The Daily Shot: 14-Dec-23

• The United States

• The United Kingdom

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. The Federal Reserve finally signaled the long-awaited “pivot,” acknowledging slowing inflation …

… and starting to discuss the timing for initiating interest rate cuts.

Chair Powell: – … that begins to come into view and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today.

• The dot plot is signaling some 75 bps of rate cuts next year.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Here is the evolution of the dot plots for 2024 and 2025.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The FOMC’s inflation projections have been revised lower.

——————–

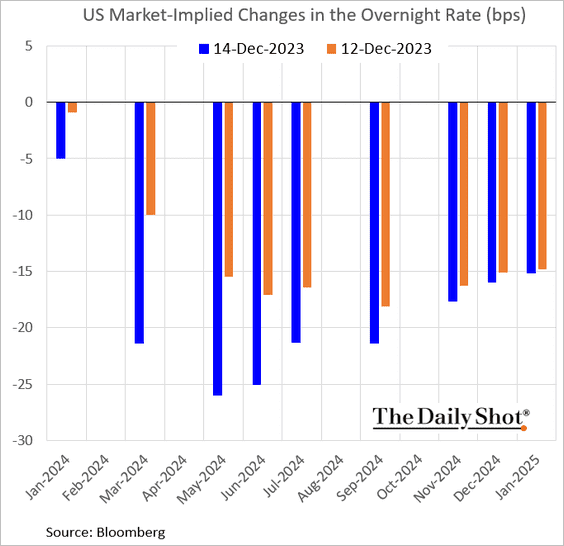

2. At the end of the day, the market was pricing in around six 25 bps rate reductions next year.

The first rate cut is slated for March (2 charts).

• Treasury yields plunged in response to the Fed’s “pivot” signal (2 charts).

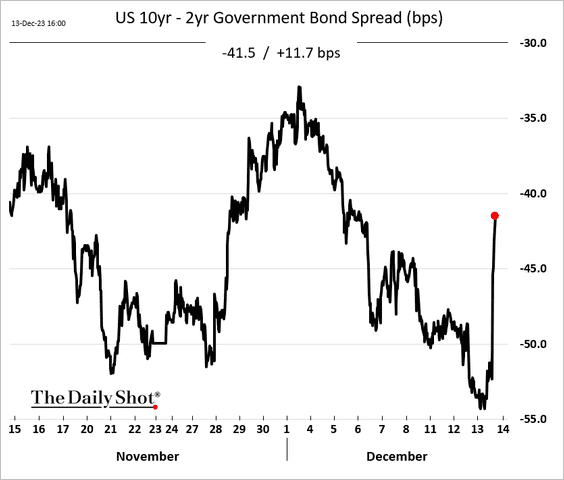

• The yield curve steepened (bull steepening).

• Real yields dropped sharply as well.

• The dollar tumbled, …

… pushing up gold prices.

• Stocks continued to surge.

——————–

3. The headline PPI index was unchanged in November.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The core PPI was below estimates.

——————–

4. Wage growth remains elevated across income groups.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

5. Mortgage applications are still at multi-year lows but have been a bit firmer.

We should see further improvements as mortgage rates dip below 7%.

Source: Mortgage News Daily

Source: Mortgage News Daily

Back to Index

The United Kingdom

1. The monthly GDP index declined in October.

All production indicators were lower.

• Services:

• Manufacturing:

• Construction:

——————–

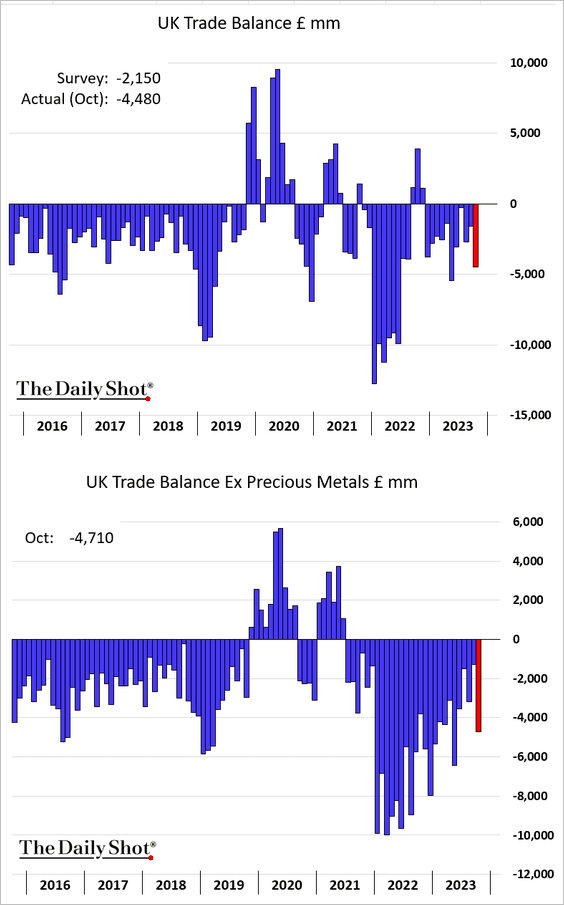

2. The trade deficit widened.

3. The RICS report showed some improvement in the housing market last month, …

… with surveyors signaling optimism.

Source: @economics Read full article

Source: @economics Read full article

Back to Index

The Eurozone

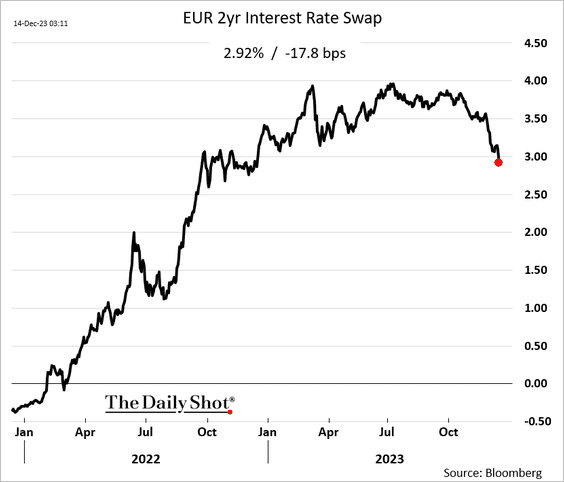

1. Bond yields and swap rates declined sharply after the Fed’s pivot. The euro jumped.

2. Euro-area industrial production declined again in October, …

Source: Reuters Read full article

Source: Reuters Read full article

… further underperforming the overall EU indicator.

Source: @EU_Eurostat Read full article

Source: @EU_Eurostat Read full article

• Germany has been a drag on the region’s industrial output (2 charts).

Source: @Gavekal

Source: @Gavekal

Source: @DanielKral1

Source: @DanielKral1

Back to Index

Asia-Pacific

1. Dollar-yen dipped below the 200-day moving average as the Fed signaled a pivot.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

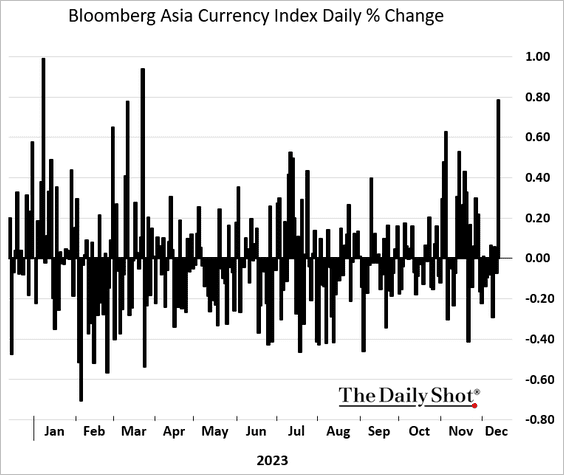

• Asian currencies surged.

——————–

2. New Zealand’s housing sales showed improvement last month.

3. Next, we have some updates on Australia.

• The jobs report topped expectations.

– The unemployment rate climbed again.

Source: Reuters Read full article

Source: Reuters Read full article

However, the unemployment increase was due in part to more people entering the labor force, as the participation rate hit a new high.

• The Aussie dollar rallied.

– Bond yields are lower in response to the FOMC.

Stocks are surging.

• Inflation expectations are easing.

Back to Index

China

1. Last month’s loan growth was softer than expected

Source: @markets Read full article

Source: @markets Read full article

This chart shows China’s aggregate financing (including bonds).

Source: Reuters Read full article

Source: Reuters Read full article

• Money supply growth continues to ease.

——————–

2. The renminbi jumped in response to the FOMC.

3. Stocks keep widening their underperformance relative to EM peers.

Back to Index

Emerging Markets

1. Let’s begin with South Africa.

• Last month’s inflation was a bit hotter than expected.

• Inflation expectations have been rising.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

• Manufacturing output declined again in October.

But mining production jumped.

• Retail sales declined.

——————–

2. India’s stocks continue to hit new highs.

3. Brazil’s central bank cut rates again as inflation moderates.

4. Argentina massively devalued the official peso exchange rate.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Inflation climbed above 160%.

Back to Index

Commodities

1. The copper/gold ratio remains in a downtrend, possibly reflecting economic growth concerns.

Source: Alpine Macro

Source: Alpine Macro

2. How did different commodity markets respond to the Fed’s pivot?

Back to Index

Energy

1. US oil inventories declined again.

• Gasoline stockpiles edged higher.

• Distillates’ inventories remain tight.

——————–

2. Energy shares continue to widen their underperformance.

3. Oil dependency has significantly declined over the past 40 years.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Equities

1. The S&P 500 is now less than 2% below its peak.

• Apple hit a record high.

• Here is the SPDR tech ETF (XLK).

– XLK saw some robust inflows this week.

——————–

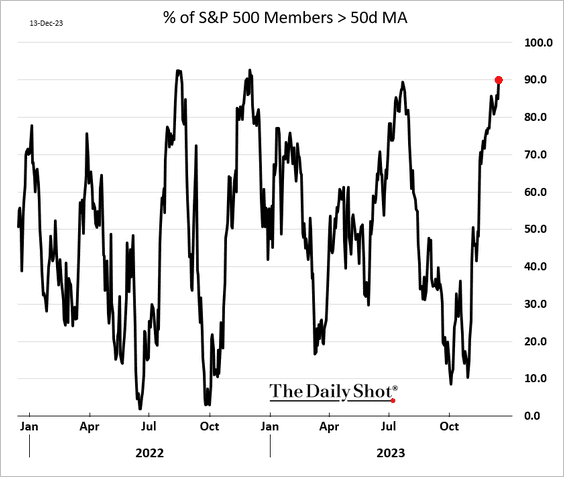

2. 90% of S&P 500 members are above their 50-day moving average.

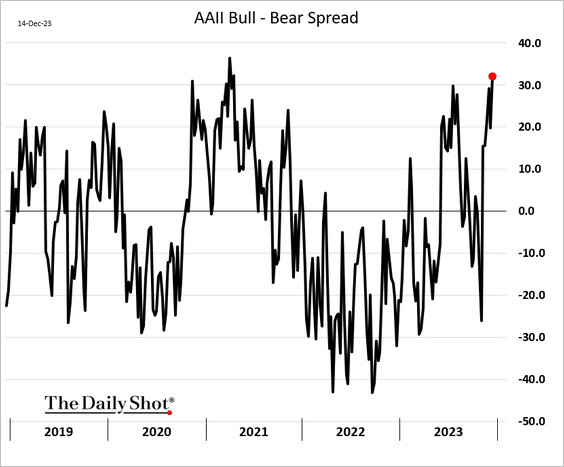

3. Retail investors haven’t been this bullish since early 2021.

4. How did stocks respond to the Fed’s pivot?

• Sectors (rate-sensitive shares outperformed):

• Equity factors (small caps have been surging):

——————–

5. Here is a look at cumulative returns during previous tech booms.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Credit

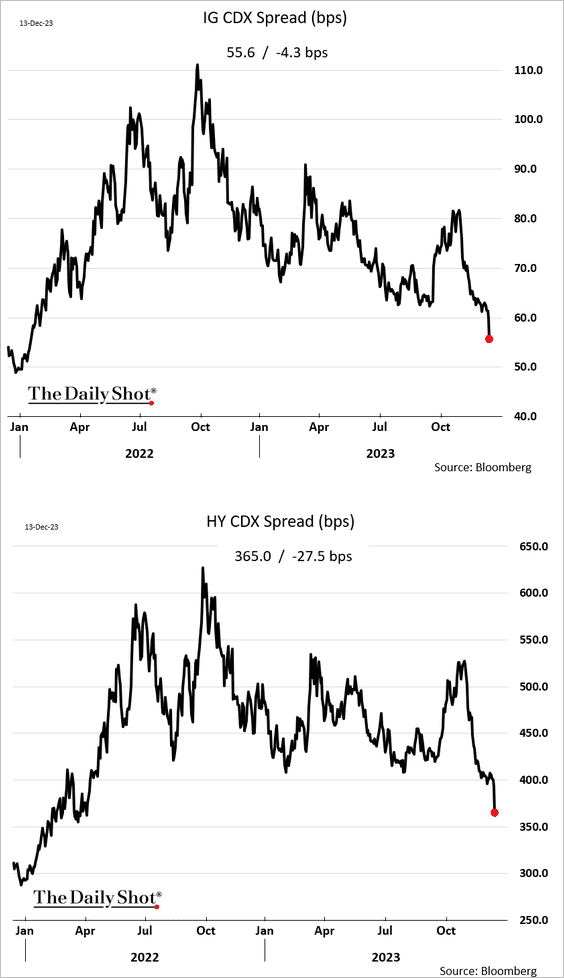

1. Credit spreads tightened sharply in response to the Fed’s pivot.

2. Here is a look at the small-cap debt maturity wall by sector.

Source: PGM Global

Source: PGM Global

3. Chapter 11 bankruptcy filings have been surging.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Rates

1. The 10-year Treasury yield dipped below its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. Last year was an extreme for the 10-year Treasury note. Even this year, bond performance has fallen into the left tail.

Source: Alpine Macro

Source: Alpine Macro

3. Based on market expectations for long-term rates, the Fed’s policy is fairly restrictive.

Furthermore, the proxy policy rate remains well above the current fed funds rate.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

1. The US dollar trade-weighted index dipped below the 200-day moving average in response to the Fed’s pivot.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. Goldman’s 2024 GDP forecasts are generally above consensus, but much more so for the US.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

1. Taking on debt to purchase holiday gifts:

Source: Bank of America Institute

Source: Bank of America Institute

2. Work-from-home rates:

Source: BofA Global Research

Source: BofA Global Research

3. International students in the US:

Source: Statista

Source: Statista

4. Does science have a positive effect on society?

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

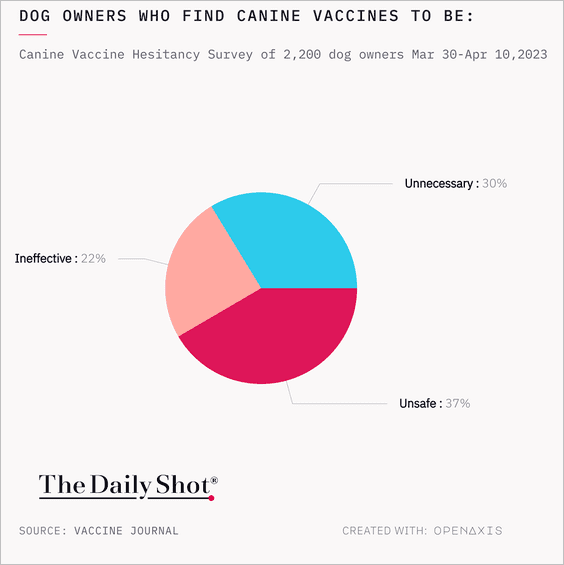

5. Views on canine vaccines:

Source: @TheDailyShot

Source: @TheDailyShot

6. How do people feel about their place in their family’s birth order?

Source: YouGov

Source: YouGov

——————–

Back to Index