The Daily Shot: 28-Nov-23

• The United States

• Canada

• The United Kingdom

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

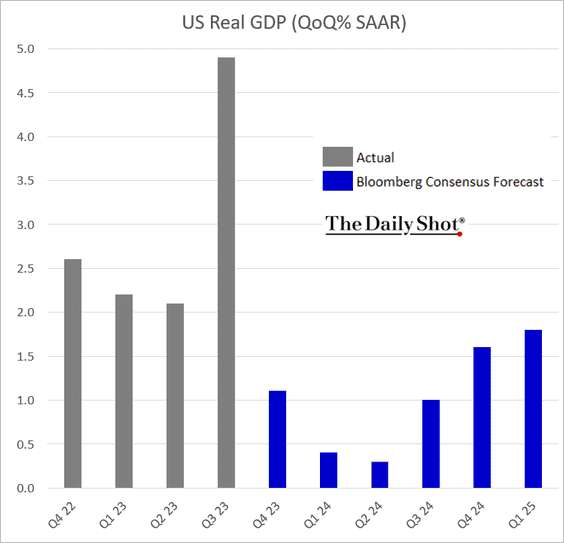

1. Economists upgraded their forecasts for next year’s GDP growth, …

… with no recession expected over the next few quarters.

——————–

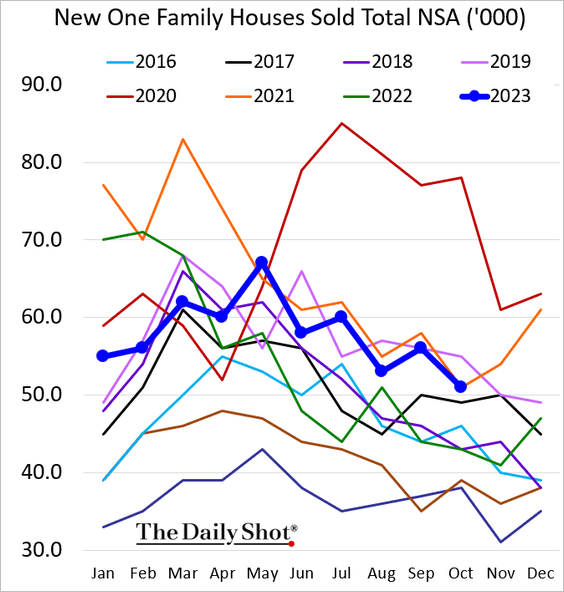

2. New home sales softened last month but held well above 2022 levels.

• This seasonally adjusted chart shows the breakdown by stage of construction.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

• Next, we have new home inventories in months of supply.

• The median new home price dropped sharply, …

… as more builders offered incentives.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

3. The Dallas Fed’s manufacturing report showed deteriorating Texas factory activity this month.

Manufacturers have been cutting workers’ hours.

——————–

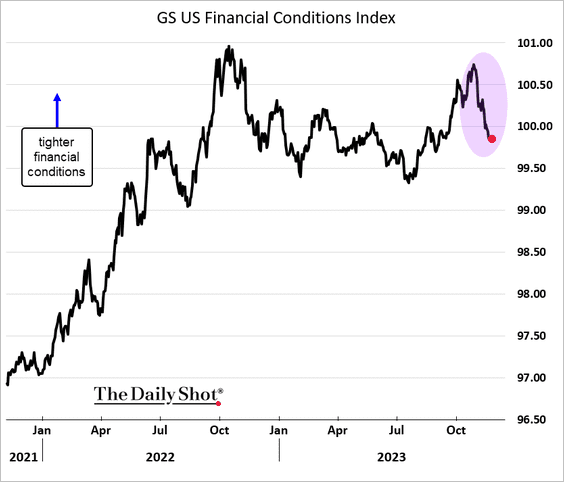

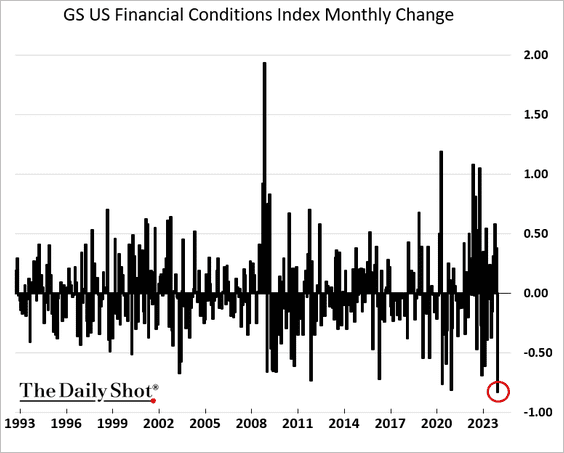

4. US financial conditions eased sharply this month, …

… with the largest monthly decline in Goldman’s indicator in recent decades.

——————–

5. US air travel surged last week.

6. Shoppers are cautious about holiday spending mostly because of economic concerns, according to a survey by Global X. (2 charts)

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

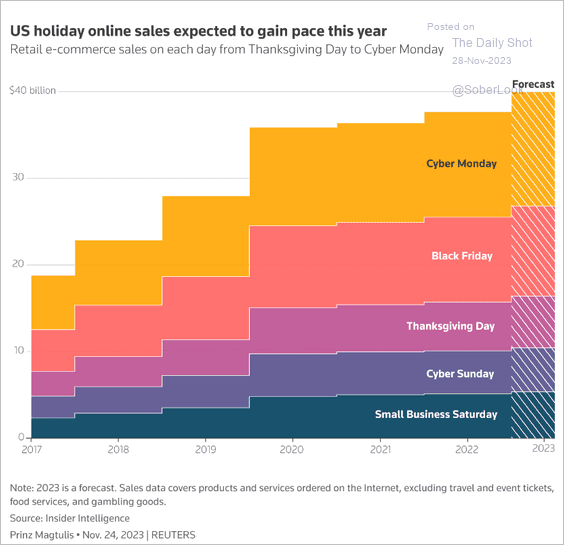

So far, however, holiday spending indicators for 2023 are not terrible (2 charts).

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Canada

1. Forecasters expect Canada’s economy to grow by 0.6% next year.

2. Retail sales unexpectedly increased in September.

Back to Index

The United Kingdom

1. The CBI retail sales report showed some improvement this month.

Source: Checkout Read full article

Source: Checkout Read full article

——————–

2. Retail store price inflation eased further in November (2 charts).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Reuters Read full article

Source: Reuters Read full article

——————–

3. Home prices have been outpacing wages for decades.

Source: The Guardian Read full article

Source: The Guardian Read full article

4. Productivity in the UK public sector has trailed behind that of the private sector.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Europe

1. Norway’s GDP contracted again in Q3.

2. Next, we have some updates on Poland.

• Retail sales (upside surprise):

• Consumer confidence (rebounding):

• Budget deficit:

——————–

3. This map shows the tertiary educational attainment across Europe.

Source: Eurostat Read full article

Source: Eurostat Read full article

4. Here is a look at women’s employment rates and fertility rates in the EU.

Source: Eurostat

Source: Eurostat

Back to Index

Asia-Pacific

1. South Korea’s consumer sentiment continues to fall.

2. Australia’s retail sales unexpectedly declined last month.

Back to Index

China

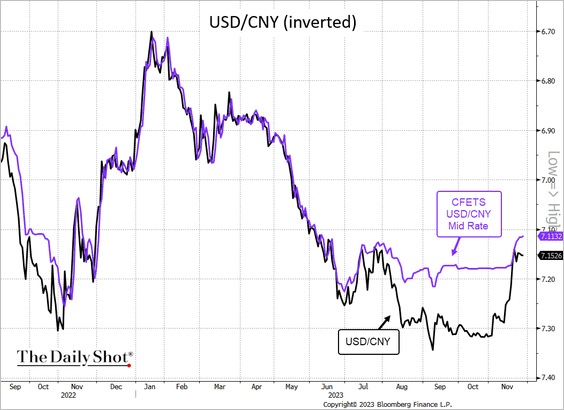

1. The renminbi’s rebound has brought the currency closer to Beijing’s target.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. Mortgage loan balances are now down on a year-over-year basis.

Source: @markets Read full article

Source: @markets Read full article

3. Banks’ bad loan balances keep climbing while interest margin continues to shrink.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

4. Hong Kong’s trade deficit narrowed more than expected last month, …

… as exports grew.

• Separately, Hong Kong’s one-month interbank rate hit its highest level since 2008 amid expectations for a year-end liquidity crunch.

Back to Index

Emerging Markets

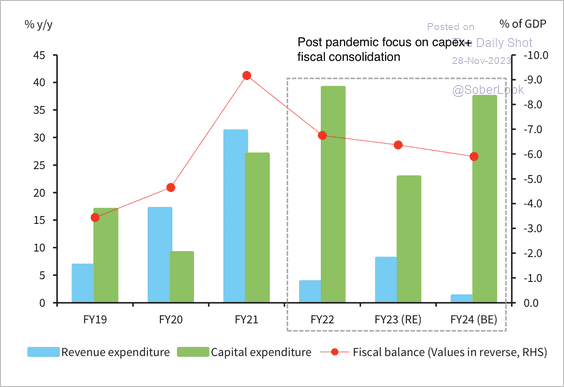

1. India’s fiscal deficit is on a downward trend.

Source: Barclays Research

Source: Barclays Research

2. Mexico’s trade surplus reached a record high for this time of the year.

3. Latin America has experienced an anti-incumbent wave in recent years.

Source: Latinometrics

Source: Latinometrics

Back to Index

Cryptocurrency

1. Crypto funds saw the largest surge in inflows since 2021 last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

• Long-bitcoin products continued to dominate inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

2. The Grayscale Bitcoin Trust’s (GBTC) discount to NAV narrowed significantly this year as investors hope that a US bitcoin-spot ETF will be approved.

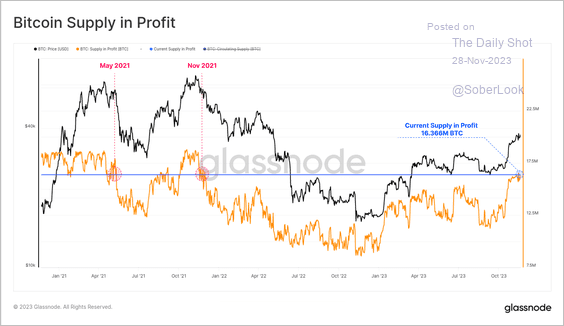

3. Roughly 83% of the total BTC circulating supply is held in profit, similar to the 2021 bull market highs.

Source: Glassnode Read full article

Source: Glassnode Read full article

4. Speculative NFT trading activity collapsed over the past year but appears to have stabilized during the recent crypto rally.

Source: World Economic Forum Read full article

Source: World Economic Forum Read full article

• NFTs have been used in sports, ticketing, video games, luxury items, and more.

Source: World Economic Forum Read full article

Source: World Economic Forum Read full article

Source: World Economic Forum Read full article

Source: World Economic Forum Read full article

Back to Index

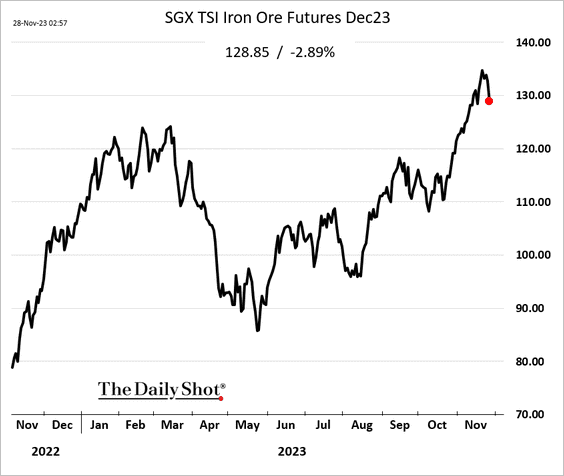

Commodities

1. Iron ore prices extended losses as Beijing jawbones the commodity lower.

2. Palladium, which depends on automotive demand, continues to underperform.

3. Will gold hit resistance around $2065/oz?

Source: barchart.com

Source: barchart.com

4. Corn futures continue to tumble on record US harvest.

5. US spring wheat futures (high-protein wheat) dipped below $7/bsh.

Back to Index

Energy

1. All eyes are on the OPEC decision. Here is Brent.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. US gross crude oil exports have been running near record levels in recent months.

3. Here is a look at oil transport chokepoints across the Middle East.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

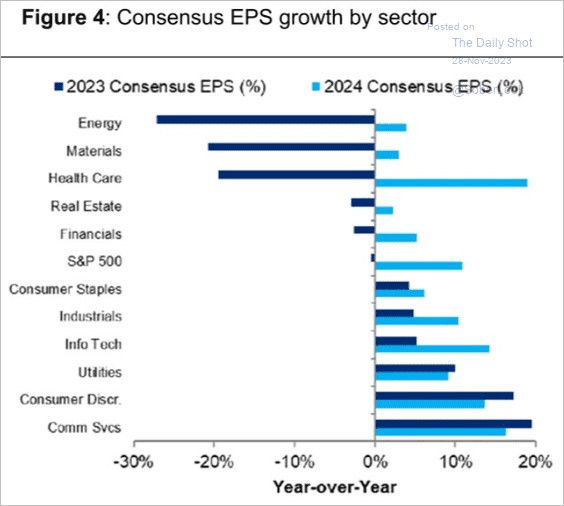

Equities

1. Let’s start with sector earnings growth expectations for 2024.

Source: Citi Private Bank

Source: Citi Private Bank

2. Dividend-focused ETFs saw minimal net inflows this year after hitting a record in 2022.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Shares of dividend growers continue to underperform.

——————–

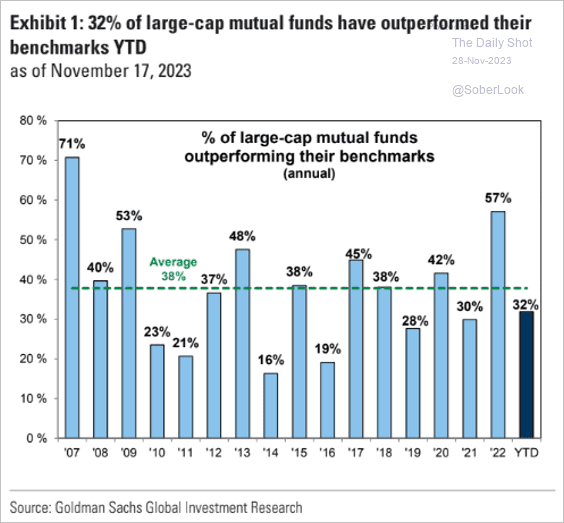

3. Only 32% of large-cap mutual funds outperformed their benchmarks this year, with underperformance driven by underallocation to tech megacaps.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

4. Investment managers continue to boost exposure to stocks.

Source: NAAIM

Source: NAAIM

5. Deteriorating credit impulse is expected to be a headwind for global stock prices next year.

Source: @MikaelSarwe

Source: @MikaelSarwe

6. Stocks with the highest options volume continue to outperform.

7. The Reddit crowd is not pouncing on the most shorted stocks in this rally.

8. The 1-day volatility index hit the lowest level since the CBOE launched it.

• Dealers are very short VIX call options.

Source: Nomura Securities; @WallStJesus

Source: Nomura Securities; @WallStJesus

• The recent decline in VIX has occurred alongside a higher valuation for the S&P 500 versus Treasuries.

Source: Capital Economics

Source: Capital Economics

Back to Index

Credit

1. Business loan balances held by banks are now firmly below last year’s levels.

2. Here is a look at leveraged loan use of proceeds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. This chart shows the percentage of loans in CMBS portfolios that werepaid off by September of each year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

1. Housing affordability fell while house prices rose across OECD countries over the past year.

Source: Oxford Economics

Source: Oxford Economics

• Home price-to-income ratios are above historical averages.

Source: Oxford Economics

Source: Oxford Economics

——————–

2. Countries that experienced a greater change in net corporate interest expense have seen the sharpest decline in their 2024 consensus GDP forecast.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Realized volatility across some major assets remains elevated relative to their averages over the past decade.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

1. Office occupancy relative to pre-pandemic levels:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

2. US COVID-era real income by race/ethnicity:

Source: Reuters Read full article

Source: Reuters Read full article

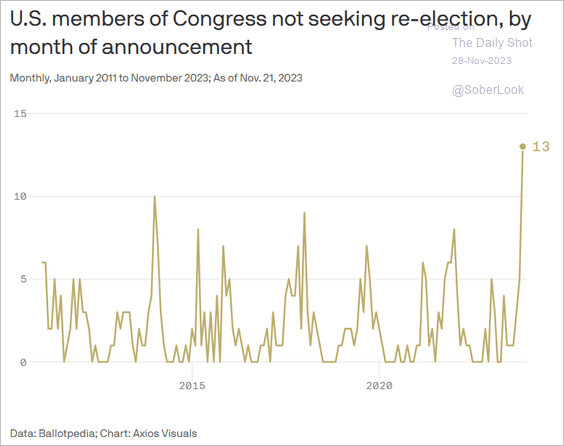

3. Members of Congress not seeking re-election:

Source: @axios Read full article

Source: @axios Read full article

4. Generative AI milestones:

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

5. Russia boosting defense spending:

Source: The Economist Read full article

Source: The Economist Read full article

6. Eliminating daylight savings:

Source: USAFacts

Source: USAFacts

——————–

Back to Index