The Daily Shot: 16-Jan-24

• Administrative Update

• The United States

• Canada

• The Eurozone

• Europe

• Asia-Pacific

• China

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

We wanted to inform you that due to a necessary medical procedure, there will be a brief hiatus in the publication of The Daily Shot. This pause will be from January 24th to at least January 26th (perhaps longer). We are committed to ensuring that our content remains as insightful and informative as ever, and we eagerly anticipate resuming publication shortly after this period.

Your understanding and support during this time is greatly appreciated.

Back to Index

The United States

1. Let’s begin with some data on the US consumer.

• Real household deposits are nearing pre-pandemic levels.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

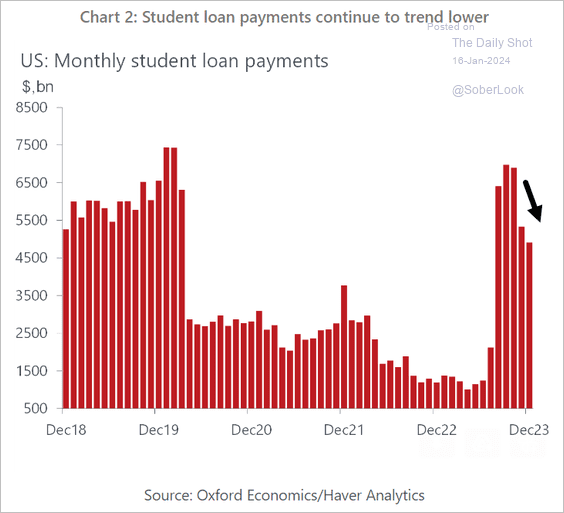

• Following an initial spike after the payment holiday ended, student loan payments are rapidly trending lower.

Source: Oxford Economics

Source: Oxford Economics

• Here is a look at real household income growth this year (a forecast from Goldman).

Source: Goldman Sachs

Source: Goldman Sachs

——————–

2. Next, we have a couple of updates on inflation.

• Sharp declines in the money supply signal slower inflation ahead.

Source: Gavekal Research

Source: Gavekal Research

• The Phillips Curve has been shifting lower.

Source: Alpine Macro

Source: Alpine Macro

——————–

3. Goldman anticipates US job gains to stabilize around 100k per month, aligning closely with the breakeven pace – the number of new jobs required to maintain a steady unemployment rate in light of labor supply growth.

Source: Goldman Sachs

Source: Goldman Sachs

• Last year saw a record number of individuals holding multiple jobs. Yet, at 5.3% of total employment, the proportion of multiple jobholders is not exceptionally high, returning to the 2019 highs.

——————–

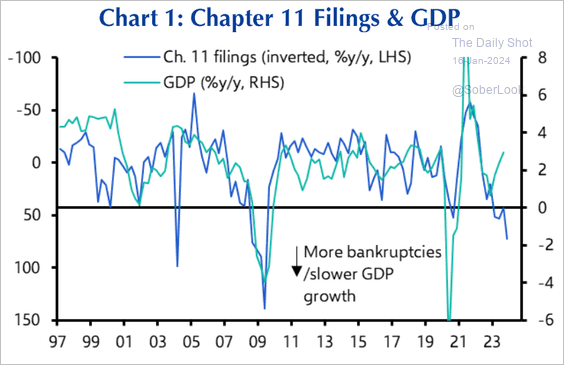

4. Chapter 11 filings may signal a downshift in US economic growth.

Source: Capital Economics

Source: Capital Economics

5. Here is a look at the share of US imports by country/region.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

6. The dollar has been rebounding, with the Deutsche Bank Trade Weighted Index back at its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Canada

1. Consumer confidence moved higher in recent weeks.

2. Manufacturing sales increased in November.

3. Existing home sales surged last month.

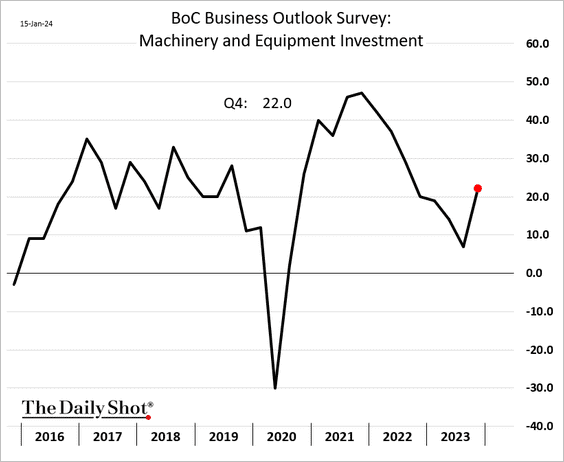

4. Next, we have some trends from the BoC’s business survey (as of Q4).

• The overall sentiment (still depressed):

• Sales expectations (a strong rebound):

• CapEx (improvement in Q4):

• Credit conditions (tight):

• Employment (slowing):

• No labor shortages:

• Price inflation balance (still slowing):

• Inflation expectations (elevated):

Source: The Globe and Mail Read full article

Source: The Globe and Mail Read full article

——————–

5. Leading indicators point to slower wage growth and softer inflation ahead.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

The Eurozone

1. Euro-area industrial output declined again in November.

2. The trade surplus has been rising.

3. Economists have downgraded their forecasts for this year’s inflation.

4. Four rate cuts this year?

Source: @economics Read full article

Source: @economics Read full article

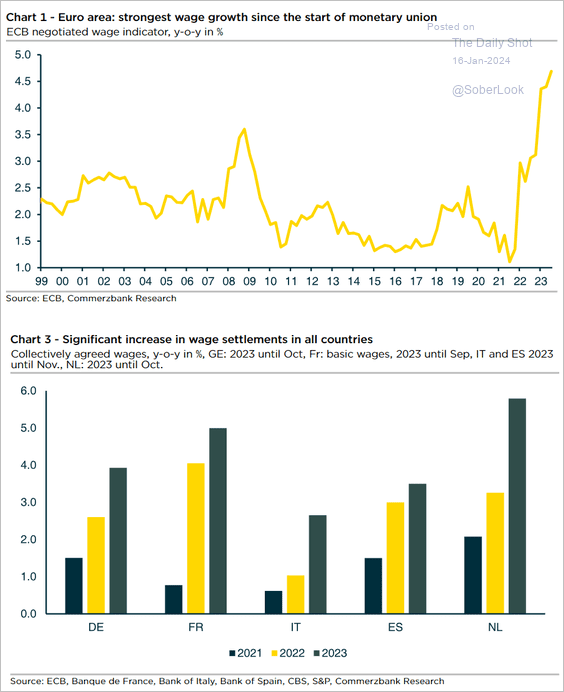

5. Inflation hawks are focused on the euro area’s strong wage growth.

Source: Commerzbank Research

Source: Commerzbank Research

6. Germany’s economy contracted in 2023.

Back to Index

Europe

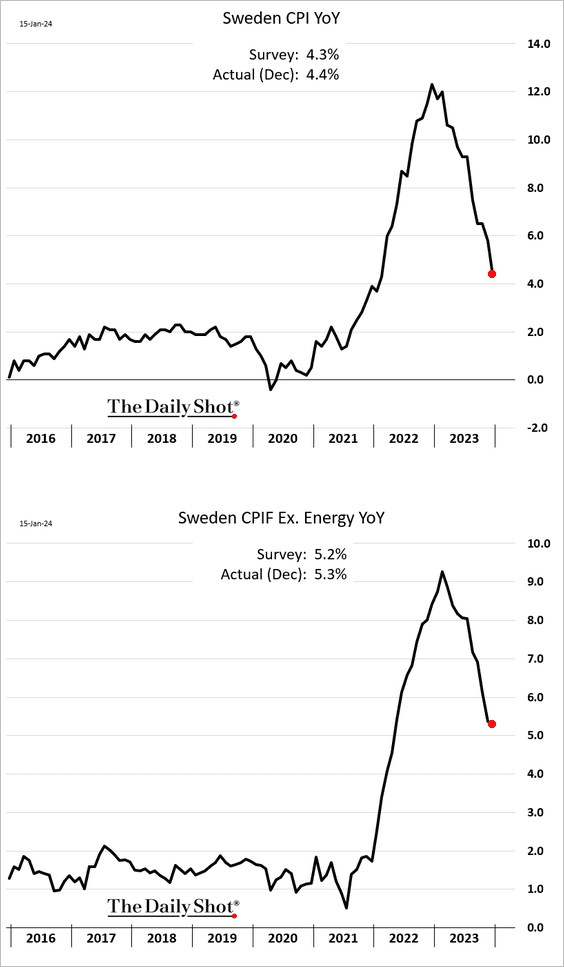

1. Sweden’s inflation report was a bit stronger than expected.

Source: @economics Read full article

Source: @economics Read full article

——————–

2. Here is a look at net electricity exports across the EU.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

Asia-Pacific

1. Japan’s PPI hit zero last month (on a year-over-year basis).

2. Asian currencies have been weakening this year.

3. Next, we have some updates on Australia.

• Consumer confidence (still soft):

• Household spending (a sharp decline last month):

• Mortgage lending (a rebound over the past few months):

• The trade balance (an upside surprise due to softer imports):

• Wage growth (a slowdown ahead):

Source: Capital Economics

Source: Capital Economics

• The Aussie dollar (falling):

Back to Index

China

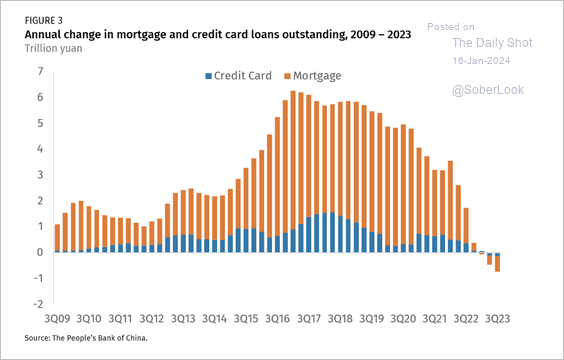

1. Household credit has been contracting, …

Source: Rhodium Group Read full article

Source: Rhodium Group Read full article

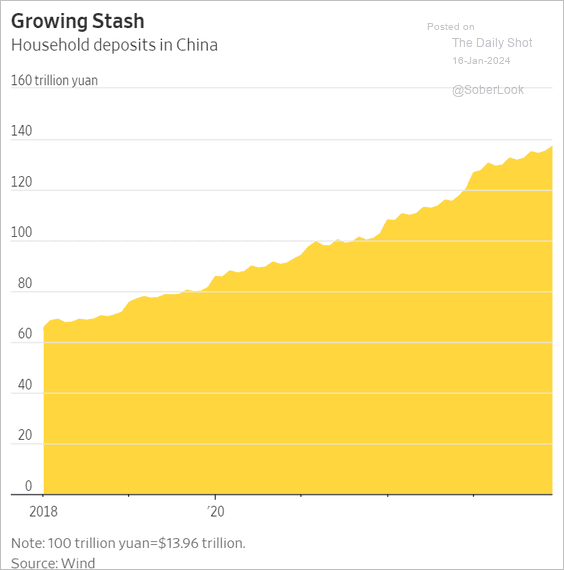

…. while household deposits continue to rise.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

2. Investors expect weaker economic growth ahead.

Source: BofA Global Research

Source: BofA Global Research

3. Automobiles have been dominating exports.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

1. BTC/USD appears overbought within its intermediate-term uptrend.

2. Previous bitcoin product launches occurred around major price peaks.

Source: @donnelly_brent

Source: @donnelly_brent

3. Large spikes in bitcoin futures open interest also occur around price peaks.

Source: @McClellanOsc

Source: @McClellanOsc

4. The Crypto Fear & Greed Index declined from “extreme greed” territory over the past week.

Source: Alternative.me

Source: Alternative.me

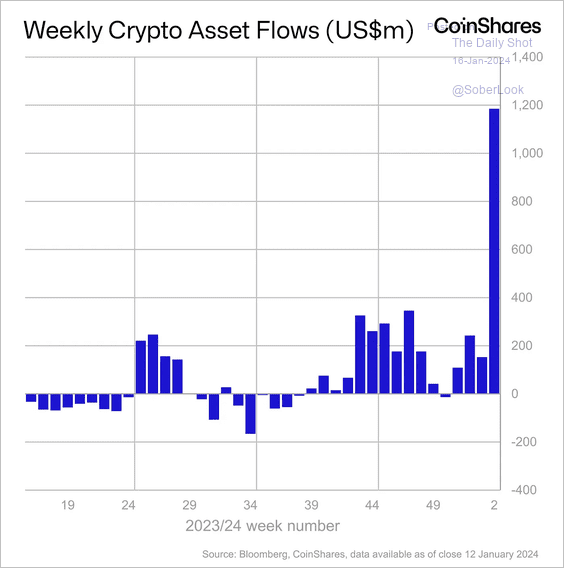

5. Crypto funds saw a near-record spike in inflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

6. Miners’ average cost of production per bitcoin is around $37,856, according to CoinShares.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Energy

1. Demand on the Texas power grid has been surging.

2. Capital Economics expects OPEC oil output to increase from April.

Source: Capital Economics

Source: Capital Economics

3. Goldman has revised its forecast for US natural gas production higher.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

4. European natural gas futures continue to sink amid ample supplies in storage.

5. Here is a look at renewables capacity additions.

Source: IEA Read full article

Source: IEA Read full article

Back to Index

Equities

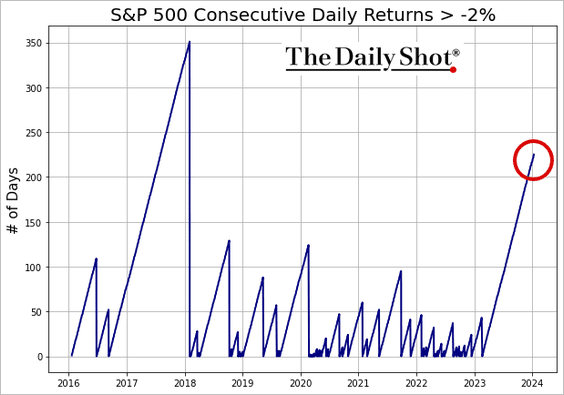

1. The S&P 500 hasn’t had a 2% down day in almost a year (225 trading sessions).

2. Investors see the tech mega-caps as the most crowded trade.

Source: BofA Global Research

Source: BofA Global Research

3. Fund flows have turned negative.

Source: BNP Paribas; @WallStJesus

Source: BNP Paribas; @WallStJesus

4. Here is a look at the S&P 500 dividend yield compared to counterparts abroad.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

5. Dividend growers’ valuation discount to the S&P 500 has been widening …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… due to the tech mega-cap distortion.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

6. Call option activity in defensive shares surged in recent weeks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

7. Lagging stocks in the S&P 500 typically post their best performance around the end of the year.

Source: Mensur Pocini; Julius Baer

Source: Mensur Pocini; Julius Baer

8. The US value factor’s underperformance is extreme, although earnings momentum remains weak. (2 charts)

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

9. Implied correlations are near multi-year lows.

Back to Index

Credit

1. Last year’s bankruptcy filings hit their highest level since 2010.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

2. European leveraged loans posted stellar returns last year, matching high-yield bonds in the region and trouncing equities.

Source: PitchBook

Source: PitchBook

3. Midle-market CLO volume surged last year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

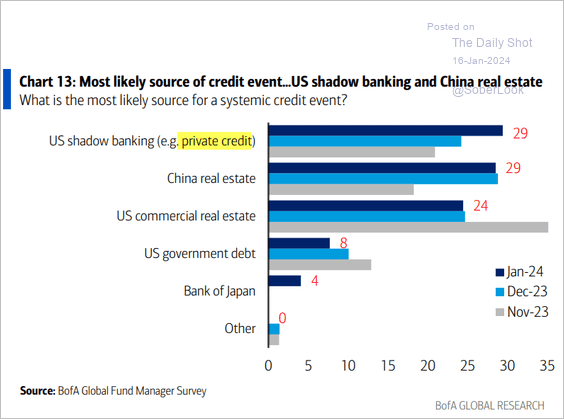

4. Investors are concerned about private credit.

Source: BofA Global Research

Source: BofA Global Research

5. Most US public finance sectors continue to benefit from their post-pandemic liquidity boost.

Source: Breckinridge Capital Advisors Read full article

Source: Breckinridge Capital Advisors Read full article

• US public sector unfunded pension liabilities continue to decline as a percentage of GDP.

Source: Breckinridge Capital Advisors Read full article

Source: Breckinridge Capital Advisors Read full article

• State general fund revenue is expected to drop by nearly 2% this year.

Source: Breckinridge Capital Advisors Read full article

Source: Breckinridge Capital Advisors Read full article

Back to Index

Rates

1. The Fed’s reverse repo facility balance continues to shrink as money market funds find higher-yielding opportunities in private markets (T-bills, private repo).

2. Here is a look at the Fed’s balance sheet.

Source: Oxford Economics

Source: Oxford Economics

3. Goldman sees Fed rate cuts starting in March.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Global Developments

1. Most central banks have paused rate hikes after an aggressive tightening phase.

Source: @topdowncharts

Source: @topdowncharts

2. Speculative accounts remain bearish on the US dollar.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

3. This chart shows CapEx trends for the US, Germany, and Japan.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

1. What’s keeping Americans from buying an EV?

Source: @CivicScience Read full article

Source: @CivicScience Read full article

2. Poverty rates:

Source: Census Bureau Read full article

Source: Census Bureau Read full article

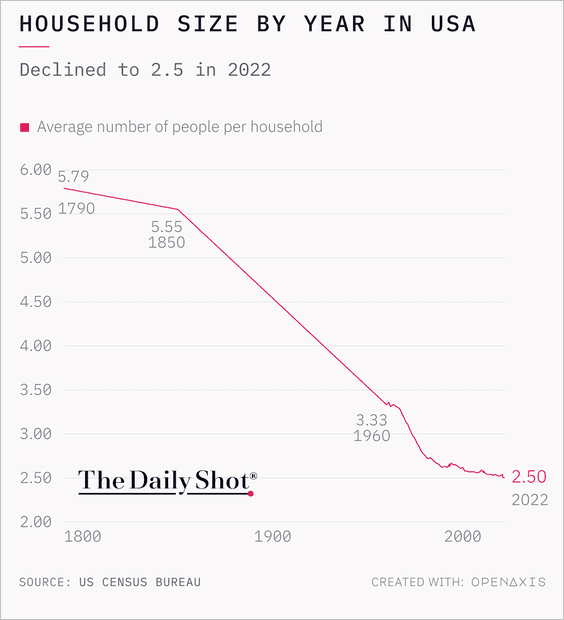

3. US household size over time:

Source: @TheDailyShot

Source: @TheDailyShot

4. Gen Z and STEM:

Source: Gallup Read full article

Source: Gallup Read full article

5. Teacher shortages:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

6. Wealthier, better-educated Russians are more supportive of Putin’s war.

Source: The Economist Read full article

Source: The Economist Read full article

7. Pedestrian death rates:

Source: The New York Times Read full article

Source: The New York Times Read full article

8. Antisemitic incidents:

Source: ADL

Source: ADL

9. How long does it take to put on makeup?

Source: YouGov

Source: YouGov

——————–

Back to Index