The Daily Shot: 22-Dec-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The Daily Shot will not be published next week (from December 25th to January 1st).

The United States

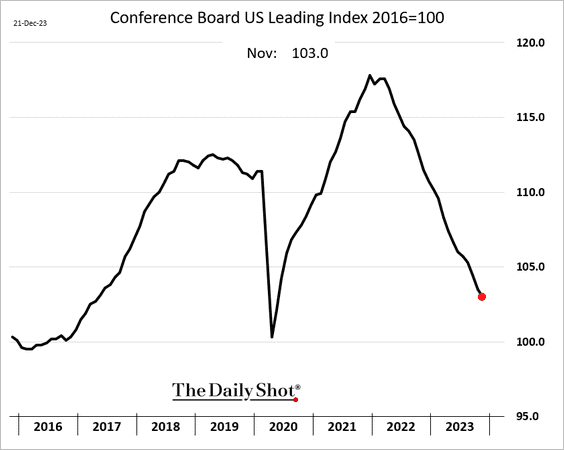

1. The Conference Board’s index of leading indicators has declined for 20 months in a row.

• The six-month changes in the leading index continue to signal a recession.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The sharp decline in leading indicators versus coincident indicators is consistent with the lead-up to past recessions.

Source: Variant Perception

Source: Variant Perception

• This chart shows the six-month changes in the soft and hard data components.

Source: Oxford Economics

Source: Oxford Economics

• Here are the contributions to the November changes.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

2. The second revision to the Q3 GDP growth takes us back to the figure reported in the initial release (4.9%). But the composition has changed.

• The quarterly core PCE inflation was revised lower (back at the Fed’s 2% target).

——————–

3. There are concerns that inflation could re-accelerate next year, following the late 1970s trajectory.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

• A rebound in wage growth could trigger faster inflation.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

• Here is a look at the average starting wage offer in the private sector.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

4. Initial jobless claims remain exceptionally low for this time of the year.

Here are the continuing jobless claims.

——————–

5. The Philly Fed’s regional manufacturing index moved deeper into contraction territory this month as demand slumped.

• This report points to further weakness in factory activity at the national level (ISM).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Manufacturers are more upbeat about future demand.

• CapEx plans hit the lowest level since the GFC.

——————–

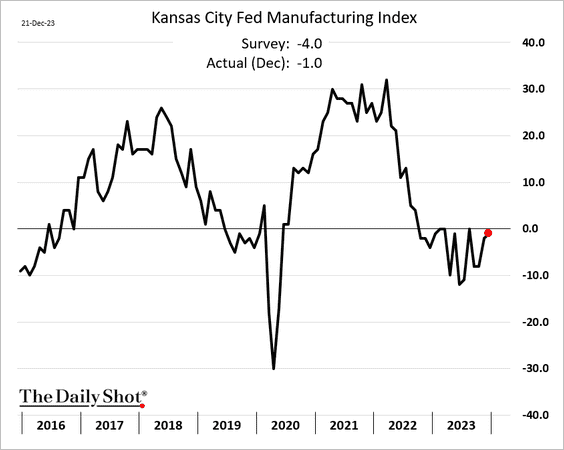

6. The Kansas City Fed’s manufacturing index shows signs of stabilization in the region’s factory activity.

• Employment:

• Expected shipments:

——————–

7. Debt refinancing, excess cash, and healthier household balance sheets have limited the pass-through of higher US interest rates.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Canada

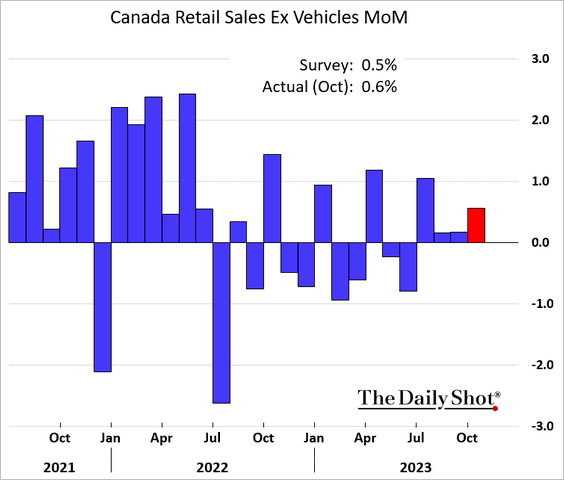

1. Retail sales grew in October.

2. Will the BoC deliver rate cuts in Q2?

Source: Desjardins

Source: Desjardins

3. What is the expected impact of mortgage resets (at much higher rates) on mortgage payments?

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

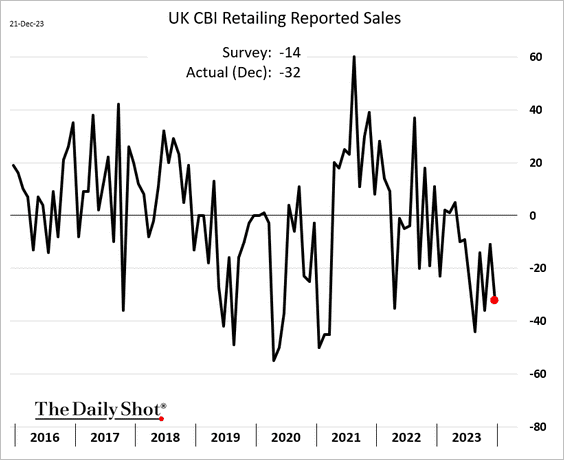

1. Retail sales have been weak this month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Public sector borrowing was higher than expected in November.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @economics Read full article

Source: @economics Read full article

——————–

3. Will we see a bounce in mortgage approvals?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

1. French manufacturing sentiment strengthened this month, contradicting the PMI data.

• Real retail sales continue to trend lower.

——————–

2. Spain’s mortgage lending is down 27.5% relative to 2022.

3. The EU’s new fiscal requirements are much more gradual.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

4. This chart shows the UN’s forecasts for the working-age population.

Source: Capital Economics

Source: Capital Economics

Back to Index

Europe

1. Sweden’s consumer confidence improved again this month but remains at exceptionally low levels.

Manufacturing sentiment hit the lowest level since the initial COVID shock.

Here is the Economic Tendency Indicator.

Economists expect virtually no economic growth in Sweden next year.

——————–

2. The Czech central bank cut rates for the first time since 2020.

Short-term bond yields moved lower.

——————–

3. Here is a look at top EU airports.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

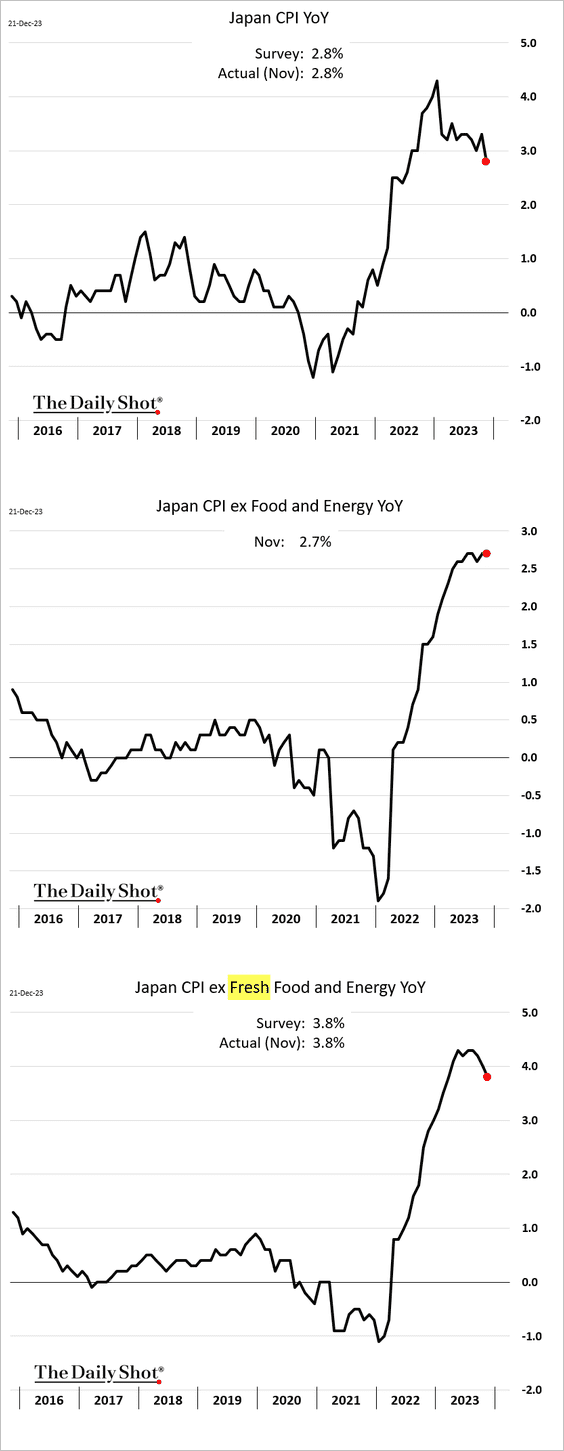

Japan

1. The CPI eased in November, in line with forecasts. Core inflation remains sticky.

Services CPI continues to accelerate.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. The Japan-US monetary policy divergence will be a tailwind for the yen.

Source: BCA Research

Source: BCA Research

Back to Index

China

1. Tech stocks are under pressure in Hong Kong as Beijing goes after the gaming industry.

Source: @technology Read full article

Source: @technology Read full article

——————–

2. China’s 30-year bond yield reached a multi-year low.

Source: @markets Read full article

Source: @markets Read full article

——————–

3. Utilized foreign direct investment slumped in November (multi-year lows).

Source: @economics Read full article

Source: @economics Read full article

——————–

4. It will be a while before China’s economy catches up to the US.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Emerging Markets

1. Mexican inflation continues to moderate.

2. Last quarter, Argentina’s unemployment rate reached a new low.

• Economic activity declined by less than expected in October.

——————–

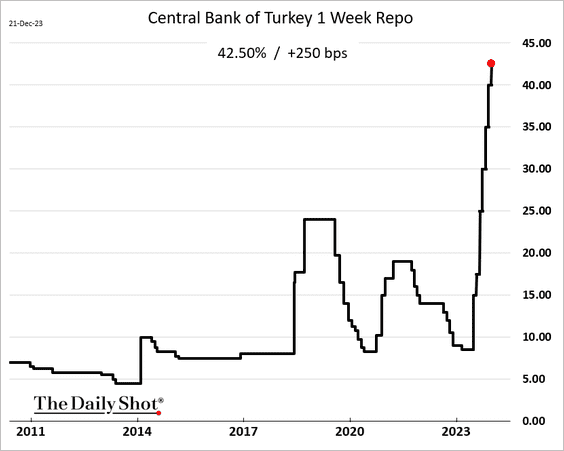

3. Turkey’s central bank hiked rates again, this time by 250 bps.

The lira devalution continues.

——————–

4. India’s consumer credit has exploded in recent years.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Delinquencies are rising.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

5. What are the external financing requirements across EM economies (as a percentage of FX reserves)?

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

1. Cryptos rallied this year, with Bitcoin outperforming while Litecoin’s LTC lagged.

Source: FinViz

Source: FinViz

2. Here is a comparison of risk-adjusted returns this year.

Source: @KaikoData

Source: @KaikoData

3. The rally since late October is responsible for most of crypto’s gains.

Source: Glassnode Read full article

Source: Glassnode Read full article

4. So far, BTC’s max drawdown this year has been shallow relative to previous cycles.

Source: Glassnode Read full article

Source: Glassnode Read full article

Ether saw a deeper drawdown than bitcoin but still less than previous cycles.

Source: Glassnode Read full article

Source: Glassnode Read full article

——————–

5. Only 27% of altcoins outperformed BTC this year.

Source: BlockchainCenter

Source: BlockchainCenter

Back to Index

Commodities

1. The current commodity bull market is behaving similarly to past cycles.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

2. The commodities/stock ratio remains in a long-term downtrend.

3. Iron ore futures continue to rally.

4. The selloff in sugar futures has been relentless.

Back to Index

Equities

1. Market sentiment is now extremely bullish.

• Retail investors:

• Investment managers:

Source: NAAIM

Source: NAAIM

——————–

2. The uptrend in global equities remains intact, with early signs of improving breadth.

Source: MRB Partners

Source: MRB Partners

3. 72% of S&P 500 members have underperformed the index this year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Here is the breakdown by sector.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

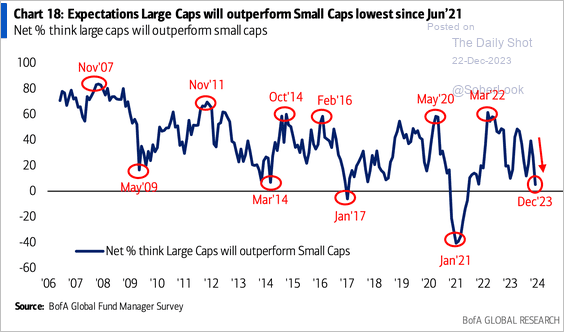

4. Fund managers are less sure about large caps outperforming small caps.

Source: BofA Global Research

Source: BofA Global Research

5. Active managers have been increasingly tracking the benchmark.

Source: BofA Global Research; @dailychartbook

Source: BofA Global Research; @dailychartbook

6. US stocks continue to outperform their global counterparts. The US’s proportion of the global market capitalization is reaching new highs.

Source: Merrill Lynch

Source: Merrill Lynch

7. Global factor ETFs have become increasingly popular over the years.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

8. Dealers’ call option delta exposure has been rising.

Source: @DaTaChArTGuY, @Nomura

Source: @DaTaChArTGuY, @Nomura

9. Finally, here is a look at US stock market cycles over the past 60 years.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Credit

1. Banks’ borrowings from the Fed’s emergency facility keep climbing.

Source: @markets Read full article

Source: @markets Read full article

• The chart below shows the unequal distribution of US bank reserves. This could magnify tail risks for funding as small banks also increase their demand for reserves, pushing overnight funding rates higher, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

2. BofA’s private clients have been buying high-yield ETFs.

Source: BofA Global Research

Source: BofA Global Research

3. Companies’ liquidity positions are still relatively strong.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

4. US CLOs’ share of the leveraged loan market climbs above 70%.

Source: @theleadleft

Source: @theleadleft

5. CMBS debt has underperformed other credit asset classes this year.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

Back to Index

Rates

1. Investors continue to dump Treasury Inflation-Protected Securities (TIPS).

Source: BofA Global Research

Source: BofA Global Research

Here are the assets of the iShares TIPS Bond ETF (TIP).

——————–

2. Fund managers are bullish on bonds.

Source: BofA Global Research

Source: BofA Global Research

3. Treasury coupon issuance is projected to rise sharply next year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• A substantial shift to more coupons and fewer bills means more duration will need to be absorbed by the market.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Treasury borrowing over the coming quarters will be on par with pandemic-era levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

4. Treasury funds saw record inflows in 2023.

Source: BofA Global Research

Source: BofA Global Research

5. Here is Morgan Stanley’s forecast for the Fed’s policy rate over the next couple of years.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Global Developments

1. The NY Fed’s Global Supply Chain Pressure Index is rebounding as the Suez Canal attacks escalate.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

2. 2023 was a good year for global bonds.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

3. Here is a look at fund flows by asset class in 2023.

Source: BofA Global Research

Source: BofA Global Research

4. A rebound in global inflation ahead?

Source: @JeffreyKleintop

Source: @JeffreyKleintop

5. The global manufacturing slump appears to be ending.

Source: Oxford Economics

Source: Oxford Economics

6. 2024 will be a busy election year around the world.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

Food for Thought

1. Homeowners vs. renters, by income:

Source: Quill Intelligence

Source: Quill Intelligence

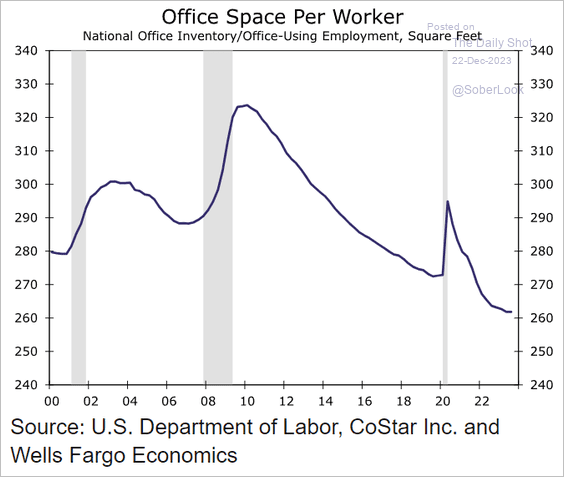

2. Office space per worker:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

3. US wood-pellet exports:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Walmart’s thin margins:

Source: @chartrdaily

Source: @chartrdaily

5. Weekly hours worked:

Source: @JonSteinsson

Source: @JonSteinsson

6. Top New Year’s resolutions for 2024:

Source: Statista

Source: Statista

7. Favorite Christmas cookie:

Source: Monmouth University Read full article

Source: Monmouth University Read full article

——————–

The Daily Shot will not be published next week (from December 25th to January 1st).

Happy holidays!

Back to Index