The Daily Shot: 19-Dec-23

• The United States

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

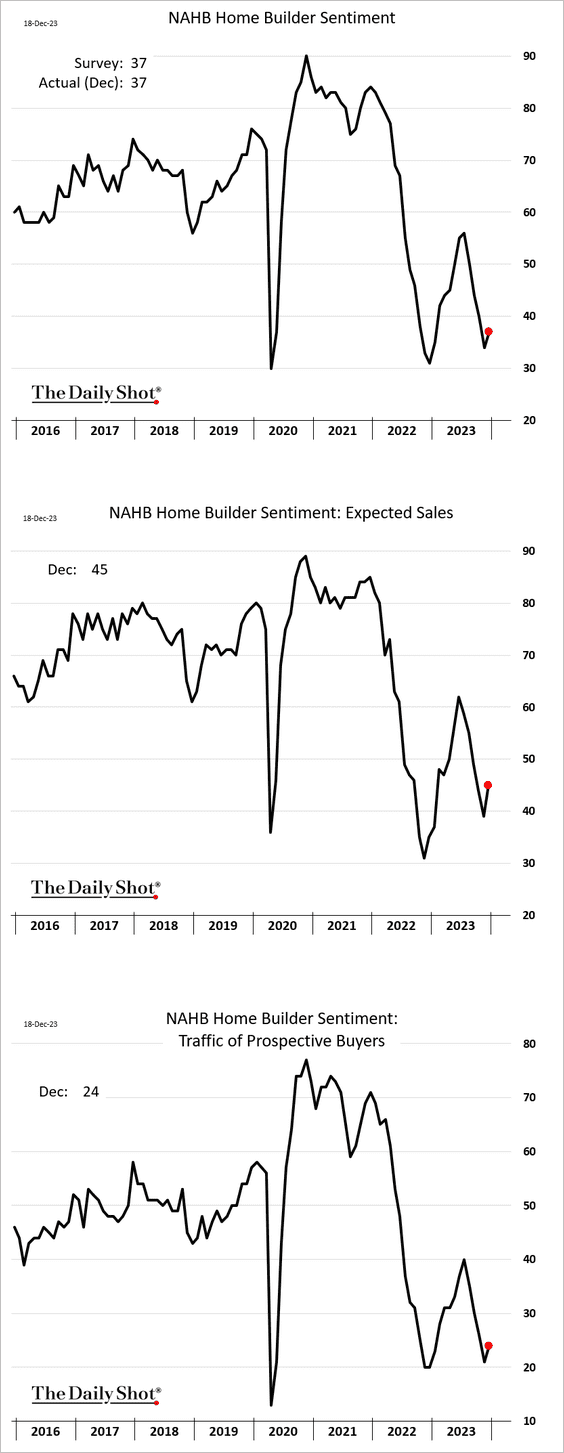

1. Let’s begin with the housing market.

• The NAHB homebuilder sentiment index showed a modest improvement this month, driven by a pullback in mortgage rates.

Source: Reuters Read full article

Source: Reuters Read full article

• Asking prices for newly-listed homes are well above last year’s levels.

Source: Redfin

Source: Redfin

• CoreLogic sees home price appreciation running below 3% next year.

Source: CoreLogic

Source: CoreLogic

• Over 41% of household income now goes into mortgage payments for recently purchased homes.

Source: Redfin

Source: Redfin

• The proportion of mortgage-free homes has been rising.

Source: @axios Read full article

Source: @axios Read full article

——————–

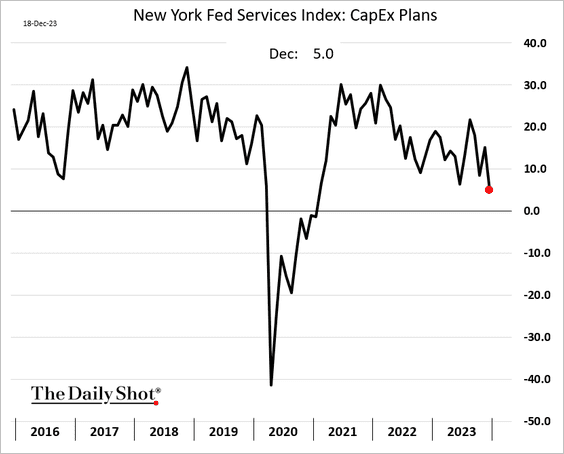

2. Next, let’s take a look at the regional service-sector report from the NY Fed.

• The overall index remains in contraction territory, …

… with companies starting to reduce staff.

• Fewer companies are raising wages.

• Input costs are moderating, …

… but more firms expect to boost prices in the months ahead.

• The index of CapEx expectations hit the lowest level since 2021.

——————–

3. At the national level, the World Economics SMI index remains in growth mode.

Source: World Economics

Source: World Economics

4. The stock market is pricing in a sharp rebound in US manufacturing activity.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

5. The NFIB (small business) data points to wage growth accelerating next year.

![]() Source: @MikaelSarwe

Source: @MikaelSarwe

6. Too many “soft landing” stories out there?

Source: TS Lombard

Source: TS Lombard

• Goldman remains upbeat on US GDP growth next year.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

The Eurozone

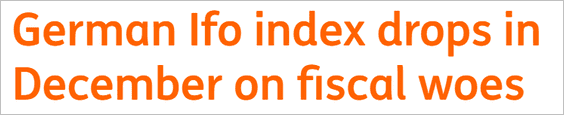

1. Germany’s Ifo Business Climate indicator unexpectedly declined this month.

Source: ifo Institute

Source: ifo Institute

Source: ING Read full article

Source: ING Read full article

——————–

2. The Eurozone’s trade balance has been rebounding as energy prices eased.

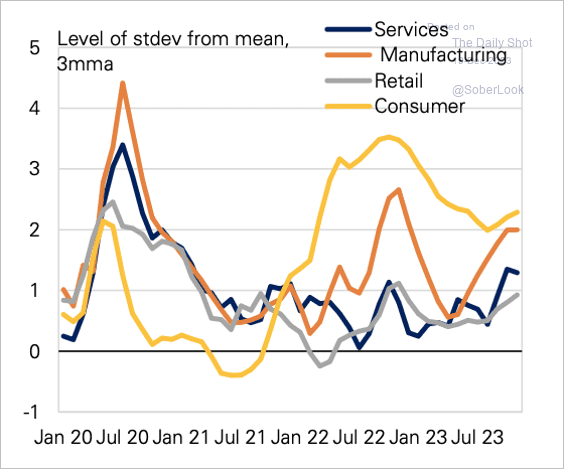

3. Economic uncertainty is highest within the euro area consumer sector.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4. Most euro area corporate debt is financed through banks and is mostly fixed for a short duration. This makes corporate borrowers more sensitive to changes in interest rates, especially more so than the US.

Source: Vanguard Read full article

Source: Vanguard Read full article

Back to Index

Europe

1. Here is a look at vacancy rates across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

2. This scatterplot shows COVID-era GDP and consumption growth.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

Japan

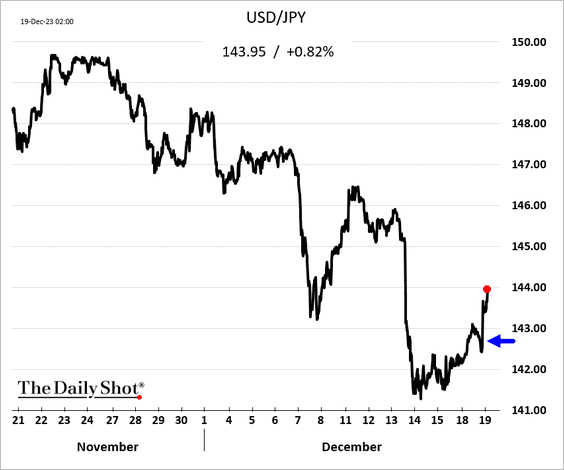

1. Despite all the rumors of policy tightening, the BoJ did not signal a rate hike ahead.

Source: @markets Read full article

Source: @markets Read full article

The yen dropped.

——————–

2. Wage growth has been picking up.

Source: Scotiabank Economics

Source: Scotiabank Economics

3. Rising shareholder proposals signify an enhancement in Japan’s stock market conditions.

Source: Matthews Read full article

Source: Matthews Read full article

4. Chinese tourists are starting to return.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

China

1. The equity risk premium for both onshore and offshore Chinese stocks remains very low.

Source: BCA Research

Source: BCA Research

• China’s underperformance versus India continues to widen.

——————–

2. The World Economics SMI report shows manufacturing contraction but faster services growth this month.

Source: World Economics

Source: World Economics

3. Households are sitting on a lot of cash.

Source: Longview Economics

Source: Longview Economics

4. The M1-to-M2 ratio has been falling, which suggests that banking-sector liquidity is not translating into loan growth.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Emerging Markets

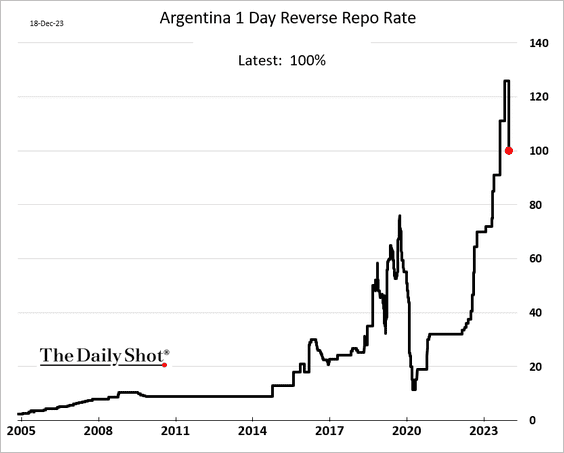

1. Argentina cut rates after the massive currency devaluation.

Source: @economics Read full article

Source: @economics Read full article

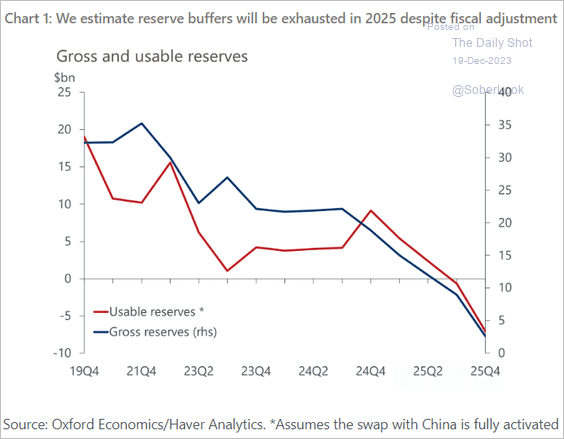

The nation is expected to run out of foreign reserves in 2025.

Source: Oxford Economics

Source: Oxford Economics

——————–

2. Colombia’s economy is contracting.

3. South Africa’s real loan growth is negative again.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

4. EM government bonds have outperformed US government bonds as the dollar weakened.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

Cryptocurrency

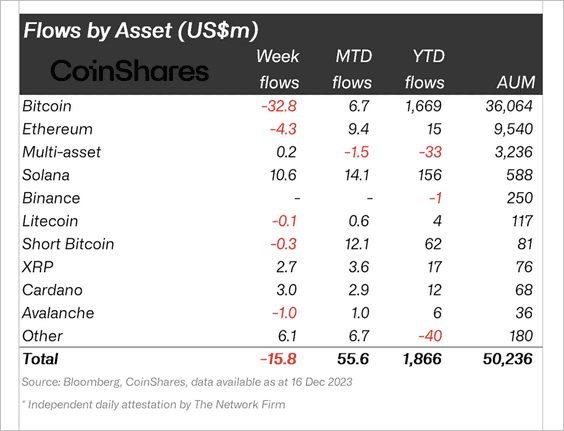

1. Crypto funds saw minor outflows, ending an 11-week run of inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Bitcoin and Ethereum-focused funds saw outflows last week, while some altcoin funds bucked the trend.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

2. The SOL/ETH price ratio is trending higher.

Source: @KaikoData

Source: @KaikoData

3. Historically, bitcoin has deviated -40% by year-end from its annual price peak. So far, BTC is hovering near its yearly high, similar to 2016 and 2020.

Source: @KaikoData

Source: @KaikoData

4. The market for tokenized Treasury bills significantly increased this year.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

5. Here is a look at blockchain-based private credit.

Source: @crypto Read full article

Source: @crypto Read full article

Back to Index

Commodities

1. UK sanctions on Russia are causing headaches for the LME.

Source: @markets Read full article

Source: @markets Read full article

Traders are rushing to deliver Russian metal to the LME.

——————–

2. Nippon is making a massive bet on steel demand in the US.

Source: @markets Read full article

Source: @markets Read full article

3. Gold prices are still negatively correlated with US real yields but at higher levels.

Source: Oxford Economics

Source: Oxford Economics

4. Sugar futures are in bear-market territory.

Back to Index

Energy

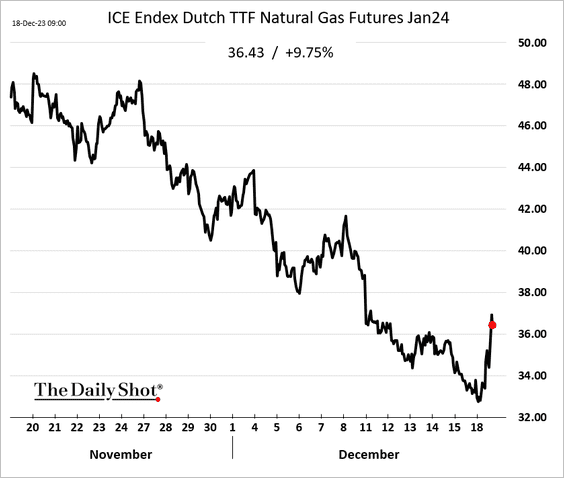

1. The Houthi threat is disrupting shipping markets, …

Source: Reuters Read full article

Source: Reuters Read full article

… which boosted natural gas prices in Europe.

• The overall shipping costs to Europe have risen.

Source: Gavekal Research

Source: Gavekal Research

• Shipping companies’ shares are higher.

——————–

2. Crude oil positioning has become very cautious.

Source: @markets Read full article

Source: @markets Read full article

Source: HFI Research

Source: HFI Research

CTAs are now net short.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Equities

1. A gain of 1.2% from here will bring the S&P 500 to its record-high close. The RSI indicator is now deep in overbought territory.

2. Deutsche Bank’s positioning index shows investors becoming more overweight on stocks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Bullish options bets have increased in most sectors, especially financials.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

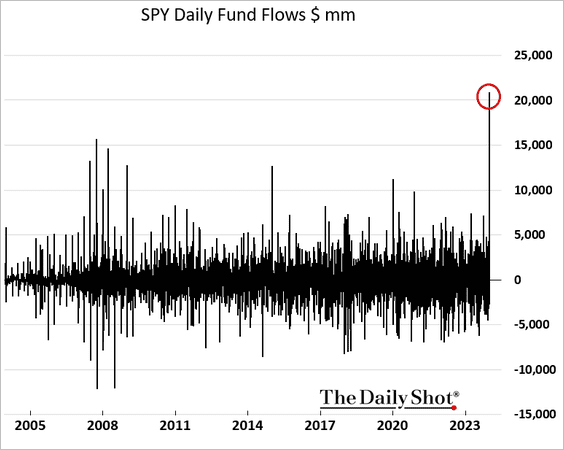

3. The SPDR S&P 500 ETF (SPY) saw a record spike in inflows last Friday (SPY is the largest ETF).

4. The Fed’s “pivot” brought out the Reddit crowd. Speculative stocks have been surging.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

SPACs are back.

——————–

5. Long-duration stocks have been outperforming.

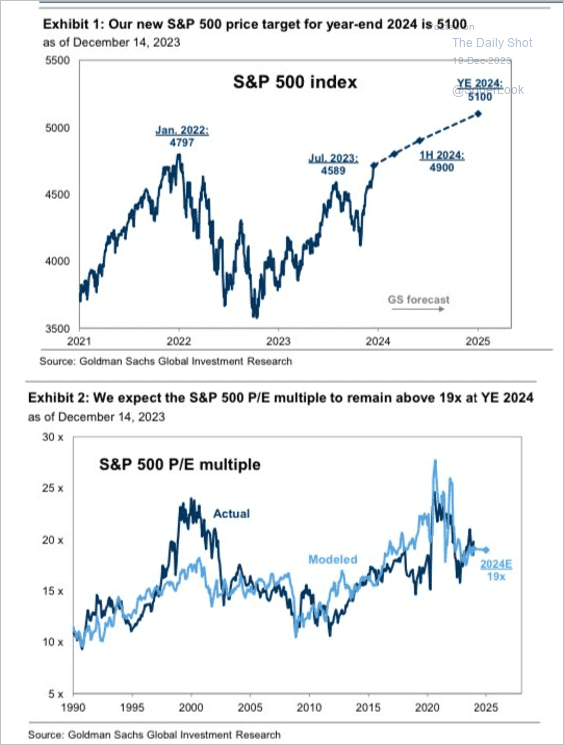

6. Goldman sees more gains for the S&P 500 next year, targeting 5100 by the end of 2024.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

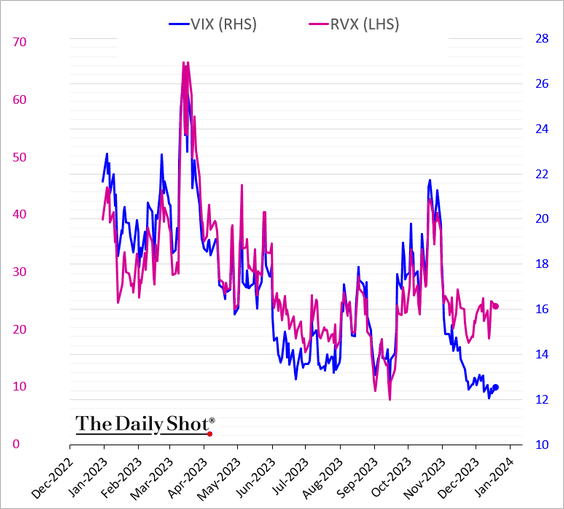

7. Demand for small-cap options created a sharp divergence between VIX and RVX (Russell 2000 VIX equivalent).

——————–

8. The largest seven stocks now represent almost 30% of the S&P 500’s market cap.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Credit

1. High-yield bonds are still outperforming investment-grade corporate debt year-to-date.

2. Munis haven’t been this expensive relative to Treasuries since 2021.

Back to Index

Rates

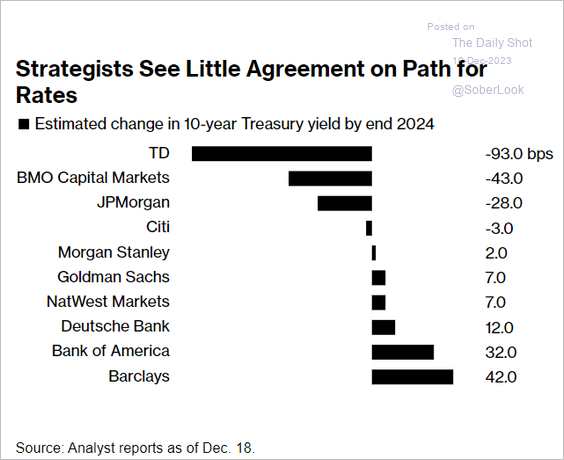

1. There is little agreement on the direction of Treasury yields next year.

Source: @markets Read full article

Source: @markets Read full article

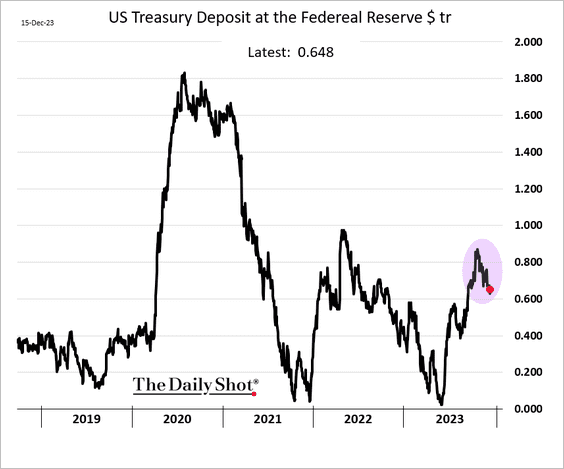

2. The Fed’s RRP facility balances continue to shrink as money markets prefer T-bills and private repo.

The US Treasury’s cash balances at the Fed have also been declining.

• As a result, reserve balances have surged (which tends to be a tailwind for stocks).

• More liquidity in the private markets (driven by the above trends) has been boosting bank deposits.

——————–

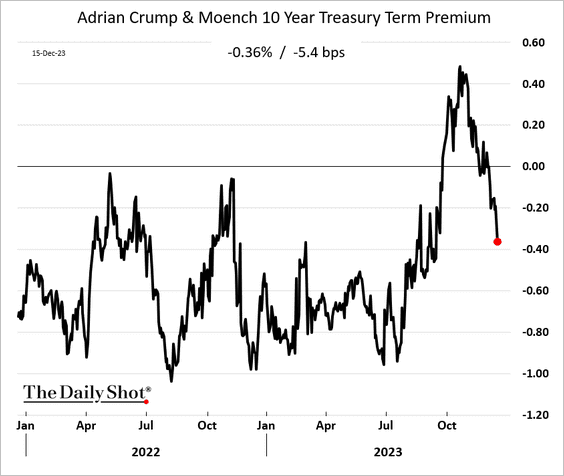

3. Treasury term premium continues to sink.

4. The bond/equity correlation implies an estimate of the neutral rate (r*) in a 1.25%-1.50% range.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

1. Office construction starts:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

2. Global fertiliser use:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

3. Shoplifting incidents:

Source: Statista

Source: Statista

4. Inmigration and outmigration rates:

Source: US Census Bureau

Source: US Census Bureau

5. US population by age:

Source: @WSJ Read full article

Source: @WSJ Read full article

6. China’s continuing reliance on coal:

Source: @JKempEnergy

Source: @JKempEnergy

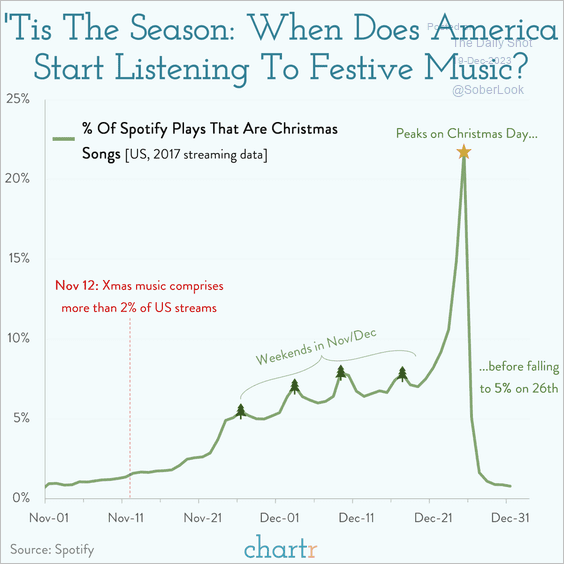

7. Listening to festive music:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index