The Daily Shot: 08-Dec-23

• The United States

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with some data on the US consumer.

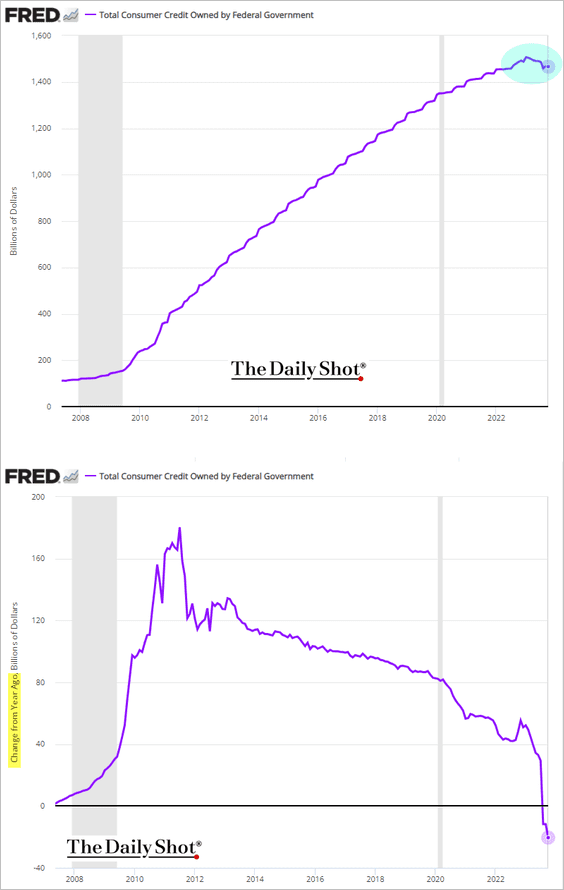

• Consumer credit growth in October was smaller than expected, maintaining its downward trend.

– Nominal credit card debt reached a new high, but real balances remain below pre-COVID levels.

Here is credit card debt as a share of disposable income.

– Student loans held by the federal government declined further on a year-over-year basis due in part to debt forgiveness.

• Here is a look at trends in real consumer spending on goods and services.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

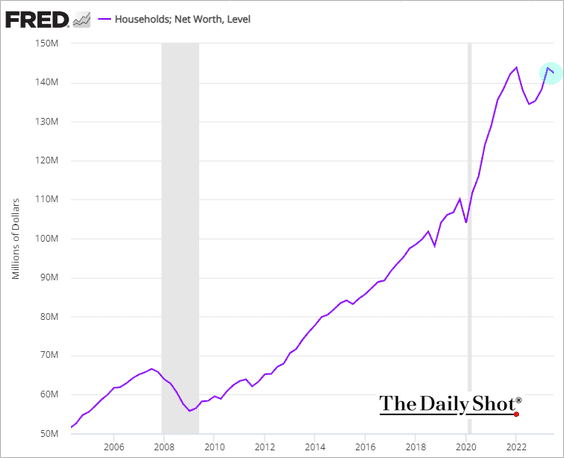

• Household net worth declined last quarter due to lower equity prices. We should see a rebound in Q4.

– The value of real estate held by households reached a record high.

– Residential mortgage debt as a share of GDP hit the lowest level in over two decades.

– This chart shows household leverage (liabilities/disposable income).

——————–

2. Job cuts were subdued in November.

• What should we expect from the employment report today? Here is an estimate from Morgan Stanley.

– Payorlls growth (consensus is 183k):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

– The unemployment rate:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

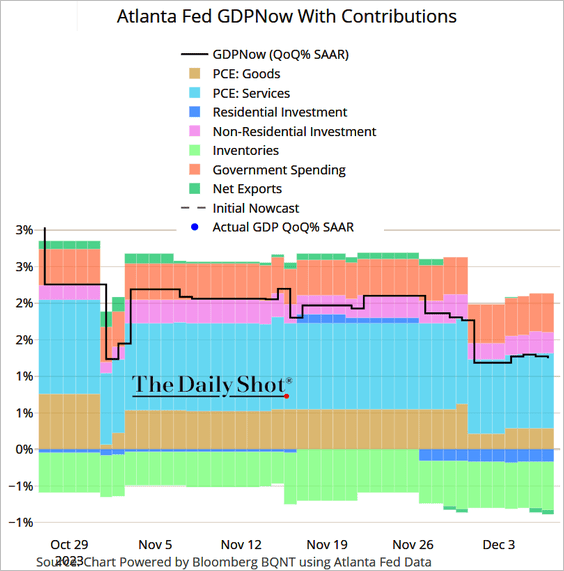

3. The Atlanta Fed’s GDPNow model estimate for the current quarter’s GDP growth is 1.2% (annualized), which is in line with economists’ forecasts.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

Here are the contributions.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

The Eurozone

1. Euro-area bond yields keep moving lower.

2. It turns out that consumer spending grew last quarter.

3. The French trade deficit narrowed slightly in October.

4. Italian industrial production has been trending lower.

Back to Index

Europe

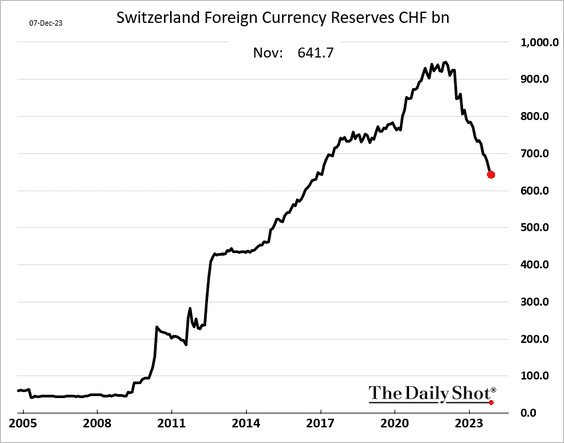

1. Switzerland’s central bank continues to shrink its balance sheet.

2. Here is a look at contributions to disposable income.

Source: Eurostat Read full article

Source: Eurostat Read full article

3. Next, we have recycled materials use rate.

Source: Eurostat Read full article

Source: Eurostat Read full article

The overall recycling rate in the EU has been trending lower.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Japan

1. Yesterday’s increase in JGB yields was the highest in years (after the BoJ’s hawkish signals).

• The yen continues to strengthen.

• Japan’s stocks are now underperforming.

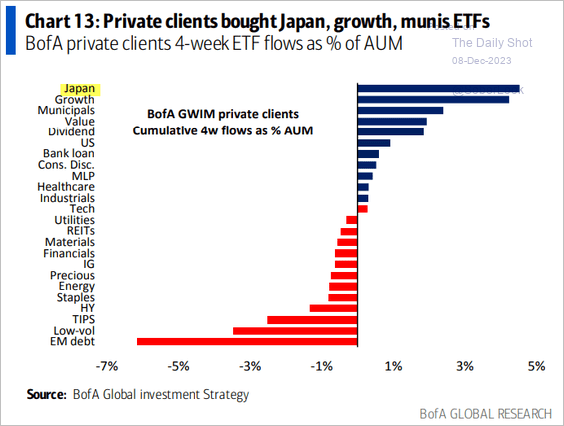

But BofA’s private clients still like Japanese stocks.

Source: BofA Global Research

Source: BofA Global Research

——————–

2. Last quarter’s GDP contraction was larger than estimated.

Source: Reuters Read full article

Source: Reuters Read full article

Consumption declined for the second quarter in a row.

——————–

3. Household spending was a bit stronger than expected in October but was still down on a year-over-year basis.

The same was true for real wages.

——————–

4. The trade deficit was wider than expected in October.

But the current account surplus hit a record high for this time of the year.

——————–

5. Here is a look at Japan’s petroleum consumption.

Source: @EIAgov

Source: @EIAgov

Back to Index

China

1. FX reserves are rebounding.

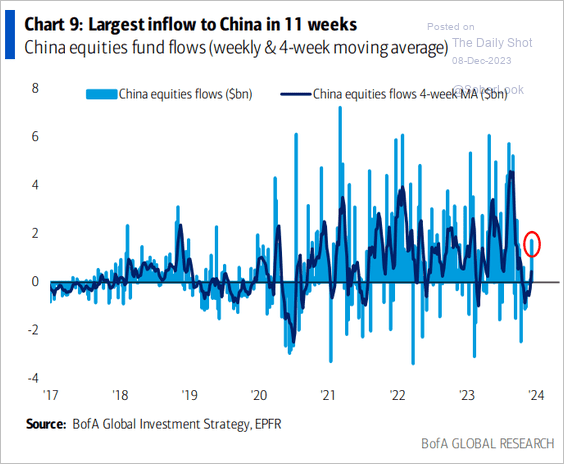

2. China-focused equity funds reported some inflows.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Emerging Markets

1. Chile’s inflation declined less than expected last month.

• The nation’s trade surplus is back above last year’s levels.

Copper exports strengthened.

——————–

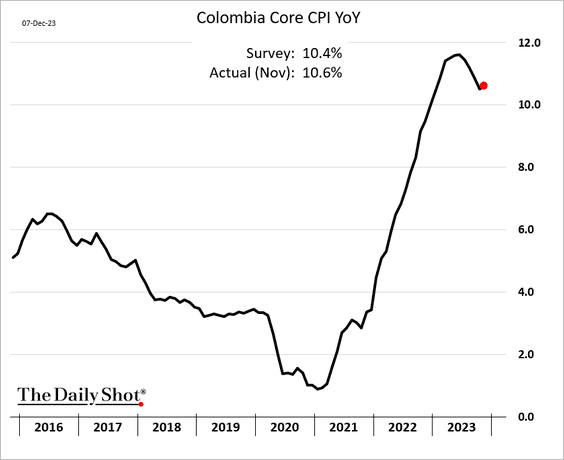

2. Here is Colombia’s core inflation.

3. Argentina’s vehicle sales slowed in November.

4. Mexico’s CPI was slightly lower than expected.

5. The Philippine CPI continues to moderate.

6. Next, we have some updates on South Africa.

• The current account deficit narrowed more than expected.

Source: @markets Read full article

Source: @markets Read full article

• Electricity output remains depressed.

• Potential growth has shifted lower amid electricity production limits.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

——————–

7. EM growth outperformance vs. DM is expected to widen.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

Commodities

1. Dry bulk shipping costs are starting to moderate.

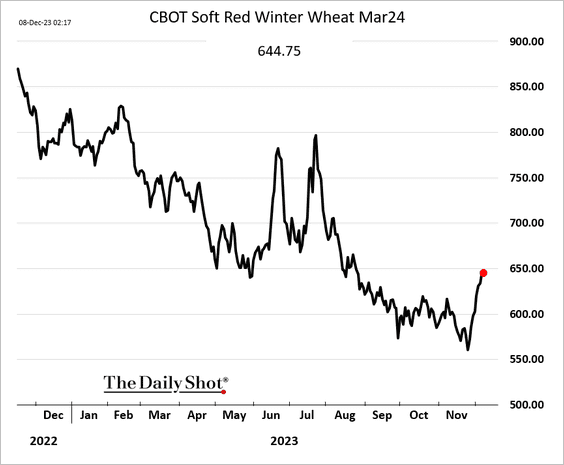

2. US wheat futures are rebounding.

Back to Index

Energy

1. At current prices, some North American oil production becomes unprofitable.

Source: Morgan Stanley Research; @ResearchQf

Source: Morgan Stanley Research; @ResearchQf

2. The US has been offsetting a large portion of OPEC+ production cuts.

Source: The Economist Read full article

Source: The Economist Read full article

3. Canada wants to break its dependence on the US for its oil exports.

Source: @EIAgov

Source: @EIAgov

4. Inflation-adjusted capex remains in a long-term downtrend.

Source: The Crude Chronicles

Source: The Crude Chronicles

5. Here is a look at low-carbon hydrogen projects across the US.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Equities

1. Cyclical sectors continue to outperform defensives.

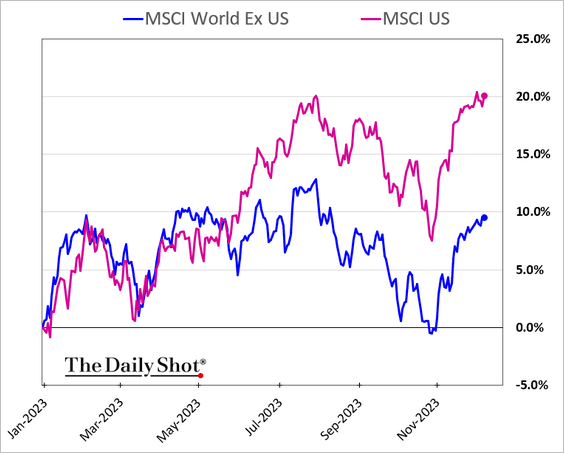

2. US stocks have outperformed international shares by over 10% year-to-date.

3. Most S&P 500 stocks are still in a profit recession.

Source: @tatianadariee, @business

Source: @tatianadariee, @business

4. Retail order flows surged last week.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

5. Avoiding a recession will be key for stocks after the Fed starts cutting rates.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

6. Small-cap stock positioning has been increasingly cautious.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

But bullish options bets on the Russell 2000 are near record highs.

——————–

7. Finally, we have a couple of sector trends.

• Banks:

• Semiconductors:

Back to Index

Alternatives

1. Despite record deal volumes, European investors have slowed their US buyout activity.

Source: PitchBook

Source: PitchBook

2. Buyout equity contributions have been higher than in 2009 (reduced leverage).

Source: Alex Lykken / PitchBook; @theleadleft

Source: Alex Lykken / PitchBook; @theleadleft

3. Here is a look at PE fundraising by fund size.

Source: @theleadleft

Source: @theleadleft

4. Private credit returns have been outpacing private equity recently.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Credit

1. Credit card delinquencies at small US banks remain elevated.

2. The percentage of uninsured deposits (by FDIC) in the US banking sector has been trending lower.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

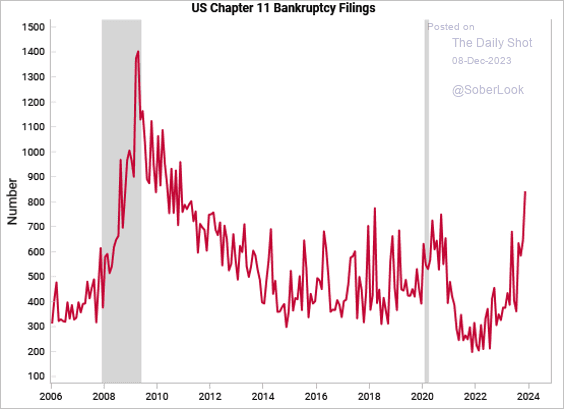

3. This chart shows the number of US Chapter 11 bankruptcy filings.

Source: Variant Perception

Source: Variant Perception

Back to Index

Rates

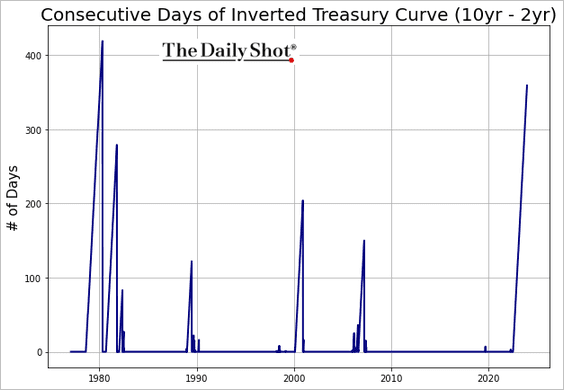

1. The current yield curve inversion duration has been unusually long.

2. Treasury funds are seeing some ouflows.

Source: BofA Global Research

Source: BofA Global Research

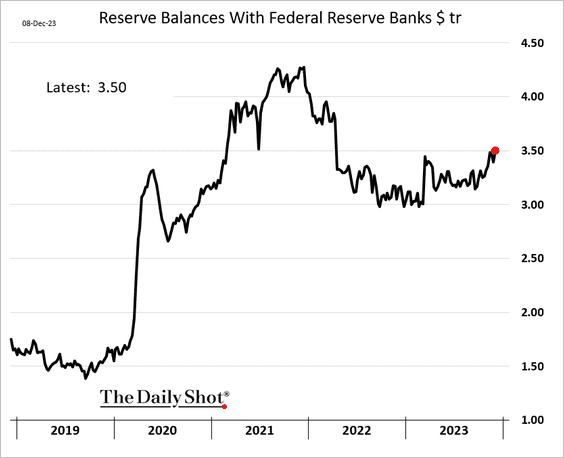

3. Reserve balances are climbing despite the Fed’s QT (which tends to be a tailwind for stocks).

Back to Index

Global Developments

1. Here is a look at GDP-per-capita changes since 2010.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

2. Next, we have sovereign wealth funds’ size and recent performance.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Food for Thought

1. Metals production:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

2. Valuations of selected privately-held growth companies:

Source: Statista

Source: Statista

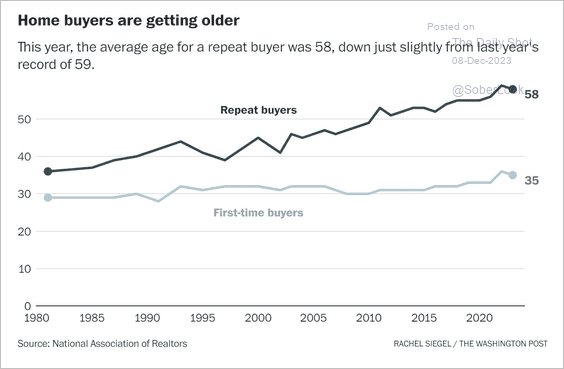

3. US home buyers’ average age:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

4. The US population is now expected to peak in 2080.

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Global undernourished population:

Source: @markets Read full article

Source: @markets Read full article

6. Punitive actions in the House of Representatives:

Source: @axios Read full article

Source: @axios Read full article

7. What is Chanukah?

Source: Michael Sandberg Read full article

Source: Michael Sandberg Read full article

——————–

Have a great weekend!

Back to Index