The Daily Shot: 20-Dec-23

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

Administrative Update

Please note that The Daily Shot will not be published next week (from December 25th to January 1st).

Back to Index

The United States

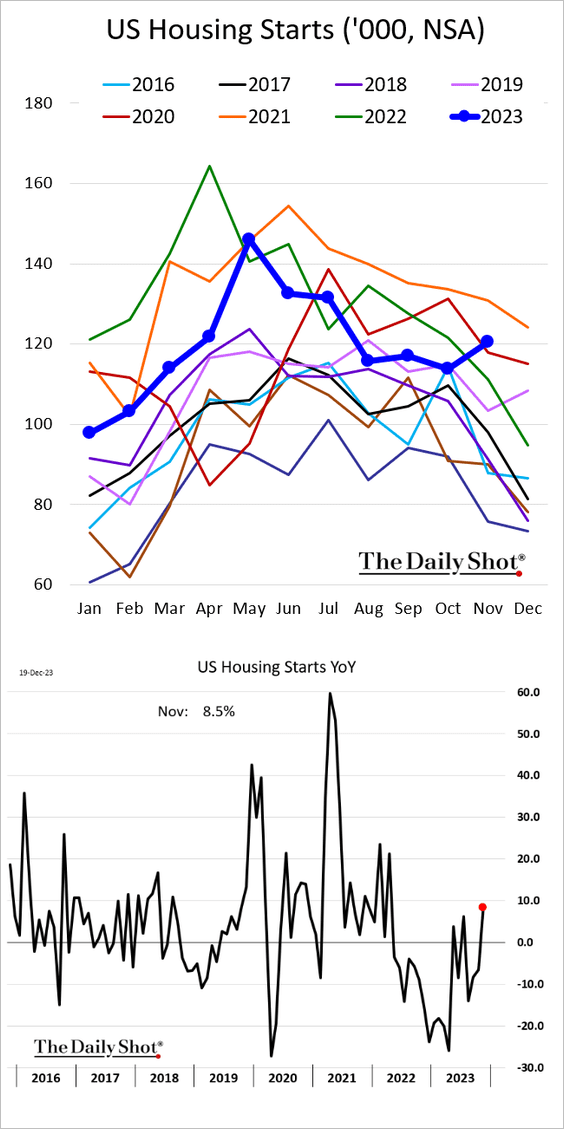

1. Last month’s residential construction data exceeded expectations, boosted by single-family housing.

Single-family housing starts were up almost 44% relative to 2022 (2nd panel).

Source: Reuters Read full article

Source: Reuters Read full article

• Will we see a jump in new home sales?

Source: Capital Economics

Source: Capital Economics

• Building permits were not as impressive.

– The overall index:

– Single-family:

– The divergence between single-family starts and permits does not look sustainable.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Multi-family housing activity remains depressed.

– Multifamily units under construction appear to have peaked.

——————–

2. Strong housing starts boosted the Atlanta Fed’s GDPNow estimate for the current quarter’s economic growth.

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

3. Next, we have some updates on inflation.

• The Cleveland Fed’s median CPI measure remains elevated.

• Here is a look at the food-at-home vs. food-away-from-home CPI components.

Source: BofA Global Research

Source: BofA Global Research

• Nomura expects a soft core PCE inflation print for November (estimate based on the CPI and the PPI reports).

Source: Nomura Securities

Source: Nomura Securities

• Freight rates are stabilizing.

Source: Cass Information Systems

Source: Cass Information Systems

• Longer-term market-based inflation expectations have been moderating.

• Hospital inflation faces upside risks as wages surge.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Used vehicle prices will be a drag on the CPI in the months ahead.

Source: Oxford Economics

Source: Oxford Economics

——————–

4. New business applications remain elevated relative to pre-COVID levels.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Canada

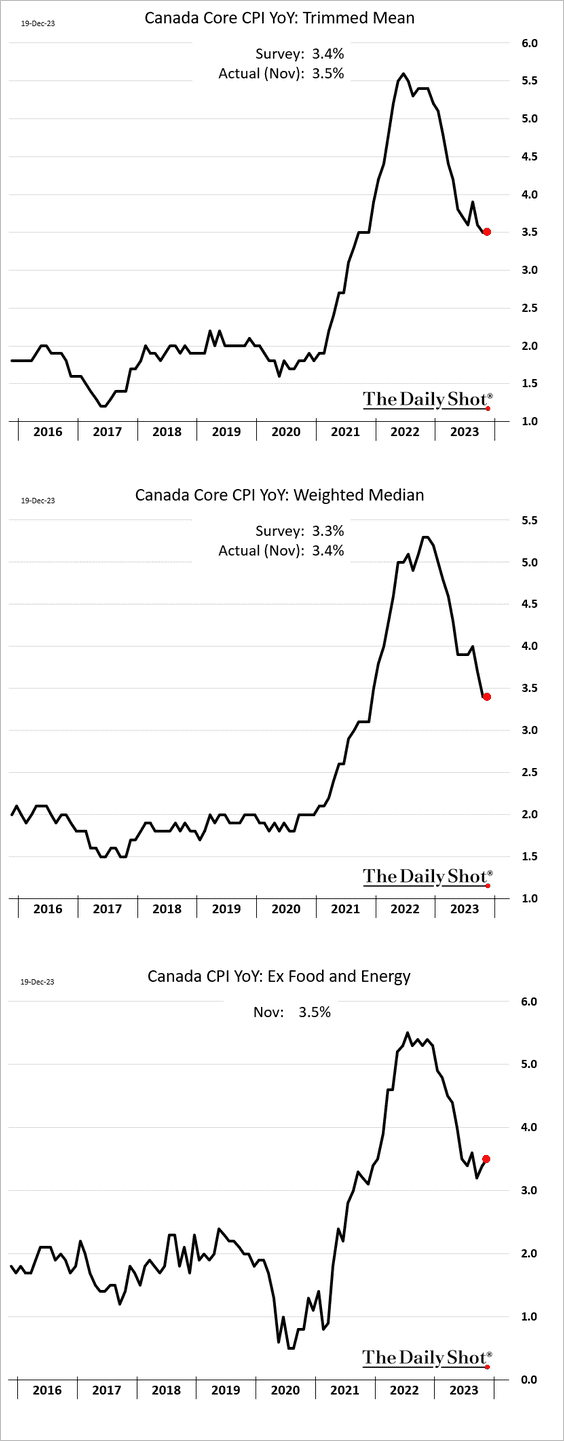

1. The CPI report topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article

• Core inflation measures were also above forecasts.

– Services inflation remains elevated, …

Source: Desjardins

Source: Desjardins

…as rental costs continue to surge.

Source: Scotiabank Economics

Source: Scotiabank Economics

• Wages have been outpacing inflation.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

2. The Canadian dollar climbed further in response to the CPI report.

Back to Index

The United Kingdom

1. According to CBI, the contraction in UK industrial orders slowed this month.

Price pressures are moderating.

——————–

2. The FTSE 100’s valuation is among the cheapest in the G10.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

UK government bonds also trade at the cheapest levels in the G10 relative to neutral rate estimates.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

3. UK rental price inflation has sharply deviated from that of the Eurozone.

Source: ING

Source: ING

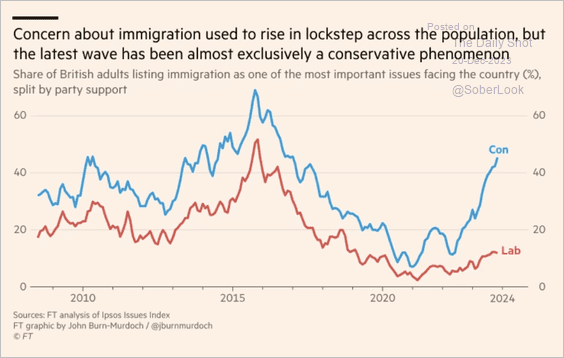

4. Who is concerned about immigration?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

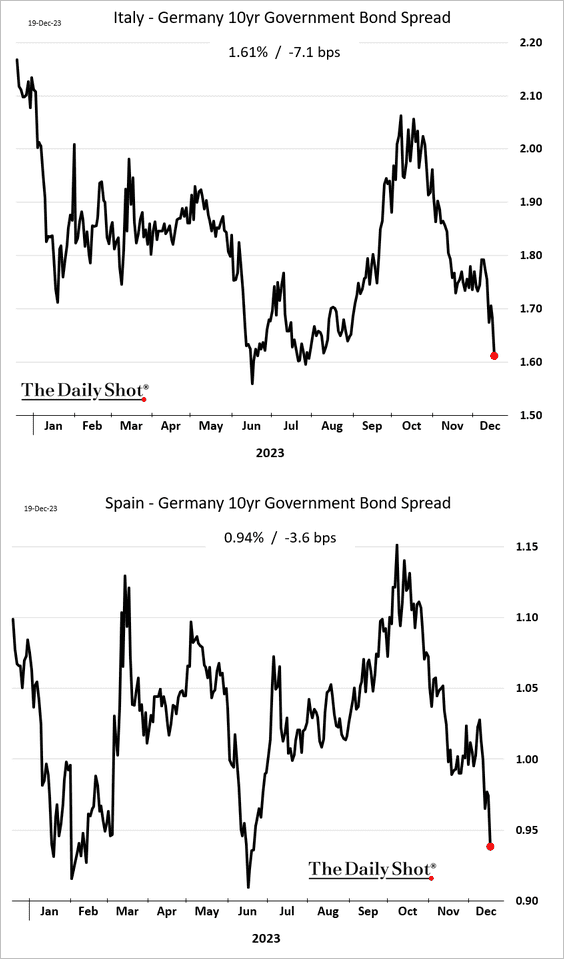

1. Sovereign spreads have been tightening on ECB rate-cut bets.

2. Euro-area wage indicators have peaked.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. The Eurozone fiscal stance is becoming more restrictive.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Next, let’s take a look at some inflation trends.

• CPI dispersion:

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

• Attributions:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Europe

1. Corporate bankruptcies have been rising.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

2. Here is a look at inflation rates across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

3. Which countries are most dependent on exports?

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

1. Amid scant indications of the BoJ tightening its monetary policy in the near term, JGB yields are falling.

The curve has been flattening.

——————–

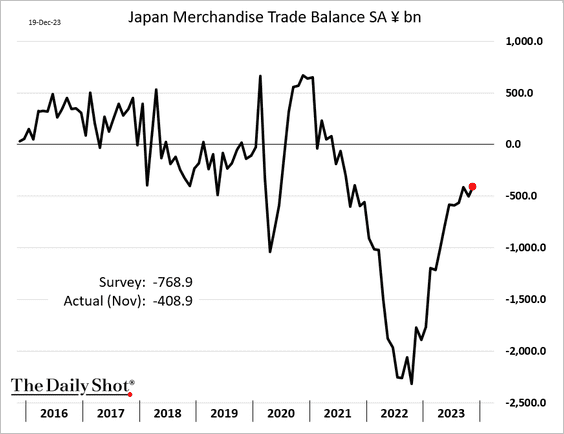

2. The trade gap was narrower than expected in November.

Exports were slightly below 2022 levels.

Back to Index

China

1. The stock market selloff persists as investors lose confidence in Beijing’s stimulus efforts.

2. Aggregate government spending is contracting despite fiscal stimulus.

Source: BCA Research

Source: BCA Research

3. The real lending rate has increased even though the nominal rate has declined.

Source: BCA Research

Source: BCA Research

• Softer loan approvals signal slower credit growth ahead.

Source: Longview Economics

Source: Longview Economics

——————–

4. China has been buying a lot of coal.

Source: @JKempEnergy

Source: @JKempEnergy

Back to Index

Emerging Markets

1. Several central banks cut rates this week.

• Chile:

• Colombia:

• Hungary:

——————–

2. The recent trough in cyclical indicators points to improving EM earnings.

Source: Alpine Macro

Source: Alpine Macro

3. EM relative fund outflows have been extreme. Will we get a reversal next year?

Source: Oxford Economics

Source: Oxford Economics

4. Here is a look at China’s loans to poor countries.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Commodities

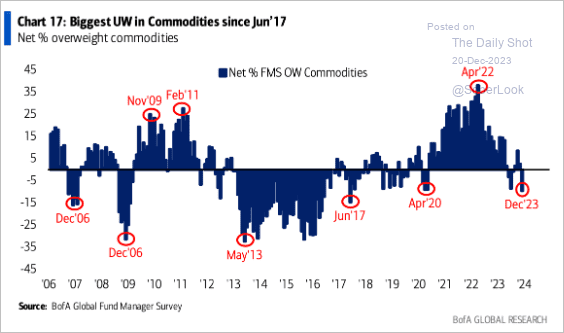

1. Fund managers are underweight commodities.

Source: BofA Global Research

Source: BofA Global Research

2. Very large ships, such as those carrying dry bulk and LNG, are having problems moving through the Panama Canal.

Source: Capital Economics

Source: Capital Economics

3. Due to threats posed by the Houthis, shipping companies are increasingly diverting vessels destined for Europe to alternative routes.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

4. The heatwave linked to El Niño is baking Brazil’s coffee-growing regions, raising concerns about potential crop losses. Coffee futures are surging.

Back to Index

Energy

1. Brent crude is headed toward $80/bbl as Suez Canal-bound vessels are pausing or rerouting.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

2. Time for a breakout for WTI crude?

h/t @MikeZaccardi

h/t @MikeZaccardi

3. Fund managers are underweight in energy.

Source: BofA Global Research

Source: BofA Global Research

4. Here is a look at oil reserves.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Equities

1. It’s been 493 trading days since the S&P 500 hit an all-time high. Almost there.

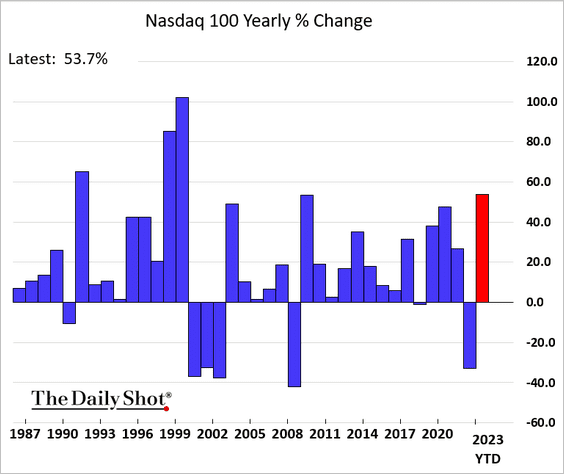

2. The Nasdaq 100 is up almost 54% this year.

3. Fund managers have increased their equity exposure relative to cash.

Source: BofA Global Research

Source: BofA Global Research

4. Next, we have some updates on small caps.

• The S&P 600 (small-cap index) is now outperforming the average S&P 500 stock year-to-date.

• Microcaps are lagging.

• Valuations look attractive.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Small-cap profits relative to assets have been trending lower.

Source: @markets Read full article

Source: @markets Read full article

——————–

5. Foreigners dumped US stocks in October and have been playing catchup since.

6. Companies focused on ESG have underperformed this year.

7. The average equity ETF is up roughly 15% since the October market low but down over 7% since the end of 2021.

Source: Strategas

Source: Strategas

Back to Index

Credit

1. High-yield spreads continue to trend lower.

2. Leveraged loans are still outperforming high-yield bonds year-to-date.

• It’s been a good year for BDCs.

——————–

3. Over the past six weeks, the Fed’s bank term funding program (BTFP) and discount window loans increased, suggesting that some banks still have a liquidity problem.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Rates

1. Given the increased T-bills issuance, the Fed’s pivot timing is helpful.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

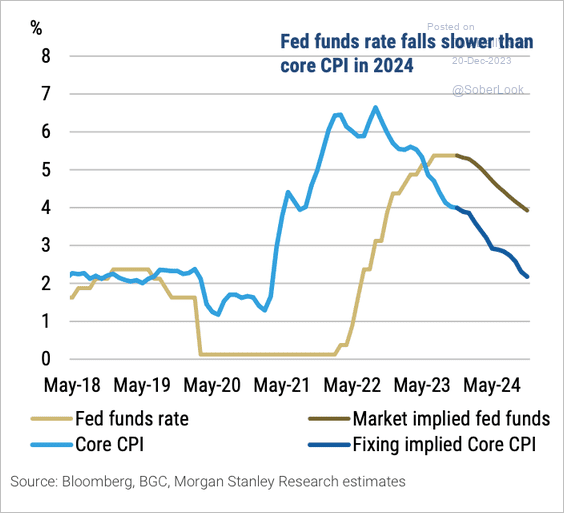

2. The fed funds rate is expected to decline at a slower pace than core CPI next year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

3. The US real yield curve is not yet signaling a recession.

Source: Alpine Macro

Source: Alpine Macro

——————–

Food for Thought

1. Views on the US justice system:

Source: Gallup Read full article

Source: Gallup Read full article

2. A record number of people will witness elections in their countries next year.

Source: The Economist Read full article

Source: The Economist Read full article

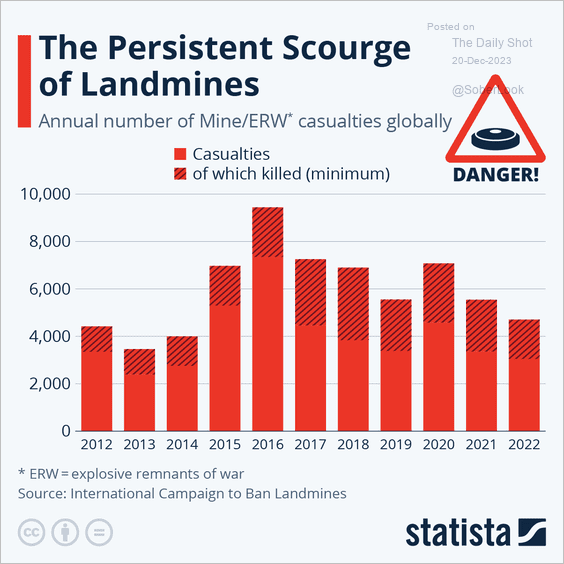

3. Landmine casualties:

Source: Statista

Source: Statista

4. Tech megacaps’ revenue components:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

5. Companies with the longest employee tenure:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

6. States that decorate the most for Christmas and the most popular decoration in each state:

Source: Lombardo Homes Read full article

Source: Lombardo Homes Read full article

——————–

Back to Index