The Daily Shot: 07-Dec-23

• Energy

• Commodities

• Equities

• Credit

• Rates

• Cryptocurrency

• Emerging Markets

• China

• Asia-Pacific

• Japan

• The Eurozone

• Canada

• The United States

• Food for Thought

Energy

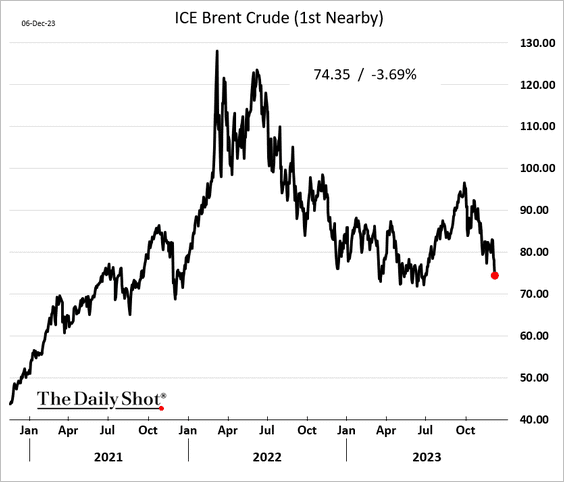

1. Brent crude declined sharply on Wednesday, …

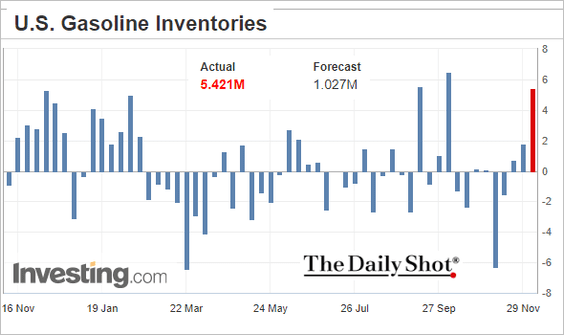

… as US weekly gasoline inventory build boosted concerns about weakening demand.

Source: Reuters Read full article

Source: Reuters Read full article

• The front end of the Brent curve shifted into contango, an indication of a well-supplied market (2 charts).

——————–

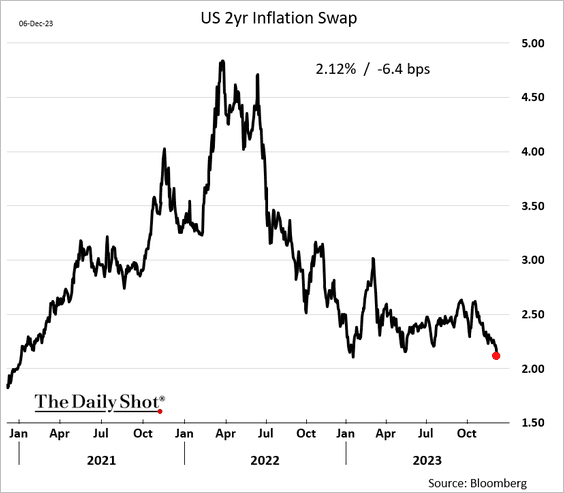

2. Lower oil prices have been driving US market-based inflation expectations lower.

Here is the 2-year inflation swap.

The crude oil contango contributed to a steeper inflation expectations curve.

——————–

3. Implied US gasoline demand remains relatively soft.

• Gasoline futures signal lower prices at the pump over the next few days.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

5. US crude oil inventories declined last week, but the change wasn’t large enough to offset the spike in gasoline stocks.

——————–

6. OPEC’s oil production edged lower in November, but it’s not enough to offset non-OPEC output.

7. US natural gas prices are hitting multi-year lows (2 charts).

——————–

8. The SPDR Oil & Gas Exploration ETF (XOP) broke below its 200-day moving average.

Source: @mnkahn

Source: @mnkahn

9. Uranium ETFs have seen a surge in inflows.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Commodities

1. Central banks bought a lot of gold this year.

Source: BofA Global Research

Source: BofA Global Research

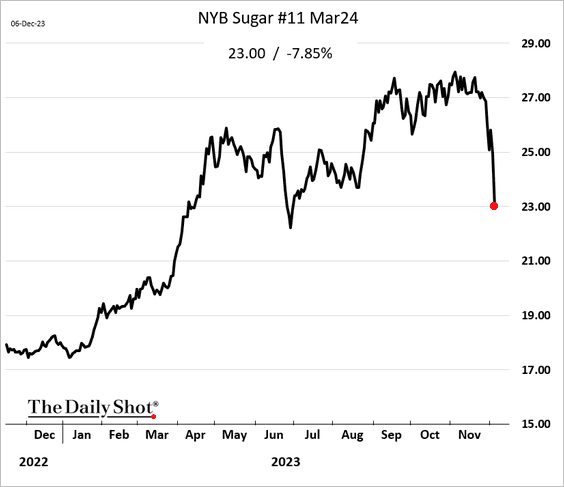

2. Sugar futures are plunging. Declining crude oil prices pressure the ethanol market, prompting global sugar mills to shift their focus from ethanol to sugar production. This change tends to increase sugar supplies.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

3. US cattle futures remain under pressure.

Back to Index

Equities

1. The S&P 500 has not been this concentrated in decades.

Source: Truist Advisory Services

Source: Truist Advisory Services

2. The IWM (Russell 2000 ETF) call option volume remains elevated.

• The ETF’s implied volatility is well below realized vol.

Source: @MikeZaccardi

Source: @MikeZaccardi

——————–

3. Equity market implied volatility (VIX) continues to diverge from the rate vol (MOVE). The VIX/MOVE ratio is near multi-year lows.

4. Short interest in S&P 500 stocks has been rising.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

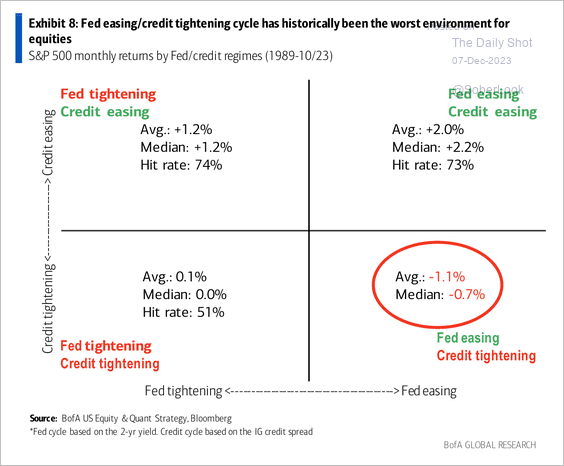

5. The S&P 500 typically struggles when the Fed is easing into tight credit conditions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

6. Here is a look at the most actively traded securities.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Back to Index

Credit

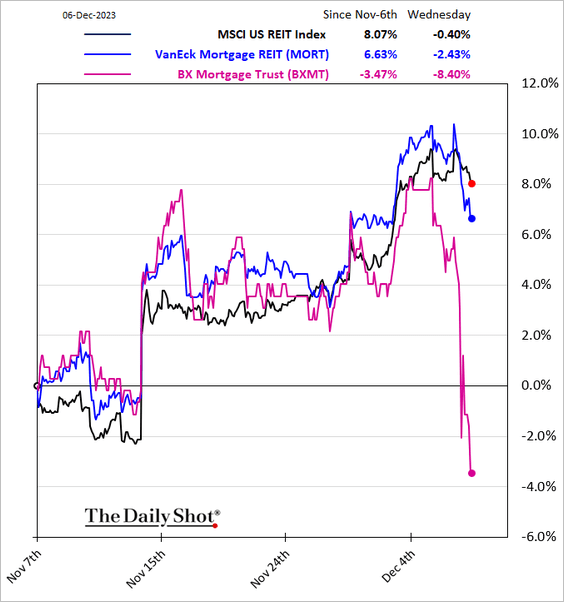

1. Blackstone’s mortgage REIT is in Muddy Waters’ crosshairs.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. A disinversion of the Treasury yield curve typically aligns with wider credit spreads.

Source: Alpine Macro

Source: Alpine Macro

3. the US corporate sector’s financial strength has been deteriorating by some measures.

Source: @johnauthers, @opinion Read full article

Source: @johnauthers, @opinion Read full article

4. Some banks had trouble borrowing in the secured funding markets this month, forcing them to tap the rarely used Standing Repo Facility.

Source: @markets Read full article

Source: @markets Read full article

5. Investment-grade bond trading volume surged last month.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Back to Index

Rates

1. The 10-year Treasury yield is nearing its 200-day moving average.

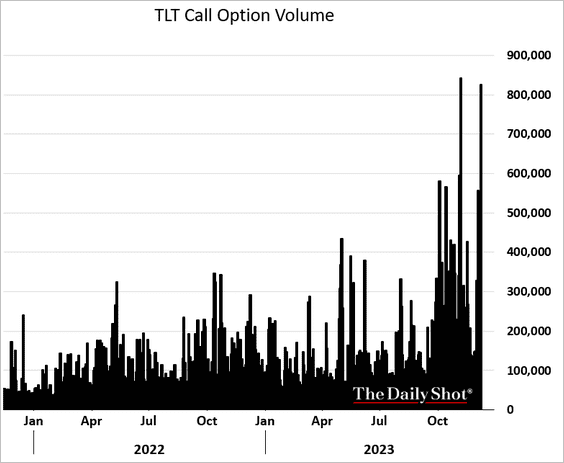

2. The rally in long-dated Treasuries (TLT) appears stretched.

3. Options bets on a further rally in TLT have surged.

Back to Index

Cryptocurrency

1. Bitcoin continues to climb.

2. Here is a look at the month-to-date performance across some of the more liquid cryptos.

3. Ether’s underperformance has intensified.

4. There are some very bullish options bets on bitcoin maturing in late January.

Source: @crypto Read full article

Source: @crypto Read full article

Back to Index

Emerging Markets

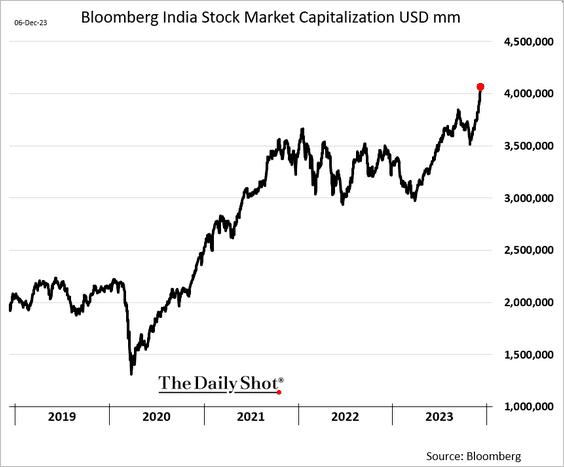

1. India’s stock market capitalization hit a record high.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. Brazil’s debt-to-GDP ratio is back at 60%.

3. Mexico’s consumer confidence is surging amid low unemployment.

Vehicle production remains well above last year’s levels.

——————–

4. Venezuela has been left behind.

Source: @BrasilemMapas

Source: @BrasilemMapas

Back to Index

China

1. Stocks remain under pressure.

The Shanghai Shenzhen CSI 300 index is down over 40% from the peak.

——————–

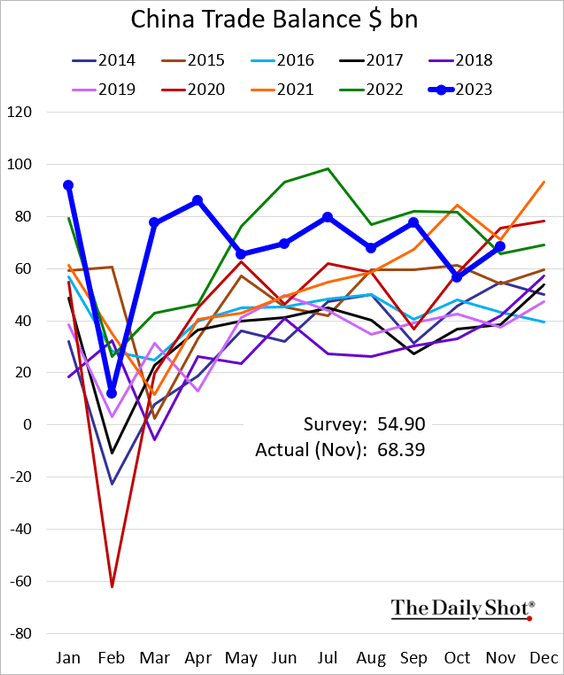

2. The trade surplus topped expectations, rising above last year’s level.

Exports strengthened.

Back to Index

Asia-Pacific

1. Taiwan’s core inflation is easing.

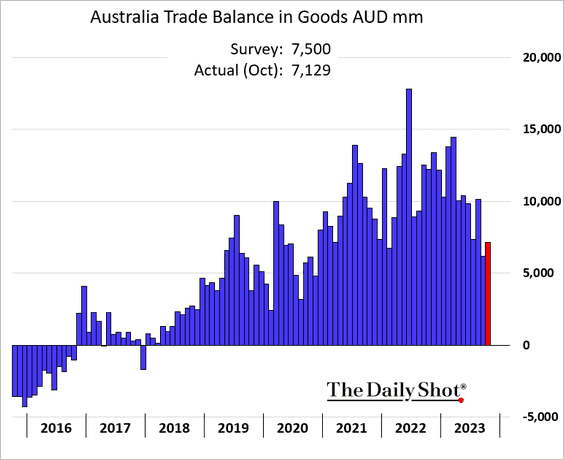

2. Australia’s trade surplus was lower than expected.

Back to Index

Japan

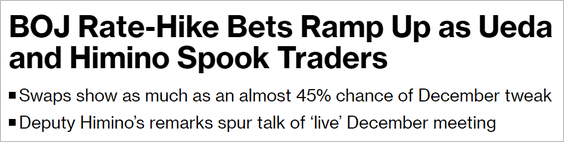

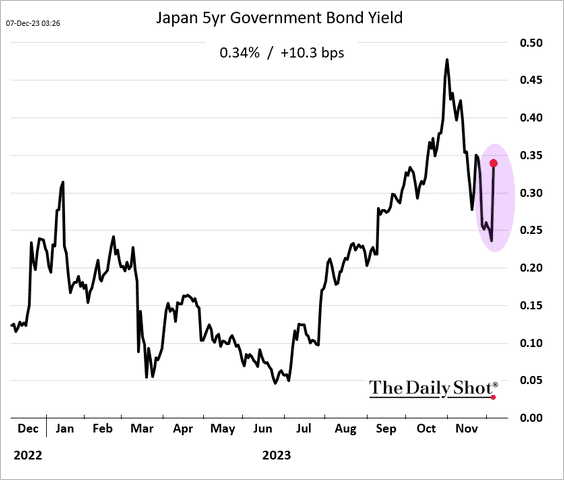

1. Rate hikes ahead?

Source: @markets Read full article

Source: @markets Read full article

JGB yields surged, …

… and the yen strengthened.

——————–

2. Japanese investors are back in overseas real estate markets.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

The Eurozone

1. Let’s begin with Germany.

• Factory orders dropped in October, …

Source: @economics Read full article

Source: @economics Read full article

… and so did industrial production.

Source: @WSJ Read full article

Source: @WSJ Read full article

• Construction activity has been crashing.

• Bunds continue to rally amid recession concerns.

——————–

2. Euro-area retail sales edged higher in October.

3. The ECB policy transmission has been uneven.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Canada

1. The BoC left rates unchanged. The market now anticipates faster rate cuts ahead (chart shows market expectations on BoC meeting dates).

Source: Reuters Read full article

Source: Reuters Read full article

Bond yields continue to move lower.

——————–

2. Labor productivity keeps weakening.

3. The PMI report from S&P Global is signaling a recession.

But the Ivey PMI, which includes public-sector activity, is more upbeat.

——————–

4. The trade surplus surged in October.

Back to Index

The United States

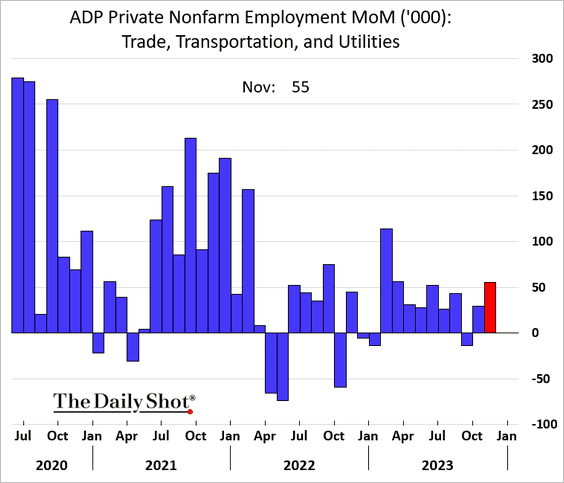

1. The ADP private payrolls report surprised to the downside, suggesting a slowdown in the labor market.

• The Leisure and hospitality sector (hotels and restaurants/bars) registered its first labor force decline since early 2021.

• Here are some additional ADP trends.

– Manufacturing:

– Trade, Transportation, and Utilities:

– Small business:

——————–

2. Last quarter’s decline in unit labor costs was bigger than the earlier estimate.

Source: Reuters Read full article

Source: Reuters Read full article

The increase in labor productivity was larger than the previous estimate.

• Could we see another US productivity boom?

Source: Alpine Macro

Source: Alpine Macro

——————–

3. Next, we have some updates on the housing market.

• With mortgage rates now down almost 100 bps from the peak, …

Source: Mortgage News Daily

Source: Mortgage News Daily

… loan applications were a bit stronger last week.

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

• Home prices were up 5% vs. a year ago in October.

Source: AEI Housing Center

Source: AEI Housing Center

• Many households took advantage of low interest rates on offer during the pandemic.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

• The divergence between median new and existing home prices has been widening.

Source: Jeff Sparshott; @WSJ

Source: Jeff Sparshott; @WSJ

• Cash buyers are now a larger component of home purchases than first-time buyers.

Source: Bank of America Institute

Source: Bank of America Institute

• Shares of homebuilders and other housing-related firms have staged a massive outperformance as mortgage rates drop.

——————–

4. Market expectations for the fed funds rate (OIS) have diverged massively from the September Fed dot plot.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

Food for Thought

1. Share of the global economy over the past 2000 years:

Source: BofA Global Research

Source: BofA Global Research

2. The number of times US women have given birth in their lifetime:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

3. Share of global semiconductor production:

![]() Source: OECD

Source: OECD

4. Rapid growth of investment products:

Source: Morningstar

Source: Morningstar

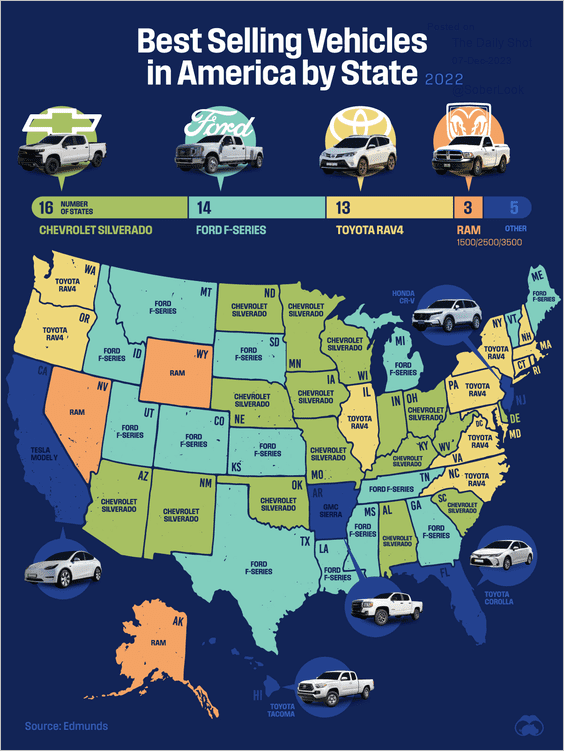

5. The best-selling vehicle in every state:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

6. Pearl Harbor casualties on December 7th, 1941.

Source: ScouterLife Read full article

Source: ScouterLife Read full article

——————–

Back to Index