The Daily Shot: 16-Nov-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

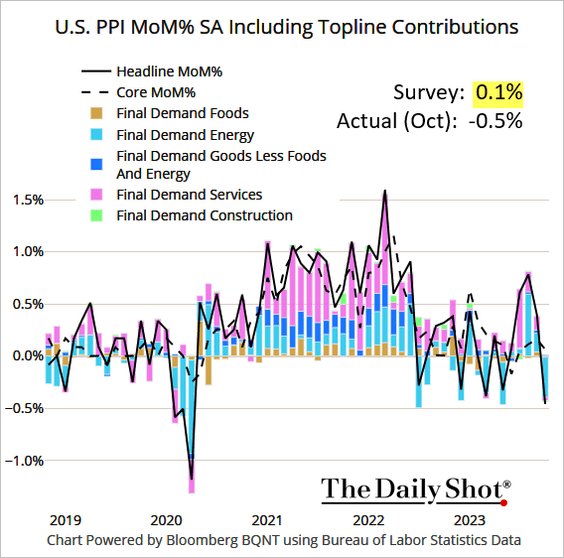

1. The October PPI report was softer than expected, with the headline figure pulled lower by energy prices.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Here is the core PPI.

Based on the CPI and PPI data, Nomura sees the October core PCE inflation increasing by around 0.2% (below consensus).

Source: Nomura Securities

Source: Nomura Securities

——————–

2. Retail sales slowed last month, …

… dragged lower by automobile sales.

• Below are the components of last month’s changes in retail sales (nominal and real).

Source: @GregDaco, @EY_Parthenon

Source: @GregDaco, @EY_Parthenon

• The “core” retail sales saw a modest gain.

• Here is a look at retail sales levels.

This chart shows the divergence between US and German real retail sales.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

——————–

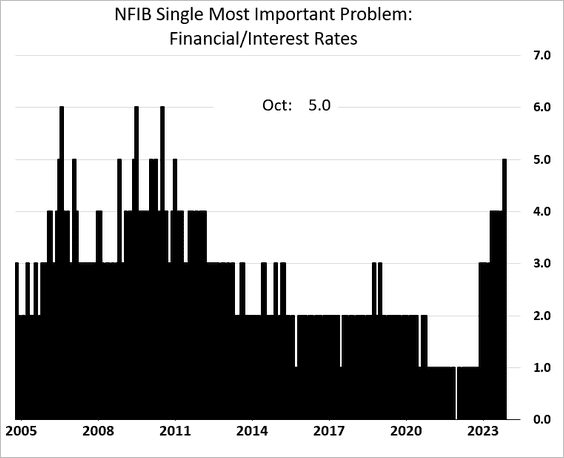

3. The NFIB small business sentiment index edged lower in October.

• Businesses are increasingly reporting declining sales and earnings.

• Employment indicators have been holding up.

Many businesses continue to boost wages.

• More firms are reporting expensive financing as a problem.

– This chart from BofA shows rising small business credit card balances.

Source: Bank of America Institute

Source: Bank of America Institute

——————–

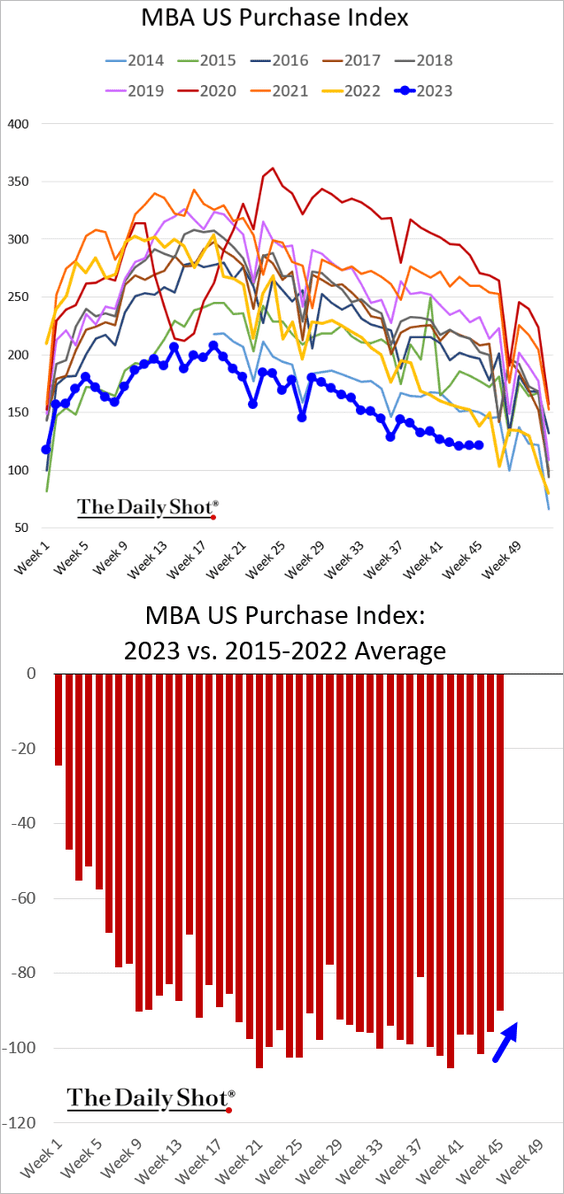

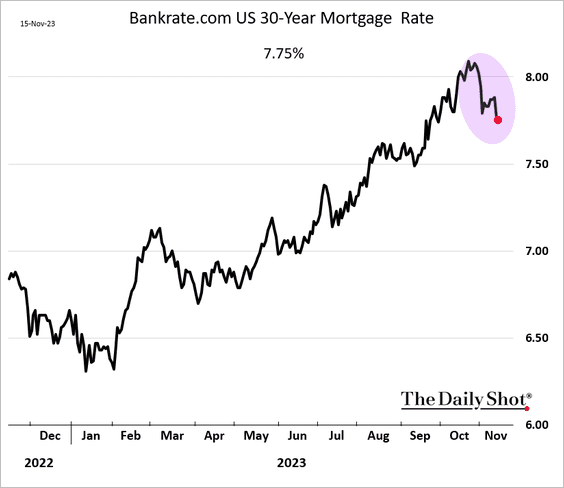

4. Mortgage applications edged higher again, …

… as mortgage rates ease from multi-year highs.

——————–

5. The Atalanta Fed’s GDPNow Q4 growth estimate is holding above 2% (annualized).

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

Here are the contributions to the model (inventories are less of a drag on growth).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

6. This week, US financial conditions eased, driven by the subdued CPI report, which led to a decrease in yields, the dollar, and credit spreads, while lifting stock prices.

Back to Index

Canada

1. Existing home sales declined sharply last month.

2. Nominal September manufacturing sales were stronger than expected, still running above last year’s levels.

Back to Index

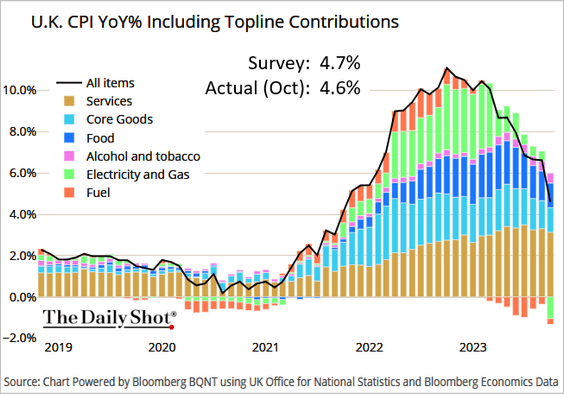

The United Kingdom

1. The CPI report was a bit softer than expected.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Core inflation dipped below 6%.

• Services inflation is still elevated, with rent CPI remaining stubbornly high.

• The retail sector inflation (RPI) is falling rapidly.

——————–

2. The Land Registry house price index is down year-over-year for the first time in over a decade. However, the decline was smaller than expected.

Back to Index

The Eurozone

1. Euro-area industrial production contracted further in September.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

2. The trade surplus was higher than expected.

• Here is a look at exports of services.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

• By the way, below is the Eurozone’s trade balance with China.

Source: Alpine Macro

Source: Alpine Macro

——————–

3. German construction firms increasingly see softening demand.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

4. French unemployment increased last quarter.

Back to Index

Japan

1. The trade gap was smaller than expected last month, …

… as exports remain robust.

——————–

2. Service sector output edged lower in September.

Back to Index

Asia-Pacific

1. New Zealand’s house sales are holding above last year’s levels.

2. Next, we have some updates on Australia.

• The employment report topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article

– The unemployment rate increased, …

.. but so did the labor force participation rate.

• Inflation expectations remain elevated.

Back to Index

China

1. New home prices declined for the fifth month in a row.

2. Advisory services in China’s capital markets and M&A deals have become much less lucrative.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

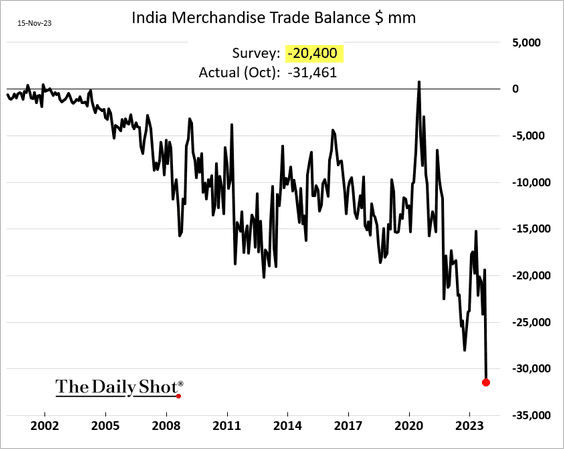

1. India’s trade gap hit a record high, …

… as imports surge.

Source: The Indian Express Read full article

Source: The Indian Express Read full article

——————–

2. South Africa’s retail sales volume continues to grow.

3. Colombia and Peru report shrinking economic activity (year-over-year).

——————–

4. Argentina’s CPI exceeded 140% in October.

Back to Index

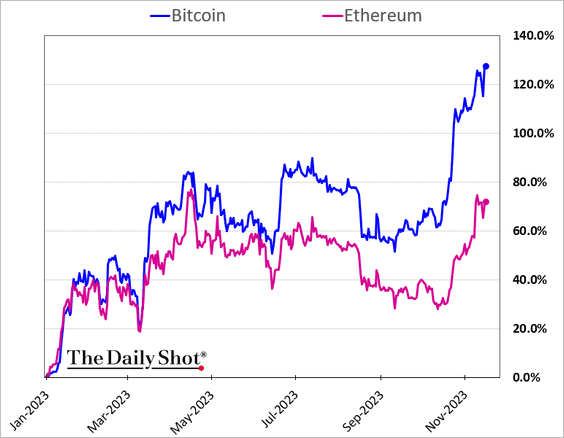

Cryptocurrency

Bitcoin is up almost 130% year-to-date.

Back to Index

Commodities

1. Coffee futures continue to climb.

2. China’s soybean market is well supplied.

Source: USDA Read full article

Source: USDA Read full article

Back to Index

Energy

1. US oil inventories continue to rise.

– Barrels:

– Days of supply:

– Cushing, OK stocks:

• US refinery runs and utilization have been relatively soft.

• After the recent surge, US gasoline inventories are back near last year’s levels.

——————–

2. Oil prices eased in response to rising US inventories.

Back to Index

Equities

1. Analysts are upbeat on the growth prospects of tech mega-caps.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

• As a group, the Magnificent Seven stocks are now up over 100% year-to-date, outpacing the S&P 500 by over 80%.

——————–

2. The trade services PPI signals slowing margin growth.

3. The latest pullback in earnings was relatively mild.

Source: Capital Economics

Source: Capital Economics

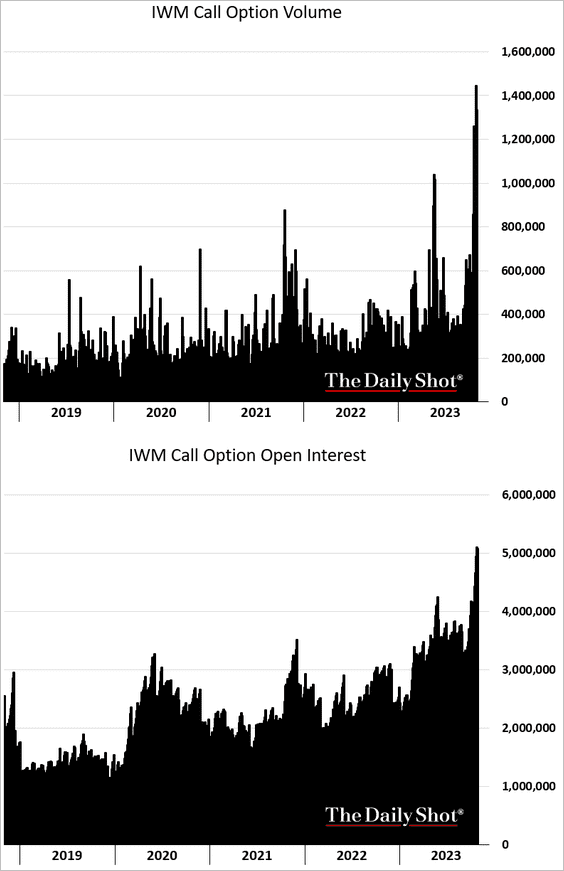

4. Bullish options bets on small caps are hitting record highs.

5. The S&P 500 futures liquidity has been improving.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

6. Next, we have some sector performance data (over the past five business days).

• Retail:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Banks:

• Transportation:

• Communication Services:

• Metals & Mining:

• Healthcare:

Back to Index

Credit

1. Total available credit declined from its recent peak, which particularly impacts small businesses.

Source: MUFG Securities

Source: MUFG Securities

2. This chart shows foreclosure notices for commercial real-estate mezzanine loans.

Source: @WSJ Read full article

Source: @WSJ Read full article

3. Banks’ preferred share offerings stalled this year.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Global Developments

1. Where are the G-20 economies in the economic cycle? Here is the analysis from Moody’s.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

• How will G-20 economies expand over the next couple of years compared to pre-COVID growth?

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

2. Govenments’ interest expense is expected to surge.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

1. US trade with China and the rest of Asia:

Source: @WSJ Read full article

Source: @WSJ Read full article

2. US bookkeepers vs. financial managers:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Graduates with accounting degrees:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

3. Job postings for remote and in-person work:

Source: Indeed Hiring Lab

Source: Indeed Hiring Lab

• Top and bottom work-from-home states:

Source: @thefuture Read full article

Source: @thefuture Read full article

——————–

4. Using sick days:

Source: @WSJ Read full article

Source: @WSJ Read full article

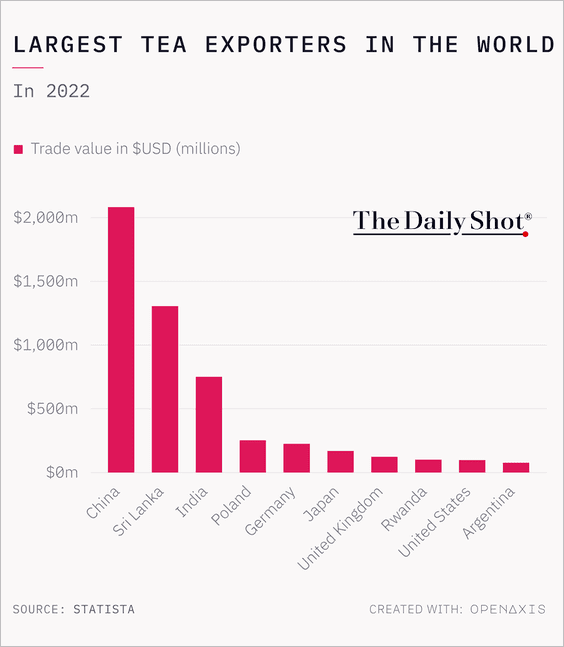

5. Largest tea exporters:

Source: @TheDailyShot

Source: @TheDailyShot

——————–

Back to Index