The Daily Shot: 15-Jan-24

• The United States

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

1. The December PPI report was below forecasts, …

Source: @economics Read full article

Source: @economics Read full article

… with the core PPI remaining unchanged again (an increase was expected).

• The decline in business markups (trade services) was a drag on core producer inflation. This indicator points to softer corporate margins.

Trade services PPI has seen a decline for four straight months.

• Excluding trade services, the core PPI climbed in line with forecasts.

——————–

2. The downside PPI surprise has heightened market expectations for Fed easing, with predictions now almost at 170 bps in rate cuts for this year. This contrasts with the December FOMC forecasts, which indicated just 75 bps in reductions. Numerous analysts perceive the market’s stance as excessively dovish.

Despite a pushback from some Fed officials, markets see a March rate cut as highly probable.

• The 2-year Treasury yield declined again, …

Source: MarketWatch Read full article

Source: MarketWatch Read full article

… now down for six days in a row.

• The Treasury curve’s bull steepening continued, with the 30-year/2-year spread moving into positive territory.

——————–

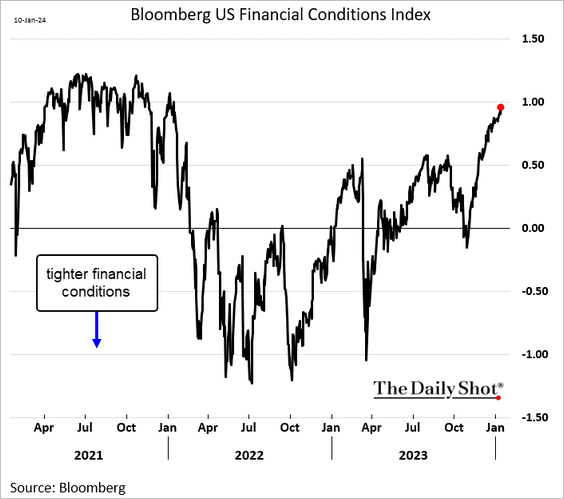

3. Financial conditions have eased sharply in recent weeks.

4. Card spending has been holding up, according to Bank of America’s data.

Source: BofA Global Research

Source: BofA Global Research

• The boost to household incomes from higher rates will likely fade.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

1. The November GDP estimate topped expectations.

• Services and manufacturing output increased.

– Construction activity continued to move lower.

• The trade gap narrowed.

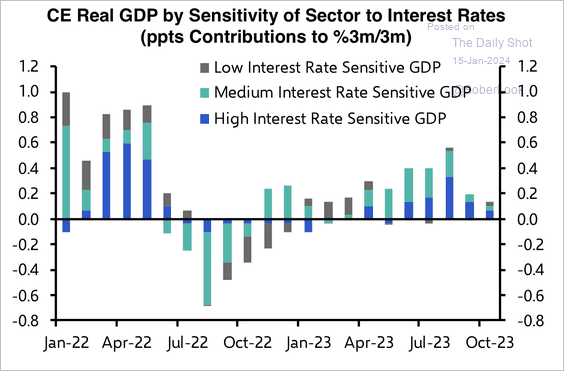

• The slowdown in real GDP growth has been driven by sectors with high interest rate sensitivity.

Source: Capital Economics

Source: Capital Economics

– Capital Economics expects a recovery in real GDP due to interest rate cuts, falling inflation, and a boost to real household incomes.

Source: Capital Economics

Source: Capital Economics

——————–

2. Home prices increased in this month.

• UK housing affordability has been deteriorating for decades.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

3. What do companies view as their top concerns?

Source: ING

Source: ING

Back to Index

The Eurozone

1. French goods consumption increased in November.

2. Here is a look at employment PMIs by sector. Construction and manufacturing employment is contracting, while services are still in growth mode.

Source: ECB

Source: ECB

3. Here is a look at electricity generation by source in Germany, France, Italy, and Spain.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

Japan

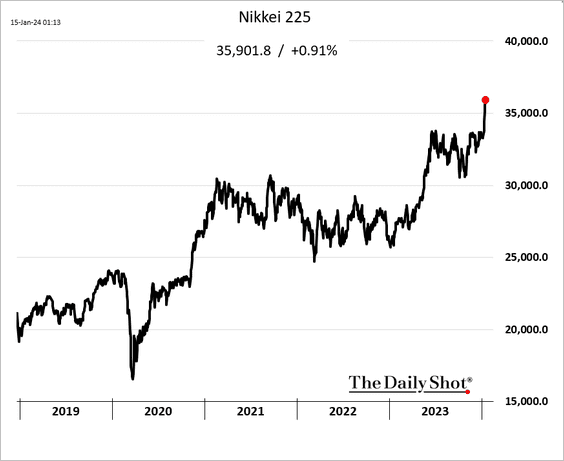

1. Stock prices continue to surge.

• The correlation between equities and dollar-yen has strengthened this year.

Source: George Lei, Bloomberg Read full article

Source: George Lei, Bloomberg Read full article

• The correlation between the Nikkei and the S&P 500 moved further into negative territory.

Source: George Lei, Bloomberg Read full article

Source: George Lei, Bloomberg Read full article

——————–

2. Dollar-yen is holding resistance at the 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

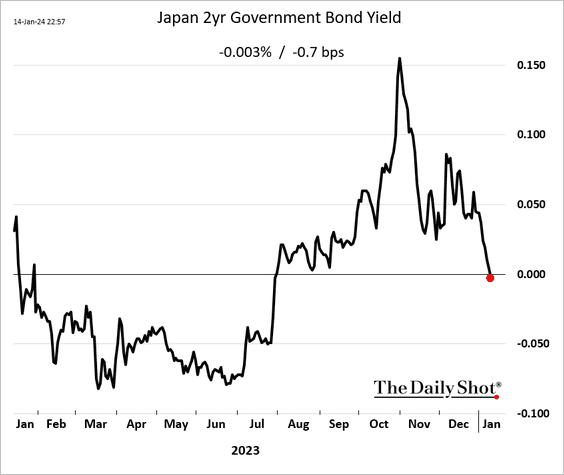

3. The 2-year JGB yield is negative again.

4. The Economy Watchers Expectations indicator edged lower in December.

Back to Index

China

1. Last month’s loan growth surprised to the downside.

Here is China’s loan growth on a year-over-year basis.

Source: @markets Read full article

Source: @markets Read full article

• Aggregate financing was also softer than expected.

• Growth in monetary aggregates continues to slow.

——————–

2. Despite soft credit growth, the PBoC left the 1-year rate unchanged (the market expected a cut).

3. Onshore ETF flows were robust last year, driven in part by state funds trying to prop up the market.

Source: @markets Read full article

Source: @markets Read full article

4. Baidu could face US sanctions due to its collaboration with China’s military.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

Back to Index

Emerging Markets

1. EM currencies appear undervalued based on their average deviation from real effective exchange rates.

Source: Oxford Economics

Source: Oxford Economics

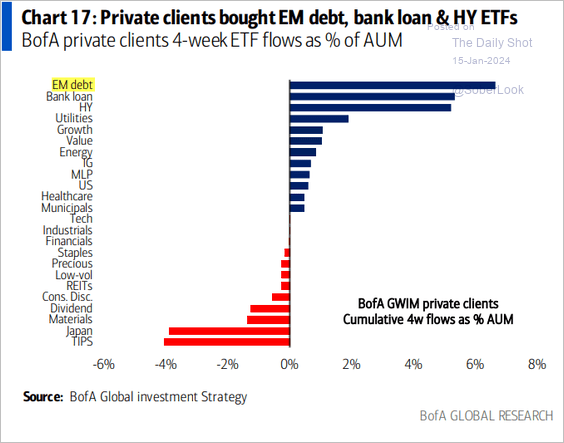

2. BofA’s private clients like EM bonds.

Source: BofA Global Research

Source: BofA Global Research

3. India’s middle class has been growing quickly.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. Romania’s industrial production continues to trend lower (partly due to the Eurozone’s manufacturing slump).

5. Finally, we have some performance data from last week.

• Currencies:

• Bond yields:

Back to Index

Cryptocurrency

1. “Buy the rumor, sell the news.” Bitcoin dipped below $43k after the launch of spot ETFs.

2. Ether continues to outperform.

3. Here is a look at last week’s performance across some of the most liquid cryptos.

Back to Index

Commodities

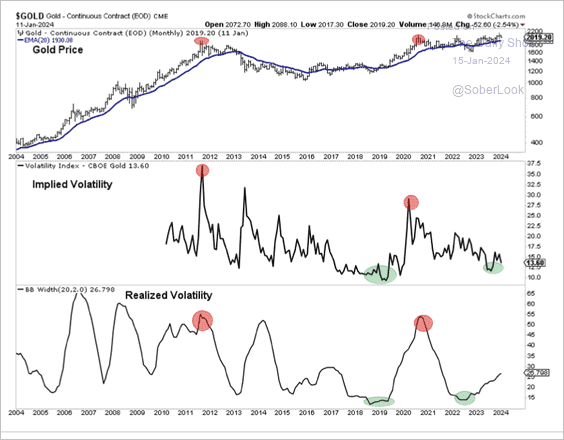

1. Silver continues to underperform gold.

• July-September is typically the strongest period for gold.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

• Volatility in gold futures remains historically low, which typically does not indicate the end of an uptrend.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

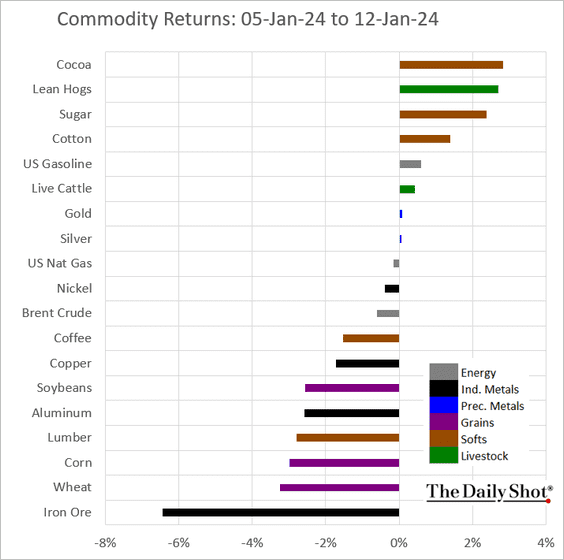

2. Corn futures hit their lowest level since the end of 2020.

• Speculative accounts continue to boost their bets against corn.

• Treaders are also increasingly bearish on soybeans.

——————–

3. Cocoa futures are surging again.

4. Here is a look at last week’s performance across key commodity markets.

Back to Index

Energy

1. US natural gas futures climbed further on Friday, …

… as the “Arctic blast” moved toward Texas.

Source: NOAA

Source: NOAA

• Spot natural gas and electricity prices soared.

Source: @climate Read full article

Source: @climate Read full article

Texas electricity demand jumped.

——————–

2. US fracking activity continues to trend lower.

3. Uranium prices keep rising.

Back to Index

Equities

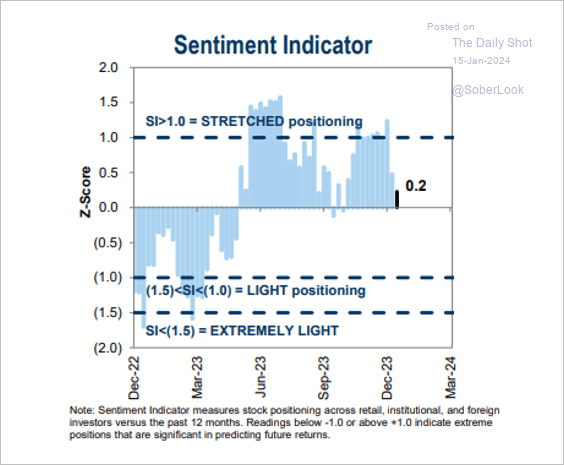

1. Goldman’s sentiment indicator shows investors becoming more cautious.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Corporate insiders are very nervous.

Source: homson Reuters

Source: homson Reuters

——————–

2. Small businesses are reporting falling sales. What does that mean for larger firms?

Source: @MikaelSarwe

Source: @MikaelSarwe

3. Share buybacks have been lagging earnings growth.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4. Historically, very strong December periods for the S&P 500 precede subdued returns in January.

Source: Citi Private Bank

Source: Citi Private Bank

5. The momentum factor has been outperforming.

h/t @MikeZaccardi

h/t @MikeZaccardi

6. Earnings preannouncements have been negatively skewed.

Source: @MichaelKantro

Source: @MichaelKantro

7. Non-US equity markets have greater room to rerate, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

8. The stock market’s negative correlation to the dollar intensified post-COVID.

9. Finally, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

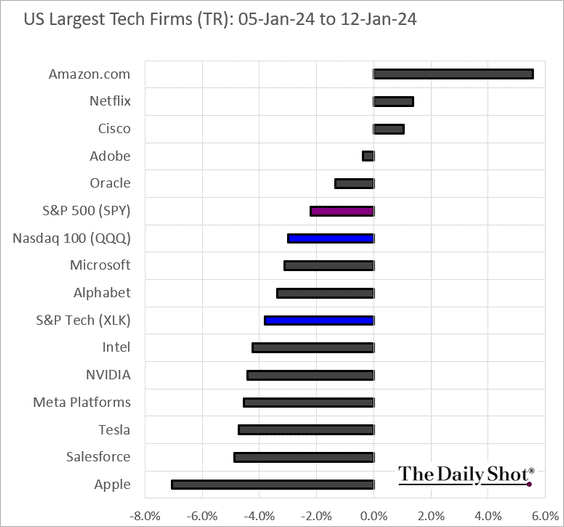

• Largest US tech firms:

Back to Index

Credit

1. US loan growth has stalled.

The loan-to-deposit ratio remains well below pre-COVID levels.

——————–

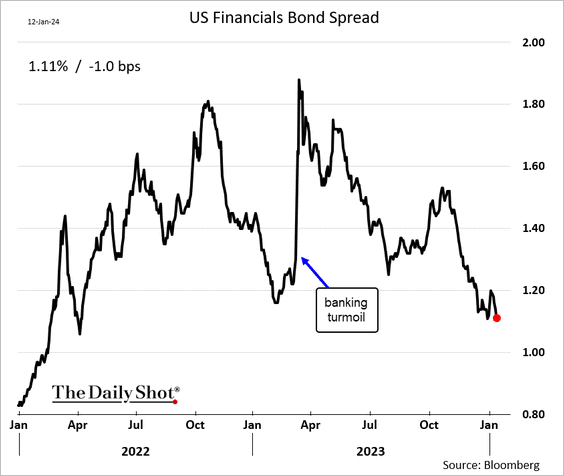

2. Financial sector spreads have been tightening.

3. Repricing of US leveraged loans continued its advance from late last year. However, PitchBook data shows depressed buyout deals as the base borrowing rate remains elevated, potentially softening recent bullish activity.

Source: PitchBook

Source: PitchBook

4. Money market funds’ AUM hit another record high.

Source: BofA Global Research

Source: BofA Global Research

——————–

5. Finally, we have some performance data from last week.

Back to Index

Global Developments

1. Container shipping costs from Asia continue to climb.

2. Gavekal’s global growth indicators are improving. (2 charts)

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

——————–

3. Here is a look at housing prices in advanced economies since 2005.

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

1. Sports betting:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

2. Twitter advertising revenue:

Source: The Economist Read full article

Source: The Economist Read full article

3. Child care arrangements:

Source: US Census Read full article

Source: US Census Read full article

4. Global government debt:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

5. Happiness vs. GDP per capita:

Source: @chartrdaily

Source: @chartrdaily

6. Retirement age around the world:

Source: @TheDailyShot

Source: @TheDailyShot

7. The median age of US home buyers:

Source: @chartrdaily

Source: @chartrdaily

8. College majors with the highest unemployment rates:

Source: @genuine_impact

Source: @genuine_impact

9. Martin Luther King Jr. – by the numbers:

Source: NBC News

Source: NBC News

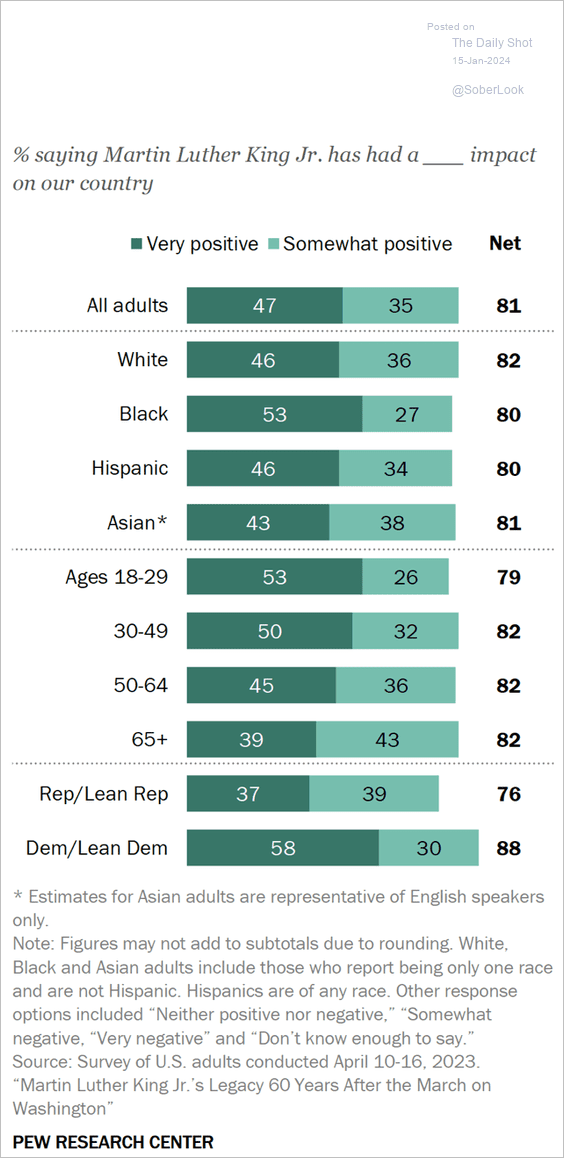

• Views on Martin Luther King’s impact on the US:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

• Views on progress made since the March on Washington:

Source: Statista

Source: Statista

——————–

Back to Index