The Daily Shot: 29-Jan-24

• The United States

• The Eurozone

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

Dear Readers,

We would like to extend our heartfelt thanks for your incredible support and understanding during this unexpected hiatus.

We are going to resume with an abbreviated version of The Daily Shot over the next few days. Our goal is to return to our regular, comprehensive editions starting next month.

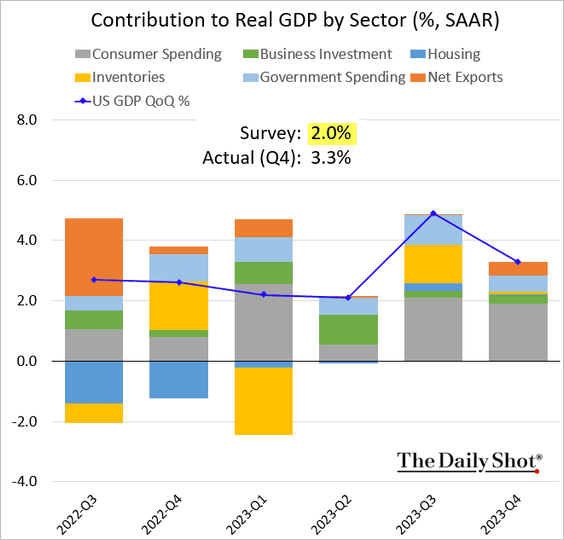

The United States

1. The US economy continues to surprise to the upside, with the fourth-quarter GDP report exceeding forecasts. Consumer spending held up well.

• Business investment has increased for nine consecutive quarters.

• This chart shows the real final sales to private domestic purchasers, the “core GDP” (quarter-over-quarter, annualized).

——————–

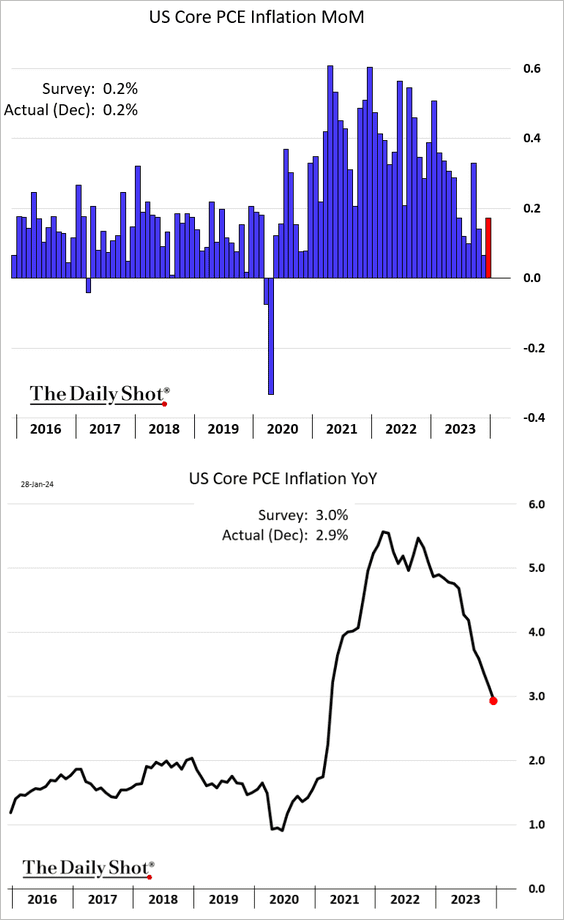

2. The December core PCE inflation measure was in line with forecasts. The year-over-year indicator dipped below 3% (2nd panel below).

The supercore PCE inflation measure (core services ex. housing) strengthened.

——————–

3. The PMI report from S&P Global showed both manufacturing and services in growth territory this month.

Back to Index

The Eurozone

1. While the manufacturing sector’s decline slowed this month, services moved deeper into contraction. The PMI report continues to signal recessionary conditions in the Eurozone.

Below is Germany’s composite PMI.

——————–

2. Here is a look at interest payments on government debt.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

Back to Index

China

1. Flows into China-focused funds surged after Beijing announced massive support for the stock market.

Source: Goldman Sachs

Source: Goldman Sachs

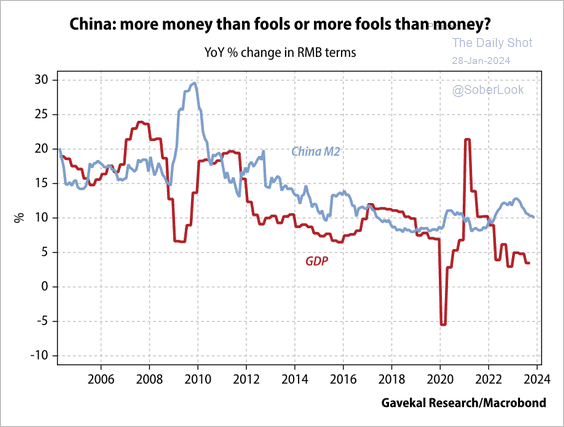

2. The money supply is growing at roughly twice the rate of nominal GDP.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

EM-focused equity funds are seeing strong inflows.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

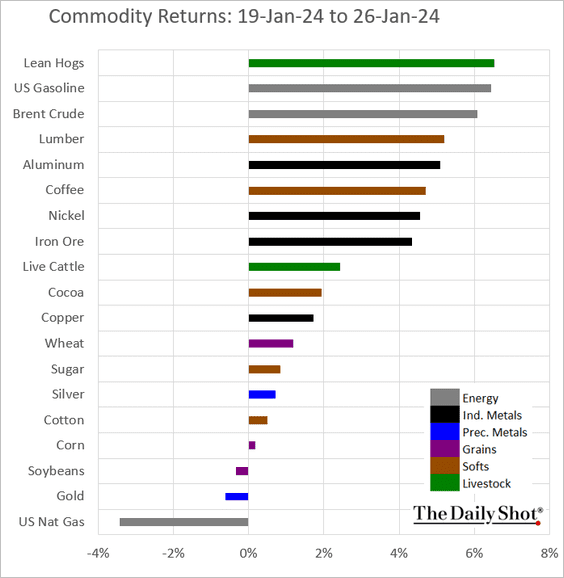

Commodities

Here is a look at last week’s performance.

Back to Index

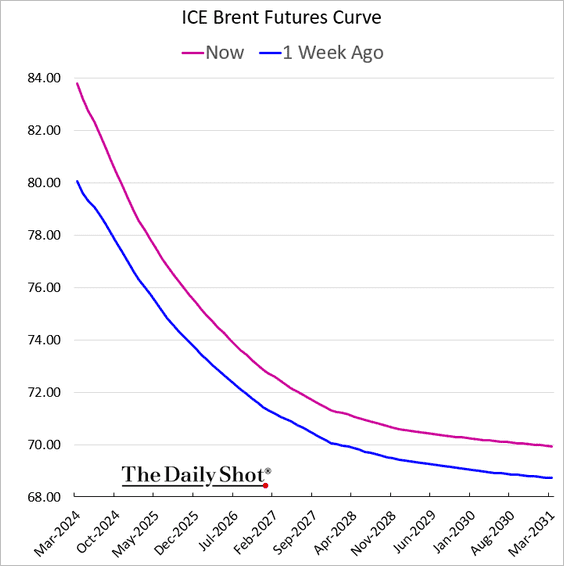

Energy

Crude oil backwardation strengthened amid tensions in the Middle East.

Back to Index

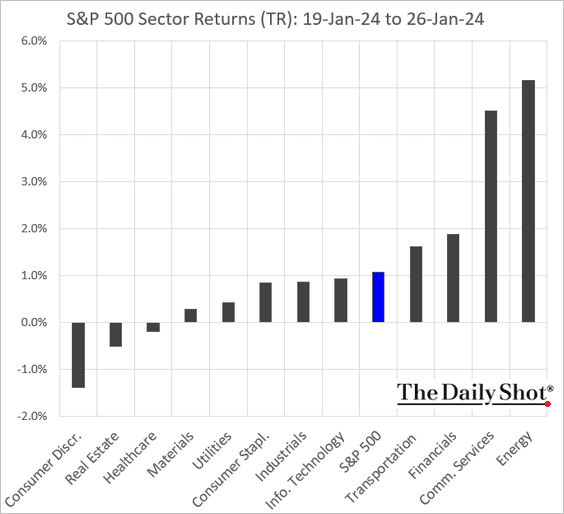

Equities

1. Downside protection on the S&P 500 hasn’t been this cheap since before the pandemic. Below is the 6-month 95% implied vol.

2. Historically, the longest periods without a new high in the S&P 500 have a strong bias to a high starting valuation. The recent two-year stretch is only the seventh longest, going back to 1928.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Here is a look at last week’s performance by sector.

Back to Index

Credit

Global corporate bond spreads continue to tighten.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

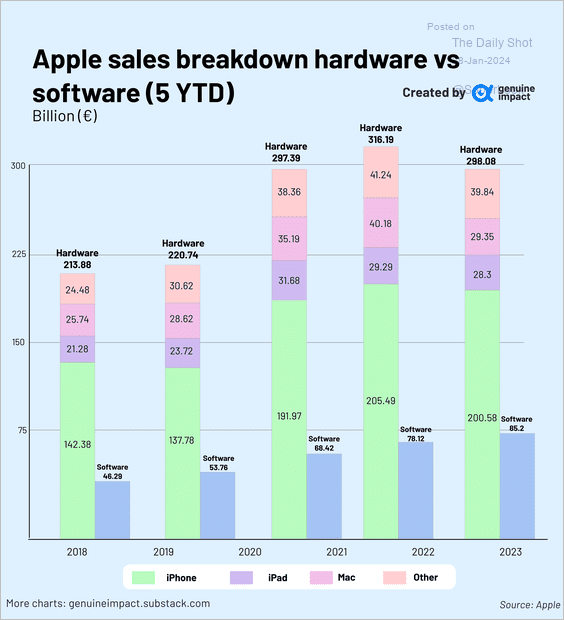

Food for Thought

1. Apple’s sales by product category:

Source: @genuine_impact

Source: @genuine_impact

2. Participating in video meetings while on the toilet:

Source: @YouGov Read full article

Source: @YouGov Read full article

——————–

Back to Index