The Daily Shot: 03-Nov-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

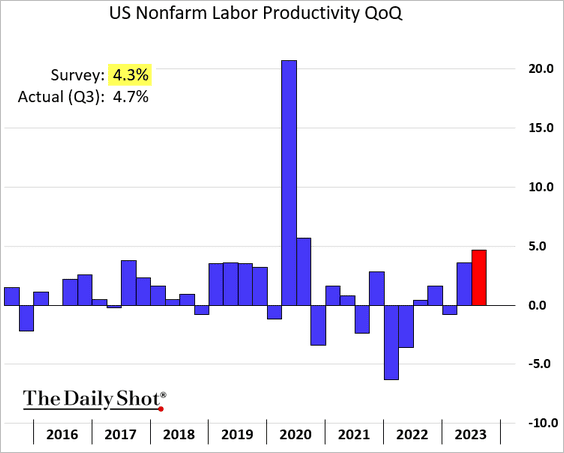

1. US labor productivity increased more than expected last quarter.

Source: MarketWatch Read full article

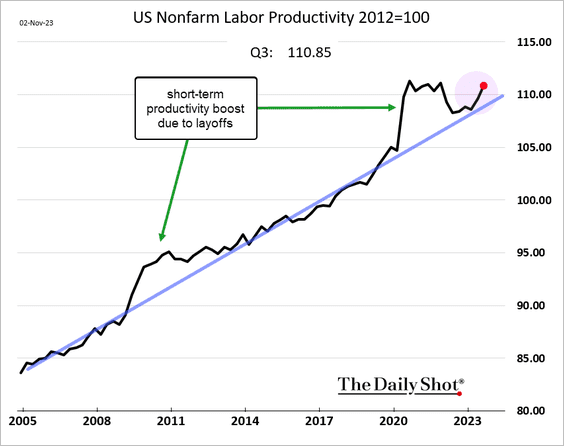

Source: MarketWatch Read full article

Is the trend changing?

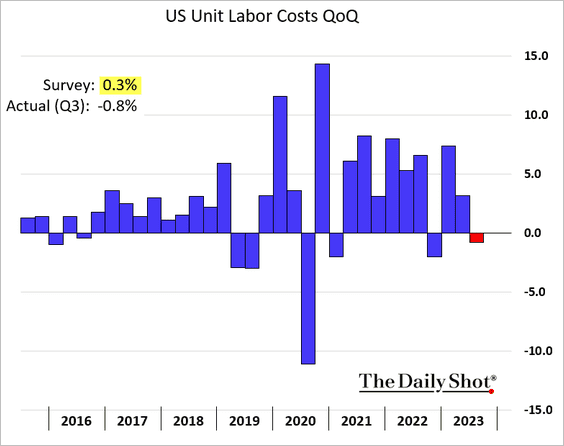

• Unit labor costs unexpectedly declined.

Source: CNBC Read full article

Source: CNBC Read full article

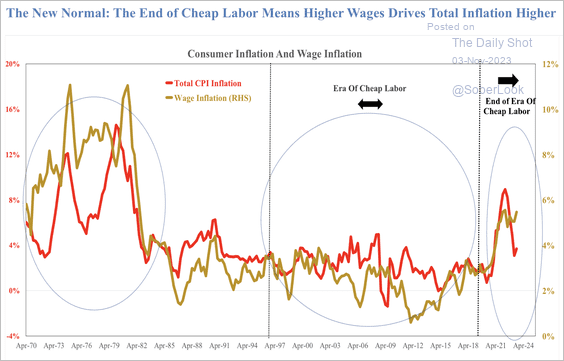

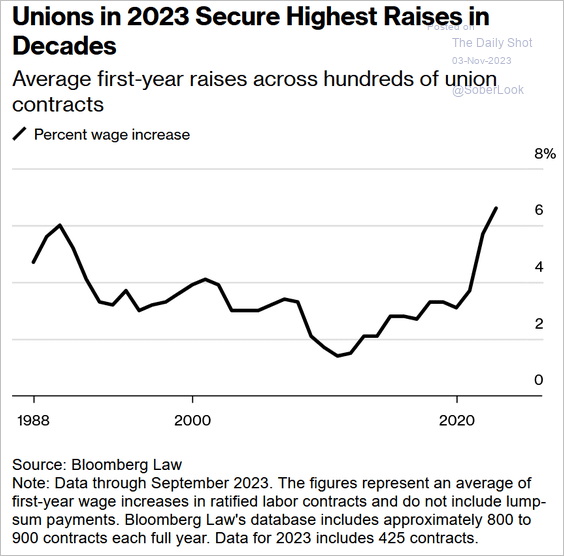

– Nonetheless, wage inflation remains elevated (2 charts).

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Source: @thefuture Read full article

Source: @thefuture Read full article

——————–

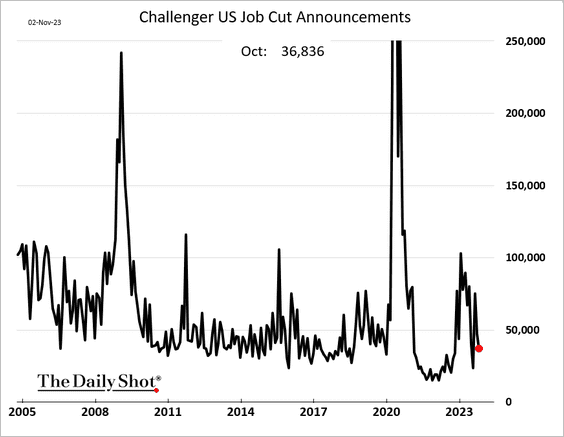

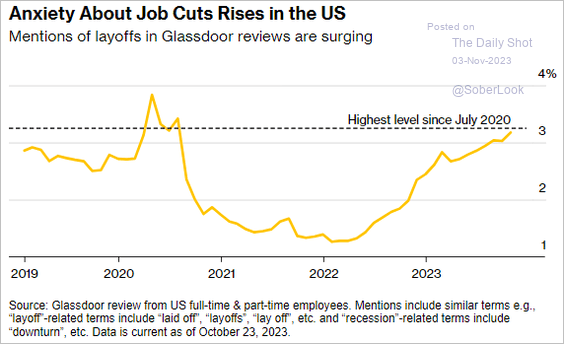

2. Next, we have some updates on the labor market.

• Layoffs slowed again last month.

But Americans are increasingly worried about job cuts.

Source: @economics Read full article

Source: @economics Read full article

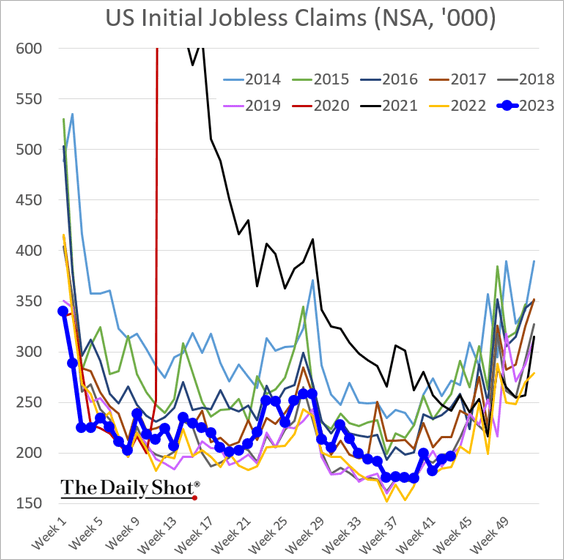

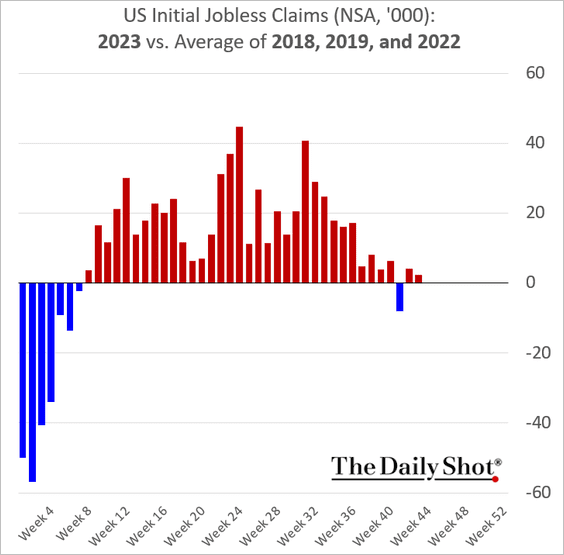

• Initial jobless claims remain near multi-year lows.

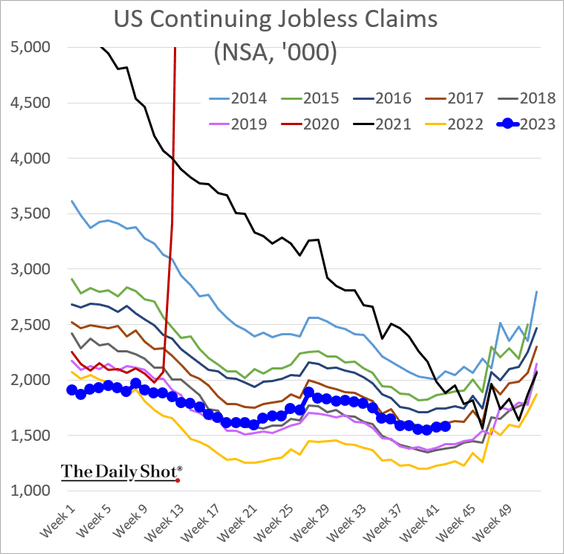

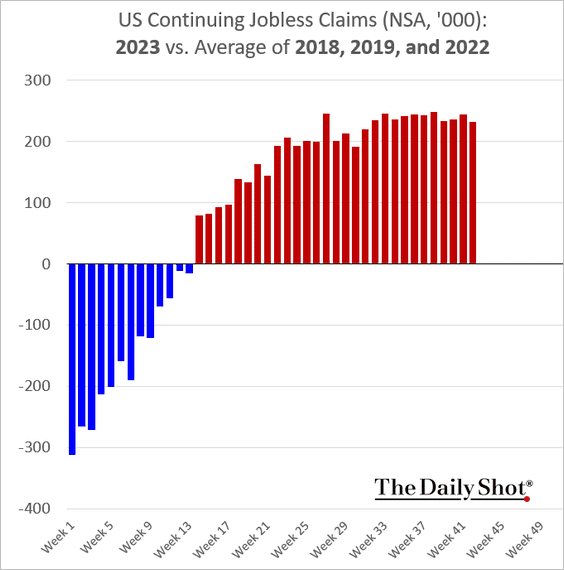

– Continuing claims are elevated but appear to be stable.

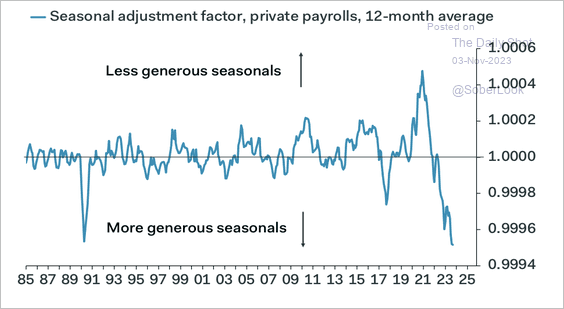

• The latest run of favorable seasonal adjustments to private payrolls looks unsustainable.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

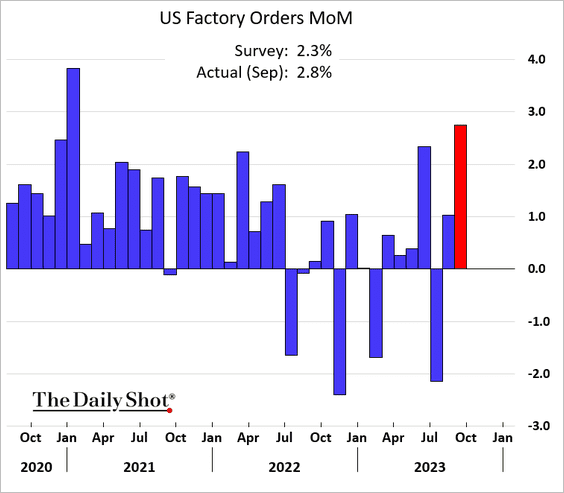

3. Manufacturing orders were very strong in September, boosted by aircraft sales.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

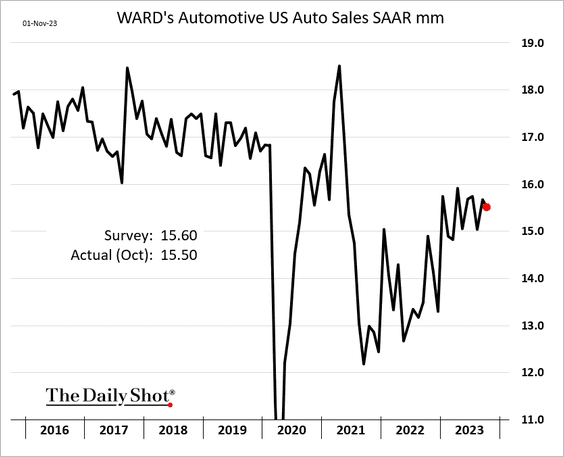

4. Automobile sales edged lower last month.

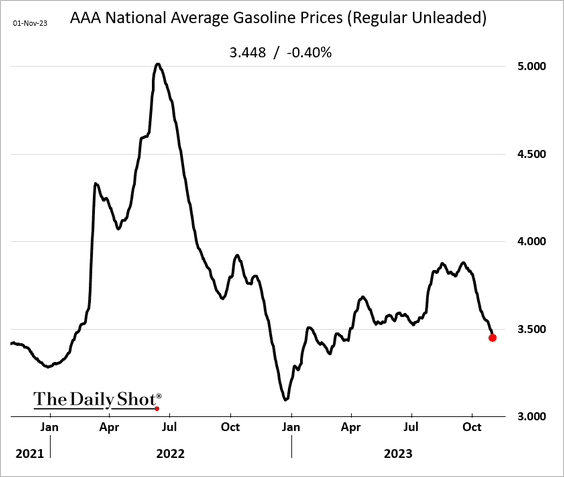

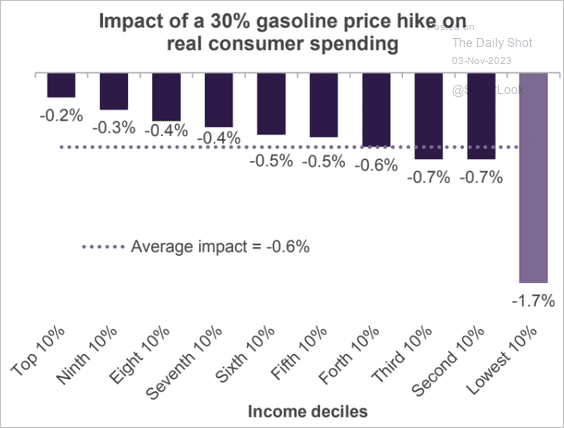

5. Retail gasoline prices continue to drift lower.

How do gasoline prices impact consumer spending?

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

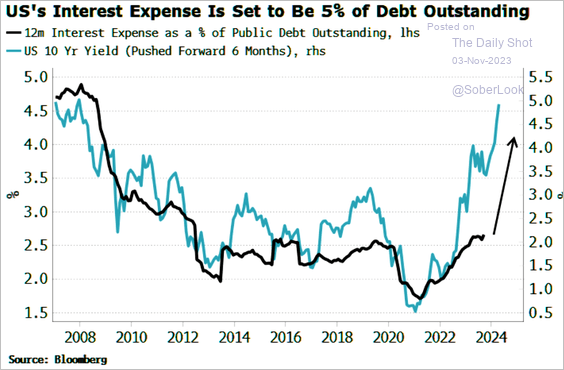

6. Federal interest expense is expected to hit 5% of the total debt outstanding.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

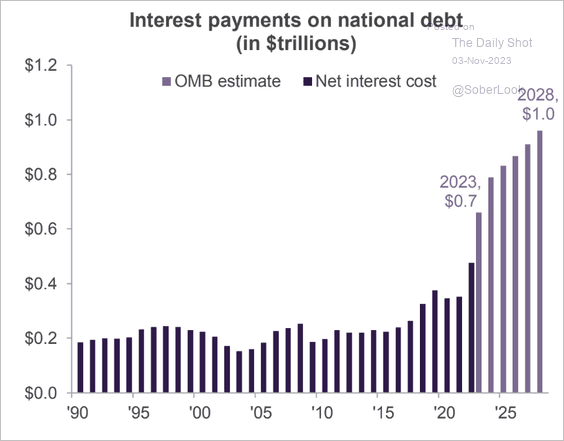

Here are the projections in dollar terms.

Source: Truist Advisory Services

Source: Truist Advisory Services

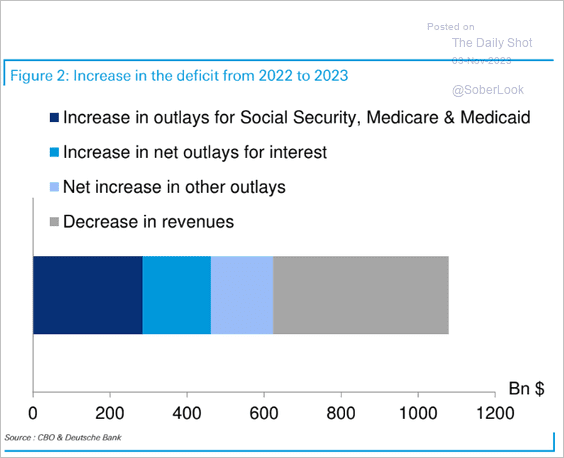

• What drove the increase in the US fiscal deficit over the past year?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The United Kingdom

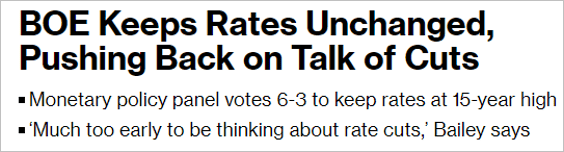

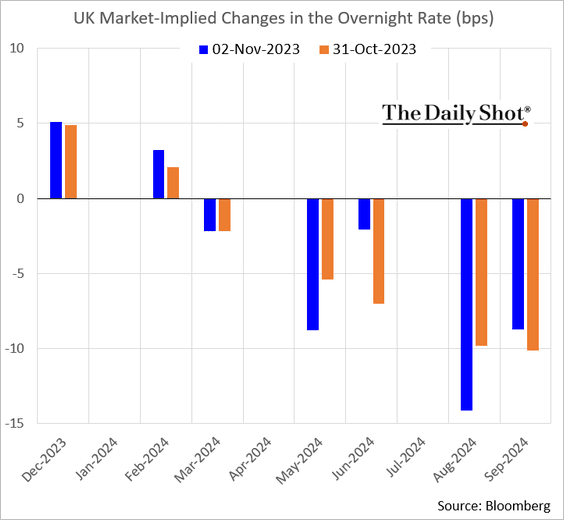

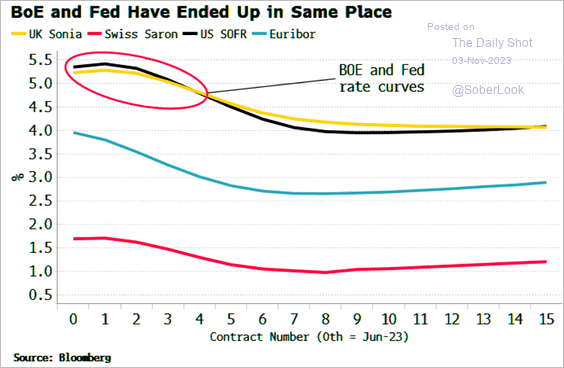

1. The BoE left rates unchanged.

Source: @economics Read full article

Source: @economics Read full article

• The market still sees a one-in-three chance of another rate increase in this cycle.

• But expectations have shifted toward deeper rate cuts over the next couple of years.

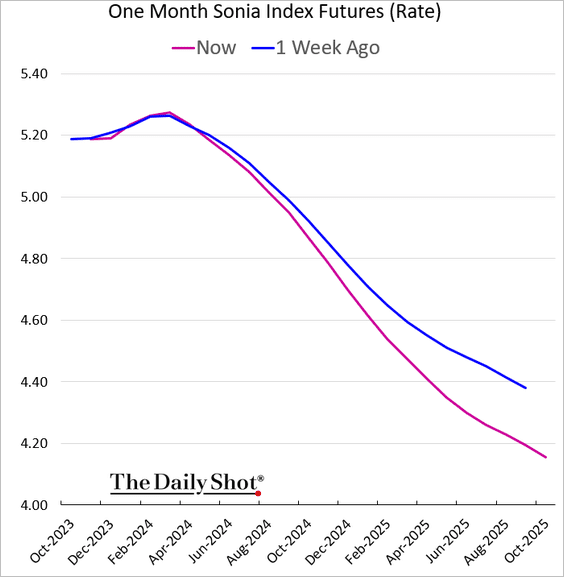

• The expected rate trajectory is similar to the US.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

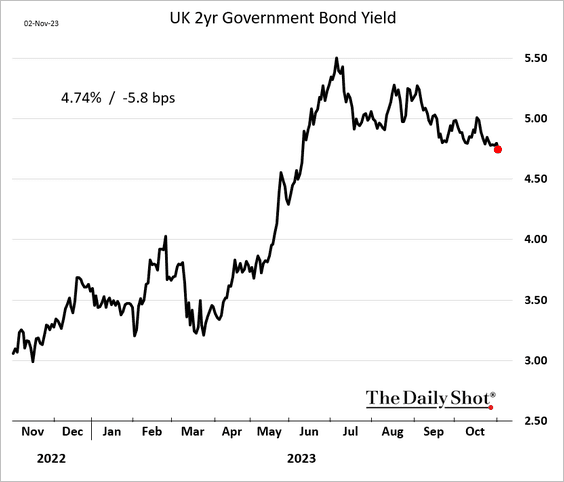

2. The 2-year gilt yield has been trending lower.

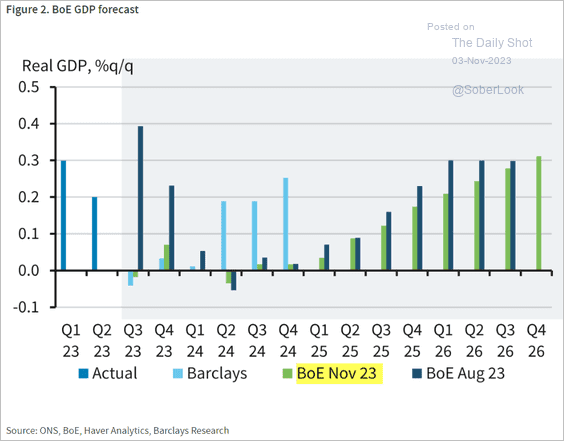

3. The BoE sees no economic growth next year.

Source: Barclays Research

Source: Barclays Research

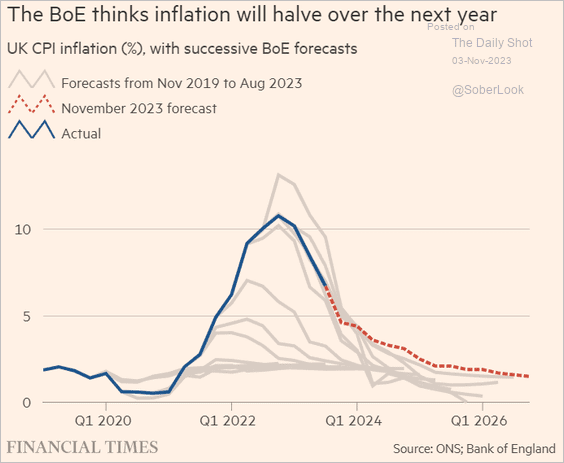

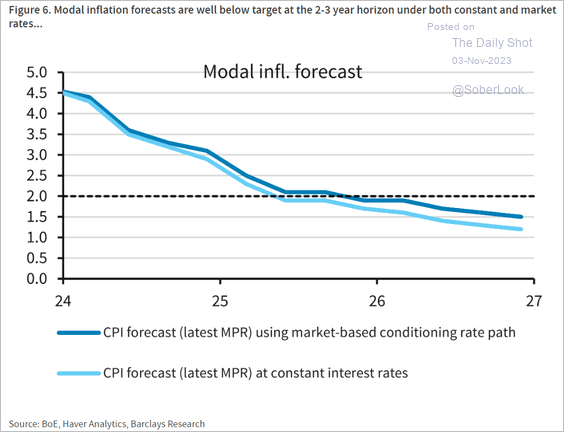

• The central bank expects rapid declines ahead for UK inflation.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Barclays Research

Source: Barclays Research

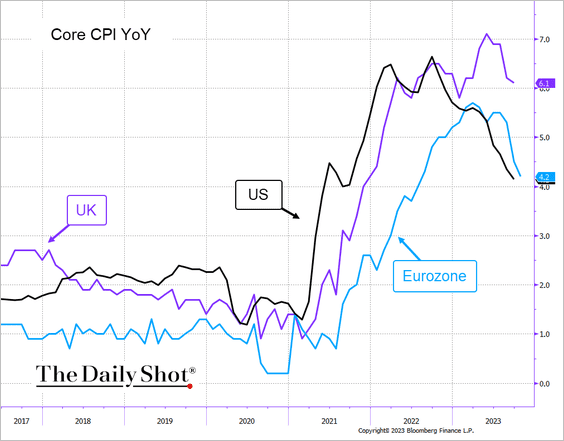

– For now, UK inflation is trailing behind the deceleration seen in the US and Eurozone.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

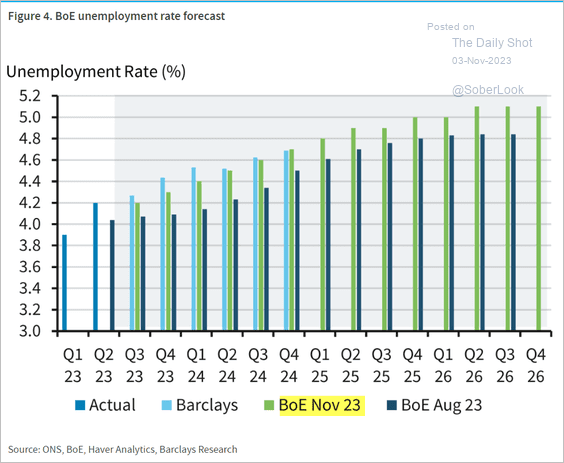

• Forecasts show unemployment rising all the way into 2026.

Source: Barclays Research

Source: Barclays Research

——————–

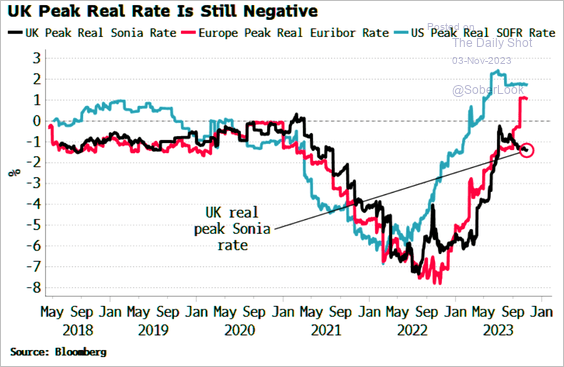

4. The UK real overnight rate remains negative, unlike in the US and Eurozone.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

The Eurozone

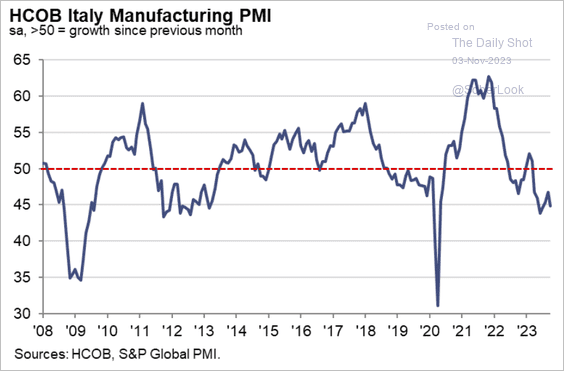

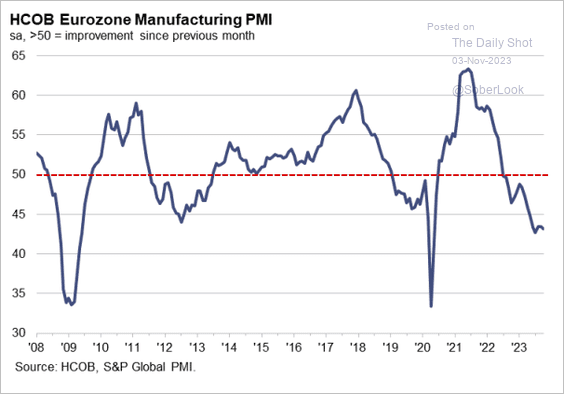

1. The manufacturing PMI reports continue to show deep contraction in factory activity.

• Italy:

Source: S&P Global PMI

Source: S&P Global PMI

• Eurozone (final):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

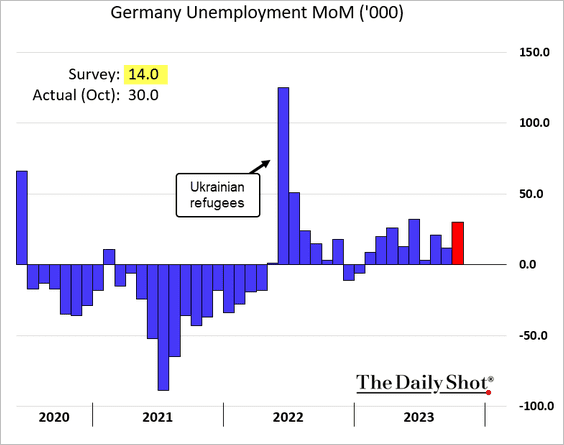

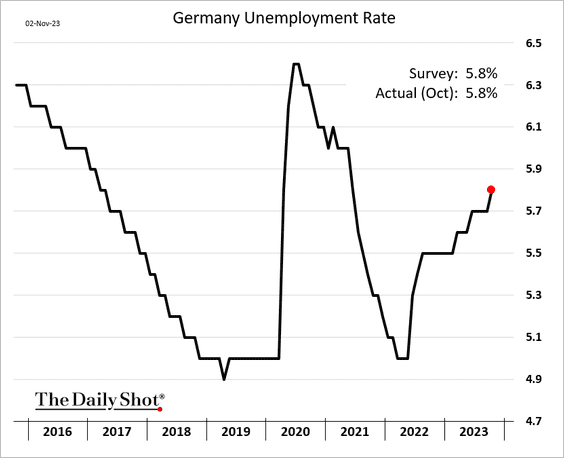

2. Next, we have some updates on Germany.

• Unemployment jumped last month.

Here is the unemployment rate.

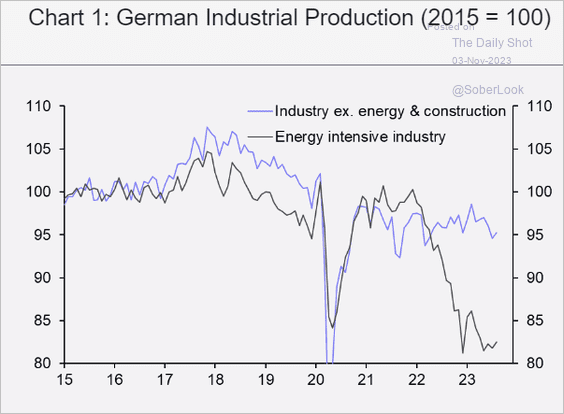

• Energy-intensive industries continue to struggle.

Source: Capital Economics

Source: Capital Economics

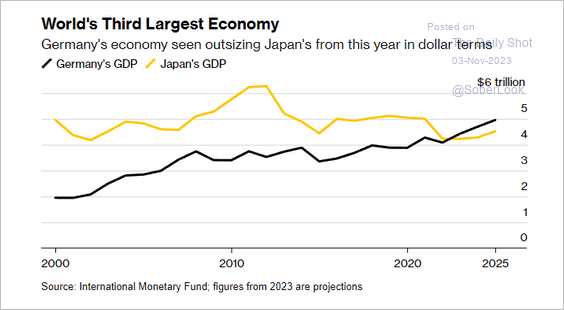

• Will Germany’s GDP surpass Japan’s?

Source: @economics Read full article

Source: @economics Read full article

——————–

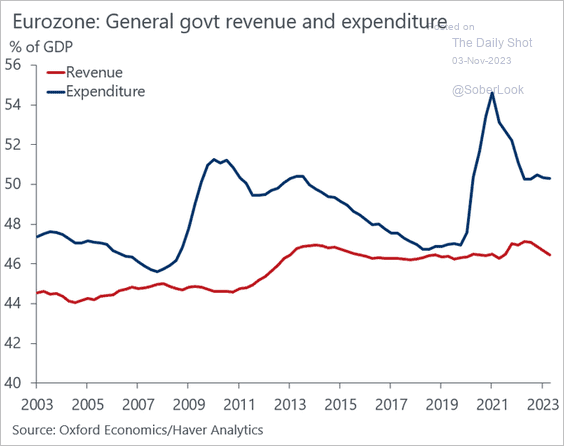

3. Euro-area government deficits remain wide.

Source: @DanielKral1

Source: @DanielKral1

Back to Index

Europe

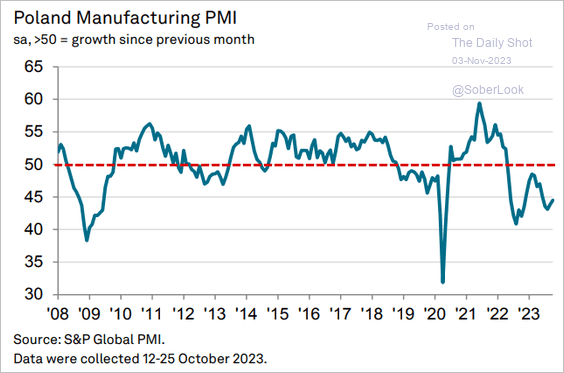

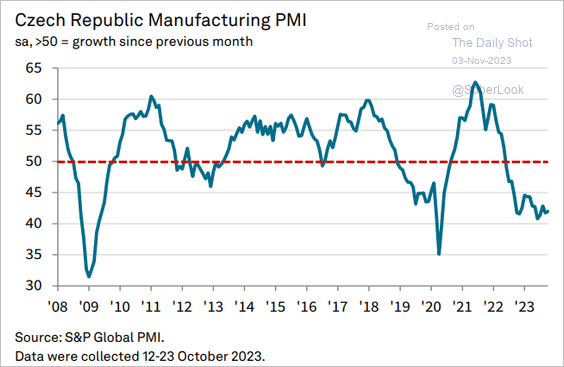

1. Central European manufacturing hubs continue to struggle. Here are the PMI trends.

• Poland:

Source: S&P Global PMI

Source: S&P Global PMI

• The Czech Republic:

Source: S&P Global PMI

Source: S&P Global PMI

——————–

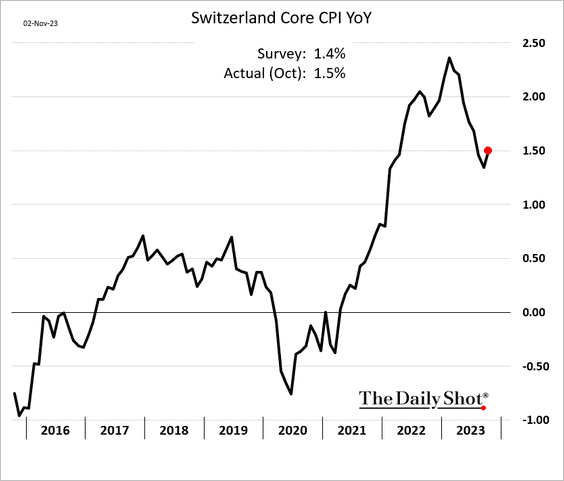

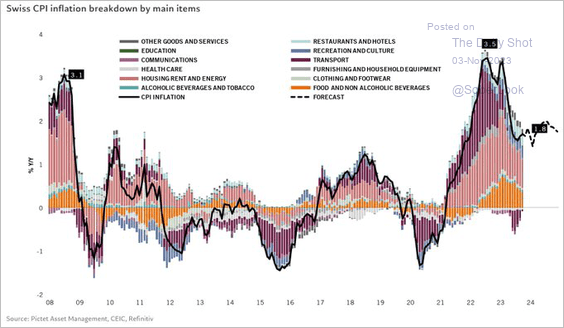

2. Swiss core inflation topped expectations, …

… boosted by core services.

Source: @MarkoNikolay

Source: @MarkoNikolay

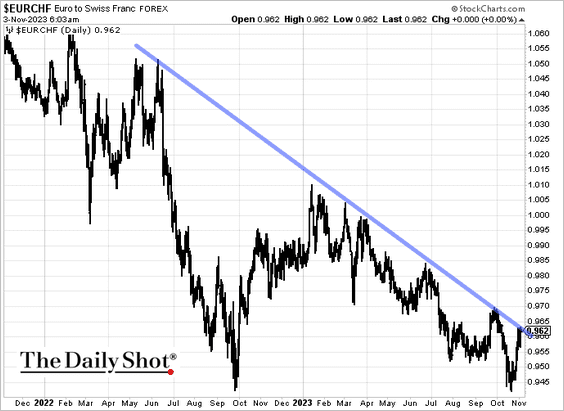

• The EUR/CHF resistance is holding.

——————–

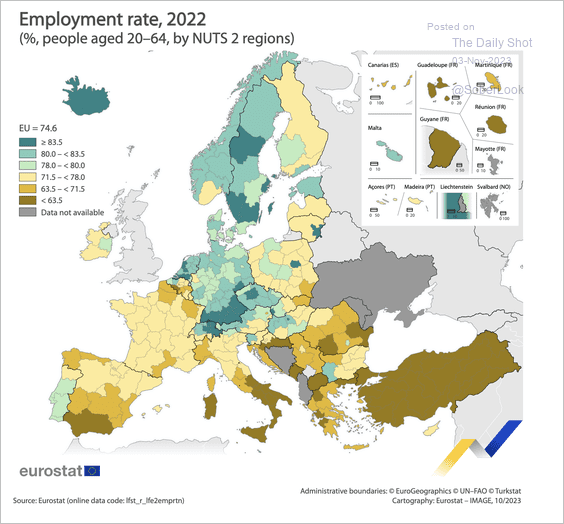

3. Here is a look at employment rates in Europe.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

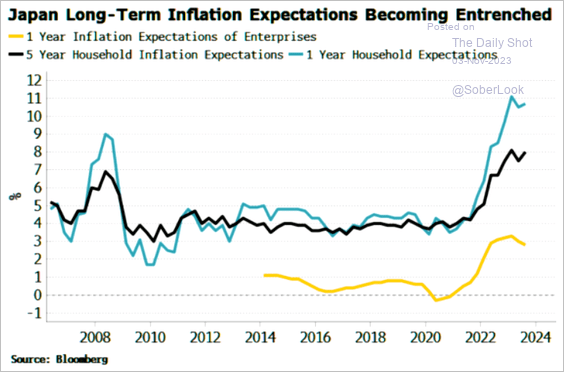

Asia-Pacific

1. Japan’s inflation expectations remain elevated.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

2. Taiwan’s trade surplus is mostly about semiconductors.

![]() Source: Macrobond

Source: Macrobond

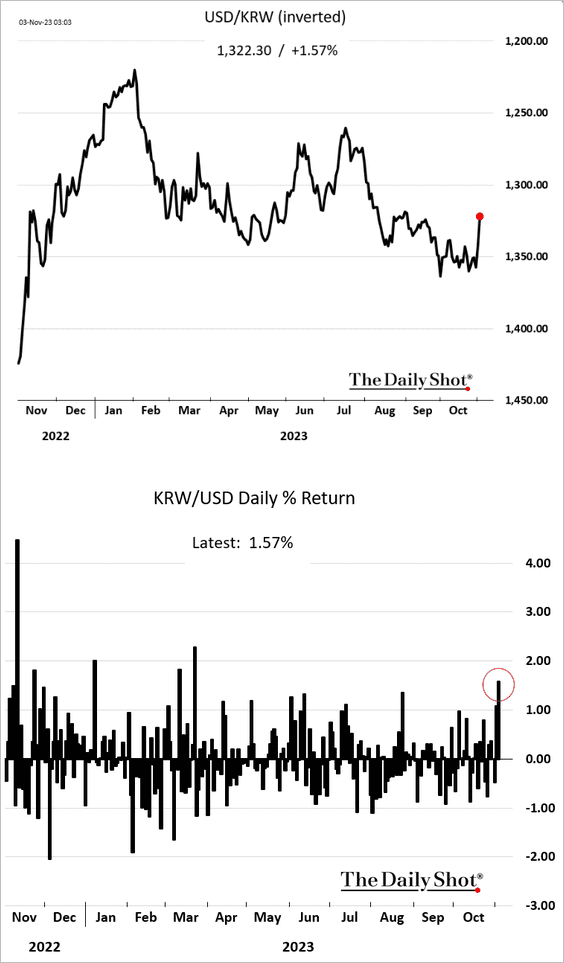

3. The South Korean won has surged since the FOMC meeting, with the market perceiving the Fed as being on hold for now.

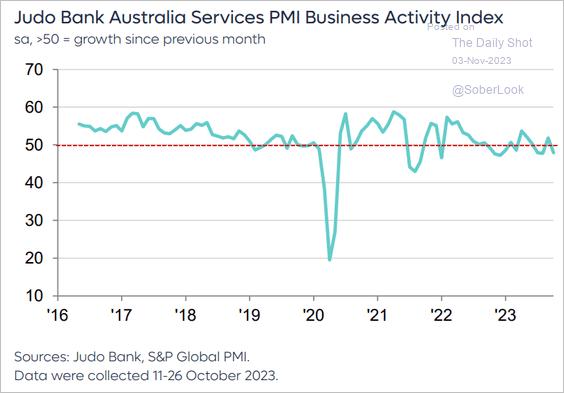

4. Australia’s service sector activity contracted last month.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

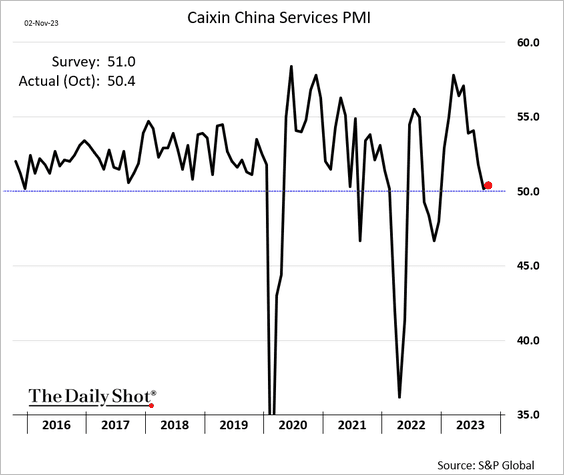

China

1. Similar to the official measure, the PMI report from S&P Global showed very little growth in services last month.

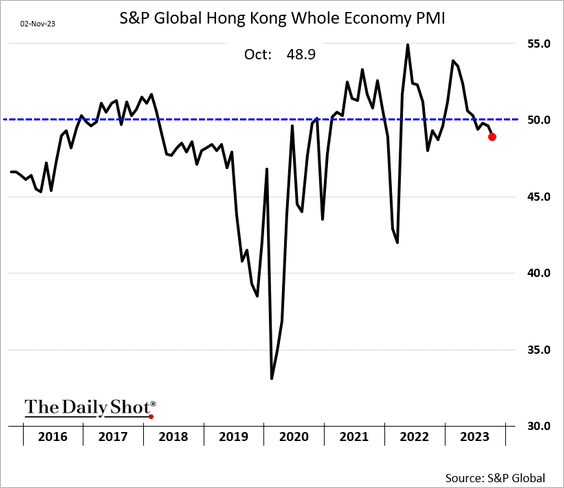

2. Hong Kong’s business activity is contracting.

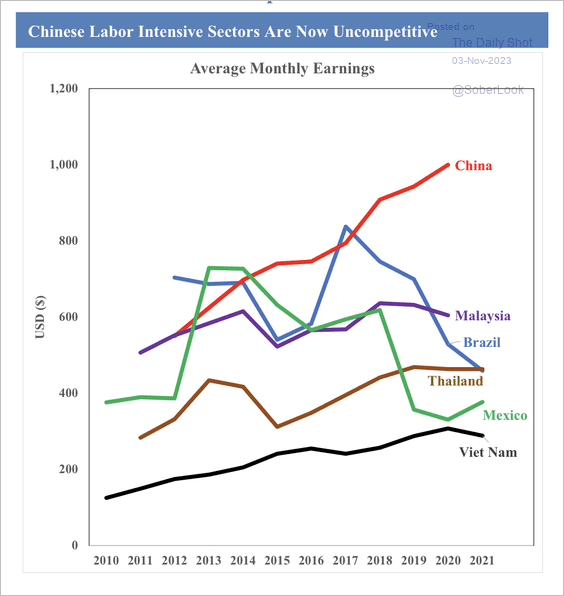

3. Average monthly earnings remain high relative to other EM countries.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

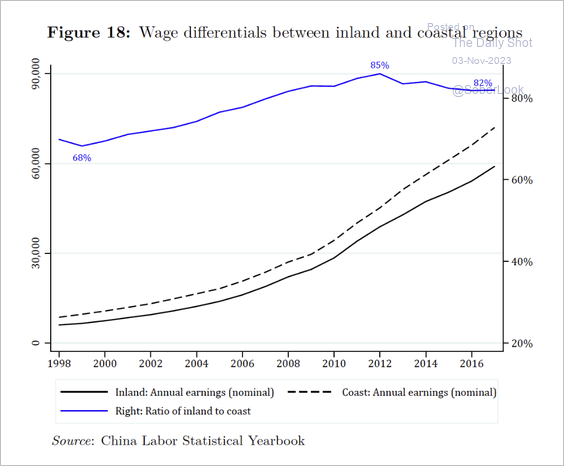

• Wages for coastal workers have outpaced inland workers in recent years.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Back to Index

Emerging Markets

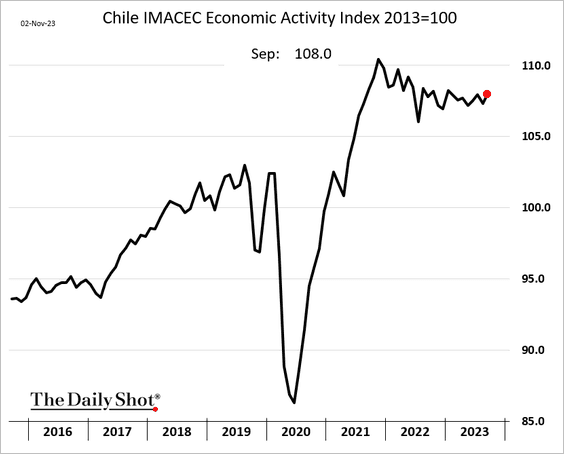

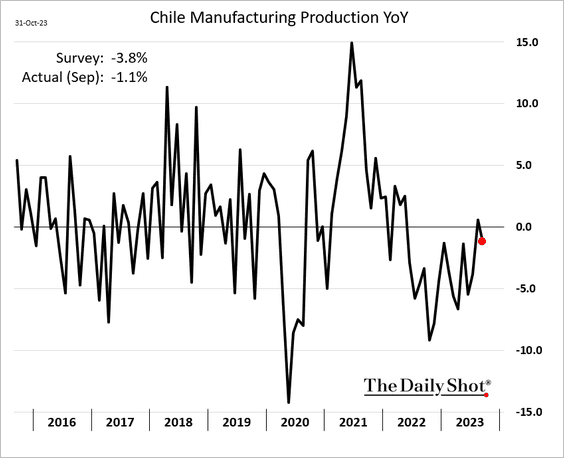

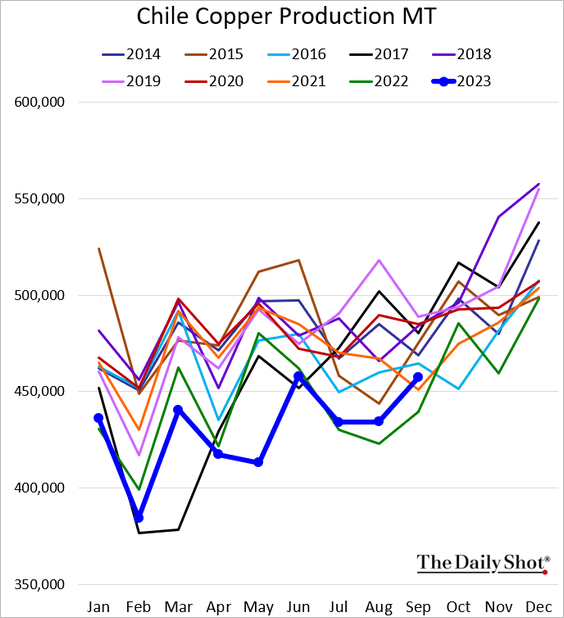

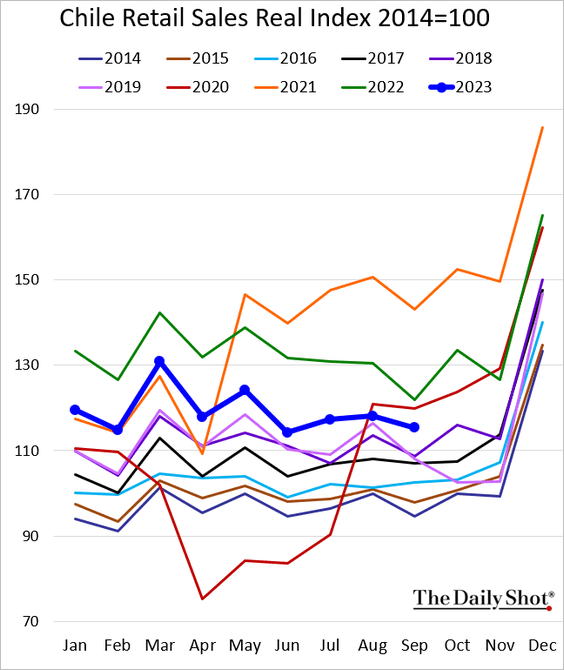

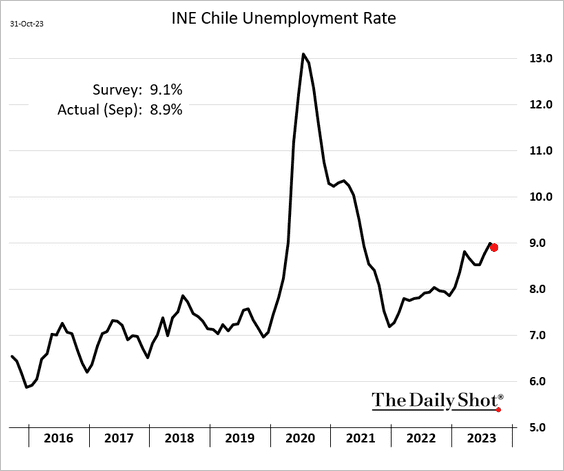

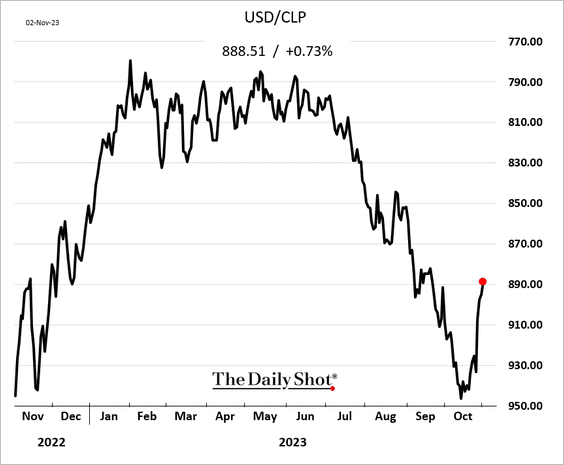

1. Let’s begin with Chile.

• Economic activity (an improvement in September):

• Manufacturing output (better than expected):

• Copper production (above last year’s levels):

• Retail sales (held up reasonably well in September):

• The unemployment rate (lower than expected):

• The Chilean peso (a sharp rebound):

——————–

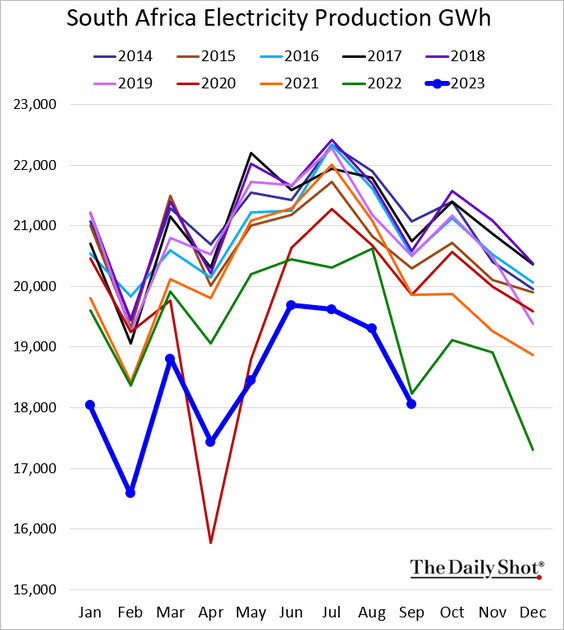

2. South Africa’s electricity output remains depressed, creating a drag on economic growth.

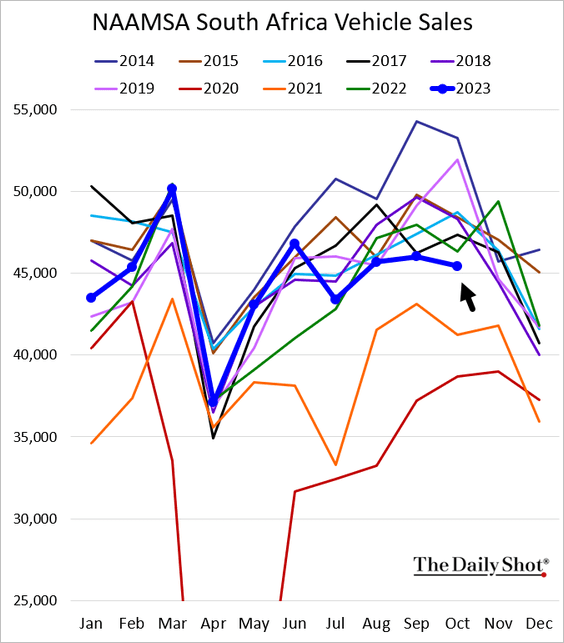

• Vehicle sales have been soft.

——————–

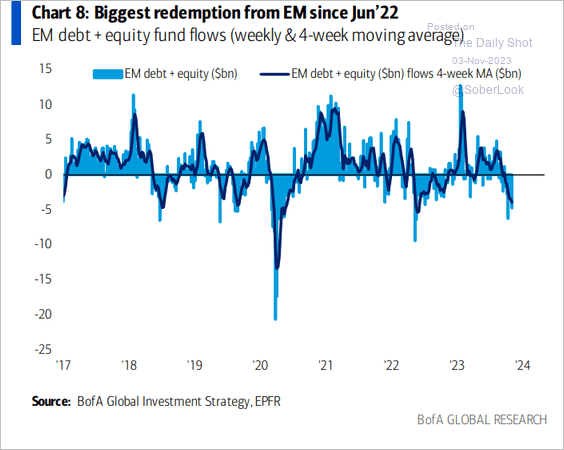

3. EM fund outflows have accelerated.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

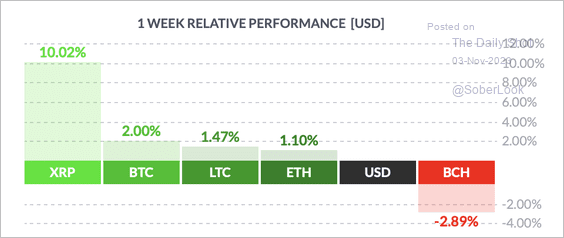

1. Most of the top cryptos extended their rally this week, with XRP in the lead and bitcoin cash (BCH) underperforming.

Source: FinViz

Source: FinViz

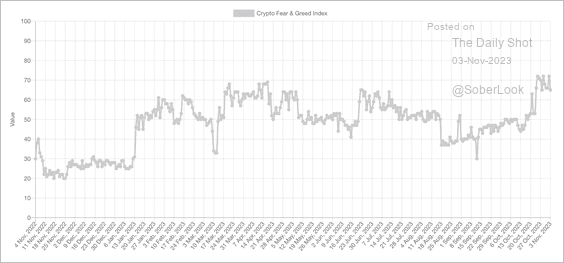

2. The Crypto Fear & Greed Index entered “greed” territory last week.

Source: Alternative.me

Source: Alternative.me

Back to Index

Commodities

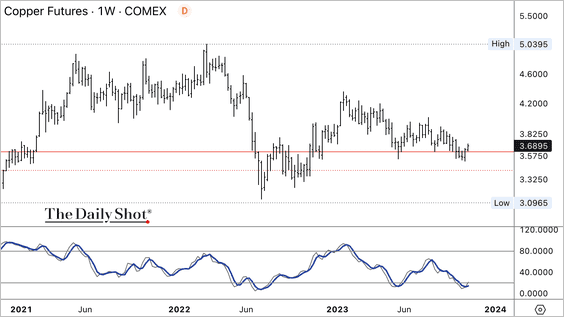

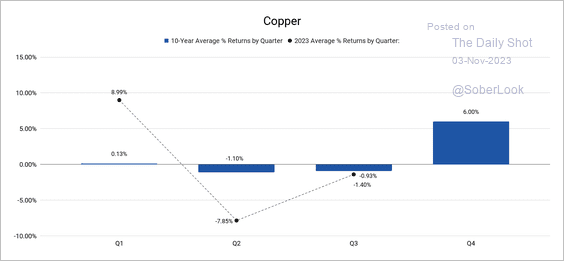

1. So far, copper is holding short-term support above $3.50 and appears oversold.

• The earlier rally in copper faded alongside weakness in China, but seasonals point to a positive Q4.

Source: Kyaw Swar Ye Myint

Source: Kyaw Swar Ye Myint

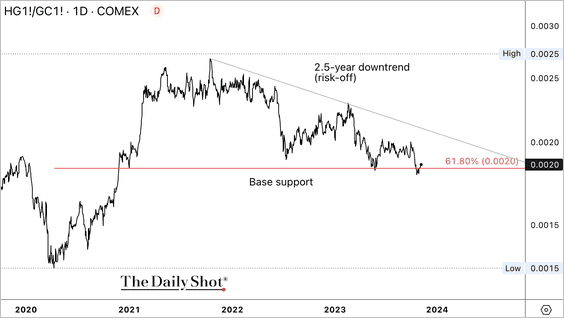

• The copper/gold ratio is testing initial support within its broader downtrend.

——————–

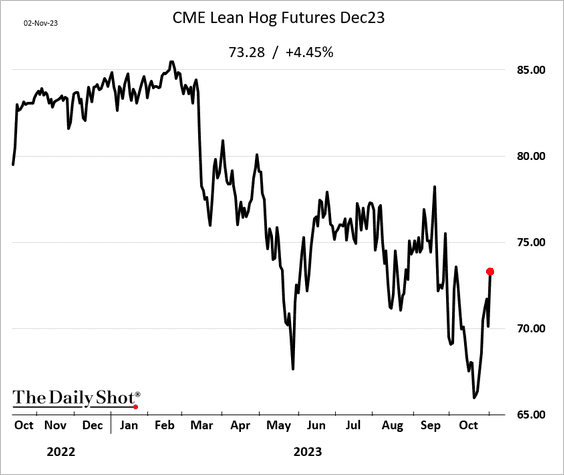

2. Chicago hog futures are rebounding.

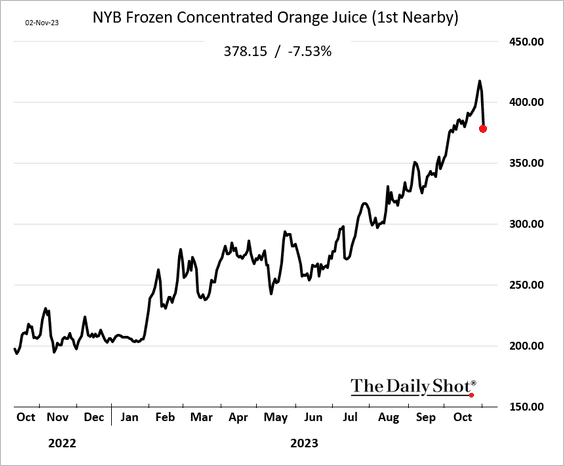

3. The orange juice fever seems to be breaking.

Back to Index

Energy

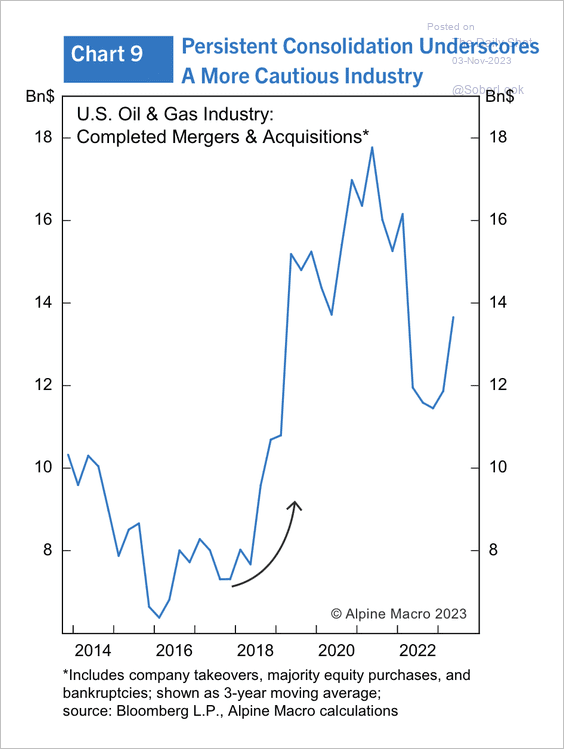

1. M&A activity in the US oil and gas industry has been rising.

Source: Alpine Macro

Source: Alpine Macro

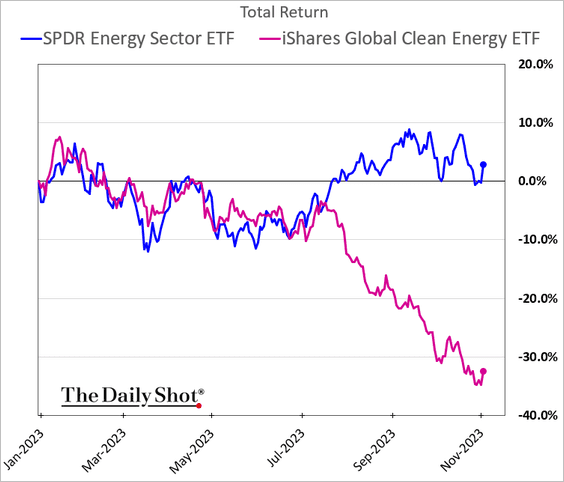

2. Clean energy stocks continue to underperform.

Back to Index

Equities

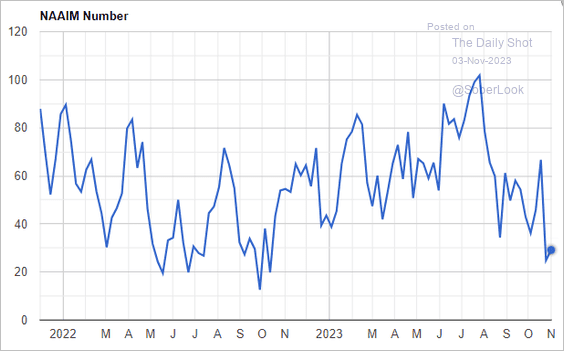

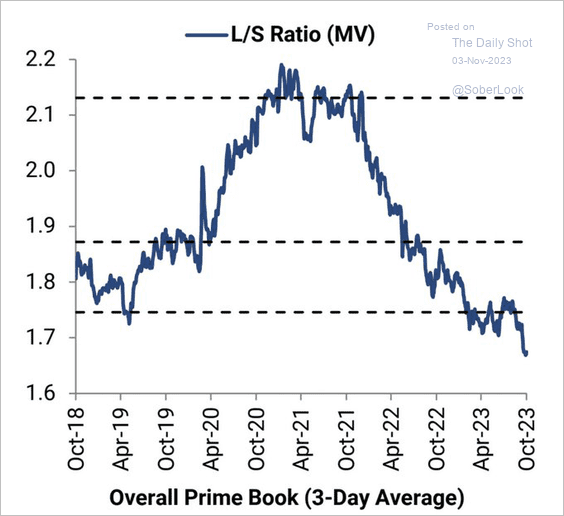

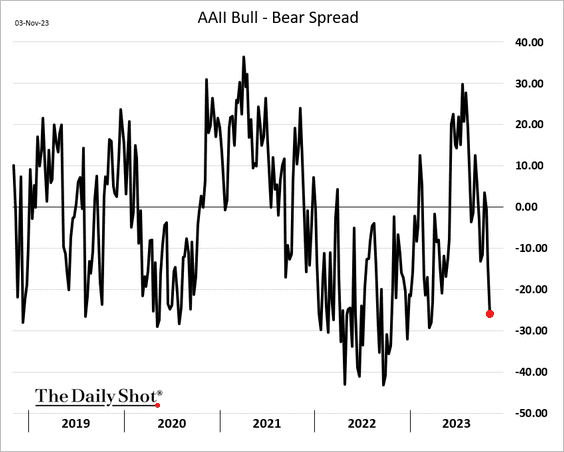

1. Market sentiment remains gloomy.

• Investment managers:

Source: NAAIM

Source: NAAIM

• Hedge funds:

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

• Retail investors:

——————–

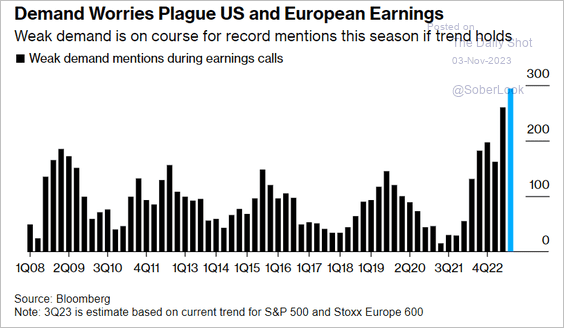

2. Companies are increasingly concerned about weak demand.

Source: @markets Read full article

Source: @markets Read full article

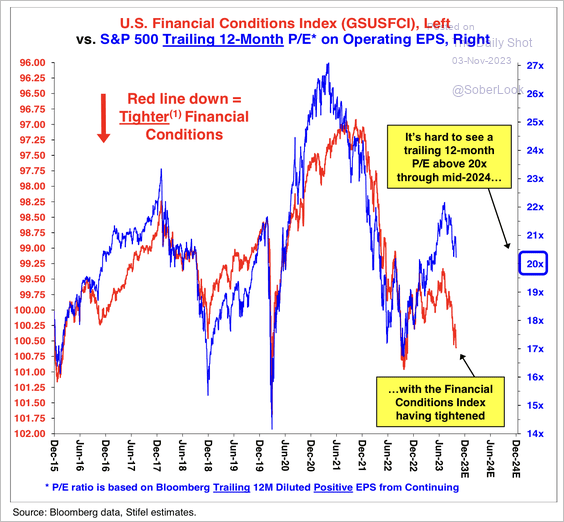

3. Tighter financial conditions could weigh on the S&P 500 over time.

Source: Stifel

Source: Stifel

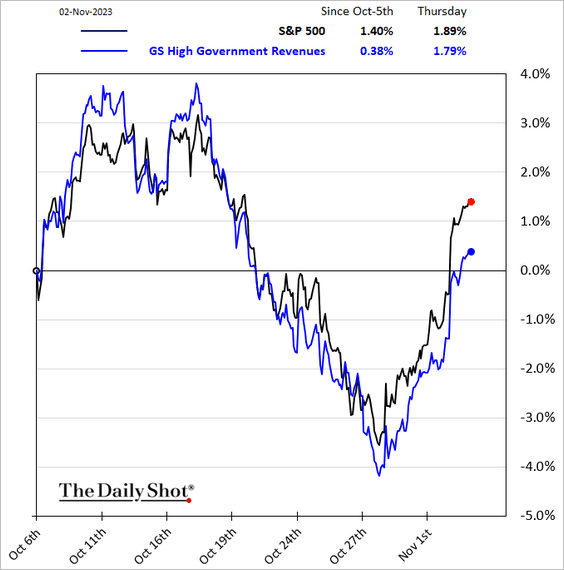

4. Are investors concerned about the risk of a government shutdown this month?

Source: NBC News Read full article

Source: NBC News Read full article

——————–

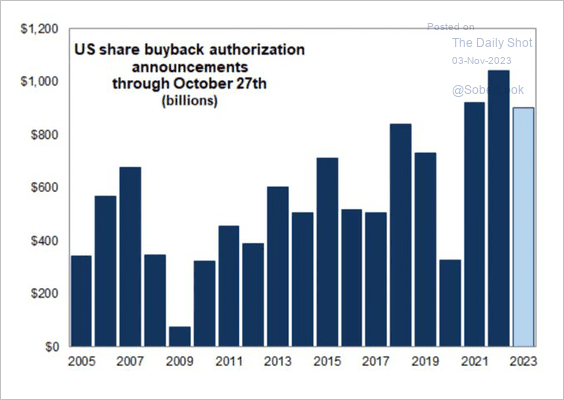

5. Share buyback authorizations are below last year’s levels but still robust.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

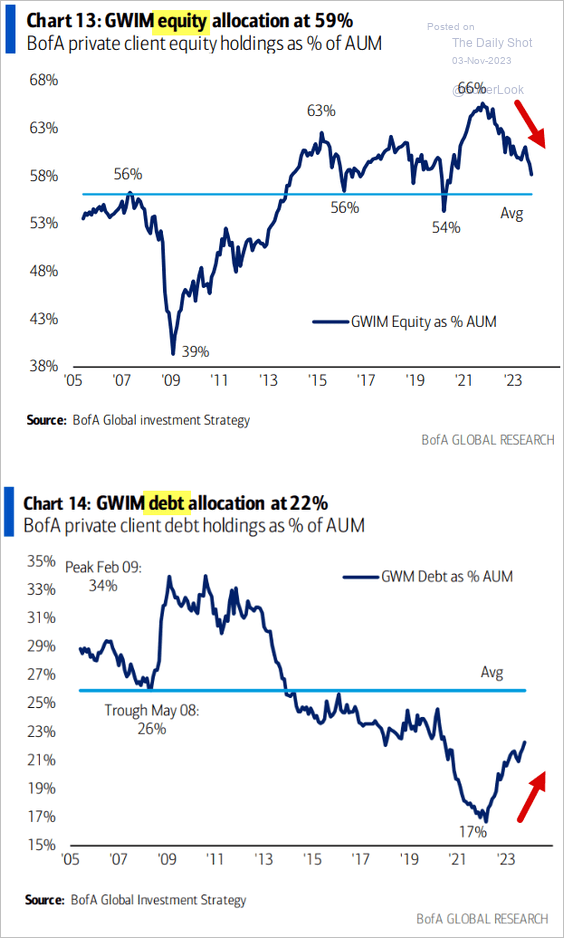

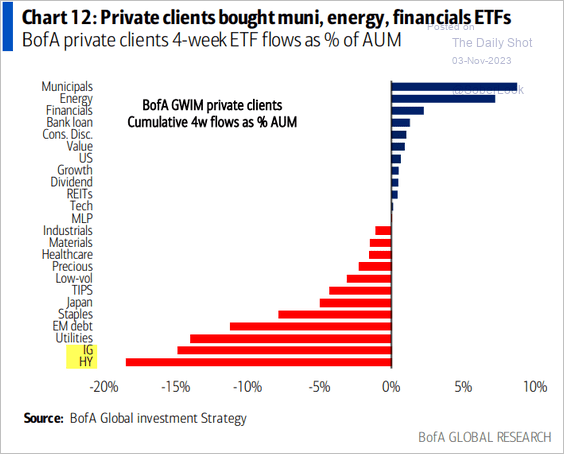

6. BofA’s private clients continue to rotate from stocks to bonds.

Source: BofA Global Research

Source: BofA Global Research

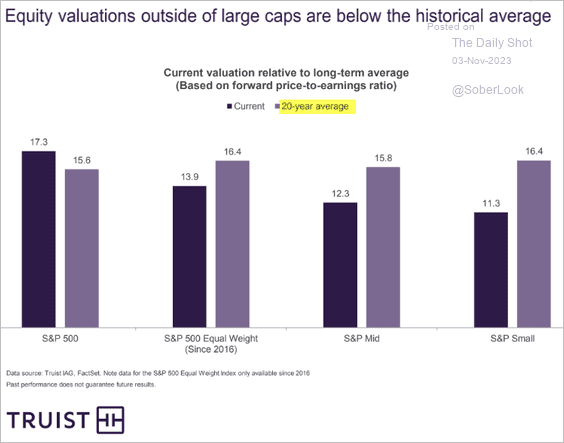

7. Here is a look at valuations relative to the past 20 years by size.

Source: Truist Advisory Services

Source: Truist Advisory Services

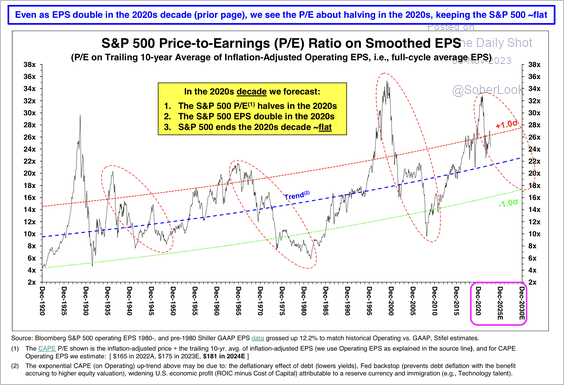

• There is still scope for S&P 500 valuation compression.

Source: Stifel

Source: Stifel

——————–

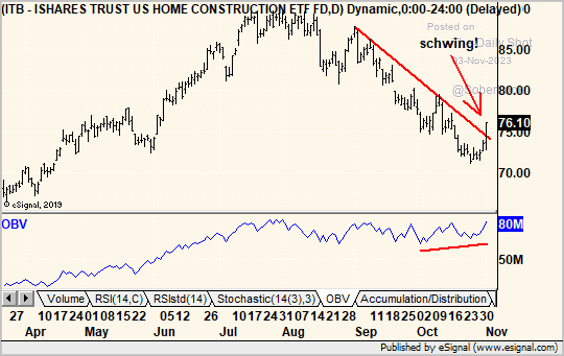

8. US housing stocks are breaking above their short-term downtrend with strong volume.

Source: @mnkahn

Source: @mnkahn

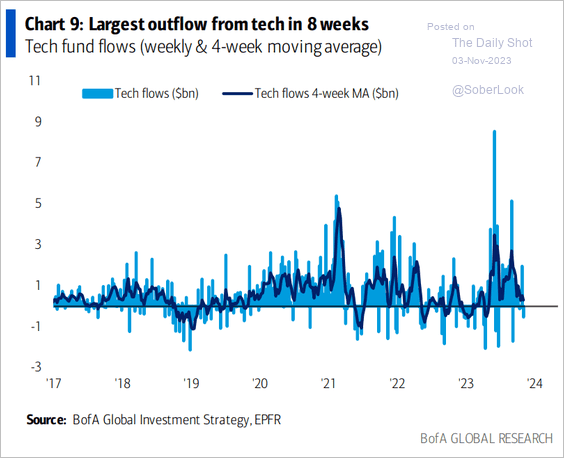

9. Tech funds are seeing some ouflows.

Source: BofA Global Research

Source: BofA Global Research

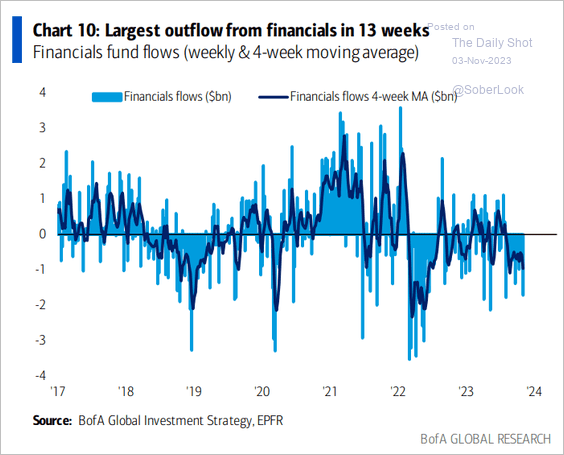

Outflows from financials have accelerated.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Credit

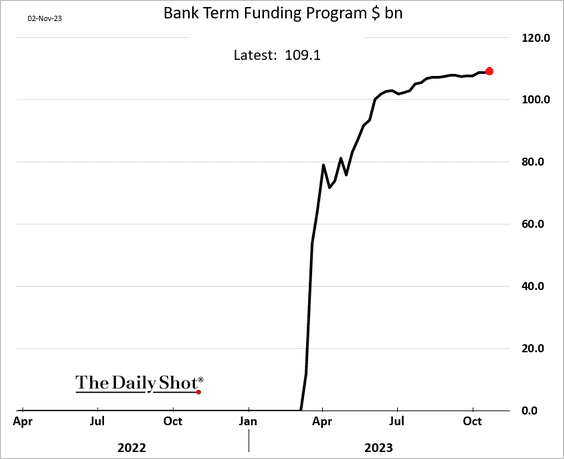

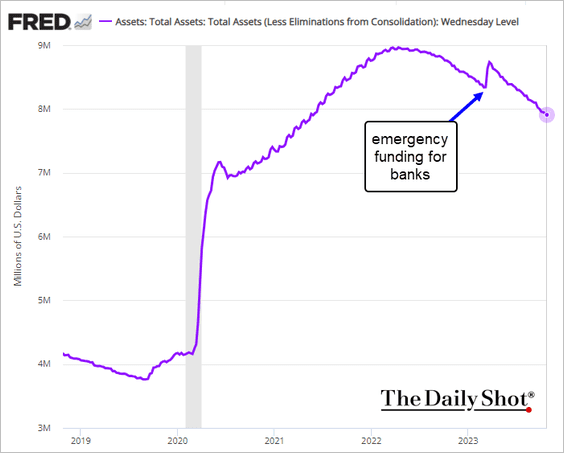

1. The Fed’s emergency facility for banks continues to expand gradually.

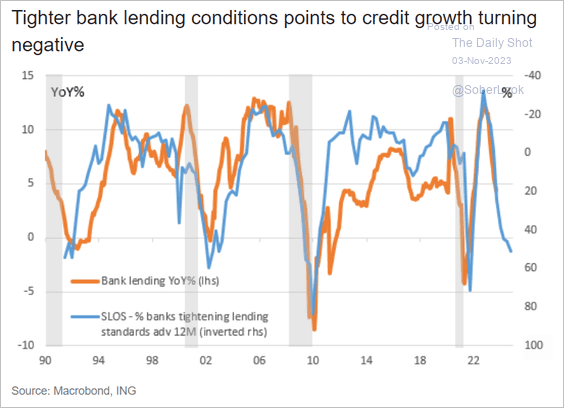

2. Loan growth is expected to slow sharply.

Source: ING

Source: ING

3. BofA’s private clients have been dumping corporate bonds.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Rates

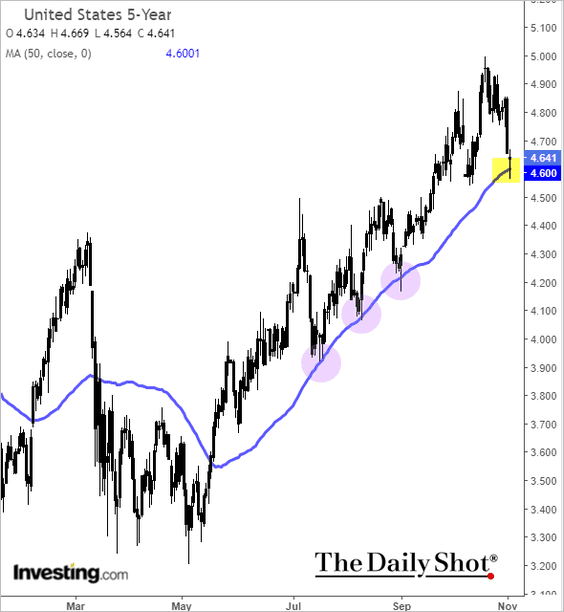

1. The 5-year Treasury yield is testing support at the 50-day moving average.

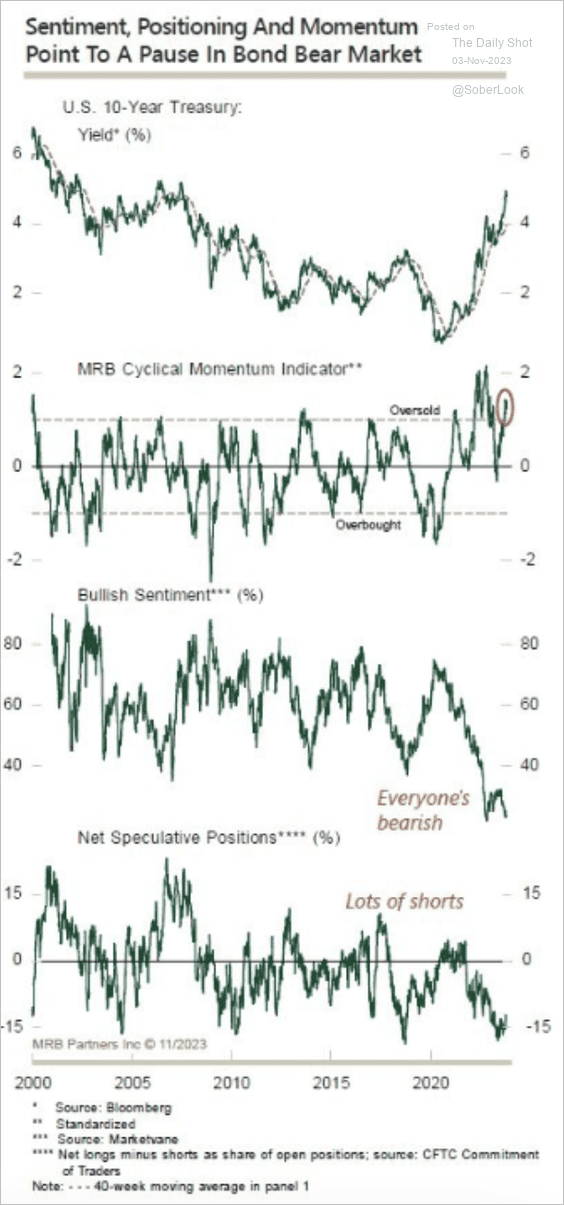

2. The pullback in Treasury yields has occurred alongside extreme bearish positioning.

Source: MRB Partners

Source: MRB Partners

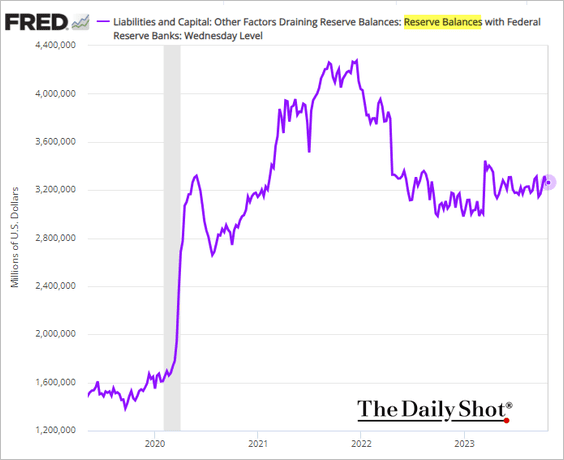

3. The Fed’s balance sheet continues to shrink.

But reserves remain stable.

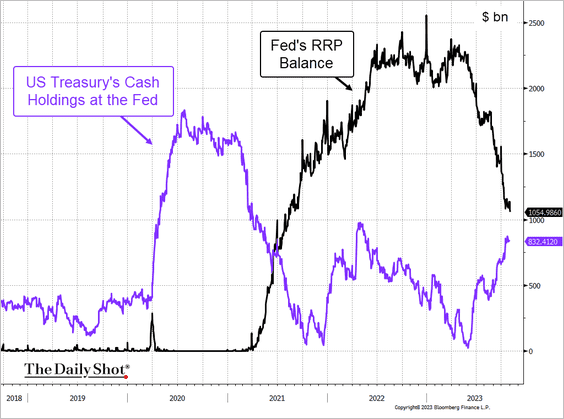

The reason lies in the continuous decrease of the reverse repo program (RRP) balances, which have been outpacing the gains in the US Treasury’s cash holdings at the Fed.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

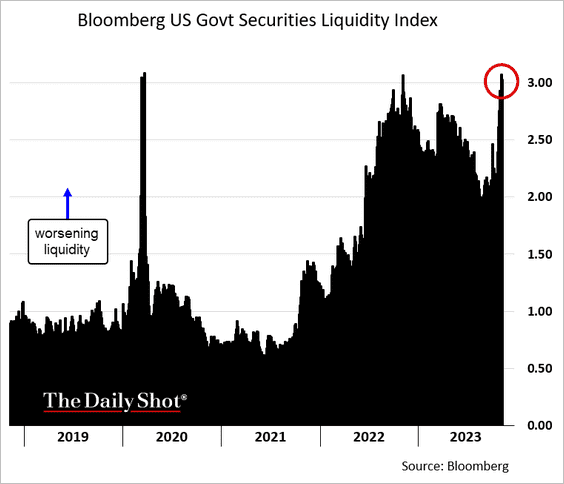

4. Treasury market liquidity is near its worst levels of the COVID era. This chart shows the aggregate deviations from the fitted yield curve.

——————–

Food for Thought

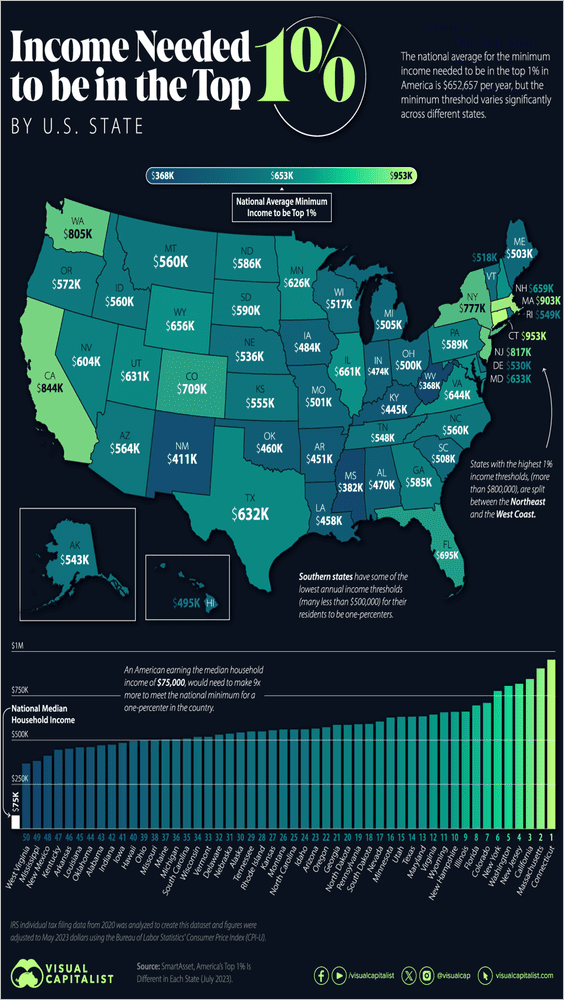

1. Income needed to be in the top 1%:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

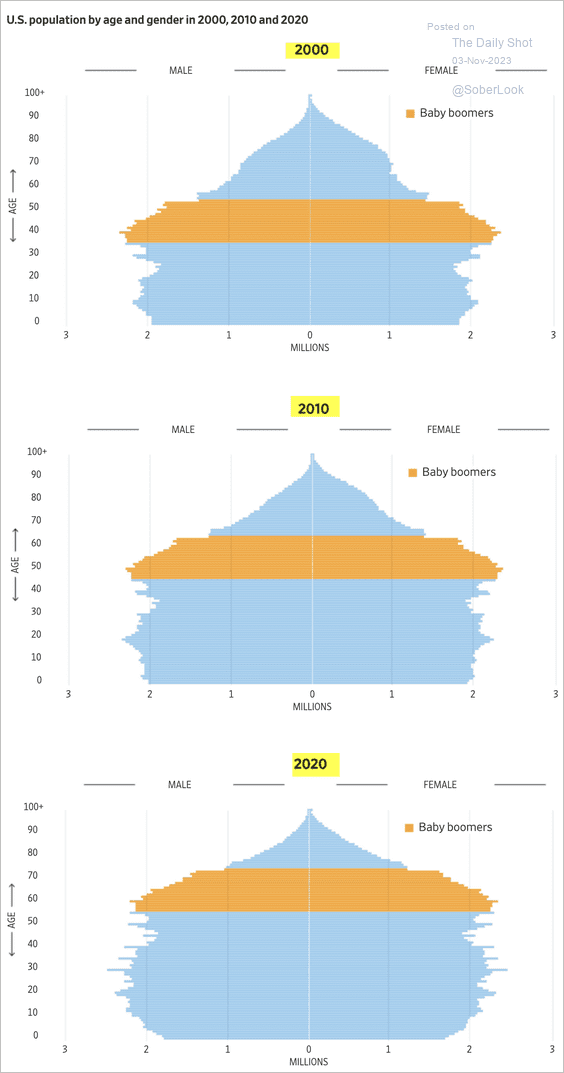

2. The US population pyramid:

Source: @WSJ Read full article

Source: @WSJ Read full article

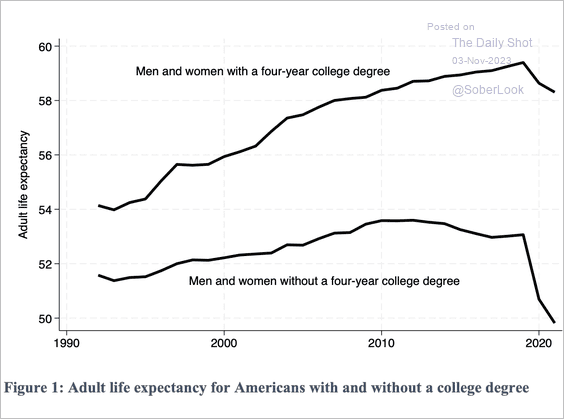

3. US remaining life expectancy at the age of 25:

Source: Brookings Read full article

Source: Brookings Read full article

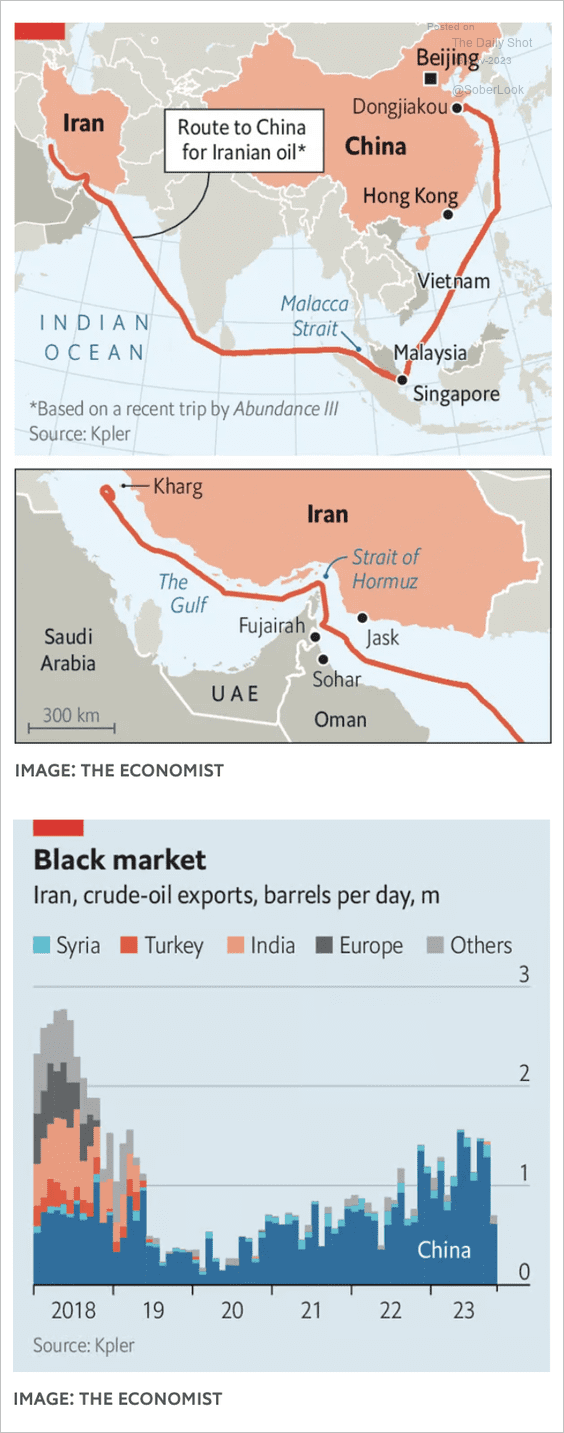

4. Iran selling oil to China:

Source: The Economist Read full article

Source: The Economist Read full article

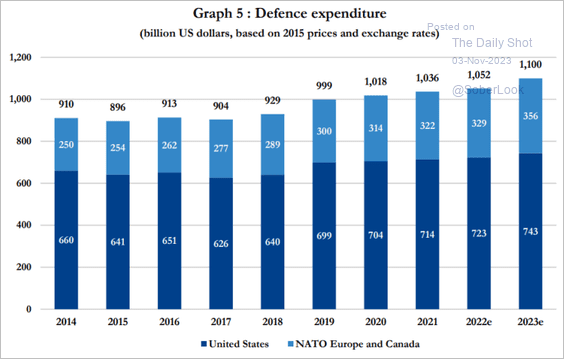

5. Inflation-adjusted defense spending:

Source: Danske Bank

Source: Danske Bank

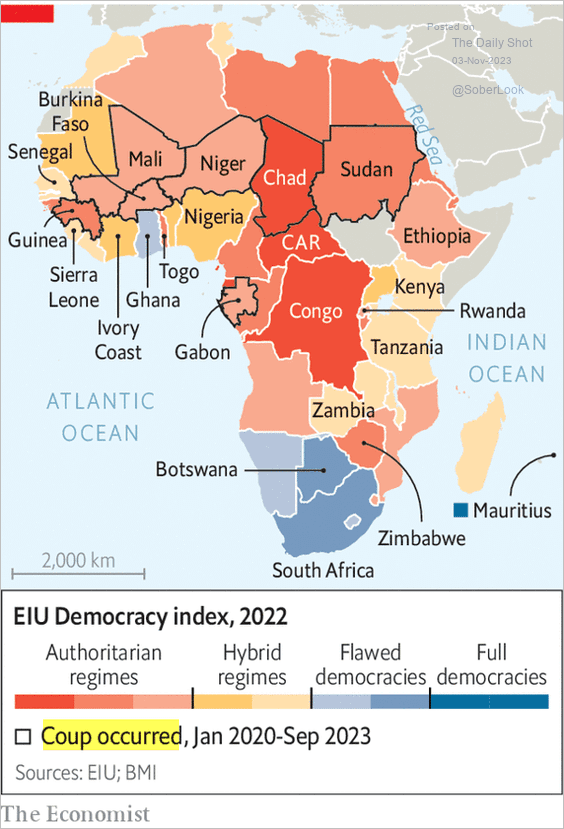

6. The EIU Democracy Index for Africa:

Source: The Economist Read full article

Source: The Economist Read full article

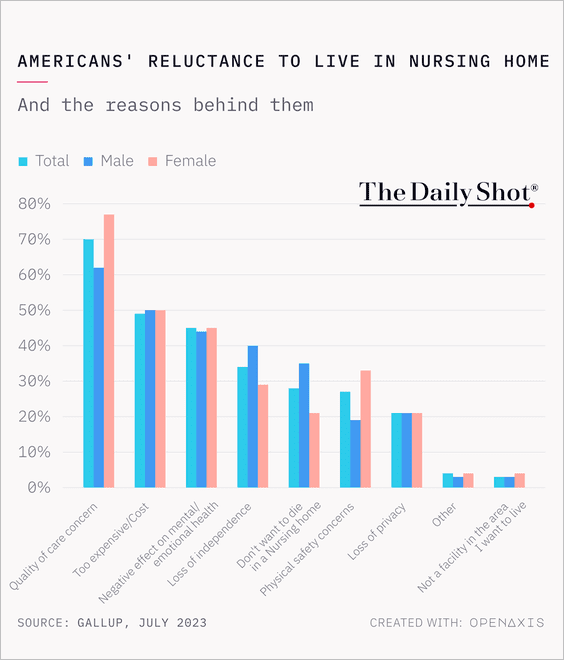

7. Americans’ reluctance to live in a nursing home:

Source: @TheDailyShot

Source: @TheDailyShot

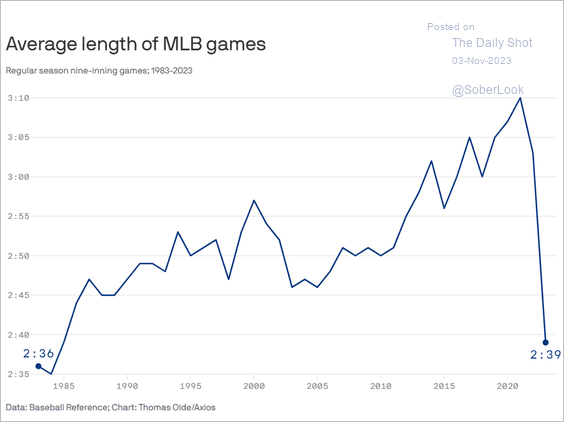

8. The average length of MLB games:

Source: @axios Read full article Further reading

Source: @axios Read full article Further reading

——————–

Have a great weekend!

Back to Index