The Daily Shot: 02-Nov-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

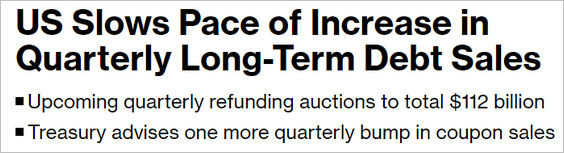

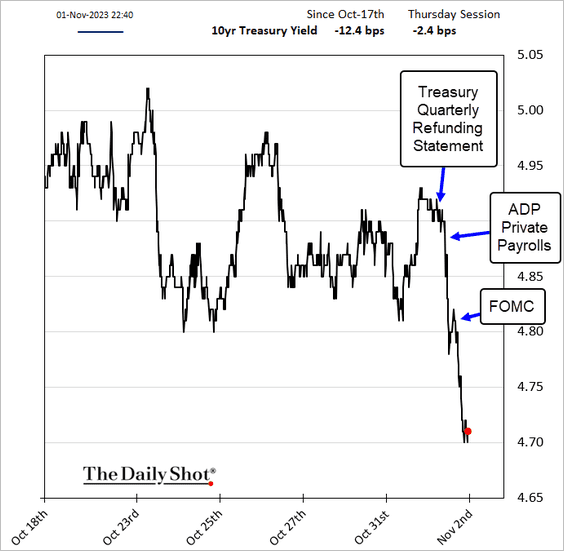

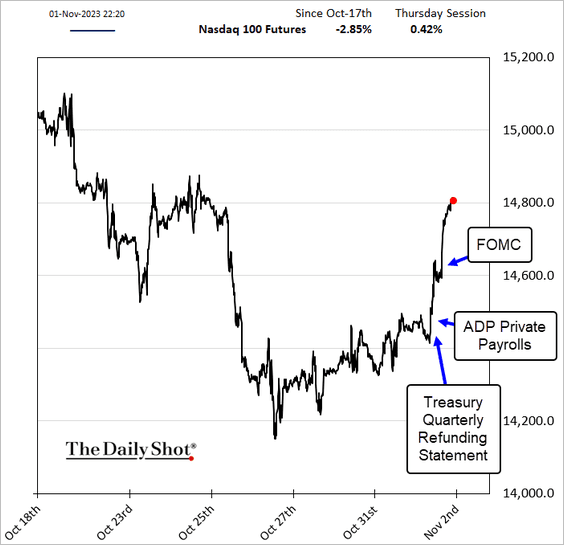

1. Three events brought about a shift in the Treasury market on Wednesday.

• The US Treasury slowed the increases in longer-term bond sales, moving some financing to bills.

Source: @markets Read full article

Source: @markets Read full article

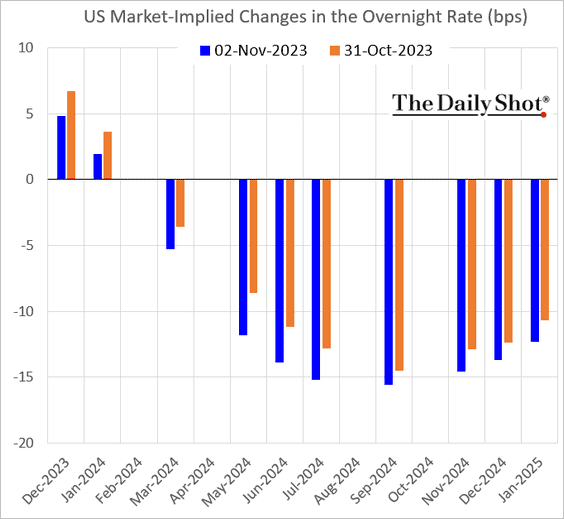

Source: US Treasury Read full article

Source: US Treasury Read full article

• The ADP private payrolls report showed the labor market softening (more on this below).

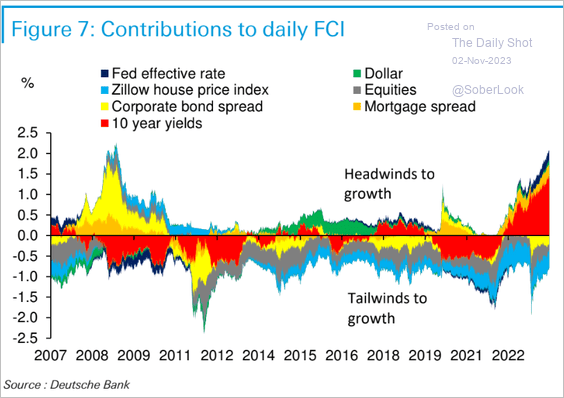

• Chair Powell kept up the hawkish rhetoric after the FOMC left rates unchanged, but the markets saw some dovishness between the lines. The prevailing view now is that the Fed is likely done raising rates.

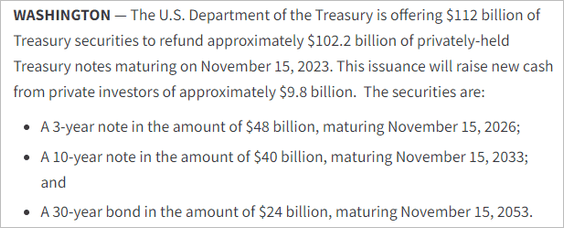

– The FOMC remains focused on tight financial conditions.

Financial conditions have tightened significantly in recent months, driven by higher longer-term bond yields, among other factors. Because persistent changes in financial conditions can have implications for the path of monetary policy, we monitor financial developments closely.

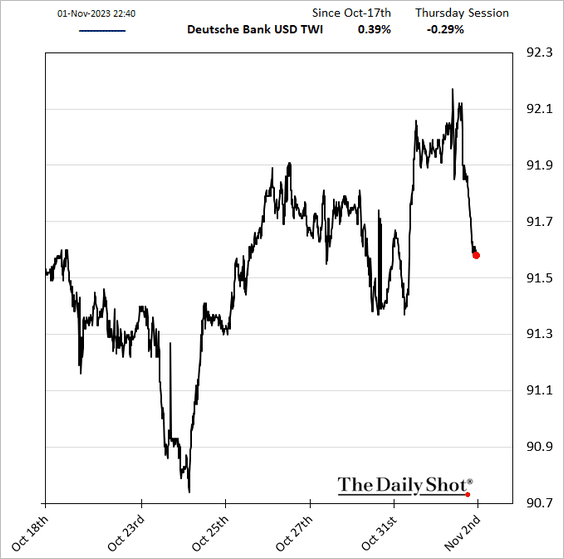

Source: Deutsche Bank Research

Source: Deutsche Bank Research

– The monetary policy lag was mentioned again.

… the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

– The FOMC is comfortable with pausing.

Slowing down is giving us, I think, a better sense of how much more we need to do, if we need to do more ….

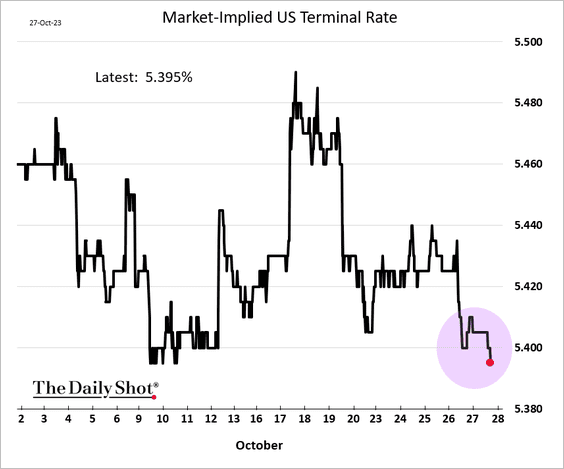

The market-based probability of a December rate hike declined.

– The implied terminal rate dipped below 5.4%.

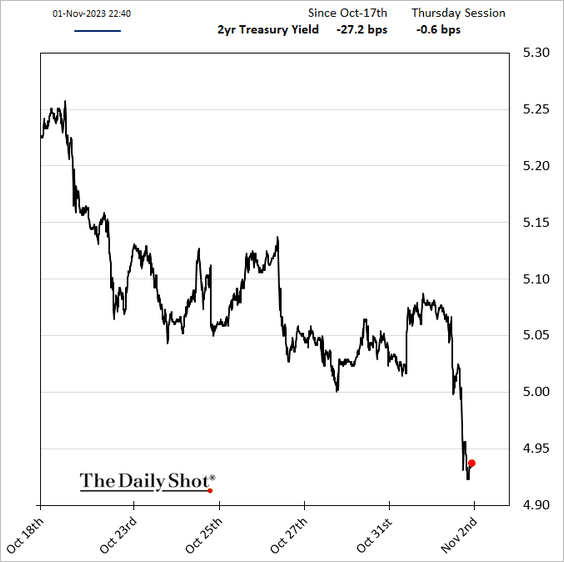

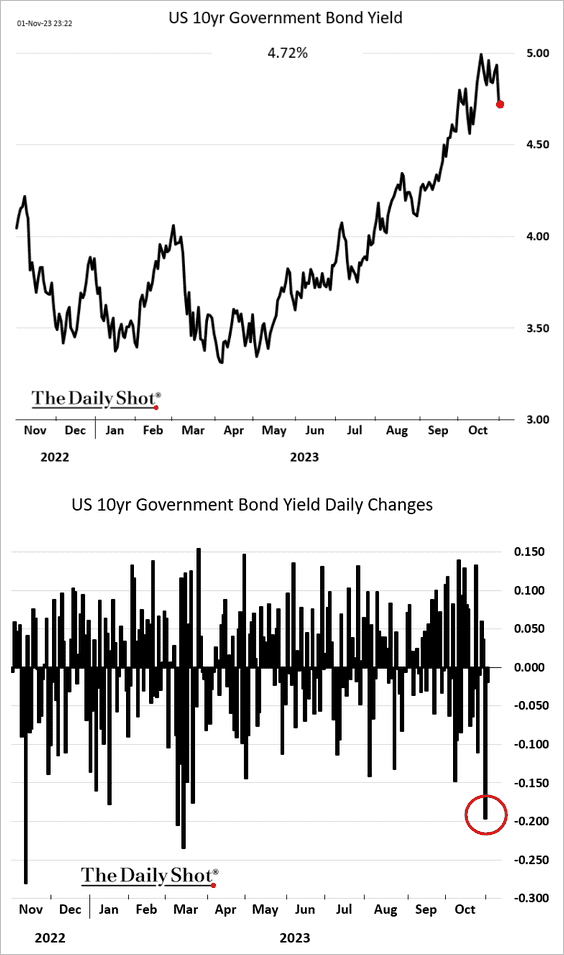

– Treasury yields dropped sharply, …

… boosting equity prices.

– The US dollar fell.

——————–

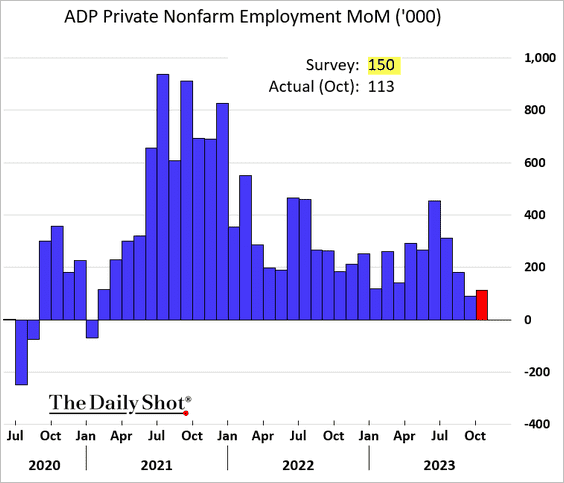

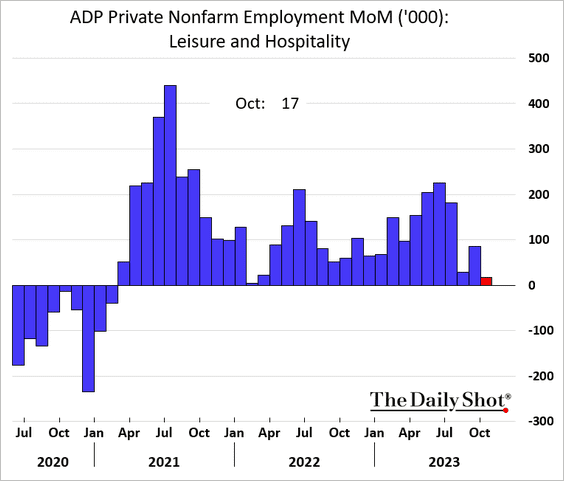

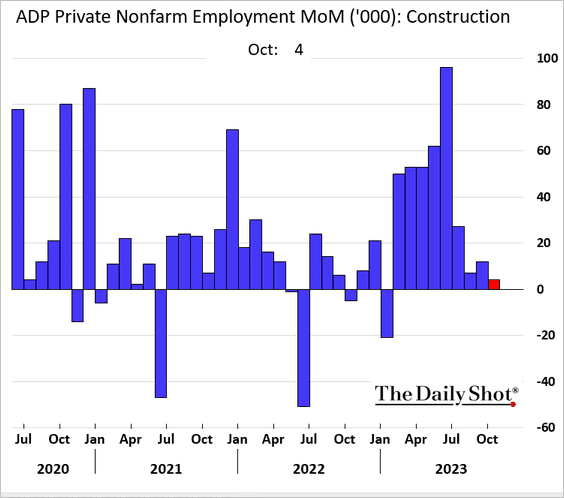

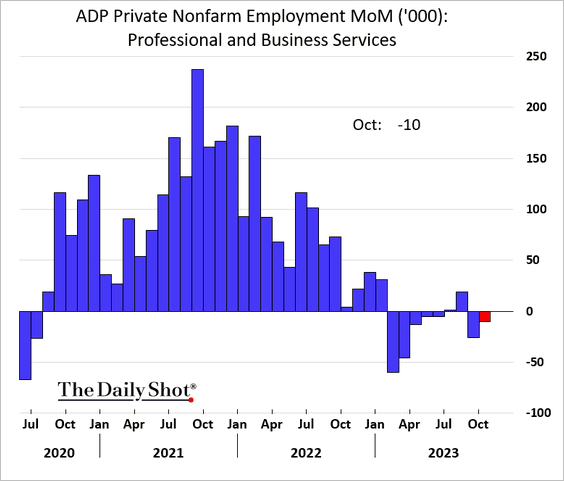

2. The October ADP private payrolls surprised to the downside again, …

Source: CNBC Read full article

Source: CNBC Read full article

… as hiring at hotels, restaurants, and bars slowed further.

• Construction job gains slowed as well.

• And business services registered their second monthly decline.

——————–

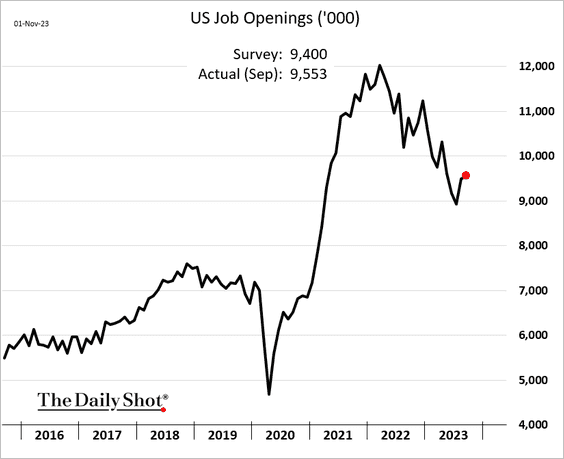

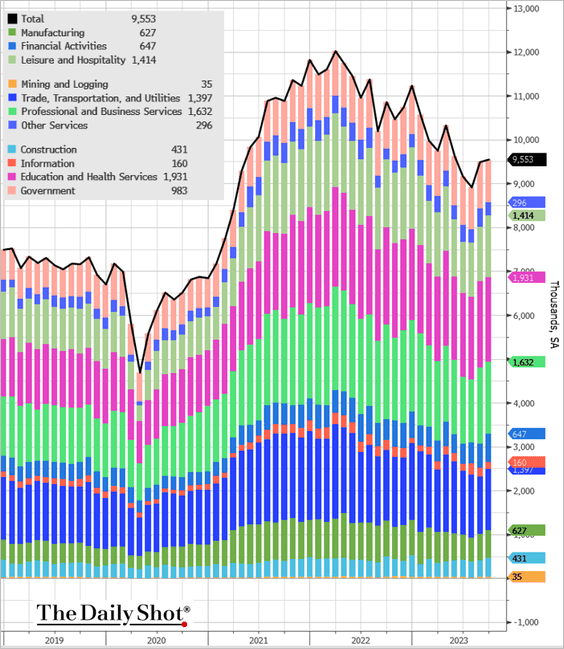

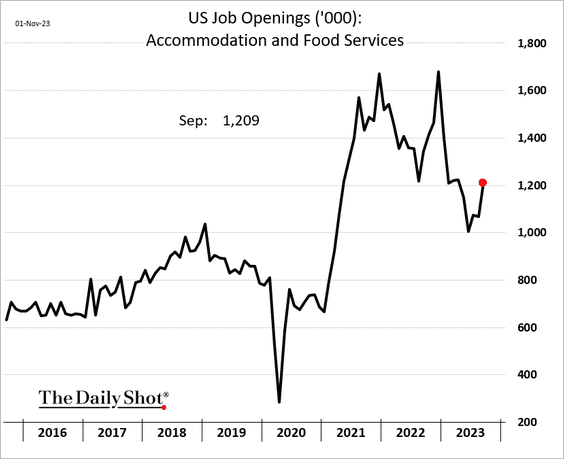

3. Job openings continued to reflect tight labor markets in September. However, due to the data’s lag, this measure may now be somewhat outdated.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @economics Read full article

Source: @economics Read full article

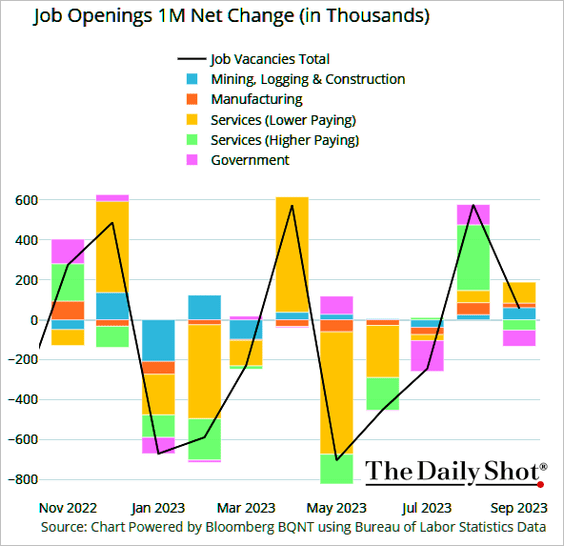

• Much of the increase in job openings was driven by low-wage services (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

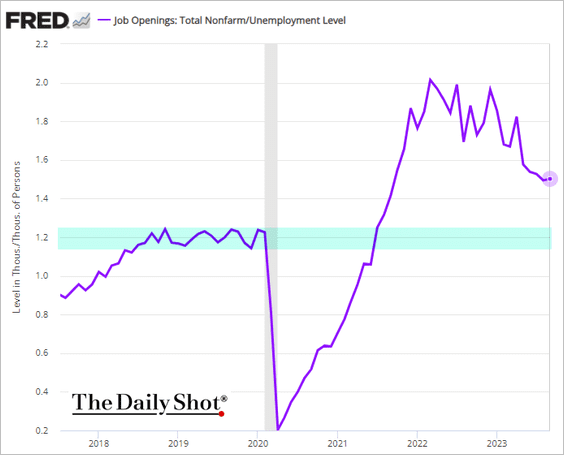

• The number of job openings per unemployed American remains well above pre-COVID levels.

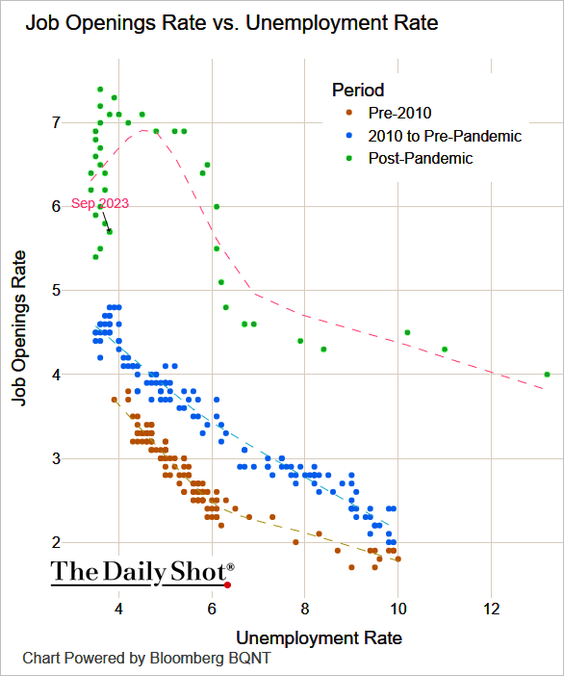

– The Beveridge curve also continues to indicate labor market imbalances.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

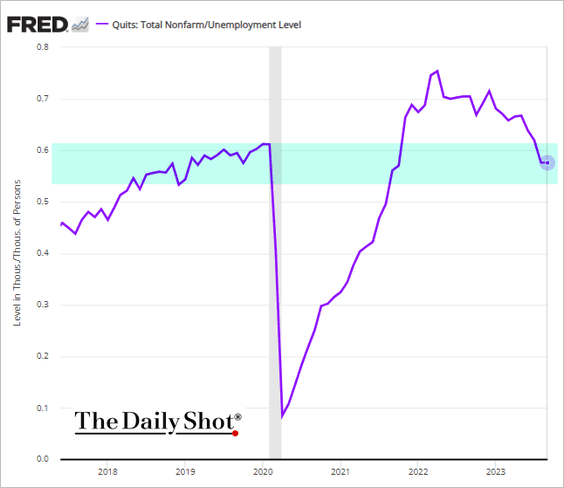

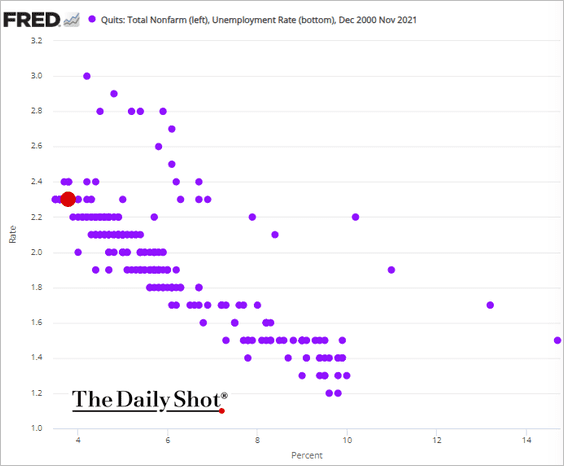

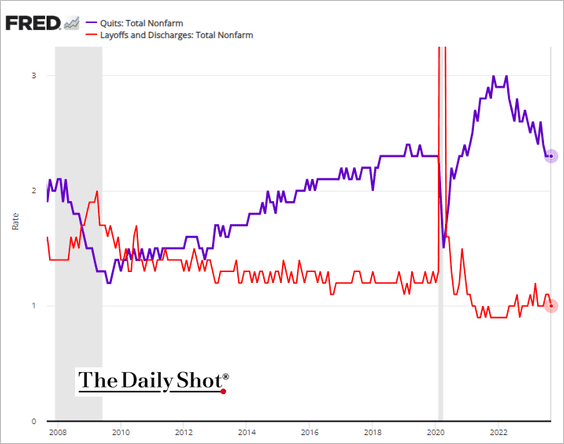

– However, the quits rate (voluntary resignations) has been in line with pre-pandemic levels.

This scatterplot shows the quits rate and the unemployment rate.

• Layoffs remained relatively low.

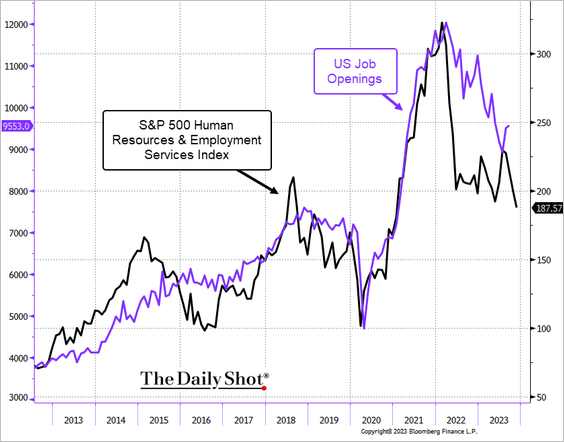

• Stock prices of recruitment firms signal fewer job vacancies ahead.

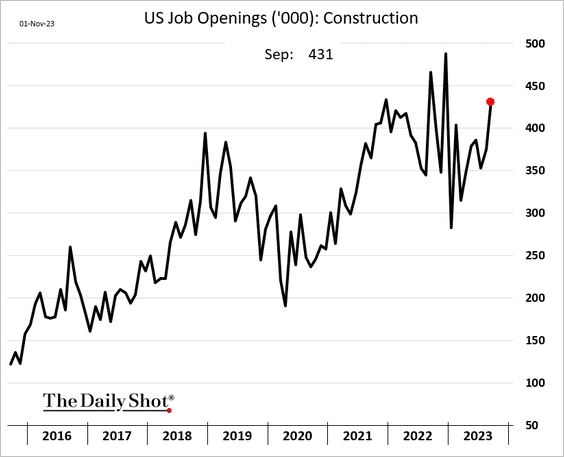

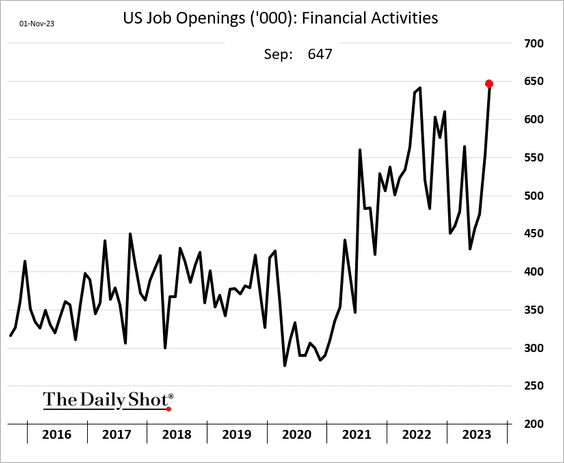

• Remarkably, construction and financial activities, which include real estate and rental/ leasing services, registered solid increases in job vacancies.

——————–

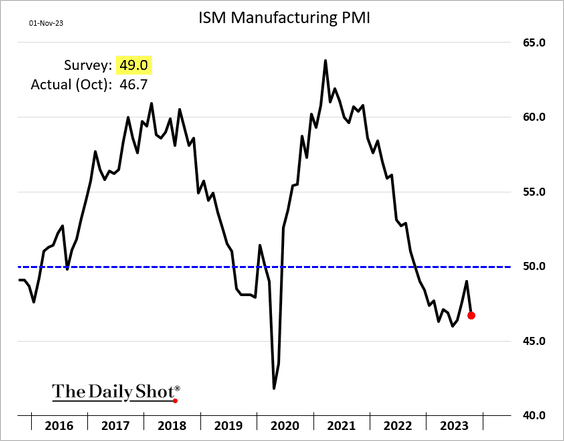

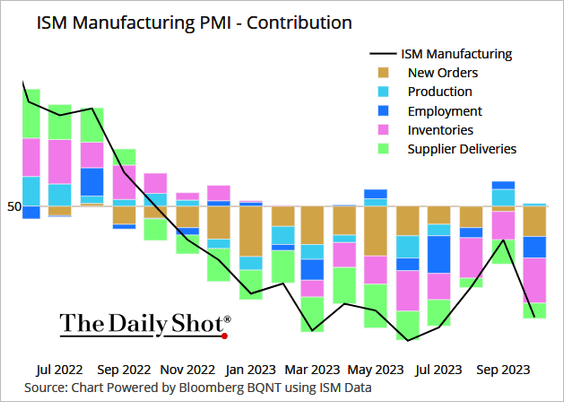

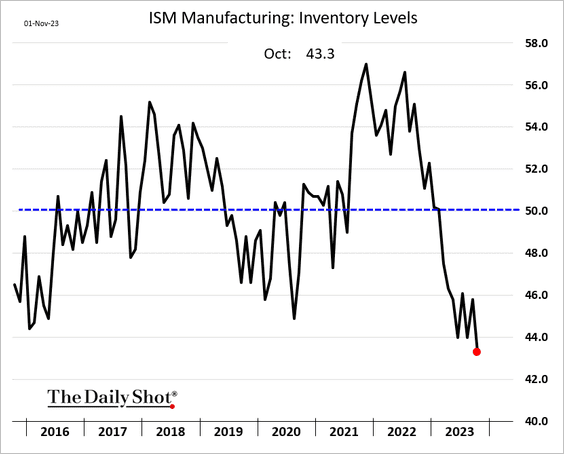

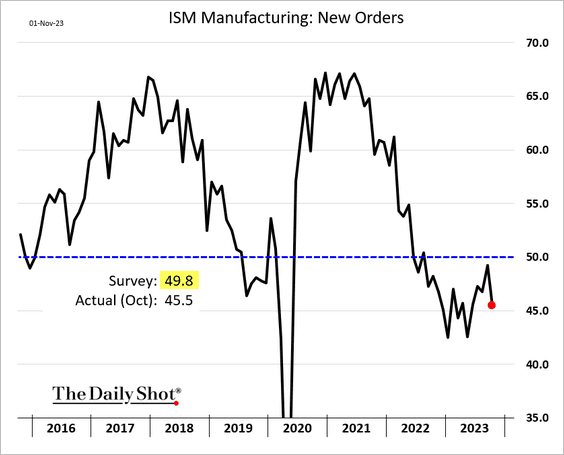

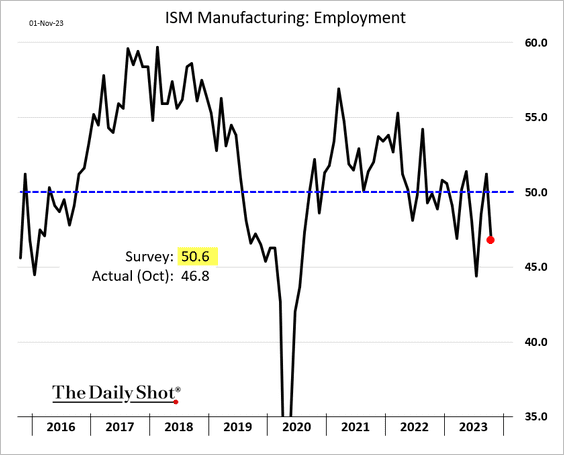

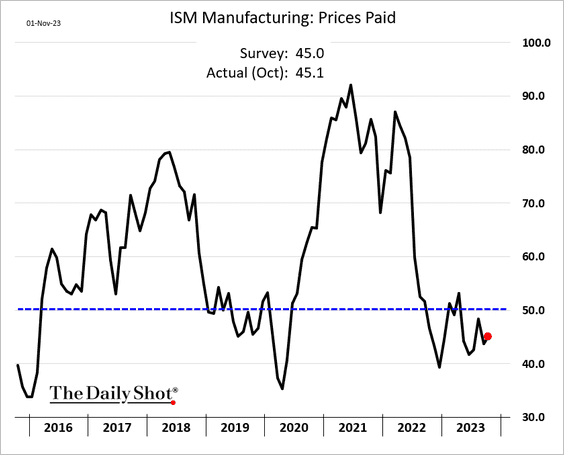

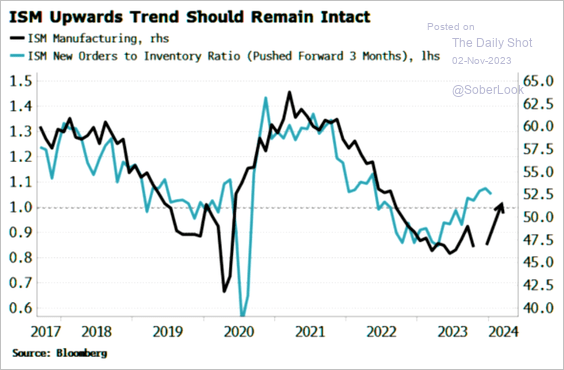

4. The ISM Manufacturing PMI declined sharply in October (well below forecasts), suggesting that US factories continue to face challenges.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

• Manufacturers have been cutting inventories, …

… amid soft demand.

• Manufacturers are reporting employee reductions again.

• Costs have been easing.

• The orders-to-inventories ratio points to a rebound in factory activity next year.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

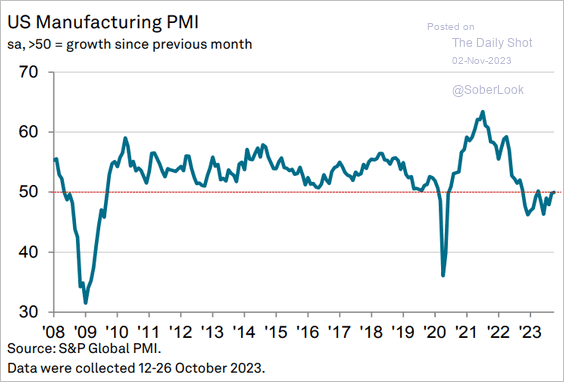

• A similar report from S&P Global suggests that while manufacturing activity is not growing, it seems to have stabilized.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

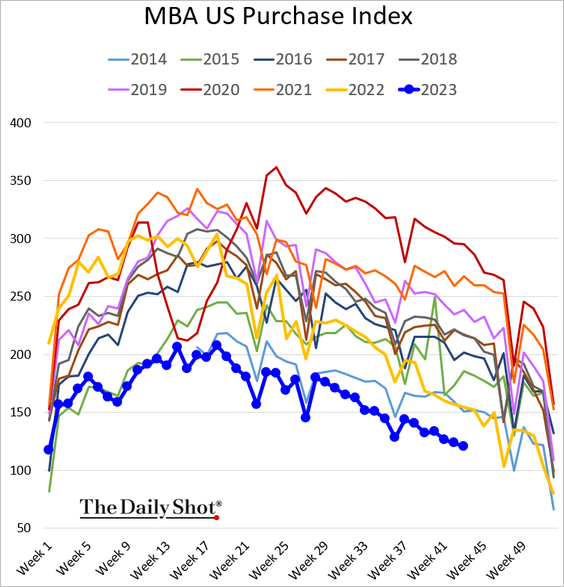

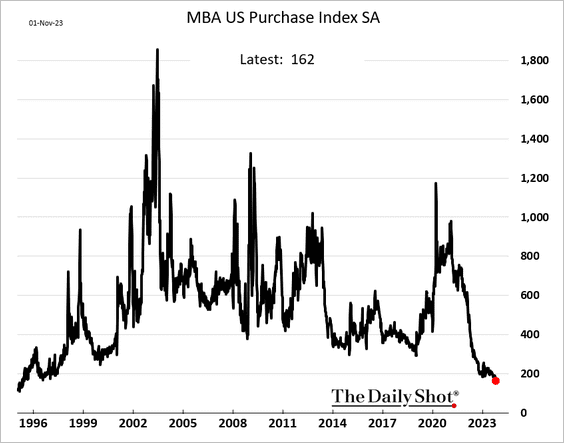

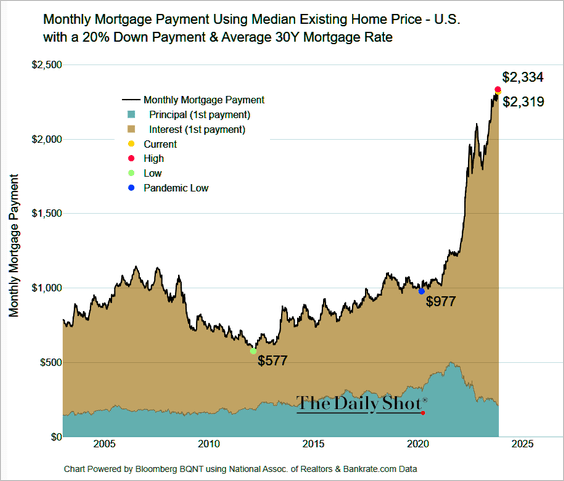

5. Mortgage applications remain at multi-year lows.

• The seasonally adjusted index shows that loan demand hasn’t been this weak since 1995, …

… as affordability worsens.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

The United Kingdom

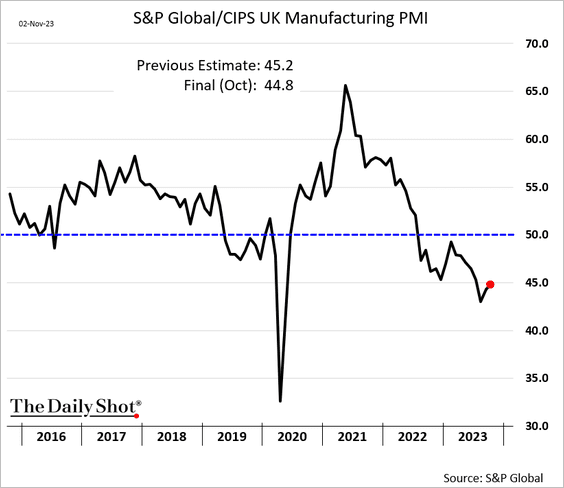

1. The final manufacturing PMI figure was weaker than the earlier estimate, with British factories struggling to return to growth.

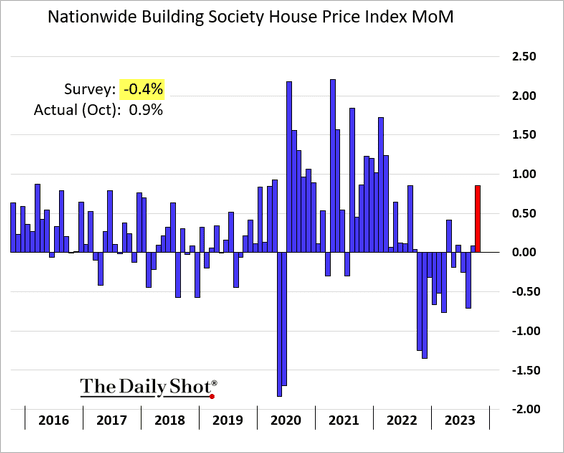

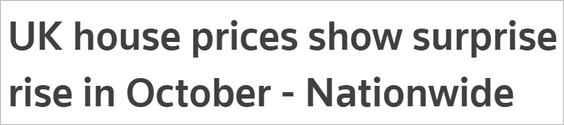

2. UK home prices unexpectedly jumped in October.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

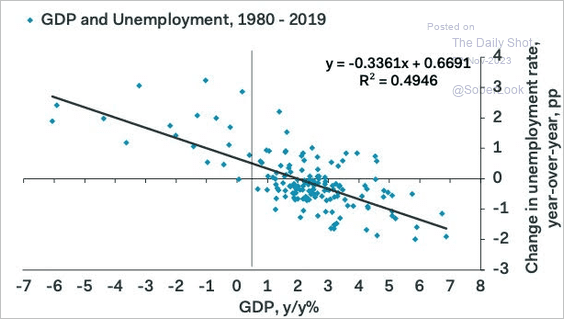

3. Weaker economic activity is expected to boost unemployment.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

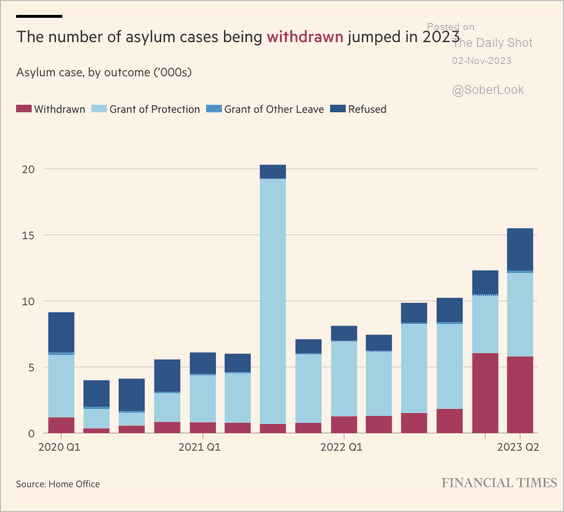

3. More asylum applications are being withdrawn.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

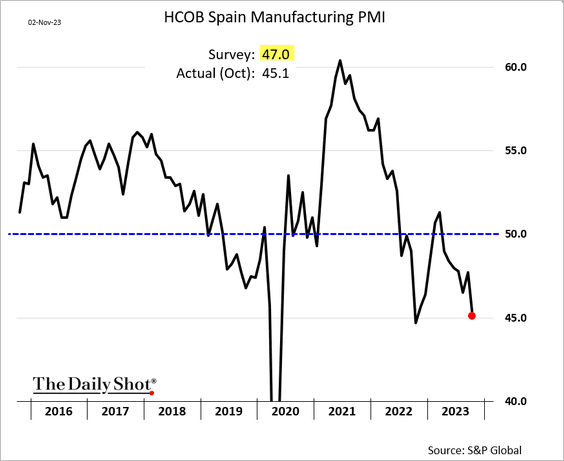

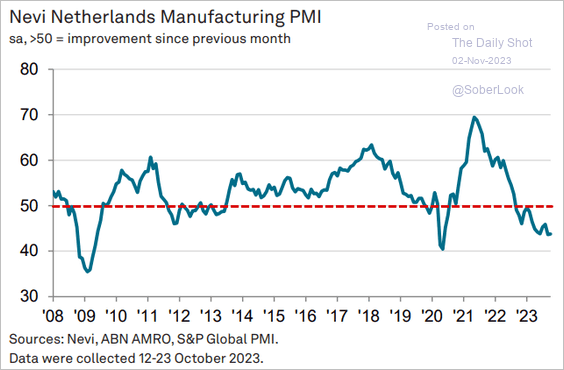

1. The manufacturing PMI reports remain awful.

• Spain (sharp deterioration):

• The Netherlands (ongoing contraction):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

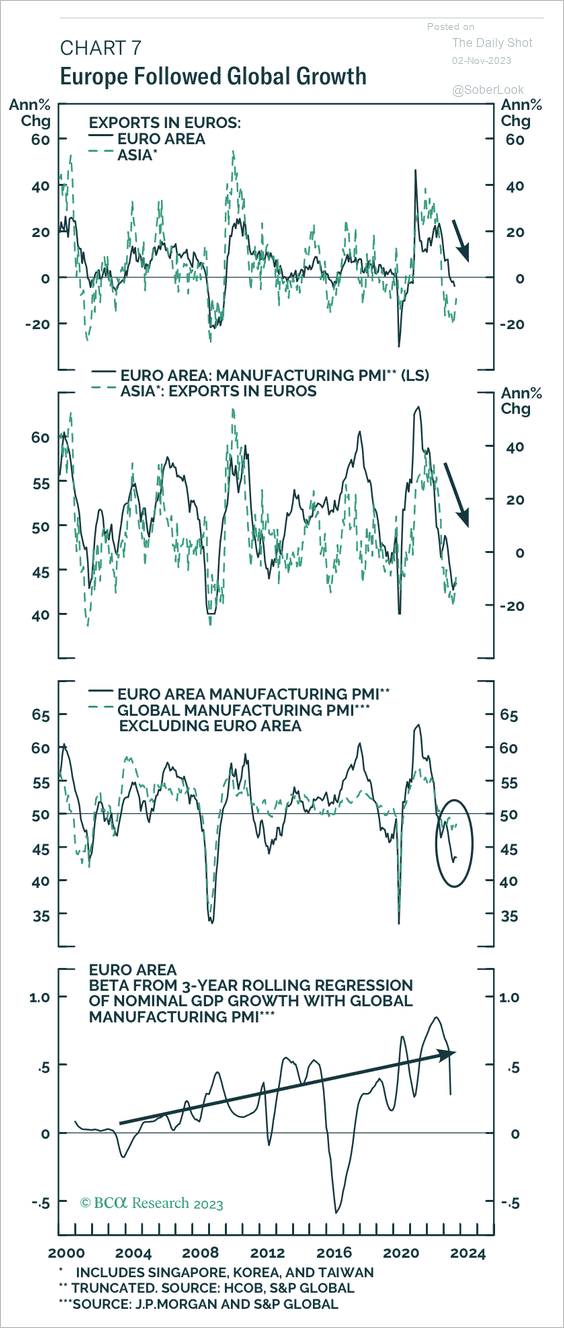

2. Softness in the global industrial cycle has weighed on the Euro area economy.

Source: BCA Research

Source: BCA Research

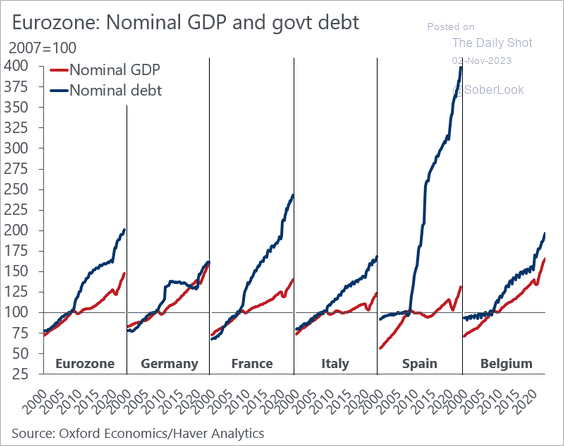

3. Government debt growth has been outpacing economic expansion.

Source: @DanielKral1

Source: @DanielKral1

Back to Index

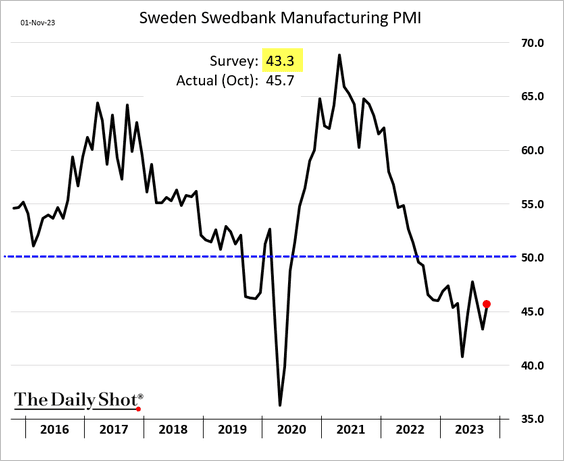

Europe

1. The slump in Sweden’s factory activity eased somewhat last month.

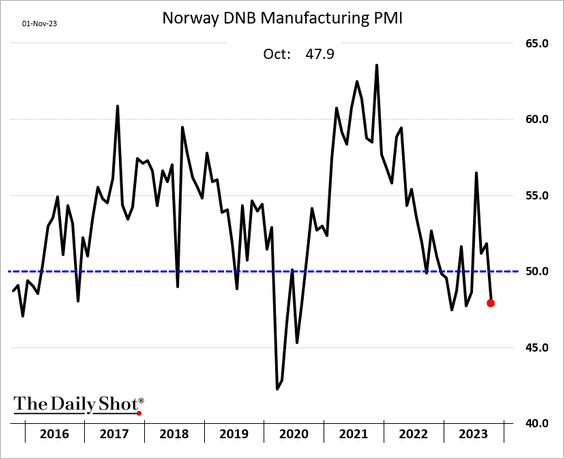

2. Norway’s manufacturing PMI is back in contraction mode.

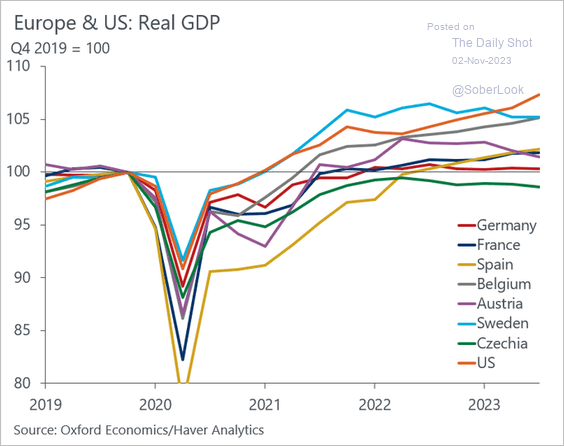

3. Here is a look at COVID-era GDP growth.

Source: @DanielKral1

Source: @DanielKral1

Back to Index

Japan

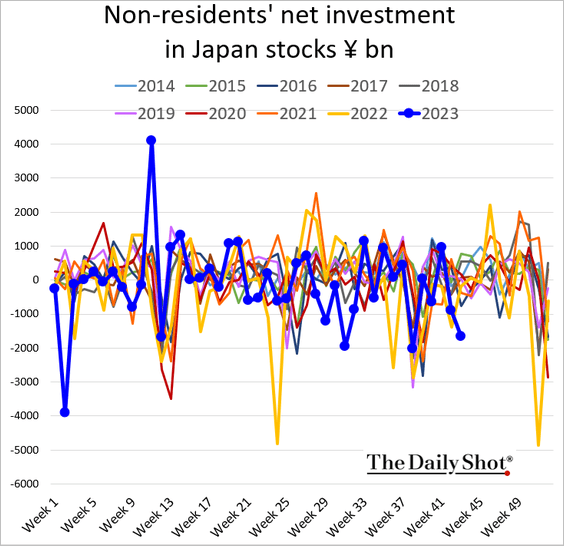

1. Foreigners were exiting Japanese equities last week.

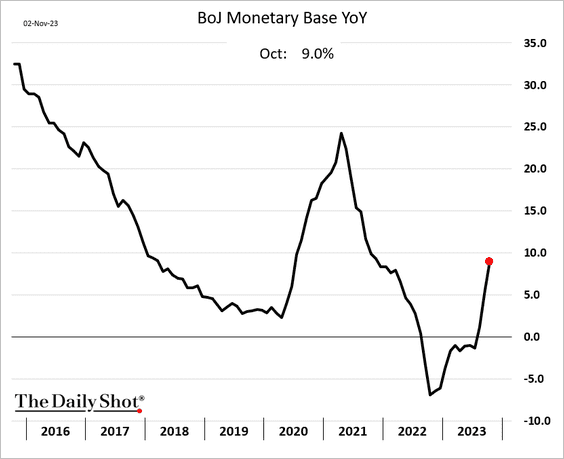

2. The BoJ’s monetary base has been rebounding.

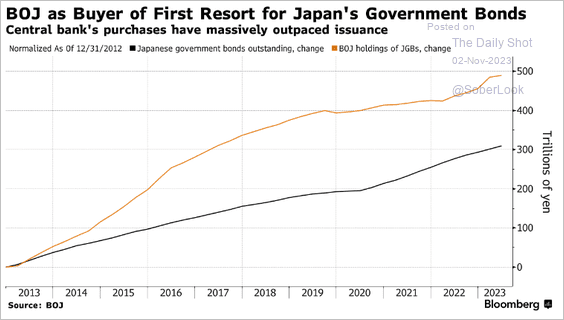

• The BoJ’s bond purchases have been outpacing the JGB market growth.

Source: @GarfieldR1966 Read full article

Source: @GarfieldR1966 Read full article

——————–

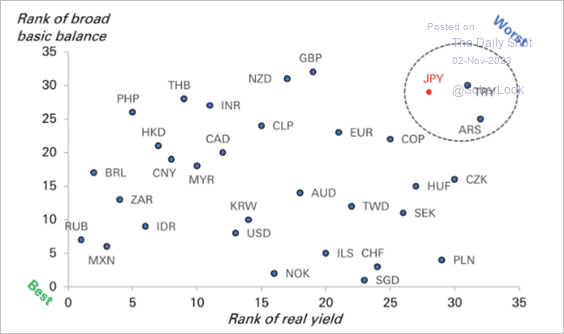

3. The yen’s currency drivers are in the same league as Turkey and Argentina.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Asia-Pacific

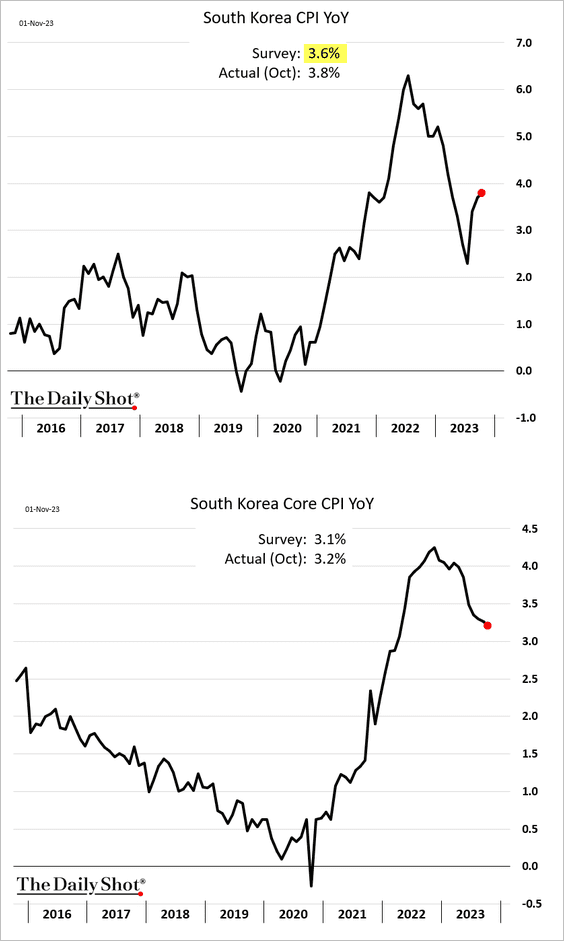

1. South Korea’s CPI report was firmer than expected.

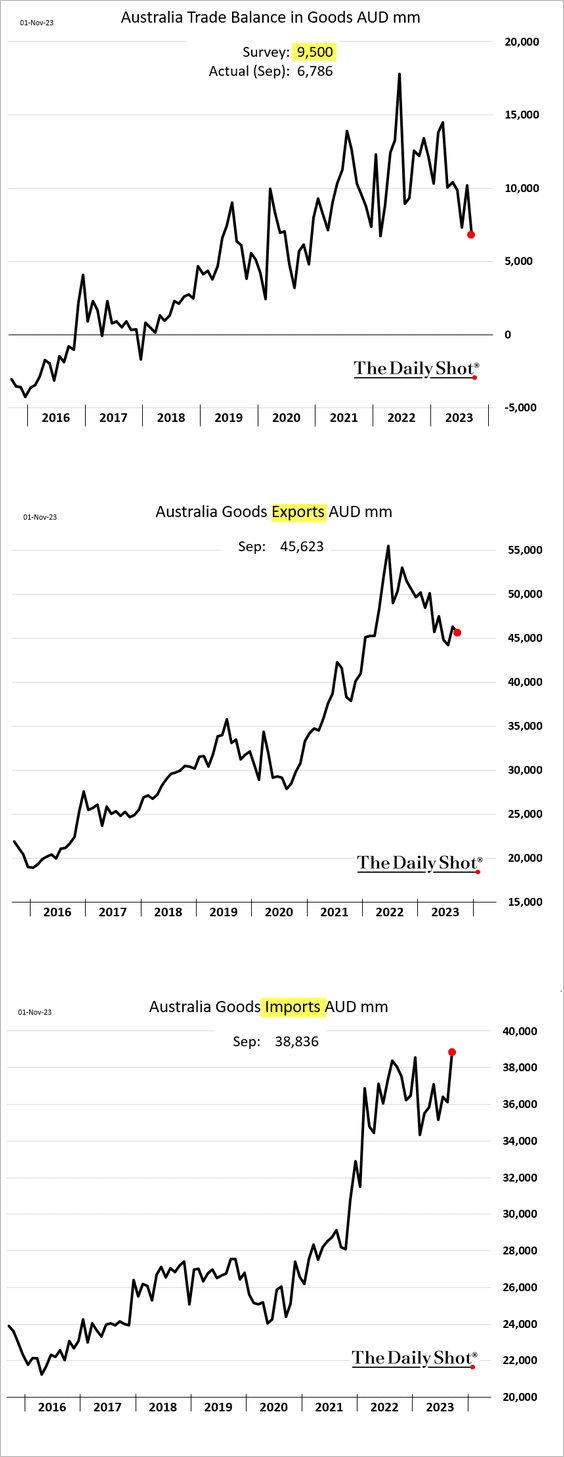

2. Australia’s trade surplus narrowed sharply as imports surged in September.

Back to Index

China

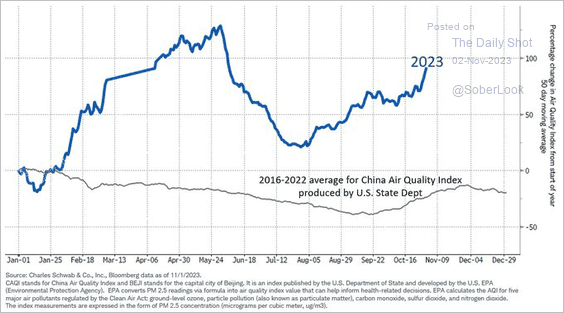

1. Rising air pollution is signaling stronger economic activity.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

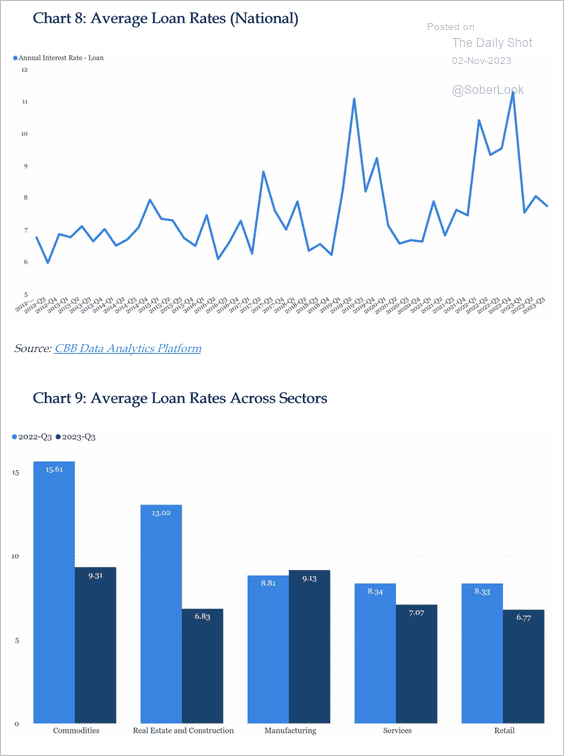

2. Average loan rates declined across sectors but remain elevated relative to historical levels.

Source: China Beige Book

Source: China Beige Book

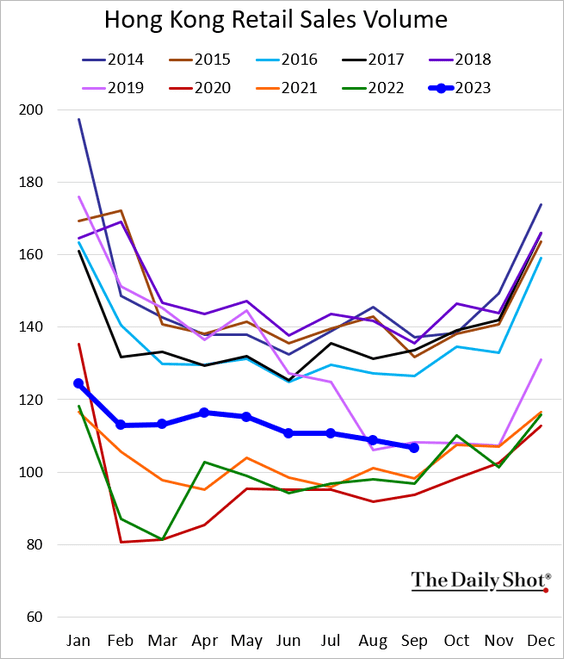

3. While above last year’s levels, Hong Kong’s retail sales have been slowing.

Back to Index

Emerging Markets

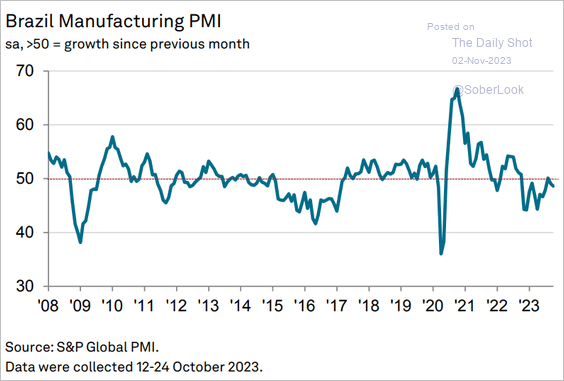

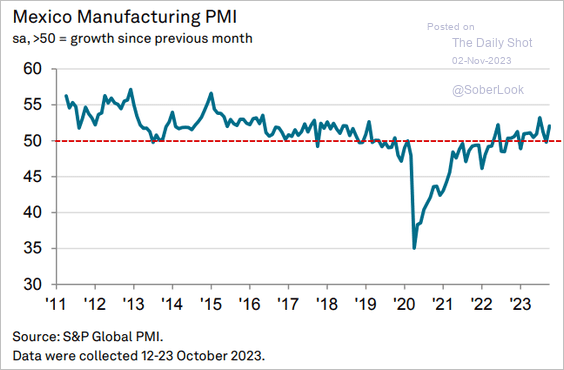

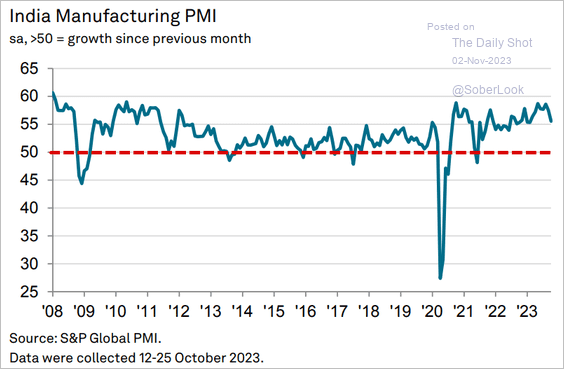

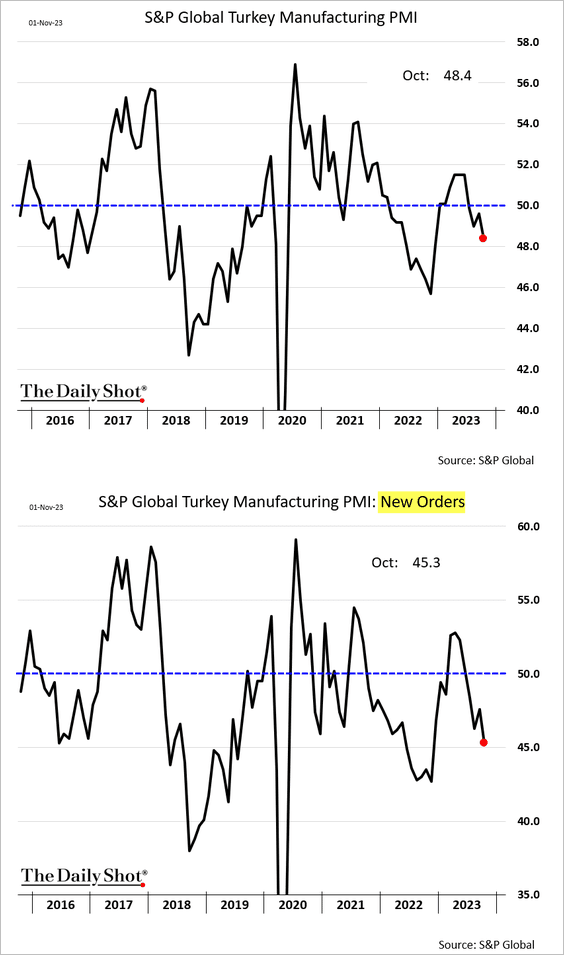

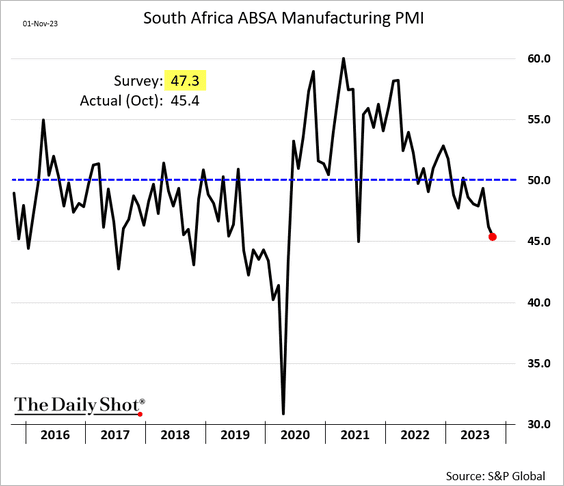

1. Let’s start with some key manufacturing PMI reports.

• Brazil (back in contraction):

Source: S&P Global PMI

Source: S&P Global PMI

• Mexico (faster growth):

Source: S&P Global PMI

Source: S&P Global PMI

• India (slower but still robust growth):

Source: S&P Global PMI

Source: S&P Global PMI

• Turky (tumbling demand):

• South Africa (rapid deterioration):

——————–

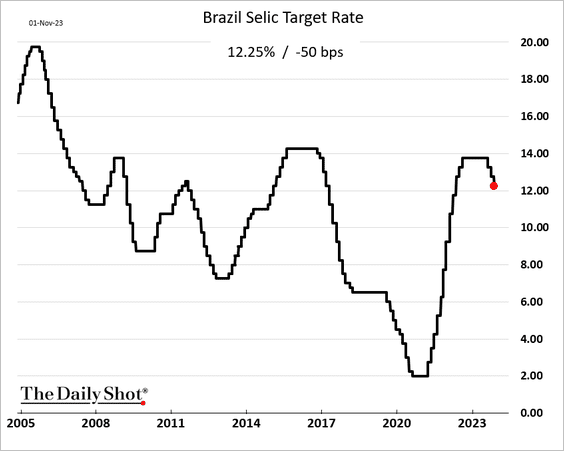

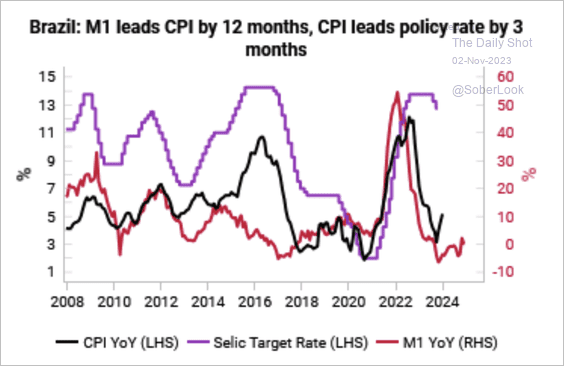

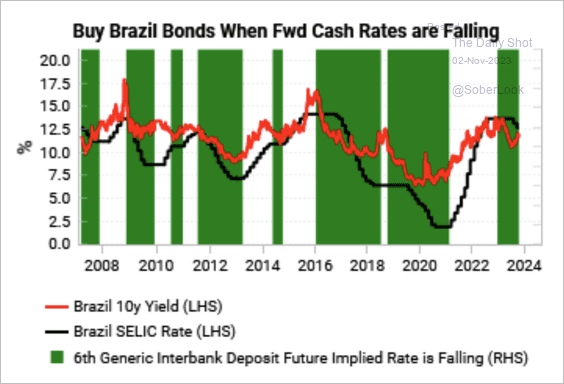

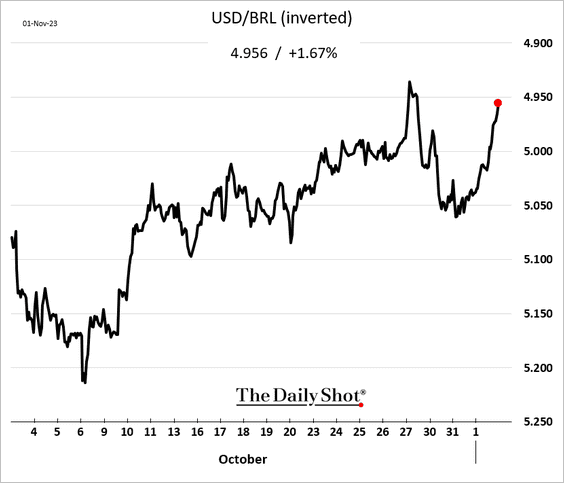

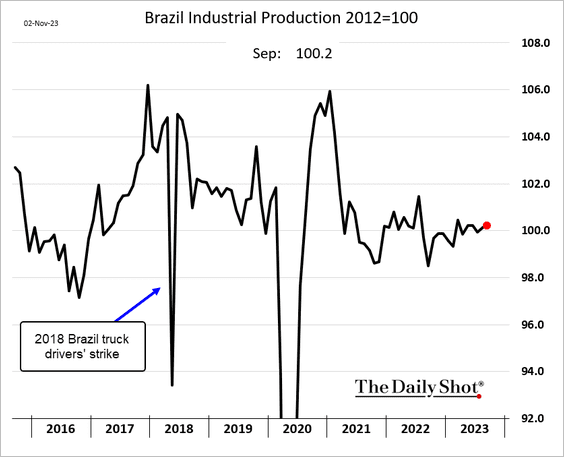

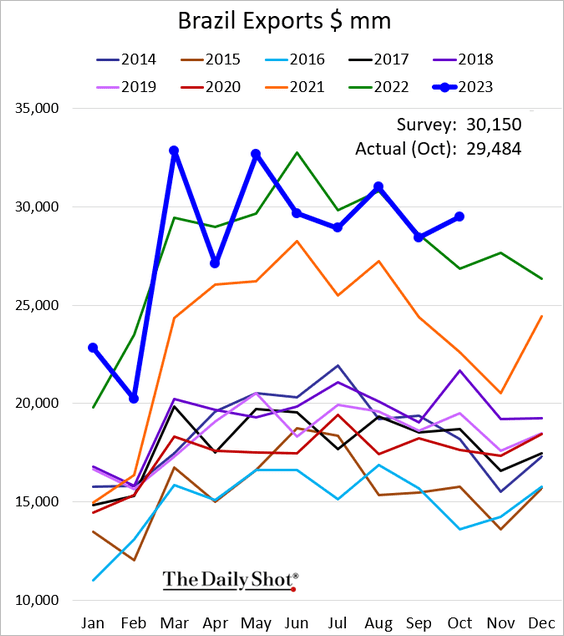

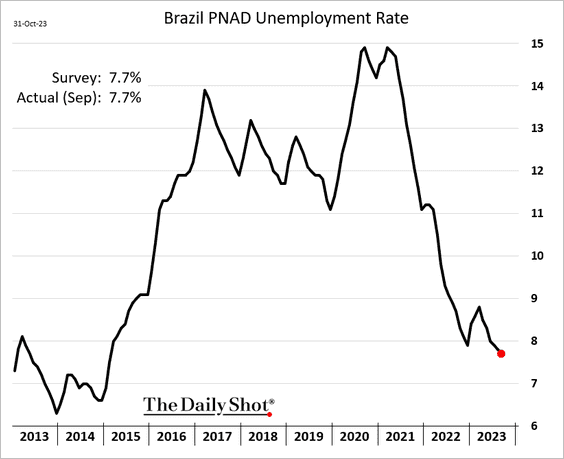

2. Next, we have some updates on Brazil.

• The central bank cut its policy rate again.

• The decline in Brazil’s money supply and inflation points to a continued easing cycle, which may benefit sovereign bonds. (2 charts)

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

• The real has been strengthening over the past couple of days.

• Industrial production edged higher in September.

• Exports hit a new high for this time of the year.

• The unemployment rate continues to decline.

——————–

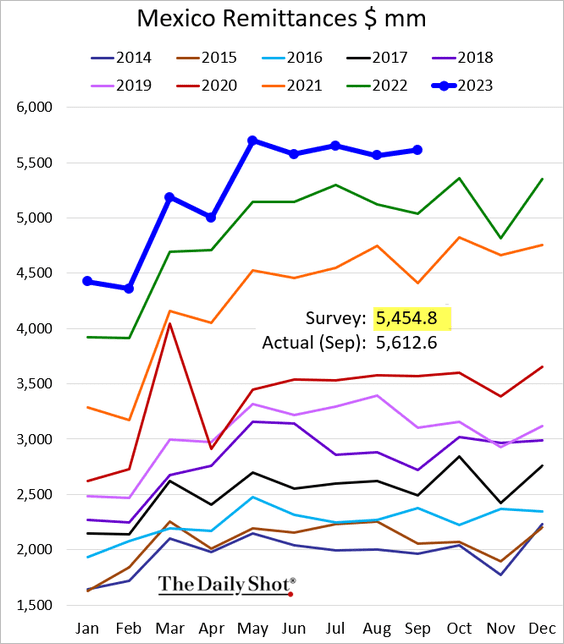

3. Mexico’s remittances are at record levels for this time of the year.

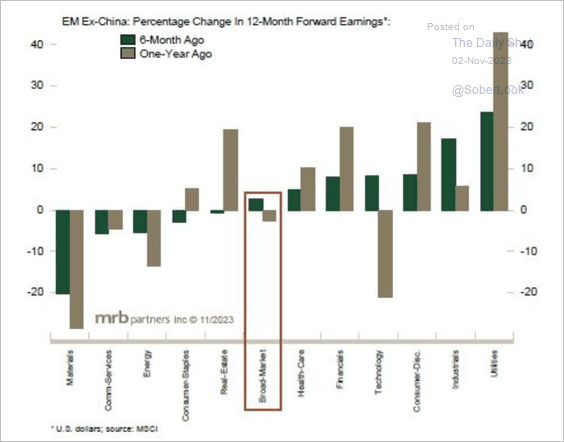

4. EM ex-China earnings momentum is stronger and more broad-based.

Source: MRB Partners

Source: MRB Partners

Back to Index

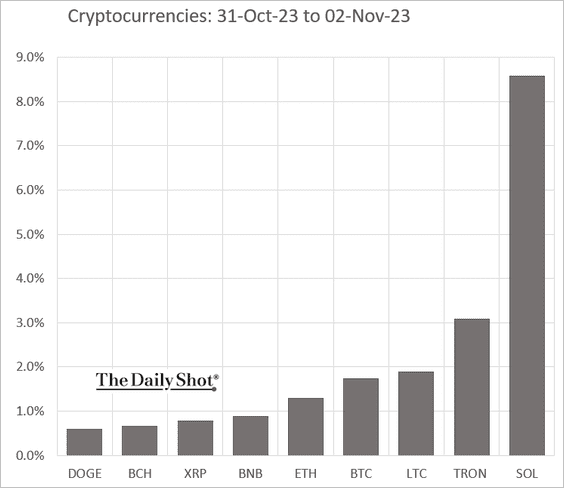

Cryptocurrency

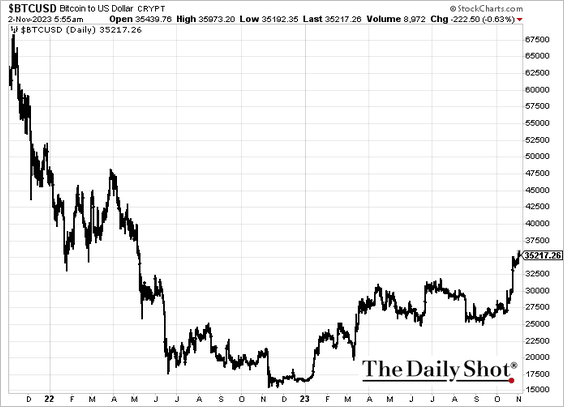

The market’s momentum extended into November, …

… with bitcoin trading above $35k.

Back to Index

Commodities

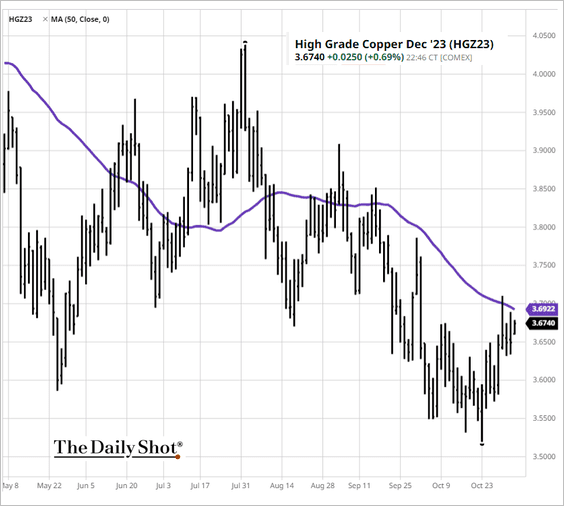

1. Copper is testing resistance at the 50-day moving average.

Source: barchart.com

Source: barchart.com

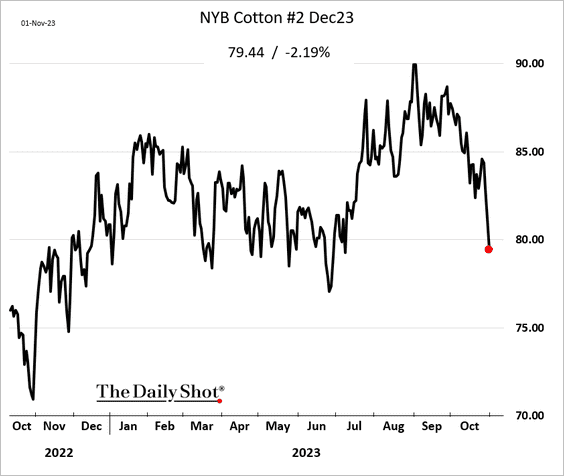

2. US cotton futures tumbled on Wednesday.

Back to Index

Energy

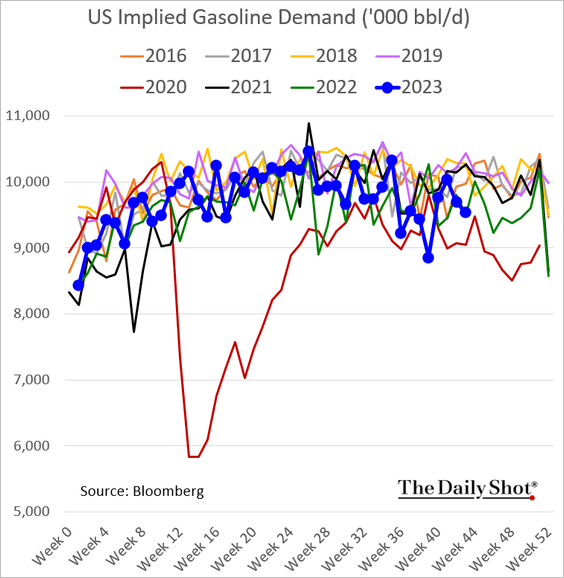

1. US gasoline demand has softened again.

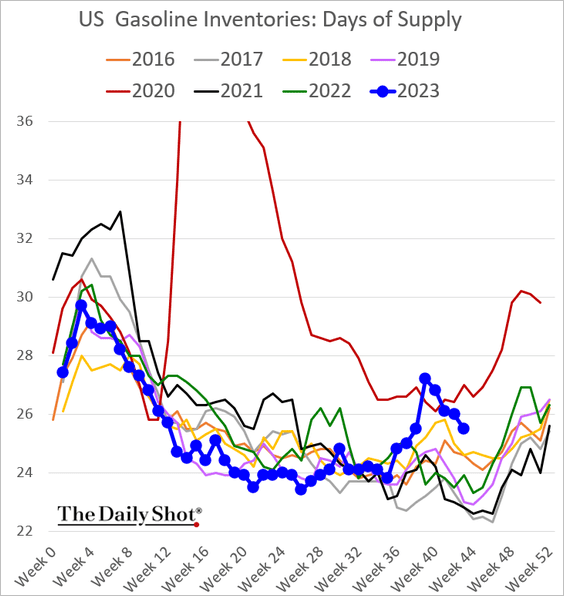

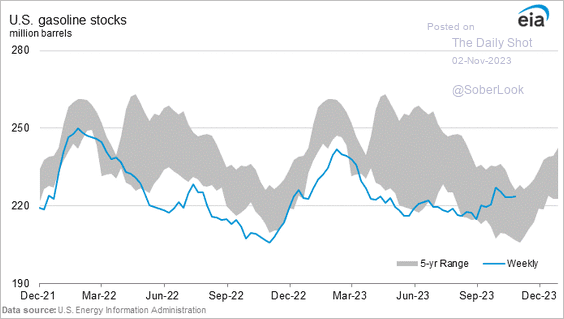

• Gasoline inventories remain elevated.

– Days of supply:

– Barrels:

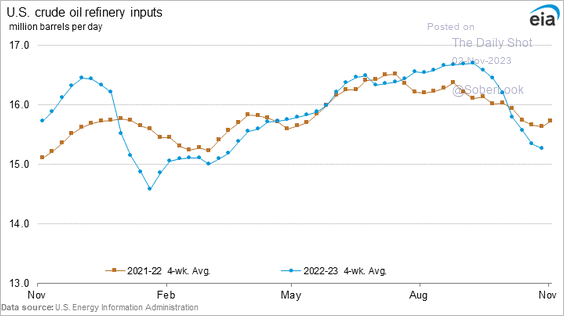

• Refinery inputs are well below last year’s levels.

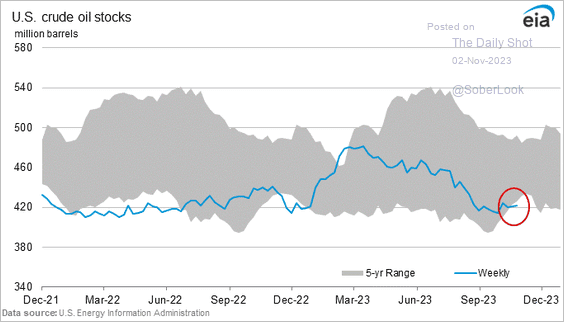

• US crude oil stockpiles are now below the five-year range.

——————–

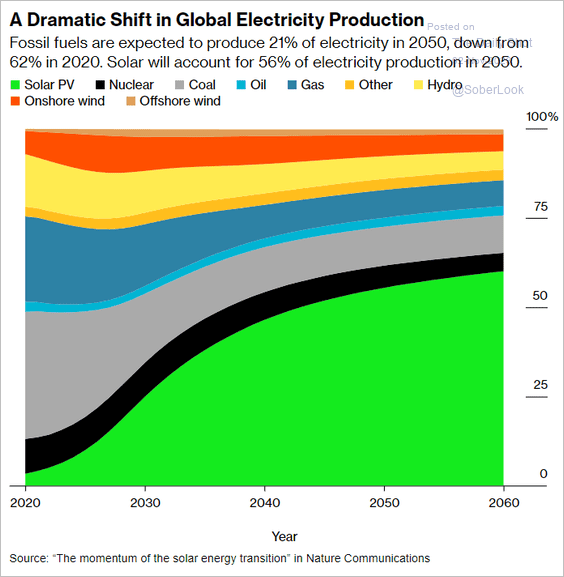

2. This chart shows a forecast for global electricity production by source.

Source: @climate Read full article

Source: @climate Read full article

Back to Index

Equities

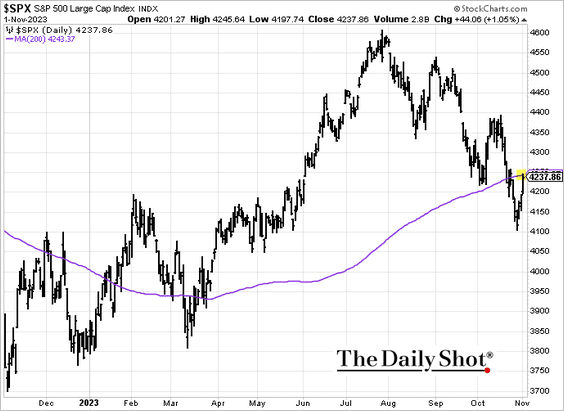

1. The S&P 500 is back at the 200-day moving average.

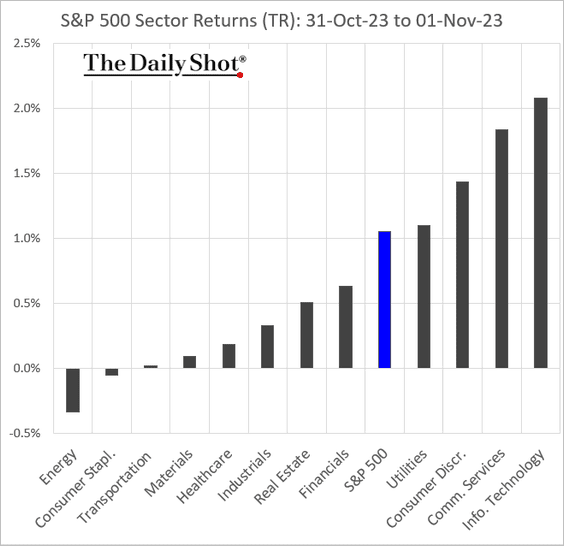

2. How did different sectors respond to Wednesday’s Treasury yield drop?

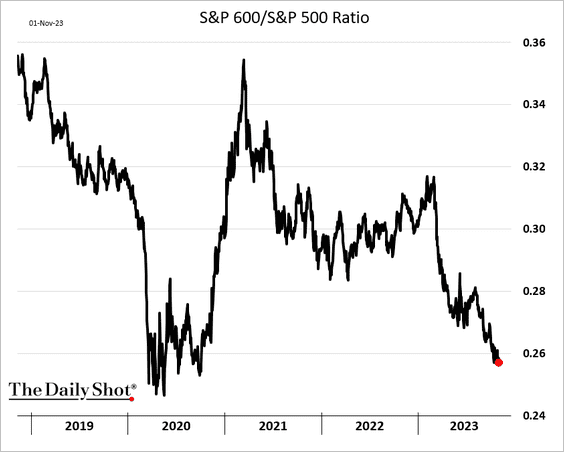

3. The S&P 600 small-cap index is nearing the 2020 lows relative to the S&P 500.

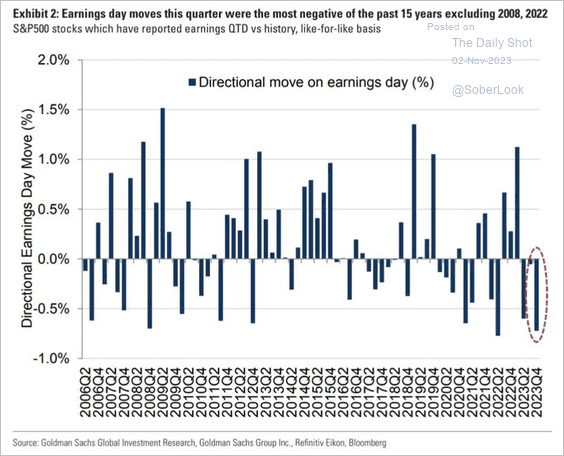

4. Earnings days haven’t been kind to stocks in this season.

Source: Goldman Sachs; @Marlin_Capital

Source: Goldman Sachs; @Marlin_Capital

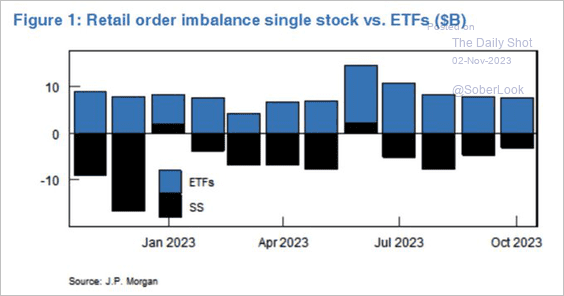

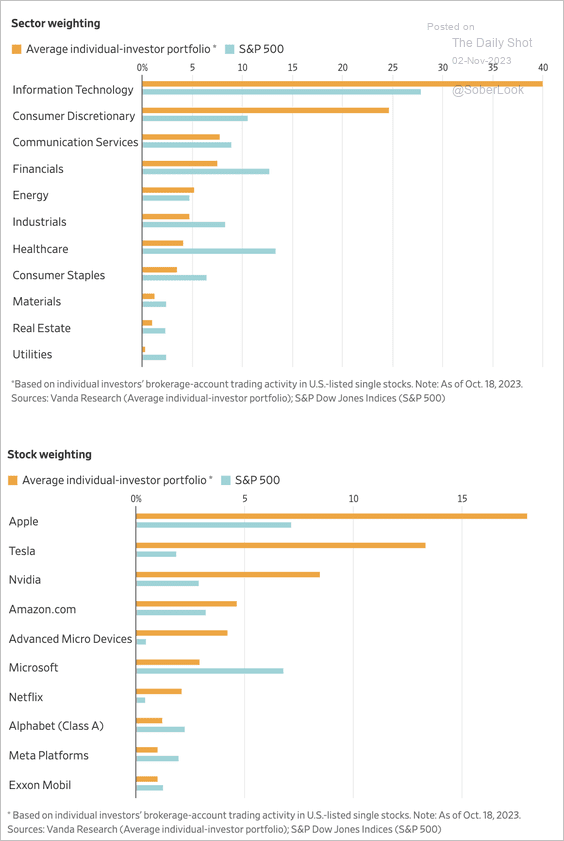

5. Retail investors have been sellers of single stocks and buyers of ETFs.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

• Retail investors are heavily exposed to tech and consumer discretionary sectors.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

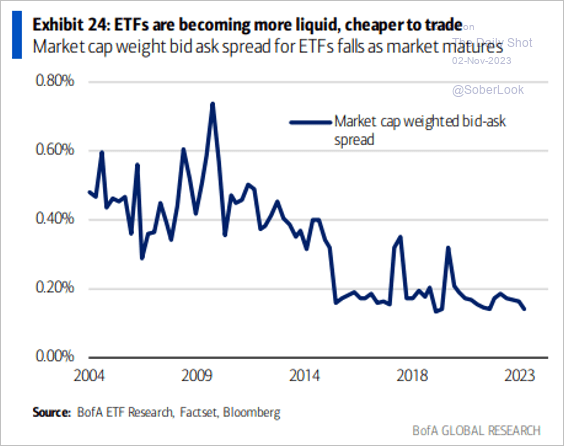

6. ETF liquidity has been improving.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

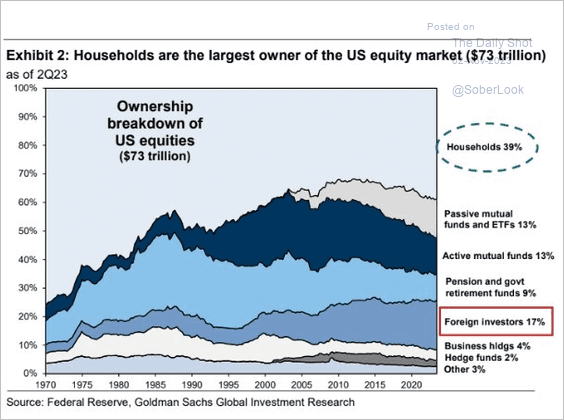

7. Who owns the US equity market?

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Credit

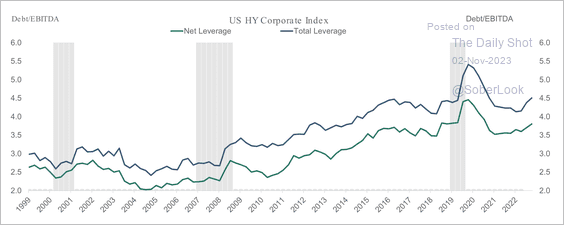

1. US high-yield leverage is rising again.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

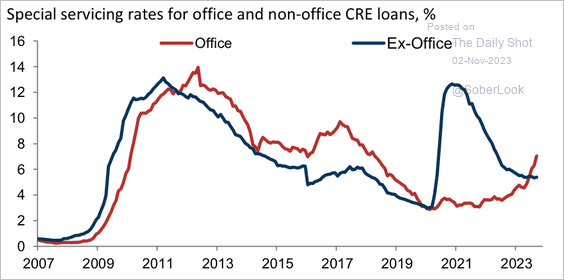

2. Special servicing rates for US commercial real estate loans are rising but moderating elsewhere.

Source: Goldman Sachs

Source: Goldman Sachs

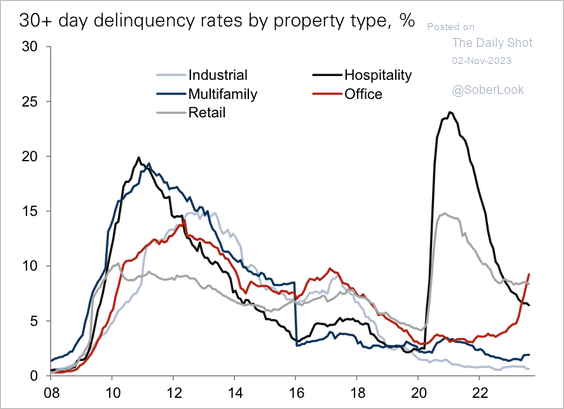

• Delinquency rates have surged for US office properties while remaining contained for other segments.

Source: Goldman Sachs

Source: Goldman Sachs

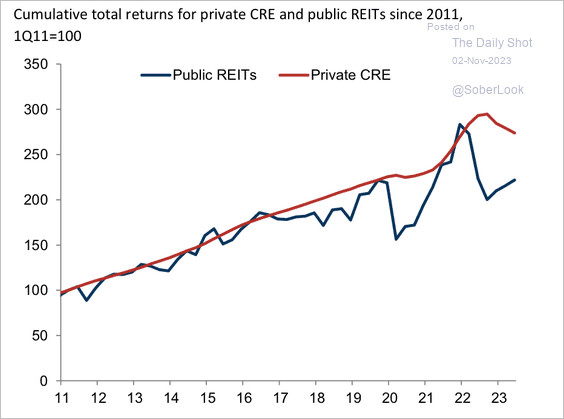

• The gap between private US commercial real estate and public REIT returns has narrowed.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

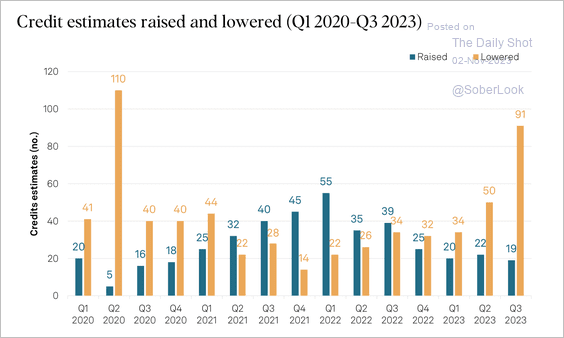

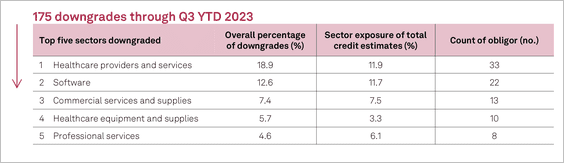

3. S&P downgrades of CLO collateral outpaced upgrades in Q3 – the most since Q2 2020.

Source: S&P Global Ratings

Source: S&P Global Ratings

Most downgrades in Q3 were in the healthcare and software industries.

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

Food for Thought

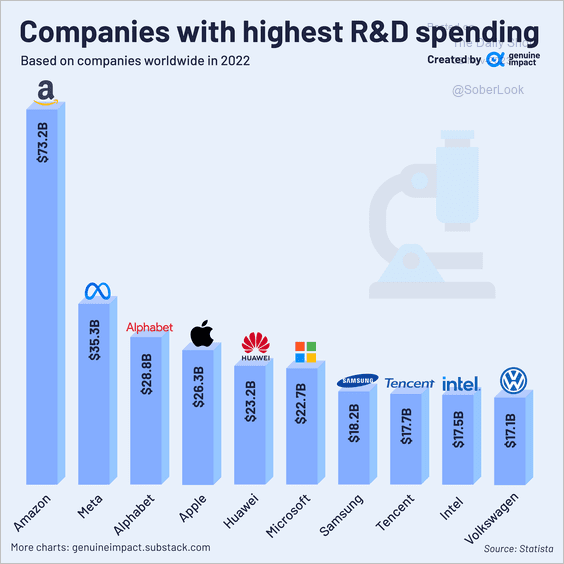

1. Companies with the highest R&D spending:

Source: @genuine_impact

Source: @genuine_impact

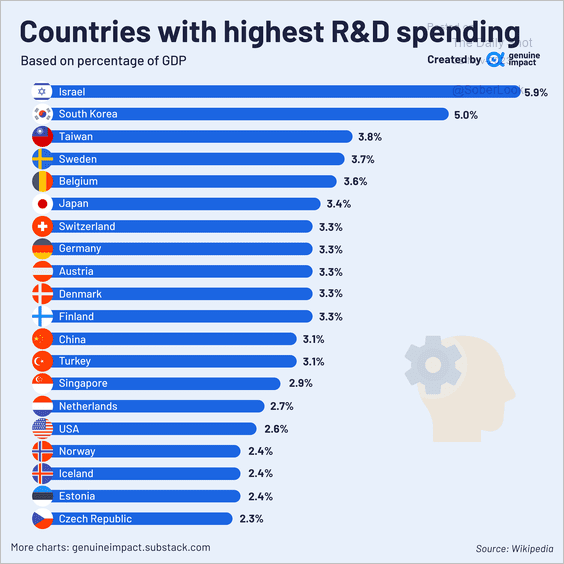

• Countries with the highest RnD spending:

Source: @genuine_impact

Source: @genuine_impact

——————–

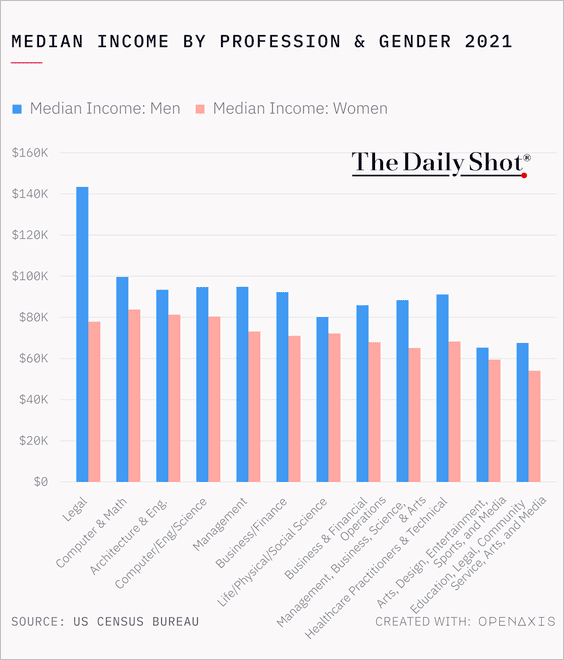

2. Median US income by profession and gender:

Source: @TheDailyShot

Source: @TheDailyShot

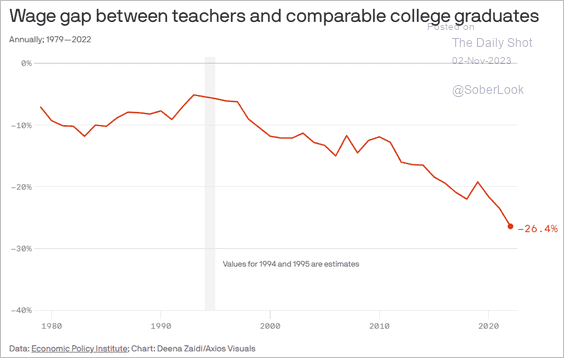

3. Teachers’ lagging wages:

Source: @axios Read full article

Source: @axios Read full article

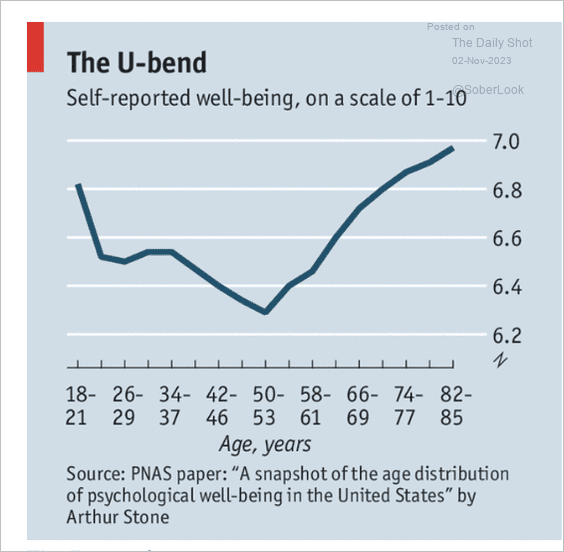

4. Self-reported well-being by age:

Source: The Economist Read full article

Source: The Economist Read full article

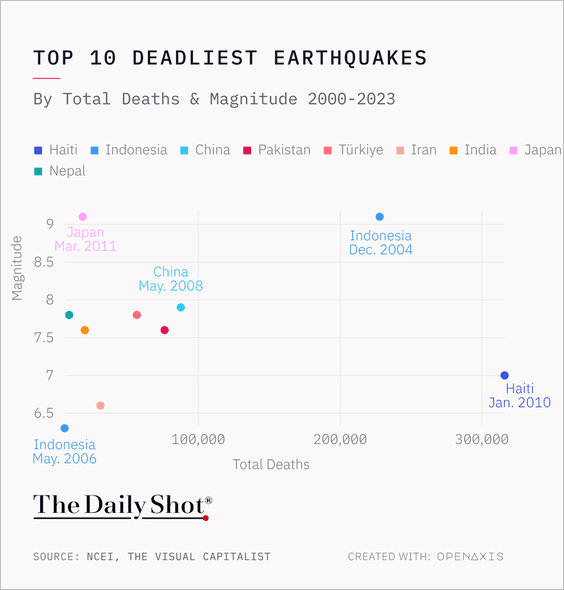

5. Top ten deadliest earthquakes:

Source: @TheDailyShot

Source: @TheDailyShot

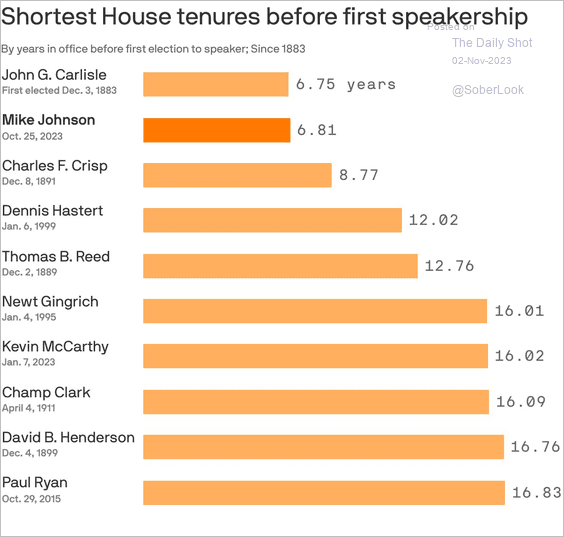

6. US House of Representatives tenures before the first speakership position:

Source: @axios Read full article

Source: @axios Read full article

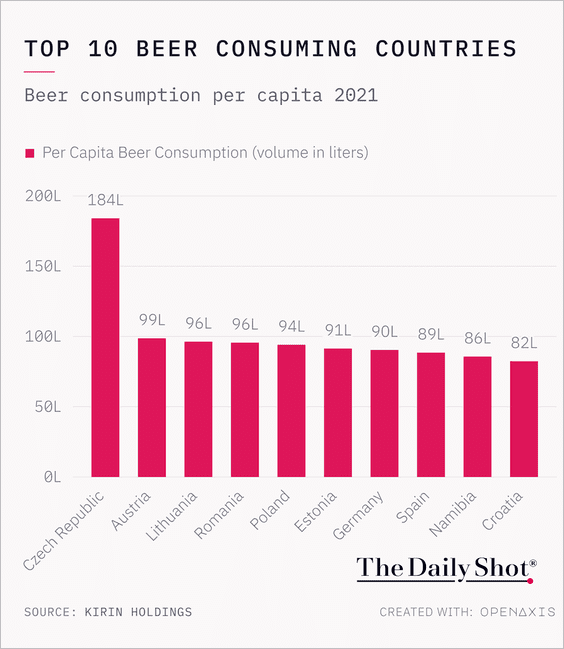

7. Top ten beer consuming countries:

Source: @TheDailyShot

Source: @TheDailyShot

——————–

Back to Index