The Daily Shot: 06-Dec-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

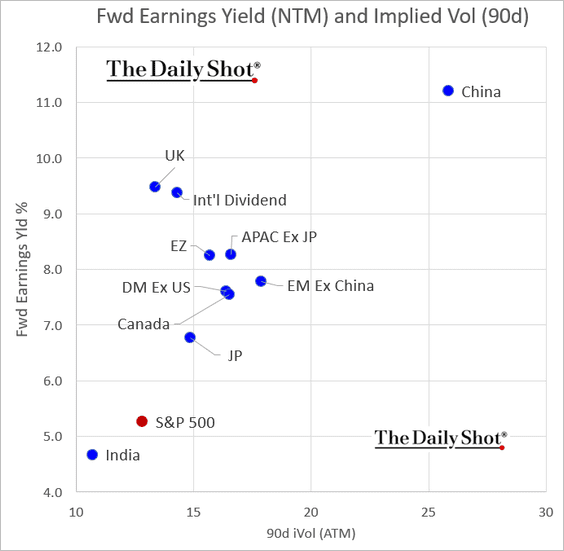

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

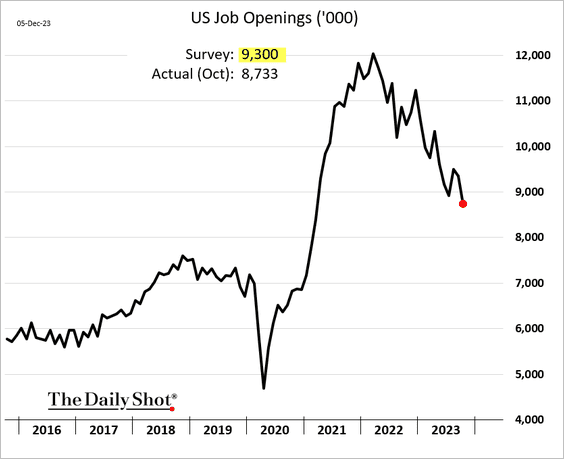

1. October job openings surprised to the downside, suggesting that labor market imbalances continue to ease.

Here is the breakdown by sector.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– Vacancies in the healthcare sector declined sharply.

– Job openings at retailers are crashing.

– But business services showed an increase in labor demand.

– Here is the attribution of monthly changes in job openings.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• While the ratio of job openings to unemployed individuals is on a downward trajectory, it remains above pre-pandemic levels.

Here is the Beveridge Curve.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• But the ratio of quits (voluntary resignations) to unemployed individuals is now well below pre-COVID levels.

• Layoffs remain subdued.

• It’s worth noting that the jobs opening report has relied on fewer survey participants.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

2. Treasury yields dropped in response to soft job openings data.

Here is the yield curve.

——————–

3. Total employment is still 3% below the pre-pandemic trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Higher unemployment ahead?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

4. The ISM Services PMI increased in November, suggesting that the services sector remains resilient.

• Demand has been holding up.

• Hiring was muted.

——————–

5. On a year-over-year basis, the wide spread between leading and coincident indicators is consistent with previous recessionary environments.

Source: Variant Perception

Source: Variant Perception

6. Here is a look at household leverage by income quintile.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

Back to Index

The United Kingdom

1. Service-sector activity is now gradually expanding.

Source: S&P Global PMI

Source: S&P Global PMI

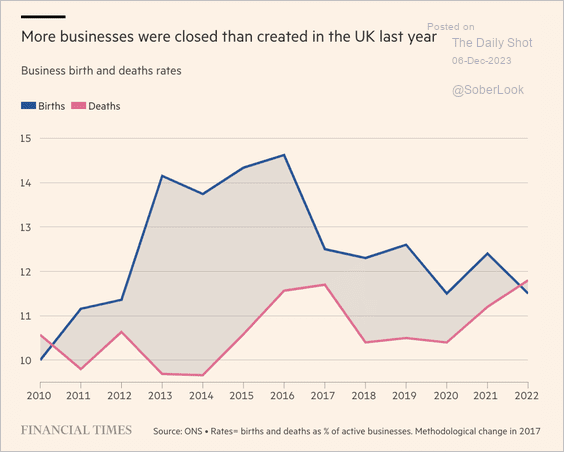

2. Company closures have been outpacing business creation.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

1. The market now expects larger rate cuts from the ECB than the Fed next year.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @economics Read full article

Source: @economics Read full article

This chart shows market expectations for rate cuts at each ECB meeting.

• Here is the 1-year interest rate swap.

• The Bund curve has downshifted sharply over the past few days.

——————–

2. French industrial production declined again last month, but manufacturing output edged higher.

Spanish industrial production was also lower.

——————–

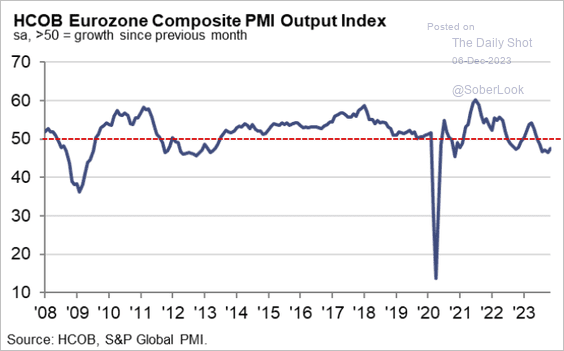

3. Germany’s final services PMI figure was substantially higher than the flash report, pointing to economic stabilization outside of manufacturing and construction.

• The composite PMI index at the Eurozone level remains firmly in contraction territory.

Source: S&P Global PMI

Source: S&P Global PMI

• Is service employment heading lower?

Source: TS Lombard

Source: TS Lombard

——————–

4. Germany’s stocks have been surging, …

… outpacing the rest of the Eurozone.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Europe

1. Sweden’s service-sector activity continues to decline.

2. When it comes to domestic natural gas production, only Romania is self-sufficient.

Source: @DanielKral1

Source: @DanielKral1

Back to Index

Asia-Pacific

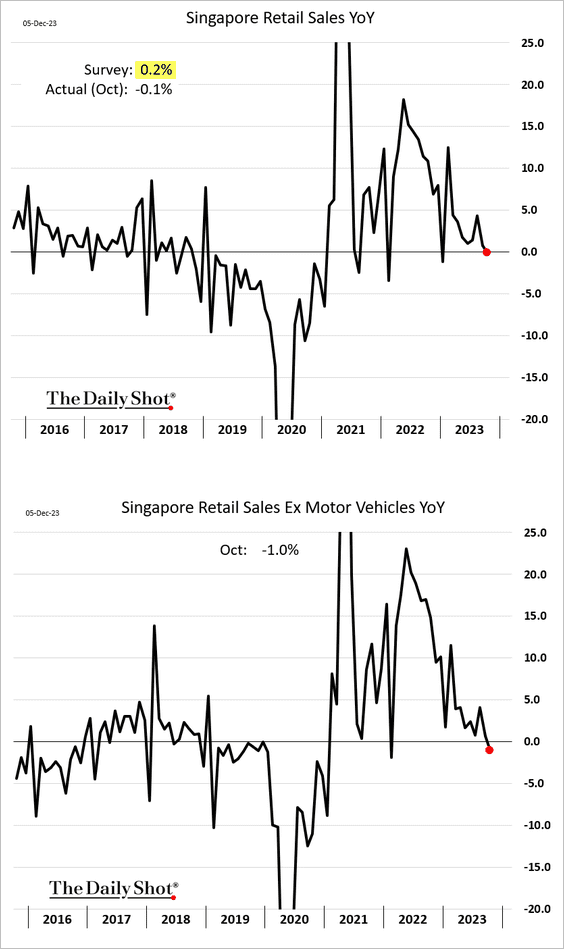

1. Singapore’s retail sales growth has stalled.

2. Australia’s Q3 GDP growth was well below consensus forecasts.

Back to Index

China

1. Moody’s moved China’s debt ratings to “negative outlook.”

Moody’s – The change to a negative outlook reflects rising evidence that financial support will be provided by the government and wider public sector to financially-stressed regional and local governments (RLGs) and State-Owned Enterprises (SOEs), posing broad downside risks to China’s fiscal, economic and institutional strength. The outlook change also reflects the increased risks related to structurally and persistently lower medium-term economic growth and the ongoing downsizing of the property sector. These trends underscore the increasing risks related to policy effectiveness, including the challenge to design and implement policies that support economic rebalancing while preventing moral hazard and containing the impact on the sovereign’s balance sheet. As such, Moody’s expects support provided to financially-stressed entities to be more selective, contributing to protracted risks of further strains for SOEs and RLGs.

Following Moody’s rating decision, Beijing is undertaking measures to bolster the renminbi.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

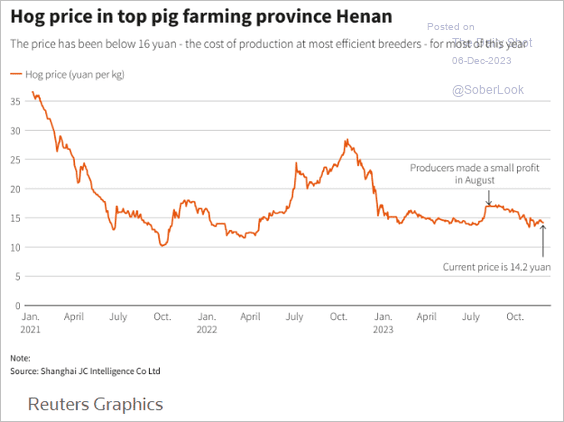

2. Hog prices have been trending lower, putting pressure on the sector and constraining China’s CPI.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Emerging Markets

1. Brazil’s Q3 GDP was more resilient than expected.

• Services remain in growth territory.

Source: S&P Global PMI

Source: S&P Global PMI

• Foreign direct investment has been slowing.

——————–

2. India’s services growth remains robust.

Source: S&P Global PMI

Source: S&P Global PMI

3. South Africa’s GDP unexpectedly contracted last quarter.

4. EM equity correlations have risen, which typically occurs with a rise in volatility.

Source: TS Lombard

Source: TS Lombard

Back to Index

Commodities

1. Dry bulk shipping costs remain elevated.

2. The real gold price is still roughly 20% below its peak in 1980.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

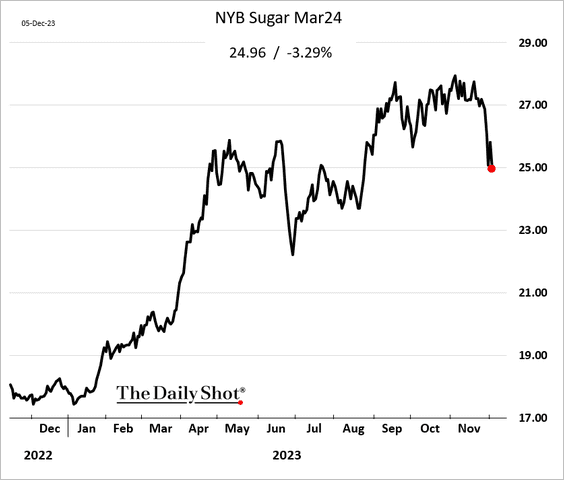

3. The correction is sugar futures continues.

4. After a massive rally, orange juice futures are rolling over.

Back to Index

Energy

1. Brent crude prices are lower again.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. Shale producers are maximizing crude oil extraction from their wells.

Source: @WSJ Read full article

Source: @WSJ Read full article

3. Refining profits per barrel peaked in 2022.

Source: The Crude Chronicles

Source: The Crude Chronicles

Back to Index

Equities

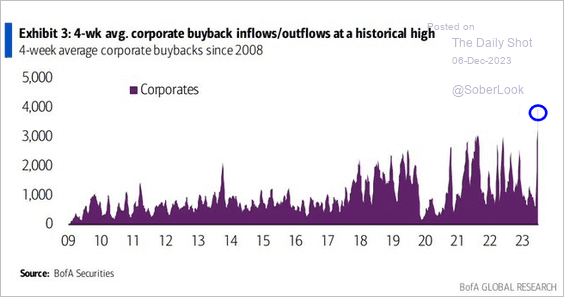

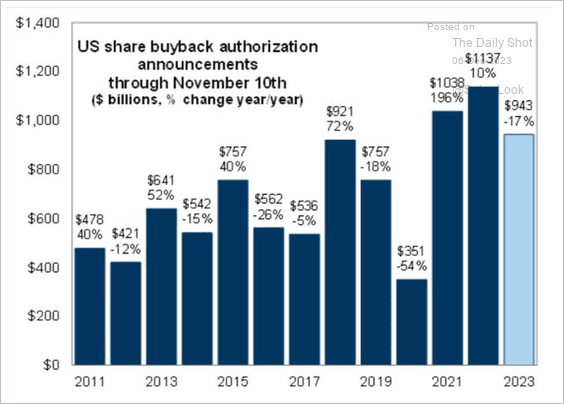

1. Share buybacks have accelerated, …

Source: BofA Global Research

Source: BofA Global Research

… but are still below last year’s levels year-to-date.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

——————–

2. The recent outperformance of companies with substantial international sales is over for now, …

… as the US dollar turns higher.

——————–

3. The S&P 500 is more reflective of coincident data, tracking between soft landing and recession.

Source: Variant Perception

Source: Variant Perception

• US small caps are trading in line with historical recessions.

Source: Variant Perception

Source: Variant Perception

——————–

4. Retail investors have pulled back from ETFs in recent weeks.

Source: Vanda Research

Source: Vanda Research

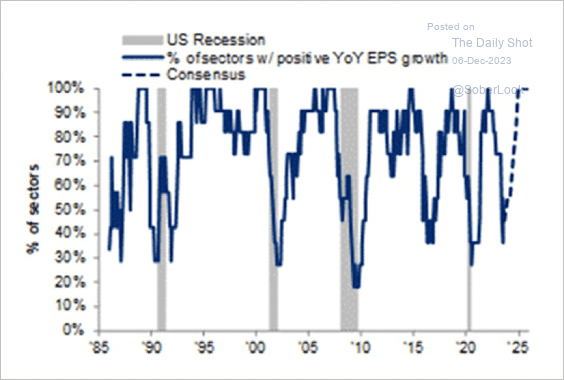

5. Citi expects most S&P 500 sectors to deliver positive earnings growth next year.

Source: Citi Private Bank

Source: Citi Private Bank

6. The stock-bond correlation remains elevated.

7. Here is a look at the expected performance (forward earnings yield) vs. perceived risk (implied vol) for international stocks.

Back to Index

Credit

1. The average life of the US and European high-yield markets took a big step down over the past year when long-term rates rose.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. Here is the maturity wall of European sub-investment-grade debt.

Source: @markets Read full article

Source: @markets Read full article

3. Money market fund balances continue to surge.

Back to Index

Rates

1. Speculator net-short Treasury positioning became stretched at the end of the previous rate hike cycle.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

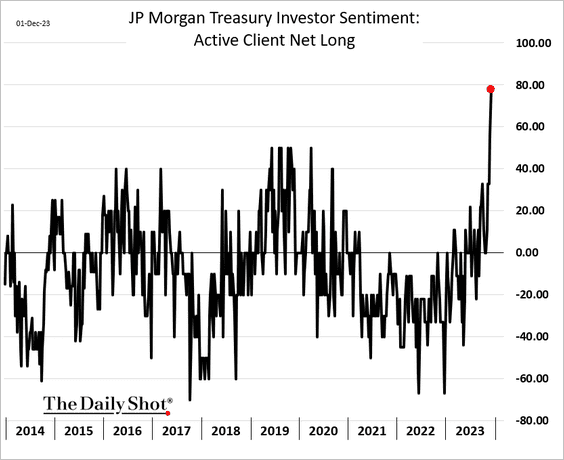

2. JP Morgan’s active clients are very bullish on Treasuries.

3. US fixed income typically beats cash after peak rates.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Global Developments

1. Global government debt continues to rise.

Source: IIF

Source: IIF

• As they say on Sesame Street, “one of these [trends] is not like the others.”

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

2. Real GDP levels across major economies have diverged from the IMF’s pre-pandemic projections.

Source: Lazard Read full article

Source: Lazard Read full article

3. Here is a look at nominal GDP and public debt levels in select economies.

Source: @DanielKral1, @USCBO

Source: @DanielKral1, @USCBO

——————–

Food for Thought

1. US infant mortality rate:

Source: @WSJ Read full article

Source: @WSJ Read full article

2. Meth production in Afghanistan:

Source: Statista

Source: Statista

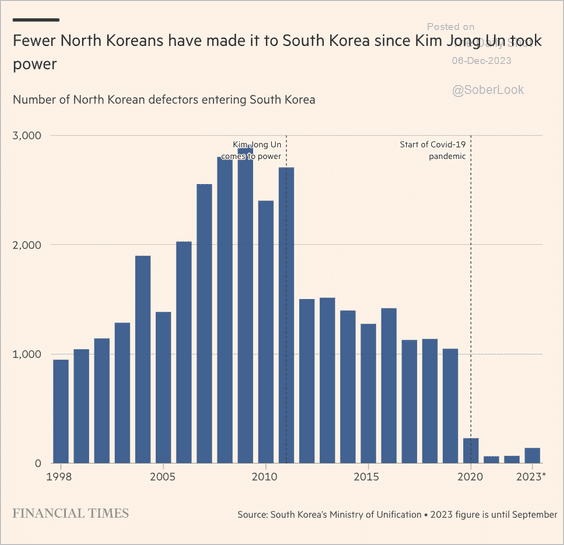

3. North Koreans escaping to South Korea:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. US aid to Israel:

Source: @axios Read full article

Source: @axios Read full article

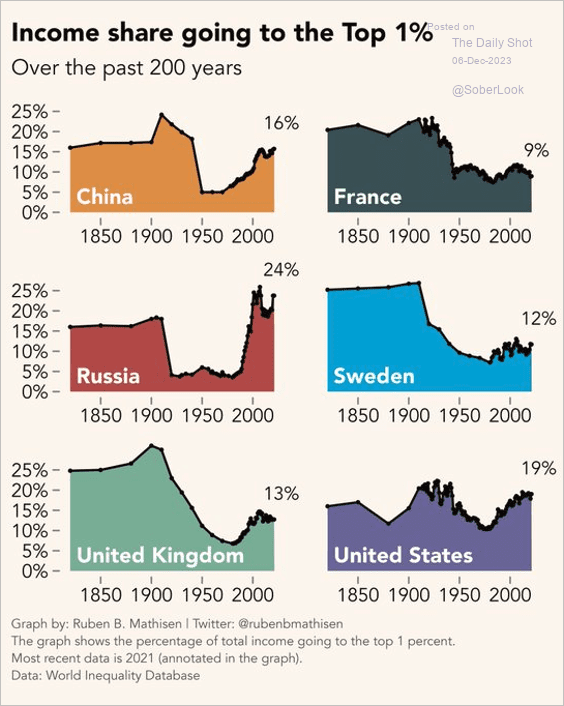

5. Income share of the top 1% over time:

Source: @rubenbmathisen

Source: @rubenbmathisen

6. Online sports betting:

Source: The Current Read full article

Source: The Current Read full article

7. Views on wedding traditions:

Source: YouGov

Source: YouGov

——————–

Back to Index