The Daily Shot: 27-Nov-23

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global developments

• Food for Thought

The United States

1. The S&P Global flash PMI report indicated a modest expansion in the US services sector this month.

– However, hiring at service companies has stalled.

– Fewer firms reported rising input costs.

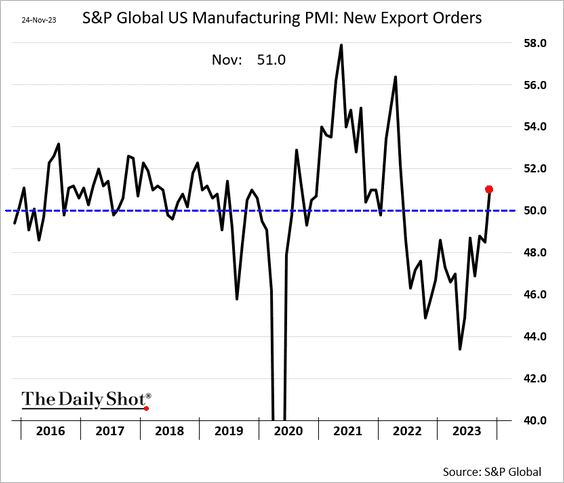

• Manufacturing activity dipped back into contraction territory.

– But export demand is improving.

– Manufacturers are reporting fewer employees.

——————–

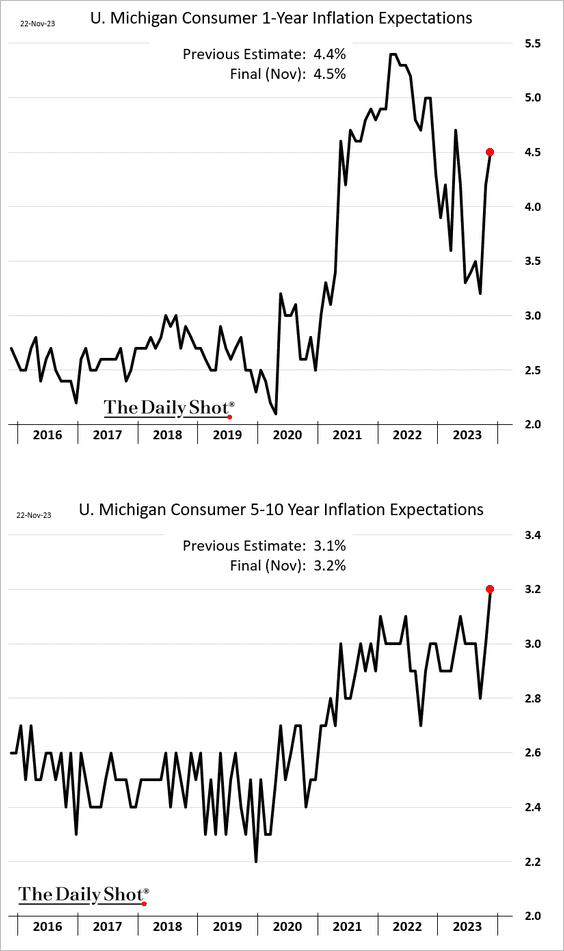

2. The revised inflation expectations data from the University of Michigan highlight consumers’ concerns about inflation resurgence.

Source: Reuters Read full article

Source: Reuters Read full article

Treasury yields moved higher in response to the University of Michigan report.

——————–

3. Durable goods orders declined sharply last month, …

… driven by the transportation sector.

Source: Reuters Read full article

Source: Reuters Read full article

• Capital goods orders edged lower.

This chart shows the nominal and real levels of capital goods orders.

——————–

4. Bloomberg’s index of US economic surprises has experienced a sharp decline in recent weeks.

5. Initial jobless claims remain very low for this time of the year.

• Continuing claims appear to be stable.

• Seasonal hiring has been relatively soft.

Source: Challenger, Gray & Christmas Read full article

Source: Challenger, Gray & Christmas Read full article

• Here is a look at the proportion of job losses each state has recovered since the onset of the pandemic.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

6. Mortgage applications continue to show some improvement, …

… as mortgage rates ease.

• Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

• The average loan size has been trending lower.

Back to Index

The United Kingdom

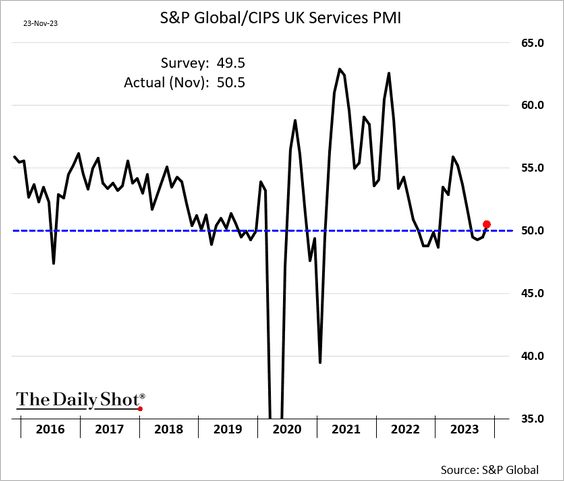

1. The flash composite PMI indicator from S&P Global signaled stabilization in business activity this month.

• Services (back in growth territory):

• Manufacturing (slower contraction):

——————–

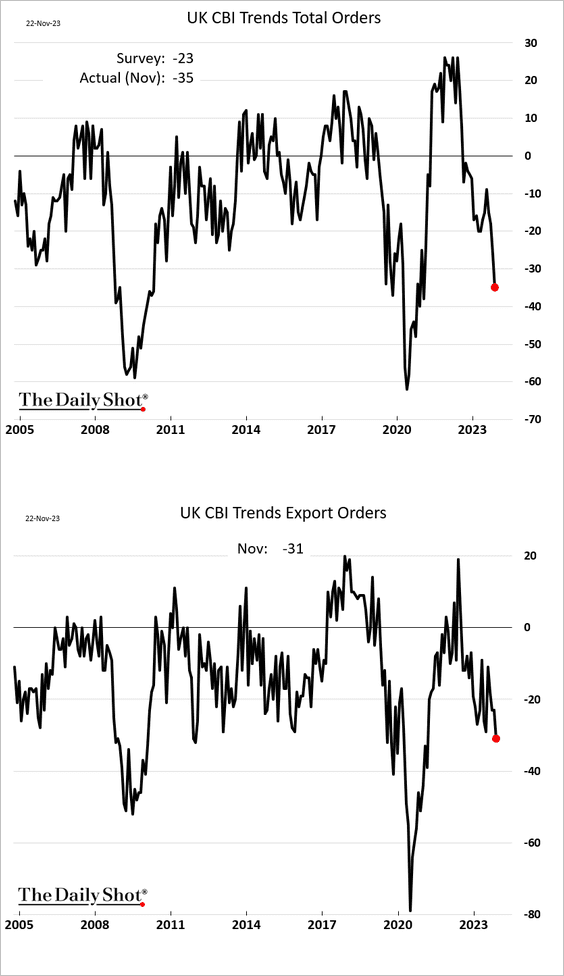

2. The CBI report showed deteriorating industrial goods demand.

3. Consumer confidence edged higher this month.

Back to Index

The Eurozone

1. The euro-area flash PMI report shows a slightly slower contraction this month.

Source: Reuters Read full article

Source: Reuters Read full article

– The PMI indicators continue to signal a GDP decline.

Source: Capital Economics

Source: Capital Economics

• Manufacturing:

– The manufacturing sector has contracted for 17 months in a row.

– Germany (a slower decline this month):

– France (severe contraction):

• Services:

– Germany:

– France:

• The PMI report shows that the euro-area labor market is under pressure.

– French service firms (hiring has stalled):

– French manufacturing (ongoing staff reductions):

– German manufacturing employment:

– The Eurozone Composite PMI employment:

– The PMI report does not bode well for employment growth.

Source: Capital Economics

Source: Capital Economics

——————–

2. Germany’s Ifo indicator remains depressed, …

Source: ifo Institute

Source: ifo Institute

… signaling further declines in the nation’s GDP.

Source: Capital Economics

Source: Capital Economics

——————–

3. Here is a look at Germany’s GDP growth components.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

4. French business sentiment has been trending lower.

5. Consumer sentiment indicators improved this month.

• The Netherlands:

• Belgium:

• The Eurozone

Back to Index

Japan

1. The CPI report was a bit softer than expected, but core inflation remains elevated.

• Economists have been boosting their forecasts for next year’s core CPI.

——————–

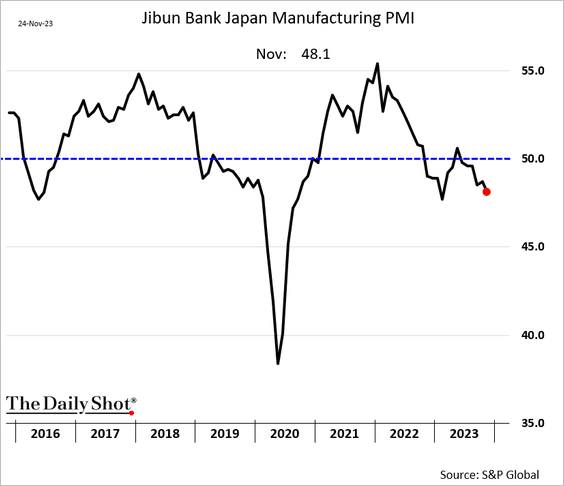

2. Manufacturing activity contracted further this month.

Services remain in expansion territory.

Back to Index

Asia-Pacific

1. Let’s begin with Taiwan.

• Industrial production surprised to the upside.

• The unemployment rate hit a multi-year low.

• The inability of Taiwan’s two primary opposition parties to form a united front for the presidential election raises the likelihood that Lai Ching-te, the current Vice President and candidate of the ruling Democratic Progressive Party (DPP), will win the upcoming presidential election scheduled for January 13th.

Source: @ThatJennieWelch, @economics Read full article

Source: @ThatJennieWelch, @economics Read full article

——————–

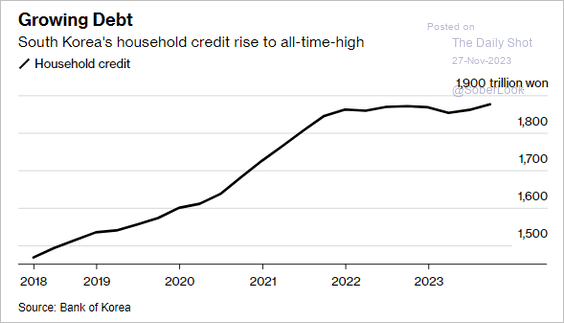

2. After last year’s plateau, South Korea’s household debt is reaching record highs.

Source: @economics Read full article

Source: @economics Read full article

3. Australia’s PMI indicators are firmly in contraction territory, …

… amid soft demand.

• Australia’s corporate insolvencies continue to climb, particularly in construction, where builders have been squeezed by fixed-price contracts.

Source: Coolabah Capital Read full article

Source: Coolabah Capital Read full article

Back to Index

China

1. The stock market remains under pressure despite Beijing’s attempts to intervene.

Hong Kong/foreign investors continue to pull capital out of mainland markets. The chart below shows the cumulative year-to-date flows.

Below are the net purchases by year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

2. Industrial profit growth has slowed.

Source: @markets Read full article

Source: @markets Read full article

3. Demographics remain a headwind for China’s longer-term growth.

Source: Nikkei Asia Read full article

Source: Nikkei Asia Read full article

Back to Index

Emerging Markets

1. Turkey’s central bank raised the benchmark rate to 40%.

The lira continues to weaken, fueling inflation.

• Separately, consumer confidence improved again this month.

——————–

2. South Africa’s CPI report topped expectations.

3. Mexico’s September retail sales disappointed.

Source: Reuters Read full article

Source: Reuters Read full article

• The Q3 GDP growth was revised higher.

– Here is the monthly economic activity index.

• Inflation continues to ease.

——————–

4. Lat Am stocks have outperformed this year.

5. Finally, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

1. Iron ore has been rallying due to low inventories in China, …

Source: @markets Read full article

Source: @markets Read full article

… as the nation boosts steel exports.

Source: @markets Read full article

Source: @markets Read full article

But Beijing wants to curb iron ore price gains.

Source: @markets Read full article

Source: @markets Read full article

——————–

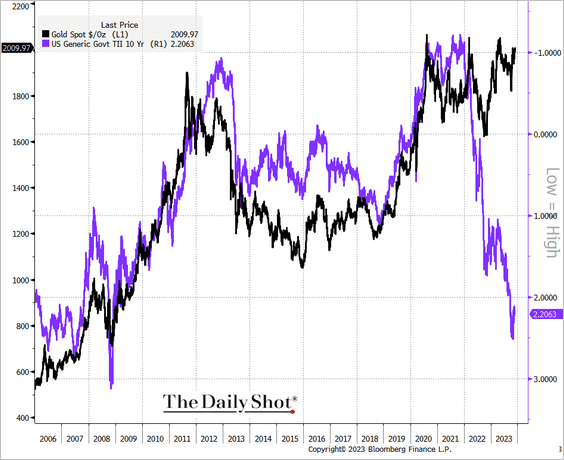

2. Gold is trading above $2,000, widening its divergence with US real yields (chart shows inverted 10-year TIPS yield).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. Here is last week’s performance across key commodity markets.

Back to Index

Energy

1. Brent crude is back below $70/bbl.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Brent put options volume surged last week.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. USO, the largest crude oil ETF, saw substantial outflows last week.

3. Malaysia has been reporting a surge in oil exports over the past year. A substantial portion of this gain is the “washing” of Russian crude oil.

Source: Gavekal Research

Source: Gavekal Research

4. US natural gas futures have tumbled this month, …

… with the latest decline driven by mild weather.

Source: NOAA

Source: NOAA

——————–

5. Sustainable funds continue to see outflows, …

Source: @WSJ Read full article

Source: @WSJ Read full article

… putting pressure on renewable energy stocks. Is the underperformance over?

Back to Index

Equities

1. So far, tt’s been a good month for the S&P 500.

Source: @markets Read full article

Source: @markets Read full article

2. Sentiment continues to improve.

• Retail investors:

• Deutsche Bank’s consolidated positioning index (now in overweight territory):

Source: Deutsche Bank Research

Source: Deutsche Bank Research

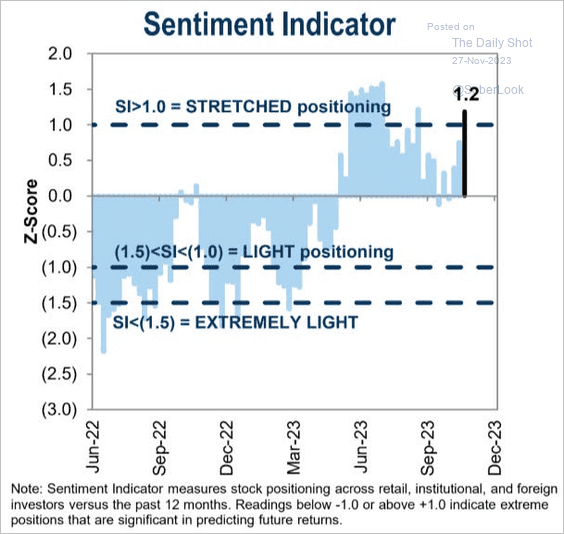

• Goldman’s sentiment indicator:

Source: Goldman Sachs

Source: Goldman Sachs

——————–

3. The rally has been broadening out.

• The S&P 500 equal-weight index (above its 200-day moving average):

• The percentage of S&P 500 stocks above their 200-day moving average:

——————–

4. Equity funds are seeing inflows, …

Source: BofA Global Research

Source: BofA Global Research

… boosted by tech flows (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• However, hedge funds have been selling tech stocks.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

——————–

5. The Russell 2000 index is holding resistance at the 200-day moving average.

• Small and micro-cap stocks are also holding key support zones.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

• Small caps continue to widen their earnings gap relative to the Nasdaq 100.

Source: SG Cross Asset Research; @WallStJesus

Source: SG Cross Asset Research; @WallStJesus

——————–

6. VIX hit its COVID-era low last week, …

… as volatility moderates.

• Low volatility could result in higher stock-market allocations by risk parity and vol control funds.

Source: Nomura Securities; @WallStJesus

Source: Nomura Securities; @WallStJesus

——————–

7. Finally, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

1. US investment-grade corporate spreads hit the lowest levels since early 2022, …

… amid robust fund inflows.

Source: BofA Global Research

Source: BofA Global Research

• It has been a good month for corporate bond flows.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

2. The dispersion among high-yield bond spreads has risen substantially.

Source: Goldman Sachs

Source: Goldman Sachs

3. Small caps face a much steeper maturity wall than large caps.

Source: @markets Read full article

Source: @markets Read full article

4. Money market fund balances continue to hit record highs.

5. Here is last week’s performance by asset class.

Back to Index

Global developments

1. Generally, the gap between GDP growth and the cost of capital is mildly positive across G7 nations.

Source: MRB Partners

Source: MRB Partners

2. The global credit impulse has moved deeper into negative territory.

Source: UBS Research; @WallStJesus

Source: UBS Research; @WallStJesus

3. Goldman expects higher returns on non-cash assets than cash next year.

Source: Goldman Sachs

Source: Goldman Sachs

4. The dollar’s share of global private transactions has been rising.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. Finally, we have some performance data from last week.

• Currencies:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

1. Declining mobility:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

2. Remote work postings:

Source: Indeed Hiring LabIndeed

Source: Indeed Hiring LabIndeed

3. US views on the Israel-Hamas war:

Source: @axios Read full article

Source: @axios Read full article

4. Health insurance deductibles:

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Overdose deaths among children and teenagers:

Source: @axios Read full article

Source: @axios Read full article

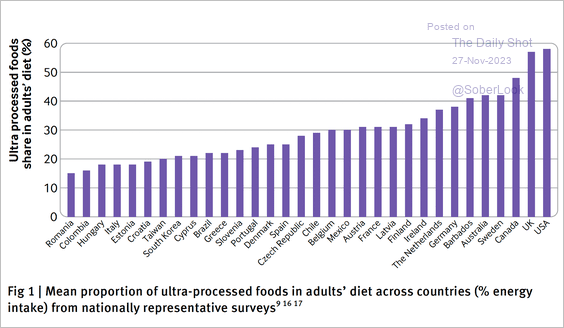

6. Ultra-processed foods:

Source: BMJ Read full article

Source: BMJ Read full article

7. Pie preferences based on Google search trends:

Source: @JeffreyKleintop

Source: @JeffreyKleintop

——————–

Back to Index