The Daily Shot: 17-Jan-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Global Developments

• Food for Thought

The United States

1. Fed officials continue to push back on market expectations for rapid-fire rate cuts this year.

Source: CNBC Read full article

Source: CNBC Read full article

• Waller’s comments sent Treasury yields higher.

– The yield curve keeps steepening.

• The dollar continues to rally, …

… sending gold prices lower.

——————–

2. The NY Fed’s manufacturing index plunged this month as demand deteriorated.

Is it noise? Seasonal adjustments?

Source: MarketWatch Read full article

Source: MarketWatch Read full article

The decline doesn’t bode well for factory activity at the national level. The Philly Fed’s index will give us more clues on Thursday.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Forward-looking measures in the NY Fed’s manufacturing report improved.

• Indicators of price expectations climbed this month.

——————–

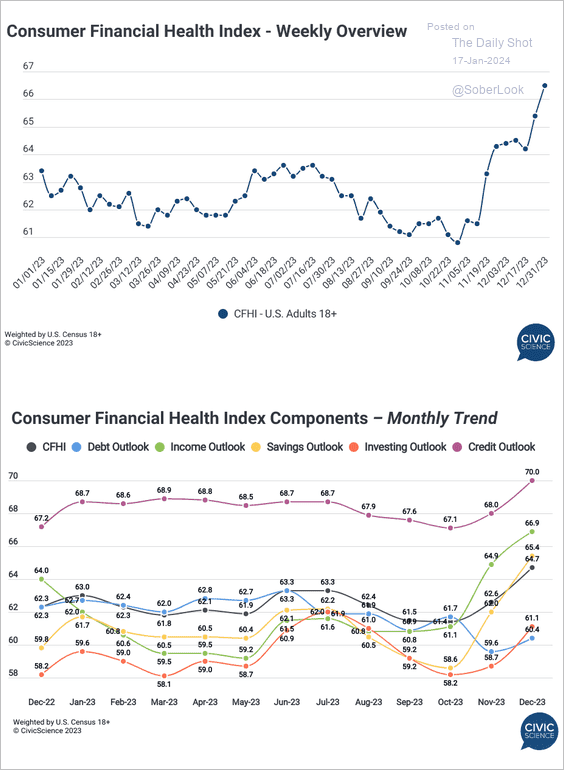

3. According to CivicScience, “consumers ended 2023 feeling increasingly optimistic about the short-term future of their overall financial health.”

Source: @CivicScience Read full article

Source: @CivicScience Read full article

4. The divergence between goods and services spending has been driven by remote work and is likely to persist, according to Goldman.

Source: Goldman Sachs

Source: Goldman Sachs

5. Employment among foreign-born individuals has returned to its pre-COVID trajectory, whereas the count of native-born workers remains significantly below the trend, partly due to elevated retirement rates.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

6. Here is a look at cyclical and acyclical components of the core PCE inflation.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

7. The majority of US household debt is comprised of fixed-rate loans.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Canada

1. The December headline CPI rose in line with expectations.

But core inflation indicators topped forecasts.

– Weighted median CPI:

– Trimmed mean CPI:

Here is the CPI excluding food and energy.

• Rent inflation remains very high.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Canadian bond yields rose sharply.

3. Housing starts increased last month.

Back to Index

The United Kingdom

1. The PAYE payrolls indicator declined sharply last month. The index is often subject to substantial revisions.

• Claimant count has been trending higher.

• Job openings continue to fall.

• Wage growth (the average of September, October, and November) surprised to the downside.

——————–

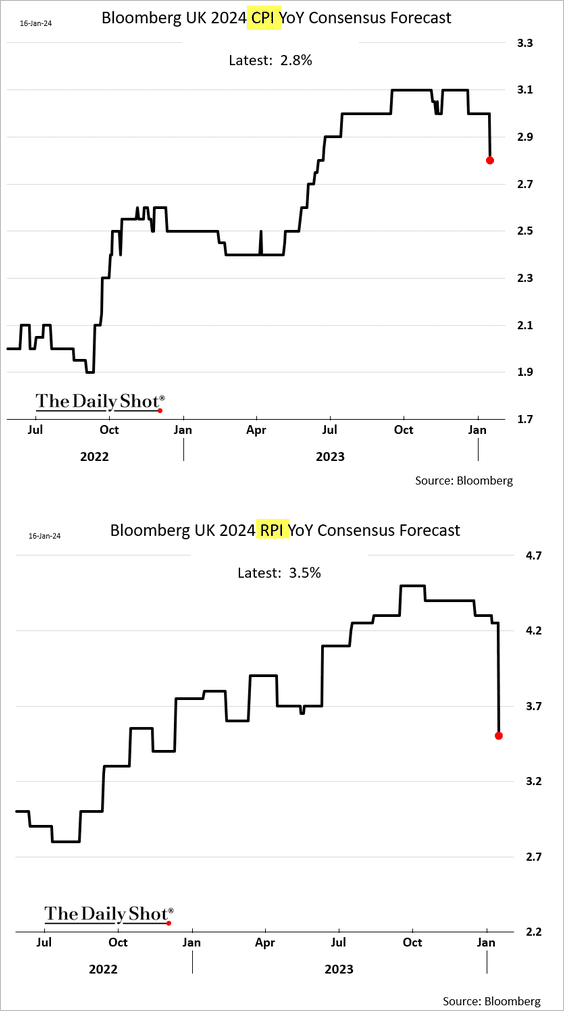

2. Economists downgraded their forecasts for this year’s inflation rate.

3. Households’ real savings are well below the pre-COVID trend.

Source: ING

Source: ING

4. Here is a look at the UK demand for mental health services.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

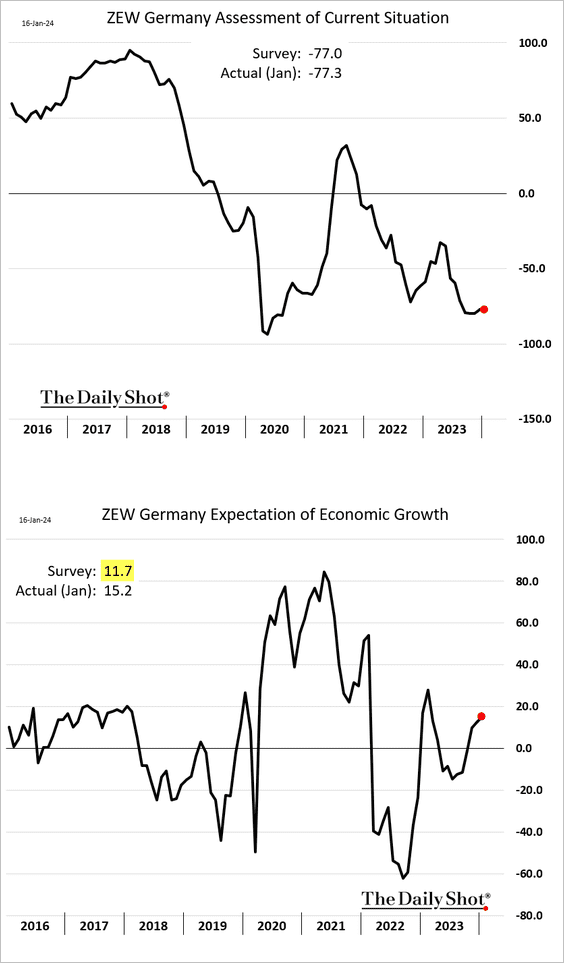

1. Germany’s ZEW expectations index continues to recover.

2. Euro-are bond yields have been climbing.

3. Consumer inflation expectations declined sharply in November.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

4. The acceleration of the ECB’s quantitative tightening could more than offset the reduction in eurozone government bond issuance.

Source: Gavekal Research

Source: Gavekal Research

5. The ECB tends to react slower than other central banks in a crisis.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

6. What drove the decline in the euro-area r-star in recent decades?

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Europe

1. Norway’s GDP contracted in November.

2. Here is a look at the EU’s imports of spices.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

1. Let’s start with JGB demand by tenor.

Source: Masaki Kondo, Bloomberg Read full article

Source: Masaki Kondo, Bloomberg Read full article

2. Asian currencies continue to ease versus the dollar.

3. New Zealand’s card spending declined sharply last month.

Source: @markets Read full article

Source: @markets Read full article

• New Zealand’s home prices are rising again.

Back to Index

China

1. The Q4 GDP report was a bit softer than expected.

• Is the economy weaker than the headline GDP suggests?

Source: @ANZ_Research

Source: @ANZ_Research

• Beijing continues to implement stimulus measures.

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

2. The December industrial production print topped forecasts.

• Retail sales softened.

• Youth unemployment is now “all fixed” …

Source: @economics Read full article

Source: @economics Read full article

——————–

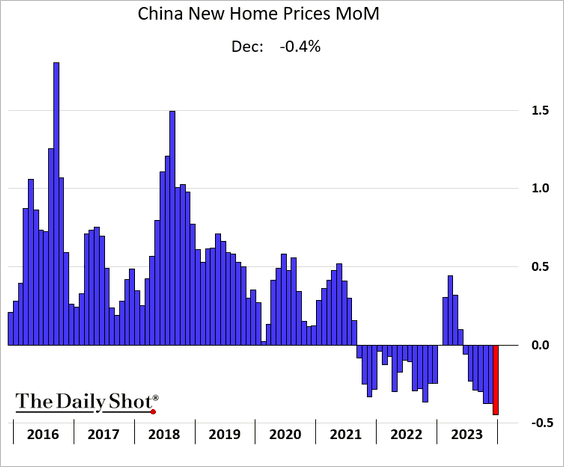

3. Home prices continue to fall.

4. The renminbi has been weakening against the dollar.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

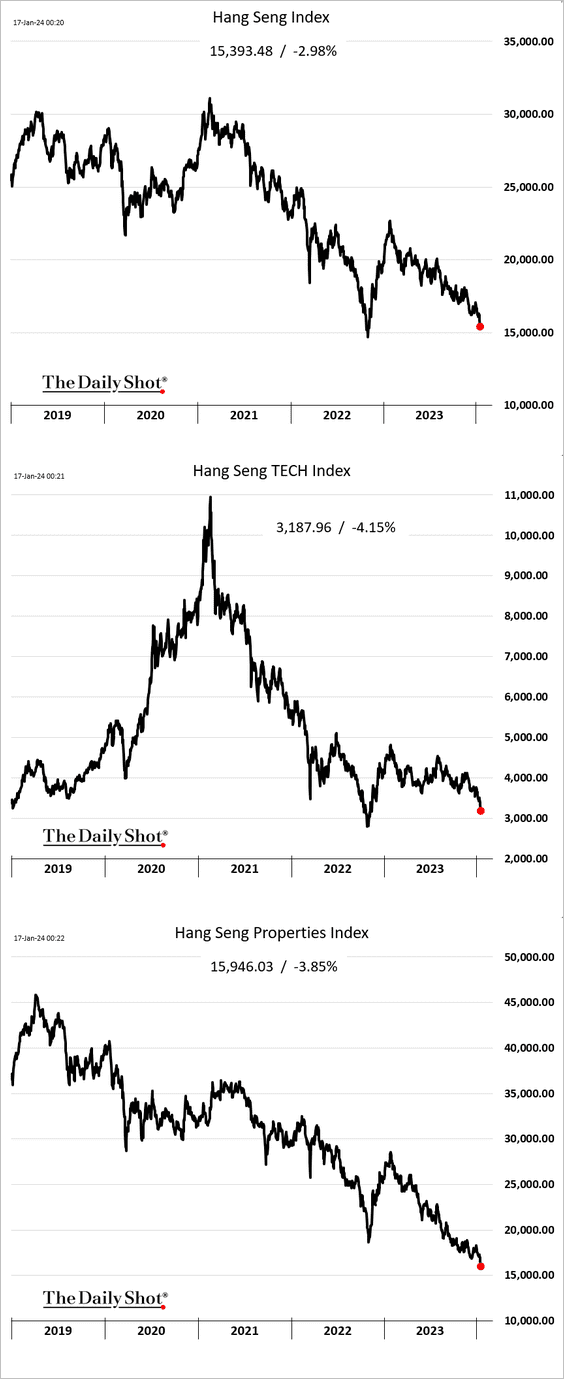

5. The stock market remains under pressure.

– Mainland:

– Hong Kong:

• This chart shows the decomposition of market underperformance relative to the US.

Source: Capital Economics

Source: Capital Economics

• The valuation discount to other markets continues to widen.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Emerging Markets

1. EM currencies have been selling off.

2. How correlated are EM currencies to the S&P 500 and the US dollar?

• Here is a look at currency carry and implied volatility.

——————–

3. Brazil’s services output edged higher in November.

4. LatAm corporate debt issuance dropped significantly last year, although some analysts expect a rebound as inflation cools and interest rates stabilize.

Source: White & Case Read full article

Source: White & Case Read full article

5. India’s exports were slightly above 2022 levels last month.

• Wholesale price inflation is back in positive territory.

——————–

6. South Africa’s electricity output is at multi-year lows, a significant headwind for economic growth.

Back to Index

Commodities

1. The selloff in iron ore futures continues. Less-than-stellar economic data from China has been a headwind for the commodity.

2. Palladium’s underperformance keeps widening.

3. The gap between gold and gold miners’ shares has blown out.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

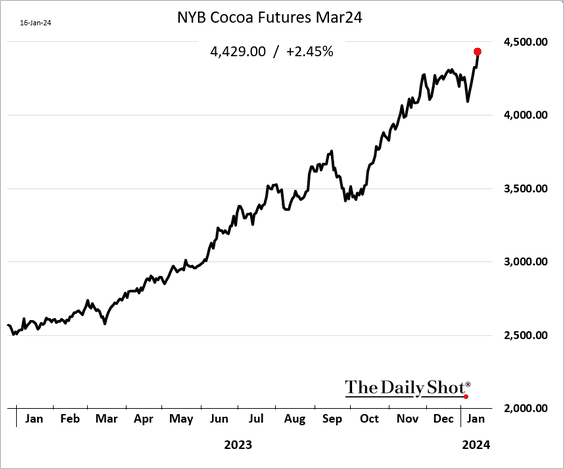

4. Cocoa futures keep moving higher.

5. US corn futures remain under pressure.

Back to Index

Energy

1. US natural gas futures are tanking …

… as temperatures are expected to rebound.

Source: NOAA

Source: NOAA

——————–

2. US pipeline gas exports to Mexico increased markedly last year.

Source: Capital Economics

Source: Capital Economics

The uptrend in US gas exports to Mexico could continue as LNG exports from the new Altamira plants begin next month.

Source: bnamericas Read full article

Source: bnamericas Read full article

——————–

3. More investment in LNG production will be needed to meet demand.

Source: @climate Read full article

Source: @climate Read full article

Back to Index

Equities

1. Speculative positioning in equity futures seems to be stretched (2 charts).

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

2. The S&P 500 appears extended, especially given the low-volatility environment.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

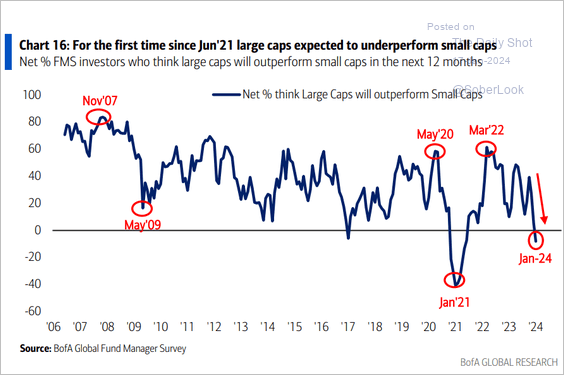

3. Investors have capitulated on small caps.

Source: BofA Global Research

Source: BofA Global Research

4. How correlated are different sectors to the S&P 500 and Treasuries?

5. Low-margin stocks are trading at a significant discount.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

6. US companies appear to be in the early stage of an earnings upcycle. However, rate cuts typically coincide with slower economic growth, which could weigh on earnings.

Source: MRB Partners

Source: MRB Partners

7. Mentions of AI-related topics in corporate transcripts are starting to fade.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Upside momentum in AI stocks has slowed relative to the S&P 500.

——————–

8. Who owns the US equity market?

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Alternatives

1. Here is a look at alternative mutual funds.

Source: @WSJ Read full article

Source: @WSJ Read full article

2. PE deal activity slowed last year.

Source: @theleadleft

Source: @theleadleft

3. US public companies’ multiples have pushed significantly higher than private M&A deal multiples.

Source: PitchBook

Source: PitchBook

4. US software and fintech ventures have relatively high post-money valuations, which could result in disproportionate pressure to provide returns.

Source: PitchBook

Source: PitchBook

5. A majority of early-stage US venture rounds were raised by companies outside of the Bay Area and NYC over the past two years.

Source: Carta

Source: Carta

Back to Index

Credit

1. Wellington expects low-single-digit excess returns in US high-yield credit as spreads appear tight relative to their historical averages. (2 charts)

Source: Wellington Management Read full article

Source: Wellington Management Read full article

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

2. Syndicated middle market loan activity declined last quarter.

Source: @theleadleft

Source: @theleadleft

3. A growing share of US investment-grade bonds matures within a year.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

4. The delinquency rate for US prime auto loans is trending higher.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

1. Very few fund managers expect a hard landing.

Source: BofA Global Research

Source: BofA Global Research

2. Here is a look at net foreign assets and total wealth per capita. World Bank estimates show that among major economies, Australia, the US, Germany, and Canada stand out for their high levels of total wealth per capita (the sum of produced capital, natural capital, human capital, and net foreign assets) based on data for 2018. Germany, Japan, and Canada have the highest net foreign assets per capita (foreign assets minus foreign liabilities), while the US and Australia have the lowest.

Source: Codera Analytics

Source: Codera Analytics

——————–

Food for Thought

1. Declines in union membership by sector:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

2. Teen social media usage:

Source: @chartrdaily

Source: @chartrdaily

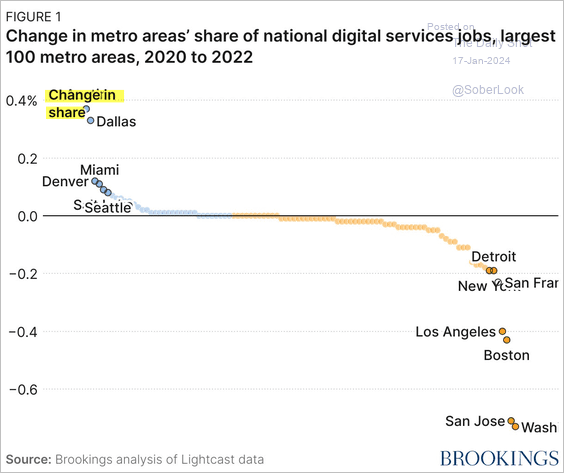

3. Tech jobs are spreading out.

Source: Brookings Read full article

Source: Brookings Read full article

4. Views on income redistribution:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

5. CO2 emissions:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

• CO2 emissions from fossil fuels:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

6. Grade inflation:

Source: @chartrdaily

Source: @chartrdaily

7. Share of most cited science and engineering publications:

Source: @axios Read full article

Source: @axios Read full article

8. Cashiers or self-checkout kiosks?

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index