The Daily Shot: 30-Nov-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the November Beige Book report from the Federal Reserve.

– Economic activity was softer, with mixed regional reports. The overall economic outlook has become less optimistic.

– Labor demand eased, with most districts reporting flat to modest employment gains. The job market saw improved applicant availability and better retention rates. Despite some instances of layoffs and a greater willingness to release underperforming staff, the labor market overall remained tight, especially for skilled labor.

– Most districts reported easing wage pressures.

– Price increases subsided across districts but remained elevated.

– Consumers displayed greater price sensitivity, notably in their spending on discretionary and durable goods. This shift points to a cautious consumer environment shaped by broader economic factors.

– Key economic concerns raised include geopolitical instability, the impact of high interest rates, and looming risks of a recession.

• The Oxford Economics Beige Book Activity Index dipped into negative territory for the first time since the COVID shock.

Source: Oxford Economics

Source: Oxford Economics

• Inflation concerns continue to moderate.

Source: Oxford Economics

Source: Oxford Economics

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

2. The market is now pricing in 120 bps of Fed rate cuts next year.

• Here is what’s priced in for each FOMC meeting.

• Is the market too “dovish”? Goldman expects the Fed to cut rates in Q4 of next year and then continue toward a neutral rate of 3.5%-3.75%, which is higher than the previous cycle.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

3. The third-quarter GDP growth was revised higher.

——————–

4. Next, we have some updates on the housing market.

• Mortgage applications are holding at multi-year lows.

• Mortgage rates are down substantially from the peak.

Source: Mortgage News Daily

Source: Mortgage News Daily

• Distressed sales remain relatively low.

Source: Arcano Economics

Source: Arcano Economics

• Will we see a pullback in US real-estate brokerage commissions after the NAR verdict?

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

5. The rise in retail inventories paused last month.

6. The trade deficit in goods widened in October as exports declined.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

7. Generative AI is expected to boost labor productivity, especially after a significant reduction in development costs and continuous product upgrades in recent years.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Canada

1. The current account remained in deficit last quarter.

2. The sales-to-new listings ratio is lower than it was in 2022, when home prices dropped by nearly 16%.

Source: Capital Economics

Source: Capital Economics

• Capital Economics expects a decline in government bond yields to trigger a dip in mortgage rates, although still well above pre-pandemic levels.

Source: Capital Economics

Source: Capital Economics

Back to Index

The United Kingdom

1. Consumer credit growth slowed in October, …

… but mortgage approvals increased.

2. The broad money supply is down substantially relative to last year, …

… as retail deposits and money market fund balances decline.

Households have been rotating into longer-term deposits that offer much higher yields.

——————–

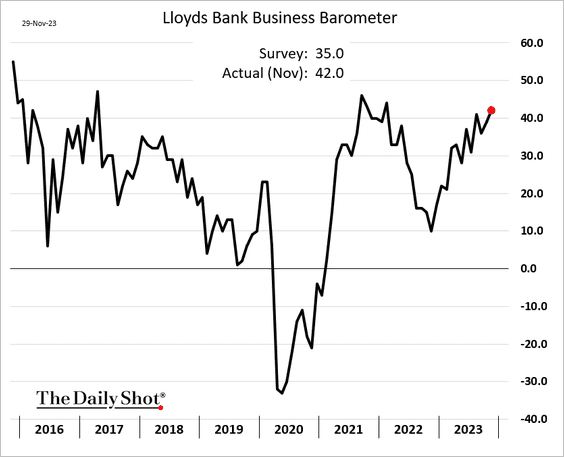

3. The Lloyds Bank business sentiment indicator has been surprising to the upside.

More businesses are planning for price increases.

Back to Index

The Eurozone

1. Inflation continues to surprise to the downside.

• Germany:

Source: @economics Read full article

Source: @economics Read full article

• France:

• Spain:

——————–

2. With inflation falling, the market is pricing in faster ECB rate cuts (2 charts).

Short-term yields are down sharply.

Here is the Bund curve.

——————–

3. The revised French GDP unexpectedly showed a contraction last quarter.

4. Sentiment indicators were mixed this month.

• Manufacturing:

• Services (an increase):

• Economic sentiment (which includes consumer confidence):

• Below are the indicators for Italy.

Back to Index

Europe

1. Here are some updates on Sweden.

• The GDP contracted again last quarter.

Source: Reuters Read full article

Source: Reuters Read full article

• Retail sales improved last month.

• Construction investment has been soft.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

• The aggregate sentiment indicator remains soft.

——————–

2. The monetary pass-through to mortgages depends on the percentage of flexible-rate loans.

Source: IMF Read full article

Source: IMF Read full article

Below is the overall impact of rate hikes on households (2 charts).

Source: Gavekal Research

Source: Gavekal Research

Source: @JeffreyKleintop

Source: @JeffreyKleintop

——————–

3. Here is a look at median disposable income.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

1. Manufacturing output climbed in October, …

… boosted by autos and electronics.

2. Retail sales declined sharply.

3. Dollar-yen is holding the uptrend support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Asia-Pacific

1. South Korea’s industrial production eased last month.

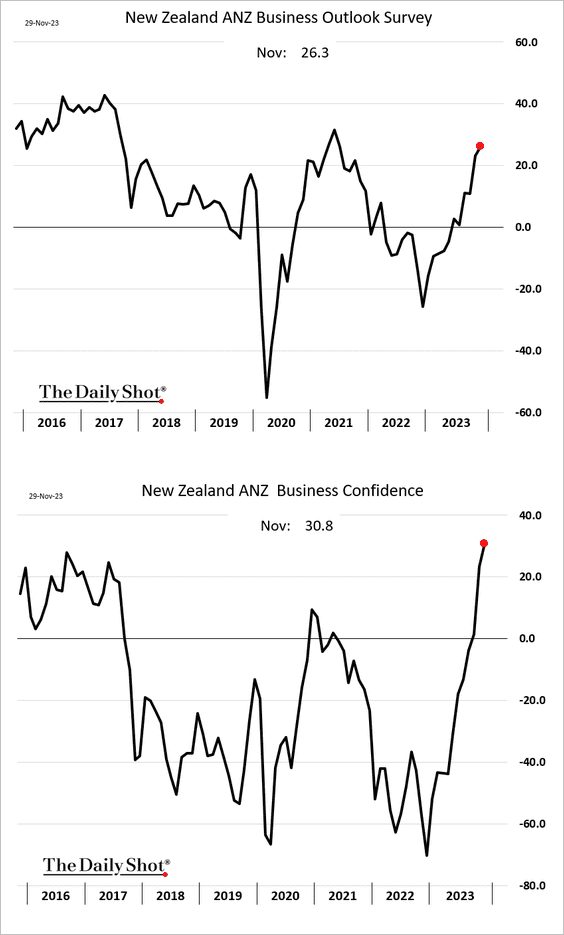

2. New Zealand’s business confidence continues to improve.

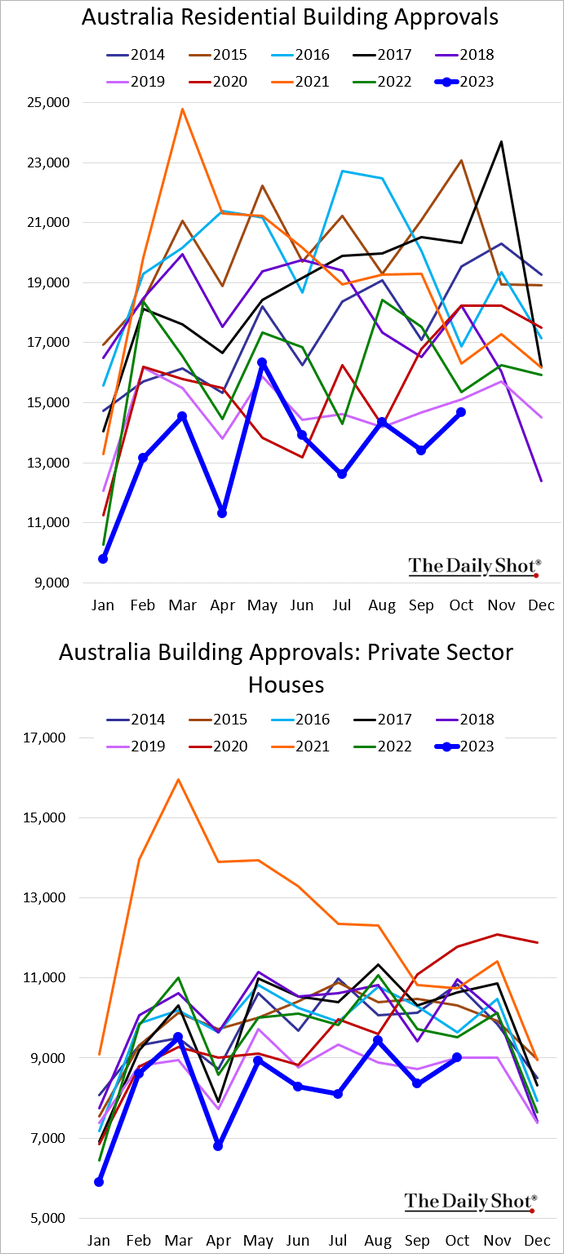

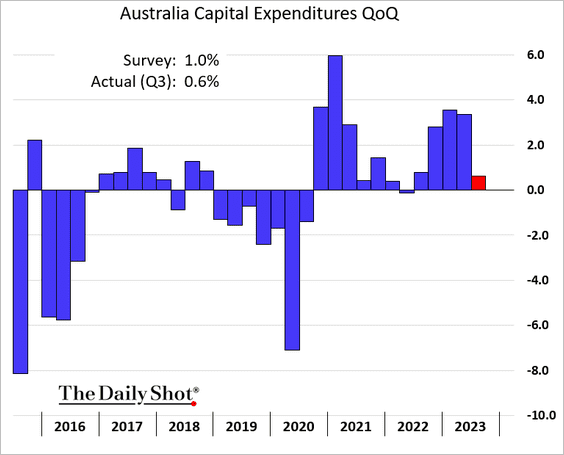

3. Next, we have some updates on Australia.

• Residential building approvals (showing some improvements):

• Credit growth (slowing):

• CapEx:

Back to Index

China

1. The official manufacturing PMI showed an ongoing contraction.

Growth in services is stalling.

——————–

2. The corporate profit cycle is starting to improve.

Source: Gavekal Research

Source: Gavekal Research

3. Here is a look at announced stimulus measures, ranked by the level of economic impact.

Source: Lazard Read full article

Source: Lazard Read full article

Back to Index

Emerging Markets

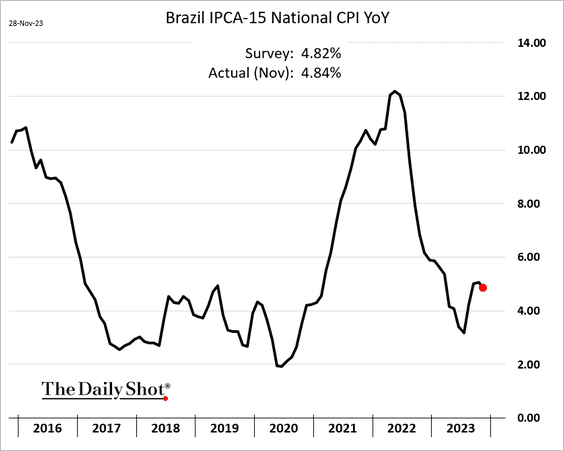

1. Brazil’s inflation edged lower this month.

Job creation is back above last year’s levels.

——————–

2. Chile’s unemployment is holding well above 2022 levels.

3. Mexican bond yields are following Treasuries lower.

4. South Africa’s credit expansion has slowed sharply.

——————–

5. The earnings outlook for EM ex-China equities is improving.

Source: MRB Partners

Source: MRB Partners

Back to Index

Commodities

1. Dry bulk shipping costs (for cargo such as iron ore) have been surging due to the Panama Canal delays. The bottleneck is most acute for capesize vessels.

Source: FreightWaves Read full article

Source: FreightWaves Read full article

Source: FreightWaves Read full article

Source: FreightWaves Read full article

——————–

2. The rally in cocoa prices appears stretched.

Source: BCA Research

Source: BCA Research

Back to Index

Energy

1. Oil is higher ahead of OPEC.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

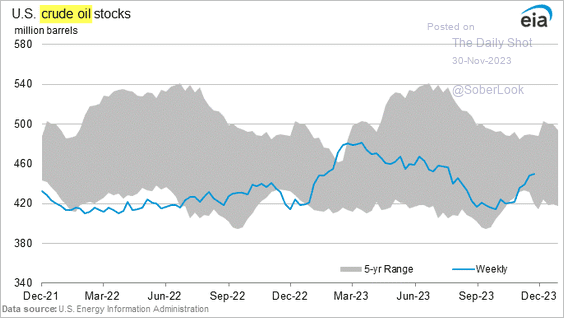

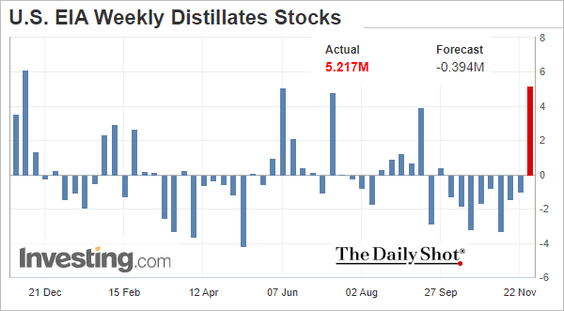

2. Last week’s US inventory data is mostly bearish.

• Crude oil:

– Weekly change:

– Level:

– Days of supply:

• Gasoline:

• Distillates:

3. Refinery runs and utilization jumped last week.

4. Gasoline demand is holding near last year’s levels.

Back to Index

Equities

1. The Russell 2000 is testing resistance at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. Hedge funds have tilted their exposure toward momentum stocks.

Source: BofA Global Research; @dailychartbook

Source: BofA Global Research; @dailychartbook

• Hedge funds’ long picks have been outperforming in recent days.

.

.

——————–

3. Mutual funds’ top picks (overweight) have been underperforming their underweight positions.

4. Long volatility bets look attractive for next year.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

• The Nasdaq 100 5% out-of-the-money puts look cheap.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

5. S&P 500 futures liquidity continues to improve.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

6. Oxford Economics expects declines in global corporate earnings due to slowing revenue growth and falling margins.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Credit

1. Mid-cap companies have more stable leverage levels than small caps.

Source: BCA Research

Source: BCA Research

2. European bank CoCos are back.

Source: @markets Read full article

Source: @markets Read full article

——————–

3. US high-yield maturity walls two and three years out are well above historical averages as a percent of debt outstanding.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

1. Global bond markets are having a good month.

2. Real yields of core assets are close to pre-financial crisis averages (2005-2007).

Source: Goldman Sachs

Source: Goldman Sachs

3. Below is the OECD’s forecast for policy rates in select economies.

Source: OECD

Source: OECD

4. Inflation has fallen sharply across developed and emerging markets, now in the vicinity of central bank target levels.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

1. Airline passenger count:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

2. Traffic fatalities during holidays:

Source: Statista

Source: Statista

3. Battery prices:

Source: Goldman Sachs

Source: Goldman Sachs

4. Gender and racial makeup of US STEM students:

Source: BayView Analytics Read full article

Source: BayView Analytics Read full article

5. Global chickpea exports:

Source: USDA Read full article

Source: USDA Read full article

——————–

——————–