields and implied volatilities (expected performance vs. perceived risk).

• S&P 500 sectors:

• Equity factors:

• International markets:

——————–

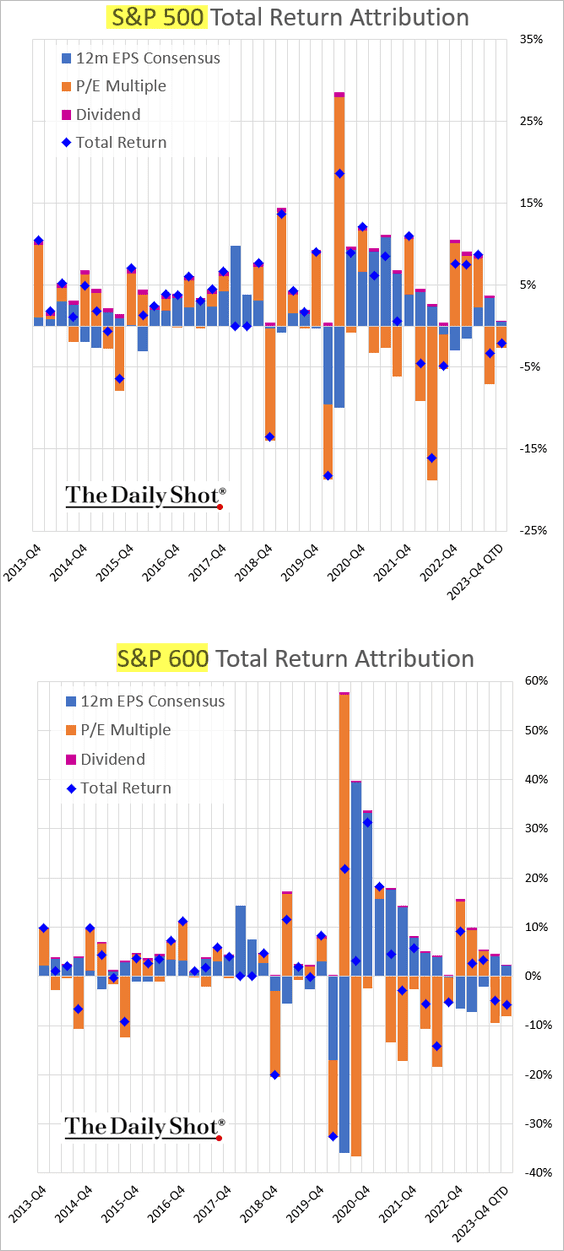

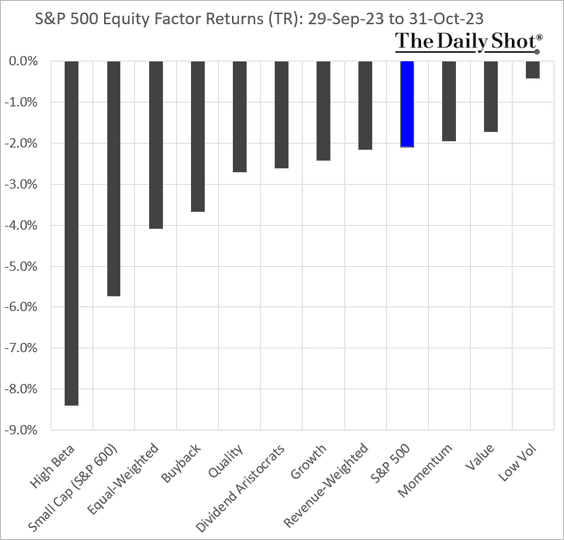

8. Here is the quarter-to-date performance attribution for the S&P 500 and S&P 600 (small caps):

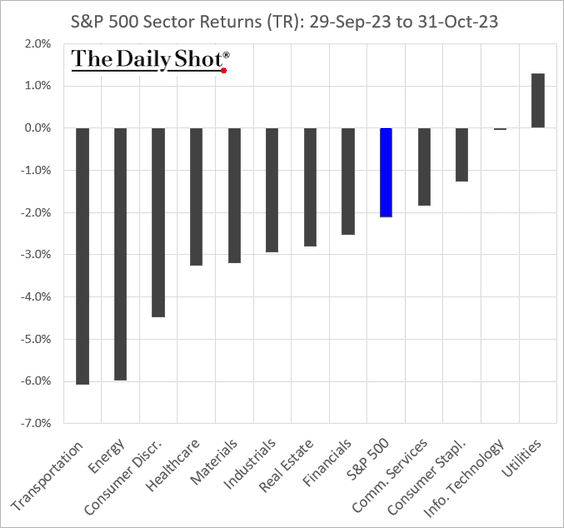

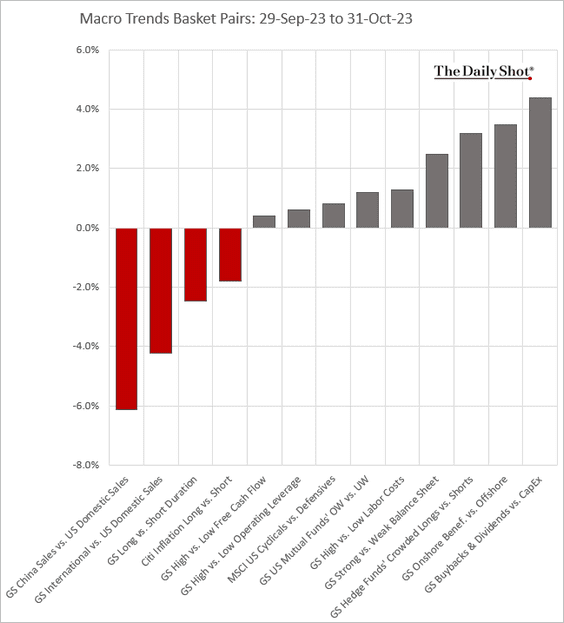

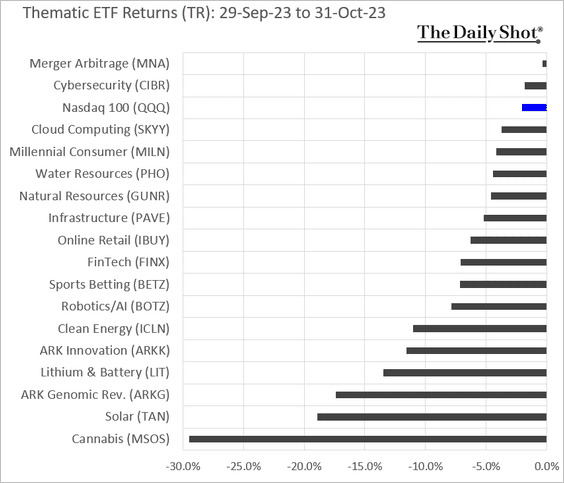

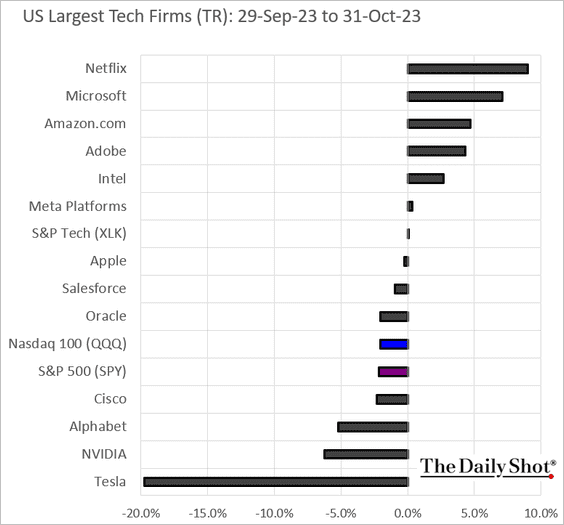

9. Finally, we have some performance data for the month of October.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Alternatives

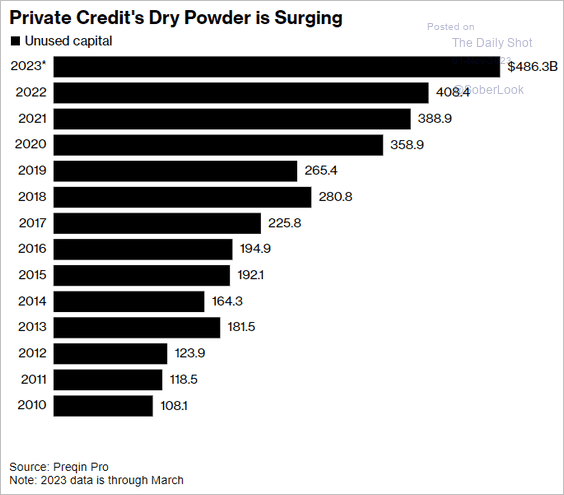

1. Private credit dry powder continues to grow. Is there too much capital chasing the same opportunities?

Source: @markets Read full article

Source: @markets Read full article

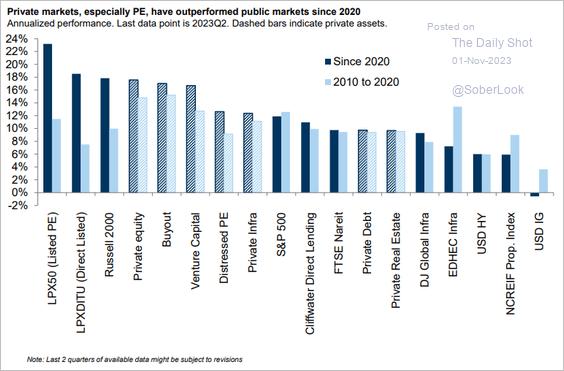

2. Here is a look at performance across private markets.

Source: Goldman Sachs

Source: Goldman Sachs

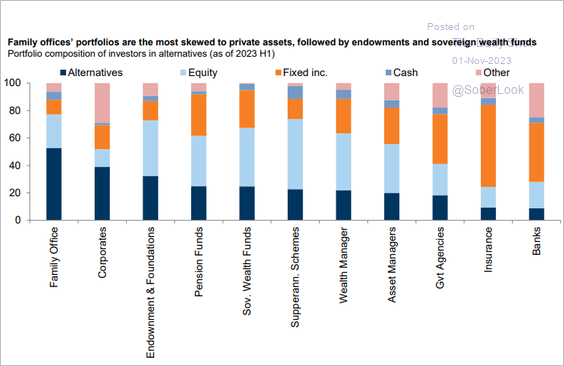

3. Family offices love alternatives.

Source: Goldman Sachs

Source: Goldman Sachs

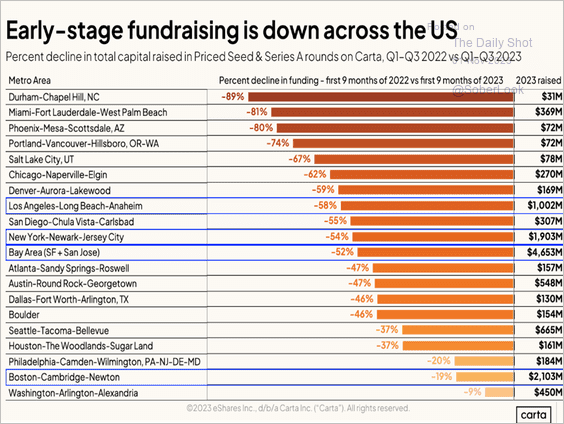

4. Early-stage startup fundraising is down across the US compared to last year. However, according to Carta, early-stage startups are doing better than late-stage startups in fundraising and valuations.

Source: Carta

Source: Carta

Back to Index

Credit

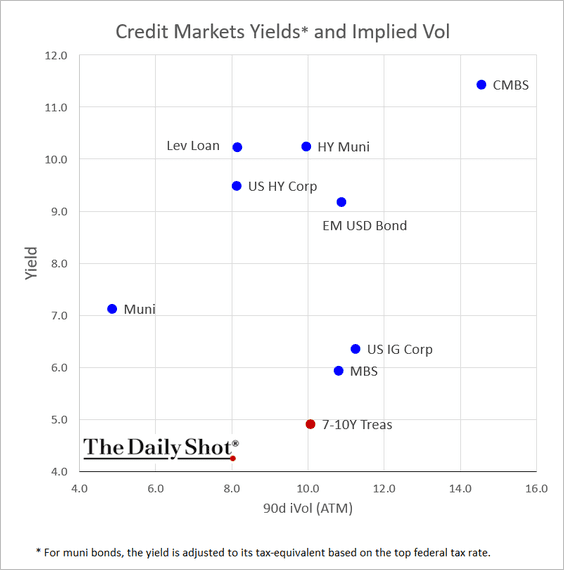

1. This scatterplot shows current yields and implied volatilities across select credit markets (expected returns vs. perceived risk).

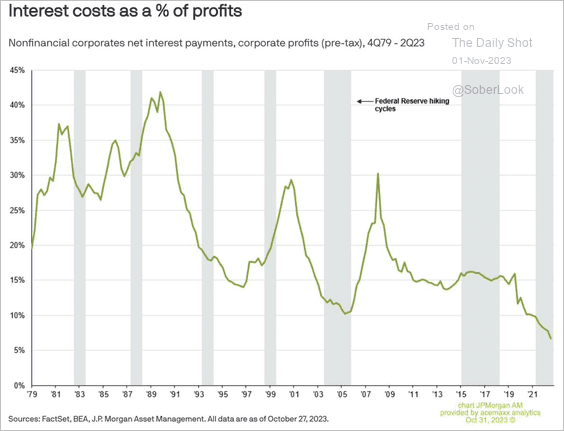

2. Interest costs as a share of US corporate profits are near the lowest levels in 40 years. This is partly because many companies have locked in long-term financing at low rates.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

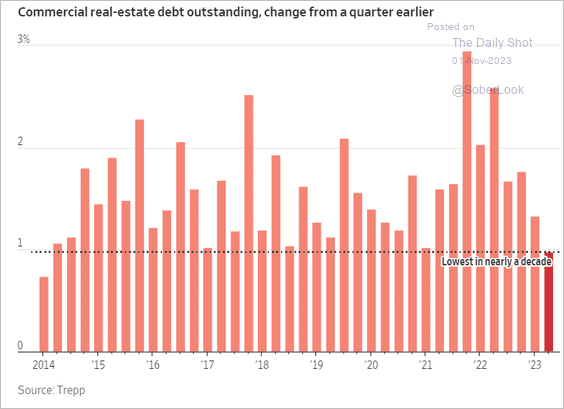

3. Commercial real estate lending has slowed sharply.

Source: @WSJ Read full article

Source: @WSJ Read full article

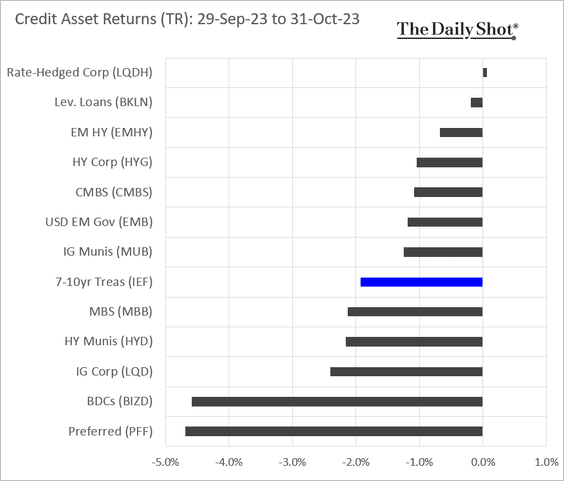

4. Finally, we have the October performance data.

Back to Index

Rates

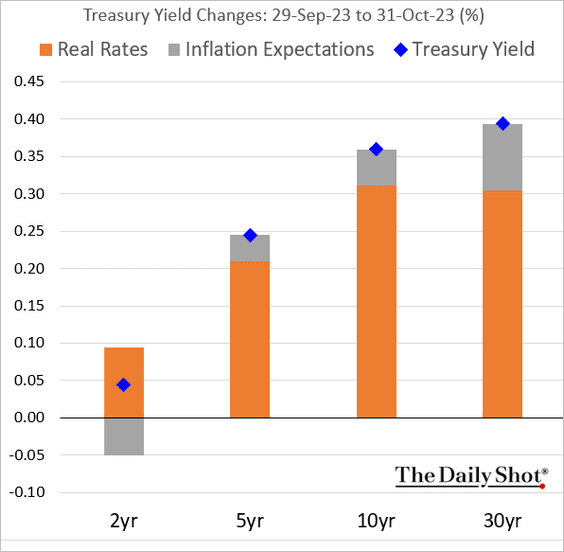

1. The surge in real rates explains most of the gains in Treasury yields in October.

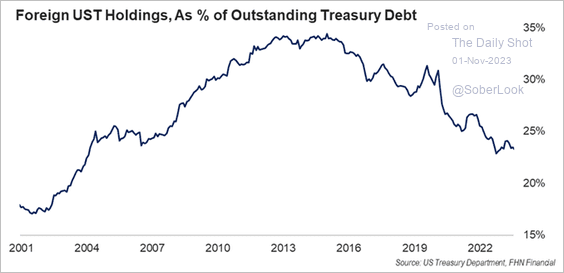

2. Foreign holders’ share of the Treasury market continues to trend lower.

Source: FHN Financial

Source: FHN Financial

Back to Index

Global Developments

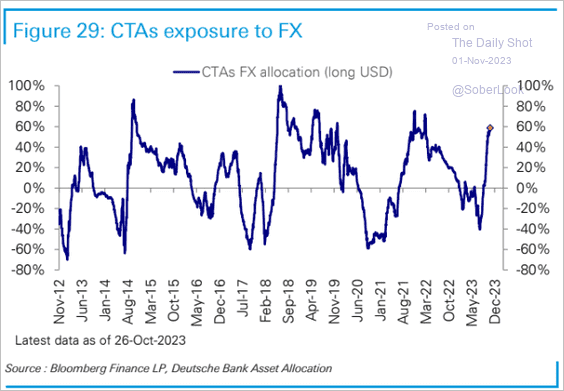

1. CTAs have been boosting their bets on the US dollar.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

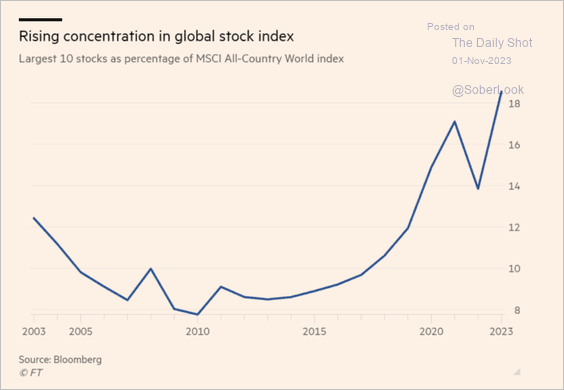

2. Global stock markets are increasingly concentrated.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

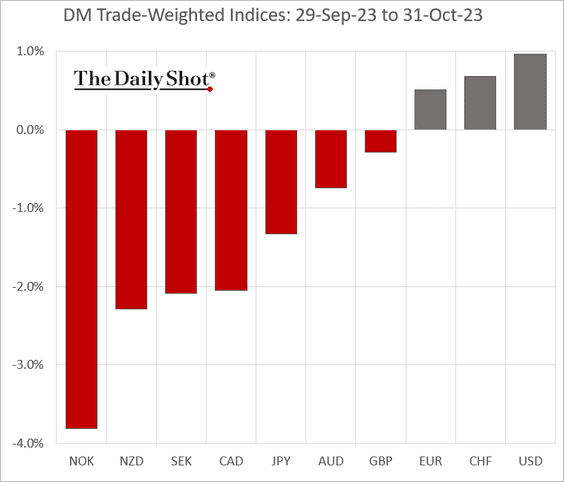

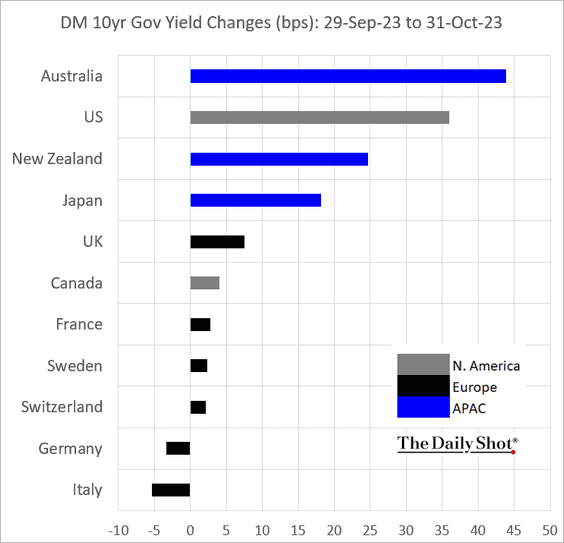

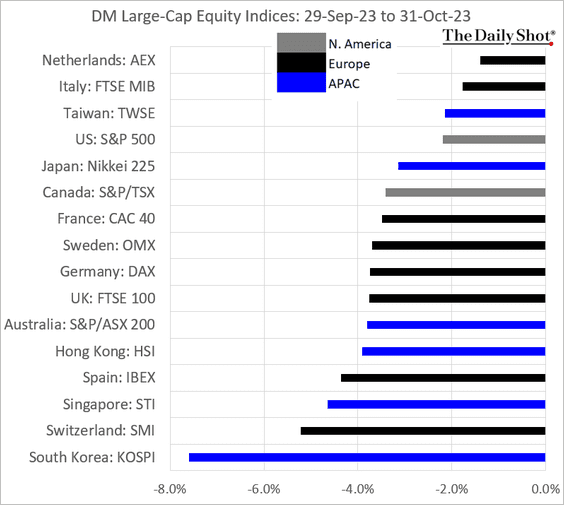

3. Next, we have some performance data for the month of October.

• Currencies:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

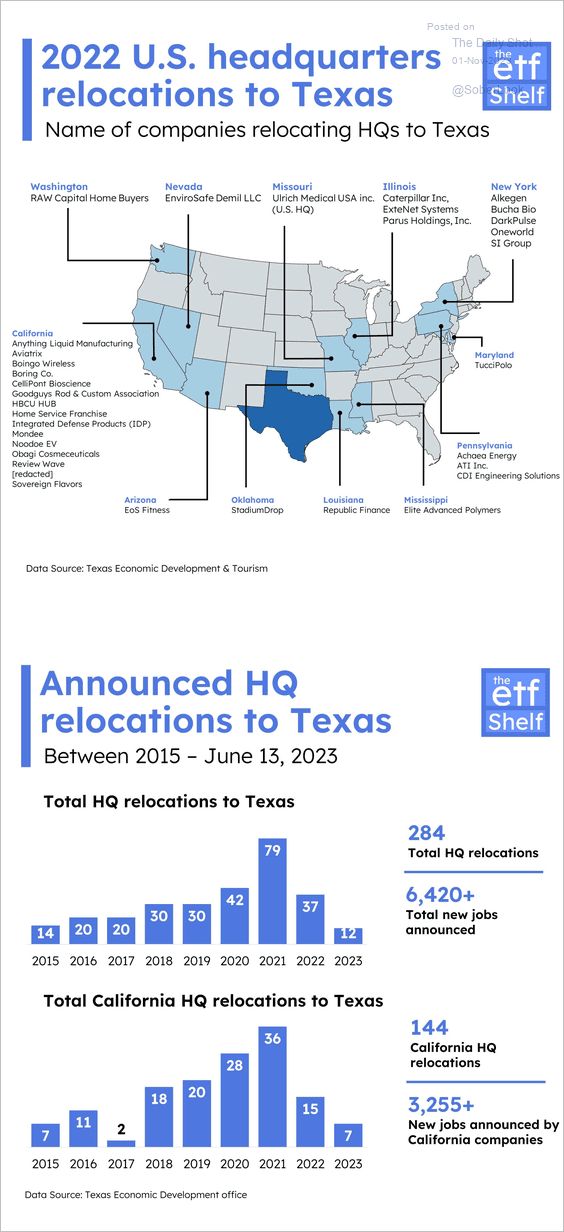

1. Businesses relocating to Texas:

Source: The ETF Shelf

Source: The ETF Shelf

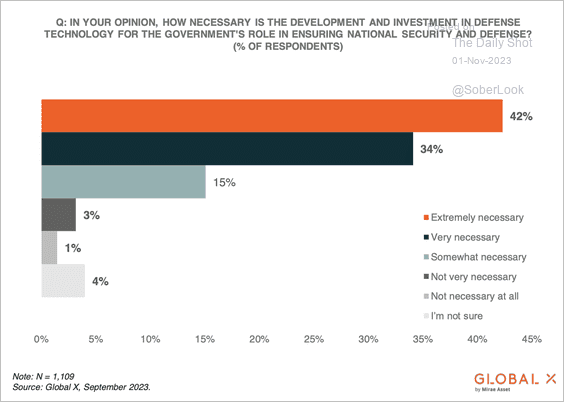

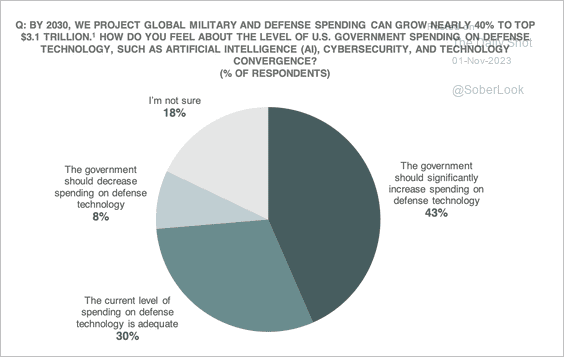

2. Most consumers find government investments in developing defense technology very or extremely necessary, which would warrant an increase in spending, according to a survey by Global X ETFs. (2 charts)

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

——————–

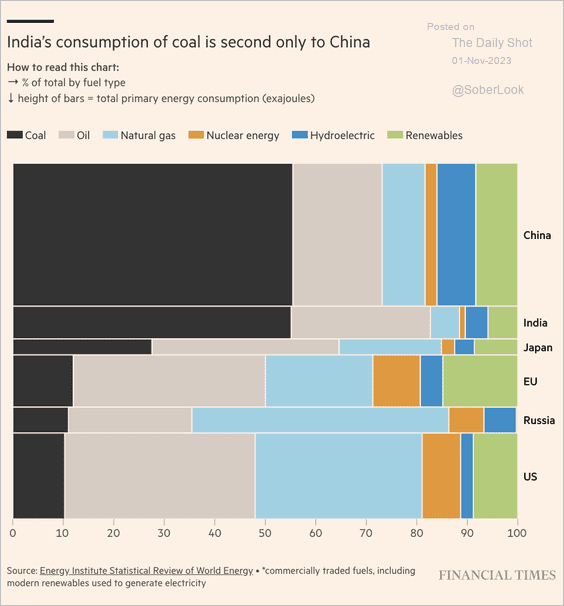

3. Coal consumption in select economies:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

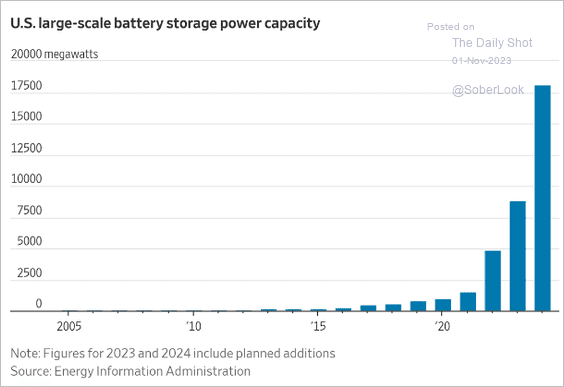

4. US utilities boosting battery storage capacity:

Source: @WSJ Read full article

Source: @WSJ Read full article

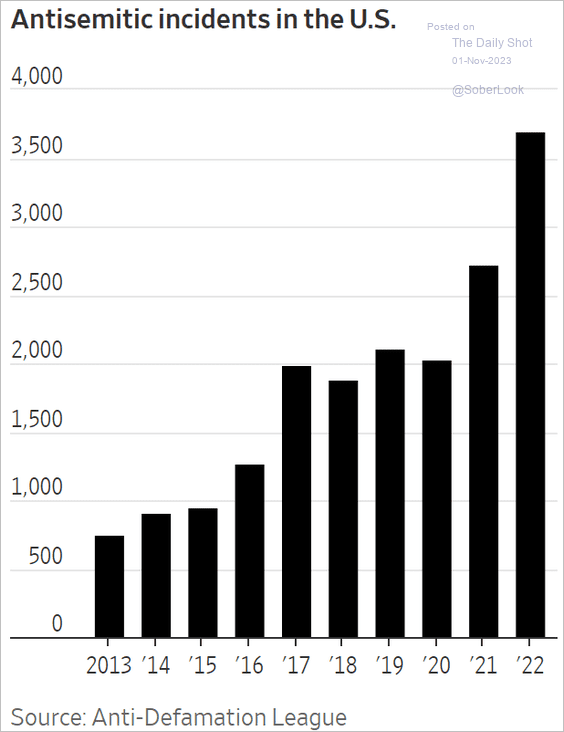

5. Antisemitic incidents in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

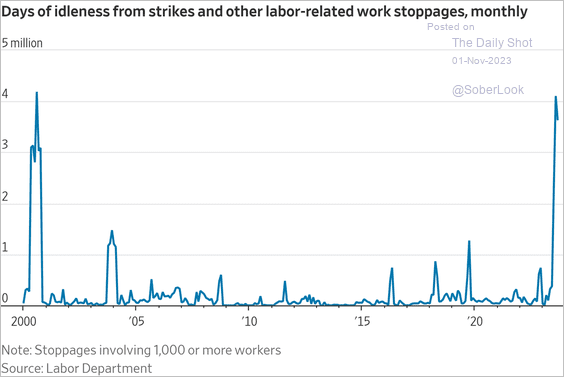

6. Work stoppages:

Source: @WSJ Read full article

Source: @WSJ Read full article

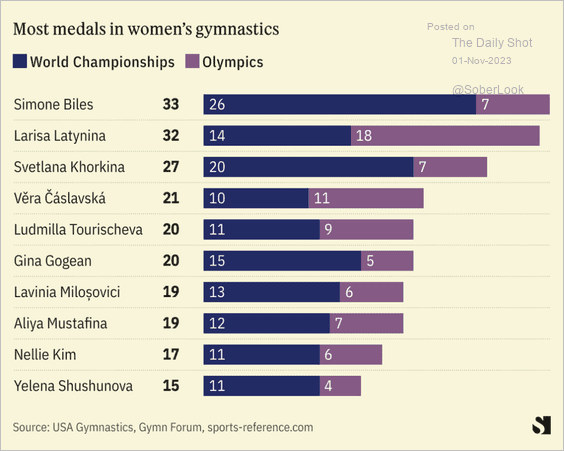

7. Most medals in women’s gymnastics:

Source: Semafor

Source: Semafor

——————–

Back to Index