The Daily Shot: 10-Jan-24

• The United States

• Canada

• The Eurozone

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. The NFIB small business sentiment showed some improvement last month.

• The percentage of firms planning to boost prices is still above the pre-COVID peak.

• A relatively high share of companies plan to increase compensation.

• The hiring plans index declined last month.

——————–

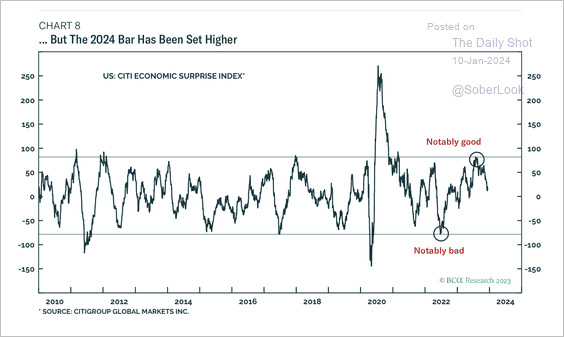

2. Economic growth came in well above consensus expectations last year …

Source: BCA Research

Source: BCA Research

… forcing economists to reverse their forecasts.

• Q4 growth estimates have been robust, …

Source: Oxford Economics

Source: Oxford Economics

… although there was a substantial drag from inventories.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Could growth disappoint this year?

Source: BCA Research

Source: BCA Research

Expectations for this year’s GDP growth are relatively tempered, …

… but have been improving relative to the Eurozone and China.

Source: Truist Advisory Services

Source: Truist Advisory Services

• Accommodative financial conditions should be a tailwind for growth.

h/t HSBC

h/t HSBC

——————–

3. Next, we have some updates on inflation.

• Softer oil prices have capped inflation expectations.

h/t Simon White, Bloomberg Markets Live Blog, @TheTerminal

h/t Simon White, Bloomberg Markets Live Blog, @TheTerminal

• A slowdown in rent increases may indicate a potential easing of core inflation toward the target.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Declining voluntary resignations signal slower wage growth ahead.

Source: Oxford Economics

Source: Oxford Economics

——————–

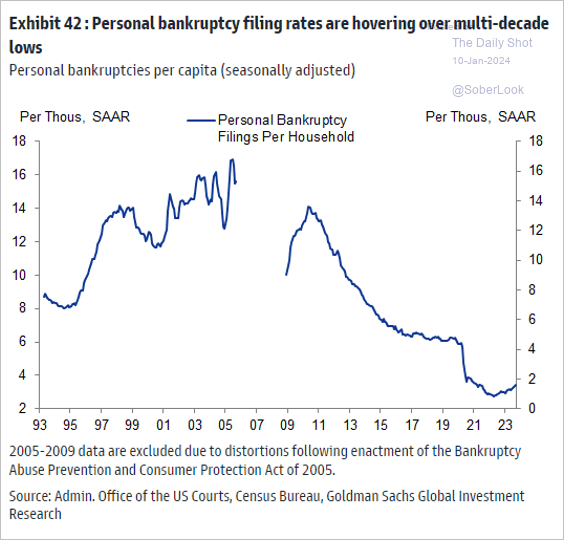

4. Personal bankruptcy filings remain relatively low.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

5. The trade deficit unexpectedly narrowed in November.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Canada

1. The trade surplus was lower than expected.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Building permits slowed in November, …

… even as the government tries to spur more residential construction.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The Eurozone

1. The euro-area unemployment rate is at record lows.

Here is Italy’s unemployment rate.

——————–

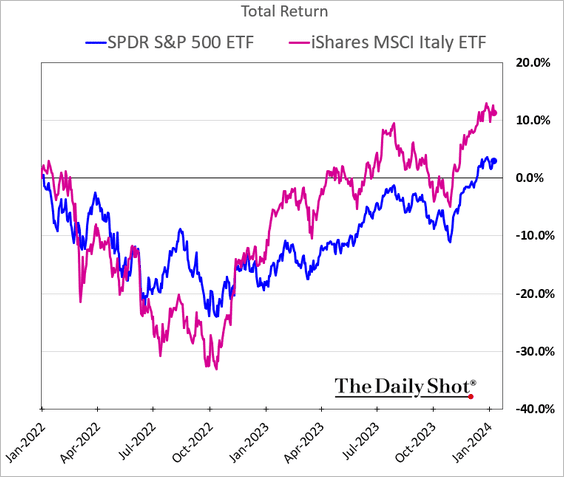

2. Italian equities have been outperforming the S&P 500.

Further reading

Further reading

3. This chart shows the contributions to Germany’s industrial production decline.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

4. The French trade deficit continues to narrow.

5. Euro-area inflation is expected to keep slowing (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Asia-Pacific

1. Japan’s real wages are not recovering.

2. Taiwan’s trade surplus hit a record high as exports rebound.

3. Next, we have some updates on Australia.

• Inflation is moderating.

Source: @economics Read full article

Source: @economics Read full article

The PMI data signals further easing in goods inflation.

Source: Capital Economics

Source: Capital Economics

• Small business activity has been deteriorating.

Source: S&P Global PMI

Source: S&P Global PMI

• Building approvals remained below 2022 levels in November.

Back to Index

China

1. The stock market selloff continues.

2. Here is a look at new car registrations.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

1. Mexico’s headline inflation increased last month, but the core CPI continues to slow.

The biweekly core CPI dipped below 5%.

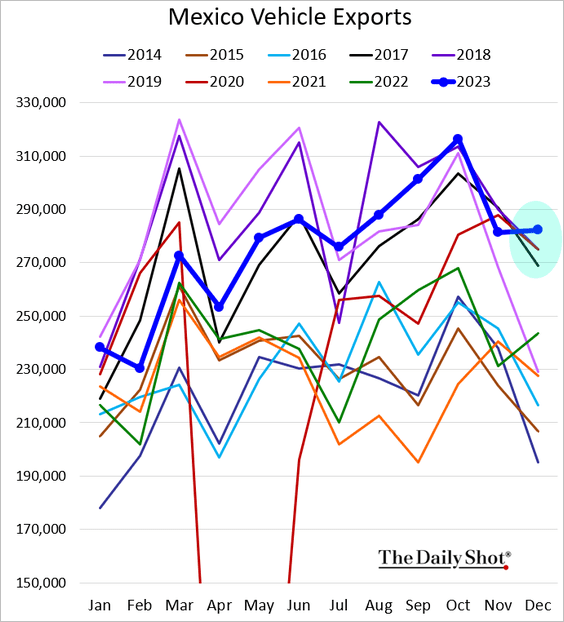

• The nation’s vehicle exports hit a multi-year high for this time of the year (driven by robust US demand).

——————–

2. Colombia’s core inflation is still above 10%.

3. Hungarian industrial production deteriorated further in November (following Germany lower).

4. South Africa’s factory activity returned to growth last month.

The trade balance swung into a robust surplus in November.

——————–

5. The Philippine trade deficit widened in November.

6. Here is a look at equity valuations across EM economies.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

1. Bitcoin briefly jumped above $45K after the SEC’s Twitter account was hacked, falsely stating that a spot-bitcoin ETF was approved.

Source: X

Source: X

BTC/USD is testing resistance, but its earlier break above $43,400 shifted momentum to the upside.

2. The recent bitcoin price rally triggered a spike in short liquidations.

Source: Coinglass

Source: Coinglass

3. BTC’s performance has tracked the growth in global money supply.

Source: Coinbase Read full article

Source: Coinbase Read full article

4. Here is a look at correlations between bitcoin and major assets over the past year.

Source: Coinbase Read full article

Source: Coinbase Read full article

5. Crypto firms have been getting hit with fines for facilitating illicit money transactions.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Commodities

1. Iron ore is rolling over.

2. Copper is lagging cyclical shares.

Source: BCA Research

Source: BCA Research

3. Industrial metals inventories have been trending higher.

Source: Capital Economics

Source: Capital Economics

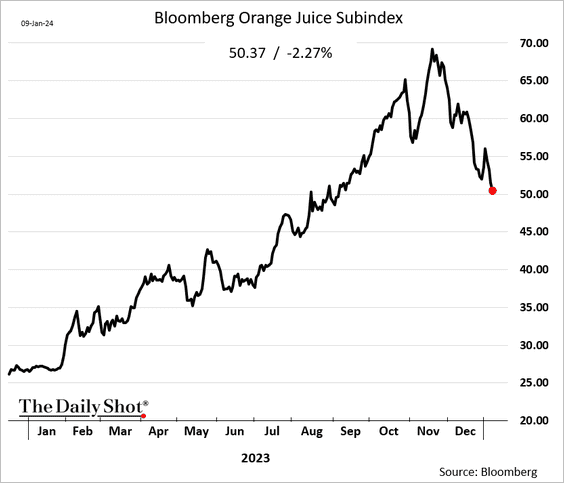

4. The correction in orange juice prices continues.

Back to Index

Energy

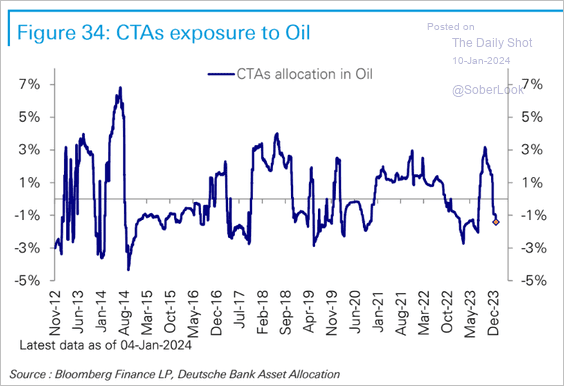

1. CTAs have reversed their crude oil bets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

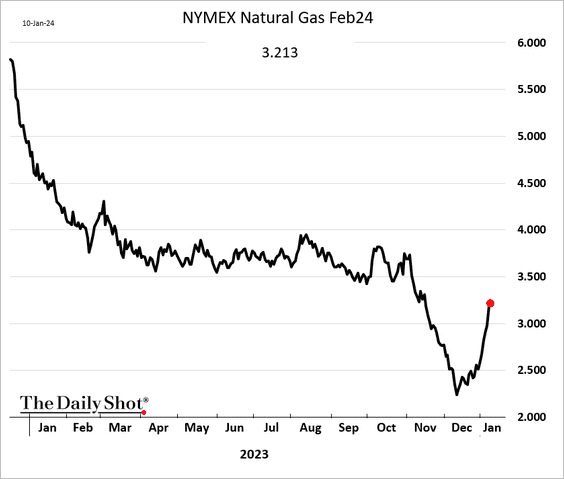

2. US natural gas futures have been rebounding, but elevated inventories will be a headwind for prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

3. The oil & gas industry is facing shortages of skilled labor.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Equities

1. Dividend growers have been outperforming.

2. The stock-bond correlation has been very strong since August.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

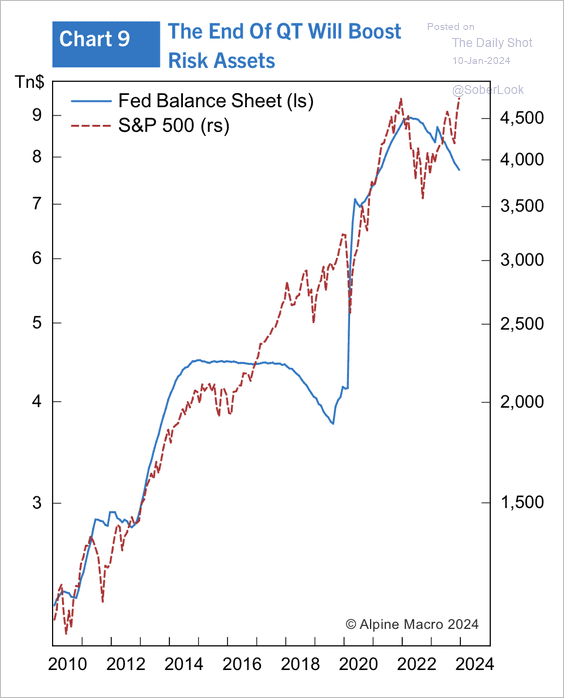

3. The S&P 500 could benefit when the Fed ends its balance sheet shrinkage, especially amid rate cuts.

Source: Alpine Macro

Source: Alpine Macro

4. Here is a look at analysts’ projections for earnings growth among S&P 500 companies.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

The ISM PMI report points to downside risks for the projected earnings recovery (above).

Source: Oxford Economics

Source: Oxford Economics

——————–

5. US equities appear overbought relative to bonds.

Source: Longview Economics

Source: Longview Economics

6. 32% of large-cap mutual funds outperformed their benchmark last year.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

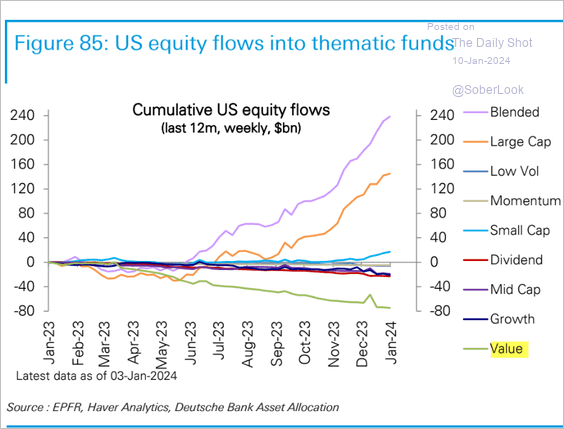

7. Value funds continue to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

8. How do the returns in the first five days of the year foreshadow January’s performance and the trend for the remainder of the year?

Source: LPL Research

Source: LPL Research

Back to Index

Credit

1. Globally, corporate bonds will face a challenging maturity wall over the next few years.

Source: Quill Intelligence

Source: Quill Intelligence

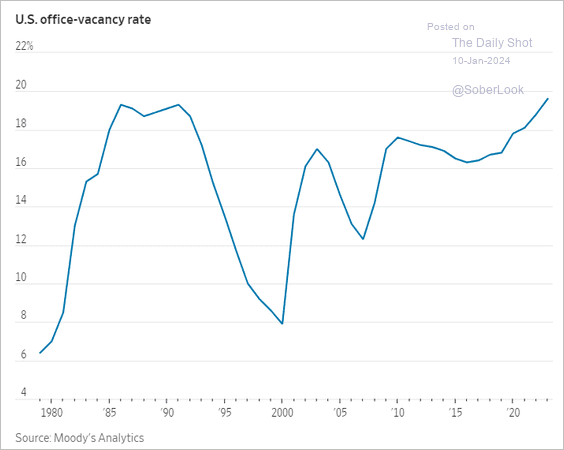

2. US office vacancy rates hit a record high

Source: @WSJ Read full article

Source: @WSJ Read full article

3. Largest banks hold the bulk of reserves. As quantitative tightening persists, indications of funding strain at smaller banks could lead the Fed to decelerate its balance sheet contraction.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Rates

1. Recently, the Fed has been more responsive to inflation shocks than prior to the pandemic.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

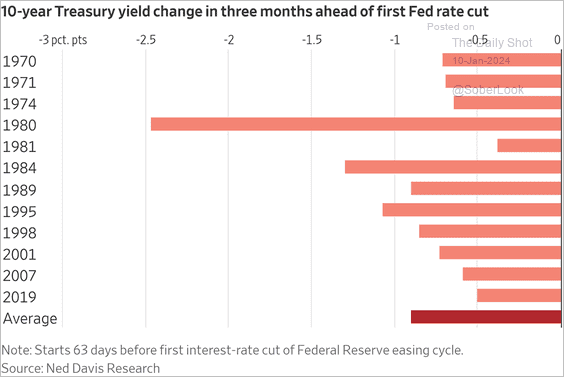

2. How do Treasury yields change ahead of the Fed’s first rate cut?

Source: @WSJ Read full article

Source: @WSJ Read full article

3. Treasury debt supply is expected to surge in the next couple of years.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Global Developments

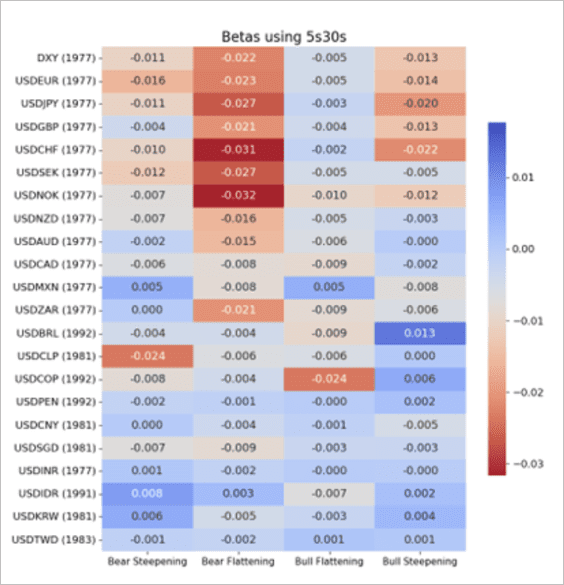

1. The dollar typically declines in a Treasury curve bull-steepening scenario. Here is a look at sensitivities to the yield curve among major dollar pairs. Years mark the start of each time series. (2 charts)

Source: Steno Research Read full article

Source: Steno Research Read full article

Source: Steno Research Read full article

Source: Steno Research Read full article

——————–

2. Here is a look at the Suez Canal traffic over time.

Source: JP Morgan Research; @carlquintanilla

Source: JP Morgan Research; @carlquintanilla

3. A conflict in the Taiwan Strait involving the US and China would lead to severe repercussions for the global economy.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

Food for Thought

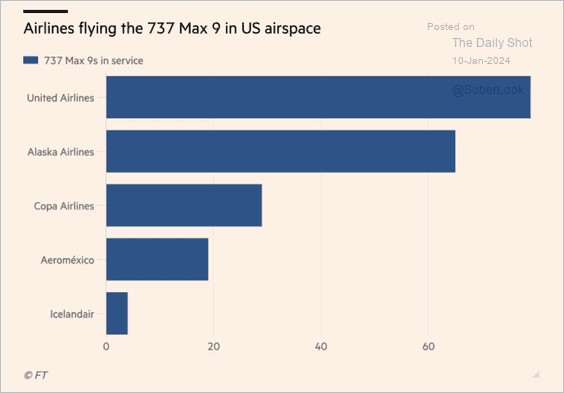

1. Airlines flying the 737 Max 9:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

2. Airline mergers:

Source: @axios Read full article

Source: @axios Read full article

3. Best-selling vehicles in the US:

Source: Statista

Source: Statista

4. Ocean cruise passengers:

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Why online firms want to charge return fees:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

6. US GDP by Industry:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

7. Average years left to live:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

8. US college rankings and costs:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

9. Amazon deforestation:

Source: The Economist Read full article

Source: The Economist Read full article

10. OBGYNs and pediatricians in selected states:

Source: Birth Injury Lawyers Group

Source: Birth Injury Lawyers Group

——————–

Back to Index