The Daily Shot: 13-Dec-23

• The United States

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

1. The CPI report was roughly in line with expectations, with the core inflation strengthening in November.

– Headline:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– Core:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– The supercore CPI:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Here is a quote from Nomura.

The pickup in November was largely driven by the mean-reversion in components, which surprised on the downside in October, including used autos and lodging away-from-home.

• The core CPI held steady on a year-over-year basis.

• Core goods prices declined again (2 charts).

Source: Nomura Securities

Source: Nomura Securities

• The core services inflation strengthened in November, …

… boosted by a surprise increase in the owners’ equivalent rent (OER) (see the 2nd panel below).

– OER gains were driven by some of the largest cities.

Source: Nomura Securities

Source: Nomura Securities

– On the other hand, smaller cities have been pushing up rent inflation.

Source: Nomura Securities

Source: Nomura Securities

• Here are some additional CPI components.

– New vehicles:

– Used vehicles:

– Car insurance (up 19% percent year-over-year):

Source: Scotiabank Economics

Source: Scotiabank Economics

– Electricity:

– Apparel:

——————–

2. The market reaction was muted, with the 2-year Treasury yield edging higher.

• The 10-year yield declined, …

… pushing the yield curve further into inversion territory.

• Stocks continued to surge.

——————–

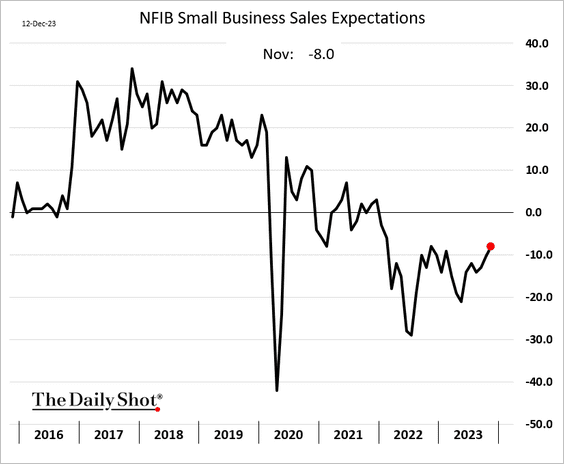

3. The NFIB small business sentiment edged lower last month.

• Sales expectations showed some improvement.

• The hiring plans index ticked up.

• More firms will be boosting wages in the months ahead.

• Fewer businesses are raising prices, …

… but more firms expect to increase prices next year.

• Credit conditions have deteriorated for small firms.

——————–

4. Consumer sentiment is rebounding.

Source: @CivicScience

Source: @CivicScience

5. The budget deficit widened last month.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The United Kingdom

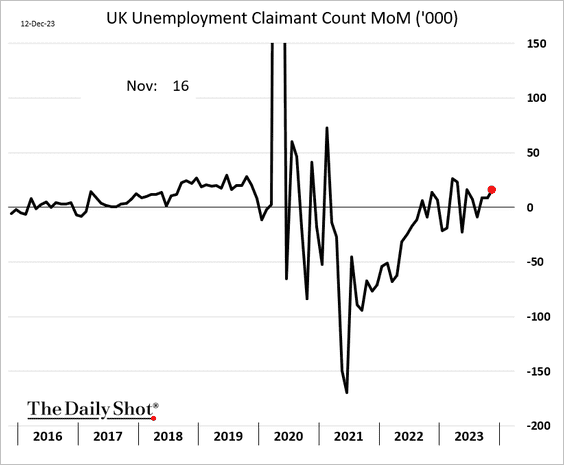

1. The ONS says it’s in the process of fixing the UK unemployment report. The data points we do have indicate a softening labor market.

• Payrolls:

• Net unemployment claims:

• Vacancies:

Wage growth slowed more than expected.

——————–

2. Bregret?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

1. Germany’s ZEW expectations index surprised to the upside again.

2. Dutch exports are down sharply on a year-over-year basis.

3. Will the euro-area credit contraction nudge the ECB to cut rates next year?

Source: @ANZ_Research

Source: @ANZ_Research

4. Growth in negotiated wages has been accelerating.

Source: Barclays Research

Source: Barclays Research

5. The PMI measures still signal a recession.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Japan

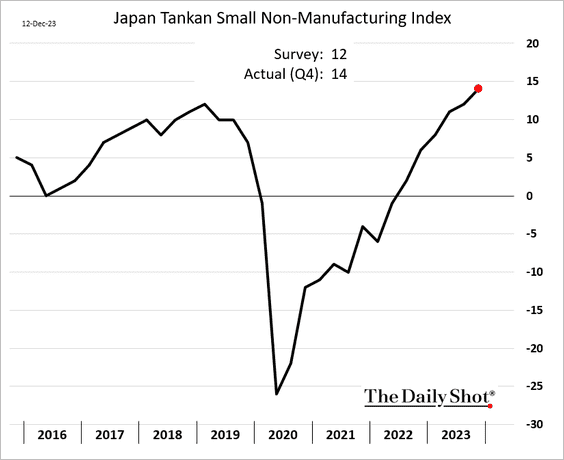

The Tankan report shows business sentiment improving this quarter.

• Large manufacturers:

• Small manufacturers:

• Large non-manufacturing firms:

• Small non-manufacturing firms:

Back to Index

China

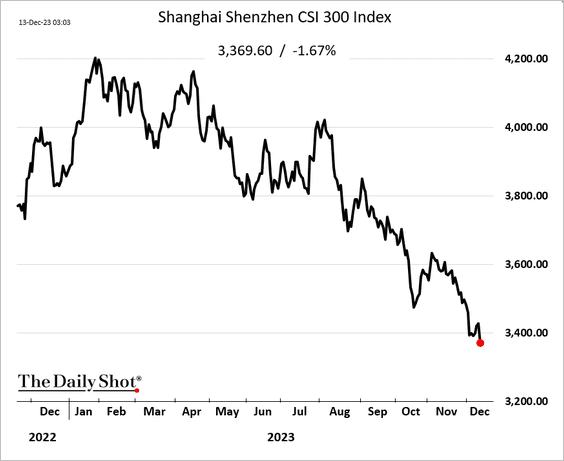

1. No bazooka stimulus means no market rebound.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

So far, the stimulus announcements haven’t been enough.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

2. China’s CPI deflation is unique.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

3. Retail volumes rebounded last month, led by luxury goods.

Source: China Beige Book

Source: China Beige Book

4. Developers’ sales remain depressed.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Real estate will remain a drag on growth for years.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Emerging Markets

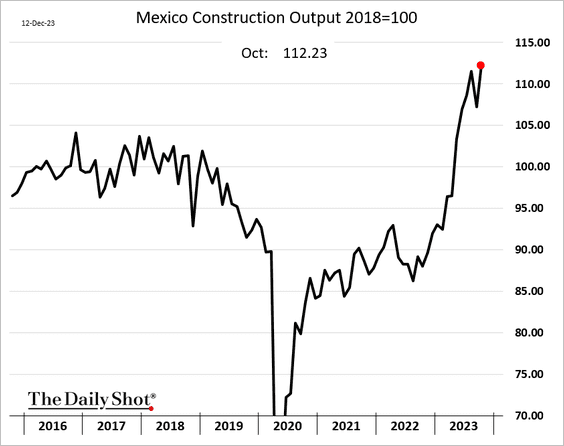

1. Mexico’s factory output edged lower in October but remained near record highs.

• The rebound in Oil & Gas production appears to be stalling.

• Construction output has been surging.

——————–

2. Brazil’s inflation declined again, suggesting more rate cuts ahead.

Here is the 2-year yield.

——————–

3. A 54% devaluation for Argentina’s currency ahead?

Source: @economics Read full article

Source: @economics Read full article

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

4. India’s industrial production accelerated in October.

Source: The Times of India Read full article

Source: The Times of India Read full article

• Inflation picked up last month but was lower than expected.

Back to Index

Energy

1. Crude oil prices continue to tumble, …

… with contango intensifying (3 charts).

• The WTI oil futures price appears oversold, although momentum remains negative.

——————–

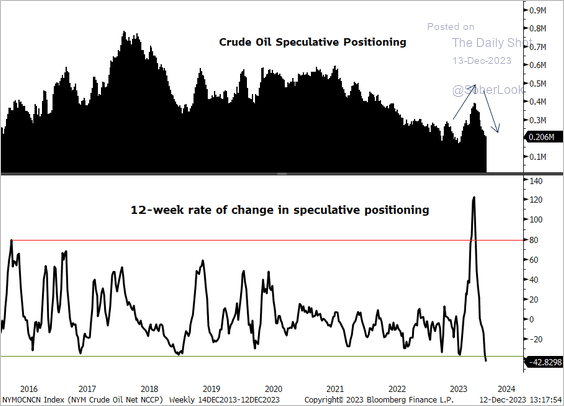

2. Crude oil speculators have quickly unwound their crowded long positions since the July-September price rally.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

3. US gasoline futures dipped below $2/gal.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

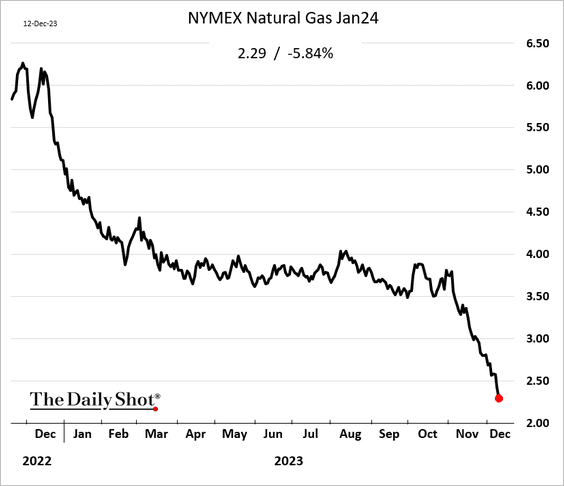

4. US natural gas futures are getting obliterated.

——————–

5. Here is a look at global LNG exports.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Equities

1. The S&P 500 hit the highest level since January of 2022. Technicals suggest that the index is overbought.

• A large number of S&P 500 stocks closed at record highs on Tuesday.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

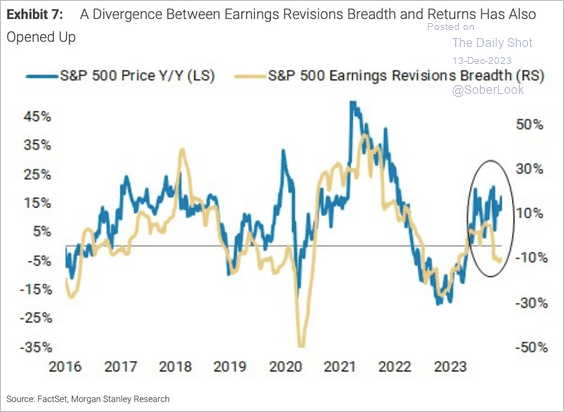

2. The S&P 500 has diverged from its earnings revision breadth.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

3. Capital Economics sees US shares continuing to outperform international markets next year.

Source: Capital Economics

Source: Capital Economics

4. Small caps tend to outperform in December.

Source: Goldman Sachs; @Marlin_Capital

Source: Goldman Sachs; @Marlin_Capital

5. Next, we have some updates on the volatility markets.

• Options average daily volume hit a record this year, …

Source: @WSJ Read full article

Source: @WSJ Read full article

… boosted by short-term contracts.

Source: @WSJ Read full article

Source: @WSJ Read full article

• VIX is nearing 12 for the first time since 2019.

Here is the 3-month VIX-equivalent.

• Relaized vol is also crashing.

• The market isn’t too worried about this week’s FOMC meeting.

Source: Nomura Securities; @WallStJesus

Source: Nomura Securities; @WallStJesus

——————–

6. One measure of market froth is the PE/VIX ratio (valuation relative to perceived risk).

Back to Index

Credit

1. “Higher for longer” will be troublesome for leveraged firms.

Source: @BW Read full article

Source: @BW Read full article

2. The quality of the US high-yield index has improved since the financial crisis…

Source: Oxford Economics

Source: Oxford Economics

…although fundamentals have weakened since the onset of the Fed’s hiking cycle.

Source: Oxford Economics

Source: Oxford Economics

——————–

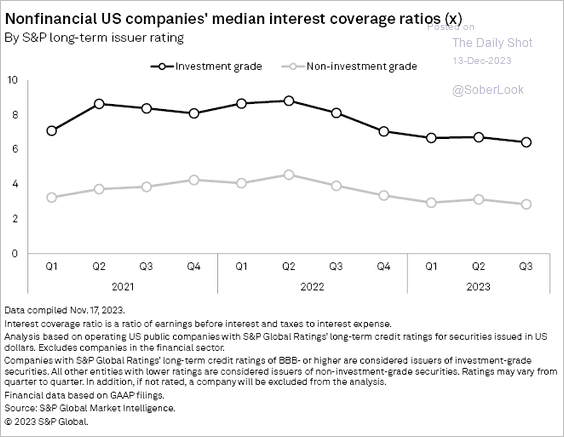

3. Interest coverage ratios are trending lower.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Global Developments

1. The sharp decline in US economic surprises relative to other G10 nations has weighed on the dollar.

Source: MRB Partners

Source: MRB Partners

2. Here is a look at government debt ownership by country.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

Food for Thought

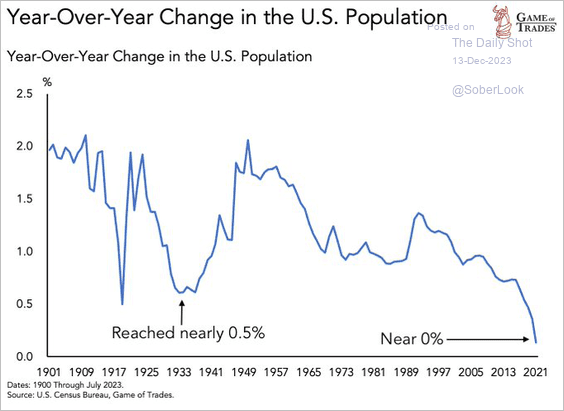

1. US population growth:

Source: @GameofTrades_

Source: @GameofTrades_

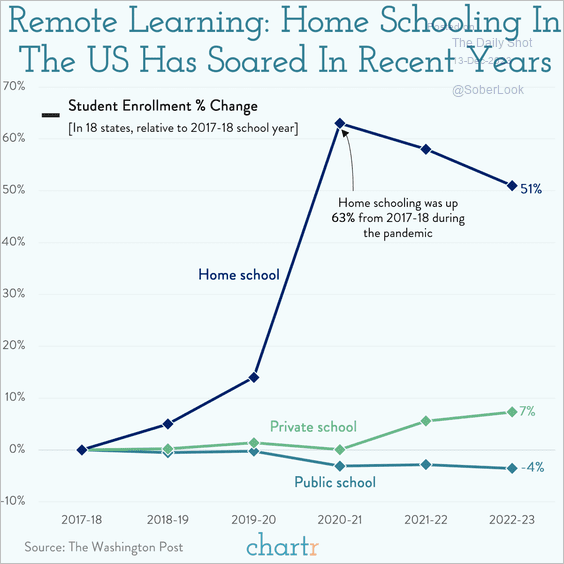

2. Homeschooling:

Source: @chartrdaily

Source: @chartrdaily

3. A failing education system?

Source: The Economist Read full article

Source: The Economist Read full article

4. Why do people immigrate to the US?

Source: Visual Capitalist

Source: Visual Capitalist

5. Afghanistan poppy cultivations:

Source: Statista

Source: Statista

6. Injuries related to Christmas decoration activities:

Source: USAFacts

Source: USAFacts

——————–

Back to Index