The Daily Shot: 20-Nov-23

• Administrative Update

• The United States

• Canada

• The United Kingdom

• Europe

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

Please note that The Daily Shot will not be published this Thursday and Friday (November 23rd and 24th).

Back to Index

The United States

1. Residential construction held up well last month amid tight inventories.

Source: Reuters Read full article

Source: Reuters Read full article

• Building permits are back to last year’s levels.

• Single-family activity is now well above 2022 levels.

– Starts:

– Permits:

– Year-over-year changes in single-family permits:

• Multi-family construction remains relatively soft.

——————–

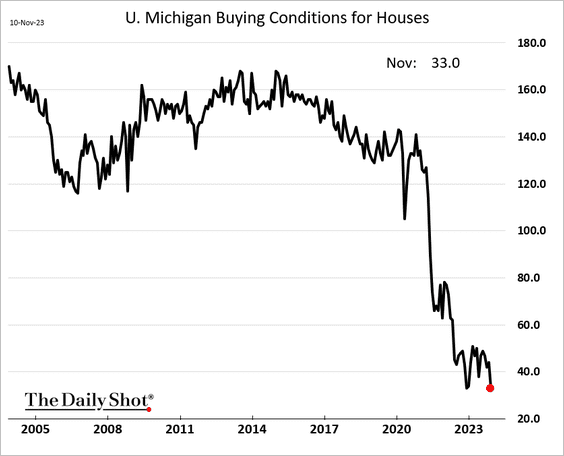

2. Next, we have some additional updates on the housing market.

• Consumers view the current buying climate for houses as the worst in recent history.

• More homes are mortgage-free.

Source: @BW Read full article

Source: @BW Read full article

• There is roughly a one-year lag between changes in the level of interest rates and corresponding changes in home prices.

Source: MUFG Securities

Source: MUFG Securities

• Higher rates are gradually bleeding into the overall mortgage pool.

Source: Bank of America Institute

Source: Bank of America Institute

• Residential investment as a share of GDP is very low, contributing to tight inventories.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

• Home inventories are further impacted by more Americans choosing to remain in their current residences.

——————–

3. Now, let’s take a look at some updates on the labor market.

• It’s been 21 months since the unemployment rate was above 4%.

• Prime-age men with less than a high school diploma have been returning to the labor force.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

– Prime-age women with at least one child continue to engage in the labor market at a lower rate than women of the same age without children at home.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Industrial production has kept rising even as the share of workers in manufacturing declined.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

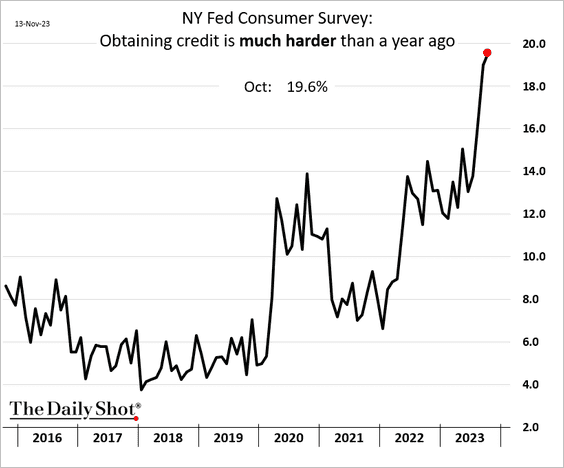

4. More Americans are reporting challenges in obtaining credit.

Back to Index

Canada

1. Last month’s housing starts topped expectations.

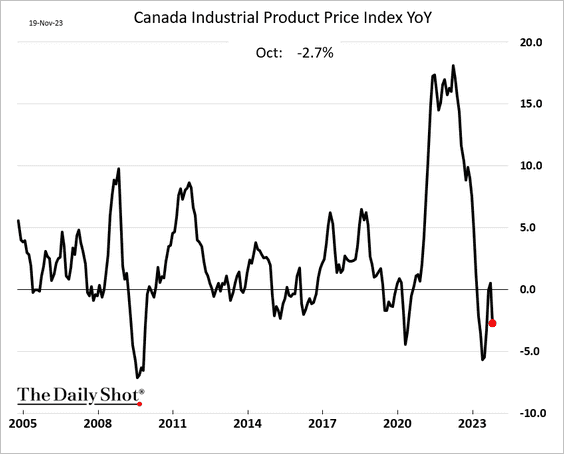

2. The industrial producer price index is back in negative territory on a year-over-year basis due to a pullback in oil prices.

3. Foreigners sold Canadian bonds in September.

Source: WP Read full article

Source: WP Read full article

——————–

4. Speculative accounts have been boosting their bets against the loonie.

Back to Index

The United Kingdom

1. Retail sales unexpectedly declined last month.

Source: @economics Read full article

Source: @economics Read full article

2. The market has almost completely discounted the possibility of another BoE rate hike in this cycle, …

… as services inflation is expected to moderate.

Source: ING

Source: ING

——————–

3. The pound has been weakening against the euro, …

… with sentiment deteriorating further last week (chart shows speculative CME futures positioning).

Back to Index

Europe

1. Here is a look at the euro-area CPI components.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. Spain’s housing sales are slowing rapidly.

3. Speculative accounts have been boosting their bets against the Swiss franc.

4. This chart shows the year-over-year changes in industrial production across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

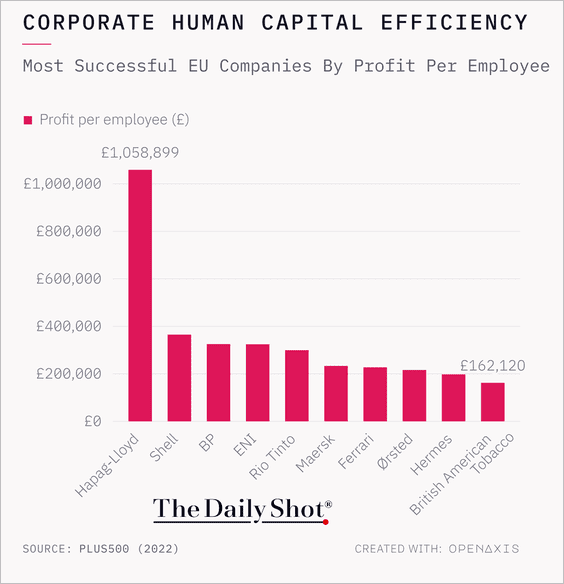

6. Finally, we have EU companies with the highest profit per employee.

Source: @TheDailyShot

Source: @TheDailyShot

Back to Index

China

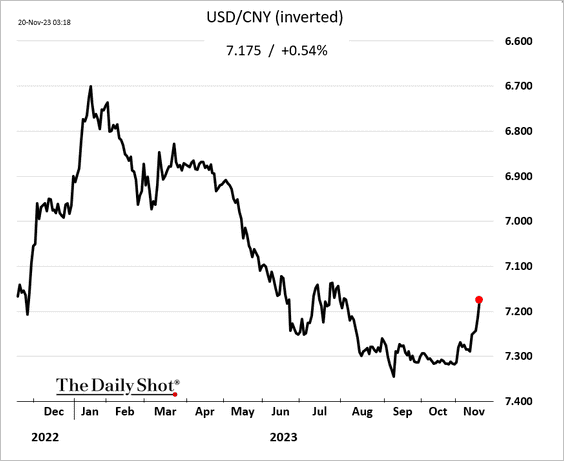

1. The renminbi is rebounding.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. Utilized foreign direct investment continues to diverge from last year’s trajectory.

3. Construction starts remain soft.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

Back to Index

Emerging Markets

1. Dollarization ahead for Argentina?

Source: AP News Read full article

Source: AP News Read full article

• The nation’s exports are over 30% below last year’s levels.

——————–

2. Next, we have some updates on Brazil.

• The economy contracted slightly in September, …

Source: The Brazilian Report Read full article

Source: The Brazilian Report Read full article

… signaling a contraction in Q3.

Economists also downgraded their forecasts for the current quarter.

• The MSCI Brazil Index is trading at a discount relative to historical levels.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

——————–

3. Ecoomists are boosting their forecasts for Mexico’s growth next year.

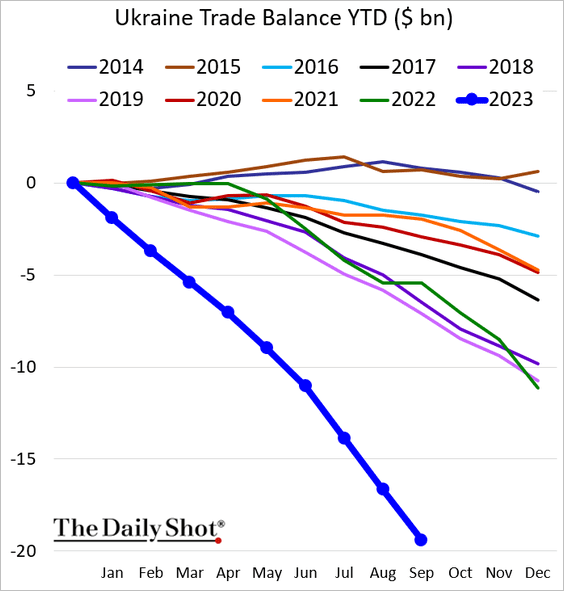

4. Here is Ukraine’s trade balance.

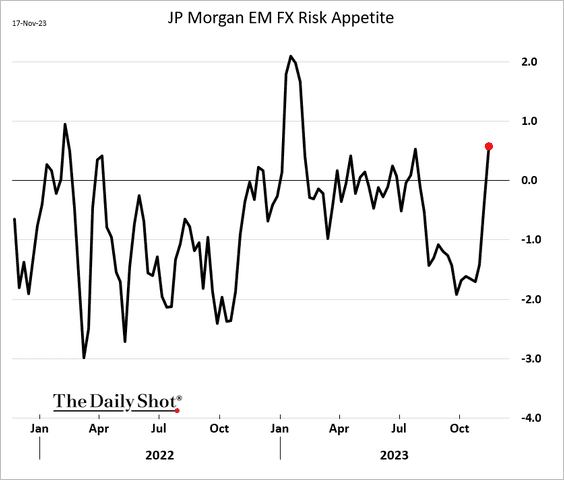

5. Risk appetite is rising in the EM FX market.

6. Finally, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

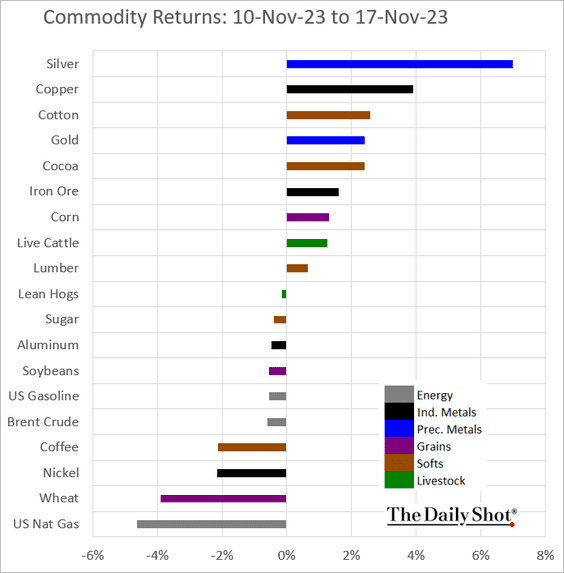

Commodities

1. The copper market is in extreme contango, suggesting flagging demand.

2. Nickel prices continue to fall.

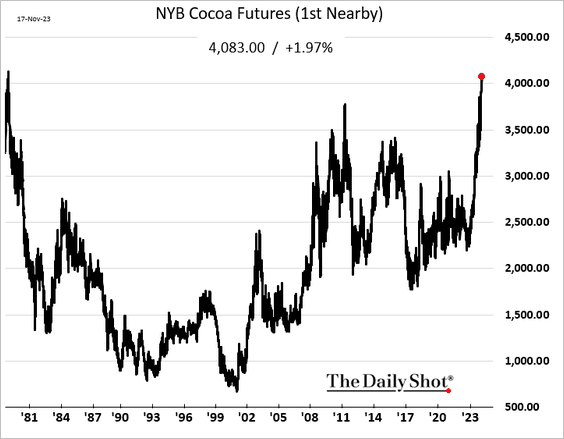

3. Cocoa prices hit the highest level since 1978.

4. Rice prices keep climbing.

Source: @markets Read full article

Source: @markets Read full article

——————–

5. Here is a look at last week’s performance across key commodity markets.

Back to Index

Energy

1. The US oil rig count increased last week.

2. Oil futures positioning is very bearish, setting the stage for a rebound.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. US natural gas futures dropped below $3/mmbtu.

Back to Index

Equities

1. Let’s start with some technicals.

• The Nasdaq 100 is at resistance.

• The S&P 500 Equal Weighted index is testing resistance at the 200-day moving average.

Source: barchart.com

Source: barchart.com

• A wedge pattern in the S&P 500?

Source: Yardeni Research

Source: Yardeni Research

• The S&P 500 RSI suggests that the rally is about to pause.

——————–

2. It has been 472 trading days since the S&P 500 reached its all-time high.

3. The S&P 500 breadth has improved markedly.

4. Asset managers are boosting their bets on the Nasdaq 100 futures.

• Funds flows into QQQ (Nasdaq 100 ETF) surged last week.

5. CTAs have become upbeat on US equities.

Source: Goldman Sachs; @Marlin_Capital

Source: Goldman Sachs; @Marlin_Capital

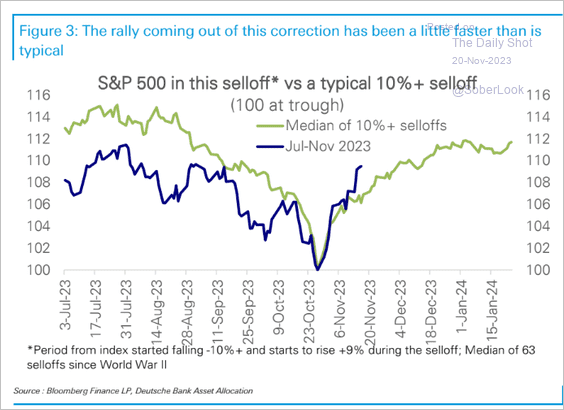

6. The last correction wasn’t unusual.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

7. Here is a look at the S&P 500 seasonality.

Source: Goldman Sachs; @Marlin_Capital

Source: Goldman Sachs; @Marlin_Capital

8. It was a good week for small caps.

Demand for call options on the Russell 2000 index (IWM) has been surging. Here is the call option skew.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

——————–

9. How do equity markets’ year-to-date returns compare to other asset classes?

Source: Bank of America Institute

Source: Bank of America Institute

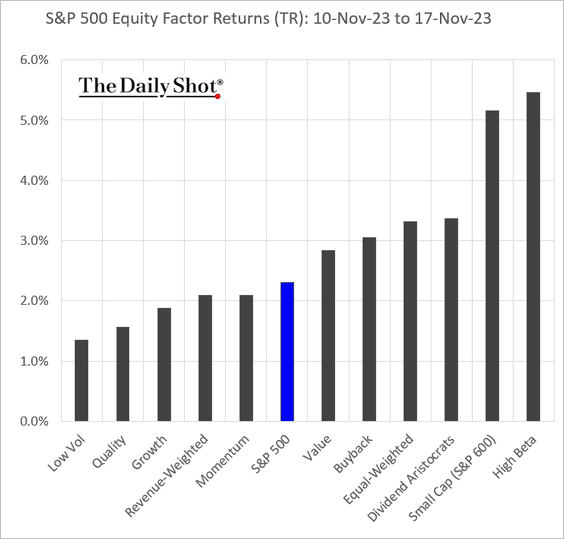

10. Finally, we have some performance updates from last week.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

1. MBS spreads have been tightening but remain above pre-COVID levels.

2. Middle-market companies’ interest coverage has been deteriorating.

Source: @theleadleft

Source: @theleadleft

4. Here is last week’s performance by asset class.

Back to Index

Rates

The 10-year Treasury yield broke below its five-month uptrend last week. The next major support level is around 4%.

Back to Index

Global Developments

1. Are markets too dovish on the Fed relative to peers?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. Here is a look at central bank staffing levels relative to the population in select economies.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

3. What are the drivers of growth in total hours worked in Europe and the US?

Source: IMF

Source: IMF

4. Finally, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

1. Average age of US vehicles:

Source: @WSJ Read full article

Source: @WSJ Read full article

2. Changes in US household wealth by income percentile:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

3. Accelerated aging across Asia:

Source: The Economist Read full article

Source: The Economist Read full article

4. 5G download speeds:

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Hype cycles:

Source: @Marlin_Capital

Source: @Marlin_Capital

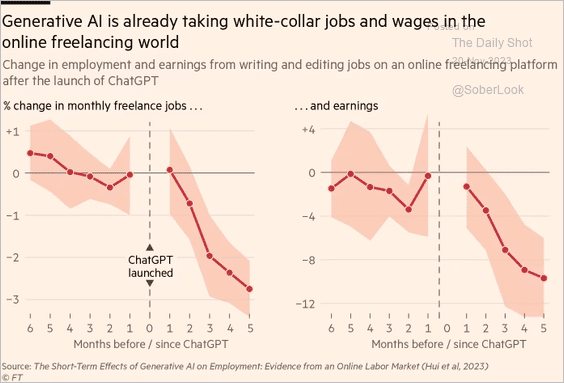

6. Generative AI is sending shockwaves through the online freelancing world:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

7. Highest-grossing horror movies:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index