The Daily Shot: 05-Jan-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Alternatives

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the labor market.

• The December ADP private payrolls index surprised to the upside.

The ADP report is generally not a good predictor of the official payrolls data, …

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

… but the market took notice of the ADP report.

Here are some ADP sector trends.

– Manufacturing:

– Leisure & Hospitality:

– Healthcare:

By the way, the latest PMI figures suggest that the healthcare sector activity accelerated last month, boosting job creation.

Source: S&P Global PMI

Source: S&P Global PMI

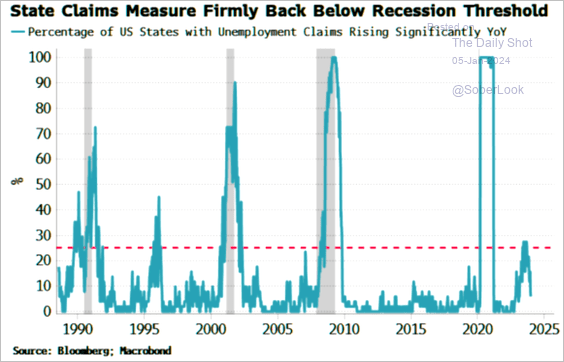

• Initial jobless claims ended the year on a strong note (multi-year lows).

– This chart shows the continuing unemployment claims.

– Fewer states are reporting significant increases in continuing jobless claims.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

• What should we expect from today’s payrolls report?

– Here are some estimates.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

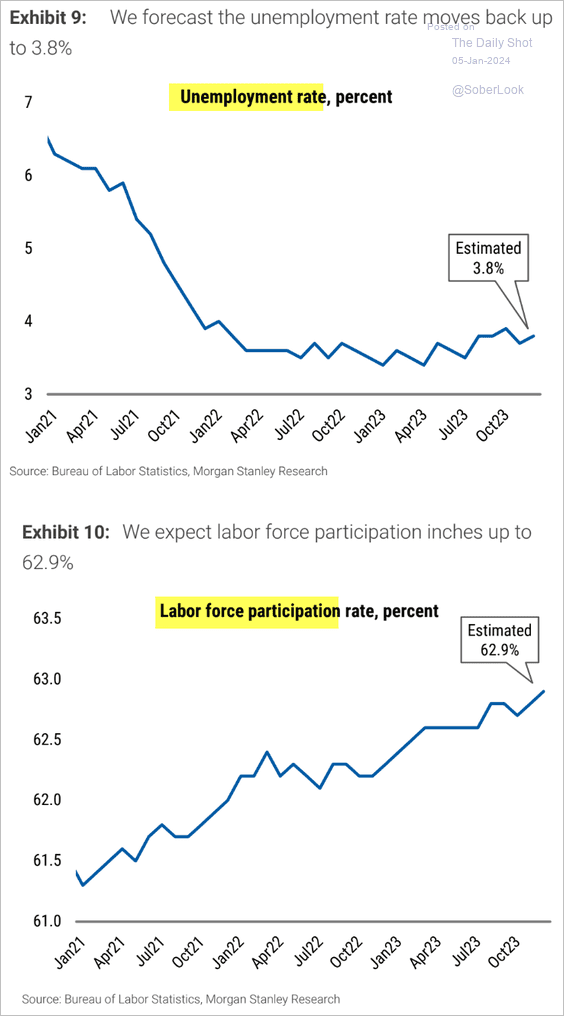

– Below is Morgan Stanley’s forecast.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Morgan Stanley sees the unemployment rate edging higher (1st panel) as more Americans enter the labor force (2nd panel).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

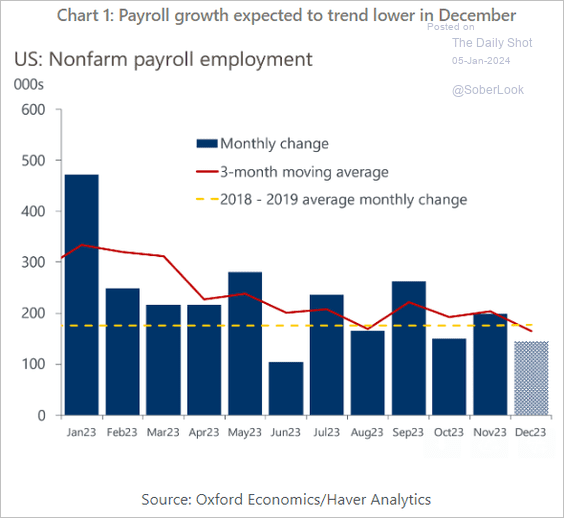

– Oxford Economics sees 135k new jobs created last month.

Source: Oxford Economics

Source: Oxford Economics

– Here is Goldman’s longer-term forecast.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Hiring has been concentrated in a few industries (2 charts). Note that a significant portion of government hiring consists of public school teachers.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Source: Oxford Economics

Source: Oxford Economics

• This chart shows the foreign-born share of the US labor force.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

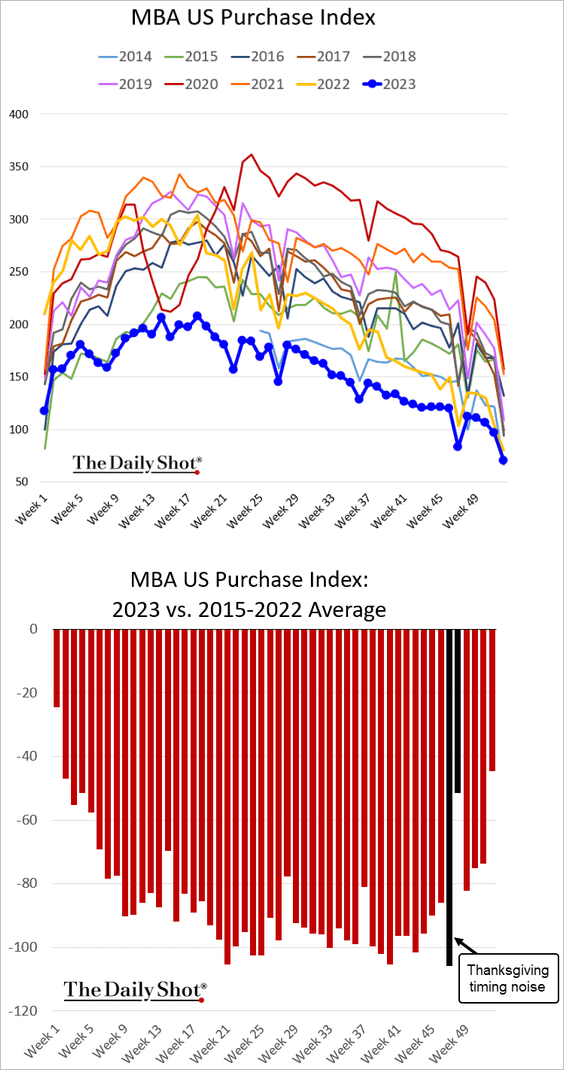

2. Next, we have some updates on the housing market.

• Mortgage applications were (relatively) firmer going into the year-end.

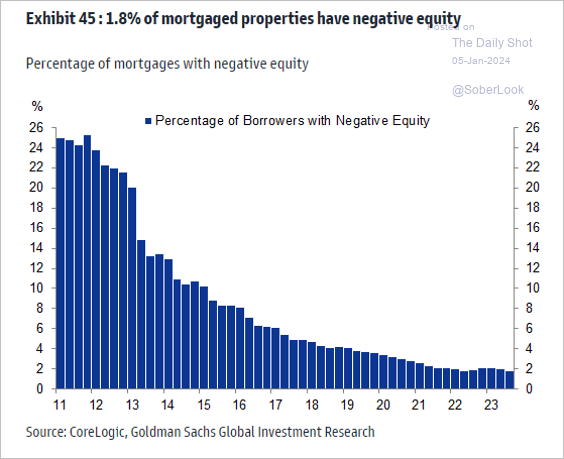

• Very few mortgage properties have negative equity.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Traffic of prospective homebuyers appears to be stabilizing, although overall housing conditions remain unaffordable. (2 charts)

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

• Goldman sees mortgage rates remaining elevated for years, …

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

… keeping housing affordability low.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

3. Consumer sentiment has been improving.

Source: Penta-CivicScience Index

Source: Penta-CivicScience Index

4. There are a lot of news articles mentioning “soft landing.”

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Canada

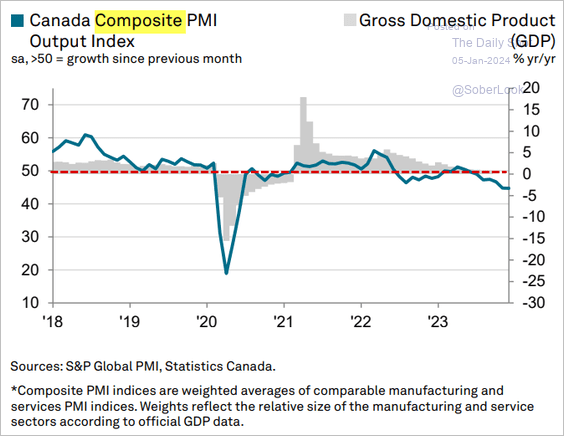

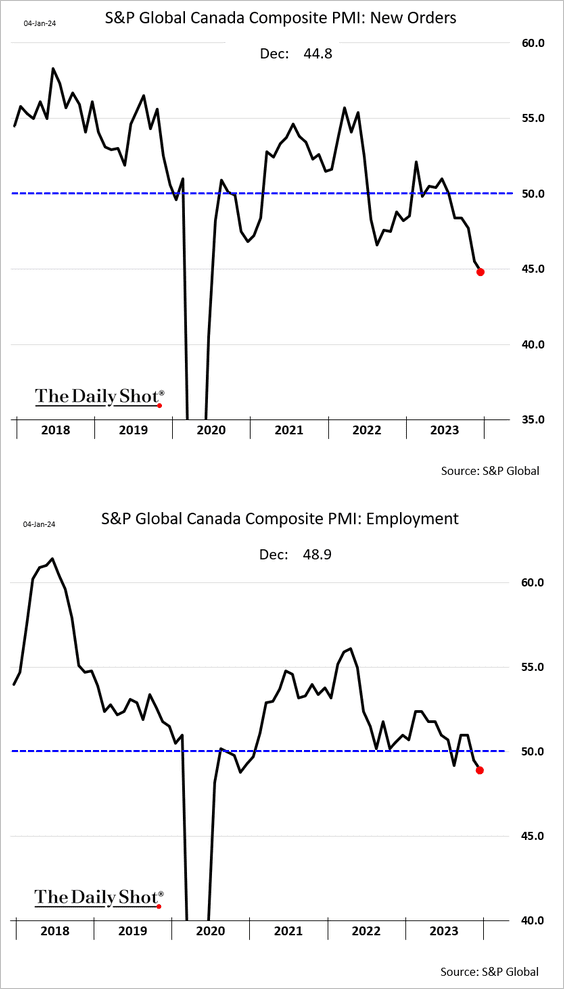

The PMI data remains recessionary.

• Services:

Source: S&P Global PMI

Source: S&P Global PMI

• Composite PMI:

Source: S&P Global PMI

Source: S&P Global PMI

The contraction in demand and employment accelerated last month.

Back to Index

The United Kingdom

1. The December services PMI was revised higher, pointing to accelerating growth.

2. Mortgage approvals surprised to the uspide, …

… with more improvements on the way.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– By the way, here is a look at mortgage rates.

Source: Capital Economics

Source: Capital Economics

• Growth in consumer credit strengthened in November.

• Liquidity is starting to recover.

– Households’ real savings are well below the pre-COVID trend.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

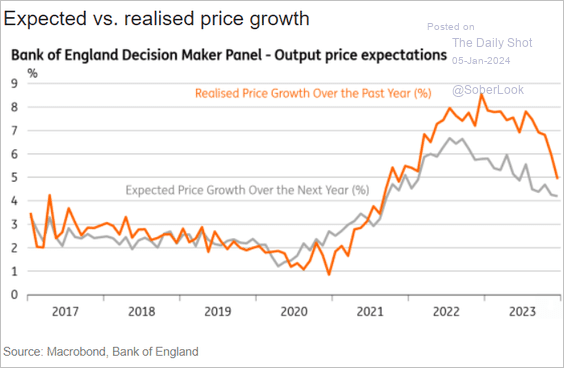

3. Inflation expectations have been trending lower.

Source: ING

Source: ING

Back to Index

The Eurozone

1. German inflation increased in December due to temporary effects in energy prices.

Source: @economics Read full article

Source: @economics Read full article

French inflation also edged higher.

Source: @economics Read full article

Source: @economics Read full article

——————–

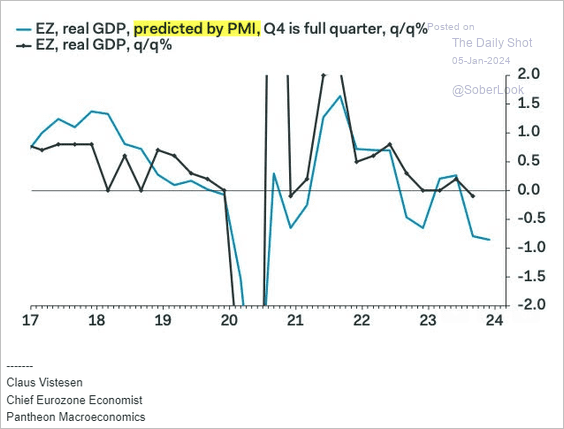

2. The December composite PMI remained in recessionary territory (2 charts).

Source: S&P Global PMI

Source: S&P Global PMI

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Spain was an exception, registering modest growth last month.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

Europe

1. Sweden’s service sector activity stabilized in December.

2. Shipping costs from Asia to Europe are surging as vessels are forced to avoid the Red Sea.

3. Here is a look at the demand for tech professionals in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

China

1. Government bond yields continue to tumble.

2. The nation’s total leverage reached a record high in 2023.

Source: Goldman Sachs; BofA Global Research Read full article

Source: Goldman Sachs; BofA Global Research Read full article

• Local governments have been borrowing more to support smaller banks.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

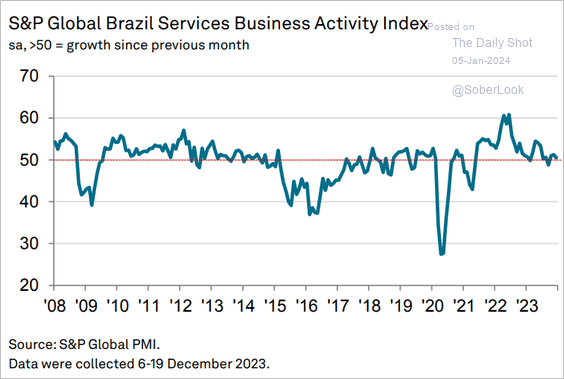

1. Let’s begin with Brazil.

• Vehicle sales (well above 2022 levels):

• Inflation (higher than expected):

• Services PMI (no growth):

Source: S&P Global PMI

Source: S&P Global PMI

• Trade surplus (well above peers):

Source: Reuters Read full article

Source: Reuters Read full article

• Last year’s approval of Brazil’s tax reform is expected to boost the economy.

Source: TS Lombard

Source: TS Lombard

——————–

2. Pantheon Macroeconomics expects further rate cuts amid slowing inflation across Latin America. (2 charts)

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

3. India’s foreign direct investment has been slowing.

Source: Goldman Sachs

Source: Goldman Sachs

Source: The New York Times Read full article

Source: The New York Times Read full article

• Will India’s equities maintain their performance edge over China’s stock market?

Source: Capital Economics

Source: Capital Economics

Here is a look at relative valuations.

Source: Capital Economics

Source: Capital Economics

——————–

4. Philippine inflation continues to moderate.

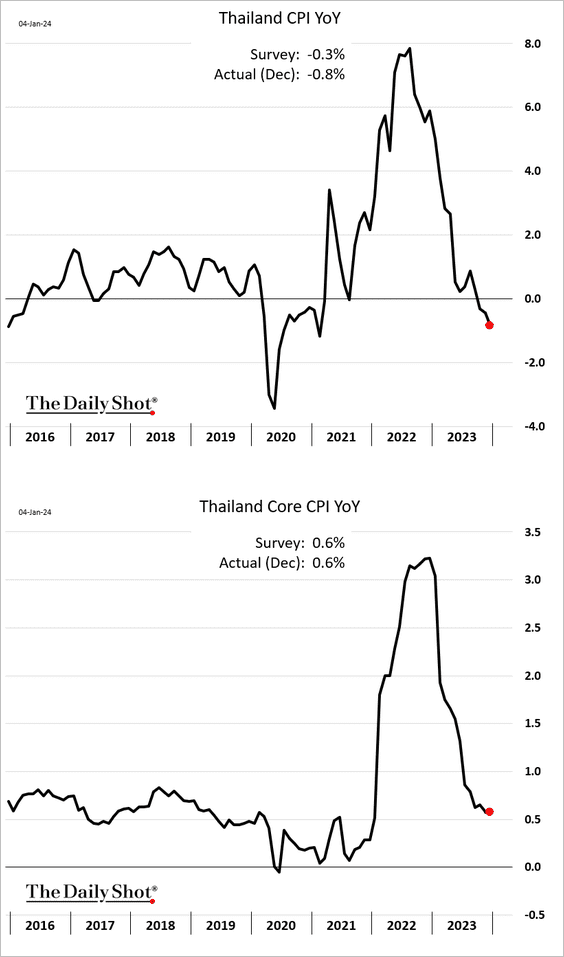

5. Thailand is in deflation.

Back to Index

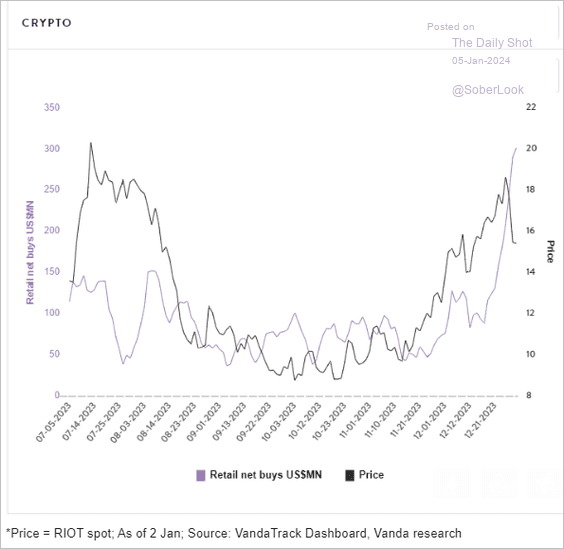

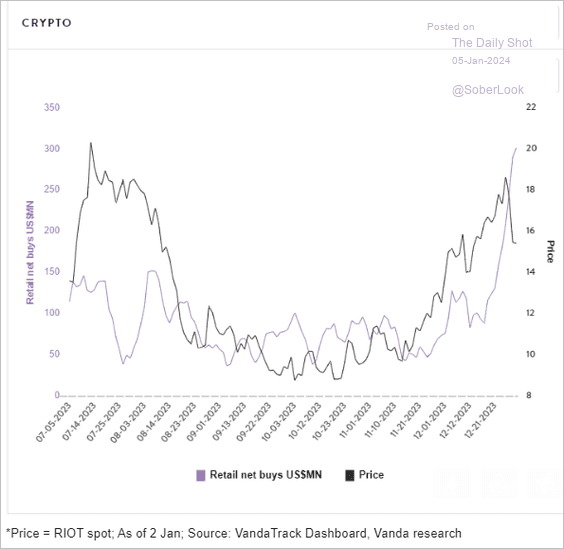

Cryptocurrency

1. Retail investors have been buying crypto-focused stocks.

Source: Vanda Research

Source: Vanda Research

2. Here is why access to crypto, especially stablecoin, is so important in many countries.

Source: Vanda Research

Source: Vanda Research

Back to Index

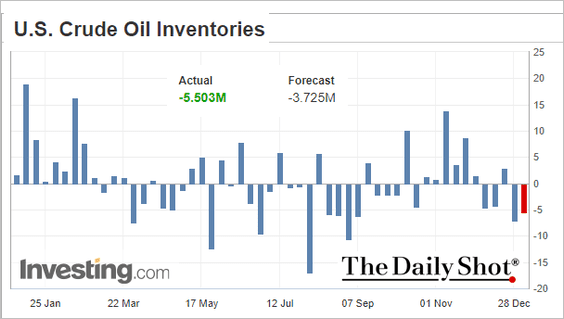

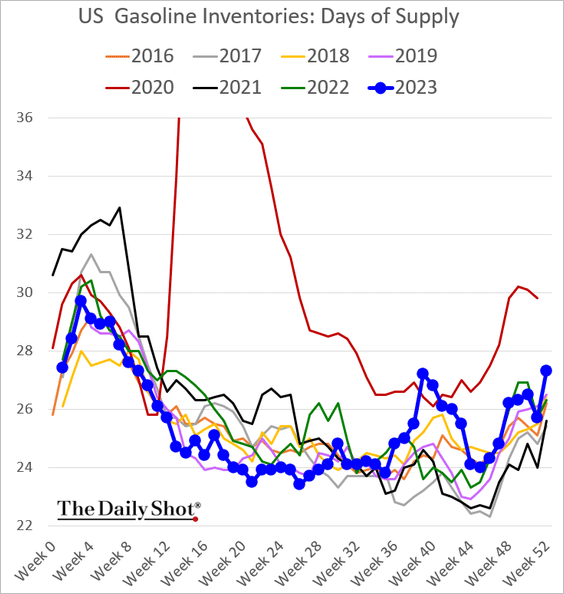

Energy

1. US crude oil inventories declined last week, …

… but the stockpiles of refined products surged.

Here are the inventory levels …

… and gasoline days of supply.

——————–

2. Oil prices remain subdued despite the Middle East tensions.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. US gross oil exports are near record highs.

By the way, the US is now the largest producer of crude oil

Source: @simongerman600, @heysidain

Source: @simongerman600, @heysidain

——————–

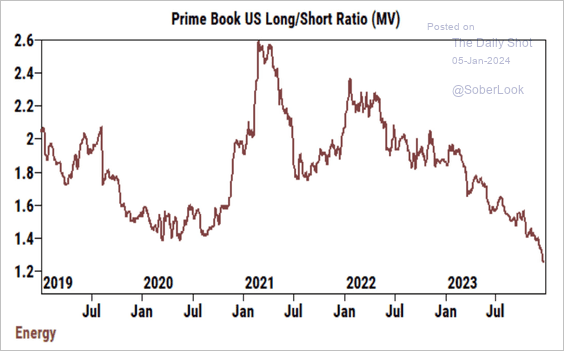

4. Hedge funds remain very cautious on energy shares.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

5. Coal equities have been surging.

Back to Index

Equities

1. Tech mega-caps have been underperforming.

• The Nasdaq 100 and the Nasdaq Composite have been down for five days in a row.

• Here is a look at the largest US tech firms’ performance this year.

• Apple is nearing the 200-day moving average.

• Here is tech mega-caps’ market value in perspective.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

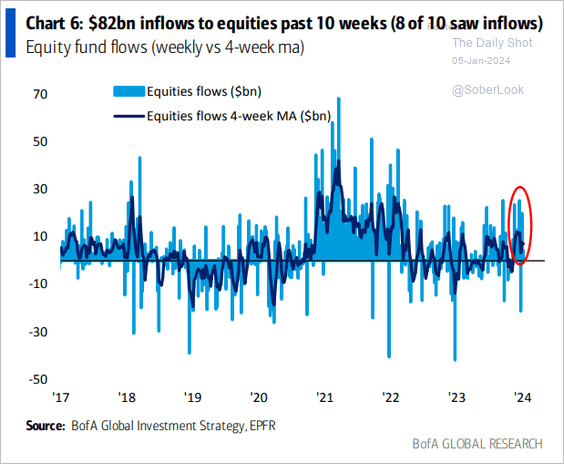

2. Equity fund flows have been robust.

Source: BofA Global Research

Source: BofA Global Research

• There is a strong correlation between the S&P 500 and net inflows, especially when accounting for reduced supply.

Source: TS Lombard

Source: TS Lombard

3. Small caps have seen substantial inflows.

Source: BofA Global Research

Source: BofA Global Research

4. Retail investors have been buying small caps and financials.

Source: Vanda Research

Source: Vanda Research

5. A rising portion of the stock market is positively correlated to Treasuries.

Source: SocGen; @johnauthers, @opinion Read full article

Source: SocGen; @johnauthers, @opinion Read full article

6. Here is a look at the equal-weight S&P 500 index and its relative performance.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

7. The net count of Variant Perception’s equity buy versus sell signals flipped to more sells.

Source: Variant Perception

Source: Variant Perception

8. Here is the percentage of stocks trading above the July highs.

Source: LPL Research

Source: LPL Research

9. Buying the dip has been profitable over the long run.

Source: @bespokeinvest

Source: @bespokeinvest

10. The market hasn’t been kind to strategic transactions

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Alternatives

1. US private equity middle-market deal activity continued to decline into Q3 2023.

Source: PitchBook

Source: PitchBook

2. Median pre-money valuations for US early-stage ventures increased in Q4.

Source: Carta Read full article

Source: Carta Read full article

• Median valuations have substantially declined for late-stage ventures over the past three years.

Source: Carta

Source: Carta

Back to Index

Rates

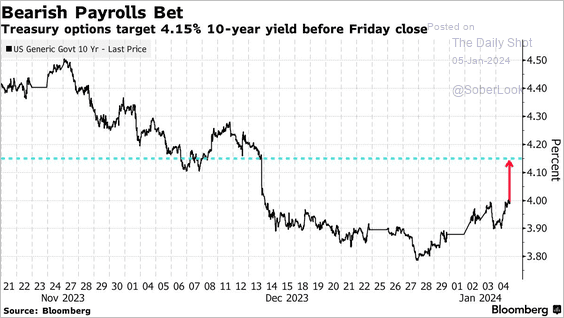

1. Significant option wagers anticipate a yield spike following today’s payrolls report.

Source: @markets Read full article

Source: @markets Read full article

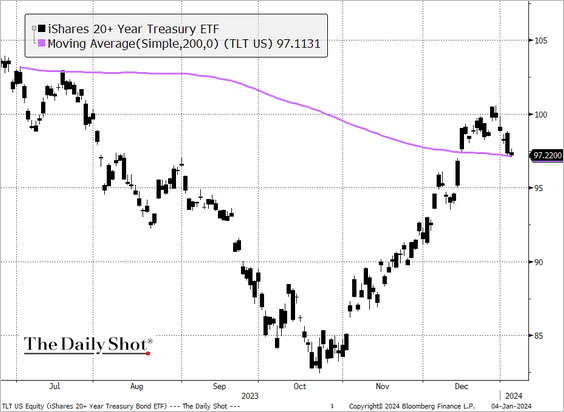

2. TLT is at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

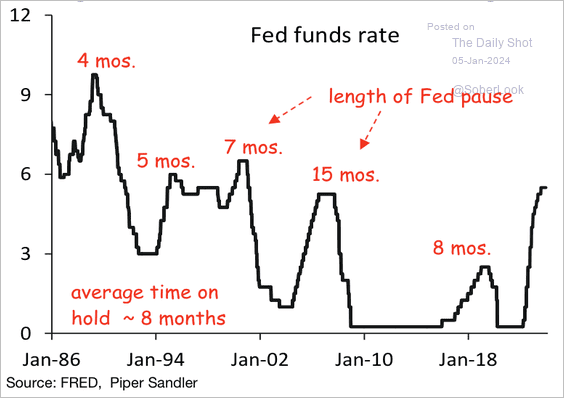

3. The Fed typically cuts rates within eight months after its first pause.

Source: Piper Sandler

Source: Piper Sandler

4. The copper/gold ratio decline preceded the recent drop in yields.

Source: Piper Sandler

Source: Piper Sandler

Back to Index

Global Developments

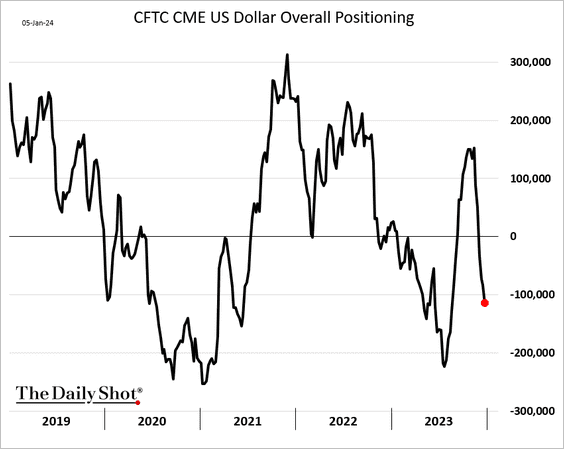

1. The US dollar positioning is increasingly bearish.

2. Most central banks are no longer under pressure to hike rates.

Source: BCA Research

Source: BCA Research

3. Here is a look at consumer spending trends in select economies.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

4. China is exporting disinflation.

Source: Mary Nicola, @TheTerminal, Bloomberg Finance L.P.

Source: Mary Nicola, @TheTerminal, Bloomberg Finance L.P.

——————–

Food for Thought

1. Job satisfaction:

Source: @WSJ Read full article

Source: @WSJ Read full article

2. Social media commerce challenges:

Source: EcommerceDB Read full article

Source: EcommerceDB Read full article

3. How will Large Language Models impact jobs?

Source: @WSJ Read full article

Source: @WSJ Read full article

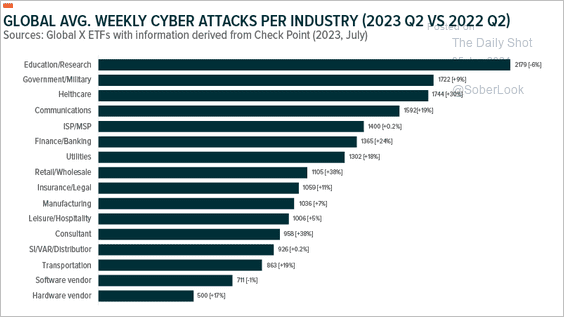

4. Average weekly cybersecurity attacks per industry:

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

5. US charitable giving:

Source: @chartrdaily

Source: @chartrdaily

6. Femicides by family or partners:

Source: Statista

Source: Statista

7. Voting in national elections:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

8. Cost of electricity by technology:

Source: @WSJ Read full article

Source: @WSJ Read full article

9. The most expensive paintings sold:

Source: @genuine_impact

Source: @genuine_impact

——————–

Have a great weekend!

Back to Index