The Daily Shot: 23-Jan-24

• The United States

• The Eurozone

• Europe

• Asia-Pacific

• China

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Global Developments

• Food for Thought

As a reminder, there will be a brief hiatus in the publication of The Daily Shot due to a necessary medical procedure. This pause will be from January 24th to at least January 26th (and perhaps longer). We are committed to ensuring that our content remains as insightful and informative as ever, and we eagerly anticipate resuming publication shortly after this period.

Your understanding and support during this time is greatly appreciated.

The United States

1. The Conference Board’s US leading index experienced another decline last month, albeit a smaller decrease than anticipated.

• Here are the contributions to the December change.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Twenty-one months of consecutive declines is unusual for this indicator.

• The index has never experienced such a large 6-month decline without a recession.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Has the Conference Board’s index been exaggerating the recent economic downturn, influenced by declining consumer sentiment and soft manufacturing activity?

Source: Oxford Economics

Source: Oxford Economics

——————–

2. Easier financial conditions may delay the Fed’s rate cuts by stimulating demand.

Source: Federal Reserve Bank of San Francisco Read full article

Source: Federal Reserve Bank of San Francisco Read full article

Here is the financial conditions index from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

• The market-based probability of a Fed rate cut in March dropped to 40% on Monday.

——————–

3. Inventories remain well above trend.

Source: Gavekal Research

Source: Gavekal Research

4. The decrease in job vacancies that small businesses find challenging to fill may signal a rise in the unemployment rate.

Source: Alpine Macro

Source: Alpine Macro

5. Goldman’s Q4 GDP growth tracker climbed above 2%, …

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

… which is consistent with the Atlanta Fed’s GDPNow model.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

——————–

6. The federal government’s interest expense is steadily rising.

Source: Oxford Economics

Source: Oxford Economics

• The federal budget deficit has diverged from economic fundamentals.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

7. With consumers looking for bargains, online retail sales growth continues to outpace that of department stores.

Source: LPL Research

Source: LPL Research

Back to Index

The Eurozone

1. What should we expect from the ECB this week? Here are some scenarios, including market impact (from ING).

Source: ING

Source: ING

The market has tempered its expectations for rate cuts, …

… which may still be too optimistic.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

2. European power prices have been dropping quickly as natural gas prices ease.

3. Germany’s unemployment rate has sharply diverged from the rest of the euro area.

Source: Alpine Macro

Source: Alpine Macro

Separately, has Germany’s population peaked?

Source: @Datawrapper

Source: @Datawrapper

——————–

4. Here is a look at the changes in government debt since the start of the pandemic.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

5. French retail sales (volume) edged lower last month.

Back to Index

Europe

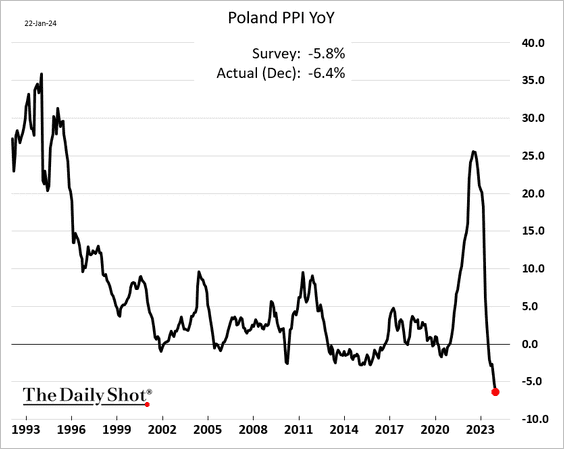

1. Let’s begin with some updates on Poland.

• The PPI (biggest decline in recent history):

• Industrial production (softer at year-end):

• Employment (slight year-over-year decline):

• Wage growth (moderating):

• Retail sales (a disappointing December):

——————–

2. Here is a look at home price appreciation and rent inflation across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

3. EU building permits have been trending lower.

Source: ING

Source: ING

4. Small-cap firms are facing a hurried debt repayment schedule versus large-cap firms.

Source: PGM Global

Source: PGM Global

• Debt issues rose significantly in 2021 as small-cap firms took advantage of easy monetary policy. Issuance picked up again last year with considerably higher financing costs.

Source: PGM Global

Source: PGM Global

Back to Index

Asia-Pacific

1. The yen appears extremely undervalued based on its deviation from purchasing power parity.

Source: Gavekal Research

Source: Gavekal Research

2. Taiwan’s export orders swooned at the end of the year.

• Taiwan’s unemployment remains very low.

——————–

3. Australia’s business confidence improved in December.

Back to Index

China

1. Stocks surged in Hong Kong, …

… as Beijing floated new stimulus (worth $279 billion).

Source: Reuters Read full article

Source: Reuters Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

• Hong Kong-listed stocks have been trading at record discounts to mainland shares.

Source: @markets Read full article

Source: @markets Read full article

• Will the new policy arrest the mainland stock market’s relentless outflows?

——————–

2. A majority of China’s listed developers are in debt trouble.

Source: Gavekal Research

Source: Gavekal Research

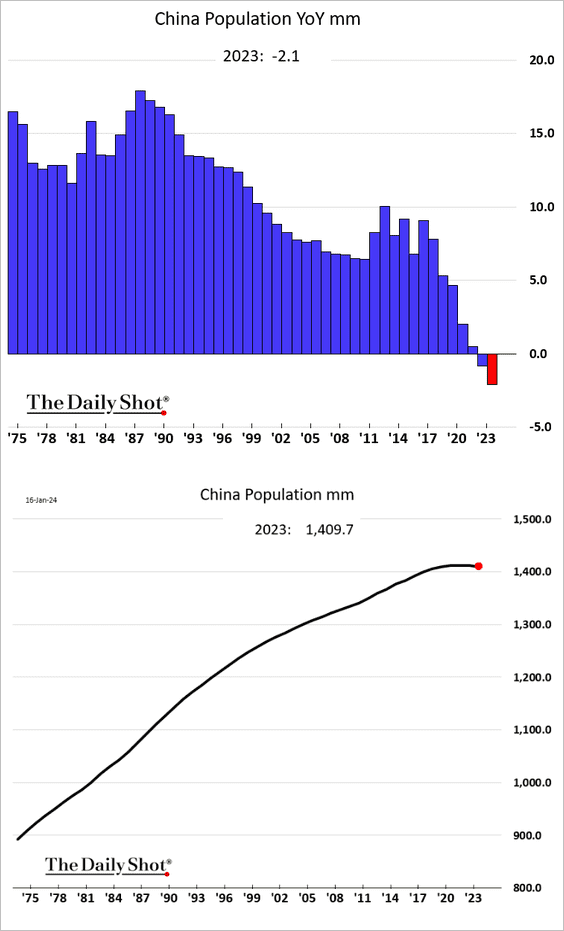

3. China’s population declined again last year, …

Source: NBC News Read full article

Source: NBC News Read full article

… as birth rates fell further (2 charts).

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @chartrdaily

Source: @chartrdaily

Back to Index

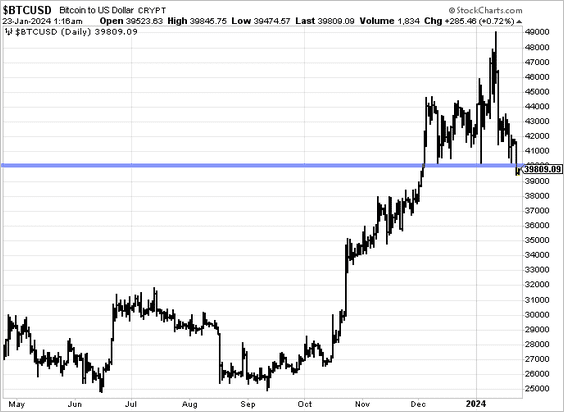

Cryptocurrency

1. Bitcoin dipped below $40k.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Bitcoin’s volatility is significantly higher than the typical 60% stocks/40% bonds portfolio.

Source: Morningstar Read full article

Source: Morningstar Read full article

3. This chart shows bitcoin’s contribution to risk in a balanced portfolio at various weights.

Source: Morningstar Read full article

Source: Morningstar Read full article

4. The typical balanced portfolio is vulnerable to greater drawdown risk with small allocations to bitcoin.

Source: Morningstar Read full article

Source: Morningstar Read full article

5. Crypto funds saw minor outflows last week, driven by higher-cost incumbent issuers. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

6. There has been an increase in smaller bitcoin holders since the start of the crypto bear market in 2021, while some larger holders have retreated.

Source: Glassnode Read full article

Source: Glassnode Read full article

7. BTC’s correlation with ETH is starting to fade.

Source: @KaikoData

Source: @KaikoData

8. ETH/USD is holding support and has strengthened relative to BTC.

Source: @StocktonKatie

Source: @StocktonKatie

Back to Index

Commodities

The Red Sea shipping disruptions have been upending coffee trade flows, …

Source: AJOT Read full article

Source: AJOT Read full article

… pushing prices higher.

• Arabica:

• Robusta (Europe):

Back to Index

Energy

1. Oil prices climbed amid Middle East tensions on Monday, with Brent now firmly above its 50-day moving average.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. Russian crude oil discount to Brent has settled near $12/bbl.

3. So far, the WTI oil price has tracked historical low-inflation/late-cycle phases.

Source: Variant Perception

Source: Variant Perception

4. Small US oil firms are focused on production, while large firms are focused on acquiring assets and reducing debt, according to a survey by the Dallas Fed.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Equities

1. The Dow climbed above 38k for the first time.

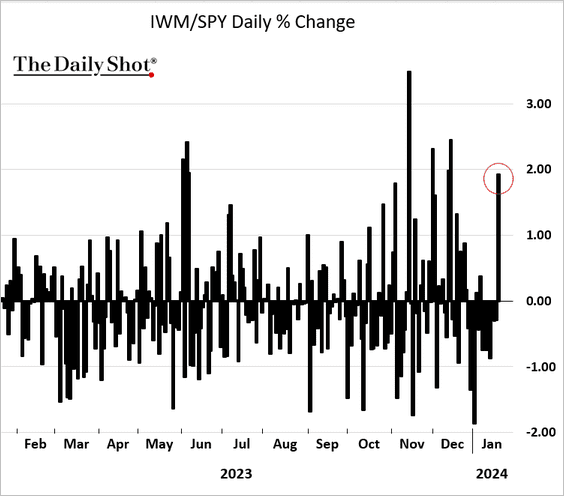

2. Monday was a good day for small caps.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Here is the IWM/SPY (Russell 2000/S&P 500) daily relative performance.

——————–

3. The Nasdaq 100 valuation has disconnected from real rates.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

4. The risk premium for the S&P 500 remains exceptionally low.

Here is the S&P 500 dividend yield less the ten-year Treasury yield.

——————–

5. The ratio of S&P 500 buybacks to earnings is at the bottom of the post-financial crisis range.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Overall, buybacks, dividends, and capex together are running well below levels implied by earnings.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

6. International stocks continue to underperform their US counterparts.

Source: Truist Advisory Services

Source: Truist Advisory Services

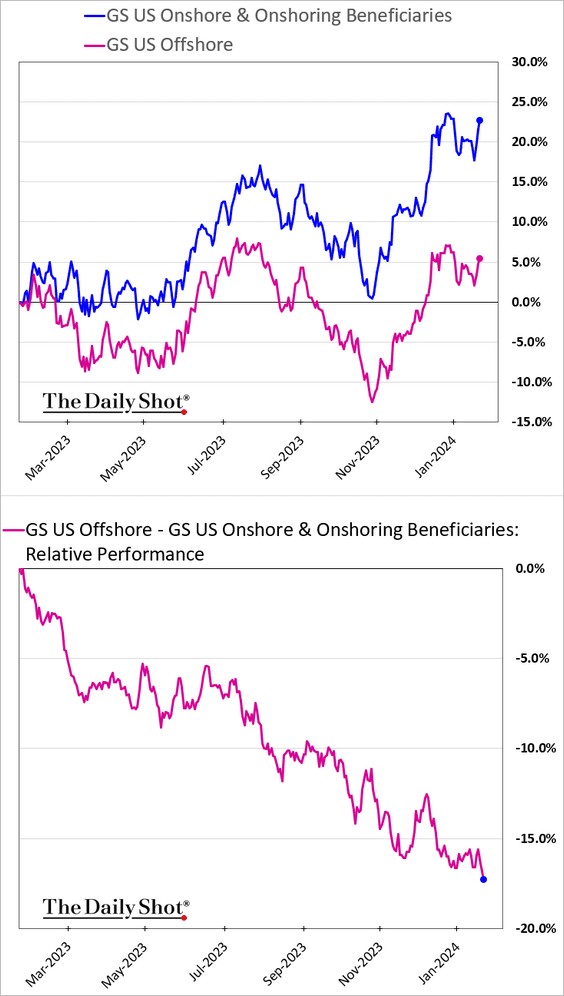

7. The market keeps rewarding companies focused on onshoring (or those benefiting from onshoring). Firms with substantial offshore presence have underperformed.

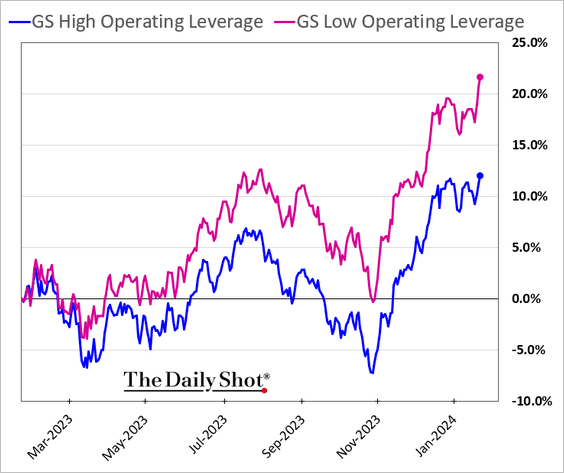

8. Firms with low operating leverage have been outperforming.

9. Companies that missed earnings and sales estimates have been punished. Beating estimates, on the other hand, did not produce substantial rewards.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

10. Here is a look at the EPS revision trajectories for Q4 2023.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

11. With short-term rates above 5%, using in-the-money stock options for interest rate arb is popular again.

Source: @markets Read full article

Source: @markets Read full article

12. Zero-day option usage jumped at the start of the year.

Source: @GunjanJS, @WSJ

Source: @GunjanJS, @WSJ

Back to Index

Alternatives

1. Private equity dry powder continues to surge, providing a tailwind for public markets.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

2. Investors want to boost their private debt allocations.

Source: @theleadleft

Source: @theleadleft

3. Fewer US SaaS companies are raising primary rounds.

Source: Carta

Source: Carta

Back to Index

Credit

1. It’s been a good start to the year for investment-grade bond issuance.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

2. The amount of CLOs outstanding surpassed $1 trillion last year, …

h/t Deutsche Bank Research

h/t Deutsche Bank Research

… boosted by middle-market CLOs.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

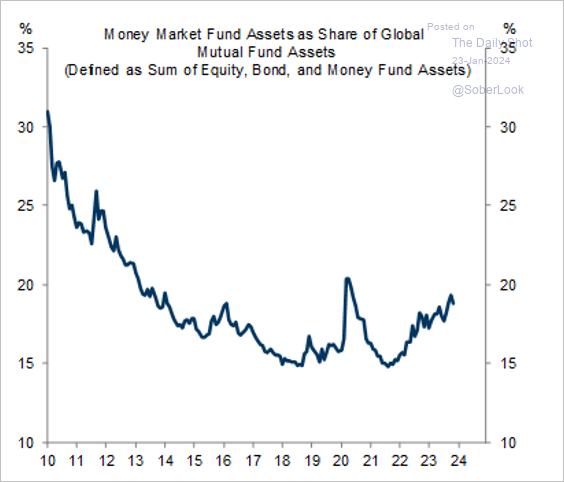

3. This chart shows money market funds’ AUM as a share of total mutual funds.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Global Developments

1. The Bab el-Mandeb Strait transit volume continues to trend lower.

Source: Commerzbank Research

Source: Commerzbank Research

• Container ships saw the biggest declines.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Container ship capacity is expected to surge this year.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

2. On average, Capital Economics expects real household income to decline across developed markets this year.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

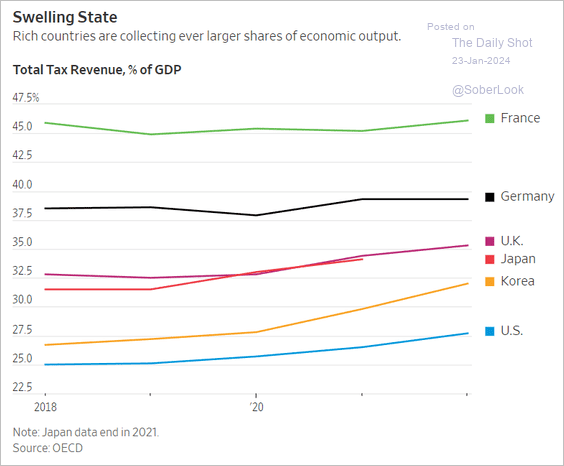

1. Tax revenue as a percentage of GDP:

Source: @WSJ Read full article

Source: @WSJ Read full article

2. Wages and remote work:

Source: HBR Read full article

Source: HBR Read full article

3. US homeless population:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Skipping meals:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

5. The China-Russia trade:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

6. The biggest cloud providers:

Source: Centre for European Policy Studies Read full article

Source: Centre for European Policy Studies Read full article

7. Ransomware victims:

Source: The Economist Read full article

Source: The Economist Read full article

8. Percent of US annual retail spending taking place in December:

Source: USAFacts

Source: USAFacts

9. The most efficient route between every Springfield in the United States:

Source: Reddit

Source: Reddit

——————–

As a reminder, there will be a brief hiatus in the publication of The Daily Shot due to a necessary medical procedure. This pause will be from January 24th to at least January 26th (and perhaps longer). We are committed to ensuring that our content remains as insightful and informative as ever, and we eagerly anticipate resuming publication shortly after this period.

Your understanding and support during this time is greatly appreciated.

If you have questions, please email [email protected]

Back to Index