The Daily Shot: 05-Dec-23

• The United States

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

1. Factory orders declined in October.

Source: RTT News Read full article

Source: RTT News Read full article

This chart shows the dollar level of vehicle and parts orders.

——————–

2. The economic surprise index has been rolling over.

3. Real GDP growth consensus estimates have been revised higher.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Here is Goldman’s forecast.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

4. The GDP-GDI divergence has reached extreme levels. Could recent GDP data be overstating the true extent of the US economic growth?

Source: USA Today Read full article

Source: USA Today Read full article

——————–

5. Next, we have some updates on the US consumer.

• Dwindling excess savings:

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

• Slowing student loan payments:

Source: Oxford Economics

Source: Oxford Economics

• Real household income vs. the pre-COVID trend:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

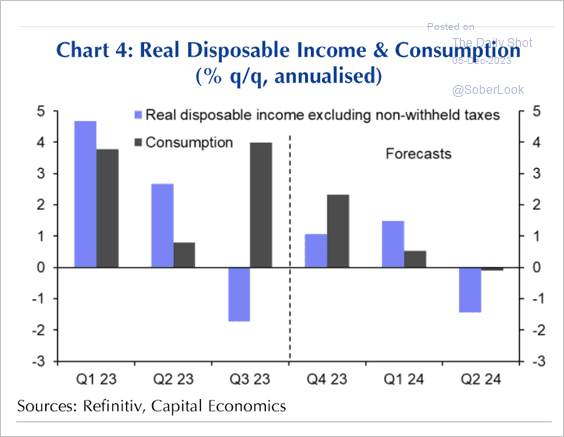

• Capital Economics expects real disposable income to remain well below the current pace of consumption growth.

Source: Capital Economics

Source: Capital Economics

——————–

5. The GS Twitter Economic Sentiment continues to diverge from the U. Michigan’s measure.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

6. The 30-year mortgage rate is approaching 7%.

Source: Mortgage News Daily

Source: Mortgage News Daily

7. Market pricing for faster Fed rate cuts suggests that the US dollar has room to decline further.

Source: BNP Paribas; @WallStJesus

Source: BNP Paribas; @WallStJesus

Back to Index

The Eurozone

1. The market is pricing in steep ECB rate cuts next year.

Here is the 2-year Bund yield.

——————–

2. While the Sentix Investor Confidence Index experienced a marginal uptick, the extent of its recovery fell short of market expectations.

3. Germany’s trade surplus increased in October.

• Amid an already faltering economy, Germany’s ‘debt brake’ may pose a significant additional obstacle to economic growth, intensifying existing headwinds.

Source: Gavekal Research

Source: Gavekal Research

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

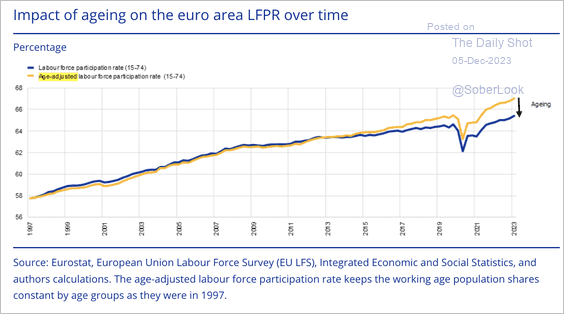

4. Here is a look at labor force participation.

Source: ECB Read full article

Source: ECB Read full article

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Europe

1. Swiss inflation eased last month.

2. Next, we have the number of FDI projects by country.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Japan

1. Tokyo’s November CPI was lower than expected, but core inflation is still elevated relative to recent history.

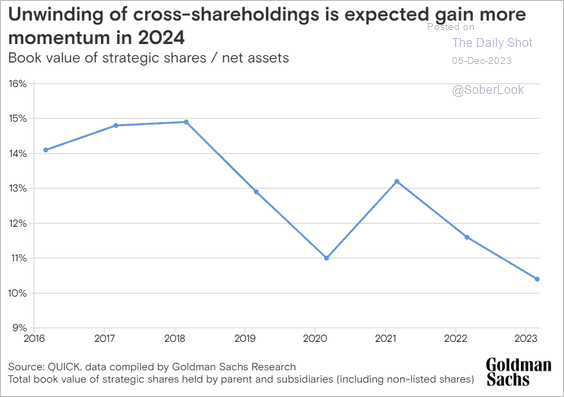

2. As Japanese firms increasingly divest from cross-shareholdings, a longstanding barrier to investment in Japan’s stock market is being dismantled, potentially altering the landscape for equity investors.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Asia-Pacific

1. South Korea’s inflation eased last month.

2. Next, we have some updates on Australia.

• Although the RBA maintained its interest rates, its less hawkish-than-expected commentary fell short of market anticipations, leading to a dip in the Australian dollar and short-term yields.

• Australia’s services sector is now a drag on economic growth.

Source: World Economics

Source: World Economics

Back to Index

China

1. The selloff continues despite Beijing’s attempts to stabilize the stock market.

• Mainland shares:

• Hong Kong:

——————–

2. Fluctuations in the excess reserve ratio lead the non-public credit impulse by several months.

Source: BCA Research

Source: BCA Research

3. Hong Kong’s retail sales have been slowing.

Back to Index

Emerging Markets

1. Let’s begin with Mexico.

• The unemployment rate (very low):

• Vehicle sales (well above last year’s levels):

• CapEx (down in September):

• Remittances (record high):

• The budget deficit (extra spending ahead of the elections):

• The latest poll:

Source: The ETF Shelf

Source: The ETF Shelf

——————–

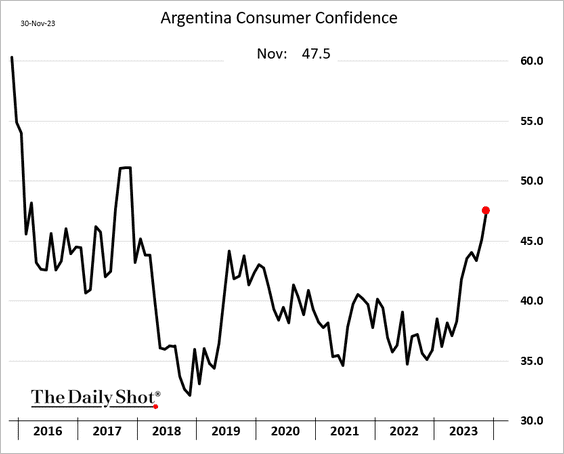

2. Argenitna’s consumer confidence is rebounding.

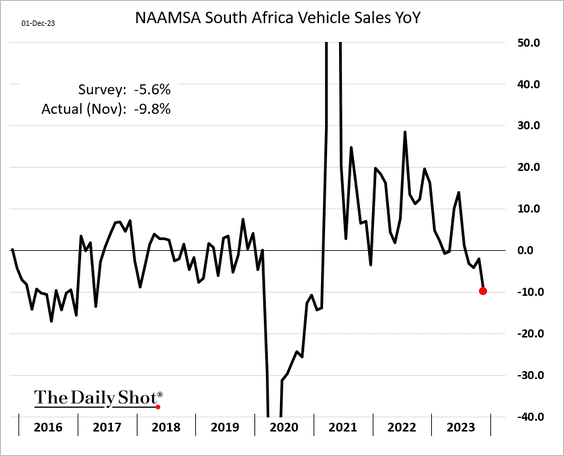

3. South Africa’s vehicle sales are 10% below last year’s levels.

• The trade balance unexpectedly swung into deficit in October.

——————–

4. Is Turkey’s inflation finally peaking as the central bank pushes rates to extreme levels?

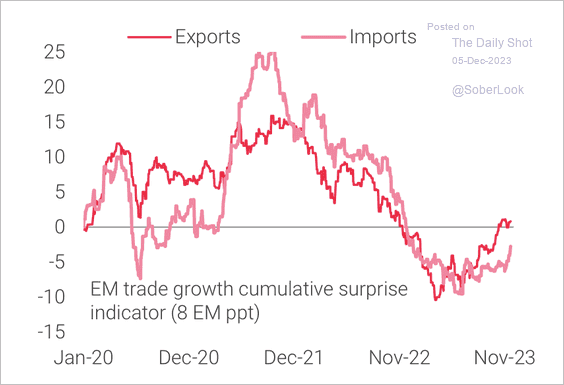

5. EM leading indicators are turning up alongside an improvement in trade.

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

1. Cryptos are off to a strong month, with bitcoin cash (BCH) and bitcoin (BTC) in the lead.

Source: FinViz

Source: FinViz

2. Bitcoin’s market cap relative to the total crypto market cap, or dominance ratio, continues to trend higher.

3. The BTC/ETH price ratio is also trending higher.

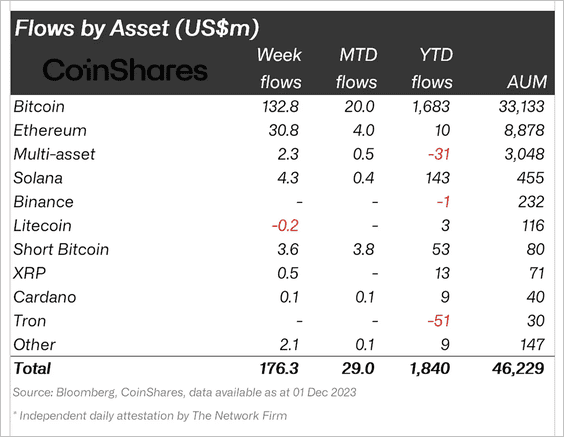

4. Crypto funds continued to see inflows last week, led by long-bitcoin products. (2 charts)

Source: CoinShares

Source: CoinShares

Source: CoinShares

Source: CoinShares

Back to Index

Energy

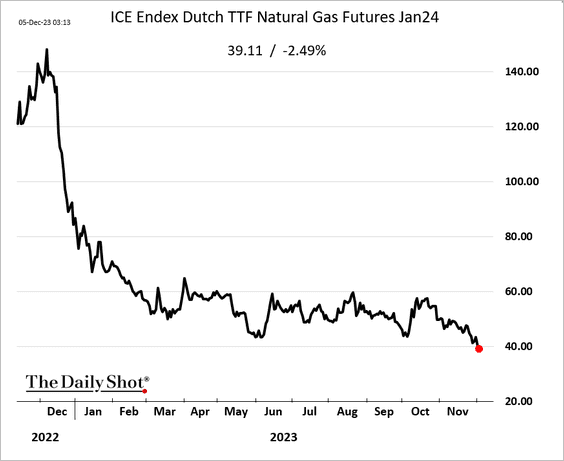

1. European natural gas futures dip below €40.0/MWh.

2. Uranium prices are surging.

Back to Index

Equities

1. There are not a lot of bearish retail investors left.

• CTAs have turned very bullish.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

• And yet, corporate insiders are bearish.

——————–

2. Fund inflows have been robust (2 charts).

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Source: BNP Paribas; @WallStJesus

Source: BNP Paribas; @WallStJesus

——————–

3. Tailwinds from higher liquidity (reserves) are fading.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

4. Many hedge funds have piled into the same stocks.

Source: Goldman Sachs

Source: Goldman Sachs

5. Deeper yield-curve inversions mean larger market corrections in a recession.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

6. US investors have been willing to pay a large premium for rising, high-quality profits this year.

Source: Citi Private Bank

Source: Citi Private Bank

7. The S&P 500 is trading at the bottom end of its long-term trend channel since 2008.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

8. How did forward PE multiples across S&P 500 sectors change in November?

• Here is a look at expected performance (forward earnings yield) vs. perceived risk (implied volatility) by sector.

——————–

9. Finally, we have detailed equity factor performance data for small and large caps over the past five weeks.

Source: CornerCap Institutional

Source: CornerCap Institutional

Back to Index

Rates

1. Repo rates jumped last week due partly to tax payment dynamics and bond settlements.

SOFR climbed above the fed funds rate.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

2. Hedge funds have been boosting their bets on rapid-fire Fed rate cuts next year. Too much enthusiasm?

Source: @markets Read full article

Source: @markets Read full article

——————–

3. The real Fed funds rate rose from very low levels back into its historically normal range.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

1. Here is a look at the November manufacturing PMIs. 22 out of 31 countries tracked by S&P Global are in contraction territory.

Source: S&P Global PMI

Source: S&P Global PMI

2. Real consumer spending has been strong in the US while the Eurozone and UK continue to see weakness.

Source: Capital Economics

Source: Capital Economics

3. The CPI distribution has shifted lower across major developed markets.

Source: TS Lombard

Source: TS Lombard

And wage pressure has started to ease.

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

1. How Americans view small businesses:

Source: @chartrdaily

Source: @chartrdaily

2. Amazon’s seasonal workforce:

Source: @chartrdaily

Source: @chartrdaily

3. US healthcare employment growth:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Allocation of defense spending by category:

Source: OECD Read full article

Source: OECD Read full article

5. Deaths attributed to smoking in selected countries:

Source: Jeremy Ney Read full article

Source: Jeremy Ney Read full article

• Smoking and median household income by US county:

Source: Jeremy Ney Read full article

Source: Jeremy Ney Read full article

• Smoking rates:

Source: Jeremy Ney Read full article

Source: Jeremy Ney Read full article

——————–

6. Common Christmas dishes in Europe:

Source: @loverofgeography

Source: @loverofgeography

——————–

Back to Index