The Daily Shot: 01-Dec-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Real consumer spending held up in October, …

…with growth remaining stable despite much higher rates.

• Excluding government transfers, real personal income has risen for six consecutive months.

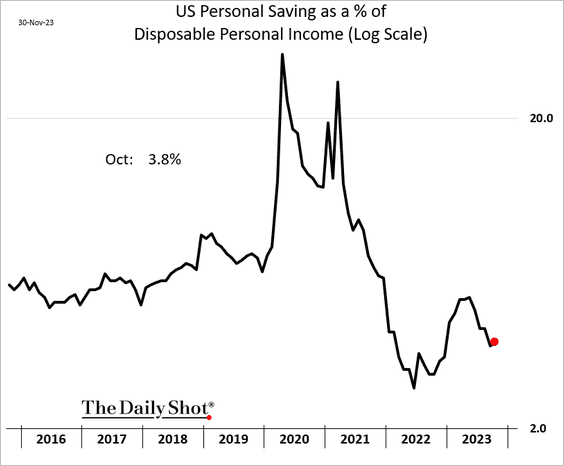

• Personal saving as a percentage of disposable income edged higher in October.

——————–

2. The headline PCE inflation was almost flat in October.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

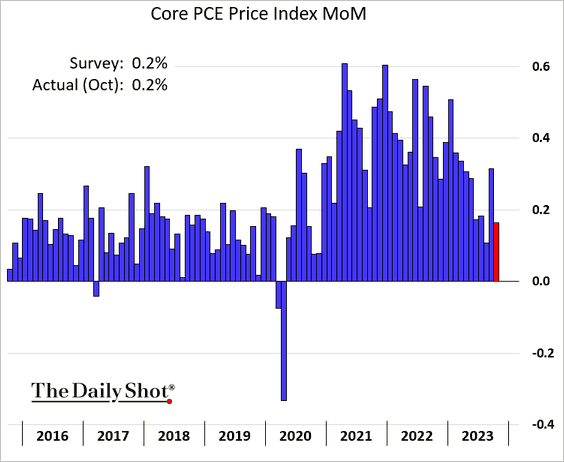

• The core PCE inflation increase was also relatively soft.

Here is the supercore index.

• While inflation figures show signs of easing, some analysts caution that it may be premature to claim success in the fight against inflation.

Source: @MikaelSarwe

Source: @MikaelSarwe

——————–

3. Based on unadjusted initial jobless claims data, less than 200k Americans filed for unemployment last week – the lowest in years.

• Continuing claims eased the week before Thanksgiving.

Media headlines indicate the highest continuing claims in two years, quoting the seasonally adjusted figure. However, seasonal adjustments tend to be very noisy around Thanksgiving.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

• The number of states with substantial increases in continuing claims has been falling.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

• The labor market is still relatively tight.

Source: TS Lombard

Source: TS Lombard

——————–

4. The MNI Chicago PMI index surged into growth territory this month.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

Does this mean we could see a substantial improvement in manufacturing activity at the national level (ISM) for the month of November?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Not necessarily. Here is a comment from Pantheon Macroeconomics.

… we think the leap in the November Chicago PMI is due to the summer surge in civilian aircraft orders, which lead the Chicago PMI by several months due to the heavy presence of Boeing in the area. The lagged trend in aircraft orders suggests that the Chicago PMI will fall back before long.

——————–

5. Pending home sales were a bit stronger than expected last month but remained at multi-year lows.

6. Small businesses are reporting softening revenues.

Source: Alignable Read full article

Source: Alignable Read full article

Back to Index

Canada

1. The GDP report unexpectedly showed a contraction in Q3.

Source: @economics Read full article

Source: @economics Read full article

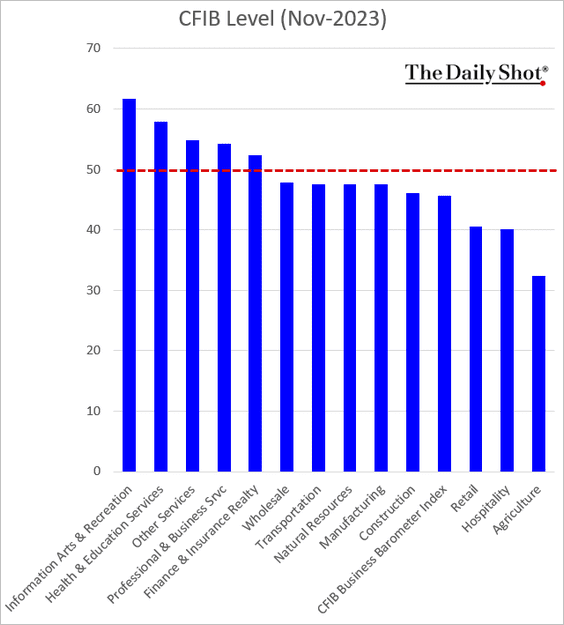

2. The CFIB index is downright recessionary.

Source: CFIB Read full article

Source: CFIB Read full article

Here is a look at the CFIB indicator by sector.

• Levels:

• Changes:

Back to Index

The United Kingdom

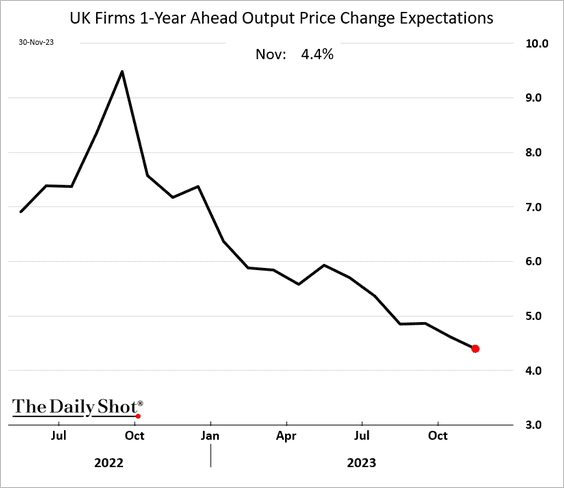

1. Companies have been lowering their expectations for price gains.

2. Goldman expects the drag from the BoE’s policy tightening to fade steadily through 2024. (2 charts)

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

• Here is a look at possible outcomes for the BoE policy rate.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

3. The government no longer expects deflation in 2025 and the early part of 2026.

Source: The Economist Read full article

Source: The Economist Read full article

4. Austerity ahead?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

5. Here is a look at the UK tax burden.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

1. Inflation reports continue to surprise to the downside.

• The Netherlands:

• Italy:

• The Eurozone:

– Headline:

– Core:

– The headline CPI index with dispersion:

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

• Will inflation stabilize at 2%?

Source: @JeffreyKleintop

Source: @JeffreyKleintop

——————–

2. Germany’s unemployment rate continues to climb.

The net number of unemployed workers in Germany has increased for ten months in a row (2 charts).

——————–

3. Italy’s unemployment rate increased as well last month.

4. Is the credit crunch ending?

Source: @skhanniche

Source: @skhanniche

Back to Index

Europe

1. Denmark’s GDP contracted for the second quarter in a row.

2. Sweden’s wage growth remains elevated.

Separately, the Swedish krona outperformed in November.

——————–

3. Here is a look at life expectancy across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

4. What percentage of adults do not know a foreign language?

Source: Statista

Source: Statista

Back to Index

Japan

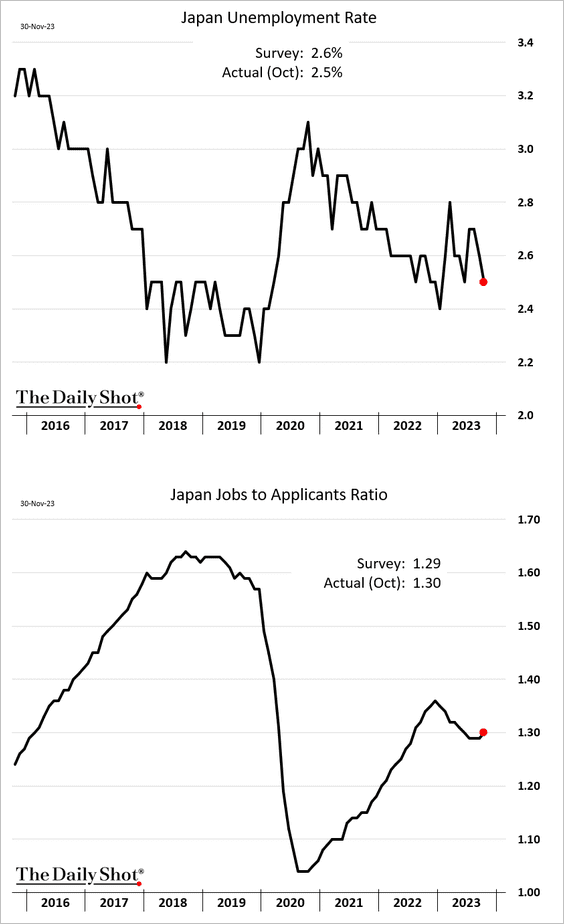

1. The unemployment rate declined in October, but the jobs-to-applicants ratio edged higher.

2. Manufacturing activity remains in contraction territory.

Source: S&P Global PMI

Source: S&P Global PMI

3. Consumer confidence improved this month.

4. Corporate profits surprised to the upside last quarter.

5. Housing starts showed some improvement in October.

6. BofA’s private clients love Japanese stocks.

Source: Bank of America Institute

Source: Bank of America Institute

Back to Index

Asia-Pacific

1. Bloomberg’s index that tracks Asian currencies failed to break above its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. South Korea’s trade surplus topped expectations, …

… as exports climbed.

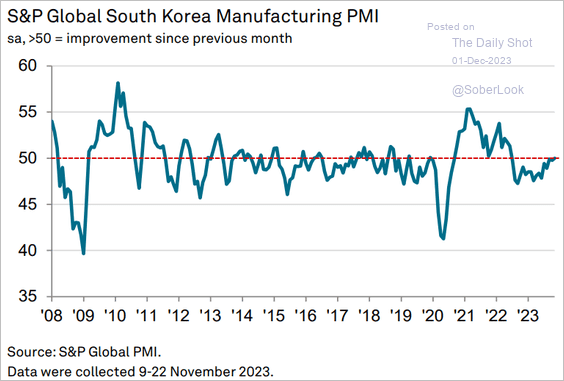

• Factory activity has stabilized.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

3. Taiwan’s manufacturing activity has nearly stabilized.

Source: S&P Global PMI

Source: S&P Global PMI

4. New Zealand’s consumer sentiment is improving.

5. Australian home prices increased again in November.

Back to Index

China

1. Stocks bounced from the lows, …

… as Beijing made another attempt to halt the decline.

Source: @markets Read full article

Source: @markets Read full article

• China’s equities have massively underperformed EM peers.

• Sales by foreigners continue.

Source: @markets Read full article

Source: @markets Read full article

• Volatility has declined.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. The manufacturing PMI from S&P Global showed factory activity returning to growth in November – contradicting the official PMI report.

3. Inventories of finished goods held by the industrial sector remain at elevated levels.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

1. Let’s run through Asian PMI trends.

• ASEAN (stable but not growing):

Source: S&P Global PMI

Source: S&P Global PMI

• India (still very strong):

Source: S&P Global PMI

Source: S&P Global PMI

• Indonesia (growing):

Source: S&P Global PMI

Source: S&P Global PMI

• Malaysia (contracting):

Source: S&P Global PMI

Source: S&P Global PMI

• The Philippines (robust):

Source: S&P Global PMI

Source: S&P Global PMI

• Thailand (struggling):

Source: S&P Global PMI

Source: S&P Global PMI

• Vietnam (contracting again):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

2. India’s Q3 GDP growth topped expectations.

The output expansion of the eight core industries remains strong.

Source: The Hindu Read full article

Source: The Hindu Read full article

• India’s stocks continue to outperform China.

Source: @markets Read full article

Source: @markets Read full article

——————–

3. Is EM underperformance vs. the US coming to an end?

Source: Bank of America Institute

Source: Bank of America Institute

4. Next, we have some performance data for November.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Cryptocurrency

1. The crypto rally cooled over the past week, although BTC outperformed top peers.

Source: FinViz

Source: FinViz

Here is a look at November’s performance.

——————–

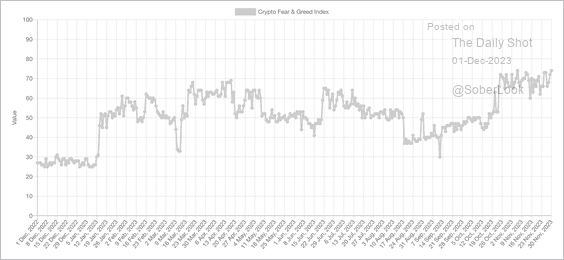

2. The Crypto Fear & Greed Index remains firmly in “greed” territory.

Source: Alternative.me

Source: Alternative.me

3. The amount of bitcoin under management by exchanged traded products hit an all-time high.

Source: @K33Research

Source: @K33Research

4. Here is a look at past cumulative returns of a balanced stock/bond portfolio with 1% allocation to BTC.

Source: @K33Research

Source: @K33Research

5. The supply of ether (ETH) decreased over the past month.

Source: @glassnode

Source: @glassnode

Back to Index

Commodities

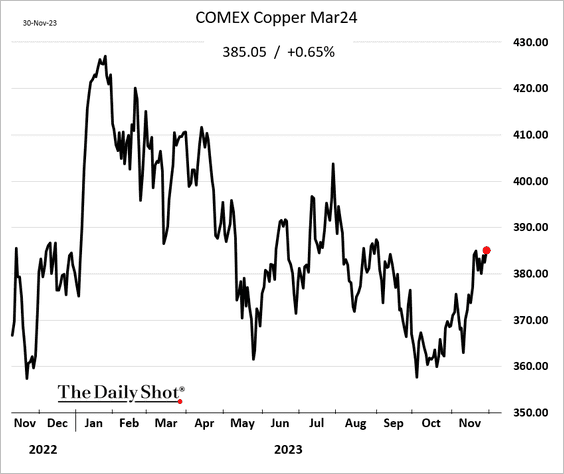

1. Copper has been rebounding, …

… boosted by the Panama situation.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. The VanEck Gold Miners ETF (GDX) broke above its 200-day moving average and is attempting to reverse its short-term downtrend.

Source: @FrankCappelleri

Source: @FrankCappelleri

3. Coffee futures surged this week, …

… as exchange inventories dwindle.

——————–

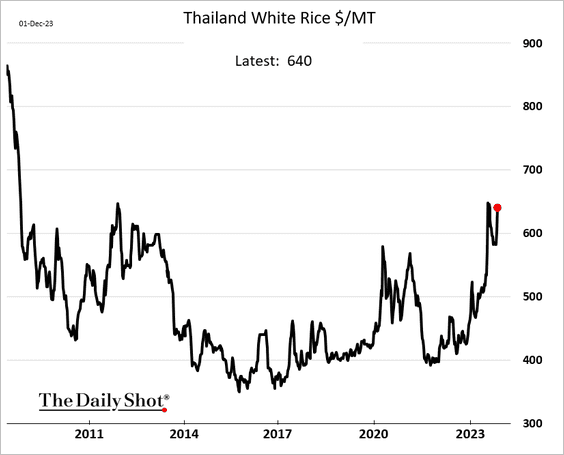

4. Asian rice futures have been surging.

Source: @markets Read full article

Source: @markets Read full article

——————–

5. Sugar futures are rolling over.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

6. Here is a look at commodity markets’ performance in November.

Back to Index

Energy

Crude oil is lower as the OPEC decision disappointed (and confused) traders.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

1. It’s been a good month for the S&P 500, …

… as well as global stocks …

… and the 60/40 portfolio.

——————–

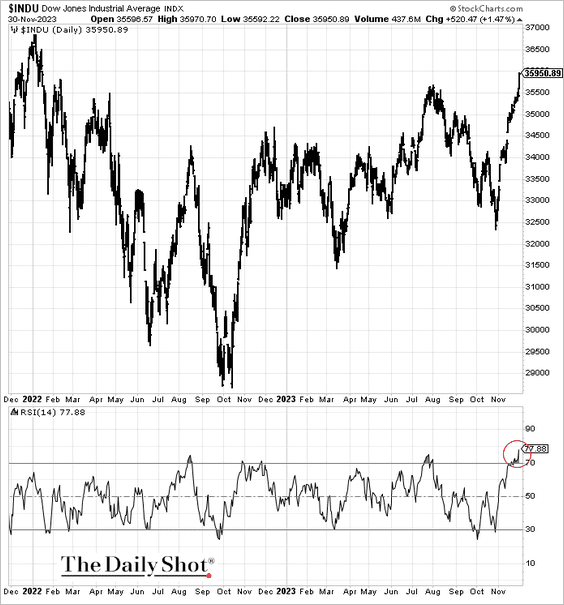

2. The Dow hit the highest level since early 2022 and is now significantly overbought.

The S&P 500 is also in overbought territory.

——————–

3. Financials are seeing robust inflows.

Source: Bank of America Institute

Source: Bank of America Institute

4. The S&P 500 return dispersion index has been trending lower.

5. Next, let’s take a look at quarterly performance attribution.

6. Finally, we have some performance data for November.

• Sectors:

• Equity factors (note that value outperformed growth in November):

• Macro basket pairs’ relative performance:

– Here are cyclical vs. defensive sectors:

• Thematic ETFs:

– It was a strong month for the ARK Innovation ETF.

Source: @markets Read full article

Source: @markets Read full article

• Largest tech firms:

Back to Index

Credit

1. The largest HY ETF saw record inflows in November.

2. The average IG bond maturity keeps falling.

Source: Bank of America Institute; @MikeZaccardi

Source: Bank of America Institute; @MikeZaccardi

3. It was a good month for munis.

Source: @markets Read full article

Source: @markets Read full article

4. Unrealized losses on investment securities at US banks remain elevated.

Source: @axios Read full article

Source: @axios Read full article

5. Here is a look at credit performance in November.

Back to Index

Rates

1. November was a good month for the long bond.

2. Here is the yield change attribution.

• November:

• QTD:

Back to Index

Global Developments

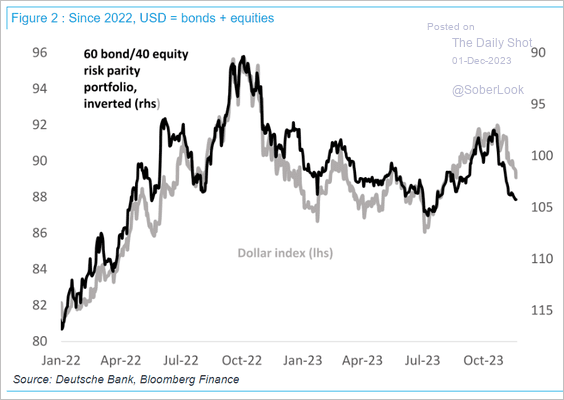

1. The dollar has been negatively correlated with a 60% equity and 40% bond portfolio. Further declines in the greenback could make balanced portfolios attractive again.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

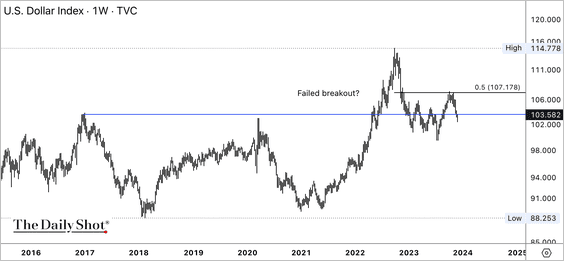

So far, the dollar index has struggled to maintain its long-term breakout above the 103 level.

——————–

2. Next, we have some performance data for November.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

1. Childcare payments:

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

2. Forested area changes over the past three decades:

Source: @genuine_impact

Source: @genuine_impact

3. Fiber adoption:

Source: Statista

Source: Statista

4. Homicide rates in select LatAm countries:

Source: The Economist Read full article

Source: The Economist Read full article

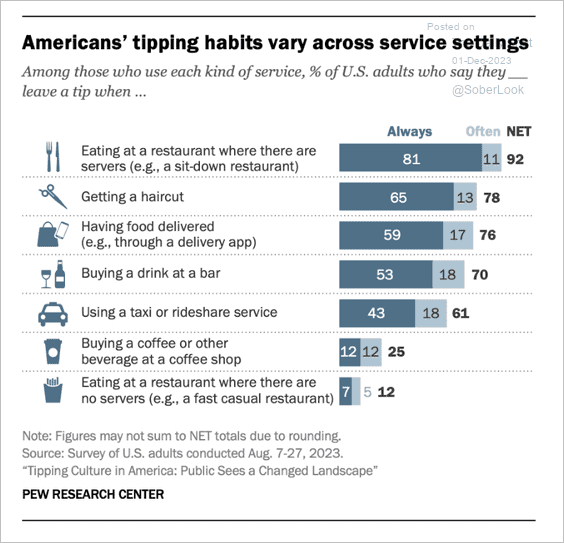

5. Americans’ tipping habits:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

Have a great weekend!

Back to Index