The Daily Shot: 22-Nov-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

As a reminder, The Daily Shot will not be published this Thursday and Friday.

The United States

1. At their last meeting, the FOMC signaled a cautious approach towards additional rate hikes.

FOMC Minutes: – In discussing the policy outlook, participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2 percent objective over time. All participants agreed that the Committee was in a position to proceed carefully and that policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks.

• The 10-year Treasury yield edged lower.

• It may be a while before we see the Fed’s first rate cut. The central bank has not previously cut rates with core CPI above 2.7% unless unemployment has also been comfortably above 5%.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

2. Existing home sales remain at multi-year lows, …

… amid depressed affordability (which is not expected to improve much next year).

Source: Oxford Economics

Source: Oxford Economics

• The inventory of homes for sale, while still very low, has been gradually increasing.

• The median sales price reached a new record for this time of the year.

——————–

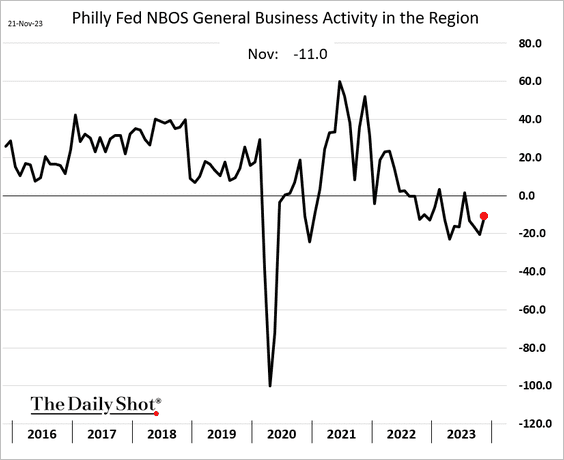

3. The Philly Fed’s NBOS index, which monitors activity among the region’s services companies, continues to reflect subdued performance.

But there were some hopeful signs this month.

• Sales:

• Employment:

Many companies continue to report rising costs.

——————–

4. The World Economics SMI report showed strengthening growth in the nation’s overall business activity.

Source: World Economics

Source: World Economics

5. Next, we have some updates on inflation.

• Housing inflation is expected to keep slowing.

Source: ING

Source: ING

• Increasing wages in hospitals are expected to further escalate the prices of hospital services.

Source: Nomura Securities

Source: Nomura Securities

• The Indeed wage tracker is now outpacing inflation.

Source: Indeed Hiring Lab

Source: Indeed Hiring Lab

——————–

6. Goldman’s GDP growth tracker for the current quarter is nearing 2%.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

7. Historically, real wage growth turned lower after the Sahm Rule’s recession threshold was breached.

Source: The Crude Chronicles

Source: The Crude Chronicles

Back to Index

Canada

1. The CPI report was roughly in line with expectations. Inflation continues to ease.

Source: Reuters Read full article

Source: Reuters Read full article

Here are the measures of core inflation.

——————–

2. The market has completely discounted any possibility of another BoC rate hike in this cycle.

Bond yields declined further.

Back to Index

The United Kingdom

1. Productivity growth has stalled.

2. Government borrowing picked up in October but is running below government projections.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

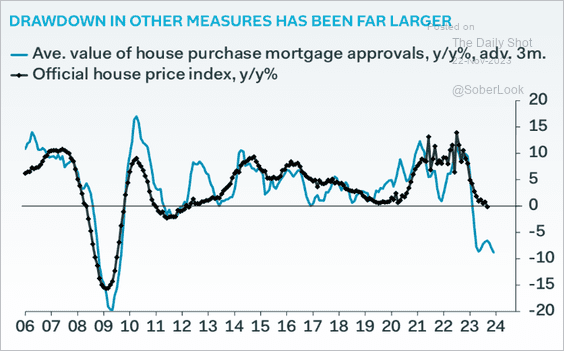

3. The official measure of home prices has been remarkably resilient.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

1. The market is pricing deeper ECB rate cuts ahead …

… with nearly 100 basis points expected for next year.

——————–

2. Germany is facing a budget crisis after the recent court ruling.

Source: @economics Read full article

Source: @economics Read full article

Bund yields continue to fall.

Separately, here is a look at Germany’s current account balance.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

——————–

3. The euro-area economic surprise index needs to be seasonally adjusted.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

Back to Index

Europe

1. New car registrations in the EU are holding above last year’s levels.

Here is the latest breakdown by power source.

Source: ACEA Read full article

Source: ACEA Read full article

——————–

2. Next, we have some updates on Poland.

• Industrial production:

• Wage growth (accelerating):

• Employment growth (stalling):

——————–

3. European banks are rushing to issue debt as spreads tighten.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

Back to Index

China

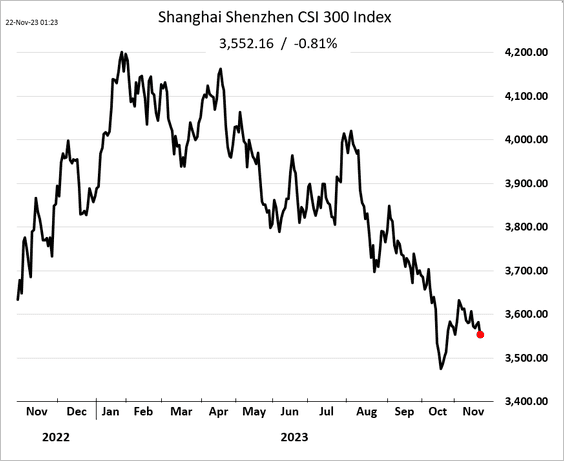

1. The stock market bounce wasn’t sustained.

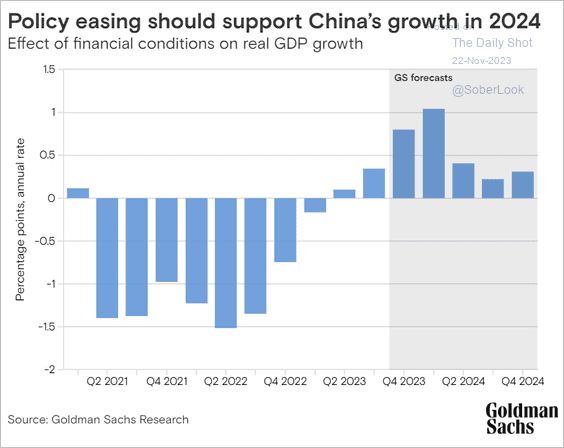

2. Goldman sees China’s growth accelerating this quarter.

Source: Goldman Sachs

Source: Goldman Sachs

The World Economics SMI report supports this projection.

Source: World Economics

Source: World Economics

——————–

3. The house price-to-income ratio is roughly five times higher in Shanghai than in New York.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

• The market cap of real estate developers declined significantly in recent years.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Emerging Markets

1. Hungary’s central bank cut rates again.

2. India’s growth differential versus the rest of the world has widened in recent years while its inflation differential has narrowed. (2 charts)

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

——————–

3. The Indonesian rupiah took a hit on Tuesday.

Source: Business Recorder Read full article

Source: Business Recorder Read full article

——————–

4. South Africa’s business sentiment eased this quarter.

Back to Index

Cryptocurrency

1. So far, ETH is outperforming top crypto peers this month, while bitcoin cash (BCH) is in the red.

Source: FinViz

Source: FinViz

2. Bitcoin’s price in Argentinian Pesos (ARS) reached an all-time-high after the country’s

Source: @KaikoData

Source: @KaikoData

3. Binance’s CEO stepped down.

Source: @WSJ Read full article

Source: @WSJ Read full article

• The news sent Binance Coin (BNB) sharply lower, reversing most of its rally over the past month versus the dollar. Technicals are not yet oversold.

• The exchange’s trade volumes have significantly fallen this year.

Source: @KaikoData

Source: @KaikoData

Back to Index

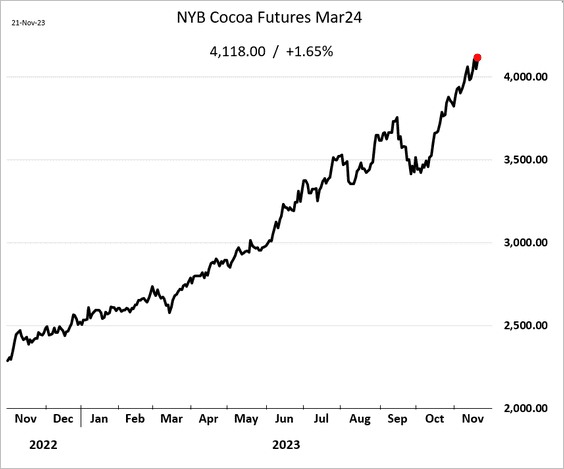

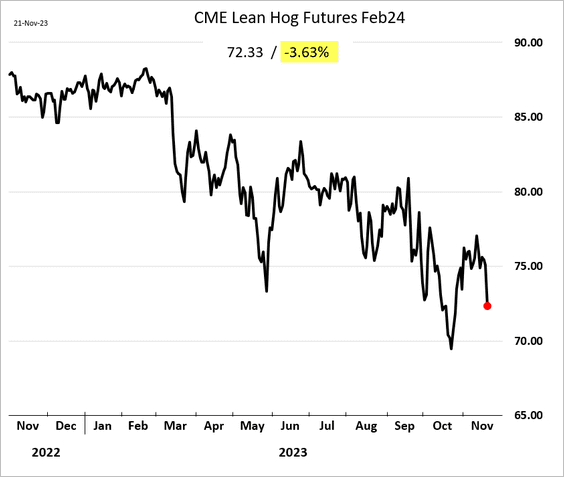

Commodities

1. Gold is trading near $2,000/oz.

2. Lithium prices keep falling.

3. Cocoa prices continue to hit multi-decade highs.

4. Chicago hog prices declined sharply on Tuesday.

Source: Farmtario Read full article

Source: Farmtario Read full article

——————–

5. El Niño is expected to persist well into next year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Energy

1. European natural gas prices are falling amid ample supplies in storage.

2. Oil demand typically slows when US real wages dip below 2%.

Source: The Crude Chronicles

Source: The Crude Chronicles

3. Japan is steadily increasing its nuclear power generation, which could lead to lower demand for LNG.

Source: Capital Economics

Source: Capital Economics

Back to Index

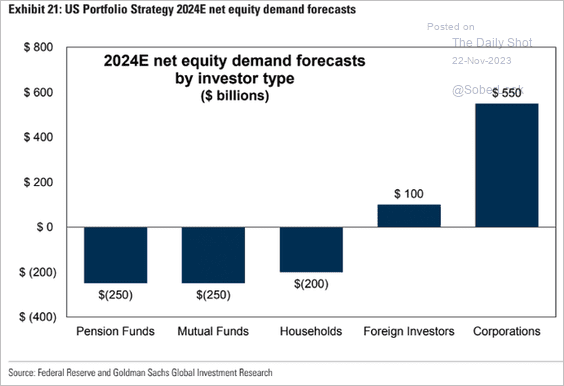

Equities

1. Here is a look at the S&P 500 performance during US presidential election years.

Source: John Lynch, Comerica Wealth Management

Source: John Lynch, Comerica Wealth Management

Volatility tends to rise going into November.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

2. Goldman expects share buybacks to drive net equity demand next year.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

3. Valuations point to low single-digit returns over the next decade.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

4. Large-cap and blended funds registered significant inflows in recent weeks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. This year has seen a substantial underperformance in the quality factor

6. S&P 500 quality high dividend stocks provided a relatively attractive risk/return profile in recent years versus peers.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

7. The Russell 2000 still has a lot of companies that are not generating a profit.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

8. The average S&P 500 stock remains inversely correlated to the Treasury market implied volatility.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• VIX is nearing COVID-era lows

Back to Index

Rates

1. The ACM measure of Treasury term premium is back in negative territory.

2. Treasury bid-ask spreads have tightened, …

Source: Oxford Economics

Source: Oxford Economics

… and Treasury trading volumes have improved.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Global Developments

1. The dollar is well off its recent peak versus major currencies and has given back roughly half of its gains since the July rally. (2 charts)

Source: Convera

Source: Convera

• Currency options traders have soured on the US dollar.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

——————–

2. More central banks have stopped hiking rates while cuts are slowly building up.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Real returns of multi-asset trend following strategies and commodities have outpaced TIPS during past inflationary periods.

Source: Return Stacked

Source: Return Stacked

——————–

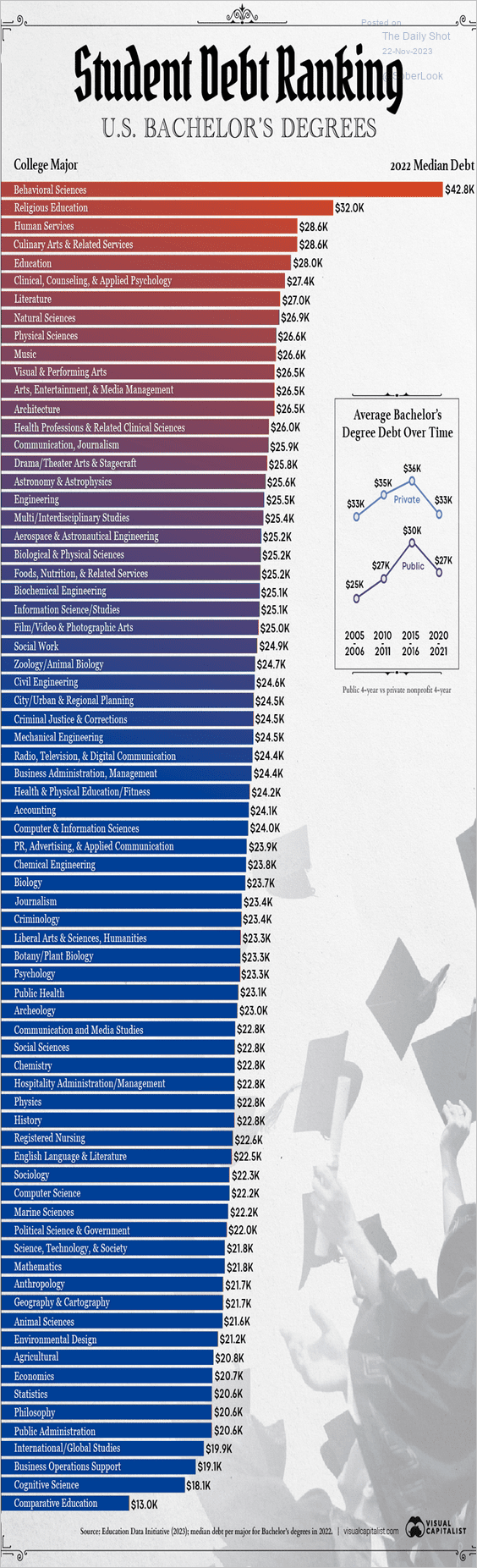

Food for Thought

1. How important are the holiday sales for US retailers?

Source: Statista

Source: Statista

2. PlayStation 5 sales growth:

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

3. Data breaches:

Source: @axios Read full article

Source: @axios Read full article

4. Fewer friends:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

5. Median student debt by college major:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

6. Teens and ChatGPT:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

7. Long Covid?

Source: The New York Times Read full article

Source: The New York Times Read full article

8. What do Americans plan to eat this Thanksgiving?

Source: Purdue University College of Agriculture

Source: Purdue University College of Agriculture

• Thanksgiving facts:

Source: WalletHub Read full article

Source: WalletHub Read full article

——————–

The next Daily Shot will be out on Monday, November 27th.

To our readers in the United States, we wish you a very Happy Thanksgiving!

Back to Index