The Daily Shot: 12-Dec-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

1. Let’s begin with some updates on inflation.

• Nomura estimates an uptick in the core CPI in November, …

Source: Nomura Securities

Source: Nomura Securities

… as some volatile items rebound.

Source: Nomura Securities

Source: Nomura Securities

Hotel costs and medical care likely boosted the supercore CPI.

Source: Nomura Securities

Source: Nomura Securities

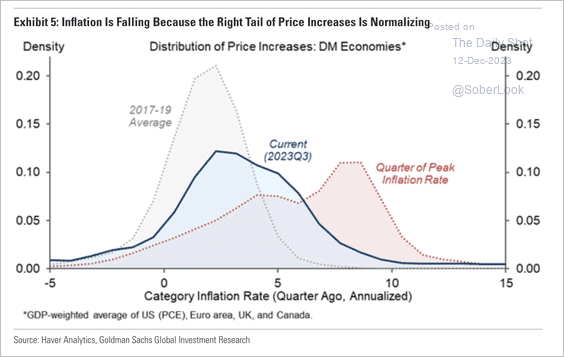

• The right-tail distribution of price changes has shifted partly back to its pre-pandemic position.

Source: Goldman Sachs

Source: Goldman Sachs

• Slower gains in labor costs point to a moderation in services inflation.

Source: Oxford Economics

Source: Oxford Economics

• Leading indicators continue to signal slower inflation ahead.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Morgan Stanley expects headline inflation to decline to the 2% target in 2025, …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

… as the relative price of core goods versus services narrows closer toward the historical trend.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Over the long run, demographics will put downward pressure on inflation.

Source: BofA Global Research

Source: BofA Global Research

• The NY Fed’s consumer survey showed falling inflation expectations last month.

——————–

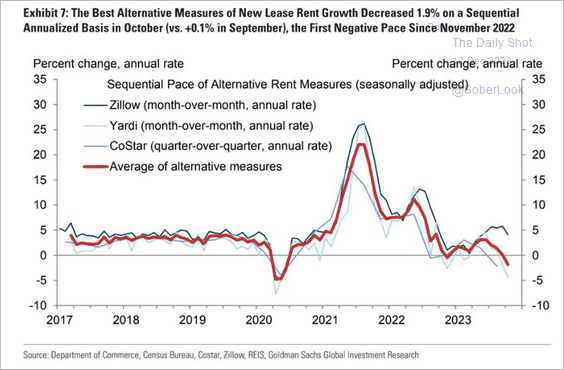

2. Next, let’s look at some rental cost trends.

• Alternative measures of new-lease rent growth:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Cities reporting negative rent growth:

Source: Apartment List

Source: Apartment List

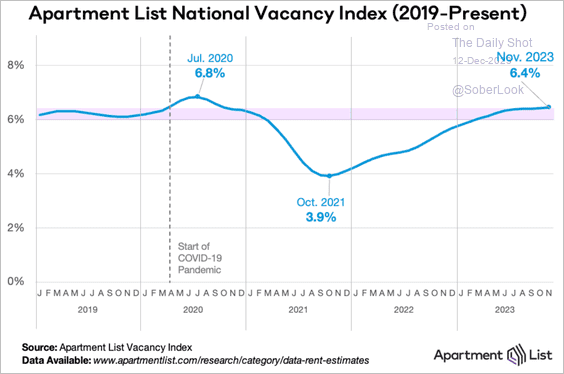

• Apartment vacancy rates (now above pre-COVID levels):

Source: Apartment List

Source: Apartment List

——————–

3. Here is an overview of US consumers’ misconceptions about the economy:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. Households’ interest income is growing.

Source: Oxford Economics

Source: Oxford Economics

5. Financial conditions continue to ease.

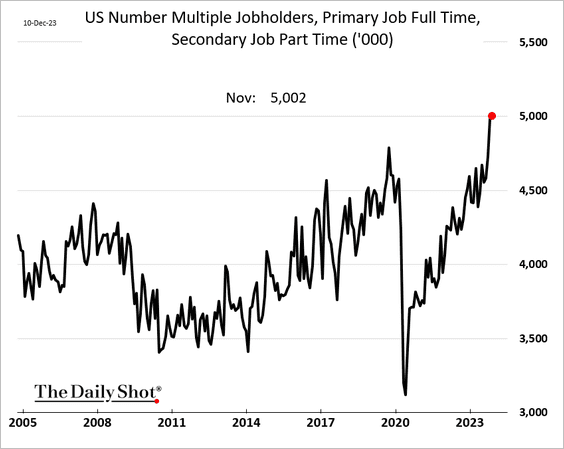

6. Finally, we have some data on the labor market.

• More Americans with full-time jobs are moonlighting.

• Job openings are increasingly driven by small businesses.

Source: @WSJ Read full article

Source: @WSJ Read full article

• Permanent job losses remain low but have been trending up.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

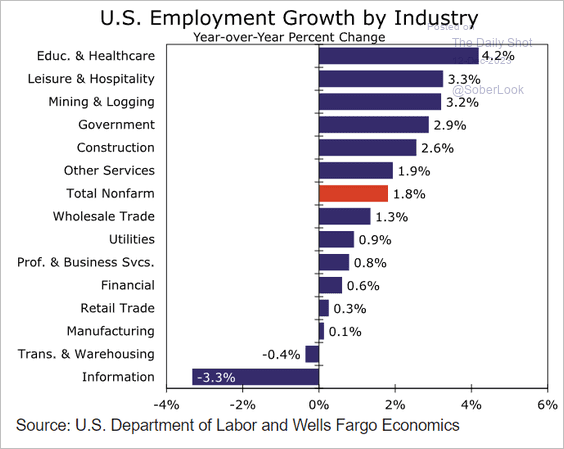

• This chart shows the year-to-date employment gains by industry.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Canada

1. The population boom is expected to ease over the coming years.

Source: Oxford Economics

Source: Oxford Economics

2. Migrant wages tend to converge with Canadian-born over time.

Source: Oxford Economics

Source: Oxford Economics

3. Canada’s GDP per capita has diverged from that of the US.

Source: PGM Global

Source: PGM Global

Back to Index

The United Kingdom

1. PMI data signals easing services inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

2. Surveys point to higher unemployment and softer wage growth ahead.

Source: Barclays Research

Source: Barclays Research

3. Who is getting skilled-work visas?

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

The Eurozone

1. Economists downgraded Germany’s 2024 GDP growth forecasts again.

Here is the consensus projection for Spain.

——————–

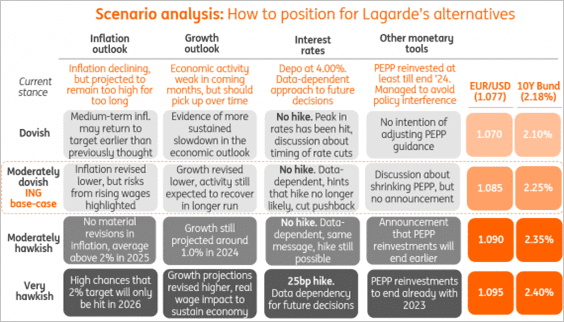

2. This table shows some scenarios for the ECB’s policy stance this week (from ING).

Source: ING

Source: ING

• Capital Economics expects five 25 bps rate cuts next year.

Source: Capital Economics

Source: Capital Economics

——————–

3. Germany’s shares continue to surge.

Back to Index

Europe

1. Norway’s core inflation eased last month.

Source: @economics Read full article

Source: @economics Read full article

Here is the 2-year yield.

——————–

2. Who are the largest dairy producers in the EU?

Source: Eurostat Read full article

Source: Eurostat Read full article

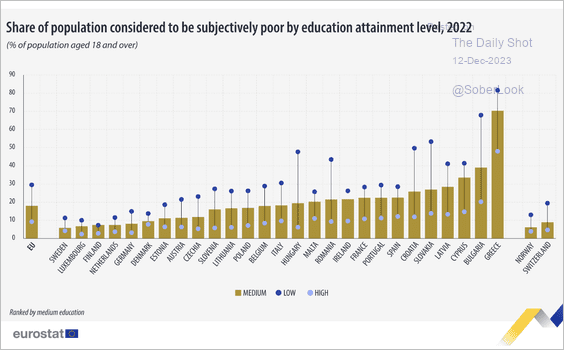

3. This chart shows the share of adults with low educational attainment.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

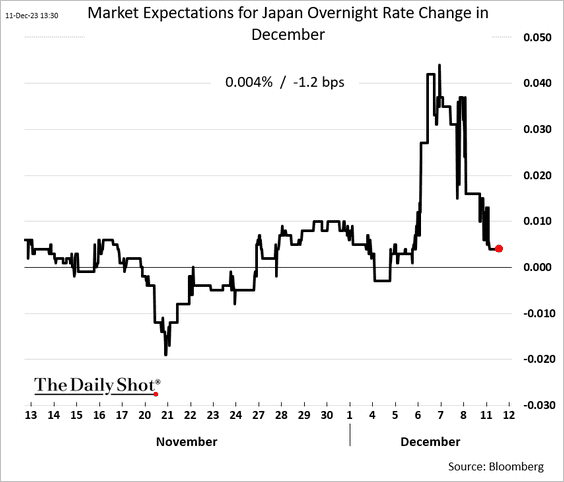

1. The markets now see almost zero chance of a rate hike this month.

Source: @economics Read full article

Source: @economics Read full article

——————–

2. Machine tool orders were relatively soft last month.

Back to Index

Asia-Pacific

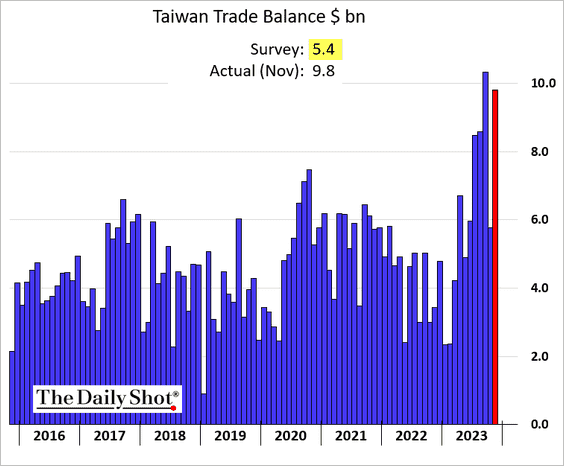

1. Taiwan’s exports were above last year’s levels in November.

The trade surplus topped expectations.

——————–

2. Australia’s consumer confidence edged higher this month.

Business sentiment is rolling over.

Back to Index

China

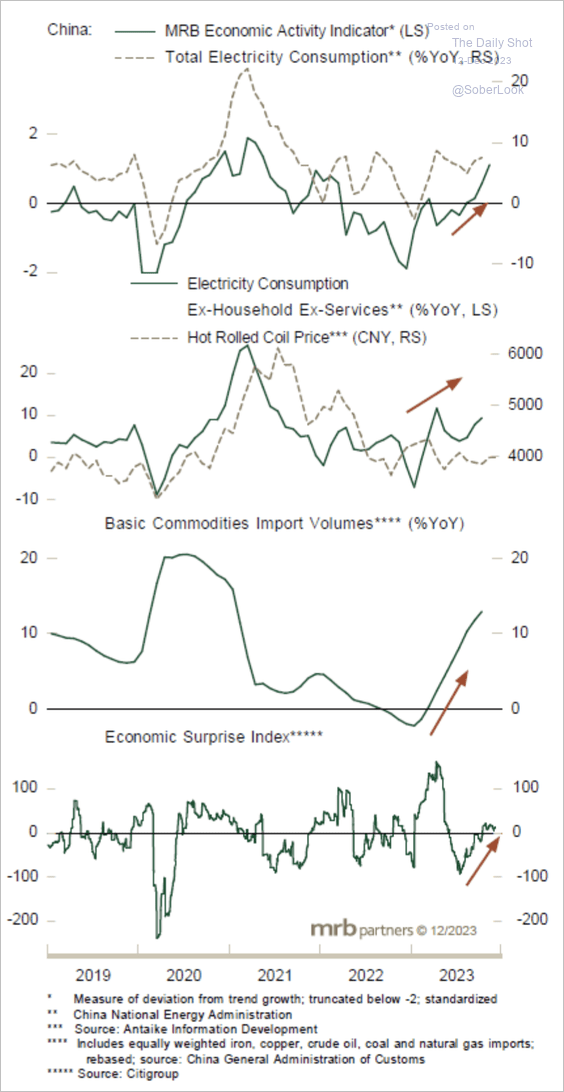

1. Economic activity is starting to improve.

Source: MRB Partners

Source: MRB Partners

2. Local government debt increasingly dominates China’s bond market.

Source: @WSJ Read full article

Source: @WSJ Read full article

3. This chart shows China’s imports of semiconductor manufacturing equipment.

![]() Source: Rhodium Group Read full article

Source: Rhodium Group Read full article

4. Hong Kong’s voter turnout tumbled this year.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Back to Index

Emerging Markets

1. Let’s begin with some updates on India.

• The stock market continues to rally.

• India experienced a capex boom over the past few years alongside a surge in credit growth. (2 charts)

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

• The rise in personal loans has not led to a pickup in consumption growth. According to Alpine Macro, some borrowings may have been channeled to asset markets.

Source: Alpine Macro

Source: Alpine Macro

——————–

2. Turkey’s industrial production declined again in October.

The unemployment rate continues to fall.

——————–

3. Here is a look at foreign investment in Vietnam.

Source: Reuters Read full article

Source: Reuters Read full article

4. Ukraine’s year-over-year GDP growth topped expectations.

Back to Index

Cryptocurrency

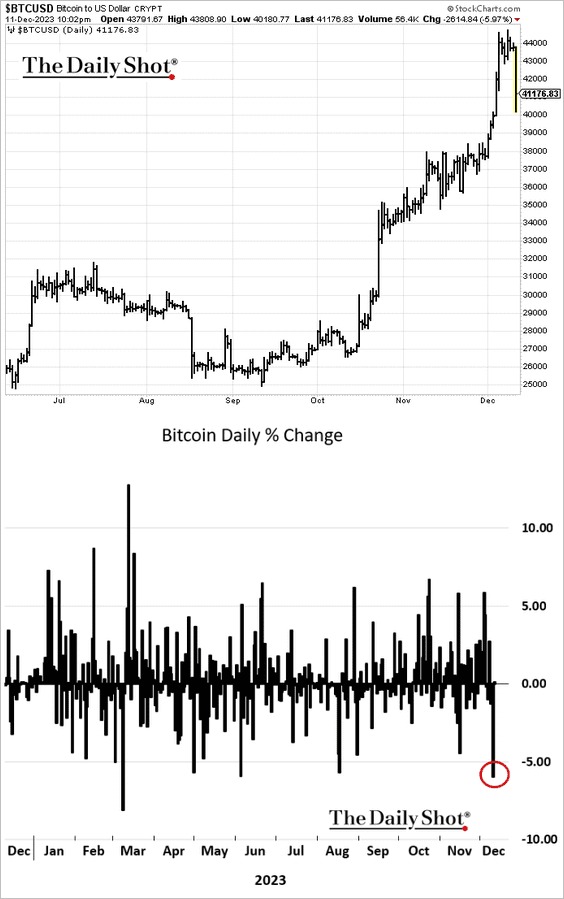

1. Bitcoin saw a sharp pullback on Monday, with leveraged players forced to exit.

2. Crypto returns are still positive month-to-date.

3. Crypto funds saw an 11th straight week of inflows, although the pace has slowed.

Source: CoinShares Read full article

Source: CoinShares Read full article

• Short-bitcoin products attracted fresh capital while investors exited multi-asset funds last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

4. Solana NFT marketplaces have experienced a rise in trading volumes.

Source: @MessariCrypto

Source: @MessariCrypto

5. Blockchain developer activity remains elevated despite the slowdown in recent years.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Commodities

1. Gold is back below $2000/oz.

• Central banks bought almost as much gold this year as in 2022.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

——————–

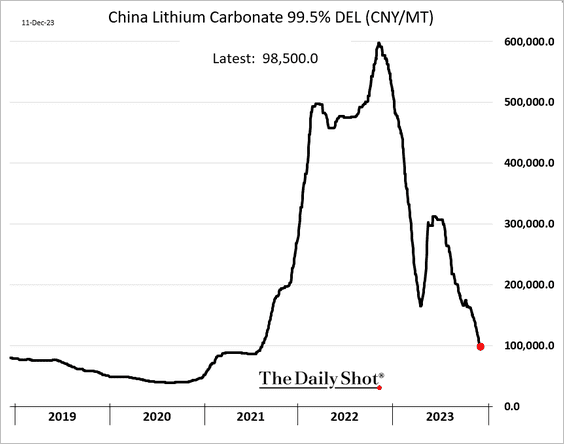

2. Lithium prices continue to sink.

3. Flash memory prices are rebounding.

4. Instant coffee prices are on the rise.

Source: @markets Read full article

Source: @markets Read full article

——————–

5. Sugar futures continue to sink.

6. Avocado prices have been moderating.

Back to Index

Energy

1. Brent crude contango has intensified.

——————–

2. This chart shows the Capital Economics forecast for OPEC production.

Source: Capital Economics

Source: Capital Economics

3. Oil supply is up year-to-date despite the OPEC+ cuts.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

4. Uranium prices keep climbing.

• This chart shows US suppliers of enriched uranium.

Source: Sophie Caronello, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: Sophie Caronello, @TheTerminal, Bloomberg Finance L.P. Read full article

Back to Index

Equities

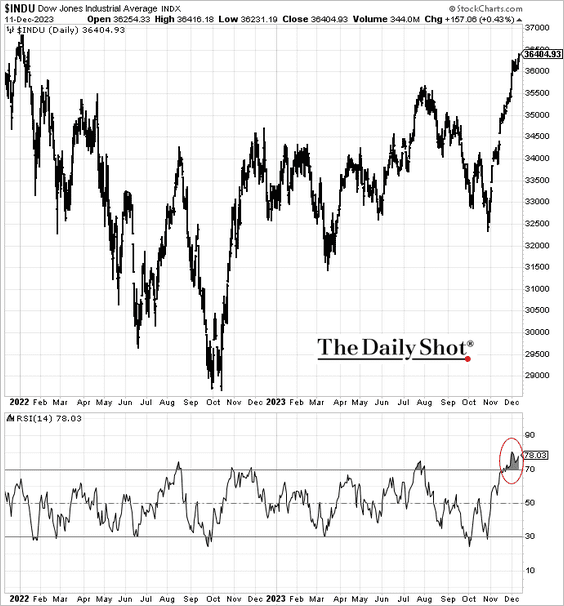

1. The Dow rally looks stretched.

2. On average, December has been the third-best month for the S&P 500 during pre-election years. Could we see another rally to close out the year? (2 charts)

Source: @ryandetrick

Source: @ryandetrick

Source: @ryandetrick

Source: @ryandetrick

——————–

3. The S&P 500 typically performs well during non-recession election years.

Source: Truist Advisory Services

Source: Truist Advisory Services

4. IPO activity has been relatively soft.

Source: @FactSet Read full article

Source: @FactSet Read full article

Post-IPO stocks rebounded since the October slump but continue to lag the Nasdaq 100.

——————–

5. High total yields and rising buybacks could partially limit equity downside.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

6. Small-cap margins have diverged from large caps.

Source: PGM Global

Source: PGM Global

Small-cap earnings revisions breadth has also been lagging.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

——————–

7. In aggregate, analysts expect the S&P 500 to top 5000 by the end of next year.

Source: @FactSet Read full article

Source: @FactSet Read full article

Here are the target gains by sectror.

Source: @FactSet Read full article

Source: @FactSet Read full article

——————–

8. This chart shows US tech mega-caps in perspective.

Source: @MichaelAArouet, @DuncanLamont2

Source: @MichaelAArouet, @DuncanLamont2

Back to Index

Credit

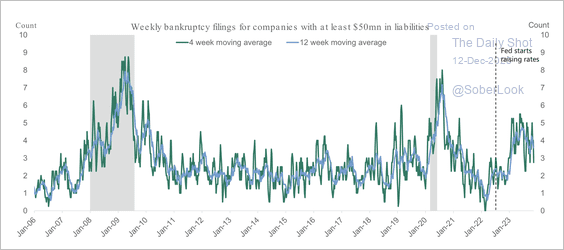

1. Weekly bankruptcy filings rose as the Fed hiked rates, although still below prior cycle highs.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

S&P Global’s data, which covers middle-market and larger firms, shows bankruptcy filings slowing last month.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

2. Investment-grade and high-yield firms show diverging corporate balance sheet strength.

Source: Oxford Economics

Source: Oxford Economics

European HY fundamentals are stronger than those of US peers.

Source: Oxford Economics

Source: Oxford Economics

——————–

3. Here is a look at leveraged loan and high-yield bond issuance as well as the use of proceeds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

1. Will global economic activity surprise to the upside again in 2024?

Source: Truist Advisory Services

Source: Truist Advisory Services

2. China’s deflation tends to signal a global recession.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

3. Leading indicators suggest that factory activity will be rebounding in the months ahead.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

1. Who is talking about AI?

Source: @FactSet Read full article

Source: @FactSet Read full article

2. Exposure to AI-driven automation:

Source: Goldman Sachs

Source: Goldman Sachs

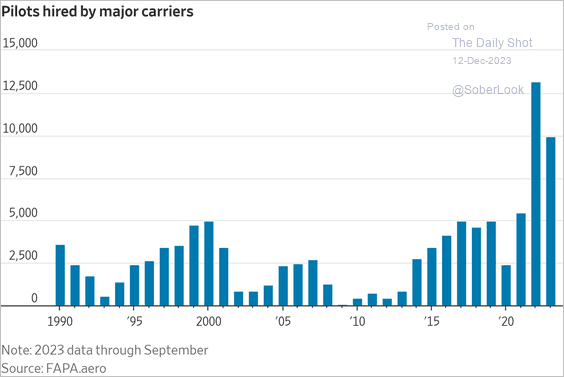

3. High demand for pilots:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Views on the death penalty:

Source: Gallup Read full article

Source: Gallup Read full article

5. Getting the news on TikTok:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

6. US land-cover changes:

Source: National Climate Assessment Read full article

Source: National Climate Assessment Read full article

7. Average length of US military service:

Source: CBO

Source: CBO

——————–

Back to Index