The Daily Shot: 29-Nov-23

• The United States

• The Eurozone

• Japan

• Asia-Pacific

• China

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

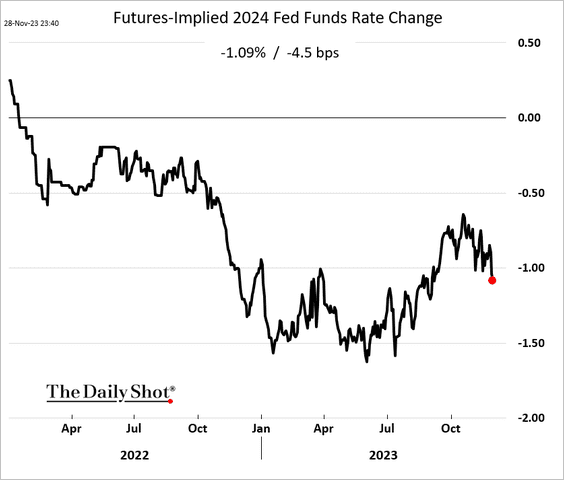

1. Markets are pricing in more substantial Fed rate cuts for 2024 (2 charts).

Source: @economics Read full article

Source: @economics Read full article

Treasury yields are down sharply this month (3 charts).

——————–

2. The Conference Board’s consumer sentiment index edged higher this month, boosted by the expectations component.

• Falling gasoline prices helped support consumer mood.

• However, consumer sentiment toward the labor market is growing more cautious, as an increasing proportion of Americans perceive jobs as ‘hard to get.’

– Here is the labor differential (“jobs plentiful” less “hard to get”).

– The changing views on the jobs market are signaling higher unemployment ahead.

Source: @MikaelSarwe

Source: @MikaelSarwe

• Consumers are not keen on purchasing an automobile in the months ahead.

• Below are a couple of longer-term charts.

– Consumer expectations less current conditions (still signaling a recession):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– The Conference Board’s index compared to the U. Michigan’s sentiment indicator:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

3. Home prices climbed again in September, …

… and are now up almost 4% relative to 2022.

• Wage growth continues to lag home price appreciation.

——————–

4. The Richmond Fed’s regional manufacturing index is back in contraction territory.

More firms expect to be boosting wages over the next few months.

——————–

5. The increase in same-store sales during the 2023 Thanksgiving week was less robust than the year-over-year gains observed in recent years.

Source: Reuters Read full article

Source: Reuters Read full article

• Online sales were relatively strong.

Source: Reuters Read full article

Source: Reuters Read full article

• Over 200 million shoppers tapped into promotions offered by retailers.

Source: Reuters Read full article

Source: Reuters Read full article

6. Overall, consumers still maintain a substantial reserve of “dry powder,” …

Source: @WSJ Read full article

Source: @WSJ Read full article

… yet an increasing number of households are experiencing financial strain.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The Eurozone

1. Private credit growth has stalled.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Here are the money supply indicators.

——————–

2. Germany’s consumer sentiment edged higher this month but remains depressed.

• France registered a healthy increase in consumer confidence.

——————–

3. Spain’s mortgage approvals continue to deteriorate.

4. Some “periphery” economies have been outperforming, which is improving their fiscal situation.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

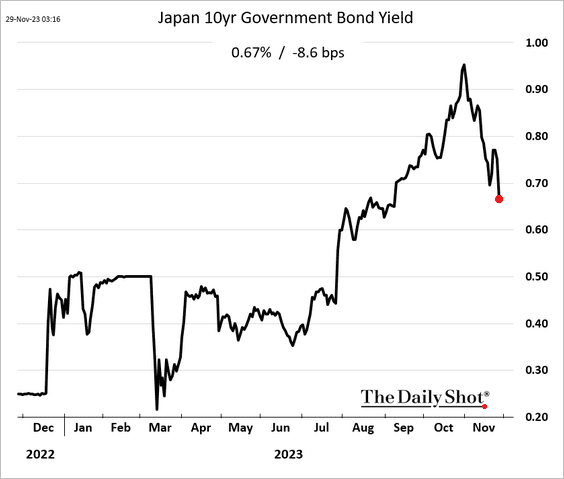

Japan

1. The yen continues to rebound, with USD/JPY reaching an uptrend support.

2. JGB yields are following Treasuries lower.

Back to Index

Asia-Pacific

1. Asian currencies keep rallying vs. USD.

• USD/TWD is testing support at the 200-day moving average as the Taiwan dollar surges.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

2. Here is a look at Taiwan’s semiconductor exports.

![]() Source: Atlantic Council, Global China Hub

Source: Atlantic Council, Global China Hub

3. The Australian monthly inflation estimate was lower than expected.

Bond yields are sharply lower.

——————–

4. The RBNZ held rates unchanged but struck a hawkish tone.

Source: @WSJ Read full article

Source: @WSJ Read full article

The Kiwi dollar jumped.

Back to Index

China

1. Investors continue to exit Mainland equities.

Both Mainland and Hong Kong stocks are under pressure.

Here is the index of property developers’ shares.

——————–

2. The PBoC has a history of guiding interest rates higher to defend the currency.

Source: BCA Research

Source: BCA Research

3. Residential housing activity remains sluggish.

Source: Arcano Economics

Source: Arcano Economics

Real estate transactions have been trending lower.

Source: Arcano Economics

Source: Arcano Economics

——————–

4. This chart shows the issuance of US dollar bonds with bank guarantees.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

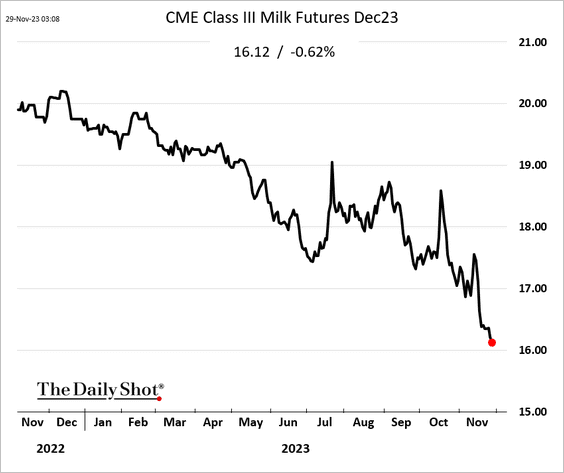

Commodities

1. Gold and gold miners’ shares keep surging.

• Money managers have substantially reduced their net long gold position recently, with some missing the rally.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

• Silver is in overbought territory.

——————–

2. Cocoa prices continue to climb.

3. Chicago milk futures are under pressure.

4. How does El Niño impact food prices?

Source: ECB Read full article

Source: ECB Read full article

Back to Index

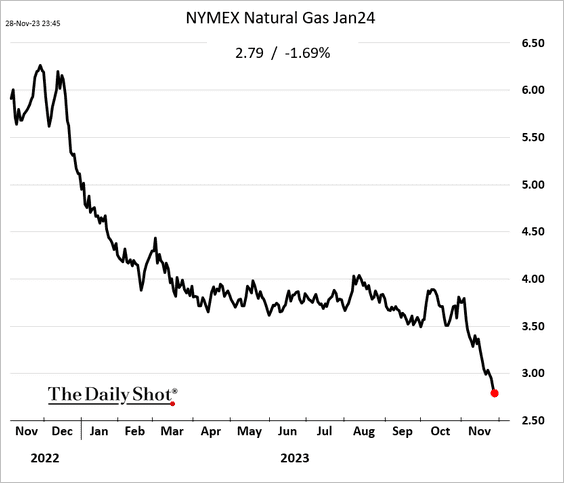

Energy

1. Crude oil prices climbed on Tuesday but held below the 200-day moving average.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

2. Oil positioning has been cautious.

Source: @markets Read full article

Source: @markets Read full article

3. US natural gas futures continue to tumble.

4. European natural gas futures are also falling, …

… amid elevated storage levels.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

Equities

1. Market breadth continues to improve.

2. The equal-weight index underperformance has been severe.

Will we see a relative rebound next year? Here is a quote from S&P Dow Jones Indices.

Currently, thanks to the dominance of the Magnificent Seven stocks, we are at high levels of mega-cap outperformance relative to history, with the S&P 500 Top 50 outperforming the S&P 500 by 9% in the 12 months through October, beyond the 10th decile by a margin of 2%. Historically, we have seen that a retreat toward a lower decile tended to follow, accompanied by Equal Weight outperformance.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

——————–

3. Share buyback activity has picked up momentum.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

But this year’s buybacks still lag 2022.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

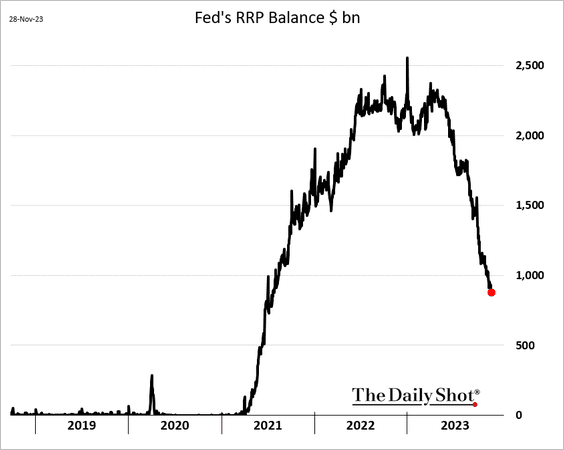

4. Improved liquidity in the form of bank reserves has been supporting the market rally.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

The primary factor behind the surge in reserves is the decreased participation in the Fed’s reverse repo facility. As money market funds redirect cash from the Fed to the private sector, the overall liquidity improves.

——————–

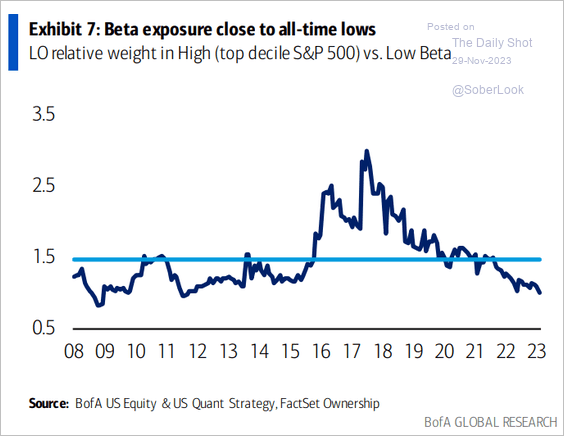

5. Long-only funds have been reducing their beta to the market.

Source: BofA Global Research

Source: BofA Global Research

6. S&P 500 puts are very cheap.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

7. Stock market implied volatility remains low relative to rates vol.

Source: @markets Read full article

Source: @markets Read full article

8. Implied correlations are still depressed despite higher market concentrations.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

Back to Index

Credit

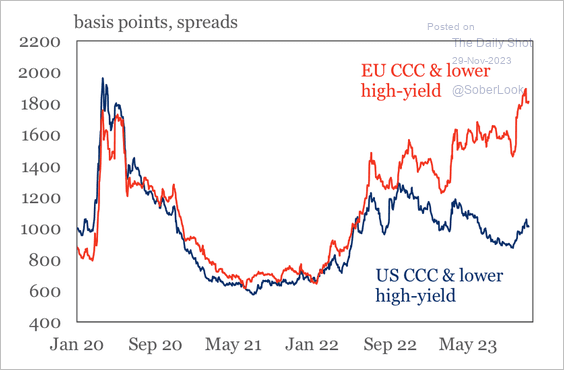

1. Credit spreads of stressed companies have diverged across US and European firms.

Source: IIF

Source: IIF

2. Established managers increasingly dominate the CLO market.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Office vacancy rates keep climbing.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

4. Here is a look at commercial real estate debt maturity wall by lender type.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

1. The 10-year Treasury yield dipped below the August peak.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. JP Morgan’s clients are very bullish on Treasuries.

3. The count of inverted segments within the Treasury yield curve remains near historically high levels.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

4. Private sector repo activity has been surging.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

1. The US dollar has been tumbling, with the trade-weighted index dipping below its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

And yet, hedge funds keep boosting their bets on the dollar.

——————–

2. The COVID-era supply pressures have dissipated.

3. There has been a sharp increase in corporate bankruptcies amid tighter funding conditions.

Source: IIF

Source: IIF

——————–

Food for Thought

1. Amount of time spent on streaming services:

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

2. Pandemic-era US price changes (January 2020 – October 2023):

Source: Bloomberg Read full article

Source: Bloomberg Read full article

3. The year of last move, by generation:

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

4. Median family net worth by education:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. Adults wishing they could change how their body looks:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

6. US Congress polarization over time:

Source: Lee Drutman Read full article

Source: Lee Drutman Read full article

7. A faster way to board an airplane:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index