The Daily Shot: 04-Jan-24

• The United States

• Canada

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the December FOMC minutes.

• The Fed sees risks becoming more balanced, but inflation risks are still skewed to the upside.

In light of the policy restraint in place, along with more favorable data on inflation, participants generally viewed risks to inflation and employment as moving toward greater balance. However, participants remained highly attentive to inflation risks.

Uncertainty around the participants’ assessments remains elevated.

• Inflation reduction’s next phase hinges on weakening demand. The economy and the labor market may need to ease further for inflation to keep slowing.

Several participants assessed that healing in supply chains and labor supply was largely complete, and therefore that continued progress in reducing inflation may need to come mainly from further softening in product and labor demand, with restrictive monetary policy continuing to play a central role.

• The message of “higher for longer” remains intact.

Several [participants] also observed that circumstances might warrant keeping the target range at its current value for longer than they currently anticipated.

Participants … reaffirmed that it would be appropriate for policy to remain at a restrictive stance for some time until inflation was clearly moving down sustainably toward the Committee’s objective.

• There is some concern about a rapid deterioration in the labor market.

Several participants noted the risk that, if labor demand were to weaken substantially further, the labor market could transition quickly from a gradual easing to a more abrupt downshift in conditions.

• Fed officials are beginning to talk about tapering QT, partially attributable to heightened repo market volatility (see the rates section here).

Several participants remarked that the Committee’s balance sheet plans indicated that it would slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level judged consistent with ample reserves. These participants suggested that it would be appropriate for the Committee to begin to discuss the technical factors that would guide a decision to slow the pace of runoff well before such a decision was reached in order to provide appropriate advance notice to the public.

• The market cut back on rate cut expectations but is still pricing almost double the rate reductions projected by the FOMC.

——————–

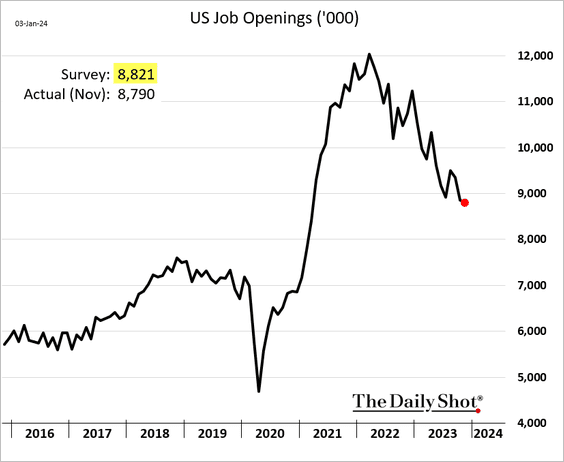

2. Job openings continue to fall, supporting the Fed’s goal of slower demand.

Source: Reuters Read full article

Source: Reuters Read full article

• Here are the contributions to the changes in job openings over the past 12 months.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The Beveridge Curve points to easing labor market imbalances.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The labor market normalization is especially visible in the declining voluntary resignations (quits). Layoffs remain very low.

– The ratio of quits to the number of unemployed Americans is now well below the pre-COVID peak.

• A lower quits rate points to softer wage growth ahead (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Oxford Economics

Source: Oxford Economics

• Next, we have a few sector trends in job openings.

– Manufacturing (continuing downward trend):

– Construction (surprisingly resilient):

– Healthcare (still very high and remains a key driver of job growth):

– Hotels, restaurants, and bars (contraction continues):

——————–

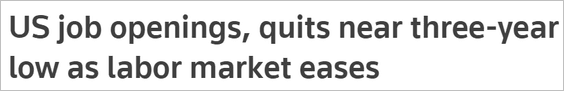

3. The US (and global) manufacturing recession remains intact, …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… amid falling demand.

• The ISM Manufacturing PMI has been in contraction territory for 14 months in a row, while new orders have declined for 16 consecutive months.

• Factories continue to shed jobs.

• Input prices declined in December.

——————–

4. The Citi Economic Surprise Index has been trending lower.

5. Vehicle sales were firmer in December, …

… with the full-year sales hitting the highest level since 2019.

Source: Reuters Read full article

Source: Reuters Read full article

Source: MarketWatch Read full article

Source: MarketWatch Read full article

• Inventories have been rebounding.

Source: BNP Paribas; @EdButowsky

Source: BNP Paribas; @EdButowsky

6. Total inflation-adjusted retail inventories continue to climb.

——————–

7. A wider budget deficit could weigh on the dollar, which typically happens during the fourth year of the presidential cycle, according to Paradigm Capital.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

Canada

1. CAD/USD is holding long-term support within a decade-long downtrend.

2. Immigration is boosting rent inflation.

Source: Capital Economics

Source: Capital Economics

Back to Index

The Eurozone

1. Germany’s unemployment has been trending higher.

2. Euro-area consumption remains below trend.

Source: MRB Partners

Source: MRB Partners

Back to Index

Europe

1. Let’s start with hiring plans in select economies.

Source: ING

Source: ING

2. This chart shows job vacancies and the unemployment rate across the EU.

Source: @DanielKral1

Source: @DanielKral1

3. European earnings growth outpaced the US in the post-pandemic cycle if the STOXX 600 is adjusted to have the same sector composition as the S&P 500.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

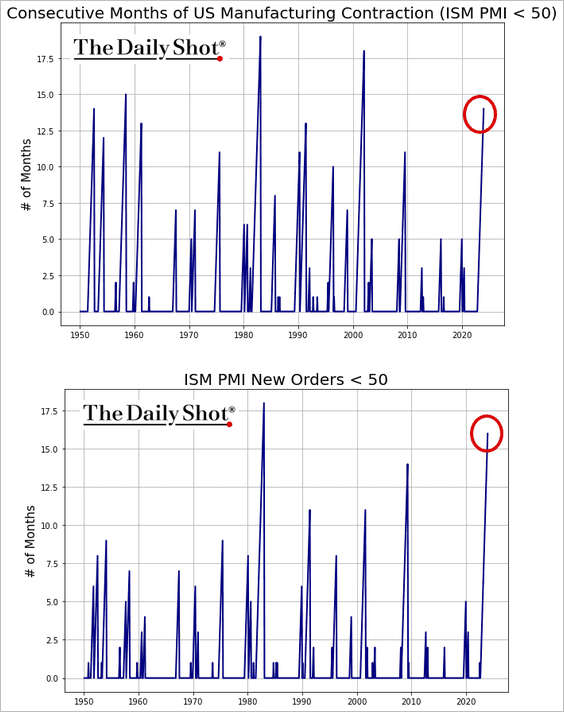

4. The EU is a key market for China’s EV exports.

Source: @technology Read full article

Source: @technology Read full article

The EU market is attractive for Chinese exporters from a price perspective.

Source: @technology Read full article

Source: @technology Read full article

Back to Index

China

1. Service firms reported faster growth in December.

2. Hong Kong’s business activity is strengthening.

3. China’s large-cap stocks are trading near the bottom of a 13-year range, although momentum remains weak.

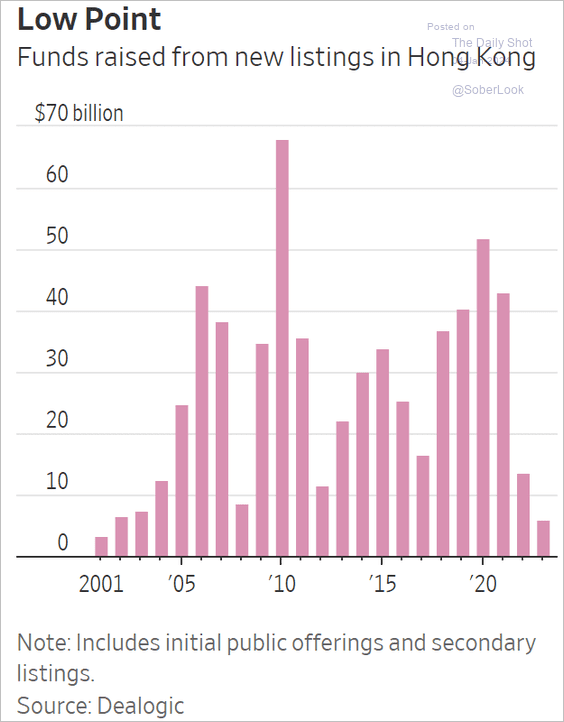

4. Hong Kong is facing an IPO drought.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

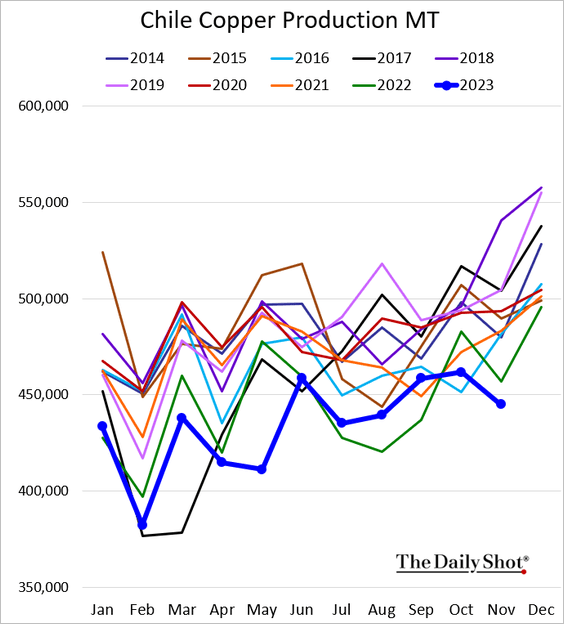

1. Let’s begin with Chile.

• Economic activity (accelerating):

• Business confidence (depressed):

• The unemployment rate (still elevated):

• Retail sales (holding below 2022 levels):

• Copper production (multi-year lows):

——————–

2. Next, we have some updates on Mexico.

• Economic activity (unexpected contraction in October):

• Exports (holding up well):

• The unemployment rate (multi-year lows):

• The budget deficit (widening ahead of elections):

• Remittances (a sharp decline in November):

——————–

3. Turkey’s core inflation exceeded 70% last month despite the surging policy rate.

4. Thailand’s current account deficit is the widest in years.

5. Vietnam’s exports strengthened in December.

The nation’s economic growth accelerated in Q4.

——————–

6. How overvalued/undervalued are EM currencies?

Source: Alpine Macro

Source: Alpine Macro

Back to Index

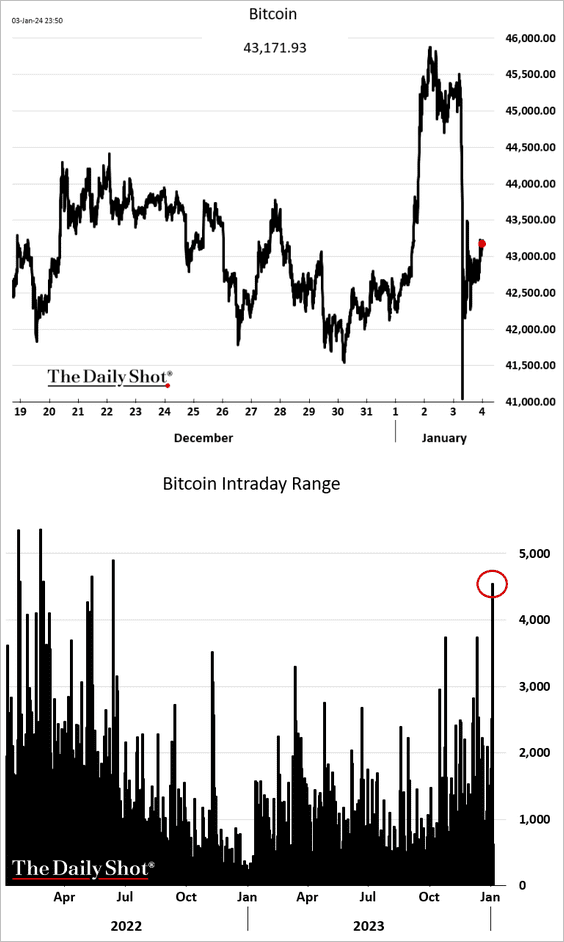

Cryptocurrency

1. Bitcoin declined sharply as volatility surged ahead of the ETF decision.

2. Flows have been robust.

Source: CoinShares

Source: CoinShares

Back to Index

Commodities

1. Fitch expects copper demand growth to shift away from China amid supply shortages. (2 charts)

Source: Fitch Ratings

Source: Fitch Ratings

Source: Fitch Ratings

Source: Fitch Ratings

——————–

2. Most lithium projects have a breakeven price of $5,000-$8,000 per tonne, which is still below current market prices.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

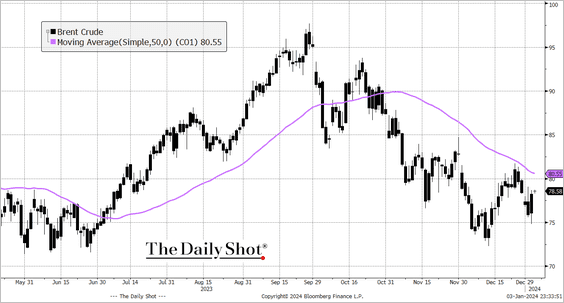

Energy

1. Crude oil is firmer amid tensions in the Middle East and the Libya oilfield shutdown.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: CNBC Read full article

Source: CNBC Read full article

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Western oil companies have been delivering robust shareholder payouts.

Source: The Guardian Read full article

Source: The Guardian Read full article

3. Most US consumers are optimistic that clean energy technology can help mitigate the effects of climate change, according to a survey by Global X.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

• High costs and limited charging infrastructure are key decision factors for electric vehicle adoption.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

——————–

4. US natural gas futures are rebounding.

5. US LNG exports hit a record high (2 charts).

Source: Reuters Read full article

Source: Reuters Read full article

Source: @markets Read full article

Source: @markets Read full article

——————–

6. European natural gas in storage remains elevated.

Source: @JKempEnergy

Source: @JKempEnergy

Back to Index

Equities

1. Investor sentiment remains upbeat despite a rocky start to the year.

Here is Goldman’s positioning indicator.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

——————–

2. The Russell 2000 is back below the resistance level. But the index formed a golden cross this week.

3. Speculative stocks are under pressure.

4. Short interest has been rising.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

5. Fiscal tailwinds have contributed to the stock market rally.

Source: Gavekal Research

Source: Gavekal Research

6. Slower growth has been a positive for global stocks last quarter.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

7. The valuation gap between international stocks and their US counterparts has reached extreme levels.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Here is a look at valuations.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

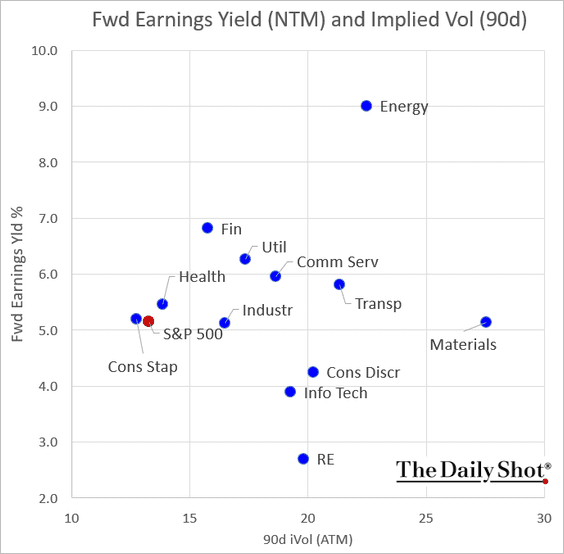

8. Next, let’s take a look at forward earnings yields versus implied volatility (expected performance vs. perceived risk).

• Sectors:

• Equity factors:

• International indices:

——————–

9. Here is a look at thematic ETF performance and net flows last year.

Source: The ETF Shelf

Source: The ETF Shelf

Back to Index

Credit

1. US CLO issuance held up in 2023.

Source: PitchBook

Source: PitchBook

2. ESG debt is losing market share.

Source: @markets Read full article

Source: @markets Read full article

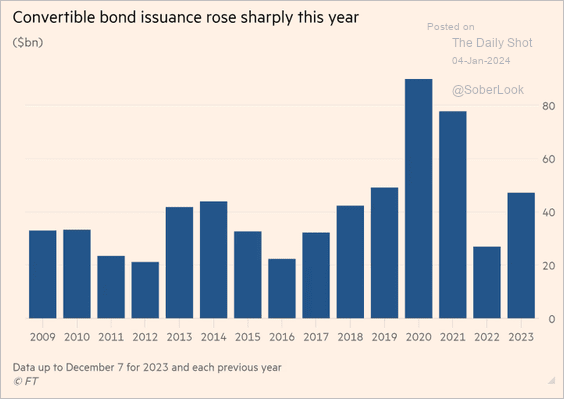

3. Convertible debt issuance climbed in 2023.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. US multi-family debt delinquencies continue to rise.

Back to Index

Global Developments

1. Most major assets have not fully recovered from 2021 when government bond yields started to rise aggressively. Only Italian equities and gold have outperformed T-Bills within the select group below.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. Container shipping costs are rising, …

… as shippers are forced to avoid the Red Sea (2 charts).

Source: @JavierBlas; h/t @dailychartbook

Source: @JavierBlas; h/t @dailychartbook

Source: IMF

Source: IMF

——————–

3. Global trade and manufacturing conditions are starting to improve, which could support cyclical currencies like AUD and CAD. (2 charts)

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

——————–

4. M&A activity slowed in 2023.

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Wells Fargo forecasts below-average global real GDP growth.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

Food for Thought

1. Construction spending on shopping malls:

Source: @WSJ Read full article

Source: @WSJ Read full article

2. Retail e-commerce sales share:

Source: @chartrdaily

Source: @chartrdaily

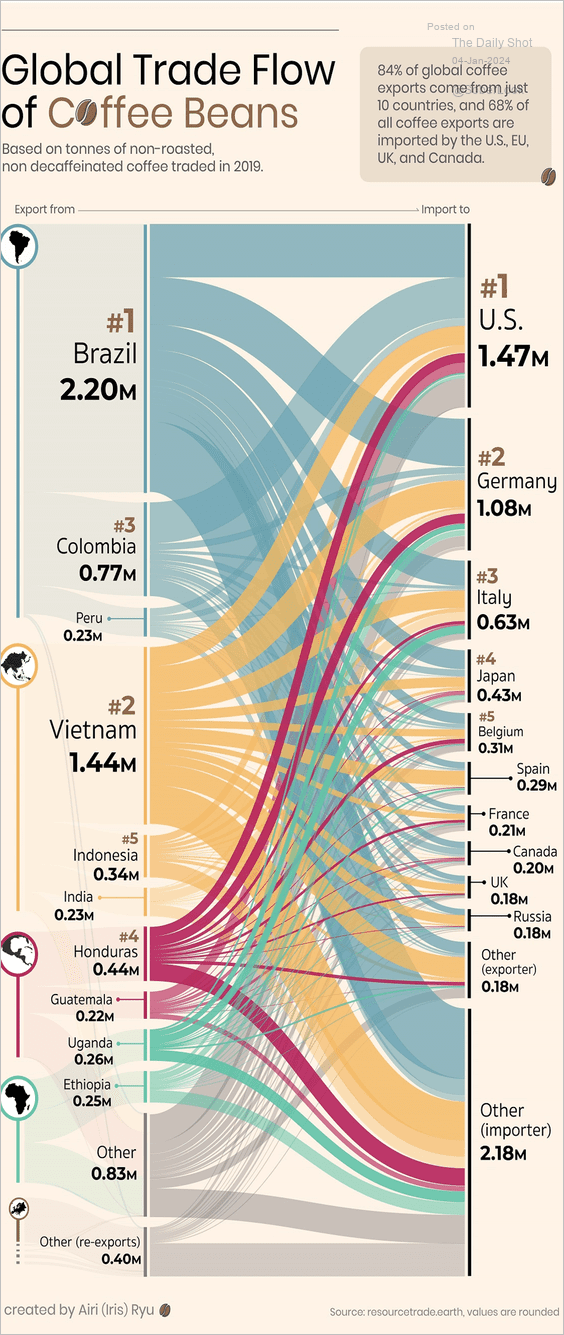

3. Coffee bean trade flows:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

4. US EV imports:

Source: @WSJ Read full article

Source: @WSJ Read full article

5. What would Millennials give up to improve their chance of purchasing a home?

Source: Bank of America Institute

Source: Bank of America Institute

6. The minimum wage by state:

Source: @axios Read full article

Source: @axios Read full article

• Changes in the minimum wage:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

7. How Russia skirts EU sanctions to obtain German technology:

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

8. US COVID-related hospital admissions:

Source: CDC

Source: CDC

9. Animal shelter intake rates:

Source: Shelter Animal Counts

Source: Shelter Animal Counts

• Animal shelter outcomes:

Source: Shelter Animal Counts

Source: Shelter Animal Counts

——————–

Back to Index