The Daily Shot: 15-Dec-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

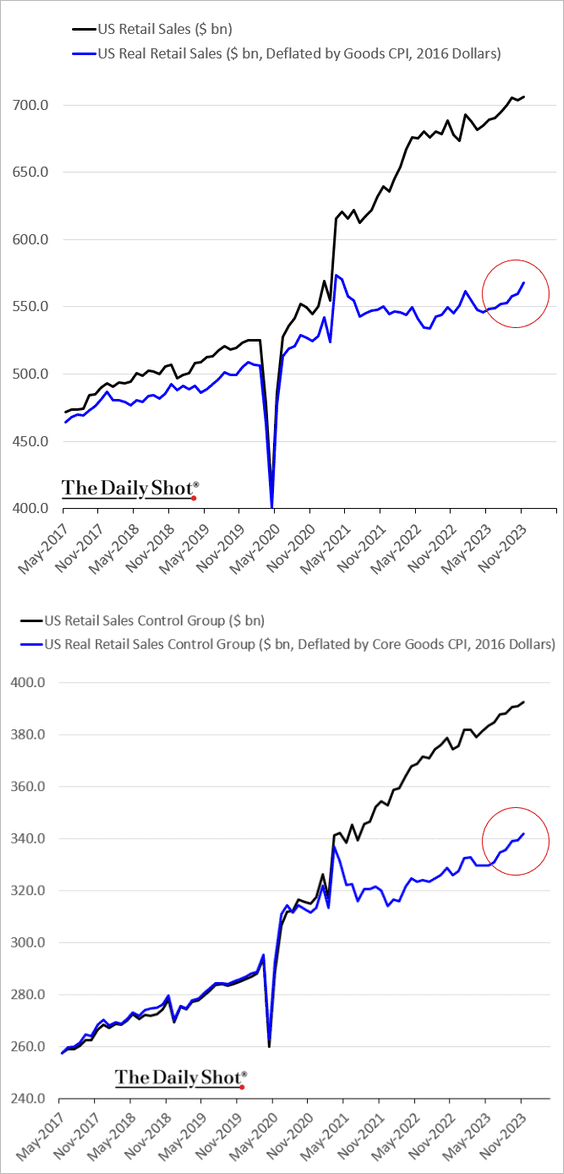

1. Last month’s retail sales exceeded expectations, signaling robust economic activity.

Source: @economics Read full article

Source: @economics Read full article

Here is the breakdown by sector (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @GregDaco

Source: @GregDaco

• Adjusted for inflation, retail sales have been accelerating.

• Separately, BofA data shows that discretionary spending remains resilient.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

And cash levels are still relatively high.

Source: Bank of America Institute

Source: Bank of America Institute

——————–

2. The GDPNow nowcast estimate for the Q4 economic growth climbed to 2.6% (annualized), …

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

… boosted by resilient consumer spending (“PCE Goods/Services”).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

3. Initial jobless claims hit a multi-year low for this time of the year.

——————–

4. Import prices unexpectedly increased last month, …

… and we could see more gains ahead due to the recent pullback in the US dollar.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

5. Fed surveys signal a reduction in CapEx.

Source: TS Lombard

Source: TS Lombard

6. Here is a look at US trade with China, Mexico, and Canada.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Canada

1. Existing home sales declined for the fifth month in a row last month.

2. Manufacturing sales dropped sharply in October.

3. Vehicle sales have been rebounding.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

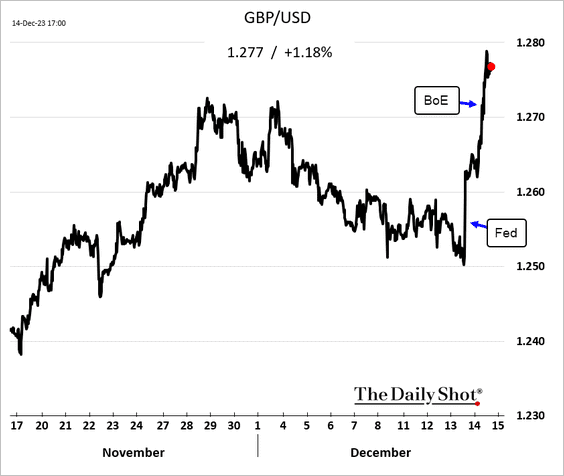

The BoE pushed back on rate cut expectations triggered by the Fed’s “pivot.”

Source: Reuters Read full article

Source: Reuters Read full article

The pound jumped.

But gilt yields continued to trend lower.

Back to Index

The Eurozone

1. The ECB also pushed back on all the talk about rate cuts. Christine Lagarde commented that we “did not discuss rate cuts at all.”

Source: Reuters Read full article

Source: Reuters Read full article

The euro climbed further, …

… making another run at the 1.10 level.

• The ECB announced plans to scale down its Pandemic Emergency Purchase Programme (PEPP) reinvestments by an average of €7.5 billion monthly throughout the latter half of 2024, with a complete cessation expected by the end of that year.

Source: @economics Read full article

Source: @economics Read full article

• The ECB lowered its forecasts for next year’s inflation.

Source: @economics Read full article

Source: @economics Read full article

——————–

2. Germany’s market-based inflation expectations have been falling.

3. Ireland has been boosting the euro area’s industrial production volatility.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. This chart shows Deutsche Bank’s forecast for the Eurozone’s hours worked.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

1. Norway’s central bank unexpectedly hiked rates despite moderating inflation.

Source: Reuters Read full article

Source: Reuters Read full article

The Norwegian krone surged.

But bond yields continue to move lower.

——————–

2. Sweden’s underlying inflation surprised to the downside.

Source: @economics Read full article

Source: @economics Read full article

——————–

3. Poland’s trade surplus topped expectations as exports exceeded last year’s levels.

4. Here is a look at electronics recycling in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

1. The PMI report showed factory activity contraction accelerating last month amid soft demand.

But services output strengthened.

——————–

2. Foreigners have taken advantage of the weak yen.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

China

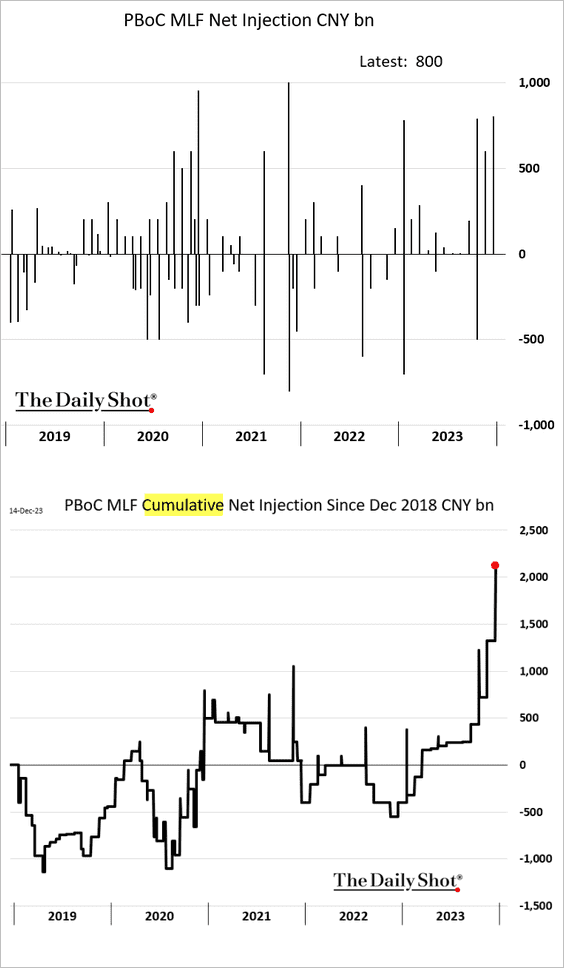

1. The PBoC accelerated liquidity injections to boost economic growth.

Source: @markets Read full article

Source: @markets Read full article

Nonetheless, the stock market is still not rebounding.

——————–

3. Economic activity has been strengthening.

• Industrial production:

• Retail sales:

Property investment and residential sales remain soft relative to recent years.

——————–

4. Economists have been downgrading their forecasts for China’s inflation next year.

Back to Index

Emerging Markets

1. Mexico’s benchmark stock market index hit a record high, boosted by the Fed’s pivot.

2. Brazil’s retail sales edged lower, but the upward trend remains intact.

3. Foreigners have been buying Turkish equities, …

… and Turkey’s domestic bonds.

Source: @markets Read full article

Source: @markets Read full article

——————–

4. Ukraine’s central bank cut rates again.

5. ASEAN and India have attracted a growing amount of foreign investment over the years.

Source: HSBC

Source: HSBC

Back to Index

Cryptocurrency

1. Cryptos gave up earlier gains this week, although bitcoin outperformed other major tokens.

Source: FinViz

Source: FinViz

2. BTC/USD maintained its uptrend from the November 2022 price low. The next key resistance level is around $48,500.

3. The Crypto Fear & Greed Index remains firmly in “greed” territory, which typically precedes price pullbacks. However, bullish sentiment is not yet extreme compared with prior cycles.

Source: Alternative.me

Source: Alternative.me

Back to Index

Energy

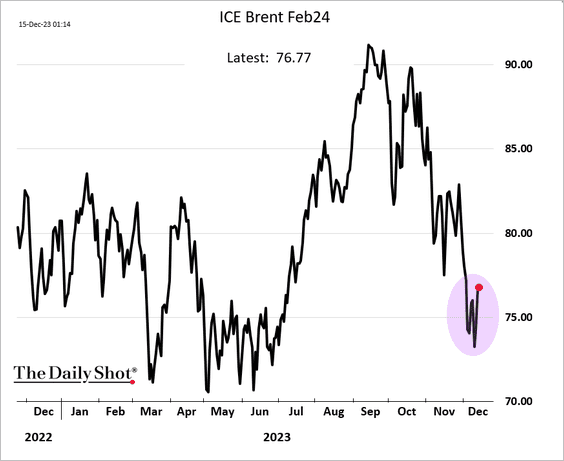

1. Crude oil bounced from the recent lows.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

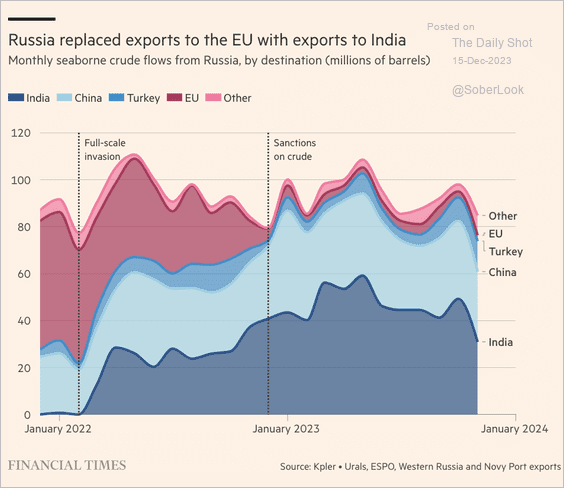

2. Who is buying Russian oil?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Who is moving Russian oil?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

3. Uranium prices keep climbing.

Back to Index

Equities

1. The rally looks increasingly stretched.

And it’s not just about the mega-caps. The average S&P 500 stock appears very overbought. Here is the equal-weight index.

However, the S&P 500 momentum remains positive. This suggests pullbacks could be contained along the uptrend from the October 2022 price low.

——————–

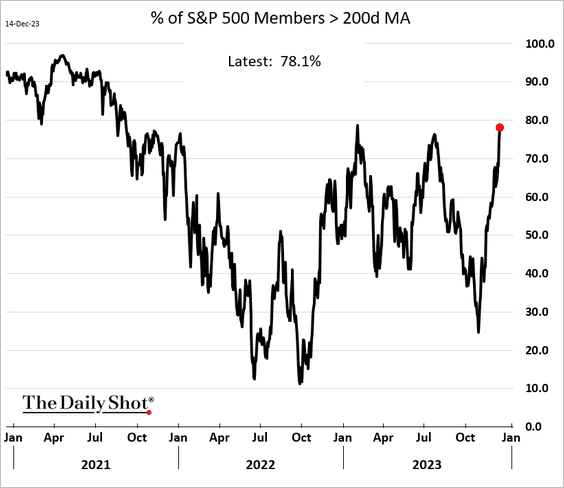

2. Market breadth has improved dramatically. Here is the percentage of S&P 500 stocks trading above their 200-day moving average.

3. Fund flows remain strong.

Source: Bank of America Institute

Source: Bank of America Institute

4. The stock/bond correlation remains elevated, although a shifting interest rate environment could help restore fixed income’s diversification benefits.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

5. Option bets on further gains in small caps are hitting record highs (IWM = Russell 2000 ETF).

It’s all about the upside, with little demand for downside protection. Here is the IWM skew.

6. The skew index on SPY (S&P 500 ETF) also points to strong demand for calls relative to puts.

7. US investors are far more optimistic about long-term stock market returns than financial professionals.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Credit

1. Morgan Stanley expects the US high-yield bond default rate to peak at 5% next year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

2. The global net rating bias improved as rising stars reached a new monthly high for the year in October, according to S&P Ratings. However, the US remains a focal point of downward pressure.

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

Rates

1. Investors are taking profits in Treasuries.

Source: Bank of America Institute

Source: Bank of America Institute

2. This chart shows private vs. official foreign holders of Treasuries.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Global Developments

1. Which countries’ stock markets are least correlated to the MSCI’s global equity index?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

2. Outside of US tech, equity valuations are not unusually high relative to history.

Source: Goldman Sachs

Source: Goldman Sachs

3. Asia continues to lead in electric vehicle sales.

Source: HSBC

Source: HSBC

——————–

Food for Thought

1. US clothing and footwear imports:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

2. Commercial jetmakers’ order backlog:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

3. US projected population by race and ethnicity:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Support for legalizing marijuana:

Source: Gallup Read full article

Source: Gallup Read full article

5. What kills birds?

Source: @lararhiannonw, @opinion Read full article

Source: @lararhiannonw, @opinion Read full article

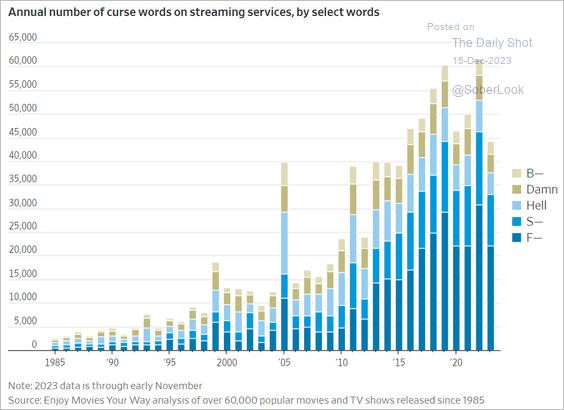

6. Number of curse words on streaming services:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Have a great weekend!

Back to Index