The Daily Shot: 11-Jan-24

• The United States

• The Eurozone

• Europe

• Japan

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

1. Let’s begin with some updates on inflation.

• Most economists see inflation near the Fed’s target in the first quarter of 2025. Is the market becoming complacent about inflation risks?

Source: TS Lombard

Source: TS Lombard

Should we be concerned about the “second wave”?

Source: TS Lombard

Source: TS Lombard

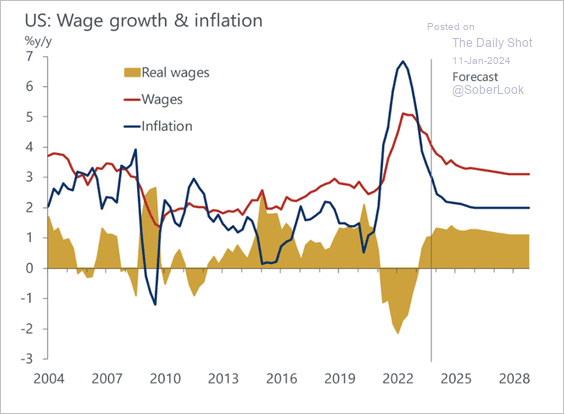

• Wage growth will likely slow from here, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

But small business compensation plans point to upside risks in the near-term.

Source: Oxford Economics

Source: Oxford Economics

– The Atlanta Fed’s wage growth tracker ticked higher last month and remains well above pre-COVID levels.

——————–

2. Mortgage applications were a bit firmer last week (just below 2016 levels).

• CoreLogic sees home prices rising 2.5% (year over year) by November of this year.

Source: CoreLogic

Source: CoreLogic

——————–

3. There is a lot of uncertainty around the trajectory of the unemployment rate.

Source: @WSJ Read full article

Source: @WSJ Read full article

4. The GDPNow model estimate for the Q4 economic growth is holding above 2%.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

Here are the contributions to GDPNow.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

5. This chart shows the contribution of energy trade to the nation’s trade balance.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

The Eurozone

1. French factory output edged higher in November.

But Dutch manufacturing production continues to sink.

——————–

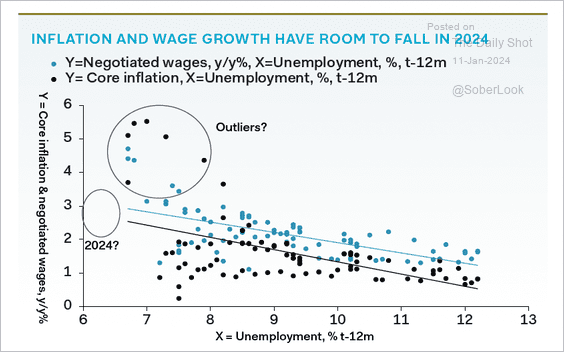

2. Leading indicators suggest that euro-area wage growth is peaking.

Source: Nomura Securities

Source: Nomura Securities

3. Pantheon Macroeconomics expects the ECB to cut rates earlier than consensus as core inflation and wage growth decline. (2 charts)

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

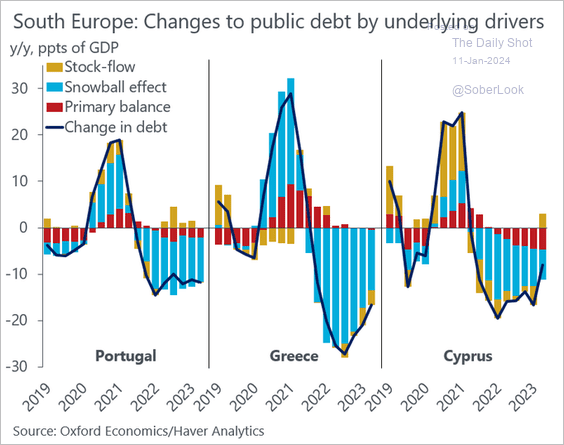

4. Some of the most indebted Eurozone states have significantly reduced their debt ratios.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Here is the Greek 10-year spread to Germany.

Back to Index

Europe

1. Sweden’s household consumption declined in November, …

… and so did private-sector output.

That’s why it was surprising to see the GDP estimate tick higher.

——————–

2. Norway’s inflation was a touch lower than expected.

3. How much financial support his the EU providing to Poland?

Source: ING

Source: ING

4. The new European Parliament will lean to the right, according to polls.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Below is a timeline of European elections this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

5. Here is a look at the EU’s trade in olive oil.

Source: USDA Read full article

Source: USDA Read full article

Back to Index

Japan

1. The TOPIX Index broke above a four-month-long range with improving momentum.

The Nikkei hit the highest level since 1990.

——————–

2. The Invesco Japanese Yen ETF (FXY) remains in a long-term downtrend, although it has stalled since the October 2022 and November 2023 price lows.

3. The output gap is almost positive.

Source: TS Lombard

Source: TS Lombard

Back to Index

Emerging Markets

1. Brazil’s vehicle sales held above 2022 levels in December.

2. Mexico’s fixed investment hit a record high.

3. Turkey’s industrial production weakened again in November.

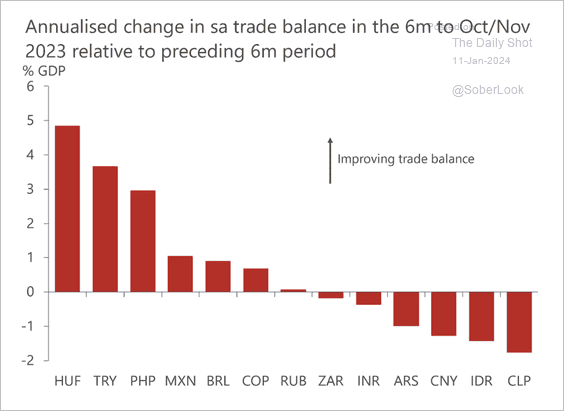

4. Most EM countries ran trade balances last year that were well within their historical norms.

Source: Oxford Economics

Source: Oxford Economics

Several EM trade balances have improved relative to the past six months, which could be a positive for local currencies.

Source: Oxford Economics

Source: Oxford Economics

——————–

5. Here is a look at nominal and real 10-year bond yields.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

1. The SEC finally approved US spot-bitcoin ETFs.

Source: @WSJ Read full article

Source: @WSJ Read full article

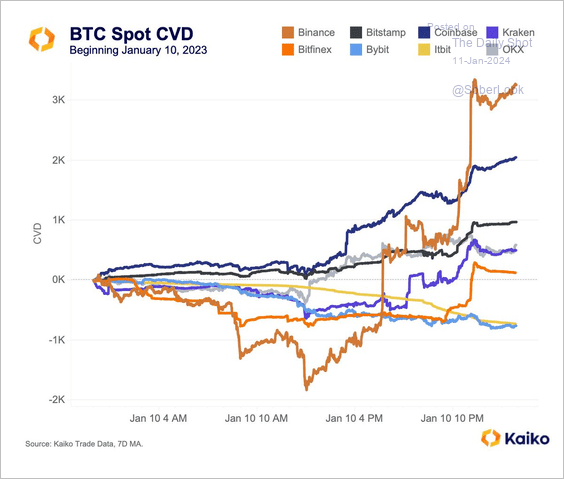

2. There was a spike in BTC buying activity on Binance on Wednesday surrounding the approval.

Source: @KaikoData

Source: @KaikoData

3. While bitcoin had mostly priced in the cash ETF approval, hopes are rising that an ether ETF approval could be next.

——————–

4. BTC futures open interest on the CME exchange reached a new high.

Source: @glassnode

Source: @glassnode

Back to Index

Commodities

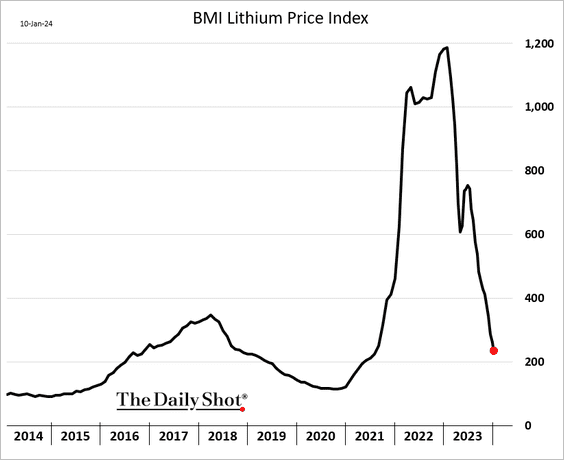

1. The lithium bubble continues to deflate.

2. This infographic illustrates commodity returns by year.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Energy

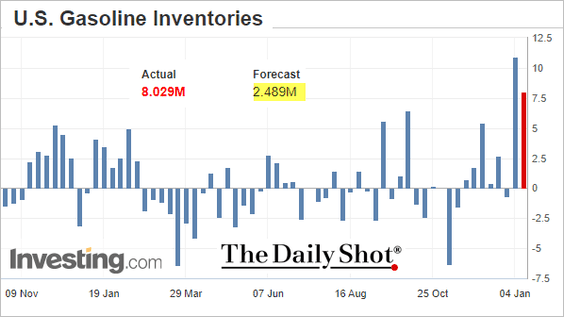

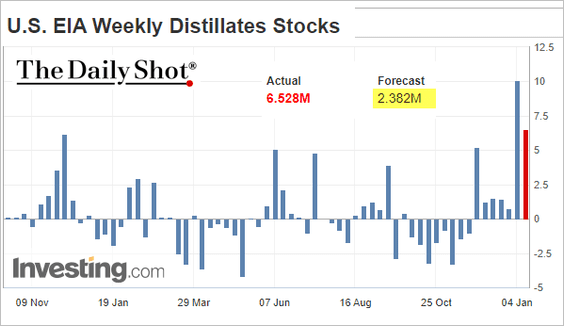

1. Last week saw another large increase in US refined product inventories.

Crude oil stockpiles unexpectedly increased as well.

Source: Reuters Read full article

Source: Reuters Read full article

Here are the inventory levels.

——————–

2. US crude oil exports to Europe continue to climb.

Source: @WSJ Read full article

Source: @WSJ Read full article

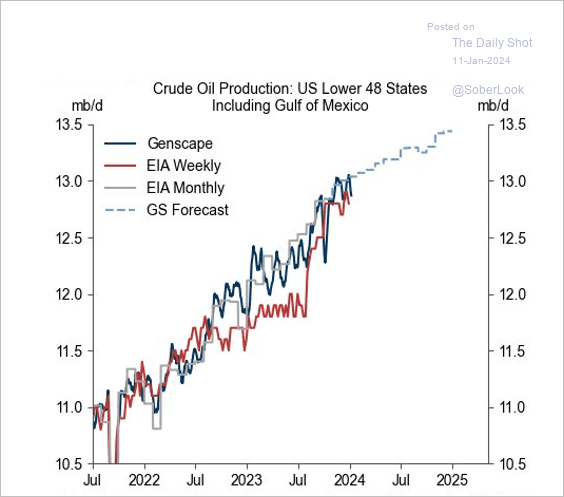

3. Here is Goldman’s forecast for US crude oil production.

Source: Wikipedia

Source: Wikipedia

4. Oil is entering a positive seasonal period.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

5. Oil flows through the Bab-El-Mandeb Strait continue to trend lower.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Source: Wikipedia

Source: Wikipedia

——————–

6. Uranium prices keep surging.

Back to Index

Equities

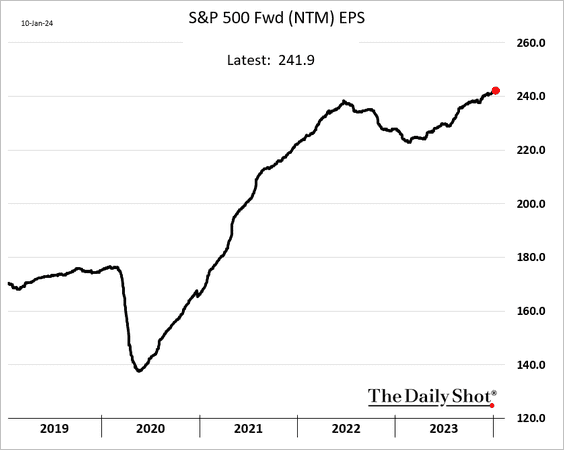

1. Rolling 12-month forward earnings estimates for the S&P 500 hit a record high.

• Expectations for US tech long-term earnings growth have soared.

Source: MRB Partners

Source: MRB Partners

——————–

2. The average S&P 500 stock valuation (equal-weight index) remains well below that of the overall index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. On average, the S&P 500 trades sideways during the first quarter of an election year.

Source: @granthawkridge

Source: @granthawkridge

4. This chart shows short interest by sector over the past two years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. The Russell 2000 has been much more volatile than the S&P 200 in recent months.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

6. The CBOE VVIX index (vol of vol) has been tumbling, reflecting falling demand for VIX call options.

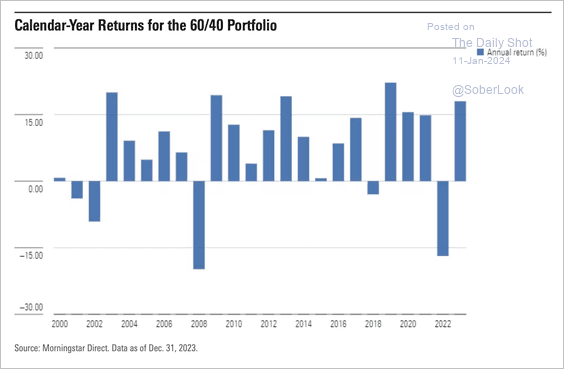

7. The traditional 60% equities/40% bonds portfolio posted its best returns since 2019 last year, staking up well against other strategies. (2 charts)

Source: Morningstar Read full article

Source: Morningstar Read full article

Source: Morningstar Read full article

Source: Morningstar Read full article

——————–

8. Homebuilding stocks are trading at a wider discount to the S&P 500 relative to the past decade.

Source: State Street Global Advisors

Source: State Street Global Advisors

Back to Index

Credit

1. Investment-grade bond issuance surged at the start of the year.

Source: @axios Read full article

Source: @axios Read full article

2. Here is a look at securitized product issuance in 2022 and 2023.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. The rise in usage of the Fed’s Bank Term Funding Program (BTFP), an emergency facility introduced following the SVB failure, has generated a lot of excitement. But the overall Fed emergency funding usage is down substantially since last March (2nd panel).

The BTFP demand is due to its low funding rates to banks.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

4. Bank deposits have been rising, …

… as the Fed’s RRP facility usage decreases, boosting liquidity in the private sector.

Back to Index

Rates

1. Goldman expects the Fed to begin tapering QT in May.

Source: Wikipedia

Source: Wikipedia

2. What drove the declines in R-star over the past four decades?

Source: III Capital Management

Source: III Capital Management

3. Deutsche Bank identifies the 2024 dot plot contributors.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

1. Back to the office?

Source: @axios Read full article

Source: @axios Read full article

2. Commuting times relative to 2019:

Source: The New York Times Read full article

Source: The New York Times Read full article

3. Tax offenders prosecuted at the federal level:

Source: Scholaroo Read full article

Source: Scholaroo Read full article

4. Photo camera shipments:

Source: Statista

Source: Statista

5. Deteriorating trust in the media:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

6. US residential solar electricity generation:

Source: @WSJ Read full article

Source: @WSJ Read full article

7. China’s surging coal capacity:

Source: MacroPolo Read full article

Source: MacroPolo Read full article

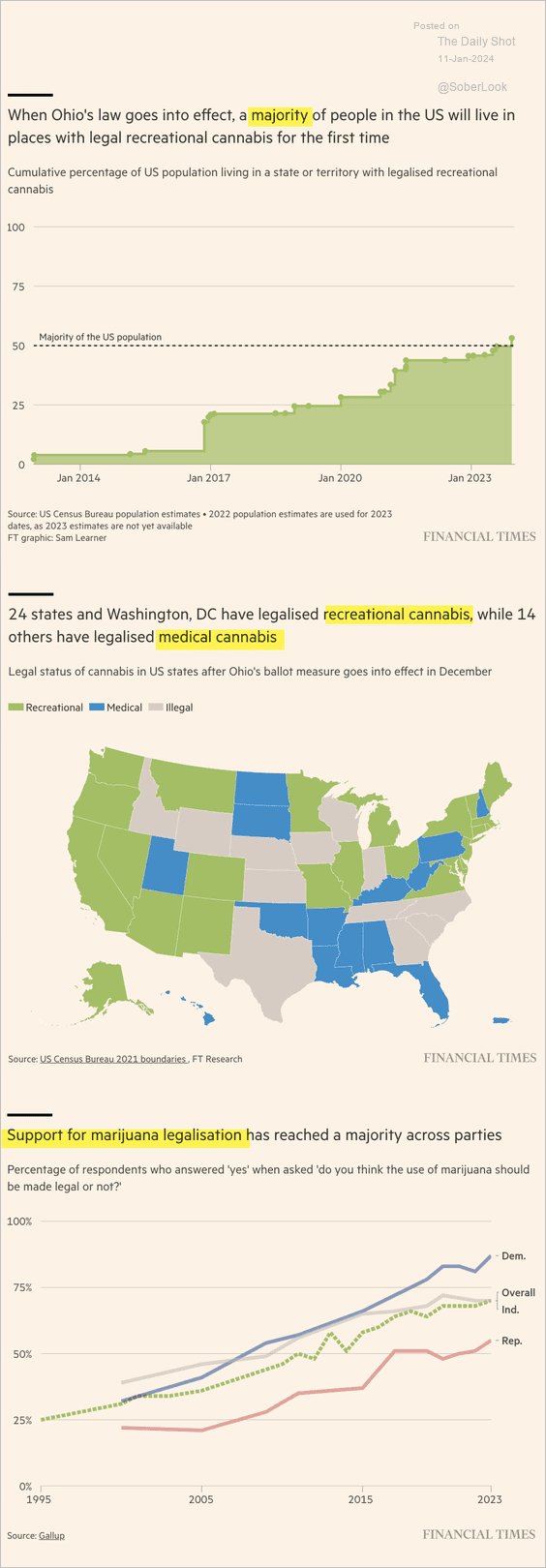

8. Legalization of cannabis in the US:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

9. Euthanasia rates for dogs in US shelters:

Source: @axios Read full article

Source: @axios Read full article

10. Lunar landings:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index