The Daily Shot: 17-Nov-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• China

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Rates

• Global Developments

• Food for Thought

The United States

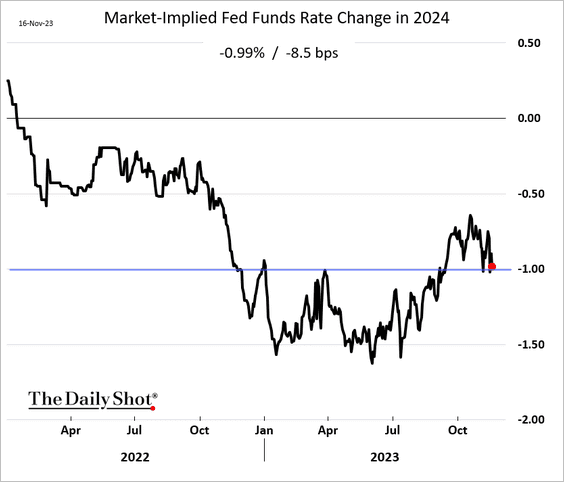

1. The market is settling on four 25 bps Fed rate cuts next year.

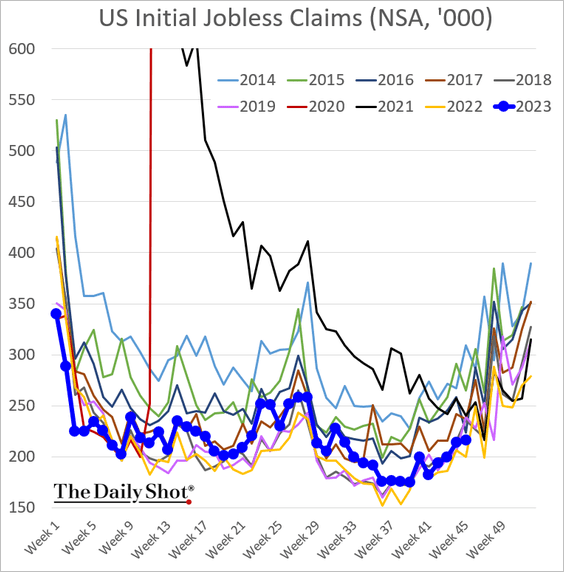

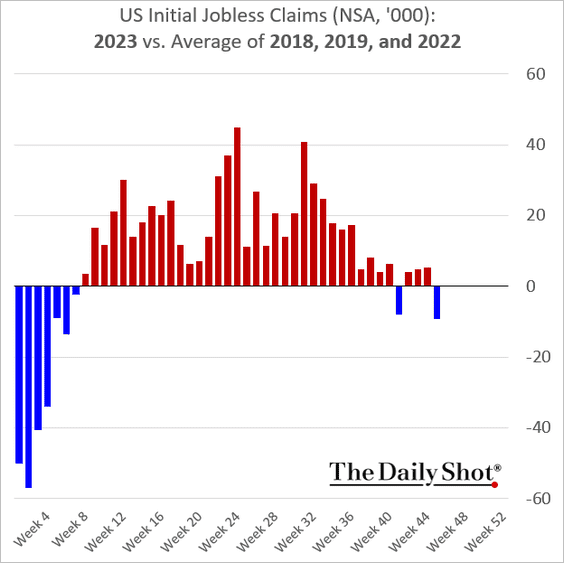

2. Initial jobless claims are near the lowest levels in recent years.

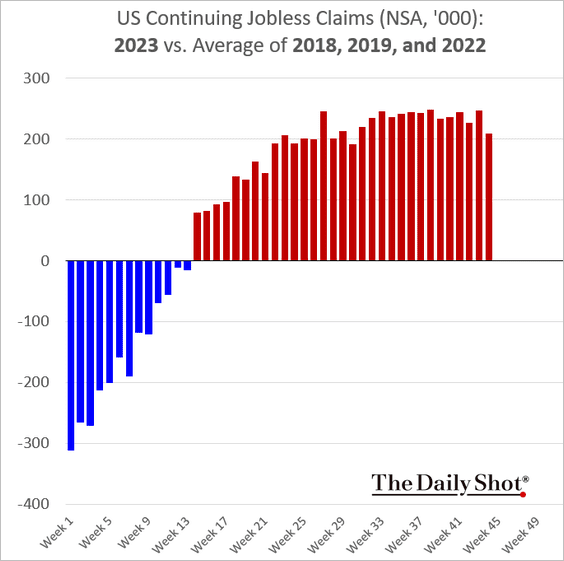

The decrease in continuing claims for the week of October 30th alleviated some concerns about unemployed Americans struggling to find work.

The pullback in unemployment claims mitigates the likelihood of a recession.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

3. Industrial production declined sharply in October due to the UAW strike.

Source: Barron’s Read full article

Source: Barron’s Read full article

• This chart shows the manufacturing production level and capacity utilization.

——————–

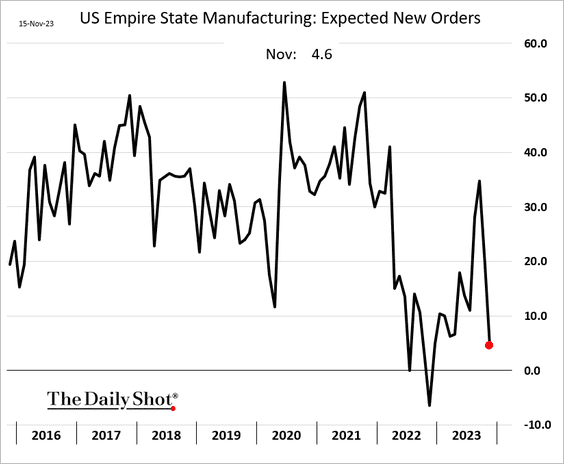

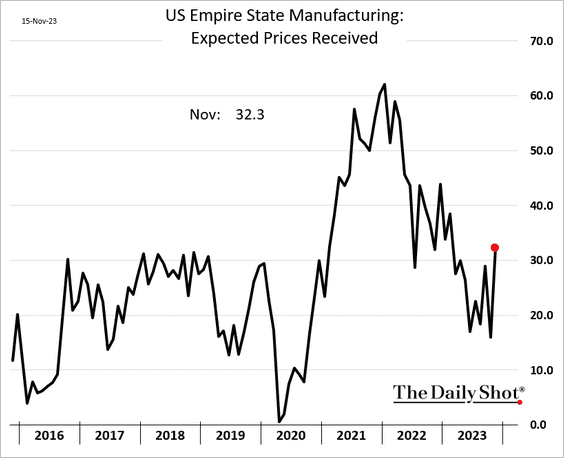

4. Next, let’s take a look at this month’s regional business surveys from the Federal Reserve.

• Factory activity improved in the NY Fed’s district.

But companies reported reduced staff levels.

– The indices of expected new orders and CapEx plans declined.

– More firms are planning to boost prices.

• The NY Fed’s survey of services firms showed that more companies expect to boost wages and prices.

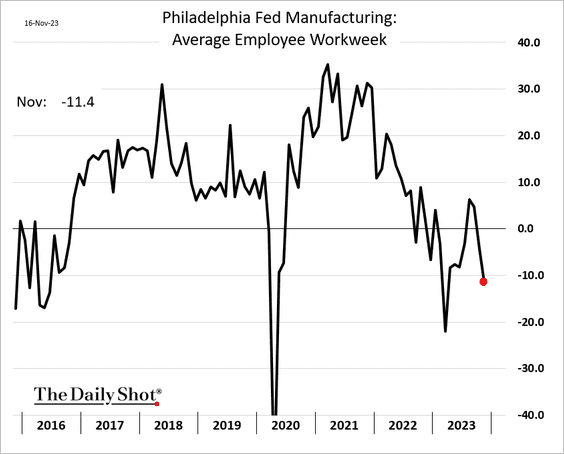

• The Philly Fed’s manufacturing survey showed a slower contraction.

But companies are cutting workers’ hours.

• The Kansas City Fed’s report showed signs of stabilization in factory activity as demand improves.

But businesses expect to cut workers’ hours in the months ahead, …

… and reduce CapEx.

——————–

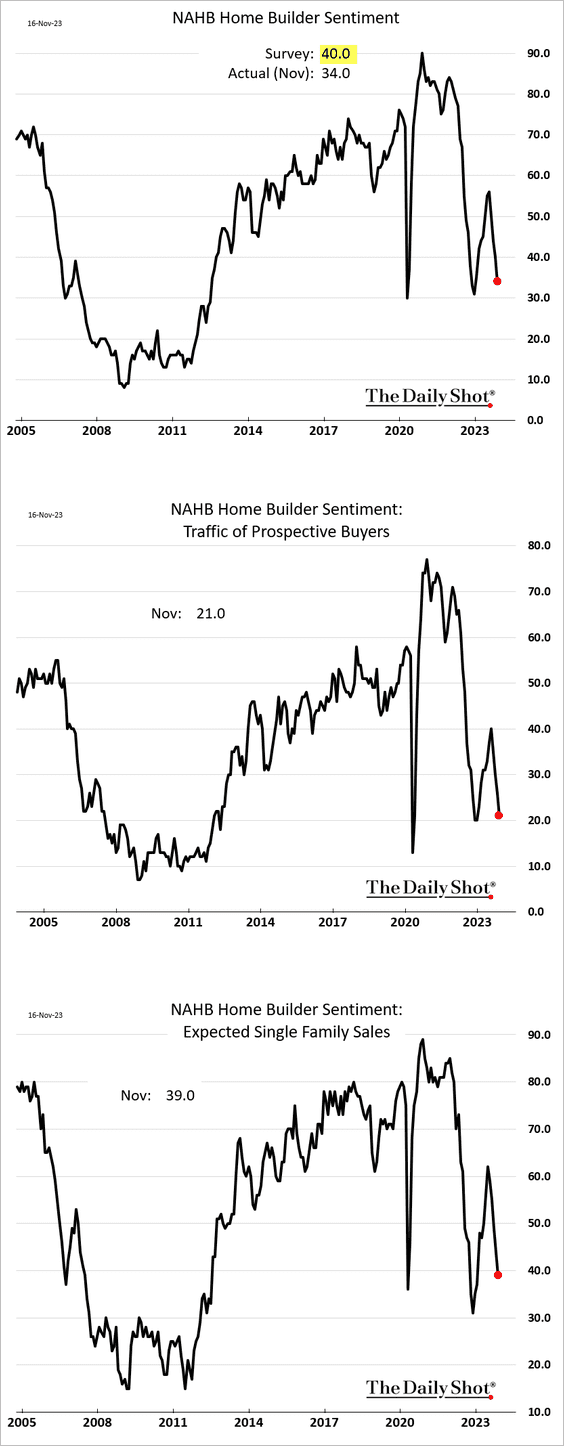

5. The NAHB homebuilder sentiment deteriorated this month, coming in well below expectations.

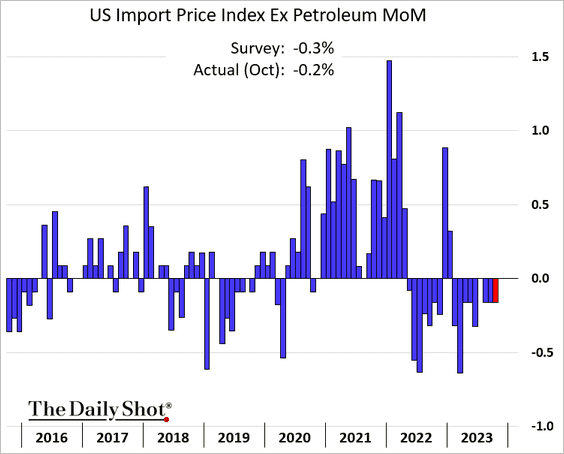

6. Import prices declined again last month.

Back to Index

The United Kingdom

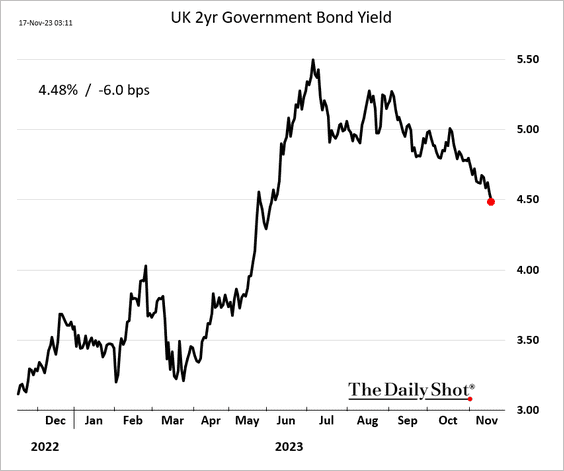

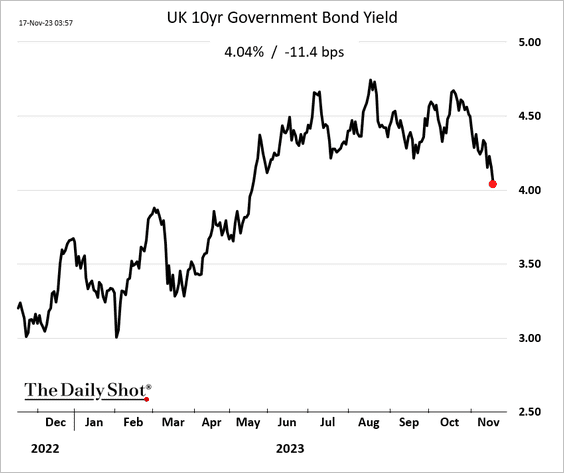

1. Gilt yields are dropping rapidly.

——————–

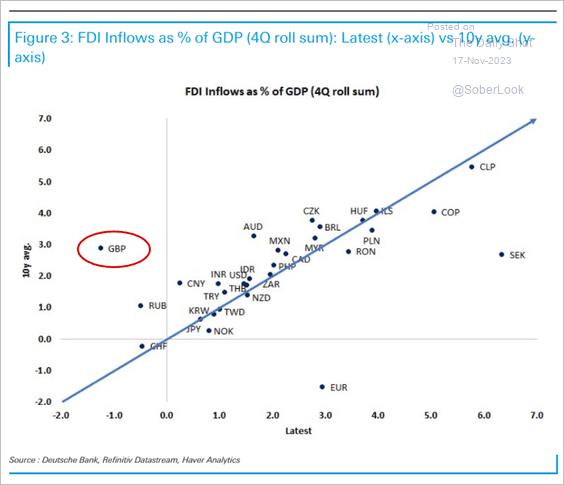

2. The UK stands out when it comes to foreign direct investment.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Here is a look at the number of UK households in temporary accommodation.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

1. Euro-area bond yields are moving lower.

2. Tight liquidity and weak PMI indicators signal a recession ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

3. Will stock prices and the euro follow the typical pre-recession downtrend next year?

Source: BCA Research

Source: BCA Research

Back to Index

Europe

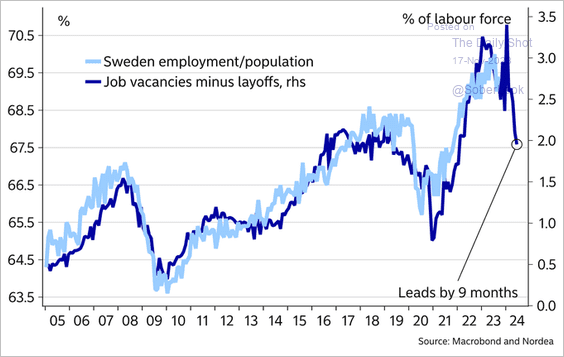

1. Sweden’s “net” job vacancies point to softer labor markets.

Source: @MikaelSarwe

Source: @MikaelSarwe

2. Here is a look at EU small business employment and sales.

Source: Eurostat Read full article

Source: Eurostat Read full article

3. Finally, we have European EV sales by manufacturer.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

Back to Index

China

1. Existing home prices continue to worsen.

Source: @markets Read full article

Source: @markets Read full article

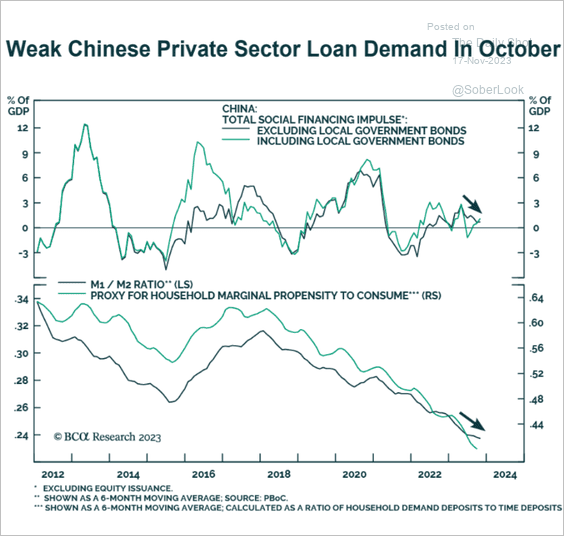

2. Consumption recovery has been slowing, …

Source: @economics Read full article

Source: @economics Read full article

… as households remain cautious.

Source: BCA Research

Source: BCA Research

——————–

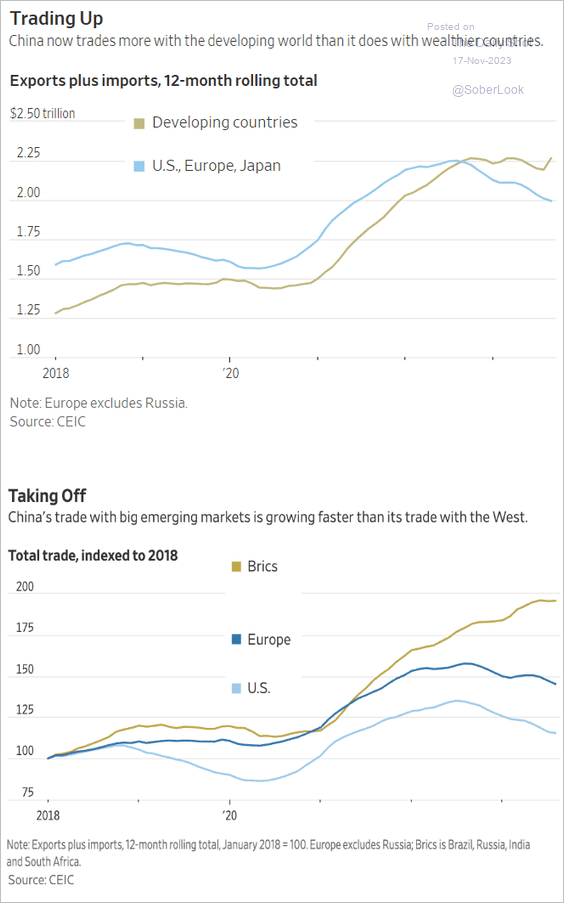

3. Here is China’s trade with advanced and emerging economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Cryptocurrency

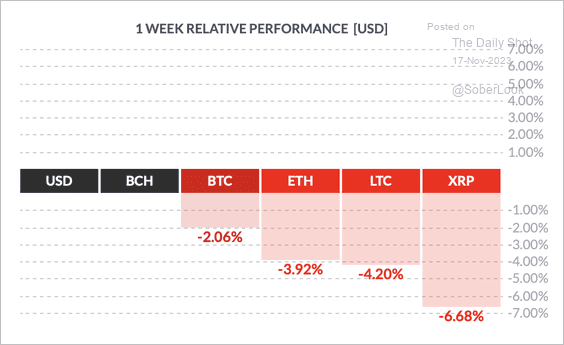

1. It has been a tough week for cryptos, with XRP underperforming top peers.

Source: FinViz

Source: FinViz

——————–

2. Kraken’s trading liquidity has improved relative to Coinbase this year.

Source: @KaikoData

Source: @KaikoData

3. The market share of altcoin and ETH spot volumes rose to the highest level in more than a year.

Source: @KaikoData

Source: @KaikoData

• Crypto trading volumes are well below last year’s levels.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

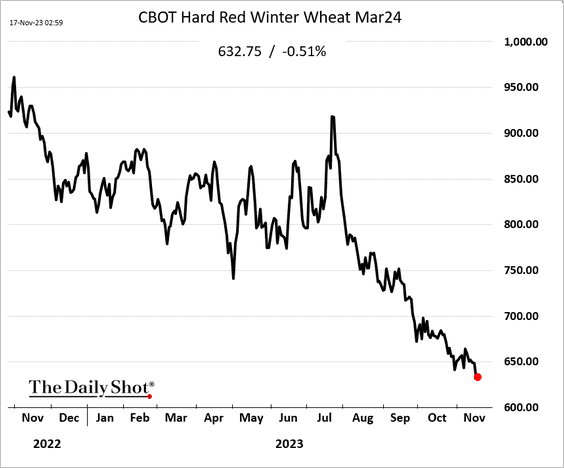

Commodities

1. US wheat futures continue to trend lower.

2. Rice futures are surging.

Back to Index

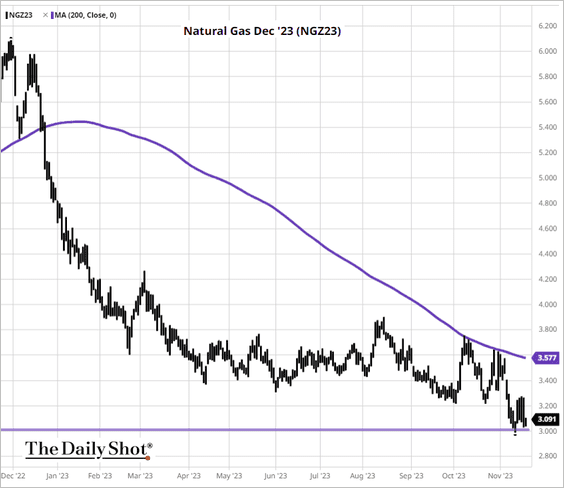

Energy

1. Brent crude is now well below the 200-day moving average.

Source: Reuters Read full article

Source: Reuters Read full article

• The front end of the curve is in contango.

——————–

2. Gasoline futures point to further declines in US prices at the pump.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. US natural gas is back near $3/mmbtu, …

Source: barchart.com

Source: barchart.com

… amid elevated inventories.

Back to Index

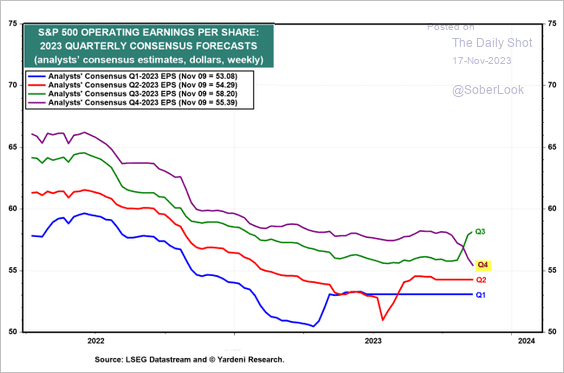

Equities

1. Sentiment remains upbeat.

• Retail investors:

• Investment managers:

Source: NAAIM

Source: NAAIM

——————–

2. Equity funds are seeing inflows, …

Source: BofA Global Research

Source: BofA Global Research

… especially US large-cap funds.

Source: BofA Global Research

Source: BofA Global Research

——————–

3. Analysts continue to downgrade their Q4 earnings estimates.

Source: Yardeni Research

Source: Yardeni Research

4. Cycle-sensitive stocks’ underperformance points to weak economic growth ahead.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

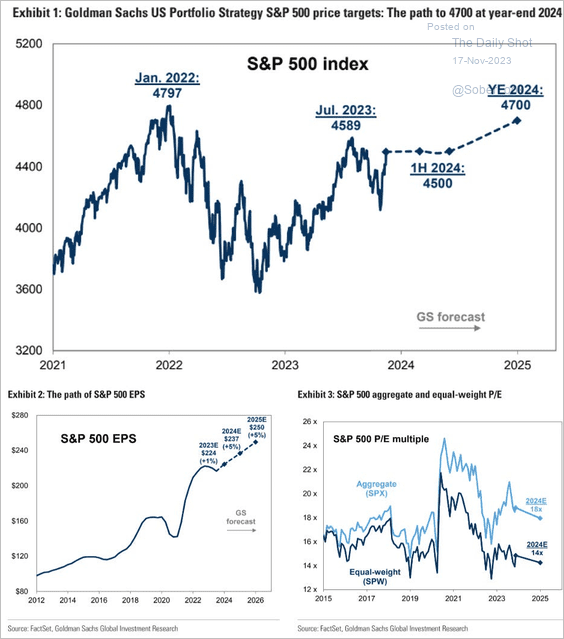

5. Goldman expects modest price gains next year, robust earnings growth, and improving multiples.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

6. This year’s IPOs haven’t performed well.

Source: @WSJ Read full article

Source: @WSJ Read full article

The broad post-IPO index is lagging the S&P 500 year-to-date.

——————–

7. US stocks’ weight in the global equity markets is near record highs.

Source: SG Cross Asset Research

Source: SG Cross Asset Research

Back to Index

Alternatives

1. Buyout remains the strategy with the largest aggregate value over the past ten years to date, while venture capital has seen the greatest number of funds raised over the same period.

Source: Bloomberg Professional Services: Private Equity

Source: Bloomberg Professional Services: Private Equity

2. Here is a look at the proportion of estimated assets under management by GP domicile and strategy.

Source: Bloomberg Professional Services: Private Equity

Source: Bloomberg Professional Services: Private Equity

3. The highest share of private capital funds raised by the ten largest managers are in infrastructure and natural resources.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

4. US secondary market transactions are taking place at steep discounts relative to last primary round prices.

Source: Carta

Source: Carta

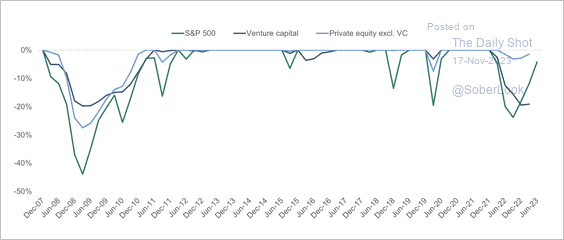

5. Here is a look at public and private market drawdowns since the financial crisis.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Rates

1. Foreigners sold Treasury bonds and notes in September.

2. Treasury funds saw outflows last week.

Source: BofA Global Research

Source: BofA Global Research

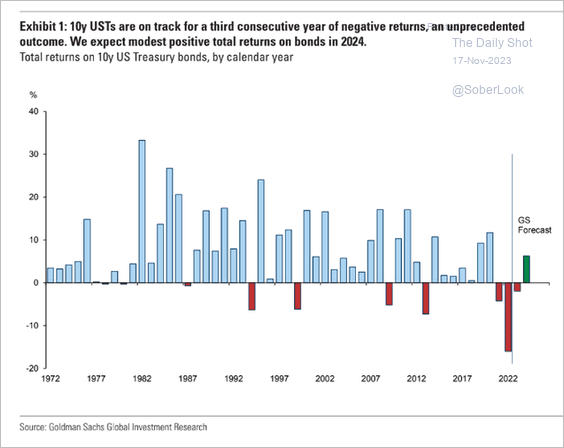

3. Goldman expects Treasuries to deliver positive single-digit returns next year.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Global Developments

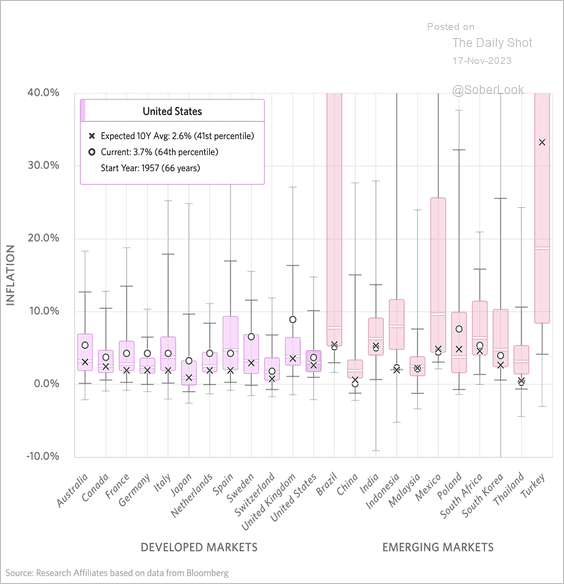

1. Here is a look at current and expected inflation rates relative to the historical range across developed markets.

Source: Research Affiliates

Source: Research Affiliates

2. The aggregate credit impulse in the largest economies is in restrictive territory.

Source: Oxford Economics

Source: Oxford Economics

3. This chart shows GDP growth forecasts from Barclays, with the latest revisions.

Source: Barclays Research

Source: Barclays Research

4. Wage growth is slowing around the world.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

1. US toy-industry sales growth:

Source: @WSJ Read full article

Source: @WSJ Read full article

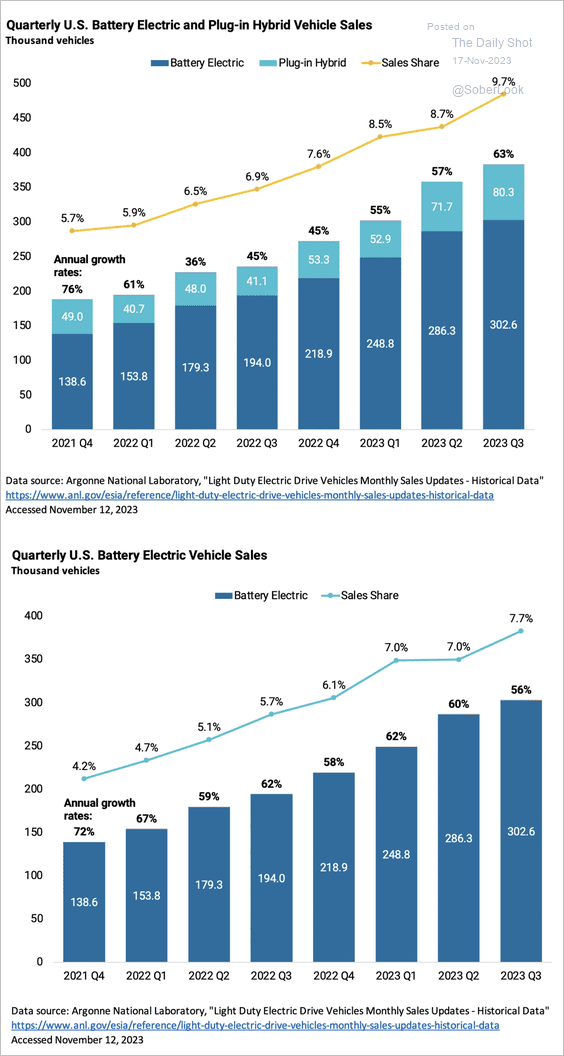

2. EV sales in the US:

Source: Heatmap Read full article

Source: Heatmap Read full article

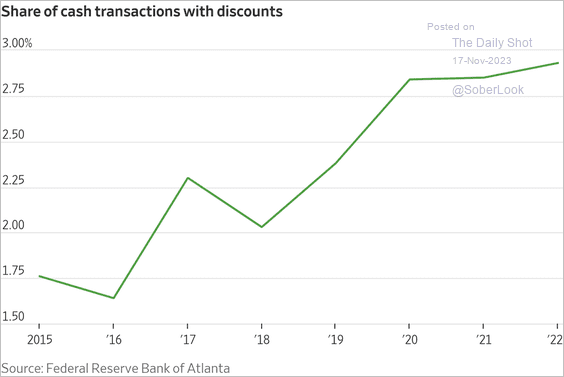

3. Businesses trying to skirt rising credit-card transaction fees:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Doctors and nurses per 1000 population;

Source: @TheDailyShot

Source: @TheDailyShot

5. Average male height and GDP per capita:

Source: @TheDailyShot

Source: @TheDailyShot

6. Thanksgiving flight patterns:

Source: FlowingData

Source: FlowingData

——————–

Have a great weekend!

Back to Index